|

|

市場調査レポート

商品コード

1601584

自動車用複合材料の世界市場:車両タイプ別、繊維タイプ別、製造プロセス別、樹脂タイプ別、用途別、地域別 - 2034年までの予測Automotive Composites Market by Fiber Type (Glass, Carbon), Resin Type (Thermoset, Thermoplastic), Manufacturing Process (Compression Molding, Injection Molding, Rtm), Application, Vehicle Type, & Region - Global Forecast to 2034 |

||||||

カスタマイズ可能

|

|||||||

| 自動車用複合材料の世界市場:車両タイプ別、繊維タイプ別、製造プロセス別、樹脂タイプ別、用途別、地域別 - 2034年までの予測 |

|

出版日: 2024年11月27日

発行: MarketsandMarkets

ページ情報: 英文 303 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

自動車用複合材料の市場規模は、2024年に96億9,000万米ドルになるとみられ、2024年から2034年までのCAGRは14.5%と見込まれており、2034年には375億4,000万米ドルに達すると予測されています。

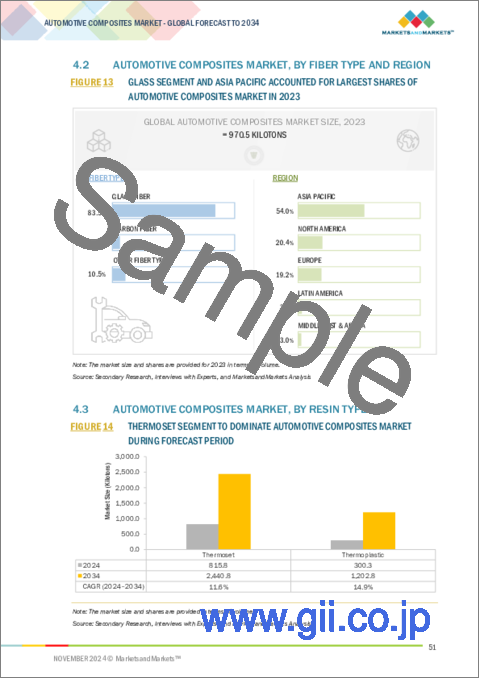

金額ベースでは、ガラス繊維タイプが世界の自動車用複合材料市場を独占しており、今後もこの傾向が続くと予想されます。高い市場シェアは、炭素繊維と比較して、柔軟性、安定性、軽量性、耐湿性・耐熱性、引裂抵抗、費用対効果などのさまざまな利点があるためです。自動車産業では、ガラス繊維複合材料はデッキリッド、バンパービーム、アンダーボディシステム、エンジンカバー、フロントエンドモジュール、エアダクト、エンジンカバーのインストルメントパネル、その他多くの車体部品に広く使用されています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2034年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2034年 |

| 対象ユニット | 金額(100万米ドル/10億米ドル)および数量(キロトン) |

| セグメント | 車両タイプ別、繊維タイプ別、製造プロセス別、樹脂タイプ別、用途別、地域別 |

| 対象地域 | 北米、アジア太平洋、ラテンアメリカ、中東・アフリカ |

2023年、自動車用複合材料市場全体では、金額ベースで内装用途分野が2番目のシェアを占めました。自動車用複合材料の内装用途には、シートバック、ロードフロア、内装トリム、内装ヘッドライナー、アンダーボディパネル、内装キャビンなどが含まれます。これらの用途に複合材料を使用することで、軽量化が可能になります。自動車の重量はOEMにとって重要な要素であるため、複合材料は車体の内装部品の製造において、アルミニウムやスチールなどの従来の材料に代わる最良の選択肢と考えられてきました。AudiやBMWのようなOEMは、ヘッドライナーやシートバックのような様々な構造部品に複合材料の使用を検討しています。

北米における自動車用複合材料の成長は、Hexcel Corporation(米国)、Owens Corning(米国)、UFP Technologies, Inc.(米国)、Huntsman Corporation(米国)、Hexion(米国)などの主要な自動車用複合材料メーカーの存在によって後押しされています。これらの企業は、複合材料の需要増に対応するため、様々な戦略に取り組んでいます。

自動車産業におけるガラス繊維複合材料やその他の複合材料の用途の増加が、北米市場の成長を後押ししています。政府による企業平均燃費(CAFE)と温室効果ガス(GHG)規制は、低燃費車の使用を奨励しています。このような規制により、メーカーは軽量化ソリューションの採用を迫られており、自動車用複合材料の需要を押し上げています。

当レポートでは、世界の自動車用複合材料市場について調査し、車両タイプ別、繊維タイプ別、製造プロセス別、樹脂タイプ別、用途別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- ポーターのファイブフォース分析

- 主な利害関係者と購入基準

- サプライチェーン分析

- エコシステム分析

- 価格分析

- バリューチェーン分析

- 貿易分析

- 技術分析

- AI/生成AIが自動車用複合材料市場に与える影響

- 自動車におけるAIのユースケース

- マクロ経済の見通し

- 特許分析

- 規制状況

- 2024年~2025年の主な会議とイベント

- ケーススタディ分析

- 顧客ビジネスに影響を与える動向と混乱

- 投資と資金調達のシナリオ

第6章 自動車用複合材料市場(車両タイプ別)

- イントロダクション

- 非電気式

- 電気式

第7章 自動車用複合材料市場(繊維タイプ別)

- イントロダクション

- 炭素繊維

- ガラス繊維

- その他

第8章 自動車用複合材料市場(製造プロセス別)

- イントロダクション

- 圧縮成形プロセス

- 射出成形プロセス

- 樹脂トランスファー成形プロセス

- その他

第9章 自動車用複合材料市場(樹脂タイプ別)

- イントロダクション

- 熱硬化性

- 熱可塑性

第10章 自動車用複合材料市場(用途別)

- イントロダクション

- 外装

- 内装

- パワートレインとシャーシ

- バッテリーエンクロージャ

第11章 自動車用複合材料市場(地域別)

- イントロダクション

- 北米

- 欧州

- ラテンアメリカ

- アジア太平洋

- 中東・アフリカ

第12章 競合情勢

- 概要

- 主要参入企業の戦略/強み

- 収益分析、2021年~2023年

- 市場シェア分析

- ブランド/製品比較分析

- 企業評価マトリックス:主要参入企業、2023年

- 企業評価マトリックス:スタートアップ/中小企業、2023年

- 自動車用複合材ベンダーの評価と財務指標

- 競合シナリオと動向

第13章 企業プロファイル

- 主要参入企業

- SGL CARBON

- SYENSQO

- POLYTEC HOLDING AG

- TORAY INDUSTRIES, INC.

- ELRINGKLINGER AG

- HENGRUI CORPORATION

- EXEL COMPOSITES

- TEIJIN LIMITED

- MITSUBISHI CHEMICAL GROUP CORPORATION

- HEXCEL CORPORATION

- IDI COMPOSITES INTERNATIONAL

- ROCHLING SE & CO. KG

- KAUTEX

- MUHR UND BENDER KG

- GEORG FRITZMEIER GMBH & CO. KG

- FLEX-N-GATE

- その他の企業

- HANKUK CARBON CO., LTD.

- CIE AUTOMOTIVE INDIA

- UFP TECHNOLOGIES, INC.

- ZHONGAO CARBON

- ATLAS FIBRE

- PIRAN ADVANCED COMPOSITES

- ENVALIOR

- TRB LIGHTWEIGHT STRUCTURES

- THE GUND COMPANY

- OPMOBILITY

第14章 付録

List of Tables

- TABLE 1 AUTOMOTIVE COMPOSITES MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 2 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS IN AUTOMOTIVE COMPOSITES MARKET

- TABLE 3 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 4 AUTOMOTIVE COMPOSITES MARKET: SUPPLY CHAIN

- TABLE 5 AVERAGE SELLING PRICE TREND, BY REGION (USD/KG), 2021-2023

- TABLE 6 TOP 10 EXPORTING COUNTRIES OF GLASS FIBERS IN 2023

- TABLE 7 TOP 10 IMPORTING COUNTRIES OF GLASS FIBERS IN 2023

- TABLE 8 COMPARATIVE STUDY OF KEY AUTOMOTIVE COMPOSITE MANUFACTURING PROCESSES

- TABLE 9 TOP APPLICATIONS AND MARKET POTENTIAL

- TABLE 10 USE CASES BY KEY AUTOMOTIVE COMPANIES

- TABLE 11 GEN AI IMPLEMENTATION IN AUTOMOTIVE COMPOSITES MARKET

- TABLE 12 AI IMPACT ON ADJACENT MARKET

- TABLE 13 GDP PERCENTAGE (%) CHANGE, KEY COUNTRY, 2020-2029

- TABLE 14 AUTOMOTIVE COMPOSITES MARKET: TOTAL NUMBER OF PATENTS

- TABLE 15 LIST OF PATENTS BY BYD CO., LTD.

- TABLE 16 LIST OF PATENTS BY BEIJING INSTITUTE OF TECHNOLOGY

- TABLE 17 TOP 10 PATENT OWNERS (US) IN LAST 10 YEARS

- TABLE 18 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 AUTOMOTIVE COMPOSITES MARKET: KEY CONFERENCES AND EVENTS, 2024-2025

- TABLE 22 AUTOMOTIVE COMPOSITES MARKET, BY VEHICLE TYPE, 2021-2023 (USD MILLION)

- TABLE 23 AUTOMOTIVE COMPOSITES MARKET, BY VEHICLE TYPE, 2021-2023 (KILOTON)

- TABLE 24 AUTOMOTIVE COMPOSITES MARKET, BY VEHICLE TYPE, 2024-2034 (USD MILLION)

- TABLE 25 AUTOMOTIVE COMPOSITES MARKET, BY VEHICLE TYPE, 2024-2034 (KILOTON)

- TABLE 26 NON-ELECTRIC: AUTOMOTIVE COMPOSITES MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 27 NON-ELECTRIC: AUTOMOTIVE COMPOSITES MARKET, BY REGION, 2021-2023 (KILOTON)

- TABLE 28 NON-ELECTRIC: AUTOMOTIVE COMPOSITES MARKET, BY REGION, 2024-2034 (USD MILLION)

- TABLE 29 NON-ELECTRIC: AUTOMOTIVE COMPOSITES MARKET, BY REGION, 2024-2034 (KILOTON)

- TABLE 30 ELECTRIC: AUTOMOTIVE COMPOSITES MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 31 ELECTRIC: AUTOMOTIVE COMPOSITES MARKET, BY REGION, 2021-2023 (KILOTON)

- TABLE 32 ELECTRIC: AUTOMOTIVE COMPOSITES MARKET, BY REGION, 2024-2034 (USD MILLION)

- TABLE 33 ELECTRIC: AUTOMOTIVE COMPOSITES MARKET, BY REGION, 2024-2034 (KILOTON)

- TABLE 34 AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2021-2023 (USD MILLION)

- TABLE 35 AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2021-2023 (KILOTON)

- TABLE 36 AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2024-2034 (USD MILLION)

- TABLE 37 AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2024-2034 (KILOTON)

- TABLE 38 CARBON FIBER: AUTOMOTIVE COMPOSITES MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 39 CARBON FIBER: AUTOMOTIVE COMPOSITES MARKET, BY REGION, 2021-2023 (KILOTON)

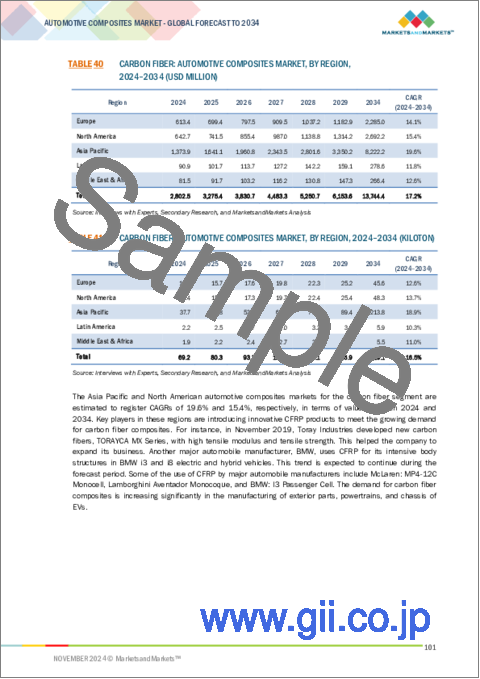

- TABLE 40 CARBON FIBER: AUTOMOTIVE COMPOSITES MARKET, BY REGION, 2024-2034 (USD MILLION)

- TABLE 41 CARBON FIBER: AUTOMOTIVE COMPOSITES MARKET, BY REGION, 2024-2034 (KILOTON)

- TABLE 42 CARBON FIBER: AUTOMOTIVE COMPOSITES MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 43 CARBON FIBER: AUTOMOTIVE COMPOSITES MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 44 CARBON FIBER: AUTOMOTIVE COMPOSITES MARKET, BY APPLICATION, 2024-2034 (USD MILLION)

- TABLE 45 CARBON FIBER: AUTOMOTIVE COMPOSITES MARKET, BY APPLICATION, 2024-2034 (KILOTON)

- TABLE 46 GLASS FIBER: AUTOMOTIVE COMPOSITES MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 47 GLASS FIBER: AUTOMOTIVE COMPOSITES MARKET, BY REGION, 2021-2023 (KILOTON)

- TABLE 48 GLASS FIBER: AUTOMOTIVE COMPOSITES MARKET, BY REGION, 2024-2034 (USD MILLION)

- TABLE 49 GLASS FIBER: AUTOMOTIVE COMPOSITES MARKET, BY REGION, 2024-2034 (KILOTON)

- TABLE 50 GLASS FIBER: AUTOMOTIVE COMPOSITES MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 51 GLASS FIBER: AUTOMOTIVE COMPOSITES MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 52 GLASS FIBER: AUTOMOTIVE COMPOSITES MARKET, BY APPLICATION, 2024-2034 (USD MILLION)

- TABLE 53 GLASS FIBER: AUTOMOTIVE COMPOSITES MARKET, BY APPLICATION, 2024-2034 (KILOTON)

- TABLE 54 APPLICATIONS OF NATURAL FIBER COMPOSITES IN AUTOMOTIVE INDUSTRY, BY MANUFACTURER

- TABLE 55 OTHER FIBER TYPES: AUTOMOTIVE COMPOSITES MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 56 OTHER FIBER TYPES: AUTOMOTIVE COMPOSITES MARKET, BY REGION, 2021-2023 (KILOTON)

- TABLE 57 OTHER FIBER TYPES: AUTOMOTIVE COMPOSITES MARKET, BY REGION, 2024-2034 (USD MILLION)

- TABLE 58 OTHER FIBER TYPES: AUTOMOTIVE COMPOSITES MARKET, BY REGION, 2024-2034 (KILOTON)

- TABLE 59 OTHER FIBER TYPES: AUTOMOTIVE COMPOSITES MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 60 OTHER FIBER TYPES: AUTOMOTIVE COMPOSITES MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 61 OTHER FIBER TYPES: AUTOMOTIVE COMPOSITES MARKET, BY APPLICATION, 2024-2034 (USD MILLION)

- TABLE 62 OTHER FIBER TYPES: AUTOMOTIVE COMPOSITES MARKET, BY APPLICATION, 2024-2034 (KILOTON)

- TABLE 63 COMPARATIVE STUDY OF MAJOR AUTOMOTIVE COMPOSITE MANUFACTURING PROCESSES

- TABLE 64 AUTOMOTIVE COMPOSITES MARKET, BY MANUFACTURING PROCESS, 2021-2023 (USD MILLION)

- TABLE 65 AUTOMOTIVE COMPOSITES MARKET, BY MANUFACTURING PROCESS, 2021-2023 (KILOTON)

- TABLE 66 AUTOMOTIVE COMPOSITES MARKET, BY MANUFACTURING PROCESS, 2024-2034 (USD MILLION)

- TABLE 67 AUTOMOTIVE COMPOSITES MARKET, BY MANUFACTURING PROCESS, 2024-2034 (KILOTON)

- TABLE 68 COMPRESSION MOLDING PROCESS: AUTOMOTIVE COMPOSITES MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 69 COMPRESSION MOLDING PROCESS: AUTOMOTIVE COMPOSITES MARKET, BY REGION, 2021-2023 (KILOTON)

- TABLE 70 COMPRESSION MOLDING PROCESS: AUTOMOTIVE COMPOSITES MARKET, BY REGION, 2024-2034 (USD MILLION)

- TABLE 71 COMPRESSION MOLDING PROCESS: AUTOMOTIVE COMPOSITES MARKET, BY REGION, 2024-2034 (KILOTON)

- TABLE 72 INJECTION MOLDING PROCESS: AUTOMOTIVE COMPOSITES MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 73 INJECTION MOLDING PROCESS: AUTOMOTIVE COMPOSITES MARKET, BY REGION, 2021-2023 (KILOTON)

- TABLE 74 INJECTION MOLDING PROCESS: AUTOMOTIVE COMPOSITES MARKET, BY REGION, 2024-2034 (USD MILLION)

- TABLE 75 INJECTION MOLDING PROCESS: AUTOMOTIVE COMPOSITES MARKET, BY REGION, 2024-2034 (KILOTON)

- TABLE 76 RESIN TRANSFER MOLDING PROCESS: AUTOMOTIVE COMPOSITES MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 77 RESIN TRANSFER MOLDING PROCESS: AUTOMOTIVE COMPOSITES MARKET, BY REGION, 2021-2023 (KILOTON)

- TABLE 78 RESIN TRANSFER MOLDING PROCESS: AUTOMOTIVE COMPOSITES MARKET, BY REGION, 2024-2034 (USD MILLION)

- TABLE 79 RESIN TRANSFER MOLDING PROCESS: AUTOMOTIVE COMPOSITES MARKET, BY REGION, 2024-2034 (KILOTON)

- TABLE 80 OTHER MANUFACTURING PROCESSES: AUTOMOTIVE COMPOSITES MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 81 OTHER MANUFACTURING PROCESSES: AUTOMOTIVE COMPOSITES MARKET, BY REGION, 2021-2023 (KILOTON)

- TABLE 82 OTHER MANUFACTURING PROCESSES: AUTOMOTIVE COMPOSITES MARKET, BY REGION, 2024-2034 (USD MILLION)

- TABLE 83 OTHER MANUFACTURING PROCESSES: AUTOMOTIVE COMPOSITES MARKET, BY REGION, 2024-2034 (KILOTON)

- TABLE 84 AUTOMOTIVE COMPOSITES MARKET, BY RESIN TYPE, 2021-2023 (USD MILLION)

- TABLE 85 AUTOMOTIVE COMPOSITES MARKET, BY RESIN TYPE, 2021-2023 (KILOTON)

- TABLE 86 AUTOMOTIVE COMPOSITES MARKET, BY RESIN TYPE, 2024-2034 (USD MILLION)

- TABLE 87 AUTOMOTIVE COMPOSITES MARKET, BY RESIN TYPE, 2024-2034 (KILOTON)

- TABLE 88 THERMOSET: AUTOMOTIVE COMPOSITES MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 89 THERMOSET: AUTOMOTIVE COMPOSITES MARKET, BY REGION, 2021-2023 (KILOTON)

- TABLE 90 THERMOSET: AUTOMOTIVE COMPOSITES MARKET, BY REGION, 2024-2034 (USD MILLION)

- TABLE 91 THERMOSET: AUTOMOTIVE COMPOSITES MARKET, BY REGION, 2024-2034 (KILOTON)

- TABLE 92 THERMOSET: AUTOMOTIVE COMPOSITES MARKET, BY RESIN TYPE, 2021-2023 (USD MILLION)

- TABLE 93 THERMOSET: AUTOMOTIVE COMPOSITES MARKET, BY RESIN TYPE, 2021-2023 (KILOTON)

- TABLE 94 THERMOSET: AUTOMOTIVE COMPOSITES MARKET, BY RESIN TYPE, 2024-2034 (USD MILLION)

- TABLE 95 THERMOSET: AUTOMOTIVE COMPOSITES MARKET, BY RESIN TYPE, 2024-2034 (KILOTON)

- TABLE 96 THERMOPLASTIC: AUTOMOTIVE COMPOSITES MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 97 THERMOPLASTIC: AUTOMOTIVE COMPOSITES MARKET, BY REGION, 2021-2023 (KILOTON)

- TABLE 98 THERMOPLASTIC: AUTOMOTIVE COMPOSITES MARKET, BY REGION, 2024-2034 (USD MILLION)

- TABLE 99 THERMOPLASTIC: AUTOMOTIVE COMPOSITES MARKET, BY REGION, 2024-2034 (KILOTON)

- TABLE 100 THERMOPLASTIC: AUTOMOTIVE COMPOSITES MARKET, BY RESIN TYPE, 2021-2023 (USD MILLION)

- TABLE 101 THERMOPLASTIC: AUTOMOTIVE COMPOSITES MARKET, BY RESIN TYPE, 2021-2023 (KILOTON)

- TABLE 102 THERMOPLASTIC: AUTOMOTIVE COMPOSITES MARKET, BY RESIN TYPE, 2024-2034 (USD MILLION)

- TABLE 103 THERMOPLASTIC: AUTOMOTIVE COMPOSITES MARKET, BY RESIN TYPE, 2024-2034 (KILOTON)

- TABLE 104 AUTOMOTIVE COMPOSITES MARKET, BY APPLICATION, 2021-2023 (USD MILLION)

- TABLE 105 AUTOMOTIVE COMPOSITES MARKET, BY APPLICATION, 2021-2023 (KILOTON)

- TABLE 106 AUTOMOTIVE COMPOSITES MARKET, BY APPLICATION, 2024-2034 (USD MILLION)

- TABLE 107 AUTOMOTIVE COMPOSITES MARKET, BY APPLICATION, 2024-2034 (KILOTON)

- TABLE 108 EXTERIOR: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2021-2023 (USD MILLION)

- TABLE 109 EXTERIOR: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2021-2023 (KILOTON)

- TABLE 110 EXTERIOR: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2024-2034 (USD MILLION)

- TABLE 111 EXTERIOR: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2024-2034 (KILOTON)

- TABLE 112 INTERIOR: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2021-2023 (USD MILLION)

- TABLE 113 INTERIOR: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2021-2023 (KILOTON)

- TABLE 114 INTERIOR: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2024-2034 (USD MILLION)

- TABLE 115 INTERIOR: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2024-2034 (KILOTON)

- TABLE 116 POWERTRAIN & CHASSIS: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2021-2023 (USD MILLION)

- TABLE 117 POWERTRAIN & CHASSIS: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2021-2023 (KILOTON)

- TABLE 118 POWERTRAIN & CHASSIS: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2024-2034 (USD MILLION)

- TABLE 119 POWERTRAIN & CHASSIS: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2024-2034 (KILOTON)

- TABLE 120 BATTERY ENCLOSURES: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2021-2023 (USD MILLION)

- TABLE 121 BATTERY ENCLOSURES: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2021-2023 (KILOTON)

- TABLE 122 BATTERY ENCLOSURES: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2024-2034 (USD MILLION)

- TABLE 123 BATTERY ENCLOSURES: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2024-2034 (KILOTON)

- TABLE 124 AUTOMOTIVE COMPOSITES MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 125 AUTOMOTIVE COMPOSITES MARKET, BY REGION, 2021-2023 (KILOTON)

- TABLE 126 AUTOMOTIVE COMPOSITES MARKET, BY REGION, 2024-2034 (USD MILLION)

- TABLE 127 AUTOMOTIVE COMPOSITES MARKET, BY REGION, 2024-2034 (KILOTON)

- TABLE 128 NORTH AMERICA: AUTOMOTIVE COMPOSITES MARKET, BY RESIN TYPE, 2021-2023 (USD MILLION)

- TABLE 129 NORTH AMERICA: AUTOMOTIVE COMPOSITES MARKET, BY RESIN TYPE, 2021-2023 (KILOTON)

- TABLE 130 NORTH AMERICA: AUTOMOTIVE COMPOSITES MARKET, BY RESIN TYPE, 2024-2034 (USD MILLION)

- TABLE 131 NORTH AMERICA: AUTOMOTIVE COMPOSITES MARKET, BY RESIN TYPE, 2024-2034 (KILOTON)

- TABLE 132 NORTH AMERICA: AUTOMOTIVE COMPOSITES MARKET, BY MANUFACTURING PROCESS, 2021-2023 (USD MILLION)

- TABLE 133 NORTH AMERICA: AUTOMOTIVE COMPOSITES MARKET, BY MANUFACTURING PROCESS, 2021-2023 (KILOTON)

- TABLE 134 NORTH AMERICA: AUTOMOTIVE COMPOSITES MARKET, BY MANUFACTURING PROCESS, 2024-2034 (USD MILLION)

- TABLE 135 NORTH AMERICA: AUTOMOTIVE COMPOSITES MARKET, BY MANUFACTURING PROCESS, 2024-2034 (KILOTON)

- TABLE 136 NORTH AMERICA: AUTOMOTIVE COMPOSITES MARKET, BY VEHICLE TYPE, 2021-2023 (USD MILLION)

- TABLE 137 NORTH AMERICA: AUTOMOTIVE COMPOSITES MARKET, BY VEHICLE TYPE, 2021-2023 (KILOTON)

- TABLE 138 NORTH AMERICA: AUTOMOTIVE COMPOSITES MARKET, BY VEHICLE TYPE, 2024-2034 (USD MILLION)

- TABLE 139 NORTH AMERICA: AUTOMOTIVE COMPOSITES MARKET, BY VEHICLE TYPE, 2024-2034 (KILOTON)

- TABLE 140 NORTH AMERICA: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2021-2023 (USD MILLION)

- TABLE 141 NORTH AMERICA: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2021-2023 (KILOTON)

- TABLE 142 NORTH AMERICA: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2024-2034 (USD MILLION)

- TABLE 143 NORTH AMERICA: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2024-2034 (KILOTON)

- TABLE 144 NORTH AMERICA: AUTOMOTIVE COMPOSITES MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 145 NORTH AMERICA: AUTOMOTIVE COMPOSITES MARKET, BY COUNTRY, 2021-2023 (KILOTON)

- TABLE 146 NORTH AMERICA: AUTOMOTIVE COMPOSITES MARKET, BY COUNTRY, 2024-2034 (USD MILLION)

- TABLE 147 NORTH AMERICA: AUTOMOTIVE COMPOSITES MARKET, BY COUNTRY, 2024-2034 (KILOTON)

- TABLE 148 US: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2021-2023 (USD MILLION)

- TABLE 149 US: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2021-2023 (KILOTON)

- TABLE 150 US: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2024-2034 (USD MILLION)

- TABLE 151 US: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2024-2034 (KILOTON)

- TABLE 152 CANADA: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2021-2023 (USD MILLION)

- TABLE 153 CANADA: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2021-2023 (KILOTON)

- TABLE 154 CANADA: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2024-2034 (USD MILLION)

- TABLE 155 CANADA: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2024-2034 (KILOTON)

- TABLE 156 EUROPE: AUTOMOTIVE COMPOSITES MARKET, BY RESIN TYPE, 2021-2023 (USD MILLION)

- TABLE 157 EUROPE: AUTOMOTIVE COMPOSITES MARKET, BY RESIN TYPE, 2021-2023 (KILOTON)

- TABLE 158 EUROPE: AUTOMOTIVE COMPOSITES MARKET, BY RESIN TYPE, 2024-2034 (USD MILLION)

- TABLE 159 EUROPE: AUTOMOTIVE COMPOSITES MARKET, BY RESIN TYPE, 2024-2034 (KILOTON)

- TABLE 160 EUROPE: AUTOMOTIVE COMPOSITES MARKET, BY MANUFACTURING PROCESS, 2021-2023 (USD MILLION)

- TABLE 161 EUROPE: AUTOMOTIVE COMPOSITES MARKET, BY MANUFACTURING PROCESS, 2021-2023 (KILOTON)

- TABLE 162 EUROPE: AUTOMOTIVE COMPOSITES MARKET, BY MANUFACTURING PROCESS, 2024-2034 (USD MILLION)

- TABLE 163 EUROPE: AUTOMOTIVE COMPOSITES MARKET, BY MANUFACTURING PROCESS, 2024-2034 (KILOTON)

- TABLE 164 EUROPE: AUTOMOTIVE COMPOSITES MARKET, BY VEHICLE TYPE, 2021-2023 (USD MILLION)

- TABLE 165 EUROPE: AUTOMOTIVE COMPOSITES MARKET, BY VEHICLE TYPE, 2021-2023 (KILOTON)

- TABLE 166 EUROPE: AUTOMOTIVE COMPOSITES MARKET, BY VEHICLE TYPE, 2024-2034 (USD MILLION)

- TABLE 167 EUROPE: AUTOMOTIVE COMPOSITES MARKET, BY VEHICLE TYPE, 2024-2034 (KILOTON)

- TABLE 168 EUROPE: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2021-2023 (USD MILLION)

- TABLE 169 EUROPE: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2021-2023 (KILOTON)

- TABLE 170 EUROPE: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2024-2034 (USD MILLION)

- TABLE 171 EUROPE: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2024-2034 (KILOTON)

- TABLE 172 EUROPE: AUTOMOTIVE COMPOSITES MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 173 EUROPE: AUTOMOTIVE COMPOSITES MARKET, BY COUNTRY, 2021-2023 (KILOTON)

- TABLE 174 EUROPE: AUTOMOTIVE COMPOSITES MARKET, BY COUNTRY, 2024-2034 (USD MILLION)

- TABLE 175 EUROPE: AUTOMOTIVE COMPOSITES MARKET, BY COUNTRY, 2024-2034 (KILOTON)

- TABLE 176 GERMANY: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2021-2023 (USD MILLION)

- TABLE 177 GERMANY: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2021-2023 (KILOTON)

- TABLE 178 GERMANY: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2024-2034 (USD MILLION)

- TABLE 179 GERMANY: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2024-2034 (KILOTON)

- TABLE 180 FRANCE: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2021-2023 (USD MILLION)

- TABLE 181 FRANCE: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2021-2023 (KILOTON)

- TABLE 182 FRANCE: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2024-2034 (USD MILLION)

- TABLE 183 FRANCE: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2024-2034 (KILOTON)

- TABLE 184 UK: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2021-2023 (USD MILLION)

- TABLE 185 UK: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2021-2023 (KILOTON)

- TABLE 186 UK: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2024-2034 (USD MILLION)

- TABLE 187 UK: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2024-2034 (KILOTON)

- TABLE 188 ITALY: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2021-2023 (USD MILLION)

- TABLE 189 ITALY: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2021-2023 (KILOTON)

- TABLE 190 ITALY: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2024-2034 (USD MILLION)

- TABLE 191 ITALY: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2024-2034 (KILOTON)

- TABLE 192 SPAIN: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2021-2023 (USD MILLION)

- TABLE 193 SPAIN: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2021-2023 (KILOTON)

- TABLE 194 SPAIN: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2024-2034 (USD MILLION)

- TABLE 195 SPAIN: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2024-2034 (KILOTON)

- TABLE 196 RUSSIA: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2021-2023 (USD MILLION)

- TABLE 197 RUSSIA: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2021-2023 (KILOTON)

- TABLE 198 RUSSIA: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2024-2034 (USD MILLION)

- TABLE 199 RUSSIA: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2024-2034 (KILOTON)

- TABLE 200 BELGIUM: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2021-2023 (USD MILLION)

- TABLE 201 BELGIUM: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2021-2023 (KILOTON)

- TABLE 202 BELGIUM: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2024-2034 (USD MILLION)

- TABLE 203 BELGIUM: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2024-2034 (KILOTON)

- TABLE 204 REST OF EUROPE: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2021-2023 (USD MILLION)

- TABLE 205 REST OF EUROPE: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2021-2023 (KILOTON)

- TABLE 206 REST OF EUROPE: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2024-2034 (USD MILLION)

- TABLE 207 REST OF EUROPE: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2024-2034 (KILOTON)

- TABLE 208 LATIN AMERICA: AUTOMOTIVE COMPOSITES MARKET, BY RESIN TYPE, 2021-2023 (USD MILLION)

- TABLE 209 LATIN AMERICA: AUTOMOTIVE COMPOSITES MARKET, BY RESIN TYPE, 2021-2023 (KILOTON)

- TABLE 210 LATIN AMERICA: AUTOMOTIVE COMPOSITES MARKET, BY RESIN TYPE, 2024-2034 (USD MILLION)

- TABLE 211 LATIN AMERICA: AUTOMOTIVE COMPOSITES MARKET, BY RESIN TYPE, 2024-2034 (KILOTON)

- TABLE 212 LATIN AMERICA: AUTOMOTIVE COMPOSITES MARKET, BY MANUFACTURING PROCESS, 2021-2023 (USD MILLION)

- TABLE 213 LATIN AMERICA: AUTOMOTIVE COMPOSITES MARKET, BY MANUFACTURING PROCESS, 2021-2023 (KILOTON)

- TABLE 214 LATIN AMERICA: AUTOMOTIVE COMPOSITES MARKET, BY MANUFACTURING PROCESS, 2024-2034 (USD MILLION)

- TABLE 215 LATIN AMERICA: AUTOMOTIVE COMPOSITES MARKET, BY MANUFACTURING PROCESS, 2024-2034 (KILOTON)

- TABLE 216 LATIN AMERICA: AUTOMOTIVE COMPOSITES MARKET, BY VEHICLE TYPE, 2021-2023 (USD MILLION)

- TABLE 217 LATIN AMERICA: AUTOMOTIVE COMPOSITES MARKET, BY VEHICLE TYPE, 2021-2023 (KILOTON)

- TABLE 218 LATIN AMERICA: AUTOMOTIVE COMPOSITES MARKET, BY VEHICLE TYPE, 2024-2034 (USD MILLION)

- TABLE 219 LATIN AMERICA: AUTOMOTIVE COMPOSITES MARKET, BY VEHICLE TYPE, 2024-2034 (KILOTON)

- TABLE 220 LATIN AMERICA: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2021-2023 (USD MILLION)

- TABLE 221 LATIN AMERICA: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2021-2023 (KILOTON)

- TABLE 222 LATIN AMERICA: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2024-2034 (USD MILLION)

- TABLE 223 LATIN AMERICA: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2024-2034 (KILOTON)

- TABLE 224 LATIN AMERICA: AUTOMOTIVE COMPOSITES MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 225 LATIN AMERICA: AUTOMOTIVE COMPOSITES MARKET, BY COUNTRY, 2021-2023 (KILOTON)

- TABLE 226 LATIN AMERICA: AUTOMOTIVE COMPOSITES MARKET, BY COUNTRY, 2024-2034 (USD MILLION)

- TABLE 227 LATIN AMERICA: AUTOMOTIVE COMPOSITES MARKET, BY COUNTRY, 2024-2034 (KILOTON)

- TABLE 228 MEXICO: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2021-2023 (USD MILLION)

- TABLE 229 MEXICO: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2021-2023 (KILOTON)

- TABLE 230 MEXICO: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2024-2034 (USD MILLION)

- TABLE 231 MEXICO: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2024-2034 (KILOTON)

- TABLE 232 BRAZIL: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2021-2023 (USD MILLION)

- TABLE 233 BRAZIL: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2021-2023 (KILOTON)

- TABLE 234 BRAZIL: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2024-2034 (USD MILLION)

- TABLE 235 BRAZIL: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2024-2034 (KILOTON)

- TABLE 236 REST OF LATIN AMERICA: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2021-2023 (USD MILLION)

- TABLE 237 REST OF LATIN AMERICA: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2021-2023 (KILOTON)

- TABLE 238 REST OF LATIN AMERICA: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2024-2034 (USD MILLION)

- TABLE 239 REST OF LATIN AMERICA: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2024-2034 (KILOTON)

- TABLE 240 ASIA PACIFIC: AUTOMOTIVE COMPOSITES MARKET, BY RESIN TYPE, 2021-2023 (USD MILLION)

- TABLE 241 ASIA PACIFIC: AUTOMOTIVE COMPOSITES MARKET, BY RESIN TYPE, 2021-2023 (KILOTON)

- TABLE 242 ASIA PACIFIC: AUTOMOTIVE COMPOSITES MARKET, BY RESIN TYPE, 2024-2034 (USD MILLION)

- TABLE 243 ASIA PACIFIC: AUTOMOTIVE COMPOSITES MARKET, BY RESIN TYPE, 2024-2034 (KILOTON)

- TABLE 244 ASIA PACIFIC: AUTOMOTIVE COMPOSITES MARKET, BY MANUFACTURING PROCESS, 2021-2023 (USD MILLION)

- TABLE 245 ASIA PACIFIC: AUTOMOTIVE COMPOSITES MARKET, BY MANUFACTURING PROCESS, 2021-2023 (KILOTON)

- TABLE 246 ASIA PACIFIC: AUTOMOTIVE COMPOSITES MARKET, BY MANUFACTURING PROCESS, 2024-2034 (USD MILLION)

- TABLE 247 ASIA PACIFIC: AUTOMOTIVE COMPOSITES MARKET, BY MANUFACTURING PROCESS, 2024-2034 (KILOTON)

- TABLE 248 ASIA PACIFIC: AUTOMOTIVE COMPOSITES MARKET, BY VEHICLE TYPE, 2021-2023 (USD MILLION)

- TABLE 249 ASIA PACIFIC: AUTOMOTIVE COMPOSITES MARKET, BY VEHICLE TYPE, 2021-2023 (KILOTON)

- TABLE 250 ASIA PACIFIC: AUTOMOTIVE COMPOSITES MARKET, BY VEHICLE TYPE, 2024-2034 (USD MILLION)

- TABLE 251 ASIA PACIFIC: AUTOMOTIVE COMPOSITES MARKET, BY VEHICLE TYPE, 2024-2034 (KILOTON)

- TABLE 252 ASIA PACIFIC: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2021-2023 (USD MILLION)

- TABLE 253 ASIA PACIFIC: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2021-2023 (KILOTON)

- TABLE 254 ASIA PACIFIC: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2024-2034 (USD MILLION)

- TABLE 255 ASIA PACIFIC: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2024-2034 (KILOTON)

- TABLE 256 ASIA PACIFIC: AUTOMOTIVE COMPOSITES MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 257 ASIA PACIFIC: AUTOMOTIVE COMPOSITES MARKET, BY COUNTRY, 2021-2023 (KILOTON)

- TABLE 258 ASIA PACIFIC: AUTOMOTIVE COMPOSITES MARKET, BY COUNTRY, 2024-2034 (USD MILLION)

- TABLE 259 ASIA PACIFIC: AUTOMOTIVE COMPOSITES MARKET, BY COUNTRY, 2024-2034 (KILOTON)

- TABLE 260 CHINA: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2021-2023 (USD MILLION)

- TABLE 261 CHINA: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2021-2023 (KILOTON)

- TABLE 262 CHINA: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2024-2034 (USD MILLION)

- TABLE 263 CHINA: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2024-2034 (KILOTON)

- TABLE 264 JAPAN: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2021-2023 (USD MILLION)

- TABLE 265 JAPAN: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2021-2023 (KILOTON)

- TABLE 266 JAPAN: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2024-2034 (USD MILLION)

- TABLE 267 JAPAN: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2024-2034 (KILOTON)

- TABLE 268 INDIA: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2021-2023 (USD MILLION)

- TABLE 269 INDIA: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2021-2023 (KILOTON)

- TABLE 270 INDIA: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2024-2034 (USD MILLION)

- TABLE 271 INDIA: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2024-2034 (KILOTON)

- TABLE 272 SOUTH KOREA: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2021-2023 (USD MILLION)

- TABLE 273 SOUTH KOREA: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2021-2023 (KILOTON)

- TABLE 274 SOUTH KOREA: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2024-2034 (USD MILLION)

- TABLE 275 SOUTH KOREA: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2024-2034 (KILOTON)

- TABLE 276 AUSTRALIA: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2021-2023 (USD MILLION)

- TABLE 277 AUSTRALIA: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2021-2023 (KILOTON)

- TABLE 278 AUSTRALIA: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2024-2034 (USD MILLION)

- TABLE 279 AUSTRALIA: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2024-2034 (KILOTON)

- TABLE 280 REST OF ASIA PACIFIC: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2021-2023 (USD MILLION)

- TABLE 281 REST OF ASIA PACIFIC: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2021-2023 (KILOTON)

- TABLE 282 REST OF ASIA PACIFIC: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2024-2034 (USD MILLION)

- TABLE 283 REST OF ASIA PACIFIC: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2024-2034 (KILOTON)

- TABLE 284 MIDDLE EAST & AFRICA: AUTOMOTIVE COMPOSITES MARKET, BY RESIN TYPE, 2021-2023 (USD MILLION)

- TABLE 285 MIDDLE EAST & AFRICA: AUTOMOTIVE COMPOSITES MARKET, BY RESIN TYPE, 2021-2023 (KILOTON)

- TABLE 286 MIDDLE EAST & AFRICA: AUTOMOTIVE COMPOSITES MARKET, BY RESIN TYPE, 2024-2034 (USD MILLION)

- TABLE 287 MIDDLE EAST & AFRICA: AUTOMOTIVE COMPOSITES MARKET, BY RESIN TYPE, 2024-2034 (KILOTON)

- TABLE 288 MIDDLE EAST & AFRICA: AUTOMOTIVE COMPOSITES MARKET, BY MANUFACTURING PROCESS, 2021-2023 (USD MILLION)

- TABLE 289 MIDDLE EAST & AFRICA: AUTOMOTIVE COMPOSITES MARKET, BY MANUFACTURING PROCESS, 2021-2023 (KILOTON)

- TABLE 290 MIDDLE EAST & AFRICA: AUTOMOTIVE COMPOSITES MARKET, BY MANUFACTURING PROCESS, 2024-2034 (USD MILLION)

- TABLE 291 MIDDLE EAST & AFRICA: AUTOMOTIVE COMPOSITES MARKET, BY MANUFACTURING PROCESS, 2024-2034 (KILOTON)

- TABLE 292 MIDDLE EAST & AFRICA: AUTOMOTIVE COMPOSITES MARKET, BY VEHICLE TYPE, 2021-2023 (USD MILLION)

- TABLE 293 MIDDLE EAST & AFRICA: AUTOMOTIVE COMPOSITES MARKET, BY VEHICLE TYPE, 2021-2023 (KILOTON)

- TABLE 294 MIDDLE EAST & AFRICA: AUTOMOTIVE COMPOSITES MARKET, BY VEHICLE TYPE, 2024-2034 (USD MILLION)

- TABLE 295 MIDDLE EAST & AFRICA: AUTOMOTIVE COMPOSITES MARKET, BY VEHICLE TYPE, 2024-2034 (KILOTON)

- TABLE 296 MIDDLE EAST & AFRICA: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2021-2023 (USD MILLION)

- TABLE 297 MIDDLE EAST & AFRICA: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2021-2023 (KILOTON)

- TABLE 298 MIDDLE EAST & AFRICA: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2024-2034 (USD MILLION)

- TABLE 299 MIDDLE EAST & AFRICA: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2024-2034 (KILOTON)

- TABLE 300 MIDDLE EAST & AFRICA: AUTOMOTIVE COMPOSITES MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 301 MIDDLE EAST & AFRICA: AUTOMOTIVE COMPOSITES MARKET, BY COUNTRY, 2021-2023 (KILOTON)

- TABLE 302 MIDDLE EAST & AFRICA: AUTOMOTIVE COMPOSITES MARKET, BY COUNTRY, 2024-2034 (USD MILLION)

- TABLE 303 MIDDLE EAST & AFRICA: AUTOMOTIVE COMPOSITES MARKET, BY COUNTRY, 2024-2034 (KILOTON)

- TABLE 304 UAE: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2021-2023 (USD MILLION)

- TABLE 305 UAE: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2021-2023 (KILOTON)

- TABLE 306 UAE: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2024-2034 (USD MILLION)

- TABLE 307 UAE: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2024-2034 (KILOTON)

- TABLE 308 REST OF GCC COUNTRIES: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2021-2023 (USD MILLION)

- TABLE 309 REST OF GCC COUNTRIES: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2021-2023 (KILOTON)

- TABLE 310 REST OF GCC COUNTRIES: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2024-2034 (USD MILLION)

- TABLE 311 REST OF GCC COUNTRIES: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2024-2034 (KILOTON)

- TABLE 312 SOUTH AFRICA: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2021-2023 (USD MILLION)

- TABLE 313 SOUTH AFRICA: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2021-2023 (KILOTON)

- TABLE 314 SOUTH AFRICA: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2024-2034 (USD MILLION)

- TABLE 315 SOUTH AFRICA: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2024-2034 (KILOTON)

- TABLE 316 REST OF MIDDLE EAST & AFRICA: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2021-2023 (USD MILLION)

- TABLE 317 REST OF MIDDLE EAST & AFRICA: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2021-2023 (KILOTON)

- TABLE 318 REST OF MIDDLE EAST & AFRICA: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2024-2034 (USD MILLION)

- TABLE 319 REST OF MIDDLE EAST & AFRICA: AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE, 2024-2034 (KILOTON)

- TABLE 320 STRATEGIES ADOPTED BY AUTOMOTIVE COMPOSITE MANUFACTURERS

- TABLE 321 DEGREE OF COMPETITION: AUTOMOTIVE COMPOSITES MARKET

- TABLE 322 AUTOMOTIVE COMPOSITES MARKET: FIBER TYPE FOOTPRINT

- TABLE 323 AUTOMOTIVE COMPOSITES MARKET: VEHICLE TYPE FOOTPRINT

- TABLE 324 AUTOMOTIVE COMPOSITES MARKET: RESIN TYPE FOOTPRINT

- TABLE 325 AUTOMOTIVE COMPOSITES MARKET: APPLICATION FOOTPRINT

- TABLE 326 AUTOMOTIVE COMPOSITES MARKET: REGION FOOTPRINT

- TABLE 327 AUTOMOTIVE COMPOSITES MARKET: KEY STARTUPS/SMES

- TABLE 328 AUTOMOTIVE COMPOSITES MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 329 AUTOMOTIVE COMPOSITES MARKET: PRODUCT LAUNCHES, JANUARY 2018 TO OCTOBER 2024

- TABLE 330 AUTOMOTIVE COMPOSITES MARKET: DEALS, JANUARY 2018-OCTOBER 2024

- TABLE 331 AUTOMOTIVE COMPOSITES MARKET: EXPANSIONS, JANUARY 2018-OCTOBER 2024

- TABLE 332 SGL CARBON: COMPANY OVERVIEW

- TABLE 333 SGL CARBON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 334 SGL CARBON: DEALS

- TABLE 335 SGL CARBON: EXPANSIONS

- TABLE 336 SYENSQO: COMPANY OVERVIEW

- TABLE 337 SYENSQO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 338 SYENSQO: PRODUCT LAUNCHES, JANUARY 2018-JUNE 2024

- TABLE 339 SYENSQO: OTHER DEVELOPMENTS, JANUARY 2018-JUNE 2024

- TABLE 340 POLYTEC HOLDING AG: COMPANY OVERVIEW

- TABLE 341 POLYTEC HOLDING AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 342 POLYTEC HOLDING AG: DEALS

- TABLE 343 TORAY INDUSTRIES, INC.: COMPANY OVERVIEW

- TABLE 344 TORAY INDUSTRIES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 345 TORAY INDUSTRIES, INC.: PRODUCT LAUNCHES

- TABLE 346 TORAY INDUSTRIES, INC.: DEALS

- TABLE 347 TORAY INDUSTRIES, INC.: EXPANSIONS

- TABLE 348 ELRINGKLINGER AG: COMPANY OVERVIEW

- TABLE 349 ELRINGKLINGER AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 350 HENGRUI CORPORATION: COMPANY OVERVIEW

- TABLE 351 HENGRUI CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 352 HENGRUI CORPORATION: DEALS

- TABLE 353 EXEL COMPOSITES: COMPANY OVERVIEW

- TABLE 354 EXEL COMPOSITES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 355 EXEL COMPOSITES: PRODUCT LAUNCHES

- TABLE 356 TEIJIN LIMITED: COMPANY OVERVIEW

- TABLE 357 TEIJIN LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 358 TEIJIN LIMITED: DEALS

- TABLE 359 MITSUBISHI CHEMICAL GROUP CORPORATION: COMPANY OVERVIEW

- TABLE 360 MITSUBISHI CHEMICAL GROUP CORPORATION: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 361 MITSUBISHI CHEMICAL GROUP CORPORATION: DEALS

- TABLE 362 MITSUBISHI CHEMICAL GROUP CORPORATION: EXPANSIONS

- TABLE 363 HEXCEL CORPORATION: COMPANY OVERVIEW

- TABLE 364 HEXCEL CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 365 HEXCEL CORPORATION: PRODUCT LAUNCHES

- TABLE 366 HEXCEL CORPORATION: DEALS

- TABLE 367 HEXCEL CORPORATION: EXPANSIONS

- TABLE 368 IDI COMPOSITES INTERNATIONAL: COMPANY OVERVIEW

- TABLE 369 IDI COMPOSITES INTERNATIONAL: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 370 IDI COMPOSITES INTERNATIONAL: PRODUCT LAUNCHES

- TABLE 371 IDI COMPOSITES INTERNATIONAL: EXPANSIONS

- TABLE 372 ROCHLING SE & CO. KG: COMPANY OVERVIEW

- TABLE 373 ROCHLING SE & CO. KG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 374 KAUTEX: COMPANY OVERVIEW

- TABLE 375 KAUTEX: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 376 MUHR UND BENDER KG: COMPANY OVERVIEW

- TABLE 377 MUHR UND BENDER KG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 378 GEORG FRITZMEIER GMBH & CO. KG: COMPANY OVERVIEW

- TABLE 379 GEORG FRITZMEIER GMBH & CO. KG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 380 FLEX-N-GATE: COMPANY OVERVIEW

- TABLE 381 FLEX-N-GATE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 382 HANKUK CARBON CO., LTD.: COMPANY OVERVIEW

- TABLE 383 CIE AUTOMOTIVE INDIA: COMPANY OVERVIEW

- TABLE 384 UFP TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 385 ZHONGAO CARBON: COMPANY OVERVIEW

- TABLE 386 ATLAS FIBRE: COMPANY OVERVIEW

- TABLE 387 PIRAN ADVANCED COMPOSITES: COMPANY OVERVIEW

- TABLE 388 ENVALIOR: COMPANY OVERVIEW

- TABLE 389 TRB LIGHTWEIGHT STRUCTURES: COMPANY OVERVIEW

- TABLE 390 THE GUND COMPANY: COMPANY OVERVIEW

- TABLE 391 OPMOBILITY: COMPANY OVERVIEW

List of Figures

- FIGURE 1 AUTOMOTIVE COMPOSITES MARKET: SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 AUTOMOTIVE COMPOSITES MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 5 AUTOMOTIVE COMPOSITES MARKET: DATA TRIANGULATION

- FIGURE 6 THERMOSET SEGMENT TO HOLD LARGER MARKET SHARE IN 2034

- FIGURE 7 GLASS SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2023

- FIGURE 8 INJECTION MOLDING SEGMENT DOMINATED AUTOMOTIVE COMPOSITES MARKET IN 2023

- FIGURE 9 NON-ELECTRIC SEGMENT DOMINATED AUTOMOTIVE COMPOSITES MARKET IN 2023

- FIGURE 10 EXTERIOR SEGMENT LED AUTOMOTIVE COMPOSITES MARKET IN 2023

- FIGURE 11 ASIA PACIFIC LED AUTOMOTIVE COMPOSITES MARKET IN 2023

- FIGURE 12 RISING DEMAND FOR AUTOMOTIVE COMPOSITES IN EV AND NON-EV PRODUCTION TO CREATE LUCRATIVE OPPORTUNITIES FOR MARKET PLAYERS

- FIGURE 13 GLASS SEGMENT AND ASIA PACIFIC ACCOUNTED FOR LARGEST SHARES OF AUTOMOTIVE COMPOSITES MARKET IN 2023

- FIGURE 14 THERMOSET SEGMENT TO DOMINATE AUTOMOTIVE COMPOSITES MARKET DURING FORECAST PERIOD

- FIGURE 15 INJECTION MOLDING SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2023

- FIGURE 16 NON-ELECTRIC SEGMENT ACCOUNTED FOR LARGER SHARE OF AUTOMOTIVE COMPOSITES MARKET IN 2023

- FIGURE 17 INTERIOR SEGMENT HELD LARGEST SHARE OF AUTOMOTIVE COMPOSITES MARKET IN 2023

- FIGURE 18 CHINA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF AUTOMOTIVE COMPOSITES MARKET

- FIGURE 20 EV SALES BY MAJOR MARKETS (REGION/COUNTRY), 2023

- FIGURE 21 EV SALES FORECAST

- FIGURE 22 PORTER'S FIVE FORCES ANALYSIS: AUTOMOTIVE COMPOSITES MARKET

- FIGURE 23 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- FIGURE 24 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- FIGURE 25 AUTOMOTIVE COMPOSITES MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 26 AUTOMOTIVE COMPOSITES MARKET: KEY STAKEHOLDERS IN ECOSYSTEM

- FIGURE 27 AUTOMOTIVE COMPOSITES MARKET: ECOSYSTEM

- FIGURE 28 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY APPLICATION, 2023

- FIGURE 29 AVERAGE SELLING PRICE TREND OF AUTOMOTIVE COMPOSITES, BY FIBER TYPE (USD/KG), 2021-2023

- FIGURE 30 AVERAGE SELLING PRICE TREND OF AUTOMOTIVE COMPOSITES, BY RESIN TYPE (USD/KG), 2021-2023

- FIGURE 31 AVERAGE SELLING PRICE TREND OF AUTOMOTIVE COMPOSITES, BY MANUFACTURING PROCESS (USD/KG), 2021-2023

- FIGURE 32 AVERAGE SELLING PRICE TREND OF AUTOMOTIVE COMPOSITES, BY APPLICATION (USD/KG), 2021-2023

- FIGURE 33 AVERAGE SELLING PRICE TREND OF AUTOMOTIVE COMPOSITES, BY VEHICLE TYPE (USD/KG), 2021-2023

- FIGURE 34 AVERAGE SELLING PRICE TREND, BY REGION (USD/KG), 2021-2023

- FIGURE 35 AUTOMOTIVE COMPOSITES MARKET: VALUE CHAIN ANALYSIS

- FIGURE 36 EXPORT OF HS CODE 7019-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2020-2023 (USD THOUSAND)

- FIGURE 37 IMPORT OF HS CODE 7019-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2020-2023 (USD THOUSAND)

- FIGURE 38 PATENT ANALYSIS, BY PATENT TYPE

- FIGURE 39 PATENT PUBLICATION TREND, 2014-2024

- FIGURE 40 EV COMPOSITES MARKET: LEGAL STATUS OF PATENTS

- FIGURE 41 CHINESE JURISDICTION REGISTERED HIGHEST NUMBER OF PATENTS

- FIGURE 42 JIANGSU UNIVERSITY REGISTERED HIGHEST NUMBER OF PATENTS

- FIGURE 43 CO2 EMISSIONS, BY SECTOR (2023)

- FIGURE 44 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS IN AUTOMOTIVE COMPOSITES MARKET

- FIGURE 45 DEALS AND FUNDING IN AUTOMOTIVE COMPOSITES MARKET SOARED IN 2022

- FIGURE 46 PROMINENT AUTOMOTIVE COMPOSITE MANUFACTURING FIRMS IN 2024 (USD BILLION)

- FIGURE 47 ELECTRIC SEGMENT TO REGISTER HIGHER CAGR BETWEEN 2024 AND 2034

- FIGURE 48 CARBON FIBER SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 49 RESIN TRANSFER MOLDING SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 50 THERMOPLASTIC SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 51 BATTERY ENCLOSURES SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 52 CHINA TO LEAD GLOBAL AUTOMOTIVE COMPOSITES MARKET DURING FORECAST PERIOD

- FIGURE 53 NORTH AMERICA: AUTOMOTIVE COMPOSITES MARKET SNAPSHOT

- FIGURE 54 EUROPE: AUTOMOTIVE COMPOSITES MARKET SNAPSHOT

- FIGURE 55 ASIA PACIFIC: AUTOMOTIVE COMPOSITES MARKET SNAPSHOT

- FIGURE 56 AUTOMOTIVE COMPOSITES MARKET: REVENUE ANALYSIS OF TOP 5 MARKET PLAYERS

- FIGURE 57 SHARES OF KEY PLAYERS IN AUTOMOTIVE COMPOSITES MARKET

- FIGURE 58 AUTOMOTIVE COMPOSITES MARKET: TOP TRENDING BRAND/ PRODUCT ANALYSIS

- FIGURE 59 BRAND/PRODUCT COMPARATIVE ANALYSIS FOR AUTOMOTIVE COMPOSITES

- FIGURE 60 AUTOMOTIVE COMPOSITES MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 61 AUTOMOTIVE COMPOSITES MARKET: COMPANY FOOTPRINT

- FIGURE 62 AUTOMOTIVE COMPOSITES MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 63 AUTOMOTIVE COMPOSITES MARKET: EV/EBITDA OF KEY VENDORS

- FIGURE 64 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 65 SGL CARBON: COMPANY SNAPSHOT

- FIGURE 66 SYENSQO: COMPANY SNAPSHOT

- FIGURE 67 POLYTEC HOLDING AG: COMPANY SNAPSHOT

- FIGURE 68 TORAY INDUSTRIES, INC.: COMPANY SNAPSHOT

- FIGURE 69 ELRINGKLINGER AG: COMPANY SNAPSHOT

- FIGURE 70 EXEL COMPOSITES: COMPANY SNAPSHOT

- FIGURE 71 TEIJIN LIMITED: COMPANY SNAPSHOT

- FIGURE 72 MITSUBISHI CHEMICAL GROUP CORPORATION: COMPANY SNAPSHOT

- FIGURE 73 HEXCEL CORPORATION: COMPANY SNAPSHOT

The automotive composites market is estimated at USD 9.69 billion in 2024 and is projected to reach USD 37.54 billion by 2034, at a CAGR of 14.5% from 2024 to 2034. In terms of value, glass fiber type dominated the global automotive composites market and expected to continue this trend over the upcoming years. The high market share is attributed to various advantages such as flexibility, stability, lightweight, moisture & temperature resistance, resistance to hear, and cost-effectiveness as compared to carbon fiber. In automotive industry, glass fiber composites get widely used in deck lids, bumper beams, underbody systems, engine covers, front-end modules, air ducts, engine cover instrument panels and many other cars body parts.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2034 |

| Base Year | 2023 |

| Forecast Period | 2024-2034 |

| Units Considered | Value (USD Million/Billion) and Volume (Kiloton) |

| Segments | Fiber Type, Resin Type, Manufacturing Process, Application, Vehicle Type, and Region |

| Regions covered | Europe, North America, Asia Pacific, Latin America, Middle East, and Africa |

''In terms of value, interior application segment accounted for the second-largest share of the overall automotive composites market.''

In 2023, the interior application segment accounted for the second-largest share of the overall automotive composites market, in terms of value. The interior applications of automotive composites include seatbacks, load floors, interior trims, interior headliners, underbody panels, and interior cabin. The usage of composites in these applications enables the reduction of weight. The weight of car is a critical factor for OEMs and hence, composites has been considered as best alternatives to other traditional materials that includes aluminum and steel for fabrication of interior parts of the car body. OEMs such as Audi and BMW have considered the usage of composites in various structural parts such as headliners and seat backs.

"During the forecast period, the automotive composites market in North America region is projected to be the second-largest region."

The growth of automotive composites in North America is fueled by the presence of some of the key automotive composite manufacturers such as Hexcel Corporation (US), Owens Corning (US), UFP Technologies, Inc. (US), Huntsman Corporation (US), and Hexion (US). These companies are undertaking various strategies to meet the growing demand for composites.

The increasing applications of glass fiber composites and other composites in the automotive industry are helping the North American market to grow. Corporate Average Fuel Economy (CAFE) and GHG regulations imposed by the government are encouraging the use of fuel-efficient vehicles. Such regulations are compelling manufacturers to adopt lightweight solutions, boosting the demand for automotive composites.

This study has been validated through primary interviews with industry experts globally. These primary sources have been divided into the following three categories:

- By Company Type- Tier 1- 55%, Tier 2- 25%, and Tier 3- 20%

- By Designation- Directors- 50%, Managers- 30%, and Others- 20%

- By Region- North America- 20%, Europe- 25%, Asia Pacific- 25%, Latin America- 15%, Middle East & Africa (MEA)-15%.

The report provides a comprehensive analysis of company profiles:

Prominent companies include Toray Industries, Inc. (Japan), SGL Carbon (Germany), POLYTEC HOLDING AG, ElringKlinger AG (Germany), Syensqo (Belgium), HENGRUI CORPORATION (HRC) (China), Exel Composites (Finland), Teijin Limited (Japan), Mitsubishi Chemical Group Corporation (Japan), Piran Advanced Composites (UK), IDI Composites International (US), and Rochling SE & Co. KG (Germany).

Research Coverage

This research report categorizes the automotive composites market By fiber (glass, carbon, others), resin (thermoset and thermoplastic), manufacturing process (compression molding, injection molding, RTM, others), application (exterior, interior, powertrain, chassis), vehicle type (non-electric, electric) and Region (Europe, North America, Asia Pacific, Latin America and Middle Eat & Africa). The scope of the report includes detailed information about the major factors influencing the growth of the automotive composites market, such as drivers, restraints, challenges, and opportunities. A thorough examination of the key industry players has been conducted in order to provide insights into their business overview, solutions, and services, key strategies, contracts, partnerships, and agreements. New product and service launches, mergers and acquisitions, and recent developments in the automotive composites market are all covered. This report includes a competitive analysis of upcoming startups in the automotive composites market ecosystem.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall automotive composites market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Increase in demand for lightweight vehicles, rising usage of cost-efficient natural fibers in automotives), restraints (High processing cost, Lack of technological advancements), opportunities (Growing stringent government regulations), and challenges (Recyclability of automotive composites) influencing the growth of the automotive composites market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in automotive composites market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the automotive composites market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the automotive composites market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players like Toray Industries, Inc. (Japan), SGL Carbon (Germany), POLYTEC HOLDING AG, ElringKlinger AG (Germany), Syensqo (Belgium), HENGRUI CORPORATION (HRC) (China), Exel Composites (Finland), Teijin Limited (Japan), Mitsubishi Chemical Group Corporation (Japan), Piran Advanced Composites (UK), IDI Composites International (US), and Rochling SE & Co. KG (Germany), among others in the automotive composites market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key primary participants

- 2.1.2.3 Breakdown of primary interviews

- 2.1.2.4 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 BASE NUMBER CALCULATION

- 2.3.1 APPROACH 1: SUPPLY-SIDE ANALYSIS

- 2.3.2 APPROACH 2: DEMAND-SIDE ANALYSIS

- 2.4 MARKET FORECAST APPROACH

- 2.4.1 SUPPLY SIDE

- 2.4.2 DEMAND SIDE

- 2.5 DATA TRIANGULATION

- 2.6 FACTOR ANALYSIS

- 2.7 RESEARCH ASSUMPTIONS

- 2.8 RESEARCH LIMITATIONS AND RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN AUTOMOTIVE COMPOSITES MARKET

- 4.2 AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE AND REGION

- 4.3 AUTOMOTIVE COMPOSITES MARKET, BY RESIN TYPE

- 4.4 AUTOMOTIVE COMPOSITES MARKET, BY MANUFACTURING PROCESS

- 4.5 AUTOMOTIVE COMPOSITES MARKET, BY VEHICLE TYPE

- 4.6 AUTOMOTIVE COMPOSITES MARKET, BY APPLICATION

- 4.7 AUTOMOTIVE COMPOSITES MARKET, BY KEY COUNTRY

5 MARKET OVERVIEW

- 5.1 MARKET DYNAMICS

- 5.1.1 DRIVERS

- 5.1.1.1 Increase in demand for lightweight and fuel-efficient vehicles

- 5.1.1.2 Growth of environment-friendly electric vehicles

- 5.1.1.3 Increasing use of cost-efficient and eco-friendly natural fibers in automotive applications

- 5.1.2 RESTRAINTS

- 5.1.2.1 High processing and manufacturing cost of composites

- 5.1.2.2 Lack of technological advancements in emerging economies

- 5.1.3 OPPORTUNITIES

- 5.1.3.1 Stringent government regulations

- 5.1.3.2 Growing demand from emerging economies

- 5.1.3.3 Penetration of carbon fiber composites in electric vehicles

- 5.1.4 CHALLENGES

- 5.1.4.1 Recyclability of composites

- 5.1.1 DRIVERS

- 5.2 PORTER'S FIVE FORCES ANALYSIS

- 5.2.1 THREAT OF NEW ENTRANTS

- 5.2.2 THREAT OF SUBSTITUTES

- 5.2.3 BARGAINING POWER OF SUPPLIERS

- 5.2.4 BARGAINING POWER OF BUYERS

- 5.2.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.3 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.3.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.3.2 BUYING CRITERIA

- 5.4 SUPPLY CHAIN ANALYSIS

- 5.5 ECOSYSTEM ANALYSIS

- 5.6 PRICING ANALYSIS

- 5.6.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY APPLICATION, 2023

- 5.6.2 AVERAGE SELLING PRICE TREND, BY FIBER TYPE, 2021-2023

- 5.6.3 AVERAGE SELLING PRICE TREND, BY RESIN TYPE, 2021-2023

- 5.6.4 AVERAGE SELLING PRICE TREND, BY MANUFACTURING PROCESS, 2021-2023

- 5.6.5 AVERAGE SELLING PRICE TREND, BY APPLICATION, 2021-2023

- 5.6.6 AVERAGE SELLING PRICE TREND, BY VEHICLE TYPE, 2021-2023

- 5.6.7 AVERAGE SELLING PRICE TREND, BY REGION, 2021-2023

- 5.7 VALUE CHAIN ANALYSIS

- 5.8 TRADE ANALYSIS

- 5.8.1 EXPORT SCENARIO (HS CODE 7019)

- 5.8.2 IMPORT SCENARIO (HS CODE 7019)

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGIES

- 5.9.1.1 Automotive composite manufacturing

- 5.9.1.2 Glass fiber composite manufacturing

- 5.9.1.3 Carbon fiber composite manufacturing

- 5.9.2 COMPLEMENTARY TECHNOLOGIES

- 5.9.2.1 Recycling technology

- 5.9.1 KEY TECHNOLOGIES

- 5.10 IMPACT OF AI/GEN AI ON AUTOMOTIVE COMPOSITES MARKET

- 5.10.1 TOP APPLICATIONS AND MARKET POTENTIAL OF AI

- 5.11 USE CASES OF AI IN AUTOMOTIVE APPLICATIONS

- 5.11.1 POSITIVE AI USAGE RESULTS WITNESSED BY KEY AUTOMAKERS

- 5.11.2 IMPACT OF AI ON ADJACENT MARKETS

- 5.12 MACROECONOMICS OUTLOOK

- 5.12.1 INTRODUCTION

- 5.12.2 GDP TRENDS AND FORECAST

- 5.12.3 TRENDS IN GLOBAL AUTOMOTIVE INDUSTRY

- 5.13 PATENT ANALYSIS

- 5.13.1 INTRODUCTION

- 5.13.2 METHODOLOGY

- 5.13.3 PATENT TYPES

- 5.13.4 INSIGHTS

- 5.13.5 LEGAL STATUS

- 5.13.6 JURISDICTION ANALYSIS

- 5.13.7 TOP APPLICANTS

- 5.14 REGULATORY LANDSCAPE

- 5.14.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.15 KEY CONFERENCES AND EVENTS IN 2024-2025

- 5.16 CASE STUDY ANALYSIS

- 5.16.1 CASE STUDY 1: MITSUBISHI'S DEVELOPMENT OF CARBON FIBER FOR STRUCTURAL AUTOMOTIVE COMPONENTS

- 5.16.2 CASE STUDY 2: WATT ELECTRIC VEHICLES PARTNERED WITH NATIONAL COMPOSITES CENTRE TO MANUFACTURE COMPOSITE BATTERIES

- 5.16.3 CASE STUDY 3: TEIJIN'S DEVELOPMENT OF CARBON FIBER BATTERY ENCLOSURE

- 5.17 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.18 INVESTMENT AND FUNDING SCENARIO

6 AUTOMOTIVE COMPOSITES MARKET, BY VEHICLE TYPE

- 6.1 INTRODUCTION

- 6.2 NON-ELECTRIC

- 6.2.1 INCREASING USE OF COMPOSITES IN NON-ELECTRIC VEHICLES TO DRIVE MARKET

- 6.3 ELECTRIC

- 6.3.1 RISING DEMAND FOR HIGH-PERFORMANCE COMPOSITES TO FUEL MARKET GROWTH

7 AUTOMOTIVE COMPOSITES MARKET, BY FIBER TYPE

- 7.1 INTRODUCTION

- 7.2 CARBON FIBER

- 7.2.1 CAPABILITY TO REDUCE WEIGHT OF BATTERY PACKS AND IMPROVE COOLING TO FUEL DEMAND

- 7.3 GLASS FIBER

- 7.3.1 HIGH USE AS REINFORCEMENT IN EV COMPOSITE, OFFERING BALANCE OF STRENGTH AND CORROSION RESISTANCE TO DRIVE MARKET

- 7.4 OTHER FIBER TYPES

- 7.4.1 NATURAL FIBER

- 7.4.2 BASALT FIBER

- 7.4.3 ARAMID FIBER

- 7.4.4 HYBRID FIBER

8 AUTOMOTIVE COMPOSITES MARKET, BY MANUFACTURING PROCESS

- 8.1 INTRODUCTION

- 8.2 COMPRESSION MOLDING PROCESS

- 8.2.1 GROWING USE TO PRODUCE HIGH-QUALITY, LIGHTWEIGHT AUTOMOTIVE COMPOSITES TO DRIVE MARKET

- 8.3 INJECTION MOLDING PROCESS

- 8.3.1 LOW MOLD-CLAMPING PRESSURE AND SCRAPE RATE TO DRIVE DEMAND

- 8.4 RESIN TRANSFER MOLDING PROCESS

- 8.4.1 INCREASING DEMAND TO MOLD COMPONENTS WITH LARGE SURFACE AREAS, COMPLEX SHAPES, AND SMOOTH FINISHES TO PROPEL MARKET

- 8.5 OTHER MANUFACTURING PROCESSES

- 8.5.1 FILAMENT WINDING PROCESS

- 8.5.2 CONTINUOUS PROCESS

- 8.5.3 LAY-UP PROCESS

9 AUTOMOTIVE COMPOSITES MARKET, BY RESIN TYPE

- 9.1 INTRODUCTION

- 9.2 THERMOSET

- 9.2.1 EXCELLENT CHARACTERISTICS OFFERED BY THERMOSET RESIN TO DRIVE MARKET

- 9.2.2 POLYESTER RESIN

- 9.2.3 VINYL ESTER RESIN

- 9.2.4 EPOXY RESIN

- 9.2.5 OTHER THERMOSET RESINS

- 9.3 THERMOPLASTIC

- 9.3.1 FASTER MOLDING CYCLE TIME AND BETTER IMPACT RESISTANCE TO DRIVE MARKET

- 9.3.2 POLYPROPYLENE

- 9.3.3 POLYAMIDE

- 9.3.4 POLYPHENYLENE SULFIDE

- 9.3.5 OTHER THERMOPLASTIC RESINS

- 9.3.5.1 Polyetheretherketone

- 9.3.5.2 Polyetherimide

10 AUTOMOTIVE COMPOSITES MARKET, BY APPLICATION

- 10.1 INTRODUCTION

- 10.2 EXTERIOR

- 10.2.1 HIGH RIGIDITY, DURABILITY, AND LOW MAINTENANCE REQUIREMENTS TO DRIVE DEMAND

- 10.3 INTERIOR

- 10.3.1 HIGH USE OF GLASS FIBER COMPOSITES IN INTERIOR APPLICATIONS TO FUEL MARKET GROWTH

- 10.4 POWERTRAIN & CHASSIS

- 10.4.1 STRINGENT GOVERNMENT REGULATIONS TO REDUCE OVERALL WEIGHT OF VEHICLES TO PROPEL DEMAND

- 10.5 BATTERY ENCLOSURES

- 10.5.1 NEED FOR SAFETY OF BATTERY AND PASSENGERS IN EVENT OF COLLISION TO DRIVE MARKET

11 AUTOMOTIVE COMPOSITES MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 US

- 11.2.1.1 High demand for lightweight materials from automobile manufacturers to drive market

- 11.2.2 CANADA

- 11.2.2.1 Presence of many medium-scale composite manufacturers and booming automotive industry to drive market

- 11.2.1 US

- 11.3 EUROPE

- 11.3.1 GERMANY

- 11.3.1.1 High demand for glass fiber automotive composites to drive market

- 11.3.2 FRANCE

- 11.3.2.1 Increasing demand from high-end car manufacturers to support market growth

- 11.3.3 UK

- 11.3.3.1 Expanding electric vehicle industry to create growth opportunities for market players

- 11.3.4 ITALY

- 11.3.4.1 Increasing demand for carbon fiber-based automotive composites to boost market growth

- 11.3.5 SPAIN

- 11.3.5.1 Booming automotive industry to fuel demand

- 11.3.6 RUSSIA

- 11.3.6.1 Large manufacturing base of passenger cars to fuel demand

- 11.3.7 BELGIUM

- 11.3.7.1 Presence of major automobile companies to drive market

- 11.3.8 REST OF EUROPE

- 11.3.1 GERMANY

- 11.4 LATIN AMERICA

- 11.4.1 MEXICO

- 11.4.1.1 Presence of largest motor vehicle producer to fuel demand

- 11.4.2 BRAZIL

- 11.4.2.1 Rising passenger car production to drive market

- 11.4.3 REST OF LATIN AMERICA

- 11.4.1 MEXICO

- 11.5 ASIA PACIFIC

- 11.5.1 CHINA

- 11.5.1.1 Widely established automotive industry to fuel demand for automotive composites

- 11.5.2 JAPAN

- 11.5.2.1 Rising consumption of automotive composites to drive market

- 11.5.3 INDIA

- 11.5.3.1 Growing end-use applications to support market growth

- 11.5.4 SOUTH KOREA

- 11.5.4.1 Shift to lightweight materials to boost fuel efficiency and vehicle performance

- 11.5.5 AUSTRALIA

- 11.5.5.1 Growing sales of electric and hybrid cars to drive market

- 11.5.6 REST OF ASIA PACIFIC

- 11.5.1 CHINA

- 11.6 MIDDLE EAST & AFRICA

- 11.6.1 GCC COUNTRIES

- 11.6.1.1 UAE

- 11.6.1.1.1 Economic growth and rising population to boost market

- 11.6.1.2 Rest of GCC countries

- 11.6.1.1 UAE

- 11.6.2 SOUTH AFRICA

- 11.6.2.1 Rising demand for carbon fibers to drive market

- 11.6.3 REST OF MIDDLE EAST & AFRICA

- 11.6.1 GCC COUNTRIES

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 12.3 REVENUE ANALYSIS, 2021-2023

- 12.4 MARKET SHARE ANALYSIS

- 12.5 BRAND/PRODUCT COMPARATIVE ANALYSIS

- 12.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 12.6.1 STARS

- 12.6.2 EMERGING LEADERS

- 12.6.3 PERVASIVE PLAYERS

- 12.6.4 PARTICIPANTS

- 12.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 12.6.5.1 Company footprint

- 12.6.5.2 Fiber type footprint

- 12.6.5.3 Vehicle type footprint

- 12.6.5.4 Resin type footprint

- 12.6.5.5 Application footprint

- 12.6.5.6 Region footprint

- 12.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 12.7.1 PROGRESSIVE COMPANIES

- 12.7.2 RESPONSIVE COMPANIES

- 12.7.3 DYNAMIC COMPANIES

- 12.7.4 STARTING BLOCKS

- 12.7.5 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 12.7.5.1 Detailed list of key startups/SMEs

- 12.7.5.2 Competitive benchmarking of key startups/SMEs

- 12.8 VALUATION AND FINANCIAL METRICS OF AUTOMOTIVE COMPOSITE VENDORS

- 12.9 COMPETITIVE SCENARIO AND TRENDS

- 12.9.1 PRODUCT LAUNCHES

- 12.9.2 DEALS

- 12.9.3 EXPANSIONS

13 COMPANY PROFILES

- 13.1 KEY COMPANIES

- 13.1.1 SGL CARBON

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Solutions/Services offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Deals

- 13.1.1.3.2 Expansions

- 13.1.1.4 MnM view

- 13.1.1.4.1 Right to win

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses and competitive threats

- 13.1.2 SYENSQO

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Solutions/Services offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Product launches

- 13.1.2.3.2 Other developments

- 13.1.2.4 MnM view

- 13.1.2.4.1 Right to win

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses and competitive threats

- 13.1.3 POLYTEC HOLDING AG

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Solutions/Services offered

- 13.1.3.3 Recent developments

- 13.1.3.4 MnM view

- 13.1.3.4.1 Right to win

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses and competitive threats

- 13.1.4 TORAY INDUSTRIES, INC.

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Solutions/Services offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Product launches

- 13.1.4.3.2 Deals

- 13.1.4.3.3 Expansions

- 13.1.4.4 MnM view

- 13.1.4.4.1 Right to win

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses and competitive threats

- 13.1.5 ELRINGKLINGER AG

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Solutions/Services offered

- 13.1.5.3 MnM view

- 13.1.5.3.1 Right to win

- 13.1.5.3.2 Strategic choices

- 13.1.5.3.3 Weaknesses and competitive threats

- 13.1.6 HENGRUI CORPORATION

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Solutions/Services offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Deals

- 13.1.6.4 MnM view

- 13.1.6.4.1 Right to win

- 13.1.6.4.2 Strategic choices

- 13.1.6.4.3 Weaknesses and competitive threats

- 13.1.7 EXEL COMPOSITES

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Solutions/Services offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Product launches

- 13.1.7.4 MnM view

- 13.1.7.4.1 Right to win

- 13.1.7.4.2 Strategic choices

- 13.1.7.4.3 Weaknesses and competitive threats

- 13.1.8 TEIJIN LIMITED

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Solutions/Services offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Deals

- 13.1.8.4 MnM view

- 13.1.8.4.1 Right to win

- 13.1.8.4.2 Strategic choices

- 13.1.8.4.3 Weaknesses and competitive threats

- 13.1.9 MITSUBISHI CHEMICAL GROUP CORPORATION

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Solutions/Services offered

- 13.1.9.3 Recent developments

- 13.1.9.3.1 Deals

- 13.1.9.3.2 Expansions

- 13.1.9.4 MnM view

- 13.1.9.4.1 Right to win

- 13.1.9.4.2 Strategic choices

- 13.1.9.4.3 Weaknesses and competitive threats

- 13.1.10 HEXCEL CORPORATION

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Solutions/Services offered

- 13.1.10.3 Recent developments

- 13.1.10.3.1 Product launches

- 13.1.10.3.2 Deals

- 13.1.10.3.3 Expansions

- 13.1.10.4 MnM view

- 13.1.10.4.1 Right to win

- 13.1.10.4.2 Strategic choices

- 13.1.10.4.3 Weaknesses and competitive threats

- 13.1.11 IDI COMPOSITES INTERNATIONAL

- 13.1.11.1 Business overview

- 13.1.11.2 Products/Solutions/Services offered

- 13.1.11.3 Recent developments

- 13.1.11.3.1 Product launches

- 13.1.11.3.2 Expansions

- 13.1.11.4 MnM view

- 13.1.11.4.1 Right to win

- 13.1.11.4.2 Strategic choices

- 13.1.11.4.3 Weaknesses and competitive threats

- 13.1.12 ROCHLING SE & CO. KG

- 13.1.12.1 Business overview

- 13.1.12.2 Products/Solutions/Services offered

- 13.1.12.3 MnM view

- 13.1.12.3.1 Right to win

- 13.1.12.3.2 Strategic choices

- 13.1.12.3.3 Weaknesses and competitive threats

- 13.1.13 KAUTEX

- 13.1.13.1 Business overview

- 13.1.13.2 Products/Solutions/Services offered

- 13.1.13.3 MnM view

- 13.1.13.3.1 Right to win

- 13.1.13.3.2 Strategic choices

- 13.1.13.3.3 Weaknesses and competitive threats

- 13.1.14 MUHR UND BENDER KG

- 13.1.14.1 Business overview

- 13.1.14.2 Products/Solutions/Services offered

- 13.1.14.3 MnM view

- 13.1.14.3.1 Right to win

- 13.1.14.3.2 Strategic choices

- 13.1.14.3.3 Weaknesses and competitive threats

- 13.1.15 GEORG FRITZMEIER GMBH & CO. KG

- 13.1.15.1 Business overview

- 13.1.15.2 Products/Solutions/Services offered

- 13.1.15.3 MnM view

- 13.1.15.3.1 Right to win

- 13.1.15.3.2 Strategic choices

- 13.1.15.3.3 Weaknesses and competitive threats

- 13.1.16 FLEX-N-GATE

- 13.1.16.1 Business overview

- 13.1.16.2 Products/Solutions/Services offered

- 13.1.16.3 MnM view

- 13.1.16.3.1 Right to win

- 13.1.16.3.2 Strategic choices

- 13.1.16.3.3 Weaknesses and competitive threats

- 13.1.1 SGL CARBON

- 13.2 OTHER PLAYERS

- 13.2.1 HANKUK CARBON CO., LTD.

- 13.2.2 CIE AUTOMOTIVE INDIA

- 13.2.3 UFP TECHNOLOGIES, INC.

- 13.2.4 ZHONGAO CARBON

- 13.2.5 ATLAS FIBRE

- 13.2.6 PIRAN ADVANCED COMPOSITES

- 13.2.7 ENVALIOR

- 13.2.8 TRB LIGHTWEIGHT STRUCTURES

- 13.2.9 THE GUND COMPANY

- 13.2.10 OPMOBILITY

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS