|

|

市場調査レポート

商品コード

1512225

コマンド・コントロールシステムの世界市場:プラットフォーム別、用途別、システム別、ソリューション別、設置別、地域別 - 2029年までの予測Command and Control Systems Market by Platform (Land, Maritime, Airborne, Space and Cyber), Application (Military, Government and Civil & Commercial), Soutions (Hardware, Software and Services), System, Installation & Region - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| コマンド・コントロールシステムの世界市場:プラットフォーム別、用途別、システム別、ソリューション別、設置別、地域別 - 2029年までの予測 |

|

出版日: 2024年07月09日

発行: MarketsandMarkets

ページ情報: 英文 329 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

世界のコマンド・コントロールシステムの市場規模は、2024年の325億米ドルから2029年には447億米ドルに達し、2024年から2029年までのCAGRは6.6%になると予測されています。

意思決定を支援する状況認識の必要性、サイバーセキュリティの脅威の増大が市場を牽引する要因です。しかし、コマンド・コントロールシステムの開発と保守に関するコストは高くなります。L3Harris Technologies, Inc.(米国)、Thales(フランス)、RTX Corporation(米国)、General Dynamics Corporation(米国)、Lockheed Martin Corporation(米国)は、コマンド・コントロールシステム市場で事業を展開する大手企業の一部です。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント別 | プラットフォーム別、用途別、システム別、ソリューション別、設置別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

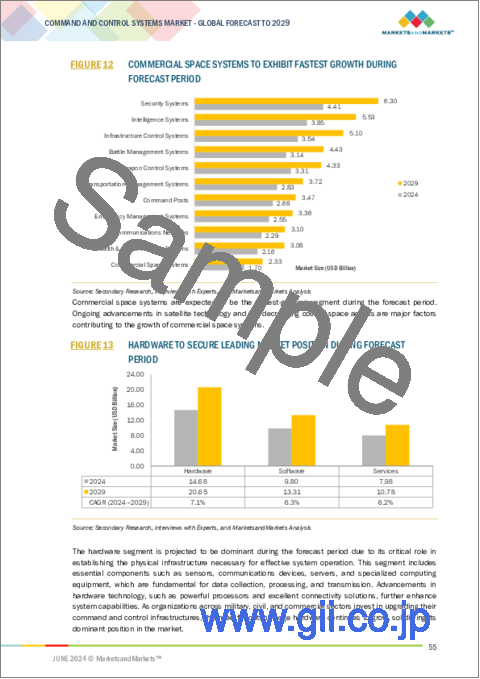

ハードウェアセグメントは、効果的なシステム運用に必要な物理的インフラを確立する上で重要な役割を果たすため、予測期間中は支配的な地位を確保すると予測されています。このセグメントには、センサー、通信機器、サーバー、専用コンピューティング機器など、データ収集、処理、伝送の基本となる重要なコンポーネントが含まれます。さらに、より強力なプロセッサーや強化された接続ソリューションなどのハードウェア技術の進歩は、システム能力を大幅に向上させ、ハードウェア・セグメントを不可欠なものにしています。軍事、民生、商業の各分野の組織がコマンド&コントロールインフラのアップグレードに投資する中、最先端のハードウェアに対するニーズは高まり続けており、市場での優位性を確固たるものにしています。

<セキュリティや運用上の課題が複雑化・頻度化していることを背景に、予測期間中は新規導入分野が市場をリードすると予測されます。脅威がより巧妙になり、運用がより複雑になるにつれ、リアルタイムのデータ分析、強固な通信、状況認識の強化を提供できる高度なコマンド・コントロールシステムが急務となっています。このため、最新の技術と機能を組み込んだ新しい設備に対する需要が高まっています。さらに、近代化の推進とAI、IoT、ビッグデータ分析などの先進技術の統合により、新しい最先端のシステムの導入が必要となり、このセグメントの成長をさらに促進しています。

2024年には、北米がコマンド・コントロールシステムの44.4%の市場シェアを占めると推定されます。これにはいくつかの強い理由があります。この地域、特に米国の多額の国防予算のおかげで、軍事目的のための最新のコマンド・コントロールシステムに多額の投資が行われています。さらに、Northrop Grumman Corporation(米国)、Lockheed Martin Corporation(米国)、General Dynamics Corporation(米国)、L3Harris Technologies(米国)など、多数の一流防衛請負業者や技術企業が北米に拠点を置き、最先端のコマンド・コントロールシステムの開発・導入の最前線に立っています。

当レポートでは、世界のコマンド・コントロールシステム市場について調査し、プラットフォーム別、用途別、システム別、ソリューション別、設置別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 顧客のビジネスに影響を与える動向と混乱

- エコシステム分析

- バリューチェーン分析

- 価格分析

- 運用データ

- ケーススタディ分析

- 2024年~2025年の主な会議とイベント

- 貿易分析

- 関税と規制状況

- 主な利害関係者と購入基準

- 技術ロードマップ

- ビジネスモデル

- 総所有コスト

- 部品表

- 技術分析

- 投資と資金調達のシナリオ

第6章 業界の動向

- イントロダクション

- 技術動向

- メガトレンドの影響

- サプライチェーン分析

- 特許分析

- 生成AIがコマンド・コントロールシステム市場に与える影響

第7章 コマンド・コントロールシステム市場(プラットフォーム別)

- イントロダクション

- 陸

- 海

- 空

- 宇宙

- サイバー

第8章 コマンド・コントロールシステム市場(用途別)

- イントロダクション

- 軍隊

- 政府

- 民間および商業

第9章 コマンド・コントロールシステム市場(システム別)

- イントロダクション

- 戦闘管理システム

- 通信ネットワーク

- 指揮所

- 武器制御システム

- インテリジェンスシステム

- 輸送管理システム

- インフラ制御システム

- セキュリティシステム

- 保健・公共サービスシステム

- 商業宇宙システム

- 緊急管理システム

第10章 コマンド・コントロールシステム市場(ソリューション別)

- イントロダクション

- ハードウェア(タイプ別)

- ソフトウェア(タイプ別)

- サービス(タイプ別)

第11章 コマンド・コントロールシステム市場(設置別)

- イントロダクション

- 新規インストール

- アップグレード

第12章 コマンド・コントロールシステム市場(地域別)

- イントロダクション

- 地域別景気後退影響分析

- 北米

- 欧州

- アジア太平洋

- 中東

- その他の地域

第13章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み、2020年~2024年

- 収益分析、2020年~2023年

- 市場シェア分析、2023年

- 企業評価マトリックス:主要参入企業、2023年

- 企業評価マトリックス:スタートアップ/中小企業、2023年

- 企業価値評価と財務指標

- ブランド/製品比較

- 競合シナリオと動向

第14章 企業プロファイル

- 主要参入企業

- L3HARRIS TECHNOLOGIES, INC.

- RTX

- GENERAL DYNAMICS CORPORATION

- NORTHROP GRUMMAN

- LOCKHEED MARTIN CORPORATION

- THALES

- BAE SYSTEMS

- LEONARDO S.P.A.

- ELBIT SYSTEMS LTD.

- RHEINMETALL AG

- SAAB AB

- AIRBUS

- SIEMENS

- LIG NEX1

- HONEYWELL INTERNATIONAL INC.

- ISRAEL AEROSPACE INDUSTRIES

- INDRA SISTEMAS, S.A.

- ASELSAN A.S.

- CACI INTERNATIONAL INC

- その他の企業

- MISTRAL SOLUTIONS PVT. LTD.

- ULTRA INTELLIGENCE & COMMUNICATIONS

- SYSTEMATIC A/S

- QINETIQ

- RGB SPECTRUM

- ROLTA INDIA LIMITED

第15章 付録

The global command and control systems market is projected to reach USD 44.7 billion by 2029, from USD 32.5 billion in 2024, at a CAGR of 6.6% from 2024 to 2029. Need for situational awareness to support decision-making, and growing cybersecurity threats are factors to drive the market. However, the costs related to the development and maintenance of command and control systems are high. L3Harris Technologies, Inc. (US), Thales (France), RTX Corporation (US), General Dynamics Corporation (US) and Lockheed Martin Corporation (US) are some of the leading players operating in the Command and control systems market.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Billion) |

| Segments | By Platform, Application, Soutions, System, Installation & Region |

| Regions covered | North America, Europe, APAC, RoW |

" Hardware segment to secure leading market position during the forecast period"

The hardware segment is projected to be dominant during the forecast period due to its critical role in establishing the physical infrastructure necessary for effective system operation. This segment includes essential components such as sensors, communication devices, servers, and specialized computing equipment, all of which are fundamental for data collection, processing, and transmission. Moreover, advancements in hardware technology, such as more powerful processors and enhanced connectivity solutions, significantly enhance system capabilities, making the hardware segment indispensable. As organizations across military, civil, and commercial sectors invest in upgrading their command and control infrastructures, the need for cutting-edge hardware continues to grow, solidifying its dominant position in the market.

"New installations segment to be prevalent during the forecast period"

The new installations segment is projected to lead the market during the forecast period, driven by the increasing complexity and frequency of security and operational challenges. As threats become more sophisticated and operations grow more intricate, there is a pressing need for advanced command and control systems that can provide real-time data analysis, robust communication, and enhanced situational awareness. This drives demand for new installations that incorporate the latest technologies and capabilities. Furthermore, the push towards modernization and the integration of advanced technologies like AI, IoT, and big data analytics necessitate the deployment of new, state-of-the-art systems, further propelling the growth of this segment.

" North America to be largest market for command and control systems during the forecast period"

In 2024, it is estimated that North America would hold a 44.4% market share for command and control systems. There are a number of strong reasons for this. Modern command and control systems for military purposes are heavily invested in thanks to the region's large defense budget, especially in the US. Furthermore, a large number of top defense contractors and technology firms, including Northrop Grumman Corporation (US), Lockheed Martin Corporation (US), General Dynamics Corporation (US), and L3Harris Technologies (US), are based in North America and are at the forefront of creating and implementing cutting-edge command and control systems.

In-depth interviews have been conducted with chief executive officers (CEOs), Directors, and other executives from various key organizations operating in the authentication and brand protection marketplace.

- By Company Type: Tier 1 - 35%, Tier 2 - 45%, and Tier 3 - 20%

- By Designation: C-level Executives - 40%, Directors - 25%, and Others - 35%

- By Region: North America- 45%, Europe - 25%, Asia Pacific- 25% and RoW- 10%

L3Harris Technologies, Inc. (US), Thales (France), RTX Corporation (US), General Dynamics Corporation (US) and Lockheed Martin Corporation (US) are some of the leading players operating in the command and control systems market .

Research Coverage

The study covers the command and control systems market across various segments and subsegments. It aims at estimating the size and growth potential of this market across different segments. This study also includes an in-depth competitive analysis of the key players in the market, along with their company profiles, key observations related to their solutions and business offerings, recent developments undertaken by them, and key market strategies adopted by them.

Key benefits of buying this report: This report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall command and control systems market and its subsegments. The report covers the entire ecosystem of the command and control systems market. It will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report will also help stakeholders understand the pulse of the market and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key Drivers (Need for Enhanced Situational Awareness to Support Decision-Making in Energency Response, Rise in Terrorism Necessitating Advanced Command and Control System, and Evolving Cybersecurity Threats), restrains (High Development and Maintenance Costs, Regulatory Constrains Related to Technology Transfer), opportunities (Significant Technological Advancements, and Demand for Integrated Command and Control Systems in Transportation, Healthcare and Law Enforcement Sectors), and challenges (Data Storage and Transmission Limitations, and Integration Challanges) influencing the growth of the market.

- Product Development/Innovation: Detailed Insights on upcoming technologies, R&D activities, and new products/solutions launched in the market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the command and control systems market across varied regions

- Market Diversification: Exhaustive information about new solutions, untapped geographies, recent developments, and investments in command and control systems market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like L3Harris Technologies, Inc. (US), Thales (France), RTX Corporation (US), General Dynamics Corporation (US) and Lockheed Martin Corporation (US) among others in the command and control systems market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- TABLE 1 INCLUSIONS AND EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 COMMAND AND CONTROL SYSTEMS MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- TABLE 2 USD EXCHANGE RATES

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

- 1.6.1 RECESSION IMPACT ANALYSIS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 RESEARCH DESIGN MODEL

- FIGURE 3 RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary sources

- 2.1.2.2 Key data from primary sources

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS

- 2.1.2.3 Insights from industry experts

- 2.2 FACTOR ANALYSIS

- 2.2.1 INTRODUCTION

- 2.2.2 DEMAND-SIDE INDICATORS

- 2.2.2.1 Geopolitical tensions

- 2.2.2.2 Advancements in command and control technologies

- 2.2.2.3 Defense modernization programs

- 2.2.2.4 International defense alliances

- 2.2.3 SUPPLY-SIDE INDICATORS

- 2.2.3.1 Financial trends of defense contractors

- 2.2.4 IMPACT OF RECESSION

- 2.2.5 IMPACT OF RUSSIA-UKRAINE WAR

- 2.2.5.1 Impact of Russia-Ukraine war on macro factors of command and control systems market

- FIGURE 5 IMPACT OF RUSSIA-UKRAINE WAR ON MACRO FACTORS OF COMMAND AND CONTROL SYSTEMS MARKET

- 2.2.5.2 Impact of Russia-Ukraine war on micro factors of command and control systems market

- TABLE 3 IMPACT OF RUSSIA-UKRAINE WAR ON MICRO FACTORS OF COMMAND AND CONTROL SYSTEMS MARKET

- FIGURE 6 IMPACT OF RUSSIA-UKRAINE WAR ON MICRO INDICATORS OF COMMAND AND CONTROL SYSTEMS MARKET

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.1.1 Market size estimation methodology

- FIGURE 7 BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- FIGURE 8 TOP-DOWN APPROACH

- 2.3.1 BOTTOM-UP APPROACH

- 2.4 DATA TRIANGULATION

- FIGURE 9 DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

- FIGURE 10 LAND TO BE LARGEST SEGMENT IN 2024

- FIGURE 11 CIVIL & COMMERCIAL TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 12 COMMERCIAL SPACE SYSTEMS TO EXHIBIT FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 13 HARDWARE TO SECURE LEADING MARKET POSITION DURING FORECAST PERIOD

- FIGURE 14 NEW INSTALLATIONS TO BE PREVALENT DURING FORECAST PERIOD

- FIGURE 15 NORTH AMERICA TO BE LARGEST MARKET FOR COMMAND AND CONTROL SYSTEMS DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN COMMAND AND CONTROL SYSTEMS MARKET

- FIGURE 16 FOCUS ON GLOBAL SECURITY TO DRIVE MARKET

- 4.2 COMMAND AND CONTROL SYSTEMS MARKET, BY PLATFORM

- FIGURE 17 LAND SEGMENT TO BE DOMINANT DURING FORECAST PERIOD

- 4.3 COMMAND AND CONTROL SYSTEMS MARKET, BY APPLICATION

- FIGURE 18 MILITARY TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- 4.4 COMMAND AND CONTROL SYSTEMS MARKET, BY SOLUTION

- FIGURE 19 HARDWARE TO SURPASS OTHER SEGMENTS DURING FORECAST PERIOD

- 4.5 COMMAND AND CONTROL SYSTEMS MARKET, BY INSTALLATION

- FIGURE 20 NEW INSTALLATIONS TO ACCOUNT FOR HIGHER SHARE THAN UPGRADES IN 2024

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 21 COMMAND AND CONTROL SYSTEMS MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Need for enhanced situational awareness to support decision-making in emergency response

- 5.2.1.2 Rise in terrorism necessitating advanced command and control systems

- FIGURE 22 FATALITIES CAUSED BY TERRORIST ATTACKS GLOBALLY, 2010-2022

- 5.2.1.3 Surge in demand for space-based command and control infrastructure for enhanced connectivity

- 5.2.1.4 Evolving cybersecurity threats

- 5.2.2 RESTRAINTS

- 5.2.2.1 High development and maintenance costs

- 5.2.2.2 Regulatory constraints related to technology transfer

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Significant technological advancements

- 5.2.3.2 Growing integration of command and control systems in transportation, healthcare, and law enforcement sectors

- 5.2.4 CHALLENGES

- 5.2.4.1 Data storage and transmission limitations

- 5.2.4.2 Integration challenges

- 5.3 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 23 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.4 ECOSYSTEM ANALYSIS

- 5.4.1 PROMINENT COMPANIES

- 5.4.2 PRIVATE AND SMALL ENTERPRISES

- 5.4.3 END USERS

- FIGURE 24 ECOSYSTEM ANALYSIS

- TABLE 4 ROLE OF COMPANIES IN ECOSYSTEM

- 5.5 VALUE CHAIN ANALYSIS

- FIGURE 25 VALUE CHAIN ANALYSIS

- 5.6 PRICING ANALYSIS

- 5.6.1 INDICATIVE PRICING ANALYSIS, BY APPLICATION

- TABLE 5 INDICATIVE PRICING ANALYSIS, BY APPLICATION (USD)

- 5.6.2 INDICATIVE PRICING ANALYSIS, BY SYSTEM

- TABLE 6 INDICATIVE PRICING ANALYSIS, BY SYSTEM (USD)

- TABLE 1 PRICE VARIATIONS, BY REGION

- 5.7 OPERATIONAL DATA

- TABLE 2 LIST OF NEW AND UPGRADED AIRPORTS

- 5.8 CASE STUDY ANALYSIS

- 5.8.1 HONEYWELL ENABLED EFFICIENT FLIGHT ROUTING FOR NEWARK LIBERTY INTERNATIONAL AIRPORT

- 5.8.2 BANE NOR SELECTED THALES TO PROVIDE NEXT-GENERATION NATIONAL TRAFFIC MANAGEMENT SYSTEMS

- 5.8.3 MISTRAL DEVELOPED MOBILE COMMAND AND CONTROL VEHICLES FOR KARNATAKA STATE POLICE

- 5.9 KEY CONFERENCES AND EVENTS, 2024-2025

- TABLE 3 KEY CONFERENCES AND EVENTS, 2024-2025

- 5.10 TRADE ANALYSIS

- 5.10.1 IMPORT DATA

- FIGURE 26 IMPORT DATA, BY COUNTRY, 2019-2023 (USD THOUSAND)

- 5.10.2 EXPORT DATA

- FIGURE 27 EXPORT DATA, BY COUNTRY, 2019-2023 (USD THOUSAND)

- 5.11 TARIFF AND REGULATORY LANDSCAPE

- 5.11.1 TARIFFS

- TABLE 4 TARIFFS FOR TRANSMISSION OR RECEPTION OF VOICE, IMAGE, OR OTHER DATA (HS CODE: 851769)

- 5.11.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 5 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.12 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 28 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY APPLICATION

- TABLE 9 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY APPLICATION (%)

- 5.12.2 BUYING CRITERIA

- FIGURE 29 KEY BUYING CRITERIA, BY APPLICATION

- TABLE 10 KEY BUYING CRITERIA, BY APPLICATION

- 5.13 TECHNOLOGY ROADMAP

- FIGURE 30 EVOLUTION OF COMMAND AND CONTROL TECHNOLOGIES

- FIGURE 31 TECHNOLOGY ROADMAP OF COMMAND AND CONTROL SYSTEMS MARKET

- FIGURE 32 EMERGING TRENDS IN COMMAND AND CONTROL SYSTEMS

- 5.14 BUSINESS MODELS

- FIGURE 33 BUSINESS MODELS

- 5.14.1 HARDWARE SALES MODEL

- 5.14.2 SUBSCRIPTION-BASED MODEL

- 5.14.3 SERVICE-BASED MODEL

- 5.14.4 HYBRID MODEL

- 5.15 TOTAL COST OF OWNERSHIP

- FIGURE 34 TOTAL COST OF OWNERSHIP OF COMMAND AND CONTROL SYSTEMS

- TABLE 11 TOTAL COST OF OWNERSHIP OF COMMAND AND CONTROL SYSTEMS, BY APPLICATION

- 5.16 BILL OF MATERIALS

- FIGURE 35 BILL OF MATERIALS FOR COMMAND AND CONTROL SYSTEM COMPONENTS

- 5.17 TECHNOLOGY ANALYSIS

- 5.17.1 KEY TECHNOLOGY

- 5.17.1.1 Networking and communication

- 5.17.1.2 Data management

- 5.17.2 COMPLEMENTARY TECHNOLOGY

- 5.17.2.1 Sensors

- 5.17.2.2 Simulation and training systems

- 5.17.3 ADJACENT TECHNOLOGY

- 5.17.3.1 Communication protocols

- 5.17.3.2 Automation

- 5.17.1 KEY TECHNOLOGY

- 5.18 INVESTMENT AND FUNDING SCENARIO

- FIGURE 36 INVESTMENT AND FUNDING SCENARIO, 2022-2024 (USD MILLION)

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 TECHNOLOGY TRENDS

- FIGURE 37 TECHNOLOGY TRENDS IN COMMAND AND CONTROL SYSTEMS MARKET

- 6.2.1 CLOUD-BASED COMMAND AND CONTROL SOLUTIONS

- 6.2.2 HUMAN-MACHINE TEAMING

- 6.2.3 CYBER-RESILIENT COMMUNICATION

- 6.2.4 GIS-BASED COMMAND AND CONTROL SYSTEMS

- 6.2.5 AUGMENTED REALITY AND VIRTUAL REALITY

- 6.3 IMPACT OF MEGATRENDS

- 6.3.1 BIG DATA AND ANALYTICS

- 6.3.2 BLOCKCHAIN

- 6.3.3 INTERNET OF THINGS

- 6.4 SUPPLY CHAIN ANALYSIS

- FIGURE 38 SUPPLY CHAIN ANALYSIS

- 6.5 PATENT ANALYSIS

- FIGURE 39 PATENT ANALYSIS

- TABLE 12 PATENT ANALYSIS

- 6.6 IMPACT OF GENERATIVE AI ON COMMAND AND CONTROL SYSTEMS MARKET

- 6.6.1 INTRODUCTION

- FIGURE 40 GENERATIVE AI IN DEFENSE

- 6.6.2 ADOPTION OF GENERATIVE AI IN DEFENSE BY TOP COUNTRIES

- FIGURE 41 ADOPTION OF GENERATIVE AI IN DEFENSE BY TOP COUNTRIES

- 6.6.3 IMPACT OF GENERATIVE AI ON DEFENSE PLATFORMS

- FIGURE 42 IMPACT OF GENERATIVE AI ON DEFENSE PLATFORMS

- TABLE 13 IMPACT OF GENERATIVE AI ON DEFENSE APPLICATIONS

- 6.6.4 IMPACT OF GENERATIVE AI ON COMMAND AND CONTROL SYSTEMS MARKET

- FIGURE 43 IMPACT OF GENERATIVE AI ON COMMAND AND CONTROL SYSTEMS MARKET

7 COMMAND AND CONTROL SYSTEMS MARKET, BY PLATFORM

- 7.1 INTRODUCTION

- FIGURE 44 COMMAND AND CONTROL SYSTEMS MARKET, BY PLATFORM, 2024-2029 (USD BILLION)

- TABLE 14 COMMAND AND CONTROL SYSTEMS MARKET, BY PLATFORM, 2020-2023 (USD BILLION)

- TABLE 15 COMMAND AND CONTROL SYSTEMS MARKET, BY PLATFORM, 2024-2029 (USD BILLION)

- 7.2 LAND

- 7.2.1 HEADQUARTERS & COMMAND CENTERS

- 7.2.1.1 Rising investments in command and control systems to drive market

- 7.2.1.2 Battalions

- 7.2.1.3 Platoons

- 7.2.1.4 Dismounted soldiers

- 7.2.1.5 Joint forces

- 7.2.2 VEHICULAR

- 7.2.2.1 Need for enhanced operational efficiency and safety to drive market

- 7.2.3 COMMERCIAL INSTALLATIONS

- 7.2.3.1 Emphasis on surveillance and management of security systems to drive market

- 7.2.1 HEADQUARTERS & COMMAND CENTERS

- 7.3 MARITIME

- 7.3.1 NAVAL SHIPS

- 7.3.1.1 Need to counter maritime threats to drive market

- 7.3.2 SUBMARINES

- 7.3.2.1 Growing complexity of naval operations to drive market

- 7.3.3 COMMERCIAL SHIPPING

- 7.3.3.1 Rise in international trade and focus on maritime security to drive market

- 7.3.1 NAVAL SHIPS

- 7.4 AIRBORNE

- 7.4.1 MANNED

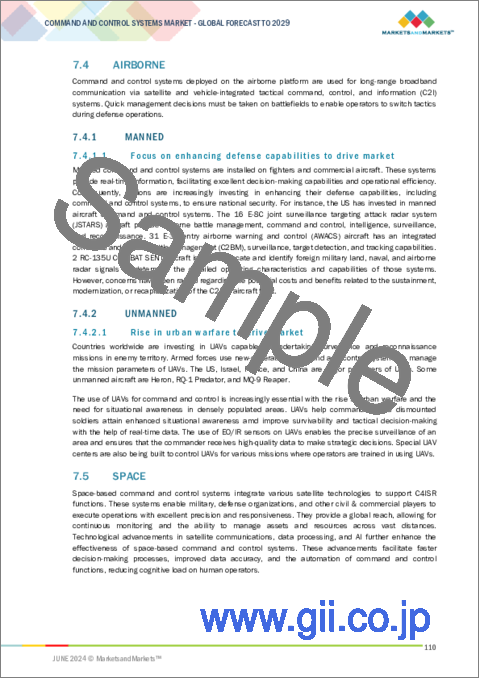

- 7.4.1.1 Focus on enhancing defense capabilities to drive market

- 7.4.2 UNMANNED

- 7.4.2.1 Rise in urban warfare to drive market

- 7.4.1 MANNED

- 7.5 SPACE

- 7.5.1 SATELLITE OPERATION CENTERS

- 7.5.1.1 Expanding satellite applications across diverse industries to drive market

- 7.5.2 SPACE STATIONS

- 7.5.2.1 Growing participation in space missions to drive market

- 7.5.3 COMMERCIAL SPACE PLATFORMS

- 7.5.3.1 Rising commercial space activities to drive market

- 7.5.1 SATELLITE OPERATION CENTERS

- 7.6 CYBER

- 7.6.1 NETWORKS

- 7.6.1.1 Rising cyber threats to drive market

- 7.6.2 ENDPOINTS

- 7.6.2.1 Proliferation of digital devices to drive market

- 7.6.3 THREAT INTELLIGENCE & RESPONSE

- 7.6.3.1 Regulatory requirements and compliance standards to drive market

- 7.6.1 NETWORKS

8 COMMAND AND CONTROL SYSTEMS MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- FIGURE 45 COMMAND AND CONTROL SYSTEMS MARKET, BY APPLICATION, 2024-2029 (USD BILLION)

- TABLE 16 COMMAND AND CONTROL SYSTEMS MARKET, BY APPLICATION, 2020-2023 (USD BILLION)

- TABLE 17 COMMAND AND CONTROL SYSTEMS MARKET, BY APPLICATION, 2024-2029 (USD BILLION)

- 8.2 MILITARY

- 8.2.1 REAL-TIME BATTLEFIELD MANAGEMENT

- 8.2.1.1 Increasing demand for enhanced situational awareness to drive market

- 8.2.2 MISSION ASSIGNMENT & COORDINATION

- 8.2.2.1 Complexity of modern military operations to drive market

- 8.2.3 CYBER & ELECTRONIC WARFARE MANAGEMENT

- 8.2.3.1 Need for safeguarding critical infrastructure to drive market

- 8.2.4 CIVIL-MILITARY COOPERATION

- 8.2.4.1 Rising frequency of humanitarian emergencies to drive market

- 8.2.5 OTHER MILITARY APPLICATIONS

- 8.2.1 REAL-TIME BATTLEFIELD MANAGEMENT

- 8.3 GOVERNMENT

- 8.3.1 DISASTER MANAGEMENT

- 8.3.1.1 Need for disaster preparedness and response to drive market

- 8.3.2 PUBLIC SAFETY & LAW ENFORCEMENT

- 8.3.2.1 Focus on enhancing operational effectiveness and response capabilities to drive market

- 8.3.3 GOVERNMENT CRITICAL INFRASTRUCTURE SECURITY

- 8.3.3.1 Government emphasis on critical infrastructure security to drive market

- 8.3.4 COASTAL & BORDER PROTECTION

- 8.3.4.1 Need to safeguard national borders against illegal activities to drive market

- 8.3.5 OTHER GOVERNMENT APPLICATIONS

- 8.3.1 DISASTER MANAGEMENT

- 8.4 CIVIL & COMMERCIAL

- 8.4.1 CRITICAL INFRASTRUCTURE

- 8.4.1.1 Proactive maintenance and informed decision-making capabilities to drive market

- 8.4.2 TRANSPORTATION & LOGISTICS

- 8.4.2.1 Innovations in data analytics and machine learning to drive market

- 8.4.3 SMART CITY COMMAND CENTERS

- 8.4.3.1 Rising investments in smart cities to drive market

- 8.4.4 TRAFFIC MANAGEMENT

- 8.4.4.1 Integration of command and control systems in aviation, railway, and maritime operations to drive market

- 8.4.5 COMMERCIAL SPACE

- 8.4.5.1 Compliance with safety protocols to drive market

- 8.4.6 ENERGY GRID MANAGEMENT

- 8.4.6.1 Automation in power sector to drive market

- 8.4.7 OTHER CIVIL & COMMERCIAL APPLICATIONS

- 8.4.1 CRITICAL INFRASTRUCTURE

9 COMMAND AND CONTROL SYSTEMS MARKET, BY SYSTEM

- 9.1 INTRODUCTION

- FIGURE 46 COMMAND AND CONTROL SYSTEMS MARKET, BY SYSTEM, 2024-2029 (USD BILLION)

- TABLE 18 COMMAND AND CONTROL SYSTEMS MARKET, BY SYSTEM, 2020-2023 (USD BILLION)

- TABLE 19 COMMAND AND CONTROL SYSTEMS MARKET, BY SYSTEM, 2024-2029 (USD BILLION)

- 9.2 BATTLE MANAGEMENT SYSTEMS

- 9.2.1 RISING GEOPOLITICAL TENSIONS AND DEFENSE BUDGETS TO DRIVE MARKET

- 9.3 COMMUNICATIONS NETWORKS

- 9.3.1 EMPHASIS ON NETWORK-CENTRIC WARFARE AND INTEGRATED COMMAND STRUCTURES TO DRIVE MARKET

- 9.3.2 VOICE COMMUNICATION

- 9.3.3 DATA COMMUNICATION

- 9.3.4 VIDEO COMMUNICATION

- 9.4 COMMAND POSTS

- 9.4.1 RISE IN ASYMMETRIC WARFARE AND HUMANITARIAN CRISES TO DRIVE MARKET

- 9.4.2 FIXED COMMAND POSTS

- 9.4.3 MOBILE COMMAND POSTS

- 9.5 WEAPON CONTROL SYSTEMS

- 9.5.1 ADVANCEMENTS IN MISSILE AND PROJECTILE TECHNOLOGIES TO DRIVE MARKET

- 9.6 INTELLIGENCE SYSTEMS

- 9.6.1 NEED FOR PROACTIVE MEASURES AGAINST SECURITY THREATS TO DRIVE MARKET

- 9.7 TRANSPORTATION MANAGEMENT SYSTEMS

- 9.7.1 RAPID URBANIZATION AND INCREASED TRAFFIC CONGESTION TO DRIVE MARKET

- 9.7.2 TRAFFIC MANAGEMENT SYSTEMS

- 9.7.3 RAIL & METRO SYSTEMS

- 9.7.4 MARITIME & PORT MANAGEMENT SYSTEMS

- 9.8 INFRASTRUCTURE CONTROL SYSTEMS

- 9.8.1 SHIFT TOWARD SMART INFRASTRUCTURE TO DRIVE MARKET

- 9.8.2 POWER GRID MANAGEMENT SYSTEMS

- 9.8.3 WATER SUPPLY MANAGEMENT SYSTEMS

- 9.8.4 INDUSTRIAL CONTROL SYSTEMS

- 9.9 SECURITY SYSTEMS

- 9.9.1 RISING CONCERNS OVER SAFETY AND SECURITY TO DRIVE MARKET

- 9.9.2 CYBERSECURITY

- 9.9.2.1 Network security

- 9.9.2.2 Endpoint security

- 9.9.3 FACILITY SECURITY MANAGEMENT

- 9.10 HEALTH & PUBLIC SERVICES SYSTEMS

- 9.10.1 EMPHASIS ON IMPROVING PUBLIC HEALTH INFRASTRUCTURE TO DRIVE MARKET

- 9.11 COMMERCIAL SPACE SYSTEMS

- 9.11.1 GROWING COMMERCIALIZATION OF SPACE ACTIVITIES TO DRIVE MARKET

- 9.11.2 SATELLITE MANAGEMENT

- 9.11.3 SPACE TRAFFIC MANAGEMENT

- 9.12 EMERGENCY MANAGEMENT SYSTEMS

- 9.12.1 INCREASING SEVERITY OF NATURAL DISASTERS TO DRIVE MARKET

- 9.12.2 DISASTER RESPONSE MANAGEMENT

- 9.12.3 PUBLIC SAFETY & SECURITY

- 9.12.4 CRISIS MANAGEMENT

10 COMMAND AND CONTROL SYSTEMS MARKET, BY SOLUTION

- 10.1 INTRODUCTION

- FIGURE 47 COMMAND AND CONTROL SYSTEMS MARKET, BY SOLUTION, 2024-2029 (USD BILLION)

- TABLE 20 COMMAND AND CONTROL SYSTEMS MARKET, BY SOLUTION, 2020-2023 (USD BILLION)

- TABLE 21 COMMAND AND CONTROL SYSTEMS MARKET, BY SOLUTION, 2024-2029 (USD BILLION)

- 10.2 HARDWARE, BY TYPE

- TABLE 22 HARDWARE: COMMAND AND CONTROL SYSTEMS MARKET, BY TYPE, 2020-2023 (USD BILLION)

- TABLE 23 HARDWARE: COMMAND AND CONTROL SYSTEMS MARKET, BY TYPE, 2024-2029 (USD BILLION)

- 10.2.1 IT INFRASTRUCTURE

- 10.2.1.1 Emphasis on improving situational awareness to drive market

- 10.2.2 COMMUNICATIONS SYSTEMS & DATALINKS

- 10.2.2.1 Need for enhanced electronic transmission capabilities to drive market

- 10.2.3 PERIPHERALS

- 10.2.3.1 High demand for improved situational awareness on battlefields to drive market

- 10.3 HARDWARE, BY APPLICATION

- TABLE 24 HARDWARE: COMMAND AND CONTROL SYSTEMS MARKET, BY APPLICATION, 2020-2023 (USD BILLION)

- TABLE 25 HARDWARE: COMMAND AND CONTROL SYSTEMS MARKET, BY APPLICATION, 2024-2029 (USD BILLION)

- 10.3.1 MILITARY

- 10.3.1.1 Increasing demand for advanced defense technologies to drive market

- 10.3.2 GOVERNMENT

- 10.3.2.1 Need for enhancing emergency preparedness to drive market

- 10.3.3 CIVIL & COMMERCIAL

- 10.3.3.1 Increasing implementation of smart city initiatives to drive market

- TABLE 26 SMART CITY INITIATIVES WORLDWIDE

- 10.4 SOFTWARE, BY TYPE

- TABLE 27 SOFTWARE: COMMAND AND CONTROL SYSTEMS MARKET, BY TYPE, 2020-2023 (USD BILLION)

- TABLE 28 SOFTWARE: COMMAND AND CONTROL SYSTEMS MARKET, BY TYPE, 2024-2029 (USD BILLION)

- 10.4.1 INFRASTRUCTURE SAFETY & SECURITY MANAGEMENT

- 10.4.1.1 Rise in cyberattacks targeting essential services to drive market

- 10.4.2 PHYSICAL SECURITY INFORMATION MANAGEMENT

- 10.4.2.1 Shift toward wireless IP-based solutions to drive market

- 10.4.3 SIGNALING & TRAFFIC MANAGEMENT

- 10.4.3.1 Growing prevalence of self-adaptive traffic signal control systems to drive market

- 10.4.4 MILITARY SITUATIONAL AWARENESS

- 10.4.4.1 Broad scope of applications to drive market

- 10.5 SOFTWARE, BY APPLICATION

- TABLE 29 SOFTWARE: COMMAND AND CONTROL SYSTEMS MARKET, BY APPLICATION, 2020-2023 (USD BILLION)

- TABLE 30 SOFTWARE: COMMAND AND CONTROL SYSTEMS MARKET, BY APPLICATION, 2024-2029 (USD BILLION)

- 10.5.1 MILITARY

- 10.5.1.1 Evolving global security threats to drive market

- 10.5.2 GOVERNMENT

- 10.5.2.1 Strategic investments to improve response capabilities to drive market

- 10.5.3 CIVIL & COMMERCIAL

- 10.5.3.1 Expansion of smart cities to drive market

- 10.6 SERVICES, BY TYPE

- TABLE 31 SERVICES: COMMAND AND CONTROL SYSTEMS MARKET, BY TYPE, 2020-2023 (USD BILLION)

- TABLE 32 SERVICES: COMMAND AND CONTROL SYSTEMS MARKET, BY TYPE, 2024-2029 (USD BILLION)

- 10.6.1 SYSTEM INTEGRATION & ENGINEERING

- 10.6.1.1 Complexity of modern command and control systems to drive market

- 10.6.2 SIMULATION & TRAINING

- 10.6.2.1 Integration of AR and VR for training of militaries to drive market

- 10.6.3 LOGISTICS & MAINTENANCE

- 10.6.3.1 Need for maintenance and replacement of hardware parts to drive market

- 10.7 SERVICES, BY APPLICATION

- TABLE 33 SERVICES: COMMAND AND CONTROL SYSTEMS MARKET, BY APPLICATION, 2020-2023 (USD BILLION)

- TABLE 34 SERVICES: COMMAND AND CONTROL SYSTEMS MARKET, BY APPLICATION, 2024-2029 (USD BILLION)

- 10.7.1 MILITARY

- 10.7.1.1 Focus on cyber defense and electronic warfare to drive market

- 10.7.2 GOVERNMENT

- 10.7.2.1 Investments in emergency management and public safety training services to drive market

- 10.7.3 CIVIL & COMMERCIAL

- 10.7.3.1 Need for improved operational efficiency to drive market

11 COMMAND AND CONTROL SYSTEMS MARKET, BY INSTALLATION

- 11.1 INTRODUCTION

- FIGURE 48 COMMAND AND CONTROL SYSTEMS MARKET, BY INSTALLATION, 2024-2029 (USD BILLION)

- TABLE 35 COMMAND AND CONTROL SYSTEMS MARKET, BY INSTALLATION, 2020-2023 (USD BILLION)

- TABLE 36 COMMAND AND CONTROL SYSTEMS MARKET, BY INSTALLATION, 2024-2029 (USD BILLION)

- 11.2 NEW INSTALLATIONS

- 11.2.1 RISING SECURITY AND OPERATIONAL CHALLENGES TO DRIVE MARKET

- 11.3 UPGRADES

- 11.3.1 REGULAR UPDATES OF COMMAND AND CONTROL SYSTEMS BY DEFENSE FORCES TO DRIVE MARKET

12 COMMAND AND CONTROL SYSTEMS MARKET, BY REGION

- 12.1 INTRODUCTION

- FIGURE 49 COMMAND AND CONTROL SYSTEMS MARKET, BY REGION, 2024-2029

- TABLE 37 COMMAND AND CONTROL SYSTEMS MARKET, BY REGION, 2020-2023 (USD BILLION)

- TABLE 38 COMMAND AND CONTROL SYSTEMS MARKET, BY REGION, 2024-2029 (USD BILLION)

- 12.2 REGIONAL RECESSION IMPACT ANALYSIS

- 12.3 NORTH AMERICA

- 12.3.1 PESTLE ANALYSIS

- 12.3.2 RECESSION IMPACT ANALYSIS

- FIGURE 50 NORTH AMERICA: COMMAND AND CONTROL SYSTEMS MARKET SNAPSHOT

- TABLE 39 NORTH AMERICA: COMMAND AND CONTROL SYSTEMS MARKET, BY COUNTRY, 2020-2023 (USD BILLION)

- TABLE 40 NORTH AMERICA: COMMAND AND CONTROL SYSTEMS MARKET, BY COUNTRY, 2024-2029 (USD BILLION)

- TABLE 41 NORTH AMERICA: COMMAND AND CONTROL SYSTEMS MARKET, BY PLATFORM, 2020-2023 (USD BILLION)

- TABLE 42 NORTH AMERICA: COMMAND AND CONTROL SYSTEMS MARKET, BY PLATFORM, 2024-2029 (USD BILLION)

- TABLE 43 NORTH AMERICA: COMMAND AND CONTROL SYSTEMS MARKET, BY APPLICATION, 2020-2023 (USD BILLION)

- TABLE 44 NORTH AMERICA: COMMAND AND CONTROL SYSTEMS MARKET, BY APPLICATION, 2024-2029 (USD BILLION)

- TABLE 45 NORTH AMERICA: COMMAND AND CONTROL SYSTEMS MARKET, BY SOLUTION, 2020-2023 (USD BILLION)

- TABLE 46 NORTH AMERICA: COMMAND AND CONTROL SYSTEMS MARKET, BY SOLUTION, 2024-2029 (USD BILLION)

- TABLE 47 NORTH AMERICA: COMMAND AND CONTROL SYSTEMS MARKET, BY SYSTEM, 2020-2023 (USD BILLION)

- TABLE 48 NORTH AMERICA: COMMAND AND CONTROL SYSTEMS MARKET, BY SYSTEM, 2024-2029 (USD BILLION)

- 12.3.3 US

- 12.3.3.1 Increasing investments in command and control technologies to drive market

- TABLE 49 US: COMMAND AND CONTROL SYSTEMS MARKET, BY PLATFORM, 2020-2023 (USD BILLION)

- TABLE 50 US: COMMAND AND CONTROL SYSTEMS MARKET, BY PLATFORM, 2024-2029 (USD BILLION)

- TABLE 51 US: COMMAND AND CONTROL SYSTEMS MARKET, BY APPLICATION, 2020-2023 (USD BILLION)

- TABLE 52 US: COMMAND AND CONTROL SYSTEMS MARKET, BY APPLICATION, 2024-2029 (USD BILLION)

- TABLE 53 US: COMMAND AND CONTROL SYSTEMS MARKET, BY SOLUTION, 2020-2023 (USD BILLION)

- TABLE 54 US: COMMAND AND CONTROL SYSTEMS MARKET, BY SOLUTION, 2024-2029 (USD BILLION)

- TABLE 55 US: COMMAND AND CONTROL SYSTEMS MARKET, BY SYSTEM, 2020-2023 (USD BILLION)

- TABLE 56 US: COMMAND AND CONTROL SYSTEMS MARKET, BY SYSTEM, 2024-2029 (USD BILLION)

- 12.3.4 CANADA

- 12.3.4.1 Modernization efforts for defense infrastructure and capabilities to drive market

- TABLE 57 CANADA: COMMAND AND CONTROL SYSTEMS MARKET, BY PLATFORM, 2020-2023 (USD BILLION)

- TABLE 58 CANADA: COMMAND AND CONTROL SYSTEMS MARKET, BY PLATFORM, 2024-2029 (USD BILLION)

- TABLE 59 CANADA: COMMAND AND CONTROL SYSTEMS MARKET, BY APPLICATION, 2020-2023 (USD BILLION)

- TABLE 60 CANADA: COMMAND AND CONTROL SYSTEMS MARKET, BY APPLICATION, 2024-2029 (USD BILLION)

- TABLE 61 CANADA: COMMAND AND CONTROL SYSTEMS MARKET, BY SOLUTION, 2020-2023 (USD BILLION)

- TABLE 62 CANADA: COMMAND AND CONTROL SYSTEMS MARKET, BY SOLUTION, 2024-2029 (USD BILLION)

- TABLE 63 CANADA: COMMAND AND CONTROL SYSTEMS MARKET, BY SYSTEM, 2020-2023 (USD BILLION)

- TABLE 64 CANADA: COMMAND AND CONTROL SYSTEMS MARKET, BY SYSTEM, 2024-2029 (USD BILLION)

- 12.4 EUROPE

- 12.4.1 PESTLE ANALYSIS

- 12.4.2 RECESSION IMPACT ANALYSIS

- FIGURE 51 EUROPE: COMMAND AND CONTROL SYSTEMS MARKET SNAPSHOT

- TABLE 65 EUROPE: COMMAND AND CONTROL SYSTEMS MARKET, BY COUNTRY, 2020-2023 (USD BILLION)

- TABLE 66 EUROPE: COMMAND AND CONTROL SYSTEMS MARKET, BY COUNTRY, 2024-2029 (USD BILLION)

- TABLE 67 EUROPE: COMMAND AND CONTROL SYSTEMS MARKET, BY PLATFORM, 2020-2023 (USD BILLION)

- TABLE 68 EUROPE: COMMAND AND CONTROL SYSTEMS MARKET, BY PLATFORM, 2024-2029 (USD BILLION)

- TABLE 69 EUROPE: COMMAND AND CONTROL SYSTEMS MARKET, BY APPLICATION, 2020-2023 (USD BILLION)

- TABLE 70 EUROPE: COMMAND AND CONTROL SYSTEMS MARKET, BY APPLICATION, 2024-2029 (USD BILLION)

- TABLE 71 EUROPE: COMMAND AND CONTROL SYSTEMS MARKET, BY SOLUTION, 2020-2023 (USD BILLION)

- TABLE 72 EUROPE: COMMAND AND CONTROL SYSTEMS MARKET, BY SOLUTION, 2024-2029 (USD BILLION)

- TABLE 73 EUROPE: COMMAND AND CONTROL SYSTEMS MARKET, BY SYSTEM, 2020-2023 (USD BILLION)

- TABLE 74 EUROPE: COMMAND AND CONTROL SYSTEMS MARKET, BY SYSTEM, 2024-2029 (USD BILLION)

- 12.4.3 UK

- 12.4.3.1 Collaborations between defense solution providers to drive market

- TABLE 75 UK: COMMAND AND CONTROL SYSTEMS MARKET, BY PLATFORM, 2020-2023 (USD BILLION)

- TABLE 76 UK: COMMAND AND CONTROL SYSTEMS MARKET, BY PLATFORM, 2024-2029 (USD BILLION)

- TABLE 77 UK: COMMAND AND CONTROL SYSTEMS MARKET, BY APPLICATION, 2020-2023 (USD BILLION)

- TABLE 78 UK: COMMAND AND CONTROL SYSTEMS MARKET, BY APPLICATION, 2024-2029 (USD BILLION)

- TABLE 79 UK: COMMAND AND CONTROL SYSTEMS MARKET, BY SOLUTION, 2020-2023 (USD BILLION)

- TABLE 80 UK: COMMAND AND CONTROL SYSTEMS MARKET, BY SOLUTION, 2024-2029 (USD BILLION)

- TABLE 81 UK: COMMAND AND CONTROL SYSTEMS MARKET, BY SYSTEM, 2020-2023 (USD BILLION)

- TABLE 82 UK: COMMAND AND CONTROL SYSTEMS MARKET, BY SYSTEM, 2024-2029 (USD BILLION)

- 12.4.4 GERMANY

- 12.4.4.1 Focus on enhancing defense capabilities and interoperability to drive market

- TABLE 83 GERMANY: COMMAND AND CONTROL SYSTEMS MARKET, BY PLATFORM, 2020-2023 (USD BILLION)

- TABLE 84 GERMANY: COMMAND AND CONTROL SYSTEMS MARKET, BY PLATFORM, 2024-2029 (USD BILLION)

- TABLE 85 GERMANY: COMMAND AND CONTROL SYSTEMS MARKET, BY APPLICATION, 2020-2023 (USD BILLION)

- TABLE 86 GERMANY: COMMAND AND CONTROL SYSTEMS MARKET, BY APPLICATION, 2024-2029 (USD BILLION)

- TABLE 87 GERMANY: COMMAND AND CONTROL SYSTEMS MARKET, BY SOLUTION, 2020-2023 (USD BILLION)

- TABLE 88 GERMANY: COMMAND AND CONTROL SYSTEMS MARKET, BY SOLUTION, 2024-2029 (USD BILLION)

- TABLE 89 GERMANY: COMMAND AND CONTROL SYSTEMS MARKET, BY SYSTEM, 2020-2023 (USD BILLION)

- TABLE 90 GERMANY: COMMAND AND CONTROL SYSTEMS MARKET, BY SYSTEM, 2024-2029 (USD BILLION)

- 12.4.5 FRANCE

- 12.4.5.1 Strategic collaborations to enhance internal security to drive market

- TABLE 91 FRANCE: COMMAND AND CONTROL SYSTEMS MARKET, BY PLATFORM, 2020-2023 (USD BILLION)

- TABLE 92 FRANCE: COMMAND AND CONTROL SYSTEMS MARKET, BY PLATFORM, 2024-2029 (USD BILLION)

- TABLE 93 FRANCE: COMMAND AND CONTROL SYSTEMS MARKET, BY APPLICATION, 2020-2023 (USD BILLION)

- TABLE 94 FRANCE: COMMAND AND CONTROL SYSTEMS MARKET, BY APPLICATION, 2024-2029 (USD BILLION)

- TABLE 95 FRANCE: COMMAND AND CONTROL SYSTEMS MARKET, BY SOLUTION, 2020-2023 (USD BILLION)

- TABLE 96 FRANCE: COMMAND AND CONTROL SYSTEMS MARKET, BY SOLUTION, 2024-2029 (USD BILLION)

- TABLE 97 FRANCE: COMMAND AND CONTROL SYSTEMS MARKET, BY SYSTEM, 2020-2023 (USD BILLION)

- TABLE 98 FRANCE: COMMAND AND CONTROL SYSTEMS MARKET, BY SYSTEM, 2024-2029 (USD BILLION)

- 12.4.6 ITALY

- 12.4.6.1 Emphasis on modernizing military capabilities to drive market

- TABLE 99 ITALY: COMMAND AND CONTROL SYSTEMS MARKET, BY PLATFORM, 2020-2023 (USD BILLION)

- TABLE 100 ITALY: COMMAND AND CONTROL SYSTEMS MARKET, BY PLATFORM, 2024-2029 (USD BILLION)

- TABLE 101 ITALY: COMMAND AND CONTROL SYSTEMS MARKET, BY APPLICATION, 2020-2023 (USD BILLION)

- TABLE 102 ITALY: COMMAND AND CONTROL SYSTEMS MARKET, BY APPLICATION, 2024-2029 (USD BILLION)

- TABLE 103 ITALY: COMMAND AND CONTROL SYSTEMS MARKET, BY SOLUTION, 2020-2023 (USD BILLION)

- TABLE 104 ITALY: COMMAND AND CONTROL SYSTEMS MARKET, BY SOLUTION, 2024-2029 (USD BILLION)

- TABLE 105 ITALY: COMMAND AND CONTROL SYSTEMS MARKET, BY SYSTEM, 2020-2023 (USD BILLION)

- TABLE 106 ITALY: COMMAND AND CONTROL SYSTEMS MARKET, BY SYSTEM, 2024-2029 (USD BILLION)

- 12.4.7 REST OF EUROPE

- TABLE 107 REST OF EUROPE: COMMAND AND CONTROL SYSTEMS MARKET, BY PLATFORM, 2020-2023 (USD BILLION)

- TABLE 108 REST OF EUROPE: COMMAND AND CONTROL SYSTEMS MARKET, BY PLATFORM, 2024-2029 (USD BILLION)

- TABLE 109 REST OF EUROPE: COMMAND AND CONTROL SYSTEMS MARKET, BY APPLICATION, 2020-2023 (USD BILLION)

- TABLE 110 REST OF EUROPE: COMMAND AND CONTROL SYSTEMS MARKET, BY APPLICATION, 2024-2029 (USD BILLION)

- TABLE 111 REST OF EUROPE: COMMAND AND CONTROL SYSTEMS MARKET, BY SOLUTION, 2020-2023 (USD BILLION)

- TABLE 112 REST OF EUROPE: COMMAND AND CONTROL SYSTEMS MARKET, BY SOLUTION, 2024-2029 (USD BILLION)

- TABLE 113 REST OF EUROPE: COMMAND AND CONTROL SYSTEMS MARKET, BY SYSTEM, 2020-2023 (USD BILLION)

- TABLE 114 REST OF EUROPE: COMMAND AND CONTROL SYSTEMS MARKET, BY SYSTEM, 2024-2029 (USD BILLION)

- 12.5 ASIA PACIFIC

- 12.5.1 PESTLE ANALYSIS

- 12.5.2 RECESSION IMPACT ANALYSIS

- FIGURE 52 ASIA PACIFIC: COMMAND AND CONTROL SYSTEMS MARKET SNAPSHOT

- TABLE 115 ASIA PACIFIC: COMMAND AND CONTROL SYSTEMS MARKET, BY COUNTRY, 2020-2023 (USD BILLION)

- TABLE 116 ASIA PACIFIC: COMMAND AND CONTROL SYSTEMS MARKET, BY COUNTRY, 2024-2029 (USD BILLION)

- TABLE 117 ASIA PACIFIC: COMMAND AND CONTROL SYSTEMS MARKET, BY PLATFORM, 2020-2023 (USD BILLION)

- TABLE 118 ASIA PACIFIC: COMMAND AND CONTROL SYSTEMS MARKET, BY PLATFORM, 2024-2029 (USD BILLION)

- TABLE 119 ASIA PACIFIC: COMMAND AND CONTROL SYSTEMS MARKET, BY APPLICATION, 2020-2023 (USD BILLION)

- TABLE 120 ASIA PACIFIC: COMMAND AND CONTROL SYSTEMS MARKET, BY APPLICATION, 2024-2029 (USD BILLION)

- TABLE 121 ASIA PACIFIC: COMMAND AND CONTROL SYSTEMS MARKET, BY SOLUTION, 2020-2023 (USD BILLION)

- TABLE 122 ASIA PACIFIC: COMMAND AND CONTROL SYSTEMS MARKET, BY SOLUTION, 2024-2029 (USD BILLION)

- TABLE 123 ASIA PACIFIC: COMMAND AND CONTROL SYSTEMS MARKET, BY SYSTEM, 2020-2023 (USD BILLION)

- TABLE 124 ASIA PACIFIC: COMMAND AND CONTROL SYSTEMS MARKET, BY SYSTEM, 2024-2029 (USD BILLION)

- 12.5.3 INDIA

- 12.5.3.1 Indigenous development of command and control systems to drive market

- TABLE 125 INDIA: COMMAND AND CONTROL SYSTEMS MARKET, BY PLATFORM, 2020-2023 (USD BILLION)

- TABLE 126 INDIA: COMMAND AND CONTROL SYSTEMS MARKET, BY PLATFORM, 2024-2029 (USD BILLION)

- TABLE 127 INDIA: COMMAND AND CONTROL SYSTEMS MARKET, BY APPLICATION, 2020-2023 (USD BILLION)

- TABLE 128 INDIA: COMMAND AND CONTROL SYSTEMS MARKET, BY APPLICATION, 2024-2029 (USD BILLION)

- TABLE 129 INDIA: COMMAND AND CONTROL SYSTEMS MARKET, BY SOLUTION, 2020-2023 (USD BILLION)

- TABLE 130 INDIA: COMMAND AND CONTROL SYSTEMS MARKET, BY SOLUTION, 2024-2029 (USD BILLION)

- TABLE 131 INDIA: COMMAND AND CONTROL SYSTEMS MARKET, BY SYSTEM, 2020-2023 (USD BILLION)

- TABLE 132 INDIA: COMMAND AND CONTROL SYSTEMS MARKET, BY SYSTEM, 2024-2029 (USD BILLION)

- 12.5.4 JAPAN

- 12.5.4.1 Increasing threats from China and North Korea to drive market

- TABLE 133 JAPAN: COMMAND AND CONTROL SYSTEMS MARKET, BY PLATFORM, 2020-2023 (USD BILLION)

- TABLE 134 JAPAN: COMMAND AND CONTROL SYSTEMS MARKET, BY PLATFORM, 2024-2029 (USD BILLION)

- TABLE 135 JAPAN: COMMAND AND CONTROL SYSTEMS MARKET, BY APPLICATION, 2020-2023 (USD BILLION)

- TABLE 136 JAPAN: COMMAND AND CONTROL SYSTEMS MARKET, BY APPLICATION, 2024-2029 (USD BILLION)

- TABLE 137 JAPAN: COMMAND AND CONTROL SYSTEMS MARKET, BY SOLUTION, 2020-2023 (USD BILLION)

- TABLE 138 JAPAN: COMMAND AND CONTROL SYSTEMS MARKET, BY SOLUTION, 2024-2029 (USD BILLION)

- TABLE 139 JAPAN: COMMAND AND CONTROL SYSTEMS MARKET, BY SYSTEM, 2020-2023 (USD BILLION)

- TABLE 140 JAPAN: COMMAND AND CONTROL SYSTEMS MARKET, BY SYSTEM, 2024-2029 (USD BILLION)

- 12.5.5 SINGAPORE

- 12.5.5.1 Emphasis on technological innovation and integration to drive market

- TABLE 141 SINGAPORE: COMMAND AND CONTROL SYSTEMS MARKET, BY PLATFORM, 2020-2023 (USD BILLION)

- TABLE 142 SINGAPORE: COMMAND AND CONTROL SYSTEMS MARKET, BY PLATFORM, 2024-2029 (USD BILLION)

- TABLE 143 SINGAPORE: COMMAND AND CONTROL SYSTEMS MARKET, BY APPLICATION, 2020-2023 (USD BILLION)

- TABLE 144 SINGAPORE: COMMAND AND CONTROL SYSTEMS MARKET, BY APPLICATION, 2024-2029 (USD BILLION)

- TABLE 145 SINGAPORE: COMMAND AND CONTROL SYSTEMS MARKET, BY SOLUTION, 2020-2023 (USD BILLION)

- TABLE 146 SINGAPORE: COMMAND AND CONTROL SYSTEMS MARKET, BY SOLUTION, 2024-2029 (USD BILLION)

- TABLE 147 SINGAPORE: COMMAND AND CONTROL SYSTEMS MARKET, BY SYSTEM, 2020-2023 (USD BILLION)

- TABLE 148 SINGAPORE: COMMAND AND CONTROL SYSTEMS MARKET, BY SYSTEM, 2024-2029 (USD BILLION)

- 12.5.6 AUSTRALIA

- 12.5.6.1 Strategic investments and collaborations to enhance national defense capabilities to drive market

- TABLE 149 AUSTRALIA: COMMAND AND CONTROL SYSTEMS MARKET, BY PLATFORM, 2020-2023 (USD BILLION)

- TABLE 150 AUSTRALIA: COMMAND AND CONTROL SYSTEMS MARKET, BY PLATFORM, 2024-2029 (USD BILLION)

- TABLE 151 AUSTRALIA: COMMAND AND CONTROL SYSTEMS MARKET, BY APPLICATION, 2020-2023 (USD BILLION)

- TABLE 152 AUSTRALIA: COMMAND AND CONTROL SYSTEMS MARKET, BY APPLICATION, 2024-2029 (USD BILLION)

- TABLE 153 AUSTRALIA: COMMAND AND CONTROL SYSTEMS MARKET, BY SOLUTION, 2020-2023 (USD BILLION)

- TABLE 154 AUSTRALIA: COMMAND AND CONTROL SYSTEMS MARKET, BY SOLUTION, 2024-2029 (USD BILLION)

- TABLE 155 AUSTRALIA: COMMAND AND CONTROL SYSTEMS MARKET, BY SYSTEM, 2020-2023 (USD BILLION)

- TABLE 156 AUSTRALIA: COMMAND AND CONTROL SYSTEMS MARKET, BY SYSTEM, 2024-2029 (USD BILLION)

- 12.5.7 REST OF ASIA PACIFIC

- TABLE 157 REST OF ASIA PACIFIC: COMMAND AND CONTROL SYSTEMS MARKET, BY PLATFORM, 2020-2023 (USD BILLION)

- TABLE 158 REST OF ASIA PACIFIC: COMMAND AND CONTROL SYSTEMS MARKET, BY PLATFORM, 2024-2029 (USD BILLION)

- TABLE 159 REST OF ASIA PACIFIC: COMMAND AND CONTROL SYSTEMS MARKET, BY APPLICATION, 2020-2023 (USD BILLION)

- TABLE 160 REST OF ASIA PACIFIC: COMMAND AND CONTROL SYSTEMS MARKET, BY APPLICATION, 2024-2029 (USD BILLION)

- TABLE 161 REST OF ASIA PACIFIC: COMMAND AND CONTROL SYSTEMS MARKET, BY SOLUTION, 2020-2023 (USD BILLION)

- TABLE 162 REST OF ASIA PACIFIC: COMMAND AND CONTROL SYSTEMS MARKET, BY SOLUTION, 2024-2029 (USD BILLION)

- TABLE 163 REST OF ASIA PACIFIC: COMMAND AND CONTROL SYSTEMS MARKET, BY SYSTEM, 2020-2023 (USD BILLION)

- TABLE 164 REST OF ASIA PACIFIC: COMMAND AND CONTROL SYSTEMS MARKET, BY SYSTEM, 2024-2029 (USD BILLION)

- 12.6 MIDDLE EAST

- 12.6.1 PESTLE ANALYSIS

- 12.6.2 RECESSION IMPACT ANALYSIS

- FIGURE 53 MIDDLE EAST: COMMAND AND CONTROL SYSTEMS MARKET SNAPSHOT

- TABLE 165 MIDDLE EAST: COMMAND AND CONTROL SYSTEMS MARKET, BY COUNTRY, 2020-2023 (USD BILLION)

- TABLE 166 MIDDLE EAST: COMMAND AND CONTROL SYSTEMS MARKET, BY COUNTRY, 2024-2029 (USD BILLION)

- TABLE 167 MIDDLE EAST: COMMAND AND CONTROL SYSTEMS MARKET, BY PLATFORM, 2020-2023 (USD BILLION)

- TABLE 168 MIDDLE EAST: COMMAND AND CONTROL SYSTEMS MARKET, BY PLATFORM, 2024-2029 (USD BILLION)

- TABLE 169 MIDDLE EAST: COMMAND AND CONTROL SYSTEMS MARKET, BY APPLICATION, 2020-2023 (USD BILLION)

- TABLE 170 MIDDLE EAST: COMMAND AND CONTROL SYSTEMS MARKET, BY APPLICATION, 2024-2029 (USD BILLION)

- TABLE 171 MIDDLE EAST: COMMAND AND CONTROL SYSTEMS MARKET, BY SOLUTION, 2020-2023 (USD BILLION)

- TABLE 172 MIDDLE EAST: COMMAND AND CONTROL SYSTEMS MARKET, BY SOLUTION, 2024-2029 (USD BILLION)

- TABLE 173 MIDDLE EAST: COMMAND AND CONTROL SYSTEMS MARKET, BY SYSTEM, 2020-2023 (USD BILLION)

- TABLE 174 MIDDLE EAST: COMMAND AND CONTROL SYSTEMS MARKET, BY SYSTEM, 2024-2029 (USD BILLION)

- 12.6.3 GCC

- 12.6.3.1 Saudi Arabia

- 12.6.3.1.1 Localization goals under Vision 2030 to drive market

- 12.6.3.1 Saudi Arabia

- TABLE 175 SAUDI ARABIA: COMMAND AND CONTROL SYSTEMS MARKET, BY PLATFORM, 2020-2023 (USD BILLION)

- TABLE 176 SAUDI ARABIA: COMMAND AND CONTROL SYSTEMS MARKET, BY PLATFORM, 2024-2029 (USD BILLION)

- TABLE 177 SAUDI ARABIA: COMMAND AND CONTROL SYSTEMS MARKET, BY APPLICATION, 2020-2023 (USD BILLION)

- TABLE 178 SAUDI ARABIA: COMMAND AND CONTROL SYSTEMS MARKET, BY APPLICATION, 2024-2029 (USD BILLION)

- TABLE 179 SAUDI ARABIA: COMMAND AND CONTROL SYSTEMS MARKET, BY SOLUTION, 2020-2023 (USD BILLION)

- TABLE 180 SAUDI ARABIA: COMMAND AND CONTROL SYSTEMS MARKET, BY SOLUTION, 2024-2029 (USD BILLION)

- TABLE 181 SAUDI ARABIA: COMMAND AND CONTROL SYSTEMS MARKET, BY SYSTEM, 2020-2023 (USD BILLION)

- TABLE 182 SAUDI ARABIA: COMMAND AND CONTROL SYSTEMS MARKET, BY SYSTEM, 2024-2029 (USD BILLION)

- 12.6.3.2 UAE

- 12.6.3.2.1 Advanced defense capabilities to drive market

- 12.6.3.2 UAE

- TABLE 183 UAE: COMMAND AND CONTROL SYSTEMS MARKET, BY PLATFORM, 2020-2023 (USD BILLION)

- TABLE 184 UAE: COMMAND AND CONTROL SYSTEMS MARKET, BY PLATFORM, 2024-2029 (USD BILLION)

- TABLE 185 UAE: COMMAND AND CONTROL SYSTEMS MARKET, BY APPLICATION, 2020-2023 (USD BILLION)

- TABLE 186 UAE: COMMAND AND CONTROL SYSTEMS MARKET, BY APPLICATION, 2024-2029 (USD BILLION)

- TABLE 187 UAE: COMMAND AND CONTROL SYSTEMS MARKET, BY SOLUTION, 2020-2023 (USD BILLION)

- TABLE 188 UAE: COMMAND AND CONTROL SYSTEMS MARKET, BY SOLUTION, 2024-2029 (USD BILLION)

- TABLE 189 UAE: COMMAND AND CONTROL SYSTEMS MARKET, BY SYSTEM, 2020-2023 (USD BILLION)

- TABLE 190 UAE: COMMAND AND CONTROL SYSTEMS MARKET, BY SYSTEM, 2024-2029 (USD BILLION)

- 12.6.4 ISRAEL

- 12.6.4.1 Significant presence of defense companies to drive market

- TABLE 191 ISRAEL: COMMAND AND CONTROL SYSTEMS MARKET, BY PLATFORM, 2020-2023 (USD BILLION)

- TABLE 192 ISRAEL: COMMAND AND CONTROL SYSTEMS MARKET, BY PLATFORM, 2024-2029 (USD BILLION)

- TABLE 193 ISRAEL: COMMAND AND CONTROL SYSTEMS MARKET, BY APPLICATION, 2020-2023 (USD BILLION)

- TABLE 194 ISRAEL: COMMAND AND CONTROL SYSTEMS MARKET, BY APPLICATION, 2024-2029 (USD BILLION)

- TABLE 195 ISRAEL: COMMAND AND CONTROL SYSTEMS MARKET, BY SOLUTION, 2020-2023 (USD BILLION)

- TABLE 196 ISRAEL: COMMAND AND CONTROL SYSTEMS MARKET, BY SOLUTION, 2024-2029 (USD BILLION)

- TABLE 197 ISRAEL: COMMAND AND CONTROL SYSTEMS MARKET, BY SYSTEM, 2020-2023 (USD BILLION)

- TABLE 198 ISRAEL: COMMAND AND CONTROL SYSTEMS MARKET, BY SYSTEM, 2024-2029 (USD BILLION)

- 12.7 REST OF THE WORLD

- 12.7.1 PESTLE ANALYSIS

- 12.7.2 RECESSION IMPACT ANALYSIS

- FIGURE 54 REST OF THE WORLD: COMMAND AND CONTROL SYSTEMS MARKET SNAPSHOT

- TABLE 199 REST OF THE WORLD: COMMAND AND CONTROL SYSTEMS MARKET, BY COUNTRY, 2020-2023 (USD BILLION)

- TABLE 200 REST OF THE WORLD: COMMAND AND CONTROL SYSTEMS MARKET, BY COUNTRY, 2024-2029 (USD BILLION)

- TABLE 201 REST OF THE WORLD: COMMAND AND CONTROL SYSTEMS MARKET, BY PLATFORM, 2020-2023 (USD BILLION)

- TABLE 202 REST OF THE WORLD: COMMAND AND CONTROL SYSTEMS MARKET, BY PLATFORM, 2024-2029 (USD BILLION)

- TABLE 203 REST OF THE WORLD: COMMAND AND CONTROL SYSTEMS MARKET, BY APPLICATION, 2020-2023 (USD BILLION)

- TABLE 204 REST OF THE WORLD: COMMAND AND CONTROL SYSTEMS MARKET, BY APPLICATION, 2024-2029 (USD BILLION)

- TABLE 205 REST OF THE WORLD: COMMAND AND CONTROL SYSTEMS MARKET, BY SOLUTION, 2020-2023 (USD BILLION)

- TABLE 206 REST OF THE WORLD: COMMAND AND CONTROL SYSTEMS MARKET, BY SOLUTION, 2024-2029 (USD BILLION)

- TABLE 207 REST OF THE WORLD: COMMAND AND CONTROL SYSTEMS MARKET, BY SYSTEM, 2020-2023 (USD BILLION)

- TABLE 208 REST OF THE WORLD: COMMAND AND CONTROL SYSTEMS MARKET, BY SYSTEM, 2024-2029 (USD BILLION)

- 12.7.3 AFRICA

- 12.7.3.1 South Africa

- 12.7.3.1.1 Strategic initiatives to strengthen defense capabilities to drive market

- 12.7.3.1 South Africa

- TABLE 209 SOUTH AFRICA: COMMAND AND CONTROL SYSTEMS MARKET, BY PLATFORM, 2020-2023 (USD BILLION)

- TABLE 210 SOUTH AFRICA: COMMAND AND CONTROL SYSTEMS MARKET, BY PLATFORM, 2024-2029 (USD BILLION)

- TABLE 211 SOUTH AFRICA: COMMAND AND CONTROL SYSTEMS MARKET, BY APPLICATION, 2020-2023 (USD BILLION)

- TABLE 212 SOUTH AFRICA: COMMAND AND CONTROL SYSTEMS MARKET, BY APPLICATION, 2024-2029 (USD BILLION)

- TABLE 213 SOUTH AFRICA: COMMAND AND CONTROL SYSTEMS MARKET, BY SOLUTION, 2020-2023 (USD BILLION)

- TABLE 214 SOUTH AFRICA: COMMAND AND CONTROL SYSTEMS MARKET, BY SOLUTION, 2024-2029 (USD BILLION)

- TABLE 215 SOUTH AFRICA: COMMAND AND CONTROL SYSTEMS MARKET, BY SYSTEM, 2020-2023 (USD BILLION)

- TABLE 216 SOUTH AFRICA: COMMAND AND CONTROL SYSTEMS MARKET, BY SYSTEM, 2024-2029 (USD BILLION)

- 12.7.4 LATIN AMERICA

- 12.7.4.1 Brazil

- 12.7.4.1.1 Rising investments in modernizing defense capabilities to drive market

- 12.7.4.1 Brazil

- TABLE 217 BRAZIL: COMMAND AND CONTROL SYSTEMS MARKET, BY PLATFORM, 2020-2023 (USD BILLION)

- TABLE 218 BRAZIL: COMMAND AND CONTROL SYSTEMS MARKET, BY PLATFORM, 2024-2029 (USD BILLION)

- TABLE 219 BRAZIL: COMMAND AND CONTROL SYSTEMS MARKET, BY APPLICATION, 2020-2023 (USD BILLION)

- TABLE 220 BRAZIL: COMMAND AND CONTROL SYSTEMS MARKET, BY APPLICATION, 2024-2029 (USD BILLION)

- TABLE 221 BRAZIL: COMMAND AND CONTROL SYSTEMS MARKET, BY SOLUTION, 2020-2023 (USD BILLION)

- TABLE 222 BRAZIL: COMMAND AND CONTROL SYSTEMS MARKET, BY SOLUTION, 2024-2029 (USD BILLION)

- TABLE 223 BRAZIL: COMMAND AND CONTROL SYSTEMS MARKET, BY SYSTEM, 2020-2023 (USD BILLION)

- TABLE 224 BRAZIL: COMMAND AND CONTROL SYSTEMS MARKET, BY SYSTEM, 2024-2029 (USD BILLION)

- 12.7.4.2 Mexico

- 12.7.4.2.1 Rigorous efforts toward enhancing security measures and operational efficiencies to drive market

- 12.7.4.2 Mexico

- TABLE 225 MEXICO: COMMAND AND CONTROL SYSTEMS MARKET, BY PLATFORM, 2020-2023 (USD BILLION)

- TABLE 226 MEXICO: COMMAND AND CONTROL SYSTEMS MARKET, BY PLATFORM, 2024-2029 (USD BILLION)

- TABLE 227 MEXICO: COMMAND AND CONTROL SYSTEMS MARKET, BY APPLICATION, 2020-2023 (USD BILLION)

- TABLE 228 MEXICO: COMMAND AND CONTROL SYSTEMS MARKET, BY APPLICATION, 2024-2029 (USD BILLION)

- TABLE 229 MEXICO: COMMAND AND CONTROL SYSTEMS MARKET, BY SOLUTION, 2020-2023 (USD BILLION)

- TABLE 230 MEXICO: COMMAND AND CONTROL SYSTEMS MARKET, BY SOLUTION, 2024-2029 (USD BILLION)

- TABLE 231 MEXICO: COMMAND AND CONTROL SYSTEMS MARKET, BY SYSTEM, 2020-2023 (USD BILLION)

- TABLE 232 MEXICO: COMMAND AND CONTROL SYSTEMS MARKET, BY SYSTEM, 2024-2029 (USD BILLION)

13 COMPETITIVE LANDSCAPE

- 13.1 INTRODUCTION

- 13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2024

- TABLE 233 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2024

- 13.3 REVENUE ANALYSIS, 2020-2023

- FIGURE 55 REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2020-2023

- 13.4 MARKET SHARE ANALYSIS, 2023

- FIGURE 56 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2023

- TABLE 234 COMMAND AND CONTROL SYSTEMS MARKET: DEGREE OF COMPETITION

- 13.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 13.5.1 STARS

- 13.5.2 EMERGING LEADERS

- 13.5.3 PERVASIVE PLAYERS

- 13.5.4 PARTICIPANTS

- FIGURE 57 COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- 13.5.5 COMPANY FOOTPRINT

- FIGURE 58 COMPANY FOOTPRINT

- TABLE 235 SOLUTION FOOTPRINT

- TABLE 236 APPLICATION FOOTPRINT

- TABLE 237 PLATFORM FOOTPRINT

- TABLE 238 REGION FOOTPRINT

- 13.6 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2023

- 13.6.1 PROGRESSIVE COMPANIES

- 13.6.2 RESPONSIVE COMPANIES

- 13.6.3 DYNAMIC COMPANIES

- 13.6.4 STARTING BLOCKS

- FIGURE 59 COMPANY EVALUATION MATRIX (START-UPS/SMES), 2023

- 13.6.5 COMPETITIVE BENCHMARKING

- TABLE 239 LIST OF START-UPS/SMES

- TABLE 240 COMPETITIVE BENCHMARKING OF START-UPS/SMES

- 13.7 COMPANY VALUATION AND FINANCIAL METRICS

- FIGURE 60 VALUATION OF PROMINENT MARKET PLAYERS

- FIGURE 61 FINANCIAL METRICS OF PROMINENT MARKET PLAYERS

- 13.8 BRAND/PRODUCT COMPARISON

- FIGURE 62 BRAND/PRODUCT COMPARISON

- 13.9 COMPETITIVE SCENARIO AND TRENDS

- 13.9.1 DEALS

- TABLE 241 COMMAND AND CONTROL SYSTEMS MARKET: DEALS, 2020-2024

- 13.9.2 OTHERS

- TABLE 242 COMMAND AND CONTROL SYSTEMS MARKET: OTHERS, 2020-2024

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- (Business overview, Products/Solutions/Services offered, Recent developments, MnM view, Right to win, Strategic choices, and Weaknesses and Competitive threats)**

- 14.1.1 L3HARRIS TECHNOLOGIES, INC.

- TABLE 243 L3HARRIS TECHNOLOGIES, INC.: COMPANY OVERVIEW

- FIGURE 63 L3HARRIS TECHNOLOGIES, INC.: COMPANY SNAPSHOT

- TABLE 244 L3HARRIS TECHNOLOGIES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 245 L3HARRIS TECHNOLOGIES, INC.: OTHERS

- 14.1.2 RTX

- TABLE 246 RTX: COMPANY OVERVIEW

- FIGURE 64 RTX: COMPANY SNAPSHOT

- TABLE 247 RTX: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 248 RTX: OTHERS

- 14.1.3 GENERAL DYNAMICS CORPORATION

- TABLE 249 GENERAL DYNAMICS CORPORATION: COMPANY OVERVIEW

- FIGURE 65 GENERAL DYNAMICS CORPORATION: COMPANY SNAPSHOT

- TABLE 250 GENERAL DYNAMICS CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 251 GENERAL DYNAMICS CORPORATION: OTHERS

- 14.1.4 NORTHROP GRUMMAN

- TABLE 252 NORTHROP GRUMMAN: COMPANY OVERVIEW

- FIGURE 66 NORTHROP GRUMMAN: COMPANY SNAPSHOT

- TABLE 253 NORTHROP GRUMMAN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 254 NORTHROP GRUMMAN: DEALS

- TABLE 255 NORTHROP GRUMMAN: OTHERS

- 14.1.5 LOCKHEED MARTIN CORPORATION

- TABLE 256 LOCKHEED MARTIN CORPORATION: COMPANY OVERVIEW

- FIGURE 67 LOCKHEED MARTIN CORPORATION: COMPANY SNAPSHOT

- TABLE 257 LOCKHEED MARTIN CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 258 LOCKHEED MARTIN CORPORATION: OTHERS

- 14.1.6 THALES

- TABLE 259 THALES: COMPANY OVERVIEW

- FIGURE 68 THALES: COMPANY SNAPSHOT

- TABLE 260 THALES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 261 THALES: DEALS

- TABLE 262 THALES: OTHERS

- 14.1.7 BAE SYSTEMS

- TABLE 263 BAE SYSTEMS: COMPANY OVERVIEW

- FIGURE 69 BAE SYSTEMS: COMPANY SNAPSHOT

- TABLE 264 BAE SYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 265 BAE SYSTEMS: OTHERS

- 14.1.8 LEONARDO S.P.A.

- TABLE 266 LEONARDO S.P.A.: COMPANY OVERVIEW

- FIGURE 70 LEONARDO S.P.A.: COMPANY SNAPSHOT

- TABLE 267 LEONARDO S.P.A.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 268 LEONARDO S.P.A.: OTHERS

- 14.1.9 ELBIT SYSTEMS LTD.

- TABLE 269 ELBIT SYSTEMS LTD.: COMPANY OVERVIEW

- FIGURE 71 ELBIT SYSTEMS LTD.: COMPANY SNAPSHOT

- TABLE 270 ELBIT SYSTEMS LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 271 ELBIT SYSTEMS LTD.: OTHERS

- 14.1.10 RHEINMETALL AG

- TABLE 272 RHEINMETALL AG: COMPANY OVERVIEW

- FIGURE 72 RHEINMETALL AG: COMPANY SNAPSHOT

- TABLE 273 RHEINMETALL AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 274 RHEINMETALL AG: DEALS

- TABLE 275 RHEINMETALL AG: OTHERS

- 14.1.11 SAAB AB

- TABLE 276 SAAB AB: COMPANY OVERVIEW

- FIGURE 73 SAAB AB: COMPANY SNAPSHOT

- TABLE 277 SAAB AB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 14.1.12 AIRBUS

- TABLE 278 AIRBUS: COMPANY OVERVIEW

- FIGURE 74 AIRBUS: COMPANY SNAPSHOT

- TABLE 279 AIRBUS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 280 AIRBUS: OTHERS

- 14.1.13 SIEMENS

- TABLE 281 SIEMENS: COMPANY OVERVIEW

- FIGURE 75 SIEMENS: COMPANY SNAPSHOT

- TABLE 282 SIEMENS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 14.1.14 LIG NEX1

- TABLE 283 LIG NEX1: COMPANY OVERVIEW

- FIGURE 76 LIG NEX1: COMPANY SNAPSHOT

- TABLE 284 LIG NEX1: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 14.1.15 HONEYWELL INTERNATIONAL INC.

- TABLE 285 HONEYWELL INTERNATIONAL INC.: COMPANY OVERVIEW

- FIGURE 77 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

- TABLE 286 HONEYWELL INTERNATIONAL INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 14.1.16 ISRAEL AEROSPACE INDUSTRIES

- TABLE 287 ISRAEL AEROSPACE INDUSTRIES: COMPANY OVERVIEW

- FIGURE 78 ISRAEL AEROSPACE INDUSTRIES: COMPANY SNAPSHOT

- TABLE 288 ISRAEL AEROSPACE INDUSTRIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 14.1.17 INDRA SISTEMAS, S.A.

- TABLE 289 INDRA SISTEMAS, S.A.: COMPANY OVERVIEW

- FIGURE 79 INDRA SISTEMAS, S.A.: COMPANY SNAPSHOT

- TABLE 290 INDRA SISTEMAS, S.A.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 14.1.18 ASELSAN A.S.

- TABLE 291 ASELSAN A.S.: COMPANY OVERVIEW

- FIGURE 80 ASELSAN A.S.: COMPANY SNAPSHOT

- TABLE 292 ASELSAN A.S.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 14.1.19 CACI INTERNATIONAL INC

- TABLE 293 CACI INTERNATIONAL INC: COMPANY OVERVIEW

- FIGURE 81 CACI INTERNATIONAL INC: COMPANY SNAPSHOT

- TABLE 294 CACI INTERNATIONAL INC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 295 CACI INTERNATIONAL INC: OTHERS

- 14.2 OTHER PLAYERS

- 14.2.1 MISTRAL SOLUTIONS PVT. LTD.

- TABLE 296 MISTRAL SOLUTIONS PVT. LTD.: COMPANY OVERVIEW

- 14.2.2 ULTRA INTELLIGENCE & COMMUNICATIONS

- TABLE 297 ULTRA INTELLIGENCE & COMMUNICATIONS: COMPANY OVERVIEW

- 14.2.3 SYSTEMATIC A/S

- TABLE 298 SYSTEMATIC A/S: COMPANY OVERVIEW

- 14.2.4 QINETIQ

- TABLE 299 QINETIQ: COMPANY OVERVIEW

- 14.2.5 RGB SPECTRUM

- TABLE 300 RGB SPECTRUM: COMPANY OVERVIEW

- 14.2.6 ROLTA INDIA LIMITED

- TABLE 301 ROLTA INDIA LIMITED: COMPANY OVERVIEW

- *Details on Business overview, Products/Solutions/Services offered, Recent developments, MnM view, Right to win, Strategic choices, and Weaknesses and Competitive threats might not be captured in case of unlisted companies.

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 ANNEXURE

- 15.2.1 DEFENSE PROGRAMS

- 15.2.2 LIST OF COMPANIES MAPPED DURING RESEARCH

- 15.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.4 CUSTOMIZATION OPTIONS

- 15.5 RELATED REPORTS

- 15.6 AUTHOR DETAILS