|

|

市場調査レポート

商品コード

1764340

クラウドコンピューティングの世界市場 (~2030年):サービスモデル (IaaS (コンピューティング・ストレージ・ネットワーキング)・PaaS (アプリケーション開発&統合・データベース&データ・アナリティクス&レポーティング)・SaaS (CRM・SCM・コラボレーション&生産性)) 別・AIの影響Cloud Computing Market by Service Model (IaaS (Compute, Storage, Networking), PaaS (Application Development & Integration, Database & Data, Analytics & Reporting), SaaS (CRM, SCM, Collaboration & Productivity)), Impact of AI - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| クラウドコンピューティングの世界市場 (~2030年):サービスモデル (IaaS (コンピューティング・ストレージ・ネットワーキング)・PaaS (アプリケーション開発&統合・データベース&データ・アナリティクス&レポーティング)・SaaS (CRM・SCM・コラボレーション&生産性)) 別・AIの影響 |

|

出版日: 2025年07月04日

発行: MarketsandMarkets

ページ情報: 英文 397 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

クラウドコンピューティングの市場規模は、2025年の約1兆2,949億ドルから、2030年には2兆2,811億ドルに達すると予測されており、予測期間中のCAGRは12.0%と推計されています。

企業は、スケーラブルなITインフラの構築、リモートワークの支援、リアルタイムでのデータアクセスを求めており、これがクラウド需要を押し上げています。また、AI、ビッグデータ分析、業務の自動化を重視する動きが高まっており、これらを支える基盤としてクラウドプラットフォームの重要性が増しています。従来のオンプレミスシステムから、より俊敏で革新的な柔軟性の高いハイブリッド、マルチクラウド環境への移行が進んでいます。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020-2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025-2030年 |

| 単位 | 米ドル |

| セグメント | サービスモデル・IaaS区分・PaaS区分・SaaS区分・導入モード・組織規模・産業別 |

| 対象地域 | 北米・欧州・アジア太平洋・中東&アフリカ・ラテンアメリカ |

"サービスモデル別では、PaaSセグメントが予測期間中に最も急速な成長を記録”

クラウドコンピューティング市場において、PaaSは進化する開発ニーズと新興技術によって、最も急速に成長しています。現在のPaaSプラットフォームは、AI/機械学習サービス、DevOpsの自動化、Kubernetesなどのコンテナオーケストレーションツールを統合しており、より迅速かつスマートなアプリケーション開発を可能にします。また、ローコード/ノーコード機能、組み込み型のCI/CDパイプライン、マイクロサービスアーキテクチャのサポートなどにより、開発者が柔軟かつシンプルにイノベーションを実現できるよう支援します。さらに、拡張性の高さ、統合されたセキュリティ、リアルタイムの監視機能、パッチの自動管理などによって、高いパフォーマンスとコンプライアンスを確保できます。サーバーレスコンピューティングもPaaS内で注目を集めており、開発者はインフラをプロビジョニングすることなく機能を展開できます。PaaSはスタートアップ、開発者、大企業などに理想的であり、市場投入までの時間を短縮し、運用コストを削減し、チーム間の連携を簡素化します。ハードウェア、ランタイム環境、バックエンドの保守から解放されることで、企業はインテリジェントで拡張性のある、ユーザー中心のアプリケーション構築に集中でき、急速に変化するデジタル環境で優位性を保つことができます。

”地域別では、北米が先導し、アジア太平洋地域はデジタル変革と政府主導のAI施策により最も急成長中"

北米は、成熟したデジタルインフラ、企業による広範なクラウド導入、AWS、Microsoft Azure、Google Cloudといった主要プロバイダーの存在を背景に、引き続き主導的地位を占めています。この地域は、生成AI、サーバーレスエッジコンピューティング、量子対応クラウドサービスなどの先進技術の導入において最前線に立っています。企業は、Azure Arc (ハイブリッド管理) 、AWS Nitro Enclaves (セキュアコンピューティング) 、AIによるDevSecOpsパイプラインなどのツールを積極的に統合しています。さらに、5Gエッジとの連携やプライベート5Gネットワークの進展により、製造、医療、自動運転などの分野で超低遅延アプリケーションの実現が加速しています。また、ソブリンクラウド構想や高度な秘密計算 (Confidential Computing) といった取り組みにより、データプライバシーやコンプライアンス強化も進んでいます。

当レポートでは、世界のクラウドコンピューティングの市場を調査し、市場概要、市場成長への各種影響因子の分析、技術・特許の動向、法規制環境、ケーススタディ、市場規模の推移・予測、各種区分・地域/主要国別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要と業界動向

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- ケーススタディ分析

- サプライチェーン分析

- エコシステム分析

- ポーターのファイブフォース分析

- 価格分析

- 技術分析

- 特許分析

- 顧客の事業に影響を与える動向/混乱

- 規制状況

- 主な会議とイベント

- 主要なステークホルダーと購入基準

- ビジネスモデル分析

- 投資情勢と資金調達シナリオ

- クラウドコンピューティングの主なユースケースとワークロード

- 業界クラウド/垂直SaaS

第6章 クラウドコンピューティング市場:サービスモデル別

- IAAS

- PAAS

- SAAS

第7章 クラウドコンピューティング市場:IAAS区分別

- コンピューティング

- ストレージ

- ネットワーキング

第8章 クラウドコンピューティング市場:PAAS区分別

- アプリケーション開発&統合プラットフォーム

- アプリケーションテスト&品質

- アナリティクス&レポーティング

- データベース&データ管理

- その他

第9章 クラウドコンピューティング市場:SaaS区分別

- CRM

- ERM

- 人材管理

- コンテンツ管理

- コラボレーションと生産性スイート

- サプライチェーンマネジメント

- システムインフラソフトウェア

- セキュリティソフトウェア

- ストレージソフトウェア

- エンドポイント管理ソフトウェア

- 物理および仮想コンピューティングソフトウェア

- システムおよびサービス管理ソフトウェア

- その他

第10章 クラウドコンピューティング市場:導入モデル別

- パブリッククラウド

- プライベートクラウド

- ハイブリッドクラウド

第11章 クラウドコンピューティング市場:組織規模別

- 大企業

- 中小企業

第12章 クラウドコンピューティング市場:産業別

- 銀行・金融サービス・保険 (BFSI)

- エネルギー・公益事業

- 政府・公共部門

- 電気通信

- ソフトウェア・ITサービス

- ヘルスケア&ライフサイエンス

- 小売・eコマース

- 製造

- 輸送・物流

- メディア&エンターテインメント

- その他

第13章 クラウドコンピューティング市場:地域別

- 北米

- マクロ経済見通し

- 市場促進要因

- 米国

- カナダ

- 欧州

- マクロ経済見通し

- 市場促進要因

- 英国

- ドイツ

- フランス

- スペイン

- イタリア

- オランダ

- その他

- アジア太平洋

- マクロ経済見通し

- 市場促進要因

- 中国

- インド

- 日本

- シンガポール

- オーストラリアとニュージーランド

- 韓国

- その他

- 中東・アフリカ

- マクロ経済見通し

- 市場促進要因

- GCC諸国

- 南アフリカ

- その他

- ラテンアメリカ

- マクロ経済見通し

- 市場促進要因

- ブラジル

- メキシコ

- その他

第14章 競合情勢

- 主要企業の戦略/有力企業

- 収益分析

- 市場シェア分析

- ブランド/製品比較

- 企業評価マトリックス:主要企業

- 企業評価マトリックス:スタートアップ/中小企業

- 主要ベンダーの企業評価と財務指標

- 競合シナリオと動向

第15章 企業プロファイル

- 主要企業

- AWS

- MICROSOFT

- ORACLE

- SALESFORCE

- ALIBABA CLOUD

- IBM

- SAP

- ADOBE

- TENCENT CLOUD

- その他の企業

- HUAWEI

- HEWLETT-PACKARD ENTERPRISE

- DELL TECHNOLOGIES

- DROPBOX

- NUTANIX

- AKAMAI TECHNOLOGIES

- SAUDI TELECOM COMPANY

- KYNDRYL

- ATOS SE

- NTT DATA CORPORATION

- WORKDAY

- FUJITSU

- BROADCOM

- RACKSPACE TECHNOLOGY

- DXC TECHNOLOGY

- NEC CORPORATION

- JOYENT

- DIGITALOCEAN

- OVH CLOUD

- NAVISITE

- INFOR

- SAGE

- INTUIT

- OPENTEXT

- CISCO

- BOX

- ZOHO

- CITRIX

- EPICOR

- UPLAND SOFTWARE

- SERVICENOW

- IFS

- APP MAISTERS

- ZYMR

- JDV TECHNOLOGIES

- TUDIP TECHNOLOGIES

- VISARTECH

- CLOUDFLEX

- VULTR

- PCLOUD

- CLOUD4C

第16章 隣接市場と関連市場

第17章 付録

List of Tables

- TABLE 1 USD EXCHANGE RATES, 2020-2024

- TABLE 2 FACTOR ANALYSIS

- TABLE 3 CLOUD COMPUTING MARKET SIZE AND GROWTH, 2020-2024 (USD BILLION, YOY GROWTH %)

- TABLE 4 CLOUD COMPUTING MARKET SIZE AND GROWTH, 2025-2030 (USD BILLION, YOY GROWTH %)

- TABLE 5 CLOUD COMPUTING MARKET: ROLE OF PLAYERS IN ECOSYSTEM

- TABLE 6 PORTERS' FIVE FORCES' IMPACT ON CLOUD COMPUTING MARKET

- TABLE 7 AVERAGE SELLING PRICE OF KEY PLAYERS, BY REGION

- TABLE 8 INDICATIVE PRICING ANALYSIS OF CLOUD COMPUTING SOLUTIONS, BY KEY PLAYER

- TABLE 9 PATENTS GRANTED TO VENDORS IN CLOUD COMPUTING MARKET

- TABLE 10 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 CLOUD COMPUTING MARKET: DETAILED LIST OF CONFERENCES AND EVENTS, 2025-2026

- TABLE 15 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP INDUSTRY VERTICALS

- TABLE 16 KEY BUYING CRITERIA FOR TOP INDUSTRY VERTICALS

- TABLE 17 CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2020-2024 (USD BILLION)

- TABLE 18 CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2025-2030 (USD BILLION)

- TABLE 19 IAAS: CLOUD COMPUTING MARKET, BY REGION, 2020-2024 (USD BILLION)

- TABLE 20 IAAS: CLOUD COMPUTING MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 21 PAAS: CLOUD COMPUTING MARKET, BY REGION, 2020-2024 (USD BILLION)

- TABLE 22 PAAS: CLOUD COMPUTING MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 23 SAAS: CLOUD COMPUTING MARKET, BY REGION, 2020-2024 (USD BILLION)

- TABLE 24 SAAS: CLOUD COMPUTING MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 25 CLOUD COMPUTING MARKET, BY IAAS, 2020-2024 (USD BILLION)

- TABLE 26 CLOUD COMPUTING MARKET, BY IAAS, 2025-2030 (USD BILLION)

- TABLE 27 COMPUTE: CLOUD COMPUTING MARKET, BY REGION, 2020-2024 (USD BILLION)

- TABLE 28 COMPUTE: CLOUD COMPUTING MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 29 STORAGE: CLOUD COMPUTING MARKET, BY REGION, 2020-2024 (USD BILLION)

- TABLE 30 STORAGE: CLOUD COMPUTING MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 31 NETWORKING: CLOUD COMPUTING MARKET, BY REGION, 2020-2024 (USD BILLION)

- TABLE 32 NETWORKING: CLOUD COMPUTING MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 33 CLOUD COMPUTING MARKET, BY PAAS, 2020-2024 (USD BILLION)

- TABLE 34 CLOUD COMPUTING MARKET, BY PAAS, 2025-2030 (USD BILLION)

- TABLE 35 APPLICATION DEVELOPMENT & INTEGRATION PLATFORMS: CLOUD COMPUTING MARKET, BY REGION, 2020-2024 (USD BILLION)

- TABLE 36 APPLICATION DEVELOPMENT & INTEGRATION PLATFORMS: CLOUD COMPUTING MARKET, BY REGION, 2025-2030 (USD BILLION)

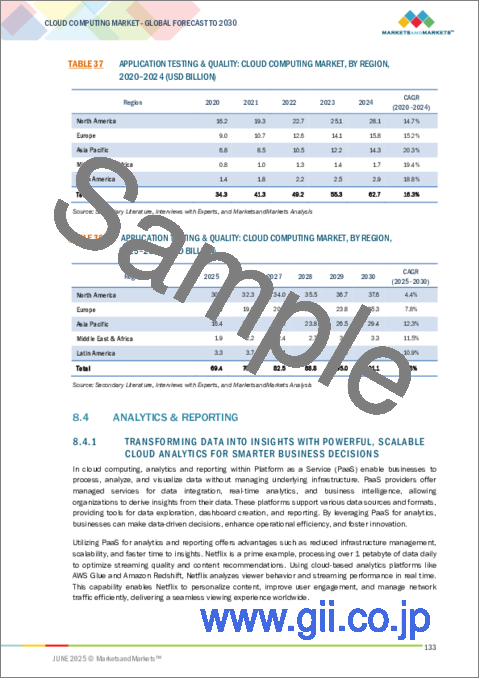

- TABLE 37 APPLICATION TESTING & QUALITY: CLOUD COMPUTING MARKET, BY REGION, 2020-2024 (USD BILLION)

- TABLE 38 APPLICATION TESTING & QUALITY: CLOUD COMPUTING MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 39 ANALYTICS & REPORTING: CLOUD COMPUTING MARKET, BY REGION, 2020-2024 (USD BILLION)

- TABLE 40 ANALYTICS & REPORTING: CLOUD COMPUTING MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 41 DATABASES & DATA MANAGEMENT: CLOUD COMPUTING MARKET, BY REGION, 2020-2024 (USD BILLION)

- TABLE 42 DATABASES & DATA MANAGEMENT: CLOUD COMPUTING MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 43 OTHER PAAS: CLOUD COMPUTING MARKET, BY REGION, 2020-2024 (USD BILLION)

- TABLE 44 OTHER PAAS: CLOUD COMPUTING MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 45 CLOUD COMPUTING MARKET, BY SAAS, 2020-2024 (USD BILLION)

- TABLE 46 CLOUD COMPUTING MARKET, BY SAAS, 2025-2030 (USD BILLION)

- TABLE 47 CUSTOMER RELATIONSHIP MANAGEMENT (CRM): CLOUD COMPUTING MARKET, BY REGION, 2020-2024 (USD BILLION)

- TABLE 48 CUSTOMER RELATIONSHIP MANAGEMENT (CRM): CLOUD COMPUTING MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 49 ENTERPRISE RESOURCE PLANNING (ERP): CLOUD COMPUTING MARKET, BY REGION, 2020-2024 (USD BILLION)

- TABLE 50 ENTERPRISE RESOURCE PLANNING (ERP): CLOUD COMPUTING MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 51 HUMAN CAPITAL MANAGEMENT (HCM): CLOUD COMPUTING MARKET, BY REGION, 2020-2024 (USD BILLION)

- TABLE 52 HUMAN CAPITAL MANAGEMENT (HCM): CLOUD COMPUTING MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 53 CONTENT MANAGEMENT: CLOUD COMPUTING MARKET, BY REGION, 2020-2024 (USD BILLION)

- TABLE 54 CONTENT MANAGEMENT: CLOUD COMPUTING MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 55 COLLABORATION AND PRODUCTIVITY SUITES: CLOUD COMPUTING MARKET, BY REGION, 2020-2024 (USD BILLION)

- TABLE 56 COLLABORATION AND PRODUCTIVITY SUITES: CLOUD COMPUTING MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 57 SUPPLY CHAIN MANAGEMENT (SCM): CLOUD COMPUTING MARKET, BY REGION, 2020-2024 (USD BILLION)

- TABLE 58 SUPPLY CHAIN MANAGEMENT (SCM): CLOUD COMPUTING MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 59 SYSTEM INFRASTRUCTURE SOFTWARE: CLOUD COMPUTING MARKET, BY REGION, 2020-2024 (USD BILLION)

- TABLE 60 SYSTEM INFRASTRUCTURE SOFTWARE: CLOUD COMPUTING MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 61 OTHER SAAS: CLOUD COMPUTING MARKET, BY REGION, 2020-2024 (USD BILLION)

- TABLE 62 OTHER SAAS: CLOUD COMPUTING MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 63 CLOUD COMPUTING MARKET, BY DEPLOYMENT MODEL, 2020-2024 (USD BILLION)

- TABLE 64 CLOUD COMPUTING MARKET, BY DEPLOYMENT MODEL, 2025-2030 (USD BILLION)

- TABLE 65 PUBLIC CLOUD: CLOUD COMPUTING MARKET, BY REGION, 2020-2024 (USD BILLION)

- TABLE 66 PUBLIC CLOUD: CLOUD COMPUTING MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 67 PRIVATE CLOUD: CLOUD COMPUTING MARKET, BY REGION, 2020-2024 (USD BILLION)

- TABLE 68 PRIVATE CLOUD: CLOUD COMPUTING MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 69 HYBRID CLOUD: CLOUD COMPUTING MARKET, BY REGION, 2020-2024 (USD BILLION)

- TABLE 70 HYBRID CLOUD: CLOUD COMPUTING MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 71 CLOUD COMPUTING MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD BILLION)

- TABLE 72 CLOUD COMPUTING MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD BILLION)

- TABLE 73 LARGE ENTERPRISES: CLOUD COMPUTING MARKET, BY REGION, 2020-2024 (USD BILLION)

- TABLE 74 LARGE ENTERPRISES: CLOUD COMPUTING MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 75 SMES: CLOUD COMPUTING MARKET, BY REGION, 2020-2024 (USD BILLION)

- TABLE 76 SMES: CLOUD COMPUTING MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 77 CLOUD COMPUTING MARKET, BY VERTICAL, 2020-2024 (USD BILLION)

- TABLE 78 CLOUD COMPUTING MARKET, BY VERTICAL, 2025-2030 (USD BILLION)

- TABLE 79 BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI): CLOUD COMPUTING MARKET, BY REGION, 2020-2024 (USD BILLION)

- TABLE 80 BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI): CLOUD COMPUTING MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 81 ENERGY & UTILITIES: CLOUD COMPUTING MARKET, BY REGION, 2020-2024 (USD BILLION)

- TABLE 82 ENERGY & UTILITIES: CLOUD COMPUTING MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 83 GOVERNMENT & PUBLIC SECTOR: CLOUD COMPUTING MARKET, BY REGION, 2020-2024 (USD BILLION)

- TABLE 84 GOVERNMENT & PUBLIC SECTOR: CLOUD COMPUTING MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 85 TELECOMMUNICATIONS: CLOUD COMPUTING MARKET, BY REGION, 2020-2024 (USD BILLION)

- TABLE 86 TELECOMMUNICATIONS: CLOUD COMPUTING MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 87 SOFTWARE AND IT SERVICES: CLOUD COMPUTING MARKET, BY REGION, 2020-2024 (USD BILLION)

- TABLE 88 SOFTWARE AND IT SERVICES: CLOUD COMPUTING MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 89 HEALTHCARE & LIFE SCIENCES: CLOUD COMPUTING MARKET, BY REGION, 2020-2024 (USD BILLION)

- TABLE 90 HEALTHCARE & LIFE SCIENCES: CLOUD COMPUTING MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 91 RETAIL AND E-COMMERCE: CLOUD COMPUTING MARKET, BY REGION, 2020-2024 (USD BILLION)

- TABLE 92 RETAIL AND E-COMMERCE: CLOUD COMPUTING MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 93 MANUFACTURING: CLOUD COMPUTING MARKET, BY REGION, 2020-2024 (USD BILLION)

- TABLE 94 MANUFACTURING: CLOUD COMPUTING MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 95 TRANSPORTATION & LOGISTICS: CLOUD COMPUTING MARKET, BY REGION, 2020-2024 (USD BILLION)

- TABLE 96 TRANSPORTATION & LOGISTICS: CLOUD COMPUTING MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 97 MEDIA & ENTERTAINMENT: CLOUD COMPUTING MARKET, BY REGION, 2020-2024 (USD BILLION)

- TABLE 98 MEDIA & ENTERTAINMENT: CLOUD COMPUTING MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 99 OTHER VERTICALS: CLOUD COMPUTING MARKET, BY REGION, 2020-2024 (USD BILLION)

- TABLE 100 OTHER VERTICALS: CLOUD COMPUTING MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 101 CLOUD COMPUTING MARKET, BY REGION, 2020-2024 (USD BILLION)

- TABLE 102 CLOUD COMPUTING MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 103 NORTH AMERICA: CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2020-2024 (USD BILLION)

- TABLE 104 NORTH AMERICA: CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2025-2030 (USD BILLION)

- TABLE 105 NORTH AMERICA: CLOUD COMPUTING MARKET, BY IAAS, 2020-2024 (USD BILLION)

- TABLE 106 NORTH AMERICA: CLOUD COMPUTING MARKET, BY IAAS, 2025-2030 (USD BILLION)

- TABLE 107 NORTH AMERICA: CLOUD COMPUTING MARKET, BY PAAS, 2020-2024 (USD BILLION)

- TABLE 108 NORTH AMERICA: CLOUD COMPUTING MARKET, BY PAAS, 2025-2030 (USD BILLION)

- TABLE 109 NORTH AMERICA: CLOUD COMPUTING MARKET, BY SAAS, 2020-2024 (USD BILLION)

- TABLE 110 NORTH AMERICA: CLOUD COMPUTING MARKET, BY SAAS, 2025-2030 (USD BILLION)

- TABLE 111 NORTH AMERICA: CLOUD COMPUTING MARKET, BY DEPLOYMENT MODEL, 2020-2024 (USD BILLION)

- TABLE 112 NORTH AMERICA: CLOUD COMPUTING MARKET, BY DEPLOYMENT MODEL, 2025-2030 (USD BILLION)

- TABLE 113 NORTH AMERICA: CLOUD COMPUTING MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD BILLION)

- TABLE 114 NORTH AMERICA: CLOUD COMPUTING MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD BILLION)

- TABLE 115 NORTH AMERICA: CLOUD COMPUTING MARKET, BY VERTICAL, 2020-2024 (USD BILLION)

- TABLE 116 NORTH AMERICA: CLOUD COMPUTING MARKET, BY VERTICAL, 2025-2030 (USD BILLION)

- TABLE 117 NORTH AMERICA: CLOUD COMPUTING MARKET, BY COUNTRY, 2020-2024 (USD BILLION)

- TABLE 118 NORTH AMERICA: CLOUD COMPUTING MARKET, BY COUNTRY, 2025-2030 (USD BILLION)

- TABLE 119 US: CLOUD COMPUTING MARKET, BY DEPLOYMENT MODEL, 2020-2024 (USD BILLION)

- TABLE 120 US: CLOUD COMPUTING MARKET, BY DEPLOYMENT MODEL, 2025-2030 (USD BILLION)

- TABLE 121 US: CLOUD COMPUTING MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD BILLION)

- TABLE 122 US: CLOUD COMPUTING MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD BILLION)

- TABLE 123 CANADA: CLOUD COMPUTING MARKET, BY DEPLOYMENT MODEL, 2020-2024 (USD BILLION)

- TABLE 124 CANADA: CLOUD COMPUTING MARKET, BY DEPLOYMENT MODEL, 2025-2030 (USD BILLION)

- TABLE 125 CANADA: CLOUD COMPUTING MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD BILLION)

- TABLE 126 CANADA: CLOUD COMPUTING MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD BILLION)

- TABLE 127 EUROPE: CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2020-2024 (USD BILLION)

- TABLE 128 EUROPE: CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2025-2030 (USD BILLION)

- TABLE 129 EUROPE: CLOUD COMPUTING MARKET, BY IAAS, 2020-2024 (USD BILLION)

- TABLE 130 EUROPE: CLOUD COMPUTING MARKET, BY IAAS, 2025-2030 (USD BILLION)

- TABLE 131 EUROPE: CLOUD COMPUTING MARKET, BY PAAS, 2020-2024 (USD BILLION)

- TABLE 132 EUROPE: CLOUD COMPUTING MARKET, BY PAAS, 2025-2030 (USD BILLION)

- TABLE 133 EUROPE: CLOUD COMPUTING MARKET, BY SAAS, 2020-2024 (USD BILLION)

- TABLE 134 EUROPE: CLOUD COMPUTING MARKET, BY SAAS, 2025-2030 (USD BILLION)

- TABLE 135 EUROPE: CLOUD COMPUTING MARKET, BY DEPLOYMENT MODEL, 2020-2024 (USD BILLION)

- TABLE 136 EUROPE: CLOUD COMPUTING MARKET, BY DEPLOYMENT MODEL, 2025-2030 (USD BILLION)

- TABLE 137 EUROPE: CLOUD COMPUTING MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD BILLION)

- TABLE 138 EUROPE: CLOUD COMPUTING MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD BILLION)

- TABLE 139 EUROPE: CLOUD COMPUTING MARKET, BY VERTICAL, 2020-2024 (USD BILLION)

- TABLE 140 EUROPE: CLOUD COMPUTING MARKET, BY VERTICAL, 2025-2030 (USD BILLION)

- TABLE 141 EUROPE: CLOUD COMPUTING MARKET, BY COUNTRY, 2020-2024 (USD BILLION)

- TABLE 142 EUROPE: CLOUD COMPUTING MARKET, BY COUNTRY, 2025-2030 (USD BILLION)

- TABLE 143 UK: CLOUD COMPUTING MARKET, BY DEPLOYMENT MODEL, 2020-2024 (USD BILLION)

- TABLE 144 UK: CLOUD COMPUTING MARKET, BY DEPLOYMENT MODEL, 2025-2030 (USD BILLION)

- TABLE 145 UK: CLOUD COMPUTING MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD BILLION)

- TABLE 146 UK: CLOUD COMPUTING MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD BILLION)

- TABLE 147 GERMANY: CLOUD COMPUTING MARKET, BY DEPLOYMENT MODEL, 2020-2024 (USD BILLION)

- TABLE 148 GERMANY: CLOUD COMPUTING MARKET, BY DEPLOYMENT MODEL, 2025-2030 (USD BILLION)

- TABLE 149 GERMANY: CLOUD COMPUTING MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD BILLION)

- TABLE 150 GERMANY: CLOUD COMPUTING MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD BILLION)

- TABLE 151 FRANCE: CLOUD COMPUTING MARKET, BY DEPLOYMENT MODEL, 2020-2024 (USD BILLION)

- TABLE 152 FRANCE: CLOUD COMPUTING MARKET, BY DEPLOYMENT MODEL, 2025-2030 (USD BILLION)

- TABLE 153 FRANCE: CLOUD COMPUTING MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD BILLION)

- TABLE 154 FRANCE: CLOUD COMPUTING MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD BILLION)

- TABLE 155 SPAIN: CLOUD COMPUTING MARKET, BY DEPLOYMENT MODEL, 2020-2024 (USD BILLION)

- TABLE 156 SPAIN: CLOUD COMPUTING MARKET, BY DEPLOYMENT MODEL, 2025-2030 (USD BILLION)

- TABLE 157 SPAIN: CLOUD COMPUTING MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD BILLION)

- TABLE 158 SPAIN: CLOUD COMPUTING MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD BILLION)

- TABLE 159 ITALY: CLOUD COMPUTING MARKET, BY DEPLOYMENT MODEL, 2020-2024 (USD BILLION)

- TABLE 160 ITALY: CLOUD COMPUTING MARKET, BY DEPLOYMENT MODEL, 2025-2030 (USD BILLION)

- TABLE 161 ITALY: CLOUD COMPUTING MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD BILLION)

- TABLE 162 ITALY: CLOUD COMPUTING MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD BILLION)

- TABLE 163 NETHERLANDS: CLOUD COMPUTING MARKET, BY DEPLOYMENT MODEL, 2020-2024 (USD BILLION)

- TABLE 164 NETHERLANDS: CLOUD COMPUTING MARKET, BY DEPLOYMENT MODEL, 2025-2030 (USD BILLION)

- TABLE 165 NETHERLANDS: CLOUD COMPUTING MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD BILLION)

- TABLE 166 NETHERLANDS: CLOUD COMPUTING MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD BILLION)

- TABLE 167 REST OF EUROPE: CLOUD COMPUTING MARKET, BY DEPLOYMENT MODEL, 2020-2024 (USD BILLION)

- TABLE 168 REST OF EUROPE: CLOUD COMPUTING MARKET, BY DEPLOYMENT MODEL, 2025-2030 (USD BILLION)

- TABLE 169 REST OF EUROPE: CLOUD COMPUTING MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD BILLION)

- TABLE 170 REST OF EUROPE: CLOUD COMPUTING MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD BILLION)

- TABLE 171 ASIA PACIFIC: CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2020-2024 (USD BILLION)

- TABLE 172 ASIA PACIFIC: CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2025-2030 (USD BILLION)

- TABLE 173 ASIA PACIFIC: CLOUD COMPUTING MARKET, BY IAAS, 2020-2024 (USD BILLION)

- TABLE 174 ASIA PACIFIC: CLOUD COMPUTING MARKET, BY IAAS, 2025-2030 (USD BILLION)

- TABLE 175 ASIA PACIFIC: CLOUD COMPUTING MARKET, BY PAAS, 2020-2024 (USD BILLION)

- TABLE 176 ASIA PACIFIC: CLOUD COMPUTING MARKET, BY PAAS, 2025-2030 (USD BILLION)

- TABLE 177 ASIA PACIFIC: CLOUD COMPUTING MARKET, BY SAAS, 2020-2024 (USD BILLION)

- TABLE 178 ASIA PACIFIC: CLOUD COMPUTING MARKET, BY SAAS, 2025-2030 (USD BILLION)

- TABLE 179 ASIA PACIFIC: CLOUD COMPUTING MARKET, BY DEPLOYMENT MODEL, 2020-2024 (USD BILLION)

- TABLE 180 ASIA PACIFIC: CLOUD COMPUTING MARKET, BY DEPLOYMENT MODEL, 2025-2030 (USD BILLION)

- TABLE 181 ASIA PACIFIC: CLOUD COMPUTING MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD BILLION)

- TABLE 182 ASIA PACIFIC: CLOUD COMPUTING MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD BILLION)

- TABLE 183 ASIA PACIFIC: CLOUD COMPUTING MARKET, BY VERTICAL, 2020-2024 (USD BILLION)

- TABLE 184 ASIA PACIFIC: CLOUD COMPUTING MARKET, BY VERTICAL, 2025-2030 (USD BILLION)

- TABLE 185 ASIA PACIFIC: CLOUD COMPUTING MARKET, BY COUNTRY, 2020-2024 (USD BILLION)

- TABLE 186 ASIA PACIFIC: CLOUD COMPUTING MARKET, BY COUNTRY, 2025-2030 (USD BILLION)

- TABLE 187 CHINA: CLOUD COMPUTING MARKET, BY DEPLOYMENT MODEL, 2020-2024 (USD BILLION)

- TABLE 188 CHINA: CLOUD COMPUTING MARKET, BY DEPLOYMENT MODEL, 2025-2030 (USD BILLION)

- TABLE 189 CHINA: CLOUD COMPUTING MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD BILLION)

- TABLE 190 CHINA: CLOUD COMPUTING MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD BILLION)

- TABLE 191 INDIA: CLOUD COMPUTING MARKET, BY DEPLOYMENT MODEL, 2020-2024 (USD BILLION)

- TABLE 192 INDIA: CLOUD COMPUTING MARKET, BY DEPLOYMENT MODEL, 2025-2030 (USD BILLION)

- TABLE 193 INDIA: CLOUD COMPUTING MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD BILLION)

- TABLE 194 INDIA: CLOUD COMPUTING MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD BILLION)

- TABLE 195 JAPAN: CLOUD COMPUTING MARKET, BY DEPLOYMENT MODEL, 2020-2024 (USD BILLION)

- TABLE 196 JAPAN: CLOUD COMPUTING MARKET, BY DEPLOYMENT MODEL, 2025-2030 (USD BILLION)

- TABLE 197 JAPAN: CLOUD COMPUTING MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD BILLION)

- TABLE 198 JAPAN: CLOUD COMPUTING MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD BILLION)

- TABLE 199 SINGAPORE: CLOUD COMPUTING MARKET, BY DEPLOYMENT MODEL, 2020-2024 (USD BILLION)

- TABLE 200 SINGAPORE: CLOUD COMPUTING MARKET, BY DEPLOYMENT MODEL, 2025-2030 (USD BILLION)

- TABLE 201 SINGAPORE: CLOUD COMPUTING MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD BILLION)

- TABLE 202 SINGAPORE: CLOUD COMPUTING MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD BILLION)

- TABLE 203 AUSTRALIA & NEW ZEALAND: CLOUD COMPUTING MARKET, BY DEPLOYMENT MODEL, 2020-2024 (USD BILLION)

- TABLE 204 AUSTRALIA & NEW ZEALAND: CLOUD COMPUTING MARKET, BY DEPLOYMENT MODEL, 2025-2030 (USD BILLION)

- TABLE 205 AUSTRALIA & NEW ZEALAND: CLOUD COMPUTING MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD BILLION)

- TABLE 206 AUSTRALIA & NEW ZEALAND: CLOUD COMPUTING MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD BILLION)

- TABLE 207 SOUTH KOREA: CLOUD COMPUTING MARKET, BY DEPLOYMENT MODEL, 2020-2024 (USD BILLION)

- TABLE 208 SOUTH KOREA: CLOUD COMPUTING MARKET, BY DEPLOYMENT MODEL, 2025-2030 (USD BILLION)

- TABLE 209 SOUTH KOREA: CLOUD COMPUTING MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD BILLION)

- TABLE 210 SOUTH KOREA: CLOUD COMPUTING MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD BILLION)

- TABLE 211 REST OF APAC: CLOUD COMPUTING MARKET, BY DEPLOYMENT MODEL, 2020-2024 (USD BILLION)

- TABLE 212 REST OF APAC: CLOUD COMPUTING MARKET, BY DEPLOYMENT MODEL, 2025-2030 (USD BILLION)

- TABLE 213 REST OF APAC: CLOUD COMPUTING MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD BILLION)

- TABLE 214 REST OF APAC: CLOUD COMPUTING MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD BILLION)

- TABLE 215 MIDDLE EAST & AFRICA: CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2020-2024 (USD BILLION)

- TABLE 216 MIDDLE EAST & AFRICA: CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2025-2030 (USD BILLION)

- TABLE 217 MIDDLE EAST & AFRICA: CLOUD COMPUTING MARKET, BY IAAS, 2020-2024 (USD BILLION)

- TABLE 218 MIDDLE EAST & AFRICA: CLOUD COMPUTING MARKET, BY IAAS, 2025-2030 (USD BILLION)

- TABLE 219 MIDDLE EAST & AFRICA: CLOUD COMPUTING MARKET, BY PAAS, 2020-2024 (USD BILLION)

- TABLE 220 MIDDLE EAST & AFRICA: CLOUD COMPUTING MARKET, BY PAAS, 2025-2030 (USD BILLION)

- TABLE 221 MIDDLE EAST & AFRICA: CLOUD COMPUTING MARKET, BY SAAS, 2020-2024 (USD BILLION)

- TABLE 222 MIDDLE EAST & AFRICA: CLOUD COMPUTING MARKET, BY SAAS, 2025-2030 (USD BILLION)

- TABLE 223 MIDDLE EAST & AFRICA: CLOUD COMPUTING MARKET, BY DEPLOYMENT MODEL, 2020-2024 (USD BILLION)

- TABLE 224 MIDDLE EAST & AFRICA: CLOUD COMPUTING MARKET, BY DEPLOYMENT MODEL, 2025-2030 (USD BILLION)

- TABLE 225 MIDDLE EAST & AFRICA: CLOUD COMPUTING MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD BILLION)

- TABLE 226 MIDDLE EAST & AFRICA: CLOUD COMPUTING MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD BILLION)

- TABLE 227 MIDDLE EAST & AFRICA: CLOUD COMPUTING MARKET, BY VERTICAL, 2020-2024 (USD BILLION)

- TABLE 228 MIDDLE EAST & AFRICA: CLOUD COMPUTING MARKET, BY VERTICAL, 2025-2030 (USD BILLION)

- TABLE 229 MIDDLE EAST & AFRICA: CLOUD COMPUTING MARKET, BY COUNTRY, 2020-2024 (USD BILLION)

- TABLE 230 MIDDLE EAST & AFRICA: CLOUD COMPUTING MARKET, BY COUNTRY, 2025-2030 (USD BILLION)

- TABLE 231 GULF COOPERATION COUNCIL (GCC): CLOUD COMPUTING MARKET, BY COUNTRY, 2020-2024 (USD BILLION)

- TABLE 232 GULF COOPERATION COUNCIL (GCC): CLOUD COMPUTING MARKET, BY COUNTRY, 2025-2030 (USD BILLION)

- TABLE 233 SAUDI ARABIA: CLOUD COMPUTING MARKET, BY DEPLOYMENT MODEL, 2020-2024 (USD BILLION)

- TABLE 234 SAUDI ARABIA: CLOUD COMPUTING MARKET, BY DEPLOYMENT MODEL, 2025-2030 (USD BILLION)

- TABLE 235 SAUDI ARABIA: CLOUD COMPUTING MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD BILLION)

- TABLE 236 SAUDI ARABIA: CLOUD COMPUTING MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD BILLION)

- TABLE 237 UAE: CLOUD COMPUTING MARKET, BY DEPLOYMENT MODEL, 2020-2024 (USD BILLION)

- TABLE 238 UAE: CLOUD COMPUTING MARKET, BY DEPLOYMENT MODEL, 2025-2030 (USD BILLION)

- TABLE 239 UAE: CLOUD COMPUTING MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD BILLION)

- TABLE 240 UAE: CLOUD COMPUTING MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD BILLION)

- TABLE 241 QATAR: CLOUD COMPUTING MARKET, BY DEPLOYMENT MODEL, 2020-2024 (USD BILLION)

- TABLE 242 QATAR: CLOUD COMPUTING MARKET, BY DEPLOYMENT MODEL, 2025-2030 (USD BILLION)

- TABLE 243 QATAR: CLOUD COMPUTING MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD BILLION)

- TABLE 244 QATAR: CLOUD COMPUTING MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD BILLION)

- TABLE 245 REST OF GCC COUNTRIES: CLOUD COMPUTING MARKET, BY DEPLOYMENT MODEL, 2020-2024 (USD BILLION)

- TABLE 246 REST OF GCC COUNTRIES: CLOUD COMPUTING MARKET, BY DEPLOYMENT MODEL, 2025-2030 (USD BILLION)

- TABLE 247 REST OF GCC COUNTRIES: CLOUD COMPUTING MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD BILLION)

- TABLE 248 REST OF GCC COUNTRIES: CLOUD COMPUTING MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD BILLION)

- TABLE 249 SOUTH AFRICA: CLOUD COMPUTING MARKET, BY DEPLOYMENT MODEL, 2020-2024 (USD BILLION)

- TABLE 250 SOUTH AFRICA: CLOUD COMPUTING MARKET, BY DEPLOYMENT MODEL, 2025-2030 (USD BILLION)

- TABLE 251 SOUTH AFRICA: CLOUD COMPUTING MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD BILLION)

- TABLE 252 SOUTH AFRICA: CLOUD COMPUTING MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD BILLION)

- TABLE 253 REST OF MIDDLE EAST & AFRICA: CLOUD COMPUTING MARKET, BY DEPLOYMENT MODEL, 2020-2024 (USD BILLION)

- TABLE 254 REST OF MIDDLE EAST & AFRICA: CLOUD COMPUTING MARKET, BY DEPLOYMENT MODEL, 2025-2030 (USD BILLION)

- TABLE 255 REST OF MIDDLE EAST & AFRICA: CLOUD COMPUTING MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD BILLION)

- TABLE 256 REST OF MIDDLE EAST & AFRICA: CLOUD COMPUTING MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD BILLION)

- TABLE 257 LATIN AMERICA: CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2020-2024 (USD BILLION)

- TABLE 258 LATIN AMERICA: CLOUD COMPUTING MARKET, BY SERVICE MODEL, 2025-2030 (USD BILLION)

- TABLE 259 LATIN AMERICA: CLOUD COMPUTING MARKET, BY IAAS, 2020-2024 (USD BILLION)

- TABLE 260 LATIN AMERICA: CLOUD COMPUTING MARKET, BY IAAS, 2025-2030 (USD BILLION)

- TABLE 261 LATIN AMERICA: CLOUD COMPUTING MARKET, BY PAAS, 2020-2024 (USD BILLION)

- TABLE 262 LATIN AMERICA: CLOUD COMPUTING MARKET, BY PAAS, 2025-2030 (USD BILLION)

- TABLE 263 LATIN AMERICA: CLOUD COMPUTING MARKET, BY SAAS, 2020-2024 (USD BILLION)

- TABLE 264 LATIN AMERICA: CLOUD COMPUTING MARKET, BY SAAS, 2025-2030 (USD BILLION)

- TABLE 265 LATIN AMERICA: CLOUD COMPUTING MARKET, BY DEPLOYMENT MODEL, 2020-2024 (USD BILLION)

- TABLE 266 LATIN AMERICA: CLOUD COMPUTING MARKET, BY DEPLOYMENT MODEL, 2025-2030 (USD BILLION)

- TABLE 267 LATIN AMERICA: CLOUD COMPUTING MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD BILLION)

- TABLE 268 LATIN AMERICA: CLOUD COMPUTING MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD BILLION)

- TABLE 269 LATIN AMERICA: CLOUD COMPUTING MARKET, BY VERTICAL, 2020-2024 (USD BILLION)

- TABLE 270 LATIN AMERICA: CLOUD COMPUTING MARKET, BY VERTICAL, 2025-2030 (USD BILLION)

- TABLE 271 LATIN AMERICA: CLOUD COMPUTING MARKET, BY COUNTRY, 2020-2024 (USD BILLION)

- TABLE 272 LATIN AMERICA: CLOUD COMPUTING MARKET, BY COUNTRY, 2025-2030 (USD BILLION)

- TABLE 273 BRAZIL: CLOUD COMPUTING MARKET, BY DEPLOYMENT MODEL, 2020-2024 (USD BILLION)

- TABLE 274 BRAZIL: CLOUD COMPUTING MARKET, BY DEPLOYMENT MODEL, 2025-2030 (USD BILLION)

- TABLE 275 BRAZIL: CLOUD COMPUTING MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD BILLION)

- TABLE 276 BRAZIL: CLOUD COMPUTING MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD BILLION)

- TABLE 277 MEXICO: CLOUD COMPUTING MARKET, BY DEPLOYMENT MODEL, 2020-2024 (USD BILLION)

- TABLE 278 MEXICO: CLOUD COMPUTING MARKET, BY DEPLOYMENT MODEL, 2025-2030 (USD BILLION)

- TABLE 279 MEXICO: CLOUD COMPUTING MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD BILLION)

- TABLE 280 MEXICO: CLOUD COMPUTING MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD BILLION)

- TABLE 281 REST OF LATIN AMERICA: CLOUD COMPUTING MARKET, BY DEPLOYMENT MODEL, 2020-2024 (USD BILLION)

- TABLE 282 REST OF LATIN AMERICA: CLOUD COMPUTING MARKET, BY DEPLOYMENT MODEL, 2025-2030 (USD BILLION)

- TABLE 283 REST OF LATIN AMERICA: CLOUD COMPUTING MARKET, BY ORGANIZATION SIZE, 2020-2024 (USD BILLION)

- TABLE 284 REST OF LATIN AMERICA: CLOUD COMPUTING MARKET, BY ORGANIZATION SIZE, 2025-2030 (USD BILLION)

- TABLE 285 CLOUD COMPUTING MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2023-2025

- TABLE 286 MARKET SHARE OF KEY VENDORS, 2024

- TABLE 287 CLOUD COMPUTING MARKET: REGION FOOTPRINT

- TABLE 288 CLOUD COMPUTING MARKET: SERVICE MODEL FOOTPRINT

- TABLE 289 CLOUD COMPUTING MARKET: DEPLOYMENT MODEL FOOTPRINT

- TABLE 290 CLOUD COMPUTING MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 291 CLOUD COMPUTING MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 292 CLOUD COMPUTING MARKET: PRODUCT LAUNCHES, MARCH 2022-MAY 2025

- TABLE 293 CLOUD COMPUTING MARKET: DEALS, JANUARY 2022-JUNE 2025

- TABLE 294 AWS: COMPANY OVERVIEW

- TABLE 295 AWS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 296 AWS: PRODUCT LAUNCHES

- TABLE 297 AWS: DEALS

- TABLE 298 MICROSOFT: COMPANY OVERVIEW

- TABLE 299 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 300 MICROSOFT: PRODUCT LAUNCHES

- TABLE 301 MICROSOFT: DEALS

- TABLE 302 GOOGLE: COMPANY OVERVIEW

- TABLE 303 GOOGLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 304 GOOGLE: PRODUCT LAUNCHES

- TABLE 305 GOOGLE: DEALS

- TABLE 306 ORACLE: COMPANY OVERVIEW

- TABLE 307 ORACLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 308 ORACLE: PRODUCT LAUNCHES

- TABLE 309 ORACLE: DEALS

- TABLE 310 SALESFORCE: COMPANY OVERVIEW

- TABLE 311 SALESFORCE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 312 SALESFORCE: PRODUCT LAUNCHES

- TABLE 313 SALESFORCE: DEALS

- TABLE 314 ALIBABA CLOUD: COMPANY OVERVIEW

- TABLE 315 ALIBABA CLOUD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 316 ALIBABA CLOUD: PRODUCT LAUNCHES

- TABLE 317 ALIBABA CLOUD: DEALS

- TABLE 318 IBM: COMPANY OVERVIEW

- TABLE 319 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 320 IBM: PRODUCT LAUNCHES

- TABLE 321 IBM: DEALS

- TABLE 322 SAP: COMPANY OVERVIEW

- TABLE 323 SAP: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 324 SAP: PRODUCT LAUNCHES

- TABLE 325 SAP: DEALS

- TABLE 326 ADOBE: COMPANY OVERVIEW

- TABLE 327 ADOBE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 328 ADOBE: PRODUCT LAUNCHES

- TABLE 329 ADOBE: DEALS

- TABLE 330 TENCENT CLOUD: COMPANY OVERVIEW

- TABLE 331 TENCENT CLOUD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 332 TENCENT CLOUD: PRODUCT LAUNCHES

- TABLE 333 TENCENT CLOUD: DEALS

- TABLE 334 EDGE COMPUTING MARKET, BY COMPONENT, 2019-2023 (USD MILLION)

- TABLE 335 EDGE COMPUTING MARKET, BY COMPONENT, 2024-2029 (USD MILLION)

- TABLE 336 HYPERSCALE COMPUTING MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 337 HYPERSCALE COMPUTING MARKET, BY OFFERING, 2023-2028 (USD MILLION)

List of Figures

- FIGURE 1 CLOUD COMPUTING MARKET: RESEARCH DESIGN

- FIGURE 2 BREAKUP OF PRIMARY INTERVIEWS, BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 3 CLOUD COMPUTING MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY - BOTTOM-UP APPROACH (SUPPLY SIDE): COLLECTIVE REVENUE OF CLOUD COMPUTING VENDORS

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY - (SUPPLY SIDE): ILLUSTRATION OF VENDOR REVENUE ESTIMATION

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 2 (DEMAND SIDE): REVENUE GENERATED FROM OFFERINGS

- FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 2 (DEMAND SIDE): CLOUD COMPUTING MARKET

- FIGURE 9 GLOBAL CLOUD COMPUTING MARKET TO WITNESS SIGNIFICANT GROWTH

- FIGURE 10 FASTEST-GROWING SEGMENTS IN CLOUD COMPUTING MARKET, 2025-2030

- FIGURE 11 CLOUD COMPUTING MARKET: REGIONAL SNAPSHOT

- FIGURE 12 ACCELERATING DIGITAL TRANSFORMATION AND HYBRID CLOUD ADOPTION UNLOCK GROWTH OPPORTUNITIES FOR CLOUD PROVIDERS

- FIGURE 13 SAAS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 14 COMPUTE SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 15 DATABASES & DATA MANAGEMENT TO HOLD SIGNIFICANT SHARE DURING FORECAST PERIOD

- FIGURE 16 SYSTEM INFRASTRUCTURE SOFTWARE TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 17 PUBLIC CLOUD TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 18 SOFTWARE & IT SERVICES TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 19 ASIA PACIFIC TO EMERGE AS MOST ATTRACTIVE MARKET FOR NEXT FIVE YEARS

- FIGURE 20 CLOUD COMPUTING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

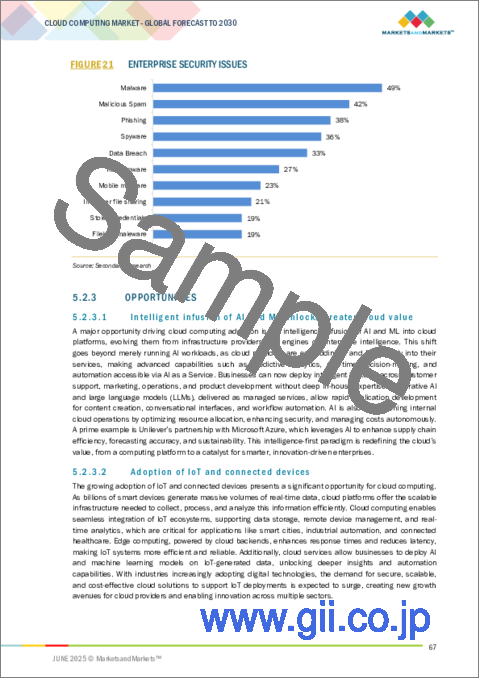

- FIGURE 21 ENTERPRISE SECURITY ISSUES

- FIGURE 22 PROGNOSIS OF WORLDWIDE SPENDING ON INTERNET OF THINGS (IOT) FROM 2018 TO 2023 (BILLION USD)

- FIGURE 23 CLOUD COMPUTING MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 24 KEY PLAYERS IN CLOUD COMPUTING ECOSYSTEM

- FIGURE 25 CLOUD COMPUTING MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 26 AVERAGE SELLING PRICE , BY REGION

- FIGURE 27 NUMBER OF PATENTS GRANTED IN LAST 10 YEARS, 2015-2025

- FIGURE 28 CLOUD COMPUTING MARKET: TRENDS/DISRUPTIONS IMPACTING BUYERS/CLIENTS

- FIGURE 29 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP INDUSTRY VERTICALS

- FIGURE 30 KEY BUYING CRITERIA FOR TOP INDUSTRY VERTICALS

- FIGURE 31 MARKET POTENTIAL OF GENERATIVE AI IN ENHANCING CLOUD COMPUTING ACROSS KEY USE CASES

- FIGURE 32 CLOUD COMPUTING MARKET: BUSINESS MODEL

- FIGURE 33 CLOUD COMPUTING MARKET: INVESTMENT LANDSCAPE AND FUNDING SCENARIO

- FIGURE 34 PAAS SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 35 NETWORKING SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 36 ANALYTICS & REPORTING SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 37 SUPPLY CHAIN MANAGEMENT (SCM) SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 38 HYBRID CLOUD SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 39 SMES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 40 HEALTHCARE & LIFESCIENCES SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 41 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET DURING FORECAST PERIOD

- FIGURE 42 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 43 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 44 REVENUE ANALYSIS OF KEY VENDORS, 2020-2024

- FIGURE 45 CLOUD COMPUTING MARKET: MARKET SHARE ANALYSIS, 2024

- FIGURE 46 CLOUD COMPUTING MARKET: MARKET SHARE ANALYSIS, BY SERVICE MODEL, 2024

- FIGURE 47 CLOUD COMPUTING MARKET: VENDOR PRODUCTS/BRANDS COMPARISON

- FIGURE 48 COMPANY EVALUATION MATRIX FOR KEY PLAYERS: CRITERIA WEIGHTAGE

- FIGURE 49 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- FIGURE 50 CLOUD COMPUTING MARKET: COMPANY FOOTPRINT

- FIGURE 51 EVALUATION MATRIX FOR STARTUPS/SMES: CRITERIA WEIGHTAGE

- FIGURE 52 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- FIGURE 53 COMPANY VALUATION OF KEY VENDORS

- FIGURE 54 EV/EBITDA ANALYSIS OF KEY VENDORS

- FIGURE 55 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 56 AWS: COMPANY SNAPSHOT

- FIGURE 57 MICROSOFT: COMPANY SNAPSHOT

- FIGURE 58 GOOGLE: COMPANY SNAPSHOT

- FIGURE 59 ORACLE: COMPANY SNAPSHOT

- FIGURE 60 SALESFORCE: COMPANY SNAPSHOT

- FIGURE 61 ALIBABA CLOUD: COMPANY SNAPSHOT

- FIGURE 62 IBM: COMPANY SNAPSHOT

- FIGURE 63 SAP: COMPANY SNAPSHOT

- FIGURE 64 ADOBE: COMPANY SNAPSHOT

- FIGURE 65 TENCENT CLOUD: COMPANY SNAPSHOT

The cloud computing market is expanding rapidly, with a projected market size anticipated to rise from about USD 1,294.9 billion in 2025 to USD 2,281.1 billion by 2030, featuring a CAGR of 12.0% during the forecast period. Businesses are driving the demand for cloud computing by seeking scalable IT infrastructure, remote work support, and real-time data access. Organizations are increasingly prioritizing AI, big data analytics, and automation, making cloud platforms more essential. The shift is moving from traditional on-premises systems to flexible, hybrid, and multi-cloud environments for greater agility and innovation.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | USD (Billion) |

| Segments | Service Models, IaaS, PaaS, SaaS, Deployment Mode, Organization Size, Vertical |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

"PaaS segment to account for the fastest growth during the forecast period"

Platform as a Service (PaaS) remains the fastest-growing segment in the cloud computing market, driven by evolving development needs and emerging technologies. Modern PaaS platforms now integrate AI/ML services, DevOps automation, and container orchestration tools such as Kubernetes, enabling faster and smarter application development. They offer low-code/no-code capabilities, built-in CI/CD pipelines, and support for microservices architectures, helping developers innovate with agility and reduce complexity. Enhanced scalability, integrated security, real-time monitoring, and automatic patch management ensure high performance and compliance. Serverless computing is also gaining traction within PaaS, allowing developers to deploy functions without provisioning infrastructure. Ideal for startups, developers, and large enterprises, PaaS accelerates time to market, lowers operational costs, and simplifies cross-team collaboration. With abstraction from hardware, runtime environments, and backend maintenance, organizations can focus on building intelligent, scalable, and user-centric applications while staying ahead in a fast-changing digital landscape.

"Public cloud to hold the largest market share during the forecast period"

Public cloud continues to dominate the cloud computing market due to its scalability, cost efficiency, and global reach. It provides on-demand access to computing resources such as servers, storage, databases, and applications via the internet, with no need for upfront hardware investment. Providers such as AWS, Microsoft Azure, and Google Cloud now offer advanced capabilities, including generative AI tools, serverless computing, and edge integration, making the public cloud suitable for dynamic workloads and digital transformation. Its flexible pricing and robust security frameworks appeal to businesses of all sizes. A standout case is the Commonwealth Bank of Australia, which migrated to AWS in 2025 and deployed 2,000 AI models across 61,000 data pipelines. This enabled 55 million AI-driven decisions daily, reducing fraud losses by 50% and cutting loan approval times to under 10 minutes. Such real-world outcomes highlight how public cloud accelerates innovation and improves operational efficiency across industries.

"North America is leading in cloud computing with strong infrastructure and early adoption, while Asia Pacific is the fastest-growing region driven by digital transformation and government-backed AI initiatives."

North America continues to dominate the cloud computing landscape, leveraging mature digital infrastructure, widespread enterprise adoption, and the presence of major providers like AWS, Microsoft Azure, and Google Cloud. The region is at the forefront of emerging technologies, including generative AI, serverless edge computing, and quantum-ready cloud services. Businesses are integrating tools such as Azure Arc for hybrid management, AWS's Nitro Enclaves for secure computing, and AI-driven DevSecOps pipelines. Advancements in 5G edge partnerships and private 5G networks are enabling ultra-low latency applications in manufacturing, healthcare, and autonomous systems. Furthermore, initiatives such as sovereign cloud efforts and enhanced confidential computing are boosting data privacy and compliance. Together, these developments reinforce North America's leadership in innovation, security, and scalability within the global cloud ecosystem.

Breakdown of Primaries

In-depth interviews were conducted with Chief Executive Officers (CEOs), innovation and technology directors, system integrators, and executives from various key organizations operating in the cloud computing market.

- By Company: Tier I - 20%, Tier II - 34%, and Tier III - 46%

- By Designation: C-Level Executives - 35%, D-Level Executives -25%, and others - 40%

- By Region: North America - 42%, Europe - 25%, Asia Pacific - 18%, Middle East & Africa - 8%, and Latin America - 7%

The report includes a study of key players offering cloud computing services. It profiles major vendors in the cloud computing market. The major market players include Microsoft (US), Google (US), IBM (US), AWS (US), Oracle (US), Salesforce (US), Tencent Cloud (China), SAP (Germany), Alibaba Cloud (China), Adobe (US), Workday (US), Fujitsu (Japan), Broadcom (California), Rackspace Technology (US), DXC Technology (US), NEC Corporation (Japan), Joyent (California), Digital Ocean (US), OVHcloud (France), NaviSite (US), Infor (US), Sage (UK), Intuit (US), OpenText (Canada), Cisco (US), Zoho (Texas), Epicor (US), ServiceNow (US), Huawei (China), Dell Technologies (US), and NTT Data Corporation (Japan).

Research Coverage

This research report categorizes the cloud computing market based on Service Model (IaaS, PaaS, SaaS), Infrastructure as a Service (Compute, Storage, Networking,), Platform as a Service (Application Development & Platforms, Application Testing & Quality, Analytics & Reporting, Data Management, Other PaaS Applications), Software as a Service (Customer Relationship Management, Enterprise Resource Management, Human Capital Management, Content Management, Collaboration & Productivity Suites, Supply Chain Management, System Infrastructure Software, Other SaaS Applications), Deployment Mode (Public Cloud, Private Cloud, Hybrid Cloud), Organization Size (Large Enterprises, Small & Medium Enterprises (SMEs)), Vertical (Government & Public sector, Banking, Financial Services, & Insurances (BFSI), Software & IT Services, Healthcare & Life Sciences, Retail & E-commerce, Manufacturing, Energy & Utilities, Telecommunications, Transportation & Logistics, Media & Entertainment, Other Verticals (Education, Real Estate, Construction, and Travel & Hospitality)), and Region (North America, Europe, Asia Pacific, Middle East & Africa, and Latin America). The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the cloud computing market. A detailed analysis of the key industry players was done to provide insights into their business overview, solutions, and services; key strategies; contracts, partnerships, agreements, product & service launches, and mergers and acquisitions; and recent developments associated with the cloud computing market. Competitive analysis of upcoming startups in the cloud computing market ecosystem was also covered in this report.

Reasons to Buy This Report

The report would provide the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall cloud computing market and its subsegments. It would help stakeholders understand the competitive landscape and gain more insights to better position their business and plan suitable go-to-market strategies. It also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Operational resilience & digital sovereignty imperative, Rising demand for AI, Accelerated spending on cloud, Personalized customer experience, Need for disaster recovery and contingency plans), restraints (Trust deficit in cloud adoption extends beyond basic security, Lack of technical knowledge and expertise, Data security and privacy concerns), opportunities (Intelligent infusion of AI and ML unlocks greater cloud value, Adoption of IoT and connected devices, Increasing government initiatives), and challenges (Multi-cloud complexity and integration challenges hinder seamless cloud operations, Risk of vendor lock-in, High complexity due to adoption of multi-cloud model).

- Product Development/Innovation: Detailed insights into upcoming technologies, research & development activities, and product & service launches in the cloud computing market.

- Market Development: Comprehensive information about lucrative markets - the report analyzes the cloud computing market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the cloud computing market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players such as Microsoft (US), Google (US), IBM (US), AWS (US), Oracle (US), Salesforce (US), Tencent Cloud (China), SAP (Germany), Alibaba Cloud (China), Adobe (US), Workday (US), Fujitsu (Japan), Broadcom (California), Rackspace Technology (US), DXC Technology (US), NEC Corporation (Japan), Joyent (California), Digital Ocean (US), OVHcloud (France), NaviSite (US), Infor (US), Sage (UK), Intuit (US), OpenText (Canada), Cisco (US), Zoho (Texas), Epicor (US), ServiceNow (US), Huawei (China), Dell Technologies (US), and NTT Data Corporation (Japan). The report also helps stakeholders understand the pulse of the cloud computing market and provides them with information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH APPROACH

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakup of primary profiles

- 2.1.2.2 Key industry insights

- 2.2 MARKET BREAKUP AND DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- 2.4 MARKET FORECAST

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN CLOUD COMPUTING MARKET

- 4.2 CLOUD COMPUTING MARKET, BY SERVICE MODEL

- 4.3 CLOUD COMPUTING MARKET, BY IAAS

- 4.4 CLOUD COMPUTING MARKET, BY PAAS

- 4.5 CLOUD COMPUTING MARKET, BY SAAS

- 4.6 CLOUD COMPUTING MARKET, BY DEPLOYMENT MODEL

- 4.7 CLOUD COMPUTING MARKET, BY VERTICAL

- 4.8 CLOUD COMPUTING MARKET, BY REGION

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Operational resilience & digital sovereignty imperative

- 5.2.1.2 Rising demand for AI

- 5.2.1.3 Accelerated spending on cloud

- 5.2.1.4 Personalized customer experience

- 5.2.1.5 Need for disaster recovery and contingency plans

- 5.2.2 RESTRAINTS

- 5.2.2.1 Trust deficit in cloud adoption extends beyond basic security

- 5.2.2.2 Lack of technical knowledge and expertise

- 5.2.2.3 Data security and privacy concerns

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Intelligent infusion of AI and ML unlocks greater cloud value

- 5.2.3.2 Adoption of IoT and connected devices

- 5.2.3.3 Increasing government initiatives

- 5.2.4 CHALLENGES

- 5.2.4.1 Multi-cloud complexity and integration challenges hinder seamless cloud operations

- 5.2.4.2 Risk of vendor lock-in

- 5.2.4.3 High complexity due to adoption of multi-cloud model

- 5.2.1 DRIVERS

- 5.3 CASE STUDY ANALYSIS

- 5.3.1 CASE STUDY 1: ZEOTAP IMPLEMENTED DEVOPS ARCHITECTURE TO IMPROVE PROCESS OPTIMIZATION

- 5.3.2 CASE STUDY 2: GHOST TEAM IMPLEMENTED DIGITALOCEAN'S APP TO MEET ITS CLOUD COMPUTING REQUIREMENTS

- 5.3.3 CASE STUDY 3: CITRIX CLOUD ENABLED AUTODESK TO ENHANCE ITS DIGITALIZATION

- 5.3.4 CASE STUDY 4: AWS CLOUD HELPED SIMSCALE SIMULATE COST-EFFECTIVE DESIGNS AND MAKE BETTER-INFORMED DECISIONS

- 5.3.5 CASE STUDY 5: ACCENTURE DIGITAL EXPERIENCE REVOLUTIONIZED MINNA BANK

- 5.4 SUPPLY CHAIN ANALYSIS

- 5.5 ECOSYSTEM ANALYSIS

- 5.6 PORTER'S FIVE FORCES ANALYSIS

- 5.6.1 THREAT OF NEW ENTRANTS

- 5.6.2 THREAT OF SUBSTITUTES

- 5.6.3 BARGAINING POWER OF SUPPLIERS

- 5.6.4 BARGAINING POWER OF BUYERS

- 5.6.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.7 PRICING ANALYSIS

- 5.7.1 AVERAGE SELLING PRICE OF KEY PLAYERS, BY REGION, 2025

- 5.7.2 INDICATIVE PRICING ANALYSIS OF CLOUD COMPUTING SOLUTIONS

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 Containerization

- 5.8.1.2 Virtualization

- 5.8.1.3 Orchestration

- 5.8.1.4 Software-defined Networking (SDN) & Network Functions Virtualization (NFV)

- 5.8.2 COMPLEMENTARY TECHNOLOGIES

- 5.8.2.1 Internet of Things (IoT)

- 5.8.2.2 Cybersecurity & Compliance

- 5.8.2.3 DevOps & CI/CD

- 5.8.2.4 Artificial Intelligence (AI) & Machine Learning (ML)

- 5.8.2.5 Big Data & Data Analytics

- 5.8.3 ADJACENT TECHNOLOGIES

- 5.8.3.1 5G

- 5.8.3.2 Edge computing

- 5.8.3.3 Industry cloud

- 5.8.3.4 Green cloud computing

- 5.8.1 KEY TECHNOLOGIES

- 5.9 PATENT ANALYSIS

- 5.10 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.11 REGULATORY LANDSCAPE

- 5.11.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.11.1.1 Regulatory implications and industry standards

- 5.11.1.2 General Data Protection Regulation

- 5.11.1.3 SEC Rule 17a-4

- 5.11.1.4 ISO/IEC 27001

- 5.11.1.5 System and Organization Controls 2 Type II compliance

- 5.11.1.6 Financial Industry Regulatory Authority

- 5.11.1.7 Freedom of Information Act

- 5.11.1.8 Health Insurance Portability and Accountability Act

- 5.11.2 REGULATIONS, BY REGION

- 5.11.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.12 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.13.2 BUYING CRITERIA

- 5.13.3 IMPACT OF GENERATIVE AI ON CLOUD COMPUTING MARKET

- 5.13.3.1 TOP USE CASES & MARKET POTENTIAL

- 5.13.3.2 Key Use Cases

- 5.13.4 CASE STUDY

- 5.13.4.1 Case Study 1: Retail & eCommerce Industry

- 5.13.4.2 Case Study 2: Healthcare & Life Sciences Industry

- 5.13.5 VENDOR INITIATIVE

- 5.13.5.1 HPE

- 5.13.5.2 VMware

- 5.14 BUSINESS MODEL ANALYSIS

- 5.14.1 PAY-AS-YOU-GO

- 5.14.2 SUBSCRIPTION MODEL

- 5.14.3 FREEMIUM

- 5.14.4 CUSTOM PRICING AGREEMENT

- 5.15 INVESTMENT LANDSCAPE AND FUNDING SCENARIO

- 5.16 MAJOR USE CASES & WORKLOADS OF CLOUD COMPUTING

- 5.16.1 COMPUTE INTENSIVE

- 5.16.1.1 High Performance Computing (HPC)

- 5.16.1.2 Artificial Intelligence (AI) & Machine Learning (ML)

- 5.16.1.3 Video Rendering

- 5.16.1.4 Simulation

- 5.16.2 DATA INTENSIVE

- 5.16.2.1 Big Data Analytics

- 5.16.2.2 Data Warehousing

- 5.16.2.3 Real-time Streaming & IoT Data

- 5.16.3 APPLICATION WORKLOADS

- 5.16.3.1 SaaS Migration & App Modernization

- 5.16.4 DEVELOPMENT & DEVOPS

- 5.16.4.1 Continuous Integration (CI)/ Continuous Delivery (CD)

- 5.16.4.2 Application Testing

- 5.16.4.3 Infrastructure as Code (IaC)

- 5.16.4.4 DevSecOps

- 5.16.5 BACKUP, DISASTER RECOVERY, AND ARCHIVING

- 5.16.5.1 Cloud Backup

- 5.16.5.2 Disaster Recovery (DR)

- 5.16.5.3 Archiving

- 5.16.1 COMPUTE INTENSIVE

- 5.17 INDUSTRY CLOUD/VERTICAL SAAS

- 5.17.1 HEALTHCARE & LIFE SCIENCES SAAS

- 5.17.2 BFSI SAAS

- 5.17.3 MANUFACTURING SAAS

- 5.17.4 EDUCATION SAAS

- 5.17.5 RETAIL & E-COMMERCE SAAS

- 5.17.6 GOVERNMENT & PUBLIC SECTOR SAAS

- 5.17.7 OTHER VERTICAL SAAS

6 CLOUD COMPUTING MARKET, BY SERVICE MODEL

- 6.1 INTRODUCTION

- 6.1.1 SERVICE MODEL: CLOUD COMPUTING MARKET DRIVERS

- 6.2 IAAS

- 6.2.1 POWER BUSINESSES WITH SCALABLE, COST-EFFECTIVE INFRASTRUCTURE AND FREEDOM TO INNOVATE WITHOUT MANAGING HARDWARE

- 6.3 PAAS

- 6.3.1 PAAS ENABLING QUICK CREATION OF NEW SOFTWARE BY PROVIDING COMPUTATION AND STORAGE INFRASTRUCTURES

- 6.4 SAAS

- 6.4.1 SIMPLIFY SOFTWARE ACCESS, BOOST COLLABORATION, AND SCALE EFFORTLESSLY WITH SECURE, SUBSCRIPTION-BASED SOLUTIONS

7 CLOUD COMPUTING MARKET, BY IAAS

- 7.1 INTRODUCTION

- 7.1.1 IAAS: CLOUD COMPUTING MARKET DRIVERS

- 7.2 COMPUTE

- 7.2.1 SCALING GLOBAL EXPERIENCES WITH AGILE, COST-EFFECTIVE COMPUTE POWER THAT ADAPTS TO DYNAMIC DEMAND

- 7.3 STORAGE

- 7.3.1 UNLOCKING REAL-TIME INSIGHTS WITH SCALABLE, COST-EFFICIENT CLOUD STORAGE AND WAREHOUSING SOLUTIONS

- 7.4 NETWORKING

- 7.4.1 NEED FOR OPTIMIZING NETWORK INFRASTRUCTURE IN IAAS CLOUD ENVIRONMENTS

8 CLOUD COMPUTING MARKET, BY PAAS

- 8.1 INTRODUCTION

- 8.1.1 PAAS APPLICATIONS: CLOUD COMPUTING MARKET DRIVERS

- 8.2 APPLICATION DEVELOPMENT & INTEGRATION PLATFORMS

- 8.2.1 APPLICATION DEVELOPMENT TO PROVIDE COST-EFFICIENCY, SCALABILITY, AND RAPID DEVELOPMENT

- 8.3 APPLICATION TESTING & QUALITY

- 8.3.1 GROWING PREFERENCE FOR EFFECTIVE TESTING STRATEGY SYSTEMS, USER INTERFACES, AND APIS

- 8.4 ANALYTICS & REPORTING

- 8.4.1 TRANSFORMING DATA INTO INSIGHTS WITH POWERFUL, SCALABLE CLOUD ANALYTICS FOR SMARTER BUSINESS DECISIONS

- 8.5 DATABASES & DATA MANAGEMENT

- 8.5.1 EMPOWERING BUSINESSES TO INNOVATE AND SCALE WITH SEAMLESS CLOUD-NATIVE DATA MANAGEMENT SOLUTIONS

- 8.6 OTHER PAAS

9 CLOUD COMPUTING MARKET, BY SAAS

- 9.1 INTRODUCTION

- 9.1.1 SAAS: CLOUD COMPUTING MARKET DRIVERS

- 9.2 CUSTOMER RELATIONSHIP MANAGEMENT

- 9.2.1 ENHANCING CUSTOMER ENGAGEMENT AND BUSINESS GROWTH THROUGH SCALABLE, CLOUD-BASED CRM SOLUTIONS

- 9.3 ENTERPRISE RESOURCE MANAGEMENT

- 9.3.1 ERP APPLICATIONS USED TO REMOVE EXPENSIVE DUPLICATIONS AND INCOMPATIBLE TECHNOLOGY

- 9.4 HUMAN CAPITAL MANAGEMENT

- 9.4.1 HUMAN CAPITAL MANAGEMENT TO HELP MAXIMIZE VALUE OF HUMAN CAPITAL VIA EFFECTIVE MANAGEMENT

- 9.5 CONTENT MANAGEMENT

- 9.5.1 RISING PREFERENCE FOR INFORMATION MANAGEMENT, RESPONSIVENESS, AND SCALABILITY

- 9.6 COLLABORATION AND PRODUCTIVITY SUITES

- 9.6.1 SHARING OF DOCUMENTS AND FILES MADE EASY BY DEPLOYING COLLABORATION AND PRODUCTIVITY SUITES

- 9.7 SUPPLY CHAIN MANAGEMENT

- 9.7.1 CLOUD-BASED SAAS SUPPLY CHAIN MANAGEMENT EMPOWERS COMPANIES TO ENHANCE EFFICIENCY, REDUCE COSTS, AND ACHIEVE REAL-TIME VISIBILITY FOR SMARTER GLOBAL OPERATIONS

- 9.8 SYSTEM INFRASTRUCTURE SOFTWARE

- 9.8.1 INCREASING NEED FOR STREAMLINING OPERATIONS, ENHANCING SCALABILITY, AND ENSURING RELIABILITY IN CLOUD-BASED SYSTEMS TO SUPPORT MARKET GROWTH

- 9.8.2 SECURITY SOFTWARE

- 9.8.3 STORAGE SOFTWARE

- 9.8.4 ENDPOINT MANAGEMENT SOFTWARE

- 9.8.5 PHYSICAL & VIRTUAL COMPUTING SOFTWARE

- 9.8.6 SYSTEM & SERVICE MANAGEMENT SOFTWARE

- 9.9 OTHER SAAS

10 CLOUD COMPUTING MARKET, BY DEPLOYMENT MODEL

- 10.1 INTRODUCTION

- 10.1.1 DEPLOYMENT MODEL: CLOUD COMPUTING MARKET DRIVERS

- 10.2 PUBLIC CLOUD

- 10.2.1 UNLOCK RAPID INNOVATION AND EFFICIENCY WITH SCALABLE, COST-EFFECTIVE PUBLIC CLOUD POWERED BY MILLIONS OF INTELLIGENT DECISIONS EVERY DAY

- 10.3 PRIVATE CLOUD

- 10.3.1 PRIVATE CLOUD TO REDUCE RISKS, SECURITY ISSUES, AND REGULATORY HURDLES ASSOCIATED WITH CLOUD ADOPTION

- 10.4 HYBRID CLOUD

- 10.4.1 SEAMLESSLY BLEND FLEXIBILITY, CONTROL, AND EFFICIENCY WITH HYBRID CLOUD SOLUTIONS TAILORED FOR MODERN BUSINESS DEMANDS

11 CLOUD COMPUTING MARKET, BY ORGANIZATION SIZE

- 11.1 INTRODUCTION

- 11.1.1 ORGANIZATION SIZE: CLOUD COMPUTING MARKET DRIVERS

- 11.2 LARGE ENTERPRISES

- 11.2.1 DRIVING ENTERPRISE INNOVATION AND RESILIENCE WITH SECURE, SCALABLE, AND AGILE HYBRID CLOUD SOLUTIONS

- 11.3 SMALL & MEDIUM-SIZED ENTERPRISES

- 11.3.1 EMPOWERING SMES TO INNOVATE AND GROW THROUGH ACCESSIBLE, SCALABLE, AND COST-EFFECTIVE CLOUD SOLUTIONS

12 CLOUD COMPUTING MARKET, BY VERTICAL

- 12.1 INTRODUCTION

- 12.1.1 VERTICAL: CLOUD COMPUTING MARKET DRIVERS

- 12.2 BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI)

- 12.2.1 NEED TO DECREASE EXPENSES, ENCOURAGE INNOVATION, AND INCREASE FLEXIBILITY

- 12.2.2 BFSI: USE CASES

- 12.2.2.1 Core banking systems

- 12.2.2.2 Online & mobile banking

- 12.2.2.3 Risk management & compliance

- 12.3 ENERGY & UTILITIES

- 12.3.1 ADDRESSING ISSUES RELATED TO CRUDE OIL, STORAGE, AND TRANSPORTATION

- 12.3.2 ENERGY & UTILITIES: USE CASES

- 12.3.2.1 Smart grid management

- 12.3.2.2 Energy monitoring & management

- 12.3.2.3 Renewable energy forecasting

- 12.4 GOVERNMENT & PUBLIC SECTOR

- 12.4.1 NEED FOR GOVERNMENT AGENCIES TO GAIN GREATER VISIBILITY AND FASTER DATA ANALYSIS TO DRIVE MARKET

- 12.4.2 GOVERNMENT & PUBLIC SECTOR: USE CASES

- 12.4.2.1 Government infrastructure migration

- 12.4.2.2 Digital government & e-government services

- 12.4.2.3 Open data & transparency

- 12.5 TELECOMMUNICATIONS

- 12.5.1 DEMAND FOR GREATER NETWORK REACH ACROSS TELECOM PROVIDERS

- 12.5.2 TELECOMMUNICATIONS: USE CASES

- 12.5.2.1 CDN, VoIP, IoT Connectivity

- 12.6 SOFTWARE & IT SERVICES

- 12.6.1 INVESTMENT IN NEW TECHNOLOGIES TO SPUR INNOVATION AND ATTRACT CONSUMERS

- 12.6.2 SOFTWARE & IT SERVICES: USE CASES

- 12.6.2.1 IT security & compliance

- 12.7 HEALTHCARE & LIFE SCIENCES

- 12.7.1 INCREASED FOCUS ON MANAGING PATIENTS' RECORDS

- 12.7.2 HEALTHCARE & LIFE SCIENCES: USE CASES

- 12.7.2.1 Electronic health records (EHRs)

- 12.7.2.2 Telemedicine & remote patient monitoring

- 12.8 RETAIL & E-COMMERCE

- 12.8.1 INCREASING DEMAND FOR DIGITAL SHOPPING EXPERIENCES AND NEED FOR OPERATIONAL EFFICIENCY TO AID MARKET GROWTH

- 12.8.2 RETAIL & E-COMMERCE: USE CASES

- 12.8.2.1 Customer relationship management (CRM)

- 12.8.2.2 Point of sale (PoS) systems

- 12.9 MANUFACTURING

- 12.9.1 SEAMLESS DATA MANAGEMENT AND REAL-TIME VISIBILITY OFFERED BY CLOUD COMPUTING SERVICES

- 12.9.2 MANUFACTURING: USE CASES

- 12.9.2.1 Supply chain management

- 12.9.2.2 Product lifecycle management

- 12.9.2.3 Manufacturing execution systems (MES)

- 12.10 TRANSPORTATION & LOGISTICS

- 12.10.1 CLOUD SOLUTIONS TO DRIVE EFFICIENCY AND INNOVATION BY ENHANCING OPERATIONS AND REDUCING COSTS

- 12.10.2 TRANSPORTATION & LOGISTICS: USE CASES

- 12.10.2.1 Supply chain management

- 12.11 MEDIA & ENTERTAINMENT

- 12.11.1 HYBRID OR MULTI-CLOUD DEPLOYMENTS TO ALLOW WORKLOADS TO BE SHIFTED ACROSS PUBLIC AND PRIVATE INFRASTRUCTURES

- 12.11.2 MEDIA & ENTERTAINMENT: USE CASES

- 12.11.2.1 Content storage & distribution

- 12.11.2.2 Media streaming

- 12.11.2.3 Content production & post-production

- 12.12 OTHER VERTICALS

13 CLOUD COMPUTING MARKET, BY REGION

- 13.1 INTRODUCTION

- 13.2 NORTH AMERICA

- 13.2.1 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 13.2.2 NORTH AMERICA: CLOUD COMPUTING MARKET DRIVERS

- 13.2.3 US

- 13.2.3.1 Driven by AI infrastructure investments, enterprise multicloud adoption, and regulatory clarity around data and generative AI

- 13.2.4 CANADA

- 13.2.4.1 Cloud growth supported by sovereign data policies, low-carbon infrastructure, and rising adoption of AI workloads and multicloud platforms

- 13.3 EUROPE

- 13.3.1 EUROPE: CLOUD COMPUTING MARKET DRIVERS

- 13.3.2 EUROPE: MACROECONOMIC OUTLOOK

- 13.3.3 UK

- 13.3.3.1 Cloud market expansion fueled by AI infrastructure investments, GDPR-compliant demand, and subsea-connected data center growth around London and South Wales

- 13.3.4 GERMANY

- 13.3.4.1 Cloud growth shaped by strict data-sovereignty laws, industrial cloud demand, and renewable-powered sovereign infrastructure in Frankfurt, Brandenburg, and North Rhine-Westphalia

- 13.3.5 FRANCE

- 13.3.5.1 Cloud market growth fueled by sovereign cloud demand, sustainable infrastructure incentives, and national policy support for AI and digital upskilling

- 13.3.6 SPAIN

- 13.3.6.1 Cloud expansion supported by hyperscaler investments, digital transformation programs, and strong regional incentives for sustainable, sovereign infrastructure deployment

- 13.3.7 ITALY

- 13.3.7.1 Cloud market acceleration supported by digital transformation programs, sovereign cloud focus, and hyperscaler growth across Milan, Turin, and regional availability zones

- 13.3.8 NETHERLANDS

- 13.3.8.1 Cloud growth led by interconnection density, early enterprise adoption, and strict sustainability mandates shaping future-ready, renewable-powered infrastructure

- 13.3.9 REST OF EUROPE

- 13.4 ASIA PACIFIC

- 13.4.1 ASIA PACIFIC: CLOUD COMPUTING MARKET DRIVERS

- 13.4.2 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 13.4.3 CHINA

- 13.4.3.1 Cloud expansion supported by national tech self-reliance, strict data localization mandates, and hyperscaler investments aligned with sovereign AI and westward infrastructure policies

- 13.4.4 INDIA

- 13.4.4.1 Cloud growth supported by DPI infrastructure, national AI initiatives, hyperscaler investment, and policy incentives for regional edge and data localization

- 13.4.5 JAPAN

- 13.4.5.1 Cloud growth reinforced by data localization, disaster resilience, and hyperscaler-backed AI infrastructure in highly regulated and energy-efficient environments

- 13.4.6 SINGAPORE

- 13.4.6.1 Cloud growth shaped by AI-focused national strategy, energy-efficient infrastructure mandates, and hyperscaler expansions supporting Southeast Asia's latency-sensitive enterprise workloads

- 13.4.7 AUSTRALIA & NEW ZEALAND (ANZ)

- 13.4.7.1 Cloud expansion anchored in public sector digitization, green data center initiatives, and robust multicloud strategies across key urban and regional hubs

- 13.4.8 SOUTH KOREA

- 13.4.8.1 Cloud growth propelled by national AI infrastructure roadmap, advanced 5G connectivity, and sovereign cloud expansion across regulated public and enterprise sectors

- 13.4.9 REST OF ASIA PACIFIC

- 13.5 MIDDLE EAST & AFRICA

- 13.5.1 MIDDLE EAST & AFRICA: CLOUD COMPUTING MARKET DRIVERS

- 13.5.2 MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

- 13.5.3 GULF COOPERATION COUNCIL (GCC)

- 13.5.3.1 Saudi Arabia

- 13.5.3.1.1 Cloud market surge fueled by Vision 2030, sovereign mandates, AI-focused infrastructure investments, and hyperscaler partnerships across Riyadh and key verticals

- 13.5.3.2 United Arab Emirates (UAE)

- 13.5.3.2.1 Cloud growth supported by AI-aligned national strategy, sovereign cloud mandates, and hyperscale-ready infrastructure backed by clean energy and policy incentives

- 13.5.3.3 QATAR

- 13.5.3.3.1 Cloud growth enabled by government-led AI and digital programs, localized infrastructure, and hyperscaler scaling for energy and regulated workloads

- 13.5.3.4 Rest of Gulf Cooperation Council (GCC) Countries

- 13.5.3.1 Saudi Arabia

- 13.5.4 SOUTH AFRICA

- 13.5.4.1 Cloud ecosystem growth powered by multi-region infrastructure, government-led digitization, POPIA compliance, and cross-border latency improvements via subsea connectivity

- 13.5.5 REST OF MIDDLE EAST & AFRICA

- 13.6 LATIN AMERICA

- 13.6.1 LATIN AMERICA: CLOUD COMPUTING MARKET DRIVERS

- 13.6.2 LATIN AMERICA: MACROECONOMIC OUTLOOK

- 13.6.3 BRAZIL

- 13.6.3.1 Cloud growth anchored in AI demand, national data localization mandates, and hyperscaler expansions focused on regional low-latency access and training

- 13.6.4 MEXICO

- 13.6.4.1 Cloud market growth supported by nearshore IT positioning, national connectivity upgrades, and hyperscaler investments targeting sovereign and latency-sensitive workloads

- 13.6.5 REST OF LATIN AMERICA

14 COMPETITIVE LANDSCAPE

- 14.1 INTRODUCTION

- 14.2 KEY PLAYERS' STRATEGIES/RIGHT TO WIN

- 14.3 REVENUE ANALYSIS

- 14.4 MARKET SHARE ANALYSIS, 2024

- 14.5 BRAND/PRODUCT COMPARISON

- 14.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 14.6.1 STARS

- 14.6.2 EMERGING LEADERS

- 14.6.3 PERVASIVE PLAYERS

- 14.6.4 PARTICIPANTS

- 14.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 14.6.5.1 Cloud Computing Market: Company Footprint

- 14.6.5.2 Cloud Computing Market: Region Footprint

- 14.6.5.3 Cloud Computing Market: Service Model Footprint

- 14.6.5.4 Cloud Computing Market: Deployment Model Footprint

- 14.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 14.7.1 PROGRESSIVE COMPANIES

- 14.7.2 RESPONSIVE COMPANIES

- 14.7.3 DYNAMIC COMPANIES

- 14.7.4 STARTING BLOCKS

- 14.7.5 COMPETITIVE BENCHMARKING: STARTUP/SMES, 2024

- 14.7.5.1 Detailed list of key startups/SMEs

- 14.7.5.2 Competitive benchmarking of startups/SMEs

- 14.8 COMPANY VALUATION AND FINANCIAL METRICS OF KEY VENDORS

- 14.8.1 COMPANY VALUATION OF KEY VENDORS

- 14.8.2 FINANCIAL METRICS OF KEY VENDORS

- 14.9 COMPETITIVE SCENARIO AND TRENDS

- 14.9.1 PRODUCT LAUNCHES

- 14.9.2 DEALS

15 COMPANY PROFILES

- 15.1 INTRODUCTION

- 15.2 KEY PLAYERS

- 15.2.1 AWS

- 15.2.1.1 Business overview

- 15.2.1.2 Products/Solutions/Services offered

- 15.2.1.3 Recent developments

- 15.2.1.4 MnM view

- 15.2.1.4.1 Key strengths/Right to win

- 15.2.1.4.2 Strategic choices

- 15.2.1.4.3 Weaknesses and competitive threats

- 15.2.2 MICROSOFT

- 15.2.2.1 Business overview

- 15.2.2.2 Products/Solutions/Services offered

- 15.2.2.3 Recent developments

- 15.2.2.4 MnM view

- 15.2.2.4.1 Key strengths/Right to win

- 15.2.2.4.2 Strategic choices

- 15.2.2.4.3 Weaknesses and competitive threats

- 15.2.3 GOOGLE

- 15.2.3.1 Business overview

- 15.2.3.2 Products/Solutions/Services offered

- 15.2.3.3 Recent developments

- 15.2.3.4 MnM view

- 15.2.3.4.1 Key strengths/Right to win

- 15.2.3.4.2 Strategic choices

- 15.2.3.4.3 Weaknesses and competitive threats

- 15.2.4 ORACLE

- 15.2.4.1 Business overview

- 15.2.4.2 Products/Solutions/Services offered

- 15.2.4.3 Recent developments

- 15.2.4.4 MnM view

- 15.2.4.4.1 Key strengths/Right to win

- 15.2.4.4.2 Strategic choices

- 15.2.4.4.3 Weaknesses and competitive threats

- 15.2.5 SALESFORCE

- 15.2.5.1 Business overview

- 15.2.5.2 Products/Solutions/Services offered

- 15.2.5.3 Recent developments

- 15.2.5.4 MnM view

- 15.2.5.4.1 Key strengths/Right to win

- 15.2.5.4.2 Strategic choices

- 15.2.5.4.3 Weaknesses and competitive threats

- 15.2.6 ALIBABA CLOUD

- 15.2.6.1 Business overview

- 15.2.6.2 Products/Solutions/Services offered

- 15.2.6.3 Recent developments

- 15.2.7 IBM

- 15.2.7.1 Business overview

- 15.2.7.2 Products/Solutions/Services offered

- 15.2.7.3 Recent developments

- 15.2.8 SAP

- 15.2.8.1 Business overview

- 15.2.8.2 Products/Solutions/Services offered

- 15.2.8.3 Recent developments

- 15.2.9 ADOBE

- 15.2.9.1 Business overview

- 15.2.9.2 Products/Solutions/Services offered

- 15.2.9.3 Recent developments

- 15.2.10 TENCENT CLOUD

- 15.2.10.1 Business overview

- 15.2.10.2 Products/Solutions/Services offered

- 15.2.10.3 Recent developments

- 15.2.1 AWS

- 15.3 OTHER PLAYERS

- 15.3.1 HUAWEI

- 15.3.2 HEWLETT-PACKARD ENTERPRISE

- 15.3.3 DELL TECHNOLOGIES

- 15.3.4 DROPBOX

- 15.3.5 NUTANIX

- 15.3.6 AKAMAI TECHNOLOGIES

- 15.3.7 SAUDI TELECOM COMPANY

- 15.3.8 KYNDRYL

- 15.3.9 ATOS SE

- 15.3.10 NTT DATA CORPORATION

- 15.3.11 WORKDAY

- 15.3.12 FUJITSU

- 15.3.13 BROADCOM

- 15.3.14 RACKSPACE TECHNOLOGY

- 15.3.15 DXC TECHNOLOGY

- 15.3.16 NEC CORPORATION

- 15.3.17 JOYENT

- 15.3.18 DIGITALOCEAN

- 15.3.19 OVH CLOUD

- 15.3.20 NAVISITE

- 15.3.21 INFOR

- 15.3.22 SAGE

- 15.3.23 INTUIT

- 15.3.24 OPENTEXT

- 15.3.25 CISCO

- 15.3.26 BOX

- 15.3.27 ZOHO

- 15.3.28 CITRIX

- 15.3.29 EPICOR

- 15.3.30 UPLAND SOFTWARE

- 15.3.31 SERVICENOW

- 15.3.32 IFS

- 15.3.33 APP MAISTERS

- 15.3.34 ZYMR

- 15.3.35 JDV TECHNOLOGIES

- 15.3.36 TUDIP TECHNOLOGIES

- 15.3.37 VISARTECH

- 15.3.38 CLOUDFLEX

- 15.3.39 VULTR

- 15.3.40 PCLOUD

- 15.3.41 CLOUD4C

16 ADJACENT AND RELATED MARKETS

- 16.1 INTRODUCTION

- 16.1.1 RELATED MARKETS

- 16.1.2 LIMITATIONS

- 16.2 EDGE COMPUTING MARKET

- 16.3 HYPERSCALE COMPUTING MARKET

17 APPENDIX

- 17.1 DISCUSSION GUIDE

- 17.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 17.3 CUSTOMIZATION OPTIONS

- 17.4 RELATED REPORTS

- 17.5 AUTHOR DETAILS