|

|

市場調査レポート

商品コード

1701633

衛星データサービスの市場規模、シェア、動向分析レポート:サービス別、用途別、展開別、最終用途別、地域別、セグメント予測、2025年~2030年Satellite Data Services Market Size, Share & Trends Analysis Report By Service (Image Data Service, Data Analytics Service), By Application, By Deployment, By End-use (Commercial, Government & Military), By Region, And Segment Forecasts, 2025 - 2030 |

||||||

カスタマイズ可能

|

|||||||

| 衛星データサービスの市場規模、シェア、動向分析レポート:サービス別、用途別、展開別、最終用途別、地域別、セグメント予測、2025年~2030年 |

|

出版日: 2025年03月26日

発行: Grand View Research

ページ情報: 英文 150 Pages

納期: 2~10営業日

|

全表示

- 概要

- 図表

- 目次

衛星データサービス市場の成長と動向:

Grand View Research, Inc.の最新レポートによると、世界の衛星データサービス市場規模は2025年から2030年にかけて16.3%のCAGRを記録し、2030年には295億9,000万米ドルに達すると推定されています。

企業間における宇宙の民営化の高まりが、この成長を牽引すると予想されています。広範な民営化により、衛星画像の利用者はより深く価値ある空間画像に関する洞察を得ることができ、より賢明な意思決定が促進されると期待されます。さらに、宇宙の民営化は、新たな宇宙技術の開発をめぐる企業間の競争を激化させ、宇宙技術分野の急速な成長を促すことが期待されます。

センサーの小型化により、1つのペイロードで複数の衛星を打ち上げることが容易になると予想されるため、画像を採用する企業にとってはミッション・コストが削減され、それに伴って新規画像プロバイダーにとっては参入障壁が低くなります。複数の小型衛星を使ってより広い地域を地図化する機会は、さらに画像採用企業の需要を促進し、魅力的な成長機会を提供すると予想されます。データ需要の増加は、衛星メーカーが地球の低・中軌道に小型衛星コンステレーションを打ち上げることを促進しています。さらに、センサーにナノ粒子を組み込むと、そのサイズと表面積の小ささにより感度が向上するため、正確なデータを得て健全な意思決定を行うことが不可欠となります。

第4次産業革命も衛星データサービス市場に魅力的な成長見通しを提供しています。インダストリー4.0の到来もまた、いくつかの衛星メーカー、OEM、アプリケーション開発者に開発機会を提供し、レガシー慣行の破壊を促進し、市場により良い成長見通しを提供すると期待されています。さらに、インダストリー4.0は衛星開発の設計・製造段階における生産性を向上させ、今後数年間の経済成長予測をもたらすと期待されています。

Satellite-as-a-Service(SataaS)の出現は、ユーザーにとって衛星画像に関する知見への容易で手頃なアクセスを約束します。商業利用における衛星の従量課金モデルの提供は、より優れたリソースと時間管理能力を提供すると期待されます。これはさらに、市場の持続的成長を確保するために、企業が衛星を一定期間所有できるようにすることで、製品を消費者に近づけることを可能にすると期待されます。小型衛星の数が増加し、衛星配備にかかる総コストが低下しているため、SataaSは費用対効果の高い選択肢となっており、企業や中規模企業の間で業界全体の採用が見込まれています。

衛星データサービス市場レポート・ハイライト

- 地政学的緊張の高まりと国家安全保障の必要性の高まりに後押しされ、防衛・安全保障アプリケーション分野が2024年の市場シェア25%超で市場を独占。

- データ分析サービス分野は、農業、防衛、環境モニタリング、都市計画などの業界全体で実用的な洞察に対する需要が高まっていることから、予測期間中に最も高いCAGRを記録すると予想されます。

- 公共展開セグメントは、宇宙プログラム、地球観測ミッション、国家安全保障イニシアティブに対する政府の多額の投資により、予測期間中に最も高いCAGRを示すと予想されています。

- 最終用途別では、企業が競争優位のために衛星データの価値をますます認識するようになっているため、2024年には商業セグメントが最大の市場シェアを占めています。

- アジア太平洋の衛星データサービス市場は、予測期間中に最も高いCAGRで成長すると予想されます。アジア太平洋地域では、環境モニタリングや管理のために衛星画像を利用する地球観測プログラムへの投資が急増しています。

目次

第1章 調査手法と範囲

第2章 エグゼクティブサマリー

第3章 衛星データサービス市場の変数、動向、範囲

- 市場系統の見通し

- 市場力学

- 市場促進要因分析

- 市場抑制要因分析

- 導入の課題

- 衛星データサービス市場分析ツール

- 展開分析- ポーター

- PESTEL分析

第4章 衛星データサービス市場:用途別推定・動向分析

- セグメントダッシュボード

- 衛星データサービス市場:変動分析、2024年および2030年

- 防衛・セキュリティ

- エネルギー・公益事業

- 農林業

- 環境および気候監視

- エンジニアリングとインフラ開発

- 海洋

- その他

第5章 衛星データサービス市場:展開別推定・動向分析

- セグメントダッシュボード

- 衛星データサービス市場:変動分析、2024年および2030年

- 民間

- 公共

- ハイブリッド

第6章 衛星データサービス市場:サービス別推定・動向分析

- セグメントダッシュボード

- 衛星データサービス市場:変動分析、2024年および2030年

- 画像データサービス

- データ分析サービス

第7章 衛星データサービス市場:最終用途の推定・動向分析

- セグメントダッシュボード

- 衛星データサービス市場:変動分析、2024年および2030年

- 商業

- 政府と軍隊

- サービスプロバイダー

第8章 地域別推定・動向分析

- 地域別衛星データサービス市場、2024年および2030年

- 北米

- 北米の衛星データサービス市場の推定と予測、2018年~2030年

- 米国

- カナダ

- メキシコ

- 欧州

- 欧州の衛星データサービス市場推計・予測、2018年~2030年

- 英国

- ドイツ

- フランス

- アジア太平洋

- アジア太平洋地域の衛星データサービス市場推計・予測、2018年~2030年

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- ラテンアメリカ

- ラテンアメリカの衛星データサービス市場推計・予測、2018年~2030年

- ブラジル

- 中東およびアフリカ

- 中東およびアフリカの衛星データサービス市場推計・予測、2018年~2030年

- サウジアラビア

- 南アフリカ

- アラブ首長国連邦

第9章 競合情勢

- 企業分類

- 企業の市場ポジショニング

- 企業ヒートマップ分析

- 企業プロファイル/リスト

- Maxar Technologies Holdings Inc.(Maxar)

- Planet Labs PBC.

- Airbus SE

- ICEYE

- L3Harris Technologies, Inc.

- Earth-i Ltd

- Geocento Limited

- NV5 Global, Inc.

- Satellite Imaging Corporation

- Satpalda

- Telstra

- Ursa Space Systems Inc.

- Geospatial Intelligence Pty Ltd

List of Tables

- Table 1 Satellite Data Services Market Size Estimates & Forecasts 2018 - 2030 (USD Million)

- Table 2 Satellite Data Services Market, By Application 2018 - 2030 (USD Million)

- Table 3 Satellite Data Services Market, By Deployment 2018 - 2030 (USD Million)

- Table 4 Satellite Data Services Market, By Service 2018 - 2030 (USD Million)

- Table 5 Satellite Data Services Market, By End Use 2018 - 2030 (USD Million)

- Table 6 Defense & Security Market Estimates & Forecasts, 2018 - 2030 (USD Million)

- Table 7 Energy & Utilities Market Estimates & Forecasts, 2018 - 2030 (USD Million)

- Table 8 Agriculture & Forestry Market Estimates & Forecasts, 2018 - 2030 (USD Million)

- Table 9 Environmental & Climate Monitoring Market Estimates & Forecasts, 2018 - 2030 (USD Million)

- Table 10 Engineering & Infrastructure Development Market Estimates & Forecasts, 2018 - 2030 (USD Million)

- Table 11 Marine Market Estimates & Forecasts, 2018 - 2030 (USD Million)

- Table 12 Others Market Estimates & Forecasts, 2018 - 2030 (USD Million)

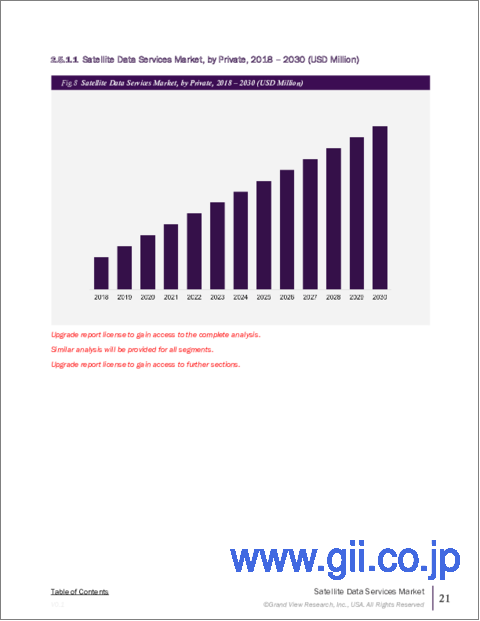

- Table 13 Private Market Estimates & Forecasts, 2018 - 2030 (USD Million)

- Table 14 Public Market Estimates & Forecasts, 2018 - 2030 (USD Million)

- Table 15 Hybrid Market Estimates & Forecasts, 2018 - 2030 (USD Million)

- Table 16 Image Data Service Market Estimates & Forecasts, 2018 - 2030 (USD Million)

- Table 17 Data Analytics Service Market Estimates & Forecasts, 2018 - 2030 (USD Million)

- Table 18 Commercial Market Estimates & Forecasts, 2018 - 2030 (USD Million)

- Table 19 Government and Military Market Estimates & Forecasts, 2018 - 2030 (USD Million)

- Table 20 Service Providers Market Estimates & Forecasts, 2018 - 2030 (USD Million)

- Table 21 North America Satellite Data Services Market, By Application 2018 - 2030 (USD Million)

- Table 22 North America Satellite Data Services Market, By Deployment 2018 - 2030 (USD Million)

- Table 23 North America Satellite Data Services Market, By Service 2018 - 2030 (USD Million)

- Table 24 North America Satellite Data Services Market, By End Use 2018 - 2030 (USD Million)

- Table 25 U.S. Satellite Data Services Market, By Application 2018 - 2030 (USD Million)

- Table 26 U.S. Satellite Data Services Market, By Deployment 2018 - 2030 (USD Million)

- Table 27 U.S. Satellite Data Services Market, By Service 2018 - 2030 (USD Million)

- Table 28 U.S. Satellite Data Services Market, By End Use 2018 - 2030 (USD Million)

- Table 29 Canada Satellite Data Services Market, By Application 2018 - 2030 (USD Million)

- Table 30 Canada Satellite Data Services Market, By Deployment 2018 - 2030 (USD Million)

- Table 31 Canada Satellite Data Services Market, By Service 2018 - 2030 (USD Million)

- Table 32 Canada Satellite Data Services Market, By End Use 2018 - 2030 (USD Million)

- Table 33 Mexico Satellite Data Services Market, By Application 2018 - 2030 (USD Million)

- Table 34 Mexico Satellite Data Services Market, By Deployment 2018 - 2030 (USD Million)

- Table 35 Mexico Satellite Data Services Market, By Service 2018 - 2030 (USD Million)

- Table 36 Mexico Satellite Data Services Market, By End Use 2018 - 2030 (USD Million)

- Table 37 Europe Satellite Data Services Market, By Application 2018 - 2030 (USD Million)

- Table 38 Europe Satellite Data Services Market, By Deployment 2018 - 2030 (USD Million)

- Table 39 Europe Satellite Data Services Market, By Service 2018 - 2030 (USD Million)

- Table 40 Europe Satellite Data Services Market, By End Use 2018 - 2030 (USD Million)

- Table 41 UK Satellite Data Services Market, By Application 2018 - 2030 (USD Million)

- Table 42 UK Satellite Data Services Market, By Deployment 2018 - 2030 (USD Million)

- Table 43 UK Satellite Data Services Market, By Service 2018 - 2030 (USD Million)

- Table 44 UK Satellite Data Services Market, By End Use 2018 - 2030 (USD Million)

- Table 45 Germany Satellite Data Services Market, By Application 2018 - 2030 (USD Million)

- Table 46 Germany Satellite Data Services Market, By Deployment 2018 - 2030 (USD Million)

- Table 47 Germany Satellite Data Services Market, By Service 2018 - 2030 (USD Million)

- Table 48 Germany Satellite Data Services Market, By End Use 2018 - 2030 (USD Million)

- Table 49 France Satellite Data Services Market, By Application 2018 - 2030 (USD Million)

- Table 50 France Satellite Data Services Market, By Deployment 2018 - 2030 (USD Million)

- Table 51 France Satellite Data Services Market, By Service 2018 - 2030 (USD Million)

- Table 52 France Satellite Data Services Market, By End Use 2018 - 2030 (USD Million)

- Table 53 Asia Pacific Satellite Data Services Market, By Application 2018 - 2030 (USD Million)

- Table 54 Asia Pacific Satellite Data Services Market, By Deployment 2018 - 2030 (USD Million)

- Table 55 Asia Pacific Satellite Data Services Market, By Service 2018 - 2030 (USD Million)

- Table 56 Asia Pacific Satellite Data Services Market, By End Use 2018 - 2030 (USD Million)

- Table 57 China Satellite Data Services Market, By Application 2018 - 2030 (USD Million)

- Table 58 China Satellite Data Services Market, By Deployment 2018 - 2030 (USD Million)

- Table 59 China Satellite Data Services Market, By Service 2018 - 2030 (USD Million)

- Table 60 China Satellite Data Services Market, By End Use 2018 - 2030 (USD Million)

- Table 61 Japan Satellite Data Services Market, By Application 2018 - 2030 (USD Million)

- Table 62 Japan Satellite Data Services Market, By Deployment 2018 - 2030 (USD Million)

- Table 63 Japan Satellite Data Services Market, By Service 2018 - 2030 (USD Million)

- Table 64 Japan Satellite Data Services Market, By End Use 2018 - 2030 (USD Million)

- Table 65 India Satellite Data Services Market, By Application 2018 - 2030 (USD Million)

- Table 66 India Satellite Data Services Market, By Deployment 2018 - 2030 (USD Million)

- Table 67 India Satellite Data Services Market, By Service 2018 - 2030 (USD Million)

- Table 68 India Satellite Data Services Market, By End Use 2018 - 2030 (USD Million)

- Table 69 South Korea Satellite Data Services Market, By Application 2018 - 2030 (USD Million)

- Table 70 South Korea Satellite Data Services Market, By Deployment 2018 - 2030 (USD Million)

- Table 71 South Korea Satellite Data Services Market, By Service 2018 - 2030 (USD Million)

- Table 72 South Korea Satellite Data Services Market, By End Use 2018 - 2030 (USD Million)

- Table 73 Australia Satellite Data Services Market, By Application 2018 - 2030 (USD Million)

- Table 74 Australia Satellite Data Services Market, By Deployment 2018 - 2030 (USD Million)

- Table 75 Australia Satellite Data Services Market, By Service 2018 - 2030 (USD Million)

- Table 76 Australia Satellite Data Services Market, By End Use 2018 - 2030 (USD Million)

- Table 77 Latin America Satellite Data Services Market, By Application 2018 - 2030 (USD Million)

- Table 78 Latin America Satellite Data Services Market, By Deployment 2018 - 2030 (USD Million)

- Table 79 Latin America Satellite Data Services Market, By Service 2018 - 2030 (USD Million)

- Table 80 Latin America Satellite Data Services Market, By End Use 2018 - 2030 (USD Million)

- Table 81 Brazil Satellite Data Services Market, By Application 2018 - 2030 (USD Million)

- Table 82 Brazil Satellite Data Services Market, By Deployment 2018 - 2030 (USD Million)

- Table 83 Brazil Satellite Data Services Market, By Service 2018 - 2030 (USD Million)

- Table 84 Brazil Satellite Data Services Market, By End Use 2018 - 2030 (USD Million)

- Table 85 Saudi Arabia Satellite Data Services Market, By Application 2018 - 2030 (USD Million)

- Table 86 Saudi Arabia Satellite Data Services Market, By Deployment 2018 - 2030 (USD Million)

- Table 87 Saudi Arabia Satellite Data Services Market, By Service 2018 - 2030 (USD Million)

- Table 88 Saudi Arabia Satellite Data Services Market, By End Use 2018 - 2030 (USD Million)

- Table 89 UAE Satellite Data Services Market, By Application 2018 - 2030 (USD Million)

- Table 90 UAE Satellite Data Services Market, By Deployment 2018 - 2030 (USD Million)

- Table 91 UAE Satellite Data Services Market, By Service 2018 - 2030 (USD Million)

- Table 92 UAE Satellite Data Services Market, By End Use 2018 - 2030 (USD Million)

- Table 93 South Africa Satellite Data Services Market, By Application 2018 - 2030 (USD Million)

- Table 94 South Africa Satellite Data Services Market, By Technology, 2018 - 2030 (USD Million)

- Table 95 South Africa Satellite Data Services Market, By Service 2018 - 2030 (USD Million)

- Table 96 South Africa Satellite Data Services Market, By End Use 2018 - 2030 (USD Million)

List of Figures

- Fig. 1 Satellite data services market segmentation

- Fig. 2 Information procurement

- Fig. 3 Data analysis models

- Fig. 4 Market formulation and validation

- Fig. 5 Data validating & publishing

- Fig. 6 Market snapshot

- Fig. 7 Segment snapshot (1/2)

- Fig. 8 Segment snapshot (2/2)

- Fig. 9 Competitive landscape snapshot

- Fig. 10 Industry value chain analysis

- Fig. 11 Market dynamics

- Fig. 12 PORTER's analysis

- Fig. 13 PESTEL analysis

- Fig. 14 Satellite data services market, by application: Key takeaways

- Fig. 15 Satellite data services market, by application: Market share, 2024 & 2030

- Fig. 16 Defense & Security market estimates & forecasts, 2018 - 2030 (USD Million)

- Fig. 17 Energy & Utilities market estimates & forecasts, 2018 - 2030 (USD Million)

- Fig. 18 Agriculture & Forestry market estimates & forecasts, 2018 - 2030 (USD Million)

- Fig. 19 Environmental & Climate Monitoring market estimates & forecasts, 2018 - 2030 (USD Million)

- Fig. 20 Engineering & Infrastructure Development market estimates & forecasts, 2018 - 2030 (USD Million)

- Fig. 21 Marine market estimates & forecasts, 2018 - 2030 (USD Million)

- Fig. 22 Others market estimates & forecasts, 2018 - 2030 (USD Million)

- Fig. 23 Satellite data services market, by organization size: Key takeaways

- Fig. 24 Satellite data services market, by deployment: Market share, 2024 & 2030

- Fig. 25 Private market estimates & forecasts, 2018 - 2030 (USD Million)

- Fig. 26 Public market estimates & forecasts, 2018 - 2030 (USD Million)

- Fig. 27 Hybrid market estimates & forecasts, 2018 - 2030 (USD Million)

- Fig. 28 Satellite data services market, by service: Key takeaways

- Fig. 29 Satellite data services market, by service: Market share, 2024 & 2030

- Fig. 30 Image Data Service market estimates & forecasts, 2018 - 2030 (USD Million)

- Fig. 31 Data analytics service market estimates & forecasts, 2018 - 2030 (USD Million)

- Fig. 32 Satellite Data Services market, by end use: Key takeaways

- Fig. 33 Satellite Data Services market, by end use: Market share, 2024 & 2030

- Fig. 34 Commercial market estimates & forecasts, 2018 - 2030 (USD Million)

- Fig. 35 Government and military market estimates & forecasts, 2018 - 2030 (USD Million)

- Fig. 36 Service providers market estimates & forecasts, 2018 - 2030 (USD Million)

- Fig. 37 Satellite data services market revenue by region, 2024 & 2030 (USD Million)

- Fig. 38 Regional marketplace: Key takeaways

- Fig. 39 North America influences marketing platform market estimates & forecasts, 2018 - 2030 (USD Million)

- Fig. 40 U.S. satellite data services market estimates & forecasts, 2018 - 2030 (USD Million)

- Fig. 41 Canada satellite data services market estimates & forecasts, 2018 - 2030 (USD Million)

- Fig. 42 Mexico satellite data services market estimates & forecasts, 2018 - 2030 (USD Million)

- Fig. 43 Europe satellite data services market estimates & forecasts, 2018 - 2030 (USD Million)

- Fig. 44 Germany satellite data services market estimates & forecasts, 2018 - 2030 (USD Million)

- Fig. 45 UK satellite data services market estimates & forecasts, 2018 - 2030 (USD Million)

- Fig. 46 France satellite data services market estimates & forecasts, 2018 - 2030 (USD Million)

- Fig. 47 Asia Pacific satellite data services market estimates & forecasts, 2018 - 2030 (USD Million)

- Fig. 48 China satellite data services market estimates & forecasts, 2018 - 2030 (USD Million)

- Fig. 49 Japan satellite data services market estimates & forecasts, 2018 - 2030 (USD Million)

- Fig. 50 India satellite data services market estimates & forecasts, 2018 - 2030 (USD Million)

- Fig. 51 South Korea satellite data services market estimates & forecasts, 2018 - 2030 (USD Million)

- Fig. 52 Australia satellite data services market estimates & forecasts, 2018 - 2030 (USD Million)

- Fig. 53 Latin America satellite data services market estimates & forecasts, 2018 - 2030 (USD Million)

- Fig. 54 Brazil satellite data services market estimates & forecasts, 2018 - 2030 (USD Million)

- Fig. 55 Middle East & Africa satellite data services market estimates & forecasts, 2018 - 2030 (USD Million)

- Fig. 56 Saudi Arabia satellite data services market estimates & forecasts, 2018 - 2030 (USD Million)

- Fig. 57 UAE satellite data services market estimates & forecasts, 2018 - 2030 (USD Million)

- Fig. 58 South Africa satellite data services market estimates & forecasts, 2018 - 2030 (USD Million)

- Fig. 59 Key company categorization

- Fig. 60 Strategic mapping

Satellite Data Services Market Growth & Trends:

The global satellite data services market size is estimated to reach USD 29.59 billion by 2030, registering a CAGR of 16.3% from 2025 to 2030, according to a new report by Grand View Research, Inc. Rising trend of privatizing the space among companies is expected to drive the growth. Extensive privatization is expected to offer satellite imagery adopters with much deeper and valuable spatial imagery insights, thus facilitating more intelligent decision making. Additionally, privatization of space facilitates higher competition amongst companies to develop new space technologies, which is expected to facilitate more rapid growth in the field of space technology.

Miniaturization of sensors is envisioned to facilitate the launching of several satellites in a single payload, thus reducing mission costs for imagery adopters and subsequently reducing entry barriers for new imagery providers. The opportunity to map larger areas using several small satellites is further expected to fuel the demand among imagery adopters, thus offering attractive growth opportunities. Increasing demand for data is promoting satellite manufacturers to launch small satellite constellations in the lower and medium orbits of Earth. Furthermore, incorporating nanoparticles in sensors offers enhanced sensitivity due to its small size and surface area, which makes it imperative to gain accurate data and enable sound decision making.

The fourth industrial revolution is also offering attractive growth prospects to the satellite data services market. The onset of Industry 4.0 also offers development opportunities to several satellite manufacturers, OEMs, and application developers, which is expected to promote disruption of legacy practices and offer better growth prospects to the market. Furthermore, Industry 4.0 is also expected to enhance productivity in the design and manufacturing stages of satellite development, subsequently offering economic growth projections over the next few years.

The emergence of Satellite-as-a-Service (SataaS) promises easier and affordable access to satellite imagery insights for users. The provision of a pay-as-you-go model for satellites in commercial applications is expected to offer better resource and time management capabilities. This is further expected to enable companies to bring their product closer to the consumer by allowing them to own the satellite for a specific amount of time to ensure sustainable growth in the market. An increasing number of small satellites and lower overall cost to deploy them makes SataaS a highly cost-effective option, thus promising industry-wide adoption amongst enterprises and medium-scale companies.

Satellite Data Services Market Report Highlights:

- The defense & security application segment dominated the market with a market share of over 25% in 2024, propelled by rising geopolitical tensions and the increasing need for national security.

- The data analytics service segment is expected to witness the highest CAGR over the forecast period, due to the increasing demand for actionable insights across industries such as agriculture, defense, environmental monitoring, and urban planning.

- The public deployment segment is expected to witness the highest CAGR over the forecast period, due to substantial government investments in space programs, Earth observation missions, and national security initiatives.

- Based on end-use, the commercial segment accounted for the largest market share in 2024, as businesses increasingly recognize the value of satellite data for competitive advantage.

- The satellite data services market in Asia Pacific is expected to grow at the highest CAGR over the forecast period. There is a surge in investment across the Asia Pacific region in earth observation programs that utilize satellite imagery for environmental monitoring and management.

Table of Contents

Chapter 1. Methodology and Scope

- 1.1. Market Segmentation and Scope

- 1.2. Market Definitions

- 1.2.1. Information analysis

- 1.2.2. Market formulation & data visualization

- 1.2.3. Data validation & publishing

- 1.3. Research Scope and Assumptions

- 1.3.1. List of Data Sources

Chapter 2. Executive Summary

- 2.1. Market Outlook

- 2.2. Segment Outlook

- 2.3. Competitive Insights

Chapter 3. Satellite Data Services Market Variables, Trends, & Scope

- 3.1. Market Lineage Outlook

- 3.2. Market Dynamics

- 3.2.1. Market Driver Analysis

- 3.2.2. Market Restraint Analysis

- 3.2.3. Deployment Challenge

- 3.3. Satellite Data Services Market Analysis Tools

- 3.3.1. Deployment Analysis - Porter's

- 3.3.1.1. Bargaining power of the suppliers

- 3.3.1.2. Bargaining power of the buyers

- 3.3.1.3. Threats of substitution

- 3.3.1.4. Threats from new entrants

- 3.3.1.5. Competitive rivalry

- 3.3.2. PESTEL Analysis

- 3.3.2.1. Political landscape

- 3.3.2.2. Economic and social landscape

- 3.3.2.3. Technological landscape

- 3.3.1. Deployment Analysis - Porter's

Chapter 4. Satellite Data Services Market: Application Estimates & Trend Analysis

- 4.1. Segment Dashboard

- 4.2. Satellite Data Services Market: Application Movement Analysis, 2024 & 2030 (USD Million)

- 4.3. Defense & Security

- 4.3.1. Defense & Security Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

- 4.4. Energy & Utilities

- 4.4.1. Energy & Utilities Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

- 4.5. Agriculture & Forestry

- 4.5.1. Agriculture & Forestry Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

- 4.6. Environmental & Climate Monitoring

- 4.6.1. Environment & Climate Monitoring Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

- 4.7. Engineering & Infrastructure Development

- 4.7.1. Engineering & Infrastructure Development Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

- 4.8. Marine

- 4.8.1. Marine Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

- 4.9. Others

- 4.9.1. Others Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 5. Satellite Data Services Market: Deployment Estimates & Trend Analysis

- 5.1. Segment Dashboard

- 5.2. Satellite Data Services Market: Deployment Movement Analysis, 2024 & 2030 (USD Million)

- 5.3. Private

- 5.3.1. Private Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

- 5.4. Public

- 5.4.1. Public Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

- 5.5. Hybrid

- 5.5.1. Hybrid Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 6. Satellite Data Services Market: Service Estimates & Trend Analysis

- 6.1. Segment Dashboard

- 6.2. Satellite Data Services Market: Service Movement Analysis, 2024 & 2030 (USD Million)

- 6.3. Image Data Service

- 6.3.1. Image Data Service Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

- 6.4. Data Analytics Service

- 6.4.1. Data Analytics Service Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 7. Satellite Data Services Market: End Use Estimates & Trend Analysis

- 7.1. Segment Dashboard

- 7.2. Satellite Data Services Market: End Use Movement Analysis, 2024 & 2030 (USD Million)

- 7.3. Commercial

- 7.3.1. Commercial Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

- 7.4. Government and Military

- 7.4.1. Government and Military Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

- 7.5. Service Providers

- 7.5.1. Service Providers Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 8. Regional Estimates & Trend Analysis

- 8.1. Satellite Data Services Market by Region, 2024 & 2030

- 8.2. North America

- 8.2.1. North America Satellite data services market estimates & forecasts, 2018 - 2030 (USD Million)

- 8.2.2. U.S.

- 8.2.2.1. Satellite Data Services Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 8.2.3. Canada

- 8.2.3.1. Canada Satellite Data Services Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 8.2.4. Mexico

- 8.2.4.1. Mexico Satellite Data Services Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 8.3. Europe

- 8.3.1. Europe Satellite Data Services Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 8.3.2. UK

- 8.3.2.1. UK Satellite Data Services Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 8.3.3. Germany

- 8.3.3.1. Germany Satellite Data Services Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 8.3.4. France

- 8.3.4.1. France Satellite Data Services Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 8.4. Asia Pacific

- 8.4.1. Asia Pacific Satellite Data Services Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 8.4.2. China

- 8.4.2.1. China Satellite Data Services Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 8.4.3. Japan

- 8.4.3.1. Japan Satellite Data Services Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 8.4.4. India

- 8.4.4.1. India Satellite Data Services Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 8.4.5. South Korea

- 8.4.5.1. South Korea Satellite Data Services Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 8.4.6. Australia

- 8.4.6.1. Australia Satellite Data Services Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 8.5. Latin America

- 8.5.1. Latin America Satellite Data Services Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 8.5.2. Brazil

- 8.5.2.1. Brazil Satellite Data Services Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 8.6. Middle East and Africa

- 8.6.1. Middle East and Africa Satellite Data Services Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 8.6.2. Saudi Arabia

- 8.6.2.1. Saudi Arabia Satellite Data Services Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 8.6.3. South Africa

- 8.6.3.1. South Africa Satellite Data Services Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 8.6.4. UAE

- 8.6.4.1. UAE Satellite Data Services Market Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 9. Competitive Landscape

- 9.1. Company Categorization

- 9.2. Company Market Positioning

- 9.3. Company Heat Map Analysis

- 9.4. Company Profiles/Listing

- 9.4.1. Maxar Technologies Holdings Inc. (Maxar)

- 9.4.1.1. Participant's Overview

- 9.4.1.2. Financial Performance

- 9.4.1.3. Service Benchmarking

- 9.4.1.4. Strategic Initiatives

- 9.4.2. Planet Labs PBC.

- 9.4.2.1. Participant's Overview

- 9.4.2.2. Financial Performance

- 9.4.2.3. Service Benchmarking

- 9.4.2.4. Strategic Initiatives

- 9.4.3. Airbus SE

- 9.4.3.1. Participant's Overview

- 9.4.3.2. Financial Performance

- 9.4.3.3. Service Benchmarking

- 9.4.3.4. Strategic Initiatives

- 9.4.4. ICEYE

- 9.4.4.1. Participant's Overview

- 9.4.4.2. Financial Performance

- 9.4.4.3. Service Benchmarking

- 9.4.4.4. Strategic Initiatives

- 9.4.5. L3Harris Technologies, Inc.

- 9.4.5.1. Participant's Overview

- 9.4.5.2. Financial Performance

- 9.4.5.3. Service Benchmarking

- 9.4.5.4. Strategic Initiatives

- 9.4.6. Earth-i Ltd

- 9.4.6.1. Participant's Overview

- 9.4.6.2. Financial Performance

- 9.4.6.3. Service Benchmarking

- 9.4.6.4. Strategic Initiatives

- 9.4.7. Geocento Limited

- 9.4.7.1. Participant's Overview

- 9.4.7.2. Financial Performance

- 9.4.7.3. Service Benchmarking

- 9.4.7.4. Strategic Initiatives

- 9.4.8. NV5 Global, Inc.

- 9.4.8.1. Participant's Overview

- 9.4.8.2. Financial Performance

- 9.4.8.3. Service Benchmarking

- 9.4.8.4. Strategic Initiatives

- 9.4.9. Satellite Imaging Corporation

- 9.4.9.1. Participant's Overview

- 9.4.9.2. Financial Performance

- 9.4.9.3. Service Benchmarking

- 9.4.9.4. Strategic Initiatives

- 9.4.10. Satpalda

- 9.4.10.1. Participant's Overview

- 9.4.10.2. Financial Performance

- 9.4.10.3. Service Benchmarking

- 9.4.10.4. Strategic Initiatives

- 9.4.11. Telstra

- 9.4.11.1. Participant's Overview

- 9.4.11.2. Financial Performance

- 9.4.11.3. Service Benchmarking

- 9.4.11.4. Strategic Initiatives

- 9.4.12. Ursa Space Systems Inc.

- 9.4.12.1. Participant's Overview

- 9.4.12.2. Financial Performance

- 9.4.12.3. Service Benchmarking

- 9.4.12.4. Strategic Initiatives

- 9.4.13. Geospatial Intelligence Pty Ltd

- 9.4.13.1. Participant's Overview

- 9.4.13.2. Financial Performance

- 9.4.13.3. Service Benchmarking

- 9.4.13.4. Strategic Initiatives

- 9.4.1. Maxar Technologies Holdings Inc. (Maxar)