|

|

市場調査レポート

商品コード

1244930

感情検出・認識の世界市場:コンポーネント別 (ソフトウェア、サービス)・活用領域別・エンドユーザー別・業種別・地域別の将来予測 (2027年まで)Emotion Detection and Recognition Market by Component (Software and Services), Application Area, End User, Vertical, and Region - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 感情検出・認識の世界市場:コンポーネント別 (ソフトウェア、サービス)・活用領域別・エンドユーザー別・業種別・地域別の将来予測 (2027年まで) |

|

出版日: 2023年03月15日

発行: MarketsandMarkets

ページ情報: 英文 317 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の感情検出・認識の市場規模は、2022年の235億米ドルから2027年には429億米ドルへと、予測期間中に12.8%のCAGRで成長すると予測されています。

市場成長の主な要因としては、人工知能 (AI)・機械学習 (ML)・ディープラーニング技術の普及や、インテリジェントシステムによる感情認識モデルのニーズの拡大、ウェアラブル技術の普及浸透などが挙げられます。

"コンポーネント別では、ソフトウェア部門が最大の市場規模を占める"

競争が激化する中、画像認識カメラはより高性能なハードウェアとソフトウェアのセンサーを使用し、より正確に商品の配置を認識できるようになっています。パンデミック危機においては、画像認識技術も多くの国で広く採用されています。例えば、人を識別してウイルスの感染を食い止めるために、ロシアや中国は画像認識・パターン認識・顔認識技術を導入しました。その結果、画像認識市場のソフトウェアコンポーネントが拡大しました。さらに、いくつかの企業は、感染拡大中に最先端の画像認識ソフトウェアの作成・ライセンス供与などに取り組みました。こうした要因が、予測期間中の感情検出・認識市場を後押ししていると考えられます。

"ソフトウェア別では、顔認識・表情認識分野が予測期間中に最も高いCAGRで成長する"

顔認識は、表情から収集した感情の識別を支援し、リアルタイムで結果を生成するため、感情検出・認識システムには不可欠な要素です。顔の表情認識は、驚き、喜び、悲しみ、怒り、恐怖などの特徴ベクトルの特定に役立ちます。そのため、面接での感情検出技術の採用を後押ししています。例えば、Unileverは求職者の信頼度をチェックし、その人が顧客と接する職務に適しているかどうかを判断するために、この技術を導入しています。さらに、マーケティング・広告分野では、Kelloggがブランディングや広告に感情検出・認識技術を活用しています。グループに表示された様々な広告をもとに、捉えた表情を分析し、どの広告を最終的に決定するかを決定します。これらの要因によって、表情・認識分野における感情検出・認識技術ソリューションの採用が促進され、その結果、表情・認識分野は予測期間中に最も高いCAGRで成長することになります。

"用途別では、医療救急分野が予測期間中に高いCAGRで成長する"

医療救急の分野では、感情検出・認識システムが大いに役立っています。この分野の事業者は、感情検出・認識技術を組み合わせて、人の心の状態、痛み、そして自閉症やうつ病など、顔の手がかりから発見される可能性のある病気を評価します。言葉で表現できない人の痛みを識別することができるため、この技術は健康科学への贈り物となります。したがって、医療救急分野は予測期間中、より高いCAGRで成長すると予想されます。

当レポートでは、世界の感情検出・認識 (EDR) の市場について分析し、市場の基本構造や最新情勢、主な市場促進・抑制要因、技術別・コンポーネント別 (ハードウェア、ソフトウェア、サービス)・用途別・エンドユーザー別・業種別・地域別の市場動向の見通し、市場競争の状態、主要企業のプロファイルなどを調査しております。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要と業界動向

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- ケーススタディ分析

- バリューチェーン分析

- エコシステム分析

- ポーターのファイブフォース分析

- 価格分析

- 技術分析

- 特許分析

- バイヤーに影響を与える動向と混乱

- 関税・規制状況

- 主な利害関係者と購入基準

- 主な会議とイベント(2023年)

第6章 感情検出・認識市場:技術別

- イントロダクション

- 特徴抽出・3Dモデリング

- バイオセンサー技術

- 自然言語処理 (NLP)

- 機械学習 (ML)

- その他の技術

第7章 感情検出・認識市場:ハードウェア別

- イントロダクション

- センサー

- カメラ

- ストレージデバイス・プロセッサ

- その他のハードウェアデバイス

第8章 感情検出・認識市場:コンポーネント別

- イントロダクション

- ソフトウェア

- サービス

- 専門サービス

- マネージドサービス

第9章 感情検出・認識市場:ソフトウェア別

- イントロダクション

- 表情認識

- バイオセンシングソリューション・アプリ

- 音声認識・言語認識

- ジェスチャー・姿勢認識

第10章 感情検出・認識市場:用途別

- イントロダクション

- 緊急医療

- マーケティング・広告

- 法執行機関・監視・モニタリング

- エンターテイメント・家電製品

- その他の活用領域

第11章 感情検出・認識市場:エンドユーザー別

- イントロダクション

- 企業

- 防衛・警備当局

- 商業用

- 工業用

- その他のエンドユーザー

第12章 感情検出・認識市場:業種別

- イントロダクション

- 教育・研究

- メディア・エンターテイメント

- IT・ITeS

- 医療・社会支援

- 通信

- 小売業・eコマース

- 自動車

- 銀行・金融サービス・保険 (BFSI)

- その他の業種

第13章 感情検出・認識市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- 欧州

- 英国

- ドイツ

- オランダ

- 他の欧州諸国

- アジア太平洋

- 中国

- 日本

- オーストラリア

- 他の欧州諸国

- 中東・アフリカ

- 中東

- アフリカ

- ラテンアメリカ

- ブラジル

- メキシコ

- 他のラテンアメリカ諸国

第14章 競合情勢

- 概要

- 主要企業の収益シェア分析

- 主要企業の市場シェア分析

- 過去の収益分析

- 主要企業のランキング

- 主要企業の評価マトリックス

- 競合ベンチマーキング

- スタートアップ/中小企業向け評価マトリックス

- 競合シナリオと動向

- 製品のリリースと機能強化

- 資本取引

第15章 企業プロファイル

- 主要企業

- NEC

- IBM

- MICROSOFT

- APPLE

- TOBII

- AFFECTIVA

- ELLIPTIC LABS

- INTEL

- COGNITEC

- NVISO

- NOLDUS

- その他の企業

- GESTURETEK

- IMOTIONS

- NUMENTA

- POINTGRAB

- AYONIX

- PYREOS

- EYERIS

- BEYOND VERBAL

- KAIROS

- SENTIANCE

- RAYDIANT

- SONY DEPTHSENSING SOLUTIONS

第16章 隣接市場

- 隣接市場:概略

- 制限事項

- 感情検出・認識のエコシステムと隣接市場

- エッジAIソフトウェアマーケット

- 音声・言語認識市場

第17章 付録

The global emotion detection and recognition market size is projected to grow from USD 23.5 billion in 2022 to USD 42.9 billion by 2027, at a Compound Annual Growth Rate (CAGR) of 12.8% during the forecast period. The major factors driving the market growth include the global adoption of Al, ML, and deep learning technologies, the increasing need for emotion recognition models by intelligent systems, and the expanding popularity of wearable technology.

By component, the software segment to hold the largest market size

With more competition, image recognition cameras are using more sophisticated hardware and software sensors to recognize product placements more accurately. In the pandemic crisis, picture recognition technology has also been widely adopted in a number of nations. For instance, to identify people and stop the transmission of the virus, Moscow, Russia, and China have implemented image recognition, pattern recognition, and facial recognition technology. As a result, the image recognition market's software component has expanded. In addition to this, several businesses created cutting-edge picture recognition software during the epidemic or have licensed its use. As an illustration, PUX has obtained a license for its FaceU software to support Driver Monitoring System (DMS) for resilience against masked faces. Thus, it can be concluded that these elements fuel the EDR market during the forecasted period.

By Software, facial expression and recognition segment to register the highest CAGR during the forecast period

Facial recognition is an integral part of the emotion detection and recognition system, as it helps the identification of emotions gathered from facial expressions and generates real-time results. Facial expression recognition helps identify feature vectors, such as surprise, happiness, sadness, anger, and fear. Therefore, this encourages the adoption of emotion detection technology in interviews. For instance, Unilever is deploying this technology to check the confidence level of the candidate and make decisions on whether the individual will be suitable for client-facing roles. Furthermore, in the marketing and advertisement segment, Kellogg's uses the emotion detection and recognition technology for branding and advertisement. Based on various ads shown to the group, it analyzes the captured expressions and makes decisions on which advertisement to finalize. These factors would drive the adoption of emotion detection and recognition technology solutions in the facial expression and recognition segment and as a result the facial expression and recognition segment registers the highest CAGR during the forecasted period.

By application area, the medical emergency segment to grow at higher CAGR during the forecast period

The realm of medical emergency greatly benefits from emotion detection and recognition systems. Businesses that operate in this sector combine emotion detection and recognition technology by assessing a person's emotional state of mind, pain, and any medical disorders that may be detected through facial clues, such as autism and depression. As it can identify pain in persons who cannot verbally express it, this technology is a gift to the health sciences. Therefore, the medical emergency segment is anticipated to grow at higher CAGR during the forecast period.

Breakdown of primaries

The study contains insights from various industry experts, ranging from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type: Tier 1 - 40%, Tier 2 - 35%, and Tier 3 - 25%

- By Designation: C-level - 45%, Directors - 35%, and Managers - 25%

- By Region: North America - 35%, Europe - 25%, Asia Pacific - 30%, MEA - 5%, Latin America -5%

Major vendors in the global EDR market include NEC (Japan), IBM (US), Microsoft (US), Apple (US), Google (US), Tobii (Sweden), Affectiva (US), Elliptic Labs (Norway), Intel (US), Cognitec (Germany), NVISO (Switzerland), Noldus (Netherlands), GestureTek (Canada), iMotions (Denmark), Numenta (US), PointGrab (Israel), Ayonix (Japan), Pyreos (UK), Eyeris (US), Beyond Verbal (Israel), Kairos (US), Sentiance (Belgium), Raydiant (US), and Sony Depthsensing Solutions (Belgium).

The study includes an in-depth competitive analysis of the key players in the EDR market, their company profiles, recent developments, and key market strategies.

Research Coverage

The report segments the EDR market and forecasts its size by component (software and services), application area (medical emergency, marketing and advertising, law enforcement, surveillance, and monitoring, entertainment and consumer electronics, and other application areas), vertical (academia and research, media and entertainment, IT and ITeS, healthcare and social assistance, telecom, retail and eCommerce, automotive, BFSI, and other verticals), end user (enterprises, defense and security agency, commercial, industrial, and other end users), and region (North America, Europe, Middle East & Africa, Asia Pacific, and Latin America).

The study also includes an in-depth competitive analysis of the market's key players, their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Key Benefits of Buying the Report

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall EDR market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Adoption of AI, ML, and deep learning technologies worldwide, Rising need for emotion recognition models by intelligent systems, Growing popularity of wearable devices), restraints (Insufficient database and technical problems to lead to discrepancies and false results, High production cost), opportunities (Increasing demand for IoT technology and applications, Increasing government initiatives to leverage benefits of EDR technology), and challenges (Privacy and data breach issues, Ethical issues in EDR technology) influencing the growth of EDR market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the EDR market.

- Market Development: Comprehensive information about lucrative markets - the report analyses of the EDR market across varied regions.

- Market Diversification: Exhaustive information about new products & services , untapped geographies, recent developments, and investments in the EDR market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players like NEC (Japan), IBM (US), Microsoft (US), Apple (US), Google (US), and Tobii (Sweden), among others in the EDR market strategies.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- TABLE 1 USD EXCHANGE RATES, 2018-2021

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 GLOBAL EMOTION DETECTION AND RECOGNITION MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakdown of primary profiles

- FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.1.2.2 Key industry insights

- 2.2 DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE): REVENUE OF SOFTWARE/SERVICES OF EMOTION DETECTION AND RECOGNITION MARKET

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH (SUPPLY SIDE): COLLECTIVE REVENUE OF ALL SOFTWARE/SERVICES OF EMOTION DETECTION AND RECOGNITION

- 2.4 MARKET FORECAST

- TABLE 2 FACTOR ANALYSIS

- 2.5 RECESSION IMPACT AND RESEARCH ASSUMPTIONS

- 2.5.1 RECESSION IMPACT

- 2.5.2 RESEARCH ASSUMPTIONS

- 2.6 LIMITATIONS

3 EXECUTIVE SUMMARY

- TABLE 3 EMOTION DETECTION AND RECOGNITION MARKET SIZE AND GROWTH, 2016-2021 (USD MILLION, Y-O-Y%)

- TABLE 4 EMOTION DETECTION AND RECOGNITION MARKET SIZE AND GROWTH, 2022-2027 (USD MILLION, Y-O-Y%)

- FIGURE 5 GLOBAL EMOTION DETECTION AND RECOGNITION MARKET SIZE AND Y-O-Y GROWTH RATE

- FIGURE 6 NORTH AMERICA TO HOLD LARGEST MARKET SHARE IN 2022

4 PREMIUM INSIGHTS

- 4.1 BRIEF OVERVIEW OF EMOTION DETECTION AND RECOGNITION MARKET

- FIGURE 7 GLOBAL ADOPTION OF ARTIFICIAL INTELLIGENCE, MACHINE LEARNING, AND DEEP LEARNING TECHNOLOGIES TO DRIVE SOLUTIONS

- 4.2 EMOTION DETECTION AND RECOGNITION MARKET: SHARE OF TOP THREE VERTICALS AND REGIONS, 2022

- FIGURE 8 HEALTHCARE AND SOCIAL ASSISTANCE SEGMENT AND NORTH AMERICA TO HOLD LARGEST MARKET SHARES IN 2022

- 4.3 EMOTION DETECTION AND RECOGNITION MARKET, BY COMPONENT, 2022-2027

- FIGURE 9 SOFTWARE SEGMENT TO HOLD LARGER MARKET SHARE DURING FORECAST PERIOD

- 4.4 EMOTION DETECTION AND RECOGNITION MARKET, BY SOFTWARE, 2022-2027

- FIGURE 10 BIOSENSING SOLUTIONS AND APPS SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- 4.5 EMOTION DETECTION AND RECOGNITION MARKET, BY END USER, 2022-2027

- FIGURE 11 DEFENSE AND SECURITY AGENCY SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- 4.6 EMOTION DETECTION AND RECOGNITION MARKET, BY APPLICATION AREA, 2022-2027

- FIGURE 12 LAW ENFORCEMENT, SURVEILLANCE, AND MONITORING SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- 4.7 EMOTION DETECTION AND RECOGNITION MARKET INVESTMENT SCENARIO, BY REGION

- FIGURE 13 ASIA PACIFIC TO EMERGE AS BEST MARKET FOR INVESTMENTS IN NEXT FIVE YEARS

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

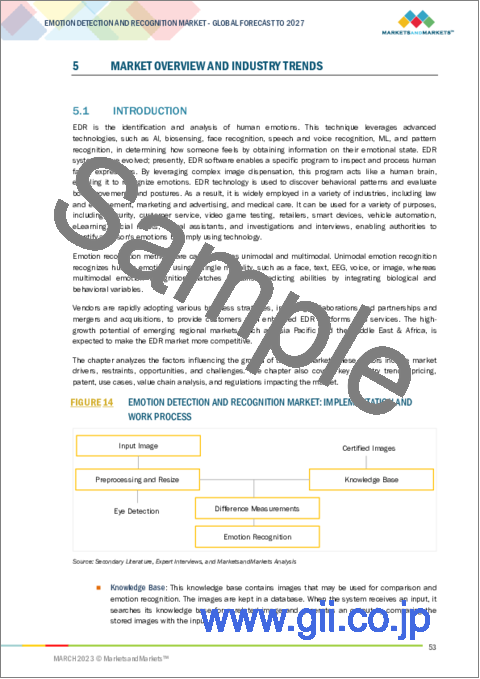

- FIGURE 14 EMOTION DETECTION AND RECOGNITION MARKET: IMPLEMENTATION AND WORK PROCESS

- 5.2 MARKET DYNAMICS

- FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: EMOTION DETECTION AND RECOGNITION MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Adoption of AI, ML, and deep learning technologies worldwide

- 5.2.1.2 Rising need for emotion recognition models by intelligent systems

- 5.2.1.3 Growing popularity of wearable devices

- 5.2.2 RESTRAINTS

- 5.2.2.1 Insufficient database and technical problems to lead to discrepancies and false results

- 5.2.2.2 High production cost

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing demand for IoT technology and applications

- 5.2.3.2 Increasing government initiatives to leverage benefits of EDR technology

- 5.2.4 CHALLENGES

- 5.2.4.1 Privacy and data breach issues

- 5.2.4.2 Ethical issues in EDR technology

- 5.3 CASE STUDY ANALYSIS

- 5.3.1 CASE STUDY 1: IBM HELPED NVISO CREATE CLOUD SYSTEM THAT ANALYZES FACIAL EXPRESSIONS

- 5.3.2 CASE STUDY 2: FACE RECOGNITION BY COGNITEC DEPLOYED IN VERIDOS EGATES AT BANGLADESH AIRPORT

- 5.3.3 CASE STUDY 3: AFFECTIVA HELPED GIPHY BRING EMOTIONS AND EXPRESSIONS TO DIGITAL COMMUNICATION

- 5.4 VALUE CHAIN ANALYSIS

- FIGURE 16 VALUE CHAIN ANALYSIS: EMOTION AND DETECTION RECOGNITION MARKET

- 5.5 ECOSYSTEM ANALYSIS

- FIGURE 17 EMOTION DETECTION AND RECOGNITION MARKET: ECOSYSTEM

- TABLE 5 EMOTION DETECTION AND RECOGNITION MARKET ECOSYSTEM

- 5.6 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 18 PORTER'S FIVE FORCES ANALYSIS

- TABLE 6 PORTER'S FIVE FORCES ANALYSIS

- 5.6.1 THREAT OF NEW ENTRANTS

- 5.6.2 THREAT OF SUBSTITUTES

- 5.6.3 BARGAINING POWER OF SUPPLIERS

- 5.6.4 BARGAINING POWER OF BUYERS

- 5.6.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.7 PRICING ANALYSIS

- 5.7.1 AVERAGE SELLING PRICE, BY KEY PLAYER AND APPLICATION

- TABLE 7 AVERAGE SELLING PRICE OF KEY PLAYERS FOR TOP APPLICATIONS (USD)

- 5.7.2 AVERAGE SELLING PRICE, BY SME PLAYER AND APPLICATION

- TABLE 8 AVERAGE SELLING PRICES OF SMES FOR TOP THREE APPLICATIONS (USD)

- 5.8 TECHNOLOGY ANALYSIS

- FIGURE 19 EMOTION DETECTION AND RECOGNITION MARKET: TECHNOLOGY ANALYSIS

- 5.8.1 EMOTION DETECTION AND RECOGNITION, ARTIFICIAL INTELLIGENCE, AND MACHINE LEARNING

- 5.8.2 EMOTION DETECTION AND RECOGNITION AND DEEP LEARNING TECHNOLOGY

- 5.8.3 ENHANCED USAGE OF EMOTION DETECTION AND RECOGNITION TECHNOLOGY IN AUTOMOBILES

- 5.8.4 EMOTION DETECTION AND RECOGNITION TECHNOLOGY IN HEALTHCARE

- 5.8.5 EMOTION RECOGNITION TECHNOLOGY FOR TRAINING SCENARIOS, SIMULATIONS, AND VIDEO GAMES

- 5.9 PATENT ANALYSIS

- TABLE 9 EMOTION DETECTION AND RECOGNITION MARKET: PATENTS

- FIGURE 20 PATENT ANALYSIS: EMOTION DETECTION AND RECOGNITION MARKET

- 5.10 TRENDS AND DISRUPTIONS IMPACTING BUYERS

- FIGURE 21 TRENDS AND DISRUPTIONS IMPACTING BUYERS

- 5.11 TARIFF AND REGULATORY LANDSCAPE

- 5.11.1 INTRODUCTION

- 5.11.2 INFORMATION TECHNOLOGY (IT) ACT, 2000

- 5.11.3 GENERAL DATA PROTECTION REGULATION COMPLIANCE

- 5.11.4 HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT

- 5.11.5 EUROPEAN NETWORK AND INFORMATION SECURITY AGENCY

- TABLE 10 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.12 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS (%)

- TABLE 11 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS (%)

- 5.13 KEY CONFERENCES AND EVENTS, 2023

- TABLE 12 DETAILED LIST OF CONFERENCES AND EVENTS, 2023

6 EMOTION DETECTION AND RECOGNITION MARKET, BY TECHNOLOGY

- 6.1 INTRODUCTION

- 6.2 FEATURE EXTRACTION AND 3D MODELING

- 6.2.1 FEATURE EXTRACTION AND 3D MODELING: EMOTION DETECTION AND RECOGNITION MARKET DRIVERS

- 6.3 BIOSENSORS TECHNOLOGY

- 6.3.1 BIOSENSORS TECHNOLOGY: EMOTION DETECTION AND RECOGNITION MARKET DRIVERS

- 6.4 NATURAL LANGUAGE PROCESSING

- 6.4.1 NATURAL LANGUAGE PROCESSING: EMOTION DETECTION AND RECOGNITION MARKET DRIVERS

- 6.5 MACHINE LEARNING

- 6.5.1 MACHINE LEARNING: EMOTION DETECTION AND RECOGNITION MARKET DRIVERS

- 6.6 OTHER TECHNOLOGIES

7 EMOTION DETECTION AND RECOGNITION MARKET, BY HARDWARE

- 7.1 INTRODUCTION

- 7.2 SENSORS

- 7.2.1 SENSORS: EMOTION DETECTION AND RECOGNITION MARKET DRIVERS

- 7.3 CAMERAS

- 7.3.1 CAMERAS: EMOTION DETECTION AND RECOGNITION MARKET DRIVERS

- 7.4 STORAGE DEVICES AND PROCESSORS

- 7.4.1 STORAGE DEVICES AND PROCESSORS: EMOTION DETECTION AND RECOGNITION MARKET DRIVERS

- 7.5 OTHER HARDWARE DEVICES

8 EMOTION DETECTION AND RECOGNITION MARKET, BY COMPONENT

- 8.1 INTRODUCTION

- FIGURE 23 SERVICES SEGMENT TO WITNESS HIGHER CAGR DURING FORECAST PERIOD

- TABLE 13 EMOTION DETECTION AND RECOGNITION MARKET, BY COMPONENT, 2016-2021 (USD MILLION)

- TABLE 14 EMOTION DETECTION AND RECOGNITION MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- 8.2 SOFTWARE

- 8.2.1 ADVANCED EMOTION MEASUREMENT SOFTWARE TOOLS TO BOOST MARKET

- 8.2.2 SOFTWARE: EMOTION RECOGNITION AND RECOGNITION MARKET DRIVERS

- TABLE 15 SOFTWARE: EMOTION DETECTION AND RECOGNITION MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 16 SOFTWARE: EMOTION DETECTION AND RECOGNITION MARKET, BY REGION, 2022-2027 (USD MILLION)

- 8.3 SERVICES

- 8.3.1 SIGNIFICANT GROWTH IN FACIAL RECOGNITION MONITORING TO GENERATE DEMAND FOR SECURITY SERVICES

- 8.3.2 SERVICES: EMOTION DETECTION AND RECOGNITION MARKET DRIVERS

- TABLE 17 SERVICES: EMOTION DETECTION AND RECOGNITION MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 18 SERVICES: EMOTION DETECTION AND RECOGNITION MARKET, BY REGION, 2022-2027 (USD MILLION)

- 8.3.3 PROFESSIONAL SERVICES

- 8.3.4 MANAGED SERVICES

9 EMOTION DETECTION AND RECOGNITION MARKET, BY SOFTWARE

- 9.1 INTRODUCTION

- FIGURE 24 FACIAL EXPRESSION RECOGNITION SEGMENT TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 19 EMOTION DETECTION AND RECOGNITION MARKET, BY SOFTWARE, 2016-2021 (USD MILLION)

- TABLE 20 EMOTION DETECTION AND RECOGNITION MARKET, BY SOFTWARE, 2022-2027 (USD MILLION)

- 9.2 FACIAL EXPRESSION RECOGNITION

- 9.2.1 RISING CONCERNS ABOUT ETHICAL PRIVACY REGARDING FACIAL RECOGNITION SOFTWARE TO BOOST MARKET

- 9.2.2 FACIAL EXPRESSION RECOGNITION: EMOTION DETECTION AND RECOGNITION MARKET DRIVERS

- TABLE 21 FACIAL EXPRESSION RECOGNITION: EMOTION DETECTION AND RECOGNITION MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 22 FACIAL EXPRESSION RECOGNITION: EMOTION DETECTION AND RECOGNITION MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.3 BIOSENSING SOLUTIONS AND APPS

- 9.3.1 RISING ACCURACY ACROSS BIOMEDICINE AND LIFE SCIENCES SECTOR TO BOOST SALES

- 9.3.2 BIOSENSING SOLUTIONS AND APPS: EMOTION DETECTION AND RECOGNITION MARKET DRIVERS

- TABLE 23 BIOSENSING SOLUTIONS AND APPS: EMOTION DETECTION AND RECOGNITION MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 24 BIOSENSING SOLUTIONS AND APPS: EMOTION DETECTION AND RECOGNITION MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.4 SPEECH AND VOICE RECOGNITION

- 9.4.1 INTEGRATION OF ADVANCED TECHNOLOGIES TO PROPEL GROWTH OF SPEECH AND VOICE RECOGNITION TECHNOLOGIES

- 9.4.2 SPEECH AND VOICE RECOGNITION: EMOTION DETECTION AND RECOGNITION MARKET DRIVERS

- TABLE 25 SPEECH AND VOICE RECOGNITION: EMOTION DETECTION AND RECOGNITION MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 26 SPEECH AND VOICE RECOGNITION: EMOTION DETECTION AND RECOGNITION MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.5 GESTURE AND POSTURE RECOGNITION

- 9.5.1 EFFECTIVE USAGE ACROSS AUTOMOTIVE SECTOR TO FUEL DEMAND

- 9.5.2 GESTURE AND POSTURE RECOGNITION: EMOTION DETECTION AND RECOGNITION MARKET DRIVERS

- TABLE 27 GESTURE AND POSTURE RECOGNITION: EMOTION DETECTION AND RECOGNITION MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 28 GESTURE AND POSTURE RECOGNITION: EMOTION DETECTION AND RECOGNITION MARKET, BY REGION, 2022-2027 (USD MILLION)

10 EMOTION DETECTION AND RECOGNITION MARKET, BY APPLICATION AREA

- 10.1 INTRODUCTION

- FIGURE 25 MEDICAL EMERGENCY SEGMENT TO RECORD HIGHEST GROWTH RATE DURING FORECAST PERIOD

- TABLE 29 EMOTION DETECTION AND RECOGNITION MARKET, BY APPLICATION AREA, 2016-2021 (USD MILLION)

- TABLE 30 EMOTION DETECTION AND RECOGNITION MARKET, BY APPLICATION AREA, 2022-2027 (USD MILLION)

- 10.2 MEDICAL EMERGENCY

- 10.2.1 NEED TO SECURE CRITICAL PATIENT DATA TO BOOST SEGMENT GROWTH

- 10.2.2 MEDICAL EMERGENCY: EMOTION DETECTION AND RECOGNITION MARKET DRIVERS

- TABLE 31 MEDICAL EMERGENCY: EMOTION DETECTION AND RECOGNITION MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 32 MEDICAL EMERGENCY: EMOTION DETECTION AND RECOGNITION MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.3 MARKETING AND ADVERTISING

- 10.3.1 DEMAND FOR EMOTION ANALYTICS MEASUREMENT ACROSS TARGET MARKETING AND ADVERTISING TO DRIVE MARKET

- 10.3.2 MARKETING AND ADVERTISING: EMOTION DETECTION AND RECOGNITION MARKET DRIVERS

- TABLE 33 MARKETING AND ADVERTISING: EMOTION DETECTION AND RECOGNITION MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 34 MARKETING AND ADVERTISING: EMOTION DETECTION AND RECOGNITION MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.4 LAW ENFORCEMENT, SURVEILLANCE, AND MONITORING

- 10.4.1 LIVENESS DETECTION AND SUSPECT TRACKING HELPING MASS SURVEILLANCE TO PROPEL MARKET

- 10.4.2 LAW ENFORCEMENT, SURVEILLANCE, AND MONITORING: EMOTION DETECTION AND RECOGNITION MARKET DRIVERS

- TABLE 35 LAW ENFORCEMENT, SURVEILLANCE, AND MONITORING: EMOTION DETECTION AND RECOGNITION MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 36 LAW ENFORCEMENT, SURVEILLANCE, AND MONITORING: EMOTION DETECTION AND RECOGNITION MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.5 ENTERTAINMENT AND CONSUMER ELECTRONICS

- 10.5.1 COGNITIVE SERVICES ACROSS ENTERTAINMENT INDUSTRY TO PROPEL GROWTH

- 10.5.2 ENTERTAINMENT AND CONSUMER ELECTRONICS: EMOTION DETECTION AND RECOGNITION MARKET DRIVERS

- TABLE 37 ENTERTAINMENT AND CONSUMER ELECTRONICS: EMOTION DETECTION AND RECOGNITION MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 38 ENTERTAINMENT AND CONSUMER ELECTRONICS: EMOTION DETECTION AND RECOGNITION MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.6 OTHER APPLICATION AREAS

- TABLE 39 OTHER APPLICATION AREAS: EMOTION DETECTION AND RECOGNITION MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 40 OTHER APPLICATION AREAS: EMOTION DETECTION AND RECOGNITION MARKET, BY REGION, 2022-2027 (USD MILLION)

11 EMOTION DETECTION AND RECOGNITION MARKET, BY END USER

- 11.1 INTRODUCTION

- FIGURE 26 COMMERCIAL SEGMENT TO ACCOUNT FOR HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 41 EMOTION DETECTION AND RECOGNITION MARKET, BY END USER, 2016-2021 (USD MILLION)

- TABLE 42 EMOTION DETECTION AND RECOGNITION MARKET, BY END USER, 2022-2027 (USD MILLION)

- 11.2 ENTERPRISES

- 11.2.1 EFFECTIVE DEMOGRAPHIC ANALYSIS ACROSS ENTERPRISES TO DRIVE MARKET

- 11.2.2 ENTERPRISES: EMOTION DETECTION AND RECOGNITION MARKET DRIVERS

- TABLE 43 ENTERPRISES: EMOTION DETECTION AND RECOGNITION MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 44 ENTERPRISES: EMOTION DETECTION AND RECOGNITION MARKET, BY REGION, 2022-2027 (USD MILLION)

- 11.3 DEFENSE AND SECURITY AGENCIES

- 11.3.1 SENSITIVE INFORMATION AND ACCURATE AUTHENTICATION ACROSS DEFENSE AGENCIES TO PROPEL MARKET

- 11.3.2 DEFENSE AND SECURITY AGENCIES: EMOTION DETECTION AND RECOGNITION MARKET DRIVERS

- TABLE 45 DEFENSE AND SECURITY AGENCIES: EMOTION DETECTION AND RECOGNITION MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 46 DEFENSE AND SECURITY AGENCIES: EMOTION DETECTION AND RECOGNITION MARKET, BY REGION, 2022-2027 (USD MILLION)

- 11.4 COMMERCIAL

- 11.4.1 MOOD DETECTION FOR CONSUMERS ACROSS COMMERCIAL END-USE SECTOR TO DRIVE MARKET

- 11.4.2 COMMERCIAL: EMOTION DETECTION AND RECOGNITION MARKET DRIVERS

- TABLE 47 COMMERCIAL: EMOTION DETECTION AND RECOGNITION MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 48 COMMERCIAL: EMOTION DETECTION AND RECOGNITION MARKET, BY REGION, 2022-2027 (USD MILLION)

- 11.5 INDUSTRIAL

- 11.5.1 ENHANCED QUALITY CONTROL AND PATTERN RECOGNITION ACROSS HEAVY INDUSTRIES TO BOOST MARKET

- 11.5.2 INDUSTRIAL: EMOTION DETECTION AND RECOGNITION MARKET DRIVERS

- TABLE 49 INDUSTRIAL: EMOTION DETECTION AND RECOGNITION MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 50 INDUSTRIAL: EMOTION DETECTION AND RECOGNITION MARKET, BY REGION, 2022-2027 (USD MILLION)

- 11.6 OTHER END USERS

- TABLE 51 OTHER END USERS: EMOTION DETECTION AND RECOGNITION MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 52 OTHER END USERS: EMOTION DETECTION AND RECOGNITION MARKET, BY REGION, 2022-2027 (USD MILLION)

12 EMOTION DETECTION AND RECOGNITION MARKET, BY VERTICAL

- 12.1 INTRODUCTION

- FIGURE 27 MEDIA AND ENTERTAINMENT SEGMENT TO ACCOUNT FOR HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 53 EMOTION DETECTION AND RECOGNITION MARKET, BY VERTICAL, 2016-2021 (USD MILLION)

- TABLE 54 EMOTION DETECTION AND RECOGNITION MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- 12.2 ACADEMIA AND RESEARCH

- 12.2.1 STUDENT MONITORING, ENHANCED RESEARCH TECHNIQUES, AND AGE DETECTION TO DRIVE DEMAND FOR SOLUTIONS

- 12.2.2 ACADEMIA AND RESEARCH: EMOTION DETECTION AND RECOGNITION MARKET DRIVERS

- TABLE 55 ACADEMIA AND RESEARCH: EMOTION DETECTION AND RECOGNITION MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 56 ACADEMIA AND RESEARCH: EMOTION DETECTION AND RECOGNITION MARKET, BY REGION, 2022-2027 (USD MILLION)

- 12.3 MEDIA AND ENTERTAINMENT

- 12.3.1 INTEGRATION ACROSS VIDEO, AUDIO, AND IMAGERY FIELD TO GAIN TRACTION

- 12.3.2 MEDIA AND ENTERTAINMENT: EMOTION DETECTION AND RECOGNITION MARKET DRIVERS

- TABLE 57 MEDIA AND ENTERTAINMENT: EMOTION DETECTION AND RECOGNITION MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 58 MEDIA AND ENTERTAINMENT: EMOTION DETECTION AND RECOGNITION MARKET, BY REGION, 2022-2027 (USD MILLION)

- 12.4 IT AND ITES

- 12.4.1 DIGITAL TRANSFORMATION ACROSS ITES COMPANIES THROUGH DEEP INTEGRATION TO DRIVE MARKET

- 12.4.2 IT AND ITES: EMOTION DETECTION AND RECOGNITION MARKET DRIVERS

- TABLE 59 IT AND ITES: EMOTION DETECTION AND RECOGNITION MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 60 IT AND ITES: EMOTION DETECTION AND RECOGNITION MARKET, BY REGION, 2022-2027 (USD MILLION)

- 12.5 HEALTHCARE AND SOCIAL ASSISTANCE

- 12.5.1 ADVANCED BIOSENSING TOOLS TO REVOLUTIONIZE MEDICAL FIELD

- 12.5.2 HEALTHCARE AND SOCIAL ASSISTANCE: EMOTION DETECTION AND RECOGNITION MARKET DRIVERS

- TABLE 61 HEALTHCARE AND SOCIAL ASSISTANCE: EMOTION DETECTION AND RECOGNITION MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 62 HEALTHCARE AND SOCIAL ASSISTANCE: EMOTION DETECTION AND RECOGNITION MARKET, BY REGION, 2022-2027 (USD MILLION)

- 12.6 TELECOMMUNICATIONS

- 12.6.1 TRACTION ACROSS CUSTOMER CHURN REDUCTION AND DIGITAL ONBOARDING TO DRIVE DEMAND FOR SOLUTIONS

- 12.6.2 TELECOMMUNICATIONS: EMOTION DETECTION AND RECOGNITION MARKET DRIVERS

- TABLE 63 TELECOMMUNICATIONS: EMOTION DETECTION AND RECOGNITION MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 64 TELECOMMUNICATIONS: EMOTION DETECTION AND RECOGNITION MARKET, BY REGION, 2022-2027 (USD MILLION)

- 12.7 RETAIL AND ECOMMERCE

- 12.7.1 USE OF COGNITIVE SCIENCE TO ATTRACT CUSTOMERS TO DRIVE MARKET

- 12.7.2 RETAIL AND ECOMMERCE: EMOTION DETECTION AND RECOGNITION MARKET DRIVERS

- TABLE 65 RETAIL AND ECOMMERCE: EMOTION DETECTION AND RECOGNITION MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 66 RETAIL AND ECOMMERCE: EMOTION DETECTION AND RECOGNITION MARKET, BY REGION, 2022-2027 (USD MILLION)

- 12.8 AUTOMOTIVE

- 12.8.1 SPECIALLY DESIGNED APIS AND SDKS FOR AUTOMOTIVE INDUSTRY TO GAIN TRACTION

- 12.8.2 AUTOMOTIVE: EMOTION DETECTION AND RECOGNITION MARKET DRIVERS

- TABLE 67 AUTOMOTIVE: EMOTION DETECTION AND RECOGNITION MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 68 AUTOMOTIVE: EMOTION DETECTION AND RECOGNITION MARKET, BY REGION, 2022-2027 (USD MILLION)

- 12.9 BANKING, FINANCIAL SERVICES, AND INSURANCE

- 12.9.1 VARIED USE CASES ACROSS BANKING AND FINANCIAL SERVICES TO PROPEL GROWTH FOR EMOTION MEASUREMENT

- 12.9.2 BANKING, FINANCIAL SERVICES, AND INSURANCE: EMOTION DETECTION AND RECOGNITION MARKET DRIVERS

- TABLE 69 BANKING, FINANCIAL SERVICES, AND INSURANCE: EMOTION DETECTION AND RECOGNITION MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 70 BANKING, FINANCIAL SERVICES, AND INSURANCE: EMOTION DETECTION AND RECOGNITION MARKET, BY REGION, 2022-2027 (USD MILLION)

- 12.10 OTHER VERTICALS

- TABLE 71 OTHER VERTICALS: EMOTION DETECTION AND RECOGNITION MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 72 OTHER VERTICALS: EMOTION DETECTION AND RECOGNITION MARKET, BY REGION, 2022-2027 (USD MILLION)

13 EMOTION DETECTION AND RECOGNITION MARKET, BY REGION

- 13.1 INTRODUCTION

- FIGURE 28 ASIA PACIFIC TO GROW AT HIGHEST CAGR BY 2027

- TABLE 73 EMOTION DETECTION AND RECOGNITION MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 74 EMOTION DETECTION AND RECOGNITION MARKET, BY REGION, 2022-2027 (USD MILLION)

- 13.2 NORTH AMERICA

- 13.2.1 NORTH AMERICA: EMOTION DETECTION AND RECOGNITION MARKET DRIVERS

- 13.2.2 NORTH AMERICA: RECESSION IMPACT

- 13.2.3 NORTH AMERICA: REGULATORY LANDSCAPE

- FIGURE 29 NORTH AMERICA: MARKET SNAPSHOT

- TABLE 75 NORTH AMERICA: EMOTION DETECTION AND RECOGNITION MARKET, BY COMPONENT, 2016-2021 (USD MILLION)

- TABLE 76 NORTH AMERICA: EMOTION DETECTION AND RECOGNITION MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 77 NORTH AMERICA: EMOTION DETECTION AND RECOGNITION MARKET, BY SOFTWARE, 2016-2021 (USD MILLION)

- TABLE 78 NORTH AMERICA: EMOTION DETECTION AND RECOGNITION MARKET, BY SOFTWARE, 2022-2027 (USD MILLION)

- TABLE 79 NORTH AMERICA: EMOTION DETECTION AND RECOGNITION MARKET, BY APPLICATION AREA, 2016-2021 (USD MILLION)

- TABLE 80 NORTH AMERICA: EMOTION DETECTION AND RECOGNITION MARKET, BY APPLICATION AREA, 2022-2027 (USD MILLION)

- TABLE 81 NORTH AMERICA: EMOTION DETECTION AND RECOGNITION MARKET, BY END USER, 2016-2021 (USD MILLION)

- TABLE 82 NORTH AMERICA: EMOTION DETECTION AND RECOGNITION MARKET, BY END USER, 2022-2027 (USD MILLION)

- TABLE 83 NORTH AMERICA: EMOTION DETECTION AND RECOGNITION MARKET, BY VERTICAL, 2016-2021 (USD MILLION)

- TABLE 84 NORTH AMERICA: EMOTION DETECTION AND RECOGNITION MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 85 NORTH AMERICA: EMOTION DETECTION AND RECOGNITION MARKET, BY COUNTRY, 2016-2021 (USD MILLION)

- TABLE 86 NORTH AMERICA: EMOTION DETECTION AND RECOGNITION MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 13.2.4 US

- 13.2.4.1 Presence of major solution vendors and heavy usage of EDR solutions in government sectors to drive market

- TABLE 87 US: EMOTION DETECTION AND RECOGNITION MARKET, BY COMPONENT, 2016-2021 (USD MILLION)

- TABLE 88 US: EMOTION DETECTION AND RECOGNITION MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 89 US: EMOTION DETECTION AND RECOGNITION MARKET, BY SOFTWARE, 2016-2021 (USD MILLION)

- TABLE 90 US: EMOTION DETECTION AND RECOGNITION MARKET, BY SOFTWARE, 2022-2027 (USD MILLION)

- TABLE 91 US: EMOTION DETECTION AND RECOGNITION MARKET, BY APPLICATION AREA, 2016-2021 (USD MILLION)

- TABLE 92 US: EMOTION DETECTION AND RECOGNITION MARKET, BY APPLICATION AREA, 2022-2027 (USD MILLION)

- TABLE 93 US: EMOTION DETECTION AND RECOGNITION MARKET, BY END USER, 2016-2021 (USD MILLION)

- TABLE 94 US: EMOTION DETECTION AND RECOGNITION MARKET, BY END USER, 2022-2027 (USD MILLION)

- TABLE 95 US: EMOTION DETECTION AND RECOGNITION MARKET, BY VERTICAL, 2016-2021 (USD MILLION)

- TABLE 96 US: EMOTION DETECTION AND RECOGNITION MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- 13.2.5 CANADA

- 13.2.5.1 Technological advancement and several initiatives to encourage growth of EDR technology

- TABLE 97 CANADA: EMOTION DETECTION AND RECOGNITION MARKET, BY COMPONENT, 2016-2021 (USD MILLION)

- TABLE 98 CANADA: EMOTION DETECTION AND RECOGNITION MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 99 CANADA: EMOTION DETECTION AND RECOGNITION MARKET, BY SOFTWARE, 2016-2021 (USD MILLION)

- TABLE 100 CANADA: EMOTION DETECTION AND RECOGNITION MARKET, BY SOFTWARE, 2022-2027 (USD MILLION)

- TABLE 101 CANADA: EMOTION DETECTION AND RECOGNITION MARKET, BY APPLICATION AREA, 2016-2021 (USD MILLION)

- TABLE 102 CANADA: EMOTION DETECTION AND RECOGNITION MARKET, BY APPLICATION AREA, 2022-2027 (USD MILLION)

- TABLE 103 CANADA: EMOTION DETECTION AND RECOGNITION MARKET, BY END USER, 2016-2021 (USD MILLION)

- TABLE 104 CANADA: EMOTION DETECTION AND RECOGNITION MARKET, BY END USER, 2022-2027 (USD MILLION)

- TABLE 105 CANADA: EMOTION DETECTION AND RECOGNITION MARKET, BY VERTICAL, 2016-2021 (USD MILLION)

- TABLE 106 CANADA: EMOTION DETECTION AND RECOGNITION MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- 13.3 EUROPE

- 13.3.1 EUROPE: EMOTION DETECTION AND RECOGNITION MARKET DRIVERS

- 13.3.2 EUROPE: RECESSION IMPACT

- 13.3.3 EUROPE: REGULATORY LANDSCAPE

- TABLE 107 EUROPE: EMOTION DETECTION AND RECOGNITION MARKET, BY COMPONENT, 2016-2021 (USD MILLION)

- TABLE 108 EUROPE: EMOTION DETECTION AND RECOGNITION MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 109 EUROPE: EMOTION DETECTION AND RECOGNITION MARKET, BY SOFTWARE, 2016-2021 (USD MILLION)

- TABLE 110 EUROPE: EMOTION DETECTION AND RECOGNITION MARKET, BY SOFTWARE, 2022-2027 (USD MILLION)

- TABLE 111 EUROPE: EMOTION DETECTION AND RECOGNITION MARKET, BY APPLICATION AREA, 2016-2021 (USD MILLION)

- TABLE 112 EUROPE: EMOTION DETECTION AND RECOGNITION MARKET, BY APPLICATION AREA, 2022-2027 (USD MILLION)

- TABLE 113 EUROPE: EMOTION DETECTION AND RECOGNITION MARKET, BY END USER, 2016-2021 (USD MILLION)

- TABLE 114 EUROPE: EMOTION DETECTION AND RECOGNITION MARKET, BY END USER, 2022-2027 (USD MILLION)

- TABLE 115 EUROPE: EMOTION DETECTION AND RECOGNITION MARKET, BY VERTICAL, 2016-2021 (USD MILLION)

- TABLE 116 EUROPE: EMOTION DETECTION AND RECOGNITION MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 117 EUROPE: EMOTION DETECTION AND RECOGNITION MARKET, BY COUNTRY, 2016-2021 (USD MILLION)

- TABLE 118 EUROPE: EMOTION DETECTION AND RECOGNITION MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 13.3.4 UK

- 13.3.4.1 Increasing adoption of EDR solutions by various sectors to boost market

- TABLE 119 UK: EMOTION DETECTION AND RECOGNITION MARKET, BY COMPONENT, 2016-2021 (USD MILLION)

- TABLE 120 UK: EMOTION DETECTION AND RECOGNITION MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 121 UK: EMOTION DETECTION AND RECOGNITION MARKET, BY SOFTWARE, 2016-2021 (USD MILLION)

- TABLE 122 UK: EMOTION DETECTION AND RECOGNITION MARKET, BY SOFTWARE, 2022-2027 (USD MILLION)

- TABLE 123 UK: EMOTION DETECTION AND RECOGNITION MARKET, BY APPLICATION AREA, 2016-2021 (USD MILLION)

- TABLE 124 UK: EMOTION DETECTION AND RECOGNITION MARKET, BY APPLICATION AREA, 2022-2027 (USD MILLION)

- TABLE 125 UK: EMOTION DETECTION AND RECOGNITION MARKET, BY END USER, 2016-2021 (USD MILLION)

- TABLE 126 UK: EMOTION DETECTION AND RECOGNITION MARKET, BY END USER, 2022-2027 (USD MILLION)

- TABLE 127 UK: EMOTION DETECTION AND RECOGNITION MARKET, BY VERTICAL, 2016-2021 (USD MILLION)

- TABLE 128 UK: EMOTION DETECTION AND RECOGNITION MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- 13.3.5 GERMANY

- 13.3.5.1 Robust economy and increased demand for EDR solutions to boost market

- TABLE 129 GERMANY: EMOTION DETECTION AND RECOGNITION MARKET, BY COMPONENT, 2016-2021 (USD MILLION)

- TABLE 130 GERMANY: EMOTION DETECTION AND RECOGNITION MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 131 GERMANY: EMOTION DETECTION AND RECOGNITION MARKET, BY SOFTWARE, 2016-2021 (USD MILLION)

- TABLE 132 GERMANY: EMOTION DETECTION AND RECOGNITION MARKET, BY SOFTWARE, 2022-2027 (USD MILLION)

- TABLE 133 GERMANY: EMOTION DETECTION AND RECOGNITION MARKET, BY APPLICATION AREA, 2016-2021 (USD MILLION)

- TABLE 134 GERMANY: EMOTION DETECTION AND RECOGNITION MARKET, BY APPLICATION AREA, 2022-2027 (USD MILLION)

- TABLE 135 GERMANY: EMOTION DETECTION AND RECOGNITION MARKET, BY END USER, 2016-2021 (USD MILLION)

- TABLE 136 GERMANY: EMOTION DETECTION AND RECOGNITION MARKET, BY END USER, 2022-2027 (USD MILLION)

- TABLE 137 GERMANY: EMOTION DETECTION AND RECOGNITION MARKET, BY VERTICAL, 2016-2021 (USD MILLION)

- TABLE 138 GERMANY: EMOTION DETECTION AND RECOGNITION MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- 13.3.6 NETHERLANDS

- 13.3.6.1 High demand for EDR solutions by security authorities to propel market growth

- TABLE 139 NETHERLANDS: EMOTION DETECTION AND RECOGNITION MARKET, BY COMPONENT, 2016-2021 (USD MILLION)

- TABLE 140 NETHERLANDS: EMOTION DETECTION AND RECOGNITION MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 141 NETHERLANDS: EMOTION DETECTION AND RECOGNITION MARKET, BY SOFTWARE, 2016-2021 (USD MILLION)

- TABLE 142 NETHERLANDS: EMOTION DETECTION AND RECOGNITION MARKET, BY SOFTWARE, 2022-2027 (USD MILLION)

- TABLE 143 NETHERLANDS: EMOTION DETECTION AND RECOGNITION MARKET, BY APPLICATION AREA, 2016-2021 (USD MILLION)

- TABLE 144 NETHERLANDS: EMOTION DETECTION AND RECOGNITION MARKET, BY APPLICATION AREA, 2022-2027 (USD MILLION)

- TABLE 145 NETHERLANDS: EMOTION DETECTION AND RECOGNITION MARKET, BY END USER, 2016-2021 (USD MILLION)

- TABLE 146 NETHERLANDS: EMOTION DETECTION AND RECOGNITION MARKET, BY END USER, 2022-2027 (USD MILLION)

- TABLE 147 NETHERLANDS: EMOTION DETECTION AND RECOGNITION MARKET, BY VERTICAL, 2016-2021 (USD MILLION)

- TABLE 148 NETHERLANDS: EMOTION DETECTION AND RECOGNITION MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- 13.3.7 REST OF EUROPE

- TABLE 149 REST OF EUROPE: EMOTION DETECTION AND RECOGNITION MARKET, BY COMPONENT, 2016-2021 (USD MILLION)

- TABLE 150 REST OF EUROPE: EMOTION DETECTION AND RECOGNITION MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 151 REST OF EUROPE: EMOTION DETECTION AND RECOGNITION MARKET, BY SOFTWARE, 2016-2021 (USD MILLION)

- TABLE 152 REST OF EUROPE: EMOTION DETECTION AND RECOGNITION MARKET, BY SOFTWARE, 2022-2027 (USD MILLION)

- TABLE 153 REST OF EUROPE: EMOTION DETECTION AND RECOGNITION MARKET, BY APPLICATION AREA, 2016-2021 (USD MILLION)

- TABLE 154 REST OF EUROPE: EMOTION DETECTION AND RECOGNITION MARKET, BY APPLICATION AREA, 2022-2027 (USD MILLION)

- TABLE 155 REST OF EUROPE: EMOTION DETECTION AND RECOGNITION MARKET, BY END USER, 2016-2021 (USD MILLION)

- TABLE 156 REST OF EUROPE: EMOTION DETECTION AND RECOGNITION MARKET, BY END USER, 2022-2027 (USD MILLION)

- TABLE 157 REST OF EUROPE: EMOTION DETECTION AND RECOGNITION MARKET, BY VERTICAL, 2016-2021 (USD MILLION)

- TABLE 158 REST OF EUROPE: EMOTION DETECTION AND RECOGNITION MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- 13.4 ASIA PACIFIC

- 13.4.1 ASIA PACIFIC: EMOTION DETECTION AND RECOGNITION MARKET DRIVERS

- 13.4.2 ASIA PACIFIC: RECESSION IMPACT

- 13.4.3 ASIA PACIFIC: REGULATORY LANDSCAPE

- FIGURE 30 ASIA PACIFIC: MARKET SNAPSHOT

- TABLE 159 ASIA PACIFIC: EMOTION DETECTION AND RECOGNITION MARKET, BY COMPONENT, 2016-2021 (USD MILLION)

- TABLE 160 ASIA PACIFIC: EMOTION DETECTION AND RECOGNITION MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 161 ASIA PACIFIC: EMOTION DETECTION AND RECOGNITION MARKET, BY SOFTWARE, 2016-2021 (USD MILLION)

- TABLE 162 ASIA PACIFIC: EMOTION DETECTION AND RECOGNITION MARKET, BY SOFTWARE, 2022-2027 (USD MILLION)

- TABLE 163 ASIA PACIFIC: EMOTION DETECTION AND RECOGNITION MARKET, BY APPLICATION AREA, 2016-2021 (USD MILLION)

- TABLE 164 ASIA PACIFIC: EMOTION DETECTION AND RECOGNITION MARKET, BY APPLICATION AREA, 2022-2027 (USD MILLION)

- TABLE 165 ASIA PACIFIC: EMOTION DETECTION AND RECOGNITION MARKET, BY END USER, 2016-2021 (USD MILLION)

- TABLE 166 ASIA PACIFIC: EMOTION DETECTION AND RECOGNITION MARKET, BY END USER, 2022-2027 (USD MILLION)

- TABLE 167 ASIA PACIFIC: EMOTION DETECTION AND RECOGNITION MARKET, BY VERTICAL, 2016-2021 (USD MILLION)

- TABLE 168 ASIA PACIFIC: EMOTION DETECTION AND RECOGNITION MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 169 ASIA PACIFIC: EMOTION DETECTION AND RECOGNITION MARKET, BY COUNTRY, 2016-2021 (USD MILLION)

- TABLE 170 ASIA PACIFIC: EMOTION DETECTION AND RECOGNITION MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 13.4.4 CHINA

- 13.4.4.1 Being early technology adopter and offering innovative EDR solutions to drive market

- TABLE 171 CHINA: EMOTION DETECTION AND RECOGNITION MARKET, BY COMPONENT, 2016-2021 (USD MILLION)

- TABLE 172 CHINA: EMOTION DETECTION AND RECOGNITION MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 173 CHINA: EMOTION DETECTION AND RECOGNITION MARKET, BY SOFTWARE, 2016-2021 (USD MILLION)

- TABLE 174 CHINA: EMOTION DETECTION AND RECOGNITION MARKET, BY SOFTWARE, 2022-2027 (USD MILLION)

- TABLE 175 CHINA: EMOTION DETECTION AND RECOGNITION MARKET, BY APPLICATION AREA, 2016-2021 (USD MILLION)

- TABLE 176 CHINA: EMOTION DETECTION AND RECOGNITION MARKET, BY APPLICATION AREA, 2022-2027 (USD MILLION)

- TABLE 177 CHINA: EMOTION DETECTION AND RECOGNITION MARKET, BY END USER, 2016-2021 (USD MILLION)

- TABLE 178 CHINA: EMOTION DETECTION AND RECOGNITION MARKET, BY END USER, 2022-2027 (USD MILLION)

- TABLE 179 CHINA: EMOTION DETECTION AND RECOGNITION MARKET, BY VERTICAL, 2016-2021 (USD MILLION)

- TABLE 180 CHINA: EMOTION DETECTION AND RECOGNITION MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- 13.4.5 JAPAN

- 13.4.5.1 Advanced economy with increased investments in deployment and development of EDR solutions to boost market

- TABLE 181 JAPAN: EMOTION DETECTION AND RECOGNITION MARKET, BY COMPONENT, 2016-2021 (USD MILLION)

- TABLE 182 JAPAN: EMOTION DETECTION AND RECOGNITION MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 183 JAPAN: EMOTION DETECTION AND RECOGNITION MARKET, BY SOFTWARE, 2016-2021 (USD MILLION)

- TABLE 184 JAPAN: EMOTION DETECTION AND RECOGNITION MARKET, BY SOFTWARE, 2022-2027 (USD MILLION)

- TABLE 185 JAPAN: EMOTION DETECTION AND RECOGNITION MARKET, BY APPLICATION AREA, 2016-2021 (USD MILLION)

- TABLE 186 JAPAN: EMOTION DETECTION AND RECOGNITION MARKET, BY APPLICATION AREA, 2022-2027 (USD MILLION)

- TABLE 187 JAPAN: EMOTION DETECTION AND RECOGNITION MARKET, BY END USER, 2016-2021 (USD MILLION)

- TABLE 188 JAPAN: EMOTION DETECTION AND RECOGNITION MARKET, BY END USER, 2022-2027 (USD MILLION)

- TABLE 189 JAPAN: EMOTION DETECTION AND RECOGNITION MARKET, BY VERTICAL, 2016-2021 (USD MILLION)

- TABLE 190 JAPAN: EMOTION DETECTION AND RECOGNITION MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- 13.4.6 AUSTRALIA

- 13.4.6.1 Being fastest developing country and early adopter of advanced technologies to drive market

- TABLE 191 AUSTRALIA: EMOTION DETECTION AND RECOGNITION MARKET, BY COMPONENT, 2016-2021 (USD MILLION)

- TABLE 192 AUSTRALIA: EMOTION DETECTION AND RECOGNITION MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 193 AUSTRALIA: EMOTION DETECTION AND RECOGNITION MARKET, BY SOFTWARE, 2016-2021 (USD MILLION)

- TABLE 194 AUSTRALIA: EMOTION DETECTION AND RECOGNITION MARKET, BY SOFTWARE, 2022-2027 (USD MILLION)

- TABLE 195 AUSTRALIA: EMOTION DETECTION AND RECOGNITION MARKET, BY APPLICATION AREA, 2016-2021 (USD MILLION)

- TABLE 196 AUSTRALIA: EMOTION DETECTION AND RECOGNITION MARKET, BY APPLICATION AREA, 2022-2027 (USD MILLION)

- TABLE 197 AUSTRALIA: EMOTION DETECTION AND RECOGNITION MARKET, BY END USER, 2016-2021 (USD MILLION)

- TABLE 198 AUSTRALIA: EMOTION DETECTION AND RECOGNITION MARKET, BY END USER, 2022-2027 (USD MILLION)

- TABLE 199 AUSTRALIA: EMOTION DETECTION AND RECOGNITION MARKET, BY VERTICAL, 2016-2021 (USD MILLION)

- TABLE 200 AUSTRALIA: EMOTION DETECTION AND RECOGNITION MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- 13.4.7 REST OF ASIA PACIFIC

- TABLE 201 REST OF ASIA PACIFIC: EMOTION DETECTION AND RECOGNITION MARKET, BY COMPONENT, 2016-2021 (USD MILLION)

- TABLE 202 REST OF ASIA PACIFIC: EMOTION DETECTION AND RECOGNITION MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 203 REST OF ASIA PACIFIC: EMOTION DETECTION AND RECOGNITION MARKET, BY SOFTWARE, 2016-2021 (USD MILLION)

- TABLE 204 REST OF ASIA PACIFIC: EMOTION DETECTION AND RECOGNITION MARKET, BY SOFTWARE, 2022-2027 (USD MILLION)

- TABLE 205 REST OF ASIA PACIFIC: EMOTION DETECTION AND RECOGNITION MARKET, BY APPLICATION AREA, 2016-2021 (USD MILLION)

- TABLE 206 REST OF ASIA PACIFIC: EMOTION DETECTION AND RECOGNITION MARKET, BY APPLICATION AREA, 2022-2027 (USD MILLION)

- TABLE 207 REST OF ASIA PACIFIC: EMOTION DETECTION AND RECOGNITION MARKET, BY END USER, 2016-2021 (USD MILLION)

- TABLE 208 REST OF ASIA PACIFIC: EMOTION DETECTION AND RECOGNITION MARKET, BY END USER, 2022-2027 (USD MILLION)

- TABLE 209 REST OF ASIA PACIFIC: EMOTION DETECTION AND RECOGNITION MARKET, BY VERTICAL, 2016-2021 (USD MILLION)

- TABLE 210 REST OF ASIA PACIFIC: EMOTION DETECTION AND RECOGNITION MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- 13.5 MIDDLE EAST & AFRICA

- 13.5.1 MIDDLE EAST & AFRICA: EMOTION DETECTION AND RECOGNITION MARKET DRIVERS

- 13.5.2 MIDDLE EAST & AFRICA: RECESSION IMPACT

- 13.5.3 MIDDLE EAST & AFRICA: REGULATORY LANDSCAPE

- TABLE 211 MIDDLE EAST & AFRICA: EMOTION DETECTION AND RECOGNITION MARKET, BY COMPONENT, 2016-2021 (USD MILLION)

- TABLE 212 MIDDLE EAST & AFRICA: EMOTION DETECTION AND RECOGNITION MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 213 MIDDLE EAST & AFRICA: EMOTION DETECTION AND RECOGNITION MARKET, BY SOFTWARE, 2016-2021 (USD MILLION)

- TABLE 214 MIDDLE EAST & AFRICA: EMOTION DETECTION AND RECOGNITION MARKET, BY SOFTWARE, 2022-2027 (USD MILLION)

- TABLE 215 MIDDLE EAST & AFRICA: EMOTION DETECTION AND RECOGNITION MARKET, BY APPLICATION AREA, 2016-2021 (USD MILLION)

- TABLE 216 MIDDLE EAST & AFRICA: EMOTION DETECTION AND RECOGNITION MARKET, BY APPLICATION AREA, 2022-2027 (USD MILLION)

- TABLE 217 MIDDLE EAST & AFRICA: EMOTION DETECTION AND RECOGNITION MARKET, BY END USER, 2016-2021 (USD MILLION)

- TABLE 218 MIDDLE EAST & AFRICA: EMOTION DETECTION AND RECOGNITION MARKET, BY END USER, 2022-2027 (USD MILLION)

- TABLE 219 MIDDLE EAST & AFRICA: EMOTION DETECTION AND RECOGNITION MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 220 MIDDLE EAST & AFRICA: EMOTION DETECTION AND RECOGNITION MARKET, BY COUNTRY, 2016-2021 (USD MILLION)

- TABLE 221 MIDDLE EAST & AFRICA: EMOTION DETECTION AND RECOGNITION MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 13.5.4 MIDDLE EAST

- 13.5.4.1 Growing adoption of EDR solutions by public and private organizations to drive market

- TABLE 222 MIDDLE EAST: EMOTION DETECTION AND RECOGNITION MARKET, BY COMPONENT, 2016-2021 (USD MILLION)

- TABLE 223 MIDDLE EAST: EMOTION DETECTION AND RECOGNITION MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 224 MIDDLE EAST: EMOTION DETECTION AND RECOGNITION MARKET, BY SOFTWARE, 2016-2021 (USD MILLION)

- TABLE 225 MIDDLE EAST: EMOTION DETECTION AND RECOGNITION MARKET, BY SOFTWARE, 2022-2027 (USD MILLION)

- TABLE 226 MIDDLE EAST: EMOTION DETECTION AND RECOGNITION MARKET, BY APPLICATION AREA, 2016-2021 (USD MILLION)

- TABLE 227 MIDDLE EAST: EMOTION DETECTION AND RECOGNITION MARKET, BY APPLICATION AREA, 2022-2027 (USD MILLION)

- TABLE 228 MIDDLE EAST: EMOTION DETECTION AND RECOGNITION MARKET, BY END USER, 2016-2021 (USD MILLION)

- TABLE 229 MIDDLE EAST: EMOTION DETECTION AND RECOGNITION MARKET, BY END USER, 2022-2027 (USD MILLION)

- TABLE 230 MIDDLE EAST: EMOTION DETECTION AND RECOGNITION MARKET, BY VERTICAL, 2016-2021 (USD MILLION)

- TABLE 231 MIDDLE EAST: EMOTION DETECTION AND RECOGNITION MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- 13.5.5 AFRICA

- 13.5.5.1 Adoption of EDR technology to tackle rising cases of cybercrimes to propel market growth

- TABLE 232 AFRICA: EMOTION DETECTION AND RECOGNITION MARKET, BY COMPONENT, 2016-2021 (USD MILLION)

- TABLE 233 AFRICA: EMOTION DETECTION AND RECOGNITION MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 234 AFRICA: EMOTION DETECTION AND RECOGNITION MARKET, BY SOFTWARE, 2016-2021 (USD MILLION)

- TABLE 235 AFRICA: EMOTION DETECTION AND RECOGNITION MARKET, BY SOFTWARE, 2022-2027 (USD MILLION)

- TABLE 236 AFRICA: EMOTION DETECTION AND RECOGNITION MARKET, BY APPLICATION AREA, 2016-2021 (USD MILLION)

- TABLE 237 AFRICA: EMOTION DETECTION AND RECOGNITION MARKET, BY APPLICATION AREA, 2022-2027 (USD MILLION)

- TABLE 238 AFRICA: EMOTION DETECTION AND RECOGNITION MARKET, BY END USER, 2016-2021 (USD MILLION)

- TABLE 239 AFRICA: EMOTION DETECTION AND RECOGNITION MARKET, BY END USER, 2022-2027 (USD MILLION)

- TABLE 240 AFRICA: EMOTION DETECTION AND RECOGNITION MARKET, BY VERTICAL, 2016-2021 (USD MILLION)

- TABLE 241 AFRICA: EMOTION DETECTION AND RECOGNITION MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- 13.6 LATIN AMERICA

- 13.6.1 LATIN AMERICA: EMOTION DETECTION AND RECOGNITION MARKET DRIVERS

- 13.6.2 LATIN AMERICA: RECESSION IMPACT

- 13.6.3 LATIN AMERICA: REGULATORY LANDSCAPE

- TABLE 242 LATIN AMERICA: EMOTION DETECTION AND RECOGNITION MARKET, BY COMPONENT, 2016-2021 (USD MILLION)

- TABLE 243 LATIN AMERICA: EMOTION DETECTION AND RECOGNITION MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 244 LATIN AMERICA: EMOTION DETECTION AND RECOGNITION MARKET, BY SOFTWARE, 2016-2021 (USD MILLION)

- TABLE 245 LATIN AMERICA: EMOTION DETECTION AND RECOGNITION MARKET, BY SOFTWARE, 2022-2027 (USD MILLION)

- TABLE 246 LATIN AMERICA: EMOTION DETECTION AND RECOGNITION MARKET, BY APPLICATION AREA, 2016-2021 (USD MILLION)

- TABLE 247 LATIN AMERICA: EMOTION DETECTION AND RECOGNITION MARKET, BY APPLICATION AREA, 2022-2027 (USD MILLION)

- TABLE 248 LATIN AMERICA: EMOTION DETECTION AND RECOGNITION MARKET, BY END USER, 2016-2021 (USD MILLION)

- TABLE 249 LATIN AMERICA: EMOTION DETECTION AND RECOGNITION MARKET, BY END USER, 2022-2027 (USD MILLION)

- TABLE 250 LATIN AMERICA: EMOTION DETECTION AND RECOGNITION MARKET, BY VERTICAL, 2016-2021 (USD MILLION)

- TABLE 251 LATIN AMERICA: EMOTION DETECTION AND RECOGNITION MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- TABLE 252 LATIN AMERICA: EMOTION DETECTION AND RECOGNITION MARKET, BY COUNTRY, 2016-2021 (USD MILLION)

- TABLE 253 LATIN AMERICA: EMOTION DETECTION AND RECOGNITION MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- 13.6.4 BRAZIL

- 13.6.4.1 Rising popularity and awareness for EDR solutions to drive market

- TABLE 254 BRAZIL: EMOTION DETECTION AND RECOGNITION MARKET, BY COMPONENT, 2016-2021 (USD MILLION)

- TABLE 255 BRAZIL: EMOTION DETECTION AND RECOGNITION MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 256 BRAZIL: EMOTION DETECTION AND RECOGNITION MARKET, BY SOFTWARE, 2016-2021 (USD MILLION)

- TABLE 257 BRAZIL: EMOTION DETECTION AND RECOGNITION MARKET, BY SOFTWARE, 2022-2027 (USD MILLION)

- TABLE 258 BRAZIL: EMOTION DETECTION AND RECOGNITION MARKET, BY APPLICATION AREA, 2016-2021 (USD MILLION)

- TABLE 259 BRAZIL: EMOTION DETECTION AND RECOGNITION MARKET, BY APPLICATION AREA, 2022-2027 (USD MILLION)

- TABLE 260 BRAZIL: EMOTION DETECTION AND RECOGNITION MARKET, BY END USER, 2016-2021 (USD MILLION)

- TABLE 261 BRAZIL: EMOTION DETECTION AND RECOGNITION MARKET, BY END USER, 2022-2027 (USD MILLION)

- TABLE 262 BRAZIL: EMOTION DETECTION AND RECOGNITION MARKET, BY VERTICAL, 2016-2021 (USD MILLION)

- TABLE 263 BRAZIL: EMOTION DETECTION AND RECOGNITION MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- 13.6.5 MEXICO

- 13.6.5.1 Rise in digitization and increased internet penetration to boost market

- TABLE 264 MEXICO: EMOTION DETECTION AND RECOGNITION MARKET, BY COMPONENT, 2016-2021 (USD MILLION)

- TABLE 265 MEXICO: EMOTION DETECTION AND RECOGNITION MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 266 MEXICO: EMOTION DETECTION AND RECOGNITION MARKET, BY SOFTWARE, 2016-2021 (USD MILLION)

- TABLE 267 MEXICO: EMOTION DETECTION AND RECOGNITION MARKET, BY SOFTWARE, 2022-2027 (USD MILLION)

- TABLE 268 MEXICO: EMOTION DETECTION AND RECOGNITION MARKET, BY APPLICATION AREA, 2016-2021 (USD MILLION)

- TABLE 269 MEXICO: EMOTION DETECTION AND RECOGNITION MARKET, BY APPLICATION AREA, 2022-2027 (USD MILLION)

- TABLE 270 MEXICO: EMOTION DETECTION AND RECOGNITION MARKET, BY END USER, 2016-2021 (USD MILLION)

- TABLE 271 MEXICO: EMOTION DETECTION AND RECOGNITION MARKET, BY END USER, 2022-2027 (USD MILLION)

- TABLE 272 MEXICO: EMOTION DETECTION AND RECOGNITION MARKET, BY VERTICAL, 2016-2021 (USD MILLION)

- TABLE 273 MEXICO: EMOTION DETECTION AND RECOGNITION MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

- 13.6.6 REST OF LATIN AMERICA

- TABLE 274 REST OF LATIN AMERICA: EMOTION DETECTION AND RECOGNITION MARKET, BY COMPONENT, 2016-2021 (USD MILLION)

- TABLE 275 REST OF LATIN AMERICA: EMOTION DETECTION AND RECOGNITION MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 276 REST OF LATIN AMERICA: EMOTION DETECTION AND RECOGNITION MARKET, BY SOFTWARE, 2016-2021 (USD MILLION)

- TABLE 277 REST OF LATIN AMERICA: EMOTION DETECTION AND RECOGNITION MARKET, BY SOFTWARE, 2022-2027 (USD MILLION)

- TABLE 278 REST OF LATIN AMERICA: EDR MARKET, BY APPLICATION AREA, 2016-2021 (USD MILLION)

- TABLE 279 REST OF LATIN AMERICA: EMOTION DETECTION AND RECOGNITION MARKET, BY APPLICATION AREA, 2022-2027 (USD MILLION)

- TABLE 280 REST OF LATIN AMERICA: EMOTION DETECTION AND RECOGNITION MARKET, BY END USER, 2016-2021 (USD MILLION)

- TABLE 281 REST OF LATIN AMERICA: EMOTION DETECTION AND RECOGNITION MARKET, BY END USER, 2022-2027 (USD MILLION)

- TABLE 282 REST OF LATIN AMERICA: EMOTION DETECTION AND RECOGNITION MARKET, BY VERTICAL, 2016-2021 (USD MILLION)

- TABLE 283 REST OF LATIN AMERICA: EMOTION DETECTION AND RECOGNITION MARKET, BY VERTICAL, 2022-2027 (USD MILLION)

14 COMPETITIVE LANDSCAPE

- 14.1 OVERVIEW

- 14.2 REVENUE SHARE ANALYSIS OF LEADING PLAYERS

- FIGURE 31 REVENUE SHARE ANALYSIS OF EMOTION DETECTION AND RECOGNITION MARKET, 2022

- 14.3 MARKET SHARE ANALYSIS OF TOP MARKET PLAYERS

- TABLE 284 EMOTION DETECTION AND RECOGNITION MARKET: DEGREE OF COMPETITION

- 14.4 HISTORICAL REVENUE ANALYSIS

- FIGURE 32 SEGMENTAL REVENUE ANALYSIS OF TOP FIVE MARKET PLAYERS

- 14.5 RANKING OF KEY PLAYERS

- FIGURE 33 RANKING OF TOP FIVE EMOTION DETECTION AND RECOGNITION PLAYERS

- 14.6 EVALUATION MATRIX FOR KEY PLAYERS

- 14.6.1 DEFINITIONS AND METHODOLOGY

- FIGURE 34 EVALUATION QUADRANT FOR KEY PLAYERS: CRITERIA WEIGHTAGE

- FIGURE 35 EVALUATION MATRIX FOR KEY PLAYERS, 2022

- 14.6.2 STARS

- 14.6.3 EMERGING LEADERS

- 14.6.4 PERVASIVE PLAYERS

- 14.6.5 PARTICIPANTS

- 14.7 COMPETITIVE BENCHMARKING

- 14.7.1 EVALUATION CRITERIA FOR KEY COMPANIES

- TABLE 285 KEY COMPANY SOFTWARE FOOTPRINT

- TABLE 286 KEY COMPANY VERTICAL FOOTPRINT

- TABLE 287 KEY COMPANY REGION FOOTPRINT

- TABLE 288 KEY COMPANY OVERALL FOOTPRINT

- 14.7.2 EVALUATION CRITERIA FOR STARTUPS/SMES

- TABLE 289 DETAILED LIST OF STARTUPS/SMES

- 14.8 EVALUATION MATRIX FOR STARTUPS/SMES

- 14.8.1 DEFINITIONS AND METHODOLOGY

- FIGURE 36 EVALUATION QUADRANT FOR STARTUPS/SMES: CRITERIA WEIGHTAGE

- FIGURE 37 EVALUATION MATRIX FOR STARTUPS/SMES, 2022

- 14.8.2 PROGRESSIVE COMPANIES

- 14.8.3 RESPONSIVE COMPANIES

- 14.8.4 DYNAMIC COMPANIES

- 14.8.5 STARTING BLOCKS

- 14.9 COMPETITIVE SCENARIO AND TRENDS

- 14.9.1 PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 290 EMOTION DETECTION AND RECOGNITION MARKET: PRODUCT LAUNCHES AND ENHANCEMENTS, 2020-2023

- 14.9.2 DEALS

- TABLE 291 EMOTION DETECTION AND RECOGNITION MARKET: DEALS, 2020-2023

15 COMPANY PROFILES

- 15.1 KEY PLAYERS

(Business overview, Products/Solutions/Services offered, Recent developments, MnM view, Right to win, Strategic choices, and Weaknesses and competitive threats)*

- 15.1.1 NEC

- TABLE 292 NEC: BUSINESS OVERVIEW

- FIGURE 38 NEC: COMPANY SNAPSHOT

- TABLE 293 NEC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 294 NEC: PRODUCT LAUNCHES

- TABLE 295 NEC: DEALS

- 15.1.2 IBM

- TABLE 296 IBM: BUSINESS OVERVIEW

- FIGURE 39 IBM: COMPANY SNAPSHOT

- TABLE 297 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 298 IBM: PRODUCT LAUNCHES

- TABLE 299 IBM: DEALS

- 15.1.3 MICROSOFT

- TABLE 300 MICROSOFT: BUSINESS OVERVIEW

- FIGURE 40 MICROSOFT: COMPANY SNAPSHOT

- TABLE 301 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 302 MICROSOFT: PRODUCT LAUNCHES

- TABLE 303 MICROSOFT: DEALS

- 15.1.4 APPLE

- TABLE 304 APPLE: BUSINESS OVERVIEW

- FIGURE 41 APPLE: COMPANY SNAPSHOT

- TABLE 305 APPLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 306 APPLE: PRODUCT LAUNCHES

- TABLE 307 APPLE: DEALS

- 15.1.5 GOOGLE

- TABLE 308 GOOGLE: BUSINESS OVERVIEW

- FIGURE 42 GOOGLE: COMPANY SNAPSHOT

- TABLE 309 GOOGLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 310 GOOGLE: DEALS

- 15.1.6 TOBII

- TABLE 311 TOBII: BUSINESS OVERVIEW

- FIGURE 43 TOBII: COMPANY SNAPSHOT

- TABLE 312 TOBII: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 313 TOBII: PRODUCT LAUNCHES

- TABLE 314 TOBII: DEALS

- 15.1.7 AFFECTIVA

- TABLE 315 AFFECTIVA: BUSINESS OVERVIEW

- TABLE 316 AFFECTIVA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 317 AFFECTIVA: PRODUCT LAUNCHES

- TABLE 318 AFFECTIVA: DEALS

- 15.1.8 ELLIPTIC LABS

- TABLE 319 ELLIPTIC LABS: BUSINESS OVERVIEW

- FIGURE 44 ELLIPTIC LABS: COMPANY SNAPSHOT

- TABLE 320 ELLIPTIC LABS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 321 ELLIPTIC LABS: PRODUCT LAUNCHES

- TABLE 322 ELLIPTIC LABS: DEALS

- 15.1.9 INTEL

- TABLE 323 INTEL: BUSINESS OVERVIEW

- FIGURE 45 INTEL: COMPANY SNAPSHOT

- TABLE 324 INTEL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 325 INTEL: PRODUCT LAUNCHES

- TABLE 326 INTEL: DEALS

- 15.1.10 COGNITEC

- TABLE 327 COGNITEC: BUSINESS OVERVIEW

- TABLE 328 COGNITEC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 329 COGNITEC: PRODUCT LAUNCHES

- TABLE 330 COGNITEC: DEALS

- 15.1.11 NVISO

- TABLE 331 NVISO: BUSINESS OVERVIEW

- TABLE 332 NVISO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 333 NVISO: PRODUCT LAUNCHES

- TABLE 334 NVISO: DEALS

- 15.1.12 NOLDUS

- TABLE 335 NOLDUS: BUSINESS OVERVIEW

- TABLE 336 NOLDUS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 337 NOLDUS: PRODUCT LAUNCHES

- TABLE 338 NOLDUS: DEALS

- 15.2 OTHER PLAYERS

- 15.2.1 GESTURETEK

- 15.2.2 IMOTIONS

- 15.2.3 NUMENTA

- 15.2.4 POINTGRAB

- 15.2.5 AYONIX

- 15.2.6 PYREOS

- 15.2.7 EYERIS

- 15.2.8 BEYOND VERBAL

- 15.2.9 KAIROS

- 15.2.10 SENTIANCE

- 15.2.11 RAYDIANT

- 15.2.12 SONY DEPTHSENSING SOLUTIONS

Details on Business overview, Products/Solutions/Services offered, Recent developments, MnM view, Right to win, Strategic choices, and Weaknesses and competitive threats might not be captured in case of unlisted companies.

16 ADJACENT MARKETS

- 16.1 INTRODUCTION TO ADJACENT MARKETS

- TABLE 339 ADJACENT MARKETS AND FORECASTS

- 16.2 LIMITATIONS

- 16.3 EMOTION DETECTION AND RECOGNITION ECOSYSTEM AND ADJACENT MARKETS

- 16.3.1 EDGE AI SOFTWARE MARKET

- TABLE 340 EDGE AI SOFTWARE MARKET, BY ORGANIZATION SIZE, 2018-2021 (USD MILLION)

- TABLE 341 EDGE AI SOFTWARE MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 342 LARGE ENTERPRISES: EDGE AI SOFTWARE MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 343 LARGE ENTERPRISES: EDGE AI SOFTWARE MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 344 SMES: EDGE AI SOFTWARE MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 345 SMES: EDGE AI SOFTWARE MARKET, BY REGION, 2022-2027 (USD MILLION)

- 16.3.2 SPEECH AND VOICE RECOGNITION MARKET

- TABLE 346 SPEECH AND VOICE RECOGNITION MARKET, BY DEPLOYMENT MODE, 2018-2021 (USD MILLION)

- TABLE 347 SPEECH AND VOICE RECOGNITION MARKET, BY DEPLOYMENT MODE, 2022-2027 (USD MILLION)

- TABLE 348 ON-PREMISES/EMBEDDED: SPEECH AND VOICE RECOGNITION MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 349 ON-PREMISES/EMBEDDED: SPEECH AND VOICE RECOGNITION MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 350 ON-CLOUD: SPEECH AND VOICE RECOGNITION MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 351 ON-CLOUD: SPEECH AND VOICE RECOGNITION MARKET, BY REGION, 2022-2027 (USD MILLION)

17 APPENDIX

- 17.1 DISCUSSION GUIDE

- 17.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 17.3 CUSTOMIZATION OPTIONS

- 17.4 RELATED REPORTS

- 17.5 AUTHOR DETAILS