|

|

市場調査レポート

商品コード

1218257

自動車用ハイパーバイザーの世界市場:種類別・車種別・エンドユーザー別・自動運転レベル別・BUSシステム別 (CAN、LIN、Ethernet、FlexRay)・販売チャネル別・地域別の将来予測 (2027年まで)Automotive Hypervisor Market by Type, Vehicle Type, End User, Level Of Autonomous Driving, Bus System (Controller Area Network (CAN), Local Interconnect Network (LIN), Ethernet, and FlexRay), Sales Channel and Region - Global Forecast to 2027 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 自動車用ハイパーバイザーの世界市場:種類別・車種別・エンドユーザー別・自動運転レベル別・BUSシステム別 (CAN、LIN、Ethernet、FlexRay)・販売チャネル別・地域別の将来予測 (2027年まで) |

|

出版日: 2023年02月09日

発行: MarketsandMarkets

ページ情報: 英文 212 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の自動車用ハイパーバイザーの市場規模は、2022年から2027年にかけて27.0%のCAGRで成長し、2022年の1億7,100万米ドルから2027年には5億6,600万米ドルに達すると予測されます。

V2V、V2I機能の普及率の上昇により、ハイパーバイザー市場の需要も高まると予想されます。

"各種の自動車用アプリケーションを統合し、一元的な機能をサポート"

ハイパーバイザーの基盤は、すでに自動車に実装されているIoT (Internet of Things)、テレマティクス、自律走行車、パーソナルアシスト、人工知能 (AI) など、自動車産業における技術進歩やイノベーションによって築かれ、今後の自動車用アプリケーションの更新が期待されています。ハイパーバイザー技術は、自動運転車やモビリティサービスの進化に重要な役割を果たすと期待されています。ADASは、すでに堅牢なシステムであることが証明されており、改良版のアップグレードが続けられています。

"現代の自動車における電気/電子 (E/E) アーキテクチャの複雑化"

現代の自動車には、80以上のECU が搭載されている場合があります。自動車への電子部品の採用は、過去20年間で急速に増加しており、そのペースはさらに加速すると予想されます。これにより、自動車ユーザーは、車内決済サービス、オンロードエンターテイメント、その他のコネクテッドサービスなどの機能を利用できるようになると予想されます。これらの機能に対する消費者の嗜好の高まりが、市場の成長を促す主な要因となっています。さらに、政府や立法機関が実施する厳しい安全基準により、自動車メーカーは各種アプリケーション向けに互換性と信頼性のあるソフトウェアを開発するようになりました。これらの安全機能は、ECUやソフトウェア・プラットフォームからの入力に大きく依存しています。このように、自動車業界ではエレクトロニクスに対する需要が急速に高まっており、それが市場成長の原動力となることが期待されています。

"先進的なユーザーインターフェースにおける革新的な技術の利用が増加"

HMI (ヒューマン・マシン・インターフェース) のソリューションは、近年、自動車産業を大きく変貌させました。機能の制御や操作における複雑さが解消されたのです。これにより、ユーザーエクスペリエンスが向上します。ユーザーは、HMIソリューションの助けを借りて、音楽システム、車両ライト、インフォテインメント・システムなどの車両アプリケーションを簡単に制御することができます。HMIはまた、ユーザーにさまざまな便利な機能を提供します。ユーザーエクスペリエンスの向上と利便性機能の増加傾向により、電子システムのコストに占める割合は、車両の8~12%に増加しました。

"コネクテッドカーと先進的な自動車技術の採用が増加"

コネクテッドカーの増加により、コネクテッドカー・エコシステムの利害関係者に新たな収益機会の創出が期待されています。今日の自動車は、もはやハードウェアベースの移動機械ではありません。自動車は約40%が電子システムで構成されており、今後数十年の間に60%以上に増加することが予想されます。電子システムの大部分は、ADAS、テレマティクス、エンジン管理システムなどの高度な車両アプリケーションに対応するドメインコントローラ、統合ECU、HMI、AIが占めると予想されます。自動車の技術的な高度化が進むにつれて、アプリケーションの複雑さも増しています。その結果、より多くのコードでシステムをプログラムすることが求められ、組み込み用ハイパーバイザー技術の必要性が高まっています。

当レポートでは、世界の自動車用ハイパーバイザーの市場について分析し、市場の基本構造や最新情勢、主な市場促進・抑制要因、エンドユーザー別・車種別・種類別・自動運転レベル別・BUSシステム別・販売チャネル別・地域別の市場動向の見通し、市場競争の状態、主要企業のプロファイルなどを調査しております。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- ポーターのファイブフォース分析

- マクロ経済指標

- 主要国のGDPの動向と予測

- 自動車用ハイパーバイザー市場の動向と混乱

- バリューチェーン分析

- 自動車用ハイパーバイザー市場のエコシステム

- 特許分析

- ケーススタディ分析

- 規制の概要

- 技術分析

- 主な利害関係者と購入基準

- 会議とイベント (2022年~2023年)

- 規制機関、政府機関、その他の組織

- 自動車用ハイパーバイザーの市場シナリオ (2022~2027年)

- 最も可能性の高いシナリオ

- 楽観的シナリオ

- 悲観的なシナリオ

第6章 自動車用ハイパーバイザー市場:エンドユーザー別

- イントロダクション

- 低価格車

- 中価格車

- 高級車

- 主要な業界考察

第7章 自動車用ハイパーバイザー市場:車種別

- イントロダクション

- 乗用車

- 小型商用車

- 大型商用車

- 主要な業界考察

第8章 自動車用ハイパーバイザー市場:種類別

- イントロダクション

- タイプ1

- タイプ2

- 主要な業界考察

第9章 自動車用ハイパーバイザー市場:自動運転レベル別

- イントロダクション

- 自動運転車

- 半自動運転車

- 主要な業界考察

第10章 自動車用ハイパーバイザー市場:BUSシステム別

- イントロダクション

- CAN

- Ethernet

- FlexRay

- LIN

第11章 自動車用ハイパーバイザー市場:販売チャネル別

- イントロダクション

- OEM

- アフターマーケット

- 主な洞察

第12章 自動車用ハイパーバイザー市場:地域別

- イントロダクション

- アジア太平洋地域

- 中国

- インド

- 日本

- 韓国

- タイ

- 他のアジア太平洋諸国

- 欧州

- フランス

- ドイツ

- ロシア

- スペイン

- 英国

- 他の欧州諸国

- 北米

- カナダ

- メキシコ

- 米国

- 他の国々 (RoW)

- ブラジル

- イラン

- その他

第13章 競合情勢

- 概要

- 自動車用ハイパーバイザーの市場シェア分析

- PANASONIC

- NXP SEMICONDUCTORS

- RENESAS ELECTRONICS

- BLACKBERRY

- VISTEON CORPORATION

- 主要企業の戦略

- 主な上場企業の収益分析

- 競合シナリオ

- 新製品の発売

- 資本取引

- その他

- 企業評価クアドラント

- スタートアップ/中小企業の評価クアドラント

第14章 企業プロファイル

- 主要企業

- PANASONIC

- NXP SEMICONDUCTORS

- RENESAS ELECTRONICS

- BLACKBERRY

- VISTEON CORPORATION

- SIEMENS

- ELEKTROBIT

- GREEN HILLS SOFTWARE

- SASKEN TECHNOLOGIES

- SYSGO

- OPENSYNERGY

- その他の企業

- HARMAN INTERNATIONAL

- KPIT TECHNOLOGIES

- TATA ELXSI

- LUXOFT

- HANGSHENG TECHNOLOGY

- QT COMPANY

- QUALCOMM TECHNOLOGIES

- VMWARE

- TEXAS INSTRUMENTS

- LYNX SOFTWARE TECHNOLOGIES

- ETAS

- INFINEON TECHNOLOGIES

第15章 MarketsandMarketsの提言

第16章 付録

Automotive Hypervisor market, is projected to grow at a CAGR of 27.0% from 2022 to 2027, to reach USD 566 million by 2027 from USD 171 million in 2022. Due to the rise in the penetration of V2V, V2I features, demand in the hypervisor market is expected to rise.

"Integration of various automotive applications to support centralized function"

The foundation of the hypervisor was laid by technological advancements and innovations in the automotive industry such as the Internet of Things (IoT), telematics, autonomous vehicle, personal assistance, and Artificial Intelligence (AI) which are already implemented in vehicles and are expected to upgrade future automotive applications. The hypervisor technology is expected to play a key role in the evolution of autonomous vehicles and mobility services. ADAS has already proved to be a robust system and continues to be upgraded with improved versions. For instance, it has been upgraded with the vehicle-to-vehicle and vehicle-to-infrastructure communication technology for safety in 2019. Radio signals transmit traffic data from car to car to alert drivers about potential road hazards.

"Increasing complexity of electrical/electronic (E/E) architecture in modern vehicles"

Modern vehicles may have more than 80 ECUs including the powertrain control module (PCM), transmission control module (TCM), engine control module (ECM), general electronic module (GEM), brake control module (BCM), suspension control module (SCM), central timing module (CTM), body control module (BCM), and others. The adoption of electronic components in vehicles has increased rapidly during the last two decades and the pace is expected to accelerate further. This is expected to enable vehicle users to use features such as in-car payment services, on-road entertainment, and other connected services. The increasing consumer preference for these features is a major factor driving the growth of the market. Moreover, stringent safety norms implemented by governments and legislative agencies have led automobile manufacturers to develop compatible and reliable software for various applications such as telematics, infotainment & communication systems, powertrain, body control & comfort, and ADAS & safety systems. These safety features rely significantly on inputs from ECUs and software platforms. Thus, the demand for electronics has increased at a rapid pace in the automotive industry, which, in turn, is expected to drive the growth of the market.

"Increasing use of innovative technologies in advanced user interface"

The human machine interface solution has transformed the automotive industry in recent years. The complexity in controlling and operating functions has been eliminated. This enhances the user experience. A user, with the help of an HMI solution, can easily control vehicle applications such as the music system, vehicle lights, and the infotainment system. HMI offers various convenience features to users such as heads-up display, rear seat entertainment systems, steering based controls, digital instrument clusters, voice recognition, and voice guidance. Earlier, the share of electronic systems in vehicles was only 1-2% of the cost of the vehicle. Due to the rising trend in enhanced user experience and convenience features, the share of the cost of electronic systems has increased to 8-12% of a vehicle.

"Increasing adoption of connected cars and advanced automotive technologies"

The increasing number of connected cars has opened new revenue generating opportunities for stakeholders in the connected car ecosystem. A high number of non-automotive players have joined the race in the development of connected cars and autonomous driving to leverage opportunities in revenue generation. Today's vehicles are no longer hardware-based moving machines. They comprise approximately 40% electronic systems which are expected to increase to more than 60% during the next few decades. A majority of electronic systems are expected to be dominated by domain controllers, consolidated ECUs, HMI, and AI for advanced vehicle applications such as ADAS, telematics, and engine management systems. These applications are required to be programmed with a significantly high number of lines of codes for proper functioning. As vehicles are being increasingly made technically advanced, the complexity of applications is increasing. As a result, systems are required to be programmed with a higher number of codes, which, in turn, is increasing the need for the embedded hypervisor technology.

The study contains insights from various industry experts, ranging from component suppliers to tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type: OEMs - 57%, Tier 1 - 29%, Tier 2 - 14%

- By Designation: CXOs - 54%, Directors - 32%, Others - 14%

- By Region: Asia Pacific- 32%, Europe - 36%, North America - 24%, RoW - 8%

Major players profiled in the report are Panasonic (Japan), NXP Semiconductors (Netherlands), Renesas Electronics (Japan), Blackberry (Canada), and Visteon Corporation (US).

Research Coverage

In this report, Automotive Hypervisor market is segmented into four major regions, namely, North America, Europe, Asia Pacific and Rest of the World. The report estimates the size of the automotive hypervisor market, by value, based on type (type 1 and type 2), by bus system (CAN, LIN, Ethernet and Flexray), by end user (economy vehicles, mid-priced vehicles and luxury vehicles), by vehicle type (passenger cars, LCVs and HCVs), by level of autonomous driving (semi-autonomous and autonomous vehicles) and by sales channel (OEM and Aftermarket).

Key Benefits of Buying the Report:

- The report will help market leaders/new entrants in this market with information on the closest approximations of revenue and volume numbers for the Automotive Hypervisor market and its sub segments.

- This report will help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies.

- The report also helps stakeholders understand the pulse of the market and provides them information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 AUTOMOTIVE HYPERVISOR MARKET, DEFINITION BY VEHICLE TYPE

- 1.2.2 AUTOMOTIVE HYPERVISOR MARKET, DEFINITION BY END USER

- 1.2.3 AUTOMOTIVE HYPERVISOR MARKET, DEFINITION BY TYPE

- 1.2.4 AUTOMOTIVE HYPERVISOR MARKET, DEFINITION BY BUS SYSTEM

- 1.2.5 AUTOMOTIVE HYPERVISOR MARKET, DEFINITION BY LEVEL OF AUTONOMOUS DRIVING

- 1.3 INCLUSIONS AND EXCLUSIONS

- TABLE 1 AUTOMOTIVE HYPERVISOR MARKET: INCLUSIONS AND EXCLUSIONS

- 1.4 MARKET SCOPE

- FIGURE 1 AUTOMOTIVE HYPERVISOR MARKET SEGMENTATION

- 1.5 YEARS CONSIDERED

- 1.6 CURRENCY CONSIDERED

- TABLE 2 CURRENCY EXCHANGE RATES (PER USD)

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.1.2 List of secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Participating companies for primary research

- FIGURE 3 KEY INDUSTRY INSIGHTS

- FIGURE 4 BREAKDOWN OF PRIMARIES

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 RECESSION IMPACT ANALYSIS

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY

- 2.2.2 BOTTOM-UP APPROACH

- FIGURE 6 BOTTOM-UP APPROACH

- 2.2.3 TOP-DOWN APPROACH

- FIGURE 7 TOP-DOWN APPROACH

- 2.3 FACTOR ANALYSIS

- 2.3.1 REGIONAL ECONOMY IMPACT ANALYSIS

- 2.3.2 FACTOR ANALYSIS FOR MARKET SIZING: DEMAND AND SUPPLY SIDES

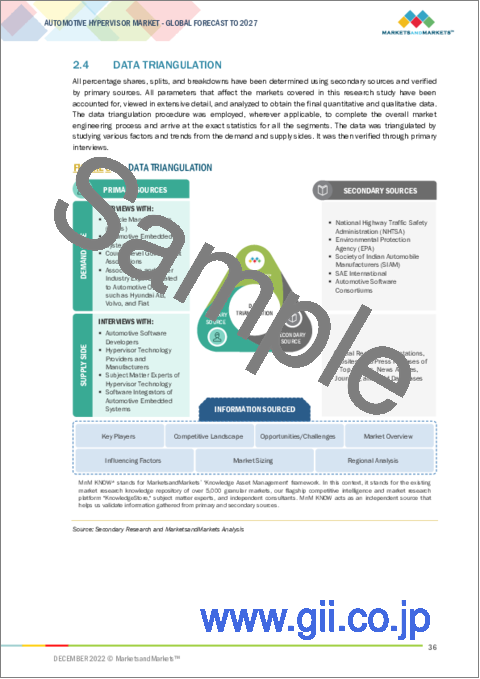

- 2.4 DATA TRIANGULATION

- FIGURE 8 DATA TRIANGULATION

- 2.5 ASSUMPTIONS

- 2.6 RISK ASSESSMENT

- 2.7 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

- FIGURE 9 AUTOMOTIVE HYPERVISOR MARKET FACTORS

- FIGURE 10 AUTOMOTIVE HYPERVISOR MARKET, BY REGION, 2022 VS. 2027 (USD MILLION)

- FIGURE 11 AUTOMOTIVE HYPERVISOR MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN AUTOMOTIVE HYPERVISOR MARKET

- FIGURE 12 INTEGRATION OF AUTOMOTIVE APPLICATIONS TO SUPPORT CENTRALIZED FUNCTIONS IN VEHICLES

- 4.2 AUTOMOTIVE HYPERVISOR MARKET, BY REGION

- FIGURE 13 ASIA PACIFIC ESTIMATED TO ACCOUNT FOR LARGEST MARKET SHARE IN 2022

- 4.3 AUTOMOTIVE HYPERVISOR MARKET, BY TYPE

- FIGURE 14 TYPE 1 TO ACQUIRE HIGHER MARKET SHARE FROM 2022 TO 2027

- 4.4 AUTOMOTIVE HYPERVISOR MARKET, BY LEVEL OF AUTONOMOUS DRIVING

- FIGURE 15 ASIA PACIFIC TO BE LARGEST MARKET DURING FORECAST PERIOD

- 4.5 AUTOMOTIVE HYPERVISOR MARKET, BY END USER

- FIGURE 16 LUXURY VEHICLES SURPASS OTHER END USERS

- 4.6 AUTOMOTIVE HYPERVISOR MARKET, BY VEHICLE TYPE

- FIGURE 17 PASSENGER CARS COMMAND LEADING MARKET POSITION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- TABLE 3 IMPACT OF MARKET DYNAMICS

- 5.2 MARKET DYNAMICS

- FIGURE 18 AUTOMOTIVE HYPERVISOR MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Integration of automotive applications to support centralized function

- FIGURE 19 VEHICLE V2X FEATURES

- 5.2.1.2 Increased complexity of electrical/electronic architecture in modern vehicles

- FIGURE 20 COMPLEXITY OF ELECTRONIC ARCHITECTURE IN MODERN VEHICLES

- 5.2.1.3 Rigorous use of innovative technologies in advanced user interface

- 5.2.1.4 Growing adoption of connected cars and advanced automotive technologies

- 5.2.2 RESTRAINTS

- 5.2.2.1 Lack of standard protocols to develop software platforms for automotive applications

- 5.2.2.2 Lower implementation of technology in economy vehicles

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rise in demand for luxury cars

- TABLE 4 PRODUCTION VOLUME OF LUXURY CAR MODELS, 2020 VS. 2021

- 5.2.3.2 Leveraging automotive software for embedded hypervisors

- FIGURE 21 TYPES OF HYPERVISORS

- 5.2.3.3 Advanced embedded technology is key for semi-autonomous and autonomous cars

- FIGURE 22 AUTONOMOUS CAR

- 5.2.3.4 Consolidation of electronic control units

- 5.2.4 CHALLENGES

- 5.2.4.1 Impact of hardware on power management

- 5.2.4.2 Risk of cybersecurity in connected vehicles

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 23 PORTER'S FIVE FORCES ANALYSIS

- TABLE 5 IMPACT OF PORTER'S FIVE FORCES

- 5.3.1 THREAT OF SUBSTITUTES

- 5.3.2 THREAT OF NEW ENTRANTS

- 5.3.3 BARGAINING POWER OF BUYERS

- 5.3.4 BARGAINING POWER OF SUPPLIERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 MACROECONOMIC INDICATORS

- 5.4.1 GDP TRENDS AND FORECASTS FOR MAJOR ECONOMIES

- TABLE 6 GDP TRENDS AND FORECASTS FOR MAJOR ECONOMIES, 2018-2026 (USD BILLION)

- 5.5 TRENDS AND DISRUPTIONS IN AUTOMOTIVE HYPERVISOR MARKET

- FIGURE 24 TRENDS AND DISRUPTIONS IN AUTOMOTIVE HYPERVISOR MARKET

- 5.6 VALUE CHAIN ANALYSIS

- FIGURE 25 VALUE CHAIN ANALYSIS

- 5.7 AUTOMOTIVE HYPERVISOR MARKET ECOSYSTEM

- FIGURE 26 AUTOMOTIVE HYPERVISOR MARKET ECOSYSTEM

- 5.7.1 OEM

- 5.7.2 AUTOMOTIVE HYPERVISOR MANUFACTURERS

- 5.7.3 AUTOMOTIVE SOFTWARE PROVIDERS

- TABLE 7 AUTOMOTIVE HYPERVISOR MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- 5.8 PATENT ANALYSIS

- TABLE 8 ACTIVE PATENTS

- TABLE 9 PATENTED DOCUMENTS ANALYSIS

- 5.9 CASE STUDY ANALYSIS

- 5.9.1 CASE STUDY 1: AUTOV - AUTOMOTIVE TESTBED FOR REAL-TIME VIRTUALIZATION

- 5.9.2 CASE STUDY 2: EVALUATION OF EMBEDDED HYPERVISOR ON AUTOMOTIVE PLATFORM

- 5.9.3 CASE STUDY 3: GREEN HILLS SOFTWARE POWERS ADVANCEMENTS IN MULTI-OS AUTOMOTIVE COCKPIT FOR MARELLI

- 5.10 REGULATORY OVERVIEW

- 5.10.1 NORTH AMERICA

- TABLE 10 NORTH AMERICA: POLICIES AND INITIATIVES SUPPORTING AUTOMOTIVE HYPERVISOR MARKET

- 5.10.2 EUROPE

- TABLE 11 EUROPE: POLICIES AND INITIATIVES SUPPORTING AUTOMOTIVE HYPERVISOR MARKET

- 5.10.3 ASIA PACIFIC

- TABLE 12 ASIA PACIFIC: POLICIES AND INITIATIVES SUPPORTING AUTOMOTIVE HYPERVISOR MARKET

- 5.11 TECHNOLOGY ANALYSIS

- 5.11.1 VIRTUALIZATION

- 5.11.2 IOT IN AUTOMOBILES

- 5.11.3 CONSOLIDATION OF ECUS

- 5.12 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

- TABLE 13 INFLUENCE OF INSTITUTIONAL BUYERS ON PURCHASE OF AUTOMOTIVE HYPERVISORS

- 5.12.2 BUYING CRITERIA

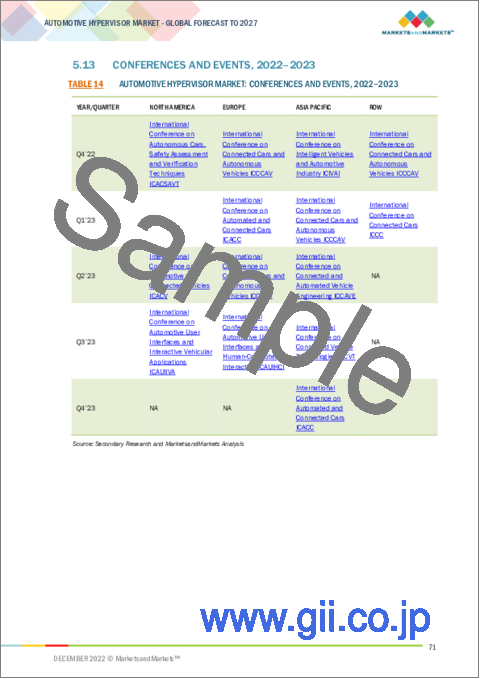

- 5.13 CONFERENCES AND EVENTS, 2022-2023

- TABLE 14 AUTOMOTIVE HYPERVISOR MARKET: CONFERENCES AND EVENTS, 2022-2023

- 5.14 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.15 AUTOMOTIVE HYPERVISOR MARKET SCENARIOS, 2022-2027

- 5.15.1 MOST LIKELY SCENARIO

- TABLE 19 AUTOMOTIVE HYPERVISOR MARKET (MOST LIKELY), BY REGION, 2022-2027 (USD MILLION)

- 5.15.2 OPTIMISTIC SCENARIO

- TABLE 20 AUTOMOTIVE HYPERVISOR MARKET (OPTIMISTIC), BY REGION, 2022-2027 (USD MILLION)

- 5.15.3 PESSIMISTIC SCENARIO

- TABLE 21 AUTOMOTIVE HYPERVISOR MARKET (PESSIMISTIC), BY REGION, 2022-2027 (USD MILLION)

6 AUTOMOTIVE HYPERVISOR MARKET, BY END USER

- 6.1 INTRODUCTION

- FIGURE 27 AUTOMOTIVE HYPERVISOR MARKET, BY END USER, 2022 VS. 2027 (USD MILLION)

- TABLE 22 AUTOMOTIVE HYPERVISOR MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 23 AUTOMOTIVE HYPERVISOR MARKET, BY END USER, 2022-2027 (USD MILLION)

- 6.1.1 OPERATIONAL DATA

- TABLE 24 NUMBER OF ECUS/MDCS, BY END USER

- 6.1.2 ASSUMPTIONS

- 6.1.3 RESEARCH METHODOLOGY

- 6.2 ECONOMY VEHICLES

- 6.2.1 LOW COST AND INCORPORATION OF ADVANCED FEATURES

- TABLE 25 ECONOMY VEHICLES: AUTOMOTIVE HYPERVISOR MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 26 ECONOMY VEHICLES: AUTOMOTIVE HYPERVISOR MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.3 MID-PRICED VEHICLES

- 6.3.1 ADVANCEMENTS IN INFOTAINMENT FEATURES

- TABLE 27 MID-PRICED VEHICLES: AUTOMOTIVE HYPERVISOR MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 28 MID-PRICED VEHICLES: AUTOMOTIVE HYPERVISOR MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.4 LUXURY VEHICLES

- 6.4.1 INCREASING ADOPTION OF V2X FEATURES

- TABLE 29 LUXURY VEHICLES: AUTOMOTIVE HYPERVISOR MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 30 LUXURY VEHICLES: AUTOMOTIVE HYPERVISOR MARKET, BY REGION, 2022-2027 (USD MILLION)

- 6.5 KEY INDUSTRY INSIGHTS

7 AUTOMOTIVE HYPERVISOR MARKET, BY VEHICLE TYPE

- 7.1 INTRODUCTION

- FIGURE 28 AUTOMOTIVE HYPERVISOR MARKET, BY VEHICLE TYPE, 2022 VS. 2027 (USD MILLION)

- TABLE 31 AUTOMOTIVE HYPERVISOR MARKET, BY VEHICLE TYPE, 2018-2021 (USD MILLION)

- TABLE 32 AUTOMOTIVE HYPERVISOR MARKET, BY VEHICLE TYPE, 2022-2027 (USD MILLION)

- 7.1.1 OPERATIONAL DATA

- TABLE 33 SOFTWARE VENDORS, BY VEHICLE TYPE

- 7.1.2 ASSUMPTIONS

- 7.1.3 RESEARCH METHODOLOGY

- 7.2 PASSENGER CARS

- 7.2.1 HIGH DEMAND FOR CONNECTED VEHICLES

- TABLE 34 PASSENGER CARS: AUTOMOTIVE HYPERVISOR MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 35 PASSENGER CARS: AUTOMOTIVE HYPERVISOR MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.3 LIGHT COMMERCIAL VEHICLES

- 7.3.1 IMPLEMENTATION OF ADVANCED FEATURES

- TABLE 36 LCVS: AUTOMOTIVE HYPERVISOR MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.4 HEAVY COMMERCIAL VEHICLES

- 7.4.1 ENHANCED COMMUNICATION AND SAFETY SYSTEMS

- TABLE 37 HCVS: AUTOMOTIVE HYPERVISOR MARKET, BY REGION, 2022-2027 (USD MILLION)

- 7.5 KEY INDUSTRY INSIGHTS

8 AUTOMOTIVE HYPERVISOR MARKET, BY TYPE

- 8.1 INTRODUCTION

- FIGURE 29 AUTOMOTIVE HYPERVISOR MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

- TABLE 38 AUTOMOTIVE HYPERVISOR MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 39 AUTOMOTIVE HYPERVISOR MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 8.1.1 OPERATIONAL DATA

- TABLE 40 SOFTWARE VENDORS, BY TYPE

- 8.1.2 ASSUMPTIONS

- 8.1.3 RESEARCH METHODOLOGY

- 8.2 TYPE 1

- 8.2.1 PREFERENCE FOR SAFETY APPLICATIONS

- TABLE 41 TYPE 1: AUTOMOTIVE HYPERVISOR MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 42 TYPE 1: AUTOMOTIVE HYPERVISOR MARKET, BY REGION, 2022-2027 (USD MILLION)

- 8.3 TYPE 2

- 8.3.1 USE IN NON-CRITICAL FEATURES

- TABLE 43 TYPE 2: AUTOMOTIVE HYPERVISOR MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 44 TYPE 2: AUTOMOTIVE HYPERVISOR MARKET, BY REGION, 2022-2027 (USD MILLION)

- 8.4 KEY INDUSTRY INSIGHTS

9 AUTOMOTIVE HYPERVISOR MARKET, BY LEVEL OF AUTONOMOUS DRIVING

- 9.1 INTRODUCTION

- 9.1.1 OPERATIONAL DATA

- TABLE 45 SOFTWARE VENDORS, BY LEVEL OF AUTONOMOUS DRIVING

- 9.1.2 ASSUMPTIONS

- 9.1.3 RESEARCH METHODOLOGY

- 9.2 AUTONOMOUS VEHICLES

- 9.2.1 NEED FOR HIGH EFFICIENCY IN SELF-DRIVING VEHICLES

- FIGURE 30 AUTOMOTIVE HYPERVISOR MARKET, BY AUTONOMOUS DRIVING, 2026 VS. 2030 (USD MILLION)

- TABLE 46 AUTONOMOUS VEHICLES: AUTOMOTIVE HYPERVISOR MARKET, BY REGION, 2026-2030 (USD MILLION)

- 9.3 SEMI-AUTONOMOUS VEHICLES

- 9.3.1 INCREASING SAFETY AND CONVENIENCE APPLICATIONS

- FIGURE 31 AUTOMOTIVE HYPERVISOR MARKET, BY SEMI-AUTONOMOUS DRIVING, 2022 VS. 2027 (USD MILLION)

- TABLE 47 SEMI-AUTONOMOUS VEHICLES: AUTOMOTIVE HYPERVISOR MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 48 SEMI-AUTONOMOUS VEHICLES: AUTOMOTIVE HYPERVISOR MARKET, BY REGION, 2022-2027 (USD MILLION)

- 9.3.1.1 Level 1 semi-autonomous vehicles

- 9.3.1.2 Level 2 semi-autonomous vehicles

- 9.3.1.3 Level 3 semi-autonomous vehicles

- TABLE 49 SEMI-AUTONOMOUS VEHICLES: AUTOMOTIVE HYPERVISOR MARKET, BY LEVEL OF AUTONOMY, 2022-2027 (USD MILLION)

- 9.4 KEY INDUSTRY INSIGHTS

10 AUTOMOTIVE HYPERVISOR MARKET, BY BUS SYSTEM

- 10.1 INTRODUCTION

- FIGURE 32 AUTOMOTIVE HYPERVISOR MARKET, BY BUS SYSTEM, 2022 VS. 2027 (USD MILLION)

- TABLE 50 AUTOMOTIVE HYPERVISOR MARKET, BY BUS SYSTEM, 2018-2021 (USD MILLION)

- TABLE 51 AUTOMOTIVE HYPERVISOR MARKET, BY BUS SYSTEM, 2022-2027 (USD MILLION)

- 10.2 CAN

- 10.3 ETHERNET

- 10.4 FLEXRAY

- 10.5 LIN

11 AUTOMOTIVE HYPERVISOR MARKET, BY SALES CHANNEL

- 11.1 INTRODUCTION

- 11.2 OEM

- 11.2.1 TREND OF OFFERING BUNDLED SOLUTIONS TO AUTOMAKERS

- 11.3 AFTERMARKET

- 11.3.1 INCREASING VEHICLE SALES

- 11.4 KEY PRIMARY INSIGHTS

- FIGURE 33 KEY PRIMARY INSIGHTS

12 AUTOMOTIVE HYPERVISOR MARKET, BY REGION

- 12.1 INTRODUCTION

- FIGURE 34 AUTOMOTIVE HYPERVISOR MARKET, BY REGION, 2022 VS. 2027 (USD MILLION)

- TABLE 52 AUTOMOTIVE HYPERVISOR MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 53 AUTOMOTIVE HYPERVISOR MARKET, BY REGION, 2022-2027 (USD MILLION)

- 12.2 ASIA PACIFIC

- FIGURE 35 ASIA PACIFIC: AUTOMOTIVE HYPERVISOR MARKET SNAPSHOT

- TABLE 54 ASIA PACIFIC: AUTOMOTIVE HYPERVISOR MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 55 ASIA PACIFIC: AUTOMOTIVE HYPERVISOR MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 56 ASIA PACIFIC: AUTOMOTIVE HYPERVISOR MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 57 ASIA PACIFIC: AUTOMOTIVE HYPERVISOR MARKET, BY END USER, 2022-2027 (USD MILLION)

- 12.2.1 CHINA

- 12.2.1.1 Increased adoption of luxury vehicles

- TABLE 58 CHINA: AUTOMOTIVE HYPERVISOR MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 59 CHINA: AUTOMOTIVE HYPERVISOR MARKET, BY END USER, 2022-2027 (USD MILLION)

- 12.2.2 INDIA

- 12.2.2.1 Significant rise in vehicle production

- TABLE 60 INDIA: AUTOMOTIVE HYPERVISOR MARKET, BY END USER, 2022-2027 (USD MILLION)

- 12.2.3 JAPAN

- 12.2.3.1 Economy vehicles to be fastest-growing segment

- TABLE 61 JAPAN: AUTOMOTIVE HYPERVISOR MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 62 JAPAN: AUTOMOTIVE HYPERVISOR MARKET, BY END USER, 2022-2027 (USD MILLION)

- 12.2.4 SOUTH KOREA

- 12.2.4.1 Introduction of premium vehicles with advanced vehicular features

- TABLE 63 SOUTH KOREA: AUTOMOTIVE HYPERVISOR MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 64 SOUTH KOREA: AUTOMOTIVE HYPERVISOR MARKET, BY END USER, 2022-2027 (USD MILLION)

- 12.2.5 THAILAND

- 12.2.5.1 Largest automotive production capacity in Southeast Asia

- TABLE 65 THAILAND: AUTOMOTIVE HYPERVISOR MARKET, BY END USER, 2022-2027 (USD MILLION)

- 12.2.6 REST OF ASIA PACIFIC

- 12.2.6.1 High demand for electronically controlled features in vehicles

- TABLE 66 REST OF ASIA PACIFIC: AUTOMOTIVE HYPERVISOR MARKET, BY END USER, 2022-2027 (USD MILLION)

- 12.3 EUROPE

- 12.3.1 EUROPE: RECESSION IMPACT

- TABLE 67 EUROPE: AUTOMOTIVE HYPERVISOR MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 68 EUROPE: AUTOMOTIVE HYPERVISOR MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 69 EUROPE: AUTOMOTIVE HYPERVISOR MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 70 EUROPE: AUTOMOTIVE HYPERVISOR MARKET, BY END USER, 2022-2027 (USD MILLION)

- 12.3.2 FRANCE

- 12.3.2.1 Government mandates for vehicle safety systems

- TABLE 71 FRANCE: AUTOMOTIVE HYPERVISOR MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 72 FRANCE: AUTOMOTIVE HYPERVISOR MARKET, BY END USER, 2022-2027 (USD MILLION)

- 12.3.3 GERMANY

- 12.3.3.1 High-end domestic automotive industry

- TABLE 73 GERMANY: AUTOMOTIVE HYPERVISOR MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 74 GERMANY: AUTOMOTIVE HYPERVISOR MARKET, BY END USER, 2022-2027 (USD MILLION)

- 12.3.4 RUSSIA

- 12.3.4.1 Rising production of mid-priced and luxury vehicles

- TABLE 75 RUSSIA: AUTOMOTIVE HYPERVISOR MARKET, BY END USER, 2022-2027 (USD MILLION)

- 12.3.5 SPAIN

- 12.3.5.1 Incorporation of advanced features in vehicles

- TABLE 76 SPAIN: AUTOMOTIVE HYPERVISOR MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 77 SPAIN: AUTOMOTIVE HYPERVISOR MARKET, BY END USER, 2022-2027 (USD MILLION)

- 12.3.6 UK

- 12.3.6.1 OEMs involved in producing luxury cars

- TABLE 78 UK: AUTOMOTIVE HYPERVISOR MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 79 UK: AUTOMOTIVE HYPERVISOR MARKET, BY END USER, 2022-2027 (USD MILLION)

- 12.3.7 REST OF EUROPE

- 12.3.7.1 Increase in vehicle-to-vehicle communication

- TABLE 80 REST OF EUROPE: AUTOMOTIVE HYPERVISOR MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 81 REST OF EUROPE: AUTOMOTIVE HYPERVISOR MARKET, BY END USER, 2022-2027 (USD MILLION)

- 12.4 NORTH AMERICA

- FIGURE 36 NORTH AMERICA: AUTOMOTIVE HYPERVISOR MARKET SNAPSHOT

- TABLE 82 NORTH AMERICA: AUTOMOTIVE HYPERVISOR MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 83 NORTH AMERICA: AUTOMOTIVE HYPERVISOR MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 84 NORTH AMERICA: AUTOMOTIVE HYPERVISOR MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 85 NORTH AMERICA: AUTOMOTIVE HYPERVISOR MARKET, BY END USER, 2022-2027 (USD MILLION)

- 12.4.1 CANADA

- 12.4.1.1 Growing demand for high-end cars

- TABLE 86 CANADA: AUTOMOTIVE HYPERVISOR MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 87 CANADA: AUTOMOTIVE HYPERVISOR MARKET, BY END USER, 2022-2027 (USD MILLION)

- 12.4.2 MEXICO

- 12.4.2.1 Integration with North American market

- TABLE 88 MEXICO: AUTOMOTIVE HYPERVISOR MARKET, BY END USER, 2022-2027 (USD MILLION)

- 12.4.3 US

- 12.4.3.1 Focus on development of high-performance vehicles

- TABLE 89 US: AUTOMOTIVE HYPERVISOR MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 90 US: AUTOMOTIVE HYPERVISOR MARKET, BY END USER, 2022-2027 (USD MILLION)

- 12.5 REST OF THE WORLD

- TABLE 91 ROW: AUTOMOTIVE HYPERVISOR MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 92 ROW: AUTOMOTIVE HYPERVISOR MARKET, BY COUNTRY, 2022-2027 (USD MILLION)

- TABLE 93 ROW: AUTOMOTIVE HYPERVISOR MARKET, BY END USER, 2018-2021(USD MILLION)

- TABLE 94 ROW: AUTOMOTIVE HYPERVISOR MARKET, BY END USER, 2022-2027 (USD MILLION)

- 12.5.1 BRAZIL

- 12.5.1.1 Strong auto manufacturing base of leading OEMs

- TABLE 95 BRAZIL: AUTOMOTIVE HYPERVISOR MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 96 BRAZIL: AUTOMOTIVE HYPERVISOR MARKET, BY END USER, 2022-2027 (USD MILLION)

- 12.5.2 IRAN

- 12.5.2.1 Preference for mid-priced passenger cars

- TABLE 97 IRAN: AUTOMOTIVE HYPERVISOR MARKET, BY END USER, 2022-2027 (USD MILLION)

- 12.5.3 OTHERS

- 12.5.3.1 Largescale use of luxury vehicles

- TABLE 98 OTHERS: AUTOMOTIVE HYPERVISOR MARKET, BY END USER, 2022-2027 (USD MILLION)

13 COMPETITIVE LANDSCAPE

- 13.1 OVERVIEW

- 13.2 AUTOMOTIVE HYPERVISOR MARKET SHARE ANALYSIS

- TABLE 99 MARKET SHARE ANALYSIS, 2021

- FIGURE 37 MARKET SHARE ANALYSIS, 2021

- 13.2.1 PANASONIC

- 13.2.2 NXP SEMICONDUCTORS

- 13.2.3 RENESAS ELECTRONICS

- 13.2.4 BLACKBERRY

- 13.2.5 VISTEON CORPORATION

- 13.3 KEY PLAYER STRATEGIES

- TABLE 100 STRATEGIES ADOPTED BY PLAYERS IN AUTOMOTIVE HYPERVISOR MARKET

- 13.4 REVENUE ANALYSIS OF TOP LISTED/PUBLIC PLAYERS

- FIGURE 38 TOP PUBLIC/LISTED PLAYERS DOMINATING AUTOMOTIVE HYPERVISOR MARKET

- 13.5 COMPETITIVE SCENARIO

- 13.5.1 NEW PRODUCT LAUNCHES

- TABLE 101 NEW PRODUCT LAUNCHES, 2018-2022

- 13.5.2 DEALS

- TABLE 102 DEALS, 2018-2022

- 13.5.3 OTHERS

- TABLE 103 OTHERS, 2018-2022

- 13.6 COMPANY EVALUATION QUADRANT

- 13.6.1 STARS

- 13.6.2 EMERGING LEADERS

- 13.6.3 PERVASIVE PLAYERS

- 13.6.4 PARTICIPANTS

- FIGURE 39 AUTOMOTIVE HYPERVISOR MARKET: COMPANY EVALUATION QUADRANT, 2022

- TABLE 104 AUTOMOTIVE HYPERVISOR MARKET: COMPANY FOOTPRINT, 2022

- TABLE 105 AUTOMOTIVE HYPERVISOR MARKET: PRODUCT FOOTPRINT, 2022

- TABLE 106 AUTOMOTIVE HYPERVISOR MARKET: REGIONAL FOOTPRINT, 2022

- 13.7 STARTUP/SME EVALUATION QUADRANT

- 13.7.1 PROGRESSIVE COMPANIES

- 13.7.2 RESPONSIVE COMPANIES

- 13.7.3 DYNAMIC COMPANIES

- 13.7.4 STARTING BLOCKS

- FIGURE 40 AUTOMOTIVE HYPERVISOR MARKET: STARTUP/SME EVALUATION QUADRANT, 2022

- TABLE 107 AUTOMOTIVE HYPERVISOR MARKET: KEY STARTUPS/SMES

- TABLE 108 AUTOMOTIVE HYPERVISOR MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- (Business Overview, Products Offered, Recent Developments, and MnM View)**

- 14.1.1 PANASONIC

- TABLE 109 PANASONIC: BUSINESS OVERVIEW

- FIGURE 41 PANASONIC: COMPANY SNAPSHOT

- TABLE 110 PANASONIC: PRODUCTS OFFERED

- TABLE 111 PANASONIC: NEW PRODUCT DEVELOPMENTS

- TABLE 112 PANASONIC: DEALS

- 14.1.2 NXP SEMICONDUCTORS

- TABLE 113 NXP SEMICONDUCTORS: BUSINESS OVERVIEW

- FIGURE 42 NXP SEMICONDUCTORS: COMPANY SNAPSHOT

- TABLE 114 NXP SEMICONDUCTORS: PRODUCTS OFFERED

- TABLE 115 NXP SEMICONDUCTORS: NEW PRODUCT DEVELOPMENTS

- TABLE 116 NXP SEMICONDUCTORS: DEALS

- 14.1.3 RENESAS ELECTRONICS

- TABLE 117 RENESAS ELECTRONICS: BUSINESS OVERVIEW

- FIGURE 43 RENESAS ELECTRONICS: COMPANY SNAPSHOT

- TABLE 118 RENESAS ELECTRONICS: PRODUCTS OFFERED

- TABLE 119 RENESAS ELECTRONICS: NEW PRODUCT DEVELOPMENTS

- TABLE 120 RENESAS ELECTRONICS: DEALS

- TABLE 121 RENESAS ELECTRONICS: OTHERS

- 14.1.4 BLACKBERRY

- TABLE 122 BLACKBERRY: BUSINESS OVERVIEW

- FIGURE 44 BLACKBERRY: COMPANY SNAPSHOT

- FIGURE 45 BLACKBERRY: AUTOMOTIVE SOFTWARE

- TABLE 123 BLACKBERRY: PRODUCTS OFFERED

- TABLE 124 BLACKBERRY: NEW PRODUCT DEVELOPMENTS

- TABLE 125 BLACKBERRY: DEALS

- 14.1.5 VISTEON CORPORATION

- TABLE 126 VISTEON CORPORATION: BUSINESS OVERVIEW

- FIGURE 46 VISTEON CORPORATION: COMPANY SNAPSHOT

- TABLE 127 VISTEON CORPORATION: PRODUCTS OFFERED

- TABLE 128 VISTEON CORPORATION: NEW PRODUCT DEVELOPMENTS

- TABLE 129 VISTEON CORPORATION: DEALS

- TABLE 130 VISTEON CORPORATION: OTHERS

- 14.1.6 SIEMENS

- TABLE 131 SIEMENS: BUSINESS OVERVIEW

- FIGURE 47 SIEMENS: COMPANY SNAPSHOT

- TABLE 132 SIEMENS: PRODUCTS OFFERED

- TABLE 133 SIEMENS: NEW PRODUCT DEVELOPMENTS

- TABLE 134 SIEMENS: DEALS

- 14.1.7 ELEKTROBIT

- TABLE 135 ELEKTROBIT: BUSINESS OVERVIEW

- TABLE 136 ELEKTROBIT: PRODUCTS OFFERED

- TABLE 137 ELEKTROBIT: NEW PRODUCT DEVELOPMENTS

- TABLE 138 ELEKTROBIT: DEALS

- 14.1.8 GREEN HILLS SOFTWARE

- TABLE 139 GREEN HILLS SOFTWARE: BUSINESS OVERVIEW

- FIGURE 48 GREEN HILLS SOFTWARE: AUTOMOTIVE PLATFORMS

- TABLE 140 GREEN HILLS SOFTWARE: PRODUCTS OFFERED

- TABLE 141 GREEN HILLS SOFTWARE: NEW PRODUCT DEVELOPMENTS

- TABLE 142 GREEN HILLS SOFTWARE: DEALS

- 14.1.9 SASKEN TECHNOLOGIES

- TABLE 143 SASKEN TECHNOLOGIES: BUSINESS OVERVIEW

- FIGURE 49 SASKEN TECHNOLOGIES: COMPANY SNAPSHOT

- FIGURE 50 SASKEN TECHNOLOGIES: PRODUCT DEVELOPMENT EXPERTISE

- TABLE 144 SASKEN TECHNOLOGIES: PRODUCTS OFFERED

- TABLE 145 SASKEN TECHNOLOGIES: NEW PRODUCT DEVELOPMENTS

- TABLE 146 SASKEN TECHNOLOGIES: DEALS

- TABLE 147 SASKEN TECHNOLOGIES: OTHERS

- 14.1.10 SYSGO

- TABLE 148 SYSGO: BUSINESS OVERVIEW

- TABLE 149 SYSGO: PRODUCTS OFFERED

- TABLE 150 SYSGO: DEALS

- 14.1.11 OPENSYNERGY

- TABLE 151 OPENSYNERGY: BUSINESS OVERVIEW

- TABLE 152 OPENSYNERGY: PRODUCTS OFFERED

- TABLE 153 OPENSYNERGY: NEW PRODUCT DEVELOPMENTS

- TABLE 154 OPENSYNERGY: DEALS

- * Business Overview, Products Offered, Recent Developments, and MnM View might not be captured in case of unlisted companies.

- 14.2 OTHER PLAYERS

- 14.2.1 HARMAN INTERNATIONAL

- TABLE 155 HARMAN INTERNATIONAL: COMPANY OVERVIEW

- 14.2.2 KPIT TECHNOLOGIES

- TABLE 156 KPIT TECHNOLOGIES: COMPANY OVERVIEW

- 14.2.3 TATA ELXSI

- TABLE 157 TATA ELXSI: COMPANY OVERVIEW

- 14.2.4 LUXOFT

- TABLE 158 LUXOFT: COMPANY OVERVIEW

- 14.2.5 HANGSHENG TECHNOLOGY

- TABLE 159 HANGSHENG TECHNOLOGY: COMPANY OVERVIEW

- 14.2.6 QT COMPANY

- TABLE 160 QT COMPANY: COMPANY OVERVIEW

- 14.2.7 QUALCOMM TECHNOLOGIES

- TABLE 161 QUALCOMM TECHNOLOGIES: COMPANY OVERVIEW

- 14.2.8 VMWARE

- TABLE 162 VMWARE: COMPANY OVERVIEW

- 14.2.9 TEXAS INSTRUMENTS

- TABLE 163 TEXAS INSTRUMENTS: COMPANY OVERVIEW

- 14.2.10 LYNX SOFTWARE TECHNOLOGIES

- TABLE 164 LYNX SOFTWARE TECHNOLOGIES: COMPANY OVERVIEW

- 14.2.11 ETAS

- TABLE 165 ETAS: COMPANY OVERVIEW

- 14.2.12 INFINEON TECHNOLOGIES

- TABLE 166 INFINEON TECHNOLOGIES: COMPANY OVERVIEW

15 RECOMMENDATIONS BY MARKETSANDMARKETS

- 15.1 LUXURY VEHICLES TO BE KEY MARKET FOR AUTOMOTIVE HYPERVISORS

- 15.2 TYPE 1 HYPERVISORS TO BE MOST PREFERRED

- 15.3 CONCLUSION

16 APPENDIX

- 16.1 INSIGHTS FROM INDUSTRY EXPERTS

- 16.2 DISCUSSION GUIDE

- 16.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.4 CUSTOMIZATION OPTIONS

- 16.5 RELATED REPORTS

- 16.6 AUTHOR DETAILS