|

|

市場調査レポート

商品コード

1648509

スマートガラスの世界市場:タイプ別、技術別、制御システム別 - 予測(~2030年)Smart Glass Market by Type (Tinted, Coated), Technology (Electrochromic, Suspended Particle Display (SPD), Liquid Crystal, Photochromic, Nanocrystalline), Control System (Voice-based, Building Automation System, Mobile-based) - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| スマートガラスの世界市場:タイプ別、技術別、制御システム別 - 予測(~2030年) |

|

出版日: 2025年01月30日

発行: MarketsandMarkets

ページ情報: 英文 236 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界のスマートガラスの市場規模は、2025年の64億2,000万米ドルから2030年までに104億2,000万米ドルに達すると予測され、予測期間にCAGRで10.2%の成長が見込まれます。

スマートガラスは、情報の投影、エンターテインメントの統合、窓の色合いなどを制御できるため、最新の高級車に広く採用されています。プライバシー、エンターテインメント、安全性を向上させるため、最新の高級車の設計・開発には技術が盛り込まれています。Mercedes-Benzを含む最大の自動車ブランドはスマートガラスを採用しており、自動車のデザインの変化や、高級車市場以外にも用途が広がっていることを示しています。このガラスは窓を着色することができ、必要に応じて最大99%の光を遮断することが可能で、従来のサンバイザーやガラスよりも優れています。これはプライバシーを向上させ、熱伝導を抑え、燃料を節約し、環境にやさしいです。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 単位 | 10億米ドル |

| セグメント | タイプ、技術、機構、制御システム、最終用途、地域 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

「コーティングセグメントがスマートガラス市場を独占する見込みです。」

コーティングセグメントは、その高い性能、柔軟性、さまざまな部門への高い適用性により、スマートガラス市場で最大のシェアを占めています。金属酸化物やナノ粒子などの先進の薄膜コーティングは、光の透過を制御し、まぶしさを低減し、断熱性を実現するのに役立ちます。建築、自動車、航空部門などでは、このような先進の制御が求められています。コーティングガラスの使用はエネルギー効率を向上させ、熱の出入りを最小化することで空調コストを削減します。また、ダイナミックライトコントロール機能は、自然光を減少させることなく、居住者の快適性を向上させます。コーティングガラスは、その堅牢性と容易なカスタマイズへの適応性から、大規模な商業および住宅規模のプロジェクトに理想的です。

「浮遊粒子ディスプレイ(SPD)セグメントが予測期間にもっとも急成長する見込みです。」

浮遊粒子ディスプレイ技術は、複数の要因からもっとも急成長が見込まれています。SPDによる光と熱の優れた制御は、リアルタイムでのダイナミックな遮光とプライバシー機能を可能にし、自動車、建築、航空用途に非常に適しています。また、スイッチ1つで透明から不透明に切り替えることができるため、人工照明や空調の必要性を減らし、大幅な省エネが期待できます。エネルギー効率の高い持続可能なソリューションの需要の増加が、大きな促進要因となっています。SPD技術により、建物や車両における太陽熱取得が管理可能になり、エネルギー効率と居住者の快適性が向上します。さらに、要求に応じたプライバシーをサポートし、適応性が要求されるスマートホーム、オフィス、車両用途に最適です。

「アジア太平洋が市場でもっとも高い成長率を持つと予測されます。」

アジア太平洋は、スマートガラス市場でもっとも急成長している地域です。特に中国、インド、東南アジアなどの国々では、急速な都市化と工業化が進み、エネルギー効率の高い建物を含む近代的なインフラへの大規模な投資に拍車をかけています。この地域の政府は持続可能性を重視しており、住宅や商業プロジェクトに対しスマートガラスなどの省エネソリューションを推進しています。自動車産業におけるハイテク自動車への需要の高まりは、スマートガラスがプライバシー保護や温度調節機能として採用されつつある主な理由の1つです。加えて、可処分所得の増加により高級車が好まれるようになり、自動車用スマートガラス市場が拡大していることも、この地域の成長に寄与しています。

当レポートでは、世界のスマートガラス市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

- スマートグラス市場の企業にとって魅力的な機会

- スマートグラス市場:タイプ別

- スマートグラス市場:技術別

- スマートガラス市場:地域別、産業別

- スマートグラス市場:国別

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- バリューチェーン分析

- エコシステム分析

- 投資と資金調達のシナリオ

- 価格分析

- エレクトロクロミックスマートグラスの平均販売価格の動向:主要企業別(2024年)

- スマートガラスの平均販売価格の動向:技術別(2020年~2024年)

- スマートガラスの平均販売価格の動向:地域別(2020年~2024年)

- 顧客ビジネスに影響を与える動向/混乱

- 技術分析

- 主要技術

- 補完技術

- 隣接技術

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- ケーススタディ分析

- 貿易分析

- 輸入データ(HSコード70)

- 輸出データ(HSコード70)

- 特許分析

- 主な会議とイベント(2025年~2026年)

- 関税と規制情勢

- 関税分析

- 規制機関、政府機関、その他の組織

- 標準

- スマートグラス市場に対するAIの影響

第6章 スマートグラス市場:タイプ別

- イントロダクション

- 着色

- コーティング

- ハイブリッド

第7章 スマートガラス市場:制御システム別

- イントロダクション

- スイッチベース

- 遠隔モニタリング

- モバイルベース

- 音声ベース

- ビルオートメーションシステム

- その他の制御システム

第8章 スマートグラス市場:機構別

- イントロダクション

- アクティブ

- パッシブ

第9章 スマートグラス市場:技術別

- イントロダクション

- エレクトロクロミック

- 浮遊粒子ディスプレイ(SPD)

- 液晶(LC)

- フォトクロミック

- サーモクロミック

- マイクロブラインド

- その他の技術

第10章 スマートガラス市場:最終用途別

- イントロダクション

- 建築

- 輸送

- 発電所

- その他の最終用途

第11章 スマートガラス市場:地域別

- イントロダクション

- 北米

- 北米のマクロ経済の見通し

- 米国

- カナダ

- メキシコ

- 欧州

- 欧州のマクロ経済の見通し

- ドイツ

- 英国

- フランス

- イタリア

- その他の欧州

- アジア太平洋

- アジア太平洋のマクロ経済の見通し

- 中国

- 日本

- 韓国

- その他のアジア太平洋

- その他の地域

- その他の地域のマクロ経済の見通し

- 中東・アフリカ

- 南米

第12章 スマートグラスの最新動向

- IoTとスマートホームとの統合

- 成長と発展の主要分野

- 持続可能なアーキテクチャ向けのスマートガラス

- ダイナミックガラスソリューションの登場

第13章 競合情勢

- 概要

- 主要参入企業の戦略/強み(2021年~2024年)

- 収益分析(2019年~2023年)

- 市場シェア分析(2024年)

- 企業の評価と財務指標(2024年)

- カバーエリア/応答時間の比較

- 企業の評価マトリクス:主要企業(2024年)

- 企業の評価マトリクス:スタートアップ/中小企業(2024年)

- 競合シナリオ

第14章 企業プロファイル

- 主要企業

- SAINT-GOBAIN

- AGC INC.

- GENTEX CORPORATION

- CORNING INCORPORATED

- NIPPON SHEET GLASS CO., LTD

- VIEW INC.

- GAUZY LTD AND ENTITIES

- XINYI GLASS HOLDINGS LIMITED

- RESEARCH FRONTIERS

- DIAMOND SWITCHABLE GLASS LTD

- その他の企業

- PLEOTINT LLC

- TAIWAN GLASS IND. CORP.

- FUYAO GROUP

- CENTRAL GLASS CO., LTD.

- CHROMOGENICS

- RAVENWINDOW

- POLYTRONIX, INC.

- PGW AUTO GLASS, LLC

- AGP GROUP

- SPD CONTROL SYSTEMS CORPORATION

- SCIENSTRY, INC.

- INNOVATIVE GLASS CORP.

- HALIO, INC.

- MIRU SMART TECHNOLOGIES

- MERCK KGAA

- HUICHI INDUSTRIAL DEVELOPMENT CO., LTD

- PRO DISPLAY

- SKYLINE DESIGN

第15章 付録

List of Tables

- TABLE 1 SMART GLASS MARKET: RESEARCH ASSUMPTIONS

- TABLE 2 SMART GLASS MARKET: RESEARCH LIMITATIONS

- TABLE 3 SMART GLASS MARKET: RISK ANALYSIS

- TABLE 4 ROLE OF COMPANIES IN SMART GLASS ECOSYSTEM

- TABLE 5 AVERAGE SELLING PRICE TREND OF ELECTROCHROMIC SMART GLASS OFFERED BY KEY PLAYERS, 2024 (USD/SQ METER)

- TABLE 6 AVERAGE SELLING PRICE TREND OF SMART GLASSES, BY TECHNOLOGY, 2020-2024 (USD/SQ METER)

- TABLE 7 AVERAGE SELLING PRICE TREND OF SMART GLASS, BY REGION, 2020-2024 (USD/SQ METER)

- TABLE 8 PORTER'S FIVE FORCES ANALYSIS

- TABLE 9 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USES

- TABLE 10 KEY BUYING CRITERIA FOR TOP THREE END USES

- TABLE 11 IMPORT DATA FOR HS CODE 70-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 12 EXPORT SCENARIO FOR HS CODE 70-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 13 LIST OF MAJOR PATENTS, 2023-2024

- TABLE 14 LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 15 MFN TARIFF FOR HS CODE 70-COMPLIANT PRODUCTS EXPORTED BY US, 2023

- TABLE 16 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 SMART GLASS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 21 SMART GLASS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 22 SMART GLASS MARKET, BY CONTROL SYSTEM, 2021-2024 (USD MILLION)

- TABLE 23 SMART GLASS MARKET, BY CONTROL SYSTEM, 2025-2030 (USD MILLION)

- TABLE 24 SWITCH-BASED: SMART GLASS MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 25 SWITCH-BASED: SMART GLASS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 26 SWITCH-BASED: SMART GLASS MARKET FOR ARCHITECTURE, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 27 SWITCH-BASED: SMART GLASS MARKET FOR ARCHITECTURE, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 28 SWITCH-BASED: SMART GLASS MARKET FOR TRANSPORTATION, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 29 SWITCH-BASED: SMART GLASS MARKET FOR TRANSPORTATION, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 30 REMOTE MONITORING: SMART GLASS MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 31 REMOTE MONITORING: SMART GLASS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 32 REMOTE MONITORING: SMART GLASS MARKET FOR ARCHITECTURE, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 33 REMOTE MONITORING: SMART GLASS MARKET FOR ARCHITECTURE, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 34 REMOTE MONITORING: SMART GLASS MARKET FOR TRANSPORTATION, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 35 REMOTE MONITORING: SMART GLASS MARKET FOR TRANSPORTATION, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 36 MOBILE-BASED: SMART GLASS MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 37 MOBILE-BASED: SMART GLASS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 38 MOBILE-BASED: SMART GLASS MARKET FOR ARCHITECTURE, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 39 MOBILE-BASED: SMART GLASS MARKET FOR ARCHITECTURE, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 40 MOBILE-BASED: SMART GLASS MARKET FOR TRANSPORTATION, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 41 MOBILE-BASED: SMART GLASS MARKET FOR TRANSPORTATION, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 42 VOICE-BASED: SMART GLASS MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 43 VOICE-BASED: SMART GLASS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 44 VOICE-BASED: SMART GLASS MARKET FOR ARCHITECTURE, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 45 VOICE-BASED: SMART GLASS MARKET FOR ARCHITECTURE, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 46 VOICE-BASED: SMART GLASS MARKET FOR TRANSPORTATION, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 47 VOICE-BASED: SMART GLASS MARKET FOR TRANSPORTATION, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 48 BUILDING AUTOMATION SYSTEM: SMART GLASS MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 49 BUILDING AUTOMATION SYSTEM: SMART GLASS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 50 BUILDING AUTOMATION SYSTEM: SMART GLASS MARKET FOR ARCHITECTURE, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 51 BUILDING AUTOMATION SYSTEM: SMART GLASS MARKET FOR ARCHITECTURE, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 52 BUILDING AUTOMATION SYSTEM: SMART GLASS MARKET FOR TRANSPORTATION, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 53 BUILDING AUTOMATION SYSTEM: SMART GLASS MARKET FOR TRANSPORTATION, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 54 OTHER CONTROL SYSTEMS: SMART GLASS MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 55 OTHER CONTROL SYSTEMS: SMART GLASS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 56 OTHER CONTROL SYSTEMS: SMART GLASS MARKET FOR ARCHITECTURE, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 57 OTHER CONTROL SYSTEMS: SMART GLASS MARKET FOR ARCHITECTURE, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 58 OTHER CONTROL SYSTEMS: SMART GLASS MARKET FOR TRANSPORTATION, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 59 OTHER CONTROL SYSTEMS: SMART GLASS MARKET FOR TRANSPORTATION, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 60 SMART GLASS MARKET, BY MECHANISM, 2021-2024 (USD MILLION)

- TABLE 61 SMART GLASS MARKET, BY MECHANISM, 2025-2030 (USD MILLION)

- TABLE 62 SMART GLASS MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 63 SMART GLASS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 64 SMART GLASS MARKET, BY TECHNOLOGY, 2021-2024 (THOUSAND SQ METERS)

- TABLE 65 SMART GLASS MARKET, BY TECHNOLOGY, 2025-2030 (THOUSAND SQ METERS)

- TABLE 66 ELECTROCHROMIC: SMART GLASS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 67 ELECTROCHROMIC: SMART GLASS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 68 SUSPENDED PARTICLE DISPLAY (SPD): SMART GLASS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 69 SUSPENDED PARTICLE DISPLAY (SPD): SMART GLASS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 70 LIQUID CRYSTAL (LC): SMART GLASS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 71 LIQUID CRYSTAL (LC): SMART GLASS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 72 LIQUID CRYSTAL (LC): SMART GLASS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 73 LIQUID CRYSTAL (LC): SMART GLASS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 74 POLYMER-DISPERSED LIQUID CRYSTALS (PDLC): SMART GLASS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 75 POLYMER-DISPERSED LIQUID CRYSTAL (PDLC): SMART GLASS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 76 POLYMER-DISPERSED LIQUID CRYSTAL (PDLC): SMART GLASS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 77 POLYMER DISPERSED LIQUID CRYSTAL (PDLC): SMART GLASS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 78 LAMINATED: SMART GLASS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 79 LAMINATED: SMART GLASS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 80 RETROFIT: SMART GLASS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 81 RETROFIT: SMART GLASS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 82 TWISTED NEMATIC (TN) LIQUID CRYSTAL: SMART GLASS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 83 TWISTED NEMATIC (TN) LIQUID CRYSTAL: SMART GLASS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 84 PHOTOCHROMIC: SMART GLASS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 85 PHOTOCHROMIC: SMART GLASS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 86 THERMOCHROMIC: SMART GLASS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 87 THERMOCHROMIC: SMART GLASS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 88 MICRO-BLINDS: SMART GLASS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 89 MICRO-BLINDS: SMART GLASS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 90 OTHER TECHNOLOGIES: SMART GLASS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 91 OTHER TECHNOLOGIES: SMART GLASS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 92 SMART GLASS MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 93 SMART GLASS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 94 ARCHITECTURE: SMART GLASS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 95 ARCHITECTURE: SMART GLASS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 96 ARCHITECTURE: SMART GLASS MARKET, BY CONTROL SYSTEM, 2021-2024 (USD MILLION)

- TABLE 97 ARCHITECTURE: SMART GLASS MARKET, BY CONTROL SYSTEM, 2025-2030 (USD MILLION)

- TABLE 98 LUXURY APARTMENTS: SMART GLASS MARKET, BY CONTROL SYSTEM, 2021-2024 (USD MILLION)

- TABLE 99 LUXURY APARTMENTS: SMART GLASS MARKET, BY CONTROL SYSTEM, 2025-2030 (USD MILLION)

- TABLE 100 COMMERCIAL: SMART GLASS MARKET, BY CONTROL SYSTEM, 2021-2024 (USD MILLION)

- TABLE 101 COMMERCIAL: SMART GLASS MARKET, BY CONTROL SYSTEM, 2025-2030 (USD MILLION)

- TABLE 102 TRANSPORTATION: SMART GLASS MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 103 TRANSPORTATION: SMART GLASS MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 104 TRANSPORTATION: SMART GLASS MARKET, BY CONTROL SYSTEM, 2021-2024 (USD MILLION)

- TABLE 105 TRANSPORTATION: SMART GLASS MARKET, BY CONTROL SYSTEM, 2025-2030 (USD MILLION)

- TABLE 106 AUTOMOTIVE: SMART GLASS MARKET, BY CONTROL SYSTEM, 2021-2024 (USD MILLION)

- TABLE 107 AUTOMOTIVE: SMART GLASS MARKET, BY CONTROL SYSTEM, 2025-2030 (USD MILLION)

- TABLE 108 AEROSPACE: SMART GLASS MARKET, BY CONTROL SYSTEM, 2021-2024 (USD MILLION)

- TABLE 109 AEROSPACE: SMART GLASS MARKET, BY CONTROL SYSTEM, 2025-2030 (USD MILLION)

- TABLE 110 MARINE: SMART GLASS MARKET, BY CONTROL SYSTEM, 2021-2024 (USD MILLION)

- TABLE 111 MARINE: SMART GLASS MARKET, BY CONTROL SYSTEM, 2025-2030 (USD MILLION)

- TABLE 112 POWER GENERATION PLANTS: SMART GLASS MARKET, BY CONTROL SYSTEM, 2021-2024 (USD MILLION)

- TABLE 113 POWER GENERATION PLANTS: SMART GLASS MARKET, BY CONTROL SYSTEM, 2025-2030 (USD MILLION)

- TABLE 114 OTHER END USES: SMART GLASS MARKET, BY CONTROL SYSTEM, 2021-2024 (USD MILLION)

- TABLE 115 OTHER END USES: SMART GLASS MARKET, BY CONTROL SYSTEM, 2025-2030 (USD MILLION)

- TABLE 116 SMART GLASS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 117 SMART GLASS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 118 SMART GLASS MARKET, BY REGION, 2021-2024 (THOUSAND SQ METERS)

- TABLE 119 SMART GLASS MARKET, BY REGION, 2025-2030 (THOUSAND SQ METERS)

- TABLE 120 NORTH AMERICA: SMART GLASS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 121 NORTH AMERICA: SMART GLASS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 122 NORTH AMERICA: SMART GLASS MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 123 NORTH AMERICA: SMART GLASS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 124 NORTH AMERICA: SMART GLASS MARKET FOR LIQUID CRYSTAL (LC), BY TYPE, 2021-2024 (USD MILLION)

- TABLE 125 NORTH AMERICA: SMART GLASS MARKET FOR LIQUID CRYSTAL (LC), BY TYPE, 2025-2030 (USD MILLION)

- TABLE 126 US: SMART GLASS MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 127 US: SMART GLASS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 128 CANADA: SMART GLASS MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 129 CANADA: SMART GLASS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 130 MEXICO: SMART GLASS MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 131 MEXICO: SMART GLASS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 132 EUROPE: SMART GLASS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 133 EUROPE: SMART GLASS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 134 EUROPE: SMART GLASS MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 135 EUROPE: SMART GLASS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 136 EUROPE: SMART GLASS MARKET FOR LIQUID CRYSTAL (LC), BY TYPE, 2021-2024 (USD MILLION)

- TABLE 137 EUROPE: SMART GLASS MARKET FOR LIQUID CRYSTAL (LC), BY TYPE, 2025-2030 (USD MILLION)

- TABLE 138 GERMANY: SMART GLASS MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 139 GERMANY: SMART GLASS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 140 UK: SMART GLASS MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 141 UK: SMART GLASS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 142 FRANCE: SMART GLASS MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 143 FRANCE: SMART GLASS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 144 ITALY: SMART GLASS MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 145 ITALY: SMART GLASS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 146 REST OF EUROPE: SMART GLASS MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 147 REST OF EUROPE: SMART GLASS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 148 ASIA PACIFIC: SMART GLASS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 149 ASIA PACIFIC: SMART GLASS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 150 ASIA PACIFIC: SMART GLASS MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 151 ASIA PACIFIC: SMART GLASS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 152 ASIA PACIFIC: SMART GLASS MARKET FOR LIQUID CRYSTAL (LC), BY TYPE, 2021-2024 (USD MILLION)

- TABLE 153 ASIA PACIFIC: SMART GLASS MARKET FOR LIQUID CRYSTAL (LC), BY TYPE, 2025-2030 (USD MILLION)

- TABLE 154 CHINA: SMART GLASS MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 155 CHINA: SMART GLASS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 156 JAPAN: SMART GLASS MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 157 JAPAN: SMART GLASS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 158 SOUTH KOREA: SMART GLASS MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 159 SOUTH KOREA: SMART GLASS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 160 REST OF ASIA PACIFIC: SMART GLASS MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 161 REST OF ASIA PACIFIC: SMART GLASS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 162 ROW: SMART GLASS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 163 ROW: SMART GLASS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 164 ROW: SMART GLASS MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 165 ROW: SMART GLASS MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 166 ROW: SMART GLASS MARKET FOR LIQUID CRYSTAL (LC), BY TYPE, 2021-2024 (USD MILLION)

- TABLE 167 ROW: SMART GLASS MARKET FOR LIQUID CRYSTAL (LC), BY TYPE, 2025-2030 (USD MILLION)

- TABLE 168 MIDDLE EAST & AFRICA: SMART GLASS MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 169 MIDDLE EAST & AFRICA: SMART GLASS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 170 MIDDLE EAST & AFRICA: SMART GLASS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 171 MIDDLE EAST & AFRICA: SMART GLASS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 172 SOUTH AMERICA: SMART GLASS MARKET, BY END USE, 2021-2024 (USD MILLION)

- TABLE 173 SOUTH AMERICA: SMART GLASS MARKET, BY END USE, 2025-2030 (USD MILLION)

- TABLE 174 SMART GLASS MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2021-2024

- TABLE 175 SMART GLASS MARKET: DEGREE OF COMPETITION, 2024

- TABLE 176 SMART GLASS MARKET: REGION FOOTPRINT

- TABLE 177 SMART GLASS MARKET: TECHNOLOGY FOOTPRINT

- TABLE 178 SMART GLASS MARKET: MECHANISM FOOTPRINT

- TABLE 179 SMART GLASS MARKET: END USE FOOTPRINT

- TABLE 180 SMART GLASS MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 181 SMART GLASS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 182 SMART GLASS MARKET: PRODUCT LAUNCHES, JANUARY 2021-DECEMBER 2024

- TABLE 183 SMART GLASS MARKET: DEALS, JANUARY 2021-DECEMBER 2024

- TABLE 184 SMART GLASS MARKET: EXPANSIONS, JANUARY 2021-DECEMBER 2024

- TABLE 185 SAINT-GOBAIN: COMPANY OVERVIEW

- TABLE 186 SAINT-GOBAIN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 187 SAINT-GOBAIN: DEALS

- TABLE 188 AGC INC.: COMPANY OVERVIEW

- TABLE 189 AGC INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 190 AGC INC.: PRODUCT LAUNCHES

- TABLE 191 AGC INC.: DEALS

- TABLE 192 AGC INC.: OTHER DEVELOPMENTS

- TABLE 193 GENTEX CORPORATION: COMPANY OVERVIEW

- TABLE 194 GENTEX CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 195 GENTEX CORPORATION: DEALS

- TABLE 196 GENTEX CORPORATION: EXPANSIONS

- TABLE 197 CORNING INCORPORATED: COMPANY OVERVIEW

- TABLE 198 CORNING INCORPORATED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 199 CORNING INCORPORATED: DEALS

- TABLE 200 NIPPON SHEET GLASS CO., LTD: COMPANY OVERVIEW

- TABLE 201 NIPPON SHEET GLASS CO., LTD: RODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 202 NIPPON SHEET GLASS CO., LTD: EXPANSIONS

- TABLE 203 VIEW INC.: COMPANY OVERVIEW

- TABLE 204 VIEW INC.: RODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 205 VIEW INC.: DEALS

- TABLE 206 GAUZY LTD AND ENTITIES: COMPANY OVERVIEW

- TABLE 207 GAUZY LTD AND ENTITIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 208 GAUZY LTD AND ENTITIES: DEALS

- TABLE 209 XINYI GLASS HOLDINGS LIMITED: COMPANY OVERVIEW

- TABLE 210 XINYI GLASS HOLDINGS LIMITED: RODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 211 RESEARCH FRONTIERS: COMPANY OVERVIEW

- TABLE 212 RESEARCH FRONTIERS: RODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 213 RESEARCH FRONTIERS: PRODUCT LAUNCHES

- TABLE 214 DIAMOND SWITCHABLE GLASS LTD: COMPANY OVERVIEW

- TABLE 215 DIAMOND SWITCHABLE GLASS LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

List of Figures

- FIGURE 1 SMART GLASS MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 SMART GLASS MARKET: RESEARCH DESIGN

- FIGURE 3 REVENUE GENERATED BY COMPANIES FROM SALES OF SMART GLASSES (SUPPLY-SIDE)

- FIGURE 4 SMART GLASS MARKET: BOTTOM-UP APPROACH

- FIGURE 5 SMART GLASS MARKET: TOP-DOWN APPROACH

- FIGURE 6 DATA TRIANGULATION

- FIGURE 7 ELECTROCHROMIC TECHNOLOGY TO DOMINATE MARKET DURING FORECAST PERIOD

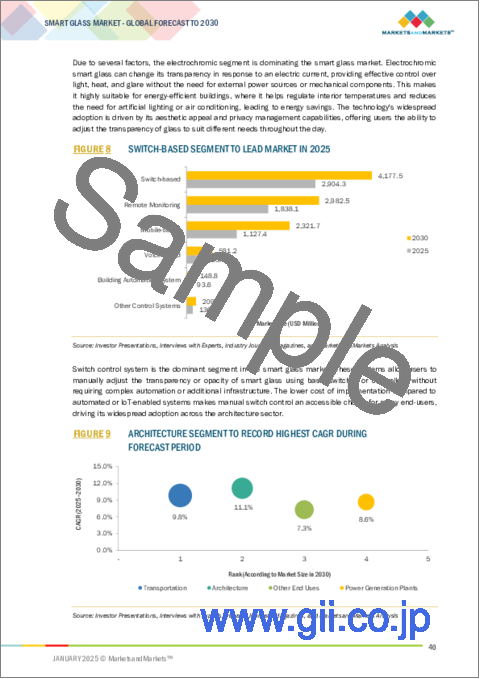

- FIGURE 8 SWITCH-BASED SEGMENT TO LEAD MARKET IN 2025

- FIGURE 9 ARCHITECTURE SEGMENT TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 10 ASIA PACIFIC TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 11 RISING INVESTMENTS IN SMART INFRASTRUCTURE TO OFFER LUCRATIVE GROWTH OPPORTUNITIES

- FIGURE 12 COATED SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2025

- FIGURE 13 SUSPENDED PARTICLE DISPLAY (SPD) TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 14 TRANSPORTATION SEGMENT AND NORTH AMERICA TO CLAIM LARGEST MARKET SHARES IN 2030

- FIGURE 15 CHINA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 16 SMART GLASS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 17 GLOBAL DATA ON VEHICLE SALES, 2020-2023

- FIGURE 18 IMPACT ANALYSIS OF DRIVERS ON SMART GLASS MARKET

- FIGURE 19 IMPACT ANALYSIS OF RESTRAINTS ON SMART GLASS MARKET

- FIGURE 20 IMPACT ANALYSIS OF OPPORTUNITIES ON SMART GLASS MARKET

- FIGURE 21 IMPACT ANALYSIS OF CHALLENGES ON SMART GLASS MARKET

- FIGURE 22 SMART GLASS MARKET: VALUE CHAIN ANALYSIS

- FIGURE 23 SMART GLASS MARKET: ECOSYSTEM ANALYSIS

- FIGURE 24 INVESTMENT AND FUNDING SCENARIO, 2019-2023

- FIGURE 25 AVERAGE SELLING PRICE TREND OF ELECTROCHROMIC SMART GLASS OFFERED BY KEY PLAYERS, 2024

- FIGURE 26 AVERAGE SELLING PRICE TREND OF SMART GLASS, BY TECHNOLOGY, 2020-2024

- FIGURE 27 AVERAGE SELLING PRICE TREND OF SMART GLASS, BY REGION, 2020-2024

- FIGURE 28 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 29 SMART GLASS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 30 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USES

- FIGURE 31 KEY BUYING CRITERIA FOR TOP THREE END USES

- FIGURE 32 IMPORT DATA FOR HS CODE 70-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023

- FIGURE 33 EXPORT DATA FOR HS CODE 70-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD MILLION)

- FIGURE 34 SMART GLASS MARKET: PATENT ANALYSIS, 2015-2024

- FIGURE 35 USE CASES OF AI IN SMART GLASS

- FIGURE 36 COATED SEGMENT TO SECURE LARGEST MARKET SHARE IN 2025

- FIGURE 37 SWITCH-BASED SEGMENT TO LEAD MARKET IN 2025

- FIGURE 38 ACTIVE SEGMENT TO DOMINATE MARKET IN 2030

- FIGURE 39 ELECTROCHROMIC SEGMENT TO LEAD MARKET IN 2030

- FIGURE 40 TRANSPORTATION SEGMENT TO LEAD MARKET IN 2030

- FIGURE 41 NORTH AMERICA TO GARNER LARGEST MARKET SHARE IN 2030

- FIGURE 42 NORTH AMERICA: SMART GLASS MARKET SNAPSHOT

- FIGURE 43 EUROPE: SMART GLASS MARKET SNAPSHOT

- FIGURE 44 ASIA PACIFIC: SMART GLASS MARKET SNAPSHOT

- FIGURE 45 REVENUE ANALYSIS OF MAJOR PLAYERS IN SMART GLASS MARKET, 2019-2023

- FIGURE 46 MARKET SHARE ANALYSIS OF KEY PLAYERS OFFERING SMART GLASSES, 2024

- FIGURE 47 COMPANY VALUATION, 2024

- FIGURE 48 FINANCIAL METRICS (EV/EBITDA), 2024

- FIGURE 49 COVERAGE AREA/RESPONSE TIME COMPARISON

- FIGURE 50 SMART GLASS MARKET: COMPANY EVALUATION MATRIX (KEY COMPANIES), 2024

- FIGURE 51 SMART GLASS MARKET: COMPANY FOOTPRINT

- FIGURE 52 SMART GLASS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 53 SAINT-GOBAIN: COMPANY SNAPSHOT

- FIGURE 54 AGC INC.: COMPANY SNAPSHOT

- FIGURE 55 GENTEX CORPORATION: COMPANY SNAPSHOT

- FIGURE 56 CORNING INCORPORATED: COMPANY SNAPSHOT

- FIGURE 57 NIPPON SHEET GLASS CO., LTD: COMPANY SNAPSHOT

- FIGURE 58 XINYI GLASS HOLDINGS LIMITED: COMPANY SNAPSHOT

- FIGURE 59 RESEARCH FRONTIERS: COMPANY SNAPSHOT

The global smart glass market is expected to reach USD 10.42 billion in 2030 from USD 6.42 billion in 2025, at a CAGR of 10.2% during the forecast period. Smart glass has witnessed wide adoption in the latest luxury vehicles due to its features, such as information projection, entertainment integration, and window tinting, which can be controlled. Technology has been included in the design and development of modern luxury cars to improve privacy, entertainment, and safety. The largest automotive brands, including Mercedes-Benz, have adopted smart glass, showing a change in the design of automobiles and an extension of its use beyond luxury markets. It can tint windows, blocking up to 99% of light when necessary, which is superior to traditional sun visors and glass. This improves privacy, reduces heat transfer, saves fuel, and is environmentally friendly.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Type, Technology, Mechanism, Control System, End Use and Region |

| Regions covered | North America, Europe, APAC, RoW |

"Coated segment is expected to dominate in smart glass market."

The coated segment accounts for the largest share in the smart glass market, owing to its higher performance, flexibility, and high applicability across various sectors. Advanced thin-film coatings, either metal oxides or nanoparticles, help control light transmission, reduce glare, and achieve thermal insulation. This extent of control is in high demand in construction, automotive, and aviation sectors, among others. Using coated glass improves energy efficiency and reduces HVAC cost by minimizing heat gain and loss. Also, the feature of dynamic light control enhances comfort to occupants while not diminishing natural light. Due to its robustness and adaptability to easy customizations, coated glass is ideally suited for substantial commercial and residential-scale projects.

"Suspended Particle Display (SPD) segment is expected to grow fastest during the forecast period."

Suspended particle display technology is expected to grow the fastest due to several factors. Excellent control over light and heat through SPD allows dynamic shading and privacy features in real time, which makes it highly suitable for automotive, architectural, and aviation applications. It can switch from transparent to opaque with the help of a switch, thus promising significant energy savings by reducing artificial lighting and air conditioning requirements. The increase in demand of energy-efficient sustainable solutions is the major driver. Through SPD technology, solar heat gain becomes manageable in buildings and vehicles, enhancing energy efficiency and occupant comfort. Moreover, it offers support for privacy-on-demand, perfect for smart homes, offices, and vehicle applications, for which adaptability becomes a requirement.

"The Asia Pacific is expected to have highest growth rate in the EMI shielding market."

Asia-Pacific is the fastest-growing region in the smart glass market. Rapid urbanization and industrialization, especially in countries like China, India, and Southeast Asia, have spurred significant investments in modern infrastructure, including energy-efficient buildings. Governments in the region are emphasizing sustainability, which is pushing energy-saving solutions such as smart glass for residential and commercial projects. The increasing demand for high-tech vehicles in the automotive industry is one of the main reasons smart glass is increasingly used for privacy and temperature control features. In addition, rising disposable incomes are leading to the preference for luxury cars, and hence the market for smart glass in automobiles is growing, which in turn contributing to the regional growth.

The Asia-Pacific market benefits from low-cost manufacturing and innovation in smart glass technology. It has also improved production from switching from manual to automated and electrically controlled smart glass, which can be achieved feasibly and economically. The more that smart home systems are deployed, the more support for demand in smart glass is expected since homeowners desire convenience and energy efficiency.

- By Company Type: Tier 1 - 40%, Tier 2 - 35%, and Tier 3 - 25%

- By Designation: Directors - 45%, Managers - 35%, and Others - 20%

- By Region: North America- 45%, Europe - 25%, Asia Pacific- 20% and RoW- 10%

Saint Gobain (France), AGC Inc. (Japan), Gentex Corporation (US), Corning Incorporated (US), Nippon Sheet Glass Co Ltd (Japan), View Inc (US), Guazy Ltd and Entities (Israel), Xinyi Glass Holdings Limited (China), Research Frontiers (US), Diamond Switchable Glass Ltd (Ireland), are some of the key players in the smart glass market.

The study includes an in-depth competitive analysis of these key players in the smart glass market, with their company profiles, recent developments, and key market strategies.

Research Coverage

This research report categorizes the smart glass market by type (Tinted, Coated, Hybrid), by technology (Electrochromic, Suspended Particle Display (SPD), Liquid Crystal (LC) (Polymer Dispersed Liquid Crystal (PDLC) (Laminated, Retrofit), Twisted Nematic (TN) Liquid Crystals), Photochromic, Thermochromic, Micro-Blinds, and Others), by mechanism (Active, Passive), by control system (Switch, Remote, Mobile-based, Voice-based, Building Automation System, Others), by end use (Architecture (Luxury Residential Buildings, Commercial), Transportation (Automotive, Aerospace, Marine), Power Generation Plants, Others) and by region (North America, Europe, Asia Pacific, and RoW). The report's scope covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the smart glass market. A detailed analysis of the key industry players has been done to provide insights into their business overview, solutions, and services; key strategies; Contracts, partnerships, agreements, new product & service launches, mergers and acquisitions; and recent developments associated with the smart glass market. This report covers the competitive analysis of upcoming startups in the smart glass market ecosystem.

Reasons to buy this report

The report will help market leaders and new entrants with information on the closest approximations of the revenue numbers for the overall smart glass market and its subsegments. It will also help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Rising demand of advanced technologies in luxury cars, integration of electrochromic materials into smart glasses, rising focus on reduced energy consumption, Emphasis on promoting low-carbon economy, growing demand in construction and real estate), restraints (High initial investment and upfront costs, operational and functional challenges, complex manufacturing process), opportunities (Growing trend of minimalist designs, shifting preference from conventional to renewable energy sources, expanding applications in automotive, aviation, and marine industries, rising development of sustainable buildings, Increasing focus on improving window insulation), and challenges (Lack of awareness about long-term benefits of smart glass technology, maintaining compliance with building codes and regulations) influencing the growth of the smart glass market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the smart glass market

- Market Development: Comprehensive information about lucrative markets - the report analyses the smart glass market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the smart glass market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players like Parker Hannifin Corp (US), PPG Industries Inc (US), 3M (US), Henkel AG & CO. KGAA (Germany), Laird Technologies, Inc. (US), among others in the EMI shielding market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 YEARS CONSIDERED

- 1.3.3 INCLUSIONS AND EXCLUSIONS

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY AND PRIMARY RESEARCH

- 2.1.2 SECONDARY DATA

- 2.1.2.1 List of key secondary sources

- 2.1.2.2 Key data from secondary sources

- 2.1.3 PRIMARY DATA

- 2.1.3.1 Intended participants and key opinion leaders

- 2.1.3.2 Key data from primary sources

- 2.1.3.3 Key industry insights

- 2.1.3.4 Breakdown of primaries

- 2.2 FACTOR ANALYSIS

- 2.3 MARKET SIZE ESTIMATION METHODOLOGY

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.1.1 Approach to estimate market size using bottom-up analysis (demand side)

- 2.3.2 TOP-DOWN APPROACH

- 2.3.2.1 Approach to estimate market size using top-down analysis (supply side)

- 2.3.1 BOTTOM-UP APPROACH

- 2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN SMART GLASS MARKET

- 4.2 SMART GLASS MARKET, BY TYPE

- 4.3 SMART GLASS MARKET, BY TECHNOLOGY

- 4.4 SMART GLASS MARKET, BY REGION AND INDUSTRY

- 4.5 SMART GLASS MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Use of smart glass in modern luxury cars

- 5.2.1.2 Integration of electrochromic materials into smart glasses

- 5.2.1.3 Rising need to balance energy supply and demand

- 5.2.1.4 Emphasis on promoting low-carbon economy

- 5.2.1.5 Growing demand in construction and real estate sectors

- 5.2.2 RESTRAINTS

- 5.2.2.1 High initial investments and upfront costs for implementing smart glasses

- 5.2.2.2 Operational and functional challenges related to smart glass technology

- 5.2.2.3 Complex manufacturing processes associated with smart glass

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing trend of minimalist designs

- 5.2.3.2 Increasing demand for alternative power sources due to rising energy costs

- 5.2.3.3 Rising emphasis on developing and commercializing smart glass technologies

- 5.2.3.4 Increasing demand for sustainable buildings

- 5.2.3.5 Growing demand for energy-efficient products

- 5.2.4 CHALLENGES

- 5.2.4.1 Lack of awareness about long-term benefits of smart glass technology

- 5.2.4.2 Compliance with building codes and regulations

- 5.2.1 DRIVERS

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 INVESTMENT AND FUNDING SCENARIO

- 5.6 PRICING ANALYSIS

- 5.6.1 AVERAGE SELLING PRICE TREND OF ELECTROCHROMIC SMART GLASSES, BY KEY PLAYER, 2024

- 5.6.2 AVERAGE SELLING PRICE TREND OF SMART GLASS, BY TECHNOLOGY, 2020-2024

- 5.6.3 AVERAGE SELLING PRICE TREND OF SMART GLASS, BY REGION, 2020-2024

- 5.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 Electrochromic

- 5.8.2 COMPLEMENTARY TECHNOLOGIES

- 5.8.2.1 IoT and smart home systems

- 5.8.3 ADJACENT TECHNOLOGIES

- 5.8.3.1 Photovoltaics

- 5.8.1 KEY TECHNOLOGIES

- 5.9 PORTER'S FIVE FORCES ANALYSIS

- 5.9.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.9.2 BARGAINING POWER OF SUPPLIERS

- 5.9.3 BARGAINING POWER OF BUYERS

- 5.9.4 THREAT OF SUBSTITUTES

- 5.9.5 THREAT OF NEW ENTRANTS

- 5.10 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.10.2 BUYING CRITERIA

- 5.11 CASE STUDY ANALYSIS

- 5.11.1 MANHATTAN-BASED COMPANY IMPLEMENTED FROSTED SMART GLASS TO ADDRESS PRIVACY AND DESIGN CHALLENGES

- 5.11.2 SMART GLASS TECHNOLOGIES HELPED MITSUBISHI TANABE WITH PDLC SWITCHABLE PRIVACY FILMS THAT OFFERED PRIVACY SOLUTIONS

- 5.11.3 SMART GLASS TECHNOLOGIES ASSISTED HALTON HEALTHCARE WITH PRIWATT SMART GLASS THAT UPGRADED INTENSIVE CARE UNITS AND MAINTAINED PATIENT PRIVACY

- 5.11.4 THERMOPLAN INSTALLED SAGEGLASS ELECTROCHROMIC GLASS THAT REDUCED ENERGY CONSUMPTION AND ENHANCED SUSTAINABILITY

- 5.12 TRADE ANALYSIS

- 5.12.1 IMPORT DATA (HS CODE 70)

- 5.12.2 EXPORT DATA (HS CODE 70)

- 5.13 PATENT ANALYSIS

- 5.14 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.15 TARIFF AND REGULATORY LANDSCAPE

- 5.15.1 TARIFF ANALYSIS

- 5.15.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.15.3 STANDARDS

- 5.16 IMPACT OF AI ON SMART GLASS MARKET

- 5.16.1 INTRODUCTION

6 SMART GLASS MARKET, BY TYPE

- 6.1 INTRODUCTION

- 6.2 TINTED

- 6.2.1 GROWING DEMAND FOR IMPROVED ENERGY EFFICIENCY AND PROTECTION AGAINST UV RAYS TO FOSTER MARKET GROWTH

- 6.3 COATED

- 6.3.1 ABILITY TO REDUCE COOLING AND HEATING COSTS TO FUEL MARKET GROWTH

- 6.4 HYBRID

- 6.4.1 INCREASING NEED TO REDUCE DEPENDENCY ON EXTERNAL SHADING SYSTEMS AND HEAVY HVAC TO BOOST DEMAND

7 SMART GLASS MARKET, BY CONTROL SYSTEM

- 7.1 INTRODUCTION

- 7.2 SWITCH-BASED

- 7.2.1 ABILITY TO ADJUST GLASS TRANSPARENCY TO FUEL MARKET GROWTH

- 7.3 REMOTE MONITORING

- 7.3.1 ABILITY TO INTEGRATE SEAMLESSLY INTO MODERN LIVING AND WORKING ENVIRONMENTS TO FOSTER MARKET GROWTH

- 7.4 MOBILE-BASED

- 7.4.1 RISING TREND OF SMART HOMES AND BUILDINGS TO ACCELERATE DEMAND

- 7.5 VOICE-BASED

- 7.5.1 INCREASING POPULARITY OF SMART HOME ECOSYSTEMS TO ACCELERATE DEMAND

- 7.6 BUILDING AUTOMATION SYSTEM

- 7.6.1 RISING NEED TO AUTOMATE SMART GLASS TRANSPARENCY AND TINTS TO FUEL MARKET GROWTH

- 7.7 OTHER CONTROL SYSTEMS

8 SMART GLASS MARKET, BY MECHANISM

- 8.1 INTRODUCTION

- 8.2 ACTIVE

- 8.2.1 INCREASING DEMAND FOR CUSTOMIZABLE AND HIGH-TECH SOLUTIONS TO FOSTER MARKET GROWTH

- 8.3 PASSIVE

- 8.3.1 ABILITY TO ENHANCE BUILDING AESTHETICS AND PROVIDE SOLUTIONS FOR MAINTAINING INDOOR TEMPERATURES TO FUEL MARKET GROWTH

9 SMART GLASS MARKET, BY TECHNOLOGY

- 9.1 INTRODUCTION

- 9.2 ELECTROCHROMIC

- 9.2.1 INCREASING NEED FOR ECO-FRIENDLY SOLUTIONS TO FUEL MARKET GROWTH

- 9.3 SUSPENDED PARTICLE DISPLAY (SPD)

- 9.3.1 RISING APPLICATION IN SUNROOFS AND WINDOWS TO ACCELERATE DEMAND

- 9.4 LIQUID CRYSTAL (LC)

- 9.4.1 POLYMER-DISPERSED LIQUID CRYSTAL (PDLC)

- 9.4.1.1 Laminated

- 9.4.1.1.1 Growing application in new construction and renovation projects to support market growth

- 9.4.1.2 Retrofit

- 9.4.1.2.1 Rising demand among budget-conscious projects to fuel market growth

- 9.4.1.1 Laminated

- 9.4.2 TWISTED NEMATIC (TN) LIQUID CRYSTAL

- 9.4.2.1 Increasing application for boosting aesthetics in interior designs to accelerate demand

- 9.4.1 POLYMER-DISPERSED LIQUID CRYSTAL (PDLC)

- 9.5 PHOTOCHROMIC

- 9.5.1 GROWING IMPLEMENTATION OF SUPPORTIVE REGULATIONS PROMOTING ENERGY-EFFICIENT MATERIALS TO FUEL MARKET GROWTH

- 9.6 THERMOCHROMIC

- 9.6.1 RISING CONSUMER AWARENESS ABOUT BENEFITS OF SMART MATERIALS TO DRIVE MARKET

- 9.7 MICRO-BLINDS

- 9.7.1 GROWING DEMAND FOR HIGH SWITCHING SPEED AND UV DURABILITY TO SUPPORT MARKET GROWTH

- 9.8 OTHER TECHNOLOGIES

10 SMART GLASS MARKET, BY END USE

- 10.1 INTRODUCTION

- 10.2 ARCHITECTURE

- 10.2.1 LUXURY APARTMENTS

- 10.2.1.1 Integration with smart home systems to offer lucrative growth opportunities

- 10.2.2 COMMERCIAL BUILDINGS

- 10.2.2.1 Growing need to manage heat and light efficiently and reduce operational costs to boost demand

- 10.2.2.2 Offices

- 10.2.2.3 Retail

- 10.2.2.4 Hospitals

- 10.2.1 LUXURY APARTMENTS

- 10.3 TRANSPORTATION

- 10.3.1 AUTOMOTIVE

- 10.3.1.1 Rising use of advanced technology to improve driving experience to accelerate segmental growth

- 10.3.2 AEROSPACE

- 10.3.2.1 Growing need to minimize reliance on air conditioning systems and reduce overall aircraft weight to fuel market growth

- 10.3.3 MARINE

- 10.3.3.1 Increasing demand for customizable shading, privacy features, and advanced functionalities to foster market growth

- 10.3.1 AUTOMOTIVE

- 10.4 POWER GENERATION PLANTS

- 10.4.1 SURGING DEMAND FOR CLEAN AND SUSTAINABLE ENERGY SOURCES TO FOSTER MARKET GROWTH

- 10.5 OTHER END USES

11 SMART GLASS MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 11.2.2 US

- 11.2.2.1 Increasing application in architecture and automotive sectors to fuel market growth

- 11.2.3 CANADA

- 11.2.3.1 Rising implementation of regulations to promote energy efficiency to foster market growth

- 11.2.4 MEXICO

- 11.2.4.1 Expanding tourism and hospitality sectors to accelerate demand

- 11.3 EUROPE

- 11.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 11.3.2 GERMANY

- 11.3.2.1 Growing investments in automotive technologies to drive market

- 11.3.3 UK

- 11.3.3.1 Growing emphasis on sustainable construction practices to offer lucrative growth opportunities

- 11.3.4 FRANCE

- 11.3.4.1 Rising demand for luxury living spaces with modern amenities to support market growth

- 11.3.5 ITALY

- 11.3.5.1 Increasing integration of advanced technologies in automobiles to offer lucrative growth opportunities

- 11.3.6 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 11.4.2 CHINA

- 11.4.2.1 Flourishing construction and real estate sectors to fuel market growth

- 11.4.3 JAPAN

- 11.4.3.1 Growing consumer preferences for eco-friendly vehicles to foster market growth

- 11.4.4 SOUTH KOREA

- 11.4.4.1 Rising integration into high-end electronic devices to support market growth

- 11.4.5 REST OF ASIA PACIFIC

- 11.5 ROW

- 11.5.1 MACROECONOMIC OUTLOOK FOR ROW

- 11.5.2 MIDDLE EAST & AFRICA

- 11.5.2.1 Increasing collaboration between regional companies and prominent smart glass providers to fuel market growth

- 11.5.2.2 GCC

- 11.5.2.3 Africa & Rest of Middle East

- 11.5.3 SOUTH AMERICA

- 11.5.3.1 Sustainable development and urbanization to boost demand

12 RECENT TRENDS IN SMART GLASS

- 12.1 INTEGRATION WITH IOT AND SMART HOMES

- 12.2 KEY AREAS OF GROWTH AND DEVELOPMENTS

- 12.3 SMART GLASS FOR SUSTAINABLE ARCHITECTURE

- 12.4 EMERGENCE OF DYNAMIC GLAZING SOLUTIONS

13 COMPETITIVE LANDSCAPE

- 13.1 OVERVIEW

- 13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2024

- 13.3 REVENUE ANALYSIS, 2019-2023

- 13.4 MARKET SHARE ANALYSIS, 2O24

- 13.5 COMPANY VALUATION AND FINANCIAL METRICS, 2024

- 13.6 COVERAGE AREA/RESPONSE TIME COMPARISON

- 13.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 13.7.1 STARS

- 13.7.2 EMERGING LEADERS

- 13.7.3 PERVASIVE PLAYERS

- 13.7.4 PARTICIPANTS

- 13.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 13.7.5.1 Company footprint

- 13.7.5.2 Region footprint

- 13.7.5.3 Technology footprint

- 13.7.5.4 Mechanism footprint

- 13.7.5.5 End use footprint

- 13.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 13.8.1 PROGRESSIVE COMPANIES

- 13.8.2 RESPONSIVE COMPANIES

- 13.8.3 DYNAMIC COMPANIES

- 13.8.4 STARTING BLOCKS

- 13.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 13.8.5.1 Detailed list of key startups/SMEs

- 13.8.5.2 Competitive benchmarking of key startups/SMEs

- 13.9 COMPETITIVE SCENARIO

- 13.9.1 PRODUCT LAUNCHES

- 13.9.2 DEALS

- 13.9.3 EXPANSIONS

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- 14.1.1 SAINT-GOBAIN

- 14.1.1.1 Business overview

- 14.1.1.2 Products/Solutions/Services offered

- 14.1.1.3 Recent developments

- 14.1.1.3.1 Deals

- 14.1.1.4 MnM view

- 14.1.1.4.1 Key strengths/Right to win

- 14.1.1.4.2 Strategic choices

- 14.1.1.4.3 Weaknesses/Competitive threats

- 14.1.2 AGC INC.

- 14.1.2.1 Business overview

- 14.1.2.2 Products/Solutions/Services offered

- 14.1.2.3 Recent developments

- 14.1.2.3.1 Product launches

- 14.1.2.3.2 Deals

- 14.1.2.3.3 Other developments

- 14.1.2.4 MnM view

- 14.1.2.4.1 Key strengths/Right to win

- 14.1.2.4.2 Strategic choices

- 14.1.2.4.3 Weaknesses/Competitive threats

- 14.1.3 GENTEX CORPORATION

- 14.1.3.1 Business overview

- 14.1.3.2 Products/Solutions/Services offered

- 14.1.3.3 Recent developments

- 14.1.3.3.1 Deals

- 14.1.3.3.2 Expansions

- 14.1.3.4 MnM view

- 14.1.3.4.1 Key strengths/Right to win

- 14.1.3.4.2 Strategic choices

- 14.1.3.4.3 Weaknesses/Competitive threats

- 14.1.4 CORNING INCORPORATED

- 14.1.4.1 Business overview

- 14.1.4.2 Products/Solutions/Services offered

- 14.1.4.3 Recent developments

- 14.1.4.3.1 Deals

- 14.1.4.4 MnM view

- 14.1.4.4.1 Key strengths/Right to win

- 14.1.4.4.2 Strategic choices

- 14.1.4.4.3 Weaknesses/Competitive threats

- 14.1.5 NIPPON SHEET GLASS CO., LTD

- 14.1.5.1 Business overview

- 14.1.5.2 Products/Solutions/Services offered

- 14.1.5.3 Recent developments

- 14.1.5.3.1 Expansions

- 14.1.5.4 MnM view

- 14.1.5.4.1 Key strengths/Right to win

- 14.1.5.4.2 Strategic choices

- 14.1.5.4.3 Weaknesses/Competitive threats

- 14.1.6 VIEW INC.

- 14.1.6.1 Business overview

- 14.1.6.2 Products/Solutions/Services offered

- 14.1.6.3 Recent developments

- 14.1.6.3.1 Deals

- 14.1.7 GAUZY LTD AND ENTITIES

- 14.1.7.1 Business overview

- 14.1.7.2 Products/Solutions/Services offered

- 14.1.7.3 Recent developments

- 14.1.7.3.1 Deals

- 14.1.8 XINYI GLASS HOLDINGS LIMITED

- 14.1.8.1 Business overview

- 14.1.8.2 Products/Solutions/Services offered

- 14.1.9 RESEARCH FRONTIERS

- 14.1.9.1 Business overview

- 14.1.9.2 Products/Solutions/Services offered

- 14.1.9.3 Recent developments

- 14.1.9.3.1 Product launches

- 14.1.10 DIAMOND SWITCHABLE GLASS LTD

- 14.1.10.1 Business overview

- 14.1.10.2 Products/Solutions/Services offered

- 14.1.1 SAINT-GOBAIN

- 14.2 OTHER PLAYERS

- 14.2.1 PLEOTINT LLC

- 14.2.2 TAIWAN GLASS IND. CORP.

- 14.2.3 FUYAO GROUP

- 14.2.4 CENTRAL GLASS CO., LTD.

- 14.2.5 CHROMOGENICS

- 14.2.6 RAVENWINDOW

- 14.2.7 POLYTRONIX, INC.

- 14.2.8 PGW AUTO GLASS, LLC

- 14.2.9 AGP GROUP

- 14.2.10 SPD CONTROL SYSTEMS CORPORATION

- 14.2.11 SCIENSTRY, INC.

- 14.2.12 INNOVATIVE GLASS CORP.

- 14.2.13 HALIO, INC.

- 14.2.14 MIRU SMART TECHNOLOGIES

- 14.2.15 MERCK KGAA

- 14.2.16 HUICHI INDUSTRIAL DEVELOPMENT CO.,LTD

- 14.2.17 PRO DISPLAY

- 14.2.18 SKYLINE DESIGN

15 APPENDIX

- 15.1 INSIGHTS FROM INDUSTRY EXPERTS

- 15.2 DISCUSSION GUIDE

- 15.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.4 CUSTOMIZATION OPTIONS

- 15.5 RELATED REPORTS

- 15.6 AUTHOR DETAILS