|

|

市場調査レポート

商品コード

1108386

特殊酵母の世界市場:タイプ別(酵母エキス、酵母自己消化物、酵母ベータグルカン)、種別(出芽酵母、メタノール資化性酵母、高温発酵性酵母)、用途別、地域別 - 2027年までの予測Specialty Yeast Market by Type (Yeast Extracts, Yeast Autolysates, Yeast Beta-glucan, and Other Yeast Derivatives), Species (Saccharomyces Cerevisiae, Pichia Pastoris, Kluyveromyces), Application and Region - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 特殊酵母の世界市場:タイプ別(酵母エキス、酵母自己消化物、酵母ベータグルカン)、種別(出芽酵母、メタノール資化性酵母、高温発酵性酵母)、用途別、地域別 - 2027年までの予測 |

|

出版日: 2022年07月27日

発行: MarketsandMarkets

ページ情報: 英文 188 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の特殊酵母の市場規模は、2022年に32億米ドルと推定されます。

2027年には46億米ドルに達し、2022年から2027年の間に金額ベースのCAGRで7.0%の成長が予測されています。特殊酵母製品は、食品、飲料、飼料、その他の産業で用途が拡大し続けており、市場は勢いを増しています。

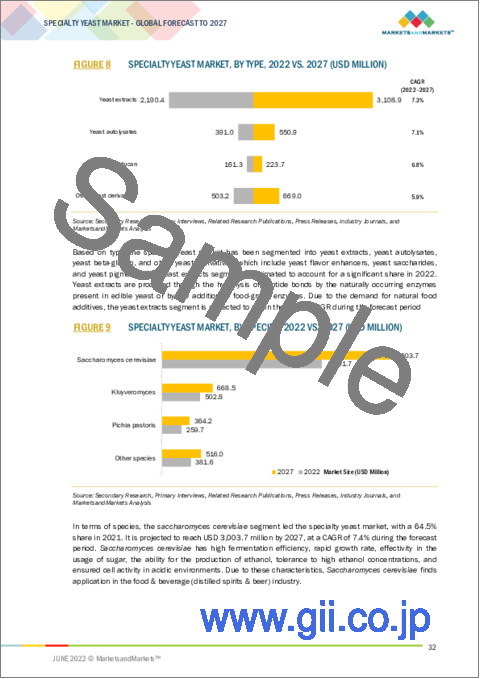

"タイプ別では、酵母エキスセグメントが予測期間中に最も高い市場シェアを占める"

タイプ別では、酵母エキスセグメントが予測期間中、金額ベースで最大の市場シェアを占めると推定されます。酵母エキスは、様々な食品産業で大きな需要があるため、食品の栄養プロファイル、味や香りの提供を強化することに貢献する、様々な食品に幅広く適用できる天然成分です。

"種別では、出芽酵母セグメントが最大の市場シェアを占めると予測される"

種別では、出芽酵母セグメントは、最大の市場シェアを占めており、予測期間中に金額で市場を独占すると思われます。出芽酵母は、堅牢性を提供し、高い発酵効率と高い成長率などの他の望ましい特性を提供するとともに、ストレスの多い条件に耐える能力を持っているので、一般的に好ましい酵母の種として使用されており、そのため、食品・飲料産業全体で幅広い用途を見つけることができます。

"用途別では、食品セグメントが予測期間中、支配的な地位を維持すると予想される"

用途別では、ベーカリー製品、機能性食品、セイボリー製品、その他の食品用途など、様々な異なる食品セグメントに特殊酵母が広く適用されるため、食品セグメントが予測期間中に最大かつ最も急成長するセグメントを占めると予想されます。

"予測期間中、アジア太平洋地域は特殊酵母市場の最速成長市場である"

アジア太平洋地域は、予測期間中、最も高い成長率を示すと予想されています。同地域では近年、著しい都市化が進み、簡便な食品への需要が高まっています。この地域の特殊酵母産業の成長に大きく寄与しているその他の要因は、健康とウェルネスに関する意識の高まりと、天然や純粋、新鮮な製品に対する需要の大幅な上昇です。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- マクロ指標

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

第6章 規制の枠組み

- イントロダクション

- 北米

- 欧州:規制環境分析

- 南米

- アジア太平洋地域

第7章 業界動向

- イントロダクション

- バリューチェーン

- サプライチェーン分析

- 価格分析:特殊酵母市場

- 市場の混乱

- 特殊酵母市場:特許分析

- 貿易データ:特殊酵母市場

- ポーターのファイブフォース分析

第8章 特殊酵母市場:タイプ別

- イントロダクション

- 酵母エキス

- 酵母自己消化物

- 酵母ベータグルカン

- その他

第9章 特殊酵母市場:種別

- イントロダクション

- 出芽酵母

- メタノール資化性酵母

- 高温発酵性酵母

- その他

第10章 特殊酵母市場:用途別

- イントロダクション

- 食品

- 飲料

- 飼料

- その他

第11章 特殊酵母市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- フランス

- 英国

- ドイツ

- イタリア

- スペイン

- その他

- アジア太平洋地域

- 中国

- 日本

- インド

- オーストラリア・ニュージーランド

- その他

- その他の地域

- 南米

- 中東・アフリカ

第12章 競合情勢

- 概要

- 市場シェア分析

- 主要企業の過去の収益分析

- 企業の評価象限

- 特殊酵母市場の評価象限

- 競合シナリオ

第13章 企業プロファイル

- 主要企業

- ASSOCIATED BRITISH FOODS PLC

- ADM

- LALLEMAND INC.

- DSM

- CHR. HANSEN HOLDING A/S

- KERRY GROUP PLC.

- LESAFFRE

- ANGELYEAST CO., LTD.

- BIORIGIN

- KEMIN INDUSTRIES, INC.

- その他の企業

- LEIBER

- FOODCHEM INTERNATIONAL CORPORATION

- KOHJIN LIFE SCIENCES CO., LTD.

- LEVEX

- ARIA INGREDIENTS

- HALCYON PROTEINS PTY. LTD.

- JEEVAN BIOTECH

- AGRANO GMBH & CO. KG

- AEB GROUP SPA

- TITAN BIOTECH

第14章 隣接・関連市場

第15章 付録

According to MarketsandMarkets, the global specialty yeast market is estimated to be valued at USD 3.2 billion in 2022. It is projected to reach USD 4.6 billion by 2027, with a CAGR of 7.0%, in terms of value between 2022 and 2027. The market is gaining momentum as specialty yeast products continue to find increased applications across food, beverage, feed and other industries.

Additionally, the rising innovation in the specialty yeast market and rising consumer awareness regarding natural ingredients and to pursue ingredients with multiple functional abilities have contributed to the growth of specialty yeast market in recent years.

"By type, the yeast extract segment occupies the highest market share during the forecast period."

Based on type, the yeast segment is estimated to account for the largest market share, in terms of value, during the forecasted period. Yeast extracts are natural ingredients that find a wide range of applicability across various food products which contributes towards enriching the nutritional profile, taste and flavor offerings of the food products due to which they are in significant demand across various food industries.

"By species, the Saccharomyces cerevisiae segment is forecasted to account for the largest market share."

Based on species, the Saccharomyces cerevisiae segment accounts for the largest market share and it would dominate the market in terms of value during the forecast period. Saccharomyces cerevisiae are commonly used as a preferred yeast species because it offers robustness and has the ability to withstand stressful conditions along with offering other desirable characteristics such as high fermentation efficiency and high growth rate due to which they find extensive applications across food & beverage industries.

By application, the food segment is expected to retain its position as the dominant segment over the forecast period."

Based on application, the food segment is expected to account for the largest and fastest-growing segment over the forecast period because of the large applicability of specialty yeasts across a variety of different food segments such as bakery products, functional foods, savory products and other food applications. Due to their wide applicability across various food products, specialty yeasts is experiencing significant demand from the food industry.

"The Asia Pacific region is the fastest growing market for the specialty yeast market during the forecast period"

Asia Pacific region is expected to witness the highest growth rate during the forecasted period. The region has been witnessing significant urbanization and increased demand for convenience food products over the recent years. The other factors that are contributing significantly to the growth of specialty yeast industry in the region are increased awareness about health & wellness and significant rise in demand for natural, pure and fresh products. The countries of China, Japan and India are key global markets for sauces, wine, dairy, and bakery products which contributes significantly to the growth of specialty yeast market in the region.

Break-up of Primaries

- By Company Type: Tier 1 - 45%, Tier 2 - 33% and Tier 3 - 22%

- By Designation: D-Level- 45%, C-Level- 33%, and Others - 22%

- By Region: Asia Pacific - 44%, Europe - 29%, North America- 15%, and RoW- 12%

Leading players profiled in this report include the following:

- Associated British Foods Plc (UK)

- ADM (US)

- Lallemand Inc. (Canada)

- DSM (Netherlands)

- Chr. Hansen Holding A/S (Denmark)

- Kerry Group Plc. (Ireland)

- Lesaffre (France)

- AngelYeast Co., Ltd. (China)

- Biorigin (Brazil)

- Kemin Industries, Inc. (US)

Research Coverage

This report segments the specialty yeast market on the basis of type, species, application, and region. In terms of insights, this research report focuses on various levels of analyses-competitive landscape, pricing insights, end-use analysis, and company profiles-which together comprise and discuss the basic views on the emerging & high-growth segments of the specialty yeast market, high-growth regions, countries, industry trends, drivers, restraints, opportunities, and challenges.

Reasons to buy this report

- To get a comprehensive overview of the specialty yeast market

- To gain wide-ranging information about the top players in this industry, their product portfolio details, and the key strategies adopted by them

- To gain insights into the major countries/regions, in which the specialty yeast market is flourishing

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- FIGURE 1 MARKET SEGMENTATION

- FIGURE 2 REGIONS COVERED

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- TABLE 1 USD EXCHANGE RATES CONSIDERED, 2018-2021

- 1.6 UNIT CONSIDERED

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 3 SPECIALTY YEAST MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Breakdown of primary interviews

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- FIGURE 7 DATA TRIANGULATION METHODOLOGY

- 2.4 ASSUMPTIONS

- 2.5 LIMITATIONS AND RISK ASSESSMENT

3 EXECUTIVE SUMMARY

- TABLE 2 SPECIALTY YEAST MARKET SNAPSHOT, 2022 VS. 2027

- FIGURE 8 SPECIALTY YEAST MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

- FIGURE 9 SPECIALTY YEAST MARKET, BY SPECIES, 2022 VS. 2027 (USD MILLION)

- FIGURE 10 SPECIALTY YEAST MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

- FIGURE 11 SPECIALTY YEAST MARKET SHARE (VALUE), BY REGION

4 PREMIUM INSIGHTS

- 4.1 BRIEF OVERVIEW OF THE SPECIALTY YEAST MARKET

- FIGURE 12 RISING DEMAND FOR CONVENIENCE FOOD PRODUCTS TO FUEL THE MARKET GROWTH

- 4.2 EUROPE: SPECIALTY YEAST MARKET, BY SPECIES AND COUNTRY

- FIGURE 13 SACCHAROMYCES CEREVISIAE ACCOUNTED FOR THE LARGEST SHARE OF THE EUROPEAN SPECIALTY YEAST MARKET IN 2021

- 4.3 SPECIALTY YEAST MARKET, BY TYPE

- FIGURE 14 YEAST EXTRACTS SEGMENT IS PROJECTED TO DOMINATE THE SPECIALTY YEAST MARKET

- 4.4 SPECIALTY YEAST MARKET, BY SPECIES

- FIGURE 15 SACCHAROMYCES CEREVISIAE IS PROJECTED TO HOLD THE LARGEST SHARE FROM 2022 TO 2027

- 4.5 SPECIALTY YEAST MARKET, BY APPLICATION

- FIGURE 16 FOOD SEGMENT IS ESTIMATED TO DOMINATE THE SPECIALTY YEAST MARKET IN 2022

- 4.6 SPECIALTY YEAST MARKET, BY FOOD APPLICATION

- FIGURE 17 BAKERY PRODUCTS SEGMENT IS ESTIMATED TO DOMINATE THE SPECIALTY YEAST MARKET IN 2022

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MACRO INDICATORS

- FIGURE 18 TOTAL PER CAPITA ALCOHOL CONSUMPTION AMONG DRINKERS, 2000-2018 (LITER)

- FIGURE 19 US: NET PRODUCTION OF FUEL ETHANOL BY BIOFUEL PLANTS, 2015-2021 (THOUSAND BARRELS/DAY)

- 5.3 MARKET DYNAMICS

- FIGURE 20 SPECIALTY YEAST MARKET DYNAMICS

- 5.3.1 DRIVERS

- 5.3.1.1 R&D driving innovations

- 5.3.1.2 Increasing demand for specialty yeast ingredients in food & beverage applications

- 5.3.1.3 Increasing demand for bio-ethanol as a fuel

- 5.3.2 RESTRAINTS

- 5.3.2.1 Stringent food safety regulations

- 5.3.2.2 Competition for basic raw materials

- 5.3.3 OPPORTUNITIES

- 5.3.3.1 Growing demand for clean label products in developed countries

- 5.3.3.2 New variants of yeast ingredients for improved functionality

- 5.3.3.3 Yeast is a promising protein source in feed

- TABLE 3 AMINO ACID COMPARISON CHART FOR YEAST- AND SOY MEAL-BASED LIVESTOCK DIET

- 5.3.4 CHALLENGES

- 5.3.4.1 Commercialization of duplicate & low-quality products

6 REGULATORY FRAMEWORK

- 6.1 INTRODUCTION

- 6.2 NORTH AMERICA

- 6.2.1 US

- 6.2.2 CANADA

- 6.3 EUROPE: REGULATORY ENVIRONMENT ANALYSIS

- 6.3.1 EUROPEAN UNION

- 6.4 SOUTH AMERICA

- 6.4.1 ARGENTINA

- 6.5 ASIA PACIFIC

- 6.5.1 AUSTRALIA AND NEW ZEALAND

7 INDUSTRY TRENDS

- 7.1 INTRODUCTION

- 7.2 VALUE CHAIN

- 7.2.1 RESEARCH AND PRODUCT DEVELOPMENT

- 7.2.2 RAW MATERIAL SOURCING

- 7.2.3 PRODUCTION & PROCESSING

- 7.2.4 DISTRIBUTION

- 7.2.5 MARKETING & SALES

- FIGURE 21 VALUE CHAIN ANALYSIS OF THE SPECIALTY YEAST MARKET

- 7.3 SUPPLY CHAIN ANALYSIS

- FIGURE 22 STRAIN DEVELOPMENT AND DISTRIBUTION PHASES PLAY A VITAL ROLE IN THE SUPPLY CHAIN

- 7.4 PRICING ANALYSIS: SPECIALTY YEAST MARKET

- TABLE 4 AVERAGE SELLING PRICE OF SPECIALTY YEAST, BY TYPE, 2020-2022 (USD/TONS)

- TABLE 5 AVERAGE SELLING PRICE OF SPECIALTY YEAST, BY REGION, 2020-2022 (USD/TONS)

- 7.5 MARKET DISRUPTION

- 7.5.1 RISING R&D ACTIVITIES FOR CREATING ALTERNATIVES TO REPLACE SPECIALTY YEAST IN THE FERMENTATION INDUSTRY

- 7.6 SPECIALTY YEAST MARKET: PATENT ANALYSIS

- FIGURE 23 NUMBER OF PATENTS GRANTED BETWEEN 2012 AND 2021

- FIGURE 24 TOP 10 INVESTORS WITH HIGHEST NUMBER OF PATENT DOCUMENTS

- FIGURE 25 TOP 10 APPLICANTS WITH HIGHEST NUMBER OF PATENT DOCUMENTS

- TABLE 6 PATENTS PERTAINING TO YEAST, 2020-APRIL 2022

- 7.7 TRADE DATA: SPECIALTY YEAST MARKET

- 7.7.1 ACTIVE YEAST: TRADE DATA

- TABLE 7 TOP 10 IMPORTERS AND EXPORTERS OF ACTIVE YEAST, 2021 (KG)

- TABLE 8 TOP 10 IMPORTERS AND EXPORTERS OF ACTIVE YEAST, 2020 (KG)

- TABLE 9 TOP 10 IMPORTERS AND EXPORTERS OF ACTIVE YEAST, 2019 (KG)

- 7.8 PORTER'S FIVE FORCES ANALYSIS

- TABLE 10 SPECIALTY YEAST MARKET: PORTER'S FIVE FORCES ANALYSIS

- 7.8.1 DEGREE OF COMPETITION

- 7.8.2 BARGAINING POWER OF SUPPLIERS

- 7.8.3 BARGAINING POWER OF BUYERS

- 7.8.4 THREAT OF SUBSTITUTES

- 7.8.5 THREAT OF NEW ENTRANTS

8 SPECIALTY YEAST MARKET, BY TYPE

- 8.1 INTRODUCTION

- FIGURE 26 SPECIALTY YEAST MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

- TABLE 11 SPECIALTY YEAST MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 12 SPECIALTY YEAST MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 13 SPECIALTY YEAST MARKET, BY TYPE, 2017-2021 (KT)

- TABLE 14 SPECIALTY YEAST MARKET, BY TYPE, 2022-2027 (KT)

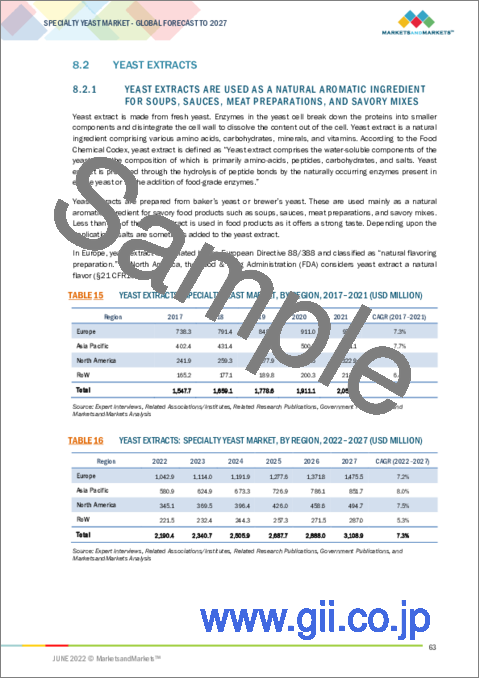

- 8.2 YEAST EXTRACTS

- 8.2.1 YEAST EXTRACTS ARE USED AS A NATURAL AROMATIC INGREDIENT FOR SOUPS, SAUCES, MEAT PREPARATIONS, AND SAVORY MIXES

- TABLE 15 YEAST EXTRACTS: SPECIALTY YEAST MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 16 YEAST EXTRACTS: SPECIALTY YEAST MARKET, BY REGION, 2022-2027 (USD MILLION)

- 8.3 YEAST AUTOLYSATES

- 8.3.1 YEAST AUTOLYSATE IS A GOOD SOURCE OF PROTEINS, VITAMINS, FIBER, AND MICRONUTRIENTS

- TABLE 17 YEAST AUTOLYSATES: SPECIALTY YEAST MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 18 YEAST AUTOLYSATES: SPECIALTY YEAST MARKET, BY REGION, 2022-2027 (USD MILLION)

- 8.4 YEAST BETA-GLUCAN

- 8.4.1 PHYSICOCHEMICAL PROPERTIES MAKE IT USEFUL IN FOOD, FEED, CHEMICAL, AND COSMETICS PRODUCTION

- TABLE 19 YEAST BETA-GLUCAN: SPECIALTY YEAST MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 20 YEAST BETA-GLUCAN: SPECIALTY YEAST MARKET, BY REGION, 2022-2027 (USD MILLION)

- 8.5 OTHER YEAST DERIVATIVES

- 8.5.1 OTHER YEAST DERIVATIVES ARE USUALLY CHARACTERIZED ACCORDING TO THEIR BIOCHEMICAL COMPOSITION

- TABLE 21 OTHER YEAST DERIVATIVES: SPECIALTY YEAST MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 22 OTHER YEAST DERIVATIVES: SPECIALTY YEAST MARKET, BY REGION, 2022-2027 (USD MILLION)

9 SPECIALTY YEAST MARKET, BY SPECIES

- 9.1 INTRODUCTION

- FIGURE 27 SPECIALTY YEAST MARKET, BY SPECIES, 2022 VS. 2027 (USD MILLION)

- TABLE 23 SPECIALTY YEAST MARKET, BY SPECIES, 2017-2021 (USD MILLION)

- TABLE 24 SPECIALTY YEAST MARKET, BY SPECIES, 2022-2027 (USD MILLION)

- 9.2 SACCHAROMYCES CEREVISIAE

- 9.2.1 SACCHAROMYCES CEREVISIAE IS USED FOR THE PREPARATION OF PEPPERY AND SPICY FLAVORS

- FIGURE 28 ROLE OF SACCHAROMYCES CEREVISIAE IN THE PRODUCTION OF FERMENTED BEVERAGES

- TABLE 25 SACCHAROMYCES CEREVISIAE: SPECIALTY YEAST MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 26 SACCHAROMYCES CEREVISIAE: SPECIALTY YEAST MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.3 KLUYVEROMYCES

- 9.3.1 KLUYVEROMYCES IS USED IN THE PREPARATION OF FRUIT-FLAVORED DAIRY PRODUCTS

- TABLE 27 KLUYVEROMYCES: SPECIALTY YEAST MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 28 KLUYVEROMYCES: SPECIALTY YEAST MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.4 PICHIA PASTORIS

- 9.4.1 ACTS AS TASTE MODULATOR DUE TO FLAVOR ESTER SYNTHESIS

- TABLE 29 PICHIA PASTORIS: SPECIALTY YEAST MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 30 PICHIA PASTORIS: SPECIALTY YEAST MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.5 OTHER SPECIES

- 9.5.1 TORULA DELBRUECKII IS AMONG THE MOST WIDELY USED NON-SACCHAROMYCES YEAST FOR WINE-MAKING

- TABLE 31 OTHER SPECIES: SPECIALTY YEAST MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 32 OTHER SPECIES: SPECIALTY YEAST MARKET, BY REGION, 2022-2027 (USD MILLION)

10 SPECIALTY YEAST MARKET, BY APPLICATION

- 10.1 INTRODUCTION

- FIGURE 29 SPECIALTY YEAST MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

- TABLE 33 SPECIALTY YEAST MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 34 SPECIALTY YEAST MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- 10.2 FOOD

- TABLE 35 SPECIALTY YEAST MARKET, BY FOOD SUBSEGMENT, 2017-2021 (USD MILLION)

- TABLE 36 SPECIALTY YEAST MARKET, BY FOOD SUBSEGMENT, 2022-2027 (USD MILLION)

- TABLE 37 FOOD: SPECIALTY YEAST MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 38 FOOD: SPECIALTY YEAST MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.2.1 BAKERY PRODUCTS

- 10.2.1.1 Changing consumer preferences and tastes and the increasing health consciousness have significantly contributed to the growth of the baker's yeast market

- TABLE 39 BAKERY PRODUCTS: SPECIALTY YEAST MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 40 BAKERY PRODUCTS: SPECIALTY YEAST MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.2.2 FUNCTIONAL FOODS

- 10.2.2.1 Functional foods are gaining significant demand among consumers to improve health and wellness

- TABLE 41 FUNCTIONAL FOODS: SPECIALTY YEAST MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 42 FUNCTIONAL FOODS: SPECIALTY YEAST MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.2.3 SAVORY PRODUCTS

- 10.2.3.1 Specialty yeast is commonly used in savory products to enhance their taste and flavor

- TABLE 43 SAVORY PRODUCTS: SPECIALTY YEAST MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 44 SAVORY PRODUCTS: SPECIALTY YEAST MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.2.4 OTHER FOOD APPLICATIONS

- 10.2.4.1 Nutritional yeast is strong in taste but can be topped onto many snack products for an authentic taste

- TABLE 45 OTHER FOOD APPLICATIONS: SPECIALTY YEAST MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 46 OTHER FOOD APPLICATIONS: SPECIALTY YEAST MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.3 BEVERAGES

- 10.3.1 NON-SACCHAROMYCES YEASTS ARE USED TO PRODUCE WINE AND BEER

- TABLE 47 BEVERAGES: SPECIALTY YEAST MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 48 BEVERAGES: SPECIALTY YEAST MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.4 FEED

- 10.4.1 SPECIALTY YEAST ENHANCES THE NUTRITIONAL VALUE OF FEED

- TABLE 49 FEED: SPECIALTY YEAST MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 50 FEED: SPECIALTY YEAST MARKET, BY REGION, 2022-2027 (USD MILLION)

- 10.5 OTHER APPLICATIONS

- 10.5.1 MULTIFUNCTIONAL BENEFITS OF SPECIALTY YEAST TO DRIVE THE MARKET FOR OTHER APPLICATIONS

- TABLE 51 OTHER APPLICATIONS: SPECIALTY YEAST MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 52 OTHER APPLICATIONS: SPECIALTY YEAST MARKET, BY REGION, 2022-2027 (USD MILLION)

11 SPECIALTY YEAST MARKET, BY REGION

- 11.1 INTRODUCTION

- FIGURE 30 CHINA AND JAPAN TO RECORD THE FASTEST GROWTH DURING THE FORECAST PERIOD

- TABLE 53 SPECIALTY YEAST MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 54 SPECIALTY YEAST MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 55 SPECIALTY YEAST MARKET, BY REGION, 2017-2021 (KT)

- TABLE 56 SPECIALTY YEAST MARKET, BY REGION, 2022-2027 (KT)

- 11.2 NORTH AMERICA

- TABLE 57 NORTH AMERICA: SPECIALTY YEAST MARKET, BY COUNTRY, 2017-2021 (USD MILLION)

- TABLE 58 NORTH AMERICA: SPECIALTY YEAST MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 59 NORTH AMERICA: SPECIALTY YEAST MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 60 NORTH AMERICA: SPECIALTY YEAST MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 61 NORTH AMERICA: SPECIALTY YEAST MARKET, BY SPECIES, 2017-2021 (USD MILLION)

- TABLE 62 NORTH AMERICA: SPECIALTY YEAST MARKET, BY SPECIES, 2022-2027 (USD MILLION)

- TABLE 63 NORTH AMERICA: SPECIALTY YEAST MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 64 NORTH AMERICA: SPECIALTY YEAST MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 65 NORTH AMERICA: SPECIALTY YEAST MARKET, BY FOOD APPLICATION, 2017-2021 (USD MILLION)

- TABLE 66 NORTH AMERICA: SPECIALTY YEAST MARKET, BY FOOD APPLICATION, 2022-2027 (USD MILLION)

- 11.2.1 US

- 11.2.1.1 Adoption of bio-fuel and increasing consumption of prepared and functional foods to fuel the market growth

- TABLE 67 US: SPECIALTY YEAST MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 68 US: SPECIALTY YEAST MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 11.2.2 CANADA

- 11.2.2.1 Rising awareness of animal health demands more natural additives

- TABLE 69 CANADA: SPECIALTY YEAST MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 70 CANADA: SPECIALTY YEAST MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 11.2.3 MEXICO

- 11.2.3.1 Mexican food industry is well supported by government initiatives

- TABLE 71 MEXICO: SPECIALTY YEAST MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 72 MEXICO: SPECIALTY YEAST MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 11.3 EUROPE

- FIGURE 31 EUROPE: SPECIALTY YEAST MARKET SNAPSHOT

- TABLE 73 EUROPE: SPECIALTY YEAST MARKET, BY COUNTRY, 2017-2021 (USD MILLION)

- TABLE 74 EUROPE: SPECIALTY YEAST MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 75 EUROPE: SPECIALTY YEAST MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 76 EUROPE: SPECIALTY YEAST MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 77 EUROPE: SPECIALTY YEAST MARKET, BY SPECIES, 2017-2021 (USD MILLION)

- TABLE 78 EUROPE: SPECIALTY YEAST MARKET, BY SPECIES, 2022-2027 (USD MILLION)

- TABLE 79 EUROPE: SPECIALTY YEAST MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 80 EUROPE: SPECIALTY YEAST MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 81 EUROPE: SPECIALTY YEAST MARKET, BY FOOD APPLICATION, 2017-2021 (USD MILLION)

- TABLE 82 EUROPE: SPECIALTY YEAST MARKET, BY FOOD APPLICATION, 2022-2027 (USD MILLION)

- 11.3.1 FRANCE

- 11.3.1.1 High livestock production in France to drive the market for specialty yeast in the feed industry

- TABLE 83 FRANCE: SPECIALTY YEAST MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 84 FRANCE: SPECIALTY YEAST MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 11.3.2 UK

- 11.3.2.1 Rising consumer demand for natural and safe products to drive the market for specialty yeast

- TABLE 85 UK: SPECIALTY YEAST MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 86 UK: SPECIALTY YEAST MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 11.3.3 GERMANY

- 11.3.3.1 Growing demand from food, beverage, and pharmaceutical industries to drive the market in the country

- TABLE 87 GERMANY: SPECIALTY YEAST MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 88 GERMANY: SPECIALTY YEAST MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 11.3.4 ITALY

- 11.3.4.1 Growing baking industry is demanding more specialty yeast

- TABLE 89 ITALY: SPECIALTY YEAST MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 90 ITALY: SPECIALTY YEAST MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 11.3.5 SPAIN

- 11.3.5.1 Increase in the potential of the food processing sector to fuel the demand for specialty yeast

- TABLE 91 SPAIN: SPECIALTY YEAST MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 92 SPAIN: SPECIALTY YEAST MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 11.3.6 REST OF EUROPE

- TABLE 93 REST OF EUROPE: SPECIALTY YEAST MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 94 REST OF EUROPE: SPECIALTY YEAST MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 11.4 ASIA PACIFIC

- FIGURE 32 ASIA PACIFIC: SPECIALTY YEAST MARKET SNAPSHOT

- TABLE 95 ASIA PACIFIC: SPECIALTY YEAST MARKET, BY COUNTRY, 2017-2021 (USD MILLION)

- TABLE 96 ASIA PACIFIC: SPECIALTY YEAST MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 97 ASIA PACIFIC: SPECIALTY YEAST MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 98 ASIA PACIFIC: SPECIALTY YEAST MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 99 ASIA PACIFIC: SPECIALTY YEAST MARKET, BY SPECIES, 2017-2021 (USD MILLION)

- TABLE 100 ASIA PACIFIC: SPECIALTY YEAST MARKET, BY SPECIES, 2022-2027 (USD MILLION)

- TABLE 101 ASIA PACIFIC: SPECIALTY YEAST MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 102 ASIA PACIFIC: SPECIALTY YEAST MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 103 ASIA PACIFIC: SPECIALTY YEAST MARKET, BY FOOD APPLICATION, 2017-2021 (USD MILLION)

- TABLE 104 ASIA PACIFIC: SPECIALTY YEAST MARKET, BY FOOD APPLICATION, 2022-2027 (USD MILLION)

- 11.4.1 CHINA

- 11.4.1.1 Berry-like flavors and floral aromas in whiskey are projected to drive the market growth

- FIGURE 33 SHARE OF WINE IMPORTS IN CHINA, 2021

- TABLE 105 CHINA: SPECIALTY YEAST MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 106 CHINA: SPECIALTY YEAST MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 11.4.2 JAPAN

- 11.4.2.1 Rising demand for bakery & confectionery products in the country is projected to drive the demand for specialty yeast

- TABLE 107 JAPAN: SPECIALTY YEAST MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 108 JAPAN: SPECIALTY YEAST MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 11.4.3 INDIA

- 11.4.3.1 Growing demand for fermented dairy products is driving the market for specialty yeast

- TABLE 109 INDIA: SPECIALTY YEAST MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 110 INDIA: SPECIALTY YEAST MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 11.4.4 AUSTRALIA & NEW ZEALAND

- 11.4.4.1 Plant-based meat alternatives offer growth opportunities for specialty yeast manufacturers in the Australian market

- FIGURE 34 NEW ZEALAND: CHEESE AND CURD EXPORTS, 2019

- TABLE 111 AUSTRALIA & NEW ZEALAND: SPECIALTY YEAST MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 112 AUSTRALIA & NEW ZEALAND: SPECIALTY YEAST MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 11.4.5 REST OF ASIA PACIFIC

- 11.4.5.1 Traditionally fermented products in Vietnam and Thailand to drive the growth of the specialty yeast market

- TABLE 113 REST OF ASIA PACIFIC: SPECIALTY YEAST MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 114 REST OF ASIA PACIFIC: SPECIALTY YEAST MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 11.5 REST OF THE WORLD (ROW)

- TABLE 115 REST OF THE WORLD: SPECIALTY YEAST MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 116 REST OF THE WORLD: SPECIALTY YEAST MARKET, BY REGION, 2022-2027 (USD MILLION

- TABLE 117 REST OF THE WORLD: SPECIALTY YEAST MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 118 REST OF THE WORLD: SPECIALTY YEAST MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 119 REST OF THE WORLD: SPECIALTY YEAST MARKET, BY SPECIES, 2017-2021 (USD MILLION)

- TABLE 120 REST OF THE WORLD: SPECIALTY YEAST MARKET, BY SPECIES, 2022-2027 (USD MILLION)

- TABLE 121 REST OF THE WORLD: SPECIALTY YEAST MARKET, BY APPLICATION, 2017-2021 (USD MILLION)

- TABLE 122 REST OF THE WORLD: SPECIALTY YEAST MARKET, BY APPLICATION, 2022-2027 (USD MILLION)

- TABLE 123 REST OF THE WORLD: SPECIALTY YEAST MARKET, BY FOOD APPLICATION, 2017-2021 (USD MILLION)

- TABLE 124 REST OF THE WORLD: SPECIALTY YEAST MARKET, BY FOOD APPLICATION, 2022-2027 (USD MILLION)

- 11.5.1 SOUTH AMERICA

- 11.5.1.1 Rising demand for traditional fermented beverages to drive the specialty yeast market in South America

- FIGURE 35 WINE PRODUCTION IN SOUTH AMERICA, BY COUNTRY, 2021

- TABLE 125 CATALOG OF TRADITIONAL FERMENTED BEVERAGES IN SOUTH AMERICA

- TABLE 126 SOUTH AMERICA: SPECIALTY YEAST MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 127 SOUTH AMERICA: SPECIALTY YEAST MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 11.5.2 MIDDLE EAST & AFRICA

- 11.5.2.1 Growing demand for clean-label ingredients to drive the growth of the specialty yeast market in the Middle East

- TABLE 128 MIDDLE EAST & AFRICA: SPECIALTY YEAST MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 129 MIDDLE EAST & AFRICA: SPECIALTY YEAST MARKET, BY TYPE, 2022-2027 (USD MILLION)

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 MARKET SHARE ANALYSIS, 2021

- TABLE 130 SPECIALTY YEAST MARKET SHARE ANALYSIS, 2021

- 12.3 HISTORICAL REVENUE ANALYSIS OF KEY PLAYERS

- FIGURE 36 TOTAL REVENUE ANALYSIS OF KEY PLAYERS IN THE MARKET, 2017-2021 (USD BILLION)

- 12.4 COMPANY EVALUATION QUADRANT (KEY PLAYERS)

- 12.4.1 STARS

- 12.4.2 PERVASIVE PLAYERS

- 12.4.3 EMERGING LEADERS

- 12.4.4 PARTICIPANTS

- FIGURE 37 SPECIALTY YEAST MARKET: COMPANY EVALUATION QUADRANT, 2021 (KEY PLAYERS)

- 12.4.5 SPECIALTY YEAST MARKET: PRODUCT FOOTPRINT (KEY PLAYERS)

- TABLE 131 COMPANY FOOTPRINT, BY TYPE (KEY PLAYERS)

- TABLE 132 COMPANY FOOTPRINT, BY SPECIES (KEY PLAYERS)

- TABLE 133 COMPANY FOOTPRINT, BY APPLICATION (KEY PLAYERS)

- TABLE 134 COMPANY FOOTPRINT, BY REGION (KEY PLAYERS)

- TABLE 135 OVERALL COMPANY FOOTPRINT (KEY PLAYERS)

- 12.5 SPECIALTY YEAST MARKET, EVALUATION QUADRANT, 2021 (OTHER PLAYERS)

- 12.5.1 PROGRESSIVE COMPANIES

- 12.5.2 STARTING BLOCKS

- 12.5.3 RESPONSIVE COMPANIES

- 12.5.4 DYNAMIC COMPANIES

- FIGURE 38 SPECIALTY YEAST MARKET: COMPANY EVALUATION QUADRANT, 2021 (OTHER PLAYERS)

- FIGURE 39 SPECIALTY YEAST MARKET: COMPETITIVE BENCHMARKING OF OTHER PLAYERS

- 12.6 COMPETITIVE SCENARIO

- 12.6.1 NEW PRODUCT LAUNCHES

- TABLE 136 SPECIALTY YEAST MARKET: NEW PRODUCT LAUNCHES, 2018-2022

- 12.6.2 DEALS

- TABLE 137 SPECIALTY YEAST MARKET: DEALS, 2018-2022

- 12.6.3 OTHERS

- TABLE 138 SPECIALTY YEAST MARKET: OTHERS, 2022

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- (Business Overview, Products/Services/Solutions offered, Recent Developments, MnM view, Key strengths/right to win, Strategic choices made, Weakness/competitive threats)**

- 13.1.1 ASSOCIATED BRITISH FOODS PLC

- TABLE 139 ASSOCIATED BRITISH FOODS PLC: BUSINESS OVERVIEW

- FIGURE 40 ASSOCIATED BRITISH FOODS PLC: COMPANY SNAPSHOT

- TABLE 140 ASSOCIATED BRITISH FOODS PLC: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 141 ASSOCIATED BRITISH FOODS PLC: DEALS

- TABLE 142 ASSOCIATED BRITISH FOODS PLC: NEW PRODUCT LAUNCHES

- TABLE 143 ASSOCIATED BRITISH FOODS PLC: OTHERS

- 13.1.2 ADM

- TABLE 144 ADM: BUSINESS OVERVIEW

- FIGURE 41 ADM: COMPANY SNAPSHOT

- TABLE 145 ADM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 146 ADM: OTHERS

- 13.1.3 LALLEMAND INC.

- TABLE 147 LALLEMAND INC.: BUSINESS OVERVIEW

- TABLE 148 LALLEMAND INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 149 LALLEMAND INC.: DEALS

- TABLE 150 LALLEMAND INC.: NEW PRODUCT LAUNCHES

- TABLE 151 LALLEMAND INC.: OTHERS

- 13.1.4 DSM

- TABLE 152 DSM: BUSINESS OVERVIEW

- FIGURE 42 DSM: COMPANY SNAPSHOT

- TABLE 153 DSM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 154 DSM: OTHERS

- 13.1.5 CHR. HANSEN HOLDING A/S

- TABLE 155 CHR. HANSEN HOLDING A/S: BUSINESS OVERVIEW

- FIGURE 43 CHR. HANSEN HOLDING A/S: COMPANY SNAPSHOT

- TABLE 156 CHR. HANSEN HOLDING A/S: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 157 CHR. HANSEN HOLDING A/S: OTHERS

- 13.1.6 KERRY GROUP PLC.

- TABLE 158 KERRY GROUP PLC.: BUSINESS OVERVIEW

- FIGURE 44 KERRY GROUP PLC.: COMPANY SNAPSHOT

- TABLE 159 KERRY GROUP PLC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 160 KERRY GROUP PLC.: NEW PRODUCT LAUNCHES

- TABLE 161 KERRY GROUP PLC.: OTHERS

- 13.1.7 LESAFFRE

- TABLE 162 LESAFFRE: BUSINESS OVERVIEW

- TABLE 163 LESAFFRE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 164 LESAFFRE: OTHERS

- 13.1.8 ANGELYEAST CO., LTD.

- TABLE 165 ANGELYEAST CO., LTD.: BUSINESS OVERVIEW

- TABLE 166 ANGELYEAST CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 167 ANGELYEAST CO., LTD.: DEALS

- TABLE 168 ANGELYEAST CO., LTD.: OTHERS

- 13.1.9 BIORIGIN

- TABLE 169 BIORIGIN: BUSINESS OVERVIEW

- TABLE 170 BIORIGIN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 171 BIORIGIN: DEALS

- 13.1.10 KEMIN INDUSTRIES, INC.

- TABLE 172 KEMIN INDUSTRIES, INC.: BUSINESS OVERVIEW

- TABLE 173 KEMIN INDUSTRIES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 174 KEMIN INDUSTRIES, INC.: OTHERS

- 13.2 OTHER PLAYERS

- 13.2.1 LEIBER

- TABLE 175 LEIBER: BUSINESS OVERVIEW

- TABLE 176 LEIBER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 177 LEIBER: DEALS

- TABLE 178 LEIBER: OTHERS

- 13.2.2 FOODCHEM INTERNATIONAL CORPORATION

- TABLE 179 FOODCHEM INTERNATIONAL CORPORATION: BUSINESS OVERVIEW

- TABLE 180 FOODCHEM INTERNATIONAL CORPORATION: PRODUCTS/ SOLUTIONS/SERVICES OFFERED

- 13.2.3 KOHJIN LIFE SCIENCES CO., LTD.

- TABLE 181 KOHJIN LIFE SCIENCES CO., LTD.: BUSINESS OVERVIEW

- TABLE 182 KOHJIN LIFE SCIENCES CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.2.4 LEVEX

- TABLE 183 LEVEX: BUSINESS OVERVIEW

- TABLE 184 LEVEX: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.2.5 ARIA INGREDIENTS

- TABLE 185 ARIA INGREDIENTS: BUSINESS OVERVIEW

- TABLE 186 ARIA INGREDIENTS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.2.6 HALCYON PROTEINS PTY. LTD.

- 13.2.7 JEEVAN BIOTECH

- 13.2.8 AGRANO GMBH & CO. KG

- 13.2.9 AEB GROUP SPA

- 13.2.10 TITAN BIOTECH

- *Details on Business Overview, Products Offered, Recent Developments, Deals, MnM view, Key strengths/right to win, Strategic choices made, Weakness/competitive threats might not be captured in case of unlisted companies.

14 ADJACENT AND RELATED MARKETS

- 14.1 INTRODUCTION

- TABLE 187 ADJACENT MARKETS

- 14.2 LIMITATIONS

- 14.3 FEED YEAST MARKET

- 14.3.1 MARKET DEFINITION

- 14.3.2 MARKET OVERVIEW

- TABLE 188 FEED YEAST MARKET, BY GENUS, 2020-2025 (USD MILLION)

- 14.4 YEAST MARKET

- 14.4.1 MARKET DEFINITION

- 14.4.2 MARKET OVERVIEW

- TABLE 189 YEAST MARKET, BY GENUS, 2018-2025 (USD MILLION)

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGE STORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 AVAILABLE CUSTOMIZATIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS