|

|

市場調査レポート

商品コード

1422234

中東のサイバーセキュリティ市場:オファリング別(ソリューションとサービス)、ソリューションタイプ別、セキュリティタイプ別、展開形態別(オンプレミス、クラウド、ハイブリッド)、組織規模別(大企業、中小企業)、業界別、地域別-2028年までの予測Middle East Cybersecurity Market by Offering (Solutions and Services), Solution Type, Security Type, Deployment Mode (On-Premises, Cloud, Hybrid), Organization Size (Large Enterprises, SME), Vertical and Region - Global Forecast to 2028 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 中東のサイバーセキュリティ市場:オファリング別(ソリューションとサービス)、ソリューションタイプ別、セキュリティタイプ別、展開形態別(オンプレミス、クラウド、ハイブリッド)、組織規模別(大企業、中小企業)、業界別、地域別-2028年までの予測 |

|

出版日: 2024年02月05日

発行: MarketsandMarkets

ページ情報: 英文 407 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

中東のサイバーセキュリティの市場規模は、2023年の148億米ドルから2028年には234億米ドルに成長し、予測期間中の年間平均成長率(CAGR)は9.6%になると予測されています。

中東のサイバーセキュリティ市場は、「KSAビジョン2030」で示された変革的ビジョンに後押しされて大きく拡大しています。この野心的な構想は極めて重要な促進要因であり、地域の展望を再構築し、市場のダイナミクスに影響を与えています。このビジョンを補完しているのが中東で急成長している新興企業のエコシステムであり、サイバーセキュリティのイノベーションの軌跡を導く上で極めて重要な役割を担っています。同地域が急速なデジタル変革を遂げる中、クラウド技術はさまざまな取り組みに広く採用されています。同時に、ダイナミックな脅威環境に対応するための規制措置も進化しており、中東におけるサイバーセキュリティの強固な基盤を確立し、安全なデジタルの未来を育んでいます。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2017年~2028年 |

| 基準年 | 2022年 |

| 予測期間 | 2023年~2028年 |

| 検討単位 | 金額(100万米ドル/10億米ドル) |

| セグメント別 | オファリング別、ソリューションタイプ別、セキュリティタイプ別、展開形態別、組織規模別、業界別、地域別 |

| 対象地域 | UAE、KSA、カタール、バーレーン、オマーン、クウェート、イスラエル、エジプト、トルコ、その他 |

銀行、金融機関、保険会社などで構成されるBFSIセグメントは、中東のサイバーセキュリティ市場で最大の市場規模を誇っています。BFSI組織にとって、機密性の高い金融データのような価値の高い資産を管理することは最重要であり、サイバー犯罪者にとって格好の標的となっているなど、いくつかの極めて重要な要因があるためです。顧客情報、支払詳細、金融取引を保護するためには、サイバーセキュリティソリューションへの大幅な投資が不可欠です。さらに、中東当局が定める厳しい規制遵守要件が、強固なサイバーセキュリティ対策の緊急性を高めています。

BFSI部門は、規制違反による多額の罰金や風評被害の可能性に直面しており、コンプライアンスを実証するための継続的なサイバーセキュリティ投資の必要性が強調されています。オンラインバンキング、モバイルバンキング、FinTechアプリケーション、クラウドサービスの急速な普及など、デジタル化が加速する同部門では、進化するサイバー脅威から保護するための専門的なサイバーセキュリティ・ソリューションへの需要がさらに高まっています。

大企業が中東のサイバーセキュリティ市場を独占しているのは、その潤沢な資金力により、高度なサイバーセキュリティソリューションへの高い支出能力を可能にしているためです。予算が豊富なため、熟練した専門家を雇い、高度な技術を導入し、包括的なセキュリティプログラムを実施する余裕があります。この財務体質により、サイバーセキュリティに長期的なアプローチを採用し、進化する脅威に対して強固なセキュリティ体制を構築・維持するための一貫した投資を行うことができます。さらに、複雑なインフラや重要なデータセンターを運用することが多い大企業では、個々のニーズに合わせたサイバーセキュリティソリューションが必要とされ、この分野での支出が増加しています。機密データの保護、厳格なコンプライアンス要件、リスク管理の必要性が、大企業がサイバーセキュリティに多額の投資を行う動機をさらに高めています。さらに、大企業の意思決定構造が一元化されているため、包括的なサイバーセキュリティ・プログラムの導入と管理が容易になり、業務効率と事業継続性が重視されます。

当レポートでは、中東のサイバーセキュリティ市場について調査し、オファリング別、ソリューションタイプ別、セキュリティタイプ別、展開形態別、組織規模別、業界別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要と業界動向

- イントロダクション

- 市場力学

- 生態系

- バリューチェーン分析

- 特許分析

- 貿易分析

- 価格分析

- 技術分析

- ケーススタディ分析

- 顧客のビジネスに影響を与える動向と混乱

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- 関税と規制状況

- 主要な会議とイベント

第6章 中東のサイバーセキュリティ市場、オファリング別

- イントロダクション

- ソリューション

- サービス

第7章 中東のサイバーセキュリティ市場、ソリューションタイプ別

- イントロダクション

- IDとアクセスの管理

- ウイルス対策/マルウェア対策

- ログ管理とSIEM

- ファイアウォール

- 暗号化とトークン化

- コンプライアンスとポリシー管理

- パッチ管理

- その他

第8章 中東のサイバーセキュリティ市場、セキュリティタイプ別

- イントロダクション

- ネットワークセキュリティ

- エンドポイントとIoTのセキュリティ

- クラウドセキュリティ

- アプリケーションのセキュリティ

第9章 中東のサイバーセキュリティ市場、展開形態別

- イントロダクション

- オンプレミス

- クラウド

- ハイブリッド

第10章 中東のサイバーセキュリティ市場、組織規模別

- イントロダクション

- 大企業

- 中小企業

第11章 中東のサイバーセキュリティ市場、業界別

- イントロダクション

- 政府

- 銀行、金融サービス、保険(BFSI)

- ITとITES

- ヘルスケアとライフサイエンス

- 航空宇宙と防衛

- 小売と電子商取引

- 製造業

- エネルギーと公共事業

- 電気通信

- 輸送と物流

- メディアとエンターテイメント

- その他

第12章 中東のサイバーセキュリティ市場、地域別

- イントロダクション

- 中東

- GCC諸国

- その他

第13章 競合情勢

- 主要企業の戦略/秘策

- 収益分析

- 市場シェア分析

- 主要企業の企業評価マトリックス

- スタートアップ/中小企業の評価マトリックス

- 競合シナリオ

第14章 企業プロファイル

- 主要参入企業

- IBM

- CISCO

- PALO ALTO NETWORKS

- CHECK POINT

- TREND MICRO

- FORTINET

- BROADCOM

- SOPHOS

- TRELLIX

- EDGE GROUP

- SECUREWORKS

- CPX

- MDS UAE

- FORESCOUT

- PROTIVITI

- MANDIANT

- LOGRHYTHM

- その他の企業

- HELP AG

- MORO HUB

- DTS SOLUTION

- RAS INFOTECH

- SPIDERSILK

- CYBERSEC CONSULTING

- CODEGREEN SYSTEMS

- MALWAREBYTES

- SAFE DECISION

- SECURITY MATTERZ

- CATO NETWORKS

- CYBERGATE DEFENSE

第15章 隣接市場

第16章 付録

The Middle East cybersecurity market size is projected to grow from USD 14.8 billion in 2023 to USD 23.4 billion by 2028 at a Compound Annual Growth Rate (CAGR) of 9.6% during the forecast period. The Middle East cybersecurity market is expanding significantly, spurred by the transformative vision outlined in KSA Vision 2030. This ambitious initiative is a crucial driver, reshaping the regional landscape and influencing market dynamics. Complementing this vision is a burgeoning startup ecosystem in the Middle East, which is pivotal in steering the trajectory of cybersecurity innovations. As the region experiences rapid digital transformation, cloud technology is widely adopted by various initiatives. Concurrently, regulatory measures are evolving to address the dynamic threat environment, establishing a robust foundation for cybersecurity in the Middle East and fostering a secure digital future.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2017-2028 |

| Base Year | 2022 |

| Forecast Period | 2023-2028 |

| Units Considered | Value (USD Million/USD Billion) |

| Segments | By Offering, Solution Type, Security Type, Deployment Mode, Organization Size, Vertical and Region. |

| Regions covered | UAE, KSA, Qatar, Bahrain, Oman, Kuwait, Israel, Egypt, Turkey, and Others. |

"By vertical, the BFSI segment accounts for a larger market share."

The BFSI segment, comprising banks, financial institutions, and insurance entities, boasts the largest market size in the Middle East cybersecurity market due to several pivotal factors such as managing high-value assets like sensitive financial data is paramount for BFSI organizations, making them prime targets for cybercriminals. Substantial investments in cybersecurity solutions are imperative to safeguard customer information, payment details, and financial transactions. Moreover, stringent regulatory compliance requirements set by Middle Eastern authorities add to the urgency for robust cybersecurity measures.

The BFSI sector faces potential hefty fines and reputational damage for regulatory violations, emphasizing the need for continuous cybersecurity investments to demonstrate compliance. The sector's accelerated digitalization, including the rapid adoption of online banking, mobile banking, FinTech applications, and cloud services, further amplifies the demand for specialized cybersecurity solutions to protect against evolving cyber threats.

"Large enterprises account for a larger market share by organization size."

Large enterprises dominate the Middle East cybersecurity market due to their substantial financial resources, enabling high spending capacity on advanced cybersecurity solutions. With larger budgets, they can afford to hire skilled professionals, deploy sophisticated technologies, and implement comprehensive security programs. This financial strength allows them to adopt a long-term approach to cybersecurity, ensuring consistent investments to build and maintain robust security postures against evolving threats. Moreover, large enterprises, often operating complex infrastructures and critical data centers, necessitate tailored cybersecurity solutions, driving increased spending in this sector. Protecting sensitive data, stringent compliance requirements, and the imperative of risk management further motivate large enterprises to invest significantly in cybersecurity. Additionally, large enterprises' centralized decision-making structures facilitate implementing and managing comprehensive cybersecurity programs, emphasizing operational efficiency and business continuity.

Breakdown of primaries

The study contains insights from various industry experts, from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type: Tier 1 - 40%, Tier 2 - 30%, and Tier 3 - 30%

- By Designation: C-level - 40% and Managers and Others - 60%

- By Region: UAE - 25%, KSA - 20%, Israel - 20%, Qatar - 10%, Egypt - 10%, and Rest of Middle East - 15%

Major vendors in the middle east cybersecurity market include IBM (US), Cisco (US), Palo Alto Networks (US), Check Point (US), Trend Micro (Japan), Fortinet (US), Broadcom (US), Sophos (UK), Trellix (US), EDGE Group (UAE), SecureWorks (US), CPX (UAE), MDS UAE (UAE), Forescout (US), Protiviti (US), Mandiant (US), LogRhythm (US), Help AG (UAE), Moro Hub (UAE), DTS Solution (UAE), Ras Infotech (UAE), spiderSilk (UAE), CyberSec Consulting (US), CodeGreen Systems (UAE), Malwarebytes (US), Safe Decision (KSA), Security Matterz (KSA), Cato Networks (Israel), CyberGate Defense (UAE).

The study includes an in-depth competitive analysis of the key players in the Middle East cybersecurity market, their company profiles, recent developments, and key market strategies.

Research Coverage

The report segments the Middle East cybersecurity market. It forecasts its size by Offering (Solutions and Services), Solution Type (Identity & Access Management (IAM), Antivirus/Antimalware, Log Management & SIEM, Firewall, Encryption & Tokenization, Compliance & Policy Management, Patch Management and Other Solution Types), Security Type (Network Security, Endpoint & IoT Security, Cloud Security, and Application Security), Deployment Mode (On-premises, Cloud, and Hybrid), Organization Size (Large Enterprises, and Small and Medium Enterprises (SMEs)), Vertical (Government, Banking, Financial Services, and Insurance (BFSI), IT & ITeS, Healthcare & Lifescience, Aerospace & Defense, Retail & eCommerce, Manufacturing, Energy and Utilities, Telecommunication, Transportation & Logistics, Media & Entertainment, and Other Verticals) and Region (Middle East).

The study also includes an in-depth competitive analysis of the market's key players, their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Key Benefits of Buying the Report

The report will help the market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall Middle East cybersecurity market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (digital transformation initiatives propel widespread cloud technological adoption, regulatory initiatives for evolving threat environment, KSA Vision 2030 driving Middle East cybersecurity market dynamics, and burgeoning startup ecosystem in the Middle East shaping trajectory), restraints (budgetary constraints on allocation of resources and resistance to emerging security technologies), opportunities (continuous investment by government and businesses for enhancement of cybersecurity infrastructure, rise in demand for cyber-insurance and awareness of cyber threats among companies, and robust development of cybersecurity services), and challenges (third-party dependencies expose weaknesses in middle east cybersecurity landscape and storage of skilled cybersecurity experts)

- Product Development/Innovation: Detailed insights on upcoming technologies, research development activities, new products, and service launches in the Middle East cybersecurity market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the Middle East cybersecurity market across varied regions.

- Market Diversification: Exhaustive information about new products and services, untapped geographies, recent developments, and investments in the Middle East cybersecurity market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players IBM (US), Cisco (US), Palo Alto Networks (US), Check Point (US), Trend Micro (Japan), among others, in the middle east cybersecurity market strategies.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.4 COUNTRIES COVERED

- 1.5 YEARS CONSIDERED

- 1.6 CURRENCY CONSIDERED

- TABLE 1 USD EXCHANGE RATES, 2019-2023

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

- 1.8.1 IMPACT OF RECESSION ON MIDDLE EASTERN REGION

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 MIDDLE EAST CYBERSECURITY MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakup of primary profiles

- 2.1.2.2 Key insights from industry experts

- 2.2 MARKET BREAKUP AND DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- FIGURE 2 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 1 (SUPPLY SIDE): REVENUE OF SERVICES OF MIDDLE EAST CYBERSECURITY MARKET

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 1-BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE OF ALL SERVICES OF MIDDLE EAST CYBERSECURITY MARKET

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 2-BOTTOM-UP (DEMAND SIDE): PRODUCTS/SOLUTIONS/SERVICES SOLD AND THEIR AVERAGE SELLING PRICE

- FIGURE 5 MIDDLE EAST CYBERSECURITY MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- 2.4 MARKET FORECAST

- TABLE 2 FACTOR ANALYSIS

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 LIMITATIONS

- 2.7 RECESSION IMPACT ANALYSIS

3 EXECUTIVE SUMMARY

- TABLE 3 MIDDLE EAST CYBERSECURITY MARKET SIZE AND GROWTH RATE, 2017-2022 (USD MILLION, Y-O-Y)

- TABLE 4 MIDDLE EAST CYBERSECURITY MARKET SIZE AND GROWTH RATE, 2023-2028 (USD MILLION, Y-O-Y)

- FIGURE 6 MIDDLE EAST CYBERSECURITY MARKET SCENARIO, 2023

4 PREMIUM INSIGHTS

- 4.1 BRIEF OVERVIEW OF MIDDLE EAST CYBERSECURITY MARKET

- FIGURE 7 INCREASED SOPHISTICATION OF CYBERATTACKS AND STRINGENT GOVERNMENT REGULATIONS TO DRIVE MARKET

- 4.2 MIDDLE EAST CYBERSECURITY MARKET SHARE: TOP THREE VERTICALS AND COUNTRIES, 2023

- FIGURE 8 BFSI SEGMENT AND KSA TO HOLD LARGEST MARKET SHARES IN 2023

- 4.3 MIDDLE EAST CYBERSECURITY MARKET, BY OFFERING, 2023-2028

- FIGURE 9 SOLUTIONS SEGMENT TO HOLD LARGER MARKET SHARE DURING FORECAST PERIOD

- 4.4 MIDDLE EAST CYBERSECURITY MARKET, BY SECURITY TYPE, 2023-2028

- FIGURE 10 NETWORK SECURITY SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- 4.5 MIDDLE EAST CYBERSECURITY MARKET INVESTMENT SCENARIO, BY COUNTRY

- FIGURE 11 ISRAEL TO EMERGE AS BEST MARKET FOR INVESTMENTS IN NEXT FIVE YEARS

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: MIDDLE EAST CYBERSECURITY MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Rapid integration of digital transformation and cloud computing

- 5.2.1.2 Regulatory initiatives for evolving threat environment

- 5.2.1.3 KSA Vision 2030 accelerating digital adoption

- 5.2.1.4 Burgeoning start-up ecosystem

- 5.2.2 RESTRAINTS

- 5.2.2.1 Budgetary constraints on allocation of resources

- 5.2.2.2 Resistance to emerging security technologies

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Continuous investments by governments and businesses to enhance cybersecurity infrastructure

- 5.2.3.2 Spike in demand for cyber-insurance policies

- 5.2.3.3 Robust development of cybersecurity services

- 5.2.4 CHALLENGES

- 5.2.4.1 Third-party dependencies exposing weaknesses in Middle East cybersecurity landscape

- 5.2.4.2 Shortage of skilled workforce

- 5.3 ECOSYSTEM

- FIGURE 13 MIDDLE EAST CYBERSECURITY MARKET: ECOSYSTEM

- TABLE 5 MIDDLE EAST CYBERSECURITY MARKET: ECOSYSTEM

- 5.4 VALUE CHAIN ANALYSIS

- FIGURE 14 MIDDLE EAST CYBERSECURITY MARKET: VALUE CHAIN ANALYSIS

- 5.5 PATENT ANALYSIS

- FIGURE 15 NUMBER OF PATENTS GRANTED FOR MIDDLE EAST CYBERSECURITY MARKET, 2019-2023

- FIGURE 16 REGIONAL ANALYSIS OF PATENTS GRANTED FOR MIDDLE EAST CYBERSECURITY MARKET

- TABLE 6 LIST OF TOP PATENTS IN MIDDLE EAST CYBERSECURITY MARKET, 2023

- 5.6 TRADE ANALYSIS

- TABLE 7 MIDDLE EAST CYBERSECURITY MARKET: IMPORT DATA, BY COUNTRY, 2018-2022 (USD MILLION)

- FIGURE 17 MIDDLE EAST CYBERSECURITY MARKET: IMPORT DATA, BY KEY COUNTRY, 2018-2022 (USD MILLION)

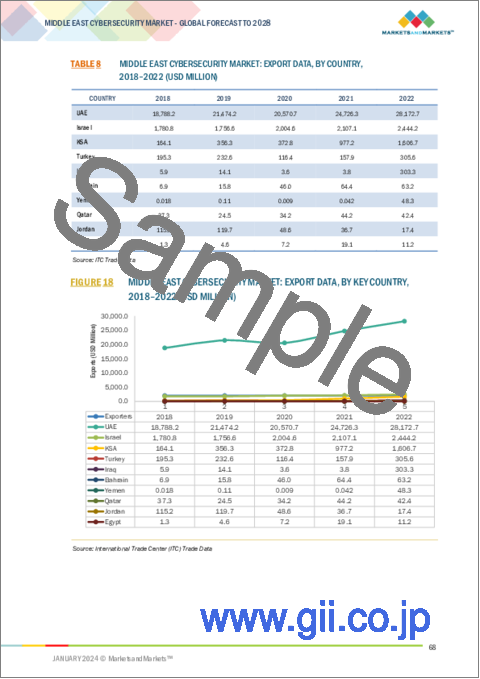

- TABLE 8 MIDDLE EAST CYBERSECURITY MARKET: EXPORT DATA, BY COUNTRY, 2018-2022 (USD MILLION)

- FIGURE 18 MIDDLE EAST CYBERSECURITY MARKET: EXPORT DATA, BY KEY COUNTRY, 2018-2022 (USD MILLION)

- 5.7 PRICING ANALYSIS

- 5.7.1 PRICING METHODS USED BY CYBERSECURITY VENDORS ACROSS MIDDLE EAST

- 5.7.2 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY SOLUTION TYPE

- FIGURE 19 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY SOLUTION TYPE

- TABLE 9 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY SOLUTION TYPE

- 5.7.3 INDICATIVE PRICING ANALYSIS

- TABLE 10 INDICATIVE PRICING ANALYSIS OF KEY MIDDLE EAST CYBERSECURITY VENDORS

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 ZERO TRUST NETWORK ACCESS

- 5.8.2 CLOUD NETWORK SECURITY

- 5.8.3 FIREWALL

- 5.8.4 SASE

- 5.8.5 BLOCKCHAIN CYBERSECURITY

- 5.9 CASE STUDY ANALYSIS

- 5.9.1 USE CASE 1: TREND MICRO HELPED OMAN ARAB BANK FORTIFY CYBERSECURITY, ENSURING ROBUST PROTECTION AND STREAMLINED MANAGEMENT

- 5.9.2 USE CASE 2: CISCO HELPED ISTANBUL GRAND AIRPORT ACHIEVE INTEGRATED SECURITY FOR GLOBAL PROMINENCE

- 5.9.3 USE CASE 3: TURKCELL GLOBAL BILGI ENHANCED CYBERSECURITY AGILITY AND EFFICIENCY BY DEPLOYING PALO ALTO NETWORKS' VM-SERIES VIRTUAL FIREWALLS

- 5.9.4 USE CASE 4: CODEGREEN'S TOKEN-LESS MULTI-FACTOR AUTHENTICATION SOLUTION HELPED LULU GROUP ENHANCE SECURITY AND REDUCE COSTS

- 5.9.5 USE CASE 5: CITY OF RAMAT-GAN ACHIEVED SECURE DIGITAL TRANSFORMATION WITH CHECK POINT'S COMPREHENSIVE SOLUTIONS

- 5.10 TRENDS & DISRUPTIONS IMPACTING CUSTOMER'S BUSINESSES

- FIGURE 20 REVENUE SHIFT FOR MIDDLE EAST CYBERSECURITY MARKET VENDORS

- 5.11 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 21 PORTER'S FIVE FORCES ANALYSIS

- TABLE 11 IMPACT OF PORTER'S FIVE FORCES ON MIDDLE EAST CYBERSECURITY MARKET

- 5.11.1 THREAT OF NEW ENTRANTS

- 5.11.2 THREAT OF SUBSTITUTES

- 5.11.3 BARGAINING POWER OF SUPPLIERS

- 5.11.4 BARGAINING POWER OF BUYERS

- 5.11.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.12 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- TABLE 12 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, TOP THREE VERTICALS

- 5.12.2 BUYING CRITERIA

- FIGURE 23 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- TABLE 13 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- 5.13 TARIFFS AND REGULATORY LANDSCAPE

- 5.13.1 TARIFFS RELATED TO MIDDLE EASTERN CYBERSECURITY SOLUTIONS

- TABLE 14 MIDDLE EAST CYBERSECURITY MARKET: TARIFFS RELATED TO MIDDLE EAST CYBERSECURITY SOLUTIONS, 2023

- 5.13.1.1 Regulatory bodies, government agencies, and other organizations

- TABLE 15 MIDDLE EAST: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13.2 STANDARDS AND REGULATIONS IN MIDDLE EAST CYBERSECURITY MARKET

- 5.13.2.1 Payment Card Industry Data Security Standard

- 5.13.2.2 Health Insurance Portability and Accountability Act

- 5.13.2.3 Federal Information Security Management Act

- 5.13.2.4 Gramm-Leach-Bliley Act

- 5.13.2.5 Sarbanes-Oxley Act

- 5.13.2.6 International Organization for Standardization (ISO) 27001

- 5.13.2.7 European Union General Data Protection Regulation

- 5.13.2.8 Service Organization Control 2 (SOC2)

- TABLE 16 REGIONAL STANDARDS

- 5.14 KEY CONFERENCES & EVENTS

- TABLE 17 MIDDLE EAST CYBERSECURITY MARKET: DETAILED LIST OF CONFERENCES & EVENTS, 2024-2025

6 MIDDLE EAST CYBERSECURITY MARKET, BY OFFERING

- 6.1 INTRODUCTION

- 6.1.1 OFFERINGS: MIDDLE EAST CYBERSECURITY MARKET DRIVERS

- FIGURE 24 SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- TABLE 18 MIDDLE EAST CYBERSECURITY MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 19 MIDDLE EAST CYBERSECURITY MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- 6.2 SOLUTIONS

- FIGURE 25 SOFTWARE SOLUTIONS SEGMENT TO HOLD LARGER MARKET DURING FORECAST PERIOD

- TABLE 20 MIDDLE EAST CYBERSECURITY MARKET, BY SOLUTION, 2017-2022 (USD MILLION)

- TABLE 21 MIDDLE EAST CYBERSECURITY MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 22 SOLUTIONS: MIDDLE EAST CYBERSECURITY MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 23 SOLUTIONS: MIDDLE EAST CYBERSECURITY MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 6.2.1 STANDALONE HARDWARE

- 6.2.1.1 Standalone hardware to prevent ever-evolving cyber threats

- TABLE 24 STANDALONE HARDWARE: MIDDLE EAST CYBERSECURITY MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 25 STANDALONE HARDWARE: MIDDLE EAST CYBERSECURITY MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 6.2.2 SOFTWARE SOLUTIONS

- 6.2.2.1 Rising demand for antivirus and antimalware solutions to detect, prevent, and eliminate malicious software

- TABLE 26 SOFTWARE SOLUTIONS: MIDDLE EAST CYBERSECURITY MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 27 SOFTWARE SOLUTIONS: MIDDLE EAST CYBERSECURITY MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 6.3 SERVICES

- FIGURE 26 MANAGED SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- TABLE 28 MIDDLE EAST CYBERSECURITY MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 29 MIDDLE EAST CYBERSECURITY MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 30 SERVICES: MIDDLE EAST CYBERSECURITY MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 31 SERVICES: MIDDLE EAST CYBERSECURITY MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 6.3.1 PROFESSIONAL SERVICES

- 6.3.1.1 Need to strategically organize, design, analyze, implement, and manage technical systems to boost demand for professional services

- FIGURE 27 RISK & THREAT MANAGEMENT SERVICES SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 32 MIDDLE EAST CYBERSECURITY MARKET, BY PROFESSIONAL SERVICE, 2017-2022 (USD MILLION)

- TABLE 33 MIDDLE EAST CYBERSECURITY MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 34 PROFESSIONAL SERVICES: MIDDLE EAST CYBERSECURITY MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 35 PROFESSIONAL SERVICES: MIDDLE EAST CYBERSECURITY MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 6.3.1.2 Design, consulting, and implementation

- TABLE 36 DESIGN, CONSULTING, AND IMPLEMENTATION: MIDDLE EAST CYBERSECURITY MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 37 DESIGN, CONSULTING, AND IMPLEMENTATION: MIDDLE EAST CYBERSECURITY MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 6.3.1.3 Risk & threat management

- TABLE 38 RISK & THREAT MANAGEMENT: MIDDLE EAST CYBERSECURITY MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 39 RISK & THREAT MANAGEMENT: MIDDLE EAST CYBERSECURITY MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 6.3.1.4 Training & education

- TABLE 40 TRAINING & EDUCATION: MIDDLE EAST CYBERSECURITY MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 41 TRAINING & EDUCATION: MIDDLE EAST CYBERSECURITY MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 6.3.1.5 Support & maintenance

- TABLE 42 SUPPORT & MAINTENANCE: MIDDLE EAST CYBERSECURITY MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 43 SUPPORT & MAINTENANCE: MIDDLE EAST CYBERSECURITY MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 6.3.2 MANAGED SERVICES

- 6.3.2.1 Need for comprehensive, continuous management and monitoring organizations' security posture to propel market

- TABLE 44 MANAGED SERVICES: MIDDLE EAST CYBERSECURITY MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 45 MANAGED SERVICES: MIDDLE EAST CYBERSECURITY MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

7 MIDDLE EAST CYBERSECURITY MARKET, BY SOLUTION TYPE

- 7.1 INTRODUCTION

- 7.1.1 SOLUTION TYPES: MIDDLE EAST CYBERSECURITY MARKET DRIVERS

- FIGURE 28 LOG MANAGEMENT & SIEM SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 46 MIDDLE EAST CYBERSECURITY MARKET, BY SOLUTION TYPE, 2017-2022 (USD MILLION)

- TABLE 47 MIDDLE EAST CYBERSECURITY MARKET, BY SOLUTION TYPE, 2023-2028 (USD MILLION)

- 7.2 IDENTITY & ACCESS MANAGEMENT

- 7.2.1 IDENTITY & ACCESS MANAGEMENT TO SAFEGUARD CONTROL SYSTEMS, AUTOMATION PROCESSES, AND NETWORK RESOURCES

- TABLE 48 IDENTITY & ACCESS MANAGEMENT: MIDDLE EAST CYBERSECURITY MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 49 IDENTITY & ACCESS MANAGEMENT: MIDDLE EAST CYBERSECURITY MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 7.3 ANTIVIRUS/ANTIMALWARE

- 7.3.1 NEED TO PROTECT ICS FROM EXTERNAL SECURITY BREACHES AND IDENTIFY, PREVENT, AND ELIMINATE MALICIOUS SOFTWARE ATTACKS TO PROPEL MARKET

- TABLE 50 ANTIVIRUS/ANTIMALWARE: MIDDLE EAST CYBERSECURITY MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 51 ANTIVIRUS/ANTIMALWARE: MIDDLE EAST CYBERSECURITY MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 7.4 LOG MANAGEMENT & SIEM

- 7.4.1 LOG MANAGEMENT & SIEM TO HELP MONITOR ORGANIZATIONS' SECURITY POSTURE AND CONDUCT FORENSIC DATA ANALYSIS

- TABLE 52 LOG MANAGEMENT & SIEM: MIDDLE EAST CYBERSECURITY MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 53 LOG MANAGEMENT & SIEM: MIDDLE EAST CYBERSECURITY MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 7.5 FIREWALLS

- 7.5.1 FIREWALLS TO HELP DETECT APPLICATION-SPECIFIC ATTACKS AND MONITOR AND CONTROL INCOMING AND OUTGOING NETWORK TRAFFIC

- TABLE 54 FIREWALLS: MIDDLE EAST CYBERSECURITY MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 55 FIREWALLS: MIDDLE EAST CYBERSECURITY MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 7.6 ENCRYPTION & TOKENIZATION

- 7.6.1 ENCRYPTION SOFTWARE TO OFFER COMPREHENSIVE RISK MITIGATION FOR INTENTIONAL AND ACCIDENTAL DATA BREACHES

- TABLE 56 ENCRYPTION & TOKENIZATION: MIDDLE EAST CYBERSECURITY MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 57 ENCRYPTION & TOKENIZATION: MIDDLE EAST CYBERSECURITY MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 7.7 COMPLIANCE & POLICY MANAGEMENT

- 7.7.1 COMPLIANCE & POLICY MANAGEMENT TO IDENTIFY, ASSESS, RESPOND, AND IMPLEMENT ACTIVITIES TO CONTROL POTENTIAL RISKS

- TABLE 58 COMPLIANCE & POLICY MANAGEMENT: MIDDLE EAST CYBERSECURITY MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 59 COMPLIANCE & POLICY MANAGEMENT: MIDDLE EAST CYBERSECURITY MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 7.8 PATCH MANAGEMENT

- 7.8.1 PATCH MANAGEMENT TO MINIMIZE DOWNTIME AND ENSURE COMPLIANCE WITH EVER-EVOLVING CYBERSECURITY STANDARDS

- TABLE 60 PATCH MANAGEMENT: MIDDLE EAST CYBERSECURITY MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 61 PATCH MANAGEMENT: MIDDLE EAST CYBERSECURITY MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 7.9 OTHER SOLUTION TYPES

- TABLE 62 OTHER SOLUTION TYPES: MIDDLE EAST CYBERSECURITY MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 63 OTHER SOLUTION TYPES: MIDDLE EAST CYBERSECURITY MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

8 MIDDLE EAST CYBERSECURITY MARKET, BY SECURITY TYPE

- 8.1 INTRODUCTION

- 8.1.1 SECURITY TYPES: MIDDLE EAST CYBERSECURITY MARKET DRIVERS

- FIGURE 29 CLOUD SECURITY SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 64 MIDDLE EAST CYBERSECURITY MARKET, BY SECURITY TYPE, 2017-2022 (USD MILLION)

- TABLE 65 MIDDLE EAST CYBERSECURITY MARKET, BY SECURITY TYPE, 2023-2028 (USD MILLION)

- 8.2 NETWORK SECURITY

- 8.2.1 NEED TO SECURE NETWORKS FROM ADVANCED THREATS BY COLLECTING AND ANALYZING EVENT INFORMATION TYPES

- TABLE 66 NETWORK SECURITY: MIDDLE EAST CYBERSECURITY MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 67 NETWORK SECURITY: MIDDLE EAST CYBERSECURITY MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 8.3 ENDPOINT & IOT SECURITY

- 8.3.1 ENDPOINT & IOT SECURITY TO PROTECT PERSONAL DEVICES FROM MALWARE ATTACKS

- TABLE 68 ENDPOINT & IOT SECURITY: MIDDLE EAST CYBERSECURITY MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 69 ENDPOINT & IOT SECURITY: MIDDLE EAST CYBERSECURITY MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 8.4 CLOUD SECURITY

- 8.4.1 INCREASED ADOPTION OF CLOUD SOLUTIONS ACROSS ENTERPRISES TO DRIVE DEMAND FOR CLOUD SECURITY SOLUTIONS

- TABLE 70 CLOUD SECURITY: MIDDLE EAST CYBERSECURITY MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 71 CLOUD SECURITY: MIDDLE EAST CYBERSECURITY MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 8.5 APPLICATION SECURITY

- 8.5.1 APPLICATION SECURITY TO ENSURE DATA CONFIDENTIALITY, ALONG WITH TRANSPARENCY AND VISIBILITY AMONG BUSINESS PROCESSES

- TABLE 72 APPLICATION SECURITY: MIDDLE EAST CYBERSECURITY MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 73 APPLICATION SECURITY: MIDDLE EAST CYBERSECURITY MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

9 MIDDLE EAST CYBERSECURITY MARKET, BY DEPLOYMENT MODE

- 9.1 INTRODUCTION

- 9.1.1 DEPLOYMENT MODES: MIDDLE EAST CYBERSECURITY MARKET DRIVERS

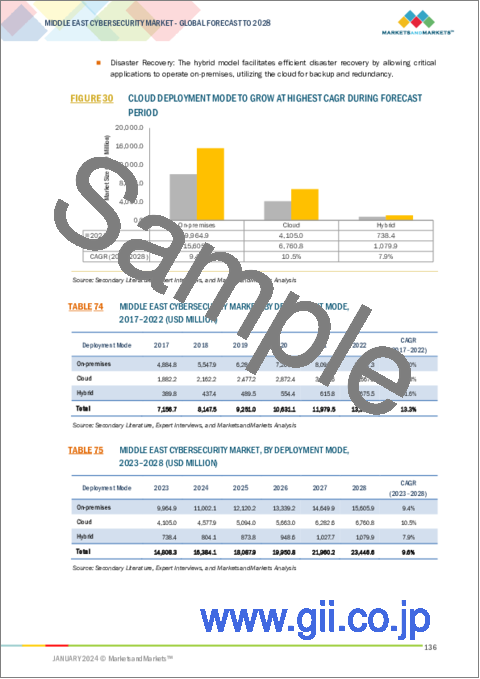

- FIGURE 30 CLOUD DEPLOYMENT MODE TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 74 MIDDLE EAST CYBERSECURITY MARKET, BY DEPLOYMENT MODE, 2017-2022 (USD MILLION)

- TABLE 75 MIDDLE EAST CYBERSECURITY MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- 9.2 ON-PREMISES

- 9.2.1 NEED TO HEIGHTEN SECURITY MEASURES AND FOSTER ENHANCED CONTROL TO FUEL DEMAND FOR ON-PREMISE CYBERSECURITY SOLUTIONS

- TABLE 76 ON-PREMISES: MIDDLE EAST CYBERSECURITY MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 77 ON-PREMISES: MIDDLE EAST CYBERSECURITY MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 9.3 CLOUD

- 9.3.1 NEED FOR AGILITY AND COST-EFFICIENCY TO BOOST DEMAND FOR CLOUD DEPLOYMENT MODE

- TABLE 78 CLOUD: MIDDLE EAST CYBERSECURITY MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 79 CLOUD: MIDDLE EAST CYBERSECURITY MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 9.4 HYBRID

- 9.4.1 NEED FOR OPTIMIZING PERFORMANCE AND COST-EFFECTIVENESS TO DRIVE DEMAND FOR HYBRID DEPLOYMENT MODE

- TABLE 80 HYBRID: MIDDLE EAST CYBERSECURITY MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 81 HYBRID: MIDDLE EAST CYBERSECURITY MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

10 MIDDLE EAST CYBERSECURITY MARKET, BY ORGANIZATION SIZE

- 10.1 INTRODUCTION

- 10.1.1 ORGANIZATION SIZES: MIDDLE EAST CYBERSECURITY MARKET DRIVERS

- FIGURE 31 LARGE ENTERPRISES SEGMENT TO HOLD LARGER MARKET DURING FORECAST PERIOD

- TABLE 82 MIDDLE EAST CYBERSECURITY MARKET, BY ORGANIZATION SIZE, 2017-2022 (USD MILLION)

- TABLE 83 MIDDLE EAST CYBERSECURITY MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- 10.2 LARGE ENTERPRISES

- 10.2.1 LARGE ENTERPRISES TO ADOPT CYBERSECURITY MEASURES TO SAFEGUARD NETWORKS FROM UNAUTHORIZED USAGE AND MALICIOUS RANSOMWARE ATTACKS

- TABLE 84 LARGE ENTERPRISES: MIDDLE EAST CYBERSECURITY MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 85 LARGE ENTERPRISES: MIDDLE EAST CYBERSECURITY MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 10.3 SMALL AND MEDIUM-SIZED ENTERPRISES

- 10.3.1 SMES TO PRIORITIZE CYBERSECURITY TO STREAMLINE OPERATIONS, ENHANCE MOBILITY, ELIMINATE ON-PREMISE INFRASTRUCTURE, AND REDUCE OPERATING COSTS

- TABLE 86 SMALL AND MEDIUM-SIZED ENTERPRISES: MIDDLE EAST CYBERSECURITY MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 87 SMALL AND MEDIUM-SIZED ENTERPRISES: MIDDLE EAST CYBERSECURITY MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

11 MIDDLE EAST CYBERSECURITY MARKET, BY VERTICAL

- 11.1 INTRODUCTION

- 11.1.1 VERTICALS: MIDDLE EAST CYBERSECURITY MARKET DRIVERS

- FIGURE 32 BFSI VERTICAL TO ACCOUNT FOR LARGEST MARKET DURING FORECAST PERIOD

- TABLE 88 MIDDLE EAST CYBERSECURITY MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 89 MIDDLE EAST CYBERSECURITY MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 11.2 GOVERNMENT

- 11.2.1 NEED FOR MONITORING CYBER RISKS AND ADHERENCE TO NCA CONTROLS TO BOOST DEMAND FOR CYBERSECURITY SOLUTIONS IN GOVERNMENT SECTOR

- TABLE 90 GOVERNMENT: MIDDLE EAST CYBERSECURITY MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 91 GOVERNMENT: MIDDLE EAST CYBERSECURITY MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 11.3 BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI)

- 11.3.1 RELIANCE ON TECHNOLOGY AND NEED TO HANDLE SENSITIVE FINANCIAL DATA TO DRIVE DEMAND FOR CYBERSECURITY IN BFSI VERTICAL

- TABLE 92 BFSI: MIDDLE EAST CYBERSECURITY MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 93 BFSI: MIDDLE EAST CYBERSECURITY MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 11.4 IT & ITES

- 11.4.1 PRESENCE OF LARGE AMOUNTS OF DATA TO BOOST DEMAND FOR CYBERSECURITY IN IT & ITES ORGANIZATIONS

- TABLE 94 IT & ITES: MIDDLE EAST CYBERSECURITY MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 95 IT & ITES: MIDDLE EAST CYBERSECURITY MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 11.5 HEALTHCARE & LIFE SCIENCES

- 11.5.1 NEED TO PROTECT SENSITIVE PATIENT DATA AND PREVENT INTERNAL AND EXTERNAL THREATS TO PROPEL DEMAND FOR CYBERSECURITY IN HEALTHCARE SECTOR

- TABLE 96 HEALTHCARE & LIFE SCIENCES: MIDDLE EAST CYBERSECURITY MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 97 HEALTHCARE & LIFE SCIENCES: MIDDLE EAST CYBERSECURITY MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 11.6 AEROSPACE & DEFENSE

- 11.6.1 CYBERSECURITY APPLICATIONS TO ENHANCE THREAT DETECTION CAPABILITIES AND ADDRESS REAL-TIME INTRUSIONS IN AEROSPACE & DEFENSE SECTOR

- TABLE 98 AEROSPACE & DEFENSE: MIDDLE EAST CYBERSECURITY MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 99 AEROSPACE & DEFENSE: MIDDLE EAST CYBERSECURITY MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 11.7 RETAIL & ECOMMERCE

- 11.7.1 NEED TO PROTECT STORES AND WAREHOUSES AMID GROWING ECOMMERCE VULNERABILITIES TO DRIVE MARKET

- TABLE 100 RETAIL & ECOMMERCE: MIDDLE EAST CYBERSECURITY MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 101 RETAIL & ECOMMERCE: MIDDLE EAST CYBERSECURITY MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 11.8 MANUFACTURING

- 11.8.1 CYBERSECURITY SOLUTIONS TO HELP MANAGE RISKS, ENHANCE BUSINESS AGILITY, AND ENSURE COMPLIANCE PRODUCTIVITY IN MANUFACTURING SECTOR

- TABLE 102 MANUFACTURING: MIDDLE EAST CYBERSECURITY MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 103 MANUFACTURING: MIDDLE EAST CYBERSECURITY MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 11.9 ENERGY & UTILITIES

- 11.9.1 ENERGY & UTILITIES ORGANIZATIONS TO PROTECT CRITICAL ASSETS AND ENHANCE LOCAL CYBERSECURITY CAPABILITIES

- TABLE 104 ENERGY & UTILITIES: MIDDLE EAST CYBERSECURITY MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 105 ENERGY & UTILITIES: MIDDLE EAST CYBERSECURITY MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 11.10 TELECOMMUNICATIONS

- 11.10.1 TELECOMMUNICATION COMPANIES TO ADOPT CYBERSECURITY SOLUTIONS TO MANAGE RISKS AND COMPLIANCES EFFICIENTLY

- TABLE 106 TELECOMMUNICATIONS: MIDDLE EAST CYBERSECURITY MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 107 TELECOMMUNICATIONS: MIDDLE EAST CYBERSECURITY MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 11.11 TRANSPORTATION & LOGISTICS

- 11.11.1 TRANSPORTATION & LOGISTICS VENDORS TO IMPLEMENT CYBERSECURITY SOLUTIONS TO DETECT, RESPOND, AND MANAGE RISKS QUICKLY

- TABLE 108 TRANSPORTATION & LOGISTICS: MIDDLE EAST CYBERSECURITY MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 109 TRANSPORTATION & LOGISTICS: MIDDLE EAST CYBERSECURITY MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 11.12 MEDIA & ENTERTAINMENT

- 11.12.1 RISING SOPHISTICATED CYBER THREATS IN MEDIA & ENTERTAINMENT INDUSTRY TO DRIVE DEMAND FOR CYBERSECURITY SOLUTIONS

- TABLE 110 MEDIA & ENTERTAINMENT: MIDDLE EAST CYBERSECURITY MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 111 MEDIA & ENTERTAINMENT: MIDDLE EAST CYBERSECURITY MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 11.13 OTHER VERTICALS

- TABLE 112 OTHER VERTICALS: MIDDLE EAST CYBERSECURITY MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 113 OTHER VERTICALS: MIDDLE EAST CYBERSECURITY MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

12 MIDDLE EAST CYBERSECURITY MARKET, BY REGION

- 12.1 INTRODUCTION

- FIGURE 33 REST OF MIDDLE EAST SUBREGION TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- TABLE 114 MIDDLE EAST CYBERSECURITY MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 115 MIDDLE EAST CYBERSECURITY MARKET, BY REGION, 2023-2028 (USD MILLION)

- 12.2 MIDDLE EAST

- 12.2.1 REGION: MIDDLE EAST CYBERSECURITY MARKET DRIVERS

- 12.2.2 MIDDLE EAST: RECESSION IMPACT

- 12.2.3 MIDDLE EAST: REGULATORY LANDSCAPE

- FIGURE 34 MIDDLE EAST CYBERSECURITY MARKET OUTLOOK

- TABLE 116 MIDDLE EAST CYBERSECURITY MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 117 MIDDLE EAST CYBERSECURITY MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 118 MIDDLE EAST CYBERSECURITY MARKET, BY SOLUTION, 2017-2022 (USD MILLION)

- TABLE 119 MIDDLE EAST CYBERSECURITY MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 120 MIDDLE EAST CYBERSECURITY MARKET, BY SOLUTION TYPE, 2017-2022 (USD MILLION)

- TABLE 121 MIDDLE EAST CYBERSECURITY MARKET, BY SOLUTION TYPE, 2023-2028 (USD MILLION)

- TABLE 122 MIDDLE EAST CYBERSECURITY MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 123 MIDDLE EAST CYBERSECURITY MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 124 MIDDLE EAST CYBERSECURITY MARKET, BY PROFESSIONAL SERVICE, 2017-2022 (USD MILLION)

- TABLE 125 MIDDLE EAST CYBERSECURITY MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 126 MIDDLE EAST CYBERSECURITY MARKET, BY SECURITY TYPE, 2017-2022 (USD MILLION)

- TABLE 127 MIDDLE EAST CYBERSECURITY MARKET, BY SECURITY TYPE, 2023-2028 (USD MILLION)

- TABLE 128 MIDDLE EAST CYBERSECURITY MARKET, BY DEPLOYMENT MODE, 2017-2022 (USD MILLION)

- TABLE 129 MIDDLE EAST CYBERSECURITY MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 130 MIDDLE EAST CYBERSECURITY MARKET, BY ORGANIZATION SIZE, 2017-2022 (USD MILLION)

- TABLE 131 MIDDLE EAST CYBERSECURITY MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 132 MIDDLE EAST CYBERSECURITY MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 133 MIDDLE EAST CYBERSECURITY MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 12.3 GCC COUNTRIES

- TABLE 134 GCC COUNTRIES: MIDDLE EAST CYBERSECURITY MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 135 GCC COUNTRIES: MIDDLE EAST CYBERSECURITY MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 12.3.1 UAE

- 12.3.1.1 Investment in advanced cybersecurity technologies and guidelines from Telecom Regulatory Authority to drive market

- TABLE 136 UAE: CYBERSECURITY MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 137 UAE: CYBERSECURITY MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 138 UAE: CYBERSECURITY MARKET, BY SOLUTION, 2017-2022 (USD MILLION)

- TABLE 139 UAE: CYBERSECURITY MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 140 UAE: CYBERSECURITY MARKET, BY SOLUTION TYPE, 2017-2022 (USD MILLION)

- TABLE 141 UAE: CYBERSECURITY MARKET, BY SOLUTION TYPE, 2023-2028 (USD MILLION)

- TABLE 142 UAE: CYBERSECURITY MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 143 UAE: CYBERSECURITY MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 144 UAE: CYBERSECURITY MARKET, BY PROFESSIONAL SERVICE, 2017-2022 (USD MILLION)

- TABLE 145 UAE: CYBERSECURITY MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 146 UAE: CYBERSECURITY MARKET, BY SECURITY TYPE, 2017-2022 (USD MILLION)

- TABLE 147 UAE: CYBERSECURITY MARKET, BY SECURITY TYPE, 2023-2028 (USD MILLION)

- TABLE 148 UAE: CYBERSECURITY MARKET, BY DEPLOYMENT MODE, 2017-2022 (USD MILLION)

- TABLE 149 UAE: CYBERSECURITY MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 150 UAE: CYBERSECURITY MARKET, BY ORGANIZATION SIZE, 2017-2022 (USD MILLION)

- TABLE 151 UAE: CYBERSECURITY MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 152 UAE: CYBERSECURITY MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 153 UAE: CYBERSECURITY MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 12.3.2 KSA

- 12.3.2.1 Vision 2030 initiative, increased internet adoption, and strong regulatory framework to fuel demand for cybersecurity

- TABLE 154 KSA: CYBERSECURITY MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 155 KSA: CYBERSECURITY MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 156 KSA: CYBERSECURITY MARKET, BY SOLUTION, 2017-2022 (USD MILLION)

- TABLE 157 KSA: CYBERSECURITY MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 158 KSA: CYBERSECURITY MARKET, BY SOLUTION TYPE, 2017-2022 (USD MILLION)

- TABLE 159 KSA: CYBERSECURITY MARKET, BY SOLUTION TYPE, 2023-2028 (USD MILLION)

- TABLE 160 KSA: CYBERSECURITY MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 161 KSA: CYBERSECURITY MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 162 KSA: CYBERSECURITY MARKET, BY PROFESSIONAL SERVICE, 2017-2022 (USD MILLION)

- TABLE 163 KSA: CYBERSECURITY MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 164 KSA: CYBERSECURITY MARKET, BY SECURITY TYPE, 2017-2022 (USD MILLION)

- TABLE 165 KSA: CYBERSECURITY MARKET, BY SECURITY TYPE, 2023-2028 (USD MILLION)

- TABLE 166 KSA: CYBERSECURITY MARKET, BY DEPLOYMENT MODE, 2017-2022 (USD MILLION)

- TABLE 167 KSA: CYBERSECURITY MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 168 KSA: CYBERSECURITY MARKET, BY ORGANIZATION SIZE, 2017-2022 (USD MILLION)

- TABLE 169 KSA: CYBERSECURITY MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 170 KSA: CYBERSECURITY MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 171 KSA: CYBERSECURITY MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 12.3.3 QATAR

- 12.3.3.1 Increased internet penetration, protection of critical infrastructure, government initiatives, and heightened awareness of cyber threats to propel market

- TABLE 172 QATAR: CYBERSECURITY MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 173 QATAR: CYBERSECURITY MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 174 QATAR: CYBERSECURITY MARKET, BY SOLUTION, 2017-2022 (USD MILLION)

- TABLE 175 QATAR: CYBERSECURITY MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 176 QATAR: CYBERSECURITY MARKET, BY SOLUTION TYPE, 2017-2022 (USD MILLION)

- TABLE 177 QATAR: CYBERSECURITY MARKET, BY SOLUTION TYPE, 2023-2028 (USD MILLION)

- TABLE 178 QATAR: CYBERSECURITY MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 179 QATAR: CYBERSECURITY MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 180 QATAR: CYBERSECURITY MARKET, BY PROFESSIONAL SERVICE, 2017-2022 (USD MILLION)

- TABLE 181 QATAR: CYBERSECURITY MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 182 QATAR: CYBERSECURITY MARKET, BY SECURITY TYPE, 2017-2022 (USD MILLION)

- TABLE 183 QATAR: CYBERSECURITY MARKET, BY SECURITY TYPE, 2023-2028 (USD MILLION)

- TABLE 184 QATAR: CYBERSECURITY MARKET, BY DEPLOYMENT MODE, 2017-2022 (USD MILLION)

- TABLE 185 QATAR: CYBERSECURITY MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 186 QATAR: CYBERSECURITY MARKET, BY ORGANIZATION SIZE, 2017-2022 (USD MILLION)

- TABLE 187 QATAR: CYBERSECURITY MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 188 QATAR: CYBERSECURITY MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 189 QATAR: CYBERSECURITY MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 12.3.4 BAHRAIN

- 12.3.4.1 Government initiatives, strategic regional positioning, and focus on protecting critical infrastructures to propel market

- TABLE 190 BAHRAIN: CYBERSECURITY MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 191 BAHRAIN: CYBERSECURITY MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 192 BAHRAIN: CYBERSECURITY MARKET, BY SOLUTION, 2017-2022 (USD MILLION)

- TABLE 193 BAHRAIN: CYBERSECURITY MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 194 BAHRAIN: CYBERSECURITY MARKET, BY SOLUTION TYPE, 2017-2022 (USD MILLION)

- TABLE 195 BAHRAIN: CYBERSECURITY MARKET, BY SOLUTION TYPE, 2023-2028 (USD MILLION)

- TABLE 196 BAHRAIN: CYBERSECURITY MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 197 BAHRAIN: CYBERSECURITY MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 198 BAHRAIN: CYBERSECURITY MARKET, BY PROFESSIONAL SERVICE, 2017-2022 (USD MILLION)

- TABLE 199 BAHRAIN: CYBERSECURITY MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 200 BAHRAIN: CYBERSECURITY MARKET, BY SECURITY TYPE, 2017-2022 (USD MILLION)

- TABLE 201 BAHRAIN: CYBERSECURITY MARKET, BY SECURITY TYPE, 2023-2028 (USD MILLION)

- TABLE 202 BAHRAIN: CYBERSECURITY MARKET, BY DEPLOYMENT MODE, 2017-2022 (USD MILLION)

- TABLE 203 BAHRAIN: CYBERSECURITY MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 204 BAHRAIN: CYBERSECURITY MARKET, BY ORGANIZATION SIZE, 2017-2022 (USD MILLION)

- TABLE 205 BAHRAIN: CYBERSECURITY MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 206 BAHRAIN: CYBERSECURITY MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 207 BAHRAIN: CYBERSECURITY MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 12.3.5 OMAN

- 12.3.5.1 Government's focus on digital transformation, economic diversification, and increasing awareness of cyber threats to drive market

- TABLE 208 OMAN: CYBERSECURITY MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 209 OMAN: CYBERSECURITY MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 210 OMAN: CYBERSECURITY MARKET, BY SOLUTION, 2017-2022 (USD MILLION)

- TABLE 211 OMAN: CYBERSECURITY MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 212 OMAN: CYBERSECURITY MARKET, BY SOLUTION TYPE, 2017-2022 (USD MILLION)

- TABLE 213 OMAN: CYBERSECURITY MARKET, BY SOLUTION TYPE, 2023-2028 (USD MILLION)

- TABLE 214 OMAN: CYBERSECURITY MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 215 OMAN: CYBERSECURITY MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 216 OMAN: CYBERSECURITY MARKET, BY PROFESSIONAL SERVICE, 2017-2022 (USD MILLION)

- TABLE 217 OMAN: CYBERSECURITY MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 218 OMAN: CYBERSECURITY MARKET, BY SECURITY TYPE, 2017-2022 (USD MILLION)

- TABLE 219 OMAN: CYBERSECURITY MARKET, BY SECURITY TYPE, 2023-2028 (USD MILLION)

- TABLE 220 OMAN: CYBERSECURITY MARKET, BY DEPLOYMENT MODE, 2017-2022 (USD MILLION)

- TABLE 221 OMAN: CYBERSECURITY MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 222 OMAN: CYBERSECURITY MARKET, BY ORGANIZATION SIZE, 2017-2022 (USD MILLION)

- TABLE 223 OMAN: CYBERSECURITY MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 224 OMAN: CYBERSECURITY MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 225 OMAN: CYBERSECURITY MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 12.3.6 KUWAIT

- 12.3.6.1 Established entities, emerging start-ups, and proactive government initiatives to propel market

- TABLE 226 KUWAIT: CYBERSECURITY MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 227 KUWAIT: CYBERSECURITY MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 228 KUWAIT: CYBERSECURITY MARKET, BY SOLUTION, 2017-2022 (USD MILLION)

- TABLE 229 KUWAIT: CYBERSECURITY MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 230 KUWAIT: CYBERSECURITY MARKET, BY SOLUTION TYPE, 2017-2022 (USD MILLION)

- TABLE 231 KUWAIT: CYBERSECURITY MARKET, BY SOLUTION TYPE, 2023-2028 (USD MILLION)

- TABLE 232 KUWAIT: CYBERSECURITY MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 233 KUWAIT: CYBERSECURITY MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 234 KUWAIT: CYBERSECURITY MARKET, BY PROFESSIONAL SERVICE, 2017-2022 (USD MILLION)

- TABLE 235 KUWAIT: CYBERSECURITY MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 236 KUWAIT: CYBERSECURITY MARKET, BY SECURITY TYPE, 2017-2022 (USD MILLION)

- TABLE 237 KUWAIT: CYBERSECURITY MARKET, BY SECURITY TYPE, 2023-2028 (USD MILLION)

- TABLE 238 KUWAIT: CYBERSECURITY MARKET, BY DEPLOYMENT MODE, 2017-2022 (USD MILLION)

- TABLE 239 KUWAIT: CYBERSECURITY MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 240 KUWAIT: CYBERSECURITY MARKET, BY ORGANIZATION SIZE, 2017-2022 (USD MILLION)

- TABLE 241 KUWAIT: CYBERSECURITY MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 242 KUWAIT: CYBERSECURITY MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 243 KUWAIT: CYBERSECURITY MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 12.4 REST OF MIDDLE EAST

- TABLE 244 REST OF MIDDLE EAST: CYBERSECURITY MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 245 REST OF MIDDLE EAST: CYBERSECURITY MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 12.4.1 ISRAEL

- TABLE 246 ISRAEL: CYBERSECURITY MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 247 ISRAEL: CYBERSECURITY MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 248 ISRAEL: CYBERSECURITY MARKET, BY SOLUTION, 2017-2022 (USD MILLION)

- TABLE 249 ISRAEL: CYBERSECURITY MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 250 ISRAEL: CYBERSECURITY MARKET, BY SOLUTION TYPE, 2017-2022 (USD MILLION)

- TABLE 251 ISRAEL: CYBERSECURITY MARKET, BY SOLUTION TYPE, 2023-2028 (USD MILLION)

- TABLE 252 ISRAEL: CYBERSECURITY MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 253 ISRAEL: CYBERSECURITY MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 254 ISRAEL: CYBERSECURITY MARKET, BY PROFESSIONAL SERVICE, 2017-2022 (USD MILLION)

- TABLE 255 ISRAEL: CYBERSECURITY MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 256 ISRAEL: CYBERSECURITY MARKET, BY SECURITY TYPE, 2017-2022 (USD MILLION)

- TABLE 257 ISRAEL: CYBERSECURITY MARKET, BY SECURITY TYPE, 2023-2028 (USD MILLION)

- TABLE 258 ISRAEL: CYBERSECURITY MARKET, BY DEPLOYMENT MODE, 2017-2022 (USD MILLION)

- TABLE 259 ISRAEL: CYBERSECURITY MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 260 ISRAEL: CYBERSECURITY MARKET, BY ORGANIZATION SIZE, 2017-2022 (USD MILLION)

- TABLE 261 ISRAEL: CYBERSECURITY MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 262 ISRAEL: CYBERSECURITY MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 263 ISRAEL: CYBERSECURITY MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 12.4.2 EGYPT

- TABLE 264 EGYPT: CYBERSECURITY MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 265 EGYPT: CYBERSECURITY MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 266 EGYPT: CYBERSECURITY MARKET, BY SOLUTION, 2017-2022 (USD MILLION)

- TABLE 267 EGYPT: CYBERSECURITY MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 268 EGYPT: CYBERSECURITY MARKET, BY SOLUTION TYPE, 2017-2022 (USD MILLION)

- TABLE 269 EGYPT: CYBERSECURITY MARKET, BY SOLUTION TYPE, 2023-2028 (USD MILLION)

- TABLE 270 EGYPT: CYBERSECURITY MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 271 EGYPT: CYBERSECURITY MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 272 EGYPT: CYBERSECURITY MARKET, BY PROFESSIONAL SERVICE, 2017-2022 (USD MILLION)

- TABLE 273 EGYPT: CYBERSECURITY MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 274 EGYPT: CYBERSECURITY MARKET, BY SECURITY TYPE, 2017-2022 (USD MILLION)

- TABLE 275 EGYPT: CYBERSECURITY MARKET, BY SECURITY TYPE, 2023-2028 (USD MILLION)

- TABLE 276 EGYPT: CYBERSECURITY MARKET, BY DEPLOYMENT MODE, 2017-2022 (USD MILLION)

- TABLE 277 EGYPT: CYBERSECURITY MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 278 EGYPT: CYBERSECURITY MARKET, BY ORGANIZATION SIZE, 2017-2022 (USD MILLION)

- TABLE 279 EGYPT: CYBERSECURITY MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 280 EGYPT: CYBERSECURITY MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 281 EGYPT: CYBERSECURITY MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 12.4.3 TURKEY

- TABLE 282 TURKEY: CYBERSECURITY MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 283 TURKEY: CYBERSECURITY MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 284 TURKEY: CYBERSECURITY MARKET, BY SOLUTION, 2017-2022 (USD MILLION)

- TABLE 285 TURKEY: CYBERSECURITY MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 286 TURKEY: CYBERSECURITY MARKET, BY SOLUTION TYPE, 2017-2022 (USD MILLION)

- TABLE 287 TURKEY: CYBERSECURITY MARKET, BY SOLUTION TYPE, 2023-2028 (USD MILLION)

- TABLE 288 TURKEY: CYBERSECURITY MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 289 TURKEY: CYBERSECURITY MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 290 TURKEY: CYBERSECURITY MARKET, BY PROFESSIONAL SERVICE, 2017-2022 (USD MILLION)

- TABLE 291 TURKEY: CYBERSECURITY MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 292 TURKEY: CYBERSECURITY MARKET, BY SECURITY TYPE, 2017-2022 (USD MILLION)

- TABLE 293 TURKEY: CYBERSECURITY MARKET, BY SECURITY TYPE, 2023-2028 (USD MILLION)

- TABLE 294 TURKEY: CYBERSECURITY MARKET, BY DEPLOYMENT MODE, 2017-2022 (USD MILLION)

- TABLE 295 TURKEY: CYBERSECURITY MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 296 TURKEY: CYBERSECURITY MARKET, BY ORGANIZATION SIZE, 2017-2022 (USD MILLION)

- TABLE 297 TURKEY: CYBERSECURITY MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 298 TURKEY: CYBERSECURITY MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 299 TURKEY: CYBERSECURITY MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 12.4.4 OTHER COUNTRIES

- TABLE 300 OTHER COUNTRIES: CYBERSECURITY MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 301 OTHER COUNTRIES: CYBERSECURITY MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 302 OTHER COUNTRIES: CYBERSECURITY MARKET, BY SOLUTION, 2017-2022 (USD MILLION)

- TABLE 303 OTHER COUNTRIES: CYBERSECURITY MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 304 OTHER COUNTRIES: CYBERSECURITY MARKET, BY SOLUTION TYPE, 2017-2022 (USD MILLION)

- TABLE 305 OTHER COUNTRIES: CYBERSECURITY MARKET, BY SOLUTION TYPE, 2023-2028 (USD MILLION)

- TABLE 306 OTHER COUNTRIES: CYBERSECURITY MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 307 OTHER COUNTRIES: CYBERSECURITY MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 308 OTHER COUNTRIES: CYBERSECURITY MARKET, BY PROFESSIONAL SERVICE, 2017-2022 (USD MILLION)

- TABLE 309 OTHER COUNTRIES: CYBERSECURITY MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 310 OTHER COUNTRIES: CYBERSECURITY MARKET, BY SECURITY TYPE, 2017-2022 (USD MILLION)

- TABLE 311 OTHER COUNTRIES: CYBERSECURITY MARKET, BY SECURITY TYPE, 2023-2028 (USD MILLION)

- TABLE 312 OTHER COUNTRIES: CYBERSECURITY MARKET, BY DEPLOYMENT MODE, 2017-2022 (USD MILLION)

- TABLE 313 OTHER COUNTRIES: CYBERSECURITY MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 314 OTHER COUNTRIES: CYBERSECURITY MARKET, BY ORGANIZATION SIZE, 2017-2022 (USD MILLION)

- TABLE 315 OTHER COUNTRIES: CYBERSECURITY MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 316 OTHER COUNTRIES: CYBERSECURITY MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 317 OTHER COUNTRIES: CYBERSECURITY MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

13 COMPETITIVE LANDSCAPE

- 13.1 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 13.2 REVENUE ANALYSIS

- FIGURE 35 KEY PLAYERS DOMINATING MARKET IN LAST FIVE YEARS

- 13.3 MARKET SHARE ANALYSIS

- FIGURE 36 MIDDLE EAST CYBERSECURITY MARKET: SHARE OF LEADING COMPANIES

- TABLE 318 MIDDLE EAST CYBERSECURITY MARKET: DEGREE OF COMPETITION

- 13.4 COMPANY EVALUATION MATRIX FOR KEY PLAYERS

- 13.4.1 STARS

- 13.4.2 EMERGING LEADERS

- 13.4.3 PERVASIVE PLAYERS

- 13.4.4 PARTICIPANTS

- FIGURE 37 MIDDLE EAST CYBERSECURITY MARKET: COMPANY EVALUATION MATRIX FOR KEY PLAYERS, 2023

- 13.4.5 COMPANY FOOTPRINT

- FIGURE 38 MIDDLE EAST CYBERSECURITY MARKET: OVERALL COMPANY FOOTPRINT

- TABLE 319 MIDDLE EAST CYBERSECURITY MARKET: COMPANY VERTICAL FOOTPRINT

- TABLE 320 MIDDLE EAST CYBERSECURITY MARKET: COMPANY COUNTRY FOOTPRINT

- 13.5 START-UPS/SMES EVALUATION MATRIX

- 13.5.1 PROGRESSIVE COMPANIES

- 13.5.2 RESPONSIVE COMPANIES

- 13.5.3 DYNAMIC COMPANIES

- 13.5.4 STARTING BLOCKS

- FIGURE 39 MIDDLE EAST CYBERSECURITY MARKET: START-UP/SME EVALUATION MATRIX, 2023

- 13.5.5 COMPETITIVE BENCHMARKING

- TABLE 321 MIDDLE EAST CYBERSECURITY MARKET: KEY START-UPS/SMES

- TABLE 322 MIDDLE EAST CYBERSECURITY MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES, BY VERTICAL

- TABLE 323 MIDDLE EAST CYBERSECURITY MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES, BY COUNTRY

- 13.6 COMPETITIVE SCENARIO

- 13.6.1 PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 324 MIDDLE EAST CYBERSECURITY MARKET: PRODUCT LAUNCHES & ENHANCEMENTS, FEBRUARY 2021-DECEMBER 2023

- 13.6.2 DEALS

- TABLE 325 MIDDLE EAST CYBERSECURITY MARKET: DEALS, MARCH 2021-JANUARY 2024

14 COMPANY PROFILES

- (Business overview, Products/Services/Solutions offered, Recent Developments, MNM view)**

- 14.1 KEY PLAYERS

- 14.1.1 IBM

- TABLE 326 IBM: COMPANY OVERVIEW

- FIGURE 40 IBM: COMPANY SNAPSHOT

- TABLE 327 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 328 IBM: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 329 IBM: DEALS

- 14.1.2 CISCO

- TABLE 330 CISCO: COMPANY OVERVIEW

- FIGURE 41 CISCO: COMPANY SNAPSHOT

- TABLE 331 CISCO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 332 CISCO: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 333 CISCO: DEALS

- 14.1.3 PALO ALTO NETWORKS

- TABLE 334 PALO ALTO NETWORKS: COMPANY OVERVIEW

- FIGURE 42 PALO ALTO NETWORKS: COMPANY SNAPSHOT

- TABLE 335 PALO ALTO NETWORKS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 336 PALO ALTO NETWORKS: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 337 PALO ALTO NETWORKS: DEALS

- 14.1.4 CHECK POINT

- TABLE 338 CHECK POINT: COMPANY OVERVIEW

- FIGURE 43 CHECK POINT: COMPANY SNAPSHOT

- TABLE 339 CHECK POINT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 340 CHECK POINT: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 341 CHECK POINT: DEALS

- 14.1.5 TREND MICRO

- TABLE 342 TREND MICRO: COMPANY OVERVIEW

- FIGURE 44 TREND MICRO: COMPANY SNAPSHOT

- TABLE 343 TREND MICRO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 344 TREND MICRO: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 345 TREND MICRO: DEALS

- TABLE 346 TREND MICRO: OTHERS

- 14.1.6 FORTINET

- TABLE 347 FORTINET: COMPANY OVERVIEW

- FIGURE 45 FORTINET: COMPANY SNAPSHOT

- TABLE 348 FORTINET: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 349 FORTINET: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 350 FORTINET: DEALS

- 14.1.7 BROADCOM

- TABLE 351 BROADCOM: COMPANY OVERVIEW

- FIGURE 46 BROADCOM: COMPANY SNAPSHOT

- TABLE 352 BROADCOM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 353 BROADCOM: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 354 BROADCOM: DEALS

- 14.1.8 SOPHOS

- TABLE 355 SOPHOS: COMPANY OVERVIEW

- TABLE 356 SOPHOS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 357 SOPHOS: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 358 SOPHOS: DEALS

- 14.1.9 TRELLIX

- TABLE 359 TRELLIX: COMPANY OVERVIEW

- TABLE 360 TRELLIX: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 361 TRELLIX: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 362 TRELLIX: DEALS

- 14.1.10 EDGE GROUP

- TABLE 363 EDGE GROUP: COMPANY OVERVIEW

- TABLE 364 EDGE GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 365 EDGE GROUP: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 366 EDGE GROUP: DEALS

- 14.1.11 SECUREWORKS

- TABLE 367 SECUREWORKS: COMPANY OVERVIEW

- FIGURE 47 SECUREWORKS: COMPANY SNAPSHOT

- TABLE 368 SECUREWORKS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 369 SECUREWORKS: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 370 SECUREWORKS: DEALS

- 14.1.12 CPX

- TABLE 371 CPX: COMPANY OVERVIEW

- TABLE 372 CPX: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 373 CPX: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 374 CPX: DEALS

- 14.1.13 MDS UAE

- TABLE 375 MDS UAE: COMPANY OVERVIEW

- TABLE 376 MDS UAE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 14.1.14 FORESCOUT

- TABLE 377 FORESCOUT: COMPANY OVERVIEW

- TABLE 378 FORESCOUT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 379 FORESCOUT: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 380 FORESCOUT: DEALS

- 14.1.15 PROTIVITI

- TABLE 381 PROTIVITI: COMPANY OVERVIEW

- TABLE 382 PROTIVITI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 14.1.16 MANDIANT

- TABLE 383 MANDIANT: COMPANY OVERVIEW

- TABLE 384 MANDIANT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 385 MANDIANT: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 386 MANDIANT: DEALS

- 14.1.17 LOGRHYTHM

- TABLE 387 LOGRHYTHM: COMPANY OVERVIEW

- TABLE 388 LOGRHYTHM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 389 LOGRHYTHM: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 390 LOGRHYTHM: DEALS

- 14.2 OTHER PLAYERS

- 14.2.1 HELP AG

- 14.2.2 MORO HUB

- 14.2.3 DTS SOLUTION

- 14.2.4 RAS INFOTECH

- 14.2.5 SPIDERSILK

- 14.2.6 CYBERSEC CONSULTING

- 14.2.7 CODEGREEN SYSTEMS

- 14.2.8 MALWAREBYTES

- 14.2.9 SAFE DECISION

- 14.2.10 SECURITY MATTERZ

- 14.2.11 CATO NETWORKS

- 14.2.12 CYBERGATE DEFENSE

- *Details on Business overview, Products/Services/Solutions offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

15 ADJACENT MARKETS

- TABLE 391 ADJACENT MARKETS AND FORECASTS

- 15.1 LIMITATIONS

- 15.1.1 MIDDLE EAST AND AFRICA CYBERSECURITY MARKET

- TABLE 392 MIDDLE EAST AND AFRICA CYBERSECURITY MARKET, BY DEPLOYMENT MODE, 2017-2022 (USD MILLION)

- TABLE 393 MIDDLE EAST AND AFRICA CYBERSECURITY MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 394 CLOUD: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 395 CLOUD: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 396 ON-PREMISES: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 397 ON-PREMISES: MIDDLE EAST AND AFRICA CYBERSECURITY MARKET, BY REGION, 2023-2028 (USD MILLION)

- 15.1.2 CYBERSECURITY MARKET

- TABLE 398 CYBERSECURITY MARKET, BY ORGANIZATION SIZE, 2017-2022 (USD MILLION)

- TABLE 399 CYBERSECURITY MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 400 LARGE ENTERPRISES: CYBERSECURITY MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 401 LARGE ENTERPRISES: CYBERSECURITY MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 402 SMES: CYBERSECURITY MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 403 SMES: CYBERSECURITY MARKET, BY REGION, 2023-2028 (USD MILLION)

16 APPENDIX

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS