|

|

市場調査レポート

商品コード

1303611

リン酸鉄リチウムイオン電池の世界市場:産業別 (自動車、電力、工業、家電、航空宇宙、船舶)・用途別 (携帯型、据置型)・電圧別 (低電圧、中電圧、高電圧)・容量別・設計別・地域別の将来予測 (2028年まで)Lithium Iron Phosphate Batteries Market by Industry (Automotive, Power, Industrial, Consumer Electronics, Aerospace, Marine), Application (Portable, Stationary), Voltage (Low, Medium, High), Capacity, Design & Region - Global forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| リン酸鉄リチウムイオン電池の世界市場:産業別 (自動車、電力、工業、家電、航空宇宙、船舶)・用途別 (携帯型、据置型)・電圧別 (低電圧、中電圧、高電圧)・容量別・設計別・地域別の将来予測 (2028年まで) |

|

出版日: 2023年07月03日

発行: MarketsandMarkets

ページ情報: 英文 278 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のリン酸鉄リチウム電池の市場規模は、2023年の177億米ドルから2028年には355億米ドルに成長すると予測されており、予測期間中のCAGRは14.9%を記録すると予測されています。

電気自動車メーカーによるLFP電池の採用増加、様々な産業における電池駆動マテリアルハンドリング機器の需要増加が、予測期間におけるリン酸鉄リチウム電池市場を牽引します。

"自動車:産業別で最大のセグメント"

リン酸鉄リチウムイオン電池市場を産業別に見ると、自動車が最大の市場シェアを占めています。このセグメントには、リン酸鉄リチウム電池の主要消費者である電気自動車 (EV:HEV、プラグインEV、電動バイクを含むEVなど) が含まれます。EVに搭載される電池は、優れた運用性が求められるため、モデル間の競合が激化しています。EVの普及と認知度の向上がリン酸鉄リチウム電池市場の成長を支えています。

"用途別では携帯型のセグメントが最大となる"

携帯型のリン酸鉄リチウム電池の市場は、自動車・建設・鉱業などの産業をカバーしています。BEVは、内燃機関を使用する代わりに、充電式電池と電気モーターのエネルギーを使って機能します。電池のエネルギーがなくなると、送電網やその他の専用充電装置からの電力を使って再充電します。BEVはディーゼルやガスで走行しないため、汚染物質を排出しません。これらの電池は、高い熱安定性、高いエネルギー、出力密度を提供し、EVに使用しても安全です。

"容量別では、100,001~540,000mAhのセグメントが予測期間中に最大の市場となる"

リン酸鉄リチウムイオン電池市場を容量別に見ると、100,001~540,000mAhのセグメントが予測期間中に最大のセグメントになると予想されます。これらの高容量電池は、大型電気自動車、産業用途、電力バックアップ、HEV、エネルギー貯蔵システム、非常用電力システム、マイクログリッド、ヨット、軍事、海洋アプリケーションの電源として使用されます。電池は単一セルでは作れないため、モジュールや、時にはモジュールのアレイ、パワーラック、パワーコンテナなどが必要になります。これらのシステムは、酸化マンガンリチウム、リン酸鉄リチウム、ニッケルマンガンコバルト、酸化チタンリチウムを使用して製造します。持続可能性への関心の高まりと、それに伴うEV採用への移行は、これらの電池の採用に影響を与え、結果として需要を増加させると予想されます。

"欧州はリン酸鉄リチウム電池市場で2番目に大きな地域になる"

予測期間中、欧州 (英国、ドイツ、オランダ、ノルウェー、その他 (スイス、スペイン、スウェーデン、ポルトガル、フランス、イタリア、ベルギー)) はリン酸鉄リチウム電池市場で2番目に大きな市場になると予想されます。欧州には、Saft (フランス) やFIAMM (イタリア) といった大手電池メーカーがあります。リン酸鉄リチウム電池は、クリーンで持続可能なコンパクト電源として、自動車や家電製品に主要な用途があります。欧州の自動車産業は、水とエネルギーの使用が最適化された、最も無駄のない生産工程を持つ先進産業です。さらに、欧州ではウェアラブルデバイスの家電市場が成長曲線を描いています。この地域の経済を牽引している主な要因としては、企業投資、輸出、有利な金融政策などが挙げられます。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 顧客のビジネスに影響を与える動向/混乱

- サプライチェーン分析

- エコシステム分析

- マーケットマップ

- 技術分析

- 価格分析

- 特許分析

- 基準と規制の分析

- 主要な会議とイベント (2023年~2024年)

- 貿易分析

- ケーススタディ分析

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

第6章 リン酸鉄リチウムイオン電池市場:設計別

- イントロダクション

- セル

- 電池パック

第7章 リン酸鉄リチウムイオン電池市場:電圧別

- イントロダクション

- 低電圧 (12V未満)

- 中電圧 (12~36V)

- 高電圧 (36V超)

第8章 リン酸鉄リチウムイオン電池市場:容量別

- イントロダクション

- 0~16,250MAH

- 16,251~50,000MAH

- 50,001~100,000MAH

- 100,001~540,000MAH

第9章 リン酸鉄リチウムイオン電池市場:用途別

- イントロダクション

- 携帯型

- 据置型

第10章 リン酸鉄リチウムイオン電池市場:産業別

- イントロダクション

- 自動車

- 電池電気自動車 (BEV)

- ハイブリッド車 (HEV)

- プラグインハイブリッド車 (PHEV)

- 2輪車・3輪車

- バス・トラック

- 電力

- 据置型

- 住宅用

- 産業用

- フォークリフト

- 鉱山機械

- 建設機械

- 家電

- UPS (無停電電源装置)

- キャンプ装備

- その他

- 航空宇宙

- 船舶

- 商船

- 遊覧船

- 軍艦

- その他

- 電気通信

- 医学

第11章 リン酸鉄リチウムイオン電池市場:地域別

- イントロダクション

- アジア太平洋

- 欧州

- 北米

- 中東・アフリカ

- 南米

第12章 競合情勢

- 概要

- 市場シェア分析 (2022年)

- 市場評価フレームワーク (2019~2023年)

- 部門別の収益分析 (2017~2022年)

- 競争シナリオと動向

- 企業評価マトリックス (2022年)

- 企業のフットプリント

- スタートアップ/中小企業 (SME) の評価マトリックス (2022年)

- 競合ベンチマーキング

第13章 企業プロファイル

- 主要企業

- BYD COMPANY LTD.

- CONTEMPORARY AMPEREX TECHNOLOGY CO., LIMITED.

- GOTION, INC.

- CHINA AVIATION LITHIUM BATTERY CO., LTD. (CALB)

- A123 SYSTEMS LLC

- ULTRALIFE CORPORATION

- K2 ENERGY

- LITHIUMWERKS

- TAICOPOWER

- BSL NEW ENERGY TECHNOLOGY CO., LTD

- ELECTRIC VEHICLE POWER SYSTEM TECHNOLOGY CO., LTD

- BENERGY TECH CO. LTD.

- RELION BATTERIES

- BHARAT POWER SOLUTIONS

- VICTRON ENERGY

- KAYO BATTERY (SHENZHEN) COMPANY LIMITED

- KARACUS ENERGY PVT. LTD.

- EVEREXCEED INDUSTRIAL CO., LTD.

- その他の企業

- OPTIMUMNANO ENERGY CO., LTD.

- EPEC, LLC.

- SHENZHEN EASTAR BATTERY CO., LTD

- SHENZHEN CYCLEN TECHNOLOGY CO., LTD.

第14章 付録

The global lithium iron phosphate batteries market is estimated to grow from USD 17.7 Billion in 2023 to USD 35.5 Billion by 2028; it is expected to record a CAGR of 14.9% during the forecast period. The rising adoption of LFP batteries by electric vehicle manufacturers and the increasing demand for battery-operated material-handling equipment across various industries will drives the lithium iron phosphate batteries market in the forecasted period.

"Automation: The largest segment of the lithium iron phosphate batteries market, by industry "

Based on industry, the lithium iron phosphate batteries market has been split into seven types: automotive, power, industrial, consumer electronics, aerospace, marine and Others. Automotive holds the largest share of the lithium iron phosphate market. This segment includes battery-driven vehicles such as EVs, which further include HEVs, plug-in EVs, and e-bikes, which are major consumers of lithium iron phosphate batteries. EVs are classified into various types, depending on their source of power and application. The main types are battery electric vehicles (BEVs), HEVs, and PHEVs. There is increasing competition between battery models installed in EVs owing to the need for operational excellence. Increasing adoption and awareness of EVs support the growth of the lithium iron phosphate batteries market..

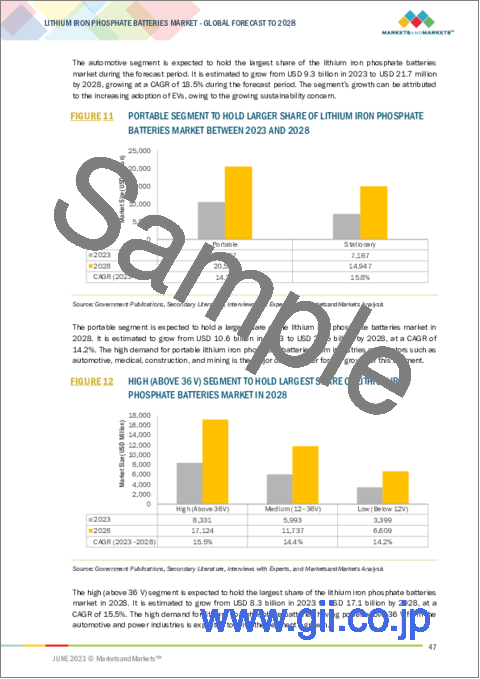

"Portable segment is expected to emerge as the largest segment based on application"

By application, the lithium iron phosphate batteries market has been segmented into portable and stationary. This portable segment covers industries such as automotive, construction, and mining. BEVs use energy from rechargeable batteries and electric motors for functioning instead of using internal combustion engines. Once the battery energy is exhausted, it is recharged using electricity from the grid or any other dedicated charging unit. BEVs do not emit pollutants as they do not run on diesel or gases. These batteries provide high thermal stability, high energy, and power density and are safe to be used in EVs..

"By capacity, the 100,001-540,000 mAh segment is expected to be the largest market during the forecast period."

Based on capacity, the lithium iron phosphate batteries market is segmented into 0-16,250 mAh; 16,251-50,000 mAh; 50,001-100,000 mAh; and 100,001-540,000 mAh. The 100,001-540,000 mAh is expected to be the largest segment during the forecast period. These high-capacity batteries are used for powering heavy electric vehicles, industrial applications, power backup, HEVs, energy storage systems, emergency power systems, micro-grids, yachts, military, and marine applications. The batteries cannot be made of a single cell and hence require a module and sometimes an array of modules, power racks, power containers, and others. These systems can be made using lithium manganese oxide, lithium iron phosphate, nickel manganese cobalt, and lithium titanium oxide. The rising sustainability concerns and the consequent transition toward the adoption of EVs are expected to influence the adoption of these batteries, consequently increasing their demand.

Europe is expected to be the second largest region in the lithium iron phosphate batteries market

Europe is expected to be the second largest lithium iron phosphate batteries market during the forecast period. The region has been segmented, by country, into the UK, Germany, the Netherlands, Norway, and the Rest of Europe. The Rest of Europe includes Switzerland, Spain, Sweden, Portugal, France, Italy, and Belgium. Europe is the home to some of the largest battery manufacturers, such as Saft (France) and FIAMM (Italy). Lithium iron phosphate batteries have major applications in automotive and consumer electronics as a clean, sustainable, and compact source of power. The automobile sector of Europe is an advanced industry with the leanest production processes where the use of water and energy is optimized. Moreover, the consumer electronics market for wearable devices is witnessing a positive growth curve in Europe. Some of the key factors driving the economy of the region are corporate investments, exports, and favorable monetary policies.

Breakdown of Primaries:

In-depth interviews have been conducted with various key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information, as well as to assess future market prospects. The distribution of primary interviews is as follows:

By Company Type: Tier 1- 65%, Tier 2- 24%, and Tier 3- 11%

By Designation: C-Level- 30%, Director Levels- 25%, and Others- 45%

By Region: North America- 15%, Asia Pacific- 35%, Europe- 25%, Middle East & Africa- 10%, and South America- 15%

Note: Others include product engineers, product specialists, and engineering leads.

Note: The tiers of the companies are defined on the basis of their total revenues as of 2021. Tier 1: > USD 1 billion, Tier 2: From USD 500 million to USD 1 billion, and Tier 3: < USD 500 million

The lithium iron phosphate batteries market is dominated by a few major players that have a wide regional presence. The leading players in the lithium iron phosphate batteries market are BYD Company Ltd. (China), Contemporary Amperex Technology Co., Limited. (China), Gotion, Inc. (US), CALB (China), and A123 Systems LLC (US).

Research Coverage:

The report defines, describes, and forecasts the global lithium iron phosphate batteries market, by type, end-user industry, application, and region. It also offers a detailed qualitative and quantitative analysis of the market. The report provides a comprehensive review of the major market drivers, restraints, opportunities, and challenges. It also covers various important aspects of the market. These include an analysis of the competitive landscape, market dynamics, market estimates, in terms of value, and future trends in the lithium iron phosphate batteries market.

Key Benefits of Buying the Report

- Growing demand for battery-operated material-handling equipment in various industries and growing rising industrial automation is the main factors driving the lithium iron phosphate batteries market. Factors such as risk related to the proper disposal of used lithium-based batteries still restrain the market. Transition from conventional power generation to renewable generation and growing investments in LFP batteries by key global players provide opportunities for the lithium iron phosphate batteries market to grow. Even though technological drawbacks of LFP batteries is the major challenge faced by countries under LFP development.

- Product Development/ Innovation: The lithium iron phosphate batteries market is witnessing significant product development and innovation, driven by the growing demand for EVs. Companies are investing in the development of advanced lithium iron phosphate batteries that are specifically designed for the unique requirements of industry.

- Market Development: As offshore renewable energy becomes more prominent in the power generation landscape, there is a growing need for specialized vessels to support the development, installation, and maintenance of offshore renewable energy projects. This presents a significant market opportunity for lithium iron phosphate batteries providers to cater to the increasing demand for services in the expanding renewable energy sector.

- Market Diversification: Contemporary Amperex Technology Co., Ltd. (CATL) and the Agricultural Bank of China (ABC) signed a agreement in Beijing, China. This deal is expected to allow CATL and ABC to enhance their strategic cooperation in a variety of areas, including battery swapping and renewable energy storage both at their facilities and overseas.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like include BYD Company Ltd. (China), Contemporary Amperex Technology Co., Limited. (China), Gotion, Inc. (US), CALB (China), and A123 Systems LLC (US) among others in the lithium iron phosphate batteries market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 INCLUSIONS AND EXCLUSIONS

- 1.4 STUDY SCOPE

- 1.4.1 MARKETS COVERED

- 1.4.2 REGIONAL SCOPE

- 1.4.3 YEARS CONSIDERED

- 1.4.4 CURRENCY CONSIDERED

- 1.5 LIMITATIONS

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

- 1.8 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 RESEARCH DESIGN

- 2.2 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 2 DATA TRIANGULATION

- 2.2.1 SECONDARY DATA

- 2.2.1.1 Key data from secondary sources

- 2.2.2 PRIMARY DATA

- 2.2.2.1 Key data from primary sources

- 2.2.2.2 Breakdown of primaries

- FIGURE 3 BREAKDOWN OF PRIMARIES: BY COMPANY, DESIGNATION, AND REGION

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- FIGURE 4 BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- FIGURE 5 TOP-DOWN APPROACH

- 2.3.3 DEMAND-SIDE ANALYSIS

- FIGURE 6 METRICS CONSIDERED TO ANALYZE AND ASSESS DEMAND FOR LITHIUM IRON PHOSPHATE BATTERIES

- 2.3.3.1 Assumptions for demand-side analysis

- 2.3.4 SUPPLY-SIDE ANALYSIS

- FIGURE 7 KEY METRICS CONSIDERED TO ASSESS SUPPLY OF LITHIUM IRON PHOSPHATE BATTERIES

- FIGURE 8 SUPPLY-SIDE ANALYSIS

- 2.3.4.1 Calculations for supply-side analysis

- 2.3.4.2 Assumptions for supply-side analysis

- 2.4 FORECAST

- 2.5 IMPACT OF RECESSION

3 EXECUTIVE SUMMARY

- TABLE 1 LITHIUM IRON PHOSPHATE BATTERIES MARKET: SNAPSHOT

- FIGURE 9 100,001-540,000 MAH TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- FIGURE 10 AUTOMOTIVE SEGMENT TO DOMINATE LITHIUM IRON PHOSPHATE BATTERIES MARKET DURING FORECAST PERIOD

- FIGURE 11 PORTABLE SEGMENT TO HOLD LARGER SHARE OF LITHIUM IRON PHOSPHATE BATTERIES MARKET BETWEEN 2023 AND 2028

- FIGURE 12 HIGH (ABOVE 36 V) SEGMENT TO HOLD LARGEST SHARE OF LITHIUM IRON PHOSPHATE BATTERIES MARKET IN 2028

- FIGURE 13 ASIA PACIFIC DOMINATED LITHIUM IRON PHOSPHATE BATTERIES MARKET IN 2022

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN LITHIUM IRON PHOSPHATE BATTERIES MARKET

- FIGURE 14 GROWING ADOPTION OF ELECTRIC VEHICLES TO DRIVE MARKET

- 4.2 LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY REGION

- FIGURE 15 ASIA PACIFIC TO WITNESS HIGHEST GROWTH IN LITHIUM IRON PHOSPHATE BATTERIES MARKET DURING FORECAST PERIOD

- 4.3 LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY CAPACITY, 2022

- FIGURE 16 100,001-540,000 MAH SEGMENT DOMINATED LITHIUM IRON PHOSPHATE BATTERIES MARKET IN 2022

- 4.4 LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY INDUSTRY, 2022

- FIGURE 17 AUTOMOTIVE SEGMENT DOMINATED LITHIUM IRON PHOSPHATE BATTERIES MARKET IN 2022

- 4.5 LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY APPLICATION, 2022

- FIGURE 18 PORTABLE SEGMENT HELD LARGER MARKET SHARE IN 2022

- 4.6 LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY VOLTAGE, 2022

- FIGURE 19 HIGH (ABOVE 36 V) SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

- 4.7 ASIA PACIFIC LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY INDUSTRY AND COUNTRY, 2022

- FIGURE 20 AUTOMOTIVE SEGMENT AND CHINA HELD LARGEST SHARES OF ASIA PACIFIC LITHIUM IRON PHOSPHATE BATTERIES MARKET IN 2022

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 21 LITHIUM IRON PHOSPHATE BATTERIES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing adoption of lithium iron phosphate batteries by EV manufacturers

- FIGURE 22 GLOBAL EV SALES, 2020-2030 (IN TERMS OF VOLUME)

- TABLE 2 GLOBAL EV SALES, BEV VS. PHEV (THOUSAND UNITS), 2017-2021

- 5.2.1.2 Growing demand for battery-operated material-handling equipment in various industries and rising industrial automation

- 5.2.2 RESTRAINTS

- 5.2.2.1 Risks associated with disposal of spent lithium-based batteries

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Transition from conventional to renewable power generation

- FIGURE 23 GLOBAL ENERGY STORAGE CAPACITY ADDITION (GWH), 2016-2020

- 5.2.3.2 Growing investments in lithium iron phosphate batteries by key companies

- 5.2.4 CHALLENGES

- 5.2.4.1 Technical drawbacks related to lithium iron phosphate batteries

- TABLE 3 LITHIUM-ION BATTERY SPECIFICATIONS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.3.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR PLAYERS IN LITHIUM IRON PHOSPHATE BATTERIES MARKET

- FIGURE 24 REVENUE SHIFT AND NEW REVENUE POCKETS FOR LITHIUM IRON PHOSPHATE BATTERY PROVIDERS

- 5.4 SUPPLY CHAIN ANALYSIS

- FIGURE 25 LITHIUM IRON PHOSPHATE BATTERIES MARKET: SUPPLY CHAIN ANALYSIS

- 5.4.1 RAW MATERIAL/COMPONENT PROVIDERS

- 5.4.2 LITHIUM IRON PHOSPHATE BATTERY MANUFACTURERS

- 5.4.3 END USERS

- 5.5 ECOSYSTEM ANALYSIS

- TABLE 4 LIST OF COMPANIES AND THEIR ROLE IN LITHIUM IRON PHOSPHATE BATTERIES ECOSYSTEM

- 5.6 MARKET MAP

- FIGURE 26 LITHIUM IRON PHOSPHATE BATTERIES MARKET MAP

- 5.7 TECHNOLOGY ANALYSIS

- TABLE 5 METHODS OF LITHIUM IRON PHOSPHATE SYNTHESIS

- TABLE 6 MATERIAL COMPOSITION OF LITHIUM IRON PHOSPHATE CATHODE, BY RAW MATERIAL SUPPLIERS

- TABLE 7 SHARE OF VARIOUS COMPONENTS OF LITHIUM IRON PHOSPHATE BATTERIES, BY WEIGHT (%)

- TABLE 8 BREAKDOWN OF RAW MATERIALS FOR LITHIUM IRON PHOSPHATE BATTERIES, BY METHOD

- 5.8 PRICING ANALYSIS

- 5.8.1 AVERAGE SELLING PRICE (ASP) OF LITHIUM IRON PHOSPHATE BATTERIES IN MAJOR REGIONS

- TABLE 9 AVERAGE SELLING PRICE (ASP) OF LITHIUM IRON PHOSPHATE BATTERIES IN MAJOR REGIONS, BY INDUSTRY

- 5.9 PATENT ANALYSIS

- TABLE 10 LITHIUM IRON PHOSPHATE BATTERIES: INNOVATIONS AND PATENT REGISTRATIONS, 2018-2023

- 5.10 STANDARDS AND REGULATORY ANALYSIS

- 5.10.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 SOUTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.10.2 STANDARDS

- TABLE 16 LITHIUM IRON PHOSPHATE BATTERIES MARKET: STANDARDS

- 5.11 KEY CONFERENCES AND EVENTS, 2023-2024

- TABLE 17 LITHIUM IRON PHOSPHATE BATTERIES MARKET: LIST OF CONFERENCES AND EVENTS

- 5.12 TRADE ANALYSIS

- 5.12.1 HS CODE 850680

- 5.12.1.1 Export scenario

- TABLE 18 EXPORT SCENARIO FOR HS CODE 850680, BY COUNTRY, 2020-2022 (USD)

- FIGURE 27 EXPORT DATA FOR HS CODE 850680 OF TOP FIVE COUNTRIES, 2020-2022 (USD)

- 5.12.1.2 Import scenario

- TABLE 19 IMPORT SCENARIO FOR HS CODE 850680, BY COUNTRY, 2020-2022 (USD)

- FIGURE 28 IMPORT DATA FOR HS CODE 850680 OF TOP FIVE COUNTRIES, 2020-2022 (USD)

- 5.12.1 HS CODE 850680

- 5.13 CASE STUDY ANALYSIS

- 5.13.1 ATZ MARINE TECHNOLOGIES RETROFITTED PORT SHAFT OF VROON VESSEL

- 5.13.1.1 Objective

- 5.13.1.2 Solution statement

- 5.13.2 XYZ ELECTRIC VEHICLES ENHANCED EV PERFORMANCE BY INCORPORATING LITHIUM IRON PHOSPHATE BATTERIES

- 5.13.2.1 Objective

- 5.13.2.2 Solution statement

- 5.13.1 ATZ MARINE TECHNOLOGIES RETROFITTED PORT SHAFT OF VROON VESSEL

- 5.14 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 29 LITHIUM IRON PHOSPHATE BATTERIES MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 20 LITHIUM IRON PHOSPHATE BATTERIES MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.14.1 THREAT OF NEW ENTRANTS

- 5.14.2 BARGAINING POWER OF BUYERS

- 5.14.3 BARGAINING POWER OF SUPPLIERS

- 5.14.4 THREAT OF SUBSTITUTES

- 5.14.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 30 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE INDUSTRIES

- TABLE 21 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE INDUSTRIES

- 5.15.2 BUYING CRITERIA

- FIGURE 31 KEY BUYING CRITERIA FOR TOP THREE INDUSTRIES

- TABLE 22 KEY BUYING CRITERIA FOR TOP THREE INDUSTRIES

6 LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY DESIGN

- 6.1 INTRODUCTION

- 6.2 CELL

- TABLE 23 LITHIUM IRON PHOSPHATE BATTERIES MARKET: COMPANY FOOTPRINT, BY DESIGN (CELL)

- 6.3 BATTERY PACK

- TABLE 24 LITHIUM IRON PHOSPHATE BATTERIES MARKET: COMPANY FOOTPRINT, BY DESIGN (BATTERY PACK)

7 LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY VOLTAGE

- 7.1 INTRODUCTION

- FIGURE 32 LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY VOLTAGE, 2022

- TABLE 25 LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY VOLTAGE, 2017-2022 (USD MILLION)

- TABLE 26 LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY VOLTAGE, 2023-2028 (USD MILLION)

- 7.2 LOW (BELOW 12 V)

- 7.2.1 LIGHTWEIGHT AND SMALL SIZE OF LOW VOLTAGE LITHIUM IRON PHOSPHATE BATTERIES TO INCREASE APPLICATION SCOPE

- TABLE 27 LITHIUM IRON PHOSPHATE BATTERIES MARKET: COMPANY FOOTPRINT, BY VOLTAGE (LOW)

- 7.3 MEDIUM (12-36 V)

- 7.3.1 RISING ADOPTION OF ENERGY STORAGE SYSTEMS AND EVS TO CREATE LUCRATIVE GROWTH OPPORTUNITIES

- TABLE 28 LITHIUM IRON PHOSPHATE BATTERIES MARKET: COMPANY FOOTPRINT, BY VOLTAGE (MEDIUM)

- 7.4 HIGH (ABOVE 36 V)

- 7.4.1 GROWING SUSTAINABILITY CONCERNS TO BOOST DEMAND

- TABLE 29 LITHIUM IRON PHOSPHATE BATTERIES MARKET: COMPANY FOOTPRINT, BY VOLTAGE (HIGH)

8 LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY CAPACITY

- 8.1 INTRODUCTION

- FIGURE 33 LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY CAPACITY, 2022

- TABLE 30 LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY CAPACITY, 2017-2022 (USD MILLION)

- TABLE 31 LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY CAPACITY, 2023-2028 (USD MILLION)

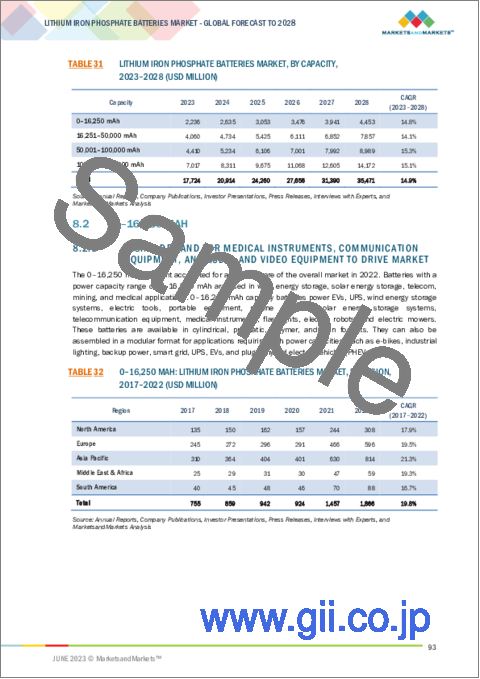

- 8.2 0-16,250 MAH

- 8.2.1 RISING DEMAND FOR MEDICAL INSTRUMENTS, COMMUNICATION EQUIPMENT, AND AUDIO AND VIDEO EQUIPMENT TO DRIVE MARKET

- TABLE 32 0-16,250 MAH: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 33 0-16,250 MAH: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.3 16,251-50,000 MAH

- 8.3.1 GROWING ADOPTION OF ENERGY STORAGE SYSTEMS TO CREATE DEMAND

- TABLE 34 16,251-50,000 MAH: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 35 16,251-50,000 MAH: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.4 50,001-100,000 MAH

- 8.4.1 STRINGENT REGULATIONS ABOUT RECYCLING OF SOLID WASTE GENERATED BY USED LEAD-ACID BATTERIES TO BOOST MARKET GROWTH

- TABLE 36 50,001-100,000 MAH: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 37 50,001-100,000 MAH: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.5 100,001-540,000 MAH

- 8.5.1 RISING SUSTAINABILITY CONCERNS AND TRANSITION TOWARD EVS TO PROPEL MARKET

- TABLE 38 100,001-540,000 MAH: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 39 100,001-540,000 MAH: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY REGION, 2023-2028 (USD MILLION)

9 LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- FIGURE 34 LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY APPLICATION, 2022

- TABLE 40 LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 41 LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 9.2 PORTABLE 113 9.2.1 RISING DEMAND FOR EVS, HEVS, AND PHEVS TO DRIVE MARKET

- TABLE 42 PORTABLE: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 43 PORTABLE: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.3 STATIONARY

- 9.3.1 RISING DEMAND FOR LITHIUM IRON PHOSPHATE BATTERIES FROM ENERGY STORAGE SYSTEM MANUFACTURERS TO BOOST MARKET

- TABLE 44 STATIONARY: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 45 STATIONARY: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY REGION, 2023-2028 (USD MILLION)

10 LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY INDUSTRY

- 10.1 INTRODUCTION

- FIGURE 35 LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY INDUSTRY, 2022

- TABLE 46 LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY INDUSTRY, 2017-2022 (USD MILLION)

- TABLE 47 LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- 10.2 AUTOMOTIVE

- 10.2.1 INCREASING ADOPTION OF EVS AND PRESENCE OF FAVORABLE GOVERNMENT POLICIES TO DRIVE MARKET

- TABLE 48 AUTOMOTIVE: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 49 AUTOMOTIVE: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 50 AUTOMOTIVE: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY TYPE, 2022-2028 (USD MILLION)

- 10.2.2 BATTERY ELECTRIC VEHICLE (BEV)

- 10.2.3 HYBRID ELECTRIC VEHICLE (HEV)

- 10.2.4 PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV)

- 10.2.5 2- & 3-WHEELERS

- 10.2.6 BUS & TRUCK

- 10.3 POWER

- 10.3.1 RISING ADOPTION OF ENERGY STORAGE SYSTEMS TO PROVIDE LUCRATIVE GROWTH OPPORTUNITIES

- TABLE 51 POWER: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 52 POWER: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 53 POWER: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY TYPE, 2022-2028 (USD MILLION)

- 10.3.2 STATIONARY

- 10.3.3 RESIDENTIAL

- 10.4 INDUSTRIAL

- 10.4.1 GROWING INFRASTRUCTURE DEVELOPMENT AND NEED FOR HIGH ENERGY DENSITY BATTERIES TO BOOST DEMAND

- FIGURE 36 CONSTRUCTION EQUIPMENT SUB-SEGMENT HELD LARGEST SHARE OF LITHIUM IRON PHOSPHATE BATTERIES MARKET FOR INDUSTRIAL SEGMENT IN 2022

- TABLE 54 INDUSTRIAL: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 55 INDUSTRIAL: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.4.2 FORKLIFTS

- 10.4.3 MINING EQUIPMENT

- 10.4.4 CONSTRUCTION EQUIPMENT

- 10.5 CONSUMER ELECTRONICS

- 10.5.1 LONG RUNTIME, FAST RECHARGE TIME, AND LIGHTWEIGHT TO FUEL DEMAND

- FIGURE 37 UPS SUB-SEGMENT HELD LARGEST SHARE OF LITHIUM IRON PHOSPHATE BATTERIES MARKET FOR CONSUMER ELECTRONICS SEGMENT IN 2022

- TABLE 56 CONSUMER ELECTRONICS: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 57 CONSUMER ELECTRONICS: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.5.2 UPS

- 10.5.3 CAMPING EQUIPMENT

- 10.5.4 OTHERS

- 10.6 AEROSPACE

- 10.6.1 GROWING DEMAND FOR LOW-COST, HIGH-POWER, AND SAFE SOLUTIONS TO DRIVE MARKET

- TABLE 58 AEROSPACE: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 59 AEROSPACE: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.7 MARINE

- 10.7.1 TECHNICAL CAPABILITIES OF LITHIUM IRON PHOSPHATE BATTERIES TO BOOST ADOPTION

- TABLE 60 MARINE: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 61 MARINE: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.7.2 COMMERCIAL

- 10.7.3 TOURISM

- 10.7.4 NAVY

- 10.8 OTHERS

- TABLE 62 OTHERS: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 63 OTHERS: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 64 OTHERS: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY TYPE, 2022-2028 (USD MILLION)

- 10.8.1 TELECOMMUNICATIONS

- 10.8.2 MEDICAL

11 LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY REGION

- 11.1 INTRODUCTION

- FIGURE 38 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 39 LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY REGION, 2022

- TABLE 65 LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 66 LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 67 LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY REGION, 2017-2022 (THOUSAND UNITS)

- TABLE 68 LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY REGION, 2023-2028 (THOUSAND UNITS)

- 11.2 ASIA PACIFIC

- 11.2.1 ASIA PACIFIC: RECESSION IMPACT

- FIGURE 40 ASIA PACIFIC: SNAPSHOT OF LITHIUM IRON PHOSPHATE BATTERIES MARKET

- 11.2.2 BY CAPACITY

- TABLE 69 ASIA PACIFIC: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY CAPACITY, 2017-2022 (USD MILLION)

- TABLE 70 ASIA PACIFIC: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY CAPACITY, 2023-2028 (USD MILLION)

- 11.2.3 BY INDUSTRY

- TABLE 71 ASIA PACIFIC: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY INDUSTRY, 2017-2022 (USD MILLION)

- TABLE 72 ASIA PACIFIC: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- 11.2.4 BY APPLICATION

- TABLE 73 ASIA PACIFIC: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 74 ASIA PACIFIC: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.2.5 BY COUNTRY

- TABLE 75 ASIA PACIFIC: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 76 ASIA PACIFIC: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 11.2.5.1 China

- 11.2.5.1.1 Increasing EV production

- 11.2.5.1 China

- TABLE 77 CHINA: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY CAPACITY, 2017-2022 (USD MILLION)

- TABLE 78 CHINA: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY CAPACITY, 2023-2028 (USD MILLION)

- TABLE 79 CHINA: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY INDUSTRY, 2017-2022 (USD MILLION)

- TABLE 80 CHINA: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 81 CHINA: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 82 CHINA: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.2.5.2 India

- 11.2.5.2.1 Rising adoption of electricity-based transportation solutions

- 11.2.5.2 India

- TABLE 83 INDIA: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY CAPACITY, 2017-2022 (USD MILLION)

- TABLE 84 INDIA: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY CAPACITY, 2023-2028 (USD MILLION)

- TABLE 85 INDIA: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY INDUSTRY, 2017-2022 (USD MILLION)

- TABLE 86 INDIA: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 87 INDIA: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 88 INDIA: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.2.5.3 Japan

- 11.2.5.3.1 Increasing developments in EVs and associated charging infrastructure

- 11.2.5.3 Japan

- TABLE 89 JAPAN: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY CAPACITY, 2017-2022 (USD MILLION)

- TABLE 90 JAPAN: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY CAPACITY, 2023-2028 (USD MILLION)

- TABLE 91 JAPAN: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY INDUSTRY, 2017-2022 (USD MILLION)

- TABLE 92 JAPAN: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 93 JAPAN: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 94 JAPAN: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.2.5.4 South Korea

- 11.2.5.4.1 Growing government-led initiatives for boosting adoption of EVs

- 11.2.5.4 South Korea

- TABLE 95 SOUTH KOREA: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY CAPACITY, 2017-2022 (USD MILLION)

- TABLE 96 SOUTH KOREA: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY CAPACITY, 2023-2028 (USD MILLION)

- TABLE 97 SOUTH KOREA: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY INDUSTRY, 2017-2022 (USD MILLION)

- TABLE 98 SOUTH KOREA: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 99 SOUTH KOREA: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 100 SOUTH KOREA: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.2.5.5 Rest of Asia Pacific

- TABLE 101 REST OF ASIA PACIFIC: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY CAPACITY, 2017-2022 (USD MILLION)

- TABLE 102 REST OF ASIA PACIFIC: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY CAPACITY, 2023-2028 (USD MILLION)

- TABLE 103 REST OF ASIA PACIFIC: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY INDUSTRY, 2017-2022 (USD MILLION)

- TABLE 104 REST OF ASIA PACIFIC: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 105 REST OF ASIA PACIFIC: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 106 REST OF ASIA PACIFIC: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.3 EUROPE

- 11.3.1 EUROPE: RECESSION IMPACT

- FIGURE 41 EUROPE: SNAPSHOT OF LITHIUM IRON PHOSPHATE BATTERIES MARKET

- 11.3.2 BY CAPACITY

- TABLE 107 EUROPE: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY CAPACITY, 2017-2022 (USD MILLION)

- TABLE 108 EUROPE: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY CAPACITY, 2023-2028 (USD MILLION)

- 11.3.3 BY INDUSTRY

- TABLE 109 EUROPE: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY INDUSTRY, 2017-2022 (USD MILLION)

- TABLE 110 EUROPE: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- 11.3.4 BY APPLICATION

- TABLE 111 EUROPE: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 112 EUROPE: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.3.5 BY COUNTRY

- TABLE 113 EUROPE: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 114 EUROPE: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 11.3.5.1 UK

- 11.3.5.1.1 Expanding EV industry

- 11.3.5.1 UK

- TABLE 115 UK: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY CAPACITY, 2017-2022 (USD MILLION)

- TABLE 116 UK: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY CAPACITY, 2023-2028 (USD MILLION)

- TABLE 117 UK: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY INDUSTRY, 2017-2022 (USD MILLION)

- TABLE 118 UK: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 119 UK: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 120 UK: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.3.5.2 Germany

- 11.3.5.2.1 Rising demand from automobile manufacturers

- 11.3.5.2 Germany

- TABLE 121 GERMANY: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY CAPACITY, 2017-2022 (USD MILLION)

- TABLE 122 GERMANY: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY CAPACITY, 2023-2028 (USD MILLION)

- TABLE 123 GERMANY: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY INDUSTRY, 2017-2022 (USD MILLION)

- TABLE 124 GERMANY: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 125 GERMANY: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 126 GERMANY: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.3.5.3 Netherlands

- 11.3.5.3.1 Growing sustainability concerns and presence of favorable government policies

- 11.3.5.3 Netherlands

- TABLE 127 NETHERLANDS: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY CAPACITY, 2017-2022 (USD MILLION)

- TABLE 128 NETHERLANDS: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY CAPACITY, 2023-2028 (USD MILLION)

- TABLE 129 NETHERLANDS: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY INDUSTRY, 2017-2022 (USD MILLION)

- TABLE 130 NETHERLANDS: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 131 NETHERLANDS: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 132 NETHERLANDS: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.3.5.4 Norway

- 11.3.5.4.1 Increasing adoption of EVs over conventional combustion vehicles

- 11.3.5.4 Norway

- TABLE 133 NORWAY: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY CAPACITY, 2017-2022 (USD MILLION)

- TABLE 134 NORWAY: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY CAPACITY, 2023-2028 (USD MILLION)

- TABLE 135 NORWAY: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY INDUSTRY, 2017-2022 (USD MILLION)

- TABLE 136 NORWAY: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 137 NORWAY: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 138 NORWAY: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.3.5.5 Rest of Europe

- TABLE 139 REST OF EUROPE: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY CAPACITY, 2017-2022 (USD MILLION)

- TABLE 140 REST OF EUROPE: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY CAPACITY, 2023-2028 (USD MILLION)

- TABLE 141 REST OF EUROPE: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY INDUSTRY, 2017-2022 (USD MILLION)

- TABLE 142 REST OF EUROPE: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 143 REST OF EUROPE: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 144 REST OF EUROPE: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.4 NORTH AMERICA

- 11.4.1 NORTH AMERICA: RECESSION IMPACT

- 11.4.2 BY CAPACITY

- TABLE 145 NORTH AMERICA: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY CAPACITY, 2017-2022 (USD MILLION)

- TABLE 146 NORTH AMERICA: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY CAPACITY, 2023-2028 (USD MILLION)

- 11.4.3 BY INDUSTRY

- TABLE 147 NORTH AMERICA: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY INDUSTRY, 2017-2022 (USD MILLION)

- TABLE 148 NORTH AMERICA: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- 11.4.4 BY APPLICATION

- TABLE 149 NORTH AMERICA: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 150 NORTH AMERICA: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.4.5 BY COUNTRY

- TABLE 151 NORTH AMERICA: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 152 NORTH AMERICA: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 11.4.5.1 US

- 11.4.5.1.1 Ongoing large-scale projects

- 11.4.5.1 US

- TABLE 153 US: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY CAPACITY, 2017-2022 (USD MILLION)

- TABLE 154 US: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY CAPACITY, 2023-2028 (USD MILLION)

- TABLE 155 US: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY INDUSTRY, 2017-2022 (USD MILLION)

- TABLE 156 US: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 157 US: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 158 US: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.4.5.2 Canada

- 11.4.5.2.1 Stringent emission regulations and sustainability concerns

- 11.4.5.2 Canada

- TABLE 159 CANADA: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY CAPACITY, 2017-2022 (USD MILLION)

- TABLE 160 CANADA: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY CAPACITY, 2023-2028 (USD MILLION)

- TABLE 161 CANADA: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY INDUSTRY, 2017-2022 (USD MILLION)

- TABLE 162 CANADA: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 163 CANADA: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 164 CANADA: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.4.5.3 Mexico

- 11.4.5.3.1 Rising foreign investments and infrastructure development

- 11.4.5.3 Mexico

- TABLE 165 MEXICO: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY CAPACITY, 2017-2022 (USD MILLION)

- TABLE 166 MEXICO: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY CAPACITY, 2023-2028 (USD MILLION)

- TABLE 167 MEXICO: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY INDUSTRY, 2017-2022 (USD MILLION)

- TABLE 168 MEXICO: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 169 MEXICO: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 170 MEXICO: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.5 MIDDLE EAST & AFRICA

- 11.5.1 MIDDLE EAST & AFRICA: RECESSION IMPACT

- 11.5.2 BY CAPACITY

- TABLE 171 MIDDLE EAST & AFRICA: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY CAPACITY, 2017-2022 (USD MILLION)

- TABLE 172 MIDDLE EAST & AFRICA: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY CAPACITY, 2023-2028 (USD MILLION)

- 11.5.3 BY INDUSTRY

- TABLE 173 MIDDLE EAST & AFRICA: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY INDUSTRY, 2017-2022 (USD MILLION)

- TABLE 174 MIDDLE EAST & AFRICA: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- 11.5.4 BY APPLICATION

- TABLE 175 MIDDLE EAST & AFRICA: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 176 MIDDLE EAST & AFRICA: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.5.5 BY COUNTRY

- TABLE 177 MIDDLE EAST & AFRICA: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 178 MIDDLE EAST & AFRICA: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 11.5.5.1 Saudi Arabia

- 11.5.5.1.1 Growing adoption of renewable energy and related infrastructure developments

- 11.5.5.1 Saudi Arabia

- TABLE 179 SAUDI ARABIA: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY CAPACITY, 2017-2022 (USD MILLION)

- TABLE 180 SAUDI ARABIA: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY CAPACITY, 2023-2028 (USD MILLION)

- TABLE 181 SAUDI ARABIA: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY INDUSTRY, 2017-2022 (USD MILLION)

- TABLE 182 SAUDI ARABIA: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 183 SAUDI ARABIA: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 184 SAUDI ARABIA: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.5.5.2 UAE

- 11.5.5.2.1 Rising investments in EV charging infrastructure

- 11.5.5.2 UAE

- TABLE 185 UAE: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY CAPACITY, 2017-2022 (USD MILLION)

- TABLE 186 UAE: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY CAPACITY, 2023-2028 (USD MILLION)

- TABLE 187 UAE: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY INDUSTRY, 2017-2022 (USD MILLION)

- TABLE 188 UAE: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 189 UAE: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 190 UAE: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.5.5.3 Turkey

- 11.5.5.3.1 Growing domestic EV production

- 11.5.5.3 Turkey

- TABLE 191 TURKEY: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY CAPACITY, 2017-2022 (USD MILLION)

- TABLE 192 TURKEY: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY CAPACITY, 2023-2028 (USD MILLION)

- TABLE 193 TURKEY: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY INDUSTRY, 2017-2022 (USD MILLION)

- TABLE 194 TURKEY: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 195 TURKEY: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 196 TURKEY: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.5.5.4 Nigeria

- 11.5.5.4.1 Rising electricity demand

- 11.5.5.4 Nigeria

- TABLE 197 NIGERIA: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY CAPACITY, 2017-2022 (USD MILLION)

- TABLE 198 NIGERIA: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY CAPACITY, 2023-2028 (USD MILLION)

- TABLE 199 NIGERIA: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY INDUSTRY, 2017-2022 (USD MILLION)

- TABLE 200 NIGERIA: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 201 NIGERIA: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 202 NIGERIA: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.5.5.5 South Africa

- 11.5.5.5.1 Increased adoption of energy storage systems

- 11.5.5.5 South Africa

- TABLE 203 SOUTH AFRICA: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY CAPACITY, 2017-2022 (USD MILLION)

- TABLE 204 SOUTH AFRICA: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY CAPACITY, 2023-2028 (USD MILLION)

- TABLE 205 SOUTH AFRICA: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY INDUSTRY, 2017-2022 (USD MILLION)

- TABLE 206 SOUTH AFRICA: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 207 SOUTH AFRICA: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 208 SOUTH AFRICA: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.5.5.6 Rest of Middle East & Africa

- TABLE 209 REST OF MIDDLE EAST & AFRICA: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY CAPACITY, 2017-2022 (USD MILLION)

- TABLE 210 REST OF MIDDLE EAST & AFRICA: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY CAPACITY, 2023-2028 (USD MILLION)

- TABLE 211 REST OF MIDDLE EAST & AFRICA: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY INDUSTRY, 2017-2022 (USD MILLION)

- TABLE 212 REST OF MIDDLE EAST & AFRICA: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 213 REST OF MIDDLE EAST & AFRICA: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 214 REST OF MIDDLE EAST & AFRICA: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.6 SOUTH AMERICA

- 11.6.1 SOUTH AMERICA: RECESSION IMPACT

- 11.6.2 BY CAPACITY

- TABLE 215 SOUTH AMERICA: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY CAPACITY, 2017-2022 (USD MILLION)

- TABLE 216 SOUTH AMERICA: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY CAPACITY, 2023-2028 (USD MILLION)

- 11.6.3 BY INDUSTRY

- TABLE 217 SOUTH AMERICA: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY INDUSTRY, 2017-2022 (USD MILLION)

- TABLE 218 SOUTH AMERICA: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- 11.6.4 BY APPLICATION

- TABLE 219 SOUTH AMERICA: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 220 SOUTH AMERICA: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.6.5 BY COUNTRY

- TABLE 221 SOUTH AMERICA: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 222 SOUTH AMERICA: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 11.6.5.1 Brazil

- 11.6.5.1.1 Rising import of EVs

- 11.6.5.1 Brazil

- TABLE 223 BRAZIL: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY CAPACITY, 2017-2022 (USD MILLION)

- TABLE 224 BRAZIL: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY CAPACITY, 2023-2028 (USD MILLION)

- TABLE 225 BRAZIL: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY INDUSTRY, 2017-2022 (USD MILLION)

- TABLE 226 BRAZIL: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 227 BRAZIL: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 228 BRAZIL: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.6.5.2 Argentina

- 11.6.5.2.1 Growing sustainability concerns and adoption of renewable energy

- 11.6.5.2 Argentina

- TABLE 229 ARGENTINA: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY CAPACITY, 2017-2022 (USD MILLION)

- TABLE 230 ARGENTINA: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY CAPACITY, 2023-2028 (USD MILLION)

- TABLE 231 ARGENTINA: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY INDUSTRY, 2017-2022 (USD MILLION)

- TABLE 232 ARGENTINA: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 233 ARGENTINA: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 234 ARGENTINA: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.6.5.3 Chile

- 11.6.5.3.1 Increasing applications of lithium iron phosphate batteries in automotive, industrial, and power sectors

- 11.6.5.3 Chile

- TABLE 235 CHILE: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY CAPACITY, 2017-2022 (USD MILLION)

- TABLE 236 CHILE: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY CAPACITY, 2023-2028 (USD MILLION)

- TABLE 237 CHILE: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY INDUSTRY, 2017-2022 (USD MILLION)

- TABLE 238 CHILE: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 239 CHILE: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 240 CHILE: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.6.5.4 Rest of South America

- TABLE 241 REST OF SOUTH AMERICA: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY CAPACITY, 2017-2022 (USD MILLION)

- TABLE 242 REST OF SOUTH AMERICA: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY CAPACITY, 2023-2028 (USD MILLION)

- TABLE 243 REST OF SOUTH AMERICA: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY INDUSTRY, 2017-2022 (USD MILLION)

- TABLE 244 REST OF SOUTH AMERICA: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 245 REST OF SOUTH AMERICA: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 246 REST OF SOUTH AMERICA: LITHIUM IRON PHOSPHATE BATTERIES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- TABLE 247 KEY STRATEGIES ADOPTED BY MAJOR MARKET PLAYERS

- 12.2 MARKET SHARE ANALYSIS, 2022

- TABLE 248 LITHIUM IRON PHOSPHATE BATTERIES MARKET: DEGREE OF COMPETITION

- FIGURE 42 MARKET SHARE ANALYSIS, 2022

- 12.3 MARKET EVALUATION FRAMEWORK, 2019-2023

- TABLE 249 MARKET EVALUATION FRAMEWORK, 2019-2023

- 12.4 SEGMENTAL REVENUE ANALYSIS, 2017-2022

- FIGURE 43 SEGMENTAL REVENUE ANALYSIS, 2017-2022

- 12.5 COMPETITIVE SCENARIOS AND TRENDS

- 12.5.1 PRODUCT LAUNCHES

- TABLE 250 LITHIUM IRON PHOSPHATE BATTERIES MARKET: PRODUCT LAUNCHES, 2019-2023

- 12.5.2 DEALS

- TABLE 251 LITHIUM IRON PHOSPHATE BATTERIES MARKET: DEALS, 2018-2022

- 12.5.3 OTHERS

- TABLE 252 LITHIUM IRON PHOSPHATE BATTERIES MARKET: OTHERS, 2019-2023

- 12.6 COMPANY EVALUATION MATRIX, 2022

- 12.6.1 STARS

- 12.6.2 EMERGING LEADERS

- 12.6.3 PERVASIVE PLAYERS

- 12.6.4 PARTICIPANTS

- FIGURE 44 LITHIUM IRON PHOSPHATE BATTERIES MARKET (GLOBAL): COMPANY EVALUATION MATRIX, 2022

- 12.7 COMPANY FOOTPRINT

- TABLE 253 CAPACITY: COMPANY FOOTPRINT

- TABLE 254 DESIGN: COMPANY FOOTPRINT

- TABLE 255 INDUSTRY: COMPANY FOOTPRINT

- TABLE 256 REGION: COMPANY FOOTPRINT

- 12.8 STARTUPS/SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION MATRIX, 2022

- 12.8.1 PROGRESSIVE COMPANIES

- 12.8.2 RESPONSIVE COMPANIES

- 12.8.3 DYNAMIC COMPANIES

- 12.8.4 STARTING BLOCKS

- FIGURE 45 LITHIUM IRON PHOSPHATE BATTERIES MARKET: STARTUPS/SMES EVALUATION MATRIX, 2022

- 12.9 COMPETITIVE BENCHMARKING

- TABLE 257 LITHIUM IRON PHOSPHATE BATTERIES MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 258 CAPACITY: STARTUPS/SMES FOOTPRINT

- TABLE 259 DESIGN: STARTUPS/SMES FOOTPRINT

- TABLE 260 INDUSTRY: STARTUPS/SMES FOOTPRINT

- TABLE 261 REGION: STARTUPS/SMES FOOTPRINT

13 COMPANY PROFILES

- (Business Overview, Products/Services/Solutions Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))**

- 13.1 KEY PLAYERS

- 13.1.1 BYD COMPANY LTD.

- TABLE 262 BYD COMPANY LTD.: COMPANY OVERVIEW

- FIGURE 46 BYD COMPANY LTD.: COMPANY SNAPSHOT

- TABLE 263 BYD COMPANY LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 264 BYD COMPANY LTD.: OTHERS

- 13.1.2 CONTEMPORARY AMPEREX TECHNOLOGY CO., LIMITED.

- TABLE 265 CONTEMPORARY AMPEREX TECHNOLOGY CO., LIMITED.: COMPANY OVERVIEW

- FIGURE 47 CONTEMPORARY AMPEREX TECHNOLOGY CO., LIMITED.: COMPANY SNAPSHOT

- TABLE 266 CONTEMPORARY AMPEREX TECHNOLOGY CO., LIMITED.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 267 CONTEMPORARY AMPEREX TECHNOLOGY CO., LIMITED.: DEALS

- TABLE 268 CONTEMPORARY AMPEREX TECHNOLOGY CO., LIMITED.: OTHERS

- 13.1.3 GOTION, INC.

- TABLE 269 GOTION, INC.: COMPANY OVERVIEW

- FIGURE 48 GOTION, INC.: COMPANY SNAPSHOT

- TABLE 270 GOTION, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 271 GOTION, INC.: DEALS

- TABLE 272 GOTION, INC.: OTHERS

- 13.1.4 CHINA AVIATION LITHIUM BATTERY CO., LTD. (CALB)

- TABLE 273 CHINA AVIATION LITHIUM BATTERY CO., LTD. (CALB): COMPANY OVERVIEW

- FIGURE 49 CHINA AVIATION LITHIUM BATTERY CO., LTD. (CALB): COMPANY SNAPSHOT

- TABLE 274 CHINA AVIATION LITHIUM BATTERY CO., LTD. (CALB): PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 275 CHINA AVIATION LITHIUM BATTERY CO., LTD. (CALB): PRODUCT LAUNCHES

- TABLE 276 CHINA AVIATION LITHIUM BATTERY CO., LTD. (CALB): DEALS

- TABLE 277 CHINA AVIATION LITHIUM BATTERY CO., LTD. (CALB): OTHERS

- 13.1.5 A123 SYSTEMS LLC

- TABLE 278 A123 SYSTEMS LLC: COMPANY OVERVIEW

- TABLE 279 A123 SYSTEMS LLC: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 280 A123 SYSTEMS LLC: DEALS

- 13.1.6 ULTRALIFE CORPORATION

- TABLE 281 ULTRALIFE CORPORATION: COMPANY OVERVIEW

- FIGURE 50 ULTRALIFE CORPORATION: COMPANY SNAPSHOT

- TABLE 282 ULTRALIFE CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 283 ULTRALIFE CORPORATION: DEALS

- 13.1.7 K2 ENERGY

- TABLE 284 K2 ENERGY: COMPANY OVERVIEW

- TABLE 285 K2 ENERGY: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 286 K2 ENERGY: PRODUCT LAUNCHES

- TABLE 287 K2 ENERGY: DEALS

- 13.1.8 LITHIUMWERKS

- TABLE 288 LITHIUMWERKS: COMPANY OVERVIEW

- TABLE 289 LITHIUMWERKS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 290 LITHIUMWERKS: DEALS

- TABLE 291 LITHIUMWERKS: OTHERS

- 13.1.9 TAICOPOWER

- TABLE 292 TAICOPOWER: COMPANY OVERVIEW

- TABLE 293 TAICOPOWER: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 13.1.10 BSL NEW ENERGY TECHNOLOGY CO., LTD

- TABLE 294 BSL NEW ENERGY TECHNOLOGY CO., LTD: COMPANY OVERVIEW

- TABLE 295 BSL NEW ENERGY TECHNOLOGY CO., LTD: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 296 BSL NEW ENERGY TECHNOLOGY CO., LTD: PRODUCT LAUNCHES

- 13.1.11 ELECTRIC VEHICLE POWER SYSTEM TECHNOLOGY CO., LTD

- TABLE 297 ELECTRIC VEHICLE POWER SYSTEM TECHNOLOGY CO., LTD: COMPANY OVERVIEW

- TABLE 298 ELECTRIC VEHICLE POWER SYSTEM TECHNOLOGY CO., LTD: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 13.1.12 BENERGY TECH CO. LTD.

- TABLE 299 BENERGY TECH CO. LTD.: COMPANY OVERVIEW

- TABLE 300 BENERGY TECH CO. LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 301 BENERGY TECH CO. LTD: PRODUCT LAUNCHES

- 13.1.13 RELION BATTERIES

- TABLE 302 RELION BATTERIES: COMPANY OVERVIEW

- TABLE 303 RELION BATTERIES: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 304 RELION BATTERIES: PRODUCT LAUNCHES

- TABLE 305 RELION BATTERIES: DEALS

- 13.1.14 BHARAT POWER SOLUTIONS

- TABLE 306 BHARAT POWER SOLUTIONS: COMPANY OVERVIEW

- TABLE 307 BHARAT POWER SOLUTIONS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 13.1.15 VICTRON ENERGY

- TABLE 308 VICTRON ENERGY: COMPANY OVERVIEW

- TABLE 309 VICTRON ENERGY: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 310 VICTRON ENERGY: PRODUCT LAUNCHES

- 13.1.16 KAYO BATTERY (SHENZHEN) COMPANY LIMITED

- TABLE 311 KAYO BATTERY (SHENZHEN) COMPANY LIMITED: COMPANY OVERVIEW

- TABLE 312 KAYO BATTERY (SHENZHEN) COMPANY LIMITED: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 13.1.17 KARACUS ENERGY PVT. LTD.

- TABLE 313 KARACUS ENERGY PVT. LTD.: COMPANY OVERVIEW

- TABLE 314 KARACUS ENERGY PVT. LTD.: PRODUCTS PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 13.1.18 EVEREXCEED INDUSTRIAL CO., LTD.

- TABLE 315 EVEREXCEED INDUSTRIAL CO., LTD: COMPANY OVERVIEW

- TABLE 316 EVEREXCEED INDUSTRIAL CO., LTD: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 317 EVEREXCEED INDUSTRIAL CO., LTD: PRODUCT LAUNCHES

- 13.2 OTHER PLAYERS

- 13.2.1 OPTIMUMNANO ENERGY CO., LTD.

- 13.2.2 EPEC, LLC.

- 13.2.3 SHENZHEN EASTAR BATTERY CO., LTD

- 13.2.4 SHENZHEN CYCLEN TECHNOLOGY CO., LTD.

- *Details on Business Overview, Products/Services/Solutions Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

14 APPENDIX

- 14.1 INSIGHTS FROM INDUSTRY EXPERTS

- 14.2 DISCUSSION GUIDE

- 14.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.4 CUSTOMIZATION OPTIONS

- 14.5 RELATED REPORTS

- 14.6 AUTHOR DETAILS