|

市場調査レポート

商品コード

1852147

カーボンナノチューブ:市場シェア分析、産業動向、統計、成長予測(2025年~2030年)Carbon Nanotubes - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| カーボンナノチューブ:市場シェア分析、産業動向、統計、成長予測(2025年~2030年) |

|

出版日: 2025年09月09日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

概要

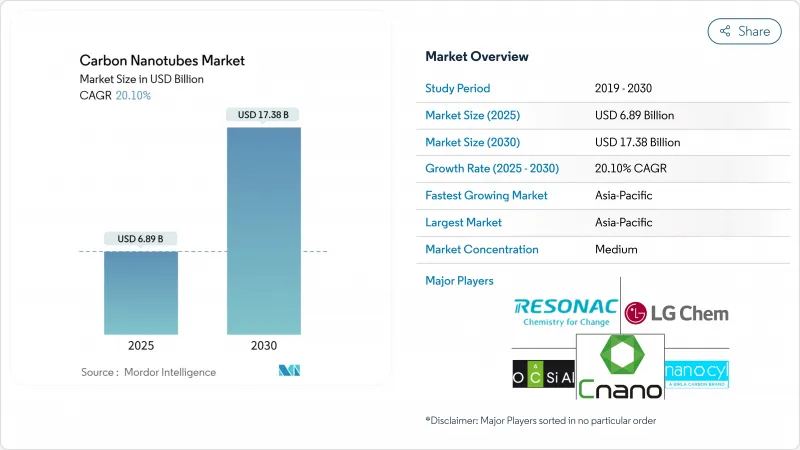

カーボンナノチューブ市場規模は2025年に68億9,000万米ドルと推定され、予測期間(2025-2030年)のCAGRは20.10%で、2030年には173億8,000万米ドルに達すると予測されます。

この好調な見通しは、バッテリー、航空宇宙用複合材料、ヘルスケア機器、水溶液などにこの材料が急速に採用されていることを反映しています。マルチウォールバリアントは依然としてコスト効率が高いため、生産者はより高い純度と均一性を追求しながら生産量を拡大しています。アジア太平洋地域は、電気自動車とエレクトロニクスのクラスターに支えられ、需要・生産能力ともに引き続き優勢です。OCSiAl社によるZyvex Technologies社の買収は、単層カーボンナノチューブの規模と知的財産を強化しました。

世界のカーボンナノチューブ市場の動向と洞察

EモビリティブームがCNT需要を加速

カーボンナノチューブは、シリコン負荷が20%近くでも導電性と機械的安定性を確保し、航続距離の不安を軽減する300Wh/kgのリチウムイオンパックを可能にします。自動車メーカーはまた、パワーエレクトロニクスから発生する熱を放散させるナノチューブ充填サーマルインターフェイスパッドを指定しており、ダウとカーバイスの2024年提携がこのニーズに対応しています。同じ導電性の利点は、バスバーやバッテリーパックシールドの可能性を広げます。シリコン-CNT複合アノードを製造する新興企業は、ベンチャー資金を集めており、商業的な自信を裏付けています。セルメーカーがサプライチェーンをローカライズするのに伴い、ナノチューブの生産能力増強がギガファクトリーの近くに配置され、材料と電池生産の統合が強化されています。

技術的フロンティアを押し広げる高エネルギー密度ストレージ

グリッド・ストレージと航空宇宙分野では、より軽量で安全な電池が求められています。カーボンナノチューブ足場を用いたリチウム硫黄電池は、硫黄を固定し、多硫化物のシャットリングを抑制します。ねじれた単層カーボンナノチューブロープは、機械的エネルギーとして2.1MJ/kgを蓄え、可燃性電解質を避けながらリチウムイオンのエネルギー密度を上回る。スーパーキャパシタ・メーカーは、急速充放電に理想的な低い等価直列抵抗を実現するために、多層電極を採用しています。これらの進歩は、高導電グレードと分散サービスの安定した受注につながります。

職業毒性学と規制強化

欧米当局は、アスベストに匹敵する繊維状であることを理由に、吸入暴露制限の草案を作成しています。学術グループは、空気中の質量とアスペクト比を肺反応に関連付けるために線量測定を改良しています。コンプライアンス遵守は、完全密閉型反応器や自動袋詰めラインへの投資を促し、新規参入企業の設備投資額を引き上げています。安全処理の記録を文書化した企業は、企業の持続可能性指標が重視される自動車や航空宇宙プログラムでの契約を確保しています。

セグメント分析

マルチウォールカーボンナノチューブは2024年のシェアの90%を占めたが、これは成熟した化学気相成長法による生産とバルク添加剤と同じ価格帯を反映しています。このセグメントのCAGRは20.51%と予測され、2030年までのカーボンナノチューブ市場規模拡大の3分の2以上を支えます。粒子技術者は外径の許容誤差を狭め、金属触媒を100ppm以下に減らし、電子機器や医療機器の閾値に適合させています。これらの改善により、導電性ペースト、携帯電話のスピーカー、スーパーキャパシターの電極への採用が促進され、量的リーダーシップが強化されます。

単層カーボンナノチューブのシェアは10%未満にとどまっているが、量子および半導体のニッチ分野ではプレミアム価格を維持しています。静電触媒は現在、直径0.95nmで99.92%の半導体純度を実現し、フレキシブル基板上の薄膜トランジスタを可能にします。閉じ込められたカルビンの調査は、フォトニクス用の将来の一次元導体を示唆しています。ニッチデバイスが商品化されるにつれ、カーボンナノチューブ市場は、多層バルク需要を駆逐することなく、高収益の増分を獲得することになると思われます。

地域分析

アジア太平洋地域は2024年の世界需要の54%を占め、CAGR21.51%で主導権を維持します。中国の総合的な電池供給エコシステムは、長期契約に基づいてギガファクトリーに供給する地元ナノチューブ・メーカーの触媒となっています。日本企業は、「超成長」法の高アスペクト比と配列品質を活用して、ディスプレイ用の超クリーン単層グレードを専門としています。韓国とインドでは、政府の優遇措置により2027年まで生産能力がさらに拡大され、地域のコスト優位性が拡大します。

北米は総売上高に大きく貢献しました。米国では、ミシガン州での生産に向けたキャボット社への5,000万米ドルのエネルギー省補助金交付などの取り組みにより、供給の安全保障が国内のバッテリーおよび防衛分野の顧客に近づいています。航空宇宙用複合材料と高周波コネクターは、国立研究所の研究開発の強みを活かした主要な需要の柱です。カナダでは、ナノチューブの製品別を利用したメタンー水素熱分解に重点を置いたパイロットプラントが稼動しており、気候政策と製造政策を結びつけています。

欧州も売上高全体に大きなシェアを占めています。ドイツとフランスの自動車メーカーは、厳格な材料トレーサビリティを要求し、ゆりかごからゲートまでの排出量を証明するようサプライヤーに働きかけています。英国の大学は、半導体相互接続をターゲットにしたベンチャー企業をスピンアウトさせ、国のナノファブリケーション・ハブによって支えられています。その周辺では、中東の海水淡水化機関やアフリカの通信塔設置業者が、水やエネルギーの課題に取り組むためにナノチューブ・コーティング膜や導電性コーティングを評価し、新たな需要を開拓しています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- EモビリティブームがCNT需要を加速する

- 高エネルギー密度リチウムイオンとスーパーキャパシタ生産の飛躍

- 航空宇宙分野における超軽量構造コンポジットの推進

- MEAとアジアにおける海水淡水化と環境センサーの普及

- 導電性フィラメントの積層造形統合

- 市場抑制要因

- 欧米における労働毒性学とナノ規制

- 熱アプリケーションにおけるグラフェンと窒化ホウ素ナノチューブの競合

- ライセンシングコストが集中する特許シケイン

- バリューチェーン分析

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競合の程度

- 特許分析

第5章 市場規模と成長予測(金額および数量)

- タイプ別

- マルチウォールカーボンナノチューブ市場

- シングルウォールカーボンナノチューブ市場

- その他のタイプ(アームチェア、ジグザグ、ダブルウォール)

- 製造方法別

- 化学気相成長(CVD)

- 高圧一酸化炭素(HiPco)

- アーク放電

- レーザーアブレーション

- 最終用途産業別

- 電気・電子

- エネルギー

- 自動車

- 航空宇宙・防衛

- ヘルスケア

- その他の産業(繊維、建設、プラスチック、複合材料)

- 地域別

- アジア太平洋地域

- 中国

- インド

- 日本

- 韓国

- その他アジア太平洋地域

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- イタリア

- フランス

- スペイン

- その他欧州地域

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 中東・アフリカ

- サウジアラビア

- 南アフリカ

- その他中東・アフリカ地域

- アジア太平洋地域

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア分析

- 企業プロファイル

- Applied Nanostructures, Inc.

- Arkema

- Cabot Corporation

- Carbon Solutions, Inc.

- CHASM

- Cheap Tubes

- Chengdu Organic Chemicals Co., Ltd.

- CNT Co., Ltd.

- FutureCarbon GmbH

- Hanwha Group

- Hyperion Catalysis International

- Jiangsu Cnano Technology Co., Ltd.

- Kumho Petrochemical

- LG Chem

- Meijo Nano Carbon Co.,Ltd

- Nano-C

- Nanocyl SA

- OCSiAl

- Raymor Industries Inc.

- Resonac Holdings Corporation

- Thomas Swan & Co., Ltd.

- Toray Industries, Inc.

- Zyvex Technologies