|

|

市場調査レポート

商品コード

1252921

スマートシティプラットフォームの世界市場:提供製品/サービス別 (プラットフォーム、サービス)・提供モデル別・用途別・地域別の将来予測 (2028年まで)Smart City Platforms Market by Offering (Platforms and Services), Delivery Model, Application and Region - Global Forecast to 2028 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| スマートシティプラットフォームの世界市場:提供製品/サービス別 (プラットフォーム、サービス)・提供モデル別・用途別・地域別の将来予測 (2028年まで) |

|

出版日: 2023年03月29日

発行: MarketsandMarkets

ページ情報: 英文 290 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のスマートシティプラットフォームの市場規模は、2023年に1,916億米ドルと推定され、2023年から2028年にかけて8.8%のCAGRで成長し、2028年には2,921億米ドルに達すると予測されます。

エコシステムには様々な大手企業が存在するため、市場は競争的で多様化しています。スマートシティの確立に向けた政府の取り組みが、今後のスマートシティプラットフォーム市場の普及を促進すると予想されます。

"サービス別では、専門サービス分野が予測期間中に最大の市場規模を維持する"

専門サービスとは、専門家やエキスパートなどを通じて提供される、事業運営をサポートするサービスのことです。専門家が採用する革新的な技術・戦略・スキルは、スマートシティプラットフォームの導入を促進します。サービスプロバイダーは、業界で定義されたベストプラクティスに従って、スマートシティプラットフォームのカスタム型実装や、旧来型ソリューションとの統合を提供し、顧客を支援します。実装サービスを提供するベンダーは、監査・コンサルティング・導入・サポート・訓練から継続的なパフォーマンス最適化まで、プラットフォーム導入のすべての段階をカバーします。

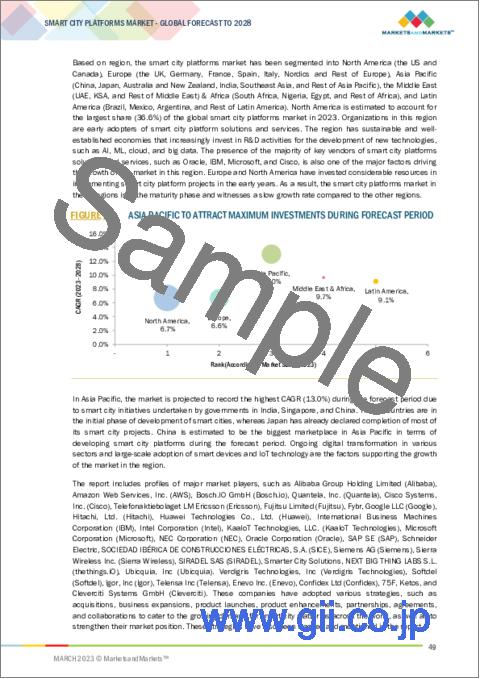

"アジア太平洋が予測期間中に最も高い成長率を記録する"

アジア太平洋 (中国・日本・インドなど) は、急速な技術発展を遂げている国々で構成されています。また、域内には急速な都市化が進む発展途上国があります。このことが、スマートシティプラットフォームベンダーにとって大きなビジネスチャンスであると同時に、持続可能な開発のための重大な課題でもあります。

近年、アジア太平洋は、低炭素モデルタウンとIoTベースのスマートシティの協力プロジェクトを成功させ、その過程で貴重な経験を蓄積し、加盟国間で共有することができるようになりました。この地域のスマートシティへの取り組みは、スマートシティプラットフォーム・プロバイダーにとってチャンスとなります。

当レポートでは、世界のスマートシティプラットフォームの市場について分析し、市場の基本構造や最新情勢、主な市場促進・抑制要因、提供製品/サービス別・提供モデル別・用途別・地域別の市場動向の見通し、市場競争の状態、主要企業のプロファイルなどを調査しております。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要と業界の動向

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- ポーターのファイブフォース分析

- 主な会議とイベント (2023年~2024年)

- 業界動向

- サプライチェーン分析

- エコシステム・マッピング

- スマートシティへの取り組みと投資

- 主な利害関係者と購入基準

- 特許分析

- スマートシティプラットフォーム市場のバイヤー/クライアントに影響を与える動向と混乱

- 平均販売価格の傾向

- 技術動向

- ケーススタディ分析

- 規制への影響

第6章 スマートシティプラットフォーム市場:提供製品/サービス別

- イントロダクション

- プラットフォーム

- 接続管理プラットフォーム

- 統合プラットフォーム

- デバイス管理プラットフォーム

- データ管理プラットフォーム

- セキュリティプラットフォーム

- サービス

- 専門サービス

- マネージドサービス

第7章 スマートシティプラットフォーム市場:提供モデル別

- イントロダクション

- オフショア

- ハイブリッド

- オンサイト

第8章 スマートシティプラットフォーム市場:用途別

- イントロダクション

- スマート輸送

- 公安

- スマートエネルギー・ユーティリティ

- インフラ管理

第9章 スマートシティプラットフォーム市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- 欧州

- 英国

- ドイツ

- フランス

- イタリア

- スペイン

- 北欧諸国

- 他の欧州諸国

- アジア太平洋

- 中国

- 日本

- 韓国

- インド

- オーストラリア・ニュージーランド

- 東南アジア

- 他のアジア太平洋諸国

- 中東・アフリカ

- 中東

- アフリカ

- ラテンアメリカ

- ブラジル

- メキシコ

- アルゼンチン

- 他のラテンアメリカ諸国

第10章 競合情勢

- 概要

- 上位企業の市場シェア分析

- 過去の収益分析

- 主要企業の市場ランキング (2023年)

- 企業評価クアドラント:調査手法

- スタートアップ/中小企業の評価マトリックス:方法論と定義

- 競合ベンチマーキング

- 競合シナリオ

- 製品の発売

- 資本取引

- その他

第11章 企業プロファイル

- 主要企業

- IBM

- SIEMENS

- CISCO

- HITACHI

- MICROSOFT

- HUAWEI

- INTEL

- ORACLE

- AWS

- その他の企業

- SAP

- NEC

- FUJITSU

- SCHNEIDER ELECTRIC

- ALIBABA

- ERICSSON

- SIERRA WIRELESS

- SICE

- スタートアップ/中小企業

- BOSCH.IO

- THETHINGS.IO

- KAAIOT TECHNOLOGIES

- SIRADEL

- SMARTER CITY SOLUTIONS

- QUANTELA

- FYBR

- UBICQUIA

- VERDIGRIS TECHNOLOGIES

- SOFTDEL

- IGOR

- 75F

- TELENSA

- ENEVO

- CONFIDEX

- KETOS

- CLEVERCITI

第12章 隣接/関連市場

- イントロダクション

- スマート輸送市場:世界市場の予測 (2025年まで)

- スマートシティ向けIoT市場:世界市場の予測 (2026年まで)

第13章 付録

The smart city platforms market is estimated at USD 191.6 billion in 2023 and is projected to reach USD 292.1 billion by 2028, at a CAGR of 8.8% from 2023 to 2028. The presence of various key players in the ecosystem has led to competitive and diverse market. Government initiatives to establish smart cities is expected to drive the adoption of the smart city platforms market in the future.

"By Services, professional services segment to hold the largest market size during the forecast period"

Professional services are services offered through professionals, specialists, or experts to support business operations. The innovative techniques, strategies, and skills adopted by professionals encourage the adoption of smart city platforms. Service providers offer customized implementation and integration of smart city platforms with legacy solutions and assist customers, following industry-defined best practices. Vendors offering deployment services cover all phases of platform deployment, right from auditing, consulting, deployment, support, and training to ongoing performance optimization.

"Asia Pacific to register the highest growth rate during the forecast period"

Asia Pacific comprises nations with rapid technological development, such as China, Japan, and India. Asia Pacific is home to several developing countries that are experiencing rapid urbanization. This offers enormous business opportunities for smart city platform vendors even while presenting grave challenges for sustainable development.

In recent years, Asia Pacific has successfully facilitated cooperation projects under the low-carbon model town and IoT-based smart cities and has gathered valuable experience in the process, which can be shared among the member economies. The overall focus of the region towards smart city initiatives offers opportunities for smart city platform providers.

Breakdown of primaries

The study contains insights from various industry experts, ranging from solution vendors to Tier 1 companies. The break-up of the primaries is as follows:

- By Company Type: Tier 1 - 35%, Tier 2 - 40%, and Tier 3 - 25%

- By Designation: C-level -35%, D-level - 25%, and Others - 40%

- By Region: North America - 30%, Europe - 35%, Asia Pacific - 25%, Middle East- 5%, and Latin America-5%.

The major players in the smart city platforms market are Alibaba Group Holding Limited (China), Amazon Web Services, Inc. (US), Bosch.IO GmbH (Germany), Quantela, Inc. (US), Cisco Systems, Inc. (US), Ericsson (Sweden), Fujitsu Limited (Japan), Fybr (US), Google LLC (US), Hitachi, Ltd. (Japan), Huawei Technologies Co., Ltd. (China), IBM (US), Intel Corporation (US), KaaIoT Technologies (US), Microsoft (US), NEC Corporation (Japan), Oracle Corporation (US), SAP SE (Germany), Schneider Electric (France), SICE (Spain), Siemens AG (Germany), Sierra Wireless Inc. (Canada), SIRADEL SAS (France), Smarter City Solutions (Australia), Thethings.Io (Spain), Ubicquia, Inc (US), Verdigris Technologies, Inc (US), Softdel (US), Igor, Inc (US), Telensa Inc (UK), Enevo Inc. (US), Confidex Ltd (Finland), 75F (US), Ketos (US), and Cleverciti Systems GmbH (Germany). These players have adopted various growth strategies, such as partnerships, agreements and collaborations, new product launches and product enhancements, and acquisitions to expand their footprint in the smart city platforms market.

Research Coverage

The market study covers the smart city platforms market size across different segments. It aims at estimating the market size and the growth potential across different segments, including offerings (platforms, services), delivery mode, application and region. The study further includes an in-depth competitive analysis of the leading market players, along with their company profiles, key observations related to product and business offerings, recent developments, and market strategies.

Key Benefits of Buying the Report

The report will help the market leaders/new entrants with information on the closest approximations of the revenue numbers for the global smart city platforms market and its subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to better position their businesses and to plan suitable go-to-market strategies. Moreover, the report will provide insights for stakeholders to understand the pulse of the market and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

Analysis of key drivers (Preference for platforms over standalone solutions, exponential rise in urban population resulting in need for smart management, increasing adoption of IoT technology for infrastructure management and city monitoring, inefficient utilization of resources in developing countries), restraints (Cost-intensive infrastructure of smart city platforms, possibility of privacy and security breaches in smart city platforms, lack of standardization in IoT protocols), opportunities (Development of smart infrastructure, industrial and commercial deployment of smart city platforms, rising smart city initiatives worldwide), and challenges (Increasing concern over data privacy and security, growing cybersecurity attacks due to proliferation of IoT devices, disruption in logistics and supply chain of IoT devices ) influencing the growth of the smart city platforms market. Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the smart city platforms market. Market Development: Comprehensive information about lucrative markets - the report analyses the smart city platforms market across varied regions Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the smart city platforms market. Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players like Alibaba Group Holding Limited (China), Amazon Web Services, Inc. (US), Bosch.IO GmbH (Germany), Quantela, Inc. (US), Cisco Systems, Inc. (US), Ericsson (Sweden), Fujitsu Limited (Japan), Fybr (US), Google LLC (US), Hitachi, Ltd. (Japan), Huawei Technologies Co., Ltd. (China), IBM (US), Intel Corporation (US), KaaIoT Technologies (US), Microsoft (US), NEC Corporation (Japan), Oracle Corporation (US), SAP SE (Germany), Schneider Electric (France), SICE (Spain), Siemens AG (Germany), Sierra Wireless Inc. (Canada), SIRADEL SAS (France), Smarter City Solutions (Australia), Thethings.Io (Spain), Ubicquia, Inc (US), Verdigris Technologies, Inc (US), Softdel (US), Igor, Inc (US), Telensa Inc (UK), Enevo Inc. (US), Confidex Ltd (Finland), 75F (US), Ketos (US), and Cleverciti Systems GmbH (Germany).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 SMART CITY PLATFORMS MARKET SEGMENTATION

- 1.3.2 GEOGRAPHIC SCOPE

- FIGURE 2 SMART CITY PLATFORMS MARKET: GEOGRAPHIC SCOPE

- 1.3.3 INCLUSIONS AND EXCLUSIONS

- 1.3.4 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- TABLE 1 USD EXCHANGE RATES, 2020-2022

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 3 SMART CITY PLATFORMS MARKET: RESEARCH DESIGN

- 2.1.1 RESEARCH METHODOLOGY

- 2.1.2 SECONDARY DATA

- 2.1.2.1 Secondary sources

- 2.1.3 PRIMARY DATA

- 2.1.3.1 Primary interviews

- 2.1.3.2 Breakup of primaries

- 2.1.3.3 Primary sources

- 2.1.3.4 Key industry insights

- 2.2 DATA TRIANGULATION

- FIGURE 4 DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE): REVENUE OF PLATFORMS AND SERVICES IN THE SMART CITY PLATFORMS MARKET

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE OF PLATFORMS AND SERVICES OF SMART CITY PLATFORMS MARKET

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (DEMAND SIDE): SMART CITY PLATFORMS MARKET

- 2.4 SMART CITY PLATFORMS MARKET: RECESSION IMPACT

- 2.5 MARKET FORECAST

- TABLE 2 FACTOR ANALYSIS

- 2.6 RESEARCH ASSUMPTIONS AND LIMITATIONS

- 2.6.1 STUDY ASSUMPTIONS

- 2.6.2 LIMITATIONS

3 EXECUTIVE SUMMARY

- FIGURE 8 SMART CITY PLATFORMS MARKET, 2021-2028 (USD BILLION)

- FIGURE 9 SMART CITY PLATFORMS MARKET, REGIONAL SHARE, 2023

- FIGURE 10 ASIA PACIFIC TO ATTRACT MAXIMUM INVESTMENTS DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR MARKET PLAYERS

- FIGURE 11 INCREASING SMART CITY INITIATIVES WORLDWIDE TO DRIVE SMART CITY PLATFORMS MARKET GROWTH DURING FORECAST PERIOD

- 4.2 NORTH AMERICA: SMART CITY PLATFORMS MARKET, BY OFFERING & COUNTRY

- FIGURE 12 PLATFORMS SEGMENT AND US TO DOMINATE MARKET IN NORTH AMERICA

- 4.3 ASIA PACIFIC: SMART CITY PLATFORMS MARKET, BY OFFERING & TOP 3 COUNTRIES

- FIGURE 13 PLATFORMS SEGMENT AND CHINA TO ACCOUNT FOR LARGEST SHARES OF ASIA PACIFIC MARKET

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: SMART CITY PLATFORMS MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Preference for platforms over standalone solutions

- 5.2.1.2 Exponential rise in urban population resulting in need for smart management

- FIGURE 15 GLOBAL URBAN POPULATION GROWTH, 2016-2020

- 5.2.1.3 Increasing adoption of IoT technology for infrastructure management and city monitoring

- 5.2.1.4 Inefficient utilization of resources in emerging economies

- 5.2.1.5 Digital transformation augmenting scope for smart cities

- FIGURE 16 EMERGING TECHNOLOGY ADOPTION FOR DIGITAL TRANSFORMATION, 2020

- 5.2.1.6 Heavy IoT investments

- 5.2.1.7 Availability of low-cost sensors

- 5.2.2 RESTRAINTS

- 5.2.2.1 Cost-intensive infrastructure of smart city platforms

- 5.2.2.2 Possibility of privacy and security breaches in smart city platforms

- 5.2.2.3 Lack of standardization in IoT protocols

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Development of smart infrastructure

- 5.2.3.2 Industrial and commercial deployment of smart city platforms

- 5.2.3.3 Rising smart city initiatives worldwide

- 5.2.4 CHALLENGES

- 5.2.4.1 Increasing concern over data privacy and security

- 5.2.4.2 Growing cybersecurity attacks due to proliferation of IoT devices

- 5.2.4.3 Disruption in logistics and supply chain of IoT devices

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- TABLE 3 SMART CITY PLATFORMS MARKET: PORTER'S FIVE FORCES MODEL

- 5.3.1 THREAT OF NEW ENTRANTS

- 5.3.2 THREAT OF SUBSTITUTES

- 5.3.3 BARGAINING POWER OF BUYERS

- 5.3.4 BARGAINING POWER OF SUPPLIERS

- 5.3.5 DEGREE OF COMPETITION

- 5.4 KEY CONFERENCES AND EVENTS, 2023-2024

- TABLE 4 SMART CITY PLATFORMS MARKET: CONFERENCES AND EVENTS

- 5.5 INDUSTRY TRENDS

- 5.5.1 SUPPLY CHAIN ANALYSIS

- FIGURE 17 SMART CITY PLATFORMS MARKET: SUPPLY CHAIN ANALYSIS

- 5.5.2 ECOSYSTEM MAPPING

- FIGURE 18 SMART CITY PLATFORMS MARKET: ECOSYSTEM

- TABLE 5 SMART CITY PLATFORMS MARKET: ECOSYSTEM

- 5.5.3 SMART CITY INITIATIVES AND INVESTMENTS

- 5.5.3.1 North America

- 5.5.3.2 Europe

- 5.5.3.3 Asia Pacific

- 5.5.3.4 Middle East & Africa

- 5.5.3.5 Latin America

- 5.5.4 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.5.4.1 Key stakeholders in buying process

- FIGURE 19 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE PLATFORMS

- TABLE 6 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE PLATFORMS

- 5.5.4.2 Buying criteria

- FIGURE 20 KEY BUYING CRITERIA FOR TOP THREE PLATFORMS

- TABLE 7 KEY BUYING CRITERIA FOR TOP THREE PLATFORMS

- 5.5.5 PATENT ANALYSIS

- 5.5.5.1 Methodology

- 5.5.5.2 Document type of patents

- TABLE 8 PATENTS FILED, 2020-2023

- 5.5.5.3 Innovation and patent applications

- FIGURE 21 TOTAL NUMBER OF PATENTS GRANTED IN A YEAR, 2020-2022

- 5.5.5.3.1 Top applicants

- FIGURE 22 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS, 2020-2022

- 5.5.6 TRENDS AND DISRUPTIONS IMPACTING BUYERS/CLIENTS IN SMART CITY PLATFORMS MARKET

- FIGURE 23 REVENUE SHIFT FOR SMART CITIES MARKET

- 5.5.7 AVERAGE SELLING PRICE TREND

- TABLE 9 PRICING ANALYSIS

- 5.5.8 TECHNOLOGY TRENDS

- 5.5.8.1 Introduction

- 5.5.8.2 Artificial intelligence (AI) and machine learning (ML)

- 5.5.8.3 Internet of things (IoT)

- 5.5.8.4 Big data analytics

- 5.5.8.5 5G network

- 5.5.9 CASE STUDY ANALYSIS

- 5.5.9.1 Case study 1: Smart City Ahmedabad Development Limited (SCADL) partners with NEC to upgrade manually operated bus transit infrastructure

- 5.5.9.2 Case study 2: Sierra Wireless helps Liveable Cities transform streetlights into sensor network

- 5.5.9.3 Case study 3: Fastned relies on ABB to expand EV fast charge network across Europe

- 5.5.9.4 Case study 4: Honeywell enables efficient flight routing for Newark Liberty International Airport

- 5.5.9.5 Case study 5: Bane NOR selects Thales to provide next-generation nationwide Traffic Management System

- 5.5.9.6 Case study 6: Curtin University adopts Hitachi IoT solution to create smart campus

- 5.5.10 REGULATORY IMPACT

6 SMART CITY PLATFORMS MARKET, BY OFFERING

- 6.1 INTRODUCTION

- FIGURE 24 SERVICES SEGMENT TO RECORD HIGHER CAGR DURING FORECAST PERIOD

- TABLE 10 SMART CITY PLATFORMS MARKET, BY OFFERING, 2016-2022 (USD BILLION)

- TABLE 11 SMART CITY PLATFORMS MARKET, BY OFFERING, 2023-2028 (USD BILLION)

- 6.2 PLATFORMS

- 6.2.1 PLATFORMS: MARKET DRIVERS

- FIGURE 25 CONNECTIVITY MANAGEMENT PLATFORMS SEGMENT TO RECORD HIGHEST CAGR

- TABLE 12 SMART CITY PLATFORMS MARKET, BY PLATFORM TYPE, 2016-2022 (USD BILLION)

- TABLE 13 SMART CITY PLATFORMS MARKET, BY PLATFORM TYPE, 2023-2028 (USD BILLION)

- TABLE 14 PLATFORM TYPE: SMART CITY PLATFORMS MARKET, BY REGION, 2016-2022 (USD BILLION)

- TABLE 15 PLATFORM TYPE: SMART CITY PLATFORMS MARKET, BY REGION, 2023-2028 (USD BILLION)

- 6.2.2 CONNECTIVITY MANAGEMENT PLATFORMS

- 6.2.2.1 Provide end-to-end connectivity solutions for seamless integration

- TABLE 16 CONNECTIVITY MANAGEMENT PLATFORMS: SMART CITY PLATFORMS MARKET, BY REGION, 2016-2022 (USD BILLION)

- TABLE 17 CONNECTIVITY MANAGEMENT PLATFORMS: SMART CITY PLATFORMS MARKET, BY REGION, 2023-2028 (USD BILLION)

- 6.2.3 INTEGRATION PLATFORMS

- 6.2.3.1 Need to merge data from different siloed systems to drive adoption

- TABLE 18 INTEGRATION PLATFORMS: SMART CITY PLATFORMS MARKET, BY REGION, 2016-2022 (USD BILLION)

- TABLE 19 INTEGRATION PLATFORMS: SMART CITY PLATFORMS MARKET, BY REGION, 2023-2028 (USD BILLION)

- 6.2.4 DEVICE MANAGEMENT PLATFORMS

- 6.2.4.1 Growing need to manage information across devices to boost adoption

- TABLE 20 DEVICE MANAGEMENT PLATFORMS: SMART CITY PLATFORMS MARKET, BY REGION, 2016-2022 (USD BILLION)

- TABLE 21 DEVICE MANAGEMENT PLATFORMS: SMART CITY PLATFORMS MARKET, BY REGION, 2023-2028 (USD BILLION)

- 6.2.5 DATA MANAGEMENT PLATFORMS

- 6.2.5.1 Ability to ease solution management of various applications to drive demand

- TABLE 22 DATA MANAGEMENT PLATFORMS: SMART CITY PLATFORMS MARKET, BY REGION, 2016-2022 (USD BILLION)

- TABLE 23 DATA MANAGEMENT PLATFORMS: SMART CITY PLATFORMS MARKET, BY REGION, 2023-2028 (USD BILLION)

- 6.2.6 SECURITY PLATFORMS

- 6.2.6.1 High demand due to rising risk of cyber threats

- TABLE 24 SECURITY PLATFORMS: SMART CITY PLATFORMS MARKET, BY REGION, 2016-2022 (USD BILLION)

- TABLE 25 SECURITY PLATFORMS: SMART CITY PLATFORMS MARKET, BY REGION, 2023-2028 (USD BILLION)

- 6.3 SERVICES

- 6.3.1 SERVICES: MARKET DRIVERS

- FIGURE 26 MANAGED SERVICES TO RECORD HIGHER CAGR DURING FORECAST PERIOD

- TABLE 26 SMART CITY PLATFORMS MARKET, BY SERVICE, 2016-2022 (USD BILLION)

- TABLE 27 SMART CITY PLATFORMS MARKET, BY SERVICE, 2023-2028 (USD BILLION)

- TABLE 28 SERVICES: SMART CITY PLATFORMS MARKET, BY REGION, 2016-2022 (USD BILLION)

- TABLE 29 SERVICES: SMART CITY PLATFORMS MARKET, BY REGION, 2023-2028 (USD BILLION)

- 6.3.2 PROFESSIONAL SERVICES

- FIGURE 27 CONSULTING & ARCHITECTURE DESIGNING SEGMENT TO RECORD HIGHEST CAGR

- TABLE 30 SMART CITY PLATFORMS MARKET, BY PROFESSIONAL SERVICE, 2016-2022 (USD BILLION)

- TABLE 31 SMART CITY PLATFORMS MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD BILLION)

- TABLE 32 PROFESSIONAL SERVICES: SMART CITY PLATFORMS MARKET, BY REGION, 2016-2022 (USD BILLION)

- TABLE 33 PROFESSIONAL SERVICES: SMART CITY PLATFORMS MARKET, BY REGION, 2023-2028 (USD BILLION)

- 6.3.2.1 Consulting & architecture designing

- 6.3.2.1.1 Growing demand to ensure cost-optimization

- 6.3.2.1 Consulting & architecture designing

- TABLE 34 CONSULTING & ARCHITECTURE DESIGNING: SMART CITY PLATFORMS MARKET, BY REGION, 2016-2022 (USD BILLION)

- TABLE 35 CONSULTING & ARCHITECTURE DESIGNING: SMART CITY PLATFORMS MARKET, BY REGION, 2023-2028 (USD BILLION)

- 6.3.2.2 Infrastructure monitoring & management

- 6.3.2.2.1 Provides high-precision information in real time

- 6.3.2.2 Infrastructure monitoring & management

- TABLE 36 INFRASTRUCTURE MONITORING & MANAGEMENT: SMART CITY PLATFORMS MARKET, BY REGION, 2016-2022 (USD BILLION)

- TABLE 37 INFRASTRUCTURE MONITORING & MANAGEMENT: SMART CITY PLATFORMS MARKET, BY REGION, 2023-2028 (USD BILLION)

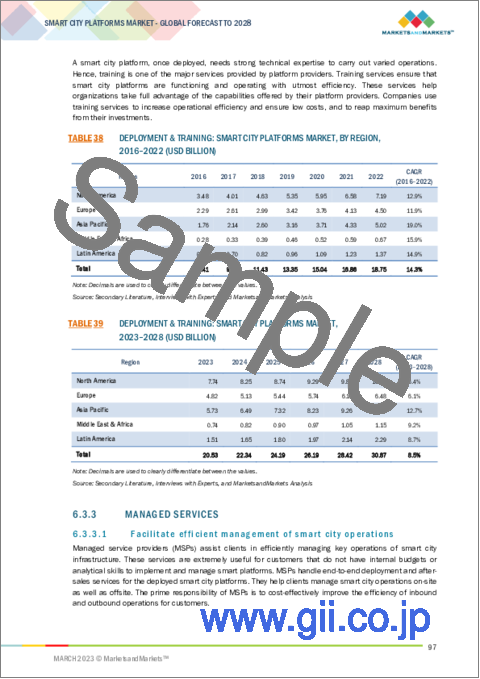

- 6.3.2.3 Deployment & training

- 6.3.2.3.1 Rising demand for services to ensure optimized functioning of platforms

- 6.3.2.3 Deployment & training

- TABLE 38 DEPLOYMENT & TRAINING: SMART CITY PLATFORMS MARKET, BY REGION, 2016-2022 (USD BILLION)

- TABLE 39 DEPLOYMENT & TRAINING: SMART CITY PLATFORMS MARKET, 2023-2028 (USD BILLION)

- 6.3.3 MANAGED SERVICES

- 6.3.3.1 Facilitate efficient management of smart city operations

- TABLE 40 MANAGED SERVICES: SMART CITY PLATFORMS MARKET, BY REGION, 2016-2022 (USD BILLION)

- TABLE 41 MANAGED SERVICES: SMART CITY PLATFORMS MARKET, BY REGION, 2023-2028 (USD BILLION)

7 SMART CITY PLATFORMS MARKET, BY DELIVERY MODEL

- 7.1 INTRODUCTION

- FIGURE 28 HYBRID PLATFORMS TO RECORD HIGHEST CAGR

- TABLE 42 SMART CITY PLATFORMS MARKET, BY DELIVERY MODEL, 2016-2022 (USD BILLION)

- TABLE 43 SMART CITY PLATFORMS MARKET, BY DELIVERY MODEL, 2023-2028 (USD BILLION)

- 7.2 OFFSHORE

- 7.2.1 GROWING PREFERENCE FOR COST-EFFECTIVE AND FLEXIBLE SOLUTIONS

- 7.2.2 OFFSHORE: MARKET DRIVERS

- TABLE 44 OFFSHORE: SMART CITY PLATFORMS MARKET, BY REGION, 2016-2022 (USD BILLION)

- TABLE 45 OFFSHORE: SMART CITY PLATFORMS MARKET, BY REGION, 2023-2028 (USD BILLION)

- 7.3 HYBRID

- 7.3.1 HIGH DEMAND DUE TO NEED FOR SECURE AND SUSTAINABLE TOOLS TO BUILD SMART CITIES

- 7.3.2 HYBRID: MARKET DRIVERS

- TABLE 46 HYBRID: SMART CITY PLATFORMS MARKET, BY REGION, 2016-2022 (USD BILLION)

- TABLE 47 HYBRID: SMART CITY PLATFORMS MARKET, BY REGION, 2023-2028 (USD BILLION)

- 7.4 ON-SITE

- 7.4.1 REQUIREMENT FOR TIMELY PROBLEM-SOLVING TO INCREASE DEMAND

- 7.4.2 ON-SITE: MARKET DRIVERS

- TABLE 48 ON-SITE: SMART CITY PLATFORMS MARKET, BY REGION, 2016-2022 (USD BILLION)

- TABLE 49 ON-SITE: SMART CITY PLATFORMS MARKET, BY REGION, 2023-2028 (USD BILLION)

8 SMART CITY PLATFORMS MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.2 SMART TRANSPORTATION

- 8.2.1 NEED FOR IMPROVED EFFICIENCY AND CONVENIENCE TO DRIVE GROWTH

- 8.2.2 SMART TRANSPORTATION: MARKET DRIVERS

- 8.2.3 USE CASE SCENARIOS

- 8.2.4 OPPORTUNITIES FOR AUTOMOTIVE ORIGINAL EQUIPMENT MANUFACTURERS AND SOLUTION VENDORS

- 8.2.4.1 US DOT announces SMART funding

- 8.2.4.2 AWS and BlackBerry partner to develop IVY software for auto sensor data inference

- 8.2.4.3 Toyota Research Institute joins SmartCityX platform

- 8.2.4.4 Otonomo expands connected car data ecosystem

- 8.2.4.5 NTT and Toyota team up to develop platform for smart cities

- 8.2.4.6 Technology developed by CLASS tested in Europe

- 8.2.4.7 Microsoft Connected Vehicle Platform and relevant partnerships

- 8.2.4.8 Conclusion

- 8.3 PUBLIC SAFETY

- 8.3.1 MAJOR PRIORITY OF SMART CITY MANAGEMENT

- 8.3.2 PUBLIC SAFETY: MARKET DRIVERS

- 8.3.3 USE CASE SCENARIOS

- 8.4 SMART ENERGY & UTILITY

- 8.4.1 NEED FOR SMART SOLUTIONS TO SAVE ENERGY AND REDUCE CARBON EMISSIONS

- 8.4.2 SMART ENERGY & UTILITY: MARKET DRIVERS

- 8.4.3 USE CASE SCENARIOS

- 8.5 INFRASTRUCTURE MANAGEMENT

- 8.5.1 RISING ADOPTION OF AUTOMATED PROBLEM-SOLVING TOOLS TO DRIVE DEMAND

- 8.5.2 INFRASTRUCTURE MANAGEMENT: MARKET DRIVERS

- 8.5.3 USE CASE SCENARIOS

- 8.6 CITIZEN ENGAGEMENT

- 8.6.1 HELPS ENHANCE CONNECTED CITY INFRASTRUCTURE

- 8.6.2 CITIZEN ENGAGEMENT: MARKET DRIVERS

- 8.6.3 USE CASE SCENARIOS

9 SMART CITY PLATFORMS MARKET, BY REGION

- 9.1 INTRODUCTION

- FIGURE 29 NORTH AMERICA TO LEAD SMART CITY PLATFORMS MARKET

- FIGURE 30 ASIA PACIFIC TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 50 SMART CITY PLATFORMS MARKET, BY REGION, 2016-2022 (USD BILLION)

- TABLE 51 SMART CITY PLATFORMS MARKET, BY REGION, 2023-2028 (USD BILLION)

- 9.2 NORTH AMERICA

- 9.2.1 RECESSION IMPACT: NORTH AMERICA

- 9.2.2 PESTLE ANALYSIS: NORTH AMERICA

- FIGURE 31 NORTH AMERICA: SMART CITY PLATFORMS MARKET SNAPSHOT

- TABLE 52 NORTH AMERICA: SMART CITY PLATFORMS MARKET, BY OFFERING, 2016-2022 (USD BILLION)

- TABLE 53 NORTH AMERICA: SMART CITY PLATFORMS MARKET, BY OFFERING, 2023-2028 (USD BILLION)

- TABLE 54 NORTH AMERICA: SMART CITY PLATFORMS MARKET, BY PLATFORM TYPE, 2016-2022 (USD BILLION)

- TABLE 55 NORTH AMERICA: SMART CITY PLATFORMS MARKET, BY PLATFORM TYPE, 2023-2028 (USD BILLION)

- TABLE 56 NORTH AMERICA: SMART CITY PLATFORMS MARKET, BY SERVICE, 2016-2022 (USD BILLION)

- TABLE 57 NORTH AMERICA: SMART CITY PLATFORMS MARKET, BY SERVICE, 2023-2028 (USD BILLION)

- TABLE 58 NORTH AMERICA: SMART CITY PLATFORMS MARKET, BY PROFESSIONAL SERVICE, 2016-2022 (USD BILLION)

- TABLE 59 NORTH AMERICA: SMART CITY PLATFORMS MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD BILLION)

- TABLE 60 NORTH AMERICA: SMART CITY PLATFORMS MARKET, BY DELIVERY MODEL, 2016-2022 (USD BILLION)

- TABLE 61 NORTH AMERICA: SMART CITY PLATFORMS MARKET, BY DELIVERY MODEL, 2023-2028 (USD BILLION)

- TABLE 62 NORTH AMERICA: SMART CITY PLATFORMS MARKET, BY COUNTRY, 2016-2022 (USD BILLION)

- TABLE 63 NORTH AMERICA: SMART CITY PLATFORMS MARKET, BY COUNTRY, 2023-2028 (USD BILLION)

- 9.2.3 US

- 9.2.3.1 Technological advancements and digital readiness to boost market growth

- TABLE 64 US: SMART CITY PLATFORMS MARKET, BY OFFERING, 2016-2022 (USD BILLION)

- TABLE 65 US: SMART CITY PLATFORMS MARKET, BY OFFERING, 2023-2028 (USD BILLION)

- TABLE 66 US: SMART CITY PLATFORMS MARKET, BY PLATFORM TYPE, 2016-2022 (USD BILLION)

- TABLE 67 US: SMART CITY PLATFORMS MARKET, BY PLATFORM TYPE, 2023-2028 (USD BILLION)

- TABLE 68 US: SMART CITY PLATFORMS MARKET, BY SERVICE, 2016-2022 (USD BILLION)

- TABLE 69 US: SMART CITY PLATFORMS MARKET, BY SERVICE, 2023-2028 (USD BILLION)

- TABLE 70 US: SMART CITY PLATFORMS MARKET, BY PROFESSIONAL SERVICE, 2016-2022 (USD BILLION)

- TABLE 71 US: SMART CITY PLATFORMS MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD BILLION)

- TABLE 72 US: SMART CITY PLATFORMS MARKET, BY DELIVERY MODEL, 2016-2022 (USD BILLION)

- TABLE 73 US: SMART CITY PLATFORMS MARKET, BY DELIVERY MODEL, 2023-2028 (USD BILLION)

- 9.2.4 CANADA

- 9.2.4.1 Rapid urbanization and use of IoT technology to drive growth of smart cities

- TABLE 74 CANADA: SMART CITY PLATFORMS MARKET, BY OFFERING, 2016-2022 (USD BILLION)

- TABLE 75 CANADA: SMART CITY PLATFORMS MARKET, BY OFFERING, 2023-2028 (USD BILLION)

- TABLE 76 CANADA: SMART CITY PLATFORMS MARKET, BY PLATFORM TYPE, 2016-2022 (USD BILLION)

- TABLE 77 CANADA: SMART CITY PLATFORMS MARKET, BY PLATFORM TYPE, 2023-2028 (USD BILLION)

- TABLE 78 CANADA: SMART CITY PLATFORMS MARKET, BY SERVICE, 2016-2022 (USD BILLION)

- TABLE 79 CANADA: SMART CITY PLATFORMS MARKET, BY SERVICE, 2023-2028 (USD BILLION)

- TABLE 80 CANADA: SMART CITY PLATFORMS MARKET, BY PROFESSIONAL SERVICE, 2016-2022 (USD BILLION)

- TABLE 81 CANADA: SMART CITY PLATFORMS MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD BILLION)

- TABLE 82 CANADA: SMART CITY PLATFORMS MARKET, BY DELIVERY MODEL, 2016-2022 (USD BILLION)

- TABLE 83 CANADA: SMART CITY PLATFORMS MARKET, BY DELIVERY MODEL, 2023-2028 (USD BILLION)

- 9.3 EUROPE

- 9.3.1 RECESSION IMPACT: EUROPE

- 9.3.2 PESTLE ANALYSIS: EUROPE

- TABLE 84 EUROPE: SMART CITY PLATFORMS MARKET, BY OFFERING, 2016-2022 (USD BILLION)

- TABLE 85 EUROPE: SMART CITY PLATFORMS MARKET, BY OFFERING, 2023-2028 (USD BILLION)

- TABLE 86 EUROPE: SMART CITY PLATFORMS MARKET, BY PLATFORM TYPE, 2016-2022 (USD BILLION)

- TABLE 87 EUROPE: SMART CITY PLATFORMS MARKET, BY PLATFORM TYPE, 2023-2028 (USD BILLION)

- TABLE 88 EUROPE: SMART CITY PLATFORMS MARKET, BY SERVICE, 2016-2022 (USD BILLION)

- TABLE 89 EUROPE: SMART CITY PLATFORMS MARKET, BY SERVICE, 2023-2028 (USD BILLION)

- TABLE 90 EUROPE: SMART CITY PLATFORMS MARKET, BY PROFESSIONAL SERVICE, 2016-2022 (USD BILLION)

- TABLE 91 EUROPE: SMART CITY PLATFORMS MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD BILLION)

- TABLE 92 EUROPE: SMART CITY PLATFORMS MARKET, BY DELIVERY MODEL, 2016-2022 (USD BILLION)

- TABLE 93 EUROPE: SMART CITY PLATFORMS MARKET, BY DELIVERY MODEL, 2023-2028 (USD BILLION)

- TABLE 94 EUROPE: SMART CITY PLATFORMS MARKET, BY COUNTRY, 2016-2022 (USD BILLION)

- TABLE 95 EUROPE: SMART CITY PLATFORMS MARKET, BY COUNTRY, 2023-2028 (USD BILLION)

- 9.3.3 UNITED KINGDOM

- 9.3.3.1 Increased adoption of innovative digital technologies to boost market growth

- TABLE 96 UK: SMART CITY PLATFORMS MARKET, BY OFFERING, 2016-2022 (USD BILLION)

- TABLE 97 UK: SMART CITY PLATFORMS MARKET, BY OFFERING, 2023-2028 (USD BILLION)

- TABLE 98 UK: SMART CITY PLATFORMS MARKET, BY PLATFORM TYPE, 2016-2022 (USD BILLION)

- TABLE 99 UK: SMART CITY PLATFORMS MARKET, BY PLATFORM TYPE, 2023-2028 (USD BILLION)

- TABLE 100 UK: SMART CITY PLATFORMS MARKET, BY SERVICE, 2016-2022 (USD BILLION)

- TABLE 101 UK: SMART CITY PLATFORMS MARKET, BY SERVICE, 2023-2028 (USD BILLION)

- TABLE 102 UK: SMART CITY PLATFORMS MARKET, BY PROFESSIONAL SERVICE, 2016-2022 (USD BILLION)

- TABLE 103 UK: SMART CITY PLATFORMS MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD BILLION)

- TABLE 104 UK: SMART CITY PLATFORMS MARKET, BY DELIVERY MODEL, 2016-2022 (USD BILLION)

- TABLE 105 UK: SMART CITY PLATFORMS MARKET, BY DELIVERY MODEL, 2023-2028 (USD BILLION)

- 9.3.4 GERMANY

- 9.3.4.1 Acceleration of urban digital transformation to drive smart city development

- 9.3.5 FRANCE

- 9.3.5.1 High usage of smart devices to drive market

- 9.3.6 ITALY

- 9.3.6.1 Growing adoption of latest technologies to boost market

- 9.3.7 SPAIN

- 9.3.7.1 Government initiatives to improve quality of life to drive market

- 9.3.8 NORDICS

- 9.3.8.1 Focus on sustainable development to boost demand for smart cities

- 9.3.9 REST OF EUROPE

- 9.4 ASIA PACIFIC

- 9.4.1 RECESSION IMPACT: ASIA PACIFIC

- 9.4.2 PESTLE ANALYSIS: ASIA PACIFIC

- FIGURE 32 ASIA PACIFIC: SMART CITY PLATFORMS MARKET SNAPSHOT

- TABLE 106 ASIA PACIFIC: SMART CITY PLATFORMS MARKET, BY OFFERING, 2016-2022 (USD BILLION)

- TABLE 107 ASIA PACIFIC: SMART CITY PLATFORMS MARKET, BY OFFERING, 2023-2028 (USD BILLION)

- TABLE 108 ASIA PACIFIC: SMART CITY PLATFORMS MARKET, BY PLATFORM TYPE, 2016-2022 (USD BILLION)

- TABLE 109 ASIA PACIFIC: SMART CITY PLATFORMS MARKET, BY PLATFORM TYPE, 2023-2028 (USD BILLION)

- TABLE 110 ASIA PACIFIC: SMART CITY PLATFORMS MARKET, BY SERVICE, 2016-2022 (USD BILLION)

- TABLE 111 ASIA PACIFIC: SMART CITY PLATFORMS MARKET, BY SERVICE, 2023-2028 (USD BILLION)

- TABLE 112 ASIA PACIFIC: SMART CITY PLATFORMS MARKET, BY PROFESSIONAL SERVICE, 2016-2022 (USD BILLION)

- TABLE 113 ASIA PACIFIC: SMART CITY PLATFORMS MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD BILLION)

- TABLE 114 ASIA PACIFIC: SMART CITY PLATFORMS MARKET, BY DELIVERY MODEL, 2016-2022 (USD BILLION)

- TABLE 115 ASIA PACIFIC: SMART CITY PLATFORMS MARKET, BY DELIVERY MODEL, 2023-2028 (USD BILLION)

- TABLE 116 ASIA PACIFIC: SMART CITY PLATFORMS MARKET, BY COUNTRY, 2016-2022 (USD BILLION)

- TABLE 117 ASIA PACIFIC: SMART CITY PLATFORMS MARKET, BY COUNTRY, 2023-2028 (USD BILLION)

- 9.4.3 CHINA

- 9.4.3.1 Government initiatives to promote growth of smart cities

- TABLE 118 CHINA: SMART CITY PLATFORMS MARKET, BY OFFERING, 2016-2022 (USD BILLION)

- TABLE 119 CHINA: SMART CITY PLATFORMS MARKET, BY OFFERING, 2023-2028 (USD BILLION)

- TABLE 120 CHINA: SMART CITY PLATFORMS MARKET, BY PLATFORM TYPE, 2016-2022 (USD BILLION)

- TABLE 121 CHINA: SMART CITY PLATFORMS MARKET, BY PLATFORM TYPE, 2023-2028 (USD BILLION)

- TABLE 122 CHINA: SMART CITY PLATFORMS MARKET, BY SERVICE, 2016-2022 (USD BILLION)

- TABLE 123 CHINA: SMART CITY PLATFORMS MARKET, BY SERVICE, 2023-2028 (USD BILLION)

- TABLE 124 CHINA: SMART CITY PLATFORMS MARKET, BY PROFESSIONAL SERVICE, 2016-2022 (USD BILLION)

- TABLE 125 CHINA: SMART CITY PLATFORMS MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD BILLION)

- TABLE 126 CHINA: SMART CITY PLATFORMS MARKET, BY DELIVERY MODEL, 2016-2022 (USD BILLION)

- TABLE 127 CHINA: SMART CITY PLATFORMS MARKET, BY DELIVERY MODEL, 2023-2028 (USD BILLION)

- 9.4.4 JAPAN

- 9.4.4.1 Highly developed telecom sector to boost development of smart cities

- 9.4.5 SOUTH KOREA

- 9.4.6 INDIA

- 9.4.6.1 Growing urban population to drive need for smart cities

- 9.4.7 AUSTRALIA AND NEW ZEALAND

- 9.4.7.1 Knowledge-based Australian economy to offer opportunities for market growth

- 9.4.8 SOUTHEAST ASIA

- 9.4.8.1 Rapid urbanization to drive market

- 9.4.9 REST OF ASIA PACIFIC

- 9.5 MIDDLE EAST & AFRICA

- 9.5.1 RECESSION IMPACT: MIDDLE EAST & AFRICA

- 9.5.2 PESTLE ANALYSIS: MIDDLE EAST & AFRICA

- TABLE 128 MIDDLE EAST & AFRICA: SMART CITY PLATFORMS MARKET, BY OFFERING, 2016-2022 (USD BILLION)

- TABLE 129 MIDDLE EAST & AFRICA: SMART CITY PLATFORMS MARKET, BY OFFERING, 2023-2028 (USD BILLION)

- TABLE 130 MIDDLE EAST & AFRICA: SMART CITY PLATFORMS MARKET, BY PLATFORM TYPE, 2016-2022 (USD BILLION)

- TABLE 131 MIDDLE EAST & AFRICA: SMART CITY PLATFORMS MARKET, BY PLATFORM TYPE, 2023-2028 (USD BILLION)

- TABLE 132 MIDDLE EAST & AFRICA: SMART CITY PLATFORMS MARKET, BY SERVICE, 2016-2022 (USD BILLION)

- TABLE 133 MIDDLE EAST & AFRICA: SMART CITY PLATFORMS MARKET, BY SERVICE, 2023-2028 (USD BILLION)

- TABLE 134 MIDDLE EAST & AFRICA: SMART CITY PLATFORMS MARKET, BY PROFESSIONAL SERVICE, 2016-2022 (USD BILLION)

- TABLE 135 MIDDLE EAST & AFRICA: SMART CITY PLATFORMS MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD BILLION)

- TABLE 136 MIDDLE EAST & AFRICA: SMART CITY PLATFORMS MARKET, BY DELIVERY MODEL, 2016-2022 (USD BILLION)

- TABLE 137 MIDDLE EAST & AFRICA: SMART CITY PLATFORMS MARKET, BY DELIVERY MODEL, 2023-2028 (USD BILLION)

- TABLE 138 MIDDLE EAST & AFRICA: SMART CITY PLATFORMS MARKET, BY REGION, 2016-2022 (USD BILLION)

- TABLE 139 MIDDLE EAST & AFRICA: SMART CITY PLATFORMS MARKET, BY REGION, 2023-2028 (USD BILLION)

- 9.5.3 MIDDLE EAST

- 9.5.3.1 Adoption of IoT networking and related technology to boost market

- TABLE 140 MIDDLE EAST: SMART CITY PLATFORMS MARKET, BY COUNTRY, 2016-2022 (USD BILLION)

- TABLE 141 MIDDLE EAST: SMART CITY PLATFORMS MARKET, BY COUNTRY, 2023-2028 (USD BILLION)

- 9.5.3.2 United Arab Emirates

- 9.5.3.2.1 Government focus on sustainable development to drive demand for smart cities

- 9.5.3.3 Kingdom of Saudi Arabia

- 9.5.3.3.1 Increasing development of smart cities to boost market

- 9.5.3.4 Rest of Middle East

- 9.5.3.2 United Arab Emirates

- 9.5.4 AFRICA

- 9.5.4.1 Rising urbanization to increase development of smart cities

- TABLE 142 AFRICA: SMART CITY PLATFORMS MARKET, BY COUNTRY, 2016-2022 (USD BILLION)

- TABLE 143 AFRICA: SMART CITY PLATFORMS MARKET, BY COUNTRY, 2023-2028 (USD BILLION)

- 9.5.4.2 South Africa

- 9.5.4.2.1 Urban transformation projects to boost market growth

- 9.5.4.3 Egypt

- 9.5.4.3.1 Introduction of people-centered digital policies to create demand for smart cities

- 9.5.4.4 Nigeria

- 9.5.4.4.1 Rising urbanization to increase demand for smart cities

- 9.5.4.5 Rest of Africa

- 9.5.4.2 South Africa

- 9.6 LATIN AMERICA

- 9.6.1 RECESSION IMPACT: LATIN AMERICA

- 9.6.2 PESTLE ANALYSIS: LATIN AMERICA

- TABLE 144 LATIN AMERICA: SMART CITY PLATFORMS MARKET, BY OFFERING, 2016-2022 (USD BILLION)

- TABLE 145 LATIN AMERICA: SMART CITY PLATFORMS MARKET, BY OFFERING, 2023-2028 (USD BILLION)

- TABLE 146 LATIN AMERICA: SMART CITY PLATFORMS MARKET, BY PLATFORM TYPE, 2016-2022 (USD BILLION)

- TABLE 147 LATIN AMERICA: SMART CITY PLATFORMS MARKET, BY PLATFORM TYPE, 2023-2028 (USD BILLION)

- TABLE 148 LATIN AMERICA: SMART CITY PLATFORMS MARKET, BY SERVICE, 2016-2022 (USD BILLION)

- TABLE 149 LATIN AMERICA: SMART CITY PLATFORMS MARKET, BY SERVICE, 2023-2028 (USD BILLION)

- TABLE 150 LATIN AMERICA: SMART CITY PLATFORMS MARKET, BY PROFESSIONAL SERVICE, 2016-2022 (USD BILLION)

- TABLE 151 LATIN AMERICA: SMART CITY PLATFORMS MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD BILLION)

- TABLE 152 LATIN AMERICA: SMART CITY PLATFORMS MARKET, BY DELIVERY MODEL, 2016-2022 (USD BILLION)

- TABLE 153 LATIN AMERICA: SMART CITY PLATFORMS MARKET, BY DELIVERY MODEL, 2023-2028 (USD BILLION)

- TABLE 154 LATIN AMERICA: SMART CITY PLATFORMS MARKET, BY COUNTRY, 2016-2022 (USD BILLION)

- TABLE 155 LATIN AMERICA: SMART CITY PLATFORMS MARKET, BY COUNTRY, 2023-2028 (USD BILLION)

- 9.6.3 BRAZIL

- 9.6.3.1 Early adoption of smart city technologies to boost market

- TABLE 156 BRAZIL: SMART CITY PLATFORMS MARKET, BY OFFERING, 2016-2022 (USD BILLION)

- TABLE 157 BRAZIL: SMART CITY PLATFORMS MARKET, BY OFFERING, 2023-2028 (USD BILLION)

- TABLE 158 BRAZIL: SMART CITY PLATFORMS MARKET, BY PLATFORM TYPE, 2016-2022 (USD BILLION)

- TABLE 159 BRAZIL: SMART CITY PLATFORMS MARKET, BY PLATFORM TYPE, 2023-2028 (USD BILLION)

- TABLE 160 BRAZIL: SMART CITY PLATFORMS MARKET, BY SERVICE, 2016-2022 (USD BILLION)

- TABLE 161 BRAZIL: SMART CITY PLATFORMS MARKET, BY SERVICE, 2023-2028 (USD BILLION)

- TABLE 162 BRAZIL: SMART CITY PLATFORMS MARKET, BY PROFESSIONAL SERVICE, 2016-2022 (USD BILLION)

- TABLE 163 BRAZIL: SMART CITY PLATFORMS MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD BILLION)

- TABLE 164 BRAZIL: SMART CITY PLATFORMS MARKET, BY DELIVERY MODEL, 2016-2022 (USD BILLION)

- TABLE 165 BRAZIL: SMART CITY PLATFORMS MARKET, BY DELIVERY MODEL, 2023-2028 (USD BILLION)

- 9.6.4 MEXICO

- 9.6.4.1 Need to create digitally smart urban areas to drive market growth

- 9.6.5 ARGENTINA

- 9.6.5.1 Rising need for smart city management tools to drive market

- 9.6.6 REST OF LATIN AMERICA

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 MARKET SHARE ANALYSIS OF TOP PLAYERS

- TABLE 166 SMART CITY PLATFORMS MARKET: DEGREE OF COMPETITION

- 10.3 HISTORICAL REVENUE ANALYSIS

- FIGURE 33 HISTORICAL FIVE-YEAR REVENUE ANALYSIS OF LEADING PLAYERS

- 10.4 MARKET RANKING OF KEY PLAYERS, 2023

- FIGURE 34 MARKET RANKING OF KEY PLAYERS, 2023

- 10.5 COMPANY EVALUATION QUADRANT METHODOLOGY

- FIGURE 35 COMPANY EVALUATION MATRIX: CRITERIA WEIGHTAGE

- 10.5.1 STARS

- 10.5.2 EMERGING LEADERS

- 10.5.3 PERVASIVE PLAYERS

- 10.5.4 PARTICIPANTS

- FIGURE 36 SMART CITY PLATFORMS MARKET COMPANY EVALUATION MATRIX, 2023

- 10.6 STARTUP/SME EVALUATION MATRIX METHODOLOGY AND DEFINITIONS

- FIGURE 37 STARTUP/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

- 10.6.1 PROGRESSIVE COMPANIES

- 10.6.2 RESPONSIVE COMPANIES

- 10.6.3 DYNAMIC COMPANIES

- 10.6.4 STARTING BLOCKS

- FIGURE 38 STARTUP/SME SMART CITY PLATFORMS MARKET EVALUATION MATRIX, 2021

- 10.7 COMPETITIVE BENCHMARKING

- TABLE 167 PRODUCT FOOTPRINT WEIGHTAGE

- TABLE 168 SMART CITY PLATFORMS MARKET: KEY STARTUPS/SMES

- TABLE 169 SMART CITY PLATFORMS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 170 SMART CITY PLATFORMS MARKET: COMPETITIVE BENCHMARKING OF MAJOR PLAYERS

- 10.8 COMPETITIVE SCENARIO

- 10.8.1 PRODUCT LAUNCHES

- TABLE 171 PRODUCT LAUNCHES, NOVEMBER 2020-SEPTEMBER 2022

- 10.8.2 DEALS

- TABLE 172 DEALS, JULY 2020-AUGUST 2022

- 10.8.3 OTHERS

- TABLE 173 OTHERS, SEPTEMBER 2019 - OCTOBER 2021

11 COMPANY PROFILES

(Business overview, Products/Solutions/Services offered, Recent developments & MnM View)*

- 11.1 MAJOR PLAYERS

- 11.1.1 IBM

- TABLE 174 IBM: COMPANY OVERVIEW

- FIGURE 39 IBM: COMPANY SNAPSHOT

- TABLE 175 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 176 IBM: PRODUCT LAUNCHES

- TABLE 177 IBM: DEALS

- 11.1.2 SIEMENS

- TABLE 178 SIEMENS: COMPANY OVERVIEW

- FIGURE 40 SIEMENS: COMPANY SNAPSHOT

- TABLE 179 SIEMENS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 180 SIEMENS: PRODUCT LAUNCHES

- TABLE 181 SIEMENS: DEALS

- 11.1.3 CISCO

- TABLE 182 CISCO: COMPANY OVERVIEW

- FIGURE 41 CISCO: COMPANY SNAPSHOT

- TABLE 183 CISCO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 184 CISCO: PRODUCT LAUNCHES

- TABLE 185 CISCO: DEALS

- 11.1.4 HITACHI

- TABLE 186 HITACHI: COMPANY OVERVIEW

- FIGURE 42 HITACHI: COMPANY SNAPSHOT

- TABLE 187 HITACHI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 188 HITACHI: PRODUCT LAUNCHES

- TABLE 189 HITACHI: DEALS

- TABLE 190 HITACHI: OTHERS

- 11.1.5 MICROSOFT

- TABLE 191 MICROSOFT: COMPANY OVERVIEW

- FIGURE 43 MICROSOFT: COMPANY SNAPSHOT

- TABLE 192 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 193 MICROSOFT: PRODUCT LAUNCHES

- TABLE 194 MICROSOFT: DEALS

- 11.1.6 HUAWEI

- TABLE 195 HUAWEI: BUSINESS OVERVIEW

- FIGURE 44 HUAWEI: COMPANY SNAPSHOT

- TABLE 196 HUAWEI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 197 HUAWEI: PRODUCT LAUNCHES

- TABLE 198 HUAWEI: DEALS

- 11.1.7 GOOGLE

- TABLE 199 GOOGLE: BUSINESS OVERVIEW

- FIGURE 45 GOOGLE: COMPANY SNAPSHOT

- TABLE 200 GOOGLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 201 GOOGLE: DEALS

- 11.1.8 INTEL

- TABLE 202 INTEL: BUSINESS OVERVIEW

- FIGURE 46 INTEL: COMPANY SNAPSHOT

- TABLE 203 INTEL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 204 INTEL: PRODUCT LAUNCHES

- TABLE 205 INTEL: DEALS

- 11.1.9 ORACLE

- TABLE 206 ORACLE: BUSINESS OVERVIEW

- FIGURE 47 ORACLE: COMPANY SNAPSHOT

- TABLE 207 ORACLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 208 ORACLE: DEALS

- 11.1.10 AWS

- TABLE 209 AWS: BUSINESS OVERVIEW

- FIGURE 48 AWS: COMPANY SNAPSHOT

- TABLE 210 AWS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 211 AWS: PRODUCT LAUNCHES

- Details on Business overview, Products/Solutions/Services offered, Recent developments & MnM View might not be captured in case of unlisted companies.

- 11.2 OTHER PLAYERS

- 11.2.1 SAP

- 11.2.2 NEC

- 11.2.3 FUJITSU

- 11.2.4 SCHNEIDER ELECTRIC

- 11.2.5 ALIBABA

- 11.2.6 ERICSSON

- 11.2.7 SIERRA WIRELESS

- 11.2.8 SICE

- 11.3 STARTUPS/SMES

- 11.3.1 BOSCH.IO

- 11.3.2 THETHINGS.IO

- 11.3.3 KAAIOT TECHNOLOGIES

- 11.3.4 SIRADEL

- 11.3.5 SMARTER CITY SOLUTIONS

- 11.3.6 QUANTELA

- 11.3.7 FYBR

- 11.3.8 UBICQUIA

- 11.3.9 VERDIGRIS TECHNOLOGIES

- 11.3.10 SOFTDEL

- 11.3.11 IGOR

- 11.3.12 75F

- 11.3.13 TELENSA

- 11.3.14 ENEVO

- 11.3.15 CONFIDEX

- 11.3.16 KETOS

- 11.3.17 CLEVERCITI

12 ADJACENT/RELATED MARKETS

- 12.1 INTRODUCTION

- 12.1.1 LIMITATIONS

- 12.2 SMART TRANSPORTATION MARKET - GLOBAL FORECAST TO 2025

- 12.2.1 MARKET DEFINITION

- 12.2.2 MARKET OVERVIEW

- 12.2.2.1 Smart transportation market, by component

- TABLE 212 SMART TRANSPORTATION MARKET, BY TRANSPORTATION MODE, 2016-2019 (USD MILLION)

- TABLE 213 SMART TRANSPORTATION MARKET, BY TRANSPORTATION MODE, 2019-2025 (USD MILLION)

- 12.2.2.2 Smart transportation market, by roadways

- TABLE 214 ROADWAYS: SMART TRANSPORTATION MARKET, BY SOLUTION, 2016-2019 (USD MILLION)

- TABLE 215 SMART TRANSPORTATION MARKET, BY SOLUTION IN ROADWAYS, 2019-2025 (USD MILLION)

- TABLE 216 SMART TRANSPORTATION MARKET, BY SERVICE IN ROADWAYS, 2016-2019 (USD MILLION)

- TABLE 217 SMART TRANSPORTATION MARKET, BY SERVICE IN ROADWAYS, 2019-2025 (USD MILLION)

- 12.2.2.3 Smart transportation market, by railways

- TABLE 218 SMART TRANSPORTATION MARKET, BY SOLUTION IN RAILWAYS, 2016-2019 (USD MILLION)

- TABLE 219 SMART TRANSPORTATION MARKET, BY SOLUTION IN RAILWAYS, 2019-2025 (USD MILLION)

- TABLE 220 SMART TRANSPORTATION MARKET, BY SERVICE IN RAILWAYS, 2016-2019 (USD MILLION)

- TABLE 221 SMART TRANSPORTATION MARKET, BY SERVICE IN RAILWAYS, 2019-2025 (USD MILLION)

- 12.2.2.4 Smart transportation market, by airways

- TABLE 222 SMART TRANSPORTATION MARKET, BY SOLUTION IN AIRWAYS, 2016-2019 (USD MILLION)

- TABLE 223 SMART TRANSPORTATION MARKET, BY SOLUTION IN AIRWAYS, 2019-2025 (USD MILLION)

- TABLE 224 SMART TRANSPORTATION MARKET, BY SERVICE IN AIRWAYS, 2016-2019 (USD MILLION)

- TABLE 225 SMART TRANSPORTATION MARKET, BY SERVICE IN AIRWAYS, 2019-2025 (USD MILLION)

- 12.2.2.5 Smart transportation market, by maritime

- TABLE 226 SMART TRANSPORTATION MARKET, BY SOLUTION IN MARITIME, 2016-2019 (USD MILLION)

- TABLE 227 SMART TRANSPORTATION MARKET, BY SOLUTION IN MARITIME, 2019-2025 (USD MILLION)

- TABLE 228 SMART TRANSPORTATION MARKET, BY SERVICE IN MARITIME, 2016-2019 (USD MILLION)

- TABLE 229 SMART TRANSPORTATION MARKET, BY SERVICE IN MARITIME, 2019-2025 (USD MILLION)

- 12.2.2.6 Smart transportation market, by region

- TABLE 230 SMART TRANSPORTATION MARKET, BY REGION, 2016-2019 (USD MILLION)

- TABLE 231 SMART TRANSPORTATION MARKET, BY REGION, 2019-2025 (USD MILLION)

- 12.3 IOT IN SMART CITIES MARKET - GLOBAL FORECAST TO 2026

- 12.3.1 MARKET DEFINITION

- 12.3.2 MARKET OVERVIEW

- 12.3.2.1 IoT in smart cities market, by offering

- TABLE 232 IOT IN SMART CITIES MARKET SIZE, BY OFFERING, 2016-2020 (USD BILLION)

- TABLE 233 IOT IN SMART CITES MARKET SIZE, BY OFFERING, 2021-2026 (USD BILLION)

- 12.3.2.2 IoT in smart cities market, by solution

- TABLE 234 IOT IN SMART CITIES MARKET SIZE, BY SOLUTION, 2016-2020 (USD BILLION)

- TABLE 235 IOT IN SMART CITIES MARKET SIZE, BY SOLUTION, 2021-2026 (USD BILLION)

- 12.3.2.3 IoT in smart cities market, by service

- TABLE 236 SERVICES: IOT IN SMART CITIES MARKET SIZE, BY TYPE, 2016-2020 (USD BILLION)

- TABLE 237 SERVICES: IOT IN SMART CITIES MARKET SIZE, BY TYPE, 2021-2026 (USD BILLION)

- 12.3.2.4 IoT in smart cities market, by application

- TABLE 238 IOT IN SMART CITIES MARKET SIZE, BY APPLICATION, 2016-2020 (USD BILLION)

- TABLE 239 IOT IN SMART CITIES MARKET SIZE, BY APPLICATION, 2021-2026 (USD BILLION)

- 12.3.2.5 IoT in smart cities market, by region

- TABLE 240 IOT IN SMART CITIES MARKET, BY REGION, 2016-2020 (USD BILLION)

- TABLE 241 IOT IN SMART CITIES MARKET, BY REGION, 2021-2026 (USD BILLION)

- 12.3.3 IOT IN HEALTHCARE MARKET - GLOBAL FORECAST TO 2025

- 12.3.3.1 Market definition

- 12.3.3.2 Market overview

- 12.3.3.3 IoT in healthcare market, by component

- TABLE 242 IOT IN HEALTHCARE MARKET, BY COMPONENT, 2015-2019 (USD BILLION)

- TABLE 243 IOT IN HEALTHCARE MARKET, BY COMPONENT, 2019-2025 (USD BILLION)

- TABLE 244 MEDICAL DEVICES: IOT IN HEALTHCARE MARKET, BY TYPE, 2015-2019 (USD BILLION)

- TABLE 245 MEDICAL DEVICES: IOT IN HEALTHCARE MARKET, BY TYPE, 2019-2025 (USD BILLION)

- TABLE 246 SYSTEMS AND SOFTWARE: IOT IN HEALTHCARE MARKET, BY TYPE, 2015-2019 (USD BILLION)

- TABLE 247 SYSTEMS AND SOFTWARE: IOT IN HEALTHCARE MARKET, BY TYPE, 2019-2025 (USD BILLION)

- TABLE 248 SERVICES: IOT IN HEALTHCARE MARKET, BY TYPE, 2015-2019 (USD BILLION)

- TABLE 249 SERVICES: IOT IN HEALTHCARE MARKET, BY TYPE, 2019-2025 (USD BILLION)

- 12.3.3.4 IoT in healthcare market, by application

- TABLE 250 IOT IN HEALTHCARE MARKET, BY APPLICATION, 2015-2019 (USD BILLION)

- TABLE 251 IOT IN HEALTHCARE MARKET, BY APPLICATION, 2019-2025 (USD BILLION)

- 12.3.3.5 IoT in healthcare market, by end user

- TABLE 252 IOT IN HEALTHCARE MARKET, BY END USER, 2015-2019 (USD BILLION)

- TABLE 253 IOT IN HEALTHCARE MARKET, BY END USER, 2019-2025 (USD BILLION)

- 12.3.3.6 IoT in healthcare market, by region

- TABLE 254 IOT IN HEALTHCARE MARKET, BY REGION, 2015-2019 (USD BILLION)

- TABLE 255 IOT IN HEALTHCARE MARKET, BY REGION, 2019-2025 (USD BILLION)

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS