|

|

市場調査レポート

商品コード

1562742

マスフローコントローラの世界市場:金属&エラストマーシール・流量・ガス&液体・熱・差圧&コリオリ・ステンレススチール・ウエハ洗浄・プラズマエッチング・カタリスト研究・曝気 - 予測(~2029年)Mass Flow Controller Market Size by Metal & Elastomer Seal, Flow Rate, Gas & Liquid, Thermal, Differential Pressure & Coriolis, Stainless Steel, Wafer Cleaning, Plasma Etching, Catalyst Research, Aeration - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| マスフローコントローラの世界市場:金属&エラストマーシール・流量・ガス&液体・熱・差圧&コリオリ・ステンレススチール・ウエハ洗浄・プラズマエッチング・カタリスト研究・曝気 - 予測(~2029年) |

|

出版日: 2024年09月23日

発行: MarketsandMarkets

ページ情報: 英文 236 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

マスフローコントローラの市場規模は、2024年の16億3,000万米ドルから、予測期間中は7.2%のCAGRで推移し、2029年には23億2,000万米ドルの規模に成長すると予測されています。

水素燃料電池への注目の高まりがマスフローコントローラ市場の成長を促進しています。燃料電池がクリーンで効率的なエネルギー源として注目される、燃料電池運転時のマスフローコントローラの必要性が重要視されています。一方で、他の技術との統合の複雑さが同市場の成長にとって課題となっています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020-2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024-2029年 |

| 単位 | 金額 (米ドル) |

| セグメント別 | 製品タイプ・メディアタイプ・流量・技術・コネクティビティ・エンドユーザー産業・地域別 |

| 対象地域 | 北米・欧州・アジア太平洋・その他の地域 |

"技術別では、コリオリの部門が予測期間中にもっとも高いCAGRで成長する見込み"

コリオリ式マスフローコントローラは、質量流量を実際に直接測定する唯一のフローセンサと見なされてきました。単純な方法で流体の質量流量を定量化する特徴的な機能が、コリオリ流量コントローラの精度を支えています。コリオリ流量コントローラは、流れる液体や気体の密度、粘度、比熱の変化に関係なく、正確な質量流量を提供し、流体の特性の変化に影響を受けません。

"コネクティビティ別では、デジタルの部門が予測期間中により大きな市場シェアを持つ見通しです"

デジタルマスフローコントローラは、高度に開発されたセンサ、マイクロプロセッサ、複雑なアルゴリズムを使用しているため、流量の測定とその制御において高い精度を誇っています。この用途には、半導体製造のほか、化学薬品の製造に使用されるような他の精密プロセスも含まれます。さらに、デジタル技術の統合により、制御の可能性が高まり、自動制御、校正、遠隔制御が可能となり、これらすべてが操作全体を高度に向上させています。また、デジタルマスフローコントローラは、測定ドリフトと自己校正機能により、より一定で安定し、メンテナンスの必要性が少なく、ランニングコストが低いです。

"地域別では、アジア太平洋地域が予測期間中2番目に高いCAGRで成長する見通しです"

アジア太平洋市場は、予測期間中に28.4%で2番目に高いCAGRを示す見込みです。同地域では、半導体製造工場の設立を目指す政府イニシアチブと民間企業による半導体製造インフラへの大規模な投資が行われています。半導体産業への投資の増加、測定と制御のための効率的なデバイスへの需要の高まり、産業オートメーションなどが同地域の成長を促進する主要な要因です。また、同地域の生産コストは他の地域よりも低いため、マスフローコントローラ市場で事業を展開する主要企業のほとんどはアジア太平洋地域に生産能力を有しています。

当レポートでは、世界のマスフローコントローラの市場を調査し、市場概要、市場成長への各種影響因子の分析、技術・特許の動向、法規制環境、ケーススタディ、市場規模の推移・予測、各種区分・地域別の詳細分析、競合環境、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 顧客ビジネスに影響を与える動向/ディスラプション

- 価格分析

- バリューチェーン分析

- エコシステム分析

- 投資と資金調達のシナリオ

- AI/生成AIがマスフローコントローラ市場に与える影響

- 技術分析

- 特許分析

- 貿易分析

- 主な会議とイベント

- ケーススタディ分析

- 規制状況

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

第6章 マスフローコントローラ市場:製品仕様別

- ディスプレイ

- ディスプレイ付き

- ディスプレイなし

- シール

- 金属

- エラストマー

- 精度

- 標準

- 高精度

第7章 マスフローコントローラ市場:材料別

- ステンレス鋼

- 合金

- その他

第8章 マスフローコントローラ市場:メディアタイプ別

- ガス

- 液体

第9章 マスフローコントローラ市場:流量別

- 低流量

- 中流量

- 高流量

第10章 マスフローコントローラ市場:技術別

- サーマル

- 差圧

- コリオリ

第11章 マスフローコントローラ市場:コネクティビティ別

- アナログ

- デジタル

- PROFIBUS

- RS-485

- PROFINET

- ETHERCAT

- ETHERNET/IP

- MODBUS RTU

- MODBUS TCP/IP

- DEVICENET

- FOUNDATION FIELDBUS

第12章 マスフローコントローラ市場:エンドユーザー産業別

- 半導体

- ウエハー洗浄

- 薄膜堆積

- スプレーコーティング

- プラズマエッチング

- 真空スパッタリング

- 石油・ガス

- バイオガスの臭気化

- 重質燃料油添加剤の投与

- 水圧破砕

- 化学薬品

- 触媒調査

- 液化ガス注入

- 医薬品

- 錠剤コーティング

- 連続製造

- 金属・鉱業

- 選択的レーザー溶融

- 製錬

- 水と廃水処理

- PHコントロール

- 食品・飲料

- エアレーション

- 無菌包装

- その他

- ラムダプローブテスト

第13章 マスフローコントローラ市場:地域別

- 北米

- 欧州

- アジア太平洋

- その他

第14章 競合情勢

- 概要

- 主要企業の戦略/有力企業

- 収益分析

- 市場シェア分析

- 企業価値評価・財務指標

- ブランド/製品比較

- 企業評価マトリックス:主要企業

- 企業評価マトリックス:スタートアップ/中小企業

- 競合シナリオ

第15章 企業プロファイル

- 主要企業

- HORIBA, LTD.

- SENSIRION AG

- MKS INSTRUMENTS

- TELEDYNE TECHNOLOGIES INCORPORATED

- BRONKHORST

- BROOKS INSTRUMENT

- CHRISTIAN BURKERT GMBH & CO. KG

- SIERRA INSTRUMENTS, INC.

- ALICAT SCIENTIFIC, INC.

- PARKER HANNIFIN CORP

- その他の地域

- TOKYO KEISO CO., LTD.

- VOGTLIN INSTRUMENTS GMBH

- AZBIL CORPORATION

- SABLE SYSTEMS INTERNATIONAL

- KOFLOC

- AALBORG

- AXETRIS AG

- DWYER INSTRUMENTS, LLC.

- FCON CO., LTD.

- KELLY PNEUMATICS, INC.

- IMI

- PROTERIAL, LTD.

- MTI CORPORATION

- OHKURA ELECTRIC CO., LTD.

- DAKOTA INSTRUMENTS, INC.

第16章 隣接市場と関連市場

第17章 付録

List of Tables

- TABLE 1 AVERAGE SELLING PRICE TREND OF MASS FLOW CONTROLLERS OFFERED BY KEY PLAYERS, BY CONNECTIVITY (USD)

- TABLE 2 INDICATIVE PRICING TREND OF MASS FLOW CONTROLLERS, BY REGION (USD)

- TABLE 3 ROLES OF COMPANIES IN MASS FLOW CONTROLLER ECOSYSTEM

- TABLE 4 LIST OF APPLIED/GRANTED PATENTS RELATED TO MASS FLOW CONTROLLERS, 2024

- TABLE 5 MASS FLOW CONTROLLER MARKET: LIST OF CONFERENCES AND EVENTS, 2024-2025

- TABLE 6 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 MASS FLOW CONTROLLER: STANDARDS

- TABLE 11 MASS FLOW CONTROLLER MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 12 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USE INDUSTRIES (%)

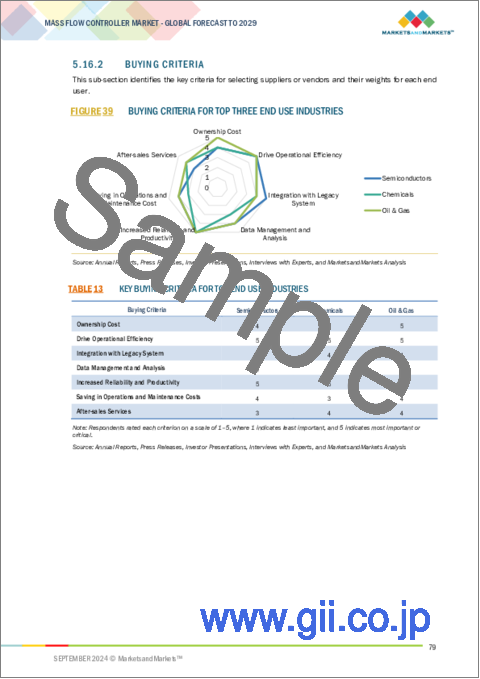

- TABLE 13 KEY BUYING CRITERIA FOR TOP END USE INDUSTRIES

- TABLE 14 MASS FLOW CONTROLLER MARKET, BY DISPLAY, 2020-2023 (USD MILLION)

- TABLE 15 MASS FLOW CONTROLLER MARKET, BY DISPLAY, 2024-2029 (USD MILLION)

- TABLE 16 MASS FLOW CONTROLLER MARKET, BY SEAL, 2020-2023 (USD MILLION)

- TABLE 17 MASS FLOW CONTROLLER MARKET, BY SEAL, 2024-2029 (USD MILLION)

- TABLE 18 MASS FLOW CONTROLLER MARKET, BY MATERIAL, 2020-2023 (USD MILLION)

- TABLE 19 MASS FLOW CONTROLLER MARKET, BY MATERIAL, 2024-2029 (USD MILLION)

- TABLE 20 MASS FLOW CONTROLLER MARKET, BY MEDIA TYPE, 2020-2023 (USD MILLION)

- TABLE 21 MASS FLOW CONTROLLER MARKET, BY MEDIA TYPE, 2024-2029 (USD MILLION)

- TABLE 22 MASS FLOW CONTROLLER MARKET, BY MEDIA TYPE, 2020-2023 (THOUSAND UNITS)

- TABLE 23 MASS FLOW CONTROLLER MARKET, BY MEDIA TYPE, 2024-2029 (THOUSAND UNITS)

- TABLE 24 MASS FLOW CONTROLLER MARKET, BY FLOW RATE, 2020-2023 (USD MILLION)

- TABLE 25 MASS FLOW CONTROLLER MARKET, BY FLOW RATE, 2024-2029 (USD MILLION)

- TABLE 26 LOW: MASS FLOW CONTROLLER MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 27 LOW: MASS FLOW CONTROLLER MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 28 MEDIUM: MASS FLOW CONTROLLER MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 29 MEDIUM: MASS FLOW CONTROLLER MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 30 HIGH: MASS FLOW CONTROLLER MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 31 HIGH: MASS FLOW CONTROLLER MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 32 MASS FLOW CONTROLLER MARKET, BY TECHNOLOGY, 2020-2023 (USD MILLION)

- TABLE 33 MASS FLOW CONTROLLER MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 34 MASS FLOW CONTROLLER MARKET, BY CONNECTIVITY, 2020-2023 (USD MILLION)

- TABLE 35 MASS FLOW CONTROLLER MARKET, BY CONNECTIVITY, 2024-2029 (USD MILLION)

- TABLE 36 MASS FLOW CONTROLLER MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 37 MASS FLOW CONTROLLER MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 38 SEMICONDUCTORS: MASS FLOW CONTROLLER MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 39 SEMICONDUCTORS: MASS FLOW CONTROLLER MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 40 SEMICONDUCTORS: MASS FLOW CONTROLLER MARKET, BY FLOW RATE, 2020-2023 (USD MILLION)

- TABLE 41 SEMICONDUCTORS: MASS FLOW CONTROLLER MARKET, BY FLOW RATE, 2024-2029 (USD MILLION)

- TABLE 42 OIL & GAS: MASS FLOW CONTROLLER MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 43 OIL & GAS: MASS FLOW CONTROLLER MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 44 OIL & GAS: MASS FLOW CONTROLLER MARKET, BY FLOW RATE, 2020-2023 (USD MILLION)

- TABLE 45 OIL & GAS: MASS FLOW CONTROLLER MARKET, BY FLOW RATE, 2024-2029 (USD MILLION)

- TABLE 46 CHEMICALS: MASS FLOW CONTROLLER MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 47 CHEMICALS: MASS FLOW CONTROLLER MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 48 CHEMICALS: MASS FLOW CONTROLLER MARKET, BY FLOW RATE, 2020-2023 (USD MILLION)

- TABLE 49 CHEMICALS: MASS FLOW CONTROLLER MARKET, BY FLOW RATE, 2024-2029 (USD MILLION)

- TABLE 50 PHARMACEUTICALS: MASS FLOW CONTROLLER MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 51 PHARMACEUTICALS: MASS FLOW CONTROLLER MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 52 PHARMACEUTICALS: MASS FLOW CONTROLLER MARKET, BY FLOW RATE, 2020-2023 (USD MILLION)

- TABLE 53 PHARMACEUTICALS: MASS FLOW CONTROLLER MARKET, BY FLOW RATE, 2024-2029 (USD MILLION)

- TABLE 54 METALS & MINING: MASS FLOW CONTROLLER MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 55 METALS & MINING: MASS FLOW CONTROLLER MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 56 METALS & MINING: MASS FLOW CONTROLLER MARKET, BY FLOW RATE, 2020-2023 (USD MILLION)

- TABLE 57 METALS & MINING: MASS FLOW CONTROLLER MARKET, BY FLOW RATE, 2024-2029 (USD MILLION)

- TABLE 58 WATER & WASTEWATER TREATMENT: MASS FLOW CONTROLLER MARKET, BY REGION, 2020-2023 (USD THOUSAND)

- TABLE 59 WATER & WASTEWATER TREATMENT: MASS FLOW CONTROLLER MARKET, BY REGION, 2024-2029 (USD THOUSAND)

- TABLE 60 WATER & WASTEWATER TREATMENT: MASS FLOW CONTROLLER MARKET, BY FLOW RATE, 2020-2023 (USD MILLION)

- TABLE 61 WATER & WASTEWATER TREATMENT: MASS FLOW CONTROLLER MARKET, BY FLOW RATE, 2024-2029 (USD MILLION)

- TABLE 62 FOOD & BEVERAGES: MASS FLOW CONTROLLER MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 63 FOOD & BEVERAGES: MASS FLOW CONTROLLER MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 64 FOOD & BEVERAGES: MASS FLOW CONTROLLER MARKET, BY FLOW RATE, 2020-2023 (USD MILLION)

- TABLE 65 FOOD & BEVERAGES: MASS FLOW CONTROLLER MARKET, BY FLOW RATE, 2024-2029 (USD MILLION)

- TABLE 66 OTHER END-USE INDUSTRIES: MASS FLOW CONTROLLER MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 67 OTHER END-USE INDUSTRIES: MASS FLOW CONTROLLER MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 68 OTHER END-USE INDUSTRIES: MASS FLOW CONTROLLER MARKET, BY FLOW RATE, 2020-2023 (USD MILLION)

- TABLE 69 OTHER END-USE INDUSTRIES: MASS FLOW CONTROLLER MARKET, BY FLOW RATE, 2024-2029 (USD MILLION)

- TABLE 70 MASS FLOW CONTROLLER MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 71 MASS FLOW CONTROLLER MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 72 NORTH AMERICA: MASS FLOW CONTROLLER MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 73 NORTH AMERICA: MASS FLOW CONTROLLER MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 74 NORTH AMERICA: MASS FLOW CONTROLLER MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 75 NORTH AMERICA: MASS FLOW CONTROLLER MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 76 US: MASS FLOW CONTROLLER MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 77 US: MASS FLOW CONTROLLER MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 78 CANADA: MASS FLOW CONTROLLER MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 79 CANADA: MASS FLOW CONTROLLER MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 80 MEXICO: MASS FLOW CONTROLLER MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 81 MEXICO: MASS FLOW CONTROLLER MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 82 EUROPE: MASS FLOW CONTROLLER MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 83 EUROPE: MASS FLOW CONTROLLER MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 84 EUROPE: MASS FLOW CONTROLLER MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 85 EUROPE: MASS FLOW CONTROLLER MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 86 GERMANY: MASS FLOW CONTROLLER MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 87 GERMANY: MASS FLOW CONTROLLER MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 88 UK: MASS FLOW CONTROLLER MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 89 UK: MASS FLOW CONTROLLER MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 90 FRANCE: MASS FLOW CONTROLLER MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 91 FRANCE: MASS FLOW CONTROLLER MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 92 REST OF EUROPE: MASS FLOW CONTROLLER MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 93 REST OF EUROPE: MASS FLOW CONTROLLER MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 94 ASIA PACIFIC: MASS FLOW CONTROLLER MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 95 ASIA PACIFIC: MASS FLOW CONTROLLER MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 96 ASIA PACIFIC: MASS FLOW CONTROLLER MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 97 ASIA PACIFIC: MASS FLOW CONTROLLER MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 98 CHINA: MASS FLOW CONTROLLER MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 99 CHINA: MASS FLOW CONTROLLER MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 100 INDIA: MASS FLOW CONTROLLER MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 101 INDIA: MASS FLOW CONTROLLER MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 102 JAPAN: MASS FLOW CONTROLLER MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 103 JAPAN: MASS FLOW CONTROLLER MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 104 TAIWAN: MASS FLOW CONTROLLER MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 105 TAIWAN: MASS FLOW CONTROLLER MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 106 SOUTH KOREA: MASS FLOW CONTROLLER MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 107 SOUTH KOREA: MASS FLOW CONTROLLER MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 108 REST OF ASIA PACIFIC: MASS FLOW CONTROLLER MARKET, BY END-USE INDUSTRY, 2020-2023 (USD THOUSAND)

- TABLE 109 REST OF ASIA PACIFIC: MASS FLOW CONTROLLER MARKET, BY END-USE INDUSTRY, 2024-2029 (USD THOUSAND)

- TABLE 110 ROW: MASS FLOW CONTROLLER MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 111 ROW: MASS FLOW CONTROLLER MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 112 MIDDLE EAST & AFRICA: MASS FLOW CONTROLLER MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 113 MIDDLE EAST & AFRICA: MASS FLOW CONTROLLER MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 114 ROW: MASS FLOW CONTROLLER MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 115 ROW: MASS FLOW CONTROLLER MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 116 SOUTH AMERICA: MASS FLOW CONTROLLER MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 117 SOUTH AMERICA: MASS FLOW CONTROLLER MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 118 MIDDLE EAST & AFRICA: MASS FLOW CONTROLLER MARKET, BY END-USE INDUSTRY, 2020-2023 (USD MILLION)

- TABLE 119 MIDDLE EAST & AFRICA: MASS FLOW CONTROLLER MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 120 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2022-2024

- TABLE 121 MASS FLOW CONTROLLER MARKET: DEGREE OF COMPETITION, 2023

- TABLE 122 MASS FLOW CONTROLLER MARKET: MATERIAL FOOTPRINT

- TABLE 123 MASS FLOW CONTROLLER MARKET: MEDIA TYPE FOOTPRINT

- TABLE 124 MASS FLOW CONTROLLER MARKET: END-USE INDUSTRY FOOTPRINT

- TABLE 125 MASS FLOW CONTROLLER MARKET: REGION FOOTPRINT

- TABLE 126 MASS FLOW CONTROLLER MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 127 MASS FLOW CONTROLLER MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 128 MASS FLOW CONTROLLER MARKET: PRODUCT LAUNCHES, JANUARY 2022-JULY 2024

- TABLE 129 MASS FLOW CONTROLLER MARKET: DEALS, JANUARY 2022-JULY 2024

- TABLE 130 HORIBA, LTD.: COMPANY OVERVIEW

- TABLE 131 HORIBA, LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 132 HORIBA, LTD.: EXPANSIONS

- TABLE 133 SENSIRION AG: COMPANY OVERVIEW

- TABLE 134 SENSIRION AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 135 SENSIRION AG: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 136 MKS INSTRUMENTS: COMPANY OVERVIEW

- TABLE 137 MKS INSTRUMENTS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 138 TELEDYNE TECHNOLOGIES INCORPORATED: COMPANY OVERVIEW

- TABLE 139 TELEDYNE TECHNOLOGIES INCORPORATED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 140 TELEDYNE TECHNOLOGIES INCORPORATED: DEALS

- TABLE 141 BRONKHORST: COMPANY OVERVIEW

- TABLE 142 BRONKHORST: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 143 BRONKHORST: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 144 BROOKS INSTRUMENT: COMPANY OVERVIEW

- TABLE 145 BROOKS INSTRUMENT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 146 BROOKS INSTRUMENT: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 147 BROOKS INSTRUMENT: DEALS

- TABLE 148 BROOKS INSTRUMENT: EXPANSIONS

- TABLE 149 CHRISTIAN BURKERT GMBH & CO. KG: COMPANY OVERVIEW

- TABLE 150 CHRISTIAN BURKERT GMBH & CO. KG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 151 CHRISTIAN BURKERT GMBH & CO. KG: DEALS

- TABLE 152 CHRISTIAN BURKERT GMBH & CO. KG: EXPANSIONS

- TABLE 153 SIERRA INSTRUMENTS, INC.: COMPANY OVERVIEW

- TABLE 154 SIERRA INSTRUMENTS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 155 SIERRA INSTRUMENTS, INC.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 156 ALICAT SCIENTIFIC, INC.: COMPANY OVERVIEW

- TABLE 157 ALICAT SCIENTIFIC, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 158 ALICAT SCIENTIFIC, INC.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 159 PARKER HANNIFIN CORP: COMPANY OVERVIEW

- TABLE 160 PARKER HANNIFIN CORP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 161 SEMICONDUCTOR MANUFACTURING EQUIPMENT MARKET

- TABLE 162 SEMICONDUCTOR MANUFACTURING EQUIPMENT MARKET, BY FAB FACILITY EQUIPMENT, 2019-2022 (USD MILLION)

- TABLE 163 SEMICONDUCTOR MANUFACTURING EQUIPMENT MARKET, BY FAB FACILITY EQUIPMENT, 2023-2028 (USD MILLION)

List of Figures

- FIGURE 1 MASS FLOW CONTROLLER MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 MASS FLOW CONTROLLER MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE): REVENUE GENERATED BY MASS FLOW CONTROLLER MANUFACTURERS/PROVIDERS

- FIGURE 4 MASS FLOW CONTROLLER MARKET: BOTTOM-UP APPROACH

- FIGURE 5 MASS FLOW CONTROLLER MARKET: TOP-DOWN APPROACH

- FIGURE 6 DATA TRIANGULATION

- FIGURE 7 ALLOYS SEGMENT TO DOMINATE MARKET IN 2029

- FIGURE 8 LOW FLOW RATE SEGMENT TO HOLD LARGEST MARKET SHARE IN 2029

- FIGURE 9 GAS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2029

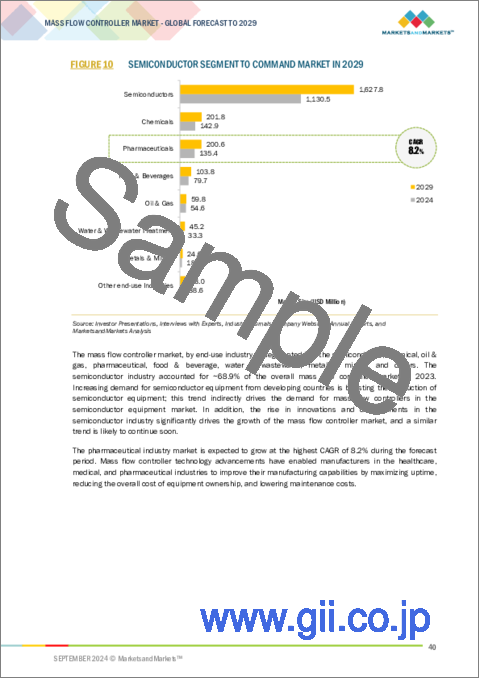

- FIGURE 10 SEMICONDUCTOR SEGMENT TO COMMAND MARKET IN 2029

- FIGURE 11 ASIA PACIFIC TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 12 EXPANDING SEMICONDUCTOR INDUSTRY TO DRIVE MARKET

- FIGURE 13 ALLOYS SEGMENT TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 14 LOW FLOW RATE SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2024

- FIGURE 15 GAS SEGMENT TO EXHIBIT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 16 SEMICONDUCTOR INDUSTRY TO DOMINATE MARKET IN 2024

- FIGURE 17 ASIA PACIFIC TO BE FASTEST-GROWING MARKET IN 2024

- FIGURE 18 CORIOLIS SEGMENT TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 19 DIGITAL SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE IN 2024

- FIGURE 20 CHINA DOMINATED MARKET IN 2023

- FIGURE 21 MASS FLOW CONTROLLER MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 22 MASS FLOW CONTROLLER MARKET: IMPACT ANALYSIS OF DRIVERS

- FIGURE 23 MASS FLOW CONTROLLER MARKET: IMPACT ANALYSIS OF RESTRAINTS

- FIGURE 24 MASS FLOW CONTROLLER MARKET: IMPACT ANALYSIS OF OPPORTUNITIES

- FIGURE 25 MASS FLOW CONTROLLER: IMPACT ANALYSIS OF CHALLENGES

- FIGURE 26 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 27 AVERAGE SELLING PRICE TREND OF MASS FLOW CONTROLLERS OFFERED BY KEY PLAYERS, BY CONNECTIVITY

- FIGURE 28 AVERAGE SELLING PRICING TREND OF MASS FLOW CONTROLLERS, 2019-2023

- FIGURE 29 MASS FLOW CONTROLLER MARKET: VALUE CHAIN ANALYSIS

- FIGURE 30 MASS FLOW CONTROLLER MARKET: ECOSYSTEM ANALYSIS

- FIGURE 31 INVESTMENT AND FUNDING SCENARIO

- FIGURE 32 AI/GENERATIVE AI USE CASES IN MASS FLOW CONTROLLER MARKET

- FIGURE 33 IMPACT OF AI/GENERATIVE AI ON MASS FLOW CONTROLLER MARKET

- FIGURE 34 PATENTS APPLIED AND GRANTED, 2014-2023

- FIGURE 35 IMPORT DATA FOR HS CODE 902610-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD MILLION)

- FIGURE 36 EXPORT DATA FOR HS CODE 902610-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD MILLION)

- FIGURE 37 MASS FLOW CONTROLLER MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 38 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USE INDUSTRIES

- FIGURE 39 BUYING CRITERIA FOR TOP THREE END USE INDUSTRIES

- FIGURE 40 MASS FLOW CONTROLLER MARKET, BY PRODUCT SPECIFICATION

- FIGURE 41 WITH DISPLAY SEGMENT TO EXHIBIT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 42 ELASTOMER SEALS SEGMENT TO LEAD MARKET IN 2029

- FIGURE 43 MASS FLOW CONTROLLER MARKET, BY MATERIAL

- FIGURE 44 ALLOYS SEGMENT TO DOMINATE MARKET IN 2029

- FIGURE 45 MASS FLOW CONTROLLER MARKET, BY MEDIA TYPE

- FIGURE 46 GAS SEGMENT TO DOMINATE MARKET IN 2024

- FIGURE 47 MASS FLOW CONTROLLER MARKET, BY FLOW RATE

- FIGURE 48 LOW FLOW RATE SEGMENT TO LEAD MARKET IN 2029

- FIGURE 49 PHARMACEUTICAL INDUSTRY TO EXHIBIT HIGHEST CAGR IN MEDIUM FLOW RATE MASS FLOW CONTROLLER MARKET DURING FORECAST PERIOD

- FIGURE 50 MASS FLOW CONTROLLER MARKET, BY TECHNOLOGY

- FIGURE 51 THERMAL SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2024

- FIGURE 52 MASS FLOW CONTROLLER MARKET, BY CONNECTIVITY

- FIGURE 53 DIGITAL SEGMENT TO LEAD MARKET IN 2029

- FIGURE 54 MASS FLOW CONTROLLER MARKET, BY END-USE INDUSTRY

- FIGURE 55 SEMICONDUCTOR INDUSTRY TO HOLD LARGEST MARKET SHARE IN 2024

- FIGURE 56 EUROPE TO DOMINATE WATER & WASTEWATER TREATMENT MARKET IN 2024

- FIGURE 57 MASS FLOW CONTROLLER MARKET, BY REGION

- FIGURE 58 CHINA TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 59 NORTH AMERICA: MASS FLOW CONTROLLER MARKET SNAPSHOT

- FIGURE 60 EUROPE: MASS FLOW CONTROLLER MARKET SNAPSHOT

- FIGURE 61 ASIA PACIFIC: MASS FLOW CONTROLLER MARKET SNAPSHOT

- FIGURE 62 SOUTH AMERICA TO LEAD MASS FLOW CONTROLLER MARKET IN ROW IN 2024

- FIGURE 63 MASS FLOW CONTROLLER MARKET: REVENUE ANALYSIS OF FOUR KEY PLAYERS, 2019-2023

- FIGURE 64 MARKET SHARE ANALYSIS OF KEY PLAYERS OFFERING MASS FLOW CONTROLLERS, 2023

- FIGURE 65 COMPANY VALUATION, 2023

- FIGURE 66 FINANCIAL METRICS, 2023 (EV/EBITDA)

- FIGURE 67 MASS FLOW CONTROLLER MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 68 MASS FLOW CONTROLLER MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 69 MASS FLOW CONTROLLER MARKET: COMPANY FOOTPRINT

- FIGURE 70 MASS FLOW CONTROLLER MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 71 HORIBA, LTD.: COMPANY SNAPSHOT

- FIGURE 72 SENSIRION AG: COMPANY SNAPSHOT

- FIGURE 73 MKS INSTRUMENTS: COMPANY SNAPSHOT

- FIGURE 74 TELEDYNE TECHNOLOGIES INCORPORATED: COMPANY SNAPSHOT

- FIGURE 75 PARKER HANNIFIN CORP: COMPANY SNAPSHOT

The global mass flow controller market was valued at USD 1.63 billion in 2024 and is projected to reach USD 2.32 billion by 2029; it is expected to register a CAGR of 7.2% during the forecast period. Rising focus on hydrogen fuel cells is driving the growth of the mass flow controller market. As fuel cells continue to gain prominence as a clean and efficient energy source, the need mass flow comntroller during fuel cell operation has become critical. Whereas complexities associated in integrating mass flow controllers with other technologies posses challenge for the growth of the mass flow controller market.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Billion) |

| Segments | By Product Specification, Material Type, Media Type, Flow Rate, Technology, Connectivity, End-user Industry, and Region |

| Regions covered | North America, Europe, APAC, RoW |

"The Coriolis mass flow controller is expected to grow at the highest CAGR during the forecast period."

A Coriolis mass flow controller has been seen as the only flow sensor that actually measures the mass flow in a directly manner. This distinctive capability underpins the accuracy of Coriolis flow controllers: They quantify the mass flow rate of a fluid in a straightforward manner, that is without having to integrate or include other properties of the fluid into the measurement. This means that the Coriolis flow controllers offers accurate mass flow rates irrespective of changes in density, viscosity or specific heat of the flowing liquid or gas. For this reason, Coriolis mass flow controllers remain insensitive to shifts in properties of the fluid.

"Digital mass flow controllers segment is likely to have a larger market share during the forecast period."

Digital mass flow controllers use highly developed sensors, microprocessors and complex algorithms, and thus boast of higher accuracy in the measurement of flow rates and control of the same. These applications include manufacturing of semiconductors besides other precision processes like those used in the manufacture of chemicals. Additionally, the integration of the digital technologies leads to the enhanced control possibilities, automatic control, calibration as well as remote control, all of which highly enhances the overall operation. Digital mass flow controllers also are more constants and stable, has less maintenance requirement and has lower run cost due to its measurement drift and self-calibration capabilities.

"The Asia Pacific segment is likely to grow at the second highest CAGR during the forecast period."

The market in Asia Pacific is expected to witness the second highest CAGR of 28.4% during the forecast period. The region witnessed substantial investments in semiconductor manufacturing infrastructure, driven by both government initiatives and private enterprises aiming to establish semiconductor manufacturing plants.. Increasing investments in the semiconductor industry, rising demand for efficient devices for measurement and control, and industrial automation are among the major factors driving the market growth in this region. Most key players operating in the mass flow controller market have their production capacity in Asia Pacific, as the production cost in this region is lower than that of other regions

Breakdown of primaries

The study contains insights from various industry experts, ranging from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type - Tier 1 - 40%, Tier 2 - 35%, Tier 3 - 25%

- By Designation- C-level Executives - 48%, Directors - 33%, Others - 19%

- By Region-North America - 35%, Europe - 18%, Asia Pacific - 40%, RoW - 7%

The mass flow controller market is dominated by a few globally established players such as HORIBA, Ltd. (Japan), Sensirion AG (Switzerland), MKS Instruments (US), Teledyne Technologies Incorporated (US), Bronkhorst (Netherlands), Brooks Instrument (US) Christian Burkert GmbH & Co. KG (Germany), Sierra Instruments, Inc. (US), Alicat Scientific Inc. (US), and PARKER HANIIFIN CORP (US). The study includes an in-depth competitive analysis of these key players in the mass flow controller market, with their company profiles, recent developments, and key market strategies.

Research Coverage:

The report segments the mas flow controller market and forecasts its size by product specification, material type, media type, flow rate, technology, connectivity, end-user industry and region. The report also discusses the drivers, restraints, opportunities, and challenges pertaining to the market. It gives a detailed view of the market across four main regions-North America, Europe, Asia Pacific, and RoW. Supply chain analysis has been included in the report, along with the key players and their competitive analysis in the mass flow controller market.

Key Benefits to Buy the Report:

- Analysis of key drivers (Expansion of solar cell manufacturing, increased investments in semiconductors and electronics production, and growing focus on hydrogen fuel cells as renewable energy source). Restraint (Calibration dependency), Opportunities (Use of mass flow controllers in space applications, Government initiatives to boost semiconductor manufacturing in Asia Pacific), Challenges (complexities associated in integration with other technologies)

- Product Development/Innovation: Detailed insights on upcoming technologies, research and development activities, and new product launches in the mass flow controller market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the mass flow controller market across varied regions.

- Market Diversification: Exhaustive information about new products and services, untapped geographies, recent developments, and investments in the mass flow controller market.

Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players as HORIBA, Ltd. (Japan), Sensirion AG (Switzerland), MKS Instruments (US), Teledyne Technologies Incorporated (US), Bronkhorst (Netherlands), Brooks Instrument (US) Christian Burkert GmbH & Co. KG (Germany), Sierra Instruments, Inc. (US), Alicat Scientific Inc. (US), and PARKER HANIIFIN CORP (US) among others in the mass flow controller market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 LIMITATIONS

- 1.6 UNITS CONSIDERED

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 List of key interview participants

- 2.1.2.2 Breakdown of primaries

- 2.1.2.3 Key data from primary sources

- 2.1.2.4 Key industry insights

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to estimate market size using bottom-up analysis

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to estimate market size using top-down analysis

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

- 2.6 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR PLAYERS IN MASS FLOW CONTROLLER MARKET

- 4.2 MASS FLOW CONTROLLER MARKET, BY MATERIAL

- 4.3 MASS FLOW CONTROLLER MARKET, BY FLOW RATE

- 4.4 MASS FLOW CONTROLLER MARKET, BY MEDIA TYPE

- 4.5 MASS FLOW CONTROLLER MARKET, BY END-USE INDUSTRY

- 4.6 MASS FLOW CONTROLLER MARKET, BY REGION

- 4.7 MASS FLOW CONTROLLER MARKET, BY TECHNOLOGY

- 4.8 MASS FLOW CONTROLLER MARKET, BY CONNECTIVITY

- 4.9 MASS FLOW CONTROLLER MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising emphasis on developing solar projects

- 5.2.1.2 Expanding semiconductor industry

- 5.2.1.3 Generation of renewable energy with hydrogen fuel cells

- 5.2.2 RESTRAINTS

- 5.2.2.1 Dependency on calibration

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Application in space stations

- 5.2.3.2 Government-led initiatives to boost semiconductor manufacturing

- 5.2.4 CHALLENGES

- 5.2.4.1 Complexities associated with integrating mass flow controllers within other devices

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY CONNECTIVITY

- 5.4.2 AVERAGE SELLING PRICE TREND OF MASS FLOW CONTROLLERS, 2019-2023

- 5.4.3 INDICATIVE PRICING TREND, BY REGION

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 INVESTMENT AND FUNDING SCENARIO

- 5.8 IMPACT OF AI/GENERATIVE AI ON MASS FLOW CONTROLLER MARKET

- 5.8.1 INTRODUCTION

- 5.8.2 AI/GENERATIVE AI-SPECIFIC USE CASES

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGIES

- 5.9.1.1 Micro-electro-mechanical systems

- 5.9.1.2 IoT

- 5.9.2 COMPLIMENTARY TECHNOLOGIES

- 5.9.2.1 Industrial ethernet

- 5.9.2.2 Digital signal processing

- 5.9.3 ADJACENT TECHNOLOGIES

- 5.9.3.1 Nanotechnology

- 5.9.1 KEY TECHNOLOGIES

- 5.10 PATENT ANALYSIS

- 5.11 TRADE ANALYSIS

- 5.11.1 IMPORT DATA (HS CODE 902610)

- 5.11.2 EXPORT DATA (HS CODE 902610)

- 5.12 KEY CONFERENCES AND EVENTS, 2023-2024

- 5.13 CASE STUDY ANALYSIS

- 5.13.1 ILS COLLABORATED WITH ALICAT TO ADDRESS MASS FLOW CONTROLLERS SOURCING-RELATED CHALLENGES

- 5.13.2 HORIBA HELPED NOAA WITH Z500 FLOW CONTROLLERS THAT PROVIDED STABLE AND CONSISTENT FLOW RATE

- 5.13.3 ALICAT ASSISTED VALCO INTEGRATE MULTIPLE BASIS OEM MASS FLOW CONTROLLERS INTO DYNACAL DEVICES THAT MANAGED LOW GAS FLOW RATES

- 5.13.4 BROOKS ASSISTED RAHR WITH SLAMF MASS FLOW CONTROLLERS THAT IMPROVED BREWERIES' PRODUCTION AND EFFICIENCY

- 5.13.5 DURALAR PARTNERED WITH ALICAT TO ENGINEER CORROSION-RESISTANT FLOW CONTROLLER WITH CUSTOM GAS CALIBRATION

- 5.14 REGULATORY LANDSCAPE

- 5.14.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14.2 STANDARDS

- 5.15 PORTER'S FIVE FORCES ANALYSIS

- 5.15.1 THREAT OF NEW ENTRANTS

- 5.15.2 THREAT OF SUBSTITUTES

- 5.15.3 BARGAINING POWER OF BUYERS

- 5.15.4 BARGAINING POWER OF SUPPLIERS

- 5.15.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.16 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.16.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.16.2 BUYING CRITERIA

6 MASS FLOW CONTROLLER MARKET, BY PRODUCT SPECIFICATION

- 6.1 INTRODUCTION

- 6.2 DISPLAYS

- 6.2.1 WITH DISPLAY

- 6.2.1.1 Enhanced control through immediate visual monitoring to drive market

- 6.2.2 WITHOUT DISPLAY

- 6.2.2.1 Low manufacturing costs to spur demand

- 6.2.1 WITH DISPLAY

- 6.3 SEALS

- 6.3.1 METALS

- 6.3.1.1 Ability to withstand harsh environmental conditions to boost demand

- 6.3.2 ELASTOMER

- 6.3.2.1 Reduced friction and minimal gas leakages to drive market

- 6.3.1 METALS

- 6.4 ACCURACY

- 6.4.1 STANDARD

- 6.4.1.1 Increasing adoption in HVAC systems and non-critical laboratory environments to fuel market growth

- 6.4.2 HIGH

- 6.4.2.1 Rising adoption in semiconductor manufacturing to accelerate demand

- 6.4.1 STANDARD

7 MASS FLOW CONTROLLER MARKET, BY MATERIAL

- 7.1 INTRODUCTION

- 7.2 STAINLESS STEEL

- 7.2.1 HIGH RESISTANCE TO CORROSION AND SULFIDES TO DRIVE MARKET

- 7.3 ALLOYS

- 7.3.1 RISING NEED FOR ALLOYS CONTAINING CHROME AND MOLYBDENUM TO BOOST DEMAND

- 7.4 OTHER MATERIALS

8 MASS FLOW CONTROLLER MARKET, BY MEDIA TYPE

- 8.1 INTRODUCTION

- 8.2 GAS

- 8.2.1 GROWING ADOPTION FOR CATALYST RESEARCH TO SPUR DEMAND

- 8.3 LIQUID

- 8.3.1 ABILITY TO OFFER FAST AND ACCURATE MEASURING SIGNALS TO BOOST DEMAND

9 MASS FLOW CONTROLLER MARKET, BY FLOW RATE

- 9.1 INTRODUCTION

- 9.2 LOW

- 9.2.1 INCREASING APPLICATION IN MANUFACTURING SEMICONDUCTOR CHIPS TO DRIVE MARKET

- 9.3 MEDIUM

- 9.3.1 RISING USE IN FLUID AND GAS MIXING AND DOSING SYSTEMS TO SPUR DEMAND

- 9.4 HIGH

- 9.4.1 GROWING APPLICATION IN GAS MEASUREMENT TO ACCELERATE DEMAND

10 MASS FLOW CONTROLLER MARKET, BY TECHNOLOGY

- 10.1 INTRODUCTION

- 10.2 THERMAL

- 10.2.1 ABILITY TO HANDLE DIVERSE RANGE OF GASES WITH VARYING THERMAL PROPERTIES TO DRIVE MARKET

- 10.3 DIFFERENTIAL PRESSURE

- 10.3.1 INCREASING APPLICATION IN SEMICONDUCTOR MANUFACTURING, CHEMICAL PROCESSING, AND AEROSPACE TESTING TO BOOST DEMAND

- 10.4 CORIOLIS

- 10.4.1 ELIMINATION OF ADDITIONAL COMPENSATION FOR TEMPERATURE OR PRESSURE VARIATIONS TO SPUR DEMAND

11 MASS FLOW CONTROLLER MARKET, BY CONNECTIVITY

- 11.1 INTRODUCTION

- 11.2 ANALOG

- 11.2.1 INCREASING DEMAND FOR COST-EFFECTIVE CONTROL SYSTEMS TO SPUR DEMAND

- 11.3 DIGITAL

- 11.3.1 IMPLEMENTATION OF ADVANCED MICROPROCESSOR TECHNOLOGY TO OBTAIN REAL-TIME MONITORING TO ACCELERATE DEMAND

- 11.3.2 PROFIBUS

- 11.3.3 RS-485

- 11.3.4 PROFINET

- 11.3.5 ETHERCAT

- 11.3.6 ETHERNET/IP

- 11.3.7 MODBUS RTU

- 11.3.8 MODBUS TCP/IP

- 11.3.9 DEVICENET

- 11.3.10 FOUNDATION FIELDBUS

12 MASS FLOW CONTROLLER MARKET, BY END-USE INDUSTRY

- 12.1 INTRODUCTION

- 12.2 SEMICONDUCTORS

- 12.2.1 INCREASING APPLICATION FOR WAFER CLEANING AND PCB TREATMENT TO BOOST DEMAND

- 12.2.2 WAFER CLEANING

- 12.2.3 THIN FILM DEPOSITION

- 12.2.4 SPRAY COATING

- 12.2.5 PLASMA ETCHING

- 12.2.6 VACUUM SPUTTERING

- 12.3 OIL & GAS

- 12.3.1 RISING ADOPTION FOR UPSTREAM PRODUCTION AND PIPELINE DETECTION TO SPUR DEMAND

- 12.3.2 ODORIZATION OF BIOGAS

- 12.3.3 HEAVY FUEL OIL ADDITIVE DOSING

- 12.3.4 FRACKING

- 12.4 CHEMICALS

- 12.4.1 INCREASING APPLICATION IN CHEMICAL REACTORS AND GAS SAMPLING TO DRIVE MARKET

- 12.4.2 CATALYST RESEARCH

- 12.4.3 LIQUEFIED GAS DOSING

- 12.5 PHARMACEUTICALS

- 12.5.1 IMPROVED ACCURACY OF VENTILATION DEVICES TO DRIVE MARKET

- 12.5.2 PILL COATING

- 12.5.3 CONTINUOUS MANUFACTURING

- 12.6 METALS & MINING

- 12.6.1 REDUCED WASTAGE AND DOWNTIME TO SPUR DEMAND

- 12.6.2 SELECTIVE LASER MELTING

- 12.6.3 SMELTING

- 12.7 WATER & WASTEWATER TREATMENT

- 12.7.1 EXPANDING GLOBAL POPULATION AND RAPID INDUSTRIALIZATION TO DRIVE DEMAND

- 12.7.2 PH CONTROL

- 12.8 FOOD & BEVERAGES

- 12.8.1 GROWING APPLICATION FOR ADJUSTING PH-LEVEL AND BLANKETING OF INERT GASES TO BOOST DEMAND

- 12.8.2 AERATION

- 12.8.3 ASEPTIC PACKAGING

- 12.9 OTHER END-USE INDUSTRIES

- 12.9.1 LAMBDA PROBE TESTING

13 MASS FLOW CONTROLLER MARKET, BY REGION

- 13.1 INTRODUCTION

- 13.2 NORTH AMERICA

- 13.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 13.2.2 US

- 13.2.2.1 Growing application for catalyst research and spray coating to drive market

- 13.2.3 CANADA

- 13.2.3.1 Expanding pharmaceutical and medical research industries to spur demand

- 13.2.4 MEXICO

- 13.2.4.1 Rising industrial expansion to accelerate demand

- 13.3 EUROPE

- 13.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 13.3.2 GERMANY

- 13.3.2.1 Government-led initiatives to address energy crisis to boost demand

- 13.3.3 UK

- 13.3.3.1 Increasing need for efficient control mechanisms in pharmaceutical and semiconductor industries to drive market

- 13.3.4 FRANCE

- 13.3.4.1 Growing need for chemicals in metal & mining and automotive industries to fuel market growth

- 13.3.5 REST OF EUROPE

- 13.4 ASIA PACIFIC

- 13.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 13.4.2 CHINA

- 13.4.2.1 Government-led initiatives to support connected technologies to offer lucrative growth opportunities

- 13.4.3 INDIA

- 13.4.3.1 Rising inflow of FDIs in semiconductor industry to accelerate demand

- 13.4.4 JAPAN

- 13.4.4.1 Growing emphasis on innovating mass flow controllers to offer lucrative growth opportunities

- 13.4.5 TAIWAN

- 13.4.5.1 Presence of leading players to drive market

- 13.4.6 SOUTH KOREA

- 13.4.6.1 Thriving consumer electronics industry to boost demand

- 13.4.7 REST OF ASIA PACIFIC

- 13.5 ROW

- 13.5.1 MACROECONOMIC OUTLOOK FOR ROW

- 13.5.2 SOUTH AMERICA

- 13.5.2.1 Growing demand in semiconductor, chemical, and oil & gas industries to fuel market growth

- 13.5.3 MIDDLE EAST & AFRICA

- 13.5.3.1 Rising economic and industrial transformation to offer lucrative growth opportunities

- 13.5.3.2 GCC

- 13.5.3.3 Rest of Middle East & Africa

14 COMPETITIVE LANDSCAPE

- 14.1 OVERVIEW

- 14.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2022-2024

- 14.3 REVENUE ANALYSIS, 2019-2023

- 14.4 MARKET SHARE ANALYSIS, 2023

- 14.5 COMPANY VALUATION AND FINANCIAL METRICS

- 14.6 BRAND/PRODUCT COMPARISON

- 14.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 14.7.1 STARS

- 14.7.2 EMERGING LEADERS

- 14.7.3 PERVASIVE PLAYERS

- 14.7.4 PARTICIPANTS

- 14.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 14.7.5.1 Company footprint

- 14.7.5.2 Material footprint

- 14.7.5.3 Media type footprint

- 14.7.5.4 End-use industry footprint

- 14.7.5.5 Region footprint

- 14.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 14.8.1 PROGRESSIVE COMPANIES

- 14.8.2 RESPONSIVE COMPANIES

- 14.8.3 DYNAMIC COMPANIES

- 14.8.4 STARTING BLOCKS

- 14.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023

- 14.8.5.1 Detailed list of key startups/SMEs

- 14.8.5.2 Competitive benchmarking of key startups/SMEs

- 14.9 COMPETITIVE SCENARIO

- 14.9.1 PRODUCT LAUNCHES

- 14.9.2 DEALS

15 COMPANY PROFILES

- 15.1 KEY PLAYERS

- 15.1.1 HORIBA, LTD.

- 15.1.1.1 Business overview

- 15.1.1.2 Products/Solutions/Services offered

- 15.1.1.3 Recent developments

- 15.1.1.3.1 Expansions

- 15.1.1.4 MnM view

- 15.1.1.4.1 Key strengths/Right to win

- 15.1.1.4.2 Strategic choices

- 15.1.1.4.3 Weaknesses/Competitive threats

- 15.1.2 SENSIRION AG

- 15.1.2.1 Business overview

- 15.1.2.2 Products/Solutions/Services offered

- 15.1.2.3 Recent developments

- 15.1.2.3.1 Product launches/Developments

- 15.1.2.4 MnM view

- 15.1.2.4.1 Key strengths/Right to win

- 15.1.2.4.2 Strategic choices

- 15.1.2.4.3 Weaknesses/Competitive threats

- 15.1.3 MKS INSTRUMENTS

- 15.1.3.1 Business overview

- 15.1.3.2 Products/Solutions/Services offered

- 15.1.3.3 MnM view

- 15.1.3.3.1 Key strengths/Right to win

- 15.1.3.3.2 Strategic choices

- 15.1.3.3.3 Weaknesses/Competitive threats

- 15.1.4 TELEDYNE TECHNOLOGIES INCORPORATED

- 15.1.4.1 Business overview

- 15.1.4.2 Products/Solutions/Services offered

- 15.1.4.3 Recent developments

- 15.1.4.3.1 Deals

- 15.1.4.4 MnM view

- 15.1.4.4.1 Key strengths/Right to win

- 15.1.4.4.2 Strategic choices

- 15.1.4.4.3 Weaknesses/Competitive threats

- 15.1.5 BRONKHORST

- 15.1.5.1 Business overview

- 15.1.5.2 Products/Solutions/Services offered

- 15.1.5.3 Recent developments

- 15.1.5.3.1 Product launches/Developments

- 15.1.5.4 MnM view

- 15.1.5.4.1 Key strengths/Right to win

- 15.1.5.4.2 Strategic choices

- 15.1.5.4.3 Weaknesses/Competitive threats

- 15.1.6 BROOKS INSTRUMENT

- 15.1.6.1 Business overview

- 15.1.6.2 Products/Solutions/Services offered

- 15.1.6.3 Recent developments

- 15.1.6.3.1 Product launches/developments

- 15.1.6.3.2 Deals

- 15.1.7 CHRISTIAN BURKERT GMBH & CO. KG

- 15.1.7.1 Business overview

- 15.1.7.2 Products/Solutions/Services offered

- 15.1.7.3 Recent developments

- 15.1.8 SIERRA INSTRUMENTS, INC.

- 15.1.8.1 Business overview

- 15.1.8.2 Products/Solutions/Services offered

- 15.1.8.3 Recent developments

- 15.1.8.3.1 Product launches/Developments

- 15.1.9 ALICAT SCIENTIFIC, INC.

- 15.1.9.1 Business overview

- 15.1.9.2 Products/Solutions/Services offered

- 15.1.9.3 Recent developments

- 15.1.9.3.1 Product launches/Developments

- 15.1.10 PARKER HANNIFIN CORP

- 15.1.10.1 Business overview

- 15.1.10.2 Products/Solutions/Services offered

- 15.1.1 HORIBA, LTD.

- 15.2 OTHER PLAYERS

- 15.2.1 TOKYO KEISO CO., LTD.

- 15.2.2 VOGTLIN INSTRUMENTS GMBH

- 15.2.3 AZBIL CORPORATION

- 15.2.4 SABLE SYSTEMS INTERNATIONAL

- 15.2.5 KOFLOC

- 15.2.6 AALBORG

- 15.2.7 AXETRIS AG

- 15.2.8 DWYER INSTRUMENTS, LLC.

- 15.2.9 FCON CO., LTD.

- 15.2.10 KELLY PNEUMATICS, INC.

- 15.2.11 IMI

- 15.2.12 PROTERIAL, LTD.

- 15.2.13 MTI CORPORATION

- 15.2.14 OHKURA ELECTRIC CO., LTD.

- 15.2.15 DAKOTA INSTRUMENTS, INC.

16 ADJACENT & RELATED MARKETS

- 16.1 INTRODUCTION

- 16.2 MARKET SCOPE

- 16.3 SEMICONDUCTOR MANUFACTURING EQUIPMENT MARKET, BY FAB FACILITY EQUIPMENT

- 16.3.1 INTRODUCTION

- 16.4 AUTOMATION

- 16.4.1 INCREASING DEMAND FOR FACTORY AUTOMATION IN SEMICONDUCTOR INDUSTRY TO BOOST DEMAND

- 16.5 CHEMICAL CONTROL

- 16.5.1 RISING DEMAND FOR HIGH-QUALITY PRODUCTS TO DRIVE MARKET

- 16.6 GAS CONTROL

- 16.6.1 NECESSITY TO PROVIDE PRECISE CONTROL AND MIXING OF INDUSTRIAL PROCESS GASES TO FUEL MARKET GROWTH

- 16.7 OTHER FAB FACILITY EQUIPMENT

17 APPENDIX

- 17.1 INSIGHTS OF INDUSTRY EXPERTS

- 17.2 DISCUSSION GUIDE

- 17.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 17.4 CUSTOMIZATION OPTIONS

- 17.5 RELATED REPORTS

- 17.6 AUTHOR DETAILS