|

|

市場調査レポート

商品コード

1403913

日本の歯科用機器:市場シェア分析、産業動向・統計、2024年~2029年の成長予測Japan Dental Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 日本の歯科用機器:市場シェア分析、産業動向・統計、2024年~2029年の成長予測 |

|

出版日: 2024年01月04日

発行: Mordor Intelligence

ページ情報: 英文 80 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

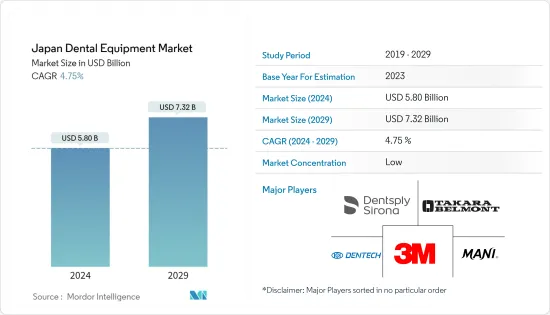

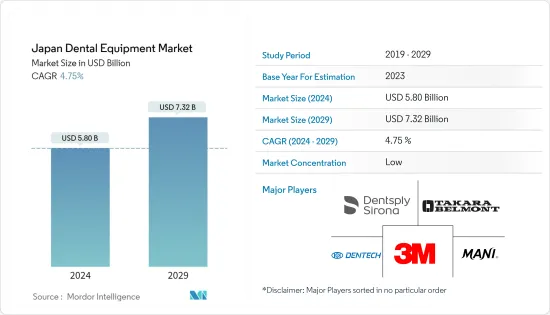

日本の歯科用機器市場規模は2024年に58億米ドルと推定され、2029年には73億2,000万米ドルに達すると予測され、予測期間中(2024年~2029年)にCAGR 4.75%で成長すると予測されます。

主なハイライト

- COVID-19の出現に伴い、日本ではSARS-CoV-2ウイルスによる感染拡大を牽制するための規制が敷かれたため、COVID-19以外の医療サービスは大きな影響を受け、研究者や製薬会社の業務に影響を与え、市場に影響を与えたう蝕の新たな進行中の診断・治療手順に影響を与えました。COVID-19症例が多かったパンデミックの間、病院を訪れる人の数は減少しました。

- 例えば、2022年10月に発表されたPubMedの論文によると、実施された調査では、日本人参加者の21.5%がCOVID-19のために歯科通院を延期しました。また、歯科医師は歯科診療を急患のみに限定するよう勧告されました。このため、パンデミック発生時の歯科受診に影響を及ぼし、市場に影響を残しました。現在では、COVID-19関連の規制が緩和されたため、歯科医療機器の需要はパンデミック以前の状態に戻っています。さらに、人口の歯に関する問題の増加と歯科用機器の技術的進歩により、市場は今後数年間で大きな成長を記録すると考えられています。

- 日本の歯科用機器市場の成長に影響を与えている要因は、口腔疾患の負担増と高齢化、審美歯科の需要増、歯科医療の技術進歩です。

- 総務省が発表した2022年9月時点の65歳以上の高齢者人口は3,627万人で、前年(3,621万人)に比べ6万人増加し、過去最高を記録しました。したがって、高い高齢者人口の存在とその継続的な増加が、予測期間における日本の歯科用機器の成長に重要な役割を果たすと予想されます。

- さらに、日本の主要企業による戦略的活動の増加は、予測期間中の市場成長を後押しすると予想されます。例えば、2021年11月、シンガポールを拠点とするスマイルコスメティックスのZenyum社は日本での事業を拡大しました。同社はテクノロジーの力と急成長する歯科医や矯正歯科医のネットワークを活用し、手頃な価格でパーソナライズされた歯科製品を提供しています。このような戦略的拡大は、予測期間中の市場成長を押し上げると予想されます。

- 日本では、口腔の健康状態を把握するためにいくつかの調査が実施されています。例えば、2022年1月、WhiteNote Media社は、日本における歯磨きの頻度を知るための調査を実施しました。

- したがって、可処分所得の増加が歯科治療を促し、それが現在歯科用機器市場を牽引しています。しかし、民間医療保険にかかる過大な費用と口腔衛生に対する怠慢が市場成長の妨げになると予想されます。

日本の歯科用機器市場動向

歯科用インプラントセグメントが日本歯科用機器市場で健全な成長を遂げる見込み

- 歯科インプラントは、損傷または欠損した歯とその歯根を顎骨で代用する外科用器具であり、後に顎骨と融合して天然歯のように機能します。これらのインプラントは、入れ歯、ブリッジ、クラウンなどの歯科補綴物を支える上で重要な役割を果たしています。歯科用インプラント分野は、人口における虫歯患者の増加や、主要企業によるその他の戦略的活動と結びついた製品発売の増加に起因して、調査された市場において大きな成長を示すことが期待されています。

- また、日本の人々の間で歯科インプラントの採用は、インプラントの需要を強化し、それによって予測期間にわたってセグメントの成長を増強する可能性があります。例えば、2022年4月にPubMedに掲載された論文によると、日本人患者の歯科インプラント治療の経験は肯定的でした。インプラントは、歯列を失った患者の安定性、咀嚼能力、快適性、審美性を大幅に改善しました。このように、日本人の歯科インプラントの普及と満足度の向上により、この分野は予測期間中に大きな成長を遂げることが予想されます。

- 材料に基づく歯科インプラントは、チタンインプラントとジルコニウムインプラントの2種類に分けられます。チタンインプラントは、治癒中の体組織と適合することが知られています。虫歯の有病率の増加のために、市場でも様々な技術革新がありました。

- 例えば、Holoeyes, Inc.は、Dental PredictionおよびSoftBank Corp.と共同で、XRを使用することの有効性を検証するための試験を2021年7月に開始しました。XR技術とは、拡張現実(AR)、仮想現実(VR)、複合現実(MR)の各技術と5Gネットワークを組み合わせた拡張現実で、歯科手術をサポートします。このトライアルでは、失った歯を補う外科手術である歯科インプラントを支援するために、これらの技術がフル活用されました。このように、歯科インプラントへの技術導入の高まりに伴い、処置の精度が向上することが予想され、これがセグメントの成長を促進することが期待されます。

- さらに、提携や買収など、主要市場プレーヤーによる重要なイニシアチブの採用は、日本における歯科インプラントのポートフォリオを強化すると予想されます。例えば、京セラは2021年8月にオステオンメディカルの日本支社であるオステオンデジタルジャパンと継続的な販売取引に関する業務提携を締結し、オステオンメディカルのデジタル技術を活用したインプラント用カスタマイズ歯科補綴物の販売を開始しました。

- このように、歯科インプラントの採用が増加し、主要企業による戦略的活動が活発化していることから、調査対象セグメントは調査期間中に成長すると予想されます。

歯周病セグメントは予測期間中に大きな市場シェアを占めると予測される

- 歯周炎は、歯肉を損傷し、顎の骨を破壊する可能性のある深刻な歯肉感染症です。通常、不十分な歯科衛生がこの疾患の主な原因です。歯周炎が原因で歯を失うこともあります。歯周病セグメントは、歯周炎の増加、戦略的活動の増加、早期診断と適切な治療について人々を教育するための様々な政府の取り組みにより、大きな成長を示すことが期待されています。

- 例えば、2022年7月にPubMedに掲載された論文によると、日本では、う蝕が口腔疾患の最大の標的であり、その治療と予防が長年の課題でした。歯周病は、それまでう蝕(男性30.2%、女性29.0%)が原因であった歯を失う最大の原因として、日本ではう蝕を抜いてトップに躍り出た。したがって、歯周炎の罹患率の高さは、予測期間中に研究セグメントを強化すると予想されます。

- さらに、主要企業による戦略的活動の増加は、予測期間中の市場成長を促進すると予想されます。例えば、2021年4月、モリタデンタルプロダクツ(株)は、モリタグループの歯科矯正事業における協力関係を強化し、歯科矯正および歯科業界の発展に貢献するため、事業のさらなる成長と進化に取り組むため、東京にあるデンツプライシロナ(株)を買収しました。

- このように、歯周炎の有病率の高さから、主要企業による戦略的な活動が、予測期間中の市場成長を後押しすると予想されます。

日本の歯科用機器産業の概要

日本の歯科医療機器市場は適度に統合されています。各社は安定した安全な製品を形成するため、研究開発に注力しています。市場はここ数年、大規模な技術開拓に注目しています。3M、タカラベルモント、Mani Inc.、デンテックコーポレーションなどが市場の主要企業です。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 市場概要

- 市場促進要因

- 口腔疾患と高齢化人口の増加

- 審美歯科に対する需要の高まり

- 歯科医療技術の進歩

- 市場抑制要因

- 民間医療保険にかかる過大な費用

- 口腔衛生に対する怠慢

- ポーターのファイブフォース分析

- 新規参入業者の脅威

- 買い手/消費者の交渉力

- 供給企業の交渉力

- 代替品の脅威

- 競争企業間の敵対関係の強さ

第5章 市場セグメンテーション(市場規模)

- 製品別

- 一般・診断機器

- 歯科用レーザー

- 軟組織レーザー

- 硬組織レーザー

- 放射線機器

- 口腔外放射線装置

- 口腔内放射線装置

- 歯科用チェアおよび機器

- その他一般・診断機器

- 歯科消耗品

- 歯科生体材料

- 歯科インプラント

- クラウン・ブリッジ

- その他歯科消耗品

- その他の歯科用機器

- 一般・診断機器

- 治療別

- 歯列矯正

- 歯内療法

- 歯周治療

- 補綴

- エンドユーザー別

- 病院

- 診療所

- その他のエンドユーザー

第6章 競合情勢

- 企業プロファイル

- 3M

- Takara Belmont

- KaVo Dental Systems Japan

- Mani Inc.

- Dentech Corporation

- The Yoshida Dental Mfg. Co., Ltd.

- Dentsply Sirona

- J. Morita Corp.

- GC Corporation

第7章 市場機会と今後の動向

The Japan Dental Equipment Market size is estimated at USD 5.80 billion in 2024, and is expected to reach USD 7.32 billion by 2029, growing at a CAGR of 4.75% during the forecast period (2024-2029).

Key Highlights

- With the emergence of COVID-19, medical services other than COVID-19 were affected severely due to the restrictions put in place to check the spread of infection due to the SARS-CoV-2 virus in Japan, which impacted the work of the researchers and pharmaceutical companies, impacting the new ongoing diagnostic and treatment procedures for dental caries which impacted the market. The number of people visiting hospitals decreased during the pandemic when COVID-19 cases were high.

- For instance, as per the PubMed article published in October 2022, in the conducted survey, 21.5% of Japanese participants postponed dental attendance due to COVID-19. Also, dentists were advised to limit their dental practice to urgent cases only. This impacted dental consultation during the pandemic outbreak, hence leaving an impact on the market. Currently, the market studied has reached its pre-pandemic nature in terms of demand for dental equipment as COVID-19-related restrictions have been eased. Moreover, it is believed that the market will be registering significant growth in the coming years due to the increase in dental issues among the population and technological advancements in dental equipment.

- The factors impacting the growth of the dental equipment market in Japan are the increasing burden of oral diseases and the aging population, the growing demand for cosmetic dentistry, and technological advancements in dentistry.

- According to the September 2022 report published by the Internal Affairs Ministry of Japan, as of September 2022, the population of elderly people aged 65 and over was 36.27 million, which was an increase of 60,000 compared to the previous year (36.21 million), reaching a record high. Hence, the presence of a high geriatric population and continuous increase in their number is expected to play a significant role in the growth of dental equipment in Japan over the forecast period.

- Furthermore, an increase in strategic activities by the key players in Japan is expected to bolster market growth over the forecast period. For instance, in November 2021, Singapore-based Smile Cosmetics company Zenyum expanded its business in Japan. The company leverages the power of technology and a fast-growing network of dentists and orthodontists to deliver affordable and personalized dental products. Thus, such strategic expansions are expected to boost market growth over the forecast period.

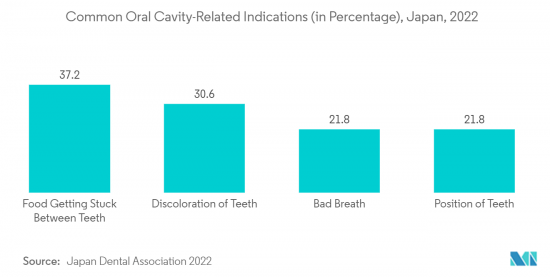

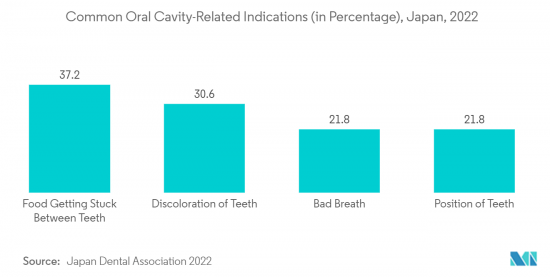

- Several surveys have been conducted in Japan to understand the oral health. For instance, in January 2022, WhiteNote Media company had conducted a survey for knowing the frequency of brushing teeth in the country and among the surveyed people, over 24% people brush their teeth only once which is causing rising oral health concerns.

- Hence, an increasing number of disposable incomes has encouraged dental procedures, which is currently driving the dental equipment market. However, excessive costs involved in private health insurance and negligence towards oral health are expected to hinder market growth.

Japan Dental Equipment Market Trends

Dental Implants Segment is Expected to Witness a Healthy Growth in the Japan Dental Equipment Market

- Dental implants are surgical fixtures that substitute the damaged or missing tooth along with its root in the jawbone, which later fuses with the jawbone to function like a natural tooth. These implants play a vital role in supporting dental prostheses such as dentures, bridges, and crowns. The dental implant segment is expected to witness significant growth in the studied market owing to the increasing incidences of dental decay cases within the population and the rise in product launches coupled with other strategic activities by the key players.

- Also, the adoption of dental implants among the Japanese population is likely to bolster the demand for implants, thereby augmenting the segment growth over the forecast period. For instance, as per the article published in April 2022 in PubMed, Japanese patients' experiences with dental implant therapy were positive. Implants have significantly improved the stability, masticatory ability, comfort, and aesthetics of patients who lost their dentition. Thus, owing to the increase in adoption and satisfaction with dental implants among Japanese populations, the studied segment is expected to witness significant growth over the forecast period.

- Dental implants based on materials can be divided into two types: titanium implants and zirconium implants. Titanium dental implants are known to be compatible with body tissues during healing. Owing to the increased prevalence of tooth decay, there have also been various technological innovations in the market.

- For instance, Holoeyes, Inc., in cooperation with Dental Prediction Co., Ltd. and SoftBank Corp., began trials in July 2021 to verify the effectiveness of using XR. The XR technology is an extended reality that includes augmented reality (AR), virtual reality (VR), and mixed reality (MR) technologies with 5G networks to support dental surgery. The trial fully utilized these technologies to assist with dental implants, a surgical procedure for replacing missing teeth. Thus, with the rising adoption of technology with dental implants, the accuracy of procedures is expected to increase, which is expected to drive segment growth.

- Furthermore, the adoption of key initiatives by major market players, such as partnerships and acquisitions, is expected to strengthen their dental implant portfolio in Japan. For instance, in August 2021, Kyocera Corporation entered into a business partnership with Osteon Digital Japan, the Japanese branch of Osteon Medical, for continuous sales transactions, beginning sales of a customized dental prosthesis for implants utilizing Osteon Medical's digital technology.

- Thus, due to the increase in the adoption of dental implants and the rise in strategic activities by the key players, the studied segment is expected to grow during the study period.

Periodontal Segment is Anticipated to Hold a Significant Market Share Over the Forecast Period

- Periodontitis is a serious gum infection that damages gums and can destroy the jawbone. Usually, inadequate dental hygiene is the main reason for the emergence of this disease. Loss of teeth can result from periodontitis. The periodontic segment is expected to witness significant growth owing to the increase in periodontitis, the rise in strategic activities, and various government initiatives to educate people about early diagnosis and proper treatment.

- For instance, as per the article published in July 2022 in PubMed, in Japan, caries has been the biggest target of oral diseases, and its treatment and prevention have been long-standing issues. Periodontal disease has overtaken dental caries as the largest cause of tooth loss, which was previously caused by dental caries (30.2% in men and 29.0% in women) in Japan. Thus, a high incidence of periodontitis is expected to bolster the studied segment over the forecast period.

- Furthermore, an increase in strategic activities by the key players is expected to fuel the market growth over the forecast period. For instance, in April 2021, Morita Dental Products Corp. acquired Dentsply Sirona K.K. located in Tokyo, Japan, to strengthen cooperation in the Morita Group's orthodontic business and work to further grow and evolve the business in order to contribute to the development of orthodontics and the dental industry.

- Thus, owing to the high prevalence of periodontitis, strategic activities by the key players are expected to bolster the market growth over the forecast period.

Japan Dental Equipment Industry Overview

The Japan dental equipment market is moderately consolidated. The players are focusing on research and development in order to form stable and safe products. The market has been noticing technological developments on a large scale for the past couple of years. 3M, Takara Belmont, Mani Inc., and Dentech Corporation are some of the key players in the market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Burden of Oral Diseases and Ageing Population

- 4.2.2 Growing Demand for Cosmetic Dentistry

- 4.2.3 Technological Advancements in Dentistry

- 4.3 Market Restraints

- 4.3.1 Excessive Costs Involved in Private Health Insurance

- 4.3.2 Negligence Towards Oral Health

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market SIze by Value - in USD)

- 5.1 By Product

- 5.1.1 General and Diagnostics Equipment

- 5.1.1.1 Dental Laser

- 5.1.1.1.1 Soft Tissue Lasers

- 5.1.1.1.2 Hard Tissue Lasers

- 5.1.1.2 Radiology Equipment

- 5.1.1.2.1 Extra Oral Radiology Equipment

- 5.1.1.2.2 Intra-oral Radiology Equipment

- 5.1.1.3 Dental Chair and Equipment

- 5.1.1.4 Other General and Diagnostic Equipment

- 5.1.2 Dental Consumables

- 5.1.2.1 Dental Biomaterial

- 5.1.2.2 Dental Implants

- 5.1.2.3 Crowns and Bridges

- 5.1.2.4 Other Dental Consumables

- 5.1.3 Other Dental Devices

- 5.1.1 General and Diagnostics Equipment

- 5.2 By Treatment

- 5.2.1 Orthodontic

- 5.2.2 Endodontic

- 5.2.3 Peridontic

- 5.2.4 Prosthodontic

- 5.3 By End-User

- 5.3.1 Hospitals

- 5.3.2 Clinics

- 5.3.3 Other End-Users

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 3M

- 6.1.2 Takara Belmont

- 6.1.3 KaVo Dental Systems Japan

- 6.1.4 Mani Inc.

- 6.1.5 Dentech Corporation

- 6.1.6 The Yoshida Dental Mfg. Co., Ltd.

- 6.1.7 Dentsply Sirona

- 6.1.8 J. Morita Corp.

- 6.1.9 GC Corporation