|

|

市場調査レポート

商品コード

1759027

EV充電ステーションの世界市場:用途別、充電ポイント事業者別、充電インフラタイプ別、充電ポイントタイプ別、充電サービスタイプ別、接続フェーズ別、DC急速充電タイプ別、電気バス充電タイプ別、設置タイプ別、充電レベル別、モード別、地域別 - 2032年までの予測EV Charging Station Market by Application, Level of Charging, Charging Point, Charging Infrastructure, Operation, DC Fast Charging, Charge Point Operator, Connection Phase, Service, Installation, and Region - Global Forecast to 2032 |

||||||

カスタマイズ可能

|

|||||||

| EV充電ステーションの世界市場:用途別、充電ポイント事業者別、充電インフラタイプ別、充電ポイントタイプ別、充電サービスタイプ別、接続フェーズ別、DC急速充電タイプ別、電気バス充電タイプ別、設置タイプ別、充電レベル別、モード別、地域別 - 2032年までの予測 |

|

出版日: 2025年06月18日

発行: MarketsandMarkets

ページ情報: 英文 471 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界のEV充電ステーションの市場規模は、2025年の284億7,000万米ドルから15.1%のCAGRで拡大し、2032年には763億1,000万米ドルに成長すると予測されています。

EV充電インフラの展開を直接促進する主な要因には、Tesla、Rivian、Hyundaiなどの企業、専有および公開ネットワークへの投資が含まれます。また、高速DC充電器(150~350kW)の進歩が最新のEVとの互換性を高めています。都市化とスマートシティプロジェクトは、商業スペースや公共スペースへの充電器の統合を促進しています。さらに、車両電化の義務化によって、ロジスティクス企業やモビリティ企業は専用の充電ハブを建設するようになっています。アジアの一部の市場では、補完的なインフラ・モデルとしてバッテリー交換が台頭しています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2032年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2032年 |

| 対象台数 | 数量(台) |

| セグメント | 用途別、充電ポイント事業者別、充電インフラタイプ別、充電ポイントタイプ別、充電サービスタイプ別、接続フェーズ別、DC急速充電タイプ別、電気バス充電タイプ別、設置タイプ別、充電レベル別、モード別、地域別 |

| 対象地域 | 中国、アジア太平洋地域、欧州、北米、中東、その他の地域 |

キオスクと一体化した固定式EV充電器は、公共施設や商業施設で一般的になりつつあり、ユーザーにシームレスで安全な充電体験を提供しています。Tata Power(EZ Charge)、ChargeZone、Statiq、Fortum Charge &Driveなどの企業は、インドのモール、高速道路、都市中心部にキオスクベースの充電ソリューションを展開し、24時間365日のアクセス、アプリベースの支払い、リアルタイムの監視などの機能を提供しています。例えば、ChargeZoneはインドの37以上の都市で、高速DC充電器と使いやすいキオスクを備えた1,500以上のEV充電ステーションを運営しています。2025年4月、Tata Power はムンバイでEZチャージ・ネットワークを拡大し、EVユーザーのアクセシビリティを高めるため、主要な場所にキオスク対応の充電ステーションを新たに追加しました。政府、規制機関、非公開会社、OEMは、EVの普及を加速させるため、固定式EV充電器への投資を増やしています。このような共同推進の背景には、信頼性の高い充電インフラを拡大する必要性があります。例えば、2025年5月、米国を拠点とする充電ポイント運営会社Zero 60は、ニューヨーク州レイクプラシッドに4基目となる再生可能エネルギーによるEV充電ステーションを開設しました。欧州では、Atlante、Ionity、Fastned、Electraなどの大手企業が2025年4月にSparkアライアンスを結成し、インフラを共有し、25カ国で11,000の充電器をカバーする最大の公共充電ネットワークを構築しました。

DC充電ステーションは、急速充電に使用される高出力の急速充電ユニットです。最大出力240kW、最大400Aの大電流を最大600Vの直流電圧で供給します。しかし、平均して約3万~5万米ドルのコストがかかり、変圧器の追加も必要です。DC急速充電システムでは、AC/DC変換は車両のAC/DCコンバーターではなく、充電装置で行われるため、車両に入る電力はすでにDCになっています。ほとんどの住宅用電気サービスは、DC充電ステーションが供給する電力容量を提供していないため、DC充電を家庭で実施することは不可能です。DC急速充電器は、目的地充電器や公共充電器として広く使われています。テスラなどのOEMは、1時間当たり20~30マイルの充電が可能な直流充電器(テスラ・スーパーチャージャー)を提供しています。DC充電ステーションの数が少ない主な理由は、DC充電ステーションの方がコストが高いためです。ChargePointやCar Charging Groupなどの充電ステーション・プロバイダーは、公共のDC急速充電ステーションを提供しています。DC急速充電ステーションの設置価格は年々低下しているため、これらの充電ステーションの需要は今後数年間で増加すると予想されます。

アジア太平洋のEV充電ステーション市場は急成長が予測されます。韓国では、グリーン・ニューディールや2030年までに120万台の充電器を設置するという国家目標など、政府の強力な政策がEV充電インフラの成長を牽引しています。都市の密集度やスマートシティへの取り組みが、コンパクトで統合された充電ソリューションへの需要を加速しています。インドネシアはこの地域で最も急成長している市場です。インドネシアのEV充電インフラの拡大は、主に戦略的な官民パートナーシップと、電動モビリティへの移行を加速することを目的とした政府の強力な支援によって推進されています。V-GREENは、Chargecore、ChargePoint、Amarta Group、CVSなどの主要パートナーとともに、2025年までに63,000以上の充電ポートを配備するため、3億米ドルの巨額投資を約束しており、EVインフラへの需要が最も高いジャボダテベック、バンドン、スラバヤ、マカッサル、バリなどの主要県に注力しています。同時に、国営電力会社PLNは、全国に数千の公共充電ステーションとバッテリー交換施設を設置することで、極めて重要な役割を果たしています。これは、オフピーク時の充電料金割引や家庭用充電設備への補助金などのインセンティブによって補完されています。政府の優遇措置、投資家のリターンの保証、PLNのスーパーアプリのようなデジタル・プラットフォームは、消費者の関心と投資家の信頼をさらに高めています。インドのこうした地域開発と歩調を合わせるように、政府はEV充電インフラへの投資を表明しています。例えば、2025年5月、インド政府はPM-E Driveスキームの下、約2億3,460万米ドルを投資して、全国に約7万2,000カ所の公共EV充電ステーションを設置する計画を発表しました。

当レポートでは、世界のEV充電ステーション市場について調査し、用途別、充電ポイント事業者別、充電インフラタイプ別、充電ポイントタイプ別、充電サービスタイプ別、接続フェーズ別、DC急速充電タイプ別、電気バス充電タイプ別、設置タイプ別、充電レベル別、モード別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- エコシステム分析

- サプライチェーン分析

- 規制状況

- 部品表

- 価格分析

- ケーススタディ分析

- 投資と資金調達のシナリオ

- AIの影響

- 特許分析

- 技術分析

- HSコード:電気変圧器、静止型コンバータ(8504)、2020年~2024年

- 2025年~2026年の主な会議とイベント

- 主要な利害関係者と購入基準

- 顧客のビジネスに影響を与える動向と混乱

- EV充電のパフォーマンス指標

- EV充電の進化

- EV充電ステーション市場における機会

- 充電の未来

- 充電システムのパワーブースター

第6章 EV充電ステーション市場(用途別)

- イントロダクション

- 主要参入企業別充電ステーションの提供

- プライベート

- 半公共

- 公共

- 主要な洞察

第7章 EV充電ステーション市場(充電ポイント事業者別)

- イントロダクション

- アジア太平洋:充電ポイント運営者

- 欧州:充電ポイント運営者

- 北米:充電ポイント運営者

第8章 EV充電ステーション市場(充電インフラタイプ別)

- イントロダクション

- 地域/国別の主要充電インフラ

- CHADEMO

- CCS

- NACS/TESLA SC(テスラスーパーチャージャー)

- GB/T高速

- 主要な洞察

第9章 EV充電ステーション市場(充電ポイントタイプ別)

- イントロダクション

- 主要参入企業別充電ポイントの比較

- AC充電

- DC充電

- 主要な洞察

第10章 EV充電ステーション市場(充電サービスタイプ別)

- イントロダクション

- EV充電サービス

- バッテリー交換サービス

第11章 EV充電ステーション市場(接続フェーズ別)

- イントロダクション

- EV充電ステーション(接続フェーズ別)

- 単相

- 三相

- 主要な洞察

第12章 EV充電ステーション市場(DC急速充電タイプ別)

- イントロダクション

- 主要参入企業別DC急速充電サービス

- 低速DC

- 高速DC

- 超低速DC

- 主要な洞察

第13章 EV充電ステーション市場(電気バス充電タイプ別)

- イントロダクション

- オフボードトップダウンパンタグラフ

- 車上式ボトムアップパンタグラフ

- コネクタ経由で充電

第14章 EV充電ステーション市場(設置タイプ別)

- イントロダクション

- 主要参入企業別ポータブル充電器

- ポータブル充電器

- 固定充電器

- 主要な洞察

第15章 EV充電ステーション市場(充電レベル別)

- イントロダクション

- 主要参入企業別EV充電器の提供

- 主要な洞察

第16章 EV充電ステーション市場(モード別)

- イントロダクション

- 主要事業者別、モード別EV充電ステーションの比較

- 主要な洞察

第17章 EV充電ステーション市場(地域別)

- イントロダクション

- アジア太平洋

- マクロ経済見通し

- インド

- 日本

- 韓国

- シンガポール

- タイ

- 台湾

- インドネシア

- 中国

- 政府支援により電動化とOEM主導の急速充電ステーションが市場を牽引

- 欧州

- マクロ経済見通し

- フランス

- ドイツ

- オランダ

- ノルウェー

- スウェーデン

- 英国

- デンマーク

- オーストリア

- スペイン

- スイス

- 北米

- マクロ経済見通し

- カナダ

- 米国

- 中東

- マクロ経済見通し

- イスラエル

- アラブ首長国連邦

- サウジアラビア

- その他の地域

- マクロ経済見通し

- ブラジル

- メキシコ

- 南アフリカ

- その他

第18章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み、2021年1月~2025年5月

- 収益分析

- 市場シェア分析、2024年

- 企業評価と財務指標

- ブランド/製品比較

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 競合シナリオ

第19章 企業プロファイル

- 主要参入企業

- ABB

- BYD COMPANY LTD.

- CHARGEPOINT, INC.

- TESLA

- EVBOX

- DELTA ELECTRONICS, INC.

- STARCHARGE

- SIEMENS

- SCHNEIDER ELECTRIC

- KEMPOWER OYJ

- EFACEC

- 主要な充電ポイント事業者

- ENGIE

- SHELL PLC

- TOTALENERGIES

- BP P.L.C.

- ENEL X S.R.L.

- VIRTA GLOBAL

- ALLEGO B.V.

- TGOOD ELECTRIC CO., LTD.

- STATE GRID CORPORATION CHINA

- VATTENFALL AB

- その他の企業

- BLINK CHARGING CO.

- ENPHASE ENERGY

- ELECTRIFY AMERICA

- OPCONNECT

- EV SAFE CHARGE INC.

- IONITY

- WALLBOX

- SPARK HORIZON

- DBT

- CHARGE+

- ALFEN NV

- IES SYNERGY

- MADIC GROUP

- BEEV

- INSTAVOLT

- FRESHMILE

- POD POINT

- BE CHARGE

- MER

- ENBW

- RWE

- POWERDOT

- SPARKCHARGE

- JOLT

- INSTALLER

- NUMBAT

- ITSELECTRIC INC

第20章 市場における提言

第21章 付録

List of Tables

- TABLE 1 MARKET DEFINITION, BY CHARGING POINT TYPE

- TABLE 2 MARKET DEFINITION, BY APPLICATION

- TABLE 3 MARKET DEFINITION, BY CHARGING INFRASTRUCTURE TYPE

- TABLE 4 MARKET DEFINITION, BY CHARGING SERVICE TYPE

- TABLE 5 MARKET DEFINITION, BY DC FAST CHARGING TYPE

- TABLE 6 MARKET DEFINITION, BY INSTALLATION TYPE

- TABLE 7 MARKET DEFINITION, BY CHARGE POINT OPERATOR

- TABLE 8 MARKET DEFINITION, BY LEVEL OF CHARGING

- TABLE 9 MARKET DEFINITION, BY OPERATION

- TABLE 10 MARKET DEFINITION, BY CONNECTION PHASE

- TABLE 11 INCLUSIONS AND EXCLUSIONS

- TABLE 12 CURRENCY EXCHANGE RATES (PER USD), 2021-2024

- TABLE 13 EV CHARGING SOLUTIONS

- TABLE 14 EV CHARGING INCENTIVES

- TABLE 15 RANGE AND COST OF DIFFERENT ELECTRIC VEHICLES

- TABLE 16 BIDIRECTIONAL EV CHARGERS

- TABLE 17 ELECTRIC VEHICLE SALES WITH BIDIRECTIONAL CHARGING, US

- TABLE 18 SMART CHARGING ELEMENTS

- TABLE 19 EV CHARGER TYPES AND UTILIZATION TRENDS, 2025-2032

- TABLE 20 IMPACT OF MARKET DYNAMICS

- TABLE 21 ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 22 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 23 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 24 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 25 NETHERLANDS: EV INCENTIVES

- TABLE 26 NETHERLANDS: EV CHARGING STATION INCENTIVES

- TABLE 27 GERMANY: EV INCENTIVES

- TABLE 28 GERMANY: EV CHARGING STATION INCENTIVES

- TABLE 29 FRANCE: EV INCENTIVES

- TABLE 30 FRANCE: EV CHARGING STATION INCENTIVES

- TABLE 31 UK: EV INCENTIVES

- TABLE 32 UK: EV CHARGING STATION INCENTIVES

- TABLE 33 CHINA: EV INCENTIVES

- TABLE 34 CHINA: EV CHARGING STATION INCENTIVES

- TABLE 35 US: EV INCENTIVES

- TABLE 36 US: EV CHARGING STATION INCENTIVES

- TABLE 37 CANADA: EV INCENTIVES

- TABLE 38 CANADA: EV CHARGING STATION INCENTIVES

- TABLE 39 EV CHARGING STATION COST SUMMARY, BY KEY PLAYERS, 2024

- TABLE 40 AVERAGE SELLING PRICE TREND, BY DC CHARGING POINT TYPE, 2022-2024 (USD)

- TABLE 41 AVERAGE SELLING PRICE TREND, BY REGION, 2022-2024 (USD)

- TABLE 42 KEY PATENTS, 2022-2025

- TABLE 43 IMPORT DATA FOR HS CODE 8504, BY COUNTRY, 2020-2024 (USD BILLION)

- TABLE 44 EXPORT DATA FOR HS CODE 8504, BY COUNTRY, 2020-2024 (USD BILLION)

- TABLE 45 KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 46 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE LEVELS OF CHARGING (%)

- TABLE 47 KEY BUYING CRITERIA FOR TOP THREE LEVELS OF CHARGING

- TABLE 48 PERFORMANCE INDICATORS FOR EV CHARGING

- TABLE 49 COMPARISON BETWEEN BATTERY AND FLYWHEEL POWER BOOSTER

- TABLE 50 EXAMPLES OF FLYWHEEL POWER BOOSTER

- TABLE 51 EV CHARGING STATION MARKET, BY APPLICATION, 2021-2024 (THOUSAND UNITS)

- TABLE 52 EV CHARGING STATION MARKET, BY APPLICATION, 2025-2032 (THOUSAND UNITS)

- TABLE 53 EV CHARGING STATIONS, BY APPLICATION

- TABLE 54 PRIVATE: EV CHARGING STATION MARKET, BY COUNTRY/REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 55 PRIVATE: EV CHARGING STATION MARKET, BY COUNTRY/REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 56 SEMI-PUBLIC: EV CHARGING STATION MARKET, BY COUNTRY/REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 57 SEMI-PUBLIC: EV CHARGING STATION MARKET, BY COUNTRY/REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 58 PUBLIC: EV CHARGING STATION MARKET, BY COUNTRY/REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 59 PUBLIC: EV CHARGING STATION MARKET, BY COUNTRY/REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 60 CHINA: LEADING CHARGE POINT OPERATORS, 2018-2024 (UNITS)

- TABLE 61 INDIA: LEADING CHARGE POINT OPERATORS, 2018-2024 (UNITS)

- TABLE 62 JAPAN: LEADING CHARGE POINT OPERATORS, 2018-2024 (UNITS)

- TABLE 63 SOUTH KOREA: LEADING CHARGE POINT OPERATORS, 2018-2024 (UNITS)

- TABLE 64 GERMANY: LEADING CHARGE POINT OPERATORS, 2018-2024 (UNITS)

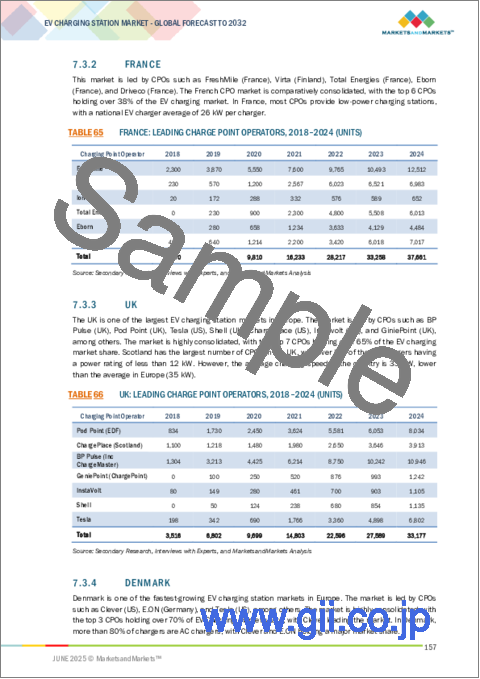

- TABLE 65 FRANCE: LEADING CHARGE POINT OPERATORS, 2018-2024 (UNITS)

- TABLE 66 UK: LEADING CHARGE POINT OPERATORS, 2018-2024 (UNITS)

- TABLE 67 DENMARK: LEADING CHARGE POINT OPERATORS, 2018-2024 (UNITS)

- TABLE 68 NETHERLANDS: LEADING CHARGE POINT OPERATORS, 2018-2024 (UNITS)

- TABLE 69 NORWAY: LEADING CHARGE POINT OPERATORS, 2018-2024 (UNITS)

- TABLE 70 SWITZERLAND: LEADING CHARGE POINT OPERATORS, 2018-2024 (UNITS)

- TABLE 71 SPAIN: LEADING CHARGE POINT OPERATORS, 2018-2024 (UNITS)

- TABLE 72 US: LEADING CHARGE POINT OPERATORS, 2018-2024 (UNITS)

- TABLE 73 CANADA: LEADING CHARGE POINT OPERATORS, 2018-2024 (UNITS)

- TABLE 74 EV CHARGING STATION MARKET, BY CHARGING INFRASTRUCTURE TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 75 EV CHARGING STATION MARKET, BY CHARGING INFRASTRUCTURE TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 76 TYPES OF CHARGING INFRASTRUCTURE

- TABLE 77 TYPE 1: EV CHARGING STATION MARKET, BY COUNTRY/REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 78 TYPE 1: EV CHARGING STATION MARKET, BY COUNTRY/REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 79 TYPE 2: EV CHARGING STATION MARKET, BY COUNTRY/REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 80 TYPE 2: EV CHARGING STATION MARKET, BY COUNTRY/REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 81 CHADEMO: EV CHARGING STATION MARKET, BY COUNTRY/REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 82 CHADEMO: EV CHARGING STATION MARKET, BY COUNTRY/REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 83 CCS: EV CHARGING STATION MARKET, BY COUNTRY/REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 84 CCS: EV CHARGING STATION MARKET, BY COUNTRY/REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 85 NACS/TESLA SC: EV CHARGING STATION MARKET, BY COUNTRY/REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 86 NACS/TESLA SC: EV CHARGING STATION MARKET, BY COUNTRY/REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 87 GB/T FAST: EV CHARGING STATION MARKET, BY COUNTRY, 2021-2024 (THOUSAND UNITS)

- TABLE 88 GB/T FAST: EV CHARGING STATION MARKET, BY COUNTRY, 2025-2032 (THOUSAND UNITS)

- TABLE 89 EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 90 EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 91 EV CHARGING STATIONS, BY CHARGING POINT TYPE

- TABLE 92 AC CHARGING: EV CHARGING STATION MARKET, BY COUNTRY/REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 93 AC CHARGING: EV CHARGING STATION MARKET, BY COUNTRY/REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 94 DC CHARGING: EV CHARGING STATION MARKET, BY COUNTRY/REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 95 DC CHARGING: EV CHARGING STATION MARKET, BY COUNTRY/REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 96 EV CHARGING POINTS, BY COUNTRY, 2024

- TABLE 97 BATTERY SWAPPING SERVICES, BY KEY PLAYER

- TABLE 98 EV CHARGING STATION MARKET, BY CONNECTION PHASE, 2021-2024 (THOUSAND UNITS)

- TABLE 99 EV CHARGING STATION MARKET, BY CONNECTION PHASE, 2025-2032 (THOUSAND UNITS)

- TABLE 100 EV CHARGING STATIONS, BY CONNECTION PHASE

- TABLE 101 SINGLE-PHASE EV CHARGING STATIONS

- TABLE 102 SINGLE PHASE: EV CHARGING STATION MARKET, BY COUNTRY/REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 103 SINGLE PHASE: EV CHARGING STATION MARKET, BY COUNTRY/REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 104 THREE-PHASE EV CHARGING STATIONS

- TABLE 105 THREE PHASE: EV CHARGING STATION MARKET, BY COUNTRY/REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 106 THREE PHASE: EV CHARGING STATION MARKET, BY COUNTRY/REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 107 EV CHARGING STATION MARKET, BY DC FAST CHARGING TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 108 EV CHARGING STATION MARKET, BY DC FAST CHARGING TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 109 EV CHARGING STATIONS, BY DC FAST CHARGING TYPE

- TABLE 110 SLOW DC CHARGER OFFERINGS, BY KEY PLAYERS

- TABLE 111 SLOW DC: EV CHARGING STATION MARKET, BY COUNTRY/REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 112 SLOW DC: EV CHARGING STATION MARKET, BY COUNTRY/REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 113 FAST DC: EV CHARGING STATION MARKET, BY COUNTRY/REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 114 FAST DC: EV CHARGING STATION MARKET, BY COUNTRY/REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 115 DC ULTRAFAST 1: EV CHARGING STATION MARKET, BY COUNTRY/REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 116 DC ULTRAFAST 1: EV CHARGING STATION MARKET, BY COUNTRY/REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 117 DC ULTRAFAST 2: EV CHARGING STATION MARKET, BY COUNTRY/REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 118 DC ULTRAFAST 2: EV CHARGING STATION MARKET, BY COUNTRY/REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 119 400 KW: EV CHARGING STATION MARKET, BY COUNTRY/REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 120 400 KW: EV CHARGING STATION MARKET, BY COUNTRY/REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 121 MEGAWATT CHARGING SYSTEMS: EV CHARGING STATION MARKET, BY COUNTRY/REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 122 MEGAWATT CHARGING SYSTEMS: EV CHARGING STATION MARKET, BY COUNTRY/REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 123 PANTOGRAPH BUS CHARGING

- TABLE 124 OFF-BOARD TOP-DOWN PANTOGRAPH OFFERINGS, BY KEY PLAYERS

- TABLE 125 ONBOARD BOTTOM-UP PANTOGRAPH OFFERINGS, BY KEY PLAYERS

- TABLE 126 ELECTRIC BUS CHARGER OFFERINGS, BY KEY PLAYERS

- TABLE 127 COMPARISON BETWEEN PORTABLE AND FIXED CHARGERS

- TABLE 128 EV CHARGING STATION MARKET, BY INSTALLATION TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 129 EV CHARGING STATION MARKET, BY INSTALLATION TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 130 PORTABLE EV CHARGING SOLUTIONS

- TABLE 131 PORTABLE CHARGERS: EV CHARGING STATION MARKET, BY COUNTRY/REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 132 PORTABLE CHARGERS: EV CHARGING STATION MARKET, BY COUNTRY/REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 133 FIXED CHARGERS: EV CHARGING STATION MARKET, BY COUNTRY/REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 134 FIXED CHARGERS: EV CHARGING STATION MARKET, BY COUNTRY/REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 135 PARC DATA: EV CHARGING STATION MARKET, BY LEVEL OF CHARGING, 2021-2024 (THOUSAND UNITS)

- TABLE 136 PARC DATA: EV CHARGING STATION MARKET, BY LEVEL OF CHARGING, 2025-2032 (THOUSAND UNITS)

- TABLE 137 NEW SALES: EV CHARGING STATION MARKET, BY LEVEL OF CHARGING, 2021-2024 (THOUSAND UNITS)

- TABLE 138 NEW SALES: EV CHARGING STATION MARKET, BY LEVEL OF CHARGING, 2025-2032 (THOUSAND UNITS)

- TABLE 139 NEW SALES: EV CHARGING STATION MARKET, BY LEVEL OF CHARGING, 2021-2024 (USD MILLION)

- TABLE 140 NEW SALES: EV CHARGING STATION MARKET, BY LEVEL OF CHARGING, 2025-2032 (USD MILLION)

- TABLE 141 EV CHARGING STATIONS, BY LEVEL

- TABLE 142 LEVEL 1 EV CHARGING STATIONS

- TABLE 143 PARC DATA LEVEL 1: EV CHARGING STATION MARKET, BY COUNTRY/REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 144 PARC DATA LEVEL 1: EV CHARGING STATION MARKET, BY COUNTRY/REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 145 NEW SALES LEVEL 1: EV CHARGING STATION MARKET, BY COUNTRY/REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 146 NEW SALES LEVEL 1: EV CHARGING STATION MARKET, BY COUNTRY/REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 147 NEW SALES LEVEL 1: EV CHARGING STATION MARKET, BY COUNTRY/REGION, 2021-2024 (USD MILLION)

- TABLE 148 NEW SALES LEVEL 1: EV CHARGING STATION MARKET, BY COUNTRY/REGION, 2025-2032 (USD MILLION)

- TABLE 149 LEVEL 2 EV CHARGING STATIONS

- TABLE 150 PARC DATA LEVEL 2: EV CHARGING STATION MARKET, BY COUNTRY/REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 151 PARC DATA LEVEL 2: EV CHARGING STATION MARKET, BY COUNTRY/REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 152 NEW SALES LEVEL 2: EV CHARGING STATION MARKET, BY COUNTRY/REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 153 NEW SALES LEVEL 2: EV CHARGING STATION MARKET, BY COUNTRY/REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 154 NEW SALES LEVEL 2: EV CHARGING STATION MARKET, BY COUNTRY/REGION, 2021-2024 (USD MILLION)

- TABLE 155 NEW SALES LEVEL 2: EV CHARGING STATION MARKET, BY COUNTRY/REGION, 2025-2032 (USD MILLION)

- TABLE 156 LEVEL 3 EV CHARGING STATIONS

- TABLE 157 PARC DATA LEVEL 3: EV CHARGING STATION MARKET, BY COUNTRY/REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 158 PARC DATA LEVEL 3: EV CHARGING STATION MARKET, BY COUNTRY/REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 159 NEW SALES LEVEL 3: EV CHARGING STATION MARKET, BY COUNTRY/REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 160 NEW SALES LEVEL 3: EV CHARGING STATION MARKET, BY COUNTRY/REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 161 NEW SALES LEVEL 3: EV CHARGING STATION MARKET, BY COUNTRY/REGION, 2021-2024 (USD MILLION)

- TABLE 162 NEW SALES LEVEL 3: EV CHARGING STATION MARKET, BY COUNTRY/REGION, 2025-2032 (USD MILLION)

- TABLE 163 EV CHARGING STATION MARKET, BY MODE, 2021-2024 (THOUSAND UNITS)

- TABLE 164 EV CHARGING STATION MARKET, BY MODE, 2025-2032 (THOUSAND UNITS)

- TABLE 165 EV CHARGING STATIONS, BY MODE

- TABLE 166 MODE 1: EV CHARGING STATION MARKET, BY COUNTRY/REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 167 MODE 1: EV CHARGING STATION MARKET, BY COUNTRY/REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 168 MODE 2 CHARGING STATISTICS

- TABLE 169 MODE 2: EV CHARGING STATION MARKET, BY COUNTRY/REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 170 MODE 2: EV CHARGING STATION MARKET, BY COUNTRY/REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 171 MODE 3 CHARGING STATISTICS

- TABLE 172 MODE 3: EV CHARGING STATION MARKET, BY COUNTRY/REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 173 MODE 3: EV CHARGING STATION MARKET, BY COUNTRY/REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 174 MODE 4 CHARGING STATISTICS

- TABLE 175 MODE 4: EV CHARGING STATION MARKET, BY COUNTRY/REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 176 MODE 4: EV CHARGING STATION MARKET, BY COUNTRY/REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 177 EV CHARGING STATION MARKET, BY REGION, 2021-2024 (THOUSAND UNITS)

- TABLE 178 EV CHARGING STATION MARKET, BY REGION, 2025-2032 (THOUSAND UNITS)

- TABLE 179 EV CHARGING STATION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 180 EV CHARGING STATION MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 181 ASIA PACIFIC: EV CHARGING STATION MARKET, BY COUNTRY, 2021-2024 (THOUSAND UNITS)

- TABLE 182 ASIA PACIFIC: EV CHARGING STATION MARKET, BY COUNTRY, 2025-2032 (THOUSAND UNITS)

- TABLE 183 EV CHARGING STANDARDS IN INDIA

- TABLE 184 INDIA: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 185 INDIA: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 186 JAPAN: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 187 JAPAN: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 188 SOUTH KOREA: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 189 SOUTH KOREA: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 190 SINGAPORE: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 191 SINGAPORE: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 192 THAILAND: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 193 THAILAND: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 194 TAIWAN: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 195 TAIWAN: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 196 INDONESIA: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 197 INDONESIA: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 198 CHINA: EV CHARGING STATION MARKET HIGHLIGHTS

- TABLE 199 CHINA: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 200 CHINA: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 201 EUROPE: EV CHARGING STATION MARKET, BY COUNTRY, 2021-2024 (THOUSAND UNITS)

- TABLE 202 EUROPE: EV CHARGING STATION MARKET, BY COUNTRY, 2025-2032 (THOUSAND UNITS)

- TABLE 203 FRANCE: EV CHARGING STATION MARKET HIGHLIGHTS

- TABLE 204 FRANCE: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 205 FRANCE: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 206 GERMANY: EV CHARGING STATION MARKET HIGHLIGHTS

- TABLE 207 GERMANY: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 208 GERMANY: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 209 NETHERLANDS: EV CHARGING STATION MARKET HIGHLIGHTS

- TABLE 210 NETHERLANDS: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 211 NETHERLANDS: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 212 NORWAY: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 213 NORWAY: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 214 SWEDEN: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 215 SWEDEN: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 216 UK: EV CHARGING STATION MARKET HIGHLIGHTS

- TABLE 217 UK: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 218 UK: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 219 DENMARK: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 220 DENMARK: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 221 AUSTRIA: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 222 AUSTRIA: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 223 SPAIN: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 224 SPAIN: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 225 SWITZERLAND: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 226 SWITZERLAND: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 227 NORTH AMERICA: LEADING CHARGING POINT OPERATORS

- TABLE 228 NORTH AMERICA: EV CHARGING STATION MARKET, BY COUNTRY, 2021-2024 (THOUSAND UNITS)

- TABLE 229 NORTH AMERICA: EV CHARGING STATION MARKET, BY COUNTRY, 2025-2032 (THOUSAND UNITS)

- TABLE 230 CANADA: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 231 CANADA: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 232 US: EV CHARGING STATION MARKET HIGHLIGHTS

- TABLE 233 US: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 234 US: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 235 MIDDLE EAST: EV CHARGING STATION MARKET, BY COUNTRY, 2021-2024 (THOUSAND UNITS)

- TABLE 236 MIDDLE EAST: EV CHARGING STATION MARKET, BY COUNTRY, 2025-2032 (THOUSAND UNITS)

- TABLE 237 ISRAEL: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2021-2024 (UNITS)

- TABLE 238 ISRAEL: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2025-2032 (UNITS)

- TABLE 239 UAE: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2021-2024 (UNITS)

- TABLE 240 UAE: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2025-2032 (UNITS)

- TABLE 241 SAUDI ARABIA: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2021-2024 (UNITS)

- TABLE 242 SAUDI ARABIA: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2025-2032 (UNITS)

- TABLE 243 REST OF THE WORLD: EV CHARGING STATION MARKET, BY COUNTRY, 2021-2024 (THOUSAND UNITS)

- TABLE 244 REST OF THE WORLD: EV CHARGING STATION MARKET, BY COUNTRY, 2025-2032 (THOUSAND UNITS)

- TABLE 245 BRAZIL: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2021-2024 (UNITS)

- TABLE 246 BRAZIL: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2025-2032 (UNITS)

- TABLE 247 MEXICO: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 248 MEXICO: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2025-2032 (THOUSAND UNITS)

- TABLE 249 SOUTH AFRICA: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2021-2024 (UNITS)

- TABLE 250 SOUTH AFRICA: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2025-2032 (UNITS)

- TABLE 251 OTHERS: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2021-2024 (UNITS)

- TABLE 252 OTHERS: EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2025-2032 (UNITS)

- TABLE 253 KEY PLAYER STRATEGIES/RIGHT TO WIN, JANUARY 2021-MAY 2025

- TABLE 254 EV CHARGING POINT MANUFACTURERS, MARKET SHARE ANALYSIS, 2024

- TABLE 255 EV CHARGING POINT OPERATORS, MARKET SHARE ANALYSIS, 2024

- TABLE 256 EV CHARGING STATION MARKET: COUNTRY/REGION FOOTPRINT

- TABLE 257 EV CHARGING STATION MARKET: CHARGING POINT FOOTPRINT

- TABLE 258 EV CHARGING STATION MARKET: LEVEL OF CHARGING FOOTPRINT

- TABLE 259 EV CHARGING STATION MARKET: DC FAST CHARGING FOOTPRINT

- TABLE 260 EV CHARGING STATION MARKET: LIST OF STARTUPS/SMES

- TABLE 261 EV CHARGING STATION MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES (1/3)

- TABLE 262 EV CHARGING STATION MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES (2/3)

- TABLE 263 EV CHARGING STATION MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES (3/3)

- TABLE 264 EV CHARGING STATION MARKET: PRODUCT LAUNCHES/DEVELOPMENTS, JANUARY 2021-MAY 2025

- TABLE 265 EV CHARGING STATION MARKET: DEALS, JANUARY 2021-MAY 2025

- TABLE 266 EV CHARGING STATION MARKET: EXPANSIONS, JANUARY 2021-MAY 2025

- TABLE 267 EV CHARGING STATION MARKET: OTHER DEVELOPMENTS, JANUARY 2021-MAY 2025

- TABLE 268 ABB: COMPANY OVERVIEW

- TABLE 269 ABB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 270 ABB: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 271 ABB: DEALS

- TABLE 272 ABB: EXPANSIONS

- TABLE 273 ABB: OTHER DEVELOPMENTS

- TABLE 274 BYD COMPANY LTD.: COMPANY OVERVIEW

- TABLE 275 BYD COMPANY LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 276 BYD COMPANY LTD.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 277 BYD COMPANY LTD.: DEALS

- TABLE 278 BYD COMPANY LTD.: EXPANSIONS

- TABLE 279 CHARGEPOINT: COMPANY OVERVIEW

- TABLE 280 CHARGEPOINT, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 281 CHARGPOINT, INC.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 282 CHARGPOINT, INC.: DEALS

- TABLE 283 CHARGPOINT, INC.: OTHER DEVELOPMENTS

- TABLE 284 TESLA: COMPANY OVERVIEW

- TABLE 285 TESLA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 286 TESLA.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 287 TESLA: DEALS

- TABLE 288 TESLA: OTHER DEVELOPMENTS

- TABLE 289 EVBOX: COMPANY OVERVIEW

- TABLE 290 EVBOX: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 291 EVBOX.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 292 EVBOX: DEALS

- TABLE 293 DELTA ELECTRONICS, INC.: COMPANY OVERVIEW

- TABLE 294 DELTA ELECTRONICS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 295 DELTA ELECTRONICS, INC.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 296 DELTA ELECTRONICS, INC.: DEALS

- TABLE 297 STARCHARGE: COMPANY OVERVIEW

- TABLE 298 STARCHARGE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 299 STARCHARGE.: SERVICE LAUNCHES/DEVELOPMENTS

- TABLE 300 STARCHARGE: DEALS

- TABLE 301 STARCHARGE.: EXPANSIONS

- TABLE 302 STARCHARGE: OTHER DEVELOPMENTS

- TABLE 303 SIEMENS: COMPANY OVERVIEW

- TABLE 304 SIEMENS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 305 SIEMENS: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 306 SIEMENS: DEALS

- TABLE 307 SIEMENS: OTHER DEVELOPMENTS

- TABLE 308 SCHNEIDER ELECTRIC: COMPANY OVERVIEW

- TABLE 309 SCHNEIDER ELECTRIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 310 SCHNEIDER ELECTRIC: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 311 SCHNEIDER ELECTRIC: DEALS

- TABLE 312 SCHNEIDER ELECTRIC: EXPANSIONS

- TABLE 313 KEMPOWER OYJ: COMPANY OVERVIEW

- TABLE 314 KEMPOWER OYJ: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 315 KEMPOWER OYJ.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 316 KEMPOWER OYJ: DEALS

- TABLE 317 KEMPOWER OYJ: EXPANSIONS

- TABLE 318 KEMPOWER OYJ: OTHER DEVELOPMENTS

- TABLE 319 EFACEC: COMPANY OVERVIEW

- TABLE 320 EFACEC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 321 EFACEC: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 322 EFACEC: DEALS

- TABLE 323 EFACEC.: EXPANSIONS

- TABLE 324 ENGIE: COMPANY OVERVIEW

- TABLE 325 ENGIE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 326 ENGIE: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 327 ENGIE: DEALS

- TABLE 328 ENGIE: EXPANSIONS

- TABLE 329 ENGIE: OTHER DEVELOPMENTS

- TABLE 330 SHELL PLC: COMPANY OVERVIEW

- TABLE 331 SHELL PLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 332 SHELL PLC: DEALS

- TABLE 333 SHELL PLC: EXPANSIONS

- TABLE 334 SHELL PLC: OTHER DEVELOPMENTS

- TABLE 335 TOTALENERGIES: COMPANY OVERVIEW

- TABLE 336 TOTALENERGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 337 TOTALENERGIES: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 338 TOTALENERGIES: DEALS

- TABLE 339 TOTALENERGIES: OTHER DEVELOPMENTS

- TABLE 340 BP P.L.C.: COMPANY OVERVIEW

- TABLE 341 BP P.L.C.: GEOGRAPHICAL PRESENCE

- TABLE 342 BP P.L.C.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 343 BP P.L.C.: DEALS

- TABLE 344 BP P.L.C.: EXPANSIONS

- TABLE 345 BP P.L.C.: OTHER DEVELOPMENTS

- TABLE 346 ENEL X S.R.L.: COMPANY OVERVIEW

- TABLE 347 ENEL X S.R.L.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 348 ENEL X S.R.L.: DEALS

- TABLE 349 ENEL X S.R.L.: EXPANSIONS

- TABLE 350 ENEL X S.R.L.: OTHER DEVELOPMENTS

- TABLE 351 VIRTA GLOBAL.: COMPANY OVERVIEW

- TABLE 352 VIRTA GLOBAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 353 VIRTA GLOBAL: DEALS

- TABLE 354 VIRTA GLOBAL: OTHER DEVELOPMENTS

- TABLE 355 ALLEGO B.V.: COMPANY OVERVIEW

- TABLE 356 ALLEGO B.V.: DEALS

- TABLE 357 ALLEGO B.V.: EXPANSIONS

- TABLE 358 ALLEGO B.V.: OTHER DEVELOPMENTS

- TABLE 359 TGOOD ELECTRIC CO., LTD.: COMPANY OVERVIEW

- TABLE 360 TGOOD ELECTRIC CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 361 TGOOD ELECTRIC CO., LTD.: DEALS

- TABLE 362 STATE GRID CORPORATION CHINA: COMPANY OVERVIEW

- TABLE 363 STATE GRID CORPORATION CHINA: DEALS

- TABLE 364 STATE GRID CORPORATION CHINA: EXPANSIONS

- TABLE 365 VATTENFALL AB: COMPANY OVERVIEW

- TABLE 366 VATTENFALL AB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 367 VATTENFALL AB: DEALS

- TABLE 368 VATTENFALL AB: EXPANSIONS

- TABLE 369 VATTENFALL AB: OTHER DEVELOPMENTS

- TABLE 370 BLINK CHARGING CO.: COMPANY OVERVIEW

- TABLE 371 ENPHASE ENERGY: COMPANY OVERVIEW

- TABLE 372 ELECTRIFY AMERICA: COMPANY OVERVIEW

- TABLE 373 OPCONNECT: COMPANY OVERVIEW

- TABLE 374 EV SAFE CHARGE INC.: COMPANY OVERVIEW

- TABLE 375 IONITY: COMPANY OVERVIEW

- TABLE 376 WALLBOX: COMPANY OVERVIEW

- TABLE 377 SPARK HORIZON: COMPANY OVERVIEW

- TABLE 378 DBT: COMPANY OVERVIEW

- TABLE 379 CHARGE+: COMPANY OVERVIEW

- TABLE 380 ALFEN NV: COMPANY OVERVIEW

- TABLE 381 IES SYNERGY: COMPANY OVERVIEW

- TABLE 382 MADIC GROUP: COMPANY OVERVIEW

- TABLE 383 BEEV: COMPANY OVERVIEW

- TABLE 384 INSTAVOLT: COMPANY OVERVIEW

- TABLE 385 FRESHMILE: COMPANY OVERVIEW

- TABLE 386 POD POINT: COMPANY OVERVIEW

- TABLE 387 BE CHARGE: COMPANY OVERVIEW

- TABLE 388 MER: COMPANY OVERVIEW

- TABLE 389 ENBW: COMPANY OVERVIEW

- TABLE 390 RWE: COMPANY OVERVIEW

- TABLE 391 POWERDOT: COMPANY OVERVIEW

- TABLE 392 SPARKCHARGE: COMPANY OVERVIEW

- TABLE 393 JOLT: COMPANY OVERVIEW

- TABLE 394 INSTALLER: COMPANY OVERVIEW

- TABLE 395 NUMBAT: COMPANY OVERVIEW

- TABLE 396 ITSELECTRIC INC: COMPANY OVERVIEW

List of Figures

- FIGURE 1 EV CHARGING STATION MARKET SEGMENTATION

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 RESEARCH PROCESS FLOW

- FIGURE 4 INSIGHTS FROM INDUSTRY EXPERTS

- FIGURE 5 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- FIGURE 6 BOTTOM-UP APPROACH

- FIGURE 7 TOP-DOWN APPROACH

- FIGURE 8 MARKET ESTIMATION NOTES

- FIGURE 9 DATA TRIANGULATION

- FIGURE 10 FACTORS IMPACTING EV CHARGING STATION MARKET

- FIGURE 11 EV CHARGING STATION MARKET OVERVIEW

- FIGURE 12 CHINA TO ACCOUNT FOR LARGEST MARKET SHARE IN 2032

- FIGURE 13 DC ULTRAFAST 1 SEGMENT TO SECURE LEADING MARKET POSITION IN 2032

- FIGURE 14 DC CHARGING TO BE LARGEST SEGMENT IN 2032

- FIGURE 15 STRONG GOVERNMENT MANDATES AND HEAVY INVESTMENTS IN EV CHARGING INFRASTRUCTURE TO DRIVE MARKET

- FIGURE 16 LEVEL 3 SEGMENT TO LEAD MARKET IN 2032

- FIGURE 17 DC CHARGING TO BE LARGEST SEGMENT IN 2032

- FIGURE 18 GB/T FAST SEGMENT TO HOLD LARGEST MARKET SHARE IN 2032

- FIGURE 19 PUBLIC SEGMENT TO CAPTURE LARGEST MARKET SHARE IN 2032

- FIGURE 20 DC ULTRAFAST 1 SEGMENT TO LEAD MARKET IN 2032

- FIGURE 21 FIXED SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 22 MODE 4 SEGMENT TO ACQUIRE LARGEST MARKET SHARE IN 2032

- FIGURE 23 THREE-PHASE SEGMENT TO REGISTER HIGHER CAGR THAN SINGLE-PHASE SEGMENT DURING FORECAST PERIOD

- FIGURE 24 CHINA TO LEAD EV CHARGING STATION MARKET IN 2025

- FIGURE 25 CHARGING INFRASTRUCTURE SOLUTIONS

- FIGURE 26 EV CHARGING STATION MARKET DYNAMICS

- FIGURE 27 GLOBAL BEV AND PHEV SALES, 2019-2024

- FIGURE 28 NUMBER OF CHARGING POINTS IN KEY EUROPEAN COUNTRIES

- FIGURE 29 PRICE TREND OF EV BATTERIES, 2020-2030 (USD PER KWH)

- FIGURE 30 TYPES OF EV CHARGING SOCKETS

- FIGURE 31 EV CHARGING STANDARDS

- FIGURE 32 US GRID SCENARIO

- FIGURE 33 OVERVIEW OF V2G CHARGING STATIONS

- FIGURE 34 BENEFITS OF SMART EV CHARGING

- FIGURE 35 IOT IN EV CHARGING

- FIGURE 36 SERVICE OFFERINGS IN EV CHARGING

- FIGURE 37 EV CHARGING THROUGH SOLAR POWER

- FIGURE 38 BATTERY SWAPPING STATION BUSINESS MODELS

- FIGURE 39 SMART EV CHARGING INFRASTRUCTURE

- FIGURE 40 COMPARISON OF DIRECT COSTS BETWEEN ICE AND BATTERY ELECTRIC VEHICLES

- FIGURE 41 GLOBAL ENERGY CONSUMPTION

- FIGURE 42 LITHIUM-ION BATTERY DEMAND, 2015-2030

- FIGURE 43 ECOSYSTEM ANALYSIS

- FIGURE 44 VALUE CHAIN ANALYSIS

- FIGURE 45 BILL OF MATERIALS FOR AC (LEVEL 2) CHARGING POINT, 2025 VS. 2032

- FIGURE 46 BILL OF MATERIALS FOR DC SLOW CHARGING POINT, 2025 VS. 2032

- FIGURE 47 BILL OF MATERIALS FOR DC FAST CHARGING POINT, 2025 VS. 2032

- FIGURE 48 BILL OF MATERIALS FOR DC ULTRAFAST 1 CHARGING POINT, 2025 VS. 2032

- FIGURE 49 AVERAGE SELLING PRICE TREND, BY DC CHARGING POINT TYPE, 2022-2024 (USD)

- FIGURE 50 AVERAGE SELLING PRICE TREND, BY REGION, 2022-2024 (USD)

- FIGURE 51 INVESTMENT AND FUNDING SCENARIO, 2022-2025

- FIGURE 52 PATENT ANALYSIS, 2015-2024

- FIGURE 53 WIRELESS EV CHARGING ROAD PROJECTS IN EUROPE

- FIGURE 54 BIDIRECTIONAL EV CHARGING ENERGY FLOW CYCLE

- FIGURE 55 MEGAWATT CHARGING PROJECTS, BY REGION

- FIGURE 56 PLUG-AND-PLAY CONNECTIVITY FOR EV CHARGING

- FIGURE 57 SMART CHARGING SYSTEMS

- FIGURE 58 ROLE OF IOT IN EV CHARGING STATIONS

- FIGURE 59 IMPORT DATA FOR HS CODE 8504, BY COUNTRY, 2020-2024 (USD BILLION)

- FIGURE 60 EXPORT DATA FOR HS CODE 8504, BY COUNTRY, 2020-2024 (USD BILLION)

- FIGURE 61 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE LEVELS OF CHARGING

- FIGURE 62 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- FIGURE 63 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 64 EV CHARGING BUSINESS MODELS

- FIGURE 65 EV CHARGING STATION MARKET, BY APPLICATION, 2024-2030 (THOUSAND UNITS)

- FIGURE 66 PORSCHE TAYCAN CHARGING CONNECTORS

- FIGURE 67 EV CHARGING STATION MARKET, BY CHARGING INFRASTRUCTURE TYPE, 2025-2032 (THOUSAND UNITS)

- FIGURE 68 TYPE 1 CHARGER KEY FINDINGS

- FIGURE 69 TYPE 2 CHARGER KEY FINDINGS

- FIGURE 70 CHADEMO KEY FINDINGS

- FIGURE 71 CCS KEY FINDINGS

- FIGURE 72 NACS KEY FINDINGS

- FIGURE 73 GB/T FAST CHARGER KEY FINDINGS

- FIGURE 74 EV CHARGING STATION MARKET, BY CHARGING POINT TYPE, 2025-2032 (THOUSAND UNITS)

- FIGURE 75 FLOW FIGURE FOR AUTOMATED BATTERY SWAPPING

- FIGURE 76 EV CHARGING STATION MARKET, BY CONNECTION PHASE, 2025-2032 (THOUSAND UNITS)

- FIGURE 77 TYPE 2 CHARGER COMPARISON, BY CONNECTION PHASE

- FIGURE 78 EV CHARGING STATION MARKET, BY DC FAST CHARGING TYPE, 2025-2032 (THOUSAND UNITS)

- FIGURE 79 MEGAWATT CHARGING SYSTEMS MARKET ECOSYSTEM

- FIGURE 80 COMPARISON BETWEEN PANTOGRAPH UP AND PANTOGRAPH DOWN FOR E-BUS CHARGING

- FIGURE 81 EV CHARGING STATION MARKET, BY INSTALLATION TYPE, 2025-2032 (THOUSAND UNITS)

- FIGURE 82 EV CHARGING STATION MARKET, BY LEVEL OF CHARGING, 2025-2032 (USD MILLION)

- FIGURE 83 EV CHARGING LEVEL COMPARISON

- FIGURE 84 EV CHARGING STATION MARKET, BY MODE, 2025-2032 (THOUSAND UNITS)

- FIGURE 85 COMPARISON BETWEEN DIFFERENT MODES

- FIGURE 86 MODE 1 CHARGING

- FIGURE 87 MODE 2 CHARGING

- FIGURE 88 MODE 3 CHARGING

- FIGURE 89 MODE 4 CHARGING

- FIGURE 90 EV CHARGING STATION MARKET, BY REGION, 2025-2032 (USD MILLION)

- FIGURE 91 ASIA PACIFIC: EV CHARGING STATION MARKET SNAPSHOT

- FIGURE 92 ASIA PACIFIC: REAL GDP GROWTH RATE, BY COUNTRY, 2024-2026

- FIGURE 93 ASIA PACIFIC: GDP PER CAPITA, BY COUNTRY, 2024-2026

- FIGURE 94 ASIA PACIFIC: INFLATION RATE AVERAGE CONSUMER PRICES, BY COUNTRY, 2024-2026

- FIGURE 95 ASIA PACIFIC: MANUFACTURING INDUSTRY'S CONTRIBUTION TO GDP, 2024

- FIGURE 96 STATES LEADING EV TRANSITION IN INDIA, 2024

- FIGURE 97 EUROPE: EV CHARGING POWER DEMAND FORECAST FOR 2030

- FIGURE 98 EUROPE: EV CHARGING STATION MARKET, BY COUNTRY, 2025-2032 (THOUSAND UNITS)

- FIGURE 99 EUROPE: REAL GDP GROWTH RATE, BY COUNTRY, 2024-2026

- FIGURE 100 EUROPE: GDP PER CAPITA, BY COUNTRY, 2024-2026

- FIGURE 101 EUROPE: INFLATION RATE AVERAGE CONSUMER PRICES, BY COUNTRY, 2024-2026

- FIGURE 102 EUROPE: MANUFACTURING'S INDUSTRY CONTRIBUTION TO GDP, 2024

- FIGURE 103 NORTH AMERICA: EV CHARGING STATION MARKET SNAPSHOT

- FIGURE 104 NORTH AMERICA: REAL GDP GROWTH RATE, BY COUNTRY, 2024-2026

- FIGURE 105 NORTH AMERICA: GDP PER CAPITA, BY COUNTRY, 2024-2026

- FIGURE 106 NORTH AMERICA: INFLATION RATE AVERAGE CONSUMER PRICES, BY COUNTRY, 2024-2026

- FIGURE 107 NORTH AMERICA: MANUFACTURING INDUSTRY'S CONTRIBUTION TO GDP, 2024

- FIGURE 108 MIDDLE EAST: EV CHARGING STATION MARKET, BY COUNTRY, 2025-2032 (THOUSAND UNITS)

- FIGURE 109 MIDDLE EAST: REAL GDP GROWTH RATE, BY COUNTRY, 2024-2026

- FIGURE 110 MIDDLE EAST: GDP PER CAPITA, BY COUNTRY, 2024-2026

- FIGURE 111 MIDDLE EAST: INFLATION RATE AVERAGE CONSUMER PRICES, BY COUNTRY, 2024-2026

- FIGURE 112 MIDDLE EAST: MANUFACTURING INDUSTRY'S CONTRIBUTION TO GDP, 2024

- FIGURE 113 REST OF THE WORLD: EV CHARGING STATION MARKET, BY COUNTRY, 2024-2030 (THOUSAND UNITS)

- FIGURE 114 REST OF THE WORLD: REAL GDP GROWTH RATE, BY COUNTRY, 2024-2026

- FIGURE 115 ROW: GDP PER CAPITA, BY COUNTRY, 2024-2026

- FIGURE 116 REST OF THE WORLD: INFLATION RATE AVERAGE CONSUMER PRICES, BY COUNTRY, 2024-2026

- FIGURE 117 REST OF THE WORLD: MANUFACTURING INDUSTRY'S CONTRIBUTION TO GDP, 2024

- FIGURE 118 REVENUE ANALYSIS OF EV CHARGING POINT MANUFACTURERS, 2020-2024 (USD BILLION)

- FIGURE 119 REVENUE ANALYSIS OF EV CHARGING POINT OPERATORS, 2020-2024 (USD BILLION)

- FIGURE 120 EV CHARGING POINT MANUFACTURERS: MARKET SHARE ANALYSIS, 2024

- FIGURE 121 EV CHARGING POINT OPERATORS, MARKET SHARE ANALYSIS, 2024

- FIGURE 122 COMPANY VALUATION OF KEY MANUFACTURERS

- FIGURE 123 FINANCIAL METRICS OF KEY MANUFACTURERS

- FIGURE 124 COMPANY VALUATION OF KEY OPERATORS

- FIGURE 125 FINANCIAL METRICS OF KEY OPERATORS

- FIGURE 126 BRAND/PRODUCT COMPARISON

- FIGURE 127 EV CHARGING STATION MARKET: COMPANY EVALUATION MATRIX (MANUFACTURERS), 2024

- FIGURE 128 EV CHARGING STATION MARKET: COMPANY EVALUATION MATRIX (OPERATORS), 2024

- FIGURE 129 EV CHARGING STATION MARKET: COMPANY FOOTPRINT

- FIGURE 130 EV CHARGING STATION MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 131 ABB: COMPANY SNAPSHOT

- FIGURE 132 ABB: PROJECT HAMBURGER HOCHBAHN

- FIGURE 133 BYD COMPANY LTD.: COMPANY SNAPSHOT

- FIGURE 134 CHARGEPOINT, INC.: COMPANY SNAPSHOT

- FIGURE 135 TESLA: COMPANY SNAPSHOT

- FIGURE 136 GROWTH OF TESLA SUPERCHARGER STATIONS AND CONNECTORS

- FIGURE 137 DELTA ELECTRONICS, INC.: COMPANY SNAPSHOT

- FIGURE 138 STARCHARGE: EV CHARGING SOLUTION

- FIGURE 139 SIEMENS: COMPANY SNAPSHOT

- FIGURE 140 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

- FIGURE 141 KEMPOWER OYJ: COMPANY SNAPSHOT

- FIGURE 142 ENGIE: COMPANY SNAPSHOT

- FIGURE 143 SHELL PLC: COMPANY SNAPSHOT

- FIGURE 144 TOTALENERGIES: COMPANY SNAPSHOT

- FIGURE 145 BP P.L.C.: COMPANY SNAPSHOT

- FIGURE 146 ENEL X S.R.L.: COMPANY SNAPSHOT

- FIGURE 147 ALLEGO B.V.: COMPANY SNAPSHOT

The global EV charging station market is projected to grow from USD 28.47 billion in 2025 to USD 76.31 billion by 2032 at a CAGR of 15.1%. Key factors directly driving the deployment of EV charging infrastructure include OEM-led investments by companies like Tesla, Rivian, and Hyundai in proprietary and public networks. Public and private funding is accelerating the rollout of fast-charging corridors, while advancements in high-speed DC chargers (150-350 kW) enhance compatibility with modern EVs. Urbanization and smart city projects are promoting charger integration into commercial and public spaces. Additionally, fleet electrification mandates are pushing logistics and mobility firms to build dedicated charging hubs. In some Asian markets, battery swapping is emerging as a complementary infrastructure model.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | Volume (Units) |

| Segments | Level of Charging, Charging Service Type, Charge Point Operator, Charging Infrastructure Type, Charging Point Type, Installation Type, Connection Phase, Application, DC Fast Charging Type, Operation, and Region |

| Regions covered | China, Asia Pacific, Europe, North America, the Middle East, and the Rest of the World |

"By level of charging, fixed charger is expected to be the largest segment of the market during the forecast period."

Fixed EV chargers integrated with kiosks are becoming increasingly common at public and commercial locations, offering users a seamless and secure charging experience. Companies such as Tata Power (EZ Charge), ChargeZone, Statiq, and Fortum Charge & Drive have deployed kiosk-based charging solutions across malls, highways, and urban centers in India, providing features like 24/7 access, app-based payments, and real-time monitoring. For instance, ChargeZone operates over 1,500 EV charging stations equipped with high-speed DC chargers and user-friendly kiosks in over 37 Indian cities. In April 2025, Tata Power expanded its EZ Charge network in Mumbai, adding new kiosk-enabled charging stations at key locations to enhance accessibility for EV users. Governments, regulatory bodies, private companies, and OEMs are increasingly investing in fixed EV chargers to accelerate EV adoption. This collaborative push is driven by the need to expand reliable charging infrastructure. For instance, in May 2025, US-based charge point operator Zero 60 launched its fourth renewable-powered EV charging station in Lake Placid, New York. In Europe, major players like Atlante, Ionity, Fastned, and Electra formed the Spark alliance in April 2025 to share infrastructure and create the largest public charging network, covering 11,000 chargers across 25 countries.

"The DC charging station segment is expected to capture the largest share of the EV charging station market during the forecast period."

DC charging stations are high-power fast charging units used for rapid charging. They deliver a maximum power of 240 kW, supplying a high current of up to 400 A at a voltage of up to 600 V DC. However, they cost approximately USD 30,000 to USD 50,000 on average, and an additional transformer is required. In a DC fast charging system, the AC/DC conversion occurs in the charging equipment rather than in a vehicle's AC/DC converter, so the power entering the vehicle is already in DC. Most residential electrical services do not provide the capacity of electrical power that the DC charging station delivers, thus making DC charging unfeasible for home implementation. DC fast chargers are widely used as destination chargers and public chargers. OEMs such as Tesla provide DC chargers (Tesla Superchargers) capable of adding 20 to 30 miles per hour of charge to a vehicle. The major reason for the lower number of DC charging stations is the cost, as DC charging stations are costlier. All Tesla models are equipped with supercharging connectors, including Model 3 and Model S. Charging station providers such as ChargePoint and Car Charging Group provide public DC fast charging stations. As the prices of setting up DC fast charging stations have been reducing over the years, the demand for these charging stations is expected to increase in the coming years.

"Asia Pacific is expected to account for a significant market share during the forecast period."

The Asia Pacific EV charging station market is projected to grow rapidly. In South Korea, EV charging infrastructure growth is driven by strong government policies, including the Green New Deal and a national target of 1.2 million chargers by 2030. Urban density and smart city initiatives are accelerating demand for compact, integrated charging solutions. Indonesia is the fastest-growing market in the region. The expansion of Indonesia's EV charging infrastructure is driven primarily by strategic public-private partnerships and strong government support aimed at accelerating the country's transition to electric mobility. V-GREEN, alongside key partners such as Chargecore, ChargePoint, Amarta Group, and CVS, has committed a significant investment of USD 300 million to deploy over 63,000 charging ports by 2025, focusing on major provinces like Jabodatebek, Bandung, Surabaya, Makassar, and Bali where the demand for EV infrastructure is the highest. Concurrently, the state-owned utility PLN plays a pivotal role by establishing thousands of public charging stations and battery swap facilities nationwide. This is complemented by incentives such as discounted charging rates during off-peak hours and subsidies on home charging installations. The government incentives, guaranteed investor returns, and digital platforms like PLN's Super Apps further drive consumer engagement and investor confidence. In line with these regional developments in India, the government has announced that it will invest in EV charging infrastructure. For instance, in May 2025, the Government of India announced plans to install around 72,000 public EV charging stations across the country under the PM-E Drive scheme, with an investment of approximately USD 234.6 million.

In-depth interviews were conducted with CEOs, marketing directors, other innovation and technology directors, and executives from various key organizations operating in this market.

- By Company Type: OEMs - 24%, Tier I - 67%, and Others - 9%

- By Designation: CXOs - 33%, Managers - 52%, and Executives - 15%

- By Region: North America - 40%, Europe - 20%, Asia Pacific - 28%, China - 6%, Middle East - 3%, and Rest of the World - 3%

The EV charging station market is dominated by major players, including ABB (Switzerland), BYD (China), ChargePoint (US), Tesla (US), and Siemens (Germany), among others. These companies have strong product portfolios as well as strong distribution networks at the global level.

Research Coverage:

This research report categorizes EV charging station market by level of charging (Level 1, Level 2, and Level 3), application (private, semi-public, and public), based on charging point type (AC charging, DC charging), charging infrastructure type (CCS, CHAdeMO, Type 1, Tesla SC (NACS), GB/T Fast, and Type 2), electric bus charging type (off-board top-down pantographs, on-board bottom-up pantographs, and charging via connectors), charging service type (EV charging services and battery swapping services), charge point operator (Asia Pacific, Europe, and North America), DC fast charging type [Slow DC (<49 kW), Fast DC (50-149 kW) and DC Ultra-Fast 1 (150-349 KW), and DC Ultra-Fast 2 (>349 kW), installation type (portable chargers and fixed chargers), operation (mode 1, mode 2, mode 3, and mode 4), connection phase (single phase and three phase), and Region (China, Asia Pacific, Europe, North America, the Middle East, and the Rest of the World). The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the EV charging station market. A detailed analysis of the key industry players has been done to provide insights into their business overview, solutions, and services; key strategies; Contracts, partnerships, agreements, product & service launches, mergers & acquisitions, and other developments. This report covers the competitive analysis of upcoming startups in the EV charging station market ecosystem.

Key Benefits of Buying the Report:

- The report will help market leaders/new entrants with information on the closest approximations of revenue numbers for the overall EV charging station market and its subsegments.

- This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies.

- The report will also help stakeholders understand the market pulse and provide information on key market drivers, restraints, challenges, and opportunities.

- The report will help stakeholders understand the current and future pricing trends of different EV charging systems based on their capacity.

The report provides insight on the following pointers:

Analysis of key drivers (surge in electric vehicle adoption, financial incentives offered by governments to promote charging networks, advancements in battery chemistry improving driving range, and fleet electrification accelerates EV charging market growth), restraints (fragmented charging standards limiting EV adoption, high capital investment required for ultrafast charging infrastructure, underdeveloped power infrastructure for EV charging, and retrofitting challenges in multistorey residential buildings), challenges (cost gap between ICE vehicles and EVs, regulatory hurdles in EV charger installation, high reliance on non-renewable energy sources for charging, scarcity of lithium resources challenging EV sector growth, and low utilization rates and profitability challenges for CPOs), and opportunities (advancements in V2G technology and bidirectional charging, adoption of IoT-enabled smart charging networks, expansion of green and sustainable EV charging solutions, battery-swapping emerging as a viable charging alternative, integration of EV charging in smart city initiatives, market shift towards smart chargers, and expansion of Charging-as-a-Service business model).

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the EV charging station market

- Market Development: Comprehensive information about lucrative markets (the report analyzes the EV charging station market across varied regions)

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the EV charging station market

- Competitive Assessment: In-depth assessment of market ranking, growth strategies, and service offerings of leading players like ABB (Switzerland), EVBox (Netherlands), BYD (China), ChargePoint (US), Tesla (US), and Charge Point Operators, including BP (UK), Shell (UK), ENGIE (France), Total Energies (France), and Enel X (Italy), among others in EV charging station market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary participants

- 2.1.2.2 Breakdown of primary interviews

- 2.1.2.3 Primary interviewees from demand and supply sides

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 FACTOR ANALYSIS

- 2.4.1 DEMAND- AND SUPPLY-SIDE FACTOR ANALYSIS

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN EV CHARGING STATION MARKET

- 4.2 EV CHARGING STATION MARKET, BY LEVEL OF CHARGING

- 4.3 EV CHARGING STATION MARKET, BY CHARGING POINT TYPE

- 4.4 EV CHARGING STATION MARKET, BY CHARGING INFRASTRUCTURE TYPE

- 4.5 EV CHARGING STATION MARKET, BY APPLICATION

- 4.6 EV CHARGING STATION MARKET, BY DC FAST CHARGING TYPE

- 4.7 EV CHARGING STATION MARKET, BY INSTALLATION TYPE

- 4.8 EV CHARGING STATION MARKET, BY MODE

- 4.9 EV CHARGING STATION MARKET, BY CONNECTION PHASE

- 4.10 EV CHARGING STATION MARKET, BY REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.1.1 EV CHARGING SOLUTIONS

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Surge in EV adoption

- 5.2.1.2 Financial incentives offered by governments to promote charging networks

- 5.2.1.2.1 EV Charging Solutions

- 5.2.1.2.2 Number of Charging Points in Key European Countries

- 5.2.1.3 Advancements in battery chemistry improving driving range

- 5.2.1.4 Range and Cost of different Electric Vehicles

- 5.2.1.5 Declining costs of EV batteries

- 5.2.1.6 Fleet electrification accelerating EV charging market growth

- 5.2.2 RESTRAINTS

- 5.2.2.1 Fragmented charging standards limiting EV adoption

- 5.2.2.1.1 Types of EV Charging Sockets

- 5.2.2.2 High capital investment for ultrafast charging infrastructure

- 5.2.2.3 Underdeveloped power infrastructure for EV charging

- 5.2.2.3.1 US Grid Scenario

- 5.2.2.4 Retrofitting issues in multistorey residential buildings

- 5.2.2.1 Fragmented charging standards limiting EV adoption

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Advancements in V2G technology and bidirectional charging

- 5.2.3.1.1 Bidirectional EV Chargers

- 5.2.3.2 Adoption of IoT-enabled smart charging networks

- 5.2.3.3 Expansion of green and sustainable EV charging solutions

- 5.2.3.4 Battery swapping as a viable charging alternative

- 5.2.3.5 Integration of EV charging in smart city initiatives

- 5.2.3.6 Market shift toward smart chargers

- 5.2.3.7 Expansion of Charging-as-a-Service (CaaS) business model

- 5.2.3.1 Advancements in V2G technology and bidirectional charging

- 5.2.4 CHALLENGES

- 5.2.4.1 Cost gap between ICE vehicles and EVs

- 5.2.4.2 Regulatory hurdles in EV charger installation

- 5.2.4.3 High reliance on non-renewable energy sources for charging

- 5.2.4.3.1 Energy consumption by fuel type

- 5.2.4.4 Scarcity of lithium resources

- 5.2.4.5 Low utilization rates and profitability challenges for CPOs

- 5.2.4.5.1 Ev charger types and utilization trends, 2025-2032

- 5.2.1 DRIVERS

- 5.3 ECOSYSTEM ANALYSIS

- 5.3.1 OEMS

- 5.3.2 CHARGING POINT MANUFACTURERS

- 5.3.3 EV CHARGING POINT OPERATORS

- 5.3.4 PAYMENT PROCESSING COMPANIES

- 5.3.5 NAVIGATION AND MAPPING PROVIDERS

- 5.4 SUPPLY CHAIN ANALYSIS

- 5.5 REGULATORY LANDSCAPE

- 5.5.1 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.5.2 KEY REGULATIONS

- 5.5.3 NETHERLANDS

- 5.5.4 GERMANY

- 5.5.5 FRANCE

- 5.5.6 UK

- 5.5.7 CHINA

- 5.5.8 US

- 5.5.9 CANADA

- 5.6 BILL OF MATERIALS

- 5.6.1 BILL OF MATERIALS FOR AC (LEVEL 2) CHARGING POINT, 2025 VS. 2032

- 5.6.2 BILL OF MATERIALS FOR DC SLOW CHARGING POINT, 2025 VS. 2032

- 5.6.3 BILL OF MATERIALS FOR DC FAST CHARGING POINT, 2025 VS. 2032

- 5.6.4 BILL OF MATERIALS FOR DC ULTRAFAST 1 CHARGING POINT, 2025 VS. 2032

- 5.7 PRICING ANALYSIS

- 5.7.1 AVERAGE SELLING PRICE OF CHARGING POINTS, BY KEY PLAYERS (2024)

- 5.7.2 AVERAGE SELLING PRICE TREND, BY DC CHARGING POINT TYPE (2022-2024)

- 5.7.3 AVERAGE SELLING PRICE TREND, BY REGION (2022-2024)

- 5.8 CASE STUDY ANALYSIS

- 5.8.1 CHARGING STATION SIZE OPTIMIZATION

- 5.8.2 LOAD BALANCING SOLUTION FOR EV CHARGING

- 5.8.3 CHARGEPOINT EV CHARGING NETWORK

- 5.8.4 EVGO FAST-CHARGING NETWORK

- 5.8.5 CITY OF BOULDER EV CHARGING NETWORK

- 5.8.6 ELECTRIFY AMERICA CHARGING NETWORK

- 5.8.7 MERCEDES-BENZ EV CHARGING NETWORK IN CHINA

- 5.9 INVESTMENT AND FUNDING SCENARIO

- 5.10 IMPACT OF AI

- 5.11 PATENT ANALYSIS

- 5.12 TECHNOLOGY ANALYSIS

- 5.12.1 KEY TECHNOLOGIES

- 5.12.1.1 Wireless charging

- 5.12.1.1.1 Wireless EV Charging Road Projects In Europe

- 5.12.1.2 Bidirectional chargers

- 5.12.1.2.1 Bidirectional EV Charging Energy Flow Cycle

- 5.12.1.3 Megawatt charging systems

- 5.12.1.1 Wireless charging

- 5.12.2 COMPLEMENTARY TECHNOLOGIES

- 5.12.2.1 Overhead charging

- 5.12.2.2 Plug-and-pay charging

- 5.12.2.3 Robotic and mobile charging unit

- 5.12.3 ADJACENT TECHNOLOGIES

- 5.12.3.1 Turbocharging for electric vehicles

- 5.12.3.2 Smart charging systems

- 5.12.3.3 IoT integration in EV charging stations

- 5.12.1 KEY TECHNOLOGIES

- 5.13 HS CODE: ELECTRICAL TRANSFORMERS, STATIC CONVERTERS (8504), 2020-2024

- 5.13.1 IMPORT DATA

- 5.13.2 EXPORT DATA

- 5.14 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 LEVEL 1

- 5.15.2 LEVEL 2

- 5.15.3 LEVEL 3

- 5.15.4 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.15.5 BUYING CRITERIA

- 5.16 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.17 PERFORMANCE INDICATORS FOR EV CHARGING

- 5.18 EVOLUTION OF EV CHARGING

- 5.19 OPPORTUNITIES IN EV CHARGING STATION MARKET

- 5.20 FUTURE OF CHARGING

- 5.20.1 FAST CHARGING HUBS

- 5.20.2 CURBSIDE CHARGING

- 5.20.3 INDUCTION CHARGING

- 5.21 POWER BOOSTER IN CHARGING SYSTEMS

6 EV CHARGING STATION MARKET, BY APPLICATION

- 6.1 INTRODUCTION

- 6.2 CHARGING STATION OFFERINGS, BY KEY PLAYERS

- 6.3 PRIVATE

- 6.3.1 RISING RESIDENTIAL EV ADOPTION AND OEM-BUNDLED CHARGERS TO DRIVE MARKET

- 6.4 SEMI-PUBLIC

- 6.4.1 INCREASING GOVERNMENT INITIATIVES FOR SETTING UP SEMI-PUBLIC CHARGING STATIONS IN PARKING LOTS TO DRIVE MARKET

- 6.5 PUBLIC

- 6.5.1 DEMAND FOR DESTINATION AND HIGHWAY CHARGING TO DRIVE MARKET

- 6.6 KEY PRIMARY INSIGHTS

7 EV CHARGING STATION MARKET, BY CHARGE POINT OPERATORS

- 7.1 INTRODUCTION

- 7.2 ASIA PACIFIC: CHARGE POINT OPERATORS

- 7.2.1 CHINA

- 7.2.2 INDIA

- 7.2.3 JAPAN

- 7.2.4 SOUTH KOREA

- 7.3 EUROPE: CHARGE POINT OPERATORS

- 7.3.1 GERMANY

- 7.3.2 FRANCE

- 7.3.3 UK

- 7.3.4 DENMARK

- 7.3.5 NETHERLANDS

- 7.3.6 NORWAY

- 7.3.7 SWITZERLAND

- 7.3.8 SPAIN

- 7.4 NORTH AMERICA: CHARGE POINT OPERATORS

- 7.4.1 US

- 7.4.2 CANADA

8 EV CHARGING STATION MARKET, BY CHARGING INFRASTRUCTURE TYPE

- 8.1 INTRODUCTION

- 8.2 PRIMARY CHARGING INFRASTRUCTURE, BY REGION/COUNTRY

- 8.3 TYPE 1

- 8.3.1 DEMAND FOR AC CHARGING IN NORTH AMERICA TO DRIVE MARKET

- 8.4 TYPE 2

- 8.4.1 DEMAND FOR AC CHARGING IN EUROPE AND ASIA PACIFIC TO DRIVE MARKET

- 8.5 CHADEMO

- 8.5.1 STRONG V2G CAPABILITIES AND CONTINUED BACKING FROM JAPANESE OEMS TO DRIVE MARKET

- 8.6 CCS

- 8.6.1 UNIFIED INTERFACE WITH ABILITY TO CHARGE VIA BOTH AC AND DC POWER TO DRIVE MARKET

- 8.7 NACS/TESLA SC (TESLA SUPERCHARGER)

- 8.7.1 GROWING TESLA SUPERCHARGER NETWORK AND NORTH AMERICA'S DECISION TO MAKE NACS DEFAULT DC CHARGER TO DRIVE MARKET

- 8.8 GB/T FAST

- 8.8.1 GROW WITH INCREASING DC CHARGING SETUPS IN CHINA TO DRIVE MARKET

- 8.9 KEY PRIMARY INSIGHTS

9 EV CHARGING STATION MARKET, BY CHARGING POINT TYPE

- 9.1 INTRODUCTION

- 9.2 CHARGING POINT COMPARISON, BY KEY PLAYERS

- 9.3 AC CHARGING

- 9.3.1 RESIDENTIAL AND WORKPLACE INSTALLATIONS TO SUPPORT MARKET GROWTH

- 9.4 DC CHARGING

- 9.4.1 HIGHWAY AND FLEET ELECTRIFICATION TO DRIVE MARKET

- 9.5 KEY PRIMARY INSIGHTS

10 EV CHARGING STATION MARKET, BY CHARGING SERVICE TYPE

- 10.1 INTRODUCTION

- 10.2 EV CHARGING SERVICES

- 10.3 BATTERY SWAPPING SERVICES

11 EV CHARGING STATION MARKET, BY CONNECTION PHASE

- 11.1 INTRODUCTION

- 11.2 EV CHARGING STATIONS, BY CONNECTION PHASE

- 11.3 SINGLE PHASE

- 11.3.1 STEADY GROWTH IN RESIDENTIAL APPLICATIONS TO DRIVE MARKET

- 11.4 THREE PHASE

- 11.4.1 EXPANSION OF PUBLIC AND COMMERCIAL CHARGING HUBS TO DRIVE MARKET

- 11.5 KEY PRIMARY INSIGHTS

12 EV CHARGING STATION MARKET, BY DC FAST CHARGING TYPE

- 12.1 INTRODUCTION

- 12.2 DC FAST CHARGING OFFERINGS, BY KEY PLAYERS

- 12.3 SLOW DC

- 12.3.1 FLEXIBLE DEPLOYMENT THROUGH SEMI-PUBLIC CHARGING POINTS TO DRIVE MARKET

- 12.4 FAST DC

- 12.4.1 INCREASING DEMAND FOR QUICK TURNAROUND CHARGING TO DRIVE MARKET

- 12.5 DC ULTRAFAST 1

- 12.5.1 EXPANDING HIGH-CAPACITY CHARGING INFRASTRUCTURE TO DRIVE MARKET

- 12.6 DC ULTRAFAST 2

- 12.6.1 RISING ELECTRIFICATION OF COMMERCIAL VEHICLE FLEETS TO DRIVE MARKET

- 12.6.2 400 KW

- 12.6.2.1 Growing demand for ultra-rapid charging and the shift to 800V EV architectures to drive market

- 12.6.3 MEGAWATT CHARGING SYSTEMS

- 12.6.3.1 Electrification of heavy-duty transport to drive market

- 12.6.3.1.1 Megawatt Charging Systems Ecosystem

- 12.6.3.1 Electrification of heavy-duty transport to drive market

- 12.7 KEY PRIMARY INSIGHTS

13 EV CHARGING STATION MARKET, BY ELECTRIC BUS CHARGING TYPE

- 13.1 INTRODUCTION

- 13.2 OFF-BOARD TOP-DOWN PANTOGRAPHS

- 13.3 ONBOARD BOTTOM-UP PANTOGRAPHS

- 13.4 CHARGING VIA CONNECTORS

14 EV CHARGING STATION MARKET, BY INSTALLATION TYPE

- 14.1 INTRODUCTION

- 14.2 PORTABLE CHARGERS BY KEY PLAYERS

- 14.3 PORTABLE CHARGERS

- 14.3.1 FLEXIBLE OFF-GRID SOLUTIONS TO DRIVE MARKET

- 14.4 FIXED CHARGERS

- 14.4.1 STRATEGIC ALLIANCES, PUBLIC-PRIVATE INVESTMENTS, AND GOVERNMENT SUBSIDIES TO DRIVE MARKET

- 14.5 KEY PRIMARY INSIGHTS

15 EV CHARGING STATION MARKET, BY LEVEL OF CHARGING

- 15.1 INTRODUCTION

- 15.2 EV CHARGER OFFERINGS, BY KEY PLAYERS

- 15.3 LEVEL 1

- 15.3.1 COST-EFFECTIVE RESIDENTIAL SOLUTIONS TO DRIVE MARKET

- 15.4 LEVEL 2

- 15.4.1 EXPANDING COMMERCIAL AND PUBLIC NETWORKS TO DRIVE MARKET

- 15.5 LEVEL 3

- 15.5.1 DEMAND FOR DESTINATION CHARGES AND GROWING FLEET ELECTRIFICATION TO DRIVE MARKET

- 15.6 KEY PRIMARY INSIGHTS

16 EV CHARGING STATION MARKET, BY MODE

- 16.1 INTRODUCTION

- 16.2 COMPARISON OF EV CHARGING STATIONS BY KEY PLAYERS, BY MODE

- 16.3 MODE 1

- 16.3.1 GROWTH IN EMERGING ECONOMIES SUPPORTING MODE 1 CHARGER ADOPTION

- 16.4 MODE 2

- 16.4.1 EXPANSION OF PUBLIC CHARGING NETWORKS TO DRIVE MARKET

- 16.5 MODE 3

- 16.5.1 FOCUS ON SAFETY AND USER EXPERIENCE TO PROPEL MARKET

- 16.6 MODE 4

- 16.6.1 RISING NEED FOR LONG-RANGE EV CAPABILITIES TO DRIVE MARKET

- 16.7 KEY PRIMARY INSIGHTS

17 EV CHARGING STATION MARKET, BY REGION

- 17.1 INTRODUCTION

- 17.2 ASIA PACIFIC

- 17.2.1 MACROECONOMIC OUTLOOK

- 17.2.2 INDIA

- 17.2.2.1 FAME-II scheme and state EV policies to drive market

- 17.2.3 JAPAN

- 17.2.3.1 Energy security and 2050 carbon neutrality goals to drive market

- 17.2.4 SOUTH KOREA

- 17.2.4.1 Rapid EV infrastructure supported by government policies in South Korea to drive market

- 17.2.5 SINGAPORE

- 17.2.5.1 Increasing investment in EV adoption to meet 2040 ICE phase-out target to drive market

- 17.2.6 THAILAND

- 17.2.6.1 Accelerating EV charging network growth to drive market

- 17.2.7 TAIWAN

- 17.2.7.1 EV charging infrastructure supported by government incentives to drive market

- 17.2.8 INDONESIA

- 17.2.8.1 Strategic public-private partnerships for EV Infrastructure to drive market

- 17.3 CHINA

- 17.3.1 STATE-BACKED ELECTRIFICATION AND OEM-LED FAST-CHARGING STATIONS TO DRIVE MARKET

- 17.4 EUROPE

- 17.4.1 MACROECONOMIC OUTLOOK

- 17.4.2 FRANCE

- 17.4.2.1 Deployment of fast & ultra-fast charging stations to drive market

- 17.4.3 GERMANY

- 17.4.3.1 Private investment with Green Financing to drive market

- 17.4.4 NETHERLANDS

- 17.4.4.1 Investment in ultra-fast charging hubs to drive market

- 17.4.5 NORWAY

- 17.4.5.1 Innovation in EV charging infrastructure to drive market

- 17.4.6 SWEDEN

- 17.4.6.1 Freight electrification goals to drive market

- 17.4.7 UK

- 17.4.7.1 Government initiatives backed by rising investments in ultra-low emission vehicles to drive market

- 17.4.8 DENMARK

- 17.4.8.1 Government support for EV infrastructure adoption to drive market

- 17.4.9 AUSTRIA

- 17.4.9.1 Rapid EV adoption and growth of EV charging infrastructure to drive market

- 17.4.10 SPAIN

- 17.4.10.1 Installation of EV charging infrastructure to drive market

- 17.4.11 SWITZERLAND

- 17.4.11.1 Partnerships between OEMs and electric energy distributors for EV charging station deployment to drive market

- 17.5 NORTH AMERICA

- 17.5.1 MACROECONOMIC OUTLOOK

- 17.5.2 CANADA

- 17.5.2.1 Partnerships between CPOs and financial bodies to drive market

- 17.5.3 US

- 17.5.3.1 Large-scale deployment of public EV charging infrastructure to drive market

- 17.6 MIDDLE EAST

- 17.6.1 MACROECONOMIC OUTLOOK

- 17.6.2 ISRAEL

- 17.6.2.1 Integration of wireless charging technology in public infrastructure to drive market

- 17.6.3 UAE

- 17.6.3.1 Government initiatives and technological advancements in EV charging infrastructure to drive market

- 17.6.4 SAUDI ARABIA

- 17.6.4.1 Partnerships and large-scale investments in EV charging stations to drive market

- 17.7 REST OF THE WORLD

- 17.7.1 MACROECONOMIC OUTLOOK

- 17.7.2 BRAZIL

- 17.7.2.1 Public-private investments between utility providers and CPOs to drive market

- 17.7.3 MEXICO

- 17.7.3.1 Increased adoption of zero-emission cars to drive market

- 17.7.4 SOUTH AFRICA

- 17.7.4.1 Government funding for EV charging infrastructure to drive market

- 17.7.5 OTHER COUNTRIES

18 COMPETITIVE LANDSCAPE

- 18.1 INTRODUCTION

- 18.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, JANUARY 2021-MAY 2025

- 18.3 REVENUE ANALYSIS

- 18.4 MARKET SHARE ANALYSIS, 2024

- 18.5 COMPANY VALUATION AND FINANCIAL METRICS

- 18.6 BRAND/PRODUCT COMPARISON

- 18.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 18.7.1 STARS

- 18.7.2 EMERGING LEADERS

- 18.7.3 PERVASIVE PLAYERS

- 18.7.4 PARTICIPANTS

- 18.7.5 COMPANY FOOTPRINT

- 18.7.5.1 Company footprint

- 18.7.5.2 Country/Region footprint

- 18.7.5.3 Charging point footprint

- 18.7.5.4 Level of charging footprint

- 18.7.5.5 DC fast charging footprint

- 18.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 18.8.1 PROGRESSIVE COMPANIES

- 18.8.2 RESPONSIVE COMPANIES

- 18.8.3 DYNAMIC COMPANIES

- 18.8.4 STARTING BLOCKS

- 18.8.5 COMPETITIVE BENCHMARKING

- 18.8.5.1 List of startups/SMEs

- 18.8.5.2 Competitive benchmarking of startups/SMEs

- 18.9 COMPETITIVE SCENARIO

- 18.9.1 PRODUCT LAUNCHES

- 18.9.2 DEALS

- 18.9.3 EXPANSIONS

- 18.9.4 OTHER DEVELOPMENTS

19 COMPANY PROFILES

- 19.1 KEY PLAYERS

- 19.1.1 ABB

- 19.1.1.1 Business overview

- 19.1.1.2 Products/Solutions/Services offered

- 19.1.1.3 Recent developments

- 19.1.1.3.1 Product launches/developments

- 19.1.1.3.2 Deals

- 19.1.1.3.3 Expansions

- 19.1.1.3.4 Other developments

- 19.1.1.4 MnM view

- 19.1.2 BYD COMPANY LTD.

- 19.1.2.1 Business overview

- 19.1.2.2 Products/Solutions/Services offered

- 19.1.2.3 Recent developments

- 19.1.2.3.1 Product launches/developments

- 19.1.2.3.2 Deals

- 19.1.2.3.3 Expansions

- 19.1.2.4 MnM view

- 19.1.3 CHARGEPOINT, INC.

- 19.1.3.1 Business overview

- 19.1.3.2 Products/Solutions/Services offered

- 19.1.3.3 Recent developments

- 19.1.3.3.1 Product launches/developments

- 19.1.3.3.2 Deals

- 19.1.3.3.3 Other developments

- 19.1.3.4 MnM view

- 19.1.4 TESLA

- 19.1.4.1 Business overview

- 19.1.4.2 Products/Solutions/Services offered

- 19.1.4.3 Recent developments

- 19.1.4.3.1 Product Launches/Developments

- 19.1.4.3.2 Deals

- 19.1.4.3.3 Other developments

- 19.1.4.4 MnM view

- 19.1.5 EVBOX

- 19.1.5.1 Business overview

- 19.1.5.2 Products/Solutions/Services offered

- 19.1.5.3 Recent developments

- 19.1.5.3.1 Product launches/developments

- 19.1.5.3.2 Deals

- 19.1.6 DELTA ELECTRONICS, INC.

- 19.1.6.1 Business overview

- 19.1.6.2 Products/Solutions/Services offered

- 19.1.6.3 Recent developments

- 19.1.6.3.1 Product launches/developments

- 19.1.6.3.2 Deals

- 19.1.7 STARCHARGE

- 19.1.7.1 Business overview

- 19.1.7.2 Products/Solutions/Services offered

- 19.1.7.3 Recent developments

- 19.1.7.3.1 Service launches/developments

- 19.1.7.3.1 Deals

- 19.1.7.3.2 Expansions

- 19.1.7.3.3 Other developments

- 19.1.8 SIEMENS

- 19.1.8.1 Business overview

- 19.1.8.2 Products/Solutions/Services offered

- 19.1.8.3 Recent developments

- 19.1.8.3.1 Product launches/developments

- 19.1.8.3.2 Deals

- 19.1.8.3.3 Other developments

- 19.1.8.4 MnM view

- 19.1.9 SCHNEIDER ELECTRIC

- 19.1.9.1 Business overview

- 19.1.9.2 Products/Solutions/Services offered

- 19.1.9.3 Recent developments

- 19.1.9.3.1 Product launches/developments

- 19.1.9.3.2 Deals

- 19.1.9.3.3 Expansions

- 19.1.10 KEMPOWER OYJ

- 19.1.10.1 Business overview

- 19.1.10.2 Products/Solutions/Services offered

- 19.1.10.3 Recent developments

- 19.1.10.3.1 Product launches/developments

- 19.1.10.3.2 Deals

- 19.1.10.3.3 Expansions

- 19.1.10.3.4 Other developments

- 19.1.11 EFACEC

- 19.1.11.1 Business overview

- 19.1.11.2 Products/Solutions/Services offered

- 19.1.11.3 Recent developments

- 19.1.11.3.1 Product launches/developments

- 19.1.11.3.2 Deals

- 19.1.11.3.3 Expansions

- 19.1.1 ABB

- 19.2 KEY CHARGING POINT OPERATORS

- 19.2.1 ENGIE

- 19.2.1.1 Business overview

- 19.2.1.2 Products/Solutions/Services offered

- 19.2.1.3 Recent developments

- 19.2.1.3.1 Product launches/developments

- 19.2.1.3.2 Deals

- 19.2.1.3.3 Expansions

- 19.2.1.3.4 Other developments

- 19.2.1.4 MnM view

- 19.2.2 SHELL PLC

- 19.2.2.1 Business overview

- 19.2.2.2 Products/Solutions/Services offered

- 19.2.2.3 Recent developments

- 19.2.2.3.1 Deals

- 19.2.2.3.2 Expansions

- 19.2.2.3.3 Other developments

- 19.2.2.4 MnM view

- 19.2.3 TOTALENERGIES

- 19.2.3.1 Business overview

- 19.2.3.2 Products/Solutions/Services offered

- 19.2.3.3 Recent developments

- 19.2.3.3.1 Product launches/developments

- 19.2.3.3.2 Deals

- 19.2.3.3.3 Other developments

- 19.2.3.4 MnM view

- 19.2.4 BP P.L.C.

- 19.2.4.1 Business overview

- 19.2.4.2 Products/Solutions/Services offered

- 19.2.4.3 Recent developments

- 19.2.4.3.1 Deals

- 19.2.4.3.2 Expansions

- 19.2.4.3.3 Other developments

- 19.2.4.4 MnM view

- 19.2.5 ENEL X S.R.L.

- 19.2.5.1 Business overview

- 19.2.5.2 Products/Solutions/Services offered

- 19.2.5.3 Recent developments

- 19.2.5.3.1 Deals

- 19.2.5.3.2 Expansions

- 19.2.5.3.3 Other developments

- 19.2.5.4 MnM view

- 19.2.6 VIRTA GLOBAL

- 19.2.6.1 Business overview

- 19.2.6.2 Products/Solutions/Services offered

- 19.2.6.3 Recent developments

- 19.2.6.3.1 Deals

- 19.2.6.3.2 Other developments

- 19.2.7 ALLEGO B.V.

- 19.2.7.1 Business overview

- 19.2.7.2 Recent developments

- 19.2.7.2.1 Deals

- 19.2.7.2.2 Expansions

- 19.2.7.2.3 Other developments

- 19.2.8 TGOOD ELECTRIC CO., LTD.

- 19.2.8.1 Business overview