|

|

市場調査レポート

商品コード

1781110

全固体電池の世界市場:電池タイプ別、容量別、用途別 - 予測(~2031年)Solid-State Battery Market by Battery Type (Primary, Secondary), Capacity (Below 20 mAh, 20-500 mAh, Above 500 mAh), Application (Consumer Electronics, Electric Vehicles, Medical Devices, Energy Harvesting, Wireless Sensors) - Global Forecast to 2031 |

||||||

カスタマイズ可能

|

|||||||

| 全固体電池の世界市場:電池タイプ別、容量別、用途別 - 予測(~2031年) |

|

出版日: 2025年07月28日

発行: MarketsandMarkets

ページ情報: 英文 243 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

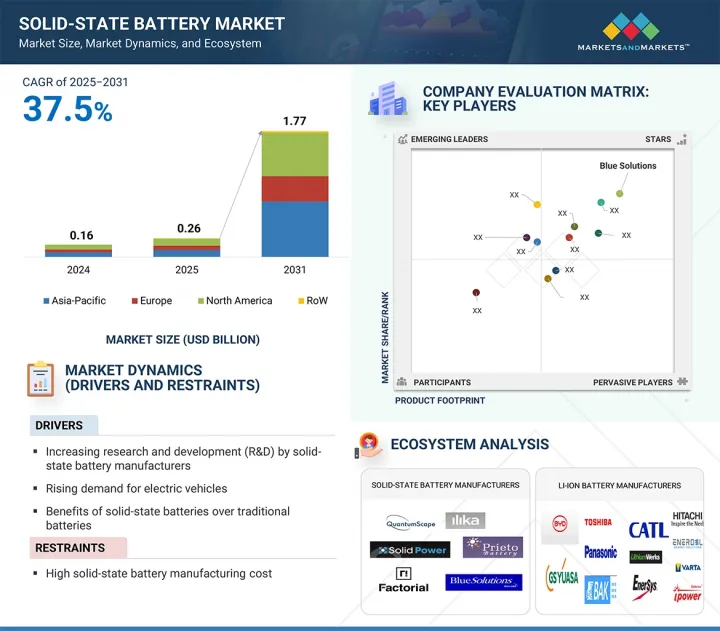

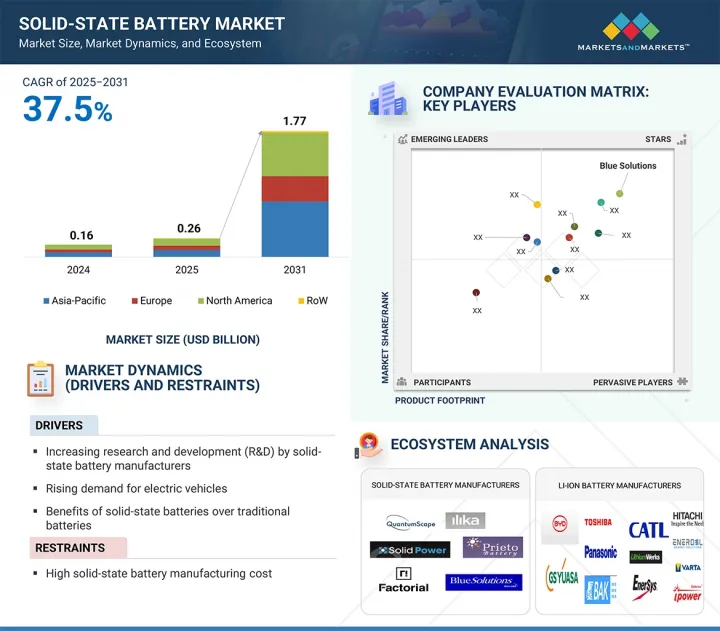

世界の全固体電池市場は2025年の2億6,000万米ドルから2031年までに17億7,000万米ドルに達すると予測され、CAGRで37.5%の成長が見込まれます。

市場は、研究開発投資の増加、エネルギー密度の進歩、より安全でコンパクトな電力ソリューションへの需要の高まりによって、将来的に力強く成長する見込みです。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2031年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2031年 |

| 単位 | 10億米ドル |

| セグメント | 容量、電池タイプ、用途、地域 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

世界が電化に向かう中、全固体電池は優れた安全性と性能で電気自動車、コンシューマーエレクトロニクス、再生可能エネルギー貯蔵を変革する可能性があるとして注目を集めています。まだ試作段階ですが、これらの電池は従来のリチウムイオン技術よりも高速な充電、長いサイクル寿命、高い熱安定性を約束します。主要な電池イノベーターと支援的な政府の取り組みは、試験的な生産を加速し、商業規模の展開に向けた基盤を築きました。産業界がよりレジリエントかつ効率的で持続可能なエネルギー貯蔵ソリューションを求める中、全固体電池は電池の技術革新の次の波において重要な役割を果たすと予測されています。

「二次全固体電池が2031年に最大の市場シェアを獲得します。」

二次(充電式)全固体電池は、電気自動車、コンシューマーエレクトロニクス、再生可能エネルギー貯蔵などの将来の用途の動力源になると予測されています。コンパクトな設計、強化された安全性、より高いエネルギー密度により、スマートフォン、ラップトップ、タブレットなどの次世代デバイスに最適で、より長い電池寿命とスマートなデザインを可能にします。サイズと性能に限界がある従来のリチウムイオン電池とは異なり、二次全固体電池は優れたエネルギー貯蔵と高速充電機能を提供します。電気自動車が高性能で長寿命の電源をますます求めるようになる中、ソリッドステート技術は有望な代替技術として浮上しています。クリーンモビリティと持続可能エネルギーへの世界的なシフトに伴い、二次全固体電池市場は今後数年で大きく成長すると予測されます。

「コンシューマーエレクトロニクス用途セグメントが2025年~2031年に全固体電池市場で2番目に高いCAGRを記録します。」

全固体電池はコンパクトながら、スマートフォン、ラップトップ、タブレット、デジタルカメラなどのコンシューマーエレクトロニクスにおいて、将来にわたる可能性を提供します。従来の液体ベースのセルを固体電解質に置き換えることで、これらの電池は安全性、熱安定性、エネルギー密度を向上させ、より軽量、薄型、高効率のデバイス設計を可能にします。このシフトにより、メーカーは携帯性と耐久性に対する市場の要求に対応することができます。スペースがますます制限されるスマートフォンでは、全固体電池は厳しい設計、温度、安全要件を満たします。物理的損傷に対する高い耐性と過熱リスクの低減により、ハンドヘルドデバイスに特に適しています。ProLogium Technology(台湾)やSakuu Corporation(米国)などの企業は、主流の電子用途向けにこの技術を進めており、電池の小型化、安全性、進化する複雑な設計をサポートする能力により、スマートフォンが早期採用を主導すると予測されています。

「アジア太平洋が全固体電池の革新と製造の中心地として台頭します。」

アジア太平洋が予測期間に全固体電池市場でもっとも高いCAGRを記録する見込みです。同地域は、クリーンエネルギーに対する政府の強力な支援、EVエコシステムの拡大、旺盛な研究開発投資によって、全固体電池の技術革新の重要な拠点となる見通しです。中国、日本、韓国、インドなどの国は、プロトタイプのテストやパイロット生産ラインの開発を積極的に進めており、将来の商業化に向けた基盤作りを行っています。Toyota、Samsung、LGといった主要な電池メーカーが技術の進歩の先頭に立っていることから、この地域は全固体電池技術の拡大において極めて重要な役割を果たすと予測されます。アジア太平洋の確立されたバッテリーサプライチェーン、大量生産に関する専門知識、重要な材料へのアクセスは、全固体電池が大量生産に入ったとき、迅速なコスト削減を可能にし、この地域を今後10年間の次世代エネルギー貯蔵ソリューションの最前線に位置づけます。

当レポートでは、世界の全固体電池市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要な知見

- 全固体電池市場の企業にとって魅力的な機会

- 全固体電池市場:電池タイプ別

- 全固体電池市場:用途別

- アジア太平洋の全固体電池市場:用途別、国別

- 全固体電池市場:国別

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- サプライチェーン分析

- エコシステム分析

- 価格分析

- リチウムイオン電池の平均販売価格の動向(2021年~2033年)

- 全固体電池の価格帯(2024年)

- 全固体電池の価格帯:地域別(2024年)

- カスタマービジネスに影響を与える動向/混乱

- 投資と資金調達のシナリオ

- 技術分析

- 主要技術

- 隣接技術

- 補完技術

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- ケーススタディ分析

- 貿易分析

- 輸入シナリオ(850,650)

- 輸出シナリオ(850,650)

- 特許分析

- 主な会議とイベント(2025年~2026年)

- 基準と規制情勢

- 規制機関、政府機関、その他の組織

- 標準

- 全固体電池市場に対するAI/生成AIの影響

- イントロダクション

- 全固体電池市場に対する影響

- 主なユースケースと市場の将来性

- 全固体電池市場に対する2025年の米国関税の影響

- イントロダクション

- 主な関税率

- 価格の影響の分析

- 国/地域に対する影響

- 用途に対する影響

第6章 全固体電池の主要コンポーネント

- イントロダクション

- 電極

- 負極

- 正極

- 固体電解質

- 固体ポリマー

- 無機電解質

- 複合電解質

- その他のコンポーネント

第7章 全固体電池のタイプ

- イントロダクション

- シングルセル

- マルチセル

第8章 全固体電池市場:容量別

- イントロダクション

- 20mAh未満

- 20~500mAh

- 500mAh超

第9章 全固体電池市場:電池タイプ別

- イントロダクション

- 一次

- 二次

第10章 全固体電池市場:用途別

- イントロダクション

- コンシューマーエレクトロニクス

- 電気自動車

- 医療機器

- エネルギーハーベスティング

- ワイヤレスセンサー

- 包装

- その他の用途

第11章 全固体電池市場:地域別

- イントロダクション

- 北米

- 北米のマクロ経済の見通し

- 米国

- カナダ

- メキシコ

- 欧州

- 欧州のマクロ経済の見通し

- ドイツ

- 英国

- フランス

- イタリア

- その他の欧州

- アジア太平洋

- アジア太平洋のマクロ経済の見通し

- 中国

- 日本

- 韓国

- インド

- その他のアジア太平洋

- その他の地域

- その他の地域のマクロ経済の見通し

- 中東

- アフリカ

- 南米

第12章 競合情勢

- 概要

- 主要参入企業の戦略/強み(2021年~2024年)

- 収益分析(2022年~2024年)

- 市場シェア分析(2024年)

- 企業の評価と財務指標

- ブランドの比較

- 企業の評価マトリクス:主要企業(2024年)

- 企業の評価マトリクス:スタートアップ/中小企業(2024年)

- 競合シナリオ

第13章 企業プロファイル

- 主要企業

- ILIKA

- BLUE SOLUTIONS

- PROLOGIUM TECHNOLOGY CO., LTD.

- SOLID POWER, INC.

- FACTORIAL INC

- EXCELLATRON

- KANADEVIA CORPORATION

- LIONVOLT

- QUANTUMSCAPE BATTERY, INC.

- SAKUU CORPORATION

- その他の企業

- AMPCERA

- GANFENG LITHIUM GROUP CO., LTD.

- PRIETO BATTERY, INC.

- QINGTAO (KUNSHAN) ENERGY DEVELOPMENT CO., LTD.

- STOREDOT

- ION STORAGE SYSTEMS

- WELION

- ITEN

- BASQUEVOLT

- その他の主要企業

- SAMSUNG SDI

- LG ENERGY SOLUTION

- HONDA MOTOR CO., LTD.

- NISSAN MOTOR CO., LTD.

- MERCEDES-BENZ GROUP AG

- TOYOTA MOTOR CORPORATION

第14章 付録

List of Tables

- TABLE 1 SOLID-STATE BATTERY MARKET: RISK ANALYSIS

- TABLE 2 ROLES OF COMPANIES IN SOLID-STATE BATTERY ECOSYSTEM

- TABLE 3 PRICING RANGE OF SOLID-STATE BATTERIES, 2024 (USD/KWH)

- TABLE 4 PRICING RANGE OF SOLID-STATE BATTERIES, BY REGION, 2024 (USD/KWH)

- TABLE 5 IMPACT OF PORTER'S FIVE FORCES ON SOLID-STATE BATTERY MARKET

- TABLE 6 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- TABLE 7 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 8 IMPORT DATA ON HS CODE 850650-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 9 EXPORT DATA ON HS CODE-850650-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 10 LIST OF PATENTS APPLIED AND GRANTED, 2021-2025

- TABLE 11 SOLID-STATE BATTERY MARKET: LIST OF CONFERENCES AND EVENTS, 2025-2026

- TABLE 12 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 SOLID-STATE BATTERY MARKET: STANDARDS

- TABLE 17 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 18 KEY PRODUCT-RELATED TARIFF EFFECTIVE FOR LITHIUM-ION BATTERY MARKET

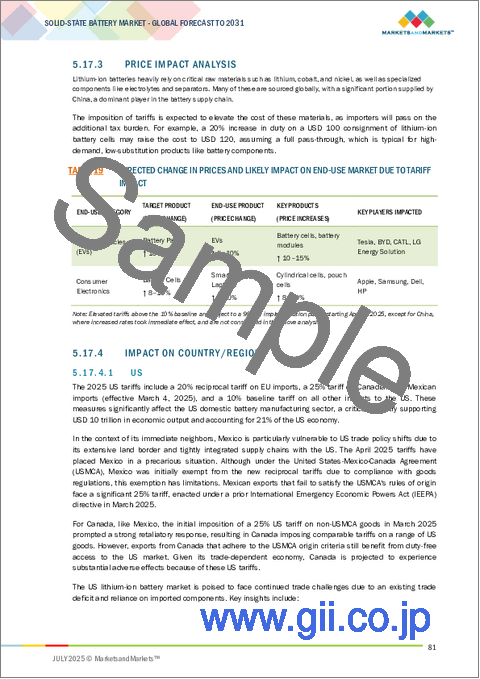

- TABLE 19 EXPECTED CHANGE IN PRICES AND LIKELY IMPACT ON END-USE MARKET DUE TO TARIFF IMPACT

- TABLE 20 SOLID-STATE BATTERY MARKET, BY CAPACITY, 2022-2024 (USD MILLION)

- TABLE 21 SOLID-STATE BATTERY MARKET, BY CAPACITY, 2025-2031 (USD MILLION)

- TABLE 22 BELOW 20 MAH: SOLID-STATE BATTERY MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 23 BELOW 20 MAH: SOLID-STATE BATTERY MARKET, BY APPLICATION, 2025-2031 (USD MILLION)

- TABLE 24 20-500 MAH: SOLID-STATE BATTERY MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 25 20-500 MAH: SOLID-STATE BATTERY MARKET, BY APPLICATION, 2025-2031 (USD MILLION)

- TABLE 26 ABOVE 500 MAH: SOLID-STATE BATTERY MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 27 ABOVE 500 MAH: SOLID-STATE BATTERY MARKET, BY APPLICATION, 2025-2031 (USD MILLION)

- TABLE 28 SOLID-STATE BATTERY MARKET, BY BATTERY TYPE, 2022-2024 (USD MILLION)

- TABLE 29 SOLID-STATE BATTERY MARKET, BY BATTERY TYPE, 2025-2031 (USD MILLION)

- TABLE 30 SOLID-STATE BATTERY MARKET, BY CAPACITY, 2022-2024 (MWH)

- TABLE 31 SOLID-STATE BATTERY MARKET, BY CAPACITY, 2025-2031 (MWH)

- TABLE 32 PRIMARY: SOLID-STATE BATTERY MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 33 PRIMARY: SOLID-STATE BATTERY MARKET, BY APPLICATION, 2025-2031 (USD MILLION)

- TABLE 34 PRIMARY: SOLID-STATE BATTERY MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 35 PRIMARY: SOLID-STATE BATTERY MARKET, BY REGION, 2025-2031 (USD MILLION)

- TABLE 36 SECONDARY: SOLID-STATE BATTERY MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 37 SECONDARY: SOLID-STATE BATTERY MARKET, BY APPLICATION, 2025-2031 (USD MILLION)

- TABLE 38 SECONDARY: SOLID-STATE BATTERY MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 39 SECONDARY: SOLID-STATE BATTERY MARKET, BY REGION, 2025-2031 (USD MILLION)

- TABLE 40 SOLID-STATE BATTERY MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 41 SOLID-STATE BATTERY MARKET, BY APPLICATION, 2025-2031 (USD MILLION)

- TABLE 42 CONSUMER ELECTRONICS: SOLID-STATE BATTERY MARKET, BY CAPACITY, 2022-2024 (USD MILLION)

- TABLE 43 CONSUMER ELECTRONICS: SOLID-STATE BATTERY MARKET, BY CAPACITY, 2025-2031 (USD MILLION)

- TABLE 44 CONSUMER ELECTRONICS: SOLID-STATE BATTERY MARKET, BY BATTERY TYPE, 2022-2024 (USD MILLION)

- TABLE 45 CONSUMER ELECTRONICS: SOLID-STATE BATTERY MARKET, BY BATTERY TYPE, 2025-2031 (USD MILLION)

- TABLE 46 CONSUMER ELECTRONICS: SOLID-STATE BATTERY MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 47 CONSUMER ELECTRONICS: SOLID-STATE BATTERY MARKET, BY REGION, 2025-2031 (USD MILLION)

- TABLE 48 CONSUMER ELECTRONICS: SOLID-STATE BATTERY MARKET IN NORTH AMERICA, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 49 CONSUMER ELECTRONICS: SOLID-STATE BATTERY MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2031 (USD MILLION)

- TABLE 50 CONSUMER ELECTRONICS: SOLID-STATE BATTERY MARKET IN EUROPE, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 51 CONSUMER ELECTRONICS: SOLID-STATE BATTERY MARKET IN EUROPE, BY COUNTRY, 2025-2031 (USD MILLION)

- TABLE 52 CONSUMER ELECTRONICS: SOLID-STATE BATTERY MARKET IN ASIA PACIFIC, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 53 CONSUMER ELECTRONICS: SOLID-STATE BATTERY MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2031 (USD MILLION)

- TABLE 54 CONSUMER ELECTRONICS: SOLID-STATE BATTERY MARKET IN ROW, BY REGION, 2022-2024 (USD MILLION)

- TABLE 55 CONSUMER ELECTRONICS: SOLID-STATE BATTERY MARKET IN ROW, BY REGION, 2025-2031 (USD MILLION)

- TABLE 56 ELECTRIC VEHICLES: SOLID-STATE BATTERY MARKET, BY CAPACITY, 2022-2024 (USD MILLION)

- TABLE 57 ELECTRIC VEHICLES: SOLID-STATE BATTERY MARKET, BY CAPACITY, 2025-2031 (USD MILLION)

- TABLE 58 ELECTRIC VEHICLES: SOLID-STATE BATTERY MARKET, BY BATTERY TYPE, 2022-2024 (USD MILLION)

- TABLE 59 ELECTRIC VEHICLES: SOLID-STATE BATTERY MARKET, BY BATTERY TYPE, 2025-2031 (USD MILLION)

- TABLE 60 ELECTRIC VEHICLES: SOLID-STATE BATTERY MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 61 ELECTRIC VEHICLES: SOLID-STATE BATTERY MARKET, BY REGION, 2025-2031 (USD MILLION)

- TABLE 62 ELECTRIC VEHICLES: SOLID-STATE BATTERY MARKET IN NORTH AMERICA, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 63 ELECTRIC VEHICLES: SOLID-STATE BATTERY MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2031 (USD MILLION)

- TABLE 64 ELECTRIC VEHICLES: SOLID-STATE BATTERY MARKET IN EUROPE, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 65 ELECTRIC VEHICLES: SOLID-STATE BATTERY MARKET IN EUROPE, BY COUNTRY, 2025-2031 (USD MILLION)

- TABLE 66 ELECTRIC VEHICLES: SOLID-STATE BATTERY MARKET IN ASIA PACIFIC, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 67 ELECTRIC VEHICLES: SOLID-STATE BATTERY MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2031 (USD MILLION)

- TABLE 68 ELECTRIC VEHICLES: SOLID-STATE BATTERY MARKET IN ROW, BY REGION, 2022-2024 (USD MILLION)

- TABLE 69 ELECTRIC VEHICLES: SOLID-STATE BATTERY MARKET IN ROW, BY REGION, 2025-2031 (USD MILLION)

- TABLE 70 MEDICAL DEVICES: SOLID-STATE BATTERY MARKET, BY CAPACITY, 2022-2024 (USD MILLION)

- TABLE 71 MEDICAL DEVICES: SOLID-STATE BATTERY MARKET, BY CAPACITY, 2025-2031 (USD MILLION)

- TABLE 72 MEDICAL DEVICES: SOLID-STATE BATTERY MARKET, BY BATTERY TYPE, 2022-2024 (USD MILLION)

- TABLE 73 MEDICAL DEVICES: SOLID-STATE BATTERY MARKET, BY BATTERY TYPE, 2025-2031 (USD MILLION)

- TABLE 74 MEDICAL DEVICES: SOLID-STATE BATTERY MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 75 MEDICAL DEVICES: SOLID-STATE BATTERY MARKET, BY REGION, 2025-2031 (USD MILLION)

- TABLE 76 MEDICAL DEVICES: SOLID-STATE BATTERY MARKET IN NORTH AMERICA, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 77 MEDICAL DEVICES: SOLID-STATE BATTERY MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2031 (USD MILLION)

- TABLE 78 MEDICAL DEVICES: SOLID-STATE BATTERY MARKET IN EUROPE, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 79 MEDICAL DEVICES: SOLID-STATE BATTERY MARKET IN EUROPE, BY COUNTRY, 2025-2031 (USD MILLION)

- TABLE 80 MEDICAL DEVICES: SOLID-STATE BATTERY MARKET IN ASIA PACIFIC, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 81 MEDICAL DEVICES: SOLID-STATE BATTERY MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2031 (USD MILLION)

- TABLE 82 MEDICAL DEVICES: SOLID-STATE BATTERY MARKET IN ROW, BY REGION, 2022-2024 (USD MILLION)

- TABLE 83 MEDICAL DEVICES: SOLID-STATE BATTERY MARKET IN ROW, BY REGION, 2025-2031 (USD MILLION)

- TABLE 84 ENERGY HARVESTING: SOLID-STATE BATTERY MARKET, BY CAPACITY, 2022-2024 (USD MILLION)

- TABLE 85 ENERGY HARVESTING: SOLID-STATE BATTERY MARKET, BY CAPACITY, 2025-2031 (USD MILLION)

- TABLE 86 ENERGY HARVESTING: SOLID-STATE BATTERY MARKET, BY BATTERY TYPE, 2022-2024 (USD MILLION)

- TABLE 87 ENERGY HARVESTING: SOLID-STATE BATTERY MARKET, BY BATTERY TYPE, 2025-2031 (USD MILLION)

- TABLE 88 ENERGY HARVESTING: SOLID-STATE BATTERY MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 89 ENERGY HARVESTING: SOLID-STATE BATTERY MARKET, BY REGION, 2025-2031 (USD MILLION)

- TABLE 90 ENERGY HARVESTING: SOLID-STATE BATTERY MARKET IN NORTH AMERICA, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 91 ENERGY HARVESTING: SOLID-STATE BATTERY MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2031 (USD MILLION)

- TABLE 92 ENERGY HARVESTING: SOLID-STATE BATTERY MARKET IN EUROPE, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 93 ENERGY HARVESTING: SOLID-STATE BATTERY MARKET IN EUROPE, BY COUNTRY, 2025-2031 (USD MILLION)

- TABLE 94 ENERGY HARVESTING: SOLID-STATE BATTERY MARKET IN ASIA PACIFIC, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 95 ENERGY HARVESTING: SOLID-STATE BATTERY MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2031 (USD MILLION)

- TABLE 96 ENERGY HARVESTING: SOLID-STATE BATTERY MARKET IN ROW, BY REGION, 2022-2024 (USD MILLION)

- TABLE 97 ENERGY HARVESTING: SOLID-STATE BATTERY MARKET IN ROW, BY REGION, 2025-2031 (USD MILLION)

- TABLE 98 WIRELESS SENSORS: SOLID-STATE BATTERY MARKET, BY CAPACITY, 2022-2024 (USD MILLION)

- TABLE 99 WIRELESS SENSORS: SOLID-STATE BATTERY MARKET, BY CAPACITY, 2025-2031 (USD MILLION)

- TABLE 100 WIRELESS SENSORS: SOLID-STATE BATTERY MARKET, BY BATTERY TYPE, 2022-2024 (USD MILLION)

- TABLE 101 WIRELESS SENSORS: SOLID-STATE BATTERY MARKET, BY BATTERY TYPE, 2025-2031 (USD MILLION)

- TABLE 102 WIRELESS SENSORS: SOLID-STATE BATTERY MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 103 WIRELESS SENSORS: SOLID-STATE BATTERY MARKET, BY REGION, 2025-2031 (USD MILLION)

- TABLE 104 WIRELESS SENSORS: SOLID-STATE BATTERY MARKET IN NORTH AMERICA, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 105 WIRELESS SENSORS: SOLID-STATE BATTERY MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2031 (USD MILLION)

- TABLE 106 WIRELESS SENSORS: SOLID-STATE BATTERY MARKET IN EUROPE, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 107 WIRELESS SENSORS: SOLID-STATE BATTERY MARKET IN EUROPE, BY COUNTRY, 2025-2031 (USD MILLION)

- TABLE 108 WIRELESS SENSORS: SOLID-STATE BATTERY MARKET IN ASIA PACIFIC, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 109 WIRELESS SENSORS: SOLID-STATE BATTERY MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2031 (USD MILLION)

- TABLE 110 WIRELESS SENSORS: SOLID-STATE BATTERY MARKET IN ROW, BY REGION, 2022-2024 (USD MILLION)

- TABLE 111 WIRELESS SENSORS: SOLID-STATE BATTERY MARKET IN ROW, BY REGION, 2025-2031 (USD MILLION)

- TABLE 112 PACKAGING: SOLID-STATE BATTERY MARKET, BY CAPACITY, 2022-2024 (USD MILLION)

- TABLE 113 PACKAGING: SOLID-STATE BATTERY MARKET, BY CAPACITY, 2025-2031 (USD MILLION)

- TABLE 114 PACKAGING: SOLID-STATE BATTERY MARKET, BY BATTERY TYPE, 2022-2024 (USD MILLION)

- TABLE 115 PACKAGING: SOLID-STATE BATTERY MARKET, BY BATTERY TYPE, 2025-2031 (USD MILLION)

- TABLE 116 PACKAGING: SOLID-STATE BATTERY MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 117 PACKAGING: SOLID-STATE BATTERY MARKET, BY REGION, 2025-2031 (USD MILLION)

- TABLE 118 PACKAGING: SOLID-STATE BATTERY MARKET IN NORTH AMERICA, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 119 PACKAGING: SOLID-STATE BATTERY MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2031 (USD MILLION)

- TABLE 120 PACKAGING: SOLID-STATE BATTERY MARKET IN EUROPE, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 121 PACKAGING: SOLID-STATE BATTERY MARKET IN EUROPE, BY COUNTRY, 2025-2031 (USD MILLION)

- TABLE 122 PACKAGING: SOLID-STATE BATTERY MARKET IN ASIA PACIFIC, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 123 PACKAGING: SOLID-STATE BATTERY MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2031 (USD MILLION)

- TABLE 124 PACKAGING: SOLID-STATE BATTERY MARKET IN ROW, BY REGION, 2022-2024 (USD MILLION)

- TABLE 125 PACKAGING: SOLID-STATE BATTERY MARKET IN ROW, BY REGION, 2025-2031 (USD MILLION)

- TABLE 126 OTHER APPLICATIONS: SOLID-STATE BATTERY MARKET, BY CAPACITY, 2022-2024 (USD MILLION)

- TABLE 127 OTHER APPLICATIONS: SOLID-STATE BATTERY MARKET, BY CAPACITY, 2025-2031 (USD MILLION)

- TABLE 128 OTHER APPLICATIONS: SOLID-STATE BATTERY MARKET, BY BATTERY TYPE, 2022-2024 (USD MILLION)

- TABLE 129 OTHER APPLICATIONS: SOLID-STATE BATTERY MARKET, BY BATTERY TYPE, 2025-2031 (USD MILLION)

- TABLE 130 OTHER APPLICATIONS: SOLID-STATE BATTERY MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 131 OTHER APPLICATIONS: SOLID-STATE BATTERY MARKET, BY REGION, 2025-2031 (USD MILLION)

- TABLE 132 OTHER APPLICATIONS: SOLID-STATE BATTERY MARKET IN NORTH AMERICA, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 133 OTHER APPLICATIONS: SOLID-STATE BATTERY MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2031 (USD MILLION)

- TABLE 134 OTHER APPLICATIONS: SOLID-STATE BATTERY MARKET IN EUROPE, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 135 OTHER APPLICATIONS: SOLID-STATE BATTERY MARKET IN EUROPE, BY COUNTRY, 2025-2031 (USD MILLION)

- TABLE 136 OTHER APPLICATIONS: SOLID-STATE BATTERY MARKET IN ASIA PACIFIC, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 137 OTHER APPLICATIONS: SOLID-STATE BATTERY MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2031 (USD MILLION)

- TABLE 138 OTHER APPLICATIONS: SOLID-STATE BATTERY MARKET IN ROW, BY REGION, 2022-2024 (USD MILLION)

- TABLE 139 OTHER APPLICATIONS: SOLID-STATE BATTERY MARKET IN ROW, BY REGION, 2025-2031 (USD MILLION)

- TABLE 140 SOLID-STATE BATTERY MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 141 SOLID-STATE BATTERY MARKET, BY REGION, 2025-2031 (USD MILLION)

- TABLE 142 NORTH AMERICA: SOLID-STATE BATTERY MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 143 NORTH AMERICA: SOLID-STATE BATTERY MARKET, BY COUNTRY, 2025-2031 (USD MILLION)

- TABLE 144 NORTH AMERICA: SOLID-STATE BATTERY MARKET, BY BATTERY TYPE, 2022-2024 (USD MILLION)

- TABLE 145 NORTH AMERICA: SOLID-STATE BATTERY MARKET, BY BATTERY TYPE, 2025-2031 (USD MILLION)

- TABLE 146 NORTH AMERICA: SOLID-STATE BATTERY MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 147 NORTH AMERICA: SOLID-STATE BATTERY MARKET, BY APPLICATION, 2025-2031 (USD MILLION)

- TABLE 148 EUROPE: SOLID-STATE BATTERY MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 149 EUROPE: SOLID-STATE BATTERY MARKET, BY COUNTRY, 2025-2031 (USD MILLION)

- TABLE 150 EUROPE: SOLID-STATE BATTERY MARKET, BY BATTERY TYPE, 2022-2024 (USD MILLION)

- TABLE 151 EUROPE: SOLID-STATE BATTERY MARKET, BY BATTERY TYPE, 2025-2031 (USD MILLION)

- TABLE 152 EUROPE: SOLID-STATE BATTERY MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 153 EUROPE: SOLID-STATE BATTERY MARKET, BY APPLICATION, 2025-2031 (USD MILLION)

- TABLE 154 ASIA PACIFIC: SOLID-STATE BATTERY MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 155 ASIA PACIFIC: SOLID-STATE BATTERY MARKET, BY COUNTRY, 2025-2031 (USD MILLION)

- TABLE 156 ASIA PACIFIC: SOLID-STATE BATTERY MARKET, BY BATTERY TYPE, 2022-2024 (USD MILLION)

- TABLE 157 ASIA PACIFIC: SOLID-STATE BATTERY MARKET, BY BATTERY TYPE, 2025-2031 (USD MILLION)

- TABLE 158 ASIA PACIFIC: SOLID-STATE BATTERY MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 159 ASIA PACIFIC: SOLID-STATE BATTERY MARKET, BY APPLICATION, 2025-2031 (USD MILLION)

- TABLE 160 ROW: SOLID-STATE BATTERY MARKET, BY REGION, 2022-2024 (USD MILLION)

- TABLE 161 ROW: SOLID-STATE BATTERY MARKET, BY REGION, 2025-2031 (USD MILLION)

- TABLE 162 ROW: SOLID-STATE BATTERY MARKET, BY BATTERY TYPE, 2022-2024 (USD MILLION)

- TABLE 163 ROW: SOLID-STATE BATTERY MARKET, BY BATTERY TYPE, 2025-2031 (USD MILLION)

- TABLE 164 ROW: SOLID-STATE BATTERY MARKET, BY APPLICATION, 2022-2024 (USD MILLION)

- TABLE 165 ROW: SOLID-STATE BATTERY MARKET, BY APPLICATION, 2025-2031 (USD MILLION)

- TABLE 166 MIDDLE EAST: SOLID-STATE BATTERY MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 167 MIDDLE EAST: SOLID-STATE BATTERY MARKET, BY COUNTRY, 2025-2031 (USD MILLION)

- TABLE 168 AFRICA: SOLID-STATE BATTERY MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 169 AFRICA: SOLID-STATE BATTERY MARKET, BY COUNTRY, 2025-2031 (USD MILLION)

- TABLE 170 SOUTH AMERICA: SOLID-STATE BATTERY MARKET, BY COUNTRY, 2022-2024 (USD MILLION)

- TABLE 171 SOUTH AMERICA: SOLID-STATE BATTERY MARKET, BY COUNTRY, 2025-2031 (USD MILLION)

- TABLE 172 SOLID-STATE BATTERY MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2021-2024

- TABLE 173 SOLID-STATE BATTERY MARKET: DEGREE OF COMPETITION

- TABLE 174 SOLID-STATE BATTERY MARKET: REGION FOOTPRINT

- TABLE 175 SOLID-STATE BATTERY MARKET: CAPACITY FOOTPRINT

- TABLE 176 SOLID-STATE BATTERY MARKET: APPLICATION FOOTPRINT

- TABLE 177 SOLID-STATE BATTERY MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 178 SOLID-STATE BATTERY MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 179 SOLID-STATE BATTERY MARKET: PRODUCT LAUNCHES, JANUARY 2021-MAY 2025

- TABLE 180 SOLID-STATE BATTERY MARKET: DEALS, JANUARY 2021-MAY 2025

- TABLE 181 SOLID-STATE BATTERY MARKET: EXPANSIONS, JANUARY 2021-MAY 2025

- TABLE 182 SOLID-STATE BATTERY MARKET: OTHER DEVELOPMENTS, JANUARY 2021-MAY 2025

- TABLE 183 ILIKA: COMPANY OVERVIEW

- TABLE 184 ILIKA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 185 ILIKA: PRODUCT LAUNCHES

- TABLE 186 ILIKA: DEALS

- TABLE 187 ILIKA: EXPANSIONS

- TABLE 188 ILIKA: OTHER DEVELOPMENTS

- TABLE 189 BLUE SOLUTIONS: COMPANY OVERVIEW

- TABLE 190 BLUE SOLUTIONS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 191 BLUE SOLUTIONS: DEALS

- TABLE 192 PROLOGIUM TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 193 PROLOGIUM TECHNOLOGY CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 194 PROLOGIUM TECHNOLOGY CO., LTD.: DEALS

- TABLE 195 PROLOGIUM TECHNOLOGY CO., LTD.: EXPANSIONS

- TABLE 196 PROLOGIUM TECHNOLOGY CO., LTD.: OTHER DEVELOPMENTS

- TABLE 197 SOLID POWER, INC.: COMPANY OVERVIEW

- TABLE 198 SOLID POWER, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 199 SOLID POWER, INC.: DEALS

- TABLE 200 SOLID POWER, INC.: OTHER DEVELOPMENTS

- TABLE 201 FACTORIAL INC: COMPANY OVERVIEW

- TABLE 202 FACTORIAL INC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 203 FACTORIAL INC: PRODUCT LAUNCHES

- TABLE 204 FACTORIAL INC: DEALS

- TABLE 205 FACTORIAL INC: OTHER DEVELOPMENTS

- TABLE 206 EXCELLATRON: COMPANY OVERVIEW

- TABLE 207 EXCELLATRON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 208 KANADEVIA CORPORATION: COMPANY OVERVIEW

- TABLE 209 KANADEVIA CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 210 LIONVOLT: COMPANY OVERVIEW

- TABLE 211 LIONVOLT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 212 QUANTUMSCAPE BATTERY, INC.: COMPANY OVERVIEW

- TABLE 213 QUANTUMSCAPE BATTERY, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 214 QUANTUMSCAPE BATTERY, INC.: DEALS

- TABLE 215 SAKUU CORPORATION: COMPANY OVERVIEW

- TABLE 216 SAKUU CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 217 SAKUU CORPORATION: PRODUCT LAUNCHES

- TABLE 218 SAKUU CORPORATION: DEALS

List of Figures

- FIGURE 1 SOLID-STATE BATTERY MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 SOLID-STATE BATTERY MARKET: RESEARCH DESIGN

- FIGURE 3 SOLID-STATE BATTERY MARKET: RESEARCH APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY FOR SOLID-STATE BATTERY MARKET: SUPPLY-SIDE ANALYSIS

- FIGURE 7 DATA TRIANGULATION

- FIGURE 8 SOLID-STATE BATTERY MARKET, 2022-2031 (USD MILLION)

- FIGURE 9 ABOVE 500 MAH CAPACITY SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 10 ELECTRIC VEHICLES SEGMENT DOMINATED MARKET IN 2024

- FIGURE 11 ASIA PACIFIC TO LEAD GLOBAL SOLID-STATE BATTERY MARKET IN 2031

- FIGURE 12 RISING SALES OF BATTERY-OPERATED ELECTRIC VEHICLES TO DRIVE MARKET

- FIGURE 13 SECONDARY BATTERY SEGMENT TO DOMINATE MARKET IN 2031

- FIGURE 14 ELECTRIC VEHICLES SEGMENT TO DOMINATE MARKET IN 2031

- FIGURE 15 ELECTRIC VEHICLES SEGMENT AND CHINA TO HOLD LARGEST SHARES OF SOLID-STATE BATTERY MARKET IN ASIA PACIFIC IN 2031

- FIGURE 16 CHINA TO RECORD HIGHEST CAGR IN GLOBAL SOLID-STATE BATTERY MARKET DURING FORECAST PERIOD

- FIGURE 17 SOLID-STATE BATTERY MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 18 GLOBAL BATTERY ELECTRIC VEHICLE (BEV) SALES, 2018-2024

- FIGURE 19 SOLID-STATE BATTERY MARKET: IMPACT ANALYSIS OF DRIVERS

- FIGURE 20 SOLID-STATE BATTERY MARKET: IMPACT ANALYSIS OF RESTRAINTS

- FIGURE 21 SOLID-STATE BATTERY MARKET: IMPACT ANALYSIS OF OPPORTUNITIES

- FIGURE 22 SOLID-STATE BATTERY MARKET: IMPACT ANALYSIS OF CHALLENGES

- FIGURE 23 SOLID-STATE BATTERY MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 24 SOLID-STATE BATTERY MARKET: ECOSYSTEM ANALYSIS

- FIGURE 25 AVERAGE SELLING PRICE TREND OF LITHIUM-ION BATTERIES, 2021-2033

- FIGURE 26 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 27 INVESTMENT AND FUNDING SCENARIO

- FIGURE 28 SOLID-STATE BATTERY MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 29 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- FIGURE 30 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- FIGURE 31 IMPORT DATA ON HS CODE-850650-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 32 EXPORT DATA ON HS CODE-850650-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 33 PATENT ANALYSIS, 2024

- FIGURE 34 KEY AI USE CASES IN SOLID-STATE BATTERIES

- FIGURE 35 SOLID-STATE BATTERY MARKET, BY CAPACITY

- FIGURE 36 ABOVE 500 MAH CAPACITY SEGMENT TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 37 SOLID-STATE BATTERY MARKET, BY BATTERY TYPE

- FIGURE 38 SECONDARY SEGMENT TO RECORD HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 39 SOLID-STATE BATTERY MARKET, BY APPLICATION

- FIGURE 40 ELECTRIC VEHICLES SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2031

- FIGURE 41 SOLID-STATE BATTERY MARKET, BY REGION

- FIGURE 42 CHINA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 43 NORTH AMERICA: SOLID-STATE BATTERY MARKET SNAPSHOT

- FIGURE 44 US TO DOMINATE NORTH AMERICAN SOLID-STATE BATTERY MARKET IN 2031

- FIGURE 45 EUROPE: SOLID-STATE BATTERY MARKET SNAPSHOT

- FIGURE 46 GERMANY TO HOLD LARGEST MARKET SHARE IN EUROPEAN SOLID-STATE BATTERY MARKET IN 2030

- FIGURE 47 ASIA PACIFIC: SOLID-STATE BATTERY MARKET SNAPSHOT

- FIGURE 48 CHINA TO DOMINATE ASIA PACIFIC SOLID-STATE BATTERY MARKET DURING FORECAST PERIOD

- FIGURE 49 MIDDLE EAST TO REGISTER HIGHER CAGR IN ROW SOLID-STATE BATTERY MARKET DURING FORECAST PERIOD

- FIGURE 50 SOLID-STATE BATTERY MARKET: REVENUE ANALYSIS, 2022-2024

- FIGURE 51 SHARE ANALYSIS OF COMPANIES OFFERING SOLID-STATE BATTERIES, 2024

- FIGURE 52 COMPANY VALUATION (USD MILLION)

- FIGURE 53 FINANCIAL METRICS (EV/EBITDA)

- FIGURE 54 BRAND COMPARISON

- FIGURE 55 SOLID-STATE BATTERY MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 56 SOLID-STATE BATTERY MARKET: COMPANY FOOTPRINT

- FIGURE 57 SOLID-STATE BATTERY MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 58 ILIKA: COMPANY SNAPSHOT

- FIGURE 59 SOLID POWER, INC.: COMPANY SNAPSHOT

- FIGURE 60 KANADEVIA CORPORATION: COMPANY SNAPSHOT

With a CAGR of 37.5%, the global solid-state battery market is projected to grow from USD 0.26 billion in 2025 to USD 1.77 billion by 2031. The global solid-state battery market is set for strong future growth, driven by rising investment in R&D, advancements in energy density, and the increasing demand for safer, more compact power solutions.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2031 |

| Base Year | 2024 |

| Forecast Period | 2025-2031 |

| Units Considered | Value (USD Billion) |

| Segments | By Capacity, Battery Type, Application, and Region |

| Regions covered | North America, Europe, APAC, RoW |

As the world moves toward electrification, solid-state batteries are gaining attention for their potential to transform electric vehicles, consumer electronics, and renewable energy storage with superior safety and performance. Though still in the prototyping phase, these batteries promise faster charging, longer cycle life, and higher thermal stability than conventional lithium-ion technologies. Leading battery innovators and supportive government initiatives accelerate pilot production and lay the groundwork for commercial-scale deployment. As industries seek more resilient, efficient, and sustainable energy storage solutions, solid-state batteries are expected to be crucial in the next wave of battery innovation.

"Secondary solid-state batteries to capture the largest market share in 2031"

Secondary (rechargeable) solid-state batteries are anticipated to power future applications across electric vehicles, consumer electronics, and renewable energy storage. Their compact design, enhanced safety, and higher energy density make them ideal for next-gen devices like smartphones, laptops, and tablets, enabling longer battery life and sleeker designs. Unlike traditional lithium-ion batteries, which face limitations in size and performance, secondary solid-state batteries offer superior energy storage and faster charging capabilities. As electric vehicles increasingly demand high-performance, long-lasting power sources, solid-state technology is emerging as a promising alternative. With the global shift toward clean mobility and sustainable energy, the secondary solid-state battery market is expected to grow significantly in the coming years.

"Consumer electronics application segment to register the second-highest CAGR in solid-state battery market during 2025 to 2031"

Solid-state batteries, while compact, offer far-reaching potential in consumer electronics, including smartphones, laptops, tablets, and digital cameras. By replacing traditional liquid-based cells with solid electrolytes, these batteries provide enhanced safety, thermal stability, and greater energy density-enabling lighter, thinner, and more efficient device designs. This shift allows manufacturers to keep pace with market demands for portability and durability. In smartphones, where space is increasingly constrained, solid-state batteries fulfill stringent design, temperature, and safety requirements. Their high resistance to physical damage and reduced risk of overheating make them especially well-suited for handheld devices. Companies such as ProLogium Technology Co, Ltd. (Taiwan) and Sakuu Corporation(US) are advancing this technology for mainstream electronic applications, with smartphones expected to lead the early adoption due to the batteries' compactness, safety, and ability to support evolving design complexities.

"Asia Pacific to emerge as the future epicenter of solid-state battery innovation and manufacturing"

The Asia Pacific region is expected to register the highest CAGR in the solid-state battery market during the forecast period. The region is poised to become a key hub for solid-state battery innovation, driven by strong government backing for clean energy, expanding EV ecosystems, and robust R&D investments. Countries such as China, Japan, South Korea, and India are actively testing prototypes and developing pilot production lines, laying the groundwork for future commercialization. With major battery manufacturers such as Toyota, Samsung, and LG spearheading technological advancements, the region is expected to be pivotal in scaling solid-state battery technology. Asia Pacific's established battery supply chain, expertise in high-volume manufacturing, and access to critical materials will enable faster cost reductions once solid-state batteries enter mass production, positioning the region at the forefront of next-generation energy storage solutions in the coming decade.

Breakdown of primaries

Various executives from key organizations operating in the solid-state battery market were interviewed in-depth, including CEOs, marketing directors, and innovation and technology directors.

- By Company Type: Tier 1 - 25%, Tier 2 - 40%, and Tier 3 - 35%

- By Designation: Directors - 20%, C-level Executives - 45%, and Others - 35%

- By Region: North America - 40%, Europe - 20%, Asia Pacific - 30%, and RoW - 10%

Note: Three tiers of companies are defined based on their total revenue as of 2024: tier 3 = revenue less than USD 50 million; tier 2 = revenue between USD 50 million and USD 100 million; and tier 1 = revenue more than USD 100 million. Other designations include sales managers, marketing managers, and product managers.

Major players profiled in this report are as follows: Blue Solutions (France), Solid Power, Inc. (US), ProLogium Technology Co, Ltd. (Taiwan), Ilika plc (UK), Factorial Energy (US), Excellatron Solid State, LLC (US), QuantumScape Battery, Inc. (US), Sakuu Corporation(US), Kanadevia Corporation (Japan), LionVolt (Netherlands), Qingtao (Kunshan) Energy Development Co., Ltd. (China), Prieto Battery Inc. (US), StoreDot Ltd. (Israel), Ganfeng Lithium Group Co., Ltd. (China), Ampcera (US), Ion Storage Systems (US), Welion (China), Iten (France) and Basquevolt (Basque Country). These leading companies possess an upfront solid-state battery technology that is being tested and sampled in emerging markets.

The study provides a detailed competitive analysis of these key players in the solid-state battery market, presenting their company profiles, most recent developments, and key market strategies.

Research Coverage

In this report, the solid-state battery market has been segmented based on capacity, battery type, application, and region. The capacity segment includes below 20 mAh, 20-500 mAh, and above 500 mAh capacities for solid-state batteries. The battery type segment includes primary and secondary batteries. The application segment comprises consumer electronics, electric vehicles, medical devices, energy harvesting, wireless sensors, packaging, and other applications (drone, aerospace, and smart textiles). The market has been segmented into four regions-North America (US, Canada, and Mexico), Asia Pacific (China, Japan, South Korea, India, and Rest of Asia Pacific), Europe (Germany, France, UK, Italy, and Rest of Europe), and RoW (Middle East, Africa, and South America).

Reasons to buy the report

The report will help the leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall market and the sub-segments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the solid-state battery market's pulse and provides information on key market drivers, restraints, challenges, and opportunities.

Key Benefits of Buying the Report

- Analysis of key Drivers (rising research and development efforts by solid-state battery manufacturers, growing adoption of electric vehicles, advantages of solid-state batteries over conventional batteries), Restraints (high manufacturing costs for solid-state batteries), Opportunities (growing R&D funding, collaborations between solid-state battery producers and automotive companies, ongoing miniaturization trend in consumer electronics industry, progress in medical devices powered by solid-state batteries), and Challenges (intricate production processes of solid-state batteries) influencing the growth of the solid-state battery market

- Product Development/Innovation: Detailed insights on upcoming technologies, research and development activities, and new product launches in the solid-state battery market

- Market Development: Comprehensive information about lucrative markets - the report analyses the solid-state battery market across varied regions

- Market Diversification: Exhaustive information about new products/services, untapped geographies, recent developments, and investments in the solid-state battery market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players, such as Blue Solutions (France), Solid Power, Inc. (US), ProLogium Technology Co, Ltd. (Taiwan), Ilika plc (UK), and Factorial Energy (US)

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 YEARS CONSIDERED

- 1.3.3 INCLUSIONS AND EXCLUSIONS

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY AND PRIMARY RESEARCH

- 2.1.2 SECONDARY DATA

- 2.1.2.1 List of major secondary sources

- 2.1.2.2 Key data from secondary sources

- 2.1.3 PRIMARY DATA

- 2.1.3.1 List of primary interview participants

- 2.1.3.2 Key data from primary sources

- 2.1.3.3 Key industry insights

- 2.1.3.4 Breakdown of primaries

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 TOP-DOWN APPROACH

- 2.2.1.1 Approach to estimate market size using top-down analysis

- 2.2.2 BOTTOM-UP APPROACH

- 2.2.2.1 Approach to estimate market size using bottom-up analysis

- 2.2.1 TOP-DOWN APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

- 2.6 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN SOLID-STATE BATTERY MARKET

- 4.2 SOLID-STATE BATTERY MARKET, BY BATTERY TYPE

- 4.3 SOLID-STATE BATTERY MARKET, BY APPLICATION

- 4.4 SOLID-STATE BATTERY MARKET IN ASIA PACIFIC, BY APPLICATION AND COUNTRY

- 4.5 SOLID-STATE BATTERY MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing R&D initiatives to launch advanced solid-state batteries

- 5.2.1.2 Growing adoption of electric vehicles

- 5.2.1.3 Enhanced shelf life and safety through stable electrolytes

- 5.2.2 RESTRAINTS

- 5.2.2.1 Intensive capital requirement for R&D and establishing manufacturing facilities

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Significant investments by established players to boost R&D activities

- 5.2.3.2 Rising demand for miniaturized devices in consumer electronics

- 5.2.3.3 Deployment of compact batteries in medical devices

- 5.2.4 CHALLENGES

- 5.2.4.1 Complications associated with developing solid-state batteries

- 5.2.1 DRIVERS

- 5.3 SUPPLY CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 PRICING ANALYSIS

- 5.5.1 AVERAGE SELLING PRICE TREND OF LITHIUM-ION BATTERIES, 2021-2033

- 5.5.2 PRICING RANGE OF SOLID-STATE BATTERIES, 2024

- 5.5.3 PRICING RANGE OF SOLID-STATE BATTERIES, BY REGION, 2024

- 5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.7 INVESTMENT AND FUNDING SCENARIO

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 Lithium-silicon batteries

- 5.8.1.2 Zinc-manganese batteries

- 5.8.2 ADJACENT TECHNOLOGIES

- 5.8.2.1 Sodium-sulfur batteries

- 5.8.3 COMPLEMENTARY TECHNOLOGIES

- 5.8.3.1 Potassium metal batteries

- 5.8.3.2 Metal-air batteries

- 5.8.3.3 Liquid-metal batteries

- 5.8.1 KEY TECHNOLOGIES

- 5.9 PORTER'S FIVE FORCES ANALYSIS

- 5.9.1 BARGAINING POWER OF SUPPLIERS

- 5.9.2 BARGAINING POWER OF BUYERS

- 5.9.3 THREAT OF NEW ENTRANTS

- 5.9.4 THREAT OF SUBSTITUTES

- 5.9.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.10 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.10.2 BUYING CRITERIA

- 5.11 CASE STUDY ANALYSIS

- 5.11.1 ILIKA PARTNERS WITH CONNECT 2 CONNECT LTD. TO DEVELOP SOLID-STATE BATTERY PRODUCTION CLEANROOM

- 5.11.2 IAAPS AND UNIVERSITY OF BATH SIMULATE HIGH-TEMPERATURE PERFORMANCE VIABILITY OF SOLID-STATE BATTERIES IN AUTOMOTIVES

- 5.11.3 GEORGIA TECH RESEARCHERS DEVELOP LOW-MELTING CERAMIC ELECTROLYTES TO REDUCE SOLID-STATE BATTERY MANUFACTURING COSTS

- 5.11.4 SAMSUNG ELECTRONICS TESTS SILVER-CARBON COMPOSITE TO SUPPRESS DENDRITIC AND IMPROVE SOLID-STATE BATTERY LIFE AND SAFETY

- 5.12 TRADE ANALYSIS

- 5.12.1 IMPORT SCENARIO (850650)

- 5.12.2 EXPORT SCENARIO (850650)

- 5.13 PATENT ANALYSIS

- 5.14 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.15 STANDARDS AND REGULATORY LANDSCAPE

- 5.15.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.15.2 STANDARDS

- 5.16 IMPACT OF AI/GEN AI ON SOLID-STATE BATTERY MARKET

- 5.16.1 INTRODUCTION

- 5.16.2 IMPACT ON SOLID-STATE BATTERY MARKET

- 5.16.3 TOP USE CASES & MARKET POTENTIAL

- 5.17 IMPACT OF 2025 US TARIFF ON SOLID-STATE BATTERY MARKET

- 5.17.1 INTRODUCTION

- 5.17.2 KEY TARIFF RATES

- 5.17.3 PRICE IMPACT ANALYSIS

- 5.17.4 IMPACT ON COUNTRY/REGION

- 5.17.4.1 US

- 5.17.4.2 Europe

- 5.17.4.3 Asia Pacific

- 5.17.5 IMPACT ON APPLICATIONS

6 KEY COMPONENTS OF SOLID-STATE BATTERIES

- 6.1 INTRODUCTION

- 6.2 ELECTRODES

- 6.2.1 ANODES

- 6.2.2 CATHODES

- 6.3 SOLID ELECTROLYTES

- 6.3.1 SOLID POLYMERS

- 6.3.2 INORGANIC ELECTROLYTES

- 6.3.2.1 Oxides

- 6.3.2.2 Sulfides

- 6.3.2.3 Glass-based inorganic electrolytes

- 6.3.2.4 Pseudo-solid electrolytes

- 6.3.3 COMPOSITE ELECTROLYTES

- 6.4 OTHER COMPONENTS

7 TYPES OF SOLID-STATE BATTERIES

- 7.1 INTRODUCTION

- 7.2 SINGLE-CELL

- 7.3 MULTI-CELL

8 SOLID-STATE BATTERY MARKET, BY CAPACITY

- 8.1 INTRODUCTION

- 8.2 BELOW 20 MAH

- 8.2.1 GROWING APPLICATIONS IN PACKAGING, SMART CARDS, AND COSMETIC PATCHES TO BOOST DEMAND

- 8.3 20-500 MAH

- 8.3.1 RISING GLOBAL DEMAND FOR IOT AND WEARABLE DEVICES TO FUEL MARKET GROWTH

- 8.4 ABOVE 500 MAH

- 8.4.1 COMBINED ADVANCEMENTS, PARTNERSHIPS, AND PILOT-SCALE INVESTMENTS TO OFFER LUCRATIVE GROWTH OPPORTUNITIES

9 SOLID-STATE BATTERY MARKET, BY BATTERY TYPE

- 9.1 INTRODUCTION

- 9.2 PRIMARY

- 9.2.1 ENVIRONMENTAL AND HEALTH SAFETY ATTRIBUTES TO FOSTER MARKET GROWTH

- 9.3 SECONDARY

- 9.3.1 INCREASING DEPLOYMENT IN EVS AND CONSUMER ELECTRONICS TO SUPPORT MARKET GROWTH

10 SOLID-STATE BATTERY MARKET, BY APPLICATION

- 10.1 INTRODUCTION

- 10.2 CONSUMER ELECTRONICS

- 10.2.1 RISING EMPHASIS ON OFFERING SLIM AND LIGHTWEIGHT PRODUCTS TO DRIVE MARKET

- 10.2.2 SMARTPHONES

- 10.2.3 WEARABLES

- 10.2.4 OTHER CONSUMER ELECTRONICS

- 10.3 ELECTRIC VEHICLES

- 10.3.1 GROWING INVESTMENTS IN SOLID-STATE BATTERY TECHNOLOGY AND RESEARCH & DEVELOPMENT ACTIVITIES TO FUEL MARKET GROWTH

- 10.4 MEDICAL DEVICES

- 10.4.1 ABILITY TO EXTEND BATTERY LIFE OF COMPACT MEDICAL DEVICES TO FOSTER MARKET GROWTH

- 10.5 ENERGY HARVESTING

- 10.5.1 INTEGRATION OF SOLID-STATE BATTERIES IN ENVIRONMENTAL ENERGY STORAGE TO SUPPORT MARKET GROWTH

- 10.6 WIRELESS SENSORS

- 10.6.1 RISING DEMAND FOR COMPACT AND HIGH-ENERGY-DENSITY BATTERIES TO FUEL MARKET GROWTH

- 10.7 PACKAGING

- 10.7.1 GROWING DEMAND FOR LONG-LIFE OF TAGS AND LABELS TO FUEL DRIVE MARKET

- 10.8 OTHER APPLICATIONS

11 SOLID-STATE BATTERY MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 11.2.2 US

- 11.2.2.1 Presence of prominent solid-state battery manufacturers to boost demand

- 11.2.3 CANADA

- 11.2.3.1 Rapid development of wearable and compact devices to foster market growth

- 11.2.4 MEXICO

- 11.2.4.1 Presence of cheap labor and proximity to developed and emerging markets to support market growth

- 11.3 EUROPE

- 11.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 11.3.2 GERMANY

- 11.3.2.1 Increased demand for compact-sized solid-state batteries to drive market

- 11.3.3 UK

- 11.3.3.1 Robust demand for wearable IoT devices to contribute to market growth

- 11.3.4 FRANCE

- 11.3.4.1 High investments in electric and hybrid vehicle production to offer lucrative growth opportunities

- 11.3.5 ITALY

- 11.3.5.1 Strategic commitment to fleet electrification to boost demand

- 11.3.6 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 11.4.2 CHINA

- 11.4.2.1 Expansion of industrial manufacturing facilities to accelerate market growth

- 11.4.3 JAPAN

- 11.4.3.1 Growing investment in automotive industry to drive market

- 11.4.4 SOUTH KOREA

- 11.4.4.1 Rising emphasis on revitalizing eco-friendly vehicle and battery sectors to boost demand

- 11.4.5 INDIA

- 11.4.5.1 Presence of skilled labor at low cost to support market growth

- 11.4.6 REST OF ASIA PACIFIC

- 11.5 ROW

- 11.5.1 MACROECONOMIC OUTLOOK FOR ROW

- 11.5.2 MIDDLE EAST

- 11.5.2.1 Awareness toward environmental concerns to boost demand

- 11.5.3 AFRICA

- 11.5.3.1 Rising popularity of consumer electronics and smart wearables to support market growth

- 11.5.4 SOUTH AMERICA

- 11.5.4.1 Increasing disposable incomes to boost demand

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2024

- 12.3 REVENUE ANALYSIS, 2022-2024

- 12.4 MARKET SHARE ANALYSIS, 2024

- 12.5 COMPANY VALUATION AND FINANCIAL METRICS

- 12.6 BRAND COMPARISON

- 12.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.7.1 STARS

- 12.7.2 EMERGING LEADERS

- 12.7.3 PERVASIVE PLAYERS

- 12.7.4 PARTICIPANTS

- 12.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.7.5.1 Company footprint

- 12.7.5.2 Region footprint

- 12.7.5.3 Capacity footprint

- 12.7.5.4 Application footprint

- 12.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.8.1 PROGRESSIVE COMPANIES

- 12.8.2 RESPONSIVE COMPANIES

- 12.8.3 DYNAMIC COMPANIES

- 12.8.4 STARTING BLOCKS

- 12.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 12.8.5.1 Detailed list of key startups/SMEs

- 12.8.5.2 Competitive benchmarking of key startups /SMEs

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 PRODUCT LAUNCHES

- 12.9.2 DEALS

- 12.9.3 EXPANSIONS

- 12.9.4 OTHER DEVELOPMENTS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 ILIKA

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Solutions/Services offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Product launches

- 13.1.1.3.2 Deals

- 13.1.1.3.3 Expansions

- 13.1.1.3.4 Other developments

- 13.1.1.4 MnM view

- 13.1.1.4.1 Key strengths/Right to win

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses/Competitive threats

- 13.1.2 BLUE SOLUTIONS

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Solutions/Services offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Deals

- 13.1.2.4 MnM view

- 13.1.2.4.1 Key strengths/Right to win

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses/Competitive threats

- 13.1.3 PROLOGIUM TECHNOLOGY CO., LTD.

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Solutions/Services offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Deals

- 13.1.3.3.2 Expansions

- 13.1.3.3.3 Other developments

- 13.1.3.4 MnM view

- 13.1.3.4.1 Key strengths/Right to win

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses/Competitive threats

- 13.1.4 SOLID POWER, INC.

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Solutions/Services offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Deals

- 13.1.4.3.2 Other developments

- 13.1.4.4 MnM view

- 13.1.4.4.1 Key strengths/Right to win

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses/Competitive threats

- 13.1.5 FACTORIAL INC

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Solutions/Services offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Product launches

- 13.1.5.3.2 Deals

- 13.1.5.3.3 Other developments

- 13.1.5.4 MnM view

- 13.1.5.4.1 Key strengths/Right to win

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses/Competitive threats

- 13.1.6 EXCELLATRON

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Solutions/Services offered

- 13.1.7 KANADEVIA CORPORATION

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Solutions/Services offered

- 13.1.8 LIONVOLT

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Solutions/Services offered

- 13.1.9 QUANTUMSCAPE BATTERY, INC.

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Solutions/Services offered

- 13.1.9.3 Recent developments

- 13.1.9.3.1 Deals

- 13.1.10 SAKUU CORPORATION

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Solutions/Services offered

- 13.1.10.3 Recent developments

- 13.1.10.3.1 Product launches

- 13.1.10.3.2 Deals

- 13.1.1 ILIKA

- 13.2 OTHER PLAYERS

- 13.2.1 AMPCERA

- 13.2.2 GANFENG LITHIUM GROUP CO., LTD.

- 13.2.3 PRIETO BATTERY, INC.

- 13.2.4 QINGTAO (KUNSHAN) ENERGY DEVELOPMENT CO., LTD.

- 13.2.5 STOREDOT

- 13.2.6 ION STORAGE SYSTEMS

- 13.2.7 WELION

- 13.2.8 ITEN

- 13.2.9 BASQUEVOLT

- 13.3 OTHER KEY PLAYERS

- 13.3.1 SAMSUNG SDI

- 13.3.2 LG ENERGY SOLUTION

- 13.3.3 HONDA MOTOR CO., LTD.

- 13.3.4 NISSAN MOTOR CO., LTD.

- 13.3.5 MERCEDES-BENZ GROUP AG

- 13.3.6 TOYOTA MOTOR CORPORATION

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS