|

|

市場調査レポート

商品コード

1373316

動物用電気手術の世界市場:製品別(バイポーラ、モノポーラ、消耗品)、用途別(一般、婦人科、歯科、整形外科、眼科)、動物タイプ別、エンドユーザー別(動物病院、クリニック)、主要市場関係者&購買基準、アンメットニーズ - 2028年までの予測Veterinary Electrosurgery Market by Product (Bipolar, Monopolar, Consumables), Application (General, Gynecology, Dental, Orthopedic, Ophthalmic), Animals, End User (Vet. Hospital, Clinic), Key Stakeholder & Buying Criteria, Unmet Need - Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 動物用電気手術の世界市場:製品別(バイポーラ、モノポーラ、消耗品)、用途別(一般、婦人科、歯科、整形外科、眼科)、動物タイプ別、エンドユーザー別(動物病院、クリニック)、主要市場関係者&購買基準、アンメットニーズ - 2028年までの予測 |

|

出版日: 2023年10月10日

発行: MarketsandMarkets

ページ情報: 英文 226 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2028年 |

| 基準年 | 2022年 |

| 予測期間 | 2023年~2028年 |

| 検討単位 | 100万米ドル |

| セグメント | 製品タイプ別、用途別、動物タイプ別、エンドユーザー別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

動物用電気手術の市場規模は、2023年に推8,500万米ドルとなるとみられ、2028年には1億2,000万米ドルに達すると予測されており、予測期間中のCAGRは7.3%と見込まれています。

動物用電気手術市場は、動物手術の精度に対するニーズの高まりに後押しされています。高度な電気外科技術により、獣医師は組織損傷を減らし、凝固を強化して手術を行うことができるため、回復が早く、合併症の発生率も低くなります。ペット数の増加と専門的な獣医療の急増が市場を牽引しています。さらに、AIの統合、安全性の向上、特殊な器具の開発などの技術的進歩が主な促進要因となっており、優れた手術結果をもたらす電気外科手術の獣医療における隆盛を確実なものにしています。

動物用電気手術市場は、製品によってモノポーラ器具、バイポーラ器具、消耗品&アクセサリーに大別されます。製品別では、2022年にはバイポーラが独占的となっています。バイポーラは、動物手術における正確で局所的な組織制御の需要により繁栄しています。AIの統合や安全機能の向上などの技術の進歩が、動物医療におけるより安全で効率的な外科手術を保証し、その成長を後押ししています。

2022年、動物用電気手術市場は小動物カテゴリーが独占的でした。ペット数の増加は、AI統合や安全性強化のような技術的進歩と相まって、小動物の手術でより良い結果を得るための電気手術の採用を促進します。

予測期間中、アジア太平洋は最も速い速度で成長すると予測されています。この地域の動物用電気手術市場の成長を促進する主な要因は、動物人口の増加、一人当たり所得の上昇、主要企業による動物ヘルスケア産業への投資の増加、高度な技術に対する需要の増加、アジア太平洋の様々な国における民間セクターの動物病院の拡大です。

当レポートでは、世界の動物用電気手術市場について調査し、製品別、用途別、動物別、エンドユーザー別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 業界の動向

- 技術分析

- 価格分析

- バリューチェーン分析

- サプライチェーン分析

- 生態系/市場マップ

- ポーターのファイブフォース分析

- 特許分析

- 主要な会議とイベント

- 貿易分析:HSコード

- 動物用電気手術市場:アンメットニーズ

- 動物用電気手術市場に対するエンドユーザーの期待

- 規制分析

- 規制機関、政府機関、その他の組織

- 主要な利害関係者と購入基準

- ケーススタディ分析

第6章 動物用電気手術市場、製品別

- イントロダクション

- バイポーラ機器

- モノポーラ機器

- 消耗品と付属品

第7章 動物用電気手術市場、用途別

- イントロダクション

- 一般外科

- 婦人科・泌尿器外科

- 歯科

- 眼科

- 整形外科

- その他

第8章 動物用電気手術市場、動物タイプ別

- イントロダクション

- 小動物

- 大型動物

第9章 動物用電気手術市場、エンドユーザー別

- イントロダクション

- 動物病院

- 獣医クリニック

- その他

第10章 動物用電気手術市場、地域別

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- ラテンアメリカ

- 中東・アフリカ

第11章 競合情勢

- 概要

- 主要参入企業の戦略

- 収益シェア分析

- 市場シェア分析

- 企業評価マトリックス

- 新興企業/中小企業の評価マトリックス

- 競争シナリオと動向

第12章 企業プロファイル

- 主要参入企業

- MEDTRONIC PLC

- B. BRAUN MELSUNGEN AG

- INTEGRA LIFESCIENCES

- OLYMPUS CORPORATION

- COVETRUS, INC.

- SYMMETRY SURGICAL, INC.

- AVANTE ANIMAL HEALTH

- SUMMIT HILL LABORATORIES

- BURTONS MEDICAL EQUIPMENT LTD.

- EICKEMEYER

- KLS MARTIN GROUP

- MACAN MANUFACTURING

- XCELLANCE MEDICAL TECHNOLOGIES PVT. LTD.

- ALSA APPARECCHI MEDICALI SRL

- KENTAMED LTD.

- PROMISE TECHNOLOGY CO., LTD.

- SHANGHAI HUIFENG MEDICAL INSTRUMENT CO., LTD.

- KWANZA VETERINARY

- KEEBOVET VETERINARY ULTRASOUND EQUIPMENT

- LED SPA

- その他の企業

- KARL STORZ

- HEAL FORCE

- SPECIAL MEDICAL TECHNOLOGY, CO. LTD.

- BEIJING TAKTVOLL TECHNOLOGY CO., LTD.

- NANJING SHOULIANG-MED TECHNOLOGY CO., LTD.

- ALAN ELECTRONIC SYSTEMS PVT. LTD.

- DELTRONIX MEDICAL DEVICES

第13章 付録

Report Description

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2028 |

| Base Year | 2022 |

| Forecast Period | 2023-2028 |

| Units Considered | Value (USD) Million |

| Segments | By product, application, animal type, end user and region |

| Regions covered | North America, Europe, APAC, RoW |

The veterinary electrosurgery market is valued at an estimated USD 85 million in 2023 and is projected to reach USD 120 million by 2028, at a CAGR of 7.3% during the forecast period. The veterinary electrosurgery market is propelled by the increasing need for precision in animal surgeries. Advanced electrosurgical technology allows veterinarians to perform procedures with reduced tissue damage and enhanced coagulation, resulting in quicker recoveries and lower complication rates. The growing pet population, coupled with a surge in specialized veterinary care, drives the market. Additionally, technological advancements such as AI integration, safety enhancements, and specialized instrument development are key drivers, ensuring electrosurgery's prominence in veterinary medicine for delivering superior surgical outcomes.

"The bipolar instruments segment is projected to witness the highest growth in the veterinary electrosurgery market, by products, during the forecast period."

The veterinary electrosurgery market can be broadly classified into monopolar instruments, bipolar instruments, and consumables & accessories, depending on the product. The veterinary electrosurgery market by product was dominated by the bipolar instruments segment in 2022. The bipolar veterinary electrosurgery market thrives due to demand for precise, localized tissue control in animal surgeries. Technology advancements, including AI integration and improved safety features, drive its growth, ensuring safer and more efficient surgical procedures in veterinary medicine.

"The small animals segment, by product type, has the highest rate during the forecast period."

Small animals and large animals make up the veterinary electrosurgery market by animal type. In 2022, the market for veterinary electrosurgery was dominated by the small animals category. The growing pet population, coupled with technological advancements like AI integration and safety enhancements, drives the adoption of electrosurgery for better outcomes in small animal surgeries.

"Asia Pacific market to witness the highest growth during the forecast period."

During the forecast period, APAC is anticipated to grow at the fastest rate. The major factors promoting the growth of the veterinary electrosurgery market in this region are the growing number of animal population, rising per capita income, growing investments in the animal healthcare industry by key players, increasing demands for advanced technologies, and expansion of private sector veterinary hospitals in various countries in the Asia Pacific.

A breakdown of the primary participants (supply-side) for the veterinary electrosurgery market referred to for this report is provided below:

- By Company Type: Tier 1: 42%, Tier 2: 35%, and Tier 3: 23%

- By Designation: C-level Executives: 28%, Directors: 35%, and Others: 37%

- By Region: North America: 33%, Europe: 24%, Asia Pacific: 18%, Latin America: 10%; Middle East: 10%; Africa: 5%

The prominent players operating in the veterinary electrosurgery market are Medtronic (Ireland), B. Braun (Germany), Integra LifeSciences (US), Olympus Corporation (Japan), Covetrus, Inc. (US), Symmetry Surgical, Inc. (US), Avante Animal Health (DRE Veterinary) (US), Summit Hill Laboratories (US), Burtons Medical Equipment Limited (UK), Eickemeyer (Germany), KLS Martin (Germany), Macan Manufacturing (US), XcelLance Medical Technologies Pvt. Ltd. (India), Alsa Apparecchi Medicali SRL (Italy), and Kentamed Ltd. (Europe).

Research Coverage:

The market study covers the veterinary electrosurgery market across various segments. It aims at estimating the market size and the growth potential of this market across different segments by product, application, animal type, end-user, and region. The study also includes an in-depth competitive analysis of the key players in the market, along with their company profiles, key observations related to their product and business offerings, recent developments, and key market strategies.

Reasons to Buy the Report

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall veterinary electrosurgery market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

This report provides insights into the following pointers:

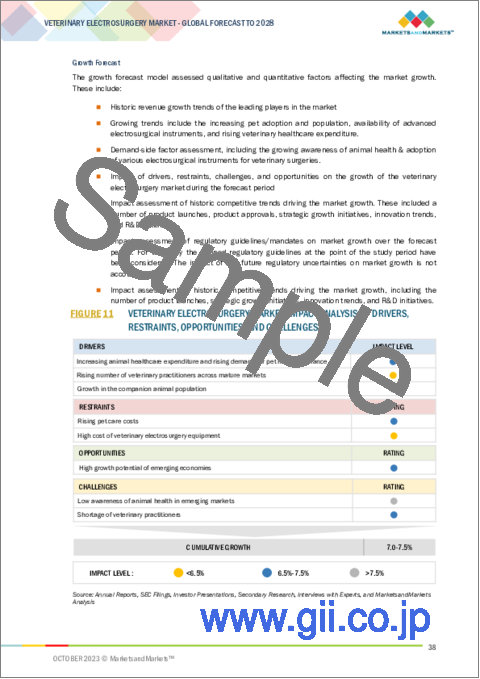

- Analysis of key drivers (Rising demand for pet health insurance and increasing animal health expenditure, Rising number of veterinary practitioners in developed economies, Growth in the companion animal population), restraints (Rising pet care costs, High cost of veterinary electrosurgery equipment), opportunities (Untapped emerging markets) and challenges (Low animal health awareness in emerging markets, Shortage of veterinary practitioners in developing economies) influencing the growth of the veterinary electrosurgery market

- Market Penetration: Comprehensive information on product portfolios offered by the top players in the global veterinary electrosurgery market. The report analyzes this market by product, application, animal type, end user, and region.

- Product Enhancement/Innovation: Detailed insights on upcoming trends and product launches in the global veterinary electrosurgery market.

- Market Development: Comprehensive information on the lucrative emerging markets by product, application, animal type, end user, and region.

- Market Diversification: Exhaustive information about new products and services, growing geographies, recent developments, and investments in the global veterinary electrosurgery market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, product and service offerings, and capabilities of leading players in the global veterinary electrosurgery market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 PRODUCT DEFINITION

- 1.2.2 APPLICATION DEFINITION

- 1.2.3 ANIMAL TYPE DEFINITION

- 1.2.4 END-USER DEFINITION

- 1.2.5 INCLUSIONS AND EXCLUSIONS

- 1.2.6 MARKET SCOPE

- FIGURE 1 MARKETS COVERED

- 1.2.7 YEARS CONSIDERED

- 1.2.8 CURRENCY CONSIDERED

- TABLE 1 STANDARD CURRENCY CONVERSION RATES

- 1.3 STAKEHOLDERS

- 1.4 SUMMARY OF CHANGES

- 1.5 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- FIGURE 3 PRIMARY SOURCES

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE PARTICIPANTS

- FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 6 MARKET SIZE APPROACH: REVENUE SHARE ANALYSIS

- FIGURE 7 VETERINARY ELECTROSURGERY MARKET: REVENUE SHARE ANALYSIS ILLUSTRATION OF MEDTRONIC

- FIGURE 8 TOP-DOWN APPROACH

- FIGURE 9 DEMAND-SIDE MARKET ESTIMATION: BIPOLAR AND MONOPOLAR ELECTROSURGICAL INSTRUMENTS

- FIGURE 10 DEMAND-SIDE MARKET ESTIMATION: VETERINARY ELECTROSURGERY CONSUMABLES AND ACCESSORIES

- FIGURE 11 VETERINARY ELECTROSURGERY MARKET: IMPACT ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 12 VETERINARY ELECTROSURGERY MARKET: CAGR PROJECTIONS

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 13 DATA TRIANGULATION METHODOLOGY

- 2.4 MARKET RANKING ANALYSIS

- 2.5 STUDY ASSUMPTIONS

- 2.6 RISK ASSESSMENT

- TABLE 2 RISK ASSESSMENT ANALYSIS

- 2.7 LIMITATIONS

- 2.7.1 METHODOLOGY-RELATED LIMITATIONS

- 2.7.2 SCOPE-RELATED LIMITATIONS

- 2.8 RECESSION IMPACT ANALYSIS

3 EXECUTIVE SUMMARY

- FIGURE 14 VETERINARY ELECTROSURGERY MARKET, BY PRODUCT, 2023 VS. 2028 (USD MILLION)

- FIGURE 15 VETERINARY ELECTROSURGERY MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 16 VETERINARY ELECTROSURGERY MARKET, BY ANIMAL TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 17 VETERINARY ELECTROSURGERY MARKET, BY END USER, 2023 VS. 2028 (USD MILLION)

- FIGURE 18 GEOGRAPHICAL SNAPSHOT: VETERINARY ELECTROSURGERY MARKET

4 PREMIUM INSIGHTS

- 4.1 VETERINARY ELECTROSURGERY MARKET OVERVIEW

- FIGURE 19 GROWTH IN COMPANION ANIMAL POPULATION AND RISING PET HEALTH EXPENDITURE TO DRIVE MARKET DURING FORECAST PERIOD

- 4.2 NORTH AMERICA: VETERINARY ELECTROSURGERY MARKET, BY PRODUCT (2022)

- FIGURE 20 BIPOLAR INSTRUMENTS SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

- 4.3 VETERINARY ELECTROSURGERY MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- FIGURE 21 CHINA TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

- 4.4 VETERINARY ELECTROSURGERY MARKET: DEVELOPED VS. EMERGING MARKETS

- FIGURE 22 EMERGING MARKETS TO REGISTER HIGHER GROWTH RATES DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- TABLE 3 VETERINARY ELECTROSURGERY MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing animal healthcare expenditure and rising demand for pet health insurance

- FIGURE 23 US: PET INDUSTRY EXPENDITURE (2010-2021)

- TABLE 4 BREAKDOWN OF PET INDUSTRY EXPENDITURE IN US (2020-2021) (USD BILLION)

- 5.2.1.2 Rising number of veterinary practitioners across mature markets

- 5.2.1.3 Growth in companion animal population

- TABLE 5 PET POPULATION, BY ANIMAL TYPE, 2014-2020 (MILLION)

- TABLE 6 EUROPE: PET POPULATION, BY COUNTRY, 2014-2022 (MILLION)

- 5.2.2 RESTRAINTS

- 5.2.2.1 Rising pet care costs

- FIGURE 24 BASIC ANNUAL EXPENSES FOR DOGS AND CATS IN US, 2021

- 5.2.2.2 High cost of veterinary electrosurgery equipment

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growth potential of emerging economies

- 5.2.4 CHALLENGES

- 5.2.4.1 Low awareness of animal health in emerging markets

- 5.2.4.2 Shortage of veterinary practitioners

- 5.3 INDUSTRY TRENDS

- 5.3.1 TECHNOLOGICAL ADVANCEMENTS IN ELECTROSURGERY UNITS

- 5.3.2 EXPANSION OF VETERINARY BUSINESSES

- 5.4 TECHNOLOGY ANALYSIS

- 5.4.1 ADVANCED BIPOLAR VESSEL SEALING SYSTEMS

- 5.4.2 ADOPTION OF BIG DATA AND ANIMAL WEARABLE DEVICES

- 5.4.3 USE OF AI IN VETERINARY ELECTROSURGERY

- TABLE 7 AI INTEGRATION IN VETERINARY ELECTROSURGERY

- 5.5 PRICING ANALYSIS

- TABLE 8 REGIONAL PRICING ANALYSIS OF VETERINARY ELECTROSURGERY PRODUCTS, 2022 (USD THOUSAND)

- 5.6 VALUE CHAIN ANALYSIS

- FIGURE 25 VETERINARY ELECTROSURGERY MARKET: VALUE CHAIN ANALYSIS

- 5.7 SUPPLY CHAIN ANALYSIS

- FIGURE 26 VETERINARY ELECTROSURGERY MARKET: SUPPLY CHAIN ANALYSIS

- 5.8 ECOSYSTEM/MARKET MAP

- FIGURE 27 VETERINARY ELECTROSURGERY MARKET: ECOSYSTEM/MARKET MAP

- 5.9 PORTER'S FIVE FORCES ANALYSIS

- TABLE 9 VETERINARY ELECTROSURGERY MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.9.1 THREAT OF NEW ENTRANTS

- 5.9.2 THREAT OF SUBSTITUTES

- 5.9.3 BARGAINING POWER OF SUPPLIERS

- 5.9.4 BARGAINING POWER OF BUYERS

- 5.9.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.10 PATENT ANALYSIS

- 5.10.1 PATENT PUBLICATION TRENDS FOR VETERINARY ELECTROSURGERY MARKET

- FIGURE 28 PATENT PUBLICATION TRENDS (JANUARY 2013-OCTOBER 2023)

- 5.10.2 INSIGHTS: JURISDICTION AND TOP APPLICANT ANALYSIS

- FIGURE 29 TOP APPLICANTS & OWNERS (COMPANIES/INSTITUTIONS) FOR VETERINARY ELECTROSURGERY PATENTS (JANUARY 2013-OCTOBER 2023)

- FIGURE 30 TOP APPLICANT COUNTRIES FOR VETERINARY ELECTROSURGERY (JANUARY 2013-OCTOBER 2023)

- TABLE 10 LIST OF PATENTS/PATENT APPLICATIONS IN VETERINARY ELECTROSURGERY MARKET, 2020-2023

- 5.11 KEY CONFERENCES AND EVENTS

- TABLE 11 KEY CONFERENCES AND EVENTS (2023-2024)

- 5.12 TRADE ANALYSIS: HS CODES

- TABLE 12 HS CODES FOR VETERINARY ELECTROSURGERY INSTRUMENTS & CONSUMABLES

- 5.13 VETERINARY ELECTROSURGERY MARKET: UNMET NEEDS

- TABLE 13 UNMET NEEDS ANALYSIS

- 5.14 END-USER EXPECTATIONS FOR VETERINARY ELECTROSURGERY MARKET

- TABLE 14 END-USER EXPECTATION ANALYSIS

- 5.15 REGULATORY ANALYSIS

- 5.15.1 US

- 5.15.2 EUROPE

- 5.16 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

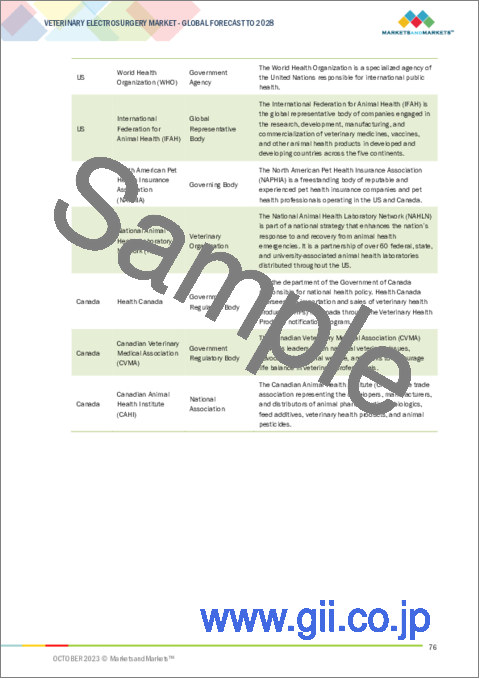

- TABLE 15 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.17 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.17.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 31 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR VETERINARY ELECTROSURGERY PRODUCTS

- TABLE 18 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR VETERINARY ELECTROSURGERY PRODUCTS

- 5.17.2 BUYING CRITERIA FOR PRODUCTS

- FIGURE 32 KEY BUYING CRITERIA FOR VETERINARY ELECTROSURGERY PRODUCTS

- TABLE 19 KEY BUYING CRITERIA FOR PRODUCTS, BY RANKING ANALYSIS

- 5.18 CASE STUDY ANALYSIS

- TABLE 20 CASE STUDY 1: ESTIMATING MARKET SIZE OF VETERINARY DIAGNOSTICS PRODUCTS AND MARKET SHARE ANALYSIS FOR KEY PRODUCTS (COUNTRY-LEVEL)

- TABLE 21 CASE STUDY 2: ESTIMATING MARKET SIZE OF VETERINARY SURGICAL INSTRUMENTS AND MARKET SHARE ANALYSIS FOR KEY PRODUCTS (COUNTRY-LEVEL)

6 VETERINARY ELECTROSURGERY MARKET, BY PRODUCT

- 6.1 INTRODUCTION

- TABLE 22 VETERINARY ELECTROSURGERY MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- 6.2 BIPOLAR INSTRUMENTS

- 6.2.1 ABILITY TO RESTRICT DAMAGE TO SURROUNDING TISSUES TO PROPEL MARKET

- TABLE 23 VETERINARY ELECTROSURGERY MARKET FOR BIPOLAR INSTRUMENTS, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.3 MONOPOLAR INSTRUMENTS

- 6.3.1 HIGH PRECISION AND IMPROVED SAFETY FEATURES TO DRIVE MARKET

- TABLE 24 VETERINARY ELECTROSURGERY MARKET FOR MONOPOLAR INSTRUMENTS, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.4 CONSUMABLES & ACCESSORIES

- 6.4.1 GROWING ADOPTION OF ELECTROSURGICAL INSTRUMENTS TO DRIVE MARKET

- TABLE 25 VETERINARY ELECTROSURGERY MARKET FOR CONSUMABLES & ACCESSORIES, BY COUNTRY, 2021-2028 (USD MILLION)

7 VETERINARY ELECTROSURGERY MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- TABLE 26 VETERINARY ELECTROSURGERY MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 7.2 GENERAL SURGERY

- 7.2.1 RISING NUMBER OF SOFT TISSUE SURGERIES TO DRIVE MARKET

- TABLE 27 VETERINARY ELECTROSURGERY MARKET FOR GENERAL SURGERY, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.3 GYNECOLOGICAL & UROLOGICAL SURGERY

- 7.3.1 GROWING PREFERENCE FOR MIS TECHNIQUES TO DRIVE MARKET

- TABLE 28 GYNECOLOGICAL SURGERIES PERFORMED, BY ANIMAL TYPE

- TABLE 29 VETERINARY ELECTROSURGERY MARKET FOR GYNECOLOGICAL & UROLOGICAL SURGERY, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.4 DENTAL SURGERY

- 7.4.1 RISING FOCUS ON ORAL HYGIENE TO SUPPORT MARKET GROWTH

- TABLE 30 VETERINARY ELECTROSURGERY MARKET FOR DENTAL SURGERY, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.5 OPHTHALMIC SURGERY

- 7.5.1 CATARACTS AND CORNEAL INFECTIONS IN COMPANION ANIMALS TO PROPEL MARKET

- TABLE 31 VETERINARY ELECTROSURGERY MARKET FOR OPHTHALMIC SURGERY, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.6 ORTHOPEDIC SURGERY

- 7.6.1 RISING INCIDENCE OF OSTEOARTHRITIS TO SUPPORT MARKET GROWTH

- TABLE 32 VETERINARY ELECTROSURGERY MARKET FOR ORTHOPEDIC SURGERY, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.7 OTHER APPLICATIONS

- TABLE 33 VETERINARY ELECTROSURGERY MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2021-2028 (USD MILLION)

8 VETERINARY ELECTROSURGERY MARKET, BY ANIMAL TYPE

- 8.1 INTRODUCTION

- TABLE 34 VETERINARY ELECTROSURGERY MARKET, BY ANIMAL TYPE, 2021-2028 (USD MILLION)

- 8.2 SMALL ANIMALS

- 8.2.1 GROWTH IN COMPANION ANIMAL POPULATION TO DRIVE MARKET

- TABLE 35 VETERINARY ELECTROSURGERY MARKET FOR SMALL ANIMALS, BY COUNTRY, 2021-2028 (USD MILLION)

- 8.3 LARGE ANIMALS

- 8.3.1 RISING FOCUS ON ANIMAL HEALTH & WELL-BEING TO SUPPORT MARKET

- FIGURE 33 ANNUAL PER CAPITA MEAT CONSUMPTION PROJECTIONS, EMERGING VS. MATURE MARKETS (2020-2030)

- TABLE 36 VETERINARY ELECTROSURGERY MARKET FOR LARGE ANIMALS, BY COUNTRY, 2021-2028 (USD MILLION)

9 VETERINARY ELECTROSURGERY MARKET, BY END USER

- 9.1 INTRODUCTION

- TABLE 37 VETERINARY ELECTROSURGERY MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.2 VETERINARY HOSPITALS

- 9.2.1 RISING DEMAND FOR ADVANCED INSTRUMENTS IN EMERGENCY CARE TO DRIVE MARKET

- TABLE 38 VETERINARY ELECTROSURGERY MARKET FOR VETERINARY HOSPITALS, BY COUNTRY, 2021-2028 (USD MILLION)

- 9.3 VETERINARY CLINICS

- 9.3.1 RISING PET OWNERSHIP RATES TO PROPEL MARKET

- TABLE 39 VETERINARY ELECTROSURGERY MARKET FOR VETERINARY CLINICS, BY COUNTRY, 2021-2028 (USD MILLION)

- 9.4 OTHER END USERS

- TABLE 40 VETERINARY ELECTROSURGERY MARKET FOR OTHER END USERS, BY COUNTRY, 2021-2028 (USD MILLION)

10 VETERINARY ELECTROSURGERY MARKET, BY REGION

- 10.1 INTRODUCTION

- FIGURE 34 GEOGRAPHIC GROWTH OPPORTUNITIES

- TABLE 41 VETERINARY ELECTROSURGERY MARKET, BY REGION, 2021-2028 (USD MILLION)

- 10.2 NORTH AMERICA

- FIGURE 35 NORTH AMERICA: VETERINARY ELECTROSURGERY MARKET SNAPSHOT

- TABLE 42 NORTH AMERICA: VETERINARY ELECTROSURGERY MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 43 NORTH AMERICA: VETERINARY ELECTROSURGERY MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 44 NORTH AMERICA: VETERINARY ELECTROSURGERY MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 45 NORTH AMERICA: VETERINARY ELECTROSURGERY MARKET, BY ANIMAL TYPE, 2021-2028 (USD MILLION)

- TABLE 46 NORTH AMERICA: VETERINARY ELECTROSURGERY MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.2.1 US

- 10.2.1.1 Rising expenditure on animal health to drive market

- TABLE 47 US: KEY MACROINDICATORS

- TABLE 48 US: VETERINARY ELECTROSURGERY MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 49 US: VETERINARY ELECTROSURGERY MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 50 US: VETERINARY ELECTROSURGERY MARKET, BY ANIMAL TYPE, 2021-2028 (USD MILLION)

- TABLE 51 US: VETERINARY ELECTROSURGERY MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.2.2 CANADA

- 10.2.2.1 Growing demand for pet care services to propel market

- TABLE 52 CANADA: KEY MACROINDICATORS

- TABLE 53 CANADA: VETERINARY ELECTROSURGERY MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 54 CANADA: VETERINARY ELECTROSURGERY MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 55 CANADA: VETERINARY ELECTROSURGERY MARKET, BY ANIMAL TYPE, 2021-2028 (USD MILLION)

- TABLE 56 CANADA: VETERINARY ELECTROSURGERY MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.2.3 NORTH AMERICA: RECESSION IMPACT

- 10.3 EUROPE

- TABLE 57 EUROPE: VETERINARY ELECTROSURGERY MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 58 EUROPE: VETERINARY ELECTROSURGERY MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 59 EUROPE: VETERINARY ELECTROSURGERY MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 60 EUROPE: VETERINARY ELECTROSURGERY MARKET, BY ANIMAL TYPE, 2021-2028 (USD MILLION)

- TABLE 61 EUROPE: VETERINARY ELECTROSURGERY MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.3.1 GERMANY

- 10.3.1.1 Rising demand for animal-derived food products to drive market

- TABLE 62 GERMANY: KEY MACROINDICATORS

- TABLE 63 GERMANY: VETERINARY ELECTROSURGERY MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 64 GERMANY: VETERINARY ELECTROSURGERY MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 65 GERMANY: VETERINARY ELECTROSURGERY MARKET, BY ANIMAL TYPE, 2021-2028 (USD MILLION)

- TABLE 66 GERMANY: VETERINARY ELECTROSURGERY MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.3.2 UK

- 10.3.2.1 Rising incidence of chronic diseases in companion animals to boost demand

- TABLE 67 UK: KEY MACROINDICATORS

- TABLE 68 UK: VETERINARY ELECTROSURGERY MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 69 UK: VETERINARY ELECTROSURGERY MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 70 UK: VETERINARY ELECTROSURGERY MARKET, BY ANIMAL TYPE, 2021-2028 (USD MILLION)

- TABLE 71 UK: VETERINARY ELECTROSURGERY MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.3.3 FRANCE

- 10.3.3.1 Increasing awareness about animal health to support market growth

- TABLE 72 FRANCE: KEY MACROINDICATORS

- TABLE 73 FRANCE: VETERINARY ELECTROSURGERY MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 74 FRANCE: VETERINARY ELECTROSURGERY MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 75 FRANCE: VETERINARY ELECTROSURGERY MARKET, BY ANIMAL TYPE, 2021-2028 (USD MILLION)

- TABLE 76 FRANCE: VETERINARY ELECTROSURGERY MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.3.4 ITALY

- 10.3.4.1 Growing establishment of veterinary practices to boost demand

- TABLE 77 ITALY: KEY MACROINDICATORS

- TABLE 78 ITALY: VETERINARY ELECTROSURGERY MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 79 ITALY: VETERINARY ELECTROSURGERY MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 80 ITALY: VETERINARY ELECTROSURGERY MARKET, BY ANIMAL TYPE, 2021-2028 (USD MILLION)

- TABLE 81 ITALY: VETERINARY ELECTROSURGERY MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.3.5 SPAIN

- 10.3.5.1 Rising awareness of animal health to support market growth

- TABLE 82 SPAIN: KEY MACROINDICATORS

- TABLE 83 SPAIN: VETERINARY ELECTROSURGERY MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 84 SPAIN: VETERINARY ELECTROSURGERY MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 85 SPAIN: VETERINARY ELECTROSURGERY MARKET, BY ANIMAL TYPE, 2021-2028 (USD MILLION)

- TABLE 86 SPAIN: VETERINARY ELECTROSURGERY MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.3.6 REST OF EUROPE

- TABLE 87 REST OF EUROPE: VETERINARY ELECTROSURGERY MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 88 REST OF EUROPE: VETERINARY ELECTROSURGERY MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 89 REST OF EUROPE: VETERINARY ELECTROSURGERY MARKET, BY ANIMAL TYPE, 2021-2028 (USD MILLION)

- TABLE 90 REST OF EUROPE: VETERINARY ELECTROSURGERY MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.3.7 EUROPE: RECESSION IMPACT

- 10.4 ASIA PACIFIC

- FIGURE 36 ASIA PACIFIC: VETERINARY ELECTROSURGERY MARKET SNAPSHOT

- TABLE 91 ASIA PACIFIC: VETERINARY ELECTROSURGERY MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 92 ASIA PACIFIC: VETERINARY ELECTROSURGERY MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 93 ASIA PACIFIC: VETERINARY ELECTROSURGERY MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 94 ASIA PACIFIC: VETERINARY ELECTROSURGERY MARKET, BY ANIMAL TYPE, 2021-2028 (USD MILLION)

- TABLE 95 ASIA PACIFIC: VETERINARY ELECTROSURGERY MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.4.1 CHINA

- 10.4.1.1 High incidence of zoonotic diseases to drive market

- TABLE 96 CHINA: KEY MACROINDICATORS

- TABLE 97 CHINA: VETERINARY ELECTROSURGERY MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 98 CHINA: VETERINARY ELECTROSURGERY MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 99 CHINA: VETERINARY ELECTROSURGERY MARKET, BY ANIMAL TYPE, 2021-2028 (USD MILLION)

- TABLE 100 CHINA: VETERINARY ELECTROSURGERY MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.4.2 JAPAN

- 10.4.2.1 Growth in veterinary care expenditure to propel market

- TABLE 101 JAPAN: KEY MACROINDICATORS

- TABLE 102 JAPAN: VETERINARY ELECTROSURGERY MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 103 JAPAN: VETERINARY ELECTROSURGERY MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 104 JAPAN: VETERINARY ELECTROSURGERY MARKET, BY ANIMAL TYPE, 2021-2028 (USD MILLION)

- TABLE 105 JAPAN: VETERINARY ELECTROSURGERY MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.4.3 INDIA

- 10.4.3.1 Growing pet ownership rates and rising establishment of veterinary clinics to drive market

- TABLE 106 INDIA: KEY MACROINDICATORS

- TABLE 107 INDIA: VETERINARY ELECTROSURGERY MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 108 INDIA: VETERINARY ELECTROSURGERY MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 109 INDIA: VETERINARY ELECTROSURGERY MARKET, BY ANIMAL TYPE, 2021-2028 (USD MILLION)

- TABLE 110 INDIA: VETERINARY ELECTROSURGERY MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.4.4 AUSTRALIA

- 10.4.4.1 Rising trend of specialized veterinary clinics to support market growth

- TABLE 111 AUSTRALIA: KEY MACROINDICATORS

- TABLE 112 AUSTRALIA: VETERINARY ELECTROSURGERY MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 113 AUSTRALIA: VETERINARY ELECTROSURGERY MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 114 AUSTRALIA: VETERINARY ELECTROSURGERY MARKET, BY ANIMAL TYPE, 2021-2028 (USD MILLION)

- TABLE 115 AUSTRALIA: VETERINARY ELECTROSURGERY MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.4.5 SOUTH KOREA

- 10.4.5.1 Increasing demand for technologically advanced electrosurgery instruments to fuel uptake

- TABLE 116 SOUTH KOREA: KEY MACROINDICATORS

- TABLE 117 SOUTH KOREA: VETERINARY ELECTROSURGERY MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 118 SOUTH KOREA: VETERINARY ELECTROSURGERY MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 119 SOUTH KOREA: VETERINARY ELECTROSURGERY MARKET, BY ANIMAL TYPE, 2021-2028 (USD MILLION)

- TABLE 120 SOUTH KOREA: VETERINARY ELECTROSURGERY MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.4.6 REST OF ASIA PACIFIC

- TABLE 121 REST OF ASIA PACIFIC: VETERINARY ELECTROSURGERY MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 122 REST OF ASIA PACIFIC: VETERINARY ELECTROSURGERY MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 123 REST OF ASIA PACIFIC: VETERINARY ELECTROSURGERY MARKET, BY ANIMAL TYPE, 2021-2028 (USD MILLION)

- TABLE 124 REST OF ASIA PACIFIC: VETERINARY ELECTROSURGERY MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.4.7 ASIA PACIFIC: RECESSION IMPACT

- 10.5 LATIN AMERICA

- 10.5.1 INCREASING NUMBER OF VETERINARY PRACTITIONERS TO SUPPORT MARKET GROWTH

- 10.5.2 LATIN AMERICA: RECESSION IMPACT

- TABLE 125 LATIN AMERICA: VETERINARY ELECTROSURGERY MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 126 LATIN AMERICA: VETERINARY ELECTROSURGERY MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 127 LATIN AMERICA: VETERINARY ELECTROSURGERY MARKET, BY ANIMAL TYPE, 2021-2028 (USD MILLION)

- TABLE 128 LATIN AMERICA: VETERINARY ELECTROSURGERY MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.6 MIDDLE EAST & AFRICA

- 10.6.1 AVAILABILITY OF FUNDS FOR ANIMAL HEALTHCARE TO SUPPORT MARKET GROWTH

- 10.6.2 MIDDLE EAST & AFRICA: RECESSION IMPACT

- TABLE 129 MIDDLE EAST & AFRICA: VETERINARY ELECTROSURGERY MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 130 MIDDLE EAST & AFRICA: VETERINARY ELECTROSURGERY MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 131 MIDDLE EAST & AFRICA: VETERINARY ELECTROSURGERY MARKET, BY ANIMAL TYPE, 2021-2028 (USD MILLION)

- TABLE 132 MIDDLE EAST & AFRICA: VETERINARY ELECTROSURGERY MARKET, BY END USER, 2021-2028 (USD MILLION)

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 KEY PLAYER STRATEGIES

- TABLE 133 KEY DEVELOPMENTS IN VETERINARY ELECTROSURGERY MARKET

- 11.3 REVENUE SHARE ANALYSIS

- FIGURE 37 REVENUE SHARE ANALYSIS OF TOP PLAYERS IN VETERINARY ELECTROSURGERY MARKET (2018-2022)

- 11.4 MARKET SHARE ANALYSIS

- FIGURE 38 VETERINARY ELECTROSURGERY MARKET: MARKET SHARE ANALYSIS (2022)

- 11.5 COMPANY EVALUATION MATRIX

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- FIGURE 39 VETERINARY ELECTROSURGERY MARKET: COMPANY EVALUATION MATRIX (2022)

- 11.5.5 COMPANY FOOTPRINT

- TABLE 134 VETERINARY ELECTROSURGERY MARKET: COMPANY FOOTPRINT ANALYSIS, BY PRODUCT

- TABLE 135 COMPANY FOOTPRINT ANALYSIS, BY APPLICATION

- TABLE 136 COMPANY FOOTPRINT ANALYSIS, BY ANIMAL TYPE

- TABLE 137 COMPANY FOOTPRINT ANALYSIS, BY END USER

- 11.5.6 REGIONAL FOOTPRINT ANALYSIS

- TABLE 138 REGIONAL FOOTPRINT ANALYSIS

- TABLE 139 COMPANY OVERALL FOOTPRINT

- 11.6 START-UP/SME EVALUATION MATRIX

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 RESPONSIVE COMPANIES

- 11.6.3 DYNAMIC COMPANIES

- 11.6.4 STARTING BLOCKS

- FIGURE 40 VETERINARY ELECTROSURGERY MARKET: START-UP/SME COMPANY EVALUATION MATRIX (2022)

- 11.6.5 COMPETITIVE BENCHMARKING FOR START-UPS/SMES

- TABLE 140 VETERINARY ELECTROSURGERY MARKET: KEY START-UP/SME COMPANIES

- 11.7 COMPETITIVE SCENARIOS AND TRENDS

- 11.7.1 PRODUCT LAUNCHES

- TABLE 141 VETERINARY ELECTROSURGERY MARKET: PRODUCT LAUNCHES (JUNE 2023)

- 11.7.2 DEALS

- TABLE 142 VETERINARY ELECTROSURGERY MARKET: DEALS (JANUARY 2020-APRIL 2021)

- 11.7.3 OTHER DEVELOPMENTS

- TABLE 143 VETERINARY ELECTROSURGERY MARKET: OTHER DEVELOPMENTS (DECEMBER 2020)

12 COMPANY PROFILES

- (Business Overview, Products Offered, Recent Developments, MnM View Right to win, Strategic choices made, Weaknesses and competitive threats) **

- 12.1 KEY PLAYERS

- 12.1.1 MEDTRONIC PLC

- TABLE 144 MEDTRONIC PLC: BUSINESS OVERVIEW

- FIGURE 41 MEDTRONIC PLC: COMPANY SNAPSHOT (2022)

- 12.1.2 B. BRAUN MELSUNGEN AG

- TABLE 145 B. BRAUN MELSUNGEN AG: BUSINESS OVERVIEW

- FIGURE 42 B. BRAUN MELSUNGEN AG: COMPANY SNAPSHOT (2022)

- 12.1.3 INTEGRA LIFESCIENCES

- TABLE 146 INTEGRA LIFESCIENCES: BUSINESS OVERVIEW

- FIGURE 43 INTEGRA LIFESCIENCES: COMPANY SNAPSHOT (2022)

- 12.1.4 OLYMPUS CORPORATION

- TABLE 147 OLYMPUS CORPORATION: BUSINESS OVERVIEW

- FIGURE 44 OLYMPUS CORPORATION: COMPANY SNAPSHOT (2022)

- 12.1.5 COVETRUS, INC.

- TABLE 148 COVETRUS, INC.: BUSINESS OVERVIEW

- 12.1.6 SYMMETRY SURGICAL, INC.

- TABLE 149 SYMMETRY SURGICAL INC.: BUSINESS OVERVIEW

- 12.1.7 AVANTE ANIMAL HEALTH

- TABLE 150 AVANTE ANIMAL HEALTH: BUSINESS OVERVIEW

- 12.1.8 SUMMIT HILL LABORATORIES

- TABLE 151 SUMMIT HILL LABORATORIES: BUSINESS OVERVIEW

- 12.1.9 BURTONS MEDICAL EQUIPMENT LTD.

- TABLE 152 BURTONS MEDICAL EQUIPMENT LTD.: BUSINESS OVERVIEW

- 12.1.10 EICKEMEYER

- TABLE 153 EICKEMEYER: BUSINESS OVERVIEW

- 12.1.11 KLS MARTIN GROUP

- TABLE 154 KLS MARTIN GROUP: BUSINESS OVERVIEW

- 12.1.12 MACAN MANUFACTURING

- TABLE 155 MACAN MANUFACTURING: BUSINESS OVERVIEW

- 12.1.13 XCELLANCE MEDICAL TECHNOLOGIES PVT. LTD.

- TABLE 156 XCELLANCE MEDICAL TECHNOLOGIES PVT. LTD.: BUSINESS OVERVIEW

- 12.1.14 ALSA APPARECCHI MEDICALI SRL

- TABLE 157 ALSA APPRECCHI MEDICALI SRL: BUSINESS OVERVIEW

- 12.1.15 KENTAMED LTD.

- TABLE 158 KENTAMED LTD.: BUSINESS OVERVIEW

- 12.1.16 PROMISE TECHNOLOGY CO., LTD.

- TABLE 159 PROMISE TECHNOLOGY CO., LTD.: BUSINESS OVERVIEW

- 12.1.17 SHANGHAI HUIFENG MEDICAL INSTRUMENT CO., LTD.

- TABLE 160 SHANGHAI HUIFENG MEDICAL INSTRUMENT CO., LTD.: BUSINESS OVERVIEW

- 12.1.18 KWANZA VETERINARY

- TABLE 161 KWANZA VETERINARY: BUSINESS OVERVIEW

- 12.1.19 KEEBOVET VETERINARY ULTRASOUND EQUIPMENT

- TABLE 162 KEEBOVET VETERINARY ULTRASOUND EQUIPMENT: BUSINESS OVERVIEW

- 12.1.20 LED SPA

- TABLE 163 LED SPA: BUSINESS OVERVIEW

- 12.2 OTHER PLAYERS

- 12.2.1 KARL STORZ

- 12.2.2 HEAL FORCE

- 12.2.3 SPECIAL MEDICAL TECHNOLOGY, CO. LTD.

- 12.2.4 BEIJING TAKTVOLL TECHNOLOGY CO., LTD.

- 12.2.5 NANJING SHOULIANG-MED TECHNOLOGY CO., LTD.

- 12.2.6 ALAN ELECTRONIC SYSTEMS PVT. LTD.

- 12.2.7 DELTRONIX MEDICAL DEVICES

- *Details on Business Overview, Products Offered, Recent Developments, MnM View, Right to win, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS