|

|

市場調査レポート

商品コード

1419281

デジタルセラピューティクス (DTx) の世界市場:提供元別、収益モデル別、用途別- 2028年までの予測Digital Therapeutics (DTx) Market by Offerings (Platform, Virtual Reality/Games), Revenue Model (Subscription, Value Based), Application (Therapy (Diabetes, Obesity, CNS, Respiratory, CVD), Drug Adherence, Rehab/Patient care) - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| デジタルセラピューティクス (DTx) の世界市場:提供元別、収益モデル別、用途別- 2028年までの予測 |

|

出版日: 2024年01月23日

発行: MarketsandMarkets

ページ情報: 英文 297 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

レポート概要

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021-2028年 |

| 基準年 | 2022年 |

| 予測期間 | 2023-2028年 |

| 単位 | 金額 (米ドル) |

| セグメント | 提供元・収益モデル・販売チャネル・用途・地域別 |

| 対象地域 | 北米・欧州・アジア太平洋・ラテンアメリカ・中東&アフリカ |

デジタルセラピューティクス (DTx) の市場規模は、予測期間中に29.1%のCAGRで推移し、2023年の61億米ドルから、2028年には219億米ドルに達すると予測されています。

DTxの急速な普及は、慢性疾患と闘う患者数の増加や、投資の拡大といった要因に後押しされています。一方で、新興国市場におけるDTxプログラムの認知度やアクセスの不足、従来型の医療提供者の抵抗、不均等な支払いモデルの存在などが、市場成長の阻害要因となっています。

収益モデル別では、サブスクリプションベースの部門が予測期間中、最大の規模を示し、最速の成長を示すと予測されています。DTxは長期的な健康成果を目指すことが多く、ユーザーは長期にわたってプログラムにコミットする必要があります。サブスクリプションモデルは、インセンティブやプラットフォームの機能への継続的なアクセスを提供することで、ユーザーのコミットメントを促します。

用途別では、糖尿病治療の部門が2022年に最大のシェアを示し、予測期間中は最大の成長率を示す見通しです。促進要因としては、糖尿病の有病率の増加、糖尿病に関連する多額の医療費、費用対効果の高いソリューションによる負担軽減に焦点を当てた政府のイニシアチブの高まりなどが挙げられます。

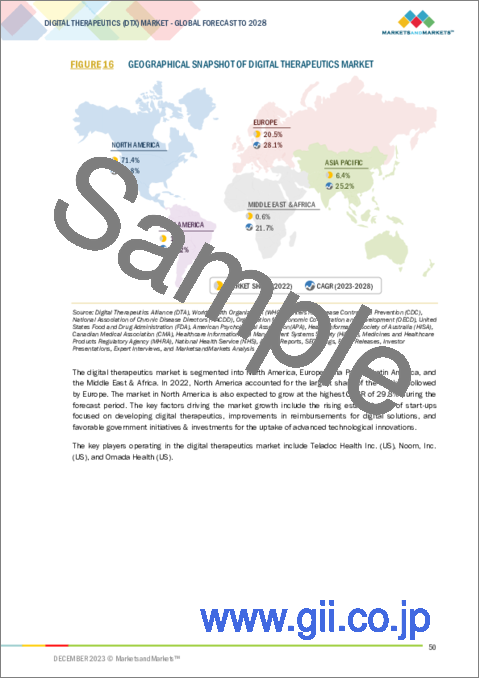

地域別では、北米地域が2022年に大きなシェアを示しています。技術開発に資金を提供する政府の制度やDTxへの有利な償還構造などの要因が同地域の市場成長を促進すると予測されています。また、同地域では、保険会社、医療提供者、その他のステークホルダーがDTxの臨床効果と費用対効果を認識し、積極的に取り組んでいます。このような早期からの採用が、さまざまなヘルスケア環境での広範な採用を後押ししています。

当レポートでは、世界のデジタルセラピューティクス (DTx) の市場を調査し、市場概要、市場影響因子および市場機会の分析、技術・特許の動向、法規制・償還環境、ケーススタディ、市場規模の推移・予測、各種区分・地域別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 業界の動向

- 技術分析

- バリューチェーン分析

- エコシステム分析

- パイプライン製品

- ケーススタディ分析

- ポーターのファイブフォース分析

- 規制状況

- 価格分析

- 償還シナリオ

- 特許分析

- 主な会議とイベント

- 主なステークホルダーと購入基準

- 収益の変化とDTx市場の新たな収益源

- 投資の情勢

第6章 デジタルセラピューティクス (DTx) 市場:サービス別

- ソフトウェア/プラットフォーム

- プログラム

- バーチャルリアリティ/ゲーム

第7章 デジタルセラピューティクス (DTx) 市場:用途別

- 治療/ケア関連

- 糖尿病

- 中枢神経系 (CNS) 障害

- 禁煙

- 慢性呼吸器疾患

- 筋骨格系疾患

- 心血管疾患

- 服薬アドヒアランス

- 胃腸障害

- リハビリテーション・患者ケア

- 薬物使用障害・依存症管理

- その他

- 予防用途

- 糖尿病前症

- 肥満

- 栄養

- ライフスタイル管理

- その他

第8章 デジタルセラピューティクス (DTx) 市場:収益モデル別

- サブスクリプションベースモデル

- ワンタイム購入/年間ライセンシングモデル

- 成果/価値ベースモデル

第9章 デジタルセラピューティクス (DTx) 市場:販売チャネル別

- B2B販売チャネル

- 保険者

- 雇用主

- 製薬会社

- プロバイダー

- その他

- B2C販売チャネル

- 介護者

- 患者

第10章 デジタルセラピューティクス (DTx) 市場:地域別

- 北米

- 欧州

- アジア太平洋

- ラテンアメリカ

- 中東・アフリカ

第11章 競合情勢

- 概要

- 主要企業の戦略

- 主要企業の収益シェア分析

- 市場シェア分析

- 企業評価マトリックス

- スタートアップ/中小企業の企業評価マトリクス

- 競合シナリオ・動向

第12章 企業プロファイル

- 主要企業

- NOOM, INC.

- TELADOC HEALTH, INC.

- OMADA HEALTH, INC.

- WELLDOC, INC.

- COGNIFIT, INC.

- HEADSPACE HEALTH

- PROPELLER HEALTH

- 2MORROW, INC.

- CANARY HEALTH

- CLICK THERAPEUTICS, INC.

- AKILI, INC.

- WELLTHY THERAPEUTICS PVT. LTD.

- COGNOA, INC.

- TWILL INC.

- KAIA HEALTH SOFTWARE GMBH

- BETTER THERAPEUTICS, INC.

- REALIZEDCARE

- BIOFOURMIS

- AYOGO INCORPORATED

- AMALGAM RX, INC.

- その他の企業

- MINDABLE HEALTH GMBH

- VIRTA HEALTH CORP.

- HINGE HEALTH

- OREXO AB

- FREESPIRA, INC.

第13章 付録

Report Description

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2028 |

| Base Year | 2022 |

| Forecast Period | 2023-2028 |

| Units Considered | Value (USD) Billion |

| Segments | By Offering, By Revenue Model, Sales Channel, Application, and Region |

| Regions covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

The digital therapeutics market is projected to reach USD 21.9 billion by 2028 from USD 6.1 billion in 2023, at a CAGR of 29.1% during the forecast period. The rapid adoption of digital therapeutics is driven by factors such as the increasing number of patients grappling with chronic diseases and escalating investments in this sector. Nonetheless, impediments to market growth include a lack of awareness and access to digital therapeutics programs in developing nations, resistance from traditional healthcare providers, and the existence of uneven payment models.

"The subscription-based revenue model segment represents the largest and fastest-growing category in the market over the forecast period."

The revenue model segment the digital therapeutics market is categorized into subscription, one-time purchase/licensing, and outcome/value based. In 2022, the subscription segment held the largest market share. Digital therapeutics often aim for long-term health outcomes, requiring users to commit to the program over an extended period. Subscription models encourage user commitment by offering incentives and continuous access to the platform's features.

"Diabetes segment is expected to grow at the highest rate during the forecast period."

Concerning the type of treatment/care-related application, the digital therapeutics market is categorized into diabetes, CNS disorders, chronic respiratory diseases, musculoskeletal disorders, cardiovascular diseases, smoking cessation, medication adherence, gastrointestinal disorders, substance use disorders & addiction management, rehabilitation & patient care, and other treatment/care-related applications.

Within the category of treatment/care-related applications, the diabetes segment is poised to register the highest growth rate during the forecast period. The market for digital therapeutics in diabetes accounted for the largest share in 2022. The driving factors include the increasing prevalence of diabetes, the significant healthcare costs associated with the condition, and rising government initiatives focused on alleviating the burden through cost-effective solutions.

"The B2B segment is expected to grow with the highest CAGR during the forecast period."

With respect to the sales channel, the digital therapeutics market is segmented into business-to-customer (B2C) and business-to-business (B2B). The B2B segment is anticipated to exhibit the highest CAGR during the forecast period, attributed to the growing partnerships of pharmaceutical companies with digital health companies to integrate digital therapeutics with their drug products. Pharmaceutical companies are actively engaging in strategic partnerships and acquisitions with digital therapeutics providers. These collaborations allow pharmaceutical companies to integrate digital therapeutics into their broader healthcare solutions, offering a holistic approach to patient care. Additionally, payers, including insurance companies and healthcare providers, are increasingly embracing value-based care models. Digital therapeutics align with these models by emphasizing outcomes, prevention, and cost-effectiveness. Payers see the potential of DTx in reducing healthcare costs through preventive interventions, ultimately driving adoption.

"North America to be the largest and the fastest-growing regional market."

North America, comprising of the US and Canada, held the lion's share for digital therapeutics market in 2022. Factors such as the government schemes to fund technological advancements progresses combined with the favorable reimbursement structure for digital therapeutics are projected to the drive market growth in this region. Additionally, payers and healthcare providers in North America have been early adopters of digital therapeutics. The region has witnessed a proactive approach from insurance companies, healthcare providers, and other stakeholders in recognizing the clinical and cost-effectiveness of DTx. This early buy-in has driven widespread adoption across different healthcare settings.

The primary interviews conducted for this report can be categorized as follows:

- By Company Type: Tier 1 (50%), Tier 2 (30%), and Tier 3 (20%)

- By Designation: C-level (75%), D-level (15%), and Others (10%)

- By Region: North America (70%), Europe (20%), APAC (7%), and the RoW (3%)

Key Players in the Digital Therapeutics Market

The prominent players in this market are Noom, Inc (US), Teladoc Health, Inc. (US), Omada Health, Inc. (US), WellDoc, Inc (US), Biofourmis (US), Better Therapeutics, Inc. (US), Amalgm Rx (US), CogniFit Inc (US), Headspace Health (US), Propeller Health (US), Virta Health Corp (US), 2Morrow, Inc. (US), Realizedcare (US), Canary Health (US), Twill Inc. (US), Click Therapeutics, Inc. (US), Akili, Inc. (US), Cognoa, Inc (US), Wellthy Therapeutics Pvt. Ltd. (India), Kaia Health (Germany), Ayogo (Canada), Mindable Health GmbH (Germany), Hinge Health, Inc. (US), and Freespira (US).

Research Coverage:

This report includes qualitative and quantitative analysis of the digital therapeutics market. The key objectives of the report are to estimate the size and future growth potential of the market across different segments, which includes sales channel, revenue model, application, offering and region. The report also comprises of extensive competitive analysis of the prominent market players, along with their financial information, recent developments, company profiles, recent developments, and prevalent market strategies.

Key Benefits of Buying the Report:

The report aims to assist market leaders and new entrants by offering close approximations of revenue figures for both the overall digital therapeutics market and its subsegments. Stakeholders can leverage this report to comprehend the competitive landscape, acquire insights for strategic business positioning, and formulate effective go-to-market strategies. Additionally, it provides stakeholders with the means to assess the market dynamics and furnishes information on crucial market opportunities, restraints, drivers, and challenges.

Reasons to Buy the Report

This report will enrich established firms as well as new entrants/smaller firms to gauge the pulse of the market, which, in turn, would help them garner a greater share of the market. Firms purchasing the report could use one or a combination of the below-mentioned strategies to strengthen their positions in the market.

This report provides insights on:

- Analysis of key drivers (increasing incidence of preventable chronic disease, rising focus on preventative healthcare, need to control healthcare costs, significant increase in venture capital investments), opportunities (growth prospects in emerging markets, large undiagnosed and untreated patient population, unexpected therapeutic applications) are influencing the growth of the digital therapeutics market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the digital therapeutics market.

- Market Development: Comprehensive information detailing lucrative market - the report analyses the digital therapeutics market across various regions as well as countries.

- Market Diversification: Exhaustive information about new software and programs, untapped geographies, recent developments, and investments in the digital therapeutics market.

- Competitive Assessment: The report provides detailed insights on key players as well as key SME/upcoming players in the market. In-depth assessment of growth strategies, market shares, product and service offerings of players and key trends in the market is provided in the report. The report will enable stakeholders to understand the pulse of the digital therapeutics market and provide them with information such as drivers, challenges, restraints and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 INCLUSIONS AND EXCLUSIONS

- 1.4 MARKET SCOPE

- 1.4.1 MARKETS COVERED

- 1.4.2 YEARS CONSIDERED

- 1.4.3 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 RESEARCH LIMITATIONS

- 1.7 SUMMARY OF CHANGES

- 1.8 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- FIGURE 2 PRIMARY SOURCES

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS (SUPPLY SIDE): BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS (DEMAND SIDE): BY TYPE OF BUYER AND REGION

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach 1: Revenue mapping-based estimation

- FIGURE 5 DIGITAL THERAPEUTICS: REVENUE MAPPING-BASED ESTIMATION

- 2.2.1.2 Approach 2: Buyer adoption-based estimation

- FIGURE 6 DIGITAL THERAPEUTICS ESTIMATION: BUYER ADOPTION-BASED ESTIMATION

- 2.2.2 TOP-DOWN APPROACH: PENETRATION RATE-BASED MARKET SIZE ESTIMATION

- FIGURE 7 PENETRATION RATE-BASED MARKET ESTIMATION

- 2.2.3 GROWTH FORECAST

- TABLE 1 IMPACT ANALYSIS

- FIGURE 8 CAGR PROJECTIONS FROM ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES (2023-2028)

- FIGURE 9 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 10 DATA TRIANGULATION METHODOLOGY

- 2.4 ASSUMPTIONS

- 2.5 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

- FIGURE 11 DIGITAL THERAPEUTICS MARKET, BY OFFERING, 2023 VS. 2028 (USD MILLION)

- FIGURE 12 DIGITAL THERAPEUTICS MARKET, BY REVENUE MODEL, 2023 VS. 2028 (USD MILLION)

- FIGURE 13 DIGITAL THERAPEUTICS MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 14 DIGITAL THERAPEUTICS MARKET FOR TREATMENT/CARE-RELATED APPLICATIONS, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 15 DIGITAL THERAPEUTICS MARKET, BY SALES CHANNEL, 2023 VS. 2028 (USD MILLION)

- FIGURE 16 GEOGRAPHICAL SNAPSHOT OF DIGITAL THERAPEUTICS MARKET

4 PREMIUM INSIGHTS

- 4.1 DIGITAL THERAPEUTICS MARKET OVERVIEW

- FIGURE 17 INCREASING INCIDENCE OF CHRONIC DISEASES AND RISING NEED TO CURB HEALTHCARE COSTS TO DRIVE MARKET

- 4.2 DIGITAL THERAPEUTICS MARKET, BY SALES CHANNEL, 2023 VS. 2O28

- FIGURE 18 B2B SALES CHANNEL SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- 4.3 DIGITAL THERAPEUTICS MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- FIGURE 19 US TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 20 DIGITAL THERAPEUTICS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing incidence of chronic diseases

- 5.2.1.2 Growing focus on preventive healthcare

- 5.2.1.3 Rising need to curb healthcare cost

- 5.2.1.4 Surge in venture capital investments

- 5.2.1.5 Benefits of digital therapeutics

- 5.2.1.5.1 Ability to induce behavioral change

- 5.2.1.5.2 Improved drug adherence

- 5.2.1.5.3 Patient convenience and user-friendly

- 5.2.2 RESTRAINTS

- 5.2.2.1 Data privacy concerns

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 High growth potential of emerging markets

- 5.2.3.2 Large undiagnosed and untreated population

- 5.2.4 CHALLENGES

- 5.2.4.1 Unstable pricing models

- 5.2.4.2 Reluctance among patients for DTx adoption

- 5.2.4.3 Limited awareness in emerging economies

- 5.2.4.4 Resistance from traditional healthcare providers

- 5.3 INDUSTRY TRENDS

- 5.3.1 VIRTUAL REALITY

- 5.3.2 RISING DEMAND FOR DIGITAL SOLUTIONS IN CBT

- 5.4 TECHNOLOGY ANALYSIS

- TABLE 2 TECHNOLOGY ENABLERS, BENEFITS, AND EXAMPLES

- 5.4.1 MACHINE LEARNING

- 5.4.2 ARTIFICIAL INTELLIGENCE

- 5.4.3 INTERNET OF THINGS

- 5.4.4 BLOCKCHAIN TECHNOLOGY

- 5.4.5 CLOUD COMPUTING

- 5.4.6 DATA ANALYTICS

- 5.4.7 EXTENDED REALITY

- 5.5 VALUE CHAIN ANALYSIS

- FIGURE 21 DIGITAL THERAPEUTICS MARKET: VALUE CHAIN ANALYSIS

- 5.5.1 RESEARCH & PRODUCT DEVELOPMENT

- 5.5.2 MATERIAL COMPONENTS

- 5.5.3 MANUFACTURERS & DEVELOPERS

- 5.5.4 DISTRIBUTION & SALES

- 5.5.5 END-USER INDUSTRIES

- 5.5.6 POST-SALE SERVICES

- 5.6 ECOSYSTEM ANALYSIS

- FIGURE 22 ECOSYSTEM MARKET/MAP

- 5.7 PIPELINE PRODUCTS

- 5.8 CASE STUDY ANALYSIS

- 5.8.1 CASE STUDY 1: WELLTHY THERAPEUTICS (INDIA)

- 5.8.2 CASE STUDY 2: HAPPIFY HEALTH (US)

- 5.8.3 CASE STUDY 3: OMADA HEALTH (US)

- 5.9 PORTER'S FIVE FORCES ANALYSIS

- 5.9.1 THREAT OF NEW ENTRANTS

- 5.9.2 BARGAINING POWER OF SUPPLIERS

- 5.9.3 BARGAINING POWER OF BUYERS

- 5.9.4 THREAT OF SUBSTITUTES

- 5.9.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.10 REGULATORY LANDSCAPE

- 5.10.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 3 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 4 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 5 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 DIGITAL THERAPEUTICS MARKET: REGULATORY DATA NEEDED FOR CLASS II DEVICES

- 5.11 PRICING ANALYSIS

- 5.11.1 COSTS INVOLVED IN DIGITAL THERAPEUTICS

- 5.11.2 INDICATIVE PRICING ANALYSIS, BY KEY PLAYER & COUNTRY

- TABLE 8 AVERAGE SELLING PRICE OF DIGITAL THERAPEUTIC PRODUCTS, BY COUNTRY

- 5.11.3 INDICATIVE PRICING ANALYSIS OF DIGITAL THERAPEUTICS, BY REGION

- FIGURE 23 INDICATIVE PRICING ANALYSIS OF TELEHEALTH & TELEMEDICINE DEVICES, BY REGION

- 5.12 REIMBURSEMENT SCENARIO

- TABLE 9 DIGITAL THERAPEUTICS MARKET: GLOBAL COVERAGE DETERMINATION STANDARDS

- 5.13 PATENT ANALYSIS

- 5.13.1 PATENT PUBLICATION TRENDS

- FIGURE 24 LIST OF MAJOR PATIENTS FOR DIGITAL THERAPEUTICS

- 5.13.2 INSIGHTS: JURISDICTION AND TOP APPLICANT ANALYSIS

- FIGURE 25 TOP APPLICANT COUNTRIES FOR DIGITAL THERAPEUTICS PATENTS (JANUARY 2016-NOVEMBER 2023)

- 5.13.3 LIST OF MAJOR PATENTS

- TABLE 10 KEY PATENTS IN DIGITAL THERAPEUTICS MARKET

- 5.14 KEY CONFERENCES AND EVENTS

- TABLE 11 DIGITAL THERAPEUTICS MARKET: DETAILED LIST OF CONFERENCES AND EVENTS (2023-2024)

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 26 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR SALES CHANNEL

- TABLE 12 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR SALES CHANNEL, BY RANKING

- 5.15.2 BUYING CRITERIA

- FIGURE 27 KEY BUYING CRITERIA FOR SALES CHANNEL

- TABLE 13 KEY BUYING CRITERIA FOR SALES CHANNEL, BY RANKING

- 5.16 REVENUE SHIFT AND NEW REVENUE POCKETS FOR DIGITAL THERAPEUTICS MARKET

- FIGURE 28 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.17 INVESTMENT LANDSCAPE

- FIGURE 29 INVESTOR DEALS & FUNDING INITIATIVES FOR DIGITAL THERAPEUTICS (2022)

- FIGURE 30 TOP FUNDING CATEGORIES FOR DIGITAL HEALTH IN 2021

- FIGURE 31 MOST VALUED TELEHEALTH & TELEMEDICINE FIRMS IN 2022 (USD BILLION)

6 DIGITAL THERAPEUTICS MARKET, BY OFFERING

- 6.1 INTRODUCTION

- TABLE 14 DIGITAL THERAPEUTICS MARKET, BY OFFERING, 2021-2028 (USD MILLION)

- 6.2 SOFTWARE/PLATFORMS

- 6.2.1 ABILITY TO PROVIDE SCALABLE SOLUTIONS FOR DEPLOYMENT TO PROPEL MARKET

- TABLE 15 DIGITAL THERAPEUTICS MARKET FOR SOFTWARE/PLATFORMS, BY REGION, 2021-2028 (USD MILLION)

- 6.3 PROGRAMS

- 6.3.1 INTRODUCTION OF EVIDENCE-BASED THERAPEUTIC PROGRAMS TO SUPPORT MARKET GROWTH

- TABLE 16 DIGITAL THERAPEUTICS MARKET FOR PROGRAMS, BY REGION, 2021-2028 (USD MILLION)

- 6.4 VIRTUAL REALITY/GAMES

- 6.4.1 RISING DEMAND FOR VR SOLUTIONS TO DRIVE MARKET

- TABLE 17 DIGITAL THERAPEUTICS MARKET FOR VIRTUAL REALITY/GAMES, BY REGION, 2021-2028 (USD MILLION)

7 DIGITAL THERAPEUTICS MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- TABLE 18 DIGITAL THERAPEUTICS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 7.2 TREATMENT/CARE-RELATED APPLICATIONS

- TABLE 19 DIGITAL THERAPEUTICS MARKET FOR TREATMENT/CARE-RELATED APPLICATIONS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 20 DIGITAL THERAPEUTICS MARKET FOR TREATMENT/CARE-RELATED APPLICATIONS, BY REGION, 2021-2028 (USD MILLION)

- 7.2.1 DIABETES

- 7.2.1.1 Rising prevalence of diabetes to drive market

- TABLE 21 DIGITAL THERAPEUTICS MARKET FOR DIABETES, BY REGION, 2021-2028 (USD MILLION)

- 7.2.2 CENTRAL NERVOUS SYSTEM (CNS) DISORDERS

- TABLE 22 DIGITAL THERAPEUTICS MARKET FOR CNS DISORDERS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 23 DIGITAL THERAPEUTICS MARKET FOR CNS DISORDERS, BY REGION, 2021-2028 (USD MILLION)

- 7.2.2.1 Mental health disorders

- 7.2.2.1.1 Benefits of digital therapeutics in managing mental health disorders to drive R&D

- 7.2.2.1 Mental health disorders

- TABLE 24 DIGITAL THERAPEUTICS MARKET FOR MENTAL HEALTH DISORDERS, BY REGION, 2021-2028 (USD MILLION)

- 7.2.2.2 Other CNS disorders

- TABLE 25 DIGITAL THERAPEUTICS MARKET FOR OTHER CNS DISORDERS, BY REGION, 2021-2028 (USD MILLION)

- 7.2.3 SMOKING CESSATION

- 7.2.3.1 Rising development of mobile applications for nicotine addiction treatment to drive market

- TABLE 26 DIGITAL THERAPEUTICS MARKET FOR SMOKING CESSATION, BY REGION, 2021-2028 (USD MILLION)

- 7.2.4 CHRONIC RESPIRATORY DISEASES

- 7.2.4.1 Growing prevalence of COPD and asthma to drive market

- TABLE 27 DIGITAL THERAPEUTICS MARKET FOR CHRONIC RESPIRATORY DISEASES, BY REGION, 2021-2028 (USD MILLION)

- 7.2.5 MUSCULOSKELETAL DISORDERS

- 7.2.5.1 Shortage of physiotherapists to boost demand

- TABLE 28 DIGITAL THERAPEUTICS MARKET FOR MUSCULOSKELETAL DISORDERS, BY REGION, 2021-2028 (USD MILLION)

- 7.2.6 CARDIOVASCULAR DISEASES

- 7.2.6.1 High incidence of CVD to propel market

- TABLE 29 DIGITAL THERAPEUTICS MARKET FOR CARDIOVASCULAR DISEASES, BY REGION, 2021-2028 (USD MILLION)

- 7.2.7 MEDICATION ADHERENCE

- 7.2.7.1 Rising number of non-adherence cases to propel market

- TABLE 30 DIGITAL THERAPEUTICS MARKET FOR MEDICATION ADHERENCE, BY REGION, 2021-2028 (USD MILLION)

- 7.2.8 GASTROINTESTINAL DISORDERS

- 7.2.8.1 Rising incidence of IBS and GERD to support market growth

- TABLE 31 DIGITAL THERAPEUTICS MARKET FOR GASTROINTESTINAL DISORDERS, BY REGION, 2021-2028 (USD MILLION)

- 7.2.9 REHABILITATION & PATIENT CARE

- 7.2.9.1 Increasing focus on development of patient care platforms to drive market

- TABLE 32 DIGITAL THERAPEUTICS MARKET FOR REHABILITATION & PATIENT CARE, BY REGION, 2021-2028 (USD MILLION)

- 7.2.10 SUBSTANCE USE DISORDERS & ADDICTION MANAGEMENT

- 7.2.10.1 Growing focus on behavioral interventions to propel market

- TABLE 33 DIGITAL THERAPEUTICS MARKET FOR SUBSTANCE USE DISORDERS & ADDICTION MANAGEMENT, BY REGION, 2021-2028 (USD MILLION)

- 7.2.11 OTHER TREATMENT/CARE-RELATED APPLICATIONS

- TABLE 34 DIGITAL THERAPEUTICS MARKET FOR OTHER TREATMENT/CARE-RELATED APPLICATIONS, BY REGION, 2021-2028 (USD MILLION)

- 7.3 PREVENTIVE APPLICATIONS

- TABLE 35 DIGITAL THERAPEUTICS MARKET FOR PREVENTIVE APPLICATIONS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 36 DIGITAL THERAPEUTICS MARKET FOR PREVENTIVE APPLICATIONS, BY REGION, 2021-2028 (USD MILLION)

- 7.3.1 PREDIABETES

- 7.3.1.1 Focus on reducing type 2 diabetes to support market growth

- TABLE 37 DIGITAL THERAPEUTICS MARKET FOR PREDIABETES, BY REGION, 2021-2028 (USD MILLION)

- 7.3.2 OBESITY

- 7.3.2.1 Availability of cost-effective solutions for obesity management to propel market

- TABLE 38 DIGITAL THERAPEUTICS MARKET FOR OBESITY, BY REGION, 2021-2028 (USD MILLION)

- 7.3.3 NUTRITION

- 7.3.3.1 Sedentary lifestyles and unhealthy diets to boost demand

- TABLE 39 DIGITAL THERAPEUTICS MARKET FOR NUTRITION, BY REGION, 2021-2028 (USD MILLION)

- 7.3.4 LIFESTYLE MANAGEMENT

- 7.3.4.1 Aim to promote holistic lifestyles to drive market

- TABLE 40 DIGITAL THERAPEUTICS MARKET FOR LIFESTYLE MANAGEMENT, BY REGION, 2021-2028 (USD MILLION)

- 7.3.5 OTHER PREVENTIVE APPLICATIONS

- TABLE 41 DIGITAL THERAPEUTICS MARKET FOR OTHER PREVENTIVE APPLICATIONS, BY REGION, 2021-2028 (USD MILLION)

8 DIGITAL THERAPEUTICS MARKET, BY REVENUE MODEL

- 8.1 INTRODUCTION

- TABLE 42 DIGITAL THERAPEUTICS MARKET, BY REVENUE MODEL, 2021-2028 (USD MILLION)

- 8.2 SUBSCRIPTION-BASED MODEL

- 8.2.1 FLEXIBILITY IN PAYMENT OPTIONS TO DRIVE MARKET

- TABLE 43 DIGITAL THERAPEUTICS MARKET FOR SUBSCRIPTION-BASED MODEL, BY REGION, 2021-2028 (USD MILLION)

- 8.3 ONE-TIME PURCHASE/ANNUAL LICENSING MODEL

- 8.3.1 BENEFITS OF LIMITED RECURRING PAYMENTS TO BOOST DEMAND

- TABLE 44 DIGITAL THERAPEUTICS MARKET FOR ONE-TIME PURCHASE/ANNUAL LICENSING MODEL, BY REGION, 2021-2028 (USD MILLION)

- 8.4 OUTCOME /VALUE-BASED MODEL

- 8.4.1 RESULT-DRIVEN APPROACH THAT ENHANCES END-USER ENGAGEMENT TO PROPEL MARKET

- TABLE 45 DIGITAL THERAPEUTICS MARKET FOR OUTCOME/VALUE-BASED MODEL, BY REGION, 2021-2028 (USD MILLION)

9 DIGITAL THERAPEUTICS MARKET, BY SALES CHANNEL

- 9.1 INTRODUCTION

- TABLE 46 DIGITAL THERAPEUTICS MARKET, BY SALES CHANNEL, 2021-2028 (USD MILLION)

- 9.2 B2B SALES CHANNEL

- TABLE 47 DIGITAL THERAPEUTICS MARKET FOR B2B SALES CHANNEL, BY BUYER, 2021-2028 (USD MILLION)

- TABLE 48 DIGITAL THERAPEUTICS MARKET FOR B2B SALES CHANNEL, BY REGION, 2021-2028 (USD MILLION)

- 9.2.1 PAYERS

- 9.2.1.1 Significant cost savings to boost demand

- TABLE 49 DIGITAL THERAPEUTICS MARKET FOR PAYERS, BY REGION, 2021-2028 (USD MILLION)

- 9.2.2 EMPLOYERS

- 9.2.2.1 Rising importance of employee health management to drive market

- TABLE 50 DIGITAL THERAPEUTICS MARKET FOR EMPLOYERS, BY REGION, 2021-2028 (USD MILLION)

- 9.2.3 PHARMACEUTICAL COMPANIES

- 9.2.3.1 Cross-industry collaborations between start-ups and pharma companies to propel market

- TABLE 51 DIGITAL THERAPEUTICS MARKET FOR PHARMACEUTICAL COMPANIES, BY REGION, 2021-2028 (USD MILLION)

- 9.2.4 PROVIDERS

- 9.2.4.1 Advanced patient management and cost-reduction benefits to support market growth

- TABLE 52 DIGITAL THERAPEUTICS MARKET FOR PROVIDERS, BY REGION, 2021-2028 (USD MILLION)

- 9.2.5 OTHER BUYERS

- TABLE 53 DIGITAL THERAPEUTICS MARKET FOR OTHER BUYERS, BY REGION, 2021-2028 (USD MILLION)

- 9.3 B2C SALES CHANNEL

- TABLE 54 DIGITAL THERAPEUTICS MARKET FOR B2C SALES CHANNEL, BY BUYER, 2021-2028 (USD MILLION)

- TABLE 55 DIGITAL THERAPEUTICS MARKET FOR B2C SALES CHANNEL, BY REGION, 2021-2028 (USD MILLION)

- 9.3.1 CAREGIVERS

- 9.3.1.1 Ability to manage chronic conditions effectively to boost demand

- TABLE 56 DIGITAL THERAPEUTICS MARKET FOR CAREGIVERS, BY REGION, 2021-2028 (USD MILLION)

- 9.3.2 PATIENTS

- 9.3.2.1 Growing awareness of preventive health to support market

- TABLE 57 DIGITAL THERAPEUTICS MARKET FOR PATIENTS, BY REGION, 2021-2028 (USD MILLION)

10 DIGITAL THERAPEUTICS MARKET, BY REGION

- 10.1 INTRODUCTION

- TABLE 58 DIGITAL THERAPEUTICS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 10.2 NORTH AMERICA

- FIGURE 32 NORTH AMERICA: DIGITAL THERAPEUTICS MARKET SNAPSHOT

- TABLE 59 NORTH AMERICA: DIGITAL THERAPEUTICS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 60 NORTH AMERICA: DIGITAL THERAPEUTICS MARKET, BY OFFERING, 2021-2028 (USD MILLION)

- TABLE 61 NORTH AMERICA: DIGITAL THERAPEUTICS MARKET, BY REVENUE MODEL, 2021-2028 (USD MILLION)

- TABLE 62 NORTH AMERICA: DIGITAL THERAPEUTICS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 63 NORTH AMERICA: DIGITAL THERAPEUTICS MARKET FOR TREATMENT/ CARE-RELATED APPLICATIONS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 64 NORTH AMERICA: DIGITAL THERAPEUTICS MARKET FOR PREVENTIVE APPLICATIONS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 65 NORTH AMERICA: DIGITAL THERAPEUTICS MARKET FOR CNS DISORDERS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 66 NORTH AMERICA: DIGITAL THERAPEUTICS MARKET, BY SALES CHANNEL, 2021-2028 (USD MILLION)

- TABLE 67 NORTH AMERICA: DIGITAL THERAPEUTICS MARKET FOR B2C SALES CHANNEL, BY BUYER, 2021-2028 (USD MILLION)

- TABLE 68 NORTH AMERICA: DIGITAL THERAPEUTICS MARKET FOR B2B SALES CHANNEL, BY BUYER, 2021-2028 (USD MILLION)

- 10.2.1 NORTH AMERICA: RECESSION IMPACT

- 10.2.2 US

- 10.2.2.1 Rising technological advancements to boost demand

- TABLE 69 US: DIGITAL THERAPEUTICS MARKET, BY OFFERING, 2021-2028 (USD MILLION)

- TABLE 70 US: DIGITAL THERAPEUTICS MARKET, BY REVENUE MODEL, 2021-2028 (USD MILLION)

- TABLE 71 US: DIGITAL THERAPEUTICS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 72 US: DIGITAL THERAPEUTICS MARKET FOR TREATMENT/CARE-RELATED APPLICATIONS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 73 US: DIGITAL THERAPEUTICS MARKET FOR PREVENTIVE APPLICATIONS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 74 US: DIGITAL THERAPEUTICS MARKET FOR CNS DISORDERS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 75 US: DIGITAL THERAPEUTICS MARKET, BY SALES CHANNEL, 2021-2028 (USD MILLION)

- TABLE 76 US: DIGITAL THERAPEUTICS MARKET FOR B2C SALES CHANNEL, BY BUYER, 2021-2028 (USD MILLION)

- TABLE 77 US: DIGITAL THERAPEUTICS MARKET FOR B2B SALES CHANNEL, BY BUYER, 2021-2028 (USD MILLION)

- 10.2.3 CANADA

- 10.2.3.1 Favorable government initiatives for advanced healthcare solutions to support market growth

- TABLE 78 CANADA: DIGITAL THERAPEUTICS MARKET, BY OFFERING, 2021-2028 (USD MILLION)

- TABLE 79 CANADA: DIGITAL THERAPEUTICS MARKET, BY REVENUE MODEL, 2021-2028 (USD MILLION)

- TABLE 80 CANADA: DIGITAL THERAPEUTICS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 81 CANADA: DIGITAL THERAPEUTICS MARKET FOR TREATMENT/ CARE-RELATED APPLICATIONS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 82 CANADA: DIGITAL THERAPEUTICS MARKET FOR PREVENTIVE APPLICATIONS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 83 CANADA: DIGITAL THERAPEUTICS MARKET FOR CNS DISORDERS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 84 CANADA: DIGITAL THERAPEUTICS MARKET, BY SALES CHANNEL, 2021-2028 (USD MILLION)

- TABLE 85 CANADA: DIGITAL THERAPEUTICS MARKET FOR B2C SALES CHANNEL, BY BUYER, 2021-2028 (USD MILLION)

- TABLE 86 CANADA: DIGITAL THERAPEUTICS MARKET FOR B2B SALES CHANNEL, BY BUYER, 2021-2028 (USD MILLION)

- 10.3 EUROPE

- TABLE 87 EUROPE: DIGITAL THERAPEUTICS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 88 EUROPE: DIGITAL THERAPEUTICS MARKET, BY OFFERING, 2021-2028 (USD MILLION)

- TABLE 89 EUROPE: DIGITAL THERAPEUTICS MARKET, BY REVENUE MODEL, 2021-2028 (USD MILLION)

- TABLE 90 EUROPE: DIGITAL THERAPEUTICS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 91 EUROPE: DIGITAL THERAPEUTICS MARKET FOR TREATMENT/ CARE-RELATED APPLICATIONS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 92 EUROPE: DIGITAL THERAPEUTICS MARKET FOR PREVENTIVE APPLICATIONS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 93 EUROPE: DIGITAL THERAPEUTICS MARKET FOR CNS DISORDERS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 94 EUROPE: DIGITAL THERAPEUTICS MARKET, BY SALES CHANNEL, 2021-2028 (USD MILLION)

- TABLE 95 EUROPE: DIGITAL THERAPEUTICS MARKET FOR B2C SALES CHANNEL, BY BUYER, 2021-2028 (USD MILLION)

- TABLE 96 EUROPE: DIGITAL THERAPEUTICS MARKET FOR B2B SALES CHANNEL, BY BUYER, 2021-2028 (USD MILLION)

- 10.3.1 EUROPE: RECESSION IMPACT

- 10.3.2 GERMANY

- 10.3.2.1 Rising investments in digital health applications to drive market

- TABLE 97 GERMANY: DIGITAL THERAPEUTICS MARKET, BY OFFERING, 2021-2028 (USD MILLION)

- TABLE 98 GERMANY: DIGITAL THERAPEUTICS MARKET, BY REVENUE MODEL, 2021-2028 (USD MILLION)

- TABLE 99 GERMANY: DIGITAL THERAPEUTICS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 100 GERMANY: DIGITAL THERAPEUTICS MARKET FOR TREATMENT/ CARE-RELATED APPLICATIONS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 101 GERMANY: DIGITAL THERAPEUTICS MARKET FOR PREVENTIVE APPLICATIONS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 102 GERMANY: DIGITAL THERAPEUTICS MARKET FOR CNS DISORDERS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 103 GERMANY: DIGITAL THERAPEUTICS MARKET, BY SALES CHANNEL, 2021-2028 (USD MILLION)

- TABLE 104 GERMANY: DIGITAL THERAPEUTICS MARKET FOR B2C SALES CHANNEL, BY BUYER, 2021-2028 (USD MILLION)

- TABLE 105 GERMANY: DIGITAL THERAPEUTICS MARKET FOR B2B SALES CHANNEL, BY BUYER, 2021-2028 (USD MILLION)

- 10.3.3 UK

- 10.3.3.1 High adoption of HCIT solutions to propel market

- TABLE 106 UK: DIGITAL THERAPEUTICS MARKET, BY OFFERING, 2021-2028 (USD MILLION)

- TABLE 107 UK: DIGITAL THERAPEUTICS MARKET, BY REVENUE MODEL, 2021-2028 (USD MILLION)

- TABLE 108 UK: DIGITAL THERAPEUTICS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 109 UK: DIGITAL THERAPEUTICS MARKET FOR TREATMENT/CARE-RELATED APPLICATIONS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 110 UK: DIGITAL THERAPEUTICS MARKET FOR PREVENTIVE APPLICATIONS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 111 UK: DIGITAL THERAPEUTICS MARKET FOR CNS DISORDERS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 112 UK: DIGITAL THERAPEUTICS MARKET, BY SALES CHANNEL, 2021-2028 (USD MILLION)

- TABLE 113 UK: DIGITAL THERAPEUTICS MARKET FOR B2C SALES CHANNEL, BY BUYER, 2021-2028 (USD MILLION)

- TABLE 114 UK: DIGITAL THERAPEUTICS MARKET FOR B2B SALES CHANNEL, BY BUYER, 2021-2028 (USD MILLION)

- 10.3.4 FRANCE

- 10.3.4.1 Favorable health insurance system to boost demand

- TABLE 115 FRANCE: DIGITAL THERAPEUTICS MARKET, BY OFFERING, 2021-2028 (USD MILLION)

- TABLE 116 FRANCE: DIGITAL THERAPEUTICS MARKET, BY REVENUE MODEL, 2021-2028 (USD MILLION)

- TABLE 117 FRANCE: DIGITAL THERAPEUTICS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 118 FRANCE: DIGITAL THERAPEUTICS MARKET FOR TREATMENT/ CARE-RELATED APPLICATIONS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 119 FRANCE: DIGITAL THERAPEUTICS MARKET FOR PREVENTIVE APPLICATIONS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 120 FRANCE: DIGITAL THERAPEUTICS MARKET FOR CNS DISORDERS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 121 FRANCE: DIGITAL THERAPEUTICS MARKET, BY SALES CHANNEL, 2021-2028 (USD MILLION)

- TABLE 122 FRANCE: DIGITAL THERAPEUTICS MARKET FOR B2C SALES CHANNEL, BY BUYER, 2021-2028 (USD MILLION)

- TABLE 123 FRANCE: DIGITAL THERAPEUTICS MARKET FOR B2B SALES CHANNEL, BY BUYER, 2021-2028 (USD MILLION)

- 10.3.5 SPAIN

- 10.3.5.1 Rising incidence of chronic diseases to support market growth

- TABLE 124 SPAIN: DIGITAL THERAPEUTICS MARKET, BY OFFERING, 2021-2028 (USD MILLION)

- TABLE 125 SPAIN: DIGITAL THERAPEUTICS MARKET, BY REVENUE MODEL, 2021-2028 (USD MILLION)

- TABLE 126 SPAIN: DIGITAL THERAPEUTICS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 127 SPAIN: DIGITAL THERAPEUTICS MARKET FOR TREATMENT/CARE-RELATED APPLICATIONS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 128 SPAIN: DIGITAL THERAPEUTICS MARKET FOR PREVENTIVE APPLICATIONS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 129 SPAIN: DIGITAL THERAPEUTICS MARKET FOR CNS DISORDERS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 130 SPAIN: DIGITAL THERAPEUTICS MARKET, BY SALES CHANNEL, 2021-2028 (USD MILLION)

- TABLE 131 SPAIN: DIGITAL THERAPEUTICS MARKET FOR B2C SALES CHANNEL, BY BUYER, 2021-2028 (USD MILLION)

- TABLE 132 SPAIN: DIGITAL THERAPEUTICS MARKET FOR B2B SALES CHANNEL, BY BUYER, 2021-2028 (USD MILLION)

- 10.3.6 ITALY

- 10.3.6.1 Increasing focus on preventive care to support market growth

- TABLE 133 ITALY: DIGITAL THERAPEUTICS MARKET, BY OFFERING, 2021-2028 (USD MILLION)

- TABLE 134 ITALY: DIGITAL THERAPEUTICS MARKET, BY REVENUE MODEL, 2021-2028 (USD MILLION)

- TABLE 135 ITALY: DIGITAL THERAPEUTICS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 136 ITALY: DIGITAL THERAPEUTICS MARKET FOR TREATMENT/CARE-RELATED APPLICATIONS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 137 ITALY: DIGITAL THERAPEUTICS MARKET FOR PREVENTIVE APPLICATIONS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 138 ITALY: DIGITAL THERAPEUTICS MARKET FOR CNS DISORDERS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 139 ITALY: DIGITAL THERAPEUTICS MARKET, BY SALES CHANNEL, 2021-2028 (USD MILLION)

- TABLE 140 ITALY: DIGITAL THERAPEUTICS MARKET FOR B2C SALES CHANNEL, BY BUYER, 2021-2028 (USD MILLION)

- TABLE 141 ITALY: DIGITAL THERAPEUTICS MARKET FOR B2B SALES CHANNEL, BY BUYER, 2021-2028 (USD MILLION)

- 10.3.7 REST OF EUROPE

- TABLE 142 REST OF EUROPE: DIGITAL THERAPEUTICS MARKET, BY OFFERING, 2021-2028 (USD MILLION)

- TABLE 143 REST OF EUROPE: DIGITAL THERAPEUTICS MARKET, BY REVENUE MODEL, 2021-2028 (USD MILLION)

- TABLE 144 REST OF EUROPE: DIGITAL THERAPEUTICS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 145 REST OF EUROPE: DIGITAL THERAPEUTICS MARKET FOR TREATMENT/ CARE-RELATED APPLICATIONS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 146 REST OF EUROPE: DIGITAL THERAPEUTICS MARKET FOR PREVENTIVE APPLICATIONS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 147 REST OF EUROPE: DIGITAL THERAPEUTICS MARKET FOR CNS DISORDERS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 148 REST OF EUROPE: DIGITAL THERAPEUTICS MARKET, BY SALES CHANNEL, 2021-2028 (USD MILLION)

- TABLE 149 REST OF EUROPE: DIGITAL THERAPEUTICS MARKET FOR B2C SALES CHANNEL, BY BUYER, 2021-2028 (USD MILLION)

- TABLE 150 REST OF EUROPE: DIGITAL THERAPEUTICS MARKET FOR B2B SALES CHANNEL, BY BUYER, 2021-2028 (USD MILLION)

- 10.4 ASIA PACIFIC

- TABLE 151 ASIA PACIFIC: DIGITAL THERAPEUTICS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 152 ASIA PACIFIC: DIGITAL THERAPEUTICS MARKET, BY OFFERING, 2021-2028 (USD MILLION)

- TABLE 153 ASIA PACIFIC: DIGITAL THERAPEUTICS MARKET, BY REVENUE MODEL, 2021-2028 (USD MILLION)

- TABLE 154 ASIA PACIFIC: DIGITAL THERAPEUTICS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 155 ASIA PACIFIC: DIGITAL THERAPEUTICS MARKET FOR TREATMENT/ CARE-RELATED APPLICATIONS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 156 ASIA PACIFIC: DIGITAL THERAPEUTICS MARKET FOR PREVENTIVE APPLICATIONS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 157 ASIA PACIFIC: DIGITAL THERAPEUTICS MARKET FOR CNS DISORDERS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 158 ASIA PACIFIC: DIGITAL THERAPEUTICS MARKET, BY SALES CHANNEL, 2021-2028 (USD MILLION)

- TABLE 159 ASIA PACIFIC: DIGITAL THERAPEUTICS MARKET FOR B2C SALES CHANNEL, BY BUYER, 2021-2028 (USD MILLION)

- TABLE 160 ASIA PACIFIC: DIGITAL THERAPEUTICS MARKET FOR B2B SALES CHANNEL, BY BUYER, 2021-2028 (USD MILLION)

- 10.4.1 ASIA PACIFIC: RECESSION IMPACT

- 10.4.2 JAPAN

- 10.4.2.1 Rising incidence of diabetes to propel market

- TABLE 161 JAPAN: DIGITAL THERAPEUTICS MARKET, BY OFFERING, 2021-2028 (USD MILLION)

- TABLE 162 JAPAN: DIGITAL THERAPEUTICS MARKET, BY REVENUE MODEL, 2021-2028 (USD MILLION)

- TABLE 163 JAPAN: DIGITAL THERAPEUTICS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 164 JAPAN: DIGITAL THERAPEUTICS MARKET FOR TREATMENT/CARE-RELATED APPLICATIONS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 165 JAPAN: DIGITAL THERAPEUTICS MARKET FOR PREVENTIVE APPLICATIONS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 166 JAPAN: DIGITAL THERAPEUTICS MARKET FOR CNS DISORDERS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 167 JAPAN: DIGITAL THERAPEUTICS MARKET, BY SALES CHANNEL, 2021-2028 (USD MILLION)

- TABLE 168 JAPAN: DIGITAL THERAPEUTICS MARKET FOR B2C SALES CHANNEL, BY BUYER, 2021-2028 (USD MILLION)

- TABLE 169 JAPAN: DIGITAL THERAPEUTICS MARKET FOR B2B SALES CHANNEL, BY BUYER, 2021-2028 (USD MILLION)

- 10.4.3 CHINA

- 10.4.3.1 Rising investments in application development to propel market

- TABLE 170 CHINA: DIGITAL THERAPEUTICS MARKET, BY OFFERING, 2021-2028 (USD MILLION)

- TABLE 171 CHINA: DIGITAL THERAPEUTICS MARKET, BY REVENUE MODEL, 2021-2028 (USD MILLION)

- TABLE 172 CHINA: DIGITAL THERAPEUTICS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 173 CHINA: DIGITAL THERAPEUTICS MARKET FOR TREATMENT/CARE-RELATED APPLICATIONS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 174 CHINA: DIGITAL THERAPEUTICS MARKET FOR PREVENTIVE APPLICATIONS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 175 CHINA: DIGITAL THERAPEUTICS MARKET FOR CNS DISORDERS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 176 CHINA: DIGITAL THERAPEUTICS MARKET, BY SALES CHANNEL, 2021-2028 (USD MILLION)

- TABLE 177 CHINA: DIGITAL THERAPEUTICS MARKET FOR B2C SALES CHANNEL, BY BUYER, 2021-2028 (USD MILLION)

- TABLE 178 CHINA: DIGITAL THERAPEUTICS MARKET FOR B2B SALES CHANNEL, BY BUYER, 2021-2028 (USD MILLION)

- 10.4.4 INDIA

- 10.4.4.1 Low patient adherence to prescribed treatments to support market growth

- TABLE 179 INDIA: DIGITAL THERAPEUTICS MARKET, BY OFFERING, 2021-2028 (USD MILLION)

- TABLE 180 INDIA: DIGITAL THERAPEUTICS MARKET, BY REVENUE MODEL, 2021-2028 (USD MILLION)

- TABLE 181 INDIA: DIGITAL THERAPEUTICS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 182 INDIA: DIGITAL THERAPEUTICS MARKET FOR TREATMENT/CARE-RELATED APPLICATIONS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 183 INDIA: DIGITAL THERAPEUTICS MARKET FOR PREVENTIVE APPLICATIONS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 184 INDIA: DIGITAL THERAPEUTICS MARKET FOR CNS DISORDERS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 185 INDIA: DIGITAL THERAPEUTICS MARKET, BY SALES CHANNEL, 2021-2028 (USD MILLION)

- TABLE 186 INDIA: DIGITAL THERAPEUTICS MARKET FOR B2C SALES CHANNEL, BY BUYER, 2021-2028 (USD MILLION)

- TABLE 187 INDIA: DIGITAL THERAPEUTICS MARKET FOR B2B SALES CHANNEL, BY BUYER, 2021-2028 (USD MILLION)

- 10.4.5 REST OF ASIA PACIFIC

- TABLE 188 REST OF ASIA PACIFIC: DIGITAL THERAPEUTICS MARKET, BY OFFERING, 2021-2028 (USD MILLION)

- TABLE 189 REST OF ASIA PACIFIC: DIGITAL THERAPEUTICS MARKET, BY REVENUE MODEL, 2021-2028 (USD MILLION)

- TABLE 190 REST OF ASIA PACIFIC: DIGITAL THERAPEUTICS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 191 REST OF ASIA PACIFIC: DIGITAL THERAPEUTICS MARKET FOR TREATMENT/ CARE-RELATED APPLICATIONS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 192 REST OF ASIA PACIFIC: DIGITAL THERAPEUTICS MARKET FOR PREVENTIVE APPLICATIONS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 193 REST OF ASIA PACIFIC: DIGITAL THERAPEUTICS MARKET FOR CNS DISORDERS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 194 REST OF ASIA PACIFIC: DIGITAL THERAPEUTICS MARKET, BY SALES CHANNEL, 2021-2028 (USD MILLION)

- TABLE 195 REST OF ASIA PACIFIC: DIGITAL THERAPEUTICS MARKET FOR B2C SALES CHANNEL, BY BUYER, 2021-2028 (USD MILLION)

- TABLE 196 REST OF ASIA PACIFIC: DIGITAL THERAPEUTICS MARKET FOR B2B SALES CHANNEL, BY BUYER, 2021-2028 (USD MILLION)

- 10.5 LATIN AMERICA

- TABLE 197 LATIN AMERICA: DIGITAL THERAPEUTICS MARKET, BY OFFERING, 2021-2028 (USD MILLION)

- TABLE 198 LATIN AMERICA: DIGITAL THERAPEUTICS MARKET, BY REVENUE MODEL, 2021-2028 (USD MILLION)

- TABLE 199 LATIN AMERICA: DIGITAL THERAPEUTICS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 200 LATIN AMERICA: DIGITAL THERAPEUTICS MARKET FOR TREATMENT/CARE-RELATED APPLICATIONS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 201 LATIN AMERICA: DIGITAL THERAPEUTICS MARKET FOR PREVENTIVE APPLICATIONS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 202 LATIN AMERICA: DIGITAL THERAPEUTICS MARKET FOR CNS DISORDERS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 203 LATIN AMERICA: DIGITAL THERAPEUTICS MARKET, BY SALES CHANNEL, 2021-2028 (USD MILLION)

- TABLE 204 LATIN AMERICA: DIGITAL THERAPEUTICS MARKET FOR B2C SALES CHANNEL, BY BUYER, 2021-2028 (USD MILLION)

- TABLE 205 LATIN AMERICA: DIGITAL THERAPEUTICS MARKET FOR B2B SALES CHANNEL, BY BUYER, 2021-2028 (USD MILLION)

- 10.5.1 LATIN AMERICA: RECESSION IMPACT

- 10.5.2 BRAZIL

- 10.5.2.1 Growing acceptance of evidence-based software applications to boost demand

- TABLE 206 BRAZIL: DIGITAL THERAPEUTICS MARKET, BY OFFERING, 2021-2028 (USD MILLION)

- TABLE 207 BRAZIL: DIGITAL THERAPEUTICS MARKET, BY REVENUE MODEL, 2021-2028 (USD MILLION)

- TABLE 208 BRAZIL: DIGITAL THERAPEUTICS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 209 BRAZIL: DIGITAL THERAPEUTICS MARKET FOR TREATMENT/ CARE-RELATED APPLICATIONS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 210 BRAZIL: DIGITAL THERAPEUTICS MARKET FOR PREVENTIVE APPLICATIONS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 211 BRAZIL: DIGITAL THERAPEUTICS MARKET FOR CNS DISORDERS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 212 BRAZIL: DIGITAL THERAPEUTICS MARKET, BY SALES CHANNEL, 2021-2028 (USD MILLION)

- TABLE 213 BRAZIL: DIGITAL THERAPEUTICS MARKET FOR B2C SALES CHANNEL, BY BUYER, 2021-2028 (USD MILLION)

- TABLE 214 BRAZIL: DIGITAL THERAPEUTICS MARKET FOR B2B SALES CHANNEL, BY BUYER, 2021-2028 (USD MILLION)

- 10.5.3 MEXICO

- 10.5.3.1 Growth in target patient population to support market growth

- TABLE 215 MEXICO: DIGITAL THERAPEUTICS MARKET, BY OFFERING, 2021-2028 (USD MILLION)

- TABLE 216 MEXICO: DIGITAL THERAPEUTICS MARKET, BY REVENUE MODEL, 2021-2028 (USD MILLION)

- TABLE 217 MEXICO: DIGITAL THERAPEUTICS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 218 MEXICO: DIGITAL THERAPEUTICS MARKET FOR TREATMENT/ CARE-RELATED APPLICATIONS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 219 MEXICO: DIGITAL THERAPEUTICS MARKET FOR PREVENTIVE APPLICATIONS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 220 MEXICO: DIGITAL THERAPEUTICS MARKET FOR CNS DISORDERS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 221 MEXICO: DIGITAL THERAPEUTICS MARKET, BY SALES CHANNEL, 2021-2028 (USD MILLION)

- TABLE 222 MEXICO: DIGITAL THERAPEUTICS MARKET FOR B2C SALES CHANNEL, BY BUYER, 2021-2028 (USD MILLION)

- TABLE 223 MEXICO: DIGITAL THERAPEUTICS MARKET FOR B2B SALES CHANNEL, BY BUYER, 2021-2028 (USD MILLION)

- 10.5.4 REST OF LATIN AMERICA

- TABLE 224 REST OF LATIN AMERICA: DIGITAL THERAPEUTICS MARKET, BY OFFERING, 2021-2028 (USD MILLION)

- TABLE 225 REST OF LATIN AMERICA: DIGITAL THERAPEUTICS MARKET, BY REVENUE MODEL, 2021-2028 (USD MILLION)

- TABLE 226 REST OF LATIN AMERICA: DIGITAL THERAPEUTICS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 227 REST OF LATIN AMERICA: DIGITAL THERAPEUTICS MARKET FOR TREATMENT/ CARE-RELATED APPLICATIONS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 228 REST OF LATIN AMERICA: DIGITAL THERAPEUTICS MARKET FOR PREVENTIVE APPLICATIONS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 229 REST OF LATIN AMERICA: DIGITAL THERAPEUTICS MARKET FOR CNS DISORDERS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 230 REST OF LATIN AMERICA: DIGITAL THERAPEUTICS MARKET, BY SALES CHANNEL, 2021-2028 (USD MILLION)

- TABLE 231 REST OF LATIN AMERICA: DIGITAL THERAPEUTICS MARKET FOR B2C SALES CHANNEL, BY BUYER, 2021-2028 (USD MILLION)

- TABLE 232 REST OF LATIN AMERICA: DIGITAL THERAPEUTICS MARKET FOR B2B SALES CHANNEL, BY BUYER, 2021-2028 (USD MILLION)

- 10.6 MIDDLE EAST & AFRICA

- TABLE 233 MIDDLE EAST & AFRICA: DIGITAL THERAPEUTICS MARKET, BY OFFERING, 2021-2028 (USD MILLION)

- TABLE 234 MIDDLE EAST & AFRICA: DIGITAL THERAPEUTICS MARKET, BY REVENUE MODEL, 2021-2028 (USD MILLION)

- TABLE 235 MIDDLE EAST & AFRICA: DIGITAL THERAPEUTICS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 236 MIDDLE EAST & AFRICA: DIGITAL THERAPEUTICS MARKET FOR TREATMENT/ CARE-RELATED APPLICATIONS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 237 MIDDLE EAST & AFRICA: DIGITAL THERAPEUTICS MARKET FOR PREVENTIVE APPLICATIONS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 238 MIDDLE EAST & AFRICA: DIGITAL THERAPEUTICS MARKET FOR CNS DISORDERS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 239 MIDDLE EAST & AFRICA: DIGITAL THERAPEUTICS MARKET, BY SALES CHANNEL, 2021-2028 (USD MILLION)

- TABLE 240 MIDDLE EAST & AFRICA: DIGITAL THERAPEUTICS MARKET FOR B2C SALES CHANNEL, BY BUYER, 2021-2028 (USD MILLION)

- TABLE 241 MIDDLE EAST & AFRICA: DIGITAL THERAPEUTICS MARKET FOR B2B SALES CHANNEL, BY BUYER, 2021-2028 (USD MILLION)

- 10.6.1 MIDDLE EAST & AFRICA: RECESSION IMPACT

- 10.6.2 GCC COUNTRIES

- 10.6.2.1 Improvements in healthcare infrastructure to drive market

- TABLE 242 GCC COUNTRIES: DIGITAL THERAPEUTICS MARKET, BY OFFERING, 2021-2028 (USD MILLION)

- TABLE 243 GCC COUNTRIES: DIGITAL THERAPEUTICS MARKET, BY REVENUE MODEL, 2021-2028 (USD MILLION)

- TABLE 244 GCC COUNTRIES: DIGITAL THERAPEUTICS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 245 GCC COUNTRIES: DIGITAL THERAPEUTICS MARKET FOR TREATMENT/ CARE-RELATED APPLICATIONS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 246 GCC COUNTRIES: DIGITAL THERAPEUTICS MARKET FOR PREVENTIVE APPLICATIONS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 247 GCC COUNTRIES: DIGITAL THERAPEUTICS MARKET FOR CNS DISORDERS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 248 GCC COUNTRIES: DIGITAL THERAPEUTICS MARKET, BY SALES CHANNEL, 2021-2028 (USD MILLION)

- TABLE 249 GCC COUNTRIES: DIGITAL THERAPEUTICS MARKET FOR B2C SALES CHANNEL, BY BUYER, 2021-2028 (USD MILLION)

- TABLE 250 GCC COUNTRIES: DIGITAL THERAPEUTICS MARKET FOR B2B SALES CHANNEL, BY BUYER, 2021-2028 (USD MILLION)

- 10.6.3 REST OF MIDDLE EAST & AFRICA

- TABLE 251 REST OF MIDDLE EAST & AFRICA: DIGITAL THERAPEUTICS MARKET, BY OFFERING, 2021-2028 (USD MILLION)

- TABLE 252 REST OF MIDDLE EAST & AFRICA: DIGITAL THERAPEUTICS MARKET, BY REVENUE MODEL, 2021-2028 (USD MILLION)

- TABLE 253 REST OF MIDDLE EAST & AFRICA: DIGITAL THERAPEUTICS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 254 REST OF MIDDLE EAST & AFRICA: DIGITAL THERAPEUTICS MARKET FOR TREATMENT/CARE-RELATED APPLICATIONS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 255 REST OF MIDDLE EAST & AFRICA: DIGITAL THERAPEUTICS MARKET FOR PREVENTIVE APPLICATIONS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 256 REST OF MIDDLE EAST & AFRICA: DIGITAL THERAPEUTICS MARKET FOR CNS DISORDERS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 257 REST OF MIDDLE EAST & AFRICA: DIGITAL THERAPEUTICS MARKET, BY SALES CHANNEL, 2021-2028 (USD MILLION)

- TABLE 258 REST OF MIDDLE EAST & AFRICA: DIGITAL THERAPEUTICS MARKET FOR B2C SALES CHANNEL, BY BUYER, 2021-2028 (USD MILLION)

- TABLE 259 REST OF MIDDLE EAST & AFRICA: DIGITAL THERAPEUTICS MARKET FOR B2B SALES CHANNEL, BY BUYER, 2021-2028 (USD MILLION)

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 KEY PLAYER STRATEGIES

- FIGURE 33 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

- 11.3 REVENUE SHARE ANALYSIS OF TOP MARKET PLAYERS

- 11.3.1 REVENUE ANALYSIS OF KEY PLAYERS IN DIGITAL THERAPEUTICS MARKET, 2020-2022 (USD MILLION)

- 11.4 MARKET SHARE ANALYSIS

- TABLE 260 DIGITAL THERAPEUTICS MARKET: INTENSITY OF COMPETITIVE RIVALRY

- FIGURE 34 DIGITAL THERAPEUTICS MARKET: MARKET SHARE ANALYSIS

- 11.5 COMPANY EVALUATION MATRIX

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- FIGURE 35 DIGITAL THERAPEUTICS MARKET: COMPANY EVALUATION MATRIX (2022)

- 11.5.5 COMPANY FOOTPRINT

- TABLE 261 DIGITAL THERAPEUTICS MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS

- TABLE 262 DIGITAL THERAPEUTICS MARKET: OFFERING FOOTPRINT ANALYSIS, BY KEY PLAYER

- TABLE 263 DIGITAL THERAPEUTICS MARKET: APPLICATION FOOTPRINT ANALYSIS, BY KEY PLAYER

- TABLE 264 DIGITAL THERAPEUTICS MARKET: SALES CHANNEL FOOTPRINT ANALYSIS, BY KEY PLAYER

- TABLE 265 DIGITAL THERAPEUTICS MARKET: REGIONAL FOOTPRINT ANALYSIS, BY KEY PLAYER

- 11.6 COMPANY EVALUATION MATRIX FOR STARTUPS/SMES

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 RESPONSIVE COMPANIES

- 11.6.3 DYNAMIC COMPANIES

- 11.6.4 STARTING BLOCKS

- FIGURE 36 DIGITAL THERAPEUTICS MARKET: STARTUP/SME EVALUATION MATRIX (2022)

- 11.6.5 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 266 DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 267 COMPETITIVE BENCHMARKING OF STARTUPS/SMES, BY REGION

- 11.7 COMPETITIVE SCENARIOS AND TRENDS

- TABLE 268 DIGITAL THERAPEUTICS MARKET: PRODUCT LAUNCHES, ENHANCEMENTS, AND APPROVALS (JANUARY 2020-NOVEMBER 2023)

- 11.7.1 DEALS

- TABLE 269 DIGITAL THERAPEUTICS MARKET: DEALS (JANUARY 2020-NOVEMBER 2023)

- 11.7.2 OTHER DEVELOPMENTS

- TABLE 270 DIGITAL THERAPEUTICS MARKET: OTHER DEVELOPMENTS (JANUARY 2020-NOVEMBER 2023)

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- (Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)**

- 12.1.1 NOOM, INC.

- TABLE 271 NOOM, INC.: BUSINESS OVERVIEW

- 12.1.2 TELADOC HEALTH, INC.

- TABLE 272 TELADOC HEALTH, INC.: BUSINESS OVERVIEW

- FIGURE 37 TELADOC HEALTH, INC.: COMPANY SNAPSHOT (2022)

- 12.1.3 OMADA HEALTH, INC.

- TABLE 273 OMADA HEALTH, INC.: BUSINESS OVERVIEW

- 12.1.4 WELLDOC, INC.

- TABLE 274 WELLDOC, INC.: BUSINESS OVERVIEW

- 12.1.5 COGNIFIT, INC.

- TABLE 275 COGNIFIT, INC.: BUSINESS OVERVIEW

- 12.1.6 HEADSPACE HEALTH

- TABLE 276 HEADSPACE HEALTH: BUSINESS OVERVIEW

- 12.1.7 PROPELLER HEALTH

- TABLE 277 PROPELLER HEALTH: BUSINESS OVERVIEW

- 12.1.8 2MORROW, INC.

- TABLE 278 2MORROW, INC.: BUSINESS OVERVIEW

- 12.1.9 CANARY HEALTH

- TABLE 279 CANARY HEALTH: BUSINESS OVERVIEW

- 12.1.10 CLICK THERAPEUTICS, INC.

- TABLE 280 CLICK THERAPEUTICS: BUSINESS OVERVIEW

- 12.1.11 AKILI, INC.

- TABLE 281 AKILI, INC.: BUSINESS OVERVIEW

- 12.1.12 WELLTHY THERAPEUTICS PVT. LTD.

- TABLE 282 WELLTHY THERAPEUTICS PVT. LTD.: BUSINESS OVERVIEW

- 12.1.13 COGNOA, INC.

- TABLE 283 COGNOA, INC.: BUSINESS OVERVIEW

- 12.1.14 TWILL INC.

- TABLE 284 TWILL INC.: BUSINESS OVERVIEW

- 12.1.15 KAIA HEALTH SOFTWARE GMBH

- TABLE 285 KAIA HEALTH SOFTWARE GMBH: BUSINESS OVERVIEW

- 12.1.16 BETTER THERAPEUTICS, INC.

- TABLE 286 BETTER THERAPEUTICS, INC.: BUSINESS OVERVIEW

- 12.1.17 REALIZEDCARE

- TABLE 287 REALIZEDCARE: BUSINESS OVERVIEW

- 12.1.18 BIOFOURMIS

- TABLE 288 BIOFOURMIS: BUSINESS OVERVIEW

- 12.1.19 AYOGO INCORPORATED

- TABLE 289 AYOGO INCORPORATED: BUSINESS OVERVIEW

- 12.1.20 AMALGAM RX, INC.

- TABLE 290 AMALGAM RX, INC.: BUSINESS OVERVIEW

- 12.2 OTHER PLAYERS

- 12.2.1 MINDABLE HEALTH GMBH

- 12.2.2 VIRTA HEALTH CORP.

- 12.2.3 HINGE HEALTH

- 12.2.4 OREXO AB

- 12.2.5 FREESPIRA, INC.

- *Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)** might not be captured in case of unlisted companies.

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS