|

|

市場調査レポート

商品コード

1427280

衛星データサービスの世界市場:業界別、最終用途別、サービス別、展開別、地域別 - 予測(~2028年)Satellite Data Services Market by Vertical (Engineering & Infrastructure, Defense & Security, Agriculture), End-Use (Government & Military, Commercial), Service (Image Data, Data Analytics), Deployment and Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 衛星データサービスの世界市場:業界別、最終用途別、サービス別、展開別、地域別 - 予測(~2028年) |

|

出版日: 2024年02月14日

発行: MarketsandMarkets

ページ情報: 英文 302 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

世界の衛星データサービスの市場規模は、2023年に93億米ドル、2028年までに209億米ドルに達し、2023年~2028年にCAGRで17.5%の成長が予測されています。

市場の主な成長促進要因は、高解像度イメージングセンサーの開発、衛星の小型化、衛星コンステレーションの急増といった衛星技術の発展です。さらに、人口増加、都市化、気候変動、天然資源管理などの要因によって、さまざまな産業で実用的な知見やインテリジェンスに対する需要が高まっていることも、市場拡大をさらに加速させています。さらに、政府の取り組み、宇宙探査への投資、衛星企業とエンドユーザーの戦略的パートナーシップが、市場の成長と革新に寄与しています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2019年~2028年 |

| 基準年 | 2022年 |

| 予測期間 | 2023年~2028年 |

| 単位 | 10億米ドル |

| セグメント | 業界別、最終用途別、サービス別、展開別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

「業界別では、農業セグメントが2023年に第2位の市場シェアを占めると推定されます。」

業界別では、農業のサブセグメントが2023年の16億3,530万米ドルから2028年までに37億7,740万米ドルに達し、2023年~2028年にCAGRで18.2%の成長が予測されています。衛星データは気象パターンに関する重要な知見を提供し、農家が悪天候を予測し、その影響を軽減するのに役立ちます。この能力は、作付けや収穫の計画を立てる上で特に重要であり、予測不可能な気象現象に伴うリスクを軽減します。世界中の多くの政府が、農業における衛星ベースの技術に投資し、その採用を促進しています。補助金やインセンティブはさらに、衛星データサービスを農作業に組み込むことを農家に促し、市場成長を促進します。これらの促進要因の重なりによって強固なエコシステムが構築され、農業セグメントが衛星データサービス市場の主な成長促進要因となっています。

「最終用途別では、政府・軍事セグメントが2023年に第2位の市場シェアを占めると推定されます。」

政府・軍事セグメントは、2023年の21億8,280万米ドルから2028年までに5兆529億米ドルに達し、予測期間にCAGRで18.3%の成長が見込まれています。測位・航法・タイミング(PNT)レジリエンス強化に向けた政府の政策枠組みは、金融、防衛、輸送、通信、緊急サービスなどの主要セグメントを強化します。この取り組みは、これらのセグメントが、中断のないサービス提供を維持し、効果的に国民にサービスを提供するために、PNT情報に安全に依存できるようにすることを目的としています。衛星データサービスは、国家安全保障と防衛活動を支援する上で極めて重要な役割を果たします。宇宙から地政学的動向をモニターし、部隊の動きを追跡し、潜在的脅威を評価する能力は、政府や軍事機関に貴重なインテリジェンスをもたらします。衛星データサービスは、監視と情報収集に大きく寄与しています。国家安全保障に対する世界の関心の高まり、地政学的力学、先進の防衛能力の必要性を考慮すると、政府・軍事セグメントは衛星データサービス市場で大幅な成長を示すことが見込まれます。

サービス別では、画像データセグメントが2023年に第2位の市場シェアを占めると推定されます。

空間解像度と時間解像度の要件は、陸上、海洋、大気の特徴やプロセスのモニタリングに対して広く変動します。リモートセンシングセンサーの各用途には、それぞれ特有の分解能要件があります。そのため、空間分解能と範囲、スペクトルバンド、S/N比はトレードオフの関係にあります。Maxar Technologies(米国)、Sanborn Map Company(米国)、ICEYE(フィンランド)を含むほとんどの主要企業は、衛星画像のより多くの機能を提供し、また解像度を向上させるための研究に多大な投資を行っています。非常に高解像度な衛星画像は、防衛や安全保障の用途に使用することができます。この用途では、その場所の非常に鮮明で詳細な画像を必要とし、存在する敵対勢力の対象、強度、能力を正しく評価します。超高解像度衛星画像の主な応用分野は、国境警備と監視で、国境警備部隊は国境での活動に関する最新情報をリアルタイムで入手できます。

当レポートでは、世界の衛星データサービス市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

- 衛星データサービス市場の企業にとって魅力的な機会

- 衛星データサービス市場:業界別

- 衛星データサービス市場:最終用途別

- 衛星データサービス市場:サービス別

- 衛星データサービス市場:地域別

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 顧客のビジネスに影響を与える動向と混乱

- ビジネスモデル

- 不況の影響

- 価格分析

- 平均販売価格の動向:地域別

- 衛星データサービスサブスクリプションの参考価格:衛星別

- 運用データ

- バリューチェーン分析

- 衛星の製造と打ち上げ

- 衛星の運用と制御

- データの送信と受信

- データの処理と分析

- データの配信と用途

- エコシステムマッピング

- 著名企業

- 民間企業、小企業

- エンドユーザー

- 主なステークホルダーと購入基準

- ユースケース分析

- 気候変動モニタリング

- 地理情報データのアクセス可能性

- 災害の検出と対応

- 規制情勢

- 衛星データサービス市場の技術ロードマップ

- 主な会議とイベント

- 投資と資金調達のシナリオ

第6章 産業の動向

- イントロダクション

- 技術動向

- アナリティクスに基づいた意思決定向けAI

- オンボードセンサー技術の進歩

- 小型衛星専用打ち上げロケット

- 小型衛星による宇宙画像の強化

- データアナリティクスにおけるハイパースペクトルとマルチスペクトルイメージングの使用の増加

- 画像の保存と分析向けのクラウドコンピューティング

- RAPIDS

- メガトレンドの影響

- データアナリティクスと処理

- 宇宙技術における小型化

- オンボードデータ処理

- 衛星間通信

- 低コストアクティブデブリ除去技術

- ハイパースペクトルイメージング

第7章 衛星データサービス市場:業界別

- イントロダクション

- エネルギー・電力

- 工学・インフラ

- 防御・セキュリティ

- 環境・天候

- 農業

- 船舶

- 林業

- 輸送・ロジスティクス

- 保険

- 学術・研究

- その他

第8章 衛星データサービス市場:最終用途別

- イントロダクション

- 政府・軍事

- 商業

- サービスプロバイダー

第9章 衛星データサービス市場:サービス別

- イントロダクション

- 画像データ

- データアナリティクス

第10章 衛星データサービス市場:展開別

- イントロダクション

- パブリッククラウド

- プライベートクラウド

- ハイブリッドクラウド

第11章 衛星データサービス市場:地域別

- イントロダクション

- 地域の不況の影響の分析

- 北米

- PESTLE分析

- 景気後退の影響の分析

- 米国

- カナダ

- 欧州

- PESTLE分析

- 景気後退の影響の分析

- 英国

- ドイツ

- フランス

- スペイン

- オランダ

- ロシア

- その他の欧州

- アジア太平洋

- PESTLE分析

- 景気後退の影響の分析

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- シンガポール

- 中東

- PESTLE分析

- 景気後退の影響の分析

- GCC

- アラブ首長国連邦

- その他の中東

- その他の地域

- PESTLE分析

- 景気後退の影響の分析

- ラテンアメリカ

- アフリカ

第12章 競合情勢

- イントロダクション

- 主要企業が採用した戦略

- 収益分析(2020年~2022年)

- 市場シェア分析(2022年)

- ランキング分析(2022年)

- 企業の評価マトリクス(2022年)

- スタートアップ/中小企業の評価マトリクス(2022年)

- 競合シナリオ

第13章 企業プロファイル

- 主要企業

- AIRBUS

- MAXAR TECHNOLOGIES

- L3HARRIS TECHNOLOGIES, INC.

- PLANET LABS, PBC

- ICEYE

- SATELLITE IMAGING CORPORATION

- URSA SPACE SYSTEMS, INC

- SATPALDA

- EARTH-I LTD.

- LAND INFO WORLDWIDE MAPPING, LLC

- IMAGESAT INTERNATIONAL (ISI)

- CEINSYS TECH LTD.

- EAST VIEW GEOSPATIAL, INC

- TRIMBLE INC.

- SPECTIR

- GEOSPATIAL INTELLIGENCE PYT. LTY.

- GISAT S.R.O.

- PLANETOBSERVER

- BLACKSKY

- ESRI

- RMSI

- ORBITAL INSIGHT

- SPIRE GLOBAL

- その他の企業

- BIRDI LTD.

- DESCARTES LABS, INC

- SATELYTICS

- APOLLO MAPPING

- PIXXEL MAPPING

- HERE TECHNOLOGIES

第14章 付録

The Satellite Data Services market is valued at USD 9.3 billion in 2023 and is projected to reach USD 20.9 billion by 2028, at a CAGR of 17.5% from 2023 to 2028. The Satellite Data Services Market encompasses a dynamic ecosystem of companies and technologies dedicated to providing geospatial information and imagery derived from satellite-based platforms. These services enable users across diverse industries to access, analyze, and leverage satellite data for various applications, ranging from agriculture and environmental monitoring to defense and disaster management. Key drivers fueling the growth of the satellite data services market include advancements in satellite technology, such as the development of high-resolution imaging sensors, the miniaturization of satellites, and the proliferation of satellite constellations. Additionally, increasing demand for actionable insights and intelligence across various industries, driven by factors like population growth, urbanization, climate change, and natural resource management, further accelerates market expansion. Moreover, government initiatives, investments in space exploration, and strategic partnerships between satellite companies and end-users contribute to market growth and innovation.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2019-2028 |

| Base Year | 2022 |

| Forecast Period | 2023-2028 |

| Units Considered | Value (USD Billion) |

| Segments | By Vertical, End-Use, Service, Deployment and Region |

| Regions covered | North America, Europe, APAC, RoW |

Prominent companies operating in the satellite data services market include industry leaders such as Maxar Technologies, Airbus, Planet Labs, L3Harris Technologies,Inc. These companies offer a wide range of satellite imagery, data analytics, and geospatial solutions tailored to meet the diverse needs of customers across different sectors and applications.

"Based on vertical, the Agriculture segment is estimated to have the second largest market share in 2023."

Based on Vertical, the satellite data services market has been segmented into Energy & Power, Engineering & Infrastructure, Defense & Security, Environmental & Weather, Agriculture, Maritime, Forestry, Transportation & Logistics, Insurance, Academic & Research and Others. The agriculture subsegment is projected to grow from USD 1,635.3 million in 2023 to USD 3,777.4 million by 2028, at a CAGR of 18.2% from 2023 to 2028. Satellite data provides crucial insights into weather patterns, helping farmers anticipate and mitigate the impact of adverse weather conditions. This capability is especially vital for planning planting and harvesting activities, reducing risks associated with unpredictable weather events. Many governments worldwide are investing in and promoting the adoption of satellite-based technologies in agriculture. Subsidies and incentives further encourage farmers to integrate satellite data services into their agricultural practices, fostering market growth. The convergence of these drivers creates a robust ecosystem, propelling the agriculture segment to be a key growth driver in the satellite data services market.

"Based on end-use, the Government & Military segment is estimated to have the second largest market share in 2023."

The government and military segment is projected to grow from USD 2,182.8 million in 2023 to USD 5,052.9 billion by 2028, at a CAGR of 18.3% during the forecast period. The government & military segment is further sub-segmented into national space agencies, departments of Defense (DOD), national security agencies, academic and research institutions, departments of environment & agriculture, national mapping & topographic agencies, and others. Others include regional administrators and ministries of natural resources and forestry. The government's policy framework for enhancing Position, Navigation, and Timing (PNT) Resilience will bolster critical sectors including finance, defense, transportation, telecommunications, and emergency services. This initiative aims to ensure these sectors can securely depend on PNT information to maintain uninterrupted service delivery and effectively serve the public. Satellite data services play a pivotal role in supporting national security and defense efforts. The ability to monitor geopolitical developments, track troop movements, and assess potential threats from space provides governments and military agencies with invaluable intelligence. Satellite data services contribute significantly to surveillance and intelligence gathering. Given the increasing global focus on national security, geopolitical dynamics, and the need for advanced defense capabilities, the government and military segment is poised for substantial growth in the satellite data services market.

Based on Services, the Image data segment is estimated to have the second-largest market share in 2023.

The image data segment is further sub-segmented into spatial, spectral, temporal, and radiometric. Spatial and temporal resolution requirements fluctuate extensively for monitoring terrestrial, oceanic, and atmospheric features and processes. Each application of remote sensing sensors has its distinctive resolution requirements. Thus, there are trade-offs between spatial resolution and coverage, spectral bands, and signal-to-noise ratios. Most of the major companies, including Maxar Technologies (US), Sanborn Map Company (US), and ICEYE (Finland), are significantly investing in research to provide more features and enhance the resolution of satellite images. Very high-resolution satellite imagery can be used for defense and security applications, which require extremely clear, detailed imagery of a location to correctly assess the objects, strength, and capabilities of hostiles present. The key application areas of very high-resolution satellite imagery are border protection and surveillance, allowing a country's border protection force to have real-time updates regarding the activities at the border.

Based on regions, the Europe region is estimated to have the second largest market share in 2023.

The European region is witnessing robust growth in the satellite data services market driven by key business factors. The UK, Germany, France, Russia, the Netherlands, and Spain are considered for the analysis of the satellite data services market in Europe. One of the major factors contributing to the growth of the market in Europe is the increasing demand for satellite data services in various verticals, such as energy & power, engineering & infrastructure, defense & security, environmental, and insurance. Europe continues to uphold its second position in the regional assessment in terms of geospatial implementation. Supported by integrated policy frameworks and mechanisms, such as the Inspire Directive and the European Space Strategy, European countries are among the top 25 in the geospatial readiness indexes. Open Geospatial Consortium (OGC), an international non-profit organization devoted to developing open standards for the geospatial community, has the highest number of members from Europe. Continuous industrial and academic participation in developing quality standards for geospatial data has opened new opportunities for satellite data services in the region.

The break-up of the profile of primary participants in the satellite data services market:

- By Company Type: Tier 1 - 35%, Tier 2 - 45%, and Tier 3 - 20%

- By Designation: C Level - 35%, Director Level - 25%, and Others - 40%

- By Region: North America - 45%, Europe - 20%, Asia Pacific - 30%, Middle East- 4%, Rest of the World (RoW) - 1%

Major companies profiled in the report include Airbus (France), Maxar Technologies (US), L3Harris Technologies,Inc (US), Planet Labs, PBC (US), and ICEYE (Finland), among others.

Research Coverage:

This market study covers the satellite data services market across various segments and subsegments. It aims to estimate this market's size and growth potential across different parts based on size, operational orbits, application, component, end user, and region. This study also includes an in-depth competitive analysis of the key players in the market, their company profiles, key observations related to their product and business offerings, recent developments, and key market strategies they adopted.

Reasons to buy this report:

The report will help the market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall satellite data services market. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities. The satellite data services market is experiencing substantial growth, primarily driven by the exchange of real-time information. The increasing trend toward international cooperation and joint operations among nations is fostering demand for satellite data services, contributing to regional and global stability. The report provides insights on the following pointers:

- Market Drivers: Market Drivers such as the Rise of Earth observation imagery and analytics, Climate Change becoming a stimulus for EO, Significant advancements in geospatial imagery analytics with the introduction of AI and big data, Increased launches of earth observation Small Satellites, nanosats and CubeSats and other drivers covered in the report.

- Market Penetration: Comprehensive information on satellite data services offered by the top players in the market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the satellite data services market

- Market Development: Comprehensive information about lucrative markets - the report analyses the satellite data services market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the satellite data services market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, products, and manufacturing capabilities of leading players in the satellite data services market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- 1.3.3 YEARS CONSIDERED

- 1.4 INCLUSIONS AND EXCLUSIONS

- TABLE 1 INCLUSIONS AND EXCLUSIONS

- 1.5 CURRENCY CONSIDERED

- TABLE 2 USD EXCHANGE RATES

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

- 1.7.1 RECESSION IMPACT ANALYSIS (RIA)

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 RESEARCH PROCESS FLOW

- FIGURE 2 RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary respondents

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Breakdown of primary interviews

- 2.2 FACTOR ANALYSIS

- 2.2.1 INTRODUCTION

- 2.2.2 DEMAND-SIDE INDICATORS

- 2.2.3 SUPPLY-SIDE INDICATORS

- 2.2.4 RECESSION IMPACT

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- FIGURE 3 BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- FIGURE 4 TOP-DOWN APPROACH

- 2.4 DATA TRIANGULATION

- FIGURE 5 DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

- FIGURE 6 AGRICULTURE TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 7 GOVERNMENT & MILITARY SEGMENT TO RECORD FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 8 DATA ANALYTICS SEGMENT TO SECURE LEADING MARKET POSITION DURING FORECAST PERIOD

- FIGURE 9 ASIA PACIFIC TO BE FASTEST-GROWING MARKET FOR SATELLITE DATA SERVICES DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN SATELLITE DATA SERVICES MARKET

- FIGURE 10 ADVANCEMENTS IN GEOSPATIAL IMAGERY ANALYTICS TO DRIVE MARKET

- 4.2 SATELLITE DATA SERVICES MARKET, BY VERTICAL

- FIGURE 11 DEFENSE & SECURITY SEGMENT TO ACQUIRE LARGEST MARKET SHARE BY 2028

- 4.3 SATELLITE DATA SERVICES MARKET, BY END USE

- FIGURE 12 COMMERCIAL TO SURPASS OTHER SEGMENTS DURING FORECAST PERIOD

- 4.4 SATELLITE DATA SERVICES MARKET, BY SERVICE

- FIGURE 13 DATA ANALYTICS SEGMENT TO HOLD MAXIMUM MARKET SHARE DURING FORECAST PERIOD

- 4.5 SATELLITE DATA SERVICES MARKET, BY REGION

- FIGURE 14 NORTH AMERICA TO BE LARGEST MARKET FOR SATELLITE DATA SERVICES DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 15 SATELLITE DATA SERVICES MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growth of Earth observation (EO) imagery and analytics

- FIGURE 16 EARTH OBSERVATION SATELLITE LAUNCHES, 2018-2023

- 5.2.1.2 Climate change provides impetus to EO technologies

- 5.2.1.3 Advancements in geospatial imagery analytics with introduction of AI and big data

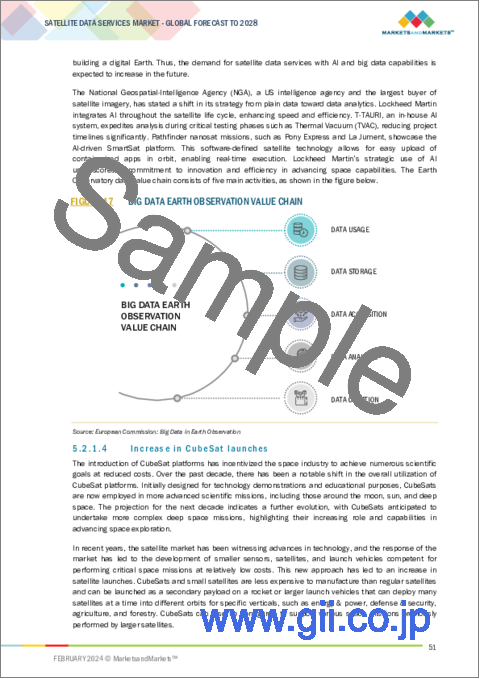

- FIGURE 17 BIG DATA EARTH OBSERVATION VALUE CHAIN

- 5.2.1.4 Increase in CubeSat launches

- TABLE 3 SMALL SATELLITE LAUNCHES AS OF JANUARY 2024 (UNITS)

- FIGURE 18 NANOSATS LAUNCHED, 2020-2023 (UNITS)

- 5.2.1.5 Privatization of space industry

- FIGURE 19 GLOBAL SATELLITE IMAGERY MARKET (USD BILLION)

- 5.2.2 RESTRAINTS

- 5.2.2.1 Lack of government space policies and regulations

- TABLE 4 BARRIERS TO COPERNICUS PROJECT

- 5.2.2.2 Absence of dedicated small satellite launch vehicles

- FIGURE 20 SMALL LAUNCHER STATUS

- 5.2.2.3 Rise of cybersecurity threats

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increased government investments in space agencies

- FIGURE 21 INVESTMENT STATUS, 2022

- 5.2.3.2 Need for real-time remote sensing data

- 5.2.3.3 Technological advancements in EO

- FIGURE 22 SPACE INVESTMENTS, 2013-2023 (USD BILLION)

- 5.2.3.4 Diversification of satellite data across industries

- 5.2.4 CHALLENGES

- 5.2.4.1 Rising concerns over space debris

- 5.2.4.2 Failure of satellite launch vehicles and satellites

- TABLE 5 EARTH OBSERVATION SATELLITE LAUNCH FAILURES

- 5.2.4.3 Data accessibility gap

- 5.3 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 23 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 BUSINESS MODELS

- 5.5 IMPACT OF RECESSION

- 5.6 PRICING ANALYSIS

- 5.6.1 AVERAGE SELLING PRICE TREND, BY REGION

- FIGURE 24 AVERAGE ANNUAL SUBSCRIPTION PRICING FOR SATELLITE DATA SERVICES, BY REGION, 2019-2023 (USD MILLION)

- 5.6.2 INDICATIVE PRICING FOR SATELLITE DATA SERVICE SUBSCRIPTIONS, BY SATELLITE

- TABLE 6 HIGH-RESOLUTION ARCHIVE PRICING FOR WORLDVIEW-2 AND WORLDVIEW-3, 2022-2023 (OPERATED BY MAXAR TECHNOLOGIES) (ANNUAL SUBSCRIPTION)

- TABLE 7 HIGH-RESOLUTION NEW TASKING PRICING FOR WORLDVIEW-2 AND WORLDVIEW-3, 2022-2023 (OPERATED BY MAXAR TECHNOLOGIES) (ANNUAL SUBSCRIPTION)

- TABLE 8 MEDIUM-RESOLUTION ARCHIVE PRICING FOR SPOT6/7, 2022-2023 (OPERATED BY AIRBUS DEFENCE & SPACE) (ANNUAL SUBSCRIPTION)

- TABLE 9 MEDIUM-RESOLUTION NEW TASKING PRICING FOR SPOT6/7, 2022-2023 (OPERATED BY AIRBUS DEFENCE & SPACE) (ANNUAL SUBSCRIPTION)

- TABLE 10 MAXAR (DIGITALGLOBE) DIGITAL ELEVATION MODEL PRICING, 2022-2023 (ANNUAL SUBSCRIPTION)

- 5.7 OPERATIONAL DATA

- TABLE 11 GLOBAL SATELLITE LAUNCHES, BY SATELLITE TYPE, 2018-2022

- TABLE 12 GLOBAL SATELLITE LAUNCHES, BY SATELLITE TYPE, 2023-2028

- 5.8 VALUE CHAIN ANALYSIS

- FIGURE 25 VALUE CHAIN ANALYSIS

- 5.8.1 SATELLITE MANUFACTURING AND LAUNCH

- 5.8.2 SATELLITE OPERATIONS AND CONTROL

- 5.8.3 DATA TRANSMISSION AND RECEPTION

- 5.8.4 DATA PROCESSING AND ANALYSIS

- 5.8.5 DATA DISTRIBUTION AND APPLICATIONS

- 5.9 ECOSYSTEM MAPPING

- 5.9.1 PROMINENT COMPANIES

- 5.9.2 PRIVATE AND SMALL ENTERPRISES

- 5.9.3 END USERS

- FIGURE 26 ECOSYSTEM MAP

- TABLE 13 ROLE OF COMPANIES IN ECOSYSTEM

- 5.10 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.10.1 STAKEHOLDERS IN BUYING PROCESS

- FIGURE 27 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF SATELLITE DATA SERVICES, BY END USE

- TABLE 14 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF SATELLITE DATA SERVICES, BY END USE (%)

- 5.10.2 BUYING CRITERIA

- FIGURE 28 KEY BUYING CRITERIA FOR SATELLITE DATA SERVICES, BY END USE

- TABLE 15 KEY BUYING CRITERIA FOR SATELLITE DATA SERVICES, BY END USE

- 5.11 USE CASE ANALYSIS

- 5.11.1 CLIMATE CHANGE MONITORING

- 5.11.2 ACCESSIBILITY OF GEOINFORMATION DATA

- 5.11.3 DISASTER DETECTION AND RESPONSE

- 5.12 REGULATORY LANDSCAPE

- TABLE 16 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 MIDDLE EAST: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13 TECHNOLOGY ROADMAP OF SATELLITE DATA SERVICES MARKET

- FIGURE 29 INTRODUCTION TO SATELLITE DATA SERVICES MARKET

- FIGURE 30 TECHNOLOGY ROADMAP OF SATELLITE DATA SERVICES MARKET

- FIGURE 31 EMERGING TRENDS IN SATELLITE DATA SERVICES MARKET

- 5.14 KEY CONFERENCES AND EVENTS

- TABLE 21 KEY CONFERENCES AND EVENTS, 2024

- 5.15 INVESTMENT AND FUNDING SCENARIO

- TABLE 22 INVESTMENT AND FUNDING SCENARIO, 2019-2022

- FIGURE 32 INVESTMENT AND FUNDING SCENARIO, 2019-2022

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 TECHNOLOGY TRENDS

- 6.2.1 ARTIFICIAL INTELLIGENCE (AI) FOR ANALYTICS-BASED DECISION-MAKING

- 6.2.2 ADVANCEMENTS IN ONBOARD SENSOR TECHNOLOGIES

- 6.2.3 DEDICATED LAUNCH VEHICLES FOR SMALL SATELLITES

- TABLE 23 STATE-OF-THE-ART SMALL SATELLITE TECHNOLOGIES

- 6.2.4 ENHANCED SPACE IMAGERY WITH SMALL SATELLITES

- 6.2.5 INCREASING USE OF HYPERSPECTRAL AND MULTISPECTRAL IMAGING IN DATA ANALYSIS

- 6.2.6 CLOUD COMPUTING FOR IMAGE STORAGE AND ANALYSIS

- TABLE 24 CLOUD COMPUTING PLATFORMS

- 6.2.7 REAL-TIME ACQUISITION AND PROCESSING INTEGRATED DATA SYSTEMS (RAPIDS)

- FIGURE 33 RAPIDS NEAR-REALTIME CHAIN: DATA RECEPTION TO GENERATION OF INFORMATION PRODUCT

- 6.3 IMPACT OF MEGATRENDS

- 6.3.1 DATA ANALYTICS AND PROCESSING

- FIGURE 34 EARTH OBSERVATION SUPPLY CHAIN

- 6.3.2 MINIATURIZATION IN SPACE TECHNOLOGY

- 6.3.3 ONBOARD DATA PROCESSING

- 6.3.4 SATELLITE-TO-SATELLITE COMMUNICATION

- 6.3.5 LOW-COST ACTIVE DEBRIS REMOVAL TECHNOLOGY

- 6.3.6 HYPERSPECTRAL IMAGING

7 SATELLITE DATA SERVICES MARKET, BY VERTICAL

- 7.1 INTRODUCTION

- FIGURE 35 AGRICULTURE VERTICAL TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 25 SATELLITE DATA SERVICES MARKET, BY VERTICAL, 2019-2022 (USD MILLION)

- TABLE 26 SATELLITE DATA SERVICES MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 7.2 ENERGY & POWER

- 7.2.1 NEED FOR SATELLITE IMAGERY AND ANALYSIS IN MINERAL DETECTION TO DRIVE MARKET

- 7.2.2 MINING AND MINERAL EXPLORATION

- 7.2.3 OIL & GAS OPERATION

- 7.2.3.1 Pipeline and transmission survey

- 7.2.4 RENEWABLE ENERGY SOURCES

- 7.2.4.1 Wind energy

- 7.2.4.2 Solar energy

- 7.2.4.3 Hydroelectric power

- 7.2.4.4 Others

- 7.2.5 UTILITY

- 7.2.5.1 Powerline management

- 7.2.5.2 Underground utility monitoring

- 7.3 ENGINEERING & INFRASTRUCTURE

- 7.3.1 USE OF SATELLITE IMAGERY TO FACILITATE DECISION-MAKING FOR SUSTAINABLE URBAN DEVELOPMENT TO DRIVE MARKET

- 7.3.2 LAND & URBAN MANAGEMENT

- 7.3.2.1 3D urban and terrain modeling (DTM)

- 7.3.3 INDUSTRIAL AND ASSET MAPPING

- 7.3.3.1 GIS integrated LiDAR mapping

- 7.4 DEFENSE & SECURITY

- 7.4.1 USE OF GEOSPATIAL SOLUTIONS FOR MILITARY OPERATIONS TO DRIVE MARKET

- 7.4.2 SURVEILLANCE

- 7.4.3 CRITICAL INFRASTRUCTURE PROTECTION

- 7.4.4 CRIME MAPPING

- 7.4.5 MONITORING OF AIRFIELDS

- 7.5 ENVIRONMENT & WEATHER

- 7.5.1 TIMELY SATELLITE IMAGERY ACQUISITION AND ANALYSIS TO HELP MINIMIZE ENVIRONMENTAL COST OF HUMAN ACTIVITIES

- 7.5.2 GLOBAL CLIMATE CHANGE

- 7.5.3 LAND COVER AND CHANGE DETECTION

- 7.5.4 AIR & WATER POLLUTION

- 7.5.5 NATURAL DISASTERS

- 7.5.6 WEATHER FORECAST

- 7.6 AGRICULTURE

- 7.6.1 NEED FOR BETTER MANAGEMENT OF GLOBAL AGRICULTURAL RESOURCES TO DRIVE MARKET

- 7.6.2 CROP TYPE IDENTIFICATION

- 7.6.3 PRECISION FARMING

- 7.7 MARITIME

- 7.7.1 ADVANCEMENT OF SATELLITE COMMUNICATIONS SERVICES TO DRIVE MARKET

- 7.7.2 PORT & HARBOR MONITORING

- 7.7.3 COASTAL MANAGEMENT (SURVEY WATERS, DETECT VESSELS, TRACK OIL SPILLS AND OTHER ACTIVITIES)

- 7.7.4 SEARCH & RESCUE

- 7.7.5 ILLEGAL FISHING MONITORING

- 7.8 FORESTRY

- 7.8.1 GROWING USE OF SATELLITE IMAGERY FOR FIRE AND EMERGENCY MAPPING TO DRIVE MARKET

- 7.8.2 FOREST COVER MAPPING

- 7.8.3 EMERGENCY WILDFIRE MONITORING

- 7.9 TRANSPORTATION & LOGISTICS

- 7.9.1 INCREASING APPLICATIONS OF SATELLITE IMAGERY AND REMOTE SENSING TO DRIVE MARKET

- 7.9.2 TRANSPORTATION ROUTE PLANNING

- 7.9.3 TRANSPORTATION & LOGISTICS SITE PLANNING

- 7.9.4 TRAFFIC MANAGEMENT

- 7.10 INSURANCE

- 7.10.1 INCREASE IN USE OF REAL-TIME IMAGERY TO ASSESS RISKS AND OPTIMIZE CLAIMS TO DRIVE MARKET

- 7.10.2 FLOOD MONITORING

- 7.10.3 PROPERTY DAMAGE ESTIMATION

- 7.11 ACADEMIC & RESEARCH

- 7.11.1 SPECIAL SATELLITE IMAGERY PACKAGES OFFERED BY LEADING COMPANIES TO DRIVE MARKET

- 7.12 OTHERS

8 SATELLITE DATA SERVICES MARKET, BY END USE

- 8.1 INTRODUCTION

- FIGURE 36 COMMERCIAL END USE SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- TABLE 27 SATELLITE DATA SERVICES MARKET, BY END USE, 2019-2022 (USD MILLION)

- TABLE 28 SATELLITE DATA SERVICES MARKET, BY END USE, 2023-2028 (USD MILLION)

- 8.2 GOVERNMENT & MILITARY

- 8.2.1 POTENTIAL OF COMMERCIAL SATELLITE IMAGERY AND DATA TO PLAY KEY ROLE IN NATIONAL SECURITY

- 8.2.2 NATIONAL SPACE AGENCIES

- 8.2.3 DEPARTMENTS OF DEFENSE

- 8.2.4 NATIONAL SECURITY AGENCIES

- 8.2.5 ACADEMIC AND RESEARCH INSTITUTIONS

- 8.2.6 DEPARTMENTS OF ENVIRONMENT & AGRICULTURE

- 8.2.7 NATIONAL MAPPING & TOPOGRAPHIC AGENCIES

- 8.2.8 OTHERS

- 8.3 COMMERCIAL

- 8.3.1 AVAILABILITY OF COMMERCIAL SMALL SATELLITE DATA TO NASA-FUNDED RESEARCHERS TO DRIVE MARKET

- 8.3.2 GEOLOGICAL COMPANIES

- 8.3.3 MAPPING AND CARTOGRAPHIC COMPANIES

- 8.3.4 MINING, OIL, AND GAS COMPANIES

- 8.3.5 TRANSPORT, CONSTRUCTION, AND INFRASTRUCTURE COMPANIES

- 8.3.6 SATELLITE OPERATORS/OWNERS

- 8.3.7 MEDIA AND ENTERTAINMENT

- 8.3.8 OTHERS

- 8.4 SERVICE PROVIDERS

- 8.4.1 INCREASING DEMAND FOR SATELLITE IMAGERY ANALYTICS ACROSS VARIOUS VERTICALS TO DRIVE MARKET

9 SATELLITE DATA SERVICES MARKET, BY SERVICE

- 9.1 INTRODUCTION

- FIGURE 37 DATA ANALYTICS SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- TABLE 29 SATELLITE DATA SERVICES MARKET, BY SERVICE, 2019-2022 (USD MILLION)

- TABLE 30 SATELLITE DATA SERVICES MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- 9.2 IMAGE DATA

- 9.2.1 GROWING INVESTMENT IN RESEARCH TO ENHANCE RESOLUTION OF SATELLITE IMAGES TO DRIVE MARKET

- 9.2.2 SPATIAL

- 9.2.2.1 Very high resolution

- 9.2.2.2 High resolution

- 9.2.2.3 Medium-low resolution

- 9.2.3 SPECTRAL

- 9.2.4 TEMPORAL

- 9.2.5 RADIOMETRIC

- 9.3 DATA ANALYTICS

- 9.3.1 INCREASING DEMAND FOR DATA ANALYTICS TO DEVELOP GIS MAPS TO DRIVE MARKET

- 9.3.2 IMAGE DATA PROCESSING

- 9.3.2.1 Pan-sharpening

- 9.3.2.2 Orthorectification

- 9.3.2.3 Mosaicking

- 9.3.2.4 Cloud patching

- 9.3.2.5 Aerial triangulation

- 9.3.3 FEATURE EXTRACTION

- 9.3.4 DIGITAL MODELS

- 9.3.4.1 Digital Terrain Model (DTM)

- 9.3.4.2 Digital Surface Model (DSM)

- 9.3.4.3 Digital Elevation Model (DEM)

- 9.3.5 CLASSIFICATION

- 9.3.5.1 Object classification or identification

- 9.3.5.2 Land cover and change detection

10 SATELLITE DATA SERVICES MARKET, BY DEPLOYMENT

- 10.1 INTRODUCTION

- 10.2 PUBLIC CLOUD

- 10.3 PRIVATE CLOUD

- 10.4 HYBRID CLOUD

11 SATELLITE DATA SERVICES MARKET, BY REGION

- 11.1 INTRODUCTION

- FIGURE 38 SATELLITE DATA SERVICES MARKET, BY REGION

- 11.2 REGIONAL RECESSION IMPACT ANALYSIS

- FIGURE 39 REGIONAL RECESSION IMPACT ANALYSIS

- TABLE 31 SATELLITE DATA SERVICES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 32 SATELLITE DATA SERVICES MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.3 NORTH AMERICA

- 11.3.1 PESTLE ANALYSIS

- 11.3.2 RECESSION IMPACT ANALYSIS

- FIGURE 40 NORTH AMERICA: SATELLITE DATA SERVICES MARKET SNAPSHOT

- TABLE 33 NORTH AMERICA: SATELLITE DATA SERVICES MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 34 NORTH AMERICA: SATELLITE DATA SERVICES MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 35 NORTH AMERICA: SATELLITE DATA SERVICES MARKET, BY VERTICAL, 2019-2022 (USD MILLION)

- TABLE 36 NORTH AMERICA: SATELLITE DATA SERVICES MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 37 NORTH AMERICA: SATELLITE DATA SERVICES MARKET, BY END USE, 2019-2022 (USD MILLION)

- TABLE 38 NORTH AMERICA: SATELLITE DATA SERVICES MARKET, BY END USE, 2023-2028 (USD MILLION)

- TABLE 39 NORTH AMERICA: SATELLITE DATA SERVICES MARKET, BY SERVICE, 2019-2022 (USD MILLION)

- TABLE 40 NORTH AMERICA: SATELLITE DATA SERVICES MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- 11.3.3 US

- 11.3.3.1 Presence of leading satellite data service providers to drive market

- TABLE 41 US: SATELLITE DATA SERVICES MARKET, BY VERTICAL, 2019-2022 (USD MILLION)

- TABLE 42 US: SATELLITE DATA SERVICES MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 43 US: SATELLITE DATA SERVICES MARKET, BY END USE, 2019-2022 (USD MILLION)

- TABLE 44 US: SATELLITE DATA SERVICES MARKET, BY END USE, 2023-2028 (USD MILLION)

- TABLE 45 US: SATELLITE DATA SERVICES MARKET, BY SERVICE, 2019-2022 (USD MILLION)

- TABLE 46 US: SATELLITE DATA SERVICES MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- 11.3.4 CANADA

- 11.3.4.1 Increasing government investments to drive market

- TABLE 47 CANADA: SATELLITE DATA SERVICES MARKET, BY VERTICAL, 2019-2022 (USD MILLION)

- TABLE 48 CANADA: SATELLITE DATA SERVICES MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 49 CANADA: SATELLITE DATA SERVICES MARKET, BY END USE, 2019-2022 (USD MILLION)

- TABLE 50 CANADA: SATELLITE DATA SERVICES MARKET, BY END USE, 2023-2028 (USD MILLION)

- TABLE 51 CANADA: SATELLITE DATA SERVICES MARKET, BY SERVICE, 2019-2022 (USD MILLION)

- TABLE 52 CANADA: SATELLITE DATA SERVICES MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- 11.4 EUROPE

- 11.4.1 PESTLE ANALYSIS

- 11.4.2 RECESSION IMPACT ANALYSIS

- FIGURE 41 EUROPE: SATELLITE DATA SERVICES MARKET SNAPSHOT

- TABLE 53 EUROPE: SATELLITE DATA SERVICES MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 54 EUROPE: SATELLITE DATA SERVICES MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 55 EUROPE: SATELLITE DATA SERVICES MARKET, BY VERTICAL, 2019-2022 (USD MILLION)

- TABLE 56 EUROPE: SATELLITE DATA SERVICES MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 57 EUROPE: SATELLITE DATA SERVICES MARKET, BY END USE, 2019-2022 (USD MILLION)

- TABLE 58 EUROPE: SATELLITE DATA SERVICES MARKET, BY END USE, 2023-2028 (USD MILLION)

- TABLE 59 EUROPE: SATELLITE DATA SERVICES MARKET, BY SERVICE, 2019-2022 (USD MILLION)

- TABLE 60 EUROPE: SATELLITE DATA SERVICES MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- 11.4.3 UK

- 11.4.3.1 Growing development of small satellite fleets to drive market

- TABLE 61 UK: SATELLITE DATA SERVICES MARKET, BY VERTICAL, 2019-2022 (USD MILLION)

- TABLE 62 UK: SATELLITE DATA SERVICES MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 63 UK: SATELLITE DATA SERVICES MARKET, BY END USE, 2019-2022 (USD MILLION)

- TABLE 64 UK: SATELLITE DATA SERVICES MARKET, BY END USE, 2023-2028 (USD MILLION)

- TABLE 65 UK: SATELLITE DATA SERVICES MARKET, BY SERVICE, 2019-2022 (USD MILLION)

- TABLE 66 UK: SATELLITE DATA SERVICES MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- 11.4.4 GERMANY

- 11.4.4.1 Need for monitoring natural catastrophes and civil security to drive market

- TABLE 67 GERMANY: SATELLITE DATA SERVICES MARKET, BY VERTICAL, 2019-2022 (USD MILLION)

- TABLE 68 GERMANY: SATELLITE DATA SERVICES MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 69 GERMANY: SATELLITE DATA SERVICES MARKET, BY END USE, 2019-2022 (USD MILLION)

- TABLE 70 GERMANY: SATELLITE DATA SERVICES MARKET, BY END USE, 2023-2028 (USD MILLION)

- TABLE 71 GERMANY: SATELLITE DATA SERVICES MARKET, BY SERVICE, 2019-2022 (USD MILLION)

- TABLE 72 GERMANY: SATELLITE DATA SERVICES MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- 11.4.5 FRANCE

- 11.4.5.1 Continuous focus on upgrading Earth observation and communications systems to drive market

- TABLE 73 FRANCE: SATELLITE DATA SERVICES MARKET, BY VERTICAL, 2019-2022 (USD MILLION)

- TABLE 74 FRANCE: SATELLITE DATA SERVICES MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 75 FRANCE: SATELLITE DATA SERVICES MARKET, BY END USE, 2019-2022 (USD MILLION)

- TABLE 76 FRANCE: SATELLITE DATA SERVICES MARKET, BY END USE, 2023-2028 (USD MILLION)

- TABLE 77 FRANCE: SATELLITE DATA SERVICES MARKET, BY SERVICE, 2019-2022 (USD MILLION)

- TABLE 78 FRANCE: SATELLITE DATA SERVICES MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- 11.4.6 SPAIN

- 11.4.6.1 Rising digitalization in strategic sectors to drive market

- TABLE 79 SPAIN: SATELLITE DATA SERVICES MARKET, BY VERTICAL, 2019-2022 (USD MILLION)

- TABLE 80 SPAIN: SATELLITE DATA SERVICES MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 81 SPAIN: SATELLITE DATA SERVICES MARKET, BY END USE, 2019-2022 (USD MILLION)

- TABLE 82 SPAIN: SATELLITE DATA SERVICES MARKET, BY END USE, 2023-2028 (USD MILLION)

- TABLE 83 SPAIN: SATELLITE DATA SERVICES MARKET, BY SERVICE, 2019-2022 (USD MILLION)

- TABLE 84 SPAIN: SATELLITE DATA SERVICES MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- 11.4.7 NETHERLANDS

- 11.4.7.1 Surge in geo-intelligence applications to drive market

- TABLE 85 NETHERLANDS: SATELLITE DATA SERVICES MARKET, BY VERTICAL, 2019-2022 (USD MILLION)

- TABLE 86 NETHERLANDS: SATELLITE DATA SERVICES MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 87 NETHERLANDS: SATELLITE DATA SERVICES MARKET, BY END USE, 2019-2022 (USD MILLION)

- TABLE 88 NETHERLANDS: SATELLITE DATA SERVICES MARKET, BY END USE, 2023-2028 (USD MILLION)

- TABLE 89 NETHERLANDS: SATELLITE DATA SERVICES MARKET, BY SERVICE, 2019-2022 (USD MILLION)

- TABLE 90 NETHERLANDS: SATELLITE DATA SERVICES MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- 11.4.8 RUSSIA

- 11.4.8.1 Expanding applications of GLONASS-K navigation system to drive market

- TABLE 91 RUSSIA: SATELLITE DATA SERVICES MARKET, BY VERTICAL, 2019-2022 (USD MILLION)

- TABLE 92 RUSSIA: SATELLITE DATA SERVICES MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 93 RUSSIA: SATELLITE DATA SERVICES MARKET, BY END USE, 2019-2022 (USD MILLION)

- TABLE 94 RUSSIA: SATELLITE DATA SERVICES MARKET, BY END USE, 2023-2028 (USD MILLION)

- TABLE 95 RUSSIA: SATELLITE DATA SERVICES MARKET, BY SERVICE, 2019-2022 (USD MILLION)

- TABLE 96 RUSSIA: SATELLITE DATA SERVICES MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- 11.4.9 REST OF EUROPE

- TABLE 97 REST OF EUROPE: SATELLITE DATA SERVICES MARKET, BY VERTICAL, 2019-2022 (USD MILLION)

- TABLE 98 REST OF EUROPE: SATELLITE DATA SERVICES MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 99 REST OF EUROPE: SATELLITE DATA SERVICES MARKET, BY END USE, 2019-2022 (USD MILLION)

- TABLE 100 REST OF EUROPE: SATELLITE DATA SERVICES MARKET, BY END USE, 2023-2028 (USD MILLION)

- TABLE 101 REST OF EUROPE: SATELLITE DATA SERVICES MARKET, BY SERVICE, 2019-2022 (USD MILLION)

- TABLE 102 REST OF EUROPE: SATELLITE DATA SERVICES MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- 11.5 ASIA PACIFIC

- 11.5.1 PESTLE ANALYSIS

- 11.5.2 RECESSION IMPACT ANALYSIS

- FIGURE 42 ASIA PACIFIC: SATELLITE DATA SERVICES MARKET SNAPSHOT

- TABLE 103 ASIA PACIFIC: SATELLITE DATA SERVICES MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 104 ASIA PACIFIC: SATELLITE DATA SERVICES MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 105 ASIA PACIFIC: SATELLITE DATA SERVICES MARKET, BY VERTICAL, 2019-2022 (USD MILLION)

- TABLE 106 ASIA PACIFIC: SATELLITE DATA SERVICES MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 107 ASIA PACIFIC: SATELLITE DATA SERVICES MARKET, BY END USE, 2019-2022 (USD MILLION)

- TABLE 108 ASIA PACIFIC: SATELLITE DATA SERVICES MARKET, BY END USE, 2023-2028 (USD MILLION)

- TABLE 109 ASIA PACIFIC: SATELLITE DATA SERVICES MARKET, BY SERVICE, 2019-2022 (USD MILLION)

- TABLE 110 ASIA PACIFIC: SATELLITE DATA SERVICES MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- 11.5.3 CHINA

- 11.5.3.1 Heightened demand for bandwidth-intensive services to drive market

- TABLE 111 CHINA: SATELLITE DATA SERVICES MARKET, BY VERTICAL, 2019-2022 (USD MILLION)

- TABLE 112 CHINA: SATELLITE DATA SERVICES MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 113 CHINA: SATELLITE DATA SERVICES MARKET, BY END USE, 2019-2022 (USD MILLION)

- TABLE 114 CHINA: SATELLITE DATA SERVICES MARKET, BY END USE, 2023-2028 (USD MILLION)

- TABLE 115 CHINA: SATELLITE DATA SERVICES MARKET, BY SERVICE, 2019-2022 (USD MILLION)

- TABLE 116 CHINA: SATELLITE DATA SERVICES MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- 11.5.4 JAPAN

- 11.5.4.1 Growing importance of satellite data for Earth observation to drive market

- TABLE 117 JAPAN: SATELLITE DATA SERVICES MARKET, BY VERTICAL, 2019-2022 (USD MILLION)

- TABLE 118 JAPAN: SATELLITE DATA SERVICES MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 119 JAPAN: SATELLITE DATA SERVICES MARKET, BY END USE, 2019-2022 (USD MILLION)

- TABLE 120 JAPAN: SATELLITE DATA SERVICES MARKET, BY END USE, 2023-2028 (USD MILLION)

- TABLE 121 JAPAN: SATELLITE DATA SERVICES MARKET, BY SERVICE, 2019-2022 (USD MILLION)

- TABLE 122 JAPAN: SATELLITE DATA SERVICES MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- 11.5.5 INDIA

- 11.5.5.1 Booming Digital India and Smart City initiatives to drive market

- TABLE 123 INDIA: SATELLITE DATA SERVICES MARKET, BY VERTICAL, 2019-2022 (USD MILLION)

- TABLE 124 INDIA: SATELLITE DATA SERVICES MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 125 INDIA: SATELLITE DATA SERVICES MARKET, BY END USE, 2019-2022 (USD MILLION)

- TABLE 126 INDIA: SATELLITE DATA SERVICES MARKET, BY END USE, 2023-2028 (USD MILLION)

- TABLE 127 INDIA: SATELLITE DATA SERVICES MARKET, BY SERVICE, 2019-2022 (USD MILLION)

- TABLE 128 INDIA: SATELLITE DATA SERVICES MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- 11.5.6 SOUTH KOREA

- 11.5.6.1 Increasing adoption of satellite imagery for defense applications to drive market

- TABLE 129 SOUTH KOREA: SATELLITE DATA SERVICES MARKET, BY VERTICAL, 2019-2022 (USD MILLION)

- TABLE 130 SOUTH KOREA: SATELLITE DATA SERVICES MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 131 SOUTH KOREA: SATELLITE DATA SERVICES MARKET, BY END USE, 2019-2022 (USD MILLION)

- TABLE 132 SOUTH KOREA: SATELLITE DATA SERVICES MARKET, BY END USE, 2023-2028 (USD MILLION)

- TABLE 133 SOUTH KOREA SATELLITE DATA SERVICES MARKET, BY SERVICE, 2019-2022 (USD MILLION)

- TABLE 134 SOUTH KOREA: SATELLITE DATA SERVICES MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- 11.5.7 AUSTRALIA

- 11.5.7.1 Increasing focus on data-driven decision-making capabilities to drive market

- TABLE 135 AUSTRALIA: SATELLITE DATA SERVICES MARKET, BY VERTICAL, 2019-2022 (USD MILLION)

- TABLE 136 AUSTRALIA: SATELLITE DATA SERVICES MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 137 AUSTRALIA: SATELLITE DATA SERVICES MARKET, BY END USE, 2019-2022 (USD MILLION)

- TABLE 138 AUSTRALIA: SATELLITE DATA SERVICES MARKET, BY END USE, 2023-2028 (USD MILLION)

- TABLE 139 AUSTRALIA: SATELLITE DATA SERVICES MARKET, BY SERVICE, 2019-2022 (USD MILLION)

- TABLE 140 AUSTRALIA: SATELLITE DATA SERVICES MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- 11.5.8 SINGAPORE

- 11.5.8.1 Use of satellites for monitoring oil and gas operations to drive market

- TABLE 141 SINGAPORE: SATELLITE DATA SERVICES MARKET, BY VERTICAL, 2019-2022 (USD MILLION)

- TABLE 142 SINGAPORE: SATELLITE DATA SERVICES MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 143 SINGAPORE: SATELLITE DATA SERVICES MARKET, BY END USE, 2019-2022 (USD MILLION)

- TABLE 144 SINGAPORE: SATELLITE DATA SERVICES MARKET, BY END USE, 2023-2028 (USD MILLION)

- TABLE 145 SINGAPORE: SATELLITE DATA SERVICES MARKET, BY SERVICE, 2019-2022 (USD MILLION)

- TABLE 146 SINGAPORE: SATELLITE DATA SERVICES MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- 11.6 MIDDLE EAST

- 11.6.1 PESTLE ANALYSIS

- 11.6.2 RECESSION IMPACT ANALYSIS

- FIGURE 43 MIDDLE EAST: SATELLITE DATA SERVICES MARKET SNAPSHOT

- TABLE 147 MIDDLE EAST: SATELLITE DATA SERVICES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 148 MIDDLE EAST: SATELLITE DATA SERVICES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 149 MIDDLE EAST: SATELLITE DATA SERVICES MARKET, BY VERTICAL, 2019-2022 (USD MILLION)

- TABLE 150 MIDDLE EAST: SATELLITE DATA SERVICES MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 151 MIDDLE EAST: SATELLITE DATA SERVICES MARKET, BY END USE, 2019-2022 (USD MILLION)

- TABLE 152 MIDDLE EAST: SATELLITE DATA SERVICES MARKET, BY END USE, 2023-2028 (USD MILLION)

- TABLE 153 MIDDLE EAST: SATELLITE DATA SERVICES MARKET, BY SERVICE, 2019-2022 (USD MILLION)

- TABLE 154 MIDDLE EAST: SATELLITE DATA SERVICES MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- 11.6.3 GCC

- TABLE 155 GCC: SATELLITE DATA SERVICES MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 156 GCC: SATELLITE DATA SERVICES MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 157 GCC: SATELLITE DATA SERVICES MARKET, BY VERTICAL, 2019-2022 (USD MILLION)

- TABLE 158 GCC: SATELLITE DATA SERVICES MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 159 GCC: SATELLITE DATA SERVICES MARKET, BY END USE, 2019-2022 (USD MILLION)

- TABLE 160 GCC: SATELLITE DATA SERVICES MARKET, BY END USE, 2023-2028 (USD MILLION)

- TABLE 161 GCC: SATELLITE DATA SERVICES MARKET, BY SERVICE, 2019-2022 (USD MILLION)

- TABLE 162 GCC: SATELLITE DATA SERVICES MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- 11.6.3.1 Saudi Arabia

- 11.6.3.1.1 Increasing need for monitoring oil fields to drive market

- 11.6.3.1 Saudi Arabia

- TABLE 163 SAUDI ARABIA: SATELLITE DATA SERVICES MARKET, BY VERTICAL, 2019-2022 (USD MILLION)

- TABLE 164 SAUDI ARABIA: SATELLITE DATA SERVICES MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 165 SAUDI ARABIA: SATELLITE DATA SERVICES MARKET, BY END USE, 2019-2022 (USD MILLION)

- TABLE 166 SAUDI ARABIA: SATELLITE DATA SERVICES MARKET, BY END USE, 2023-2028 (USD MILLION)

- TABLE 167 SAUDI ARABIA: SATELLITE DATA SERVICES MARKET, BY SERVICE, 2019-2022 (USD MILLION)

- TABLE 168 SAUDI ARABIA: SATELLITE DATA SERVICES MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- 11.6.4 UAE

- 11.6.4.1 Booming space missions to drive market

- TABLE 169 UAE: SATELLITE DATA SERVICES MARKET, BY VERTICAL, 2019-2022 (USD MILLION)

- TABLE 170 UAE: SATELLITE DATA SERVICES MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 171 UAE: SATELLITE DATA SERVICES MARKET, BY END USE, 2019-2022 (USD MILLION)

- TABLE 172 UAE: SATELLITE DATA SERVICES MARKET, BY END USE, 2023-2028 (USD MILLION)

- TABLE 173 UAE: SATELLITE DATA SERVICES MARKET, BY SERVICE, 2019-2022 (USD MILLION)

- TABLE 174 UAE: SATELLITE DATA SERVICES MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- 11.6.5 REST OF MIDDLE EAST

- TABLE 175 REST OF MIDDLE EAST: SATELLITE DATA SERVICES MARKET, BY VERTICAL, 2019-2022 (USD MILLION)

- TABLE 176 REST OF MIDDLE EAST: SATELLITE DATA SERVICES MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 177 REST OF MIDDLE EAST: SATELLITE DATA SERVICES MARKET, BY END USE, 2019-2022 (USD MILLION)

- TABLE 178 REST OF MIDDLE EAST: SATELLITE DATA SERVICES MARKET, BY END USE, 2023-2028 (USD MILLION)

- TABLE 179 REST OF MIDDLE EAST: SATELLITE DATA SERVICES MARKET, BY SERVICE, 2019-2022 (USD MILLION)

- TABLE 180 REST OF MIDDLE EAST: SATELLITE DATA SERVICES MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- 11.7 REST OF THE WORLD

- 11.7.1 PESTLE ANALYSIS

- 11.7.2 RECESSION IMPACT ANALYSIS

- FIGURE 44 REST OF THE WORLD: SATELLITE DATA SERVICES MARKET SNAPSHOT

- TABLE 181 REST OF THE WORLD: SATELLITE DATA SERVICES MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 182 REST OF THE WORLD: SATELLITE DATA SERVICES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 183 REST OF THE WORLD: SATELLITE DATA SERVICES MARKET, BY VERTICAL, 2019-2022 (USD MILLION)

- TABLE 184 REST OF THE WORLD: SATELLITE DATA SERVICES MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 185 REST OF THE WORLD: SATELLITE DATA SERVICES MARKET, BY END USE, 2019-2022 (USD MILLION)

- TABLE 186 REST OF THE WORLD: SATELLITE DATA SERVICES MARKET, BY END USE, 2023-2028 (USD MILLION)

- TABLE 187 REST OF THE WORLD: SATELLITE DATA SERVICES MARKET, BY SERVICE, 2019-2022 (USD MILLION)

- TABLE 188 REST OF THE WORLD: SATELLITE DATA SERVICES MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- 11.7.3 LATIN AMERICA

- 11.7.3.1 Growing focus on satellite space missions and climate monitoring efforts to drive market

- TABLE 189 LATIN AMERICA: SATELLITE DATA SERVICES MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 190 LATIN AMERICA: SATELLITE DATA SERVICES MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 191 LATIN AMERICA: SATELLITE DATA SERVICES MARKET, BY VERTICAL, 2019-2022 (USD MILLION)

- TABLE 192 LATIN AMERICA: SATELLITE DATA SERVICES MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 193 LATIN AMERICA: SATELLITE DATA SERVICES MARKET, BY END USE, 2019-2022 (USD MILLION)

- TABLE 194 LATIN AMERICA: SATELLITE DATA SERVICES MARKET, BY END USE, 2023-2028 (USD MILLION)

- TABLE 195 LATIN AMERICA: SATELLITE DATA SERVICES MARKET, BY SERVICE, 2019-2022 (USD MILLION)

- TABLE 196 LATIN AMERICA: SATELLITE DATA SERVICES MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- 11.7.4 AFRICA

- 11.7.4.1 Growing number of Earth observation projects to drive market

- TABLE 197 AFRICA: SATELLITE DATA SERVICES MARKET, BY VERTICAL, 2019-2022 (USD MILLION)

- TABLE 198 AFRICA: SATELLITE DATA SERVICES MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 199 AFRICA: SATELLITE DATA SERVICES MARKET, BY END USE, 2019-2022 (USD MILLION)

- TABLE 200 AFRICA: SATELLITE DATA SERVICES MARKET, BY END USE, 2023-2028 (USD MILLION)

- TABLE 201 AFRICA: SATELLITE DATA SERVICES MARKET, BY SERVICE, 2019-2022 (USD MILLION)

- TABLE 202 AFRICA: SATELLITE DATA SERVICES MARKET, BY SERVICE, 2023-2028 (USD MILLION)

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 203 STRATEGIES ADOPTED BY KEY PLAYERS, 2019-2O22

- 12.3 REVENUE ANALYSIS, 2020-2022

- FIGURE 45 REVENUE ANALYSIS OF TOP 5 PLAYERS, 2020-2022

- 12.4 MARKET SHARE ANALYSIS, 2022

- FIGURE 46 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2022

- TABLE 204 SATELLITE DATA SERVICES MARKET: DEGREE OF COMPETITION

- 12.5 RANKING ANALYSIS, 2022

- FIGURE 47 MARKET RANKING OF KEY PLAYERS, 2022

- 12.6 COMPANY EVALUATION MATRIX, 2022

- 12.6.1 STARS

- 12.6.2 EMERGING LEADERS

- 12.6.3 PERVASIVE COMPANIES

- 12.6.4 PARTICIPANTS

- FIGURE 48 COMPANY EVALUATION MATRIX, 2022

- 12.6.5 COMPANY FOOTPRINT

- TABLE 205 COMPANY FOOTPRINT

- TABLE 206 SERVICE FOOTPRINT

- TABLE 207 REGION FOOTPRINT

- 12.7 START-UP/SME EVALUATION MATRIX, 2022

- 12.7.1 PROGRESSIVE COMPANIES

- 12.7.2 RESPONSIVE COMPANIES

- 12.7.3 DYNAMIC COMPANIES

- 12.7.4 STARTING BLOCKS

- FIGURE 49 START-UP/SME EVALUATION MATRIX, 2022

- 12.7.5 COMPETITIVE BENCHMARKING

- TABLE 208 KEY START-UPS/SMES

- TABLE 209 COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

- TABLE 210 COMPANY VALUATION AND FINANCIAL METRICS, 2022

- FIGURE 50 COMPANY VALUATION - 2022

- FIGURE 51 COMPANY FINANCIAL METRICS - 2022

- 12.8 COMPETITIVE SCENARIO

- 12.8.1 MARKET EVALUATION FRAMEWORK

- 12.8.2 PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 211 SATELLITE DATA SERVICES MARKET: PRODUCT LAUNCHES/DEVELOPMENTS, 2020-2023

- 12.8.3 DEALS

- TABLE 212 SATELLITE DATA SERVICES MARKET: DEALS, 2020-2023

- 12.8.4 OTHERS

- TABLE 213 OTHERS, 2020-2023

13 COMPANY PROFILES

- (Business overview, Products/Solutions/Services offered, Recent developments & MnM View)**

- 13.1 KEY PLAYERS

- 13.1.1 AIRBUS

- TABLE 214 AIRBUS: COMPANY OVERVIEW

- FIGURE 52 AIRBUS: COMPANY SNAPSHOT

- TABLE 215 AIRBUS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 216 AIRBUS: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 217 AIRBUS: DEALS

- TABLE 218 AIRBUS: OTHERS

- 13.1.2 MAXAR TECHNOLOGIES

- TABLE 219 MAXAR TECHNOLOGIES: COMPANY OVERVIEW

- FIGURE 53 MAXAR TECHNOLOGIES: COMPANY SNAPSHOT

- TABLE 220 MAXAR TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 221 MAXAR TECHNOLOGIES: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 222 MAXAR TECHNOLOGIES: OTHERS

- 13.1.3 L3HARRIS TECHNOLOGIES, INC.

- TABLE 223 L3HARRIS TECHNOLOGIES, INC.: COMPANY OVERVIEW

- FIGURE 54 L3HARRIS TECHNOLOGIES, INC.: COMPANY SNAPSHOT

- TABLE 224 L3HARRIS TECHNOLOGIES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 225 L3HARRIS TECHNOLOGIES, INC.: DEALS

- TABLE 226 L3HARRIS TECHNOLOGIES, INC.: OTHERS

- 13.1.4 PLANET LABS, PBC

- TABLE 227 PLANET LABS, PBC: COMPANY OVERVIEW

- FIGURE 55 PLANET LABS, PBC: COMPANY SNAPSHOT

- TABLE 228 PLANET LABS, PBC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 229 PLANET LABS, PBC: DEALS

- TABLE 230 PLANET LABS, PBC: OTHERS

- 13.1.5 ICEYE

- TABLE 231 ICEYE: COMPANY OVERVIEW

- TABLE 232 ICEYE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 233 ICEYE: DEALS

- TABLE 234 ICEYE: OTHERS

- 13.1.6 SATELLITE IMAGING CORPORATION

- TABLE 235 SATELLITE IMAGING CORPORATION: COMPANY OVERVIEW

- TABLE 236 SATELLITE IMAGING CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.7 URSA SPACE SYSTEMS, INC

- TABLE 237 URSA SPACE SYSTEMS, INC: COMPANY OVERVIEW

- TABLE 238 URSA SPACE SYSTEMS, INC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 239 URSA SPACE SYSTEMS, INC: DEALS

- 13.1.8 SATPALDA

- TABLE 240 SATPALDA: COMPANY OVERVIEW

- TABLE 241 SATPALDA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.9 EARTH-I LTD.

- TABLE 242 EARTH-I LTD.: COMPANY OVERVIEW

- TABLE 243 EARTH-I LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.10 LAND INFO WORLDWIDE MAPPING, LLC

- TABLE 244 LAND INFO WORLDWIDE MAPPING, LLC: COMPANY OVERVIEW

- TABLE 245 LAND INFO WORLDWIDE MAPPING, LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.11 IMAGESAT INTERNATIONAL (ISI)

- TABLE 246 IMAGESAT INTERNATIONAL (ISI): COMPANY OVERVIEW

- TABLE 247 IMAGESAT INTERNATIONAL (ISI): PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 248 IMAGESAT INTERNATIONAL (ISI): DEALS

- TABLE 249 IMAGESAT INTERNATIONAL (ISI): OTHERS

- 13.1.12 CEINSYS TECH LTD.

- TABLE 250 CEINSYS TECH LTD.: COMPANY OVERVIEW

- FIGURE 56 CEINSYS TECH LTD.: COMPANY SNAPSHOT

- TABLE 251 CEINSYS TECH LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 252 CEINSYS TECH LTD.: DEALS

- 13.1.13 EAST VIEW GEOSPATIAL, INC

- TABLE 253 EAST VIEW GEOSPATIAL, INC: COMPANY OVERVIEW

- TABLE 254 EAST VIEW GEOSPATIAL, INC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 255 EAST VIEW GEOSPATIAL, INC: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 256 EAST VIEW GEOSPATIAL, INC: DEALS

- 13.1.14 TRIMBLE INC.

- TABLE 257 TRIMBLE INC.: COMPANY OVERVIEW

- FIGURE 57 TRIMBLE INC.: COMPANY SNAPSHOT

- TABLE 258 TRIMBLE INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 259 TRIMBLE INC.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 260 TRIMBLE INC.: DEALS

- 13.1.15 SPECTIR

- TABLE 261 SPECTIR: COMPANY OVERVIEW

- TABLE 262 SPECTIR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 263 SPECTIR: DEALS

- 13.1.16 GEOSPATIAL INTELLIGENCE PYT. LTY.

- TABLE 264 GEOSPATIAL INTELLIGENCE PYT. LTY.: COMPANY OVERVIEW

- TABLE 265 GEOSPATIAL INTELLIGENCE PYT. LTY.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 266 GEOSPATIAL INTELLIGENCE PTY. LTY.: OTHERS

- 13.1.17 GISAT S.R.O.

- TABLE 267 GISAT S.R.O.: COMPANY OVERVIEW

- TABLE 268 GISAT S.R.O.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.18 PLANETOBSERVER

- TABLE 269 PLANETOBSERVER: COMPANY OVERVIEW

- TABLE 270 PLANETOBSERVER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 271 PLANETOBSERVER: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 272 PLANETOBSERVER: DEALS

- 13.1.19 BLACKSKY

- TABLE 273 BLACKSKY: COMPANY OVERVIEW

- FIGURE 58 BLACKSKY: COMPANY SNAPSHOT

- TABLE 274 BLACKSKY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 275 BLACKSKY: DEALS

- TABLE 276 BLACKSKY: OTHERS

- 13.1.20 ESRI

- TABLE 277 ESRI: COMPANY OVERVIEW

- TABLE 278 ESRI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 279 ESRI: DEALS

- 13.1.21 RMSI

- TABLE 280 RMSI: COMPANY OVERVIEW

- TABLE 281 RMSI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 282 RMSI: DEALS

- 13.1.22 ORBITAL INSIGHT

- TABLE 283 ORBITAL INSIGHT: COMPANY OVERVIEW

- TABLE 284 ORBITAL INSIGHT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 285 ORBITAL INSIGHT: DEALS

- TABLE 286 ORBITAL INSIGHT: OTHERS

- 13.1.23 SPIRE GLOBAL

- TABLE 287 SPIRE GLOBAL: COMPANY OVERVIEW

- FIGURE 59 SPIRE GLOBAL: COMPANY SNAPSHOT

- TABLE 288 SPIRE GLOBAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 289 SPIRE GLOBAL: OTHERS

- *Details on Business overview, Products/Solutions/Services offered, Recent developments & MnM View might not be captured in case of unlisted companies.

- 13.2 OTHER PLAYERS

- 13.2.1 BIRDI LTD.

- TABLE 290 BIRDI LTD.: COMPANY OVERVIEW

- 13.2.2 DESCARTES LABS, INC

- TABLE 291 DESCARTES LABS, INC: COMPANY OVERVIEW

- 13.2.3 SATELYTICS

- TABLE 292 SATELYTICS: COMPANY OVERVIEW

- 13.2.4 APOLLO MAPPING

- TABLE 293 APOLLO MAPPING: COMPANY OVERVIEW

- 13.2.5 PIXXEL MAPPING

- TABLE 294 PIXXEL MAPPING: COMPANY OVERVIEW

- 13.2.6 HERE TECHNOLOGIES

- TABLE 295 HERE TECHNOLOGIES: COMPANY OVERVIEW

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS