|

市場調査レポート

商品コード

1852149

航空宇宙用複合材料:市場シェア分析、産業動向、統計、成長予測(2025年~2030年)Aerospace Composites - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 航空宇宙用複合材料:市場シェア分析、産業動向、統計、成長予測(2025年~2030年) |

|

出版日: 2025年09月03日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

概要

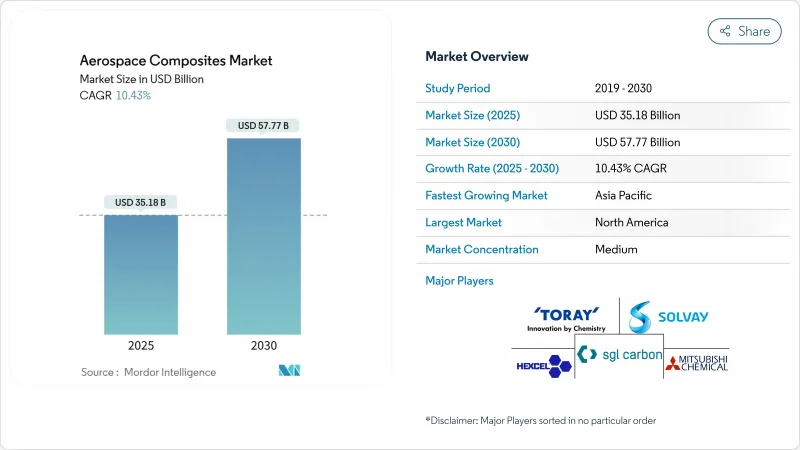

航空宇宙用複合材料市場の2025年の市場規模は351億8,000万米ドルで、2030年には577億7,000万米ドルに達すると予測され、予測期間中のCAGRは10.43%を記録します。

燃料効率を高める軽量構造への強い需要、極超音速計画の拡大、リサイクル可能な材料へのニーズの高まりが、市場を形成する中心的な力となっています。従来のレイアップラインの4~8倍のスループットを実現する自動繊維配置(AFP)システム、単通路のバックログにおける熱可塑性プラスチックの急速な普及、高温部品に対する航空機の電動化要件は、最も影響力のある促進要因のひとつです。主要な航空機OEMは、品質とコストを管理するために複合材生産を垂直統合しており、サプライヤー間の競争を激化させ、新規樹脂の認定サイクルを加速させています。アジアの製造基盤の拡大と電気推進への投資の増加は、この地域を市場で最も急成長するハブに変えています。

世界の航空宇宙用複合材料市場の動向と洞察

熱可塑性複合材の急速な採用

コリンズ・エアロスペース社は、熱可塑性プラスチック製航空構造体が生産サイクルを80%削減し、オートクレーブによる硬化を不要にし、ほぼ100%リサイクル可能であることを実証しています。同時に、アルケマとエクセルのパートナーシップにより、初の完全な熱可塑性民間航空機構造体が製造され、オートクレーブを使用しない大規模な製造が実証されました。熱可塑性プラスチックは、リサイクル性が高く、持続可能な社会の実現に貢献し、今後の市場拡大の礎となります。

次世代ナローボディ翼における炭素繊維の普及拡大

エアバスのeXtra Performance Wingのテストベッドは、抗力を低減しCO2を削減するために広範囲なCFRPスキンを組み込んでおり、長さ32mの炭素繊維ウィングスキンの製造可能性を示しています。北米のプログラムでは、欧州のCFRP使用量に匹敵するか、それを上回ることを目指し、並行して研究を進めています。アルミニウムと比較して最大50%の軽量化とAFPの処理能力向上は、滞貨の課題に直接対応します。

高いプリフォームとオートクレーブの資本コスト

航空宇宙グレードのオートクレーブには500万~1,000万米ドルのコストがかかり、大規模なインフラを必要とするため、ティア2からの参入を阻んでいます。オートクレーブ外での熱可塑性樹脂溶着と樹脂注入は、航空宇宙用複合材料市場全体でサプライヤーの参入を拡大できる、より低投資の代替手段として台頭しつつあります。

セグメント分析

炭素繊維は、成熟したサプライチェーンと優れた剛性対重量比により、2024年の航空宇宙用複合材料市場シェアの52.51%を維持した。しかしセラミック繊維は、1,500℃の耐熱性を求める極超音速機や宇宙船の需要に後押しされ、CAGR 10.92%でこのセグメントをリードしています。カーボンプライとセラミックプライを組み合わせたハイブリッドラミネートは、冷却空気の吸引量を25%削減することを目指すエンジンOEMの間で人気を集めています。現在評価中のグラフェン強化ロービングは、20~30%の弾性率向上を示すと同時に、ひずみ感知経路を埋め込んでおり、翼皮の自己監視に向けた一歩となっています。

ガラス繊維のコスト効率に優れた位置づけは、レドームやフェアリングのスキンに関連性を維持し、アラミド繊維は耐弾性ヘリコプターのフロアでシェアを維持しています。継続的な材料革新が市場の多様化を支えているが、炭素とセラミックは予測期間を通じて市場規模の基幹であり続ける。

熱硬化性エポキシとBMIシステムは、豊富な認定実績により2024年の売上高の46.12%を占めました。熱可塑性PEKKとPEIファミリーは、Collins Aerospaceが挙げた80%のサイクルタイム短縮が原動力となり、13.51%のCAGRで急伸しています。熱可塑性プラスチックの航空宇宙用複合材料市場規模は、AFPラインが現場での統合に軸足を移しているため、2030年までに170億米ドルを超えると予測されています。SHDコンポジットが開拓したバイオベース樹脂は、再生可能成分を100%近く含み、200℃の使用に耐えるため、環境目標と機械的完全性を両立させることができます。

FAAはすでにビジネスジェット機用の溶接熱可塑性樹脂製操縦面を承認しており、業界全体で使用事例の拡大が間近に迫っていることを示しています。

地域分析

北米は、ザ・ボーイング・カンパニー、GEエアロスペース、ロッキード・マーチン・コーポレーションを中心に、30.05%の市場シェアを占め、依然として最大の地域貢献国です。同地域は北米売上の約75%を占め、カナダのモントリオール・クラスターがハイエンド・ナセルを供給しています。NASAのHiCAMプログラムが熱可塑性プラスチック溶接の認証を支え、国内のサプライチェーンを強化しています。

欧州は、エアバスやドイツ、フランス、英国の強固なティアネットワークに後押しされています。EUのFit for 55パッケージのような積極的な持続可能性指令が、バイオベース複合材料の採用を促進しています。ウェールズで生産中の熱可塑性ワインスキンは、欧州の高率低炭素製造へのコミットメントを例証しています。

アジア太平洋はCAGR 10.10%と最も急成長している地域であり、中国のCOMACフリート増強と日本と韓国の電気推進R&Dハブが牽引しています。HRCの中国の新工場は、航空宇宙と高速鉄道用のAFPストリンガーを供給しており、製造規模の優位性を強調しています。インドは、ベンガルール周辺に複合材料回廊を育成し、ISROのロケットやHALの戦闘機に供給しており、この地域の航空宇宙用複合材料市場活動をさらに拡大しています。

ブラジルのエンブラエル社が率いるラテンアメリカでは、E2ジェット機ファミリーに複合材が採用され、メキシコのケレタロクラスターでは北米主力機用のナセルドアが製造されています。中東とアフリカでは、アラブ首長国連邦のStrata複合材施設と南アフリカのDenel Aerostructuresが、オフセット協定と技能移転に助けられ、新たな貢献者となっています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリスト・サポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- 熱可塑性複合材の急速な採用により、単通路プログラムの生産速度が加速(欧州主導)

- 北米で次世代ナローボディ翼への炭素繊維の浸透が進む

- 航空機の電子化と電動化(MEA)がアジアの高温複合材需要を牽引

- 宇宙打ち上げ商業化が軽量複合材構造の需要を押し上げる

- 軍用ステルス計画が極超音速用途でのセラミックマトリックス複合材の利用を促進

- OEMの持続可能性目標がリサイクル可能な複合材ソリューションを後押し

- 市場抑制要因

- プリフォームとオートクレーブの資本コストが高く、ティア2サプライヤーでの採用が制限される

- PAN系炭素繊維用航空宇宙グレード前駆体のサプライチェーン変動

- FAA/EASAによる新規樹脂システムの認定と認証の遅れ

- MRO分野における先進熱可塑性プラスチックの限られた修理可能性専門知識

- バリューチェーン分析

- 規制・技術展望

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力/消費者

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

第5章 市場規模と成長予測

- ファイバータイプ別

- ガラスファイバー

- カーボンファイバー

- セラミックファイバー

- アラミドファイバー

- その他のファイバータイプ

- 樹脂タイプ別

- 熱硬化性複合材料

- 熱可塑性複合材料

- 製造工程別

- レイアップ(手作業および自動化)

- 樹脂トランスファー成形(RTM)

- フィラメントワインディング

- 射出/圧縮成形

- 自動ファイバー配置とテープ敷設

- 複合材料の積層造形

- 航空機タイプ別

- 商用航空機

- ナローボディ

- ワイドボディ

- リージョナルジェット

- 貨物機

- ビジネスジェット

- 軍用機

- 戦闘機

- 輸送とタンカー

- ロータークラフト

- ヘリコプター

- 宇宙船・ロケット

- 商用航空機

- 構造部品別

- 内装部品

- 外装・機体

- エンジン部品

- 補助構造

- エンドユーザー別

- OEM

- アフターマーケット/MRO

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- 英国

- ドイツ

- フランス

- その他欧州地域

- アジア太平洋地域

- 中国

- 日本

- インド

- 韓国

- その他アジア太平洋地域

- 南米

- ブラジル

- その他南米

- 中東・アフリカ

- 中東

- サウジアラビア

- アラブ首長国連邦

- その他中東

- アフリカ

- 南アフリカ

- その他アフリカ

- 北米

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア分析

- 企業プロファイル

- Toray Industries, Inc.

- Hexcel Corporation

- Solvay

- SGL Carbon

- Mitsubishi Chemical Carbon Fiber and Composites, Inc.(Mitsubishi Chemical Group Corporation)

- Teijin Aramid

- DuPont de Nemours, Inc.

- Spirit AeroSystems Inc.

- General Electric Company

- Rolls-Royce plc

- Safran SA

- Bally Ribbon Mills

- Materion Corporation

- Park Aerospace Corp.

- Lee Aerospace, Inc.