|

|

市場調査レポート

商品コード

1536886

データセンター向け液体冷却:市場シェア分析、産業動向・統計、成長予測(2024~2029年)Data Center Liquid Cooling - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| データセンター向け液体冷却:市場シェア分析、産業動向・統計、成長予測(2024~2029年) |

|

出版日: 2024年08月14日

発行: Mordor Intelligence

ページ情報: 英文 207 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

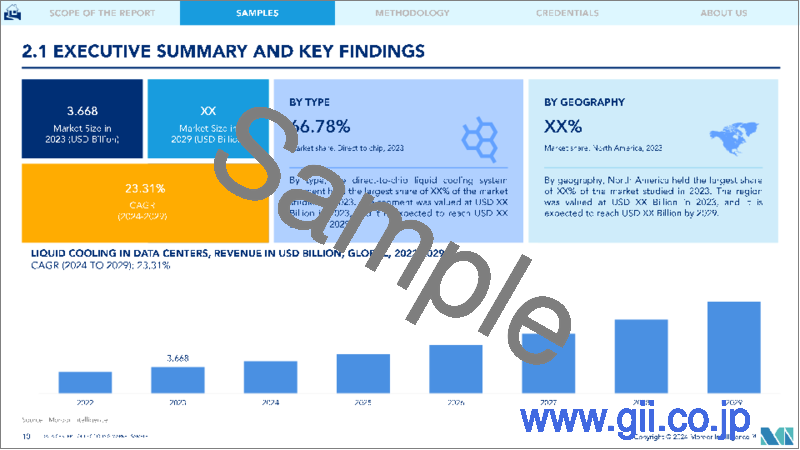

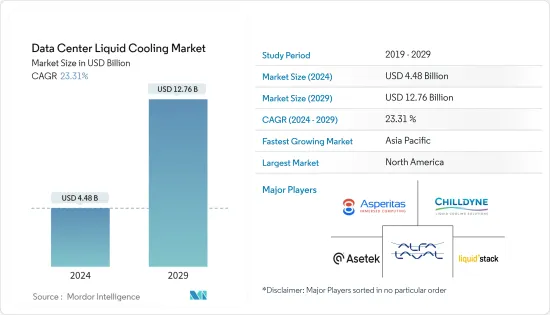

世界のデータセンター向け液体冷却の市場規模は、2024年に44億8,000万米ドルに達し、2024~2029年にかけてCAGR 23.31%で成長し、2029年には127億6,000万米ドルに達すると予測されています。

データセンターのニーズは、人口がますます増加し、デジタルインフラへの依存度が高まるにつれて高まっています。最適なパフォーマンスを確保し、データセンターの開発と成長急増による高価なダウンタイムを回避するために、効果的な冷却ソリューションが急務となっています。

主なハイライト

- データセンターの成長は、クラウドコンピューティングソリューションの導入とビッグデータ分析の普及に大きく助けられています。企業はますますクラウドベースのサービスに依存するようになり、膨大な量のデータを処理や調査のために保存するようになっています。例えば、Amazon Web Services (AWB), Microsoft Azure, Google Cloud Platformのようなクラウド産業大手は、需要の高まりに対応するため、データセンターを継続的に拡張しています。

- インド、香港、中国、インドネシアなどの新興経済諸国では、ITインフラの整備が進んでおり、データセンター需要を押し上げる可能性が高いです。IT産業にとってコスト面でも運用面でもメリットのあるクラウドモデルの採用により、データセンター需要の増加が見込まれます。

- データセンター事業者は、新しい冷却システムに移行する際の潜在的なダウンタイム損失を警戒しています。そのため、運用コストを見過ごし、旧式の冷却システムを使い続けています。この動向は、未検証と思われる新技術の採用を遅らせています。

- パンデミック後の企業におけるデジタル変革の新たな波が市場を牽引すると予想されます。多くの企業がデータセンターをサードパーティのコロケーション施設に依存し始めており、ホスティングセンターのパワーとマルチクラウド環境を組み合わせたハイブリッドITの傾向が強まっています。

データセンター向け液体冷却市場の動向

エッジコンピューティングが著しい成長を遂げる

- 予測期間中、企業はIP接続されたモバイル機器やM2M(Machine-to-Machine)機器の急増を目の当たりにし、大量のIPトラフィックを処理するようになると予想されます。

- より高速なWi-Fiサービスやオンラインプロバイダーからの用途配信に対する需要が高まると予想されます。また、自律走行車など一部のM2Mデバイスは、安全性を保証するためにローカル処理リソースとのリアルタイム通信を必要とします。

- エッジデータセンターの導入は、第5世代(5G)ネットワークやモノのインターネット(IoT)を含む多くの新技術にメリットをもたらします。IoT接続の普及は2倍以上になると予想され、2028年までに広域IoTの数は60億に達します。

- さらに、5G無線インフラの出現により、データセンター事業者は、低遅延と高い耐障害性を提供するネットワークと連携するエッジコンピューティングインフラを選択するようになった。マルチアクセスエッジコンピューティング(MEC)は、ネットワークサービスがユーザーと密接に接続できるよう支援します。そのため、効率的なエッジデータセンターの需要は、世界中で5G技術がイントロダクションされ、自律走行車や自動運転車、スマートシティの動向が高まるなど、多くの要因によって増大すると予想されます。

- しかし、大規模なエッジコンピューティングの展開における重要な要件は、運用コストの低さです。エッジの展開において、液浸冷却は劇的な省エネ効果をもたらすことが知られています。

- 液体冷却ソリューションの信頼性とノータッチ機能は、遠隔地にある機器の実行可能な運用と管理に必要な、メンテナンスまでの平均時間の延長と介入間隔の延長のニーズにマッチします。

北米が最大の市場シェアを占める

- 北米は、新しい技術をいち早く導入する国です。データセンター投資家は、液浸やチップ直下冷却ソリューションへの投資を増やしています。エッジデータセンターの重要性は、世界の5Gネットワークの出現によって後押しされており、米国はこの技術をいち早く採用した国のひとつです。EdgePresence、EdgeMicro、American Towersなど、米国の多くの事業者がこれらのセンターに投資を開始しています。

- Cisco Systemsの報告によると、米国のモバイルデータトラフィックは年々大幅に増加しており、2017年には月間1.26エクサバイトのデータトラフィックであったものが、2022年には月間7.75エクサバイトのデータトラフィックとなります。Ericssonによれば、このデータトラフィックは2030年までにさらに3倍になると予想されています。したがって、このような規模を容易に接続するために必要な低遅延と広帯域幅を確保できる可能性のある分散型クラウドが実用化されつつあります。

- 米国では、人々や企業によるインターネット利用が大幅に伸びています。同国はデータセンター運営において最大の市場であり、エンドユーザーによるデータ消費の増加により成長を続けています。モノのインターネット(IoT)の人気の高まりは、米国のハイパースケールデータセンター市場の重要な促進要因であり、ビジネスユーザーと消費者の両方から生成されるエクサバイトのデータをサポートできる施設の増設につながっています。

- 米国は今後数年間、この地域で最も急成長するデータセンター市場になると思われます。米国におけるデータセンター建設の大きな原動力は、近年の経済優遇措置と税制優遇です。約27の州が、データセンタープロジェクトの誘致にこれらの要素を活用しています。さらに、米国で実施されている大規模な減税措置は、政府主導で新しいメガデータセンターの建設や既存のデータセンターの改修が進められていることを示しています。このような市場の動きは、この地域におけるデータセンター向け液体冷却サービスのニーズをさらに高めています。

データセンター向け液体冷却産業の概要

データセンター向け液体冷却市場は細分化され、競争が激しく、Alfa Laval Corporate AB、LiquidStack Inc.A/S、AsperitasChilldyne Inc.などです。市場シェアの面では、現在少数の重要なプレーヤーが市場を独占しています。広く普及している冷却システムは依然として空冷であり、液冷システムは冷却システム全体の中で比較的小さなシェアにとどまっています。比較的高いコストが市場の課題と考えられているため、液浸冷却システム市場は代替品の脅威が大きいと推定されます。

- 2024年3月 - Summerは、産業用クーラントメーカー、相手先ブランド製造装置メーカー、相手先ブランド機器メーカー、ハイパフォーマンスコンピューティング用途オペレーター、データセンタープロバイダーなどの利害関係者で構成される一流の産業フォーラムである、最近設立された液体冷却連合(LCC)への加盟を発表しました。

- 2024年3月 - 重要インフラと継続性ソリューションの重要なプロバイダーであるVertivが、ソリューションアドバイザーに認定されています。:Nvidia Partner Network(NPN)のSolution Advisor:Consultantパートナーとなり、Vertivの経験や電源および冷却ソリューションの完全なポートフォリオをより包括的に利用できるようになりました。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場洞察

- データセンター冷却の進化

- エアコン/ハンドラー

- チラーとエコノマイザーシステム

- 液体冷却システム

- 列/ラック/ドア/天井冷却システム

- データセンター冷却市場の概要

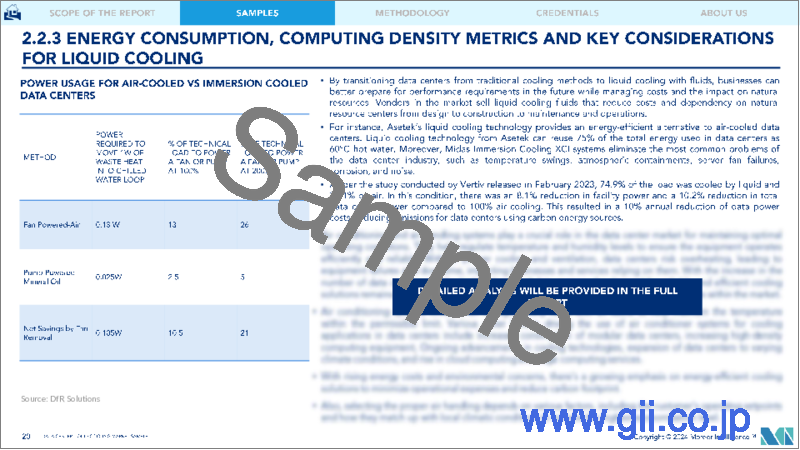

- エネルギー消費、計算密度指標、および液冷の主な検討事項

- 産業の利害関係者分析

- 産業の魅力度 - ポーターのファイブフォース分析

- 買い手の交渉力

- 供給企業の交渉力

- 新規参入業者の脅威

- 競合の程度

- 代替品の脅威

第5章 市場力学

- 市場促進要因

- 地域におけるITインフラの発展

- グリーンデータセンターの出現

- 市場抑制要因

- コスト、適応要件、停電

- COVID-19の産業への影響評価

第6章 データセンターにおけるリアドア式熱交換器(RDHx)の展望

- データセンターにおけるRDHxと液体冷却(直接・間接)の技術比較

- RDHxと液冷市場に関連するデータセンター冷却技術ベンダーの最近の動向

- RDHxのおおよその世界市場シェア(10億米ドル)

- RDHxの主なベンダー一覧(事業概要、ポートフォリオ、最近の動向)

第7章 直接冷却または液浸冷却市場

- 直接冷却市場の概要と予測

- 液浸冷却 - 主要用途

- 高性能コンピューティング

- エッジコンピューティング

- 暗号通貨マイニング

- 液浸冷却流体

- フルオロカーボン系流体

- 炭化水素系流体

第8章 間接・直接チップ冷却市場

- 間接冷却市場の概要と予測

- 間接・直接チップ冷却の主要用途

第9章 市場セグメンテーション

- 地域別

- 北米

- 欧州

- アジア

- オーストラリア・ニュージーランド

- ラテンアメリカ

- 中東・アフリカ

第10章 競合情勢

- 企業プロファイル

- Alfa Laval Corporate AB

- LiquidStack Inc.

- Asetek Inc. A/S

- Asperitas

- Chilldyne Inc.

- CoolIT Systems Inc.

- Fujitsu Ltd.

- Mikros Technologies

- Kaori Heat Treatment Co. Ltd

- Lenovo Group Limited

- LiquidCool Solutions Inc.

- Midas Green Technologies

- Iceotope Technologies Ltd

- USystems Ltd(Legrand Group)

- Rittal GmbH & Co. KG

- Schneider Electric

- Submer Technologies & Submer Inc.

- Vertiv Group Corp.

- Wakefield Thermal Solutions Inc.

- Wiwynn Corporation

- 3M Company

- Engineered Fluids Inc.

- Green Revolution Cooling Inc.

- Solvay SA

第11章 バリューチェーンにおける冷却技術の革新

第12章 投資分析と市場展望

The Data Center Liquid Cooling Market size is estimated at USD 4.48 billion in 2024, and is expected to reach USD 12.76 billion by 2029, growing at a CAGR of 23.31% during the forecast period (2024-2029).

The need for data centers has grown as the population grows increasingly connected and dependent on digital infrastructure. Effective cooling solutions are urgently needed to ensure optimal performance and avoid expensive downtime due to the data center development and growth spike.

Key Highlights

- Data center growth has been significantly aided by the uptake of cloud computing solutions and the spread of big data analytics. Businesses increasingly rely on cloud-based services and storing enormous amounts of data for processing and research. For instance, to meet the rising demand, cloud industry giants like Amazon Web Services (AWB), Microsoft Azure, and Google Cloud Platform continuously extend their data center footprints.

- Growing developments in IT infrastructure in emerging economies, such as India, Hong Kong, China, Indonesia, and other emerging countries, are likely to boost the demand for data centers. The demand for data centers is expected to increase due to the adoption of the cloud model, which has cost and operational benefits for the IT industry.

- Data center operators are wary of potential downtime losses while shifting to new cooling systems. Hence, they overlook operational expenditures and continue using outdated cooling systems. This trend slows the adoption of new technologies that are perceived to be untested.

- A new wave of post-pandemic digital transformation among businesses is expected to drive the market. Many companies have started to rely on third-party colocation facilities to house their data centers, and there's a growing trend towards hybrid IT - combining the power of hosted centers with multi-cloud environments.

Data Center Liquid Cooling Market Trends

Edge Computing to Witness Significant Growth

- In the forecast period, organizations are expected to witness rapid growth in the number of IP-connected mobile and machine-to-machine (M2M) devices, which will handle significant amounts of IP traffic.

- The demand is expected to rise for faster Wi-Fi service and application delivery from online providers. Also, some M2M devices, such as autonomous vehicles, will require real-time communications with local processing resources to guarantee safety.

- The deployment of edge data centers benefits many new technologies, including fifth-generation (5G) networks and the Internet of Things (IoT), as the adoption of (IoT) connections is expected to more than double, with the number of wide-area IoT 6 billion by 2028. and Industrial Internet of Things (IIoT) of devices, autonomous vehicles, virtual and augmented reality, artificial intelligence and machine learning, data analytics, and video streaming and surveillance.

- Moreover, the emergence of 5G wireless infrastructure has urged data center operators to opt for edge computing infrastructure to work with networks offering lower latency and higher resiliency. Multi-access edge computing (MEC) aids network services in connecting to users closely. Hence, the demand for efficient edge data centers is expected to be augmented by many factors, including the introduction of 5G technology across the world and the growing trend of autonomous or self-driving vehicles and smart cities.

- However, a key requirement of large-scale edge computing roll-outs will be low operating costs. In edge deployments, immersive liquid cooling is known to provide dramatic energy-saving benefits.

- The reliability and no-touch features of liquid cooling solutions will match the need for extended mean time to maintenance and longer intervention intervals needed for viable operation and management of remotely located equipment.

North America to Hold the Largest Market Share

- North America is an early adopter of newer technologies. The data center investors are increasingly investing in liquid immersion and direct-to-chip cooling solutions. The importance of edge data centers has been aided by the emergence of 5G networks worldwide, and the United States is among the earliest adopters of the technology. Many operators in the United States, such as EdgePresence, EdgeMicro, and American Towers, have started investing in these centers.

- The mobile data traffic in the United States increased considerably over the years, from 1.26 exabytes per month of data traffic in 2017 to 7.75 exabytes per month of data traffic by 2022, as reported by Cisco Systems. Ericsson says this data traffic is expected to triple further by 2030. Thus, the distributed cloud that may secure the low latency and high bandwidth required to connect such scale easily is coming into action.

- The United States is witnessing massive growth in internet usage by people and businesses. The country is the largest market in data center operations, and it continues to grow due to the higher consumption of data by end-users. The growing popularity of the Internet of Things (IoT) is a significant driver for the US hyper-scale data center market, leading to additional facilities that can support exabytes of data generated by both business users and consumers.

- The United States will be the fastest-growing data center market in the region in the coming years. The significant drivers of data center construction in the United States. have been recent economic incentives and tax benefits. Approximately 27 states leverage these factors to attract data center projects. In addition, the heavy tax breaks implemented in the United States indicate a government-front aim to construct new mega data centers or renovate existing ones. Such instances in the market create more of a need for data center liquid cooling services in the region.

Data Center Liquid Cooling Industry Overview

The data center liquid cooling market is fragmented and highly competitive and consists of several significant players like Alfa Laval Corporate AB, LiquidStack Inc., Asetek Inc. A/S, AsperitasChilldyne Inc., etc. In terms of market share, few important players currently dominate the market. The widely deployed cooling system is still air cooling, and liquid cooling systems have a relatively small share in the overall cooling landscape. As relatively high costs are considered market challenges, the immersion cooling systems market is estimated to have a significant threat of substitutes.

- March 2024 - Summer announced its membership in the recently established Liquid Cooling Coalition (LCC), a premier industry forum comprised of stakeholders, including industrial coolant producers, original equipment manufacturers, original device manufacturers, high-performance computing application operators, and data center providers.

- March 2024 - Vertiv, a significant provider of critical infrastructure and continuity solutions, is now a Solution Advisor: Consultant partner in the Nvidia Partner Network (NPN), providing more comprehensive access to Vertiv's experience and complete power and cooling solutions portfolio.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Evolution Of Data Center Cooling

- 4.1.1 Air Conditioners/Handlers

- 4.1.2 Chillers And Economizer Systems

- 4.1.3 Liquid Cooling Systems

- 4.1.4 Row/Rack/Ddoor/Over-head Cooling Systems

- 4.2 Overview of Data Center Cooling Market

- 4.3 Energy Consumption, Computing Density Metrics and Key Considerations For Liquid Cooling

- 4.4 Industry Stakeholder Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Buyers

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Threat of New Entrants

- 4.5.4 Degree of Competition

- 4.5.5 Threat of Substitutes

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Development of IT Infrastructure in the Region

- 5.1.2 Emergence of Green Data Centers

- 5.2 Market Restraints

- 5.2.1 Costs, Adaptability Requirements, and Power Outages

- 5.3 Assessment of COVID-19 Impact on the Industry

6 OUTLOOK OF REAR DOOR HEAT EXCHANGERS (RDHX) IN DATA CENTERS

- 6.1 Technical Comparison of RDHx and Liquid Cooling (Direct and Indirect) in Data Centers

- 6.2 Recent Developments by Data Center Cooling Technology Vendors in the Context Of RDHx and Liquid Cooling Market

- 6.3 Approximate Global Market Share of RDHx (in USD Billion)

- 6.4 List of Key RDHx Vendors (Business Overview, Portfolio and Recent Developments)

7 DIRECT COOLING OR IMMERSION COOLING MARKET

- 7.1 Direct Cooling Market Overview And Estimate

- 7.2 Immersion Cooling - Key Application

- 7.2.1 High-performance Computing

- 7.2.2 Edge Computing

- 7.2.3 Cryptocurrency Mining

- 7.3 Immersion Cooling Fluids

- 7.3.1 Fluorocarbon-based Fluids

- 7.3.2 Hydrocarbons Fluids

8 INDIRECT OR DIRECT-TO-CHIP COOLING MARKET

- 8.1 Indirect Cooling Market Overview and Estimates

- 8.2 Indirect or Direct-to-chip Cooling Key Applications

9 MARKET SEGMENTATION

- 9.1 By Geography***

- 9.1.1 North America

- 9.1.2 Europe

- 9.1.3 Asia

- 9.1.4 Australia and New Zealand

- 9.1.5 Latin America

- 9.1.6 Middle East and Africa

10 COMPETITIVE LANDSCAPE

- 10.1 Company Profiles*

- 10.1.1 Alfa Laval Corporate AB

- 10.1.2 LiquidStack Inc.

- 10.1.3 Asetek Inc. A/S

- 10.1.4 Asperitas

- 10.1.5 Chilldyne Inc.

- 10.1.6 CoolIT Systems Inc.

- 10.1.7 Fujitsu Ltd.

- 10.1.8 Mikros Technologies

- 10.1.9 Kaori Heat Treatment Co. Ltd

- 10.1.10 Lenovo Group Limited

- 10.1.11 LiquidCool Solutions Inc.

- 10.1.12 Midas Green Technologies

- 10.1.13 Iceotope Technologies Ltd

- 10.1.14 USystems Ltd (Legrand Group)

- 10.1.15 Rittal GmbH & Co. KG

- 10.1.16 Schneider Electric

- 10.1.17 Submer Technologies & Submer Inc.

- 10.1.18 Vertiv Group Corp.

- 10.1.19 Wakefield Thermal Solutions Inc.

- 10.1.20 Wiwynn Corporation

- 10.1.21 3M Company

- 10.1.22 Engineered Fluids Inc.

- 10.1.23 Green Revolution Cooling Inc.

- 10.1.24 Solvay SA