|

|

市場調査レポート

商品コード

1676639

グリーン技術および持続可能性の世界市場:製品 (炭素会計ソフトウェア・ESGレポーティングツール・コンプライアンス&リスク管理ツール)・用途 (持続可能サプライチェーン&ロジスティクス・エネルギー&排出削減) 別Green Technology & Sustainability Market by Offering (Carbon Accounting Software, ESG Reporting Tools, Compliance & Risk Management Tools), Application (Sustainable Supply Chain & Logistics, Energy & Emission Reduction) - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| グリーン技術および持続可能性の世界市場:製品 (炭素会計ソフトウェア・ESGレポーティングツール・コンプライアンス&リスク管理ツール)・用途 (持続可能サプライチェーン&ロジスティクス・エネルギー&排出削減) 別 |

|

出版日: 2025年03月06日

発行: MarketsandMarkets

ページ情報: 英文 355 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

グリーン技術および持続可能性の市場規模は、2025年の254億7,000万米ドルから、2030年には739億米ドルに増加し、予測期間を通じて23.7%のCAGRで力強く成長すると予測されています。

グリーン技術および持続可能性の市場は、AI主導のエネルギー管理ソフトウェア、クラウドベースのカーボンフットプリント追跡ソリューション、ブロックチェーン対応の持続可能性報告書の進歩によって牽引されます。ESG (環境、社会、ガバナンス) コンプライアンスに関する規制の義務付けが増加しているため、企業は排出量と資源使用量をリアルタイムで監視するための高度なデータ分析プラットフォームを導入する必要に迫られています。循環型経済モデルの台頭は、AIを活用した廃棄物最適化ツールやサプライチェーンの透明化ツールの需要に拍車をかけています。消費者の意識と企業の持続可能性へのコミットメントは、環境に優しい事業戦略のための予測分析ソフトウェアへの投資をさらに促進しています。一方で、レガシーITインフラに多様な持続可能性ソフトウェアソリューションを統合するためには、高いコストと複雑さの課題があり、中小企業にとっては採用の障壁となっています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020-2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025-2030年 |

| 単位 | 金額 (米ドル) |

| セグメント | 提供区分・技術・用途・エンドユーザー・地域 |

| 対象地域 | 北米・欧州・アジア太平洋・中東&アフリカ・ラテンアメリカ |

"提供区分別では、ソフトウェアの部門が予測期間中に最大のシェアを占める見込み"

ソフトウェア部門は、エネルギー効率の最適化、カーボンフットプリントの削減、スマートな資源管理の実現において重要な役割を果たすため、市場をリードすると予想されています。エネルギー管理システム、カーボンフットプリント追跡、AI主導の分析などのソリューションは、企業が環境規制を遵守し、持続可能性の目標を達成するのに役立ちます。クラウドコンピューティング、IoT、AIの導入が進んでいることが、ソフトウェアソリューションの需要をさらに押し上げています。さらに、ソフトウェアは拡張性、リアルタイムのモニタリング、自動化を提供するため、持続可能な運営を求める組織にとって費用対効果が高く効率的な選択肢となります。企業が持続可能性を優先する中、ソフトウェアは環境に優しいイノベーションを推進する上で不可欠な存在であり続けています。

"技術別では、ブロックチェーンが予測期間中に最も速い成長率を記録する見込み"

ブロックチェーン技術は、環境イニシアチブにおける透明性、安全性、効率性を強化する能力により、最も速い成長を示すことが期待されています。ブロックチェーンは、炭素クレジット取引、サプライチェーン監視、再生可能エネルギー取引のための安全で改ざん防止されたデータ管理を容易にします。非中央集権的で自動化されたスマートコントラクトを可能にすることで、ブロックチェーンは持続可能性プロジェクトにおけるアカウンタビリティを確保しつつ、不正行為と運用コストを削減します。さらに、ピアツーピアのエネルギー取引をサポートし、排出削減量を追跡することで、世界の持続可能性目標の遵守を推進します。産業界が環境に優しいソリューションを優先する中、グリーン技術アプリケーションの最適化におけるブロックチェーンの役割は、今後も急速に拡大していくと思われます。

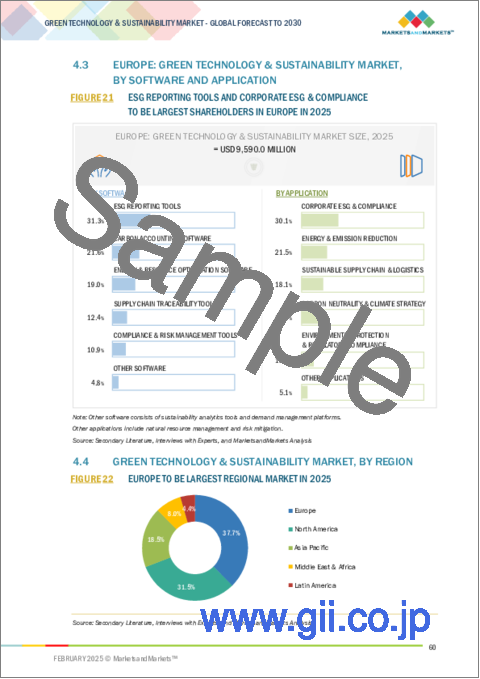

"地域別では、2025年に欧州が最大のシェアを示し、予測期間中はアジア太平洋が最大の成長を示す見通し"

欧州は、厳しい環境規制と野心的な気候政策、持続可能性イニシアチブに対する政府の強力な支援により、2025年に最大のシェアを示すと予測されています。EUのGreen Deal、カーボンニュートラル目標、再生可能エネルギー、スマートグリッド、循環型経済の実践への大規模な投資が主要な推進力となっています。また、消費者の高い意識、企業の持続可能性へのコミットメント、グリーンイノベーションへの財政的インセンティブも、同地域のリーダーシップをさらに強化しています。一方、アジア太平洋地域は、急速な都市化、環境問題への関心の高まり、持続可能な開発のための政府によるイニシアチブの高まりに後押しされ、予測期間中は最大の成長を示すと予測されています。中国、インド、日本などの国々は、クリーンエネルギー、スマートシティ、環境に優しい産業プロセスに大規模な投資を行っています。業界全体における持続可能なソリューションに対する需要の高まりや、AI主導の気候ソリューションや炭素追跡のためのブロックチェーンなどのデジタル技術の進歩などから、世界的に最も急成長する地域となると考えられています。

当レポートでは、世界のグリーン技術および持続可能性の市場を調査し、市場概要、市場成長への各種影響因子の分析、技術・特許の動向、法規制環境、ケーススタディ、市場規模の推移・予測、各種区分・地域/主要国別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- グリーン技術および持続可能性市場の進化

- サプライチェーン分析

- エコシステム分析

- 投資情勢と資金調達シナリオ

- 生成AIがグリーン技術および持続可能性市場に与える影響

- ケーススタディ分析

- 技術分析

- 規制状況

- 特許分析

- 価格分析

- 主な会議とイベント

- ポーターのファイブフォース分析

- 顧客の事業に影響を与える動向/ディスラプション

- 主なステークホルダーと購入基準

第6章 グリーン技術および持続可能性市場:提供区分別

- ソフトウェア

- 炭素会計ソフトウェア

- ESGレポーティングツール

- エネルギーとリソースの最適化ソフトウェア

- サプライチェーン追跡ツール

- コンプライアンス&リスク管理ツール

- その他

- サービス

- プロフェッショナルサービス

- マネージドサービス

第7章 グリーン技術および持続可能性市場:技術別

- クラウドコンピューティング

- AI・アナリティクス

- ブロックチェーン

- IoT

- サイバーセキュリティ

第8章 グリーン技術および持続可能性市場:用途別

- 企業のESGとコンプライアンス

- エネルギー&排出削減

- 持続可能サプライチェーン&ロジスティクス

- カーボンニュートラルと気候戦略

- 環境保護と規制遵守

- その他

第9章 グリーン技術および持続可能性市場:エンドユーザー別

- 技術およびソフトウェアプロバイダー

- 通信

- 小売・消費財

- 輸送・物流

- エネルギー・ユーティリティ

- 製造

- 化学品

- 食品・飲料

- 重機

- エレクトロニクス・半導体

- 自動車

- その他

- ヘルスケア&ライフサイエンス

- その他

第10章 グリーン技術および持続可能性市場:地域別

- 北米

- 市場促進要因

- マクロ経済見通し

- 米国

- カナダ

- 欧州

- 市場促進要因

- マクロ経済見通し

- 英国

- ドイツ

- フランス

- イタリア

- スペイン

- オランダ

- その他

- アジア太平洋

- 市場促進要因

- マクロ経済見通し

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- シンガポール

- その他

- 中東・アフリカ

- 市場促進要因

- マクロ経済見通し

- 中東

- アフリカ

- ラテンアメリカ

- 市場促進要因

- マクロ経済見通し

- ブラジル

- メキシコ

- アルゼンチン

- その他

第11章 競合情勢

- 概要

- 主要参入企業の戦略/強み

- 収益分析

- 市場シェア分析

- 製品比較分析

- 企業価値評価と財務指標

- 企業評価マトリックス:主要企業

- 企業フットプリント:主要企業

- 企業評価マトリックス:スタートアップ/中小企業

- 競合シナリオと動向

第12章 企業プロファイル

- 主要企業

- IBM

- MICROSOFT

- SCHNEIDER ELECTRIC

- SAP

- GE

- AWS

- SIEMENS

- C3.AI

- UL SOLUTIONS

- ORACLE

- ENGIE IMPACT

- SALESFORCE

- AMCS GROUP

- ECOVADIS

- UPLIGHT

- CORITY

- BENCHMARK GENSUITE

- CONSTELLATION

- スタートアップ/SME

- INTELEX

- TREENI

- ISOMETRIX

- WINT

- ENVIROSOFT

- TRACE GENOMICS

- FACTLINES

- ENECHANGE LTD

- ECOCART

- CLARITY AI

- WATERSHED

- EMITWISE

- UNRAVEL CARBON

- OPTERA

- NORMATIVE

- GREENLY

- PERSEFONI

- SWEEP

- PULSORA

- MIOTECH

- RIO AI

- CARBONCHAIN

第13章 隣接市場と関連市場

第14章 付録

List of Tables

- TABLE 1 INCLUSIONS AND EXCLUSIONS

- TABLE 2 US DOLLAR EXCHANGE RATE, 2020-2024

- TABLE 3 PRIMARY INTERVIEWS

- TABLE 4 FACTOR ANALYSIS

- TABLE 5 RESEARCH ASSUMPTIONS

- TABLE 6 GLOBAL GREEN TECHNOLOGY & SUSTAINABILITY MARKET SIZE AND GROWTH RATE, 2020-2024 (USD MILLION, Y-O-Y)

- TABLE 7 GLOBAL GREEN TECHNOLOGY & SUSTAINABILITY MARKET SIZE AND GROWTH RATE, 2025-2030 (USD MILLION, Y-O-Y)

- TABLE 8 GREEN TECHNOLOGY & SUSTAINABILITY MARKET: ECOSYSTEM

- TABLE 9 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 PATENTS FILED, 2015-2024

- TABLE 15 LIST OF SELECT PATENTS IN GREEN TECHNOLOGY & SUSTAINABILITY MARKET, 2023-2024

- TABLE 16 AVERAGE SELLING PRICE OF OFFERINGS, 2024

- TABLE 17 AVERAGE SELLING PRICE OF APPLICATIONS, 2024

- TABLE 18 GREEN TECHNOLOGY & SUSTAINABILITY MARKET: DETAILED LIST OF CONFERENCES & EVENTS, 2025-2026

- TABLE 19 PORTER'S FIVE FORCES' IMPACT ON GREEN TECHNOLOGY & SUSTAINABILITY MARKET

- TABLE 20 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

- TABLE 21 KEY BUYING CRITERIA FOR TOP THREE END USERS

- TABLE 22 GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 23 GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 24 GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY SOFTWARE, 2020-2024 (USD MILLION)

- TABLE 25 GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY SOFTWARE, 2025-2030 (USD MILLION)

- TABLE 26 CARBON ACCOUNTING SOFTWARE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 27 CARBON ACCOUNTING SOFTWARE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 28 ESG REPORTING TOOLS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 29 ESG REPORTING TOOLS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 30 ENERGY & RESOURCE OPTIMIZATION SOFTWARE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 31 ENERGY & RESOURCE OPTIMIZATION SOFTWARE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 32 SUPPLY CHAIN TRACEABILITY TOOLS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 33 SUPPLY CHAIN TRACEABILITY TOOLS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 34 COMPLIANCE & RISK MANAGEMENT TOOLS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 35 COMPLIANCE & RISK MANAGEMENT TOOLS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 36 OTHER GREEN TECHNOLOGY & SUSTAINABILITY SOFTWARE MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 37 OTHER GREEN TECHNOLOGY & SUSTAINABILITY SOFTWARE MARKET, BY REGION, 2025-2030 (USD MILLION)

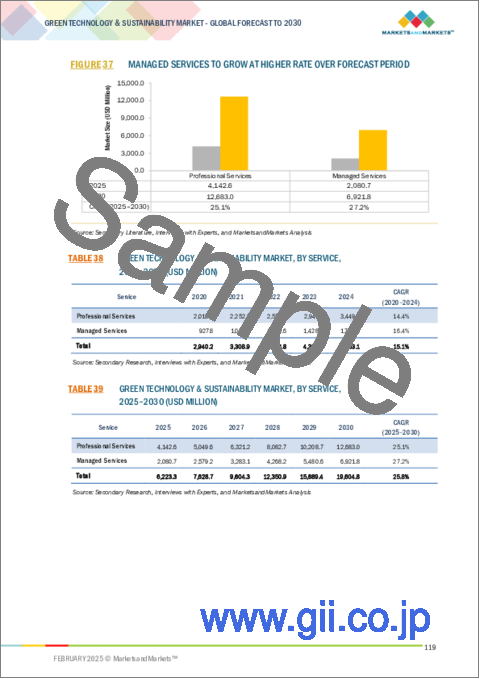

- TABLE 38 GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 39 GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 40 GREEN TECHNOLOGY & SUSTAINABILITY PROFESSIONAL SERVICES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 41 GREEN TECHNOLOGY & SUSTAINABILITY PROFESSIONAL SERVICES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 42 GREEN TECHNOLOGY & SUSTAINABILITY MANAGED SERVICES MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 43 GREEN TECHNOLOGY & SUSTAINABILITY MANAGED SERVICES MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 44 GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 45 GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 46 CLOUD COMPUTING TECHNOLOGY MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 47 CLOUD COMPUTING TECHNOLOGY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 48 ARTIFICIAL INTELLIGENCE & ANALYTICS MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 49 ARTIFICIAL INTELLIGENCE & ANALYTICS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 50 BLOCKCHAIN TECHNOLOGY MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 51 BLOCKCHAIN TECHNOLOGY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 52 IOT TECHNOLOGY MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 53 IOT TECHNOLOGY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 54 CYBERSECURITY TECHNOLOGY MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 55 CYBERSECURITY TECHNOLOGY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 56 GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 57 GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 58 GREEN TECHNOLOGY & SUSTAINABILITY MARKET FOR CORPORATE ESG & COMPLIANCE, BY REGION, 2020-2024 (USD MILLION)

- TABLE 59 GREEN TECHNOLOGY & SUSTAINABILITY MARKET FOR CORPORATE ESG & COMPLIANCE, BY REGION, 2025-2030 (USD MILLION)

- TABLE 60 GREEN TECHNOLOGY & SUSTAINABILITY MARKET FOR ENERGY & EMISSION REDUCTION, BY REGION, 2020-2024 (USD MILLION)

- TABLE 61 GREEN TECHNOLOGY & SUSTAINABILITY MARKET FOR ENERGY & EMISSION REDUCTION, BY REGION, 2025-2030 (USD MILLION)

- TABLE 62 GREEN TECHNOLOGY & SUSTAINABILITY MARKET FOR SUSTAINABLE SUPPLY CHAIN & LOGISTICS, BY REGION, 2020-2024 (USD MILLION)

- TABLE 63 GREEN TECHNOLOGY & SUSTAINABILITY MARKET FOR SUSTAINABLE SUPPLY CHAIN & LOGISTICS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 64 GREEN TECHNOLOGY & SUSTAINABILITY MARKET FOR CARBON NEUTRALITY & CLIMATE STRATEGY, BY REGION, 2020-2024 (USD MILLION)

- TABLE 65 GREEN TECHNOLOGY & SUSTAINABILITY MARKET FOR CARBON NEUTRALITY & CLIMATE STRATEGY, BY REGION, 2025-2030 (USD MILLION)

- TABLE 66 GREEN TECHNOLOGY & SUSTAINABILITY MARKET FOR ENVIRONMENTAL PROTECTION & REGULATORY COMPLIANCE, BY REGION, 2020-2024 (USD MILLION)

- TABLE 67 GREEN TECHNOLOGY & SUSTAINABILITY MARKET FOR ENVIRONMENTAL PROTECTION & REGULATORY COMPLIANCE, BY REGION, 2025-2030 (USD MILLION)

- TABLE 68 GREEN TECHNOLOGY & SUSTAINABILITY MARKET FOR OTHER APPLICATIONS, BY REGION, 2020-2024 (USD MILLION)

- TABLE 69 GREEN TECHNOLOGY & SUSTAINABILITY MARKET FOR OTHER APPLICATIONS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 70 GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 71 GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 72 GREEN TECHNOLOGY & SUSTAINABILITY MARKET FOR TECHNOLOGY & SOFTWARE PROVIDERS, BY REGION, 2020-2024 (USD MILLION)

- TABLE 73 GREEN TECHNOLOGY & SUSTAINABILITY MARKET FOR TECHNOLOGY & SOFTWARE PROVIDERS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 74 GREEN TECHNOLOGY & SUSTAINABILITY MARKET FOR TELECOMMUNICATIONS, BY REGION, 2020-2024 (USD MILLION)

- TABLE 75 GREEN TECHNOLOGY & SUSTAINABILITY MARKET FOR TELECOMMUNICATIONS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 76 GREEN TECHNOLOGY & SUSTAINABILITY MARKET FOR RETAIL & CONSUMER GOODS, BY REGION, 2020-2024 (USD MILLION)

- TABLE 77 GREEN TECHNOLOGY & SUSTAINABILITY MARKET FOR RETAIL & CONSUMER GOODS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 78 GREEN TECHNOLOGY & SUSTAINABILITY MARKET FOR TRANSPORTATION & LOGISTICS, BY REGION, 2020-2024 (USD MILLION)

- TABLE 79 GREEN TECHNOLOGY & SUSTAINABILITY MARKET FOR TRANSPORTATION & LOGISTICS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 80 GREEN TECHNOLOGY & SUSTAINABILITY MARKET FOR ENERGY & UTILITIES, BY REGION, 2020-2024 (USD MILLION)

- TABLE 81 GREEN TECHNOLOGY & SUSTAINABILITY MARKET FOR ENERGY & UTILITIES, BY REGION, 2025-2030 (USD MILLION)

- TABLE 82 GREEN TECHNOLOGY & SUSTAINABILITY MARKET FOR MANUFACTURING, BY REGION, 2020-2024 (USD MILLION)

- TABLE 83 GREEN TECHNOLOGY & SUSTAINABILITY MARKET FOR MANUFACTURING, BY REGION, 2025-2030 (USD MILLION)

- TABLE 84 GREEN TECHNOLOGY & SUSTAINABILITY MARKET FOR HEALTHCARE & LIFE SCIENCES, BY REGION, 2020-2024 (USD MILLION)

- TABLE 85 GREEN TECHNOLOGY & SUSTAINABILITY MARKET FOR HEALTHCARE & LIFE SCIENCES, BY REGION, 2025-2030 (USD MILLION)

- TABLE 86 GREEN TECHNOLOGY & SUSTAINABILITY MARKET FOR OTHER END USERS, BY REGION, 2020-2024 (USD MILLION)

- TABLE 87 GREEN TECHNOLOGY & SUSTAINABILITY MARKET FOR OTHER END USERS, BY REGION, 2025-2030 (USD MILLION)

- TABLE 88 GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 89 GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 90 NORTH AMERICA: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 91 NORTH AMERICA: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 92 NORTH AMERICA: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY SOFTWARE TYPE, 2020-2024 (USD MILLION)

- TABLE 93 NORTH AMERICA: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY SOFTWARE TYPE, 2025-2030 (USD MILLION)

- TABLE 94 NORTH AMERICA: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 95 NORTH AMERICA: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 96 NORTH AMERICA: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 97 NORTH AMERICA: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 98 NORTH AMERICA: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 99 NORTH AMERICA: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 100 NORTH AMERICA: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 101 NORTH AMERICA: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 102 NORTH AMERICA: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 103 NORTH AMERICA: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 104 US: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 105 US: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 106 CANADA: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 107 CANADA: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 108 EUROPE: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 109 EUROPE: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 110 EUROPE: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY SOFTWARE TYPE, 2020-2024 (USD MILLION)

- TABLE 111 EUROPE: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY SOFTWARE TYPE, 2025-2030 (USD MILLION)

- TABLE 112 EUROPE: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 113 EUROPE: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 114 EUROPE: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 115 EUROPE: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 116 EUROPE: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 117 EUROPE: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 118 EUROPE: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 119 EUROPE: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 120 EUROPE: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 121 EUROPE: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 122 UK: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 123 UK: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 124 GERMANY: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 125 GERMANY: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 126 FRANCE: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 127 FRANCE: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 128 ITALY: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 129 ITALY: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 130 SPAIN: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 131 SPAIN: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 132 NETHERLANDS: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 133 NETHERLANDS: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 134 REST OF EUROPE: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 135 REST OF EUROPE: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 136 ASIA PACIFIC: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 137 ASIA PACIFIC: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 138 ASIA PACIFIC: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY SOFTWARE TYPE, 2020-2024 (USD MILLION)

- TABLE 139 ASIA PACIFIC: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY SOFTWARE TYPE, 2025-2030 (USD MILLION)

- TABLE 140 ASIA PACIFIC: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 141 ASIA PACIFIC: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 142 ASIA PACIFIC: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 143 ASIA PACIFIC: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 144 ASIA PACIFIC: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 145 ASIA PACIFIC: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 146 ASIA PACIFIC: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 147 ASIA PACIFIC: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 148 ASIA PACIFIC: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 149 ASIA PACIFIC: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 150 CHINA: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 151 CHINA: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 152 JAPAN: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 153 JAPAN: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 154 INDIA: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 155 INDIA: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 156 SOUTH KOREA: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 157 SOUTH KOREA: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 158 AUSTRALIA: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 159 AUSTRALIA: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 160 SINGAPORE: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 161 SINGAPORE: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 162 REST OF ASIA PACIFIC: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 163 REST OF ASIA PACIFIC: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 164 MIDDLE EAST & AFRICA: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 165 MIDDLE EAST & AFRICA: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 166 MIDDLE EAST & AFRICA: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY SOFTWARE TYPE, 2020-2024 (USD MILLION)

- TABLE 167 MIDDLE EAST & AFRICA: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY SOFTWARE TYPE, 2025-2030 (USD MILLION)

- TABLE 168 MIDDLE EAST & AFRICA: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 169 MIDDLE EAST & AFRICA: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 170 MIDDLE EAST & AFRICA: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 171 MIDDLE EAST & AFRICA: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 172 MIDDLE EAST & AFRICA: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 173 MIDDLE EAST & AFRICA: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 174 MIDDLE EAST & AFRICA: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 175 MIDDLE EAST & AFRICA: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 176 MIDDLE EAST & AFRICA: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY COUNTRY/REGION, 2020-2024 (USD MILLION)

- TABLE 177 MIDDLE EAST & AFRICA: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY COUNTRY/REGION, 2025-2030 (USD MILLION)

- TABLE 178 UAE: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 179 UAE: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 180 SAUDI ARABIA: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY OFFERING, 2020-2024 (USD THOUSANDS)

- TABLE 181 SAUDI ARABIA: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY OFFERING, 2025-2030 (USD THOUSANDS)

- TABLE 182 QATAR: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 183 QATAR: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 184 TURKEY: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 185 TURKEY: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 186 REST OF THE MIDDLE EAST: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 187 REST OF THE MIDDLE EAST: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 188 AFRICA: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 189 AFRICA: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 190 LATIN AMERICA: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 191 LATIN AMERICA: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 192 LATIN AMERICA: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY SOFTWARE TYPE, 2020-2024 (USD MILLION)

- TABLE 193 LATIN AMERICA: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY SOFTWARE TYPE, 2025-2030 (USD MILLION)

- TABLE 194 LATIN AMERICA: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY SERVICE, 2020-2024 (USD MILLION)

- TABLE 195 LATIN AMERICA: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY SERVICE, 2025-2030 (USD MILLION)

- TABLE 196 LATIN AMERICA: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY APPLICATION, 2020-2024 (USD MILLION)

- TABLE 197 LATIN AMERICA: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 198 LATIN AMERICA: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 199 LATIN AMERICA: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 200 LATIN AMERICA: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY END USER, 2020-2024 (USD MILLION)

- TABLE 201 LATIN AMERICA: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY END USER, 2025-2030 (USD MILLION)

- TABLE 202 LATIN AMERICA: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 203 LATIN AMERICA: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 204 BRAZIL: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 205 BRAZIL: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 206 MEXICO: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 207 MEXICO: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 208 ARGENTINA: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 209 ARGENTINA: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 210 REST OF LATIN AMERICA: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 211 REST OF LATIN AMERICA: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 212 OVERVIEW OF STRATEGIES ADOPTED BY KEY GREEN TECHNOLOGY & SUSTAINABILITY VENDORS, 2022-2025

- TABLE 213 GREEN TECHNOLOGY & SUSTAINABILITY MARKET: DEGREE OF COMPETITION

- TABLE 214 OFFERING FOOTPRINT (19 COMPANIES), 2024

- TABLE 215 APPLICATION FOOTPRINT (19 COMPANIES), 2024

- TABLE 216 END USER FOOTPRINT (19 COMPANIES), 2024

- TABLE 217 REGIONAL FOOTPRINT (19 COMPANIES), 2024

- TABLE 218 GREEN TECHNOLOGY & SUSTAINABILITY MARKET: KEY STARTUPS/SMES, 2024

- TABLE 219 GREEN TECHNOLOGY & SUSTAINABILITY MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, 2024

- TABLE 220 GREEN TECHNOLOGY & SUSTAINABILITY MARKET: PRODUCT LAUNCHES AND ENHANCEMENTS, JANUARY 2021-FEBRUARY 2025

- TABLE 221 GREEN TECHNOLOGY & SUSTAINABILITY MARKET: DEALS, JANUARY 2021- FEBRUARY 2025

- TABLE 222 IBM: COMPANY OVERVIEW

- TABLE 223 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 224 IBM: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 225 IBM: DEALS

- TABLE 226 MICROSOFT: COMPANY OVERVIEW

- TABLE 227 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 228 MICROSOFT: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 229 MICROSOFT: DEALS

- TABLE 230 SCHNEIDER ELECTRIC: COMPANY OVERVIEW

- TABLE 231 SCHNEIDER ELECTRIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 232 SCHNEIDER ELECTRIC: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 233 SCHNEIDER ELECTRIC: DEALS

- TABLE 234 GOOGLE: COMPANY OVERVIEW

- TABLE 235 GOOGLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 236 GOOGLE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 237 GOOGLE: DEALS

- TABLE 238 SAP: COMPANY OVERVIEW

- TABLE 239 SAP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 240 SAP: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 241 SAP: DEALS

- TABLE 242 GE: COMPANY OVERVIEW

- TABLE 243 GE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 244 GE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 245 GE: DEALS

- TABLE 246 AWS: COMPANY OVERVIEW

- TABLE 247 AWS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 248 AWS: DEALS

- TABLE 249 SIEMENS: COMPANY OVERVIEW

- TABLE 250 SIEMENS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 251 SIEMENS: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 252 SIEMENS: DEALS

- TABLE 253 C3.AI: COMPANY OVERVIEW

- TABLE 254 C3.AI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 255 C3.AI: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 256 C3.AI: DEALS

- TABLE 257 UL SOLUTIONS: COMPANY OVERVIEW

- TABLE 258 UL SOLUTIONS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 259 UL SOLUTIONS: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 260 UL SOLUTIONS: DEALS

- TABLE 261 ORACLE

- TABLE 262 ENGIE IMPACT

- TABLE 263 SALESFORCE

- TABLE 264 AMCS GROUP

- TABLE 265 ECOVADIS

- TABLE 266 UPLIGHT

- TABLE 267 CORITY

- TABLE 268 BENCHMARK GENSUITE

- TABLE 269 CONSTELLATION

- TABLE 270 INTELEX

- TABLE 271 TREENI

- TABLE 272 ISOMETRIX

- TABLE 273 WINT

- TABLE 274 ENVIROSOFT

- TABLE 275 TRACE GENOMICS

- TABLE 276 FACTLINES

- TABLE 277 ENECHANGE LTD

- TABLE 278 ECOCART

- TABLE 279 CLARITY AI

- TABLE 280 WATERSHED

- TABLE 281 EMITWISE

- TABLE 282 UNRAVEL CARBON

- TABLE 283 OPTERA

- TABLE 284 NORMATIVE

- TABLE 285 GREENLY

- TABLE 286 PERSEFONI

- TABLE 287 SWEEP

- TABLE 288 PULSORA

- TABLE 289 MIOTECH

- TABLE 290 RIO AI

- TABLE 291 CARBONCHAIN

- TABLE 292 DIGITAL CIRCULAR ECONOMY MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 293 DIGITAL CIRCULAR ECONOMY MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 294 DIGITAL CIRCULAR ECONOMY MARKET, BY TECHNOLOGY, 2018-2022 (USD MILLION)

- TABLE 295 DIGITAL CIRCULAR ECONOMY MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- TABLE 296 DIGITAL CIRCULAR ECONOMY MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 297 DIGITAL CIRCULAR ECONOMY MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 298 DIGITAL CIRCULAR ECONOMY MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 299 DIGITAL CIRCULAR ECONOMY MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 300 ESG REPORTING SOFTWARE MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 301 ESG REPORTING SOFTWARE MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 302 ESG REPORTING SOFTWARE MARKET, BY DEPLOYMENT TYPE, 2019-2023 (USD MILLION)

- TABLE 303 ESG REPORTING SOFTWARE MARKET, BY DEPLOYMENT TYPE, 2024-2029 (USD MILLION)

- TABLE 304 ESG REPORTING SOFTWARE MARKET, BY ORGANIZATION SIZE, 2019-2023 (USD MILLION)

- TABLE 305 ESG REPORTING SOFTWARE MARKET, BY ORGANIZATION SIZE, 2024-2029 (USD MILLION)

- TABLE 306 ESG REPORTING SOFTWARE MARKET, BY VERTICAL, 2019-2023 (USD MILLION)

- TABLE 307 ESG REPORTING SOFTWARE MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 308 ESG REPORTING SOFTWARE MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 309 ESG REPORTING SOFTWARE MARKET, BY REGION, 2024-2029 (USD MILLION)

List of Figures

- FIGURE 1 GREEN TECHNOLOGY & SUSTAINABILITY MARKET SEGMENTATION

- FIGURE 2 STUDY YEARS CONSIDERED

- FIGURE 3 GREEN TECHNOLOGY & SUSTAINABILITY MARKET: RESEARCH DESIGN

- FIGURE 4 BREAKUP OF PRIMARY PROFILES, BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 5 STUDY INSIGHTS FROM KEY INDUSTRY EXPERTS

- FIGURE 6 GREEN TECHNOLOGY & SUSTAINABILITY MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 7 APPROACH 1, BOTTOM-UP (SUPPLY-SIDE): REVENUE FROM OFFERINGS IN GREEN TECHNOLOGY & SUSTAINABILITY MARKET

- FIGURE 8 APPROACH 2, BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE FROM KEY COMPANIES IN GREEN TECHNOLOGY & SUSTAINABILITY MARKET

- FIGURE 9 APPROACH 3, BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE FROM BUSINESS UNITS OF KEY VENDORS IN GREEN TECHNOLOGY & SUSTAINABILITY MARKET

- FIGURE 10 APPROACH 4, BOTTOM-UP (DEMAND-SIDE): SHARE OF GREEN TECHNOLOGY & SUSTAINABILITY THROUGH OVERALL IT SPENDING ON SUSTAINABLE SOLUTIONS

- FIGURE 11 DATA TRIANGULATION

- FIGURE 12 SOFTWARE TO BECOME LARGEST OFFERING BY MARKET SIZE IN 2025

- FIGURE 13 ESG REPORTING TOOLS SOFTWARE TO ACCOUNT FOR LARGEST SHARE IN 2025

- FIGURE 14 PROFESSIONAL SERVICES TO BE LEADING SERVICES SEGMENT IN 2025

- FIGURE 15 CORPORATE ESG & COMPLIANCE TO ACCOUNT FOR LEADING APPLICATION SHARE IN 2025

- FIGURE 16 CLOUD COMPUTING TO EMERGE AS LARGEST TECHNOLOGY SEGMENT IN 2025

- FIGURE 17 TRANSPORTATION & LOGISTICS TO BE FASTEST-GROWING END USER SEGMENT OVER FORECAST PERIOD

- FIGURE 18 ASIA PACIFIC TO REGISTER FASTEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 19 STRICTER GLOBAL ESG REGULATIONS AND RISING CORPORATE NET-ZERO COMMITMENTS TO DRIVE DEMAND FOR AI-POWERED SUSTAINABILITY

- FIGURE 20 CARBON NEUTRALITY & CLIMATE STRATEGY SEGMENT TO ACCOUNT FOR HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 21 ESG REPORTING TOOLS AND CORPORATE ESG & COMPLIANCE TO BE LARGEST SHAREHOLDERS IN EUROPE IN 2025

- FIGURE 22 EUROPE TO BE LARGEST REGIONAL MARKET IN 2025

- FIGURE 23 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: GREEN TECHNOLOGY & SUSTAINABILITY MARKET

- FIGURE 24 EVOLUTION OF GREEN TECHNOLOGY & SUSTAINABILITY MARKET

- FIGURE 25 GREEN TECHNOLOGY & SUSTAINABILITY MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 26 KEY PLAYERS IN GREEN TECHNOLOGY & SUSTAINABILITY MARKET ECOSYSTEM

- FIGURE 27 GREEN TECHNOLOGY & SUSTAINABILITY MARKET: INVESTMENT LANDSCAPE AND FUNDING SCENARIO

- FIGURE 28 MARKET POTENTIAL OF GENERATIVE AI IN VARIOUS GREEN TECHNOLOGY & SUSTAINABILITY USE CASES

- FIGURE 29 NUMBER OF PATENTS GRANTED, 2015-2025

- FIGURE 30 REGIONAL ANALYSIS OF PATENTS GRANTED, 2015-2024

- FIGURE 31 GREEN TECHNOLOGY & SUSTAINABILITY MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 32 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 33 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

- FIGURE 34 KEY BUYING CRITERIA FOR TOP THREE END USERS

- FIGURE 35 GREEN TECHNOLOGY & SUSTAINABILITY SERVICES TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 36 ESG REPORTING TOOLS TO ACCOUNT FOR LARGEST MARKET SHARE AMONG SOFTWARE IN 2025 AND 2030

- FIGURE 37 MANAGED SERVICES TO GROW AT HIGHER RATE OVER FORECAST PERIOD

- FIGURE 38 BLOCKCHAIN TECHNOLOGY TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 39 CORPORATE ESG & COMPLIANCE TO BE LEADING APPLICATION IN 2025 AND 2030

- FIGURE 40 TRANSPORTATION & LOGISTICS TO BE FASTEST-GROWING END USER DURING FORECAST PERIOD

- FIGURE 41 EUROPE TO BE LARGEST REGIONAL MARKET DURING FORECAST PERIOD

- FIGURE 42 SINGAPORE TO WITNESS FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 43 EUROPE: GREEN TECHNOLOGY & SUSTAINABILITY MARKET SNAPSHOT

- FIGURE 44 ASIA PACIFIC: GREEN TECHNOLOGY & SUSTAINABILITY MARKET SNAPSHOT

- FIGURE 45 TOP FIVE PLAYERS DOMINATING MARKET OVER LAST FIVE YEARS (USD MILLION)

- FIGURE 46 SHARE OF LEADING COMPANIES IN GREEN TECHNOLOGY & SUSTAINABILITY MARKET, 2024

- FIGURE 47 PRODUCT COMPARATIVE ANALYSIS, BY KEY PLAYER

- FIGURE 48 PRODUCT COMPARATIVE ANALYSIS, BY STARTUP/SME

- FIGURE 49 FINANCIAL METRICS OF KEY VENDORS

- FIGURE 50 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 51 GREEN TECHNOLOGY & SUSTAINABILITY MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 52 COMPANY FOOTPRINT (19 COMPANIES), 2024

- FIGURE 53 GREEN TECHNOLOGY & SUSTAINABILITY MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 54 IBM: COMPANY SNAPSHOT

- FIGURE 55 MICROSOFT: COMPANY SNAPSHOT

- FIGURE 56 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

- FIGURE 57 GOOGLE: COMPANY SNAPSHOT

- FIGURE 58 SAP: COMPANY SNAPSHOT

- FIGURE 59 GE: COMPANY SNAPSHOT

- FIGURE 60 AWS: COMPANY SNAPSHOT

- FIGURE 61 SIEMENS: COMPANY SNAPSHOT

- FIGURE 62 C3.AI: COMPANY SNAPSHOT

- FIGURE 63 UL SOLUTIONS: COMPANY SNAPSHOT

It is anticipated that the green technology and sustainability market will experience substantial growth, increasing from USD 25.47 billion in 2025 to USD 73.90 billion by 2030, with a strong CAGR of 23.7% throughout the forecast period. The green technology and sustainability market is driven by advancements in AI-driven energy management software, cloud-based carbon footprint tracking solutions, and blockchain-enabled sustainability reporting. Increasing regulatory mandates on ESG (Environmental, Social, and Governance) compliance push organizations to adopt sophisticated data analytics platforms for real-time monitoring of emissions and resource usage. The rise of circular economy models has spurred demand for AI-powered waste optimization and supply chain transparency tools. Consumer awareness and corporate sustainability commitments further drive investments in predictive analytics software for eco-friendly business strategies. However, a key restraint is the high cost and complexity of integrating diverse sustainability software solutions across legacy IT infrastructures, leading to adoption barriers for smaller enterprises.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | USD (Billion) |

| Segments | Offering, Technology, Application, End User, and Region |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

"By offering, software segment is expected to have the largest market share during the forecast period"

The software segment is expected to dominate the green technology and sustainability market due to its critical role in optimizing energy efficiency, reducing carbon footprints, and enabling smart resource management. Solutions such as energy management systems, carbon footprint tracking, and AI-driven analytics help businesses comply with environmental regulations and achieve sustainability goals. The rising adoption of cloud computing, IoT, and AI further drives demand for software solutions. Additionally, software offers scalability, real-time monitoring, and automation, making it a cost-effective and efficient choice for organizations seeking sustainable operations. As businesses prioritize sustainability, software remains essential for driving eco-friendly innovations.

"By technology, blockchain is expected to register the fastest market growth rate during the forecast period."

Blockchain technology is expected to witness the fastest growth in the green technology and sustainability market due to its ability to enhance transparency, security, and efficiency in environmental initiatives. It facilitates secure and tamper-proof data management for carbon credit trading, supply chain monitoring, and renewable energy transactions. By enabling decentralized and automated smart contracts, blockchain reduces fraud and operational costs while ensuring accountability in sustainability projects. Additionally, it supports peer-to-peer energy trading and tracks emissions reductions, driving compliance with global sustainability goals. As industries prioritize eco-friendly solutions, blockchain's role in optimizing green technology applications will continue to expand rapidly.

"By end user,manufacturing is expected to have the largest market share during the forecast period."

Manufacturing is expected to hold the largest market share in the green technology and sustainability market due to its high energy consumption, resource dependency, and environmental impact. Industries are increasingly adopting eco-friendly solutions such as renewable energy, energy-efficient machinery, and sustainable materials to reduce carbon footprints and comply with strict environmental regulations. Innovations like smart factories, circular economy practices, and green supply chains further drive growth. Government incentives and rising consumer demand for sustainable products also push manufacturers to invest in cleaner technologies. As a result, manufacturing leads in adopting green solutions, securing the largest market share during the forecast period.

"By region, Europe to have the largest market share in 2025 and Asia Pacific will account for fastest growth rate between 2025 to 2030."

Europe is projected to have the largest market share in the green technology and sustainability market in 2025 due to its stringent environmental regulations, ambitious climate policies, and strong government support for sustainable initiatives. The European Union's Green Deal, carbon neutrality goals, and significant investments in renewable energy, smart grids, and circular economy practices are key drivers. Additionally, high consumer awareness, corporate sustainability commitments, and financial incentives for green innovation further strengthen the region's leadership. Meanwhile, the Asia-Pacific region is expected to experience the fastest growth from 2025 to 2030, fueled by rapid urbanization, rising environmental concerns, and increasing government initiatives for sustainable development. Countries like China, India, and Japan are investing heavily in clean energy, smart cities, and eco-friendly industrial processes, driven by both regulatory mandates and growing economic opportunities in sustainability. The rising demand for sustainable solutions across industries, coupled with advancements in digital technologies such as AI-driven climate solutions and blockchain for carbon tracking, will accelerate market expansion in the region, making it the fastest-growing globally.

Breakdown of primaries

In-depth interviews were conducted with Chief Executive Officers (CEOs), innovation and technology directors, system integrators, and executives from various key organizations operating in the green technology and sustainability market.

- By Company: Tier I - 21%, Tier II - 46%, and Tier III - 33%

- By Designation: Directors- 38%, Managers - 46%, and others - 16%

- By Region: North America - 42%, Europe - 25%, Asia Pacific - 20%, Middle East & Africa -4%, and Latin America- 9%

The report includes the study of key players offering green technology and sustainability solutions. It profiles major vendors in the green technology and sustainability market. The major players in the green technology and sustainability market include IBM (US), Microsoft (US), AWS (US), Google (US), GE (US), Constellation (US), Salesforce (US), Schneider Electric (France), SAP (Germany), Siemens (Germany), Oracle (US), C3.ai (US), Engie Impact (US), UL Solutions (US), AMCS Group (Ireland), EcoVadis (France), Uplight (US), Cority (Canada), Benchmark Gensuite (US), Intelex (Canada), Treeni (India), IsoMetrix (US), Wint (US), Envirosoft (Canada), Trace Genomics (US), Factlines (Norway), Enechange Ltd (Japan), Ecocart (US), Clarity AI (US), Watershed (US), Emitwise (UK), Unravel Carbon (Singapore), Optera (US), Normative (Sweden), Greenly (France), Persefoni (US), Sweep (France), Pulsora (US), MioTech (Hong Kong), Rio AI (UK), CarbonChain (UK).

Research coverage

This research report categorizes the green technology and sustainability Market by offering (software and services), by application (corporate ESG & compliance, energy & emission reduction, sustainable supply chain & logistics, carbon neutrality & climate strategy, environmental protection & regulatory compliance, and other applications), by technology (cloud computing, artificial intelligence & analytics, blockchain, IOT, and cybersecurity) by end user (technology & software providers, telecommunications, retail & consumer goods, transportation & logistics, energy & utilities, manufacturing, healthcare & life sciences, and other end users) and by Region (North America, Europe, the Middle East and Africa, Asia Pacific, and Latin America). The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the green technology and sustainability market. A detailed analysis of the key industry players has been done to provide insights into their business overview, solutions, and services; key strategies; contracts, partnerships, agreements, new product & service launches, mergers and acquisitions, and recent developments associated with the green technology and sustainability market. Competitive analysis of upcoming startups in the green technology and sustainability market ecosystem is covered in this report.

Key Benefits of Buying the Report

The report would provide the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall green technology and sustainability market and its subsegments. It would help stakeholders understand the competitive landscape and gain more insights better to position their business and plan suitable go-to-market strategies. It also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Rise in government initiatives for low-carbon policies, corporate net-zero and ESG commitments, Consumer demand for sustainable products & services, energy transition and decarbonization goals), restraints (High implementation costs and RoI concerns, resistance to change and industry-specific barriers), opportunities (Expansion of water-tech & smart resource management, growth in AI & digital carbon management solutions, carbon markets and decentralized trading platforms), and challenges (Data complexity & lack of standardized reporting frameworks, lack of tailored solutions to address unique environmental issues).

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the green technology and sustainability market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the green technology and sustainability market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the green technology and sustainability market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players like IBM (US), Microsoft (US), AWS (US), Google (US), GE (US), Constellation (US), Salesforce (US), Schneider Electric (France), SAP (Germany), Siemens (Germany), Oracle (US), C3.ai (US), Engie Impact (US), UL Solutions (US), AMCS Group (Ireland), EcoVadis (France), Uplight (US), Cority (Canada), Benchmark Gensuite (US), Intelex (Canada), Treeni (India), IsoMetrix (US), Wint (US), Envirosoft (Canada), Trace Genomics (US), Factlines (Norway), Enechange Ltd (Japan), Ecocart (US), Clarity AI (US), Watershed (US), Emitwise (UK), Unravel Carbon (Singapore), Optera (US), Normative (Sweden), Greenly (France), Persefoni (US), Sweep (France), Pulsora (US), MioTech (Hong Kong), Rio AI (UK), CarbonChain (UK) among others in the green technology and sustainability market. The report also helps stakeholders understand the pulse of the green technology and sustainability market and provides them with information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakup of primary profiles

- 2.1.2.2 Key industry insights

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 TOP-DOWN APPROACH

- 2.2.2 BOTTOM-UP APPROACH

- 2.3 MARKET FORECAST

- 2.4 DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 STUDY LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN GREEN TECHNOLOGY & SUSTAINABILITY MARKET

- 4.2 GREEN TECHNOLOGY & SUSTAINABILITY MARKET: TOP THREE APPLICATIONS

- 4.3 EUROPE: GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY SOFTWARE AND APPLICATION

- 4.4 GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY REGION

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rise in government initiatives for low-carbon policies

- 5.2.1.2 Corporate net-zero and ESG commitments

- 5.2.1.3 Consumer demand for sustainable products & services

- 5.2.1.4 Energy transition and decarbonization goals

- 5.2.2 RESTRAINTS

- 5.2.2.1 High implementation costs and RoI concerns

- 5.2.2.2 Resistance to change and industry-specific barriers

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Expansion of water-tech & smart resource management

- 5.2.3.2 Growth in AI & digital carbon management solutions

- 5.2.3.3 Carbon markets and decentralized trading platforms

- 5.2.4 CHALLENGES

- 5.2.4.1 Data complexity and lack of standardized reporting frameworks

- 5.2.4.2 Lack of tailored solutions to address unique environmental issues

- 5.2.1 DRIVERS

- 5.3 EVOLUTION OF GREEN TECHNOLOGY & SUSTAINABILITY MARKET

- 5.4 SUPPLY CHAIN ANALYSIS

- 5.5 ECOSYSTEM ANALYSIS

- 5.5.1 CARBON ACCOUNTING SOFTWARE PROVIDERS

- 5.5.2 ESG REPORTING TOOL PROVIDERS

- 5.5.3 ENERGY AND RESOURCE OPTIMIZATION SOFTWARE PROVIDERS

- 5.5.4 SUPPLY CHAIN TRACEABILITY TOOL PROVIDERS

- 5.5.5 COMPLIANCE AND RISK MANAGEMENT TOOL PROVIDERS

- 5.5.6 OTHER PARTICIPANTS

- 5.6 INVESTMENT LANDSCAPE & FUNDING SCENARIO

- 5.7 IMPACT OF GENERATIVE AI ON GREEN TECHNOLOGY & SUSTAINABILITY MARKET

- 5.7.1 SMART ENERGY MANAGEMENT

- 5.7.2 CARBON FOOTPRINT MONITORING AND REDUCTION

- 5.7.3 SUSTAINABLE AGRICULTURE AND PRECISION FARMING

- 5.7.4 ECO-FRIENDLY MANUFACTURING AND MATERIAL DISCOVERY

- 5.7.5 CIRCULAR ECONOMY AND WASTE MANAGEMENT

- 5.7.6 CLIMATE RISK ASSESSMENT AND ADAPTATION

- 5.8 CASE STUDY ANALYSIS

- 5.8.1 GUNVOR PARTNERED WITH CARBONCHAIN TO STREAMLINE EMISSION REPORTING AND ENHANCE SUPPLY CHAIN SUSTAINABILITY

- 5.8.2 ENGIE IMPACT GUIDED ISBANK TO BUILD ENERGY-EFFICIENT DATA CENTERS TO ATTAIN SUSTAINABILITY

- 5.8.3 AMCS SUSTAINABILITY PLATFORM TRANSFORMED GLOBAL TIRE AND RUBBER COMPANY'S DATA MANAGEMENT FOR ENHANCED EFFICIENCY AND ACCURACY

- 5.8.4 LIDL IMPROVED SUPPLY CHAIN SUSTAINABILITY AND COMPLIANCE THROUGH ECOVADIS

- 5.8.5 ARES MANAGEMENT ENHANCED DECARBONIZATION EFFORTS WITH WATERSHED'S EMISSIONS-TRACKING PLATFORM

- 5.8.6 DSM ENHANCED DATA MANAGEMENT AND SUSTAINABILITY REPORTING THROUGH TREENI'S CENTRALIZED SOLUTION

- 5.8.7 GLOBAL FASHION GROUP STREAMLINED SUSTAINABILITY WITH UNRAVEL CARBON, ACHIEVING 29% EMISSION REDUCTION AND ENHANCED REPORTING EFFICIENCY

- 5.8.8 OPTERA'S ESG INSIGHTS PLATFORM IMPROVED EMISSION DATA ACCURACY AND STRENGTHENED SUSTAINABILITY REPORTING FOR GROVE COLLABORATIVE

- 5.8.9 C3.AI'S HELPED ACHIEVE 23% ENERGY REDUCTION AND USD 500 MILLION IN SAVINGS FOR LEADING US UTILITY

- 5.8.10 ELTEL GROUP STREAMLINED CARBON EMISSION TRACKING WITH NORMATIVE FOR IMPROVED SUSTAINABILITY AND REPORTING

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGIES

- 5.9.1.1 Artificial intelligence (AI) and machine learning (ML)

- 5.9.1.2 Internet of Things (IoT) and smart sensors

- 5.9.1.3 Cloud computing

- 5.9.1.4 Blockchain

- 5.9.2 COMPLEMENTARY TECHNOLOGIES

- 5.9.2.1 Edge computing

- 5.9.2.2 Digital twin

- 5.9.2.3 Big data

- 5.9.3 ADJACENT TECHNOLOGIES

- 5.9.3.1 5G and low-power networks

- 5.9.3.2 Cybersecurity

- 5.9.1 KEY TECHNOLOGIES

- 5.10 REGULATORY LANDSCAPE

- 5.10.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.10.1.1 North America

- 5.10.1.2 Europe

- 5.10.1.3 Asia Pacific

- 5.10.1.4 Middle East & Africa

- 5.10.1.5 Latin America

- 5.10.2 REGULATORY FRAMEWORK

- 5.10.2.1 North America

- 5.10.2.1.1 Energy Policy Act of 2005 (US)

- 5.10.2.1.2 Clean Power Plan (US)

- 5.10.2.1.3 California Global Warming Solutions Act (AB 32) (US)

- 5.10.2.2 Europe

- 5.10.2.2.1 EU Green Deal (European Green Deal)

- 5.10.2.2.2 EU Emissions Trading System (ETS) (European Union)

- 5.10.2.2.3 Renewable Energy Directive (RED II) (European Union)

- 5.10.2.3 Asia Pacific

- 5.10.2.3.1 14th Five-Year Plan for Ecological and Environmental Protection (China)

- 5.10.2.3.2 National Action Plan on Climate Change (NAPCC) (India)

- 5.10.2.3.3 Japan's Act on Promotion of Global Warming Countermeasures (Japan)

- 5.10.2.4 Middle East & Africa

- 5.10.2.4.1 Federal Decree-Law No. 14/2023 (UAE)

- 5.10.2.4.2 Egypt's Sustainable Development Strategy: Egypt Vision 2030 (Egypt)

- 5.10.2.5 Latin America

- 5.10.2.5.1 National Policy on Climate Change (PNMC) (Brazil)

- 5.10.2.5.2 General Climate Change Law (LGCC) (Mexico)

- 5.10.2.1 North America

- 5.10.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.11 PATENT ANALYSIS

- 5.11.1 METHODOLOGY

- 5.11.2 PATENTS FILED, BY DOCUMENT TYPE

- 5.11.3 INNOVATION AND PATENT APPLICATIONS

- 5.12 PRICING ANALYSIS

- 5.12.1 AVERAGE SELLING PRICE OF OFFERINGS

- 5.12.2 AVERAGE SELLING PRICE OF APPLICATIONS

- 5.13 KEY CONFERENCES AND EVENTS

- 5.14 PORTER'S FIVE FORCES ANALYSIS

- 5.14.1 THREAT OF NEW ENTRANTS

- 5.14.2 THREAT OF SUBSTITUTES

- 5.14.3 BARGAINING POWER OF SUPPLIERS

- 5.14.4 BARGAINING POWER OF BUYERS

- 5.14.5 INTENSITY OF COMPETITION RIVALRY

- 5.15 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.15.1 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.16 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.16.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.16.2 BUYING CRITERIA

6 GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY OFFERING

- 6.1 INTRODUCTION

- 6.1.1 OFFERING: GREEN TECHNOLOGY & SUSTAINABILITY MARKET DRIVERS

- 6.2 SOFTWARE

- 6.2.1 CARBON ACCOUNTING SOFTWARE

- 6.2.1.1 Empowering companies with detailed insights to identify carbon-intensive processes and optimize operations for greater sustainability

- 6.2.2 ESG REPORTING TOOLS

- 6.2.2.1 Integration of AI and blockchain in ESG reporting tools to streamline data collection, making process more efficient, accurate

- 6.2.3 ENERGY & RESOURCE OPTIMIZATION SOFTWARE

- 6.2.3.1 With increase in awareness of environmental issues, companies to focus on operational efficiency and more sustainable future

- 6.2.4 SUPPLY CHAIN TRACEABILITY TOOLS

- 6.2.4.1 Allowing companies to track environmental impacts at each production stage

- 6.2.5 COMPLIANCE & RISK MANAGEMENT TOOLS

- 6.2.5.1 Essential for driving accountability, transparency, and sustainability, helping organizations build resilience

- 6.2.6 OTHER SOFTWARE

- 6.2.1 CARBON ACCOUNTING SOFTWARE

- 6.3 SERVICES

- 6.3.1 PROFESSIONAL SERVICES

- 6.3.1.1 Integrating innovation and sustainability to navigate climate challenges and gain competitive edge

- 6.3.2 MANAGED SERVICES

- 6.3.2.1 Working closely with businesses to create customized solutions that fit companies' specific needs

- 6.3.1 PROFESSIONAL SERVICES

7 GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY TECHNOLOGY

- 7.1 INTRODUCTION

- 7.1.1 TECHNOLOGY: GREEN TECHNOLOGY & SUSTAINABILITY MARKET DRIVERS

- 7.2 CLOUD COMPUTING

- 7.2.1 ALIGNING TECHNOLOGICAL ADVANCEMENTS WITH ENVIRONMENTAL RESPONSIBILITY THROUGH CLOUD COMPUTING

- 7.3 ARTIFICIAL INTELLIGENCE & ANALYTICS

- 7.3.1 CONTRIBUTING TO MORE SUSTAINABLE PRACTICES BY DRIVING CIRCULAR ECONOMY

- 7.4 BLOCKCHAIN

- 7.4.1 PROVIDING MORE EFFICIENT, TRANSPARENT, AND ACCOUNTABLE GREEN TECHNOLOGY ECOSYSTEM

- 7.5 IOT

- 7.5.1 IOT ENABLING SUSTAINABLE PRACTICES AND REDUCING CARBON FOOTPRINTS

- 7.6 CYBERSECURITY

- 7.6.1 CYBERSECURITY STRATEGIES: KEY TO PROTECTING IP, ENSURING COMPLIANCE, AND BUILDING TRUST IN GREEN TECH

8 GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.1.1 APPLICATION: GREEN TECHNOLOGY & SUSTAINABILITY MARKET DRIVERS

- 8.2 CORPORATE ESG & COMPLIANCE

- 8.2.1 DRIVING INNOVATION AND ACCOUNTABILITY IN RENEWABLE ENERGY, ELECTRIC MOBILITY, CIRCULAR ECONOMY PRACTICES, AND SUSTAINABLE MANUFACTURING

- 8.3 ENERGY & EMISSION REDUCTION

- 8.3.1 ADVANCING GREEN TECHNOLOGY FOR ENERGY EFFICIENCY AND EMISSION REDUCTION TO COMBAT CLIMATE CHANGE

- 8.4 SUSTAINABLE SUPPLY CHAIN & LOGISTICS

- 8.4.1 COMPANIES TO ENHANCE ENVIRONMENTAL FOOTPRINT AND COST-EFFICIENCY BY EMBEDDING SUSTAINABILITY INTO CORE LOGISTICAL OPERATIONS

- 8.5 CARBON NEUTRALITY & CLIMATE STRATEGY

- 8.5.1 DRIVING INNOVATION AND LONG-TERM VALUE THROUGH CARBON NEUTRALITY AND CLIMATE STRATEGIES

- 8.6 ENVIRONMENTAL PROTECTION & REGULATORY COMPLIANCE

- 8.6.1 DRIVING INNOVATION AND SUSTAINABILITY THROUGH ENVIRONMENTAL PROTECTION AND REGULATORY COMPLIANCE TO COMBAT CLIMATE CHANGE

- 8.7 OTHER APPLICATIONS

9 GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY END USER

- 9.1 INTRODUCTION

- 9.1.1 END USER: GREEN TECHNOLOGY & SUSTAINABILITY MARKET DRIVERS

- 9.2 TECHNOLOGY & SOFTWARE PROVIDERS

- 9.2.1 OPTIMIZING CLOUD INFRASTRUCTURE AND AI-DRIVEN COMPUTING FOR LOW-CARBON DIGITAL ECONOMY

- 9.3 TELECOMMUNICATIONS

- 9.3.1 REDUCING NETWORK ENERGY CONSUMPTION THROUGH AI-POWERED OPTIMIZATION AND CARBON-AWARE DATA TRANSMISSION

- 9.4 RETAIL & CONSUMER GOODS

- 9.4.1 EMBEDDING AI-DRIVEN EMISSIONS TRACKING AND BLOCKCHAIN-ENABLED SUPPLY CHAIN TRANSPARENCY FOR SUSTAINABLE COMMERCE

- 9.5 TRANSPORTATION & LOGISTICS

- 9.5.1 LEVERAGING AI-DRIVEN FLEET OPTIMIZATION AND REAL-TIME CARBON TRACKING TO DECARBONIZE GLOBAL SUPPLY CHAINS

- 9.6 ENERGY & UTILITIES

- 9.6.1 INTEGRATING AI AND BLOCKCHAIN FOR SMART GRIDS, RENEWABLE ENERGY OPTIMIZATION, AND REAL-TIME EMISSIONS MONITORING

- 9.7 MANUFACTURING

- 9.7.1 DEPLOYING AI-POWERED PREDICTIVE MAINTENANCE AND BLOCKCHAIN-BASED TRACEABILITY TO ENHANCE INDUSTRIAL SUSTAINABILITY

- 9.7.2 CHEMICALS

- 9.7.3 FOOD & BEVERAGE

- 9.7.4 HEAVY MACHINERY

- 9.7.5 ELECTRONICS & SEMICONDUCTORS

- 9.7.6 AUTOMOTIVE

- 9.7.7 OTHER MANUFACTURING APPLICATIONS

- 9.8 HEALTHCARE & LIFE SCIENCES

- 9.8.1 UTILIZING AI FOR PRECISION MEDICINE AND BLOCKCHAIN FOR SECURE, SUSTAINABLE SUPPLY CHAINS IN HEALTHCARE

- 9.9 OTHER END USERS

10 GREEN TECHNOLOGY & SUSTAINABILITY MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 NORTH AMERICA: GREEN TECHNOLOGY & SUSTAINABILITY MARKET DRIVERS

- 10.2.2 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 10.2.3 US

- 10.2.3.1 Demand for sustainable products and services to influence shift toward green technologies

- 10.2.4 CANADA

- 10.2.4.1 Strong focus on green technologies aimed at reducing carbon emissions and protecting ecosystems

- 10.3 EUROPE

- 10.3.1 EUROPE: GREEN TECHNOLOGY & SUSTAINABILITY MARKET DRIVERS

- 10.3.2 EUROPE: MACROECONOMIC OUTLOOK

- 10.3.3 UK

- 10.3.3.1 Increasingly diverse green technology market with advancements in smart grids, energy storage, and circular economy

- 10.3.4 GERMANY

- 10.3.4.1 Growth in industry demand, government support, and data privacy regulations

- 10.3.5 FRANCE

- 10.3.5.1 Aims to lead in green manufacturing practices, striving to innovate using clean technologies in production processes

- 10.3.6 ITALY

- 10.3.6.1 Rise in eco-conscious consumer behavior to prompt embracing of sustainable business models and green technologies

- 10.3.7 SPAIN

- 10.3.7.1 Sets clear targets for transitioning to circular economy, promoting eco-friendly solutions in waste management, agriculture, and water conservation

- 10.3.8 NETHERLANDS

- 10.3.8.1 Emphasis on sustainability reflected in investment in sustainable agriculture, water management, and eco-friendly transportation systems

- 10.3.9 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 ASIA PACIFIC: GREEN TECHNOLOGY & SUSTAINABILITY MARKET DRIVERS

- 10.4.2 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 10.4.3 CHINA

- 10.4.3.1 Government policy framework encouraging transition to low-carbon industries, particularly in energy production and transportation

- 10.4.4 JAPAN

- 10.4.4.1 Green technology revolution advancing sustainability through innovation and investments

- 10.4.5 INDIA

- 10.4.5.1 Integration of digital technologies into green solutions enabled efficient resource management and energy optimization

- 10.4.6 SOUTH KOREA

- 10.4.6.1 Embraced "Green New Deal" as part of its commitment to reduce carbon emissions and invest in eco-friendly technologies

- 10.4.7 AUSTRALIA

- 10.4.7.1 Large financial institutions prioritizing sustainable investments and reducing their carbon footprint, aligning with global sustainability frameworks

- 10.4.8 SINGAPORE

- 10.4.8.1 Market characterized by robust investment in green innovations and policies driving eco-conscious business practices

- 10.4.9 REST OF ASIA PACIFIC

- 10.5 MIDDLE EAST & AFRICA

- 10.5.1 MIDDLE EAST & AFRICA: GREEN TECHNOLOGY & SUSTAINABILITY MARKET DRIVERS

- 10.5.2 MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

- 10.5.3 MIDDLE EAST

- 10.5.3.1 UAE

- 10.5.3.1.1 Focus on innovations in renewable energy, sustainable infrastructure, and eco-friendly technologies

- 10.5.3.2 Saudi Arabia

- 10.5.3.2.1 Increasing investments in green technology innovation to improve environmental outcomes

- 10.5.3.3 Qatar

- 10.5.3.3.1 Commitment to sustainable development evident in its efforts to integrate green technology into its rapidly expanding economy

- 10.5.3.4 Turkey

- 10.5.3.4.1 Steady rise in green technologies driven by both governmental support and private-sector innovation

- 10.5.3.5 Rest of the Middle East

- 10.5.3.1 UAE

- 10.5.4 AFRICA

- 10.6 LATIN AMERICA

- 10.6.1 LATIN AMERICA: GREEN TECHNOLOGY & SUSTAINABILITY MARKET DRIVERS

- 10.6.2 LATIN AMERICA: MACROECONOMIC OUTLOOK

- 10.6.3 BRAZIL

- 10.6.3.1 Investing in smart waste solutions, recycling programs, and initiatives to reduce urban carbon footprints in cities

- 10.6.4 MEXICO

- 10.6.4.1 Mexican companies focus on eco-friendly innovation, supported by government incentives and international cooperation

- 10.6.5 ARGENTINA

- 10.6.5.1 Sustainability market propelled by growing local initiatives and international partnerships

- 10.6.6 REST OF LATIN AMERICA

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2022-2025

- 11.3 REVENUE ANALYSIS, 2020-2024

- 11.4 MARKET SHARE ANALYSIS, 2024

- 11.5 PRODUCT COMPARATIVE ANALYSIS

- 11.5.1 PRODUCT COMPARATIVE ANALYSIS: KEY PLAYERS

- 11.5.1.1 GE Renewable Energy Solutions (General Electric)

- 11.5.1.2 Siemens Smart Infrastructure (Siemens)

- 11.5.1.3 SAP ESG Management (SAP)

- 11.5.1.4 Schneider Electric Energy Management (Schneider Electric)

- 11.5.1.5 IBM AI for Sustainability (IBM)

- 11.5.2 PRODUCT COMPARATIVE ANALYSIS: STARTUPS/SMES

- 11.5.2.1 Watershed Carbon Solutions (Watershed)

- 11.5.2.2 Clarity AI Sustainability Analytics (Clarity AI)

- 11.5.2.3 Normative Carbon Accounting (Normative)

- 11.5.2.4 Persefoni Carbon Management (Persefoni)

- 11.5.2.5 Enechange Renewable Energy Optimization (ENECHANGE Ltd.)

- 11.5.1 PRODUCT COMPARATIVE ANALYSIS: KEY PLAYERS

- 11.6 COMPANY VALUATION AND FINANCIAL METRICS

- 11.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.7.1 STARS

- 11.7.2 EMERGING LEADERS

- 11.7.3 PERVASIVE PLAYERS

- 11.7.4 PARTICIPANTS

- 11.8 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.8.1 COMPANY FOOTPRINT

- 11.8.2 OFFERING FOOTPRINT

- 11.8.3 APPLICATION FOOTPRINT

- 11.8.4 END USER FOOTPRINT

- 11.8.5 REGIONAL FOOTPRINT

- 11.9 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.9.1 PROGRESSIVE COMPANIES

- 11.9.2 RESPONSIVE COMPANIES

- 11.9.3 DYNAMIC COMPANIES

- 11.9.4 STARTING BLOCKS

- 11.9.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 11.9.5.1 Detailed list of key startups/SMEs

- 11.9.5.2 Competitive benchmarking of key startups/SMEs

- 11.10 COMPETITIVE SCENARIO AND TRENDS

- 11.10.1 PRODUCT LAUNCHES AND ENHANCEMENTS

- 11.10.2 DEALS

12 COMPANY PROFILES

- 12.1 INTRODUCTION

- 12.2 KEY PLAYERS

- 12.2.1 IBM

- 12.2.1.1 Business overview

- 12.2.1.2 Products/Solutions/Services offered

- 12.2.1.3 Recent developments

- 12.2.1.3.1 Product launches and enhancements

- 12.2.1.3.2 Deals

- 12.2.1.4 MnM view

- 12.2.1.4.1 Key strengths

- 12.2.1.4.2 Strategic choices

- 12.2.1.4.3 Weaknesses and competitive threats

- 12.2.2 MICROSOFT

- 12.2.2.1 Business overview

- 12.2.2.2 Products/Solutions/Services offered

- 12.2.2.3 Recent developments

- 12.2.2.3.1 Product launches and enhancements

- 12.2.2.3.2 Deals

- 12.2.2.4 MnM view

- 12.2.2.4.1 Key strengths

- 12.2.2.4.2 Strategic choices

- 12.2.2.4.3 Weaknesses and competitive threats

- 12.2.3 SCHNEIDER ELECTRIC

- 12.2.3.1 Business overview

- 12.2.3.2 Products/Solutions/Services offered

- 12.2.3.3 Recent developments

- 12.2.3.3.1 Product launches and enhancements

- 12.2.3.3.2 Deals

- 12.2.3.4 MnM view

- 12.2.3.4.1 Key strengths

- 12.2.3.4.2 Strategic choices

- 12.2.3.4.3 Weaknesses and competitive threats

- 12.2.4 GOOGLE

- 12.2.4.1 Business overview

- 12.2.4.2 Products/Solutions/Services offered

- 12.2.4.3 Recent developments

- 12.2.4.3.1 Product launches and enhancements

- 12.2.4.3.2 Deals

- 12.2.4.4 MnM view

- 12.2.4.4.1 Key strengths

- 12.2.4.4.2 Strategic choices

- 12.2.4.4.3 Weaknesses and competitive threats

- 12.2.5 SAP

- 12.2.5.1 Business overview

- 12.2.5.2 Products/Solutions/Services offered

- 12.2.5.3 Recent developments

- 12.2.5.3.1 Product launches and enhancements

- 12.2.5.3.2 Deals

- 12.2.5.4 MnM view

- 12.2.5.4.1 Key strengths

- 12.2.5.4.2 Strategic choices

- 12.2.5.4.3 Weaknesses and competitive threats

- 12.2.6 GE

- 12.2.6.1 Business overview

- 12.2.6.2 Products/Solutions/Services offered

- 12.2.6.3 Recent developments

- 12.2.6.3.1 Product launches and enhancements

- 12.2.6.3.2 Deals

- 12.2.7 AWS

- 12.2.7.1 Business overview

- 12.2.7.2 Products/Solutions/Services offered

- 12.2.7.3 Recent developments

- 12.2.7.3.1 Deals

- 12.2.8 SIEMENS

- 12.2.8.1 Business overview

- 12.2.8.2 Products/Solutions/Services offered

- 12.2.8.3 Recent developments

- 12.2.8.3.1 Product launches and enhancements

- 12.2.8.3.2 Deals

- 12.2.9 C3.AI

- 12.2.9.1 Business overview

- 12.2.9.2 Products/Solutions/Services offered

- 12.2.9.3 Recent developments

- 12.2.9.3.1 Product launches and enhancements

- 12.2.9.3.2 Deals

- 12.2.10 UL SOLUTIONS

- 12.2.10.1 Business overview

- 12.2.10.2 Products/Solutions/Services offered

- 12.2.10.3 Recent developments

- 12.2.10.3.1 Product launches and enhancements

- 12.2.10.3.2 Deals

- 12.2.11 ORACLE

- 12.2.12 ENGIE IMPACT

- 12.2.13 SALESFORCE

- 12.2.14 AMCS GROUP

- 12.2.15 ECOVADIS

- 12.2.16 UPLIGHT

- 12.2.17 CORITY

- 12.2.18 BENCHMARK GENSUITE

- 12.2.19 CONSTELLATION

- 12.2.1 IBM

- 12.3 STARTUPS/SMES

- 12.3.1 INTELEX

- 12.3.2 TREENI

- 12.3.3 ISOMETRIX

- 12.3.4 WINT

- 12.3.5 ENVIROSOFT

- 12.3.6 TRACE GENOMICS

- 12.3.7 FACTLINES

- 12.3.8 ENECHANGE LTD

- 12.3.9 ECOCART

- 12.3.10 CLARITY AI

- 12.3.11 WATERSHED

- 12.3.12 EMITWISE

- 12.3.13 UNRAVEL CARBON

- 12.3.14 OPTERA

- 12.3.15 NORMATIVE

- 12.3.16 GREENLY

- 12.3.17 PERSEFONI

- 12.3.18 SWEEP

- 12.3.19 PULSORA

- 12.3.20 MIOTECH

- 12.3.21 RIO AI

- 12.3.22 CARBONCHAIN

13 ADJACENT AND RELATED MARKETS

- 13.1 INTRODUCTION

- 13.2 DIGITAL CIRCULAR ECONOMY MARKET

- 13.2.1 MARKET DEFINITION

- 13.2.2 MARKET OVERVIEW

- 13.2.2.1 Digital Circular Economy Market, by Application

- 13.2.2.2 Digital Circular Economy Market, by Technology

- 13.2.2.3 Digital Circular Economy Market, by Vertical

- 13.2.2.4 Digital Circular Economy Market, by Region

- 13.3 ESG REPORTING SOFTWARE MARKET

- 13.3.1 MARKET DEFINITION

- 13.3.2 MARKET OVERVIEW

- 13.3.2.1 ESG Reporting Software Market, by Deployment Type

- 13.3.2.2 ESG Reporting Software Market, by Organization Size

- 13.3.2.3 ESG Reporting Software Market, by Vertical

- 13.3.2.4 ESG Reporting Software Market, by Region

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS