|

|

市場調査レポート

商品コード

1442280

マイクロバイオーム診断の世界市場:製品別、技術別、サンプル別、用途別 - 予測(~2028年)Microbiome Diagnostics Market by Product (Kits & Reagents, Instruments), Technology (16s rRNA Sequencing, Shot Gun Metagenomics, Metatranscriptomics), Sample (Fecal, Saliva, Skin), Application (GI, Metabolic Disorders) - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| マイクロバイオーム診断の世界市場:製品別、技術別、サンプル別、用途別 - 予測(~2028年) |

|

出版日: 2024年02月22日

発行: MarketsandMarkets

ページ情報: 英文 179 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

世界のマイクロバイオーム診断の市場規模は、2023年の1億4,600万米ドルから、予測期間中に15.5%のCAGRで推移し、2028年には3億米ドルの規模に成長すると予測されています。

同市場の成長は、マイクロバイオーム診断の認知度の向上、個別化医療の需要の増加、疾患の発生率増加などの要因によって推進されています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2022-2028年 |

| 基準年 | 2023年 |

| 予測期間 | 2023-2028年 |

| 検討単位 | 金額 (米ドル) |

| セグメント | 製品・技術・サンプル・用途・エンドユーザー・地域 |

| 対象地域 | 北米・欧州・アジア太平洋・その他の地域 |

製品別では、試薬・キットが最大のシェアを示しています。成長の主な原動力となっているのは、マイクロバイオームベースの診断処置における試薬&キットの反復使用と、世界中で実施されるマイクロバイオームベースの検査量の増加です。さらに、効率的な結果と診断の精度を提供する優れた試薬&キットが入手可能になったことも、同部門の成長を後押ししています。

技術別では、16s rRNAシーケンシングの部門が予測期間中に大きな成長率を示す見通しです。キャピラリーシーケンシングやPCRベースのアプローチと比較して、16S rRNAシーケンシングは培養を必要としない技術であり、研究者はサンプル内の微生物群集全体を分析することができます。NGSベースの16S rRNAシーケンシングは、1回のシーケンシング実行で多数のサンプルを組み合わせることができるため、従来の手法では見つからないような細菌株を同定するためのコスト効率の高い手法です。

地域別では、アジア太平洋地域が最大の成長を示しています。同地域の高成長の背景には、アジア諸国における疾患の増加、マイクロバイオーム研究活動の活発化があります。

当レポートでは、世界のマイクロバイオーム診断の市場を調査し、市場概要、市場影響因子および市場機会の分析、技術・特許の動向、法規制環境、ケーススタディ、市場規模の推移・予測、各種区分・地域別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- バリューチェーン分析

- サプライチェーン分析

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- 規制状況

- エコシステム分析

- 特許分析

- 主な会議とイベント

- 価格分析

- 顧客のビジネスに影響を与える動向/ディスラプション

- 技術分析

- 貿易分析

第6章 マイクロバイオーム診断市場:製品別

- キット・試薬

- 機器

第7章 マイクロバイオーム診断市場:技術別

- 16s rRNAシーケンシング

- ショットガンメタゲノミクス

- メタトランスクリプトミクス

- その他

第8章 マイクロバイオーム診断市場:サンプル別

- 便

- 唾液

- 皮膚

- その他

第9章 マイクロバイオーム診断市場:用途別

- 病気診断用途

- 胃腸障害

- 代謝異常症

- その他

- 研究用途

第10章 マイクロバイオーム診断市場:エンドユーザー別

- 病院

- 研究機関

- 製薬およびバイオテクノロジー会社

第11章 マイクロバイオーム診断市場:地域別

- 北米

- 欧州

- アジア太平洋

- その他の地域

第12章 競合情勢

- 概要

- 主要企業の戦略/有力企業

- 収益分析

- 市場シェア分析

- 企業評価マトリックス

- 新興企業/中小企業の評価マトリックス

- 競合シナリオ・動向

第13章 企業プロファイル

- 主要企業

- GENETIC ANALYSIS AS

- DNA GENOTEK (ORASURE TECHNOLOGIES, INC.)

- MICROBA LIFE SCIENCES

- ILLUMINA INC.

- OXFORD NANOPORE TECHNOLOGIES, PLC

- BIOME OXFORD LTD.

- VIENNALAB DIAGNOSTICS GMBH

- METABIOMICS

- VIOME LIFE SCIENCES

- LUXIA SCIENTIFIC

- SUN GENOMICS

- ATLAS BIOMED

- QUANTBIOME, INC. (DBA OMBRE)

- BECTON, DICKINSON AND COMPANY

- DAYTWO

- その他の企業

- MICRONOMA

- TERAOMICS S.L.

- FLIGHTPATH BIOSCIENCES

- MICROBIOME RESEARCH PVT. LTD.

- ORIGIN SCIENCES

- LEUCINE RICH BIO PRIVATE LIMITED

- DECODE AGE

- EVVY

- ALPHABIOMICS, LTD.

- GOODGUT

第14章 付録

The global microbiome diagnostics market is valued at an estimated USD 146 million in 2023 and is projected to reach USD 300 million by 2028, at a CAGR of 15.5% during the forecast period. Market growth is driven by factors such as increasing awareness of microbiome diagnostics, increasing demand of personalize medicine and increasing incidences of diseases.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2022-2028 |

| Base Year | 2023 |

| Forecast Period | 2023-2028 |

| Units Considered | Value (USD) Million |

| Segments | Product, Technology, Sample, Application, End User, and Region |

| Regions covered | North America, Europe, Asia Pacific, Rest of the World |

"The reagents & kits to register the largest share of the microbiome diagnostics market, by product."

The global microbiome diagnostics market is segmented into reagents & kits and instruments on product. Market growth is largely driven by the repetitive use of reagents & kits for microbiome-based diagnostic procedures coupled with the increase in the volume of microbiome-based tests conducted worldwide. Moreover, the availability of better reagents & kits that offer efficient results and precision in diagnosis attributes to their growing requirement resulting in growth of the segment.

"16s rRNA sequencing segment to grow at a considerable rate among technology during the forecast period."

The microbiome diagnostics market is segmented into 16s rRNA sequencing, shotgun metagenomics, metatranscriptomics and other technologies. As compared to capillary sequencing or PCR-based approaches, 16S rRNA sequencing is a culture-free technique that enables researchers to analyze the entire microbial community within a sample. Due to its ability to combine many samples in a sequencing run, NGS-based 16S rRNA sequencing is a cost-effective technique for identifying bacterial strains that may not be found using traditional methods.

"Research application segment accounted for the largest share in the microbiome diagnostics market, by application."

The global microbiome diagnostics market is segmented into research application, disease diagnostic application. The application segment of disease diagnostic application accounted for a considerable share in 2022, primarily due to rising prevalence of diseases.

"Asia Pacific: The fastest-growing region in the microbiome diagnostics market."

The global microbiome diagnostics market is segmented into five regions - North America, Europe, the Asia Pacific, Rest of the World. The Asia Pacific region is expected to grow at the highest rate during the forecast period in the microbiome-based diagnostics market. The high growth in the region is due to the increasing incidences of diseases, increasing microbiome research activities in Asian countries.

The break-up of the profile of primary participants in the microbiome diagnostics market:

- By Company Type: Tier 1 - 55%, Tier 2 - 40%, and Tier 3 - 5%

- By Designation: C-level - 37%, D-level - 48%, and Others - 15%

- By Region: North America - 56%, Europe - 20%, Asia Pacific - 17%, Rest of the World- 7%,

The key players in this market are DNA Genotek (Canada), Invivo Healthcare (UK), Microba Life Sciences (US), Genetic Analysis AS (Norway), Metabiomics (US), Teraomics (US), Becton, Dickinson and Company (US), BioMe Oxford Ltd (UK), Viennalab Diagnostics (Austria), Viome Life Sciences, Inc. (US), Luxia Scientific (France), DayTwo (US), Sun Genomics (US), Atlas Biomed (UK), Quantbiome, Inc. (US), GoodGut (US), Micronoma (US), FlightPath Biosciences (US), and Microbiome Research Pvt. Ltd. (India)

Research Coverage:

This research report categorizes the microbiome diagnostics market by product (reagents & kits and instruments), sample (feces, saliva, skin and other sample), technology (16s rRNA sequencing, shotgun metagenomics, metatranscriptomics and other technology), application (research application, disease diagnosis and monitoring), end user (research institutes, pharmaceutical and biotechnology companies, hospitals and other end user), and region (North America, Europe, Asia Pacific, Rest of the World). The scope of the report covers detailed information regarding the major factors, such as drivers, opportunities, and challenges, influencing the growth of the microbiome diagnostics market. A detailed analysis of the key industry players has been done to provide insights into their business overview, products offered, key strategies, acquisitions, and partnerships. New product launches and approvals, and recent developments associated with the microbiome diagnostics market. This report covers the competitive analysis of upcoming startups in the microbiome-based diagnostics market ecosystem.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall microbiome diagnostics market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (The collaborative efforts between the microbiome industry and academia for microbiome research and the growing demand for personalized medicine, growing awareness about the importance of the human microbiome diagnostics, rising incidences of disease), opportunities (Increased collaboration of key players and small innovative companies to work on new microbiome technologies), and challenges (Adverse impact of complex regulatory policies on commercialization of microbiome ) influencing the growth of the microbiome-based market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the microbiome diagnostics market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the microbiome diagnostics market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the microbiome diagnostics market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and product offerings of leading players like DNA Genotek (Canada), Invivo Healthcare (UK), Microba Life Sciences (US), and Genetic Analysis AS (Norway)among others in the microbiome-based diagnostics market strategies.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- TABLE 1 INCLUSIONS & EXCLUSIONS

- 1.3 STUDY SCOPE

- FIGURE 1 MICROBIOME-BASED DIAGNOSTICS MARKET SCOPE

- 1.3.1 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 MICROBIOME-BASED DIAGNOSTICS MARKET: RESEARCH DESIGN METHODOLOGY

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- FIGURE 3 PRIMARY SOURCES

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY- AND DEMAND-SIDE PARTICIPANTS

- 2.1.2.3 Breakdown of primary interviews

- FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach 1: Company revenue estimation approach

- FIGURE 6 BOTTOM-UP APPROACH: COMPANY REVENUE ESTIMATION APPROACH

- 2.2.1.2 Approach 2: Presentations of companies and primary interviews

- 2.2.1.3 Approach 3: Primary research

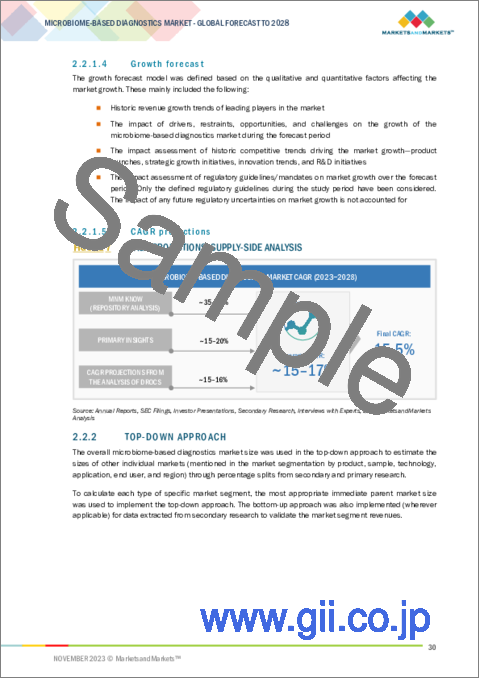

- 2.2.1.4 Growth forecast

- 2.2.1.5 CAGR projections

- FIGURE 7 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- 2.2.2 TOP-DOWN APPROACH

- FIGURE 8 MICROBIOME-BASED DIAGNOSTICS MARKET: TOP-DOWN APPROACH

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 DATA TRIANGULATION

- FIGURE 9 DATA TRIANGULATION METHODOLOGY

- 2.4 STUDY ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS AND RISK ASSESSMENT

- TABLE 2 RISK ASSESSMENT: MICROBIOME-BASED DIAGNOSTICS MARKET

- 2.6 IMPACT OF RECESSION ON MICROBIOME-BASED DIAGNOSTICS MARKET

3 EXECUTIVE SUMMARY

- FIGURE 10 MICROBIOME-BASED DIAGNOSTICS MARKET, BY PRODUCT, 2023 VS. 2028 (USD MILLION)

- FIGURE 11 MICROBIOME-BASED DIAGNOSTICS MARKET, BY TECHNOLOGY, 2023 VS. 2028 (USD MILLION)

- FIGURE 12 MICROBIOME-BASED DIAGNOSTICS MARKET, BY SAMPLE, 2023 VS. 2028 (USD MILLION)

- FIGURE 13 MICROBIOME-BASED DIAGNOSTICS MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 14 MICROBIOME-BASED DIAGNOSTICS MARKET, BY END USER, 2023 VS. 2028 (USD MILLION)

- FIGURE 15 GEOGRAPHICAL SNAPSHOT OF MICROBIOME-BASED DIAGNOSTICS MARKET

4 PREMIUM INSIGHTS

- 4.1 MICROBIOME-BASED DIAGNOSTICS MARKET OVERVIEW

- FIGURE 16 RISING DISEASE INCIDENCE AND TECHNOLOGICAL ADVANCEMENTS TO DRIVE MARKET GROWTH

- 4.2 NORTH AMERICA: MICROBIOME-BASED DIAGNOSTICS MARKET, BY PRODUCT & COUNTRY (2022)

- FIGURE 17 KITS & REAGENTS ACCOUNTED FOR LARGEST SHARE OF NORTH AMERICAN MARKET IN 2022

- 4.3 MICROBIOME-BASED DIAGNOSTICS MARKET: GEOGRAPHICAL SNAPSHOT

- FIGURE 18 CHINA AND INDIA TO WITNESS HIGHEST GROWTH RATES DURING FORECAST PERIOD

- 4.4 MICROBIOME-BASED DIAGNOSTICS MARKET: GEOGRAPHIC MIX

- FIGURE 19 APAC TO WITNESS HIGHEST GROWTH DURING FORECAST PERIOD

- 4.5 MICROBIOME-BASED DIAGNOSTICS MARKET: DEVELOPED VS. EMERGING ECONOMIES

- FIGURE 20 EMERGING ECONOMIES TO REGISTER HIGHER GROWTH DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 21 MICROBIOME-BASED DIAGNOSTICS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Growing prevalence of chronic diseases

- FIGURE 22 GLOBAL INCIDENCE OF DIABETES, 2021 VS. 2045

- 5.2.1.2 Collaborative efforts between microbiome industry and academia for microbiome research

- 5.2.1.3 Growing demand for personalized medicine

- 5.2.1.4 Rising awareness about importance of human microbiomes

- 5.2.1.5 Rising funding and investments in microbiome research

- 5.2.2 RESTRAINTS

- 5.2.2.1 End-user budget constraints in developing countries

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increased collaboration between key players and small innovative companies to work on new microbiome technologies

- TABLE 3 COLLABORATIONS IN MICROBIOME-BASED DIAGNOSTICS MARKET

- 5.2.4 CHALLENGES

- 5.2.4.1 Adverse impact of complex regulatory policies on commercialization of microbiome

- 5.3 VALUE CHAIN ANALYSIS

- FIGURE 23 VALUE CHAIN ANALYSIS: MAJOR VALUE ADDED DURING MANUFACTURING AND ASSEMBLY PHASES

- 5.4 SUPPLY CHAIN ANALYSIS

- FIGURE 24 DIRECT DISTRIBUTION-PREFERRED STRATEGY FOR PROMINENT COMPANIES

- 5.5 PORTER'S FIVE FORCES ANALYSIS

- 5.5.1 THREAT OF NEW ENTRANTS

- 5.5.2 INTENSITY OF COMPETITIVE RIVALRY

- 5.5.3 BARGAINING POWER OF BUYERS

- 5.5.4 BARGAINING POWER OF SUPPLIERS

- 5.5.5 THREAT OF SUBSTITUTES

- 5.6 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.6.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 25 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 2 END USERS

- 5.6.2 BUYING CRITERIA

- FIGURE 26 KEY BUYING CRITERIA FOR TOP 2 END USERS

- 5.7 REGULATORY LANDSCAPE

- 5.7.1 NORTH AMERICA

- TABLE 4 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.7.2 EUROPE

- TABLE 5 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.7.3 ASIA PACIFIC

- TABLE 6 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.7.4 REST OF THE WORLD

- TABLE 7 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.8 ECOSYSTEM ANALYSIS

- TABLE 8 ROLE IN ECOSYSTEM

- FIGURE 27 KEY PLAYERS OPERATING IN MICROBIOME-BASED DIAGNOSTICS MARKET

- 5.9 PATENT ANALYSIS

- 5.10 KEY CONFERENCES & EVENTS

- TABLE 9 LIST OF CONFERENCES & EVENTS IN 2023-2024

- 5.11 PRICING ANALYSIS

- 5.11.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY APPLICATION

- TABLE 10 PRICE RANGE OF PRODUCTS OFFERED BY KEY PLAYERS FOR APPLICATIONS (USD)

- 5.12 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.13 TECHNOLOGY ANALYSIS

- 5.13.1 DEVELOPMENT OF NOVEL MICROBIOME SAMPLING DEVICES

- 5.14 TRADE ANALYSIS

- TABLE 11 IMPORT DATA FOR HS CODE 902780, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 12 EXPORT DATA FOR HS CODE 902780, BY COUNTRY, 2018-2021 (USD MILLION)

6 MICROBIOME-BASED DIAGNOSTICS MARKET, BY PRODUCT

- 6.1 INTRODUCTION

- TABLE 13 MICROBIOME-BASED DIAGNOSTICS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- 6.2 KITS & REAGENTS

- 6.2.1 KITS & REAGENTS TO DOMINATE MICROBIOME-BASED DIAGNOSTICS MARKET DURING FORECAST PERIOD

- TABLE 14 MICROBIOME-BASED DIAGNOSTIC KITS & REAGENTS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 6.3 INSTRUMENTS

- 6.3.1 INCREASING VOLUME OF BLOOD COLLECTION PROCEDURES TO DRIVE MARKET GROWTH

- TABLE 15 MICROBIOME-BASED DIAGNOSTIC INSTRUMENTS MARKET, BY REGION, 2021-2028 (USD MILLION)

7 MICROBIOME-BASED DIAGNOSTICS MARKET, BY TECHNOLOGY

- 7.1 INTRODUCTION

- TABLE 16 MICROBIOME-BASED DIAGNOSTICS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- 7.2 16S RRNA SEQUENCING

- 7.2.1 ABILITY TO COMBINE MANY SAMPLES IN SEQUENCING RUN TO DRIVE DEMAND FOR NGS-BASED 16S RRNA SEQUENCING

- TABLE 17 MICROBIOME-BASED DIAGNOSTICS MARKET FOR 16S RRNA SEQUENCING, BY REGION, 2021-2028 (USD MILLION)

- 7.3 SHOTGUN METAGENOMICS

- 7.3.1 ABILITY OF SHOTGUN METAGENOMICS TO PROVIDE DETAILED GENETIC INFORMATION TO BOOST DEMAND

- TABLE 18 COMPARISON BETWEEN SHOTGUN METAGENOMICS AND 16S RRNA SEQUENCING

- TABLE 19 MICROBIOME-BASED DIAGNOSTICS MARKET FOR SHOTGUN METAGENOMICS, BY REGION, 2021-2028 (USD MILLION)

- 7.4 METATRANSCRIPTOMICS

- 7.4.1 ONGOING TECHNOLOGICAL ADVANCEMENTS IN SEQUENCING INSTRUMENTS TO DRIVE GROWTH

- TABLE 20 MICROBIOME-BASED DIAGNOSTICS MARKET FOR METATRANSCRIPTOMICS, BY REGION, 2021-2028 (USD MILLION)

- 7.5 OTHER TECHNOLOGIES

- TABLE 21 MICROBIOME-BASED DIAGNOSTICS MARKET FOR OTHER TECHNOLOGIES, BY REGION, 2021-2028 (USD MILLION)

8 MICROBIOME-BASED DIAGNOSTICS MARKET, BY SAMPLE

- 8.1 INTRODUCTION

- TABLE 22 MICROBIOME-BASED DIAGNOSTICS MARKET, BY SAMPLE, 2021-2028 (USD MILLION)

- 8.2 FECAL SAMPLES

- 8.2.1 FECAL SAMPLES TO DOMINATE MICROBIOME-BASED DIAGNOSTICS MARKET DURING FORECAST PERIOD

- TABLE 23 LIST OF MICROBIOME-BASED DIAGNOSTIC KITS FOR FECAL SAMPLES

- TABLE 24 MICROBIOME-BASED DIAGNOSTICS MARKET FOR FECAL SAMPLES, BY REGION, 2021-2028 (USD MILLION)

- 8.3 SALIVA SAMPLES

- 8.3.1 ADVANCEMENTS IN ORAL DIAGNOSTICS TO DRIVE MARKET GROWTH

- TABLE 25 LIST OF MICROBIOME-BASED DIAGNOSTIC KITS FOR SALIVA SAMPLES

- TABLE 26 MICROBIOME-BASED DIAGNOSTICS MARKET FOR SALIVA SAMPLES, BY REGION, 2021-2028 (USD MILLION)

- 8.4 SKIN SAMPLES

- 8.4.1 GROWING FOCUS ON MICROBIOME RESEARCH ACTIVITIES TO BOOST MARKET

- TABLE 27 LIST OF MICROBIOME-BASED DIAGNOSTIC KITS FOR SKIN SAMPLES

- TABLE 28 MICROBIOME-BASED DIAGNOSTICS MARKET FOR SKIN SAMPLES, BY REGION, 2021-2028 (USD MILLION)

- 8.5 OTHER SAMPLES

- TABLE 29 LIST OF MICROBIOME-BASED DIAGNOSTIC KITS FOR OTHER SAMPLES

- TABLE 30 MICROBIOME-BASED DIAGNOSTICS MARKET FOR OTHER SAMPLES, BY REGION, 2021-2028 (USD MILLION)

9 MICROBIOME-BASED DIAGNOSTICS MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- TABLE 31 MICROBIOME-BASED DIAGNOSTICS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 9.2 DISEASE DIAGNOSTIC APPLICATIONS

- TABLE 32 MICROBIOME-BASED DIAGNOSTICS MARKET FOR DISEASE DIAGNOSTIC APPLICATIONS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 33 MICROBIOME-BASED DIAGNOSTICS MARKET FOR DISEASE DIAGNOSTIC APPLICATIONS, BY REGION, 2021-2028 (USD MILLION)

- 9.2.1 GASTROINTESTINAL DISORDERS

- 9.2.1.1 Growing incidence of gastrointestinal disorders to drive market growth

- TABLE 34 MICROBIOME-BASED DIAGNOSTICS MARKET FOR GASTROINTESTINAL DISORDERS, BY REGION, 2021-2028 (USD MILLION)

- 9.2.2 METABOLIC DISORDERS

- 9.2.2.1 High prevalence of metabolic disorders to drive demand for microbiome-based diagnostic products

- TABLE 35 MICROBIOME-BASED DIAGNOSTICS MARKET FOR METABOLIC DISORDERS, BY REGION, 2021-2028 (USD MILLION)

- 9.2.3 OTHER DISEASE DIAGNOSTIC APPLICATIONS

- TABLE 36 MICROBIOME-BASED DIAGNOSTICS MARKET FOR OTHER DISEASE DIAGNOSTIC APPLICATIONS, BY REGION, 2021-2028 (USD MILLION)

- 9.3 RESEARCH APPLICATIONS

- 9.3.1 GROWING RESEARCH ACTIVITIES TO BOOST MARKET

- TABLE 37 MICROBIOME-BASED DIAGNOSTICS MARKET FOR RESEARCH APPLICATIONS, BY REGION, 2021-2028 (USD MILLION)

10 MICROBIOME-BASED DIAGNOSTICS MARKET, BY END USER

- 10.1 INTRODUCTION

- TABLE 38 MICROBIOME-BASED DIAGNOSTICS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.2 HOSPITALS

- 10.2.1 HOSPITALS ACCOUNTED FOR LARGEST SHARE OF MICROBIOME-BASED DIAGNOSTICS MARKET IN 2022

- TABLE 39 MICROBIOME-BASED DIAGNOSTICS MARKET FOR HOSPITALS, BY REGION, 2021-2028 (USD MILLION)

- 10.3 RESEARCH INSTITUTES

- 10.3.1 GROWING FUNDING FOR MICROBIOME RESEARCH TO SUPPORT MARKET GROWTH

- TABLE 40 MICROBIOME-BASED DIAGNOSTICS MARKET FOR RESEARCH INSTITUTES, BY REGION, 2021-2028 (USD MILLION)

- 10.4 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES

- 10.4.1 GROWING FOCUS ON PERSONALIZED MEDICINE TO DRIVE DEMAND FOR MICROBIOME-BASED PRODUCTS

- TABLE 41 MICROBIOME-BASED DIAGNOSTICS MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY REGION, 2021-2028 (USD MILLION)

11 MICROBIOME-BASED DIAGNOSTICS MARKET, BY REGION

- 11.1 INTRODUCTION

- TABLE 42 NORTH AMERICA: MICROBIOME-BASED DIAGNOSTICS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 11.2 NORTH AMERICA

- FIGURE 28 NORTH AMERICA: MICROBIOME-BASED DIAGNOSTICS MARKET SNAPSHOT

- TABLE 43 NORTH AMERICA: MICROBIOME-BASED DIAGNOSTICS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 44 NORTH AMERICA: MICROBIOME-BASED DIAGNOSTICS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 45 NORTH AMERICA: MICROBIOME-BASED DIAGNOSTICS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 46 NORTH AMERICA: MICROBIOME-BASED DIAGNOSTICS MARKET, BY SAMPLE, 2021-2028 (USD MILLION)

- TABLE 47 NORTH AMERICA: MICROBIOME-BASED DIAGNOSTICS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 48 NORTH AMERICA: MICROBIOME-BASED DIAGNOSTICS MARKET FOR DISEASE DIAGNOSTIC APPLICATIONS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 49 NORTH AMERICA: MICROBIOME-BASED DIAGNOSTICS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 11.2.1 US

- 11.2.1.1 US to account for largest share of during forecast period

- TABLE 50 US: MICROBIOME-BASED DIAGNOSTICS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 51 US: MICROBIOME-BASED DIAGNOSTICS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 52 US: MICROBIOME-BASED DIAGNOSTICS MARKET, BY SAMPLE, 2021-2028 (USD MILLION)

- TABLE 53 US: MICROBIOME-BASED DIAGNOSTICS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 54 US: MICROBIOME-BASED DIAGNOSTICS MARKET FOR DISEASE DIAGNOSTIC APPLICATIONS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 55 US: MICROBIOME-BASED DIAGNOSTICS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 11.2.2 CANADA

- 11.2.2.1 High prevalence of diseases in Canada to support market growth

- TABLE 56 CANADA: MICROBIOME-BASED DIAGNOSTICS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 57 CANADA: MICROBIOME-BASED DIAGNOSTICS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 58 CANADA: MICROBIOME-BASED DIAGNOSTICS MARKET, BY SAMPLE, 2021-2028 (USD MILLION)

- TABLE 59 CANADA: MICROBIOME-BASED DIAGNOSTICS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 60 CANADA: MICROBIOME-BASED DIAGNOSTICS MARKET FOR DISEASE DIAGNOSTIC APPLICATIONS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 61 CANADA: MICROBIOME-BASED DIAGNOSTICS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 11.2.3 NORTH AMERICA: RECESSION IMPACT

- 11.3 EUROPE

- TABLE 62 EUROPE: MICROBIOME-BASED DIAGNOSTICS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 63 EUROPE: MICROBIOME-BASED DIAGNOSTICS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 64 EUROPE: MICROBIOME-BASED DIAGNOSTICS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 65 EUROPE: MICROBIOME-BASED DIAGNOSTICS MARKET, BY SAMPLE, 2021-2028 (USD MILLION)

- TABLE 66 EUROPE: MICROBIOME-BASED DIAGNOSTICS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 67 EUROPE: MICROBIOME-BASED DIAGNOSTICS MARKET FOR DISEASE DIAGNOSTIC APPLICATIONS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 68 EUROPE: MICROBIOME-BASED DIAGNOSTICS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 11.3.1 GERMANY

- 11.3.1.1 Germany to dominate European microbiome-based diagnostics market during forecast period

- TABLE 69 GERMANY: MICROBIOME-BASED DIAGNOSTICS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 70 GERMANY: MICROBIOME-BASED DIAGNOSTICS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 71 GERMANY: MICROBIOME-BASED DIAGNOSTICS MARKET, BY SAMPLE, 2021-2028 (USD MILLION)

- TABLE 72 GERMANY: MICROBIOME-BASED DIAGNOSTICS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 73 GERMANY: MICROBIOME-BASED DIAGNOSTICS MARKET FOR DISEASE DIAGNOSTIC APPLICATIONS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 74 GERMANY: MICROBIOME-BASED DIAGNOSTICS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 11.3.2 FRANCE

- 11.3.2.1 Growing number of microbiome sequencing start-ups to boost market growth

- TABLE 75 FRANCE: MICROBIOME-BASED DIAGNOSTICS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 76 FRANCE: MICROBIOME-BASED DIAGNOSTICS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 77 FRANCE: MICROBIOME-BASED DIAGNOSTICS MARKET, BY SAMPLE, 2021-2028 (USD MILLION)

- TABLE 78 FRANCE: MICROBIOME-BASED DIAGNOSTICS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 79 FRANCE: MICROBIOME-BASED DIAGNOSTICS MARKET FOR DISEASE DIAGNOSTIC APPLICATIONS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 80 FRANCE: MICROBIOME-BASED DIAGNOSTICS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 11.3.3 UK

- 11.3.3.1 Supportive environment for microbiome sequencing R&D to support growth

- TABLE 81 UK: MICROBIOME-BASED DIAGNOSTICS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 82 UK: MICROBIOME-BASED DIAGNOSTICS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 83 UK: MICROBIOME-BASED DIAGNOSTICS MARKET, BY SAMPLE, 2021-2028 (USD MILLION)

- TABLE 84 UK: MICROBIOME-BASED DIAGNOSTICS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 85 UK: MICROBIOME-BASED DIAGNOSTICS MARKET FOR DISEASE DIAGNOSTIC APPLICATIONS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 86 UK: MICROBIOME-BASED DIAGNOSTICS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 11.3.4 REST OF EUROPE

- TABLE 87 REST OF EUROPE: MICROBIOME-BASED DIAGNOSTICS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 88 REST OF EUROPE: MICROBIOME-BASED DIAGNOSTICS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 89 REST OF EUROPE: MICROBIOME-BASED DIAGNOSTICS MARKET, BY SAMPLE, 2021-2028 (USD MILLION)

- TABLE 90 REST OF EUROPE: MICROBIOME-BASED DIAGNOSTICS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 91 REST OF EUROPE: MICROBIOME-BASED DIAGNOSTICS MARKET FOR DISEASE DIAGNOSTIC APPLICATIONS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 92 REST OF EUROPE: MICROBIOME-BASED DIAGNOSTICS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 11.3.5 EUROPE: RECESSION IMPACT

- 11.4 ASIA PACIFIC

- FIGURE 29 ASIA PACIFIC: MICROBIOME-BASED DIAGNOSTICS MARKET SNAPSHOT

- TABLE 93 ASIA PACIFIC: MICROBIOME-BASED DIAGNOSTICS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 94 ASIA PACIFIC: MICROBIOME-BASED DIAGNOSTICS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 95 ASIA PACIFIC: MICROBIOME-BASED DIAGNOSTICS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 96 ASIA PACIFIC: MICROBIOME-BASED DIAGNOSTICS MARKET, BY SAMPLE, 2021-2028 (USD MILLION)

- TABLE 97 ASIA PACIFIC: MICROBIOME-BASED DIAGNOSTICS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 98 ASIA PACIFIC: MICROBIOME-BASED DIAGNOSTICS MARKET FOR DISEASE DIAGNOSTIC APPLICATIONS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 99 ASIA PACIFIC: MICROBIOME-BASED DIAGNOSTICS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 11.4.1 CHINA

- 11.4.1.1 Collaborations between academic institutes and private companies to drive growth

- TABLE 100 CHINA: MICROBIOME-BASED DIAGNOSTICS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 101 CHINA: MICROBIOME-BASED DIAGNOSTICS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 102 CHINA: MICROBIOME-BASED DIAGNOSTICS MARKET, BY SAMPLE, 2021-2028 (USD MILLION)

- TABLE 103 CHINA: MICROBIOME-BASED DIAGNOSTICS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 104 CHINA: MICROBIOME-BASED DIAGNOSTICS MARKET FOR DISEASE DIAGNOSTIC APPLICATIONS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 105 CHINA: MICROBIOME-BASED DIAGNOSTICS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 11.4.2 JAPAN

- 11.4.2.1 Rising aging population to drive market growth

- TABLE 106 JAPAN: MICROBIOME-BASED DIAGNOSTICS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 107 JAPAN: MICROBIOME-BASED DIAGNOSTICS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 108 JAPAN: MICROBIOME-BASED DIAGNOSTICS MARKET, BY SAMPLE, 2021-2028 (USD MILLION)

- TABLE 109 JAPAN: MICROBIOME-BASED DIAGNOSTICS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 110 JAPAN: MICROBIOME-BASED DIAGNOSTICS MARKET FOR DISEASE DIAGNOSTIC APPLICATIONS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 111 JAPAN: MICROBIOME-BASED DIAGNOSTICS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 11.4.3 INDIA

- 11.4.3.1 Increasing prevalence of diseases to drive market growth

- TABLE 112 INDIA: MICROBIOME-BASED DIAGNOSTICS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 113 INDIA: MICROBIOME-BASED DIAGNOSTICS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 114 INDIA: MICROBIOME-BASED DIAGNOSTICS MARKET, BY SAMPLE, 2021-2028 (USD MILLION)

- TABLE 115 INDIA: MICROBIOME-BASED DIAGNOSTICS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 116 INDIA: MICROBIOME-BASED DIAGNOSTICS MARKET FOR DISEASE DIAGNOSTIC APPLICATIONS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 117 INDIA: MICROBIOME-BASED DIAGNOSTICS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 11.4.4 REST OF ASIA PACIFIC

- TABLE 118 REST OF ASIA PACIFIC: MICROBIOME-BASED DIAGNOSTICS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 119 REST OF ASIA PACIFIC: MICROBIOME-BASED DIAGNOSTICS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 120 REST OF ASIA PACIFIC: MICROBIOME-BASED DIAGNOSTICS MARKET, BY SAMPLE, 2021-2028 (USD MILLION)

- TABLE 121 REST OF ASIA PACIFIC: MICROBIOME-BASED DIAGNOSTICS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 122 REST OF ASIA PACIFIC: MICROBIOME-BASED DIAGNOSTICS MARKET FOR DISEASE DIAGNOSTIC APPLICATIONS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 123 REST OF ASIA PACIFIC: MICROBIOME-BASED DIAGNOSTICS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 11.4.5 ASIA PACIFIC: RECESSION IMPACT

- 11.5 REST OF THE WORLD

- TABLE 124 REST OF THE WORLD: MICROBIOME-BASED DIAGNOSTICS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 125 REST OF THE WORLD: MICROBIOME-BASED DIAGNOSTICS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 126 REST OF THE WORLD: MICROBIOME-BASED DIAGNOSTICS MARKET, BY SAMPLE, 2021-2028 (USD MILLION)

- TABLE 127 REST OF THE WORLD: MICROBIOME-BASED DIAGNOSTICS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 128 REST OF THE WORLD: MICROBIOME-BASED DIAGNOSTICS MARKET FOR DISEASE DIAGNOSTIC APPLICATIONS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 129 REST OF THE WORLD: MICROBIOME-BASED DIAGNOSTICS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 11.5.1 REST OF THE WORLD: RECESSION IMPACT

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- TABLE 130 OVERVIEW OF STRATEGIES ADOPTED BY KEY MICROBIOME-BASED DIAGNOSTIC MANUFACTURERS

- 12.3 REVENUE ANALYSIS

- FIGURE 30 REVENUE ANALYSIS OF KEY PLAYERS

- 12.4 MARKET SHARE ANALYSIS

- TABLE 131 MICROBIOME-BASED DIAGNOSTICS MARKET: DEGREE OF COMPETITION

- 12.5 COMPANY EVALUATION MATRIX

- 12.5.1 STARS

- 12.5.2 EMERGING LEADERS

- 12.5.3 PERVASIVE PLAYERS

- 12.5.4 PARTICIPANTS

- FIGURE 31 MICROBIOME-BASED DIAGNOSTICS MARKET: COMPANY EVALUATION MATRIX

- 12.5.5 COMPANY FOOTPRINT ANALYSIS

- TABLE 132 COMPANY FOOTPRINT

- TABLE 133 COMPANY PRODUCT FOOTPRINT

- TABLE 134 COMPANY REGIONAL FOOTPRINT

- 12.6 START-UP/SME EVALUATION MATRIX

- 12.6.1 PROGRESSIVE COMPANIES

- 12.6.2 RESPONSIVE COMPANIES

- 12.6.3 DYNAMIC COMPANIES

- 12.6.4 STARTING BLOCKS

- FIGURE 32 MICROBIOME-BASED DIAGNOSTICS MARKET: START-UP/SME EVALUATION MATRIX, 2022

- 12.6.5 COMPETITIVE BENCHMARKING

- TABLE 135 MICROBIOME-BASED DIAGNOSTICS MARKET: DETAILED LIST OF KEY START-UPS/SMES

- 12.7 COMPETITIVE SCENARIO & TRENDS

- 12.7.1 PRODUCT LAUNCHES & APPROVALS

- TABLE 136 MICROBIOME-BASED DIAGNOSTICS MARKET: PRODUCT LAUNCHES & APPROVALS, 2020-2023

- 12.7.2 DEALS

- TABLE 137 MICROBIOME-BASED DIAGNOSTICS MARKET: DEALS, 2020-2023

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- (Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments)**

- 13.1.1 GENETIC ANALYSIS AS

- TABLE 138 GENETIC ANALYSIS AS: COMPANY OVERVIEW

- FIGURE 33 GENETIC ANALYSIS AS: COMPANY SNAPSHOT (2022)

- 13.1.2 DNA GENOTEK (ORASURE TECHNOLOGIES, INC.)

- TABLE 139 DNA GENOTEK: COMPANY OVERVIEW

- FIGURE 34 ORASURE TECHNOLOGIES, INC.: COMPANY SNAPSHOT (2022)

- 13.1.3 MICROBA LIFE SCIENCES

- TABLE 140 MICROBA LIFE SCIENCES: COMPANY OVERVIEW

- FIGURE 35 MICROBA LIFE SCIENCES: COMPANY SNAPSHOT (2023)

- 13.1.4 ILLUMINA INC.

- TABLE 141 ILLUMINA INC.: COMPANY OVERVIEW

- FIGURE 36 ILLUMINA INC.: COMPANY SNAPSHOT (2022)

- 13.1.5 OXFORD NANOPORE TECHNOLOGIES, PLC

- TABLE 142 OXFORD NANOPORE TECHNOLOGIES, PLC: COMPANY OVERVIEW

- FIGURE 37 OXFORD NANOPORE TECHNOLOGIES, PLC.: COMPANY SNAPSHOT (2022)

- 13.1.6 BIOME OXFORD LTD.

- TABLE 143 BIOME OXFORD LTD.: COMPANY OVERVIEW

- 13.1.7 VIENNALAB DIAGNOSTICS GMBH

- TABLE 144 VIENNALAB DIAGNOSTICS GMBH: COMPANY OVERVIEW

- 13.1.8 METABIOMICS (A SUBSIDIARY OF PRESCIENT MEDICINE HOLDINGS, INC.)

- TABLE 145 METABIOMICS: COMPANY OVERVIEW

- 13.1.9 VIOME LIFE SCIENCES

- TABLE 146 VIOME LIFE SCIENCES: COMPANY OVERVIEW

- 13.1.10 LUXIA SCIENTIFIC

- TABLE 147 LUXIA SCIENTIFIC: COMPANY OVERVIEW

- 13.1.11 SUN GENOMICS

- TABLE 148 SUN GENOMICS: COMPANY OVERVIEW

- 13.1.12 ATLAS BIOMED

- TABLE 149 ATLAS BIOMED: COMPANY OVERVIEW

- 13.1.13 QUANTBIOME, INC. (DBA OMBRE)

- TABLE 150 QUANTBIOME, INC.: COMPANY OVERVIEW

- 13.1.14 BECTON, DICKINSON AND COMPANY

- TABLE 151 BECTON, DICKINSON AND COMPANY: COMPANY OVERVIEW

- FIGURE 38 BECTON, DICKINSON AND COMPANY: COMPANY SNAPSHOT (2022)

- 13.1.15 DAYTWO

- TABLE 152 DAYTWO: COMPANY OVERVIEW

- *Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments might not be captured in case of unlisted companies.

- 13.2 OTHER PLAYERS

- 13.2.1 MICRONOMA

- 13.2.2 TERAOMICS S.L.

- 13.2.3 FLIGHTPATH BIOSCIENCES

- 13.2.4 MICROBIOME RESEARCH PVT. LTD.

- 13.2.5 ORIGIN SCIENCES

- 13.2.6 LEUCINE RICH BIO PRIVATE LIMITED

- 13.2.7 DECODE AGE

- 13.2.8 EVVY

- 13.2.9 ALPHABIOMICS, LTD.

- 13.2.10 GOODGUT

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS