|

市場調査レポート

商品コード

1640513

酸素ガスセンサ:市場シェア分析、産業動向・統計、成長予測(2025~2030年)Oxygen Gas Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 酸素ガスセンサ:市場シェア分析、産業動向・統計、成長予測(2025~2030年) |

|

出版日: 2025年01月05日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

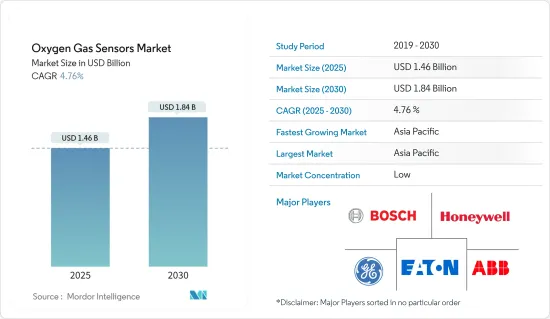

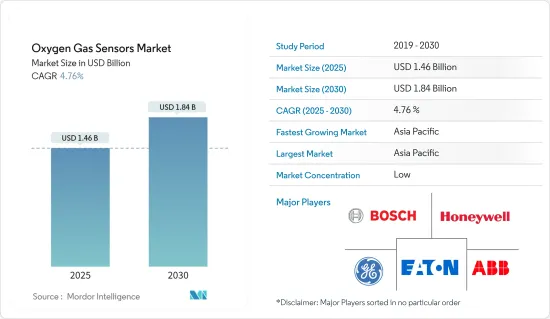

酸素ガスセンサの市場規模は2025年に14億6,000万米ドルと推定され、予測期間(2025~2030年)のCAGRは4.76%で、2030年には18億4,000万米ドルに達すると予測されます。

主要ハイライト

- 酸素濃度や酸素分圧を確実に測定し、異常状態を警告する能力は、鉱山、石油生産施設、化学工場などの産業安全環境において極めて重要です。これが市場成長の原動力となっています。

- 市場成長の背景には、医療、自動車、産業など、さまざまな用途で酸素ガスセンサに対する需要が高まっていることがあります。また、センシング技術の急速な技術進歩と相まって、酸素センサの用途が増加しています。さらに、安全・安心に対する意識の高まりも同市場の成長を後押ししています。

- さらに、環境への配慮も酸素ガスセンサの成長を促進する上で重要な役割を果たしています。溶存酸素は、河口水域と沿岸近海の両方で、貝類、魚類、その他の水生生物の個体数のバランスを維持するための重要な要件であることが知られています。水中の溶存酸素を測定するために、さまざまなプロジェクトが実施されてきたし、今後も実施される見込みです。さらに、アンモニア、オゾン、塩素はいずれも、廃水処理や浄水場の除染段階で使用される有毒ガスです。こうした要因が酸素ガスセンサの需要を押し上げると考えられます。

- さらに、自動車の空燃比の調整から工業プロセスの制御まで、酸素レベルを正確に把握することが不可欠なため、酸素センサの需要が高まっています。例えば、2022年8月、Premier Auto Tradeは、酸素・空燃比センサ製品群の大幅拡大を発表しました。PATは現在、ガソリン車、LPG車、ディーゼル車向けに800種類以上のダイレクトフィット酸素センサを取り揃え、日本、韓国、米国、欧州のメーカーに供給しています。これは、オーストラリアとニュージーランドの1,400万台以上の車両用途をカバーし、オーストラリアのアフターマーケットで最も広範な製品群となっています。

- 例えば、2022年8月、マハラシュトラ州の新興企業が水素ガス検知技術の固有開発のために政府から3,290万インドルピー(40万米ドル)の支援を受けました。マルチ・ナノセンス・ Technologiesは、水素検知・分析技術の独自開発のため、DST傘下の技術開発委員会と覚書を交わしました。

- また、これらの酸素ガスセンサの医療用途は、病院やその他の医療施設で低濃度の酸素を測定できる精密機器へのニーズが高まっていることから、急成長が見込まれています。これらの機器は、低酸素症や無酸素症の患者や心肺停止患者のモニタリングに利用されます。さらに、喘息や慢性閉塞性肺疾患(COPD)のような呼吸器疾患の患者に対する非侵襲的換気処置にも使用されます。

- 各社は最近、市場競合を維持するために新製品を投入しています。さらに、Crowcon Detection Instruments LtdはGasmanポータブルガス検知器に長寿命酸素センサを発売しました。この新型センサは寿命が延び、総所有コストを削減できるほか、鉛を完全に含まないため、企業が差し迫った有害物質規制(RoHS)変更に対応し、環境への害を減らすのに役立ちます。

酸素ガスセンサ市場動向

自動車セクターが大きな市場需要を占める

- 酸素ガスセンサは、自動車のシリンダーに入る酸素の量を正確に測定するため、自動車の排気ガスに主に採用されています。この計測器は、ガソリン、ディーゼル、ガスエンジンの排出ガス管理に使用されます。自動車保有台数の増加と政府の厳しい排ガス規制が相まって、自動車用酸素ガスセンサの売上は今後刺激されると予想されます。

- さらに、年代物の自動車に自動車用酸素ガスセンサを後付けする動きが活発化しており、今後数年間、利害関係者に大きなビジネス機会がもたらされると予想されます。2022年8月、インド政府はインド初の2階建て電気バスをムンバイで発売しました。同国は、都市交通改革を重視し、低カーボンフットプリントで高乗客密度の統合電気自動車(EV)モビリティ・エコシステムの構築に取り組んでいます。

- 自動車用酸素ガスセンサ用コーティング材料の急速な進歩は、世界の自動車用酸素センサ市場に新たなパラダイムをもたらすと予想されます。現在、ほとんどの企業が高温同時焼成セラミック(HTCC)グリーンテープを酸素センサに使用し、高強度で長寿命の自動車用センサを製造しています。

- さらに2022年8月、Boschはサウスカロライナ州アンダーソンで燃料電池スタックを生産するために2億米ドル以上を投資すると発表しました。水素イオンが燃料電池のプレート上を通過すると、酸素と結合して電気が発生します。製品別は水だけであり、二酸化炭素を排出することなく走行することができます。

- さらに、この産業は国内外当局の厳しい規制と施策によって管理されており、これらのシステムを利用することが義務付けられています。産業は、政府や関係当局が定める排出基準を満たすために酸素センサに依存しています。例えば、ほとんどのガソリン車には、米国環境保護庁の排ガス規制強化に対応するため、触媒コンバーターが搭載されています。

アジア太平洋が最速の成長率を示す

- この地域の自動車セクターは、自動車生産台数の増加により酸素センサ搭載の重要な原動力になると予想されています。India Brand Equity Foundation(IBEF)によると、インドの乗用車市場は2027年までに548億4,000万米ドルに達すると予測されています。インドの自動車産業は、2016~2026年の間に自動車の輸出を5倍に増やすことを目標としています。さらに、2022年度のインドからの自動車輸出総額は561万7,246台でした。

- また、2022年3月、中国の上海汽車傘下のMGモーターズは、電気自動車(EV)拡大を含む将来のニーズに対応するため、インドで3億5,000万~5億米ドルの未公開株を調達する計画を発表しました。また、二輪車EVメーカーのHOP Electric Mobilityは、Rays Power Infraの多角化事業ベンチャーであり、今後2年間で10億インドルピー(1,324万米ドル)を投資し、電気自動車の生産能力を拡大することを検討しています。同地域では自動車の利用が増加しており、酸素ガスセンサ市場を牽引しています。

- さらに、インド政府は自動車セグメントへの外国投資を奨励し、自動ルートによる100%直接投資を認めています。さらに、2022年2月には、Tata Motors Ltd、Suzuki Motor Gujarat、Mahindra and Mahindra、Hyundai、Kia India Pvt.Ltdなどの自動車メーカーが、現地での自動車製造を増やし、新たな投資を呼び込むという政府の計画の一環としてPLIを受けました。自動車会社20社は、約4,500億インドルピー(59億5,000万米ドル)の投資を提案しました。自動車セクターにおける政府の施策やイニシアティブは、今後、研究市場の需要をさらに押し上げる可能性があります。

- この地域の工業生産も、新興経済諸国と"Make in China "や"Make in India "のような政府の取り組みにより、増加すると見られます。工業セグメントの成長は、工業セグメントでの幅広い用途により、酸素センサ市場を押し上げると予想されます。

- 化学・石油化学セグメントでは酸素センサの用途が多いです。同地域は世界で最も大規模な探鉱が行われている地域の一つです。例えば、IBEFによると、2022~2023年度連邦予算で、政府は化学・石油化学省に20億9,000万インドルピー(2,743万米ドル)を割り当てました。さらに、2025年までにインドの化学・石油化学部門には8兆インドルピー(1,073億8,000万米ドル)の投資が見込まれています。

酸素ガスセンサ産業概要

酸素ガスセンサ市場は、多数の参入企業が存在し、参入障壁が比較的低いため、著しいセグメント化が特徴です。ABB、Honeywell、Eaton、GEなどの主要市場参入企業は、市場シェア拡大のために戦略的パートナーシップや製品開拓に継続的に取り組んでいます。

2023年3月、LogiDataTechは混合ガス中の酸素濃度を正確に測定するために設計された最先端のソリューションであるMF420-O-Zr酸素センサを発表しました。このセンサは、2枚の二酸化ジルコニウムスライスを利用して密閉チャンバーを形成するダイナミックプロセスを採用しており、全レンジにわたって正確なリニア測定が可能です。さらに、この酸素センサには診断機能が内蔵されており、使用中の性能をモニタリングし、ハードウェアやセンサの潜在的な問題について警告を発します。その結果、追加の酸素センサは必要ないです。

2022年5月、Angst+Pfister Sensors and Powerは、金属、セラミック、ポリマー積層造形用に特別に設計された革新的な酸素センサを発表しました。これらのアディティブ・マニュファクチャリング用の長寿命デジタル酸素センサとセンサモジュールは、高ppmの信号分解能を提供し、他のほとんどのガスからの干渉の影響を受けないです。

2022年3月、Sea-Bird Scientificは、GO-BGCプログラムの一環としてNavisフロートの標準センサとなるSBS 83光学式酸素センサの発売を発表しました。GO-BGCプログラムは、世界の海洋の健全性をモニタリングするための化学的と生物学的センサのネットワークを構築することを目的としています。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査の成果

- 調査の前提

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 市場概要

- 市場促進要因と市場抑制要因の採用

- 市場促進要因

- 職場における安全確保のための政府規制

- 市場抑制要因

- 中小企業における酸素センサの用途と使用に関する認識不足

- バリューチェーン分析

- 産業の魅力-ポーターのファイブフォース分析

- 新規参入業者の脅威

- 買い手の交渉力

- 供給企業の交渉力

- 代替品の脅威

- 競争企業間の敵対関係の強さ

第5章 市場セグメンテーション

- タイプ別

- 電位差

- アンペロメトリック

- 抵抗式

- その他

- 技術別

- 赤外線

- 触媒式

- その他

- エンドユーザー産業別

- 化学・石油化学

- 自動車

- 医療ライフサイエンス

- 工業

- 上下水道

- スマートビルディング

- その他

- 地域別

- 北米

- 米国

- カナダ

- 欧州

- ドイツ

- 英国

- フランス

- ロシア

- アジア

- 中国

- 日本

- インド

- 韓国

- オーストラリア・ニュージーランド

- ラテンアメリカ

- ブラジル

- アルゼンチン

- メキシコ

- 中東・アフリカ

- アラブ首長国連邦

- サウジアラビア

- 南アフリカ

- 北米

第6章 競合情勢

- 企業プロファイル

- Robert Bosch GmbH

- ABB Limited

- Honeywell International Corporation

- Eaton Corporation

- General Electric Company

- Figaro Engineering Inc.

- Advanced Micro Instruments Inc.

- Yokogawa Electric Corporation

- City Technology Limited

- Delphi Automotive PLC

- Hamilton Company

- Sensore Electronic GmbH

- Aeroqual Limited

- AlphaSense Inc.

- Control Instruments Corporation

- Fujikura Limited

- Membrapor AG

- Mettler-Toledo International Inc.

- Francisco Albero SAU

- Maxtec LLC

第7章 投資分析

第8章 市場の将来

The Oxygen Gas Sensors Market size is estimated at USD 1.46 billion in 2025, and is expected to reach USD 1.84 billion by 2030, at a CAGR of 4.76% during the forecast period (2025-2030).

Key Highlights

- The ability to reliably measure oxygen concentration or partial pressure and warn about abnormal conditions is critical in industrial safety environments, such as mines, oil production facilities, and chemical plants. This helps in driving the growth of the market.

- The growth in the market can be attributed to the rising demand for oxygen gas sensors in a range of applications, including medical, automotive, and industrial sectors. Also, the increasing number of applications for oxygen sensors, coupled with rapid technological advancements in sensing technologies. Furthermore, the increasing awareness regarding safety and security is also driving the growth of this market.

- Moreover, environmental concerns play a crucial role in driving the growth of oxygen gas sensors. It is known that dissolved oxygen is a critical requirement for the maintenance of balanced populations of shellfish, fish, and other aquatic organisms in both estuarine and nearshore coastal waters. Various projects have been and are expected to be implemented to measure the dissolved oxygen in the water. Furthermore, ammonia, ozone, and chlorine are all toxic gases used in the decontamination stage of wastewater treatment and water purification plants. Such factors will boost the demand for oxygen gas sensors.

- Furthermore, applications ranging from adjusting the air-fuel ratio in automobiles to controlling industrial processes increasingly demand oxygen sensors, as ascertaining oxygen levels accurately is essential. For instance, in August 2022, Premier Auto Trade announced a significant expansion to its Oxygen and Air Fuel Ratio Sensors range. The PAT range now includes over 800 Direct Fit Oxygen Sensors for petrol, LPG, and diesel vehicles with a spread across Japanese, Korean, USA, and European manufacturers. This covers over 14 million vehicle applications in Australia and New Zealand, making it the most extensive range in the Australian Aftermarket.

- For instance, in August 2022, a Maharashtra Startup Got INR 32.9 million (USD 0.40 million) support from the Government for Indigenous Development of Hydrogen Gas Detecting Technology. Multi Nano Sense Technologies signed a memorandum of understanding (MoU) Technology Development Board under DST for the indigenous development of hydrogen sensing and analysis technology.

- Also, the medical application of these oxygen gas sensors is expected to experience rapid growth due to a rising need for precise devices that can measure low levels of oxygen in hospitals and other healthcare facilities. These devices are utilized for monitoring patients who have hypoxic or anoxic injuries, as well as those experiencing cardiopulmonary arrest. Additionally, they are also employed in non-invasive ventilation procedures for patients with respiratory disorders like asthma or chronic obstructive pulmonary disease (COPD).

- Companies are rolling out new products lately to remain competitive in the market. Further, Crowcon Detection Instruments Ltd launched a long-life oxygen sensor in its Gasman portable gas detector. The new sensor has an extended lifespan, which reduces the total cost of ownership and is also completely free of lead, helping organizations to comply with imminent changes to the restriction of hazardous substances (RoHS) regulations and reducing harm to the environment.

Oxygen Gas Sensors Market Trends

Automotive Sector to Occupy a Significant Market Demand

- Oxygen gas sensors are majorly employed in automobile exhausts to measure the amount of oxygen entering the car cylinders accurately. This instrument is used to manage the released emissions of petrol, diesel, and gas engines. The growing fleet of automotive vehicles, combined with tight government emission control regulations, is expected to stimulate automotive oxygen gas sensor sales in the future.

- Furthermore, the growing retrofitting of automotive oxygen gas sensors for vintage vehicles is expected to provide considerable opportunities for stakeholders in the coming years. In August 2022, the Indian government launched India's first double-decker electric bus in Mumbai. It is working to create an integrated electric vehicle (EV) mobility ecosystem with a low carbon footprint and high passenger density, emphasizing urban transportation reform.

- Rapid advancements in coating materials for automotive oxygen gas sensors are expected to usher in new paradigms in the worldwide automotive oxygen sensor market. Most players now use high-temperature co-fired ceramic (HTCC) green tapes with oxygen sensors to create high-strength and long-lasting vehicle sensors.

- Furthermore, in August 2022, Bosch announced a more than USD 200 million investment to produce fuel cell stacks in Anderson, S.C. A fuel cell operates by using hydrogen to generate electrical energy. As the hydrogen ions pass over the fuel cell plates, they combine with oxygen to create electricity. The only by-product is water, allowing the vehicle to run with zero local carbon emissions.

- Moreover, the industry is governed by strict policies and regulations employed by both national and international authorities, making it mandatory to utilize these systems. The industry depends on oxygen sensors to meet the emission standards governments and concerned authorities set. For instance, most gasoline-powered vehicles are equipped with catalytic converters to comply with the US Environmental Protection Agency's stricter regulation of exhaust emissions.

Asia-Pacific to Mark the Fastest Growth Rate

- The automotive sector in this region is expected to be the significant driver for incorporating oxygen sensors due to the increasing automobile production. According to the India Brand Equity Foundation (IBEF), the Indian passenger car market is predicted to reach a value of USD 54.84 billion by 2027. Indian automotive industry is targeting to increase the export of vehicles by five times during 2016-2026. Furthermore, in FY 2022, total automobile exports from India stood at 5,617,246.

- In addition, in March 2022, MG Motors, owned by China's SAIC Motor Corp, announced plans to raise USD 350-500 million in private equity in India to fund its future needs, including electric vehicle (EV) expansion. In addition, Two-wheeler EV maker HOP Electric Mobility, a diversified business venture of Rays Power Infra, is looking at investing INR 100 crore (USD 13.24 million) over the next two years to extend manufacturing capacity for Electric Vehicles. The increased usage of automobiles in the region consequently drives the market for oxygen gas sensors.

- Furthermore, the government of India encourages foreign investment in the automobile sector and has allowed 100% FDI under the automatic route. Furthermore, in February 2022, carmakers, including Tata Motors Ltd, Suzuki Motor Gujarat, Mahindra and Mahindra, Hyundai, and Kia India Pvt. Ltd received PLI as part of the government's plan to increase local vehicle manufacturing and attract new investment. The 20 automobile companies proposed an investment of around INR 45,000 crore (USD 5.95 billion). Government policies and initiatives in the automotive sector may further drive the studied market demand in the future.

- The region's industrial manufacturing is also set to increase due to developing economies and government initiatives like "Make in China" and "Make in India." The growth of the industrial sector is expected to boost the oxygen sensors market due to its wide applications in the industrial sector.

- The chemical and petrochemical sectors have many applications for oxygen sensors. The region is home to one of the most extensive explorations in the world. For instance, According to IBEF, under the Union Budget 2022-2023, the government allotted INR 209 crores (USD 27.43 million) to the Department of Chemicals and Petrochemicals. Furthermore, an investment of INR 8 lakh crore (USD 107.38 billion) is estimated in the Indian chemicals and petrochemicals sector by 2025.

Oxygen Gas Sensors Industry Overview

The oxygen gas sensors market is characterized by significant fragmentation due to the presence of numerous players and relatively low entry barriers. Key industry participants, including ABB, Honeywell, Eaton, and GE, continuously engage in strategic partnerships and product development initiatives to expand their market share.

In March 2023, LogiDataTech introduced the MF420-O-Zr oxygen sensor, a cutting-edge solution designed for precise measurement of oxygen concentration in gas mixtures. This sensor employs a dynamic process that utilizes two zirconium dioxide slices to create a sealed chamber, enabling accurate linear measurement across the entire range. Additionally, the oxygen sensor features a built-in diagnostic function that monitors its performance during use and provides alerts about potential hardware or sensor issues. Consequently, there is no need for an extra oxygen sensor.

In May 2022, Angst+Pfister Sensors and Power unveiled an innovative oxygen sensor designed specifically for metal, ceramic, and polymer Additive Manufacturing procedures. These long-life digital oxygen sensors and sensor modules for Additive Manufacturing offer high ppm signal resolution and are not affected by interference from most other gases.

In March 2022, Sea-Bird Scientific announced the launch of the SBS 83 Optical Oxygen Sensor, which is set to become the standard sensor for Navis floats as part of the GO-BGC program. The GO-BGC program aims to create a network of chemical and biological sensors to monitor the health of the global oceans.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 Government Regulations to Ensure Safety in Work Places

- 4.4 Market Restraints

- 4.4.1 Lack of Awareness of Applications and Usage of Oxygen Sensors in SMEs

- 4.5 Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Potentiometric

- 5.1.2 Amperometric

- 5.1.3 Resistive

- 5.1.4 Other Types

- 5.2 By Technology

- 5.2.1 Infrared

- 5.2.2 Catalytic

- 5.2.3 Other Technologies

- 5.3 By End-User Industry

- 5.3.1 Chemical and Petrochemical

- 5.3.2 Automotive

- 5.3.3 Medical and Life Sciences

- 5.3.4 Industrial

- 5.3.5 Water and Wastewater

- 5.3.6 Smart Buildings

- 5.3.7 Other End-User Industries

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Russia

- 5.4.3 Asia

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 South Korea

- 5.4.3.5 Australia and New Zealand

- 5.4.4 Latin America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Mexico

- 5.4.5 Middle East and Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 South Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Robert Bosch GmbH

- 6.1.2 ABB Limited

- 6.1.3 Honeywell International Corporation

- 6.1.4 Eaton Corporation

- 6.1.5 General Electric Company

- 6.1.6 Figaro Engineering Inc.

- 6.1.7 Advanced Micro Instruments Inc.

- 6.1.8 Yokogawa Electric Corporation

- 6.1.9 City Technology Limited

- 6.1.10 Delphi Automotive PLC

- 6.1.11 Hamilton Company

- 6.1.12 Sensore Electronic GmbH

- 6.1.13 Aeroqual Limited

- 6.1.14 AlphaSense Inc.

- 6.1.15 Control Instruments Corporation

- 6.1.16 Fujikura Limited

- 6.1.17 Membrapor AG

- 6.1.18 Mettler-Toledo International Inc.

- 6.1.19 Francisco Albero SAU

- 6.1.20 Maxtec LLC