|

|

市場調査レポート

商品コード

1096517

インテリジェントパワーモジュール(IPM)の世界市場 - 2027年までの予測:定格電圧別(600V 以下、601~1,200V、1,200V 超)、定格電流別、回路構成別(6パック、7パック)、パワーデバイス別(IGBT、MOSFET)、業種別、地域別Intelligent Power Module Market by Voltage Rating (Up to 600V, 601-1,200V, Above 1,200V), Current Rating, Circuit Configuration (6-Pack, 7-Pack), Power Devices (IGBT, MOSFET), Vertical, Region (North America, Europe, APAC, RoW) - Global Forecast -2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| インテリジェントパワーモジュール(IPM)の世界市場 - 2027年までの予測:定格電圧別(600V 以下、601~1,200V、1,200V 超)、定格電流別、回路構成別(6パック、7パック)、パワーデバイス別(IGBT、MOSFET)、業種別、地域別 |

|

出版日: 2022年06月29日

発行: MarketsandMarkets

ページ情報: 英文 200 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

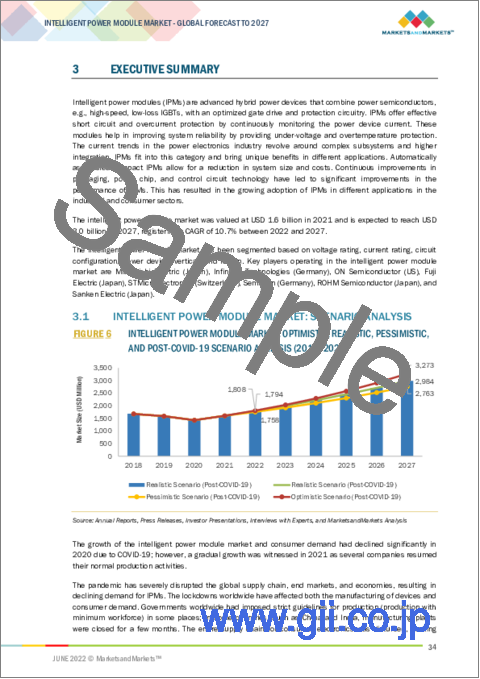

世界のインテリジェントパワーモジュール(IPM)の市場規模は、2022年の18億米ドルから、2027年までに30億米ドルに達し、2022年~2027年のCAGRで10.7%の成長が予測されています。

再生可能エネルギー源による発電要件の増加、新規かつ効率的なエネルギー・電力監視モジュールの提供に対するOEMの注力、工業・自動車・コンシューマーエレクトロニクス業界におけるIPMの需要の急増などの要因が、インテリジェントパワーモジュール(IPM)市場の成長を促進する主な要因となっています。

当レポートでは、世界のインテリジェントパワーモジュール(IPM)市場について調査分析し、市場概要、業界動向、セグメント別の市場分析、競合情勢、主要企業などについて、最新の情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- バリューチェーン分析

- エコシステム:パワーエレクトロニクス

- 価格分析

- 技術分析

- ケーススタディ分析

- 貿易分析

- 特許分析

- 規制情勢

第6章 インテリジェントパワーモジュール(IPM)市場:定格電流別

- 100A 以下

- 101~600A

- 600A 超

第7章 インテリジェントパワーモジュール(IPM)市場:定格電圧別

- 600V 以下

- 601~1,200V

- 1,200V 超

第8章 インテリジェントパワーモジュール(IPM)市場:回路構成別

- 6パック

- 7パック

- その他

第9章 インテリジェントパワーモジュール(IPM)市場:パワーデバイス別

- IGBT

- MOSFET

第10章 インテリジェントパワーモジュール(IPM)市場:業種別

- コンシューマーエレクトロニクス

- ICT

- 工業

- 自動車

- 航空宇宙

- その他

第11章 地域分析

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- その他

- アジア太平洋地域

- 日本

- 中国

- インド

- 韓国

- その他

- その他の地域

- 中東・アフリカ

- 南米

第12章 競合情勢

- 概要

- 主要企業戦略/有力企業

- 主要企業の収益分析

- 市場シェア分析

- 企業の評価象限

- 競合シナリオ

第13章 企業プロファイル

- 主要企業

- MITSUBISHI ELECTRIC

- ON SEMICONDUCTOR

- INFINEON TECHNOLOGIES

- FUJI ELECTRIC

- SEMIKRON

- ROHM SEMICONDUCTOR

- SANKEN ELECTRIC

- STMICROELECTRONICS

- HANGZHOU SILAN MICROELECTRONICS

- SINO MICROELECTRONICS

- その他の企業

- ALPHA & OMEGA SEMICONDUCTOR

- CISSOID

- SENSITRON SEMICONDUCTOR

- RONGTECH INDUSTRY

- POWEREX

- OZTEK CORPORATION

- HIRATA CORPORATION

- MICROSEMI CORPORATION

- TOSHIBA ELECTRONIC DEVICES & STORAGE CORPORATION

- TEXAS INSTRUMENTS

- RENESAS ELECTRONICS

- SOLITRON DEVICES

- VINCOTECH-A GROUP COMPANY OF MITSUBISHI ELECTRIC

第14章 隣接市場

第15章 付録

The global intelligent power module market size is anticipated to grow from USD 1.8billion in 2022 to USD 3.0billion by 2027, at a CAGR of 10.7% from 2022 to 2027. Rising requirements for power generation through renewable sources, focus of OEMs on providing novel and efficient energy and power monitoring modules as well as surging demand for IPMs in industrial, automotive and consumer electronics vertical are some of the major factors propelling the growth of intelligent power module market.

COVID-19 has emerged as a global pandemic that has spread worldwide and disrupted various industries around the world. The prominent players across industries have been affected by this pandemic. The foreseeable decline in the growth of end-user industries may have a considerable direct impact on theintelligent power module market.

"Up to 100 A current rating segment toaccount for the larger share of market from 2022 to 2027"

IPMs with a current rating of up to 100 A suffice for domestic applications, which comprise daily use appliances such as washing machines, air conditioners, and dishwashers. Such IPMs are manufactured by all major players, such as Mitsubishi Electric Corp. (Japan), Fuji Electric Co., Ltd. (Japan), ON Semiconductor Corporation (US), and Infineon Technologies AG (Germany). The key target segment of these IPMs is the consumer electronics sector. Some of the benefits of these IPMs are the cost savings from a smaller footprint and reduced PCB space. Easy implementation of 2- or 3-phase motor drives with half-bridge IPMs and half-bridge configuration enables a more flexible board design with better thermal performance.

"Industrial verticalis expected to contribute largest market share of the intelligent power module market during the forecast period."

The industrial segment is projected to hold the largest share of the intelligent power module marketduring forecast. Industrial is among the key verticals for the intelligent power module market. The industrial segment comprises industrial manufacturing, process industries, and the energy & power industry. Industrial devices, such as pumps, conveyors, compressors, cranes, winders, extruders, and rollers use powered modules for controlling and protecting the circuitry. Processes such as electroplating, electrolysis, welding, lighting, and induction heating are equipped with power modules to use electric power efficiently and safely. The ease of manufacturing has led to the availability of these devices in a vast range of current ratings and high voltage ratings. IPMs control all motors employed in rolling, textile, and cement mills.

"Asia is expectedto account for the largest share of market during the forecast period."

Asia Pacific is expected to contribute the largest size of the intelligent power module market in 2022. Rapid industrialization and infrastructure development are driving the growth of consumer electronics and automotive industries in China, which is expected to increase the demand for intelligent power module in the region. China is the world's largest producer and end user of consumer electronics devices, such as smartphones, tablets, and home appliances. The increasing need for power management in consumer electronics products is fueling the demand for intelligent power modules in the consumer electronics vertical.

Break-up of the profiles ofprimary participants:

- By Company Type -Tier 1 - 56%, Tier 2 - 23%, and Tier 3 - 21%

- By Designation - C-level Executives - 45%, Directors - 30%, and Others - 25%

- By Region- North America - 40%, Europe - 23%, Asia Pacific - 26%, and RoW - 11%

Research Coverage:

Theintelligent power module markethas been segmentedintocurrent rating, voltage rating, circuit configuration, power devices, vertical and region. The intelligent power module markethas been studied for North America, Europe, AsiaPacific, and the Rest of the World (RoW).

Reasons to buy the report:

- Illustrative segmentation, analysis, and forecast of the market based oncurrent rating, voltage rating, circuit configuration, power devices, vertical and region have been conducted to give an overall view of theintelligent power module market.

- Avalue chain analysis has been performed to provide in-depth insightsinto the intelligent power module market.

- The key drivers, restraints, opportunities, and challengespertaining to the intelligent power module markethave been detailed in this report.

- The report includes adetailed competitive landscape of the market,along with key players, as well as an in-depth analysis of their revenues

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 INTELLIGENT POWER MODULE MARKET: SEGMENTATION

- 1.3.2 GEOGRAPHIC SCOPE

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 INTELLIGENT POWER MODULE MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakdown of primaries

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Key industry insights

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 TOP-DOWN APPROACH

- 2.2.1.1 Approach for estimating market size by top-down analysis (supply side)

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1-SUPPLY SIDE

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2-SUPPLY SIDE

- 2.2.2 BOTTOM-UP APPROACH

- 2.2.2.1 Approach for estimating market size by bottom-up analysis (demand side)

- 2.2.1 TOP-DOWN APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 5 DATA TRIANGULATION

- 2.4 LIMITATIONS

- 2.5 RESEARCH ASSUMPTIONS

- TABLE 1 ASSUMPTIONS

3 EXECUTIVE SUMMARY

- 3.1 INTELLIGENT POWER MODULE MARKET: SCENARIO ANALYSIS

- FIGURE 6 INTELLIGENT POWER MODULE MARKET: OPTIMISTIC, REALISTIC, PESSIMISTIC, AND POST-COVID-19 SCENARIO ANALYSIS (2018-2027)

- 3.2 INTELLIGENT POWER MODULE MARKET: REALISTIC SCENARIO

- TABLE 2 REALISTIC SCENARIO (POST-COVID-19): INTELLIGENT POWER MODULE MARKET, 2022-2027 (USD MILLION)

- 3.3 INTELLIGENT POWER MODULE MARKET: OPTIMISTIC SCENARIO

- TABLE 3 OPTIMISTIC SCENARIO (POST-COVID-19): INTELLIGENT POWER MODULE MARKET, 2022-2027 (USD MILLION)

- 3.4 INTELLIGENT POWER MODULE MARKET: PESSIMISTIC SCENARIO

- TABLE 4 PESSIMISTIC SCENARIO (POST-COVID-19): INTELLIGENT POWER MODULE MARKET, 2022-2027 (USD MILLION)

- FIGURE 7 UP TO 100 A SEGMENT TO HOLD LARGEST SHARE OF INTELLIGENT POWER MODULE MARKET, BY CURRENT RATING, IN 2022

- FIGURE 8 IGBT SEGMENT TO HOLD LARGER SHARE OF INTELLIGENT POWER MODULE MARKET, BY POWER DEVICE, IN 2022

- FIGURE 9 6-PACK SEGMENT TO ACCOUNT FOR LARGEST SHARE OF INTELLIGENT POWER MODULE MARKET, BY CIRCUIT CONFIGURATION, IN 2022

- FIGURE 10 CONSUMER ELECTRONICS TO BE FASTEST-GROWING VERTICAL IN INTELLIGENT POWER MODULE MARKET DURING FORECAST PERIOD

- FIGURE 11 ASIA PACIFIC HELD LARGEST SHARE OF INTELLIGENT POWER MODULE MARKET IN 2021

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN INTELLIGENT POWER MODULE MARKET

- FIGURE 12 INCREASING DEMAND FOR INTELLIGENT POWER MODULES IN CONSUMER ELECTRONICS AND INDUSTRIAL VERTICALS TO DRIVE MARKET GROWTH

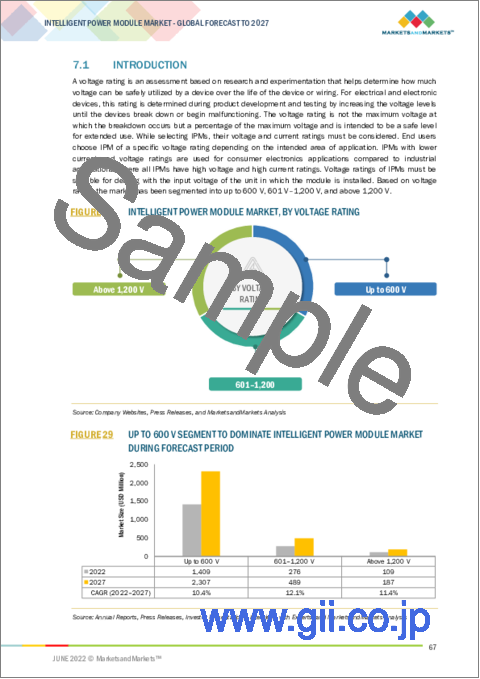

- 4.2 INTELLIGENT POWER MODULE MARKET, BY VOLTAGE RATING

- FIGURE 13 UP TO 600 V SEGMENT TO HOLD LARGEST MARKET SHARE BY 2027

- 4.3 INTELLIGENT POWER MODULE MARKET, BY POWER DEVICE

- FIGURE 14 IGBT SEGMENT TO HOLD LARGER MARKET SHARE IN 2022

- 4.4 INTELLIGENT POWER MODULE MARKET, BY VERTICAL

- FIGURE 15 INDUSTRIAL VERTICAL TO ACCOUNT FOR LARGEST MARKET SHARE DURING 2022-2027

- 4.5 INTELLIGENT POWER MODULE MARKET, BY COUNTRY

- FIGURE 16 CHINA INTELLIGENT POWER MODULE MARKET TO WITNESS HIGHEST GROWTH DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 17 INTELLIGENT POWER MODULE MARKET: MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising focus of governments on generating power using renewable sources

- 5.2.1.2 Surging global electric vehicle demand

- 5.2.1.3 Growing need for improving system reliability and performance

- 5.2.1.4 Compact design and high energy efficiency features of intelligent power modules (IPMs)

- FIGURE 18 IMPACT ANALYSIS OF DRIVERS

- 5.2.2 RESTRAINTS

- 5.2.2.1 Slow adoption of novel technologies and complex design of intelligent power modules (IPMs)

- FIGURE 19 IMPACT ANALYSIS OF RESTRAINTS

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing demand for intelligent power modules (IPMs) in consumer electronics industry

- 5.2.3.2 Growing adoption of GaN and SiC materials in automobile and power semiconductor applications

- FIGURE 20 IMPACT ANALYSIS OF OPPORTUNITIES

- 5.2.4 CHALLENGES

- 5.2.4.1 Designing and operational challenges related to next-generation intelligent power modules (IPMs)

- 5.2.4.2 Supply chain disruptions and semiconductor shortage owing to COVID-19

- FIGURE 21 IMPACT ANALYSIS OF CHALLENGES

- 5.3 VALUE CHAIN ANALYSIS

- FIGURE 22 VALUE CHAIN ANALYSIS: INTELLIGENT POWER MODULE MARKET

- 5.3.1 R&D ENGINEERS

- 5.3.2 MANUFACTURERS

- 5.3.3 DISTRIBUTORS

- 5.3.4 END-USER INDUSTRIES

- 5.4 ECOSYSTEM: POWER ELECTRONICS

- FIGURE 23 POWER ELECTRONICS ECOSYSTEM

- 5.5 PRICING ANALYSIS

- TABLE 5 INDICATIVE PRICES OF INTELLIGENT POWER MODULES

- 5.6 TECHNOLOGY ANALYSIS

- 5.7 CASE STUDY ANALYSIS

- 5.7.1 INFINEON TECHNOLOGIES: HOME APPLIANCES CASE STUDY

- 5.7.1.1 Use of Infineon's IPMs in home appliances

- 5.7.2 MITSUBISHI ELECTRIC: HOME APPLIANCES CASE STUDY

- 5.7.2.1 Use of Mitsubishi Electric's IPMs in home appliances

- 5.7.3 MITSUBISHI ELECTRIC: RENEWABLE ENERGY CASE STUDY

- 5.7.3.1 Use of Mitsubishi Electric's IPMs in renewable energy

- 5.7.4 ON SEMICONDUCTOR: 3-PHASE INVERTER CASE STUDY

- 5.7.4.1 Use of ON Semiconductor's IPMs in 3-phase inverters

- 5.7.5 ON SEMICONDUCTOR: NIO INC CASE STUDY

- 5.7.5.1 Use of ON Semiconductor's IPMs in NIO Inc's next-generation EVs

- 5.7.6 INFINEON TECHNOLOGIES: SHOWA DENKO K.K. CASE STUDY

- 5.7.6.1 Use of Infineon Technologies' SiC-based modules for EVs

- 5.7.1 INFINEON TECHNOLOGIES: HOME APPLIANCES CASE STUDY

- 5.8 TRADE ANALYSIS

- 5.8.1 IMPORT SCENARIO OF ELECTRONIC INTEGRATED CIRCUITS

- FIGURE 24 IMPORT DATA FOR HS CODE 8542, BY COUNTRY, 2017-2021 (BILLION UNITS)

- TABLE 6 IMPORT DATA FOR HS CODE 8542, BY COUNTRY, 2017-2021 (BILLION UNITS)

- 5.8.2 EXPORT SCENARIO OF ELECTRONIC INTEGRATED CIRCUITS

- FIGURE 25 EXPORT DATA FOR HS CODE 8542, BY COUNTRY, 2017-2021 (BILLION UNITS)

- TABLE 7 EXPORT DATA FOR HS CODE 8542, BY COUNTRY, 2017-2021 (BILLION UNITS)

- 5.9 PATENT ANALYSIS

- TABLE 8 KEY PATENTS REGISTERED, 2003-2022

- 5.10 REGULATORY LANDSCAPE

- TABLE 9 KEY REGULATIONS APPLICABLE TO PLAYERS IN IPM MARKET

6 INTELLIGENT POWER MODULE MARKET, BY CURRENT RATING

- 6.1 INTRODUCTION

- FIGURE 26 INTELLIGENT POWER MODULE MARKET, BY CURRENT RATING

- FIGURE 27 UP TO 100 A SEGMENT TO LEAD INTELLIGENT POWER MODULE MARKET DURING FORECAST PERIOD

- TABLE 10 INTELLIGENT POWER MODULE MARKET, BY CURRENT RATING, 2018-2021 (USD MILLION)

- TABLE 11 INTELLIGENT POWER MODULE MARKET, BY CURRENT RATING, 2022-2027 (USD MILLION)

- 6.2 UP TO 100 A

- 6.2.1 GROWING USE OF INTELLIGENT POWER MODULES WITH CURRENT RATINGS UP TO 100 A IN CONSUMER ELECTRONICS VERTICAL

- 6.3 101-600 A

- 6.3.1 RISING APPLICATIONS OF INTELLIGENT POWER MODULES WITH 101-600 A CURRENT RATINGS IN INDUSTRIAL VERTICAL

- 6.4 ABOVE 600 A

- 6.4.1 HIGH PREFERENCE FOR ABOVE 600 A INTELLIGENT POWER MODULES IN HEAVY-DUTY INDUSTRIAL APPLICATIONS

7 INTELLIGENT POWER MODULE MARKET, BY VOLTAGE RATING

- 7.1 INTRODUCTION

- FIGURE 28 INTELLIGENT POWER MODULE MARKET, BY VOLTAGE RATING

- FIGURE 29 UP TO 600 V SEGMENT TO DOMINATE INTELLIGENT POWER MODULE MARKET DURING FORECAST PERIOD

- TABLE 12 INTELLIGENT POWER MODULE MARKET, BY VOLTAGE RATING, 2018-2021 (USD MILLION)

- TABLE 13 INTELLIGENT POWER MODULE MARKET, BY VOLTAGE RATING, 2022-2027 (USD MILLION)

- 7.2 UP TO 600 V

- 7.2.1 HIGH USE OF INTELLIGENT POWER MODULES HAVING UP TO 600 V IN CONSUMER ELECTRONICS

- 7.3 601-1,200 V

- 7.3.1 RISING ADOPTION OF 601-1,200 V INTELLIGENT POWER MODULES IN INDUSTRIAL APPLICATIONS

- 7.4 ABOVE 1,200 V

- 7.4.1 INCREASING PREFERENCE FOR ABOVE 1,200 V INTELLIGENT POWER MODULES IN INDUSTRIAL VERTICAL

8 INTELLIGENT POWER MODULE MARKET, BY CIRCUIT CONFIGURATION

- 8.1 INTRODUCTION

- FIGURE 30 INTELLIGENT POWER MODULE MARKET, BY CIRCUIT CONFIGURATION

- FIGURE 31 6-PACK CIRCUIT CONFIGURATION SEGMENT TO LEAD INTELLIGENT POWER MODULE MARKET DURING FORECAST PERIOD

- TABLE 14 INTELLIGENT POWER MODULE MARKET, BY CIRCUIT CONFIGURATION, 2018-2021 (USD MILLION)

- TABLE 15 INTELLIGENT POWER MODULE MARKET, BY CIRCUIT CONFIGURATION, 2022-2027 (USD MILLION)

- 8.2 6-PACK

- 8.2.1 HIGH ADOPTION OF 6-PACK INTELLIGENT POWER MODULES IN CONSUMER ELECTRONICS AND LIGHT-DUTY INDUSTRIAL APPLICATIONS

- 8.3 7-PACK

- 8.3.1 RISING PREFERENCE FOR 7-PACK INTELLIGENT POWER MODULES IN HEAVY-DUTY INDUSTRIAL APPLICATIONS

- 8.4 OTHERS

9 INTELLIGENT POWER MODULE MARKET, BY POWER DEVICE

- 9.1 INTRODUCTION

- FIGURE 32 INTELLIGENT POWER MODULE MARKET, BY POWER DEVICE

- FIGURE 33 IGBT SEGMENT TO DOMINATE INTELLIGENT POWER MODULE MARKET DURING FORECAST PERIOD

- TABLE 16 INTELLIGENT POWER MODULE MARKET, BY POWER DEVICE, 2018-2021 (USD MILLION)

- TABLE 17 INTELLIGENT POWER MODULE MARKET, BY POWER DEVICE, 2022-2027 (USD MILLION)

- 9.2 IGBT

- 9.2.1 IGBT SEGMENT TO HOLD LARGER MARKET SHARE DURING REVIEW PERIOD

- 9.3 MOSFET

- 9.3.1 RISING DEMAND FOR MOSFET-BASED IPMS TO INCREASE ENERGY EFFICIENCY OF SYSTEMS TO DRIVE MARKET GROWTH

10 INTELLIGENT POWER MODULE MARKET, BY VERTICAL

- 10.1 INTRODUCTION

- FIGURE 34 INTELLIGENT POWER MODULE MARKET, BY VERTICAL

- FIGURE 35 INDUSTRIAL VERTICAL TO ACCOUNT FOR LARGEST SHARE OF INTELLIGENT POWER MODULE MARKET DURING FORECAST PERIOD

- TABLE 18 INTELLIGENT POWER MODULE MARKET, BY VERTICAL, 2018-2021 (USD MILLION)

- TABLE 19 INTELLIGENT POWER MODULE MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- 10.2 CONSUMER ELECTRONICS

- 10.2.1 GROWING ADOPTION OF CONSUMER ELECTRONICS TO PROPEL MARKET GROWTH

- TABLE 20 INTELLIGENT POWER MODULE MARKET FOR CONSUMER ELECTRONICS VERTICAL, BY REGION, 2018-2021 (USD MILLION)

- TABLE 21 INTELLIGENT POWER MODULE MARKET FOR CONSUMER ELECTRONICS VERTICAL, BY REGION, 2022-2027 (USD MILLION)

- TABLE 22 INTELLIGENT POWER MODULE MARKET FOR CONSUMER ELECTRONICS VERTICAL IN NORTH AMERICA, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 23 INTELLIGENT POWER MODULE MARKET FOR CONSUMER ELECTRONICS VERTICAL IN NORTH AMERICA, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 24 INTELLIGENT POWER MODULE MARKET FOR CONSUMER ELECTRONICS VERTICAL IN EUROPE, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 25 INTELLIGENT POWER MODULE MARKET FOR CONSUMER ELECTRONICS VERTICAL IN EUROPE, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 26 INTELLIGENT POWER MODULE MARKET FOR CONSUMER ELECTRONICS VERTICAL IN ASIA PACIFIC, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 27 INTELLIGENT POWER MODULE MARKET FOR CONSUMER ELECTRONICS VERTICAL IN ASIA PACIFIC, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 28 INTELLIGENT POWER MODULE MARKET FOR CONSUMER ELECTRONICS VERTICAL IN ROW, BY REGION, 2018-2021 (USD MILLION)

- TABLE 29 INTELLIGENT POWER MODULE MARKET FOR CONSUMER ELECTRONICS VERTICAL IN ROW, BY REGION, 2022-2027 (USD MILLION)

- 10.3 ICT

- 10.3.1 RISING DEMAND FOR ADVANCED POWER DEVICES TO BOOST MARKET GROWTH DURING FORECAST PERIOD

- TABLE 30 INTELLIGENT POWER MODULE MARKET FOR ICT VERTICAL, BY REGION, 2018-2021 (USD MILLION)

- TABLE 31 INTELLIGENT POWER MODULE MARKET FOR ICT VERTICAL, BY REGION, 2022-2027 (USD MILLION)

- TABLE 32 INTELLIGENT POWER MODULE MARKET FOR ICT VERTICAL IN NORTH AMERICA, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 33 INTELLIGENT POWER MODULE MARKET FOR ICT VERTICAL IN NORTH AMERICA, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 34 INTELLIGENT POWER MODULE MARKET FOR ICT VERTICAL IN EUROPE, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 35 INTELLIGENT POWER MODULE MARKET FOR ICT VERTICAL IN EUROPE, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 36 INTELLIGENT POWER MODULE MARKET FOR ICT VERTICAL IN ASIA PACIFIC, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 37 INTELLIGENT POWER MODULE MARKET FOR ICT VERTICAL IN ASIA PACIFIC, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 38 INTELLIGENT POWER MODULE MARKET FOR ICT VERTICAL IN ROW, BY REGION, 2018-2021 (USD MILLION)

- TABLE 39 INTELLIGENT POWER MODULE MARKET FOR ICT VERTICAL IN ROW, BY REGION, 2022-2027 (USD MILLION)

- 10.4 INDUSTRIAL

- 10.4.1 INCREASED USAGE OF INTELLIGENT POWER MODULES IN RENEWABLE POWER SOURCES TO FUEL MARKET GROWTH

- TABLE 40 INTELLIGENT POWER MODULE MARKET FOR INDUSTRIAL VERTICAL, BY REGION, 2018-2021 (USD MILLION)

- TABLE 41 INTELLIGENT POWER MODULE MARKET FOR INDUSTRIAL VERTICAL, BY REGION, 2022-2027 (USD MILLION)

- TABLE 42 INTELLIGENT POWER MODULE MARKET FOR INDUSTRIAL VERTICAL IN NORTH AMERICA, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 43 INTELLIGENT POWER MODULE MARKET FOR INDUSTRIAL VERTICAL IN NORTH AMERICA, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 44 INTELLIGENT POWER MODULE MARKET FOR INDUSTRIAL VERTICAL IN EUROPE, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 45 INTELLIGENT POWER MODULE MARKET FOR INDUSTRIAL VERTICAL IN EUROPE, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 46 INTELLIGENT POWER MODULE MARKET FOR INDUSTRIAL VERTICAL IN ASIA PACIFIC, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 47 INTELLIGENT POWER MODULE MARKET FOR INDUSTRIAL VERTICAL IN ASIA PACIFIC, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 48 INTELLIGENT POWER MODULE MARKET FOR INDUSTRIAL VERTICAL IN ROW, BY REGION, 2018-2021 (USD MILLION)

- TABLE 49 INTELLIGENT POWER MODULE MARKET FOR INDUSTRIAL VERTICAL IN ROW, BY REGION, 2022-2027 (USD MILLION)

- 10.5 AUTOMOTIVE

- 10.5.1 SURGING ADOPTION OF EVS, HEVS, AND BEVS TO DRIVE MARKET GROWTH

- TABLE 50 INTELLIGENT POWER MODULE MARKET FOR AUTOMOTIVE VERTICAL, BY REGION, 2018-2021 (USD MILLION)

- TABLE 51 INTELLIGENT POWER MODULE MARKET FOR AUTOMOTIVE VERTICAL, BY REGION, 2022-2027 (USD MILLION)

- TABLE 52 INTELLIGENT POWER MODULE MARKET FOR AUTOMOTIVE VERTICAL IN NORTH AMERICA, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 53 INTELLIGENT POWER MODULE MARKET FOR AUTOMOTIVE VERTICAL IN NORTH AMERICA, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 54 INTELLIGENT POWER MODULE MARKET FOR AUTOMOTIVE VERTICAL IN EUROPE, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 55 INTELLIGENT POWER MODULE MARKET FOR AUTOMOTIVE VERTICAL IN EUROPE, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 56 INTELLIGENT POWER MODULE MARKET FOR AUTOMOTIVE VERTICAL IN ASIA PACIFIC, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 57 INTELLIGENT POWER MODULE MARKET FOR AUTOMOTIVE VERTICAL IN ASIA PACIFIC, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 58 INTELLIGENT POWER MODULE MARKET FOR AUTOMOTIVE VERTICAL IN ROW, BY REGION, 2018-2021 (USD MILLION)

- TABLE 59 INTELLIGENT POWER MODULE MARKET FOR AUTOMOTIVE VERTICAL IN ROW, BY REGION, 2022-2027 (USD MILLION)

- 10.6 AEROSPACE

- 10.6.1 INCREASED DEMAND FOR ADVANCED MISSION-CRITICAL COMPONENTS IN AEROSPACE VERTICAL TO FUEL MARKET GROWTH

- TABLE 60 INTELLIGENT POWER MODULE MARKET FOR AEROSPACE VERTICAL, BY REGION, 2018-2021 (USD MILLION)

- TABLE 61 INTELLIGENT POWER MODULE MARKET FOR AEROSPACE VERTICAL, BY REGION, 2022-2027 (USD MILLION)

- TABLE 62 INTELLIGENT POWER MODULE MARKET FOR AEROSPACE VERTICAL IN NORTH AMERICA, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 63 INTELLIGENT POWER MODULE MARKET FOR AEROSPACE VERTICAL IN NORTH AMERICA, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 64 INTELLIGENT POWER MODULE MARKET FOR AEROSPACE VERTICAL IN EUROPE, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 65 INTELLIGENT POWER MODULE MARKET FOR AEROSPACE VERTICAL IN EUROPE, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 66 INTELLIGENT POWER MODULE MARKET FOR AEROSPACE VERTICAL IN ASIA PACIFIC, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 67 INTELLIGENT POWER MODULE MARKET FOR AEROSPACE VERTICAL IN ASIA PACIFIC, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 68 INTELLIGENT POWER MODULE MARKET FOR AEROSPACE VERTICAL IN ROW, BY REGION, 2018-2021 (USD MILLION)

- TABLE 69 INTELLIGENT POWER MODULE MARKET FOR AEROSPACE IN ROW, BY REGION, 2022-2027 (USD MILLION)

- 10.7 OTHERS

- TABLE 70 INTELLIGENT POWER MODULE MARKET FOR OTHERS, BY REGION, 2018-2021 (USD MILLION)

- TABLE 71 INTELLIGENT POWER MODULE MARKET FOR OTHERS, BY REGION, 2022-2027 (USD MILLION)

- TABLE 72 INTELLIGENT POWER MODULE MARKET FOR OTHERS IN NORTH AMERICA, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 73 INTELLIGENT POWER MODULE MARKET FOR OTHERS IN NORTH AMERICA, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 74 INTELLIGENT POWER MODULE MARKET FOR OTHERS IN EUROPE, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 75 INTELLIGENT POWER MODULE MARKET FOR OTHERS IN EUROPE, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 76 INTELLIGENT POWER MODULE MARKET FOR OTHERS IN ASIA PACIFIC, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 77 INTELLIGENT POWER MODULE MARKET FOR OTHERS IN ASIA PACIFIC, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 78 INTELLIGENT POWER MODULE MARKET FOR OTHERS IN ROW, BY REGION, 2018-2021 (USD MILLION)

- TABLE 79 INTELLIGENT POWER MODULE MARKET FOR OTHERS IN ROW, BY REGION, 2022-2027 (USD MILLION)

11 GEOGRAPHIC ANALYSIS

- 11.1 INTRODUCTION

- FIGURE 36 GEOGRAPHIC SNAPSHOT (2022-2027): CHINA TO BE FASTEST-GROWING MARKET FOR INTELLIGENT POWER MODULES

- TABLE 80 INTELLIGENT POWER MODULE MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 81 INTELLIGENT POWER MODULE MARKET, BY REGION, 2022-2027 (USD MILLION)

- 11.2 NORTH AMERICA

- FIGURE 37 INTELLIGENT POWER MODULE MARKET: NORTH AMERICA SNAPSHOT

- TABLE 82 INTELLIGENT POWER MODULE MARKET IN NORTH AMERICA, BY VERTICAL, 2018-2021 (USD MILLION)

- TABLE 83 INTELLIGENT POWER MODULE MARKET IN NORTH AMERICA, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 84 INTELLIGENT POWER MODULE MARKET IN NORTH AMERICA, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 85 INTELLIGENT POWER MODULE MARKET IN NORTH AMERICA, BY COUNTRY, 2022-2027 (USD MILLION)

- 11.2.1 US

- 11.2.1.1 Rising penetration of power semiconductors in automotive and industrial verticals to boost market growth

- 11.2.2 CANADA

- 11.2.2.1 Expanding automotive industry in Canada to spur market growth

- 11.2.3 MEXICO

- 11.2.3.1 Large manufacturing base and growing aerospace vertical to provide growth opportunities for market players in Mexico

- 11.3 EUROPE

- FIGURE 38 INTELLIGENT POWER MODULE MARKET: EUROPE SNAPSHOT

- TABLE 86 INTELLIGENT POWER MODULE MARKET IN EUROPE, BY VERTICAL, 2018-2021 (USD MILLION)

- TABLE 87 INTELLIGENT POWER MODULE MARKET IN EUROPE, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 88 INTELLIGENT POWER MODULE MARKET IN EUROPE, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 89 INTELLIGENT POWER MODULE MARKET IN EUROPE, BY COUNTRY, 2022-2027 (USD MILLION)

- 11.3.1 GERMANY

- 11.3.1.1 Rising investments in manufacturing electric and hybrid vehicles to support market growth in Germany

- 11.3.2 UK

- 11.3.2.1 Growth of aerospace and automotive verticals to fuel demand for intelligent power modules in UK

- 11.3.3 FRANCE

- 11.3.3.1 Expansion of power electronics, aerospace, and industrial verticals to create growth opportunities for market players

- 11.3.4 ITALY

- 11.3.4.1 Growing demand for advanced intelligent power modules in automotive vertical to drive market growth

- 11.3.5 REST OF EUROPE

- 11.4 ASIA PACIFIC

- FIGURE 39 INTELLIGENT POWER MODULE MARKET: ASIA PACIFIC SNAPSHOT

- TABLE 90 INTELLIGENT POWER MODULE MARKET IN ASIA PACIFIC, BY VERTICAL, 2018-2021 (USD MILLION)

- TABLE 91 INTELLIGENT POWER MODULE MARKET IN ASIA PACIFIC, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 92 INTELLIGENT POWER MODULE MARKET IN ASIA PACIFIC, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 93 INTELLIGENT POWER MODULE MARKET IN ASIA PACIFIC, BY COUNTRY, 2022-2027 (USD MILLION)

- 11.4.1 JAPAN

- 11.4.1.1 Expanding automotive and industrial verticals to drive market growth

- 11.4.2 CHINA

- 11.4.2.1 Growing consumer electronics and automotive verticals to propel demand for intelligent power modules

- 11.4.3 INDIA

- 11.4.3.1 Government-led initiatives to boost domestic manufacturing capacity to fuel demand for intelligent power modules

- 11.4.4 SOUTH KOREA

- 11.4.4.1 Rising demand for consumer electronics and automobiles to fuel demand for intelligent power modules

- 11.4.5 REST OF ASIA PACIFIC

- 11.5 ROW

- TABLE 94 INTELLIGENT POWER MODULE MARKET IN ROW, BY VERTICAL, 2018-2021 (USD MILLION)

- TABLE 95 INTELLIGENT POWER MODULE MARKET IN ROW, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 96 INTELLIGENT POWER MODULE MARKET IN ROW, BY REGION, 2018-2021 (USD MILLION)

- TABLE 97 INTELLIGENT POWER MODULE MARKET IN ROW, BY REGION, 2022-2027 (USD MILLION)

- 11.5.1 MIDDLE EAST & AFRICA

- 11.5.1.1 Rising demand for and production of renewable energy to propel market growth

- 11.5.2 SOUTH AMERICA

- 11.5.2.1 Rising use of motor-based machinery to promote market growth

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- TABLE 98 OVERVIEW OF STRATEGIES ADOPTED BY KEY INTELLIGENT POWER MODULE MANUFACTURERS

- 12.3 REVENUE ANALYSIS OF TOP COMPANIES

- FIGURE 40 FIVE-YEAR REVENUE ANALYSIS OF TOP PLAYERS IN INTELLIGENT POWER MODULE MARKET

- 12.4 MARKET SHARE ANALYSIS, 2021

- TABLE 99 MARKET SHARE OF TOP FIVE PLAYERS IN INTELLIGENT POWER MODULE MARKET IN 2021

- 12.5 COMPANY EVALUATION QUADRANT

- 12.5.1 STARS

- 12.5.2 EMERGING LEADERS

- 12.5.3 PERVASIVES

- 12.5.4 PARTICIPANTS

- FIGURE 41 INTELLIGENT POWER MODULE MARKET: COMPANY EVALUATION QUADRANT, 2021

- 12.6 COMPETITIVE SCENARIO

- 12.6.1 PRODUCT LAUNCHES

- TABLE 100 PRODUCT LAUNCHES, 2020-2022

- 12.6.2 DEALS

- TABLE 101 DEALS, 2019-2022

- 12.6.3 OTHERS

- TABLE 102 OTHERS, 2020-2022

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- (Business Overview, Products Offered, Recent Developments, and MnM View)**

- 13.1.1 MITSUBISHI ELECTRIC

- TABLE 103 MITSUBISHI ELECTRIC: BUSINESS OVERVIEW

- FIGURE 42 MITSUBISHI ELECTRIC: COMPANY SNAPSHOT

- TABLE 104 MITSUBISHI ELECTRIC: PRODUCTS OFFERED

- TABLE 105 MITSUBISHI ELECTRIC: PRODUCT LAUNCHES

- TABLE 106 MITSUBISHI: DEALS

- TABLE 107 MITSUBISHI ELECTRIC: OTHERS

- 13.1.2 ON SEMICONDUCTOR

- TABLE 108 ON SEMICONDUCTOR: BUSINESS OVERVIEW

- FIGURE 43 ON SEMICONDUCTOR: COMPANY SNAPSHOT

- TABLE 109 ON SEMICONDUCTOR: PRODUCTS OFFERED

- TABLE 110 ON SEMICONDUCTOR: PRODUCT LAUNCHES

- TABLE 111 ON SEMICONDUCTOR: DEALS

- 13.1.3 INFINEON TECHNOLOGIES

- TABLE 112 INFINEON TECHNOLOGIES: BUSINESS OVERVIEW

- FIGURE 44 INFINEON TECHNOLOGIES: COMPANY SNAPSHOT

- TABLE 113 INFINEON TECHNOLOGIES: PRODUCTS OFFERED

- TABLE 114 INFINEON TECHNOLOGIES: PRODUCT LAUNCHES

- TABLE 115 INFINEON TECHNOLOGIES: DEALS

- TABLE 116 INFINEON TECHNOLOGIES: OTHERS

- 13.1.4 FUJI ELECTRIC

- TABLE 117 FUJI ELECTRIC: BUSINESS OVERVIEW

- FIGURE 45 FUJI ELECTRIC: COMPANY SNAPSHOT

- TABLE 118 FUJI ELECTRIC: PRODUCTS OFFERED

- TABLE 119 FUJI ELECTRIC: PRODUCT LAUNCHES

- TABLE 120 FUJI ELECTRIC: DEALS

- 13.1.5 SEMIKRON

- TABLE 121 SEMIKRON: BUSINESS OVERVIEW

- TABLE 122 SEMIKRON: PRODUCTS OFFERED

- TABLE 123 SEMIKRON: PRODUCT LAUNCHES

- TABLE 124 SEMIKRON: DEALS

- TABLE 125 SEMIKRON: OTHERS

- 13.1.6 ROHM SEMICONDUCTOR

- TABLE 126 ROHM SEMICONDUCTOR: BUSINESS OVERVIEW

- FIGURE 46 ROHM SEMICONDUCTOR: COMPANY SNAPSHOT

- TABLE 127 ROHM SEMICONDUCTOR: PRODUCTS OFFERED

- TABLE 128 ROHM SEMICONDUCTOR: PRODUCT LAUNCHES

- TABLE 129 ROHM SEMICONDUCTOR: DEALS

- 13.1.7 SANKEN ELECTRIC

- TABLE 130 SANKEN ELECTRIC: BUSINESS OVERVIEW

- FIGURE 47 SANKEN ELECTRIC: COMPANY SNAPSHOT

- TABLE 131 SANKEN ELECTRIC: PRODUCTS OFFERED

- TABLE 132 SANKEN ELECTRIC: DEALS

- 13.1.8 STMICROELECTRONICS

- TABLE 133 STMICROELECTRONICS: BUSINESS OVERVIEW

- FIGURE 48 STMICROELECTRONICS: COMPANY SNAPSHOT

- TABLE 134 STMICROELECTRONICS: PRODUCTS OFFERED

- TABLE 135 STMICROELECTRONICS: DEALS

- 13.1.9 HANGZHOU SILAN MICROELECTRONICS

- TABLE 136 HANGZHOU SILAN MICROELECTRONICS: BUSINESS OVERVIEW

- TABLE 137 HANGZHOU SILAN MICROELECTRONICS: PRODUCTS OFFERED

- 13.1.10 SINO MICROELECTRONICS

- TABLE 138 SINO MICROELECTRONICS: BUSINESS OVERVIEW

- TABLE 139 SINO MICROELECTRONICS: PRODUCTS OFFERED

- * Business Overview, Products Offered, Recent Developments, and MnM View might not be captured in case of unlisted companies.

- 13.2 OTHER PLAYERS

- 13.2.1 ALPHA & OMEGA SEMICONDUCTOR

- TABLE 140 ALPHA & OMEGA SEMICONDUCTOR: COMPANY OVERVIEW

- 13.2.2 CISSOID

- TABLE 141 CISSOID: COMPANY OVERVIEW

- 13.2.3 SENSITRON SEMICONDUCTOR

- TABLE 142 SENSITRON SEMICONDUCTOR: COMPANY OVERVIEW

- 13.2.4 RONGTECH INDUSTRY

- TABLE 143 RONGTECH INDUSTRY: COMPANY OVERVIEW

- 13.2.5 POWEREX

- TABLE 144 POWEREX: COMPANY OVERVIEW

- 13.2.6 OZTEK CORPORATION

- TABLE 145 OZTEK CORPORATION: COMPANY OVERVIEW

- 13.2.7 HIRATA CORPORATION

- TABLE 146 HIRATA CORPORATION: COMPANY OVERVIEW

- 13.2.8 MICROSEMI CORPORATION

- TABLE 147 MICROSEMI CORPORATION: COMPANY OVERVIEW

- 13.2.9 TOSHIBA ELECTRONIC DEVICES & STORAGE CORPORATION

- TABLE 148 TOSHIBA ELECTRONIC DEVICES & STORAGE CORPORATION: COMPANY OVERVIEW

- 13.2.10 TEXAS INSTRUMENTS

- TABLE 149 TEXAS INSTRUMENTS: COMPANY OVERVIEW

- 13.2.11 RENESAS ELECTRONICS

- TABLE 150 RENESAS ELECTRONICS: COMPANY OVERVIEW

- 13.2.12 SOLITRON DEVICES

- TABLE 151 SOLITRON DEVICES: COMPANY OVERVIEW

- 13.2.13 VINCOTECH-A GROUP COMPANY OF MITSUBISHI ELECTRIC

- TABLE 152 VINCOTECH: COMPANY OVERVIEW

14 ADJACENT MARKET

- 14.1 IGBT AND THYRISTOR MARKET

- 14.2 INTRODUCTION

- FIGURE 49 IGBT MARKET, BY PACKAGING TYPE

- FIGURE 50 IGBT MODULE MARKET TO GROW AT HIGHER CAGR FROM 2020 TO 2025

- TABLE 153 IGBT MARKET, BY PACKAGING TYPE, 2017-2025 (USD BILLION)

- 14.3 IGBT DISCRETE

- 14.3.1 IGBT DISCRETE OFFERS FAST RESPONSE WITH NO OVERSHOOT

- TABLE 154 IGBT DISCRETE MARKET, BY POWER RATING, 2017-2025 (USD MILLION)

- TABLE 155 IGBT DISCRETE MARKET, BY APPLICATION, 2017-2025 (USD MILLION)

- TABLE 156 IGBT DISCRETE MARKET FOR POWER TRANSMISSION SYSTEMS, BY REGION, 2017-2025 (USD MILLION)

- TABLE 157 IGBT DISCRETE MARKET FOR RENEWABLE ENERGY, BY REGION, 2017-2025 (USD MILLION)

- TABLE 158 IGBT DISCRETE MARKET FOR RAIL TRACTION SYSTEMS, BY REGION, 2017-2025 (USD MILLION)

- TABLE 159 IGBT DISCRETE MARKET FOR UPS, BY REGION, 2017-2025 (USD MILLION)

- TABLE 160 IGBT DISCRETE MARKET FOR ELECTRIC AND HYBRID VEHICLES, BY REGION, 2017-2025 (USD MILLION)

- TABLE 161 IGBT DISCRETE MARKET FOR MOTOR DRIVES, BY REGION, 2017-2025 (USD MILLION)

- TABLE 162 IGBT DISCRETE MARKET FOR CONSUMER ELECTRONICS, BY REGION, 2017-2025 (USD MILLION)

- TABLE 163 IGBT DISCRETE MARKET FOR OTHERS, BY REGION, 2017-2025 (USD THOUSAND)

- TABLE 164 IGBT DISCRETE MARKET, BY REGION, 2017-2025 (USD THOUSAND)

- TABLE 165 IGBT DISCRETE MARKET IN NORTH AMERICA, BY COUNTRY, 2017-2025 (USD THOUSAND)

- TABLE 166 IGBT DISCRETE MARKET IN EUROPE, BY COUNTRY, 2017-2025 (USD THOUSAND)

- TABLE 167 IGBT DISCRETE MARKET IN ASIA PACIFIC, BY COUNTRY, 2017-2025 (USD THOUSAND)

- TABLE 168 IGBT DISCRETE MARKET IN ROW, BY REGION, 2017-2025 (USD THOUSAND)

- 14.4 IGBT MODULE

- 14.4.1 HIGH DURABILITY AND LOW DOWNTIME TO DRIVE MARKET FOR IGBT MODULE

- TABLE 169 IGBT MODULE MARKET, BY POWER RATING, 2017-2025 (USD MILLION)

- TABLE 170 IGBT MODULE MARKET, BY APPLICATION, 2017-2025 (USD MILLION)

- TABLE 171 IGBT MODULE MARKET FOR POWER TRANSMISSION SYSTEMS, BY REGION, 2017-2025 (USD MILLION)

- FIGURE 51 ASIA PACIFIC TO REGISTER HIGHEST CAGR IN IGBT MODULE MARKET FOR RENEWABLE ENERGY FROM 2020 TO 2025

- TABLE 172 IGBT MODULE MARKET FOR RENEWABLE ENERGY, BY REGION, 2017-2025 (USD MILLION)

- TABLE 173 IGBT MODULE MARKET FOR RAIL TRACTION SYSTEMS, BY REGION, 2017-2025 (USD MILLION)

- TABLE 174 IGBT MODULE MARKET FOR UPS, BY REGION, 2017-2025 (USD MILLION)

- FIGURE 52 IGBT MODULE MARKET FOR ELECTRIC AND HYBRID ELECTRIC VEHICLES IN ASIA PACIFIC TO GROW AT HIGHER CAGR FROM 2020 TO 2025

- TABLE 175 IGBT MODULE MARKET FOR ELECTRIC AND HYBRID ELECTRIC VEHICLES, BY REGION, 2017-2025 (USD MILLION)

- TABLE 176 IGBT MODULE MARKET FOR MOTOR DRIVES, BY REGION, 2017-2025 (USD MILLION)

- TABLE 177 IGBT MODULE MARKET FOR CONSUMER ELECTRONICS, BY REGION, 2017-2025 (USD MILLION)

- TABLE 178 IGBT MODULE MARKET FOR OTHERS, BY REGION, 2017-2025 (USD MILLION)

- TABLE 179 IGBT MODULE MARKET, BY REGION, 2017-2025 (USD THOUSAND)

- TABLE 180 IGBT MODULE MARKET IN NORTH AMERICA, BY COUNTRY, 2017-2025 (USD THOUSAND)

- TABLE 181 IGBT MODULE MARKET IN EUROPE, BY COUNTRY, 2017-2025 (USD THOUSAND)

- TABLE 182 IGBT MODULE MARKET IN ASIA PACIFIC, BY COUNTRY, 2017-2025 (USD THOUSAND)

- TABLE 183 IGBT MODULE MARKET IN ROW, BY REGION, 2017-2025 (USD THOUSAND)

15 APPENDIX

- 15.1 KEY INDUSTRY INSIGHTS

- 15.2 DISCUSSION GUIDE

- 15.3 KNOWLEDGE STORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.4 AVAILABLE CUSTOMIZATIONS

- 15.5 RELATED REPORTS

- 15.6 AUTHOR DETAILS