|

|

市場調査レポート

商品コード

1443911

バイオシミラー:市場シェア分析、業界動向と統計、成長予測(2024~2029年)Global Biosimilars - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| バイオシミラー:市場シェア分析、業界動向と統計、成長予測(2024~2029年) |

|

出版日: 2024年02月15日

発行: Mordor Intelligence

ページ情報: 英文 116 Pages

納期: 2~3営業日

|

- 全表示

- 概要

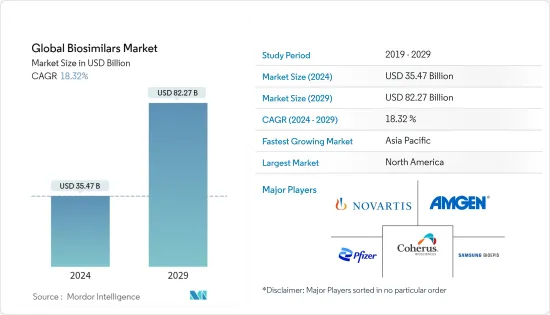

- 目次

世界のバイオシミラー市場規模は、2024年に354億7,000万米ドルと推定され、2029年までに822億7,000万米ドルに達すると予測されており、予測期間(2024年から2029年)中に18.32%のCAGRで成長します。

COVID-19がバイオシミラー市場に与える影響は重大である可能性があり、バイオシミラー開発に注力する製薬会社に大きな課題を課しています。現在のパンデミック中に新型コロナウイルス以外の治療薬の規制当局による承認が減少したことで、製品の承認と発売のプロセスが遅れ、市場の成長が妨げられると予想されています。さらに、2020年9月に発表された「がん治療に対するCOVID-19症の影響:世界規模の共同研究」と題された調査論文によると、がん治療センターのほぼ88%が、予防策など多くの理由から通常のがん治療を提供する上で課題に直面しています。、個人用保護具の不足、新型コロナウイルス感染症(COVID-19)による人員不足。バイオシミラーは専門家の投与が必要な注射薬であり、パンデミックの初期段階でサプライチェーンが大きく損なわれたため、市場の成長に大きな影響を与えました。したがって、COVID-19は、初期段階ではバイオシミラー市場の成長に影響を与えましたが、世界中でサプライチェーン活動と医薬品開発のための臨床試験が再開されたことで、今後数年間で市場の成長率が押し上げられると考えられます。

さらに、Truvada、Chantix、Forteo、Ciprodex、Afinitor、その他多くの医薬品など、大手製薬会社のいくつかの大ヒット生物製剤が2020年に米国独占権を失いました。今後10年間で、特許の有効期限が増加する見込みです。Erbitux、Avastin、Orenciaなどのいくつかの既存の生物学的医薬品は、多くの革新企業やジェネリックメーカーにとって、バイオシミラー向けに特別に調整されたサービスを提供する機会を提供するでしょう。さらに、バイオシミラーの費用対効果の高い性質、さまざまな利害関係者による受け入れと採用の増加、技術とビジネスモデルの多様化の必要性、慢性疾患の有病率の増加などの要因が、世界のバイオシミラー市場を推進すると予想されます。

さらに、がんの負担の増大とがんによる死亡の増加により、手頃な価格の治療の必要性が生じ、バイオシミラー市場の成長を促進します。たとえば、GLOBOCAN 2020によると、米国では、2020年に推定新規がん症例数が2,281,658人、死亡者数が約612,390人でした。さらに、主要な市場関係者は、製品発売などのさまざまな戦略的活動を通じて、予測期間中の市場の成長を予想していました。たとえば、2021年7月、食品医薬品局(FDA)は、LANTUS(insulin glargine)のバイオシミラーであるViatris Inc.(旧Mylan Pharmaceuticals Inc.)のSEMGLEE(insulin-glargine-yfgn)を承認しました。

一方で、代替性や互換性に関する懸念によるリスクが大きいことを考慮すると、承認のための明確な基準や適切な収益性の欠如などの要因により、多くの企業がこの市場への投資を思いとどまり、調査対象市場の成長が妨げられています。

バイオシミラー市場動向

オンコロジー部門は世界のバイオシミラー市場で主要なシェアを保持

腫瘍学分野はバイオシミラー市場で主要なシェアを握ると予想されており、世界のがんの発生率の高さが、予測期間中に調査対象分野の成長を促進する主な要因となっています。国際がん調査機関の2020年版によると、2020年の新規白血病症例数は世界全体で474,519人と推定されています。同じ情報源によると、この病気による死亡率も非常に高く、世界の死者数は合計 311,594人でした。さらに、国際がん調査機関(IARC)の推計によると、2040年までに世界のがんの負担は新たに2,750万人に増加し、世界中で1,630万人が死亡すると予想されています。がんの発生率の増加により、患者の効果的な治療のための先進的ながん治療薬の必要性が高まることが予想されます。

さらに、腫瘍学に焦点を当てた主要企業による研究開発活動の増加と、さまざまな規制当局による承認の増加が、調査対象市場の成長を促進すると予想されます。たとえば、2020年12月、Amgenは、非ホジキンリンパ腫、慢性リンパ性白血病、多発血管炎性肉芽腫症、顕微鏡的多発血管炎の成人患者の治療薬として、Rituxan(rituximab)のバイオシミラーであるRIABNI(rituximab-arrx)の承認を米国食品医薬品局(USFDA)から取得しました。さらに、2022年5月、Biocon Biologics Ltd.とViatris Inc.は、RocheのAvastin (Bevacizumab)のバイオシミラーであるAbevmy (Bevacizumab)の4つの腫瘍学適応症にわたってカナダ保健省から承認を取得しました。

したがって、上記の要因により、腫瘍学セグメントは予測期間中に大幅な成長を遂げると予想されます。

北米が主要シェアを占め、予測期間中にバイオシミラー市場を独占すると予想される

北米では、バイオシミラー市場において予測期間中に大幅なCAGRが観察されると予想されます。この地域の調査対象市場の成長を促進する主な要因には、がんなどの慢性疾患の発生率が高いこと、および大手企業による研究開発活動への投資の増加が含まれます。 GLOBOCAN 2020によると、2020年に米国で新たにがんと診断された患者数は2,281,658人で、死亡者は612,390人でした。すべてのがんの中で最も発生率が高かったのは乳がんの25万3,465件で、次いで肺がん(22万7,875人)、前立腺がん(20万9,512人)、結腸がん(10万1,809人)となりました。

さらに、北米は、Pfizer Inc.、Mylan NV, Amgen Inc.、Coherus Biosciences Inc.など、市場の多くの主要企業のハブとなっています。製品パイプラインの増加と新製品の上市は、この地域の市場成長を増加させます。例えば、2020年6月、Pfizer Inc.はペグフィルグラスチムのバイオシミラーであるNyvepriaの米国における承認を取得しました。さらに2021年2月、Coherus BioSciencesは、Humira(adalimumab)のバイオシミラー候補品、CHS-1420の351(k)を生物製剤承認申請(BLA)が米国食品医薬品局(FDA)に受理されたと報告しました。

したがって、北米ではがんなどの慢性疾患の発生率が高く、研究開発活動が増加しているため、市場は予測期間中に大幅に成長すると予想されます。

バイオシミラー業界の概要

バイオシミラー市場は競争が激しく、多くの主要企業が市場を独占しています。調査対象市場の主要企業には、Novartis AG、Pfizer Inc.、Amgen Inc.、Coherus Biosciences Inc.、Mylan NV(Viatris Inc.)、およびSamsung Bioepisなどが含まれます。ほとんどの市場参加者は、世界市場での地位を確保するために、買収、提携、新製品の発売など、さまざまな成長戦略を採用しています。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3か月のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 市場概要

- 市場促進要因

- 今後5~10年間でいくつかの大ヒットバイオ医薬品が特許切れに

- 慢性疾患の負担の増大と研究開発投資の増加

- 費用対効果の高さからバイオシミラー医薬品の需要が増加

- 市場抑制要因

- 代替性と互換性に関する懸念

- 規制の不確実性とバイオベッターズとの競合の激化

- 製造における高コストの関与と複雑さ

- ポーターのファイブフォース分析

- 新規参入業者の脅威

- 買い手の交渉力

- 供給企業の交渉力

- 代替製品の脅威

- 競争企業間の敵対関係の激しさ

第5章 市場セグメンテーション

- 製品クラス別

- モノクローナル抗体

- 組換えホルモン

- 免疫調節剤

- 抗炎症剤

- 他の製品クラス

- 用途別

- 血液疾患

- 成長ホルモン欠乏症

- 慢性疾患および自己免疫疾患

- 腫瘍学

- その他の用途

- 地域

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他欧州

- アジア太平洋

- 中国

- 日本

- インド

- オーストラリア

- 韓国

- その他アジア太平洋地域

- 中東とアフリカ

- GCC

- 南アフリカ

- その他中東およびアフリカ

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 北米

第6章 競合情勢

- 企業プロファイル

- Pfizer Inc.

- Eli Lilly and Company

- Celltrion Healthcare

- Viatris Inc.(Mylan)

- Novartis AG

- Samsung Bioepis Co. Ltd

- Stada Arzneimittel AG

- Teva Pharmaceutical Industries Ltd

- Intas Pharmaceutical Ltd

- LG Life Sciences(LG Chem)

- Biocon Limited

- Amgen Inc.

- Dr. Reddy's Laboratories

- Coherus Biosciences Inc.

- Biocad

第7章 市場機会と将来の動向

The Global Biosimilars Market size is estimated at USD 35.47 billion in 2024, and is expected to reach USD 82.27 billion by 2029, growing at a CAGR of 18.32% during the forecast period (2024-2029).

The impact of COVID-19 on the biosimilars market may be significant, and it has imposed a great challenge on the pharmaceutical companies focused on biosimilar development. The reduction in the approval by regulatory bodies of non-COVID therapeutics during the current pandemic is expected to delay the process of product approvals and launches, hindering the market's growth. Additionally, as per the research article titled "Impact of Covid-19 on Cancer Care: A Global Collaborative Study" published in September 2020, nearly 88% of the cancer care centers faced challenges in delivering usual cancer care for many reasons, including preventive measures, lack of personal protective equipment, and staff shortages due to COVID-19. As biosimilars are injections that need experts to be administered and also as the supply chain was greatly impaired in the early pandemic phase, it has significantly impacted the market growth. Therefore, COVID-19 impacted the growth of the biosimilars market in its initial phase, however, the resumption of supply chain activities and clinical trials for drug development globally will boost the market growth rate over the coming years.

Moreover, several blockbuster biologic drugs of major pharmaceutical companies, such as Truvada, Chantix, Forteo, Ciprodex, Afinitor, and many other drugs, lost United States exclusivity in 2020. In the coming decade, there will be a rise in the patent expiration of several existing biological drugs, such as Erbitux, Avastin, and Orencia, which would provide an opportunity for many innovator companies as well as generic manufacturers to offer services specially tailored toward biosimilars. Besides, factors such as the cost-effective nature of biosimilars, rising acceptance and adoption by various stakeholders, the need for diversification in technology and business models, and the growing prevalence of chronic diseases are expected to drive the global biosimilar market.

Furthermore, the growing burden of cancer and increasing deaths due to it create the need for affordable treatment and thus boost the growth of the biosimilar market. For instance, according to GLOBOCAN 2020, in the United States, there were 2,281,658 estimated new cases of cancer and nearly 612,390 deaths in 2020. Additionally, the key market players anticipated market growth over the forecast period through various strategic activities, such as product launches, mergers, and acquisitions. For instance, in July 2021, the Food and Drug Administration (FDA) approved Viatris Inc.'s (formerly Mylan Pharmaceuticals Inc.) SEMGLEE (insulin-glargine-yfgn), a biosimilar to LANTUS (insulin glargine).

On the other hand, factors such as lack of definitive standards for approval and adequate profitability, given the greater risk with concerns regarding substitutability and interchangeability, discourage many companies from investing in this market, thus impeding the growth of the market studied.

Biosimilars Market Trends

The Oncology Segment Holds the Major Share in the Global Biosimilars Market

The oncology segment is expected to hold the major share in the biosimilars market, and the high incidence of cancers worldwide is the major factor driving the growth of the studied segment over the forecast period. According to the International Agency for Research on Cancer 2020, the estimated number of new leukemia cases in 2020 was 474,519 globally. According to the same source, the disease also had significantly high mortality, with a total global death toll of 311,594. Additionally, according to estimates from the International Agency for Research on Cancer (IARC), by 2040, the global burden of cancer is expected to grow to 27.5 million new cancer cases and 16.3 million deaths worldwide. The increasing incidence of cancer cases is expected to drive the need for advanced cancer drugs for the effective treatment of patients.

Additionally, the increasing research and development activities by key players focused on oncology, along with rising approvals by different regulatory bodies, are expected to drive the studied market's growth. For instance, in December 2020, Amgen received United States Food and Drug Administration (USFDA) approval for its RIABNI (rituximab-arrx), a biosimilar to Rituxan (rituximab), for the treatment of adult patients with non-Hodgkin's lymphoma, chronic lymphocytic leukemia, granulomatosis with polyangiitis, and microscopic polyangiitis. Moreover, in May 2022, Biocon Biologics Ltd. and Viatris Inc. received approval from Health Canada across four oncology indications for Abevmy (Bevacizumab), a biosimilar to Roche's Avastin (Bevacizumab).

Thus, because of the factors above, the oncology segment is anticipated to witness significant growth over the forecast period.

North America Holds the Major Share and is Expected to Dominate the Biosimilars Market Over the Forecast Period

North America is anticipated to observe a significant CAGR over the forecast period in the biosimilars market. The major factors driving the growth of the studied market in the region include the high incidence of chronic diseases, such as cancers, along with the increased investment in research and development activities by the major players. According to GLOBOCAN 2020, the number of new cancer cases diagnosed was 2,281,658 in the United States in 2020, with 612,390 deaths. Among all cancers, breast cancer had the highest incidence with 253,465 cases, followed by lung (227,875), prostate (209,512), and colon (101,809).

Moreover, North America is the hub for many key players in the market, such as Pfizer Inc., Mylan NV, Amgen Inc., and Coherus Biosciences Inc., among others. The increasing pipeline of products and new product launches increase the market growth in the region. For instance, in June 2020, Pfizer Inc. received United States approval for its pegfilgrastim biosimilar, Nyvepria, indicated for lowering infection incidence. Additionally, in February 2021, Coherus BioSciences, Inc. reported that the United States Food and Drug Administration ("FDA") has accepted for review the 351(k) Biologics License Application ("BLA") for CHS-1420, a Humira (adalimumab) biosimilar product candidate.

Thus, the market is expected to propel significantly over the forecast period in North America due to the high incidence of chronic diseases, such as cancer, and increasing R&D activities.

Biosimilars Industry Overview

The biosimilars market is highly competitive, with many key players dominating the market. The major players in the studied market comprise Novartis AG, Pfizer Inc., Amgen Inc., Coherus Biosciences Inc., Mylan NV (Viatris Inc.), and Samsung Bioepis Co., Ltd., among others. Most market players are adopting various growth strategies, such as acquisitions, partnerships, and new product launches, to secure their position in the global market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Several Blockbuster Biopharmaceuticals Going Off-patent over the Next Five to Ten Years

- 4.2.2 Growing Burden of Chronic Diseases and Increasing R&D Investments

- 4.2.3 Increasing Demand for Biosimilar Drugs Due to Their Cost Effectiveness

- 4.3 Market Restraints

- 4.3.1 Concerns Regarding Substitutability and Interchangeability

- 4.3.2 Regulatory Uncertainty and Growing Competition from Biobetters

- 4.3.3 High Cost Involvement and Complexities in Manufacturing

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD million)

- 5.1 By Product Class

- 5.1.1 Monoclonal Antibodies

- 5.1.2 Recombinant Hormones

- 5.1.3 Immunomodulators

- 5.1.4 Anti-Inflammatory Agents

- 5.1.5 Other Product Classes

- 5.2 By Application

- 5.2.1 Blood Disorders

- 5.2.2 Growth Hormonal Deficiency

- 5.2.3 Chronic and Autoimmune Disorders

- 5.2.4 Oncology

- 5.2.5 Other Applications

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 Middle East and Africa

- 5.3.4.1 GCC

- 5.3.4.2 South Africa

- 5.3.4.3 Rest of Middle East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Pfizer Inc.

- 6.1.2 Eli Lilly and Company

- 6.1.3 Celltrion Healthcare

- 6.1.4 Viatris Inc. (Mylan)

- 6.1.5 Novartis AG

- 6.1.6 Samsung Bioepis Co. Ltd

- 6.1.7 Stada Arzneimittel AG

- 6.1.8 Teva Pharmaceutical Industries Ltd

- 6.1.9 Intas Pharmaceutical Ltd

- 6.1.10 LG Life Sciences (LG Chem)

- 6.1.11 Biocon Limited

- 6.1.12 Amgen Inc.

- 6.1.13 Dr. Reddy's Laboratories

- 6.1.14 Coherus Biosciences Inc.

- 6.1.15 Biocad