|

|

市場調査レポート

商品コード

1730662

産業用通信の世界市場:オファリング別、通信プロトコル別、業界別、地域別 - 2030年までの予測Industrial Communication Market by Fieldbus, Industrial Ethernet, Wireless, IO-Link, Router & WAP, Switch, Gateway, Communication Interface & Converter, Controller & Connector and Power Supply Device - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 産業用通信の世界市場:オファリング別、通信プロトコル別、業界別、地域別 - 2030年までの予測 |

|

出版日: 2025年05月16日

発行: MarketsandMarkets

ページ情報: 英文 363 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の産業用通信の市場規模は、2025年の204億5,000万米ドルから2030年には260億6,000万米ドルに成長し、2025年から2030年のCAGRは5.0%になると予測されています。

この成長の背景には、製造業におけるSCADAとPLCの統合、エネルギー分野におけるスマートグリッド技術の統合、デジタルツイン技術と産業用AIの融合、産業効率と自動化技術を最適化するためのマシン間通信に対する需要の高まりなど、金融面でのインセンティブの増加があります。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 金額(100万米ドル) |

| セグメント別 | オファリング別、通信プロトコル別、業界別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

PROFINETセグメントは、その高いスケーラビリティ、リアルタイム性能、特に欧州のトップオートメーションサプライヤーによる広範なサポートにより、2025年から2030年の間に産業用イーサネット市場を独占する可能性が高いです。標準的かつタイムクリティカルな産業用アプリケーションを処理するために設計されたこの技術は、現在の設備とのシームレスな統合を実現し、ファクトリーオートメーションからプロセス制御まで、数多くの異種産業環境に理想的なものとなっています。高速データ交換、決定論的通信、オープン・ネットワーク・トポロジーをサポートしているため、他のプロトコルに対して競争力があります。さらに、業界リーダーによって全面的に受け入れられ、膨大な数のデバイスと互換性があることから、産業用イーサネットの選択肢として、その地位はさらに確実なものとなっています。

「2025年から2030年にかけて、無線産業用通信市場ではWLANセグメントが最も高いCAGRを示すと予測されています。

WLANセグメントは、スマート製造におけるワイヤレス、柔軟性、スケーラブルな接続に対する需要の高まりによって、ワイヤレス産業用通信市場で最も速い速度で成長する可能性が高いです。企業が分散型ワイヤレスデバイス、無人搬送車(AGV)、遠隔監視システムを使用するにつれて、WLANは有線インフラストラクチャの制約を受けることなくワイヤレス通信を可能にします。リアルタイムのデータ共有、迅速な展開、高デバイス密度をサポートする能力により、ダイナミックでスペースが限られた産業環境に最適です。プライベート・ワイヤレス・ネットワークとWi-Fi 6を使用することで、パフォーマンス、信頼性、セキュリティが強化され、幅広い産業用ユースケースでWLANの利用が進んでいます。

インドは、産業化の加速、Make in IndiaやDigital Indiaなどの政府の強力な推進、製造、エネルギー、輸送などの業界別での自動化導入の増加により、予測期間中に世界の産業用通信市場で最高のCAGRを記録する見込みです。産業基盤の拡大、スマート工場への投資、IIoTとインダストリー4.0を実現するための安全な通信インフラに対する需要の増加は、主要な成長促進要因です。さらに、有利な政策、デジタルインフラの進歩、地域技術ベンダーの出現が、この地域における産業用通信ソリューションの採用を後押ししています。

当レポートでは、世界の産業用通信市場について調査し、オファリング別、通信プロトコル別、業界別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- バリューチェーン分析

- 価格分析

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- 特許分析

- 貿易分析

- 投資と資金調達のシナリオ

- 技術分析

- 顧客ビジネスに影響を与える動向/混乱

- エコシステム分析

- ケーススタディ分析

- 2025年~2026年の主な会議とイベント

- 関税と規制状況

- AI/生成AIが産業用通信市場に与える影響

- 2025年の米国関税が産業用通信市場に与える影響

第6章 産業用通信の応用

- イントロダクション

- プロセス制御

- マシンツーマシン(M2M)通信

- リモートモニタリング

- エネルギー管理

- 資産追跡と状態監視

第7章 産業用通信市場(オファリング別)

- イントロダクション

- コンポーネント

- ソフトウェア

- サービス

第8章 産業用通信市場(通信プロトコル別)

- イントロダクション

- フィールドバス

- 産業用イーサネット

- 無線

- IO-LINK

第9章 産業用通信市場(業界別)

- イントロダクション

- 自動車

- 電気・電子工学

- 航空宇宙・防衛

- 石油・ガス

- 化学薬品・肥料

- 食品・飲料

- 医薬品・医療機器

- エネルギー・電力

- 金属・鉱業

- エンジニアリング・製造

- 水と廃水管理

- その他

第10章 産業用通信市場(地域別)

- イントロダクション

- 北米

- 北米のマクロ経済見通し

- 米国

- カナダ

- メキシコ

- 欧州

- 欧州のマクロ経済見通し

- 英国

- ドイツ

- フランス

- スペイン

- イタリア

- ポーランド

- 北欧

- その他

- アジア太平洋

- アジア太平洋のマクロ経済見通し

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- インドネシア

- マレーシア

- タイ

- ベトナム

- その他

- その他の地域

- その他の地域のマクロ経済見通し

- 南米

- 中東

- アフリカ

第11章 競合情勢

- 概要

- 主要参入企業の戦略/強み、2021年~2025年

- 市場シェア分析、2024年

- 収益分析、2020年~2024年

- 企業評価と財務指標

- 技術比較

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 競合シナリオ

第12章 企業プロファイル

- イントロダクション

- 主要参入企業

- CISCO SYSTEMS, INC.

- SIEMENS

- ROCKWELL AUTOMATION

- OMRON CORPORATION

- HUAWEI TECHNOLOGIES CO., LTD.

- MOXA INC.

- SICK AG

- SCHNEIDER ELECTRIC

- ABB

- BELDEN INC.

- その他の企業

- GE GRID SOLUTIONS, LLC

- ADVANTECH CO., LTD.

- IFM ELECTRONIC GMBH

- FANUC CORPORATION

- BOSCH REXROTH AG

- AAEON TECHNOLOGY INC.

- HMS NETWORKS

- HONEYWELL INTERNATIONAL INC.

- MITSUBISHI ELECTRIC CORPORATION

- TELEFONAKTIEBOLAGET LM ERICSSON

- HANS TURCK GMBH & CO. KG

- ACS MOTION CONTROL

- EATON

- BECKHOFF AUTOMATION

- HITACHI, LTD.

第13章 付録

List of Tables

- TABLE 1 LIST OF KEY SECONDARY SOURCES

- TABLE 2 LIST OF PRIMARY INTERVIEW PARTICIPANTS

- TABLE 3 KEY DATA FROM PRIMARY SOURCES

- TABLE 4 INDUSTRIAL COMMUNICATION MARKET: RISK ANALYSIS

- TABLE 5 AVERAGE SELLING PRICE OF INDUSTRIAL COMMUNICATION SOLUTIONS OFFERED BY KEY PLAYERS, BY COMPONENT TYPE, 2024 (USD)

- TABLE 6 AVERAGE SELLING PRICE TREND OF GATEWAYS, BY REGION, 2020-2024 (USD)

- TABLE 7 AVERAGE SELLING PRICE TREND OF SWITCHES, BY REGION, 2020-2024 (USD)

- TABLE 8 PORTER'S FIVE FORCES ANALYSIS

- TABLE 9 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE INDUSTRIES (%)

- TABLE 10 KEY BUYING CRITERIA FOR TOP THREE INDUSTRIES

- TABLE 11 LIST OF KEY PATENTS, 2022-2024

- TABLE 12 IMPORT DATA FOR HS CODE 853690-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 13 EXPORT DATA FOR HS CODE 853690-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 14 LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 15 MFN TARIFF FOR HS CODE 853690-COMPLIANT PRODUCTS, BY COUNTRY, 2024

- TABLE 16 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 US-ADJUSTED RECIPROCAL TARIFF RATES, 2024

- TABLE 21 INDUSTRIAL COMMUNICATION MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 22 INDUSTRIAL COMMUNICATION MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 23 COMPONENTS: INDUSTRIAL COMMUNICATION MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 24 COMPONENTS: INDUSTRIAL COMMUNICATION MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 25 COMPONENTS: INDUSTRIAL COMMUNICATION MARKET, BY TYPE, 2021-2024 (THOUSAND UNITS)

- TABLE 26 COMPONENTS: INDUSTRIAL COMMUNICATION MARKET, BY TYPE, 2025-2030 (THOUSAND UNITS)

- TABLE 27 INDUSTRIAL COMMUNICATION MARKET, BY COMMUNICATION PROTOCOL, 2021-2024 (USD MILLION)

- TABLE 28 INDUSTRIAL COMMUNICATION MARKET, BY COMMUNICATION PROTOCOL, 2025-2030 (USD MILLION)

- TABLE 29 FIELDBUS: INDUSTRIAL COMMUNICATION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 30 FIELDBUS: INDUSTRIAL COMMUNICATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 31 FIELDBUS: INDUSTRIAL COMMUNICATION MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 32 FIELDBUS: INDUSTRIAL COMMUNICATION MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 33 FIELDBUS: INDUSTRIAL COMMUNICATION MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 34 FIELDBUS: INDUSTRIAL COMMUNICATION MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 35 FIELDBUS: INDUSTRIAL COMMUNICATION MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 36 FIELDBUS: INDUSTRIAL COMMUNICATION MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 37 FIELDBUS: INDUSTRIAL COMMUNICATION MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 38 FIELDBUS: INDUSTRIAL COMMUNICATION MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 39 FIELDBUS: INDUSTRIAL COMMUNICATION MARKET, BY PROTOCOL TYPE, 2021-2024 (USD MILLION)

- TABLE 40 FIELDBUS: INDUSTRIAL COMMUNICATION MARKET, BY PROTOCOL TYPE, 2025-2030 (USD MILLION)

- TABLE 41 INDUSTRIAL ETHERNET: INDUSTRIAL COMMUNICATION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 42 INDUSTRIAL ETHERNET: INDUSTRIAL COMMUNICATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 43 INDUSTRIAL ETHERNET: INDUSTRIAL COMMUNICATION MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 44 INDUSTRIAL ETHERNET: INDUSTRIAL COMMUNICATION MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 45 INDUSTRIAL ETHERNET: INDUSTRIAL COMMUNICATION MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 46 INDUSTRIAL ETHERNET: INDUSTRIAL COMMUNICATION MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 47 INDUSTRIAL ETHERNET: INDUSTRIAL COMMUNICATION MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 48 INDUSTRIAL ETHERNET: INDUSTRIAL COMMUNICATION MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 49 INDUSTRIAL ETHERNET: INDUSTRIAL COMMUNICATION MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 50 INDUSTRIAL ETHERNET: INDUSTRIAL COMMUNICATION MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 51 INDUSTRIAL ETHERNET: INDUSTRIAL COMMUNICATION MARKET, BY PROTOCOL TYPE, 2021-2024 (USD MILLION)

- TABLE 52 INDUSTRIAL ETHERNET: INDUSTRIAL COMMUNICATION MARKET, BY PROTOCOL TYPE, 2025-2030 (USD MILLION)

- TABLE 53 WIRELESS: INDUSTRIAL COMMUNICATION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 54 WIRELESS: INDUSTRIAL COMMUNICATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 55 WIRELESS: INDUSTRIAL COMMUNICATION MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 56 WIRELESS: INDUSTRIAL COMMUNICATION MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 57 WIRELESS: INDUSTRIAL COMMUNICATION MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 58 WIRELESS: INDUSTRIAL COMMUNICATION MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 59 WIRELESS: INDUSTRIAL COMMUNICATION MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 60 WIRELESS: INDUSTRIAL COMMUNICATION MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 61 WIRELESS: INDUSTRIAL COMMUNICATION MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 62 WIRELESS: INDUSTRIAL COMMUNICATION MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 63 WIRELESS: INDUSTRIAL COMMUNICATION MARKET, BY PROTOCOL TYPE, 2021-2024 (USD MILLION)

- TABLE 64 WIRELESS: INDUSTRIAL COMMUNICATION MARKET, BY PROTOCOL TYPE, 2025-2030 (USD MILLION)

- TABLE 65 IO-LINK: INDUSTRIAL COMMUNICATION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 66 IO-LINK: INDUSTRIAL COMMUNICATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 67 IO-LINK: INDUSTRIAL COMMUNICATION MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 68 IO-LINK: INDUSTRIAL COMMUNICATION MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 69 IO-LINK: INDUSTRIAL COMMUNICATION MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 70 IO-LINK: INDUSTRIAL COMMUNICATION MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 71 IO-LINK: INDUSTRIAL COMMUNICATION MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 72 IO-LINK: INDUSTRIAL COMMUNICATION MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 73 IO-LINK: INDUSTRIAL COMMUNICATION MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 74 IO-LINK: INDUSTRIAL COMMUNICATION MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 75 INDUSTRIAL COMMUNICATION MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 76 INDUSTRIAL COMMUNICATION MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 77 AUTOMOTIVE: INDUSTRIAL COMMUNICATION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 78 AUTOMOTIVE: INDUSTRIAL COMMUNICATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 79 ELECTRICAL & ELECTRONICS: INDUSTRIAL COMMUNICATION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 80 ELECTRICAL & ELECTRONICS: INDUSTRIAL COMMUNICATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 81 AEROSPACE & DEFENSE: INDUSTRIAL COMMUNICATION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 82 AEROSPACE & DEFENSE: INDUSTRIAL COMMUNICATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 83 OIL & GAS: INDUSTRIAL COMMUNICATION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 84 OIL & GAS: INDUSTRIAL COMMUNICATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 85 CHEMICALS & FERTILIZERS: INDUSTRIAL COMMUNICATION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 86 CHEMICALS & FERTILIZERS: INDUSTRIAL COMMUNICATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 87 FOOD & BEVERAGES: INDUSTRIAL COMMUNICATION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 88 FOOD & BEVERAGES: INDUSTRIAL COMMUNICATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 89 PHARMACEUTICALS & MEDICAL DEVICES: INDUSTRIAL COMMUNICATION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 90 PHARMACEUTICALS & MEDICAL DEVICES: INDUSTRIAL COMMUNICATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 91 ENERGY & POWER: INDUSTRIAL COMMUNICATION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 92 ENERGY & POWER: INDUSTRIAL COMMUNICATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 93 METALS & MINING: INDUSTRIAL COMMUNICATION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 94 METALS & MINING: INDUSTRIAL COMMUNICATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 95 ENGINEERING & FABRICATION: INDUSTRIAL COMMUNICATION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 96 ENGINEERING & FABRICATION: INDUSTRIAL COMMUNICATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 97 WATER & WASTEWATER MANAGEMENT: INDUSTRIAL COMMUNICATION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 98 WATER & WASTEWATER MANAGEMENT: INDUSTRIAL COMMUNICATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 99 OTHER INDUSTRIES: INDUSTRIAL COMMUNICATION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 100 OTHER INDUSTRIES: INDUSTRIAL COMMUNICATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 101 INDUSTRIAL COMMUNICATION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 102 INDUSTRIAL COMMUNICATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 103 NORTH AMERICA: INDUSTRIAL COMMUNICATION MARKET, BY COMMUNICATION PROTOCOL, 2021-2024 (USD MILLION)

- TABLE 104 NORTH AMERICA: INDUSTRIAL COMMUNICATION MARKET, BY COMMUNICATION PROTOCOL, 2025-2030 (USD MILLION)

- TABLE 105 NORTH AMERICA: INDUSTRIAL COMMUNICATION MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 106 NORTH AMERICA: INDUSTRIAL COMMUNICATION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 107 NORTH AMERICA: INDUSTRIAL COMMUNICATION MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 108 NORTH AMERICA: INDUSTRIAL COMMUNICATION MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 109 US: INDUSTRIAL COMMUNICATION MARKET, BY COMMUNICATION PROTOCOL, 2021-2024 (USD MILLION)

- TABLE 110 US: INDUSTRIAL COMMUNICATION MARKET, BY COMMUNICATION PROTOCOL, 2025-2030 (USD MILLION)

- TABLE 111 CANADA: INDUSTRIAL COMMUNICATION MARKET, BY COMMUNICATION PROTOCOL, 2021-2024 (USD MILLION)

- TABLE 112 CANADA: INDUSTRIAL COMMUNICATION MARKET, BY COMMUNICATION PROTOCOL, 2025-2030 (USD MILLION)

- TABLE 113 MEXICO: INDUSTRIAL COMMUNICATION MARKET, BY COMMUNICATION PROTOCOL, 2021-2024 (USD MILLION)

- TABLE 114 MEXICO: INDUSTRIAL COMMUNICATION MARKET, BY COMMUNICATION PROTOCOL, 2025-2030 (USD MILLION)

- TABLE 115 EUROPE: INDUSTRIAL COMMUNICATION MARKET, BY COMMUNICATION PROTOCOL, 2021-2024 (USD MILLION)

- TABLE 116 EUROPE: INDUSTRIAL COMMUNICATION MARKET, BY COMMUNICATION PROTOCOL, 2025-2030 (USD MILLION)

- TABLE 117 EUROPE: INDUSTRIAL COMMUNICATION MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 118 EUROPE: INDUSTRIAL COMMUNICATION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 119 EUROPE: INDUSTRIAL COMMUNICATION MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 120 EUROPE: INDUSTRIAL COMMUNICATION MARKET, BY INDUSTRY 2025-2030 (USD MILLION)

- TABLE 121 UK: INDUSTRIAL COMMUNICATION MARKET, BY COMMUNICATION PROTOCOL, 2021-2024 (USD MILLION)

- TABLE 122 UK: INDUSTRIAL COMMUNICATION MARKET, BY COMMUNICATION PROTOCOL, 2025-2030 (USD MILLION)

- TABLE 123 GERMANY: INDUSTRIAL COMMUNICATION MARKET, BY COMMUNICATION PROTOCOL, 2021-2024 (USD MILLION)

- TABLE 124 GERMANY: INDUSTRIAL COMMUNICATION MARKET, BY COMMUNICATION PROTOCOL, 2025-2030 (USD MILLION)

- TABLE 125 FRANCE: INDUSTRIAL COMMUNICATION MARKET, BY COMMUNICATION PROTOCOL, 2021-2024 (USD MILLION)

- TABLE 126 FRANCE: INDUSTRIAL COMMUNICATION MARKET, BY COMMUNICATION PROTOCOL, 2025-2030 (USD MILLION)

- TABLE 127 SPAIN: INDUSTRIAL COMMUNICATION MARKET, BY COMMUNICATION PROTOCOL, 2021-2024 (USD MILLION)

- TABLE 128 SPAIN: INDUSTRIAL COMMUNICATION MARKET, BY COMMUNICATION PROTOCOL, 2025-2030 (USD MILLION)

- TABLE 129 ITALY: INDUSTRIAL COMMUNICATION MARKET, BY COMMUNICATION PROTOCOL, 2021-2024 (USD MILLION)

- TABLE 130 ITALY: INDUSTRIAL COMMUNICATION MARKET, BY COMMUNICATION PROTOCOL, 2025-2030 (USD MILLION)

- TABLE 131 POLAND: INDUSTRIAL COMMUNICATION MARKET, BY COMMUNICATION PROTOCOL, 2021-2024 (USD MILLION)

- TABLE 132 POLAND: INDUSTRIAL COMMUNICATION MARKET, BY COMMUNICATION PROTOCOL, 2025-2030 (USD MILLION)

- TABLE 133 NORDICS: INDUSTRIAL COMMUNICATION MARKET, BY COMMUNICATION PROTOCOL, 2021-2024 (USD MILLION)

- TABLE 134 NORDICS: INDUSTRIAL COMMUNICATION MARKET, BY COMMUNICATION PROTOCOL, 2025-2030 (USD MILLION)

- TABLE 135 REST OF EUROPE: INDUSTRIAL COMMUNICATION MARKET, BY COMMUNICATION PROTOCOL, 2021-2024 (USD MILLION)

- TABLE 136 REST OF EUROPE: INDUSTRIAL COMMUNICATION MARKET, BY COMMUNICATION PROTOCOL, 2025-2030 (USD MILLION)

- TABLE 137 ASIA PACIFIC: INDUSTRIAL COMMUNICATION MARKET, BY COMMUNICATION PROTOCOL, 2021-2024 (USD MILLION)

- TABLE 138 ASIA PACIFIC: INDUSTRIAL COMMUNICATION MARKET, BY COMMUNICATION PROTOCOL, 2025-2030 (USD MILLION)

- TABLE 139 ASIA PACIFIC: INDUSTRIAL COMMUNICATION MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 140 ASIA PACIFIC: INDUSTRIAL COMMUNICATION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 141 ASIA PACIFIC: INDUSTRIAL COMMUNICATION MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 142 ASIA PACIFIC: INDUSTRIAL COMMUNICATION MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 143 CHINA: INDUSTRIAL COMMUNICATION MARKET, BY COMMUNICATION PROTOCOL, 2021-2024 (USD MILLION)

- TABLE 144 CHINA: INDUSTRIAL COMMUNICATION MARKET, BY COMMUNICATION PROTOCOL, 2025-2030 (USD MILLION)

- TABLE 145 JAPAN: INDUSTRIAL COMMUNICATION MARKET, BY COMMUNICATION PROTOCOL, 2021-2024 (USD MILLION)

- TABLE 146 JAPAN: INDUSTRIAL COMMUNICATION MARKET, BY COMMUNICATION PROTOCOL, 2025-2030 (USD MILLION)

- TABLE 147 INDIA: INDUSTRIAL COMMUNICATION MARKET, BY COMMUNICATION PROTOCOL, 2021-2024 (USD MILLION)

- TABLE 148 INDIA: INDUSTRIAL COMMUNICATION MARKET, BY COMMUNICATION PROTOCOL, 2025-2030 (USD MILLION)

- TABLE 149 SOUTH KOREA: INDUSTRIAL COMMUNICATION MARKET, BY COMMUNICATION PROTOCOL, 2021-2024 (USD MILLION)

- TABLE 150 SOUTH KOREA: INDUSTRIAL COMMUNICATION MARKET, BY COMMUNICATION PROTOCOL, 2025-2030 (USD MILLION)

- TABLE 151 AUSTRALIA: INDUSTRIAL COMMUNICATION MARKET, BY COMMUNICATION PROTOCOL, 2021-2024 (USD MILLION)

- TABLE 152 AUSTRALIA: INDUSTRIAL COMMUNICATION MARKET, BY COMMUNICATION PROTOCOL, 2025-2030 (USD MILLION)

- TABLE 153 INDONESIA: INDUSTRIAL COMMUNICATION MARKET, BY COMMUNICATION PROTOCOL, 2021-2024 (USD MILLION)

- TABLE 154 INDONESIA: INDUSTRIAL COMMUNICATION MARKET, BY COMMUNICATION PROTOCOL, 2025-2030 (USD MILLION)

- TABLE 155 MALAYSIA: INDUSTRIAL COMMUNICATION MARKET, BY COMMUNICATION PROTOCOL, 2021-2024 (USD MILLION)

- TABLE 156 MALAYSIA: INDUSTRIAL COMMUNICATION MARKET, BY COMMUNICATION PROTOCOL, 2025-2030 (USD MILLION)

- TABLE 157 THAILAND: INDUSTRIAL COMMUNICATION MARKET, BY COMMUNICATION PROTOCOL, 2021-2024 (USD MILLION)

- TABLE 158 THAILAND: INDUSTRIAL COMMUNICATION MARKET, BY COMMUNICATION PROTOCOL, 2025-2030 (USD MILLION)

- TABLE 159 VIETNAM: INDUSTRIAL COMMUNICATION MARKET, BY COMMUNICATION PROTOCOL, 2021-2024 (USD MILLION)

- TABLE 160 VIETNAM: INDUSTRIAL COMMUNICATION MARKET, BY COMMUNICATION PROTOCOL, 2025-2030 (USD MILLION)

- TABLE 161 REST OF ASIA PACIFIC: INDUSTRIAL COMMUNICATION MARKET, BY COMMUNICATION PROTOCOL, 2021-2024 (USD MILLION)

- TABLE 162 REST OF ASIA PACIFIC: INDUSTRIAL COMMUNICATION MARKET, BY COMMUNICATION PROTOCOL, 2025-2030 (USD MILLION)

- TABLE 163 ROW: INDUSTRIAL COMMUNICATION MARKET, BY COMMUNICATION PROTOCOL, 2021-2024 (USD MILLION)

- TABLE 164 ROW: INDUSTRIAL COMMUNICATION MARKET, BY COMMUNICATION PROTOCOL, 2025-2030 (USD MILLION)

- TABLE 165 ROW: INDUSTRIAL COMMUNICATION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 166 ROW: INDUSTRIAL COMMUNICATION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 167 ROW: INDUSTRIAL COMMUNICATION MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 168 ROW: INDUSTRIAL COMMUNICATION MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 169 MIDDLE EAST: INDUSTRIAL COMMUNICATION MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 170 MIDDLE EAST: INDUSTRIAL COMMUNICATION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 171 AFRICA: INDUSTRIAL COMMUNICATION MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 172 AFRICA: INDUSTRIAL COMMUNICATION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 173 INDUSTRIAL COMMUNICATION MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, JANUARY 2021-APRIL 2025

- TABLE 174 INDUSTRIAL COMMUNICATION MARKET: DEGREE OF COMPETITION, 2024

- TABLE 175 INDUSTRIAL COMMUNICATION MARKET: REGION FOOTPRINT

- TABLE 176 INDUSTRIAL COMMUNICATION MARKET: COMMUNICATION PROTOCOL FOOTPRINT

- TABLE 177 INDUSTRIAL COMMUNICATION MARKET: OFFERING FOOTPRINT

- TABLE 178 INDUSTRIAL COMMUNICATION MARKET: INDUSTRY FOOTPRINT

- TABLE 179 INDUSTRIAL COMMUNICATION MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 180 INDUSTRIAL COMMUNICATION MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 181 INDUSTRIAL COMMUNICATION MARKET: PRODUCT LAUNCHES/DEVELOPMENTS, JANUARY 2021-APRIL 2025

- TABLE 182 INDUSTRIAL COMMUNICATION MARKET: DEALS, JANUARY 2021-APRIL 2025

- TABLE 183 INDUSTRIAL COMMUNICATION MARKET: EXPANSIONS, JANUARY 2021-APRIL 2025

- TABLE 184 INDUSTRIAL COMMUNICATION MARKET: OTHER DEVELOPMENTS, JANUARY 2021-APRIL 2025

- TABLE 185 CISCO SYSTEMS, INC.: COMPANY OVERVIEW

- TABLE 186 CISCO SYSTEMS, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 187 CISCO SYSTEMS, INC.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 188 CISCO SYSTEMS, INC.: DEALS

- TABLE 189 SIEMENS: COMPANY OVERVIEW

- TABLE 190 SIEMENS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 191 SIEMENS: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 192 SIEMENS: DEALS

- TABLE 193 ROCKWELL AUTOMATION: COMPANY OVERVIEW

- TABLE 194 ROCKWELL AUTOMATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 195 ROCKWELL AUTOMATION: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 196 ROCKWELL AUTOMATION: DEALS

- TABLE 197 ROCKWELL AUTOMATION: EXPANSIONS

- TABLE 198 ROCKWELL AUTOMATION: OTHER DEVELOPMENTS

- TABLE 199 OMRON CORPORATION: COMPANY OVERVIEW

- TABLE 200 OMRON CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 201 OMRON CORPORATION: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 202 OMRON CORPORATION: DEALS

- TABLE 203 HUAWEI TECHNOLOGIES CO., LTD.: COMPANY OVERVIEW

- TABLE 204 HUAWEI TECHNOLOGIES CO., LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 205 HUAWEI TECHNOLOGIES CO., LTD.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 206 HUAWEI TECHNOLOGIES CO., LTD.: DEALS

- TABLE 207 HUAWEI TECHNOLOGIES CO., LTD.: OTHER DEVELOPMENTS

- TABLE 208 MOXA INC.: COMPANY OVERVIEW

- TABLE 209 MOXA INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 210 MOXA INC.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 211 MOXA INC.: DEALS

- TABLE 212 MOXA INC.: OTHER DEVELOPMENTS

- TABLE 213 SICK AG: COMPANY OVERVIEW

- TABLE 214 SICK AG: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 215 SICK AG: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 216 SICK AG: DEALS

- TABLE 217 SICK AG: EXPANSIONS

- TABLE 218 SCHNEIDER ELECTRIC: COMPANY OVERVIEW

- TABLE 219 SCHNEIDER ELECTRIC: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 220 SCHNEIDER ELECTRIC: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 221 SCHNEIDER ELECTRIC: DEALS

- TABLE 222 SCHNEIDER ELECTRIC: EXPANSIONS

- TABLE 223 ABB: COMPANY OVERVIEW

- TABLE 224 ABB: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 225 ABB: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 226 ABB: DEALS

- TABLE 227 ABB: EXPANSIONS

- TABLE 228 ABB: OTHER DEVELOPMENTS

- TABLE 229 BELDEN INC.: COMPANY OVERVIEW

- TABLE 230 BELDEN INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 231 BELDEN INC.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 232 BELDEN INC.: DEALS

- TABLE 233 BELDEN INC.: EXPANSIONS

List of Figures

- FIGURE 1 INDUSTRIAL COMMUNICATION MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 INDUSTRIAL COMMUNICATION MARKET: RESEARCH DESIGN

- FIGURE 3 INDUSTRIAL COMMUNICATION MARKET: RESEARCH APPROACH

- FIGURE 4 KEY DATA FROM SECONDARY SOURCES

- FIGURE 5 KEY INDUSTRY INSIGHTS

- FIGURE 6 BREAKDOWN OF PRIMARIES

- FIGURE 7 INDUSTRIAL COMMUNICATION MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE)

- FIGURE 8 INDUSTRIAL COMMUNICATION MARKET SIZE ESTIMATION METHODOLOGY (DEMAND SIDE)

- FIGURE 9 INDUSTRIAL COMMUNICATION MARKET: BOTTOM-UP APPROACH

- FIGURE 10 INDUSTRIAL COMMUNICATION MARKET: TOP-DOWN APPROACH

- FIGURE 11 INDUSTRIAL COMMUNICATION MARKET: DATA TRIANGULATION

- FIGURE 12 INDUSTRIAL COMMUNICATION MARKET: RESEARCH ASSUMPTIONS

- FIGURE 13 INDUSTRIAL COMMUNICATION MARKET: RESEARCH LIMITATIONS

- FIGURE 14 INDUSTRIAL COMMUNICATION MARKET SIZE, 2021-2030

- FIGURE 15 PHARMACEUTICALS & MEDICAL DEVICES SEGMENT TO EXHIBIT HIGHEST CAGR BETWEEN 2025 AND 2030

- FIGURE 16 INDUSTRIAL ETHERNET SEGMENT TO DOMINATE INDUSTRIAL COMMUNICATION MARKET DURING FORECAST PERIOD

- FIGURE 17 COMPONENTS SEGMENT TO HOLD LARGEST SHARE OF INDUSTRIAL COMMUNICATION MARKET IN 2025

- FIGURE 18 ASIA PACIFIC TO RECORD HIGHEST CAGR IN INDUSTRIAL COMMUNICATION MARKET FROM 2025 TO 2030

- FIGURE 19 MOUNTING ADOPTION OF INDUSTRY 4.0 INITIATIVES TO CONTRIBUTE TO MARKET GROWTH

- FIGURE 20 SERVICES SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2030

- FIGURE 21 INDUSTRIAL ETHERNET SEGMENT TO DOMINATE MARKET BETWEEN 2025 AND 2030

- FIGURE 22 AUTOMOTIVE SEGMENT TO HOLD LARGEST MARKET SHARE IN 2030

- FIGURE 23 ASIA PACIFIC TO HOLD LARGEST SHARE OF INDUSTRIAL COMMUNICATION MARKET IN 2030

- FIGURE 24 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 25 IMPACT ANALYSIS OF DRIVERS

- FIGURE 26 ANNUAL INSTALLATION OF INDUSTRIAL ROBOTS, BY INDUSTRY, 2023

- FIGURE 27 IMPACT ANALYSIS OF RESTRAINTS

- FIGURE 28 IMPACT ANALYSIS OF OPPORTUNITIES

- FIGURE 29 IMPACT ANALYSIS OF CHALLENGES

- FIGURE 30 VALUE CHAIN ANALYSIS

- FIGURE 31 AVERAGE SELLING PRICE OF INDUSTRIAL COMMUNICATION SOLUTIONS OFFERED BY KEY PLAYERS, BY COMPONENT TYPE, 2024

- FIGURE 32 AVERAGE SELLING PRICE TREND OF GATEWAYS, BY REGION, 2020-2024

- FIGURE 33 AVERAGE SELLING PRICE TREND OF SWITCHES, BY REGION, 2020-2024

- FIGURE 34 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 35 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE INDUSTRIES

- FIGURE 36 KEY BUYING CRITERIA FOR TOP THREE INDUSTRIES

- FIGURE 37 PATENTS APPLIED AND GRANTED, 2015-2024

- FIGURE 38 IMPORT DATA FOR HS CODE 853690-COMPLIANT PRODUCTS FOR TOP FIVE COUNTRIES, 2020-2024

- FIGURE 39 EXPORT DATA FOR HS CODE 853690-COMPLIANT PRODUCTS FOR TOP FIVE COUNTRIES, 2020-2024

- FIGURE 40 INVESTMENT AND FUNDING SCENARIO, 2020-2024

- FIGURE 41 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 42 INDUSTRIAL COMMUNICATION ECOSYSTEM

- FIGURE 43 IMPACT OF AI/GEN AI ON INDUSTRIAL COMMUNICATION MARKET

- FIGURE 44 COMPONENTS SEGMENT TO ACCOUNT FOR LARGEST SHARE OF INDUSTRIAL COMMUNICATION MARKET IN 2025

- FIGURE 45 INDUSTRIAL ETHERNET SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 46 AUTOMOTIVE SEGMENT TO DOMINATE INDUSTRIAL COMMUNICATION MARKET BETWEEN 2025 AND 2030

- FIGURE 47 ASIA PACIFIC TO RECORD HIGHEST CAGR IN INDUSTRIAL COMMUNICATION MARKET BETWEEN 2025 AND 2030

- FIGURE 48 INDIA TO EXHIBIT HIGHEST CAGR IN GLOBAL INDUSTRIAL COMMUNICATION MARKET DURING FORECAST PERIOD

- FIGURE 49 NORTH AMERICA: INDUSTRIAL COMMUNICATION MARKET SNAPSHOT

- FIGURE 50 EUROPE: INDUSTRIAL COMMUNICATION MARKET SNAPSHOT

- FIGURE 51 ASIA PACIFIC: INDUSTRIAL COMMUNICATION MARKET SNAPSHOT

- FIGURE 52 ROW: INDUSTRIAL COMMUNICATION MARKET SNAPSHOT

- FIGURE 53 MARKET SHARE ANALYSIS OF COMPANIES OFFERING INDUSTRIAL COMMUNICATION SOLUTIONS, 2024

- FIGURE 54 INDUSTRIAL COMMUNICATION MARKET: REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2020-2024

- FIGURE 55 COMPANY VALUATION

- FIGURE 56 FINANCIAL METRICS

- FIGURE 57 TECHNOLOGY COMPARISON

- FIGURE 58 INDUSTRIAL COMMUNICATION MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 59 INDUSTRIAL COMMUNICATION MARKET: COMPANY FOOTPRINT

- FIGURE 60 INDUSTRIAL COMMUNICATION MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 61 CISCO SYSTEMS, INC.: COMPANY SNAPSHOT

- FIGURE 62 SIEMENS: COMPANY SNAPSHOT

- FIGURE 63 ROCKWELL AUTOMATION: COMPANY SNAPSHOT

- FIGURE 64 OMRON CORPORATION: COMPANY SNAPSHOT

- FIGURE 65 HUAWEI TECHNOLOGIES CO., LTD.: COMPANY SNAPSHOT

- FIGURE 66 SICK AG: COMPANY SNAPSHOT

- FIGURE 67 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

- FIGURE 68 ABB: COMPANY SNAPSHOT

- FIGURE 69 BELDEN INC.: COMPANY SNAPSHOT

The global industrial communication market is anticipated to grow from USD 20.45 billion in 2025 to USD 26.06 billion by 2030 at a CAGR of 5.0% between 2025 and 2030. This growth is driven by the increasing financial incentives to integrate SCADA and PLCs in manufacturing sectors, the integration of smart grid technologies in the energy sector, the convergence of digital twin technology and industrial AI, and the rising demand for machine-to-machine communication to optimize industrial efficiency and automation technologies.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) |

| Segments | By Offering, By Communication Protocol, By Vertical, By Geography |

| Regions covered | North America, Europe, APAC, RoW |

"PROFINET segment is expected to dominate the market for industrial Ethernet during the forecast period."

The PROFINET segment is likely to dominate the industrial Ethernet market between 2025 and 2030 due to its high scalability, real-time performance, and widespread support by top automation suppliers, particularly in Europe. Designed to handle standard and time-critical industrial applications, this technology delivers seamless integration with current installations, making it ideal for numerous disparate industrial environments, ranging from factory automation to process control. Its support for high-speed data exchange, deterministic communications, and open network topologies makes it competitive against other protocols. Moreover, its acceptance across the board by industry leaders and compatibility with a vast array of devices further confirm its status as the go-to industrial Ethernet option.

"WLAN segment is projected to witness the highest CAGR in the wireless industrial communication market from 2025 to 2030."

The WLAN segment is likely to grow at the fastest rate in the wireless industrial communication market, driven by the growing demand for wireless, flexible, and scalable connections in smart manufacturing. As businesses use distributed wireless devices, automated guided vehicles (AGVs), and remote monitoring systems, WLAN makes wireless communication possible without the confines of wired infrastructure. Its ability to support real-time data sharing, speedy deployment, and high device density makes it ideal for dynamic, space-limited industrial settings. The use of private wireless networks and Wi-Fi 6 enhances performance, reliability, and security, which is driving WLAN use in a wide range of industrial use cases.

"India is expected to exhibit the highest CAGR in the global industrial communication market during forecast period."

India is poised to record the highest CAGR in the global industrial communication market during the forecast period owing to the accelerating industrialization, robust government drives such as Make in India and Digital India, and increasing automation adoption in industry verticals, such as manufacturing, energy, and transportation. The expanding industry base, investments in smart factories, and the increasing demand for secure communications infrastructure to enable IIoT and Industry 4.0 are key growth drivers. In addition, favorable policies, advancements in digital infrastructure, and the emergence of regional technology vendors boost the adoption of industrial communication solutions in the region.

Extensive primary interviews were conducted with key industry experts in the industrial communication market space to determine and verify the market size for various segments and subsegments gathered through secondary research. The breakdown of primary participants for the report has been shown below: The study contains insights from various industry experts, from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type: Tier 1 - 30%, Tier 2 - 50%, and Tier 3 - 20%

- By Designation: C-level Executives - 10%, Directors - 30%, and Others - 60%

- By Region: North America - 25%, Europe - 25%, Asia Pacific - 40%, and RoW - 10%

Cisco Systems, Inc. (US), Siemens (Germany), OMRON Corporation (Japan), Huawei Technologies Co., Ltd. (China), Rockwell Automation (US), Moxa Inc. (Taiwan), Belden Inc. (US), and ABB (Switzerland) are some key players in the industrial communication market.

Research Coverage: This research report categorizes the industrial communication market based on offering (components, software, services), communication protocol (fieldbus, industrial Ethernet, wireless, IO-link), industry [automotive, electrical & electronics, aerospace & defense, oil & gas, chemicals & fertilizers, food & beverages, pharmaceuticals & medical devices, energy & power, metals & mining, engineering & fabrication, water & wastewater management, and other industries (paper & pulp, glass, cement)], and region (North America, Asia Pacific, Europe, and RoW). The report describes the major drivers, restraints, challenges, and opportunities pertaining to the industrial communication market and forecasts the same till 2030. Apart from this, the report also consists of leadership mapping and analysis of all the companies included in the industrial communication ecosystem.

Key Benefits of Buying the Report The report will help the market leaders/new entrants in this market by providing information on the closest approximations of the revenue numbers for the overall industrial communication market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities. The report provides insights on the following pointers:

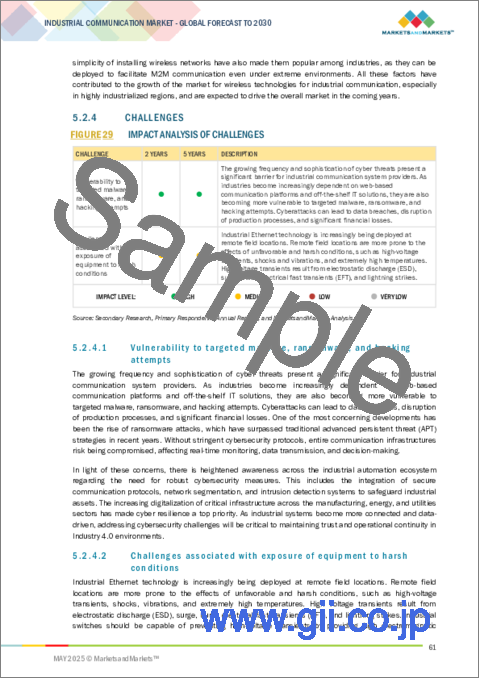

- Analysis of key drivers (Surging adoption of Industry 4.0; Convergence of industrial AI and digital twin technology; Integration of smart grid technologies in energy sector; Rising preference for machine-to-machine communication to optimize industrial efficiency and automation technologies; Implementation of incentive program to integrate PLCs and SCADA into manufacturing sectors; Deployment of 5G technology in automotive, construction, and manufacturing sectors) restraints (Lack of standardization in industrial communication protocols and interfaces), opportunities (Enhanced smart manufacturing and digital transformation with evolution of 5G technology; Accelerating adoption of wireless networks across industrial sectors), and challenges (Vulnerability to targeted malware, ransomware, and hacking attempts; Challenges associated with exposure of equipment to harsh conditions) influencing the growth of the industrial communication market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the industrial communication market

- Market Development: Comprehensive information about lucrative markets - the report analyzes the industrial communication market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the industrial communication market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players, such Cisco Systems, Inc. (US), Siemens (Germany), OMRON Corporation (Japan), Huawei Technologies Co., Ltd. (China), Rockwell Automation (US), Moxa Inc. (Taiwan), Belden Inc. (US), and ABB (Switzerland), in the industrial communication market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY AND PRIMARY RESEARCH

- 2.1.2 SECONDARY DATA

- 2.1.2.1 List of key secondary sources

- 2.1.2.2 Key data from secondary sources

- 2.1.3 PRIMARY DATA

- 2.1.3.1 List of primary interview participants

- 2.1.3.2 Key industry insights

- 2.1.3.3 Breakdown of primaries

- 2.1.3.4 Key data from primary sources

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to arrive at market size using bottom-up analysis (demand side)

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to arrive at market size using top-down analysis (supply side)

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

- 2.6 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN INDUSTRIAL COMMUNICATION MARKET

- 4.2 INDUSTRIAL COMMUNICATION MARKET, BY OFFERING

- 4.3 INDUSTRIAL COMMUNICATION MARKET, BY COMMUNICATION PROTOCOL

- 4.4 INDUSTRIAL COMMUNICATION MARKET, BY INDUSTRY

- 4.5 INDUSTRIAL COMMUNICATION MARKET, BY REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Surging adoption of Industry 4.0

- 5.2.1.2 Convergence of industrial AI and digital twin technologies

- 5.2.1.3 Deployment of smart grid technologies in energy sector

- 5.2.1.4 Rising preference for machine-to-machine communication to optimize industrial efficiency and automation

- 5.2.1.5 Implementation of incentive programs to integrate PLCs and SCADA into manufacturing sectors

- 5.2.1.6 Deployment of 5G technology in automotive, construction, and manufacturing sectors

- 5.2.2 RESTRAINTS

- 5.2.2.1 Lack of standardization in industrial communication protocols and interfaces

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Enhanced smart manufacturing and digital transformation with evolution of 5G technology

- 5.2.3.2 Accelerating adoption of wireless networks across industrial sectors

- 5.2.4 CHALLENGES

- 5.2.4.1 Vulnerability to targeted malware, ransomware, and hacking attempts

- 5.2.4.2 Challenges associated with exposure of equipment to harsh conditions

- 5.2.1 DRIVERS

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE OF INDUSTRIAL COMMUNICATION SOLUTIONS OFFERED BY KEY PLAYERS, BY COMPONENT TYPE, 2024

- 5.4.2 AVERAGE SELLING PRICE TREND OF GATEWAYS AND SWITCHES, BY REGION, 2020-2024

- 5.5 PORTER'S FIVE FORCES ANALYSIS

- 5.5.1 THREAT OF NEW ENTRANTS

- 5.5.2 THREAT OF SUBSTITUTES

- 5.5.3 BARGAINING POWER OF BUYERS

- 5.5.4 BARGAINING POWER OF SUPPLIERS

- 5.5.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.6 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.6.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.6.2 BUYING CRITERIA

- 5.7 PATENT ANALYSIS

- 5.8 TRADE ANALYSIS

- 5.8.1 IMPORT SCENARIO (HS CODE 853690)

- 5.8.2 EXPORT SCENARIO (HS CODE 853690)

- 5.9 INVESTMENT AND FUNDING SCENARIO

- 5.10 TECHNOLOGY ANALYSIS

- 5.10.1 KEY TECHNOLOGIES

- 5.10.1.1 Time-sensitive networking

- 5.10.1.2 Open platform communication unified architecture

- 5.10.2 COMPLEMENTARY TECHNOLOGIES

- 5.10.2.1 Power over Ethernet

- 5.10.3 ADJACENT TECHNOLOGIES

- 5.10.3.1 Industrial Internet of Things (IIoT)

- 5.10.3.2 Edge computing

- 5.10.3.3 Digital twin

- 5.10.1 KEY TECHNOLOGIES

- 5.11 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.12 ECOSYSTEM ANALYSIS

- 5.13 CASE STUDY ANALYSIS

- 5.13.1 MOXA HELPED PEA STANDARDIZE AND SIMPLIFY INFRASTRUCTURE USING MOXA IEC 61850 PRP/HSR

- 5.13.2 FALORIA IMPLEMENTED CISCO ULTRA-RELIABLE WIRELESS BACKHAUL SOLUTION AND SECURITYTRUST'S CABLE CAR 4.0 SYSTEM FOR ROBUST AND SECURE COMMUNICATION

- 5.13.3 AUTOMOTIVE INSPECTION CENTER LEVERAGED ADVANTECH'S WISE-PAAS END-TO-CLOUD IOT TOTAL SOLUTION FOR REMOTE VIDEO SURVEILLANCE AND DEVICE STATUS MONITORING

- 5.13.4 OPTIMA CONTROL SOLUTIONS DEPLOYED ROCKWELL AUTOMATION'S ALLEN-BRADLEY CONTROLLOGIX AND SCADA SYSTEMS TO IMPROVE OPERATIONAL EFFICIENCY AND SYSTEM RELIABILITY

- 5.14 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.15 TARIFF AND REGULATORY LANDSCAPE

- 5.15.1 TARIFF ANALYSIS

- 5.15.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.15.3 REGULATIONS

- 5.16 IMPACT OF AI/GEN AI ON INDUSTRIAL COMMUNICATION MARKET

- 5.17 IMPACT OF 2025 US TARIFF ON INDUSTRIAL COMMUNICATION MARKET

- 5.17.1 INTRODUCTION

- 5.17.2 KEY TARIFF RATES

- 5.17.3 PRICE IMPACT ANALYSIS

- 5.17.4 IMPACT ON COUNTRY/REGION

- 5.17.4.1 US

- 5.17.4.2 Europe

- 5.17.4.3 Asia Pacific

- 5.17.4.3.1 China

- 5.17.4.3.2 Japan

- 5.17.4.3.3 South Korea and Taiwan

- 5.17.5 IMPACT ON INDUSTRIES

6 INDUSTRIAL COMMUNICATION APPLICATIONS

- 6.1 INTRODUCTION

- 6.2 PROCESS CONTROL

- 6.3 MACHINE-TO-MACHINE (M2M) COMMUNICATION

- 6.4 REMOTE MONITORING

- 6.5 ENERGY MANAGEMENT

- 6.6 ASSET TRACKING & CONDITION MONITORING

7 INDUSTRIAL COMMUNICATION MARKET, BY OFFERING

- 7.1 INTRODUCTION

- 7.2 COMPONENTS

- 7.2.1 SWITCHES

- 7.2.1.1 Rising deployment in process and discrete automation industries to fuel segmental growth

- 7.2.2 GATEWAYS

- 7.2.2.1 Increasing need for reliable and low-latency connectivity in Industry 4.0 applications to augment segmental growth

- 7.2.3 ROUTERS & WAP

- 7.2.3.1 Rising integration of 5G technology into routers to contribute to segmental growth

- 7.2.4 CONTROLLERS & CONNECTORS

- 7.2.4.1 Growing focus on determining task priorities and handling interruptions efficiently to spur demand

- 7.2.5 COMMUNICATION INTERFACES & CONVERTERS

- 7.2.5.1 Increasing need to facilitate data exchange between different network devices to foster segmental growth

- 7.2.6 POWER SUPPLY DEVICES

- 7.2.6.1 Growing emphasis on smooth operation of industrial communication systems to boost segmental growth

- 7.2.7 OTHER COMPONENTS

- 7.2.1 SWITCHES

- 7.3 SOFTWARE

- 7.3.1 ABILITY TO STREAMLINE CONFIGURATION, OPERATION, AND MAINTENANCE OF COMPLEX NETWORK ENVIRONMENTS TO DRIVE MARKET

- 7.4 SERVICES

- 7.4.1 RISE IN IIOT INTEGRATION TO CONTRIBUTE TO SEGMENTAL GROWTH

8 INDUSTRIAL COMMUNICATION MARKET, BY COMMUNICATION PROTOCOL

- 8.1 INTRODUCTION

- 8.2 FIELDBUS

- 8.2.1 PROFIBUS

- 8.2.1.1 Continuous updates and compatibility with different automation systems to boost segmental growth

- 8.2.2 MODBUS

- 8.2.2.1 Simplicity and adaptability in legacy and modern automation systems to augment segmental growth

- 8.2.3 CC-LINK

- 8.2.3.1 Ability to support high-speed communication in factory and process automation applications to spur demand

- 8.2.4 DEVICENET

- 8.2.4.1 Emergence as low-cost and sturdy communication protocol to contribute to segmental growth

- 8.2.5 CANOPEN

- 8.2.5.1 Precise real-time data exchange and flexible configuration to foster segmental growth

- 8.2.6 OTHER FIELDBUS PROTOCOLS

- 8.2.1 PROFIBUS

- 8.3 INDUSTRIAL ETHERNET

- 8.3.1 PROFINET

- 8.3.1.1 High-speed cyclic data exchange and precise synchronization attributes to accelerate segmental growth

- 8.3.2 ETHERNET/IP

- 8.3.2.1 Broad deployment in hybrid, process, and discrete manufacturing sectors to fuel segmental growth

- 8.3.3 ETHERCAT

- 8.3.3.1 Real-time synchronization and high-speed control performance to boost segmental growth

- 8.3.4 MODBUS-TCP

- 8.3.4.1 Seamless interoperability and ease of integration to augment segmental growth

- 8.3.5 POWERLINK

- 8.3.5.1 Reliable and synchronized data exchange to contribute to segmental growth

- 8.3.6 SERCOS III

- 8.3.6.1 Requirement for ultra-low latency, precise synchronization, and high reliability in industries to drive market

- 8.3.7 CC-LINK IE

- 8.3.7.1 Seamless integration of I/O control, motion control, and safety systems over a single high-speed network to spur demand

- 8.3.8 OTHER INDUSTRIAL ETHERNET PROTOCOLS

- 8.3.1 PROFINET

- 8.4 WIRELESS

- 8.4.1 WLAN

- 8.4.1.1 Increasing focus on wide-area and high-speed industrial communication to offer lucrative opportunities

- 8.4.2 BLUETOOTH

- 8.4.2.1 Burgeoning demand for low-power, short-range communication to fuel segmental growth

- 8.4.3 ISA100.11A

- 8.4.3.1 Rising deployment to enhance reliable wireless communication in process industries to foster segmental growth

- 8.4.4 CELLULAR

- 8.4.4.1 High preference for cellular networks in long-distance IIoT applications to fuel segmental growth

- 8.4.5 ZIGBEE

- 8.4.5.1 Growing adoption to support low-power industrial wireless communication to bolster segmental growth

- 8.4.6 WHART

- 8.4.6.1 Ease of integration and compatibility with traditional HART devices to accelerate segmental growth

- 8.4.7 OTHER WIRELESS PROTOCOLS

- 8.4.1 WLAN

- 8.5 IO-LINK

- 8.5.1 INCREASING DEMAND FOR INTELLIGENT AND DECENTRALIZED FACTORY AUTOMATION TO DRIVE MARKET

9 INDUSTRIAL COMMUNICATION MARKET, BY INDUSTRY

- 9.1 INTRODUCTION

- 9.2 AUTOMOTIVE

- 9.2.1 SURGING ADOPTION OF AUTOMATION AND CONNECTIVITY TECHNOLOGIES TO FACILITATE SEGMENTAL GROWTH

- 9.3 ELECTRICAL & ELECTRONICS

- 9.3.1 GROWING FOCUS ON REDUCING DOWNTIME AND IMPROVING PROCESS VISIBILITY TO DRIVE MARKET

- 9.4 AEROSPACE & DEFENSE

- 9.4.1 RISING NEED FOR PRECISION ENGINEERING AND HIGH-PERFORMANCE MATERIALS TO BOLSTER SEGMENTAL GROWTH

- 9.5 OIL & GAS

- 9.5.1 INCREASING RELIANCE ON ADVANCED TECHNOLOGIES FOR REAL-TIME MONITORING TO FUEL SEGMENTAL GROWTH

- 9.6 CHEMICALS & FERTILIZERS

- 9.6.1 GROWING EMPHASIS ON PRECISE CONTROL AND CONTINUOUS OPERATIONS OF COMPLEX, MULTI-STAGE PROCESSES TO SPUR DEMAND

- 9.7 FOOD & BEVERAGES

- 9.7.1 INCREASING NEED TO MAINTAIN STRICT REGULATORY COMPLIANCE TO CONTRIBUTE TO SEGMENTAL GROWTH

- 9.8 PHARMACEUTICALS & MEDICAL DEVICES

- 9.8.1 GROWING FOCUS ON HIGH-INTEGRITY DATA EXCHANGE ACROSS VARIOUS SYSTEMS TO BOOST SEGMENTAL GROWTH

- 9.9 ENERGY & POWER

- 9.9.1 RISING INTEGRATION OF RENEWABLE ENERGY INTO ELECTRICAL GRID TO FOSTER SEGMENTAL GROWTH

- 9.10 METALS & MINING

- 9.10.1 GROWING IMPORTANCE OF CONTINUOUS MONITORING AND PROCESS CONTROL TO AUGMENT SEGMENTAL GROWTH

- 9.11 ENGINEERING & FABRICATION

- 9.11.1 RISING NEED FOR REAL-TIME SYNCHRONIZATION OF MULTI-AXIS OPERATIONS TO FOSTER SEGMENTAL GROWTH

- 9.12 WATER & WASTEWATER MANAGEMENT

- 9.12.1 INCREASING DEPLOYMENT OF LOW-COST, LOW-POWER SENSORS AND EDGE-COMPUTING DEVICES TO FUEL SEGMENTAL GROWTH

- 9.13 OTHER INDUSTRIES

10 INDUSTRIAL COMMUNICATION MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 10.2.2 US

- 10.2.2.1 High concentration of large-scale industries to contribute to market growth

- 10.2.3 CANADA

- 10.2.3.1 Rising deployment of automated manufacturing technologies to drive market

- 10.2.4 MEXICO

- 10.2.4.1 Mounting investment in local manufacturing facilities to bolster market growth

- 10.3 EUROPE

- 10.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 10.3.2 UK

- 10.3.2.1 Increasing reliance on automation technologies to improve productivity and operational efficiency to drive market

- 10.3.3 GERMANY

- 10.3.3.1 Rapid innovation of automobile technologies to boost market growth

- 10.3.4 FRANCE

- 10.3.4.1 Rising implementation of smart factory initiatives to augment market growth

- 10.3.5 SPAIN

- 10.3.5.1 Thriving automotive, consumer electronics, and pharmaceutical industries to contribute to market growth

- 10.3.6 ITALY

- 10.3.6.1 Increasing adoption of Industry 4.0 practices by automobile manufacturers to fuel market growth

- 10.3.7 POLAND

- 10.3.7.1 Rapid industrial automation through digital technology and foreign direct investments to bolster market growth

- 10.3.8 NORDICS

- 10.3.8.1 Mounting adoption of smart grid technologies to accelerate market growth

- 10.3.9 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 10.4.2 CHINA

- 10.4.2.1 Increasing deployment of Industry 4.0 technologies to fuel market growth

- 10.4.3 JAPAN

- 10.4.3.1 Government initiatives to promote digital transformation to provide lucrative growth opportunities

- 10.4.4 INDIA

- 10.4.4.1 Large-scale industrial development and high internet penetration to drive market

- 10.4.5 SOUTH KOREA

- 10.4.5.1 Increasing production of electronic goods and semiconductors to accelerate market growth

- 10.4.6 AUSTRALIA

- 10.4.6.1 Growing emphasis on automation and digital transformation to augment market growth

- 10.4.7 INDONESIA

- 10.4.7.1 Rising adoption of Industry 4.0 technologies in industries to boost market growth

- 10.4.8 MALAYSIA

- 10.4.8.1 Government-led automation initiatives to contribute to market growth

- 10.4.9 THAILAND

- 10.4.9.1 Increasing development of smart factories to drive market

- 10.4.10 VIETNAM

- 10.4.10.1 Increasing deployment of Ethernet-based industrial networks to foster market growth

- 10.4.11 REST OF ASIA PACIFIC

- 10.5 ROW

- 10.5.1 MACROECONOMIC OUTLOOK FOR ROW

- 10.5.2 SOUTH AMERICA

- 10.5.2.1 Burgeoning demand for 5G networks to augment market growth

- 10.5.3 MIDDLE EAST

- 10.5.3.1 Bahrain

- 10.5.3.1.1 Government-led digital transformation strategies to drive market

- 10.5.3.2 Kuwait

- 10.5.3.2.1 High investment in ICT infrastructure to accelerate market growth

- 10.5.3.3 Oman

- 10.5.3.3.1 Strong focus on modernization of oil & gas sector to fuel market growth

- 10.5.3.4 Qatar

- 10.5.3.4.1 Growing emphasis on automation and IoT implementation to boost market growth

- 10.5.3.5 Saudi Arabia

- 10.5.3.5.1 Mounting demand for industrial Ethernet and wireless communication systems to drive market

- 10.5.3.6 UAE

- 10.5.3.6.1 Increasing investment in infrastructure development projects to bolster market growth

- 10.5.3.7 Rest of Middle East

- 10.5.3.1 Bahrain

- 10.5.4 AFRICA

- 10.5.4.1 South Africa

- 10.5.4.1.1 Rising need for low-latency and high-bandwidth communication protocols to drive market

- 10.5.4.2 Other African countries

- 10.5.4.1 South Africa

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- 11.3 MARKET SHARE ANALYSIS, 2024

- 11.4 REVENUE ANALYSIS, 2020-2024

- 11.5 COMPANY VALUATION AND FINANCIAL METRICS

- 11.6 TECHNOLOGY COMPARISON

- 11.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.7.1 STARS

- 11.7.2 EMERGING LEADERS

- 11.7.3 PERVASIVE PLAYERS

- 11.7.4 PARTICIPANTS

- 11.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.7.5.1 Company footprint

- 11.7.5.2 Region footprint

- 11.7.5.3 Communication protocol footprint

- 11.7.5.4 Offering footprint

- 11.7.5.5 Industry footprint

- 11.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.8.1 PROGRESSIVE COMPANIES

- 11.8.2 RESPONSIVE COMPANIES

- 11.8.3 DYNAMIC COMPANIES

- 11.8.4 STARTING BLOCKS

- 11.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 11.8.5.1 Detailed list of key startups/SMEs

- 11.8.5.2 Competitive benchmarking of key startups/SMEs

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT LAUNCHES/DEVELOPMENTS

- 11.9.2 DEALS

- 11.9.3 EXPANSIONS

- 11.9.4 OTHER DEVELOPMENTS

12 COMPANY PROFILES

- 12.1 INTRODUCTION

- 12.2 KEY PLAYERS

- 12.2.1 CISCO SYSTEMS, INC.

- 12.2.1.1 Business overview

- 12.2.1.2 Products/Services/Solutions offered

- 12.2.1.3 Recent developments

- 12.2.1.3.1 Product launches/developments

- 12.2.1.3.2 Deals

- 12.2.1.4 MnM view

- 12.2.1.4.1 Key strengths/Right to win

- 12.2.1.4.2 Strategic choices

- 12.2.1.4.3 Weaknesses/Competitive threats

- 12.2.2 SIEMENS

- 12.2.2.1 Business overview

- 12.2.2.2 Products/Services/Solutions offered

- 12.2.2.3 Recent developments

- 12.2.2.3.1 Product launches/developments

- 12.2.2.3.2 Deals

- 12.2.2.4 MnM view

- 12.2.2.4.1 Key strengths/Right to win

- 12.2.2.4.2 Strategic choices

- 12.2.2.4.3 Weaknesses/Competitive threats

- 12.2.3 ROCKWELL AUTOMATION

- 12.2.3.1 Business overview

- 12.2.3.2 Products/Services/Solutions offered

- 12.2.3.3 Recent developments

- 12.2.3.3.1 Product launches/developments

- 12.2.3.3.2 Deals

- 12.2.3.3.3 Expansions

- 12.2.3.3.4 Other developments

- 12.2.3.4 MnM view

- 12.2.3.4.1 Key strengths/Right to win

- 12.2.3.4.2 Strategic choices

- 12.2.3.4.3 Weaknesses/Competitive threats

- 12.2.4 OMRON CORPORATION

- 12.2.4.1 Business overview

- 12.2.4.2 Products/Services/Solutions offered

- 12.2.4.3 Recent developments

- 12.2.4.3.1 Product launches/developments

- 12.2.4.3.2 Deals

- 12.2.4.4 MnM view

- 12.2.4.4.1 Key strengths/Right to win

- 12.2.4.4.2 Strategic choices

- 12.2.4.4.3 Weaknesses/Competitive threats

- 12.2.5 HUAWEI TECHNOLOGIES CO., LTD.

- 12.2.5.1 Business overview

- 12.2.5.2 Products/Services/Solutions offered

- 12.2.5.3 Recent developments

- 12.2.5.3.1 Product launches/developments

- 12.2.5.3.2 Deals

- 12.2.5.3.3 Other developments

- 12.2.5.4 MnM view

- 12.2.5.4.1 Key strengths/Right to win

- 12.2.5.4.2 Strategic choices

- 12.2.5.4.3 Weaknesses/Competitive threats

- 12.2.6 MOXA INC.

- 12.2.6.1 Business overview

- 12.2.6.2 Products/Services/Solutions offered

- 12.2.6.3 Recent developments

- 12.2.6.3.1 Product launches/developments

- 12.2.6.3.2 Deals

- 12.2.6.3.3 Other developments

- 12.2.7 SICK AG

- 12.2.7.1 Business overview

- 12.2.7.2 Products/Services/Solutions offered

- 12.2.7.3 Recent developments

- 12.2.7.3.1 Product launches/developments

- 12.2.7.3.2 Deals

- 12.2.7.3.3 Expansions

- 12.2.8 SCHNEIDER ELECTRIC

- 12.2.8.1 Business overview

- 12.2.8.2 Product/Services/Solutions Offered

- 12.2.8.3 Recent developments

- 12.2.8.3.1 Product launches/developments

- 12.2.8.3.2 Deals

- 12.2.8.3.3 Expansions

- 12.2.9 ABB

- 12.2.9.1 Business overview

- 12.2.9.2 Products/Services/Solutions Offered

- 12.2.9.3 Recent developments

- 12.2.9.3.1 Product launches/developments

- 12.2.9.3.2 Deals

- 12.2.9.3.3 Expansions

- 12.2.9.3.4 Other developments

- 12.2.10 BELDEN INC.

- 12.2.10.1 Business overview

- 12.2.10.2 Products/Services/Solutions offered

- 12.2.10.3 Recent developments

- 12.2.10.3.1 Product launches/developments

- 12.2.10.3.2 Deals

- 12.2.10.3.3 Expansions

- 12.2.1 CISCO SYSTEMS, INC.

- 12.3 OTHER PLAYERS

- 12.3.1 GE GRID SOLUTIONS, LLC

- 12.3.2 ADVANTECH CO., LTD.

- 12.3.3 IFM ELECTRONIC GMBH

- 12.3.4 FANUC CORPORATION

- 12.3.5 BOSCH REXROTH AG

- 12.3.6 AAEON TECHNOLOGY INC.

- 12.3.7 HMS NETWORKS

- 12.3.8 HONEYWELL INTERNATIONAL INC.

- 12.3.9 MITSUBISHI ELECTRIC CORPORATION

- 12.3.10 TELEFONAKTIEBOLAGET LM ERICSSON

- 12.3.11 HANS TURCK GMBH & CO. KG

- 12.3.12 ACS MOTION CONTROL

- 12.3.13 EATON

- 12.3.14 BECKHOFF AUTOMATION

- 12.3.15 HITACHI, LTD.

13 APPENDIX

- 13.1 INSIGHTS FROM INDUSTRY EXPERTS

- 13.2 DISCUSSION GUIDE

- 13.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.4 CUSTOMIZATION OPTIONS

- 13.5 RELATED REPORTS

- 13.6 AUTHOR DETAILS