|

市場調査レポート

商品コード

1851538

活性炭:市場シェア分析、産業動向、統計、成長予測(2025年~2030年)Activated Carbon - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 活性炭:市場シェア分析、産業動向、統計、成長予測(2025年~2030年) |

|

出版日: 2025年07月01日

発行: Mordor Intelligence

ページ情報: 英文 240 Pages

納期: 2~3営業日

|

概要

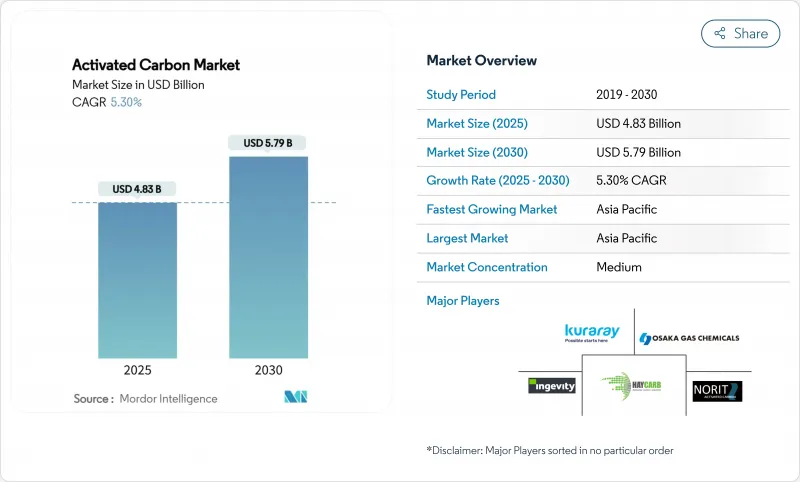

活性炭の市場規模は2025年に48億3,000万米ドルと推定・予測され、2030年には57億9,000万米ドルに達すると予測され、予測期間(2025-2030年)のCAGRは5.30%です。

厳しい水質規制、アジア太平洋における急速な工業化、製薬、鉱業、高度空気ろ過プロセスにおける特殊グレードの需要増加が成長を後押しします。ヤシ殻原料は依然として高性能グレードの高級原料であるが、供給の逼迫と石炭価格の変動が垂直統合と代替前駆物質の探求に拍車をかけています。特に米国環境保護庁(EPA)の2024年PFAS飲料水基準では、粒状活性炭(GAC)が利用可能な最善の技術(Best Available Technology)として指定されています。同時に、粉末状の活性炭(PAC)は石炭火力発電の水銀排出抑制において極めて重要であり、木質系カーボンは持続可能な生産のブレークスルーによって投資を集めています。原材料の確実性を確保し、再活性化能力に投資し、デジタル監視サービスをバンドルできるメーカーは、今後の契約を獲得するために最適な立場にあります。

世界の活性炭市場の動向と洞察

飲料水のPFASコンプライアンス規制

米国EPAの2024年4月の全国一次飲料水規制は、6種類のPFAS化合物に上限を設定し、GACを利用可能な最善の技術として正式にリストアップし、すべての米国の公共水道システムに2027年にモニタリングを開始し、2029年までに完全に遵守することを義務付けた。この義務化により、PFOAとPFOSの除去効率は99%を超え、活性炭システムの年間市場規模は15億5,000万米ドルに達すると予測されています。PFASと微量汚染物質の閾値強化に備える欧州の電力会社は、これらの仕様の複製を始めており、米国と日本のサプライヤーに輸出の窓口を作っています。システムの改修は、GAC媒体、ステンレス鋼コンタクター、現場での再活性化サービス契約を統合し、複数年の交換量を固定することが多いです。迅速な再活性化キルンとデジタルベッド寿命分析を持つサプライヤーは、入札評価の際に競争上の優位性を得ることができます。

石炭火力発電の大気汚染防止

北米では現在、55GWを超える発電容量に相当する135以上のプラントが、90%以上の水銀捕獲を達成する粉末炭素噴射システムを導入しています。EPAの2024年5月の技術見直しは、許容される水銀と粒子状物質の規制値をさらに狭め、湿式スクラバーのアップグレードに投資したくない所有者にとって、PACが最も低コストの改修となります。中国の規制当局も排ガス規制を再編成しており、小型ボイラー向けの吸着ベースのソリューションを加速させています。高い噴射温度と厳しい着火損失閾値に合わせた粉末配合は供給不足に陥っているため、気孔の閉塞に強い米国産ココナッツシェルPACグレードのプレミアム価格が可能になっています。

ココナツ殻の原料供給途絶

熱帯諸国は世界のココナツ殻炭の80%以上を供給しているが、フィリピンのサイクロンによる収穫の後退により、2024年中の原料供給が減少します。Carbon Activated Corporationのような生産者は垂直統合を加速させ、スリランカに2つ目のチャー工場を開設する一方、中国のシェル・チャー輸出業者とオーバーフロー供給契約を結びました。不測の事態に備え、広葉樹のチップやパーム核の殻を使用することも検討されているが、こうした代替品では細孔分布が広くなり、PFASや貴金属イオンの除去効率が低下することが多いです。

セグメント分析

ヤシ殻製品は2024年の活性炭市場の36.5%を占め、PFAS吸着と金担持作業に優れた微細孔分布を反映しています。99%を超える硬度は逆洗時のフラグメンテーションを最小限に抑え、自治体フィルターの床寿命を延ばします。しかし、アジア太平洋の工場拡張はシェル・チャーをめぐって熾烈な競争を繰り広げ、2024年の天候不順は単独調達の脆弱性を浮き彫りにしました。

持続可能な森林認証制度と、高いヨウ素価をもたらす熱分解の改良を背景に、CAGRが5.8%で上昇しています。石炭系は、微細孔の容積がそれほど重要でない排ガスや溶剤回収の用途では、依然としてコスト効率が高いです。有望ではあるが、汚泥やおがくず由来の炭化物に関する学術的研究はまだパイロット・スケールであり、主流の生産者は従来の前駆物質に依存しています。

粒状製品は、再活性化能力と充填ベッドでの一貫したヘッドロス性能により、2024年には圧倒的な50%のシェアを占め、2030年までのCAGRは6.33%と最も高くなると予想されます。押出/ペレット化カーボンは、溶剤蒸気吸着、圧縮空気乾燥、自動車キャニスターなど、低圧力損失と高い破砕強度が最も重要な用途に対応します。革新的な気相法GACユニットは、電気ヒーターを使用してその場でベッドを再生する温度スイング吸着を統合しています。

粉末グレードは、再利用性は低いもの、数時間以内に濁った水源を処理できる災害救助用水パックに代表されるように、迅速に供給される高表面積製品を必要とする市場でシェアを獲得しています。ペレット化製品は現在、バイオガス浄化に軸足を移しており、欧州の埋立地ガス処理業者は、硫化水素除去用の硫黄含浸添加剤を注入したペレットを調達しています。長期的には、環境廃棄規則とカーボンフットプリント会計によって、経済性は再生可能なGACシステムへとさらに傾き、活性炭市場成長への貢献が大きくなる可能性があります。

地域分析

アジア太平洋地域は、2024年の収益シェアで63%を占め、2030年までのCAGRは6.11%で成長すると予測され、活性炭市場拡大の中心的存在となっています。中国は、ヤシ殻、石炭、おがくずを国内の水道事業や輸出市場に合わせた幅広いカーボンに変換する垂直統合型プラントで地域生産を支えています。インドのJal Jeevanミッションは、農村部での普遍的な水利用を目標としており、ヒ素とフッ素除去用のGACフィルターを規定する入札書類を発行しています。

北米は、規制の確実性と一人当たりの消費量の多さに支えられています。2024年のEPA PFAS規則だけでも、10年末までにGAC需要が倍増する可能性があります。欧州は、規模は小さいが技術的に洗練された市場です。ケンブリッジ大学の調査では、エネルギー投入量を抑えながら空気中のCO2を直接吸着する電化木炭スポンジが開発され、気候緩和用途への将来の多様化を示唆しています。

南米と中東では、採掘やガス処理に使用される炭素の採用が急速に進んでいます。チリの金採掘業者はCIL回路にココナッツ・シェル・カーボンを指定し、カタールのLNG製造業者は低温分離前の厳しい水銀仕様の汚染制限を満たすためにペレット化カーボンを採用しています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- 米国における水処理用途の厳しい環境規制への対応

- 大気汚染防止(特に水銀除去)の注目度アップ

- 高まる浄水需要

- 金採掘と金属回収

- 農業と農薬からの高い需要

- 市場抑制要因

- ヤシ殻原料のサプライチェーン混乱

- 焼成炭価格の高騰が石炭系PACメーカーの利幅を狭める

- 循環型ビジネスモデルを制限する再稼働工場の高い資本集約度

- バリューチェーン分析

- ポーターのファイブフォース

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競合の程度

第5章 市場規模と成長予測

- 原材料別

- 石炭ベース

- ココナッツ殻ベース

- ウッドベース

- その他原料(泥炭、褐炭など)

- 形態別

- 粉末活性炭(PAC)

- 粒状活性炭(GAC)

- 押出/ペレット化活性炭(EAC)

- 用途別

- 脱色処理

- 砂糖生産量

- 濃縮処理

- 溶剤回収

- PFAS吸着処理

- 飲料水処理

- その他の用途

- エンドユーザー業界別

- 水処理

- 工業加工

- ヘルスケア

- 飲食品

- 自動車

- その他のエンドユーザー業界

- 地域別

- アジア太平洋地域

- 中国

- インド

- 日本

- 韓国

- その他アジア太平洋地域

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他欧州地域

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 中東・アフリカ

- サウジアラビア

- 南アフリカ

- その他の中東・アフリカ

- アジア太平洋地域

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア分析

- 企業プロファイル

- Albemarle Corporation

- Arq, Inc.

- Carbon Activated Corporation

- CarboTech

- CPL

- Donau Carbon GmbH

- HAYCARB PLC

- Ingevity

- KALPAKA CHEMICALS

- KURARAY CO., LTD.

- MICBAC INDIA

- Nanping Yuanli Active Carbon Company

- Norit

- Osaka Gas Chemicals Co., Ltd

- Rotocarb

- Silcarbon Aktivkohle GmbH

- Suneeta Carbons