|

市場調査レポート

商品コード

1639520

消泡剤-市場シェア分析、産業動向・統計、成長予測(2025~2030年)Defoamers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 消泡剤-市場シェア分析、産業動向・統計、成長予測(2025~2030年) |

|

出版日: 2025年01月05日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

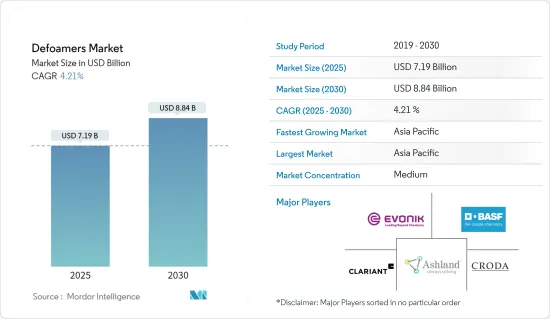

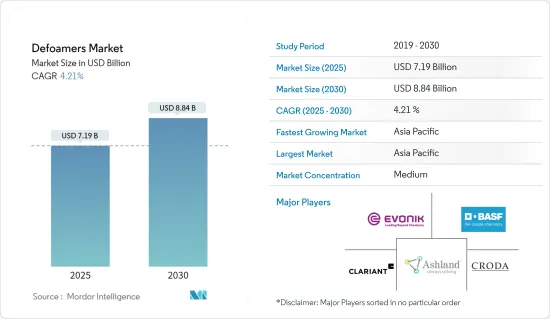

消泡剤市場規模は2025年に71億9,000万米ドルと推定され、予測期間(2025~2030年)のCAGRは4.21%で、2030年には88億4,000万米ドルに達すると予測されます。

COVID-19の流行は消泡剤部門に打撃を与えました。世界の封鎖と各国政府による厳しい規則により、ほとんどの生産拠点が閉鎖され、壊滅的な打撃を受けました。それにもかかわらず、事業は2021年から回復しつつあり、今後数年で大幅に上昇すると予想されます。

主要ハイライト

- 短期的には、世界の化学産業の著しい成長が、調査対象市場の成長を促進する主要要因のひとつです。

- その反面、製品に伴う副作用が、予測期間中の消泡剤市場の成長を妨げると予想されます。

- 環境に優しい消泡剤に対する需要の高まりは、同市場に有利な成長機会をもたらす可能性が高いです。

- アジア太平洋は、中国とインドからの需要が大半を占め、世界の市場を独占すると予想されます。

消泡剤の市場動向

上下水道治療セグメントが市場成長を牽引

- 消泡剤は、産業と自治体の廃水処理技術に応用されています。消泡剤の用途は、生産能力、生産量の増加、運用コストの削減を通じて、これらのプロセスに利益をもたらします。

- 廃水処理システムにおける泡は、生物学的活性、機械的作用、化学的汚染、流入水中の界面活性剤、または一部のポリマー治療に起因する可能性があります。そのため、消泡剤は廃水処理プラントにおける泡の形成による健康被害を軽減します。

- WHOによると、中国では全国的に都市人口が増加しているため、2030年までに国民の70%が都市部に居住するようになると予想されています。都市人口の増加に伴い、廃水や汚泥の流入にも直面します。現在、中国の汚泥の80%は不適切に投棄されており、都市部では廃水処理施設(WWTP)を改善することで汚染を減らそうと躍起になっており、環境問題としてますます議論を呼んでいます。

- 中華人民共和国(PRC)の国家改革委員会(National Development of Reform and Commission)によると、同国の汚泥量は2025年までに9,000万トン近くに達する可能性があるといいます。専門家は、2021~2025年の間に、汚泥処理施設の新設・設置に約80億米ドルが投資されると予測しています。

- 中国はまた、今後5年間で2,000万立方メートル/日の廃水処理能力を追加建設すると発表しました。

- メキシコの水処理産業は、健全な成長率を記録すると予想されています。例えば、国家水委員会(CONAGUA)が作成した最新の全国インベントリーによると、メキシコには2786のプラントがあり、設置容量は196.7m3 s1、処理流量は144.7m3 s1です。同国で進行中の調査によると、政府は、主に都市部での自治体廃水処理プラントの開発に重点を置いており、これにより市場が拡大する可能性が高いです。

- スウェーデンでは、ほとんどの家庭が自治体の汚水処理施設に接続されているにもかかわらず、約100万人がまだ私設の汚水処理施設を利用しています。スウェーデンは、効果的な水資源管理のための廃水浄化強化や水源選別廃水システムなど、様々なセグメントで研究開発を行っています。

- 例えば、Veidekkeは2022年3月、スウェーデンのストックホルム市シックラで廃水処理プラントの建設・設置契約を獲得しました。この契約はStockholm Vatten och Avfallが発注しました。この契約は実行契約であり、プロジェクトは共同契約として実施されます。当初の契約金額は約1億5,300万米ドル。このプロジェクトは2027年に完了する予定です。このため、消泡剤市場には上下水道処理セグメントからの上向きの需要が見込まれます。

- 上記の要因は、予測期間中に消泡剤市場に大きな影響を与えると予想されます。

アジア太平洋が市場を独占する

- 中国やインドのような国々からの高い需要により、アジア太平洋が主要な市場シェアを占めています。

- 自動車用途における塗料・コーティング産業の需要増加により、中国はアジア太平洋における消泡剤の最大消費国の一つとなっています。同国は最大の自動車生産国であり、SUV市場の成長において最大の市場シェアを占めています。例えば、国際自動車製造者機構(OICA)によると、2023年の中国の自動車生産台数は3,016万966台で、2022年と比較して12%の増加を示しています。したがって、自動車生産台数の増加は、塗料・コーティングセグメントからの消泡剤市場に上向きの需要を生み出すと予想されます。

- さらに、同国は同地域最大の建設市場でもあります。建設セクターの成長は、塗料とコーティング剤の需要増につながると予想され、ひいては同国における消泡剤の成長を後押しする可能性が高いです。中国国家統計局によると、2023年の中国の建設生産額は約31兆5,900億人民元(4兆4,300億米ドル)でピークに達しました。

- 中国は石油・ガスの消費量では世界第2位だが、生産量では世界第6位にすぎないです。大きな石油消費国である中国の石油消費量は、成長率を変動させながら年々増加しています。しかし、石油供給は依然として需要を満たすことができず、中国は主に輸入に頼っています。例えば、Trading Economicsによると、中国の原油輸入(金額)は2024年1月の2万5,600米ドルから2024年2月には2万5,700米ドルに増加しています。

- さらに、インドの住宅部門は増加傾向にあり、政府の支援とイニシアチブが需要をさらに押し上げています。2024年から25年にかけて、住宅都市省(MoHUA)は8,257億6,000万インドルピーを受け取っています。このうち36.5%は、プラダン・マントリ・アワス・ヨジャナ(都市部)またはPMAY(U)の下、困窮層への住宅供給に割り当てられています。

- 上記の理由から、アジア太平洋が予測期間中に最も高い成長率を示すと考えられます。

消泡剤産業概要

消泡剤市場は適度に統合されています。この市場の主要企業(順不同)には、BASF SE、Croda International Plc、Ashland、Evonik Industries AG、CLARIANTなどが含まれます。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 促進要因

- 化学産業の拡大と適応性

- 塗料生産の増加

- その他の促進要因

- 抑制要因

- 製品に伴う副作用

- 原料不足と出荷遅延

- その他の抑制要因

- 産業バリューチェーン分析

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競合の程度

第5章 市場セグメンテーション(金額ベース市場規模)

- タイプ

- 油性消泡剤

- エマルジョン系消泡剤

- シリコン系消泡剤

- 粉末消泡剤

- ポリマー系消泡剤

- その他

- エンドユーザー産業

- 塗料とコーティング

- 石油・ガス

- パルプ・製紙

- 飲食品

- 上下水道治療

- その他

- 地域

- アジア太平洋

- インド

- 日本

- 韓国

- マレーシア

- タイ

- インドネシア

- ベトナム

- その他のアジア太平洋

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- イタリア

- フランス

- イタリア

- スペイン

- 北欧諸国

- トルコ

- ロシア

- その他の欧州

- 南米

- ブラジル

- アルゼンチン

- コロンビア

- その他の南米

- 中東・アフリカ

- サウジアラビア

- カタール

- アラブ首長国連邦

- ナイジェリア

- エジプト

- 南アフリカ

- その他の中東・アフリカ

- アジア太平洋

第6章 競合情勢

- M&A、合弁事業、提携、協定

- 市場シェア(%)**/ランキング分析

- 主要企業の戦略

- 企業プロファイル

- Accepta Water Treatment

- Air Products Inc.

- Aqua-Clear, Inc.

- Ashland

- BASF SE

- BRB International

- Buckman

- CLARIANT

- Croda International Plc

- Dow

- Eastman Chemical Company

- ELEMENTIS PLC

- Elkem ASA

- Evonik Industries AG

- Kemira

- SAN NOPCO LIMITED

- Solvay

- Wacker Chemie AG

第7章 市場機会と今後の動向

第8章 環境に優しい消泡剤への需要の高まり

第9章 様々なエンドユーザー産業におけるポリマー需要の拡大

The Defoamers Market size is estimated at USD 7.19 billion in 2025, and is expected to reach USD 8.84 billion by 2030, at a CAGR of 4.21% during the forecast period (2025-2030).

The COVID-19 epidemic harmed the defoamers sector. Global lockdowns and severe rules enforced by governments resulted in a catastrophic setback as most production hubs were shut down. Nonetheless, the business is recovering from 2021 and is expected to rise significantly in the coming years.

Key Highlights

- Over the short term, significant growth in the chemical industry worldwide is one of the key factors driving the studied market growth.

- On the flip side, side effects associated with the products are expected to hinder the defoamers' market growth during the forecast period.

- Nevertheless, the rising demand for eco-friendly defoamers will likely create lucrative growth opportunities for the studied market.

- Asia-Pacific region is expected to dominate the market across the world, with the majority of demand coming from China and India.

Defoamers Market Trends

Water and Wastewater Treatment Segment to Drive the Market Growth

- The defoamers find their applications in industrial and municipal wastewater treatment technologies. The applications of defoamers benefit these processes through increased production capacity, output volume, and reduced operational cost.

- The foam in wastewater treatment systems can result from biological activity, mechanical action, chemical contamination, surfactants in the influent, or some polymer treatments. Thus defoamers reduce the health hazard of foam formation in wastewater treatment plants.

- According to WHO, 70% of the nation's population in China is expected to reside in cities by 2030 due to the increase in the urban population throughout the country. As the urban population increases, they also face an influx of wastewater and sludge. Currently, 80% of sludge in China is improperly dumped, an increasingly controversial environmental issue with urban centers scrambling to decrease pollution by improving their wastewater treatment plants (WWTPs).

- According to the People's Republic of China (PRC's) National Development of Reform and Commission, the country's sludge volume could reach nearly 90 million tons by 2025. Experts estimate that between 2021 and 2025, the country will likely invest about USD 8 billion to construct and install new sludge processing facilities.

- China also announced that it will be constructing 20 million cubic meters/day of additional wastewater treatment capacity over the next five years.

- The water treatment industry in Mexico is expected to register a healthy growth rate. For instance, according to the latest National Inventory made by the National Water Commission (CONAGUA), there are 2786 plants in Mexico with an installed capacity of 196.7 m3 s1 and a treated flow of 144.7 m3 s1. Ongoing research in the country indicates the government to majorly focus on developing municipal wastewater treatment plants, mostly in the urban areas, which will likely augment the market.

- About 1 million people in Sweden still include private sewage treatment plants despite most homes connected to municipal sewage treatment facilities. Sweden conducts research and development in various areas, including enhanced wastewater purification and source-sorting wastewater systems for effective water resource management.

- For instance, Veidekke secured a contract to construct and install a wastewater treatment plant in Sickla, Stockholm, Sweden, in March 2022. The contract was awarded by Stockholm Vatten och Avfall. It is an execution contract under which the project will be carried out as a collaborative contract. The initial contract value is around USD 153 million. This project is anticipated to be completed in 2027. Therefore, this is expected to create an upside demand for the defoamers market from the water and wastewater treatment segment.

- The factors above are expected to significantly impact the defoamers market during the forecast period.

Asia-Pacific to Dominate the Market

- Asia-Pacific accounted for the major market share, owing to the high demand from countries like China and India.

- Due to increased demand for the paints and coatings industry in automobile applications, China is one of the largest consumers of defoamers in the Asia-Pacific region. The country is the largest producer of automobiles and contains the largest market share in the growth of the SUV market. For instance, according to Organisation Internationale des Constructeurs d'Automobiles (OICA), in 2023, automobile production in China amounted to 30,160,966 units, which showed an increase of 12% compared to 2022. Therefore, increasing the production of automobiles is expected to create an upside demand for the defoamers market from the paints and coatings segment.

- Moreover, the country is the largest construction market in the region. The growth in the construction sector is expected to lead to an increase in the demand for paints and coatings and, in turn, is likely to push the growth for defoamers in the country. According to the National Bureau of Statistics of China, in 2023, the construction output value in China peaked at around CNY 31.59 trillion (USD 4.43 trillion).

- China is the world's second-largest consumer of oil and gas but only the sixth-largest producer of the same. As a big oil consumer, China's oil consumption is increasing yearly with fluctuating growth rates. However, the oil supply still cannot meet the demand, and China mainly relies on imports. For instance, according to Trading Economics, imports of Crude Petroleum (value) in China increased to USD 25.7 thousand in February 2024 from USD 25.6 thousand in January 2024.

- Furthermore, the residential sector in India is on an increasing trend, with government support and initiatives further boosting the demand. For the year 2024-25, Ministry of Housing and Urban Affairs (MoHUA) has received INR 825.76. billion. Of this amount, 36.5 percent is allocated for the provision of houses to the needy population under Pradhan Mantri Awas Yojana (Urban) or PMAY (U).

- Owing to the reasons above, Asia-Pacific will likely witness the highest growth rate during the forecast period.

Defoamers Industry Overview

The Defoamers Market is moderately consolidated in nature. The major players in this market (not in any particular order) include BASF SE, Croda International Plc, Ashland, Evonik Industries AG, and CLARIANT, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Expansion and adaptability in the chemical industry

- 4.1.2 Increasing Paints and Coatings Production

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Side Effects Associated with the Products

- 4.2.2 Raw Material Shortage and Shipping Delays

- 4.2.3 Other Restraints

- 4.3 Industry Value-chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Oil-based Defoamer

- 5.1.2 Emulsion Defoamer

- 5.1.3 Silicone-based Defoamer

- 5.1.4 Powder Defoamer

- 5.1.5 Polymer-based Defoamers

- 5.1.6 Other Types

- 5.2 End-user Industry

- 5.2.1 Paints and Coatings

- 5.2.2 Oil and Gas

- 5.2.3 Pulp and Paper

- 5.2.4 Food and Beverages

- 5.2.5 Water and Wastewater Treatment

- 5.2.6 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 India

- 5.3.1.2 Japan

- 5.3.1.3 South Korea

- 5.3.1.4 Malaysia

- 5.3.1.5 Thailand

- 5.3.1.6 Indonesia

- 5.3.1.7 Vietnam

- 5.3.1.8 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Italy

- 5.3.3.6 Spain

- 5.3.3.7 Nordic Countries

- 5.3.3.8 Turkey

- 5.3.3.9 Russia

- 5.3.3.10 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 Qatar

- 5.3.5.3 United Arab Emirates

- 5.3.5.4 Nigeria

- 5.3.5.5 Egypt

- 5.3.5.6 South Africa

- 5.3.5.7 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Accepta Water Treatment

- 6.4.2 Air Products Inc.

- 6.4.3 Aqua-Clear, Inc.

- 6.4.4 Ashland

- 6.4.5 BASF SE

- 6.4.6 BRB International

- 6.4.7 Buckman

- 6.4.8 CLARIANT

- 6.4.9 Croda International Plc

- 6.4.10 Dow

- 6.4.11 Eastman Chemical Company

- 6.4.12 ELEMENTIS PLC

- 6.4.13 Elkem ASA

- 6.4.14 Evonik Industries AG

- 6.4.15 Kemira

- 6.4.16 SAN NOPCO LIMITED

- 6.4.17 Solvay

- 6.4.18 Wacker Chemie AG