|

|

市場調査レポート

商品コード

1235842

産業用バルブの世界市場:種類別・材料別・コンポーネント別・機能別の将来予測 (2028年まで)Industrial Valves Market by Type (Ball, Butterfly, Globe, Gate, Diaphragm, Safety, Check, Plug), Material (Steel, Cast Iron, Alloy Based, Cryogenic, Plastic, Bronze, Brass), Component (Actuator, Positioner), Function - Global Forecast to 2028 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 産業用バルブの世界市場:種類別・材料別・コンポーネント別・機能別の将来予測 (2028年まで) |

|

出版日: 2023年03月02日

発行: MarketsandMarkets

ページ情報: 英文 298 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の産業用バルブの市場規模は、2023年の804億米ドルから、2028年には998億米ドルに達すると予測され、2023年から2028年の間に4.4%のCAGRで成長する、と予想されています。

産業用バルブ市場の成長を促進する主な要因は、IIoT統合型バルブの採用拡大、自動化ソリューションの採用に向けてプロセス産業の焦点が急速に変化していること、発電所の新設と既存発電所の改修の世界的ニーズ、バルブメーカーのメンテナンスとアフターマーケットサービスの充実に向けての焦点変更、旧式バルブの代替としてのスマートバルブの採用増加です。

種類別では、安全弁が予測期間中に最も高いCAGRで成長すると考えられています。

コンポーネント別に将来のCAGRを見てみると、アクチュエーターが最も高く、バルブ本体が2番目となっています。

機能別では、制御分野が最も高いCAGRで成長すると予想されます。

材料別で今後のCAGRを見てみると、プラスチックバルブが最も高いCAGRで成長し、極低温バルブが2番目となると考えられています。

サイズ別では、50インチ以上のバルブが予測期間中に最も高いCAGRを記録すると予想されます。

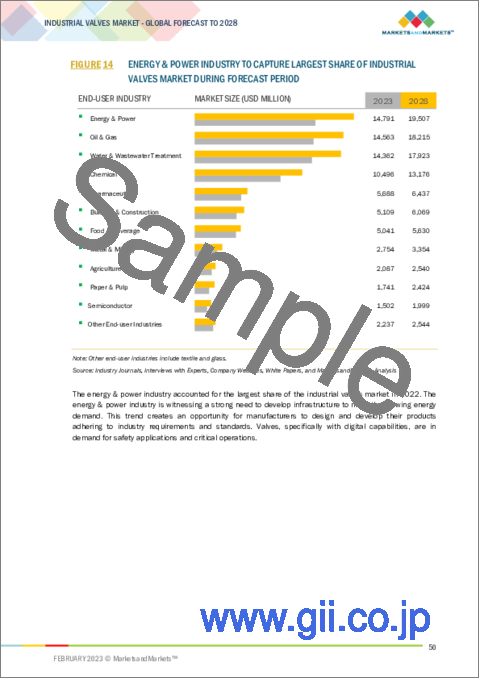

産業別では、製紙・パルプ産業が最も高いCAGRで成長する見通しです。

地域別に見ると、北米が予測期間中に最も高いCAGRで成長すると見込まれています。特に米国では、石油・ガスやエネルギー・電力産業を中心とした大規模な産業基盤が、市場成長の主な要因となっています。

当レポートでは、世界の産業用バルブの市場について分析し、市場の基本構造や最新情勢、主な市場促進・抑制要因、種類別・コンポーネント別・機能別・材料別・サイズ別・エンドユーザー産業別・地域別の市場動向の見通し、市場競争の状態、主要企業のプロファイルなどを調査しております。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- バリューチェーン分析

- エコシステムマッピング

- 価格分析

- 顧客ビジネスに影響を与える動向/混乱

- 技術分析

- ポーターのファイブフォース分析

- 主な利害関係者と購入基準

- ケーススタディ分析

- 貿易分析

- 特許分析

- 主な会議とイベント (2023年~2024年)

- 規制と基準

第6章 産業用バルブ市場:種類別

- イントロダクション

- ボールバルブ

- バタフライバルブ

- チェックバルブ (逆止弁)

- ダイヤフラムバルブ

- ゲートバルブ (仕切弁)

- グローブバルブ (球形弁)

- プラグバルブ

- 安全弁

第7章 産業用バルブ市場:コンポーネント別

- イントロダクション

- アクチュエーター

- 空圧式アクチュエータ

- 電動式アクチュエータ

- 油圧式アクチュエータ

- バルブ本体

- その他のコンポーネント

第8章 産業用バルブ市場:機能別

- イントロダクション

- 開放/閉鎖 (オン/オフ)

- 制御 (コントロール)

第9章 産業用バルブ市場:材料別

- イントロダクション

- 鋼鉄

- 鋳鉄

- 合金ベース

- 極低温

- プラスチック

- その他の材料

- 青銅

- 真鍮

第10章 産業用バルブ市場:サイズ別

- イントロダクション

- 1インチ以下

- 1~6インチ

- 7~25インチ

- 26~50インチ

- 50インチ以上

第11章 産業用バルブ市場:エンドユーザー産業別

- イントロダクション

- 石油・ガス

- 水道・下水処理

- エネルギー・電力

- 医薬品

- 食品・飲料

- 化学

- 建築・建設

- 製紙・パルプ

- 金属・鉱業

- 農業

- 半導体

- その他のエンドユーザー産業

第12章 産業用バルブ市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- 英国

- ドイツ

- フランス

- イタリア

- 他の欧州諸国

- アジア太平洋

- 中国

- 日本

- インド

- 韓国

- 他のアジア太平洋諸国

- 他の国々 (RoW)

- 中東

- 南米

- アフリカ

第13章 競合情勢

- 概要

- 上位5社の収益分析

- 市場シェア分析 (2022年)

- 企業評価クアドラント

- 中小企業 (SME) の評価クアドラント (2022年)

- 企業のフットプリント

- 競合ベンチマーキング

- 競合状況・動向

- 製品の発売

- 資本取引

- その他

第14章 企業プロファイル

- 主要企業

- EMERSON

- SCHLUMBERGER LIMITED

- FLOWSERVE CORPORATION

- IMI PLC

- NELES(VALMET)

- CRANE CO.

- KITZ CORPORATION

- KSB SE & CO. KGAA 0

- ALFA LAVAL

- CURTISS-WRIGHT CORPORATION

- PARKER HANNIFIN CORPORATION

- BRAY INTERNATIONAL

- CIRCOR INTERNATIONAL, INC.

- IDEX CORPORATION

- NEWAY VALVE CO

- VELAN INC

- DANFOSS

- GEORG FISCHER LTD

- SAMSON

- AVK HOLDING A/S

- KLINGER HOLDING

- TRILLIUM FLOW TECHNOLOGIES

- その他の企業

- EBRO ARMATUREN GEBR. BRÖER GMBH

- VALVITALIA SPA

- GEFA PROCESSTECHNIK GMBH

- AVCON CONTROLS PVT LTD

- FORBES MARSHALL

- FRENSTAR

- HAM-LET GROUP

- DWYER INSTRUMENTS LTD.

- APOLLO VALVES

第15章 隣接・関連市場

- イントロダクション

- 製薬事項

- ライニングバルブ市場:種類別

- ボールバルブ

- バタフライバルブ

- ゲートバルブ

- グローブバルブ

- プラグバルブ

- その他

第16章 付録

The industrial valves market size is expected to grow from USD 80.4 billion in 2023 to USD 99.8 billion by 2028; it is expected to grow at a CAGR of 4.4% from 2023 to 2028. The key factors driving the growth of the industrial valves market are the growing adoption of IIoT-integrated valves, the rapidly shifting focus of process industries towards adoption of automation solutions, the global need for establishment of new power plants and revamping of existing ones, the changing focus of valve manufacturers towards better maintenance and aftermarket services, and the increasing adoption of smart valves as replacement for outdated valves.

"Safety valves are expected to register the highest CAGR during the forecast period"

Industries such as oil & gas, energy & power, chemical & petrochemical, pharmaceutical, metal & mining, and water & wastewater treatment require highly reliable safety valves. Safety valves protect the pipeline against implosion due to the vacuum caused by cold rinsing after hot cleaning or blocking the gas supply during emptying. The increasing use of safety valves in critical processes in oil & gas, chemical, energy & power industries to release excess pressure and protect equipment and people from harm would drive the growth of the industrial safety valves market during the forecast period.

"Actuators are expected to register the highest CAGR during the forecast period and valve body are expected to register the second highest CAGR"

Pneumatic actuators, the most commonly used actuators due to their reliability and simple design, are typically used in applications involving extreme temperatures. Pneumatically operated piston actuators work faster than electric and hydraulic actuators. These actuators are advantageous when no air supply source is available, and low ambient temperatures could freeze the condensed water in pneumatic supply lines. In the case of heavy-duty applications, hydraulic actuators are preferred over pneumatic and electric actuators. The valve body is the main element of a valve assembly, as it holds all the internal parts together. The body is the largest component. Media flows through the body between the ports, and all other components are connected to the body.

"Control segment is expected to register the higher CAGR during the forecast period"

A control valve is an important element in process industries as it automatically regulates important process variables, including temperature, level, direction, pressure, and flow rate of gas, steam, water, and chemical compounds within a required operating range. Control valves are designed to withstand harsh conditions and ensure the safety and efficiency of multiple production processes in an industrial plant. Due to these benefits, these valves are used in oil & gas, energy & power, petrochemical, and chemical industries.

"Plastic valves are expected to register the highest CAGR during the forecast period and cryogenic valves are expected to register the second highest CAGR"

Owing to their high durability and corrosion resistance capabilities, plastic valves are preferred in applications that require regulating and monitoring of flow of corrosive fluids. In addition, due to their high impermeability feature, they offer long service life. Also, plastic valves offer very low-pressure drops, making them ideal for various industries such as food & beverage, chemical, and paper & pulp. Cryogenic valves are used in the oil & gas industry at cryogenic temperatures starting from -238ºF. Production, transport, and storage of liquefied gases such as oxygen, nitrogen, argon, natural gas, hydrogen, or helium (down to -425°F/-253.9ºC) present several specific technical requirements, such as service conditions; material, pressure, and temperature ratings; and other technical or environmental requirements. Such requirements generate the need for cryogenic materials to handle cryogenic temperatures safely, which are most popularly used by companies that work with liquefied natural gas (LNG) or compressed natural gas (CNG).

"Valves in the size range of >50" are expected to register the highest CAGR during the forecast period"

The rising demand for >50" valves in high-pressure and high-temperature applications in the chemical, energy & power, and oil & gas industries is likely to propel market growth. These valves have longer lead times, as they feature custom-designed class 1,500 mm and 2,500 mm butt-welding end valves. L&T (India) offers gate, Y-globe, and swing check valves, which feature a pressure seal bonnet design for high-pressure services in these size ranges.

"Paper & pulp industry is expected to register the highest CAGR during the forecast period"

In paper & pulp industry, plug valves, V-port ball valves, knife gate valves, high-performance butterfly valves, and rotary control valves are used in applications such as basis weight control, cleaner and pump isolation, flow-level control, vacuum control, and steam and condensate flow control. For the pulping process, V-port ball valves and eccentric plug valves, among others, are used for steam and chemical handling applications such as steam impregnation, steam venting, and flow and pressure control. Valves with hardened trim are well-suited for steam and chemical handling applications. Therefore, industrial valves play a vital role across several applications in the paper & pulp industry, which in turn propels their increasing adoption in the industry.

"North America is expected to register the highest CAGR during forecast period"

The growth of the industrial valves market in the US is mainly driven by the large industrial base, particularly the oil & gas and energy & power industries. Discovery of shale oil in the country and recent uptrends in the oil & gas industry are the major reasons for the increasing investments in the US oil & gas industry. The US rig count is set to increase over the next three years, which is expected to drive the demand for industrial valves in the oil & gas industry. In the US, the water & wastewater treatment industry is facing the challenge of aging infrastructure However, fresh investments in the industry for modernizing the existing facilities and services are expected to contribute to the rise in the demand for industrial valves in the US. In Canada, investments in natural gas projects have resulted in the expansion of the pipeline network for gas transportation. Hence, the oil & gas industry in Canada is likely to witness a huge demand for industrial valves.

The break-up of the profiles of primary participants for the report has been given below:

- By Company Type: Tier 1 = 40%, Tier 2 = 35%, and Tier 3 = 25%

- By Designation: C-Level Executives = 40%, Directors = 35%, and Others= 25%

- By Region: North America = 30%, Europe = 25%, Asia Pacific = 35%, and RoW = 10%

Major players operating in the industrial valves market include Emerson (US), Flowserve Corporation (US), Schlumberger Limited (US), Crane Co. (Sweden), Neles (Finland), KITZ Corporation (Japan), IMI PLC (UK), KSB SE & Co. KGaA (Germany), Bray International (US), and Spirax-Sarco Engineering PLC (UK), among others.

Research Coverage:

The research report on the global industrial valves market covers the market based on type, component, function, material, size, end-user industry, and region. Based on type, the industrial valves market is segregated into ball, butterfly, check, gate, globe, plug, diaphragm, and safety valves. Based on component, the industrial valves market is segmented into actuators, valve body, and other components (positioners and I/P converters). Based on function, the industrial valves market is segmented into on/off and control. Based on material, the industrial valves market is segmented into steel, cast iron, alloy-based, cryogenic, plastic, and other materials (bronze and brass). Based on size, the industrial valves market is segmented into <1", 1" to 6". 7" to 25". 26" to 50", and >50". Based on end-user industry, the industrial valves market is segmented into segmented into oil & gas, water & wastewater treatment, energy & power, food & beverage, metal & mining, chemical, pharmaceutical, building & construction, pulp & paper, agriculture, semiconductor, and other end-user indsutries (textile and glass). The report covers four major regions: North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW).

Key Benefits of Buying the Report:

This report segments the industrial valves market comprehensively and provides the closest approximations of the overall market size, as well as that of the subsegments across different types, components, functions, materials, sizes, end-user industries, and regions.

The report helps stakeholders understand the market's pulse and expected market scenario and provides information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 INCLUSIONS AND EXCLUSIONS

- TABLE 1 INDUSTRIAL VALVES MARKET: INCLUSIONS AND EXCLUSIONS

- 1.4 STUDY SCOPE

- 1.4.1 MARKETS COVERED

- FIGURE 1 INDUSTRIAL VALVES MARKET: SEGMENTATION

- 1.4.2 GEOGRAPHIC SCOPE

- FIGURE 2 INDUSTRIAL VALVES MARKET: GEOGRAPHIC SEGMENTATION

- 1.4.3 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 3 INDUSTRIAL VALVES MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY AND PRIMARY RESEARCH

- 2.1.2 SECONDARY DATA

- 2.1.2.1 Major secondary sources

- 2.1.2.2 Key data from secondary sources

- 2.1.3 PRIMARY DATA

- 2.1.3.1 Primary interviews with experts

- 2.1.3.2 Key data from primary sources

- 2.1.3.3 Key industry insights

- 2.1.3.4 Breakdown of primaries

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE): REVENUE GENERATED BY COMPANIES FROM SALES OF INDUSTRIAL VALVES (2/2)

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to arrive at market size through bottom-up analysis (demand side)

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to arrive at market size through top-down analysis (supply side)

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 7 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- FIGURE 8 ASSUMPTIONS FOR RESEARCH STUDY

- 2.5 PARAMETERS CONSIDERED TO ANALYZE RECESSION IMPACT

- 2.6 RESEARCH LIMITATIONS AND RISK ASSESSMENT

- TABLE 2 LIMITATIONS AND ASSOCIATED RISKS

3 EXECUTIVE SUMMARY

- FIGURE 9 CONTROL VALVES TO EXHIBIT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 10 STEEL SEGMENT TO CAPTURE LARGEST SHARE OF INDUSTRIAL VALVES MARKET, BY MATERIAL, THROUGHOUT FORECAST PERIOD

- FIGURE 11 SAFETY VALVES TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 12 ACTUATORS TO DOMINATE INDUSTRIAL VALVES MARKET, BY COMPONENT, IN 2028

- FIGURE 13 1" TO 6" SEGMENT TO ACCOUNT FOR LARGEST SHARE OF INDUSTRIAL VALVES MARKET, BY SIZE, IN 2028

- FIGURE 14 ENERGY & POWER INDUSTRY TO CAPTURE LARGEST SHARE OF INDUSTRIAL VALVES MARKET DURING FORECAST PERIOD

- FIGURE 15 ASIA PACIFIC HELD LARGEST SHARE OF INDUSTRIAL VALVES MARKET IN 2022

- 3.1 RECESSION IMPACT AT GLOBAL LEVEL

- FIGURE 16 GDP GROWTH PROJECTIONS FOR MAJOR ECONOMIES TILL 2023

- FIGURE 17 IMPACT OF UPCOMING RECESSION ON GLOBAL INDUSTRIAL VALVES MARKET

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN INDUSTRIAL VALVES MARKET

- FIGURE 18 INCREASED DEMAND FOR INDUSTRIAL VALVES FROM HEALTHCARE AND PHARMACEUTICAL INDUSTRIES TO PROVIDE OPPORTUNITIES FOR PLAYERS IN INDUSTRIAL VALVES MARKET

- 4.2 INDUSTRIAL VALVES MARKET, BY FUNCTION

- FIGURE 19 ON/OFF VALVES TO HOLD LARGER MARKET SHARE THAN CONTROL VALVES IN 2023

- 4.3 INDUSTRIAL VALVES MARKET, BY MATERIAL

- FIGURE 20 PLASTIC VALVES TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- 4.4 INDUSTRIAL VALVES MARKET, BY TYPE

- FIGURE 21 GLOBE VALVES TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- 4.5 INDUSTRIAL VALVES MARKET, BY COMPONENT

- FIGURE 22 ACTUATORS TO REGISTER HIGHEST CAGR IN INDUSTRIAL VALVES MARKET DURING FORECAST PERIOD

- 4.6 INDUSTRIAL VALVES MARKET, BY SIZE

- FIGURE 23 >50" INDUSTRIAL VALVES TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- 4.7 INDUSTRIAL VALVES MARKET, BY END-USER INDUSTRY

- FIGURE 24 PAPER & PULP INDUSTRY TO REGISTER HIGHEST CAGR IN INDUSTRIAL VALVES MARKET DURING FORECAST PERIOD

- 4.8 INDUSTRIAL VALVES MARKET, BY COUNTRY

- FIGURE 25 US TO ACCOUNT FOR LARGEST SHARE OF GLOBAL INDUSTRIAL VALVES MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 26 INDUSTRIAL VALVES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Rising demand for valves from healthcare and pharmaceutical industries

- 5.2.1.2 Increasing need to establish new power plants and revamp existing ones

- 5.2.1.3 Rapid deployment of connected networks to monitor valve conditions and predict system failure

- 5.2.1.4 Shifting focus of process industries toward adoption of automation solutions

- 5.2.1.5 Establishment of smart cities globally

- FIGURE 27 INDUSTRIAL VALVES MARKET: IMPACT ANALYSIS OF DRIVERS

- 5.2.2 RESTRAINTS

- 5.2.2.1 High capital investment and low profit margin due to varying valve standards across regions

- 5.2.2.2 Customer dissatisfaction owing to higher lead time and late order delivery

- FIGURE 28 INDUSTRIAL VALVES MARKET: IMPACT ANALYSIS OF RESTRAINTS

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Integration of industrial valves with IIoT and Industry 4.0

- 5.2.3.2 Rising demand for AI-integrated valves for intelligent water supply

- 5.2.3.3 Use of 3D printing technique to manufacture industrial valves

- 5.2.3.4 Thriving petrochemical industry with growing demand for fuel

- 5.2.3.5 Shifting focus of valve manufacturers toward better maintenance and aftermarket services

- 5.2.3.6 Increasing adoption of smart valves as replacement for outdated valves

- FIGURE 29 INDUSTRIAL VALVES MARKET: IMPACT ANALYSIS OF OPPORTUNITIES

- 5.2.4 CHALLENGES

- 5.2.4.1 Focus of valve manufacturers on acquisitions affecting profit margins and cash flow

- 5.2.4.2 Fierce competition owing to reduced product differentiation

- 5.2.4.3 Unplanned downtime due to malfunctioning and failure of valves

- 5.2.4.4 High cost of valve manufacturing

- FIGURE 30 INDUSTRIAL VALVES MARKET: IMPACT ANALYSIS OF CHALLENGES

- 5.3 VALUE CHAIN ANALYSIS

- FIGURE 31 INDUSTRIAL VALVES MARKET: VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM MAPPING

- FIGURE 32 INDUSTRIAL VALVES MARKET: ECOSYSTEM ANALYSIS

- TABLE 3 COMPANIES AND THEIR ROLE IN INDUSTRIAL VALVES ECOSYSTEM

- 5.5 PRICING ANALYSIS

- 5.5.1 COMPANY-WISE AVERAGE SELLING PRICE OF INDUSTRIAL VALVES, BY TYPE

- TABLE 4 AVERAGE SELLING PRICE OF INDUSTRIAL VALVES OFFERED BY TOP COMPANIES, 2023

- FIGURE 33 AVERAGE SELLING PRICE OF INDUSTRIAL VALVES OFFERED BY KEY PLAYERS, BY TYPE (USD)

- TABLE 5 AVERAGE SELLING PRICE OF INDUSTRIAL VALVES OFFERED BY THREE GLOBAL MARKET PLAYERS, BY TYPE

- TABLE 6 AVERAGE SELLING PRICE OF INDUSTRIAL VALVES, BY REGION

- FIGURE 34 AVERAGE SELLING PRICE OF INDUSTRIAL VALVES, 2019-2028

- 5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 35 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 DIGITALIZATION AND ARTIFICIAL INTELLIGENCE

- 5.7.2 INDUSTRIAL INTERNET OF THINGS (IIOT)

- 5.7.3 VALVE CONDITION MONITORING

- 5.8 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 36 INDUSTRIAL VALVES MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.8.1 BARGAINING POWER OF SUPPLIERS

- 5.8.2 BARGAINING POWER OF BUYERS

- 5.8.3 THREAT OF NEW ENTRANTS

- 5.8.4 THREAT OF SUBSTITUTES

- 5.8.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.9 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.9.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 37 INFLUENCE OF STAKEHOLDERS FROM TOP 3 END-USER INDUSTRIES ON BUYING PROCESS

- TABLE 7 INFLUENCE OF STAKEHOLDERS FROM TOP 3 END-USER INDUSTRIES ON BUYING PROCESS (%)

- 5.9.2 BUYING CRITERIA

- FIGURE 38 KEY BUYING CRITERIA OF TOP 3 END-USER INDUSTRIES

- TABLE 8 KEY BUYING CRITERIA OF TOP 3 INDUSTRIES

- 5.10 CASE STUDY ANALYSIS

- TABLE 9 SEVERSTAL ADOPTED EMERSON'S FISHER CONTROL-DISK BUTTERFLY VALVES TO REDUCE WATER USAGE

- TABLE 10 KRUGER, INC. NEWSPRINT MILL DEPLOYED FISHER CONTROL-DISK'S VALVES TO REDUCE FLOW VARIABILITY AND SAVE MAINTENANCE COSTS

- TABLE 11 BRAY INTERNATIONAL'S KNIFE GATE VALVE OFFERED INCREASED UPTIME OF HYDROCLONE APPLICATION AND REDUCED PRODUCTION LOSS

- TABLE 12 STADTENTWASSERUNG HANNOVER SIGNED CONTRACT WITH KSB SE & CO. KGAA FOR COMPLETE REPAIR AND REFURBISHMENT OF ITS WASTEWATER PUMPING STATION

- 5.11 TRADE ANALYSIS

- FIGURE 39 IMPORT DATA FOR TAPS, COCKS, AND SIMILAR APPLIANCES FOR PIPES, BOILER SHELLS, TANKS, VATS, AND PRESSURE-REDUCING AND THERMOSTATICALLY CONTROLLED VALVES, 2017-2021 (USD MILLION)

- FIGURE 40 EXPORT DATA FOR TAPS, COCKS, AND SIMILAR APPLIANCES FOR PIPES, BOILER SHELLS, TANKS, VATS, AND PRESSURE-REDUCING AND THERMOSTATICALLY CONTROLLED VALVES, 2017-2021 (USD MILLION)

- 5.12 PATENT ANALYSIS

- FIGURE 41 NUMBER OF PATENTS GRANTED EVERY YEAR FROM 2013 TO 2022

- FIGURE 42 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS

- TABLE 13 TOP 20 PATENT OWNERS IN LAST 10 YEARS

- 5.12.1 LIST OF MAJOR PATENTS

- TABLE 14 KEY PATENTS PERTAINING TO INDUSTRIAL VALVES

- 5.13 KEY CONFERENCES AND EVENTS, 2023-2024

- TABLE 15 INDUSTRIAL VALVES MARKET: REGION-WISE CONFERENCES AND EVENTS

- 5.14 REGULATIONS AND STANDARDS

- 5.14.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14.2 STANDARDS

- TABLE 20 STANDARDS FOLLOWED BY MANUFACTURERS OF INDUSTRIAL VALVES

6 INDUSTRIAL VALVES MARKET, BY TYPE

- 6.1 INTRODUCTION

- FIGURE 43 INDUSTRIAL VALVES MARKET, BY VALVE TYPE

- FIGURE 44 GLOBE VALVES TO LEAD MARKET THROUGHOUT FORECAST PERIOD

- TABLE 21 INDUSTRIAL VALVES MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 22 INDUSTRIAL VALVES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 6.2 BALL VALVES

- 6.2.1 TIGHT SEALING AND LOW OPERATING TORQUE TO DRIVE DEMAND FOR BALL VALVES

- TABLE 23 BALL VALVES: INDUSTRIAL VALVES MARKET, BY END-USER INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 24 BALL VALVES: INDUSTRIAL VALVES MARKET, BY END-USER INDUSTRY, 2023-2028 (USD MILLION)

- 6.2.1.1 Trunnion-mounted ball valves

- 6.2.1.1.1 Suitable for pipelines requiring high pressure

- 6.2.1.2 Floating ball valves

- 6.2.1.2.1 Bi-directional sealing enables free movement of ball to halt media flowing in any direction

- 6.2.1.3 Rising stem ball valves

- 6.2.1.3.1 Designed for quick shutoff applications in chemical plants

- 6.2.1.1 Trunnion-mounted ball valves

- 6.3 BUTTERFLY VALVES

- 6.3.1 LOW PRESSURE DROP AND COST-EFFECTIVENESS TO BOOST DEMAND FOR BUTTERFLY VALVES

- TABLE 25 BUTTERFLY VALVES: INDUSTRIAL VALVES MARKET, BY END-USER INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 26 BUTTERFLY VALVES: INDUSTRIAL VALVES MARKET, BY END-USER INDUSTRY, 2023-2028 (USD MILLION)

- 6.3.1.1 Zero-offset butterfly valves

- 6.3.1.1.1 Suitable for basic and specialty liquid and gas applications up to 200 PSI and 400°F

- 6.3.1.2 Double-offset butterfly valves

- 6.3.1.2.1 Widely adopted by energy & power, pulp & paper, HVAC, chemical, oil & gas, and water & wastewater treatment industries

- 6.3.1.3 Triple-offset butterfly valves

- 6.3.1.3.1 Function effectively in tight shutoff applications

- 6.3.1.1 Zero-offset butterfly valves

- 6.4 CHECK VALVES

- 6.4.1 ABILITY TO PREVENT REVERSAL PIPELINE FLOW TO STIMULATE DEMAND FOR CHECK VALVES

- TABLE 27 CHECK VALVES: INDUSTRIAL VALVES MARKET, BY END-USER INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 28 CHECK VALVES: INDUSTRIAL VALVES MARKET, BY END-USER INDUSTRY, 2023-2028 (USD MILLION)

- 6.5 DIAPHRAGM VALVES

- 6.5.1 ABILITY TO HANDLE CORROSIVE FLUIDS, FIBROUS SLURRIES, AND RADIOACTIVE FLUIDS TO INCREASE REQUIREMENT FOR DIAPHRAGM VALVES

- TABLE 29 DIAPHRAGM VALVES: INDUSTRIAL VALVES MARKET, BY END-USER INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 30 DIAPHRAGM VALVES: INDUSTRIAL VALVES MARKET, BY END-USER INDUSTRY, 2023-2028 (USD MILLION)

- 6.6 GATE VALVES

- 6.6.1 EASY FLOW OF MEDIA DUE TO UNOBSTRUCTED PASSAGEWAY TO BOOST DEMAND FOR GATE VALVES IN OIL & GAS AND PETROCHEMICAL APPLICATIONS

- TABLE 31 GATE VALVES: INDUSTRIAL VALVES MARKET, BY END-USER INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 32 GATE VALVES: INDUSTRIAL VALVES MARKET, BY END-USER INDUSTRY, 2023-2028 (USD MILLION)

- 6.6.1.1 Standard plate gate valves

- 6.6.1.1.1 Appropriate for transporting dry solids, granules, and powders

- 6.6.1.2 Wedge-type gate valves

- 6.6.1.2.1 Designed to handle flow of low-viscosity fluids

- 6.6.1.3 Knife gate valves

- 6.6.1.3.1 Preferred to handle slurries, as well as viscous, corrosive, and abrasive media

- 6.6.1.1 Standard plate gate valves

- 6.7 GLOBE VALVES

- 6.7.1 DEPLOYMENT IN HIGH-PRESSURE SYSTEMS TO CONTRIBUTE TO SEGMENTAL GROWTH

- TABLE 33 GLOBE VALVES: INDUSTRIAL VALVES MARKET, BY END-USER INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 34 GLOBE VALVES: INDUSTRIAL VALVES MARKET, BY END-USER INDUSTRY, 2023-2028 (USD MILLION)

- 6.8 PLUG VALVES

- 6.8.1 EASY SEALING AND ISOLATION ABILITIES TO BOOST ADOPTION OF PLUG VALVES IN WASTEWATER TREATMENT PLANTS

- TABLE 35 PLUG VALVES: INDUSTRIAL VALVES MARKET, BY END-USER INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 36 PLUG VALVES: INDUSTRIAL VALVES MARKET, BY END-USER INDUSTRY, 2023-2028 (USD MILLION)

- 6.9 SAFETY VALVES

- 6.9.1 RISING DEMAND FROM OIL & GAS, ENERGY & POWER, AND CHEMICAL INDUSTRIES TO PROPEL SEGMENTAL GROWTH

- TABLE 37 SAFETY VALVES: INDUSTRIAL VALVES MARKET, BY END-USER INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 38 SAFETY VALVES: INDUSTRIAL VALVES MARKET, BY END-USER INDUSTRY, 2023-2028 (USD MILLION)

7 INDUSTRIAL VALVES MARKET, BY COMPONENT

- 7.1 INTRODUCTION

- FIGURE 45 INDUSTRIAL VALVES MARKET, BY COMPONENT

- FIGURE 46 ACTUATORS TO DOMINATE INDUSTRIAL VALVES MARKET DURING FORECAST PERIOD

- TABLE 39 INDUSTRIAL VALVES MARKET, BY COMPONENT, 2019-2022 (USD MILLION)

- TABLE 40 INDUSTRIAL VALVES MARKET, BY COMPONENT, 2023-2028 (USD MILLION)

- 7.2 ACTUATORS

- 7.2.1 FOCUS ON REDUCING MAINTENANCE COST, INCREASING UPTIME, AND ENHANCING PLANT SAFETY TO DRIVE DEMAND FOR ACTUATORS

- 7.2.2 PNEUMATIC ACTUATORS

- 7.2.2.1 Diaphragm actuators

- 7.2.2.1.1 Suitable for control valves used in oil & gas industry

- 7.2.2.2 Piston actuators

- 7.2.2.2.1 Designed for butterfly valves used in food, chemical, and pharmaceutical industries

- 7.2.2.1 Diaphragm actuators

- 7.2.3 ELECTRIC ACTUATORS

- 7.2.3.1 Wide use in water & wastewater treatment and chemical plants to boost segmental growth

- 7.2.4 HYDRAULIC ACTUATORS

- 7.2.4.1 Integration of hydraulic actuators in HVAC, fire protection, and irrigation systems to propel growth

- TABLE 41 ACTUATORS: INDUSTRIAL VALVES MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 42 ACTUATORS: INDUSTRIAL VALVES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 7.3 VALVE BODY

- 7.3.1 RISING DEMAND FOR VALVE BODIES FEATURING HIGH CORROSION RESISTANCE AND BETTER CHEMICAL COMPATIBILITY TO SUPPORT SEGMENTAL GROWTH

- 7.4 OTHER COMPONENTS

8 INDUSTRIAL VALVES MARKET, BY FUNCTION

- 8.1 INTRODUCTION

- FIGURE 47 ON/OFF VALVES TO HOLD LARGER MARKET SHARE THROUGHOUT FORECAST PERIOD

- TABLE 43 INDUSTRIAL VALVES MARKET, BY FUNCTION, 2019-2022 (USD MILLION)

- TABLE 44 INDUSTRIAL VALVES MARKET, BY FUNCTION, 2023-2028 (USD MILLION)

- 8.2 ON/OFF

- 8.2.1 USE OF ON/OFF VALVES IN THROTTLING APPLICATIONS

- 8.3 CONTROL

- 8.3.1 IMPLEMENTATION OF CONTROL VALVES TO CONTROL TEMPERATURE, FLOW, AND PRESSURE IN INDUSTRIAL PROCESSES

9 INDUSTRIAL VALVES MARKET, BY MATERIAL

- 9.1 INTRODUCTION

- FIGURE 48 INDUSTRIAL VALVES MARKET, BY MATERIAL

- FIGURE 49 STEEL SEGMENT TO HOLD LARGEST SHARE OF INDUSTRIAL VALVES MARKET, BY MATERIAL, IN 2023

- TABLE 45 INDUSTRIAL VALVES MARKET, BY MATERIAL, 2019-2022 (USD MILLION)

- TABLE 46 INDUSTRIAL VALVES MARKET, BY MATERIAL, 2023-2028 (USD MILLION)

- 9.2 STEEL

- 9.2.1 RESISTANCE TO STRESS CORROSION CRACKING TO BOOST DEMAND FOR STEEL VALVES

- 9.3 CAST IRON

- 9.3.1 INCREASING USE OF CAST IRON VALVES IN WATER & WASTEWATER TREATMENT AND HYDROELECTRIC POWER PLANTS TO DRIVE MARKET

- 9.4 ALLOY BASED

- 9.4.1 RISING DEMAND FOR ALLOY-BASED VALVES TO RESOLVE PRESSURE-, TEMPERATURE-, AND CORROSION-RELATED ISSUES DURING PRODUCTION TO FUEL MARKET GROWTH

- 9.5 CRYOGENIC

- 9.5.1 INCREASING ADOPTION OF CRYOGENIC VALVES IN OIL & GAS INDUSTRY TO REGULATE LIQUIFIED GASES TO FUEL MARKET GROWTH

- 9.6 PLASTIC

- 9.6.1 HIGH DURABILITY AND ENHANCED CORROSION RESISTANCE OF PLASTIC VALVES TO DRIVE DEMAND

- 9.7 OTHER MATERIALS

- 9.7.1 BRONZE

- 9.7.2 BRASS

10 INDUSTRIAL VALVES MARKET, BY SIZE

- 10.1 INTRODUCTION

- FIGURE 50 INDUSTRIAL VALVES MARKET, BY SIZE

- FIGURE 51 1" TO 6" SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE THROUGHOUT FORECAST PERIOD

- TABLE 47 INDUSTRIAL VALVES MARKET, BY SIZE, 2019-2022 (USD MILLION)

- TABLE 48 INDUSTRIAL VALVES MARKET, BY SIZE, 2023-2028 (USD MILLION)

- 10.2 <1"

- 10.2.1 INCREASING NEED FOR <1" VALVES FOR PRECISE FLUID CONTROL TO DRIVE MARKET

- 10.3 1" TO 6"

- 10.3.1 RISING ADOPTION OF 1" TO 6" VALVES IN OIL & GAS AND CHEMICAL INDUSTRIES TO BOOST MARKET

- 10.4 7" TO 25"

- 10.4.1 INCREASING ADOPTION OF 7" TO 25" VALVES IN OIL & GAS, WATER & WASTEWATER TREATMENT, AGRICULTURE, AND MINING APPLICATIONS TO CREATE OPPORTUNITIES FOR VALVE PROVIDERS

- 10.5 26" TO 50"

- 10.5.1 GROWING NEED FOR VALVES THAT REMAIN FUNCTIONAL IN HIGH-TEMPERATURE AND HIGH-PRESSURE ENVIRONMENTS TO PROPEL MARKET

- 10.6 >50"

- 10.6.1 OIL & GAS, POWER, AND PETROCHEMICAL INDUSTRIES TO CONTRIBUTE TO MARKET GROWTH

11 INDUSTRIAL VALVES MARKET, BY END-USER INDUSTRY

- 11.1 INTRODUCTION

- FIGURE 52 INDUSTRIAL VALVES MARKET, BY END-USER INDUSTRY

- FIGURE 53 ENERGY & POWER INDUSTRY TO ACCOUNT FOR LARGEST SHARE OF INDUSTRIAL VALVES MARKET IN 2028

- TABLE 49 INDUSTRIAL VALVES MARKET, BY END-USER INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 50 INDUSTRIAL VALVES MARKET, BY END-USER INDUSTRY, 2023-2028 (USD MILLION)

- 11.2 OIL & GAS

- 11.2.1 STEADY RECOVERY OF OIL & GAS INDUSTRY TO FOSTER DEMAND FOR INDUSTRIAL VALVES

- TABLE 51 OIL & GAS: INDUSTRIAL VALVES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 52 OIL & GAS: INDUSTRIAL VALVES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 53 OIL & GAS: INDUSTRIAL VALVES MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 54 OIL & GAS: INDUSTRIAL VALVES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.3 WATER & WASTEWATER TREATMENT

- 11.3.1 INCREASING INVESTMENTS IN ESTABLISHING WATER TREATMENT PLANTS TO DRIVE MARKET

- TABLE 55 WATER & WASTEWATER TREATMENT: INDUSTRIAL VALVES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 56 WATER & WASTEWATER TREATMENT: INDUSTRIAL VALVES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 57 WATER & WASTEWATER TREATMENT: INDUSTRIAL VALVES MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 58 WATER & WASTEWATER TREATMENT: INDUSTRIAL VALVES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.4 ENERGY & POWER

- 11.4.1 INCREASING ENERGY DEMAND IN DEVELOPING COUNTRIES TO BOOST MARKET

- TABLE 59 ENERGY & POWER: INDUSTRIAL VALVES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 60 ENERGY & POWER: INDUSTRIAL VALVES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 61 ENERGY & POWER: INDUSTRIAL VALVES MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 62 ENERGY & POWER: INDUSTRIAL VALVES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.5 PHARMACEUTICAL

- 11.5.1 AUTOMATION IN PHARMA COMPANIES TO REDUCE DRUG SHORTAGE RISK TO INCREASE DEMAND FOR INDUSTRIAL VALVES

- TABLE 63 PHARMACEUTICAL: INDUSTRIAL VALVES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 64 PHARMACEUTICAL: INDUSTRIAL VALVES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 65 PHARMACEUTICAL: INDUSTRIAL VALVES MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 66 PHARMACEUTICAL: INDUSTRIAL VALVES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.6 FOOD & BEVERAGE

- 11.6.1 RISING NEED TO IMPROVE PROCESS EFFICIENCY TO DRIVE MARKET

- TABLE 67 FOOD & BEVERAGE: INDUSTRIAL VALVES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 68 FOOD & BEVERAGE: INDUSTRIAL VALVES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 69 FOOD & BEVERAGE: INDUSTRIAL VALVES MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 70 FOOD & BEVERAGE: INDUSTRIAL VALVES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.7 CHEMICAL

- 11.7.1 NEED TO COMPLY WITH STRINGENT SAFETY STANDARDS TO BOOST DEMAND

- TABLE 71 CHEMICAL: INDUSTRIAL VALVES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 72 CHEMICAL: INDUSTRIAL VALVES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 73 CHEMICAL: INDUSTRIAL VALVES MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 74 CHEMICAL: INDUSTRIAL VALVES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.8 BUILDING & CONSTRUCTION

- 11.8.1 RISING APPLICATIONS OF VALVES IN BUILDING & CONSTRUCTION INDUSTRY TO DRIVE DEMAND

- TABLE 75 BUILDING & CONSTRUCTION: INDUSTRIAL VALVES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 76 BUILDING & CONSTRUCTION: INDUSTRIAL VALVES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 77 BUILDING & CONSTRUCTION: INDUSTRIAL VALVES MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 78 BUILDING & CONSTRUCTION: INDUSTRIAL VALVES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.9 PAPER & PULP

- 11.9.1 INCREASING USE OF INDUSTRIAL VALVES IN REPULPING AND RECYCLING APPLICATIONS TO SUPPORT MARKET GROWTH

- TABLE 79 PAPER & PULP: INDUSTRIAL VALVES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 80 PAPER & PULP: INDUSTRIAL VALVES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 81 PAPER & PULP: INDUSTRIAL VALVES MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 82 PAPER & PULP: INDUSTRIAL VALVES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.10 METAL & MINING

- 11.10.1 GROWING DEMAND FOR PREDICTIVE MAINTENANCE TO DRIVE MARKET

- TABLE 83 METAL & MINING: INDUSTRIAL VALVES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 84 METAL & MINING: INDUSTRIAL VALVES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 85 METAL & MINING: INDUSTRIAL VALVES MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 86 METAL & MINING: INDUSTRIAL VALVES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.11 AGRICULTURE

- 11.11.1 SURGING USE OF INDUSTRIAL VALVES IN IRRIGATION APPLICATIONS TO SPUR DEMAND

- TABLE 87 AGRICULTURE: INDUSTRIAL VALVES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 88 AGRICULTURE: INDUSTRIAL VALVES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 89 AGRICULTURE: INDUSTRIAL VALVES MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 90 AGRICULTURE: INDUSTRIAL VALVES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.12 SEMICONDUCTOR

- 11.12.1 NECESSITY TO OPTIMIZE ATOMIC LAYER DEPOSITION PROCESSES IN SEMICONDUCTOR MANUFACTURING TO DRIVE DEMAND

- TABLE 91 SEMICONDUCTOR: INDUSTRIAL VALVES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 92 SEMICONDUCTOR: INDUSTRIAL VALVES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 93 SEMICONDUCTOR: INDUSTRIAL VALVES MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 94 SEMICONDUCTOR: INDUSTRIAL VALVES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 11.13 OTHER END-USER INDUSTRIES

- TABLE 95 OTHER END-USER INDUSTRIES: INDUSTRIAL VALVES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 96 OTHER END-USER INDUSTRIES: INDUSTRIAL VALVES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 97 OTHER END-USER INDUSTRIES: INDUSTRIAL VALVES MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 98 OTHER END-USER INDUSTRIES: INDUSTRIAL VALVES MARKET, BY TYPE, 2023-2028 (USD MILLION)

12 INDUSTRIAL VALVES MARKET, BY REGION

- 12.1 INTRODUCTION

- FIGURE 54 US TO REGISTER HIGHEST CAGR IN OVERALL INDUSTRIAL VALVES MARKET DURING FORECAST PERIOD

- FIGURE 55 ASIA PACIFIC TO ACCOUNT FOR LARGEST SHARE OF INDUSTRIAL VALVES MARKET DURING FORECAST PERIOD

- TABLE 99 INDUSTRIAL VALVES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 100 INDUSTRIAL VALVES MARKET, BY REGION, 2023-2028 (USD MILLION)

- 12.2 NORTH AMERICA

- FIGURE 56 NORTH AMERICA: SNAPSHOT OF INDUSTRIAL VALVES MARKET

- FIGURE 57 US TO REGISTER HIGHEST CAGR IN NORTH AMERICAN INDUSTRIAL VALVES MARKET DURING FORECAST PERIOD

- TABLE 101 NORTH AMERICA: INDUSTRIAL VALVES MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 102 NORTH AMERICA: INDUSTRIAL VALVES MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 103 NORTH AMERICA: INDUSTRIAL VALVES MARKET, BY END-USER INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 104 NORTH AMERICA: INDUSTRIAL VALVES MARKET, BY END-USER INDUSTRY, 2023-2028 (USD MILLION)

- 12.2.1 US

- 12.2.1.1 Aging water & wastewater infrastructure in US to accelerate market growth

- 12.2.2 CANADA

- 12.2.2.1 Rising adoption of valves in oil & gas sector to contribute to market growth

- 12.2.3 MEXICO

- 12.2.3.1 Thriving semiconductor industry to boost growth

- 12.3 EUROPE

- FIGURE 58 EUROPE: SNAPSHOT OF INDUSTRIAL VALVES MARKET

- FIGURE 59 GERMANY TO REGISTER HIGHEST CAGR IN EUROPEAN INDUSTRIAL VALVES MARKET DURING FORECAST PERIOD

- TABLE 105 EUROPE: INDUSTRIAL VALVES MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 106 EUROPE: INDUSTRIAL VALVES MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 107 EUROPE: INDUSTRIAL VALVES MARKET, BY END-USER INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 108 EUROPE: INDUSTRIAL VALVES MARKET, BY END-USER INDUSTRY, 2023-2028 (USD MILLION)

- 12.3.1 UK

- 12.3.1.1 Water industry to propel demand for control valves

- 12.3.2 GERMANY

- 12.3.2.1 Rising adoption of industrial valves by process industries to stimulate market growth

- 12.3.3 FRANCE

- 12.3.3.1 Ongoing nuclear and chemical projects to boost demand

- 12.3.4 ITALY

- 12.3.4.1 Investments in refurbishing and retrofitting water & wastewater treatment plants to support market growth

- 12.3.5 REST OF EUROPE

- 12.4 ASIA PACIFIC

- FIGURE 60 ASIA PACIFIC: INDUSTRIAL VALVES MARKET SNAPSHOT

- FIGURE 61 SOUTH KOREA TO REGISTER HIGHEST CAGR IN INDUSTRIAL VALVES MARKET IN ASIA PACIFIC DURING FORECAST PERIOD

- TABLE 109 ASIA PACIFIC: INDUSTRIAL VALVES MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 110 ASIA PACIFIC: INDUSTRIAL VALVES MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 111 ASIA PACIFIC: INDUSTRIAL VALVES MARKET, BY END-USER INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 112 ASIA PACIFIC: INDUSTRIAL VALVES MARKET, BY END-USER INDUSTRY, 2023-2028 (USD MILLION)

- 12.4.1 CHINA

- 12.4.1.1 Booming pharmaceutical industry to promote demand for industrial valves

- 12.4.2 JAPAN

- 12.4.2.1 Increasing focus on renewable energy projects to boost requirement for industrial valves

- 12.4.3 INDIA

- 12.4.3.1 Oil and gas exploration activities to fuel market growth

- 12.4.4 SOUTH KOREA

- 12.4.4.1 Presence of leading chemical companies to accelerate demand for industrial valves

- 12.4.5 REST OF ASIA PACIFIC

- 12.5 REST OF THE WORLD (ROW)

- FIGURE 62 MIDDLE EAST TO DOMINATE INDUSTRIAL VALVES MARKET IN ROW DURING FORECAST PERIOD

- TABLE 113 ROW: INDUSTRIAL VALVES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 114 ROW: INDUSTRIAL VALVES MARKET IN ROW, BY REGION, 2023-2028 (USD MILLION)

- TABLE 115 ROW: INDUSTRIAL VALVES MARKET, BY END-USER INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 116 ROW: INDUSTRIAL VALVES MARKET, BY END-USER INDUSTRY, 2023-2028 (USD MILLION)

- 12.5.1 MIDDLE EAST

- 12.5.1.1 Booming oil & gas and chemical industries to increase demand for industrial valves

- TABLE 117 MIDDLE EAST: INDUSTRIAL VALVES MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 118 MIDDLE EAST: INDUSTRIAL VALVES MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 12.5.2 SOUTH AMERICA

- 12.5.2.1 Thriving petrochemical and mining industries to contribute to market growth

- 12.5.3 AFRICA

- 12.5.3.1 Increasing investments in improving water management infrastructure to generate opportunities for valve manufacturers

13 COMPETITIVE LANDSCAPE

- 13.1 OVERVIEW

- 13.1.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN INDUSTRIAL VALVES MARKET

- 13.2 REVENUE ANALYSIS OF TOP 5 PLAYERS

- FIGURE 63 INDUSTRIAL VALVES MARKET: MARKET SHARE ANALYSIS (2022)

- 13.3 MARKET SHARE ANALYSIS, 2022

- TABLE 119 INDUSTRIAL VALVES MARKET: MARKET SHARE OF KEY COMPANIES

- FIGURE 64 INDUSTRIAL VALVES MARKET: MARKET SHARE ANALYSIS (2022)

- 13.4 COMPANY EVALUATION QUADRANT

- 13.4.1 STARS

- 13.4.2 EMERGING LEADERS

- 13.4.3 PERVASIVE PLAYERS

- 13.4.4 PARTICIPANTS

- FIGURE 65 INDUSTRIAL VALVES MARKET (GLOBAL): COMPANY EVALUATION QUADRANT, 2022

- 13.5 SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION QUADRANT, 2022

- 13.5.1 PROGRESSIVE COMPANIES

- 13.5.2 RESPONSIVE COMPANIES

- 13.5.3 DYNAMIC COMPANIES

- 13.5.4 STARTING BLOCKS

- FIGURE 66 INDUSTRIAL VALVES MARKET (GLOBAL): SMES EVALUATION QUADRANT, 2022

- 13.6 COMPANY FOOTPRINT

- TABLE 120 COMPANY FOOTPRINT

- TABLE 121 END-USER INDUSTRY: COMPANY FOOTPRINT

- TABLE 122 TYPE: COMPANY FOOTPRINT

- TABLE 123 REGION: COMPANY FOOTPRINT

- 13.7 COMPETITIVE BENCHMARKING

- TABLE 124 INDUSTRIAL VALVES MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 125 INDUSTRIAL VALVES MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 13.8 COMPETITIVE SITUATIONS AND TRENDS

- 13.8.1 PRODUCT LAUNCHES

- TABLE 126 INDUSTRIAL VALVES MARKET: PRODUCT LAUNCHES, APRIL 2021-DECEMBER 2022

- 13.8.2 DEALS

- TABLE 127 INDUSTRIAL VALVES MARKET: DEALS, JUNE 2021-NOVEMBER 2022

- 13.8.3 OTHERS

- TABLE 128 INDUSTRIAL VALVES MARKET: OTHERS, FEBRUARY 2022-NOVEMBER 2022

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- 14.1.1 EMERSON

- 14.1.2 SCHLUMBERGER LIMITED

- 14.1.3 FLOWSERVE CORPORATION

- 14.1.4 IMI PLC

- 14.1.5 NELES (VALMET)

- 14.1.7 CRANE CO.

- 14.1.8 KITZ CORPORATION

- 14.1.9 KSB SE & CO. KGAA 0

- 14.1.10 ALFA LAVAL

- 14.1.11 CURTISS-WRIGHT CORPORATION

- 14.1.12 PARKER HANNIFIN CORPORATION

- 14.1.13 BRAY INTERNATIONAL

- 14.1.14 CIRCOR INTERNATIONAL, INC.

- 14.1.15 IDEX CORPORATION

- 14.2 OTHER KEY PLAYERS9

- 14.2.1 NEWAY VALVE CO

- 14.2.2 VELAN INC

- 14.2.3 DANFOSS

- 14.2.4 GEORG FISCHER LTD

- 14.2.5 SAMSON

- 14.2.6 AVK HOLDING A/S

- 14.2.7 KLINGER HOLDING

- 14.2.8 TRILLIUM FLOW TECHNOLOGIES

- 14.3 OTHER PLAYERS

- 14.3.1 EBRO ARMATUREN GEBR. BRÖER GMBH

- 14.3.2 VALVITALIA SPA

- 14.3.3 GEFA PROCESSTECHNIK GMBH

- 14.3.4 AVCON CONTROLS PVT LTD

- 14.3.5 FORBES MARSHALL

- 14.3.6 FRENSTAR

- 14.3.7 HAM-LET GROUP

- 14.3.8 DWYER INSTRUMENTS LTD.

- 14.3.9 APOLLO VALVES

- 15 ADJACENT AND RELATED MARKETS

- 15.1 INTRODUCTION

- 15.2 LIMITATIONS

- 15.3 LINED VALVES MARKET, BY TYPE

- 15.4 BALL VALVES

- 15.5 BUTTERFLY VALVES

- 15.6 GATE VALVES

- 15.7 GLOBE VALVES

- 15.8 PLUG VALVES

- 15.9 OTHERS

16 APPENDIX

- 16.1 INSIGHTS FROM INDUSTRY EXPERTS

- 16.2 DISCUSSION GUIDE

- 16.3 KNOWLEDGESTORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

- 16.4 CUSTOMIZATION OPTIONS

- 16.5 RELATED REPORTS

- 16.6 AUTHOR DETAILS