|

市場調査レポート

商品コード

1906963

ポリエチレンテレフタレート(PET):市場シェア分析、業界動向と統計、成長予測(2026年~2031年)Polyethylene Terephthalate (PET) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| ポリエチレンテレフタレート(PET):市場シェア分析、業界動向と統計、成長予測(2026年~2031年) |

|

出版日: 2026年01月12日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

概要

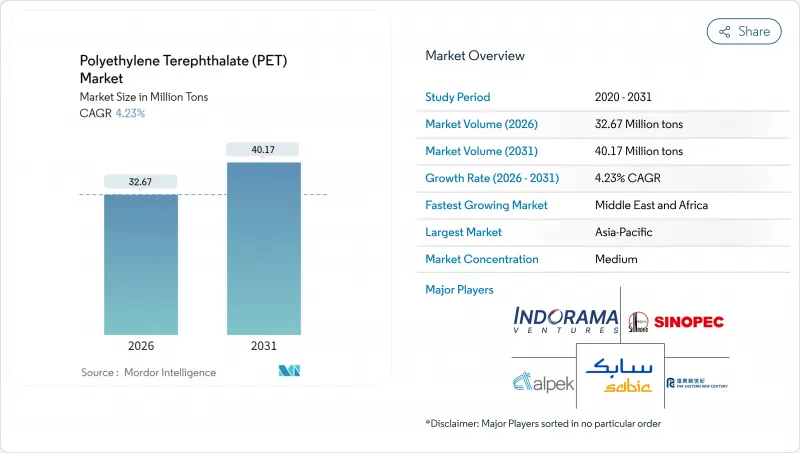

ポリエチレンテレフタレート(PET)市場の規模は、2026年には3,267万トンに達すると予測されております。

これは2025年の3,134万トンから成長した数値であり、2031年には4,017万トンに達すると見込まれております。2026年から2031年にかけての年間平均成長率(CAGR)は4.23%と予測されております。

成長は、バリア性能、コスト競争力、リサイクル可能性のバランスに支えられており、電子機器やテクニカルテキスタイルでの応用範囲が広がる中でも、飲料包装における役割を強化しています。アジア太平洋地域での堅調な需要、再生材使用に関する規制要件の拡大、化学的リサイクル技術の進歩が、数量拡大の基盤となっています。ブランドオーナーの持続可能性への取り組みは再生ポリエチレンテレフタレート(rPET)の安定的な需要創出につながり、一方、新興市場におけるコスト重視の調達姿勢はバージン樹脂の需要を持続させています。原料価格の変動やPEF(ポリエチレンフラノエート)やアルミニウムによる代替品の脅威が逆風となるもの、クローズドループシステムや特殊グレードへの投資により、PET(ポリエチレンテレフタレート)市場は多様な成長の基盤を整えています。

世界のポリエチレンテレフタレート(PET)市場の動向と洞察

ボトルからボトルへのクローズドルーグリサイクルへの移行

2024年、欧州におけるポリエチレンテレフタレート(PET)飲料ボトルの回収率は75%に達し、新規ボトルへの再生材含有率は24%に上昇。2025年末に発効予定の25%義務化基準に近づいています。トレイ用途から転用された高品質フレークが地域供給を逼迫させ、欧州の再生ポリエチレンテレフタレート(rPET)プレミアムはバージン樹脂比でトン当たり750~800米ドル前後の高値を維持しています。機械的リサイクルの限界が触媒分解・熱分解技術への投資を促進する一方、スケールアップコストと原料変動性が即時的な効果を抑制しています。多国籍企業は原料確保のためインフラへの共同出資を継続し、ポリエチレンテレフタレート(PET)市場における長期調達戦略を再定義しています。

新興市場における無菌・高温充填PET包装の急成長

東南アジアやラテンアメリカの新興市場では、コールドチェーンの不足が続く中、ヒートセットボトルの導入が加速しています。ポリエチレンテレフタレート(PET)の耐熱性により、ジュースや乳飲料の常温保存が可能となり、電力供給が不安定な地域での腐敗を減少させています。ヒートセットグレードの高価格化は、専用設備を有する既存メーカーに有利に働きます。一方、規制当局は無菌包装を食品安全政策の柱として位置付ける傾向を強めております。この動向により、ポリエチレンテレフタレート(PET)市場の適用範囲は炭酸飲料を超えて拡大し、地域ごとの樹脂コンバーターがストレッチブロー成形設備のアップグレード投資を推進する後押しとなっております。

パラキシレン(PX)およびモノエチレングリコール(MEG)原料価格の変動性

パラキシレン(PX)とモノエチレングリコール(MEG)はPET変動費の約85%を占め、マージンは原油価格の変動に連動します。アジアの統合型複合施設は物流面で優位性を有する一方、欧州および北米のメーカーは運賃とエネルギーコストのプレミアムを吸収しています。地政学的混乱と輸送制約により、地域間の価格差が拡大し、単独プラントの輸出競争力が低下しています。ヘッジ手段は部分的な緩和策となりますが、契約の複雑化を招き、特に財務基盤が脆弱な小規模コンバーターにとっては負担となります。

セグメント分析

2025年の世界出荷量のうち、コスト効率と均一な品質からバージン樹脂が76.10%(約2,385万トン)を占めました。再生PETは750万トン弱ながら、規制義務やブランド目標による需要増で8.02%という最も高いCAGRが見込まれています。欧州は導入を主導し、2024年には現地生産の再生PETの39%がボトルに再利用されました。しかし原料不足と分別収集の課題により、北米ではバージン樹脂比でトン当たり150~200米ドル、EU(欧州連合)では最大800米ドルの価格プレミアムが持続しています。

機械的リサイクルにおける着色や汚染物質の制限が化学的脱重合への関心を加速させていますが、資本集約性により2028年以前の広範な展開は困難です。食品グレードペレット化ラインへの投資により利用可能な再生PET比率が拡大し、コスト差が縮小しています。バージン供給業者は自社リサイクル施設でヘッジを行い、ベール原料の確保を図っており、進化するPET市場においてバージンと再生材の連続体における競争構造が再構築されています。

ポリエチレンテレフタレート(PET)市場レポートは、原料タイプ別(バージンPETと再生PET)、エンドユーザー産業別(自動車、建築・建設、電気・電子、産業・機械、その他エンドユーザー産業)、地域別(北米、南米、欧州、アジア太平洋、中東・アフリカ)に分類されています。市場予測は、数量(トン)および金額(米ドル)で提供されます。

地域別分析

アジア太平洋地域は、統合された原料供給能力と急成長する消費者需要により、2025年の生産量の47.10%(約1,480万トン)を占め、市場を牽引しています。中国は最大の生産拠点を維持する一方、インドでは包装食品市場の成長とリサイクル投資により消費が加速しています。インドネシアやタイなどの東南アジア諸国は、地域の飲料・繊維産業拠点に対応するため生産能力を拡充しています。Indorama Ventures社はVarun Beverages社との合弁事業を通じて現地での事業基盤を強化し、規模拡大と現地市場へのアクセスを両立させる戦略を示しました。

欧州と北米は生産量こそ少ないもの、再生PET(rPET)導入を促進する規制枠組みにおいて主導的役割を果たしています。EUでは2024年にPETボトルリサイクル率75%を達成し、国内の再生PET需要を世界水準を上回る水準に押し上げました。高いエネルギー・労働コストが現地生産者を圧迫する一方、低炭素包装を求めるブランドオーナーとの地理的近接性が、高付加価値の特殊製品生産を支えています。北米はシェール由来原料の経済性に恵まれますが、アジアからの輸入圧力により利益率の伸びは抑制され、PET市場での競争力を維持するため、生産者はテクニカルグレードや再生グレードへの転換を迫られています。

中東・アフリカ地域は5.05%という最速のCAGRが見込まれています。湾岸地域の生産者は有利な原料を活用し、ボルージュ社などの企業は2028年までに年間660万トンを超える生産能力を計画しており、アジアやアフリカへの輸出を目標としています。都市化とインフラ投資に伴い、特にボトル入り飲料水や乳飲料向けの国内需要が増加しています。政治的不安定や水不足といった課題は存在するもの、原料コスト面での優位性と欧州・アジア間の地理的位置は、戦略的な輸送ルートを提供しています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- アナリストによる3ヶ月間のサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- ボトルからボトルへのクローズドループリサイクルへの移行

- 新興市場における無菌・ホットフィルPET包装の急速な成長

- テクニカルテキスタイルにおけるフィラメントグレードPETの拡大

- ブランドオーナーによる2030年までに50%の再生ポリエチレン(rPET)含有率達成の誓約

- 使い捨てプラスチック代替に関する政府の義務付け

- 市場抑制要因

- PX及びMEG原料価格の変動性

- ボトルから繊維へのダウンサイクリング供給過剰リスク

- PEFおよびアルミニウムによる代替品の脅威

- バリューチェーン分析

- ポーターのファイブフォース

- 新規参入業者の脅威

- 供給企業の交渉力

- 買い手の交渉力

- 代替品の脅威

- 競争企業間の敵対関係

- 輸入・輸出動向

- 価格動向

- 形態の動向

- リサイクル概要

- 規制の枠組み

- 最終用途セクター動向

- 航空宇宙(航空宇宙部品生産収益)

- 自動車(自動車生産台数)

- 建築・建設(新築床面積)

- 電気・電子機器(電気・電子機器生産収益)

- 包装(プラスチック包装量)

第5章 市場規模と成長予測(金額ベースおよび数量ベース)

- 原料タイプ別

- バージンPET

- 再生PET(rPET)

- エンドユーザー産業別

- 自動車

- 建築・建設

- 電気・電子機器

- 産業・機械

- 包装

- その他のエンドユーザー産業

- 地域別

- アジア太平洋地域

- 中国

- インド

- 日本

- 韓国

- オーストラリア

- マレーシア

- その他アジア太平洋地域

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- フランス

- 英国

- イタリア

- ロシア

- その他欧州地域

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 中東・アフリカ

- サウジアラビア

- アラブ首長国連邦

- 南アフリカ

- ナイジェリア

- その他中東・アフリカ地域

- アジア太平洋地域

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア(%)/ランキング分析

- 企業プロファイル

- Alpek S.A.B. de C.V.

- CR Chemical Materials Technology Inc.

- Far Eastern New Century Co., Ltd.

- Hengli Group Co. Ltd

- Indorama Ventures Public Company Limited.

- LOTTE Chemical CORPORATION

- Mitsubishi Chemical Group Corporation

- NAN YA Plastics Industrial Co., Ltd.

- Reliance Industries Limited

- SABIC

- Sanfangxiang Group Co., Ltd.

- Sinopec(China Petrochemical Corporation)

- Zhejiang Hengyi Group Co., Ltd.

- Zhink Group Co., Ltd.