|

|

市場調査レポート

商品コード

1449539

医療廃棄物管理の世界市場:サービス・廃棄物タイプ・処理場所・廃棄物排出者別 - 予測(~2028年)Medical Waste Management Market by Service, Type of Waste, Treatment Site, Waste Generator - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 医療廃棄物管理の世界市場:サービス・廃棄物タイプ・処理場所・廃棄物排出者別 - 予測(~2028年) |

|

出版日: 2024年03月08日

発行: MarketsandMarkets

ページ情報: 英文 222 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

医療廃棄物管理の市場規模は、予測期間中に5.9%のCAGRで推移し、2023年の92億米ドルから、2028年には122億米ドルの規模に成長すると予測されています。

同市場の成長の原動力は、外傷や火傷の増加、侵襲的処置の急増に起因する術創の増加、入院期間の長期化などの要因です。一方、医療廃棄物管理のためのインフラが不十分であることや、新興国や低所得国では医療廃棄物管理に使用されるさまざまな技術に対する認識がほとんどないことが、市場の成長を抑制する主な要因となっています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021-2028年 |

| 基準年 | 2022年 |

| 予測期間 | 2023-2028年 |

| 単位 | 金額 (米ドル) |

| セグメント | サービス・廃棄物タイプ・処理サイト・廃棄物排出者・地域 |

| 対象地域 | 北米・欧州・アジア太平洋・ラテンアメリカ・中東&アフリカ・GCC諸国 |

サービス別では、収集・運搬・保管サービスの部門が予測期間中にもっとも高い成長率を示す見通し:

米国や英国などの主要地域の一人当たりの資本所得の上昇や、ヘルスケア施設の増加が同部門の成長の主な要因の一つとなっています。

廃棄物タイプ別では、非有害廃棄物の部門が予測期間中に最大の成長を示す見通し:

糖尿病患者や腎臓病、肝臓病などの疾患にかかりやすい老齢人口の増加が同部門の成長に寄与する主な要因です。

オフサイト処理の部門がもっとも高いシェアを占める:

処理サイト別では、2022年にオフサイト処理の部門がもっとも高いCAGRを示しています。これは、環境汚染を減らすために医療廃棄物を適切に処理するための厳しい規制や、製薬会社、病院、その他のヘルスケア施設に対する法的責任の増加により、廃棄物管理への注目が高まっているためです。

病院・診断ラボの部門がもっとも高いシェアを占める:

廃棄物排出者別では、病院・診断ラボの部門が2022年に最大のシェアを示しています。感染症の抑制・減少に政府が注力するようになったこと、また、政府機関の廃棄物管理の負担を軽減するために、使い捨て医療廃棄物の分別や病院内での医療廃棄物処理といったイニシアチブが実施されるようになったことなどから、同部門のシェアが拡大しています。

アジア太平洋がもっとも急成長している地域:

アジア太平洋地域は予測期間中にもっとも高いCAGRを記録すると予測されています。医療廃棄物管理啓蒙のための会議数の増加が、同地域の医療廃棄物管理市場の成長を促進しています。

当レポートでは、世界の医療廃棄物管理の市場を調査し、市場概要、市場影響因子および市場機会の分析、技術・特許の動向、法規制環境、ケーススタディ、市場規模の推移・予測、各種区分・地域別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 特許分析

- 貿易分析

- バリューチェーン分析

- サプライチェーン分析

- エコシステム分析

- ポーターのファイブフォース分析

- PESTLE分析

- 規制分析

- 技術分析

- 主要な会議とイベント

- 顧客のビジネスに影響を与える動向/ディスラプション

- 主要なステークホルダーと購入基準

- ケーススタディ分析

第6章 医療廃棄物管理市場:サービス別

- 収集・輸送・保管サービス

- 処理・廃棄サービス

- 焼却

- オートクレーブ滅菌

- 化学処理

- その他

- リサイクルサービス

第7章 医療廃棄物管理市場:廃棄物タイプ別

- 非有害廃棄物

- 有害廃棄物

- 感染性および病理学的廃棄物

- 鋭利な廃棄物

- 医薬品廃棄物

- その他

第8章 医療廃棄物管理市場:処理サイト別

- オフサイト

- オンサイト

第9章 医療廃棄物管理市場:廃棄物排出者別

- 病院・診断ラボ

- その他

第10章 医療廃棄物管理市場:地域別

- 北米

- 欧州

- アジア太平洋

- ラテンアメリカ

- 中東・アフリカ

- GCC諸国

第11章 競合情勢

- 概要

- 主要企業の戦略/有力企業

- 収益シェア分析

- 市場シェア分析

- 企業評価マトリックス:主要企業

- 企業評価マトリックス:スタートアップ/中小企業

- 競合シナリオ

第12章 企業プロファイル

- 主要企業

- VEOLIA ENVIRONNEMENT S.A.

- CLEAN HARBORS, INC.

- STERICYCLE INC.

- WASTE MANAGEMENT, INC.

- CLEANAWAY WASTE MANAGEMENT LIMITED

- CASELLA WASTE SYSTEMS, INC.

- その他の企業

- COVANTA HOLDING CORPORATION

- HAZARDOUS WASTE EXPERTS

- REMONDIS SE & CO. KG

- BIOMEDICAL WASTE SOLUTIONS, LLC

- ECOMED SERVICES

- GRP & ASSOCIATES, INC.

- BWS INCORPORATED

- MEDPRO DISPOSAL, LLC

- GIC MEDICAL DISPOSAL

- GAMMA WASTE SERVICES

- TRIUMVIRATE ENVIRONMENTAL

- EPCO

- ALL MEDICAL WASTE AUSTRALIA PTY LTD.

- PRO-DISPOSAL MEDICAL WASTE SERVICES

- SSO MEDICAL WASTE MANAGEMENT

- SAFEGUARD WASTE SOLUTIONS

- MEDWASTE INDUSTRIES, INC.

- DULSCO

第13章 付録

The global medical waste management market is projected to reach USD 12.2 billion by 2028 from USD 9.2 billion in 2023, at a CAGR of 5.9% during the forecast period. Market growth is driven by factors such as rise in traumatic and burn injuries, an increase in wound occurrences attributable to a surge in invasive procedures, and heightened durations of hospital stays. Where as lack of inadequate infrastructure for medical waste management and minimum to no awareness of the different technologies which are used for medical waste management in the developing and low income countries are the major factors impeding the growth of ths market.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2028 |

| Base Year | 2022 |

| Forecast Period | 2023-2028 |

| Units Considered | Value (USD) Billion |

| Segments | Service, type of waste, treatment site, waste generator and region |

| Regions covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa and GCC Countries |

"The collection, transport and storage services segment accounted for the highest growth rate in the medical waste management market, by services, during the forecast period."

The medical waste management market is divided into collection, transport and storage services, treatment & disposal services and recycling services. Treatment & disposal services is estimated to hold the highest CAGR in 2022. Rise in the per capital income of the major regions like US and UK and increase in the healthcare facilities has improved the healthcare facilities which acts as one of the major factor for the growth of this market.

"The non-hazardous waste segment accounted for the highest growth rate in the medical waste management market, by type of waste, during the forecast period."

The medical waste management market is segmented into non-hazardous waste and hazardous waste based on type of waste. In 2022, the non-hazardous waste segment accounted for the highest growth rate in the medical waste management market. Increasing number of geriatric population leading to increase in diabetic cases and other health conditions like kidney and liver diseases are major factors contributing to the growth of this segment.

"Offsite treatment segment accounted for the highest share"

Based on treatment site, the medical waste management market has been segmented into offsite treatment and onsite treatment. In 2022, the offsite treatment segment accounted for the highest CAGR. This can be attributed to the increasing focus on waste management with stringent regulations and increased legal liabilities on pharmaceutical companies, hospitals and other healthcare facilities for the appropriate disposal of the medical waste to reduce the enivironmental contamination.

"Hospital & diagnostic laboratories segment accounted for the highest share"

Medical waste management market is segmented into hospitals & diagnostic laboratories and other waste generators based of waste generator. In 2022, hospitals & diagnostic laboratories segmented accounted for the highest share of this market. The highest share was attributed to the increased government focus on controlling and reducing the infectious diseases and implementing waste reduction initiatives such as seggregartion reducing the single use medical waste and possible treatment of medical waste in hospital for easing the burden of waste management on the government bodies.

"Asia Pacific: The fastest-growing region in medical waste management market"

The global medical waste management market is segmented into North America, Europe, the Asia Pacific, Latin America, the Middle East & Africa and GCC Countfries. The Asia Pacific region is projected to register the highest CAGR during the forecast period. Rising number of conferences for medical waste management awareness is driving the growth of the medical waste management market in this region.

The break-up of the profile of primary participants in the medical waste management market:

- By Company Type: Tier 1 - 40%, Tier 2 - 30%, and Tier 3 - 30%

- By Designation: C-level - 27%, D-level - 18%, and Others - 55%

- By Region: North America - 42%, Europe - 31%, Asia Pacific - 20%, Latin America - 4%, Middle East & Africa- 2%, GCC Countries- 1%

The key players in this market are Veolia Environnement S.A. (France), Clean Harbors, Inc. (US), Stericycle Inc. (US), Waste Management, Inc. (US), Cleanaway Waste Management Limited (Australia), Casella Waste Systems, Inc. (US), Sharps Compliance, Inc. (US), Covanta Holding Corporation (US), Hazardous Waste Experts (US), REMONDIS SE & Co. KG. (UK), BioMedical Waste Solutions, LLC (US), EcoMed Services (Canada), GRP & Associates, Inc. (US), BWS Incorporated (US), MEDPRO Disposal LLC (US), GIC Medical Disposal (Canada), Gamma Waste Services (US), Triumvirate Environmental (US), EPCO (Saudi Arabia), All Medical Waste Australia Pty Ltd. (Australia), Pro-Disposal Medical Waste Services (Georgia), SSO Medical Waste Management (US), Safeguard Waste Solutions (US), MedWaste Industries Inc. (US), DULSCO (UAE).

Research Coverage:

This report provides a detailed picture of the global medical waste management market. It aims at estimating the size and future growth potential of the market across different segments, such as services, type of waste, treatment site, waste generator and region. The report also includes an in-depth competitive analysis of the key market players, along with their company profiles, recent developments, and key market strategies. The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, opportunities and challenges, influencing the growth of the medical waste management market. A detailed analysis of the key industry players has been done to provide insights into their business overview, solutions and services, key strategies. New service launches and recent developments associated with the medical waste management market. Competitive analysis of upcoming startups in the medical waste management market ecosystem is covered in this report.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall medical waste management market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, opportunities and challenges.

The report provides insights on the following pointers:

- Analysis of key drivers (increasing volume of healthcare waste, growing geriatric and obese population and rising number of surgical procedures), restraints (high capital investment), opportunities (increasing number of medical waste awareness programs in developed countries and rising adoption of single use medical non wovens and devices) and challenges (lack of awareness about medical waste in developing countries) influencing the growth of the medical waste management market.

- Service Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new service launches in the medical waste management market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the medical waste management market across varied regions.

- Market Diversification: Exhaustive information about new services, untapped geographies, recent developments, and investments in the medical waste management market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Veolia Environnement S.A. (France), Clean Harbors, Inc. (US), Stericycle Inc. (US), Waste Management, Inc. (US), Cleanaway Waste Management Limited (Australia), Casella Waste Systems, Inc. (US), Sharps Compliance, Inc. (US), among others in the medical waste management market strategies.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 OBJECTIVES OF THE STUDY

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 REGIONS COVERED

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

- 1.6 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 MEDICAL WASTE MANAGEMENT MARKET: RESEARCH DESIGN METHODOLOGY

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary sources

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Key industry insights

- 2.1.2.4 Breakdown of primary interviews

- FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach 1: Company revenue estimation approach

- FIGURE 4 BOTTOM-UP APPROACH: COMPANY REVENUE ESTIMATION APPROACH

- 2.2.1.2 Approach 2: Presentations of companies and primary interviews

- 2.2.1.3 Growth forecast

- 2.2.1.4 CAGR projections

- FIGURE 5 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- 2.2.2 TOP-DOWN APPROACH

- FIGURE 6 MEDICAL WASTE MANAGEMENT MARKET: TOP-DOWN APPROACH

- 2.2.1 BOTTOM-UP APPROACH

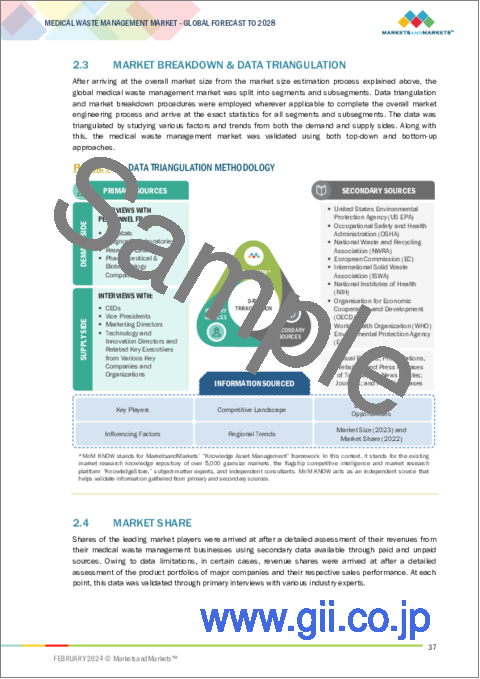

- 2.3 MARKET BREAKDOWN & DATA TRIANGULATION

- FIGURE 7 DATA TRIANGULATION METHODOLOGY

- 2.4 MARKET SHARE

- 2.5 ASSUMPTIONS AND LIMITATIONS

- 2.5.1 GROWTH RATE ASSUMPTIONS

- 2.5.2 LIMITATIONS

- 2.6 RISK ASSESSMENT

- TABLE 1 RISK ASSESSMENT: MEDICAL WASTE MANAGEMENT MARKET

- 2.7 RECESSION IMPACT ANALYSIS

3 EXECUTIVE SUMMARY

- FIGURE 8 MEDICAL WASTE MANAGEMENT MARKET, BY SERVICE, 2023 VS. 2028 (USD MILLION)

- FIGURE 9 MEDICAL WASTE MANAGEMENT MARKET, BY TYPE OF WASTE, 2023 VS. 2028 (USD MILLION)

- FIGURE 10 MEDICAL WASTE MANAGEMENT MARKET, BY TREATMENT SITE, 2023 VS. 2028 (USD MILLION)

- FIGURE 11 MEDICAL WASTE MANAGEMENT MARKET, BY WASTE GENERATOR, 2023 VS. 2028 (USD MILLION)

- FIGURE 12 MEDICAL WASTE MANAGEMENT MARKET, BY REGION, 2023 VS. 2028 (USD MILLION)

4 PREMIUM INSIGHTS

- 4.1 MEDICAL WASTE MANAGEMENT MARKET OVERVIEW

- FIGURE 13 INCREASING VOLUME OF HEALTHCARE WASTE TO DRIVE MARKET

- 4.2 MEDICAL WASTE MANAGEMENT MARKET SHARE, BY SERVICE, 2023 VS. 2028

- FIGURE 14 COLLECTION, TRANSPORTATION, AND STORAGE SERVICES SEGMENT TO DOMINATE MARKET TILL 2028

- 4.3 MEDICAL WASTE MANAGEMENT MARKET SHARE, BY TYPE OF WASTE, 2023 VS. 2028

- FIGURE 15 NON-HAZARDOUS WASTE SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- 4.4 MEDICAL WASTE MANAGEMENT MARKET SHARE, BY TREATMENT SITE, 2023 VS. 2028

- FIGURE 16 OFFSITE TREATMENT SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE IN 2022

- 4.5 MEDICAL WASTE MANAGEMENT MARKET SHARE, BY WASTE GENERATOR, 2023 VS. 2028

- FIGURE 17 HOSPITALS & DIAGNOSTIC LABORATORIES TO DOMINATE MEDICAL WASTE MANAGEMENT MARKET

- 4.6 MEDICAL WASTE MANAGEMENT MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- FIGURE 18 ASIA PACIFIC REGION TO REGISTER HIGHEST GROWTH IN FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 19 MEDICAL WASTE MANAGEMENT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing volume of healthcare waste

- 5.2.1.2 Growing geriatric and obese population

- TABLE 2 ESTIMATED INCREASE IN GERIATRIC POPULATION, BY REGION (2019-2050)

- 5.2.1.3 Rising number of surgical procedures

- TABLE 3 TOTAL NUMBER OF KNEE REPLACEMENTS, 2021

- TABLE 4 TOTAL NUMBER OF CORONARY ARTERY BYPASS GRAFT PROCEDURES, 2022

- 5.2.2 RESTRAINTS

- 5.2.2.1 High capital investments

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing medical waste awareness programs in developed countries

- 5.2.3.2 Rising adoption of single-use medical nonwovens and devices

- 5.2.4 CHALLENGES

- 5.2.4.1 Lack of awareness in developing economies

- 5.3 PATENT ANALYSIS

- FIGURE 20 PATENT ANALYSIS OF MEDICAL WASTE MANAGEMENT MARKET (JANUARY 2014-DECEMBER 2023)

- TABLE 5 MEDICAL WASTE MANAGEMENT MARKET: LIST OF MAJOR PATENTS

- 5.4 TRADE ANALYSIS

- 5.4.1 TRADE ANALYSIS FOR INCINERATORS

- TABLE 6 IMPORT DATA FOR INCINERATORS, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 7 EXPORT DATA FOR INCINERATORS, BY COUNTRY, 2018-2022 (USD MILLION)

- 5.5 VALUE CHAIN ANALYSIS

- FIGURE 21 SORTING AND PROCESSING PHASES CLAIM MAJOR VALUE ADDITION

- 5.6 SUPPLY CHAIN ANALYSIS

- FIGURE 22 MEDICAL WASTE MANAGEMENT MARKET: SUPPLY CHAIN ANALYSIS

- 5.7 ECOSYSTEM ANALYSIS

- FIGURE 23 MEDICAL WASTE MANAGEMENT MARKET: ECOSYSTEM ANALYSIS

- TABLE 8 MEDICAL WASTE MANAGEMENT MARKET: ROLE IN ECOSYSTEM

- 5.8 PORTER'S FIVE FORCES ANALYSIS

- TABLE 9 MEDICAL WASTE MANAGEMENT MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.8.1 THREAT OF NEW ENTRANTS

- 5.8.2 THREAT OF SUBSTITUTES

- 5.8.3 BARGAINING POWER OF BUYERS

- 5.8.4 BARGAINING POWER OF SUPPLIERS

- 5.8.5 DEGREE OF COMPETITION

- 5.9 PESTLE ANALYSIS

- 5.10 REGULATORY ANALYSIS

- TABLE 10 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 LATIN AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.10.1 NORTH AMERICA

- 5.10.1.1 US

- 5.10.1.2 Canada

- 5.10.2 EUROPE

- 5.10.3 ASIA PACIFIC

- 5.10.3.1 Japan

- 5.10.3.2 India

- 5.10.4 LATIN AMERICA

- 5.10.4.1 Brazil

- 5.10.4.2 Mexico

- 5.10.5 MIDDLE EAST

- 5.10.6 AFRICA

- 5.11 TECHNOLOGY ANALYSIS

- 5.11.1 INCINERATION

- 5.11.2 AUTOCLAVING

- 5.12 KEY CONFERENCES & EVENTS, 2024-2025

- TABLE 15 MEDICAL WASTE MANAGEMENT MARKET: DETAILED LIST OF CONFERENCES & EVENTS

- 5.13 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 24 REVENUE SHIFT IN MEDICAL WASTE MANAGEMENT MARKET

- 5.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 25 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR MEDICAL WASTE MANAGEMENT SERVICES

- TABLE 16 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR MEDICAL WASTE MANAGEMENT SERVICES (%)

- 5.14.2 BUYING CRITERIA

- FIGURE 26 KEY BUYING CRITERIA FOR MEDICAL WASTE MANAGEMENT END USERS

- TABLE 17 KEY BUYING CRITERIA, BY END USER

- 5.15 CASE STUDY ANALYSIS

- 5.15.1 CASE STUDY: HEALTHCARE WASTE MANAGEMENT IN SUDAN

6 MEDICAL WASTE MANAGEMENT MARKET, BY SERVICE

- 6.1 INTRODUCTION

- TABLE 18 MEDICAL WASTE MANAGEMENT MARKET, BY SERVICE, 2021-2028 (USD MILLION)

- 6.1.1 PRIMARY NOTES

- 6.1.1.1 Key industry insights

- 6.2 COLLECTION, TRANSPORTATION, AND STORAGE SERVICES

- 6.2.1 COLLECTION, TRANSPORTATION, STORAGE SERVICES TO HOLD DOMINANT MARKET SHARE

- TABLE 19 MEDICAL WASTE MANAGEMENT MARKET FOR COLLECTION, TRANSPORTATION, AND STORAGE SERVICES, BY REGION, 2021-2028 (USD MILLION)

- TABLE 20 NORTH AMERICA: MEDICAL WASTE MANAGEMENT MARKET FOR COLLECTION, TRANSPORTATION, AND STORAGE SERVICES, BY COUNTRY, 2021-2028 (USD MILLION)

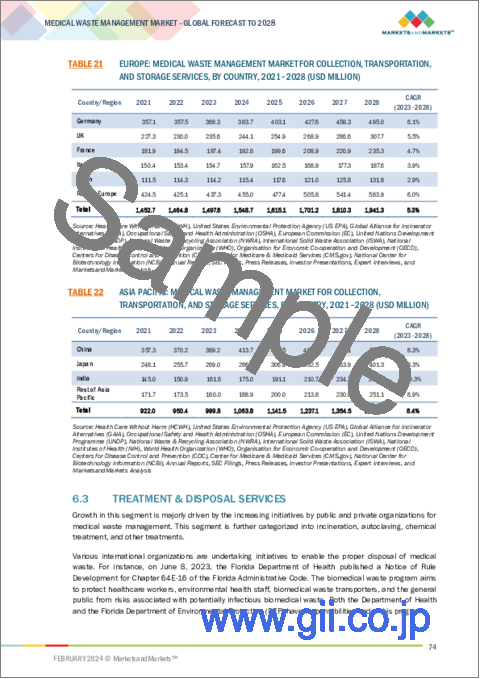

- TABLE 21 EUROPE: MEDICAL WASTE MANAGEMENT MARKET FOR COLLECTION, TRANSPORTATION, AND STORAGE SERVICES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 22 ASIA PACIFIC: MEDICAL WASTE MANAGEMENT MARKET FOR COLLECTION, TRANSPORTATION, AND STORAGE SERVICES, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.3 TREATMENT & DISPOSAL SERVICES

- TABLE 23 MEDICAL WASTE MANAGEMENT MARKET FOR TREATMENT & DISPOSAL SERVICES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 24 MEDICAL WASTE MANAGEMENT MARKET FOR TREATMENT & DISPOSAL SERVICES, BY REGION, 2021-2028 (USD MILLION)

- TABLE 25 NORTH AMERICA: MEDICAL WASTE MANAGEMENT MARKET FOR TREATMENT & DISPOSAL SERVICES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 26 EUROPE: MEDICAL WASTE MANAGEMENT MARKET FOR TREATMENT & DISPOSAL SERVICES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 27 ASIA PACIFIC: MEDICAL WASTE MANAGEMENT MARKET FOR TREATMENT & DISPOSAL SERVICES, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.3.1 INCINERATION

- 6.3.1.1 Rising investments in developing incinerators for small and medium-scale healthcare facilities to drive market

- TABLE 28 MEDICAL WASTE MANAGEMENT MARKET FOR INCINERATION, BY REGION, 2021-2028 (USD MILLION)

- TABLE 29 NORTH AMERICA: MEDICAL WASTE MANAGEMENT MARKET FOR INCINERATION, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 30 EUROPE: MEDICAL WASTE MANAGEMENT MARKET FOR INCINERATION, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 31 ASIA PACIFIC: MEDICAL WASTE MANAGEMENT MARKET FOR INCINERATION, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.3.2 AUTOCLAVING

- 6.3.2.1 Initiatives by government and non-government organizations to support market growth

- TABLE 32 MEDICAL WASTE MANAGEMENT MARKET FOR AUTOCLAVING, BY REGION, 2021-2028 (USD MILLION)

- TABLE 33 NORTH AMERICA: MEDICAL WASTE MANAGEMENT MARKET FOR AUTOCLAVING, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 34 EUROPE: MEDICAL WASTE MANAGEMENT MARKET FOR AUTOCLAVING, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 35 ASIA PACIFIC: MEDICAL WASTE MANAGEMENT MARKET FOR AUTOCLAVING, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.3.3 CHEMICAL TREATMENT

- 6.3.3.1 Increasing focus on onsite treatment of medical waste to support market growth

- TABLE 36 MEDICAL WASTE MANAGEMENT MARKET FOR CHEMICAL TREATMENT, BY REGION, 2021-2028 (USD MILLION)

- TABLE 37 NORTH AMERICA: MEDICAL WASTE MANAGEMENT MARKET FOR CHEMICAL TREATMENT, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 38 EUROPE: MEDICAL WASTE MANAGEMENT MARKET FOR CHEMICAL TREATMENT, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 39 ASIA PACIFIC: MEDICAL WASTE MANAGEMENT MARKET FOR CHEMICAL TREATMENT, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.3.4 OTHER TREATMENTS

- TABLE 40 MEDICAL WASTE MANAGEMENT MARKET FOR OTHER TREATMENTS, BY REGION, 2021-2028 (USD MILLION)

- TABLE 41 NORTH AMERICA: MEDICAL WASTE MANAGEMENT MARKET FOR OTHER TREATMENTS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 42 EUROPE: MEDICAL WASTE MANAGEMENT MARKET FOR OTHER TREATMENTS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 43 ASIA PACIFIC: MEDICAL WASTE MANAGEMENT MARKET FOR OTHER TREATMENTS, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.4 RECYCLING SERVICES

- 6.4.1 INCREASING AWARENESS ABOUT RECYCLING TO DRIVE MARKET

- TABLE 44 MEDICAL WASTE MANAGEMENT MARKET FOR RECYCLING SERVICES, BY REGION, 2021-2028 (USD MILLION)

- TABLE 45 NORTH AMERICA: MEDICAL WASTE MANAGEMENT MARKET FOR RECYCLING SERVICES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 46 EUROPE: MEDICAL WASTE MANAGEMENT MARKET FOR RECYCLING SERVICES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 47 ASIA PACIFIC: MEDICAL WASTE MANAGEMENT MARKET FOR RECYCLING SERVICES, BY COUNTRY, 2021-2028 (USD MILLION)

7 MEDICAL WASTE MANAGEMENT MARKET, BY TYPE OF WASTE

- 7.1 INTRODUCTION

- TABLE 48 MEDICAL WASTE MANAGEMENT MARKET, BY TYPE OF WASTE, 2021-2028 (USD MILLION)

- TABLE 49 MEDICAL WASTE MANAGEMENT MARKET, BY TYPE OF WASTE, 2021-2028 (TONS)

- 7.2 NON-HAZARDOUS WASTE

- 7.2.1 GROWING VOLUME OF SURGICAL PROCEDURES TO INCREASE GENERATION OF NON-HAZARDOUS WASTE

- TABLE 50 NON-HAZARDOUS MEDICAL WASTE MANAGEMENT MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 51 NORTH AMERICA: NON-HAZARDOUS MEDICAL WASTE MANAGEMENT MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 52 EUROPE: NON-HAZARDOUS MEDICAL WASTE MANAGEMENT MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 53 ASIA PACIFIC: NON-HAZARDOUS MEDICAL WASTE MANAGEMENT MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.3 HAZARDOUS WASTE

- TABLE 54 HAZARDOUS MEDICAL WASTE MANAGEMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 55 HAZARDOUS MEDICAL WASTE MANAGEMENT MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 56 NORTH AMERICA: HAZARDOUS MEDICAL WASTE MANAGEMENT MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 57 EUROPE: HAZARDOUS MEDICAL WASTE MANAGEMENT MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 58 ASIA PACIFIC: HAZARDOUS MEDICAL WASTE MANAGEMENT MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.3.1 INFECTIOUS & PATHOLOGICAL WASTE

- 7.3.1.1 Rising incidence of infectious diseases to drive large-volume infectious waste generation

- TABLE 59 INFECTIOUS & PATHOLOGICAL MEDICAL WASTE MANAGEMENT MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 60 NORTH AMERICA: INFECTIOUS & PATHOLOGICAL MEDICAL WASTE MANAGEMENT MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 61 EUROPE: INFECTIOUS & PATHOLOGICAL MEDICAL WASTE MANAGEMENT MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 62 ASIA PACIFIC: INFECTIOUS & PATHOLOGICAL MEDICAL WASTE MANAGEMENT MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.3.2 SHARPS WASTE

- 7.3.2.1 Increasing surgical volume to support market growth

- TABLE 63 SHARPS MEDICAL WASTE MANAGEMENT MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 64 NORTH AMERICA: SHARPS MEDICAL WASTE MANAGEMENT MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 65 EUROPE: SHARPS MEDICAL WASTE MANAGEMENT MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 66 ASIA PACIFIC: SHARPS MEDICAL WASTE MANAGEMENT MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.3.3 PHARMACEUTICAL WASTE

- 7.3.3.1 Stringent regulations and protocols for monitoring and disposal of pharmaceutical waste to drive market

- TABLE 67 PHARMACEUTICAL MEDICAL WASTE MANAGEMENT MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 68 NORTH AMERICA: PHARMACEUTICAL MEDICAL WASTE MANAGEMENT MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 69 EUROPE: PHARMACEUTICAL MEDICAL WASTE MANAGEMENT MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 70 ASIA PACIFIC: PHARMACEUTICAL MEDICAL WASTE MANAGEMENT MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.3.4 OTHER HAZARDOUS WASTE

- TABLE 71 CHEMICAL WASTE GENERATED FROM HEALTHCARE ACTIVITIES

- TABLE 72 MEDICAL WASTE MANAGEMENT MARKET FOR OTHER HAZARDOUS WASTE, BY REGION, 2021-2028 (USD MILLION)

- TABLE 73 NORTH AMERICA: MEDICAL WASTE MANAGEMENT MARKET FOR OTHER HAZARDOUS WASTE, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 74 EUROPE: MEDICAL WASTE MANAGEMENT MARKET FOR OTHER HAZARDOUS WASTE, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 75 ASIA PACIFIC: MEDICAL WASTE MANAGEMENT MARKET FOR OTHER HAZARDOUS WASTE, BY COUNTRY, 2021-2028 (USD MILLION)

8 MEDICAL WASTE MANAGEMENT MARKET, BY TREATMENT SITE

- 8.1 INTRODUCTION

- TABLE 76 MEDICAL WASTE MANAGEMENT MARKET, BY TREATMENT SITE, 2021-2028 (USD MILLION)

- 8.2 OFFSITE TREATMENT

- 8.2.1 COST-EFFECTIVENESS OF OFFSITE TREATMENT TO DRIVE MARKET GROWTH

- TABLE 77 OFFSITE MEDICAL WASTE TREATMENT MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 78 NORTH AMERICA: OFFSITE MEDICAL WASTE TREATMENT MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 79 EUROPE: OFFSITE MEDICAL WASTE TREATMENT MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 80 ASIA PACIFIC: OFFSITE MEDICAL WASTE TREATMENT MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 8.3 ONSITE TREATMENT

- 8.3.1 GROWING COMPANY INITIATIVES TO PROVIDE ADVANCED ONSITE EQUIPMENT TO SUPPORT MARKET GROWTH

- TABLE 81 ONSITE MEDICAL WASTE TREATMENT MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 82 NORTH AMERICA: ONSITE MEDICAL WASTE TREATMENT MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 83 EUROPE: ONSITE MEDICAL WASTE TREATMENT MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 84 ASIA PACIFIC: ONSITE MEDICAL WASTE TREATMENT MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

9 MEDICAL WASTE MANAGEMENT MARKET, BY WASTE GENERATOR

- 9.1 INTRODUCTION

- TABLE 85 MEDICAL WASTE MANAGEMENT MARKET, BY WASTE GENERATOR, 2021-2028 (USD MILLION)

- 9.2 HOSPITALS & DIAGNOSTIC LABORATORIES

- 9.2.1 RISING NUMBER OF SURGERIES TO CONTRIBUTE TO WASTE GENERATION

- TABLE 86 HEALTHCARE WASTE GENERATED BY HOSPITALS & DIAGNOSTIC LABORATORIES

- TABLE 87 MEDICAL WASTE MANAGEMENT FOR HOSPITALS & DIAGNOSTIC LABORATORIES, BY REGION, 2021-2028 (USD MILLION)

- TABLE 88 NORTH AMERICA: MEDICAL WASTE MANAGEMENT FOR HOSPITALS & DIAGNOSTIC LABORATORIES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 89 EUROPE: MEDICAL WASTE MANAGEMENT FOR HOSPITALS & DIAGNOSTIC LABORATORIES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 90 ASIA PACIFIC: MEDICAL WASTE MANAGEMENT FOR HOSPITALS & DIAGNOSTIC LABORATORIES, BY COUNTRY, 2021-2028 (USD MILLION)

- 9.3 OTHER WASTE GENERATORS

- TABLE 91 MEDICAL WASTE MANAGEMENT FOR OTHER WASTE GENERATORS, BY REGION, 2021-2028 (USD MILLION)

- TABLE 92 NORTH AMERICA: MEDICAL WASTE MANAGEMENT FOR OTHER WASTE GENERATORS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 93 EUROPE: MEDICAL WASTE MANAGEMENT FOR OTHER WASTE GENERATORS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 94 ASIA PACIFIC: MEDICAL WASTE MANAGEMENT FOR OTHER WASTE GENERATORS, BY COUNTRY, 2021-2028 (USD MILLION)

10 MEDICAL WASTE MANAGEMENT MARKET, BY REGION

- 10.1 INTRODUCTION

- TABLE 95 MEDICAL WASTE MANAGEMENT MARKET, BY REGION, 2021-2028 (USD MILLION)

- 10.2 NORTH AMERICA

- 10.2.1 NORTH AMERICA: RECESSION IMPACT

- FIGURE 27 NORTH AMERICA: MEDICAL WASTE MANAGEMENT MARKET SNAPSHOT

- TABLE 96 NORTH AMERICA: MEDICAL WASTE MANAGEMENT MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 97 NORTH AMERICA: MEDICAL WASTE MANAGEMENT MARKET, BY SERVICE, 2021-2028 (USD MILLION)

- TABLE 98 NORTH AMERICA: MEDICAL WASTE MANAGEMENT MARKET FOR TREATMENT & DISPOSAL SERVICES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 99 NORTH AMERICA: MEDICAL WASTE MANAGEMENT MARKET, BY TYPE OF WASTE, 2021-2028 (USD MILLION)

- TABLE 100 NORTH AMERICA: HAZARDOUS MEDICAL WASTE MANAGEMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 101 NORTH AMERICA: MEDICAL WASTE MANAGEMENT MARKET, BY TREATMENT SITE, 2021-2028 (USD MILLION)

- TABLE 102 NORTH AMERICA: MEDICAL WASTE MANAGEMENT MARKET, BY WASTE GENERATOR, 2021-2028 (USD MILLION)

- 10.2.2 US

- 10.2.2.1 Stringent regulations for handling medical waste to support market growth

- TABLE 103 US: MEDICAL WASTE MANAGEMENT MARKET, BY SERVICE, 2021-2028 (USD MILLION)

- TABLE 104 US: MEDICAL WASTE MANAGEMENT MARKET FOR TREATMENT & DISPOSAL SERVICES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 105 US: MEDICAL WASTE MANAGEMENT MARKET, BY TYPE OF WASTE, 2021-2028 (USD MILLION)

- TABLE 106 US: HAZARDOUS MEDICAL WASTE MANAGEMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 107 US: MEDICAL WASTE MANAGEMENT MARKET, BY TREATMENT SITE, 2021-2028 (USD MILLION)

- TABLE 108 US: MEDICAL WASTE MANAGEMENT MARKET, BY WASTE GENERATOR, 2021-2028 (USD MILLION)

- 10.2.3 CANADA

- 10.2.3.1 Increasing number of surgical procedures to drive market

- TABLE 109 CANADA: INCIDENCE OF DIABETES, 2022 VS. 2032

- TABLE 110 CANADA: MEDICAL WASTE MANAGEMENT MARKET, BY SERVICE, 2021-2028 (USD MILLION)

- TABLE 111 CANADA: MEDICAL WASTE MANAGEMENT MARKET FOR TREATMENT & DISPOSAL SERVICES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 112 CANADA: MEDICAL WASTE MANAGEMENT MARKET, BY TYPE OF WASTE, 2021-2028 (USD MILLION)

- TABLE 113 CANADA: HAZARDOUS MEDICAL WASTE MANAGEMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 114 CANADA: MEDICAL WASTE MANAGEMENT MARKET, BY TREATMENT SITE, 2021-2028 (USD MILLION)

- TABLE 115 CANADA: MEDICAL WASTE MANAGEMENT MARKET, BY WASTE GENERATOR, 2021-2028 (USD MILLION)

- 10.3 EUROPE

- 10.3.1 EUROPE: RECESSION IMPACT

- TABLE 116 EUROPE: HEALTHCARE EXPENDITURE, BY COUNTRY (% OF GDP)

- TABLE 117 EUROPE: MEDICAL WASTE MANAGEMENT MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 118 EUROPE: MEDICAL WASTE MANAGEMENT MARKET, BY SERVICE, 2021-2028 (USD MILLION)

- TABLE 119 EUROPE: MEDICAL WASTE MANAGEMENT MARKET FOR TREATMENT & DISPOSAL SERVICES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 120 EUROPE: MEDICAL WASTE MANAGEMENT MARKET, BY TYPE OF WASTE, 2021-2028 (USD MILLION)

- TABLE 121 EUROPE: HAZARDOUS MEDICAL WASTE MANAGEMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 122 EUROPE: MEDICAL WASTE MANAGEMENT MARKET, BY TREATMENT SITE, 2021-2028 (USD MILLION)

- TABLE 123 EUROPE: MEDICAL WASTE MANAGEMENT MARKET, BY WASTE GENERATOR, 2021-2028 (USD MILLION)

- 10.3.2 GERMANY

- 10.3.2.1 Increasing healthcare expenditure to drive market

- TABLE 124 GERMANY: MEDICAL WASTE MANAGEMENT MARKET, BY SERVICE, 2021-2028 (USD MILLION)

- TABLE 125 GERMANY: MEDICAL WASTE MANAGEMENT MARKET FOR TREATMENT & DISPOSAL SERVICES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 126 GERMANY: MEDICAL WASTE MANAGEMENT MARKET, BY TYPE OF WASTE, 2021-2028 (USD MILLION)

- TABLE 127 GERMANY: HAZARDOUS MEDICAL WASTE MANAGEMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 128 GERMANY: MEDICAL WASTE MANAGEMENT MARKET, BY TREATMENT SITE, 2021-2028 (USD MILLION)

- TABLE 129 GERMANY: MEDICAL WASTE MANAGEMENT MARKET, BY WASTE GENERATOR, 2021-2028 (USD MILLION)

- 10.3.3 UK

- 10.3.3.1 Rising incidence of chronic diseases to propel market growth

- TABLE 130 UK: MEDICAL WASTE MANAGEMENT MARKET, BY SERVICE, 2021-2028 (USD MILLION)

- TABLE 131 UK: MEDICAL WASTE MANAGEMENT MARKET FOR TREATMENT & DISPOSAL SERVICES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 132 UK: MEDICAL WASTE MANAGEMENT MARKET, BY TYPE OF WASTE, 2021-2028 (USD MILLION)

- TABLE 133 UK: HAZARDOUS MEDICAL WASTE MANAGEMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 134 UK: MEDICAL WASTE MANAGEMENT MARKET, BY TREATMENT SITE, 2021-2028 (USD MILLION)

- TABLE 135 UK: MEDICAL WASTE MANAGEMENT MARKET, BY WASTE GENERATOR, 2021-2028 (USD MILLION)

- 10.3.4 FRANCE

- 10.3.4.1 Growing geriatric population to aid market growth

- TABLE 136 FRANCE: MEDICAL WASTE MANAGEMENT MARKET, BY SERVICE, 2021-2028 (USD MILLION)

- TABLE 137 FRANCE: MEDICAL WASTE MANAGEMENT MARKET FOR TREATMENT & DISPOSAL SERVICES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 138 FRANCE: MEDICAL WASTE MANAGEMENT MARKET, BY TYPE OF WASTE, 2021-2028 (USD MILLION)

- TABLE 139 FRANCE: HAZARDOUS MEDICAL WASTE MANAGEMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 140 FRANCE: MEDICAL WASTE MANAGEMENT MARKET, BY TREATMENT SITE, 2021-2028 (USD MILLION)

- TABLE 141 FRANCE: MEDICAL WASTE MANAGEMENT MARKET, BY WASTE GENERATOR, 2021-2028 (USD MILLION)

- 10.3.5 ITALY

- 10.3.5.1 Improving quality and accessibility to medical to favor market growth

- TABLE 142 ITALY: MEDICAL WASTE MANAGEMENT MARKET, BY SERVICE, 2021-2028 (USD MILLION)

- TABLE 143 ITALY: MEDICAL WASTE MANAGEMENT MARKET FOR TREATMENT & DISPOSAL SERVICES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 144 ITALY: MEDICAL WASTE MANAGEMENT MARKET, BY TYPE OF WASTE, 2021-2028 (USD MILLION)

- TABLE 145 ITALY: HAZARDOUS MEDICAL WASTE MANAGEMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 146 ITALY: MEDICAL WASTE MANAGEMENT MARKET, BY TREATMENT SITE, 2021-2028 (USD MILLION)

- TABLE 147 ITALY: MEDICAL WASTE MANAGEMENT MARKET, BY WASTE GENERATOR, 2021-2028 (USD MILLION)

- 10.3.6 SPAIN

- 10.3.6.1 Increasing life expectancy and growing geriatric population to ensure market growth

- TABLE 148 SPAIN: MEDICAL WASTE MANAGEMENT MARKET, BY SERVICE, 2021-2028 (USD MILLION)

- TABLE 149 SPAIN: MEDICAL WASTE MANAGEMENT MARKET FOR TREATMENT & DISPOSAL SERVICES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 150 SPAIN: MEDICAL WASTE MANAGEMENT MARKET, BY TYPE OF WASTE, 2021-2028 (USD MILLION)

- TABLE 151 SPAIN: HAZARDOUS MEDICAL WASTE MANAGEMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 152 SPAIN: MEDICAL WASTE MANAGEMENT MARKET, BY TREATMENT SITE, 2021-2028 (USD MILLION)

- TABLE 153 SPAIN: MEDICAL WASTE MANAGEMENT MARKET, BY WASTE GENERATOR, 2021-2028 (USD MILLION)

- 10.3.7 REST OF EUROPE

- TABLE 154 REST OF EUROPE: PERCENTAGE OF GDP ON HEALTHCARE EXPENDITURE, BY COUNTRY

- TABLE 155 REST OF EUROPE: MEDICAL WASTE MANAGEMENT MARKET, BY SERVICE, 2021-2028 (USD MILLION)

- TABLE 156 REST OF EUROPE: MEDICAL WASTE MANAGEMENT MARKET FOR TREATMENT & DISPOSAL SERVICES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 157 REST OF EUROPE: MEDICAL WASTE MANAGEMENT MARKET, BY TYPE OF WASTE, 2021-2028 (USD MILLION)

- TABLE 158 REST OF EUROPE: HAZARDOUS MEDICAL WASTE MANAGEMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 159 REST OF EUROPE: MEDICAL WASTE MANAGEMENT MARKET, BY TREATMENT SITE, 2021-2028 (USD MILLION)

- TABLE 160 REST OF EUROPE: MEDICAL WASTE MANAGEMENT MARKET, BY WASTE GENERATOR, 2021-2028 (USD MILLION)

- 10.4 ASIA PACIFIC

- 10.4.1 ASIA PACIFIC: RECESSION IMPACT

- FIGURE 28 ASIA PACIFIC: MEDICAL WASTE MANAGEMENT MARKET SNAPSHOT

- TABLE 161 ASIA PACIFIC: MEDICAL WASTE MANAGEMENT MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 162 ASIA PACIFIC: MEDICAL WASTE MANAGEMENT MARKET, BY SERVICE, 2021-2028 (USD MILLION)

- TABLE 163 ASIA PACIFIC: MEDICAL WASTE MANAGEMENT MARKET FOR TREATMENT & DISPOSAL SERVICES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 164 ASIA PACIFIC: MEDICAL WASTE MANAGEMENT MARKET, BY TYPE OF WASTE, 2021-2028 (USD MILLION)

- TABLE 165 ASIA PACIFIC: HAZARDOUS MEDICAL WASTE MANAGEMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 166 ASIA PACIFIC: MEDICAL WASTE MANAGEMENT MARKET, BY TREATMENT SITE, 2021-2028 (USD MILLION)

- TABLE 167 ASIA PACIFIC: MEDICAL WASTE MANAGEMENT MARKET, BY WASTE GENERATOR, 2021-2028 (USD MILLION)

- 10.4.2 CHINA

- 10.4.2.1 China to hold largest share of APAC market

- TABLE 168 CHINA: MEDICAL WASTE MANAGEMENT MARKET, BY SERVICE, 2021-2028 (USD MILLION)

- TABLE 169 CHINA: MEDICAL WASTE MANAGEMENT MARKET FOR TREATMENT & DISPOSAL SERVICES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 170 CHINA: MEDICAL WASTE MANAGEMENT MARKET, BY TYPE OF WASTE, 2021-2028 (USD MILLION)

- TABLE 171 CHINA: HAZARDOUS MEDICAL WASTE MANAGEMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 172 CHINA: MEDICAL WASTE MANAGEMENT MARKET, BY TREATMENT SITE, 2021-2028 (USD MILLION)

- TABLE 173 CHINA: MEDICAL WASTE MANAGEMENT MARKET, BY WASTE GENERATOR, 2021-2028 (USD MILLION)

- 10.4.3 JAPAN

- 10.4.3.1 Large geriatric population and well-developed healthcare system to drive market

- TABLE 174 JAPAN: MEDICAL WASTE MANAGEMENT MARKET, BY SERVICE, 2021-2028 (USD MILLION)

- TABLE 175 JAPAN: MEDICAL WASTE MANAGEMENT MARKET FOR TREATMENT & DISPOSAL SERVICES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 176 JAPAN: MEDICAL WASTE MANAGEMENT MARKET, BY TYPE OF WASTE, 2021-2028 (USD MILLION)

- TABLE 177 JAPAN: HAZARDOUS MEDICAL WASTE MANAGEMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 178 JAPAN: MEDICAL WASTE MANAGEMENT MARKET, BY TREATMENT SITE, 2021-2028 (USD MILLION)

- TABLE 179 JAPAN: MEDICAL WASTE MANAGEMENT MARKET, BY WASTE GENERATOR, 2021-2028 (USD MILLION)

- 10.4.4 INDIA

- 10.4.4.1 Government initiatives and expansion in healthcare infrastructure to drive demand for waste management

- TABLE 180 INDIA: MEDICAL WASTE MANAGEMENT MARKET, BY SERVICE, 2021-2028 (USD MILLION)

- TABLE 181 INDIA: MEDICAL WASTE MANAGEMENT MARKET FOR TREATMENT & DISPOSAL SERVICES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 182 INDIA: MEDICAL WASTE MANAGEMENT MARKET, BY TYPE OF WASTE, 2021-2028 (USD MILLION)

- TABLE 183 INDIA: HAZARDOUS MEDICAL WASTE MANAGEMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 184 INDIA: MEDICAL WASTE MANAGEMENT MARKET, BY TREATMENT SITE, 2021-2028 (USD MILLION)

- TABLE 185 INDIA: MEDICAL WASTE MANAGEMENT MARKET, BY WASTE GENERATOR, 2021-2028 (USD MILLION)

- 10.4.5 REST OF ASIA PACIFIC

- TABLE 186 REST OF ASIA PACIFIC: MEDICAL WASTE MANAGEMENT MARKET, BY SERVICE, 2021-2028 (USD MILLION)

- TABLE 187 REST OF ASIA PACIFIC: MEDICAL WASTE MANAGEMENT MARKET FOR TREATMENT & DISPOSAL SERVICES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 188 REST OF ASIA PACIFIC: MEDICAL WASTE MANAGEMENT MARKET, BY TYPE OF WASTE, 2021-2028 (USD MILLION)

- TABLE 189 REST OF ASIA PACIFIC: HAZARDOUS MEDICAL WASTE MANAGEMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 190 REST OF ASIA PACIFIC: MEDICAL WASTE MANAGEMENT MARKET, BY TREATMENT SITE, 2021-2028 (USD MILLION)

- TABLE 191 REST OF ASIA PACIFIC: MEDICAL WASTE MANAGEMENT MARKET, BY WASTE GENERATOR, 2021-2028 (USD MILLION)

- 10.5 LATIN AMERICA

- 10.5.1 RISING PENETRATION OF HEALTHCARE TO SUPPORT MARKET GROWTH

- 10.5.2 LATIN AMERICA: RECESSION IMPACT

- TABLE 192 LATIN AMERICA: MEDICAL WASTE MANAGEMENT MARKET, BY SERVICE, 2021-2028 (USD MILLION)

- TABLE 193 LATIN AMERICA: MEDICAL WASTE MANAGEMENT MARKET FOR TREATMENT & DISPOSAL SERVICES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 194 LATIN AMERICA: MEDICAL WASTE MANAGEMENT MARKET, BY TYPE OF WASTE, 2021-2028 (USD MILLION)

- TABLE 195 LATIN AMERICA: HAZARDOUS MEDICAL WASTE MANAGEMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 196 LATIN AMERICA: MEDICAL WASTE MANAGEMENT MARKET, BY TREATMENT SITE, 2021-2028 (USD MILLION)

- TABLE 197 LATIN AMERICA: MEDICAL WASTE MANAGEMENT MARKET, BY WASTE GENERATOR, 2021-2028 (USD MILLION)

- 10.6 MIDDLE EAST & AFRICA

- 10.6.1 INCREASING TARGET POPULATION TO DRIVE MARKET

- 10.6.2 MIDDLE EAST & AFRICA: RECESSION IMPACT

- TABLE 198 MIDDLE EAST & AFRICA: MEDICAL WASTE MANAGEMENT MARKET, BY SERVICE, 2021-2028 (USD MILLION)

- TABLE 199 MIDDLE EAST & AFRICA: MEDICAL WASTE MANAGEMENT MARKET FOR TREATMENT & DISPOSAL SERVICES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 200 MIDDLE EAST & AFRICA: MEDICAL WASTE MANAGEMENT MARKET, BY TYPE OF WASTE, 2021-2028 (USD MILLION)

- TABLE 201 MIDDLE EAST & AFRICA: HAZARDOUS MEDICAL WASTE MANAGEMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 202 MIDDLE EAST & AFRICA: MEDICAL WASTE MANAGEMENT MARKET, BY TREATMENT SITE, 2021-2028 (USD MILLION)

- TABLE 203 MIDDLE EAST & AFRICA: MEDICAL WASTE MANAGEMENT MARKET, BY WASTE GENERATOR, 2021-2028 (USD MILLION)

- 10.7 GCC COUNTRIES

- 10.7.1 RISING POPULATION AND PREVALENCE OF CHRONIC DISEASES TO SUPPORT MARKET GROWTH

- 10.7.2 GCC COUNTRIES: RECESSION IMPACT

- TABLE 204 GCC COUNTRIES: MEDICAL WASTE MANAGEMENT MARKET, BY SERVICE, 2021-2028 (USD MILLION)

- TABLE 205 GCC COUNTRIES: MEDICAL WASTE MANAGEMENT MARKET FOR TREATMENT & DISPOSAL SERVICES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 206 GCC COUNTRIES: MEDICAL WASTE MANAGEMENT MARKET, BY TYPE OF WASTE, 2021-2028 (USD MILLION)

- TABLE 207 GCC COUNTRIES: HAZARDOUS MEDICAL WASTE MANAGEMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 208 GCC COUNTRIES: MEDICAL WASTE MANAGEMENT MARKET, BY TREATMENT SITE, 2021-2028 (USD MILLION)

- TABLE 209 GCC COUNTRIES: MEDICAL WASTE MANAGEMENT MARKET, BY WASTE GENERATOR, 2021-2028 (USD MILLION)

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- TABLE 210 OVERVIEW OF STRATEGIES DEPLOYED BY KEY MEDICAL WASTE MANAGEMENT SERVICE PROVIDERS

- 11.3 REVENUE SHARE ANALYSIS

- FIGURE 29 REVENUE SHARE ANALYSIS OF TOP PLAYERS IN MEDICAL WASTE MANAGEMENT MARKET (2018-2022)

- 11.4 MARKET SHARE ANALYSIS

- FIGURE 30 MARKET SHARE OF KEY PLAYERS (2022)

- TABLE 211 MEDICAL WASTE MANAGEMENT MARKET: DEGREE OF COMPETITION

- 11.5 COMPANY EVALUATION MATRIX: KEY PLAYERS

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- FIGURE 31 MEDICAL WASTE MANAGEMENT MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2022

- 11.5.5 COMPANY FOOTPRINT

- FIGURE 32 MEDICAL WASTE MANAGEMENT MARKET: COMPANY FOOTPRINT

- TABLE 212 COMPANY FOOTPRINT

- TABLE 213 COMPANY SERVICE FOOTPRINT

- TABLE 214 COMPANY REGIONAL FOOTPRINT

- 11.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 STARTING BLOCKS

- 11.6.3 RESPONSIVE COMPANIES

- 11.6.4 DYNAMIC COMPANIES

- FIGURE 33 MEDICAL WASTE MANAGEMENT MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2022

- 11.6.5 COMPETITIVE BENCHMARKING OF STARTUPS/SME PLAYERS

- TABLE 215 MEDICAL WASTE MANAGEMENT MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- 11.7 COMPETITIVE SCENARIO

- 11.7.1 SERVICE LAUNCHES

- TABLE 216 KEY SERVICE LAUNCHES (JANUARY 2020-JANUARY 2024)

- 11.7.2 DEALS

- TABLE 217 KEY DEALS (JANUARY 2020- JANUARY 2024)

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- (Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)**

- 12.1.1 VEOLIA ENVIRONNEMENT S.A.

- TABLE 218 VEOLIA ENVIRONNEMENT S.A.: COMPANY OVERVIEW

- FIGURE 34 VEOLIA ENVIRONNEMENT S.A.: COMPANY SNAPSHOT (2022)

- TABLE 219 VEOLIA ENVIRONNEMENT S.A.: SERVICES OFFERED

- TABLE 220 VEOLIA ENVIRONNEMENT S.A.: SERVICE LAUNCHES (JANUARY 2020-JANUARY 2024)

- TABLE 221 VEOLIA ENVIRONNEMENT S.A.: DEALS (JANUARY 2020-JANUARY 2024)

- 12.1.2 CLEAN HARBORS, INC.

- TABLE 222 CLEAN HARBORS, INC.: COMPANY OVERVIEW

- FIGURE 35 CLEAN HARBORS, INC.: COMPANY SNAPSHOT (2022)

- TABLE 223 CLEAN HARBORS, INC.: SERVICES OFFERED

- 12.1.3 STERICYCLE INC.

- TABLE 224 STERICYCLE INC.: COMPANY OVERVIEW

- FIGURE 36 STERICYCLE INC.: COMPANY SNAPSHOT (2022)

- TABLE 225 STERICYCLE INC.: SERVICES OFFERED

- 12.1.4 WASTE MANAGEMENT, INC.

- TABLE 226 WASTE MANAGEMENT INC.: COMPANY OVERVIEW

- FIGURE 37 WASTE MANAGEMENT, INC.: COMPANY SNAPSHOT (2022)

- TABLE 227 WASTE MANAGEMENT, INC.: SERVICES OFFERED

- TABLE 228 WASTE MANAGEMENT, INC.: DEALS (JANUARY 2020-JANUARY 2024)

- 12.1.5 CLEANAWAY WASTE MANAGEMENT LIMITED

- TABLE 229 CLEANAWAY WASTE MANAGEMENT LIMITED: COMPANY OVERVIEW

- FIGURE 38 CLEANAWAY WASTE MANAGEMENT LIMITED: COMPANY SNAPSHOT (2023)

- TABLE 230 CLEANAWAY WASTE MANAGEMENT LIMITED: SERVICES OFFERED

- 12.1.6 CASELLA WASTE SYSTEMS, INC.

- TABLE 231 CASELLA WASTE SYSTEMS, INC.: COMPANY OVERVIEW

- FIGURE 39 CASELLA WASTE SYSTEMS, INC.: COMPANY SNAPSHOT (2022)

- TABLE 232 CASELLA WASTE SYSTEMS, INC.: SERVICES OFFERED

- TABLE 233 SHARPS COMPLIANCE, INC.: COMPANY OVERVIEW

- TABLE 234 SHARPS COMPLIANCE, INC.: SERVICES OFFERED

- TABLE 235 SHARPS COMPLIANCE, INC.: DEALS (JANUARY 2020-JANUARY 2024)

- 12.2 OTHER PLAYERS

- 12.2.1 COVANTA HOLDING CORPORATION

- 12.2.2 HAZARDOUS WASTE EXPERTS

- 12.2.3 REMONDIS SE & CO. KG

- 12.2.4 BIOMEDICAL WASTE SOLUTIONS, LLC

- 12.2.5 ECOMED SERVICES

- 12.2.6 GRP & ASSOCIATES, INC.

- 12.2.7 BWS INCORPORATED

- 12.2.8 MEDPRO DISPOSAL, LLC

- 12.2.9 GIC MEDICAL DISPOSAL

- 12.2.10 GAMMA WASTE SERVICES

- 12.2.11 TRIUMVIRATE ENVIRONMENTAL

- 12.2.12 EPCO

- 12.2.13 ALL MEDICAL WASTE AUSTRALIA PTY LTD.

- 12.2.14 PRO-DISPOSAL MEDICAL WASTE SERVICES

- 12.2.15 SSO MEDICAL WASTE MANAGEMENT

- 12.2.16 SAFEGUARD WASTE SOLUTIONS

- 12.2.17 MEDWASTE INDUSTRIES, INC.

- 12.2.18 DULSCO

- *Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)** might not be captured in case of unlisted companies.

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS