|

市場調査レポート

商品コード

1685702

世界の局所麻酔薬の市場シェア分析、産業動向と統計、成長予測(2025年~2030年)Global Local Anesthesia Drugs - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 世界の局所麻酔薬の市場シェア分析、産業動向と統計、成長予測(2025年~2030年) |

|

出版日: 2025年03月18日

発行: Mordor Intelligence

ページ情報: 英文 127 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

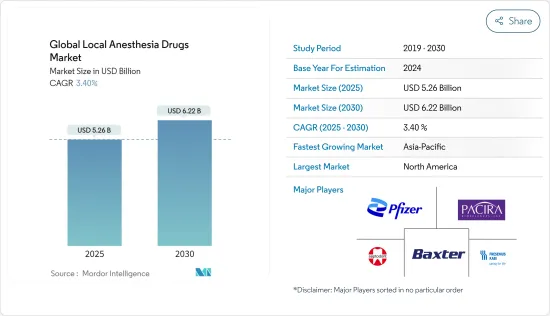

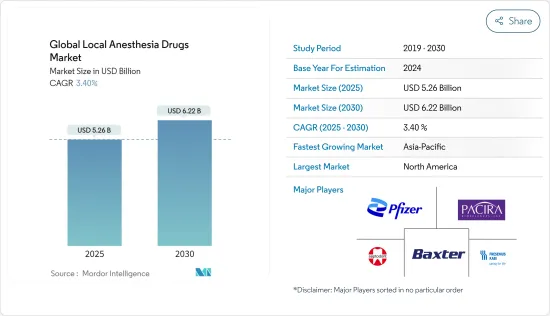

局所麻酔薬の世界市場規模は2025年に52億6,000万米ドルと推定され、予測期間(2025年~2030年)のCAGRは3.4%で、2030年には62億2,000万米ドルに達すると予測されます。

COVID-19に感染した患者の治療における局所麻酔の使用は、その利点とウイルス感染のリスクの最小化により、高い需要があります。さらに、「COVID-19の口腔咽頭サンプリングのための局所リグノカイン麻酔」と題された2020年10月に発表された論文によると、局所口腔咽頭リグノカイン塗布は、COVID-19の口腔咽頭サンプリング中の患者の快適レベルを有意に増加させ、上気道のSARS-CoV-2の検出には影響しませんでした。したがって、本研究は、COVID-19感染が疑われる人のウイルス接種サンプリングを減らすための対策として、局所口腔咽頭リグノカインを考慮すべきことを示唆しました。このような研究は、COVID-19患者の治療における局所麻酔薬の投与と使用を世界的に後押しすると思われます。

さらに、局所麻酔薬市場の成長は、手術件数の増加、麻酔薬の新規承認、術後疼痛における局所麻酔薬の使用の増加など、さまざまな要因によって牽引されています。手術件数の増加は、調査期間中の市場成長を牽引する主要因でした。例えば、米国形成外科学会(American Society of Plastic Surgeons)による「形成外科統計レポート」によると、2020年に米国で実施された美容整形手術の総数は2,314,720件であり、この中には211,067件の脂肪吸引手術が含まれています。このような手術では局所麻酔が広く使用されるため、このような手術件数の増加は麻酔薬の需要を促進します。さらに、新規局所麻酔薬の開発と承認は、市場企業にとって新たな収益源となることが証明されつつあります。例えば、2021年2月、ペインパスは、慢性疼痛を持つ人々をターゲットとし、筋肉を外部から麻痺させるための最初のカンナビジオール(CBD)/リドカイン製品ラインを発売しました。

しかし、これらの薬剤の副作用と厳格な規制の枠組みは、調査された市場を抑制すると予想されます。

局所麻酔薬市場の動向

ブピバカインは予測期間中に大幅な成長が見込まれる

薬剤の種類別では、ブピバカインが予測期間中に大きな成長を遂げる見込みです。ブピバカインは、痛みの信号を脳に送る神経インパルスを遮断する局所麻酔薬として使用される処方薬です。この注射は、手術や診断、治療、産科処置など、いくつかの処置の局所麻酔や局部麻酔として使用されます。したがって、世界的に手術件数が増加していることから、近い将来、ビプビケインの需要が高まると思われます。

さらに、複数の市場企業が戦略的イニシアチブの実施に取り組んでおり、それによって市場の成長に寄与しています。例えば、2021年3月に米国食品医薬品局(FDA)は、Pacira BioSciences Inc.が提出したExparel(ブピバカインリポソーム注射用懸濁液)の小児患者への使用拡大に関する追加新薬承認申請(sNDA)を承認しました。したがって、手術件数の増加や製品開発がビプビカインの需要を増大させており、予測期間中の同分野の成長を促進すると予想されます。

北米が市場を独占し、予測期間中も支配が続く見込み

北米では米国が市場の主要シェアを占めています。これは、手術件数の増加、慢性疾患を患う高齢化人口の増加、術後疼痛における局所麻酔薬の使用の増加、麻酔投与の進歩などに起因しています。例えば、米国形成外科学会(ASPS)によると、2020年には、10~29歳で約76万8000件の美容整形手術が行われ、40~54歳では610万件の美容整形手術が行われました。これらの統計は、この地域で外科手術が絶えず増加しており、最終的に麻酔薬の需要を牽引していることを示しています。

さらに、複数の市場企業が戦略的イニシアチブの実施に取り組んでおり、これが市場成長に寄与しています。例えば、2021年12月、Hikma Pharmaceuticals PLC(Hikma)は、米国の関連会社Hikma Pharmaceuticals USA Inc.を通じてブピバカイン塩酸塩注射液USPを発売しました。同社は10ミリリットルと30ミリリットルの用量で0.25%、0.5%、0.75%を発売しました。

こうした開発は、麻酔薬を使用する手術件数の増加と相まって、同地域の市場成長を後押しすると予想されます。

局所麻酔薬産業の概要

局所麻酔薬市場は、複数の世界企業が参入しており、市場競争は激しいです。各社は市場シェアを拡大するため、大規模な提携、合併、買収に注力しています。主な市場企業は、Fresenius SE &Co.KGaA、Septodont、Pfizer Inc.、Baxter International Inc.、Pacira Pharmaceuticals Inc.です。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 市場概要

- 市場促進要因

- 手術件数の増加

- 麻酔薬の新規承認

- 術後疼痛に対する局所麻酔薬の使用拡大

- 市場抑制要因

- 麻酔薬の副作用

- 規制の枠組み

- ポーターのファイブフォース分析

- 新規参入業者の脅威

- 買い手・消費者の交渉力

- 供給企業の交渉力

- 代替品の脅威

- 競争企業間の敵対関係の強さ

第5章 市場セグメンテーション

- 薬剤タイプ別

- ブピバカイン

- リドカイン

- ベンゾカイン

- ロピバカイン

- プリロカイン

- クロロプロカイン

- その他の薬剤

- 投与方法別

- 注射剤

- 表面麻酔薬

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他の欧州

- アジア太平洋

- 中国

- 日本

- インド

- オーストラリア

- 韓国

- その他のアジア太平洋

- 中東・アフリカ

- GCC

- 南アフリカ

- その他の中東・アフリカ

- 南米

- ブラジル

- アルゼンチン

- その他の南米

- 北米

第6章 競合情勢

- 企業プロファイル

- Baxter International Inc.

- Fresenius SE & Co. KGaA

- Glenmark Pharmaceutical Inc.

- Mylan NV

- Pacira Pharmaceuticals Inc.

- Pfizer Inc.

- Septodont

- Teva Pharmaceutical Industries Ltd

- Aspen Pharmacare

- Nuventra Pharma Sciences

- Endo Pharmaceuticals

- Actavis

第7章 市場機会と今後の動向

The Global Local Anesthesia Drugs Market size is estimated at USD 5.26 billion in 2025, and is expected to reach USD 6.22 billion by 2030, at a CAGR of 3.4% during the forecast period (2025-2030).

The use of local anesthesia in treating patients infected with COVID-19 is in high demand due to its benefits and minimal risk of viral transmission. Additionally, as per an article published in October 2020, titled "Topical Lignocaine Anesthesia for Oropharyngeal Sampling for COVID-19," topical oropharyngeal lignocaine applications significantly increased comfort levels for the patient during oropharyngeal sampling for COVID-19 and did not affect the detection of SARS-CoV-2 in the upper airway. Thus, the study suggested that topical oropharyngeal lignocaine should be considered as a measure to reduce the viral inoculum sampling of a person suspected of being infected by COVID-19. Such studies are likely to boost the administration and use of local anesthesia drugs in treating COVID-19 patients globally.

Further, the growth of the local anesthesia drugs market is driven by various factors such as the rising number of surgeries, new approval of anesthetic drugs, and the growing use of local anesthetics in post-operative pain. The increasing number of surgeries was a major factor driving the market growth over the study period. For instance, as per the Plastic Surgery Statistics Report by the American Society of Plastic Surgeons, in 2020, the total number of cosmetic procedures performed were 2,314,720, including 211,067 procedures of liposuction in the US. As local anesthesia is widely used in such procedures, the growth in the number of such surgeries performed will propel the demand for anesthesia drugs. Furthermore, the development and approvals of novel local anesthesia drugs are proving to be a new revenue-generating resource for market players. For instance, in February 2021, PainPass launched the first Cannabidiol (CBD)/lidocaine product line targeting those with chronic pain and for numbing muscles externally.

However, the side effects of these drugs and strict regulatory framework are expected to restrain the market studied.

Local Anesthesia Drugs Market Trends

Bupivacaine Expected to Register Significant Growth over the Forecast Period

By drug type, bipuvicane is expected to witness significant growth over the forecast period. Bupivacaine is a prescription medication used as a local anesthetic to block the nerve impulses that send pain signals to the brain. This injection is used as an anesthetic for local and regional anesthesia for several procedures, such as surgery and diagnostic, therapeutic, and obstetrical procedures. Thus, the growing number of surgeries globally will fuel the demand for bipuvicane in the near future.

Furthermore, several market players are engaged in implementing strategic initiatives, thereby contributing to market growth. For instance, in March 2021, the US Food and Drug Administration (FDA) approved a supplemental new drug application (sNDA) submitted by Pacira BioSciences Inc. for the expanded use of its Exparel (Bupivacaine Liposome Injectable Suspension) in pediatric patients. Hence, the increasing number of surgeries and product developments is augmenting the demand for bipuvicane, and it is expected to propel the segment's growth over the forecast period.

North America Dominates the Market and Expected to Continue Dominance over the Forecast Period

Within North America, the US holds the major share of the market. This can be attributed to the increasing number of surgeries, the rising aging population suffering from chronic conditions, the growing use of local anesthetics in post-operative pain, and advancements in anesthesia administration. For instance, according to the American Society of Plastic Surgeons (ASPS), in 2020, about 768,000 total cosmetic procedures were performed in people aged 10-29 years, and 6.1 million total cosmetic procedures were performed among the age group of 40-54-year-olds. These statistics indicate that surgical procedures are constantly increasing in the region, ultimately driving the demand for anesthesia drugs.

Moreover, several market players are also engaged in implementing strategic initiatives, which are contributing to market growth. For instance, in December 2021, Hikma Pharmaceuticals PLC (Hikma) launched Bupivacaine HCl Injection USP through its US affiliate Hikma Pharmaceuticals USA Inc. The company launched 0.25%, 0.5%, and 0.75% in 10 milliliter and 30 milliliter doses.

Such developments coupled with growth in the number of surgeries using anesthesia drugs are anticipated to bolster market growth in the region.

Local Anesthesia Drugs Industry Overview

The local anesthesia drugs market is competitive with several global players operating in the market. Companies are focusing on major collaborations, mergers, and acquisitions in order to enhance their market share. The major market players are Fresenius SE & Co. KGaA, Septodont, Pfizer Inc., Baxter International Inc., and Pacira Pharmaceuticals Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definiton

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Number of Surgeries

- 4.2.2 New Approval of Anesthetic Drugs

- 4.2.3 Growing Use of Local Anesthetic for Post-operative Pain

- 4.3 Market Restraints

- 4.3.1 Side Effects of Anesthetic Drugs

- 4.3.2 Regulatory Framework

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size By Value - USD Million)

- 5.1 By Drug Type

- 5.1.1 Bupivacaine

- 5.1.2 Lidocaine

- 5.1.3 Benzocaine

- 5.1.4 Ropivacaine

- 5.1.5 Prilocaine

- 5.1.6 Chloroprocaine

- 5.1.7 Other Drug Types

- 5.2 By Mode of Administration

- 5.2.1 Injectable

- 5.2.2 Surface Anesthetic

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 US

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 UK

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 Middle-East and Africa

- 5.3.4.1 GCC

- 5.3.4.2 South Africa

- 5.3.4.3 Rest of Middle-East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Baxter International Inc.

- 6.1.2 Fresenius SE & Co. KGaA

- 6.1.3 Glenmark Pharmaceutical Inc.

- 6.1.4 Mylan NV

- 6.1.5 Pacira Pharmaceuticals Inc.

- 6.1.6 Pfizer Inc.

- 6.1.7 Septodont

- 6.1.8 Teva Pharmaceutical Industries Ltd

- 6.1.9 Aspen Pharmacare

- 6.1.10 Nuventra Pharma Sciences

- 6.1.11 Endo Pharmaceuticals

- 6.1.12 Actavis