|

|

市場調査レポート

商品コード

1442026

自動化テストの世界市場:提供区分別、エンドポイントインターフェース別、産業別、地域別 - 予測(~2028年)Automation Testing Market by Offering (Testing Types (Static Testing and Dynamic Testing) and Services), Endpoint Interface (Mobile, Web, Desktop, and Embedded Software), Vertical (BFSI, Automotive, IT & ITeS) and Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 自動化テストの世界市場:提供区分別、エンドポイントインターフェース別、産業別、地域別 - 予測(~2028年) |

|

出版日: 2024年02月23日

発行: MarketsandMarkets

ページ情報: 英文 296 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

世界の自動化テストの市場規模は、2023年の281億米ドルから、予測期間中に14.5%のCAGRで推移し、2028年には551億米ドルの規模に成長すると予測されています。

サイバー脅威の急増と機密データ保護の重要性が、自動化セキュリティテストの役割を高め、自動化テストの成長を促進する重要な要因となっています。自動セキュリティテストツールは、アプリケーションのコード、構成設定、依存関係内の脆弱性を積極的にスキャンし、特定する上で極めて重要です。定期的かつ自動化されたセキュリティテストを実施することで、企業は潜在的な脅威に対する強固な防御を確立し、ソフトウェア資産の継続的な保護を確保することができます。サイバー脅威の動的な性質は、セキュリティテストに対する継続的かつ体系的なアプローチを必要とするため、自動化は、進化するリスクからアプリケーションを保護する上で不可欠なコンポーネントとなります。自動化されたセキュリティテストの統合は、アプリケーションの全体的なセキュリティを強化するだけでなく、弾力性のある安全なソフトウェア環境を維持するための業界のベストプラクティスにも合致しています。自動化テスト、特にセキュリティ分野での自動化テストの需要は、進化し続ける脅威の状況に直面して、安全で弾力性のあるソフトウェアソリューションを提供する必要性によって促進されています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2018-2028年 |

| 基準年 | 2022年 |

| 予測期間 | 2023-2028年 |

| 対象単位 | 金額 (米ドル) |

| セグメント | 提供区分 (テストタイプ (ダイナミックテスト)・サービス)・エンドポイントインターフェース・産業別 |

| 対象地域 | 北米・欧州・アジア太平洋・中東&アフリカ・ラテンアメリカ |

産業別では、IT&ITESの部門が予測期間中に最大の規模を維持する見込みです。IT環境におけるサーバーレスコンピューティングモデルの採用の増加により、検証への強固なアプローチが必要となり、自動化テストはサーバーレスアーキテクチャの有効性を確保する上で不可欠な要素として台頭しています。このパラダイムでは、アプリケーションは従来のサーバーインフラ管理なしで構築され、自動化テストは機能のシームレスな実行と最適なパフォーマンスを検証する上で極めて重要な役割を果たします。自動化ツールは、サーバーレス環境の動的でイベント駆動型の性質をシミュレートし、機能の拡張性、さまざまなワークロードへの対応、他のコンポーネントとのシームレスな統合を評価することができます。さらに、自動化テストは、サーバーレスアーキテクチャに固有のリソース割り当て、機能の依存関係、パフォーマンスのボトルネックに関連する潜在的な問題を特定します。サーバーレスコンピューティングテストで自動化を活用することで、企業はサーバーレス機能が意図したとおりに動作し、効率的に拡張され、動的で予測不可能なワークロードに対応して最適なパフォーマンスを提供できていることを確認しながら、自信を持ってアプリケーションを展開することができます。

地域別では、アジア太平洋地域が予測期間中にもっとも高い成長を示す見通しです。同地域におけるeラーニングプラットフォームとEdTechの著しい拡大により、教育用ソフトウェアの綿密なテストの必要性が高まり、自動化テストはこの活気ある状況において極めて重要な要素となっています。デジタル学習ソリューションの導入が急増する中、この地域の多くの国々で、教育ソフトウェアアプリケーションの信頼性と有効性を確保することが重視されるようになっています。自動化テストは、オンライン学習アプリケーションの機能性、拡張性、パフォーマンスを体系的に検証する上で非常に重要です。

当レポートでは、世界の自動化テストの市場を調査し、市場概要、市場影響因子および市場機会の分析、技術・特許の動向、ケーススタディ、ビジネスモデル、ベストプラクティス、市場規模の推移・予測、各種区分・地域別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要と業界動向

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 自動化テスト技術の歴史

- エコシステム/市場マップ

- 自動化テストの投資情勢

- ケーススタディ分析

- バリューチェーン分析

- 特許分析

- 技術分析

- 価格分析

- ポーターのファイブフォース分析

- 顧客のビジネスに影響を与える動向とディスラプション

- 主なステークホルダーと購入基準

- 主要な会議とイベント

- 自動化テスト市場のベストプラクティス

- 現在および新たなビジネスモデル

- 自動化テストツール、フレームワーク、技術

- 自動化テスト市場の将来の情勢

第6章 自動化テスト市場:提供区分別

- テストタイプ

- サービス

第7章 自動化テスト市場:テストタイプ別

- 静的テスト

- 動的テスト

第8章 自動化テスト市場:サービス別

- アドバイザリーおよびコンサルティングサービス

- 文書化およびトレーニングサービス

- サポートおよびメンテナンスサービス

- 企画開発

- 導入サービス

- マネージドサービス

- その他のサービス

第9章 自動化テスト市場:動的テスト別

- 機能テスト

- 非機能テスト

- セキュリティテスト

- 性能試験

- 互換性テスト

- コンプライアンステスト

- ユーザビリティテスト

- その他

第10章 自動化テスト市場:エンドポイントインターフェイス別

- モバイル

- ウェブ

- デスクトップ

- 組込みソフトウェア

第11章 自動化テスト市場:産業別

- BFSI

- 自動車

- 航空宇宙・防衛

- ヘルスケア・ライフサイエンス

- 小売

- IT・ITES

- 通信

- 製造

- 輸送・物流

- エネルギー・ユーティリティ

- メディア・エンターテイメント

- その他

第12章 自動化テスト市場:地域別

- 北米

- 欧州

- アジア太平洋

- 中東・アフリカ

- ラテンアメリカ

第13章 競合情勢

- 主要企業の戦略/有力企業

- 収益分析

- 市場シェア分析

- 企業評価マトリックス

- 新興企業/中小企業の評価マトリックス

- 競合シナリオと動向

- 自動化テスト製品のベンチマーキング

- 主要な自動化テストプロバイダーの評価と財務指標

第14章 企業プロファイル

- 主要企業

- IBM

- ACCENTURE

- OPENTEXT CORPORATION

- CAPGEMINI

- MICROSOFT

- BROADCOM

- TRICENTIS

- CIGNITI TECHNOLOGIES

- KEYSIGHT TECHNOLOGIES

- APEXON

- CYGNET DIGITAL

- QUALITYKIOSK TECHNOLOGIES PVT. LTD.

- INVENSIS TECHNOLOGIES PVT. LTD.

- QASOURCE INC.

- IDERA, INC.

- スタートアップ/SME

- SMARTBEAR SOFTWARE

- PARASOFT

- SAUCE LABS INC.,

- ACCELQ INC.

- APPLITOOLS

- THE QT COMPANY

- ASTEGIC INC.

- MOBISOFT INFOTECH

- THINKSYS INC.

- QA MENTOR

- AFOUR TECHNOLOGIES

- CODOID

- WORKSOFT, INC.

- TESTGRID

第15章 隣接/関連市場

第16章 付録

The automation testing market is estimated at USD 28.1 billion in 2023 to USD 55.1 billion by 2028, at a Compound Annual Growth Rate (CAGR) of 14.5%. The surge in cyber threats and the critical importance of safeguarding sensitive data have elevated the role of automated security testing as a significant factor driving the growth of automation testing. Automated security testing tools are pivotal in proactively scanning and identifying vulnerabilities within an application's code, configuration settings, and dependencies. By conducting regular and automated security tests, organizations can establish a robust defense against potential threats, ensuring ongoing protection of their software assets. The dynamic nature of cyber threats requires a continuous and systematic approach to security testing, making automation an indispensable component in the arsenal of tools used to fortify applications against evolving risks. The integration of automated security testing not only enhances the overall security posture of applications and aligns with industry best practices for maintaining a resilient and secure software environment. As a result, the demand for automation testing, particularly in security, is fueled by the imperative to deliver safe and resilient software solutions in the face of an ever-evolving threat landscape.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2018-2028 |

| Base Year | 2022 |

| Forecast Period | 2023-2028 |

| Units Considered | Value (USD Billion) |

| Segments | By offering, testing type, dynamic testing, services, endpoint Interface, vertical. |

| Regions covered | North America, Europe, Asia Pacific, Middle East and Africa, and Latin America |

"The IT & ITes segment is expected to hold the largest market size during the forecast period." The increasing adoption of serverless computing models in the IT landscape necessitates a robust approach to validation, and automation testing emerges as an essential component in ensuring the efficacy of serverless architectures. In this paradigm, where applications are built without traditional server infrastructure management, automation testing plays a pivotal role in validating the seamless execution and optimal performance of functions. Automation tools can simulate the dynamic and event-driven nature of serverless environments, assessing how well functions scale, respond to varying workloads, and seamlessly integrate with other components. Moreover, automated testing identifies potential issues related to resource allocation, function dependencies, and performance bottlenecks inherent in serverless architectures. By leveraging automation in serverless computing testing, organizations can confidently deploy applications, knowing that the serverless functions operate as intended, scale efficiently, and deliver optimal performance in response to dynamic and unpredictable workloads.

"The non-functional testing segment to register the fastest growth rate during the forecast period." In industries characterized by stringent regulatory frameworks, such as finance, healthcare, and government, adherence to compliance standards is paramount. Non-functional testing assumes a critical role in ensuring that applications within these sectors align with industry-specific regulations, thereby establishing a secure and compliant software environment. In the finance industry, where data integrity and confidentiality are imperative, non-functional testing validates the robustness of security measures to safeguard financial transactions and sensitive information. Similarly, in healthcare, where patient data privacy is a top priority, non-functional testing ensures that applications meet the stringent requirements of health data protection regulations. For government entities, compliance with regulatory mandates is essential for maintaining public trust and data security. Non-functional testing, encompassing security, reliability, and performance, becomes a cornerstone in verifying that applications meet and exceed the established industry standards. By incorporating rigorous non-functional testing protocols, organizations in these regulated sectors can instill confidence in stakeholders, mitigate risks associated with non-compliance, and ultimately provide a secure and resilient software environment aligned with the specific regulatory demands of their respective industries.

"Asia Pacific's highest growth rate during the forecast period."

The remarkable expansion of e-learning platforms and EdTech endeavors across the Asia Pacific region has heightened the necessity for meticulous testing of educational software, establishing automation testing as a pivotal component in this vibrant landscape. With a surge in the adoption of digital learning solutions, there is an increased emphasis on ensuring the reliability and effectiveness of educational software applications throughout the diverse countries in the region. Automation testing is critical in systematically validating the functionality, scalability, and performance of online learning applications. Given the diverse educational needs addressed by these platforms across the Asia Pacific, automation testing proves instrumental in identifying and addressing potential issues related to user interfaces, interactive features, and content delivery. The scalability aspect gains particular significance as e-learning platforms must seamlessly accommodate varying numbers of users, ensuring a smooth and responsive learning experience across different devices and connectivity scenarios prevalent in the diverse regions of the Asia Pacific. By integrating automation testing into the development and deployment processes, EdTech companies in the Asia Pacific can elevate the quality of their educational software, optimize performance, and deliver a robust and reliable learning experience for students and educators, thereby contributing to the sustained growth and success of the e-learning ecosystem across the region.

In-depth interviews have been conducted with chief executive officers (CEOs), Directors, and other executives from various key organizations operating in the automation testing market.

- By Company Type: Tier 1 - 35%, Tier 2 - 45%, and Tier 3 - 20%

- By Designation: C-level -35%, D-level - 25%, and Others - 40%

- By Region: North America - 30%, Europe - 30%, Asia Pacific - 25%, Latin America- 5%, and Middle East & Africa - 10%,

The major players in the automation testing include IBM (US), Accenture (Ireland), Broadcom (US), OpenText (Canada), Capgemini (France), Microsoft (US), Keysight Technologies (US), Cigniti Technologies (India), Tricentis (US), Cygnet Infotech (India), Invensis Technologies Pvt Ltd (India), QualityKiosk Technologies Pvt. Ltd. (India), Apexon (US), Idera, Inc. (US), QA Source (US), Astegic (US), Worksoft (US), ACCELQ (US), Sauce Labs (US), SmartBear (US), Parasoft (US), Applitools (US), AFour Technologies (India), QA mentor (US), Mobisoft Infotech (US), ThinkSys (US), Qt Group (Finland), Codoid (India). These players have adopted various growth strategies, such as partnerships, agreements and collaborations, new product launches, enhancements, and acquisitions to expand their automation testing market footprint.

Research Coverage

The market study covers the automation testing market size across different segments. It aims at estimating the market size and the growth potential across different segments, including By offering (testing type, services), testing type (static testing, dynamic testing), dynamic testing( functional testing, non-functional testing) services (advisory and consulting services, planning and development services, support and maintenance services, documentation and training services, implementation services, managed services, other services) endpoint Interface (mobile, web, desktop, embedded software) vertical (banking, financial services, and insurance, automotive, aerospace and defense, healthcare and life sciences, retail, IT and ITeS, telecom, manufacturing, transportation and logistics, energy and utilities, media and entertainment, other verticals) and Region (North America, Europe, Asia Pacific, Middle East & Africa, and Latin America). The study includes an in-depth competitive analysis of the leading market players, their company profiles, key observations related to product and business offerings, recent developments, and market strategies.

Key Benefits of Buying the Report

The report will help the market leaders/new entrants with information on the closest approximations of the global automation testing market's revenue numbers and subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. Moreover, the report will provide insights for stakeholders to understand the market's pulse and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

1. Analysis of key drivers ( Accelerated Software Development Lifecycles, Continuous Integration and Continuous Deployment (CI/CD), rise in mobile and web applications), restraints (The impediment of skill and knowledge gaps in automation testing, Incompatibility with legacy systems), opportunities (Integration of artificial intelligence and machine learning, The rising adoption of cloud-based solutions), and challenges (Limited testing for UX and UI elements, Complexity of Test Script Maintenance) influencing the growth of the automation testing market.

2. Product Development/Innovation: Detailed insights on upcoming technologies, research and development activities, and new product and service launches in the automation testing market.

3. Market Development: Comprehensive information about lucrative markets - the report analyses the automation testing market across various regions.

4. Market Diversification: Exhaustive information about new products and services, untapped geographies, recent developments, and investments in the automation testing market.

5. Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading include IBM (US), Accenture (Ireland), Broadcom (US), OpenText (Canada), Capgemini (France), Microsoft (US), Keysight Technologies (US), Cigniti Technologies (India), Tricentis (US), Cygnet Infotech (India), Invensis Technologies Pvt Ltd (India), QualityKiosk Technologies Pvt. Ltd. (India), Apexon (US), Idera, Inc. (US), QA Source (US), Astegic (US), Worksoft (US), ACCELQ (US), Sauce Labs (US), SmartBear (US), Parasoft (US), Applitools (US), AFour Technologies (India), QA mentor (US), Mobisoft Infotech (US), ThinkSys (US), Qt Group (Finland), Codoid (India).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION

- FIGURE 1 AUTOMATION TESTING MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- FIGURE 1 AUTOMATION TESTING MARKET SEGMENTATION, BY REGION

- 1.4 YEARS CONSIDERED

- FIGURE 2 YEARS CONSIDERED FOR STUDY

- 1.5 CURRENCY CONSIDERED

- TABLE 1 USD EXCHANGE RATES, 2021-2023

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

- 1.7.1 IMPACT OF RECESSION

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 3 AUTOMATION TESTING MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Secondary sources

- FIGURE 4 SECONDARY SOURCES FOR KEY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interviews with experts

- 2.1.2.2 List of key primary interview participants

- 2.1.2.3 Breakdown of primary profiles

- FIGURE 5 BREAKDOWN OF PRIMARY PROFILES, BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.1.2.4 Primary sources

- FIGURE 6 KEY DATA FROM PRIMARY SOURCES

- 2.1.2.5 Key industry insights

- FIGURE 7 KEY INDUSTRY INSIGHTS FROM EXPERTS

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 TOP-DOWN APPROACH

- FIGURE 8 TOP-DOWN APPROACH

- 2.2.2 AUTOMATION TESTING MARKET ESTIMATION: DEMAND-SIDE ANALYSIS

- FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY: DEMAND-SIDE ANALYSIS

- 2.2.3 BOTTOM-UP APPROACH

- FIGURE 10 BOTTOM-UP APPROACH

- FIGURE 11 BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE FROM ALL SOLUTIONS/SERVICES OF AUTOMATION TESTING MARKET

- 2.3 DATA TRIANGULATION

- FIGURE 12 DATA TRIANGULATION

- 2.4 RISK ASSESSMENT

- TABLE 2 RISK ASSESSMENT

- 2.5 LIMITATIONS

- 2.6 RESEARCH ASSUMPTIONS

- 2.6.1 FACTOR ASSESSMENT

- TABLE 3 FACTOR ASSESSMENT: AUTOMATION TESTING MARKET

- 2.7 AUTOMATION TESTING MARKET: RECESSION IMPACT

3 EXECUTIVE SUMMARY

- FIGURE 13 AUTOMATION TESTING MARKET TO WITNESS SIGNIFICANT GROWTH DURING FORECAST PERIOD

- FIGURE 14 AUTOMATION TESTING MARKET: REGIONAL SNAPSHOT

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN AUTOMATION TESTING MARKET

- FIGURE 15 RAPID INDUSTRIALIZATION AND DIGITAL TRANSFORMATION IN DEVELOPING ECONOMIES TO DRIVE MARKET

- 4.2 AUTOMATION TESTING MARKET: TOP-GROWING SEGMENTS

- FIGURE 16 TOP-GROWING SEGMENTS IN MARKET IN 2023

- 4.3 AUTOMATION TESTING MARKET, BY DYNAMIC TESTING

- FIGURE 17 FUNCTIONAL TESTING SEGMENT LED MARKET IN 2023

- 4.4 AUTOMATION TESTING MARKET, BY OFFERING

- FIGURE 18 TESTING TYPES SEGMENT EXPECTED TO HAVE HIGHER GROWTH RATE DURING FORECAST PERIOD

- 4.5 AUTOMATION TESTING MARKET, BY SERVICE

- FIGURE 19 ADVISORY AND CONSULTING SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- 4.6 NORTH AMERICA: AUTOMATION TESTING MARKET, BY OFFERING AND VERTICAL

- FIGURE 20 SERVICES SEGMENT AND IT & ITES HELD LARGEST MARKET SHARES IN 2023

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 21 AUTOMATION TESTING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Widespread adoption of agile development methodologies

- 5.2.1.2 Continuous Integration and Continuous Deployment (CI/CD)

- 5.2.1.3 Rise in mobile and web applications

- 5.2.2 RESTRAINTS

- 5.2.2.1 Knowledge gaps in automation testing

- 5.2.2.2 Incompatibility with legacy systems

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Integration of AI and machine learning

- 5.2.3.2 Cloud-based testing services

- 5.2.4 CHALLENGES

- 5.2.4.1 Limited testing for UX and UI elements

- 5.2.4.2 Complexity of test script maintenance

- 5.3 HISTORY OF AUTOMATION TESTING TECHNOLOGY

- FIGURE 22 HISTORY OF AUTOMATION TESTING TECHNOLOGY

- 5.3.1 1940S-1950S

- 5.3.2 1980S-1990S

- 5.3.3 1990S-2010S

- 5.3.4 2011-2023

- 5.4 ECOSYSTEM/MARKET MAP

- FIGURE 23 KEY PLAYERS IN AUTOMATION TESTING MARKET ECOSYSTEM

- TABLE 4 ROLE OF PLAYERS IN MARKET ECOSYSTEM

- 5.5 AUTOMATION TESTING INVESTMENT LANDSCAPE

- 5.6 CASE STUDY ANALYSIS

- 5.6.1 CASE STUDY 1: COX AUTOMOTIVE INITIATED QUALITY IMPROVEMENT EFFORT TO REDUCE ESCAPED DEFECTS

- 5.6.2 CASE STUDY 2: UZA IMPLEMENTED KEYSIGHT'S EGGPLANT TO TRANSITION FROM MANUAL TO AUTOMATED TESTING

- 5.6.3 CASE STUDY 3: LEADING EUROPEAN BANK DEPLOYED IBM'S RATIONAL TEST VIRTUALIZATION SERVER TO ENHANCE PERFORMANCE TESTING

- 5.6.4 CASE STUDY 4: ACCENTURE'S CROSS-FUNCTIONAL TEAM HELPED SWISSCOM EMBED MODERN QUALITY ENGINEERING AND CONTINUOUS TESTING PRINCIPLES ACROSS SOFTWARE DELIVERY PIPELINE

- 5.6.5 CASE STUDY 5: TRICENTIS TOSCA'S MODEL-BASED APPROACH HELPED SPAR ICS IMPLEMENT AUTOMATED TEST PORTFOLIOS

- 5.6.6 CASE STUDY 6: CIGNITI TECHNOLOGIES' PERFORMANCE TESTING PLATFORM HELPED GOVERNMENT IMPROVE SYSTEM RESPONSE TIME

- 5.6.7 CASE STUDY 7: QUICK BASE DEPLOYED SAUCE LABS' CLOUD-BASED AUTOMATED TEST EXECUTION PLATFORM TO IMPROVE EFFICIENCY

- 5.7 VALUE CHAIN ANALYSIS

- FIGURE 24 AUTOMATION TESTING MARKET: VALUE CHAIN ANALYSIS

- 5.7.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 5 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.7.1.1 North America

- 5.7.1.1.1 US

- 5.7.1.1.2 Canada

- 5.7.1.2 Europe

- 5.7.1.2.1 UK

- 5.7.1.3 Asia Pacific

- 5.7.1.3.1 China

- 5.7.1.3.2 India

- 5.7.1.3.3 Japan

- 5.7.1.4 Rest of the World

- 5.7.1.4.1 Africa

- 5.7.1.4.2 Brazil

- 5.7.1.1 North America

- 5.8 PATENT ANALYSIS

- FIGURE 25 LIST OF MAJOR PATENTS FOR AUTOMATION TESTING

- 5.8.1 LIST OF MAJOR PATENTS

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGIES

- 5.9.1.1 Artificial intelligence

- 5.9.1.2 Machine learning

- 5.9.1.3 Big data

- 5.9.2 COMPLEMENTARY TECHNOLOGIES

- 5.9.2.1 Robot framework

- 5.9.2.2 Cloud

- 5.9.3 ADJACENT TECHNOLOGIES

- 5.9.3.1 Quantum computing

- 5.9.1 KEY TECHNOLOGIES

- 5.10 PRICING ANALYSIS

- 5.10.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY BILLING CYCLE

- FIGURE 26 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY BILLING CYCLE

- TABLE 9 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY BILLING CYCLE (USD)

- 5.10.2 INDICATIVE PRICING ANALYSIS OF KEY PLAYERS, BY FEATURE

- TABLE 10 INDICATIVE PRICING ANALYSIS OF KEY PLAYERS, BY FEATURE (USD)

- 5.11 PORTER'S FIVE FORCES ANALYSIS

- TABLE 11 IMPACT OF PORTER'S FORCES ON AUTOMATION TESTING MARKET

- FIGURE 27 PORTER'S FIVE FORCES ANALYSIS

- 5.11.1 THREAT OF NEW ENTRANTS

- 5.11.2 THREAT OF SUBSTITUTES

- 5.11.3 BARGAINING POWER OF BUYERS

- 5.11.4 BARGAINING POWER OF SUPPLIERS

- 5.11.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.12 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 28 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 29 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- TABLE 12 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- 5.13.2 BUYING CRITERIA

- FIGURE 30 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- TABLE 13 KEY BUYING CRITERIA FOR TOP 3 VERTICALS

- 5.14 KEY CONFERENCES & EVENTS

- TABLE 14 DETAILED LIST OF CONFERENCES & EVENTS, 2023-2024

- 5.15 BEST PRACTICES IN AUTOMATION TESTING MARKET

- 5.15.1 SELECTING RIGHT AUTOMATED TESTING TOOL

- 5.15.2 DIVIDING AUTOMATED TESTING EFFORTS

- 5.15.3 CREATING GOOD, QUALITY TEST DATA

- 5.15.4 CREATING AUTOMATED TESTS RESISTANT TO CHANGES IN UI

- 5.16 CURRENT AND EMERGING BUSINESS MODELS

- 5.16.1 CONSULTING SERVICES

- 5.16.2 TOOL LICENSING OR SUBSCRIPTION

- 5.16.3 SOFTWARE-AS-A-SERVICE (SAAS)

- 5.16.4 TESTING-AS-A-SERVICE (TAAS)

- 5.16.5 FREEMIUM MODEL

- 5.16.6 OPEN-SOURCE MODEL

- 5.16.7 TRAINING & CERTIFICATION

- 5.17 AUTOMATION TESTING TOOLS, FRAMEWORKS, AND TECHNIQUES

- FIGURE 31 AUTOMATION TESTING TOOLS, TECHNIQUES, AND FRAMEWORKS

- 5.18 FUTURE LANDSCAPE OF AUTOMATION TESTING MARKET

- 5.18.1 SHORT-TERM ROADMAP (2023-2025)

- 5.18.2 MID-TERM ROADMAP (2026-2028)

- 5.18.3 LONG-TERM ROADMAP (2029-2030)

6 AUTOMATION TESTING MARKET, BY OFFERING

- 6.1 INTRODUCTION

- 6.1.1 OFFERING: AUTOMATION TESTING MARKET DRIVERS

- TABLE 15 AUTOMATION TESTING MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 16 AUTOMATION TESTING MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- FIGURE 32 SERVICES SEGMENT TO HOLD LARGER MARKET SIZE DURING FORECAST PERIOD

- 6.2 TESTING TYPES

- 6.2.1 TESTING TYPES TO ACCELERATE DEPLOYMENT OF SOFTWARE WITH EFFICIENCY AND ACCURACY

- TABLE 17 TESTING TYPES: AUTOMATION TESTING MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 18 TESTING TYPES: AUTOMATION TESTING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3 SERVICES

- 6.3.1 NEED FOR CONSULTANTS TO PROVIDE 24/7 SERVICE RESPONSE

- TABLE 19 SERVICES: AUTOMATION TESTING MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 20 SERVICES: AUTOMATION TESTING MARKET, BY REGION, 2023-2028 (USD MILLION)

7 AUTOMATION TESTING MARKET, BY TESTING TYPE

- 7.1 INTRODUCTION

- 7.1.1 TESTING TYPE: AUTOMATION TESTING MARKET DRIVERS

- FIGURE 33 DYNAMIC TESTING SEGMENT TO HOLD LARGER MARKET SIZE DURING FORECAST PERIOD

- TABLE 21 AUTOMATION TESTING MARKET, BY TESTING TYPE, 2018-2022 (USD MILLION)

- TABLE 22 AUTOMATION TESTING MARKET, BY TESTING TYPE, 2023-2028 (USD MILLION)

- 7.2 STATIC TESTING

- 7.2.1 IDENTIFIES AND ELIMINATES ERRORS AND AMBIGUITIES IN SUPPORTING DOCUMENTS

- TABLE 23 STATIC TESTING: AUTOMATION TESTING MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 24 STATIC TESTING: AUTOMATION TESTING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.3 DYNAMIC TESTING

- 7.3.1 TESTS SOFTWARE BEHAVIOR WITH DYNAMIC VARIABLES BY EXECUTING CODES

- TABLE 25 DYNAMIC TESTING: AUTOMATION TESTING MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 26 DYNAMIC TESTING: AUTOMATION TESTING MARKET, BY REGION, 2023-2028 (USD MILLION)

8 AUTOMATION TESTING MARKET, BY SERVICE

- 8.1 INTRODUCTION

- 8.1.1 SERVICE: AUTOMATION TESTING MARKET DRIVERS

- FIGURE 34 IMPLEMENTATION SERVICES SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

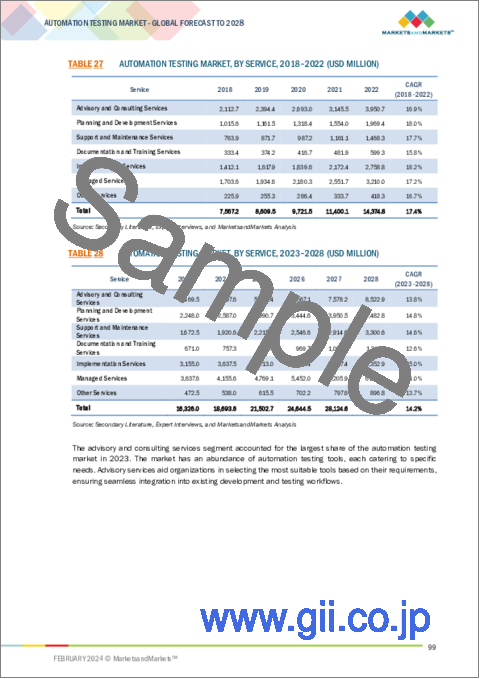

- TABLE 27 AUTOMATION TESTING MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 28 AUTOMATION TESTING MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- 8.2 ADVISORY AND CONSULTING SERVICES

- 8.2.1 ACCURATE FEASIBILITY ASSESSMENTS TO DRIVE GROWTH

- TABLE 29 ADVISORY AND CONSULTING SERVICES: AUTOMATION TESTING MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 30 ADVISORY AND CONSULTING SERVICES: AUTOMATION TESTING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.3 DOCUMENTATION & TRAINING SERVICES

- 8.3.1 SPECIALIZED TRAINING & KNOWLEDGE TRANSFER TO DRIVE GROWTH

- TABLE 31 DOCUMENTATION AND TRAINING SERVICES: AUTOMATION TESTING MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 32 DOCUMENTATION AND TRAINING SERVICES: AUTOMATION TESTING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.4 SUPPORT AND MAINTENANCE SERVICES

- 8.4.1 SUSTAINABLE AUTOMATION TESTING PRACTICES TO DRIVE MARKET GROWTH

- TABLE 33 SUPPORT AND MAINTENANCE: AUTOMATION TESTING MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 34 SUPPORT AND MAINTENANCE: AUTOMATION TESTING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.5 PLANNING AND DEVELOPMENT

- 8.5.1 INTRICATE PLANNING AND STRATEGIC DEVELOPMENT TO DRIVE MARKET GROWTH

- TABLE 35 PLANNING AND DEVELOPMENT: AUTOMATION TESTING MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 36 PLANNING AND DEVELOPMENT: AUTOMATION TESTING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.6 IMPLEMENTATION SERVICES

- 8.6.1 STRATEGIC IMPLEMENTATION OF AUTOMATION TESTING TO DRIVE GROWTH

- TABLE 37 IMPLEMENTATION SERVICES: AUTOMATION TESTING MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 38 IMPLEMENTATION SERVICES: AUTOMATION TESTING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.7 MANAGED SERVICES

- 8.7.1 LEVERAGING THIRD-PARTY TESTING SERVICE PROVIDERS TO DRIVE GROWTH

- TABLE 39 MANAGED SERVICES: AUTOMATION TESTING MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 40 MANAGED SERVICES: AUTOMATION TESTING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.8 OTHER SERVICES

- TABLE 41 OTHER SERVICES: AUTOMATION TESTING MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 42 OTHER SERVICES: AUTOMATION TESTING MARKET, BY REGION, 2023-2028 (USD MILLION)

9 AUTOMATION TESTING MARKET, BY DYNAMIC TESTING

- 9.1 INTRODUCTION

- FIGURE 35 NON-FUNCTIONAL TESTING SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- 9.1.1 DYNAMIC TESTING: AUTOMATION TESTING MARKET DRIVERS

- TABLE 43 AUTOMATION TESTING MARKET, BY DYNAMIC TESTING, 2018-2022 (USD MILLION)

- TABLE 44 AUTOMATION TESTING MARKET, BY DYNAMIC TESTING, 2023-2028 (USD MILLION)

- 9.2 FUNCTIONAL TESTING

- 9.2.1 ENSURES SYSTEMS FUNCTION ACCORDING TO DESIRED RESULTS

- TABLE 45 FUNCTIONAL TESTING: AUTOMATION TESTING MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 46 FUNCTIONAL TESTING: AUTOMATION TESTING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.3 NON-FUNCTIONAL TESTING

- TABLE 47 NON-FUNCTIONAL TESTING: AUTOMATION TESTING MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 48 NON-FUNCTIONAL TESTING: AUTOMATION TESTING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.3.1 SECURITY TESTING

- 9.3.1.1 Provides data security to help identify security threats

- TABLE 49 SECURITY TESTING: AUTOMATION TESTING MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 50 SECURITY TESTING: AUTOMATION TESTING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.3.2 PERFORMANCE TESTING

- 9.3.2.1 Rising use of IoT and Ai-based devices in various verticals

- TABLE 51 PERFORMANCE TESTING: AUTOMATION TESTING MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 52 PERFORMANCE TESTING: AUTOMATION TESTING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.4 COMPATIBILITY TESTING

- 9.4.1 CHECKS COMPATIBILITY OF APPLICATIONS WITH DIFFERENT PLATFORMS/ENVIRONMENTS

- TABLE 53 COMPATIBILITY TESTING: AUTOMATION TESTING MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 54 COMPATIBILITY TESTING: AUTOMATION TESTING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.5 COMPLIANCE TESTING

- 9.5.1 ENSURES EFFICACY OF PRODUCTS OR APPLICATIONS TO MEET STANDARD REQUIREMENTS

- TABLE 55 COMPLIANCE TESTING: AUTOMATION TESTING MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 56 COMPLIANCE TESTING: AUTOMATION TESTING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.6 USABILITY TESTING

- 9.6.1 IDENTIFIES USABILITY PROBLEMS BEFORE DESIGN IMPLEMENTATION

- TABLE 57 USABILITY TESTING: AUTOMATION TESTING MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 58 USABILITY TESTING: AUTOMATION TESTING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.7 OTHERS

- TABLE 59 OTHERS: AUTOMATION TESTING MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 60 OTHERS: AUTOMATION TESTING MARKET, BY REGION, 2023-2028 (USD MILLION)

10 AUTOMATION TESTING MARKET, BY ENDPOINT INTERFACE

- 10.1 INTRODUCTION

- FIGURE 36 MOBILE SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- 10.1.1 ENDPOINT INTERFACE: AUTOMATION TESTING MARKET DRIVERS

- TABLE 61 AUTOMATION TESTING MARKET, BY ENDPOINT INTERFACE, 2018-2022 (USD MILLION)

- TABLE 62 AUTOMATION TESTING MARKET, BY ENDPOINT INTERFACE, 2023-2028 (USD MILLION)

- 10.2 MOBILE

- 10.2.1 INCREASING DEMAND FOR MOBILE APPLICATIONS AND DEVELOPMENTS IN SMARTPHONE TO DRIVE GROWTH

- TABLE 63 MOBILE: AUTOMATION TESTING MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 64 MOBILE: AUTOMATION TESTING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.3 WEB

- 10.3.1 DIVERSE WEB PLATFORMS TO DRIVE GROWTH

- TABLE 65 WEB: AUTOMATION TESTING MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 66 WEB: AUTOMATION TESTING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.4 DESKTOP

- 10.4.1 INCREASING DEVELOPMENT IN DESKTOP APPLICATIONS TO DRIVE GROWTH

- TABLE 67 DESKTOP: AUTOMATION TESTING MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 68 DESKTOP: AUTOMATION TESTING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.5 EMBEDDED SOFTWARE

- 10.5.1 TAILOR-MADE TOOLS FOR EMBEDDED SOFTWARE TO DRIVE GROWTH

- TABLE 69 EMBEDDED SOFTWARE: AUTOMATION TESTING MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 70 EMBEDDED SOFTWARE: AUTOMATION TESTING MARKET, BY REGION, 2023-2028 (USD MILLION)

11 AUTOMATION TESTING MARKET, BY VERTICAL

- 11.1 INTRODUCTION

- 11.1.1 VERTICAL: AUTOMATION TESTING MARKET DRIVERS

- FIGURE 37 RETAIL SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 71 AUTOMATION TESTING MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 72 AUTOMATION TESTING MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 11.2 BFSI

- 11.2.1 AUTOMATES REDUNDANT TASKS AND GIVES CONTROL TO END CUSTOMERS

- 11.2.2 USE CASE

- 11.2.2.1 Transaction validation

- 11.2.2.2 Safety compliance

- TABLE 73 BFSI: AUTOMATION TESTING MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 74 BFSI: AUTOMATION TESTING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.3 AUTOMOTIVE

- 11.3.1 SUPPORTS ROBOTICS APPLICATION IN AUTOMOTIVE INDUSTRY

- 11.3.2 USE CASE

- 11.3.2.1 In-vehicle Infotainment (IVI) system testing

- 11.3.2.2 Advanced Driver Assistance Systems (ADAS) testing

- TABLE 75 AUTOMOTIVE: AUTOMATION TESTING MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 76 AUTOMOTIVE: AUTOMATION TESTING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.4 AEROSPACE & DEFENSE

- 11.4.1 ENSURES DEPLOYMENT OF SAFE, SECURE SOFTWARE FOR AEROSPACE AND DEFENSE SYSTEMS

- 11.4.2 USE CASE

- 11.4.2.1 Avionics system integration testing

- 11.4.2.2 Flight simulation and validation

- TABLE 77 AEROSPACE & DEFENSE: AUTOMATION TESTING MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 78 AEROSPACE & DEFENSE: AUTOMATION TESTING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.5 HEALTHCARE & LIFE SCIENCES

- 11.5.1 NEED FOR TECHNOLOGICAL ADVANCEMENTS TO MAINTAIN RECORDS OF PATIENTS

- 11.5.2 USE CASE

- 11.5.2.1 Electronic Health Record (EHR) system testing

- 11.5.2.2 Medical device software validation

- TABLE 79 HEALTHCARE AND LIFE SCIENCES: AUTOMATION TESTING MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 80 HEALTHCARE AND LIFE SCIENCES: AUTOMATION TESTING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.6 RETAIL

- 11.6.1 RETAILERS TO SELECT AUTOMATION TESTING SOLUTIONS FOR ENHANCING CUSTOMER EXPERIENCE

- 11.6.2 USE CASE

- 11.6.2.1 E-commerce website functionality testing

- 11.6.2.2 Inventory management system validation

- TABLE 81 RETAIL: AUTOMATION TESTING MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 82 RETAIL: AUTOMATION TESTING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.7 IT & ITES

- 11.7.1 ENHANCES SECURITY OF DATA TRANSMITTED AND SHARED OVER NETWORK

- 11.7.2 USE CASE

- 11.7.2.1 Enterprise Resource Planning (ERP) system testing

- 11.7.2.2 Cloud-based application testing

- TABLE 83 IT & ITES: AUTOMATION TESTING MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 84 IT & ITES: AUTOMATION TESTING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.8 TELECOM

- 11.8.1 REDUCES COST OF OPERATIONS BOOSTING ADOPTION OF AUTOMATION TESTING SERVICES

- 11.8.2 USE CASE

- 11.8.2.1 Telecommunication network protocol testing

- 11.8.2.2 Mobile network performance testing

- TABLE 85 TELECOM: AUTOMATION TESTING MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 86 TELECOM: AUTOMATION TESTING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.9 MANUFACTURING

- 11.9.1 ENHANCES OPERATIONAL EFFICIENCY AND REDUCES REQUIRED COST

- 11.9.2 USE CASE

- 11.9.2.1 Manufacturing process automation testing

- 11.9.2.2 Quality control inspection system testing

- TABLE 87 MANUFACTURING: AUTOMATION TESTING MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 88 MANUFACTURING: AUTOMATION TESTING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.10 TRANSPORTATION AND LOGISTICS

- 11.10.1 EFFICIENCY IN FLEET AUTOMATION TO DRIVE GROWTH

- 11.10.2 USE CASE

- 11.10.2.1 Fleet management software testing

- 11.10.2.2 Warehouse management system validation

- TABLE 89 TRANSPORTATION & LOGISTICS: AUTOMATION TESTING MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 90 TRANSPORTATION & LOGISTICS: AUTOMATION TESTING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.11 ENERGY & UTILITIES

- 11.11.1 RELIABLE BILLING AND MONITORING SOFTWARE TO DRIVE GROWTH

- 11.11.2 USE CASE

- 11.11.2.1 Smart grid system testing

- 11.11.2.2 SCADA (Supervisory Control and Data Acquisition) system validation

- TABLE 91 ENERGY AND UTILITIES: AUTOMATION TESTING MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 92 ENERGY AND UTILITIES: AUTOMATION TESTING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.12 MEDIA & ENTERTAINMENT

- 11.12.1 OTT TESTING AND BUG PREVENTION TO DRIVE GROWTH

- 11.12.2 USE CASE

- 11.12.2.1 Video streaming platform testing

- 11.12.2.2 Gaming application performance testing

- TABLE 93 MEDIA AND ENTERTAINMENT: AUTOMATION TESTING MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 94 MEDIA AND ENTERTAINMENT: AUTOMATION TESTING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.13 OTHER VERTICALS

- 11.13.1 USE CASE

- 11.13.1.1 E-government services

- 11.13.1.2 Reservation systems

- 11.13.1.3 Learning Management Systems (LMS)

- TABLE 95 OTHER VERTICALS: AUTOMATION TESTING MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 96 OTHER VERTICALS: AUTOMATION TESTING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.13.1 USE CASE

12 AUTOMATION TESTING MARKET, BY REGION

- 12.1 INTRODUCTION

- TABLE 97 AUTOMATION TESTING MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 98 AUTOMATION TESTING MARKET, BY REGION, 2023-2028 (USD MILLION)

- 12.2 NORTH AMERICA

- 12.2.1 NORTH AMERICA: AUTOMATION TESTING MARKET DRIVERS

- 12.2.2 NORTH AMERICA: RECESSION IMPACT

- FIGURE 38 NORTH AMERICA: MARKET SNAPSHOT

- TABLE 99 NORTH AMERICA: AUTOMATION TESTING MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 100 NORTH AMERICA: AUTOMATION TESTING MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 101 NORTH AMERICA: AUTOMATION TESTING MARKET, BY TESTING TYPE, 2018-2022 (USD MILLION)

- TABLE 102 NORTH AMERICA: AUTOMATION TESTING MARKET, BY TESTING TYPE, 2023-2028 (USD MILLION)

- TABLE 103 NORTH AMERICA: AUTOMATION TESTING MARKET, BY DYNAMIC TESTING, 2018-2022 (USD MILLION)

- TABLE 104 NORTH AMERICA: AUTOMATION TESTING MARKET, BY DYNAMIC TESTING, 2023-2028 (USD MILLION)

- TABLE 105 NORTH AMERICA: AUTOMATION TESTING MARKET, BY NON-FUNCTIONAL TESTING, 2018-2022 (USD MILLION)

- TABLE 106 NORTH AMERICA: AUTOMATION TESTING MARKET, BY NON-FUNCTIONAL TESTING, 2023-2028 (USD MILLION)

- TABLE 107 NORTH AMERICA: AUTOMATION TESTING MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 108 NORTH AMERICA: AUTOMATION TESTING MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 109 NORTH AMERICA: AUTOMATION TESTING MARKET, BY ENDPOINT INTERFACE, 2018-2022 (USD MILLION)

- TABLE 110 NORTH AMERICA: AUTOMATION TESTING MARKET, BY ENDPOINT INTERFACE, 2023-2028 (USD MILLION)

- TABLE 111 NORTH AMERICA: AUTOMATION TESTING MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 112 NORTH AMERICA: AUTOMATION TESTING MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 113 NORTH AMERICA: AUTOMATION TESTING MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 114 NORTH AMERICA: AUTOMATION TESTING MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 12.2.3 US

- 12.2.3.1 Prevalence of app developers and need for maintaining quality and reliability of mobile applications to propel market

- TABLE 115 US: AUTOMATION TESTING MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 116 US: AUTOMATION TESTING MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 117 US: AUTOMATION TESTING MARKET, BY TESTING TYPE, 2018-2022 (USD MILLION)

- TABLE 118 US: AUTOMATION TESTING MARKET, BY TESTING TYPE, 2023-2028 (USD MILLION)

- TABLE 119 US: AUTOMATION TESTING MARKET, BY DYNAMIC TESTING, 2018-2022 (USD MILLION)

- TABLE 120 US: AUTOMATION TESTING MARKET, BY DYNAMIC TESTING, 2023-2028 (USD MILLION)

- TABLE 121 US: AUTOMATION TESTING MARKET, BY NON-FUNCTIONAL TESTING, 2018-2022 (USD MILLION)

- TABLE 122 US: AUTOMATION TESTING MARKET, BY NON-FUNCTIONAL TESTING, 2023-2028 (USD MILLION)

- TABLE 123 US: AUTOMATION TESTING MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 124 US: AUTOMATION TESTING MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 125 US: AUTOMATION TESTING MARKET, BY ENDPOINT INTERFACE, 2018-2022 (USD MILLION)

- TABLE 126 US AUTOMATION TESTING MARKET, BY ENDPOINT INTERFACE, 2023-2028 (USD MILLION)

- TABLE 127 US: AUTOMATION TESTING MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 128 US: AUTOMATION TESTING MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 12.2.4 CANADA

- 12.2.4.1 Need for enhancing software quality and efficiency and refining development processes to drive market

- TABLE 129 CANADA: AUTOMATION TESTING MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 130 CANADA AUTOMATION TESTING MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 131 CANADA: AUTOMATION TESTING MARKET, BY TESTING TYPE, 2018-2022 (USD MILLION)

- TABLE 132 CANADA: AUTOMATION TESTING MARKET, BY TESTING TYPE, 2023-2028 (USD MILLION)

- TABLE 133 CANADA: AUTOMATION TESTING MARKET, BY DYNAMIC TESTING, 2018-2022 (USD MILLION)

- TABLE 134 CANADA: AUTOMATION TESTING MARKET, BY DYNAMIC TESTING, 2023-2028 (USD MILLION)

- TABLE 135 CANADA: AUTOMATION TESTING MARKET, BY NON-FUNCTIONAL TESTING, 2018-2022 (USD MILLION)

- TABLE 136 CANADA: AUTOMATION TESTING MARKET, BY NON-FUNCTIONAL TESTING, 2023-2028 (USD MILLION)

- TABLE 137 CANADA: AUTOMATION TESTING MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 138 CANADA: AUTOMATION TESTING MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 139 CANADA: AUTOMATION TESTING MARKET, BY ENDPOINT INTERFACE, 2018-2022 (USD MILLION)

- TABLE 140 CANADA: AUTOMATION TESTING MARKET, BY ENDPOINT INTERFACE, 2023-2028 (USD MILLION)

- TABLE 141 CANADA: AUTOMATION TESTING MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 142 CANADA: AUTOMATION TESTING MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 12.3 EUROPE

- 12.3.1 EUROPE: AUTOMATION TESTING MARKET DRIVERS

- 12.3.2 EUROPE: RECESSION IMPACT

- TABLE 143 EUROPE: AUTOMATION TESTING MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 144 EUROPE: AUTOMATION TESTING MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 145 EUROPE: AUTOMATION TESTING MARKET, BY TESTING TYPE, 2018-2022 (USD MILLION)

- TABLE 146 EUROPE: AUTOMATION TESTING MARKET, BY TESTING TYPE, 2023-2028 (USD MILLION)

- TABLE 147 EUROPE: AUTOMATION TESTING MARKET, BY DYNAMIC TESTING, 2018-2022 (USD MILLION)

- TABLE 148 EUROPE: AUTOMATION TESTING MARKET, BY DYNAMIC TESTING, 2023-2028 (USD MILLION)

- TABLE 149 EUROPE: AUTOMATION TESTING MARKET, BY NON-FUNCTIONAL TESTING, 2018-2022 (USD MILLION)

- TABLE 150 EUROPE: AUTOMATION TESTING MARKET, BY NON-FUNCTIONAL TESTING, 2023-2028 (USD MILLION)

- TABLE 151 EUROPE: AUTOMATION TESTING MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 152 EUROPE: AUTOMATION TESTING MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 153 EUROPE: AUTOMATION TESTING MARKET, BY ENDPOINT INTERFACE, 2018-2022 (USD MILLION)

- TABLE 154 EUROPE: AUTOMATION TESTING MARKET, BY ENDPOINT INTERFACE, 2023-2028 (USD MILLION)

- TABLE 155 EUROPE: AUTOMATION TESTING MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 156 EUROPE: AUTOMATION TESTING MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 157 EUROPE: AUTOMATION TESTING MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 158 EUROPE: AUTOMATION TESTING MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 12.3.3 GERMANY

- 12.3.3.1 Confluence of stringent quality requirements and technological advancements to fuel demand for automation testing solutions

- 12.3.4 UK

- 12.3.4.1 Digital transformation of software industry, demand for proficient software professionals, and government initiatives to drive market

- TABLE 159 UK: AUTOMATION TESTING MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 160 UK: AUTOMATION TESTING MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 161 UK: AUTOMATION TESTING MARKET, BY TESTING TYPE, 2018-2022 (USD MILLION)

- TABLE 162 UK: AUTOMATION TESTING MARKET, BY TESTING TYPE, 2023-2028 (USD MILLION)

- TABLE 163 UK: AUTOMATION TESTING MARKET, BY DYNAMIC TESTING, 2018-2022 (USD MILLION)

- TABLE 164 UK: AUTOMATION TESTING MARKET, BY DYNAMIC TESTING, 2023-2028 (USD MILLION)

- TABLE 165 UK: AUTOMATION TESTING MARKET, BY NON-FUNCTIONAL TESTING, 2018-2022 (USD MILLION)

- TABLE 166 UK: AUTOMATION TESTING MARKET, BY NON-FUNCTIONAL TESTING, 2023-2028 (USD MILLION)

- TABLE 167 UK: AUTOMATION TESTING MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 168 UK: AUTOMATION TESTING MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 169 UK: AUTOMATION TESTING MARKET, BY ENDPOINT INTERFACE, 2018-2022 (USD MILLION)

- TABLE 170 UK: AUTOMATION TESTING MARKET, BY ENDPOINT INTERFACE, 2023-2028 (USD MILLION)

- TABLE 171 UK: AUTOMATION TESTING MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 172 UK: AUTOMATION TESTING MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 12.3.5 ITALY

- 12.3.5.1 Growing adoption of Industry 4.0 technologies and flourishing eCommerce sector to boost demand for automation testing solutions

- 12.3.6 FRANCE

- 12.3.6.1 France Industrie 2025 initiative, thriving mobile app industry, and government support to digitalize SMEs to spur market growth

- 12.3.7 SPAIN

- 12.3.7.1 Focus on high-quality software applications and growing complexity of software systems to accelerate market growth

- 12.3.8 REST OF EUROPE

- 12.4 ASIA PACIFIC

- 12.4.1 ASIA PACIFIC: AUTOMATION TESTING MARKET DRIVERS

- 12.4.2 ASIA PACIFIC: RECESSION IMPACT

- FIGURE 39 ASIA PACIFIC: MARKET SNAPSHOT

- TABLE 173 ASIA PACIFIC: AUTOMATION TESTING MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 174 ASIA PACIFIC: AUTOMATION TESTING MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 175 ASIA PACIFIC: AUTOMATION TESTING MARKET, BY TESTING TYPE, 2018-2022 (USD MILLION)

- TABLE 176 ASIA PACIFIC: AUTOMATION TESTING MARKET, BY TESTING TYPE, 2023-2028 (USD MILLION)

- TABLE 177 ASIA PACIFIC: AUTOMATION TESTING MARKET, BY DYNAMIC TESTING, 2018-2022 (USD MILLION)

- TABLE 178 ASIA PACIFIC: AUTOMATION TESTING MARKET, BY DYNAMIC TESTING, 2023-2028 (USD MILLION)

- TABLE 179 ASIA PACIFIC: AUTOMATION TESTING MARKET, BY NON-FUNCTIONAL TESTING, 2018-2022 (USD MILLION)

- TABLE 180 ASIA PACIFIC: AUTOMATION TESTING MARKET, BY NON-FUNCTIONAL TESTING, 2023-2028 (USD MILLION)

- TABLE 181 ASIA PACIFIC: AUTOMATION TESTING MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 182 ASIA PACIFIC: AUTOMATION TESTING MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 183 ASIA PACIFIC: AUTOMATION TESTING MARKET, BY ENDPOINT INTERFACE, 2018-2022 (USD MILLION)

- TABLE 184 ASIA PACIFIC: AUTOMATION TESTING MARKET, BY ENDPOINT INTERFACE, 2023-2028 (USD MILLION)

- TABLE 185 ASIA PACIFIC: AUTOMATION TESTING MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 186 ASIA PACIFIC: AUTOMATION TESTING MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 187 ASIA PACIFIC: AUTOMATION TESTING MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 188 ASIA PACIFIC: AUTOMATION TESTING MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 12.4.3 CHINA

- 12.4.3.1 Labor shortage, substantial investment in digitalization, and focus on software testing to propel market

- TABLE 189 CHINA: AUTOMATION TESTING MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 190 CHINA: AUTOMATION TESTING MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 191 CHINA: AUTOMATION TESTING MARKET, BY TESTING TYPE, 2018-2022 (USD MILLION)

- TABLE 192 CHINA: AUTOMATION TESTING MARKET, BY TESTING TYPE, 2023-2028 (USD MILLION)

- TABLE 193 CHINA: AUTOMATION TESTING MARKET, BY DYNAMIC TESTING, 2018-2022 (USD MILLION)

- TABLE 194 CHINA: AUTOMATION TESTING MARKET, BY DYNAMIC TESTING, 2023-2028 (USD MILLION)

- TABLE 195 CHINA: AUTOMATION TESTING MARKET, BY NON-FUNCTIONAL TESTING, 2018-2022 (USD MILLION)

- TABLE 196 CHINA: AUTOMATION TESTING MARKET, BY NON-FUNCTIONAL TESTING, 2023-2028 (USD MILLION)

- TABLE 197 CHINA: AUTOMATION TESTING MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 198 CHINA: AUTOMATION TESTING MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 199 CHINA: AUTOMATION TESTING MARKET, BY ENDPOINT INTERFACE, 2018-2022 (USD MILLION)

- TABLE 200 CHINA: AUTOMATION TESTING MARKET, BY ENDPOINT INTERFACE, 2023-2028 (USD MILLION)

- TABLE 201 CHINA: AUTOMATION TESTING MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 202 CHINA: AUTOMATION TESTING MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 12.4.4 INDIA

- 12.4.4.1 Substantial expansion of IT industry, focus on digital transformation, and improved software quality to drive market

- 12.4.5 JAPAN

- 12.4.5.1 Rising production of robots and factory automation systems to fuel demand for automation testing solutions

- 12.4.6 AUSTRALIA & NEW ZEALAND

- 12.4.6.1 Government initiatives to support digitalization and adoption of new technologies to boost market growth

- 12.4.7 REST OF ASIA PACIFIC

- 12.5 MIDDLE EAST & AFRICA

- 12.5.1 MIDDLE EAST & AFRICA: AUTOMATION TESTING MARKET DRIVERS

- 12.5.2 MIDDLE EAST & AFRICA: RECESSION IMPACT

- TABLE 203 MIDDLE EAST & AFRICA: AUTOMATION TESTING MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 204 MIDDLE EAST & AFRICA: AUTOMATION TESTING MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 205 MIDDLE EAST & AFRICA: AUTOMATION TESTING MARKET, BY TESTING TYPE, 2018-2022 (USD MILLION)

- TABLE 206 MIDDLE EAST & AFRICA: AUTOMATION TESTING MARKET, BY TESTING TYPE, 2023-2028 (USD MILLION)

- TABLE 207 MIDDLE EAST & AFRICA: AUTOMATION TESTING MARKET, BY DYNAMIC TESTING, 2018-2022 (USD MILLION)

- TABLE 208 MIDDLE EAST & AFRICA: AUTOMATION TESTING MARKET, BY DYNAMIC TESTING, 2023-2028 (USD MILLION)

- TABLE 209 MIDDLE EAST & AFRICA: AUTOMATION TESTING MARKET, BY NON-FUNCTIONAL TESTING, 2018-2022 (USD MILLION)

- TABLE 210 MIDDLE EAST & AFRICA: AUTOMATION TESTING MARKET, BY NON-FUNCTIONAL TESTING, 2023-2028 (USD MILLION)

- TABLE 211 MIDDLE EAST & AFRICA: AUTOMATION TESTING MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 212 MIDDLE EAST & AFRICA: AUTOMATION TESTING MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 213 MIDDLE EAST & AFRICA: AUTOMATION TESTING MARKET, BY ENDPOINT INTERFACE, 2018-2022 (USD MILLION)

- TABLE 214 MIDDLE EAST & AFRICA: AUTOMATION TESTING MARKET, BY ENDPOINT INTERFACE, 2023-2028 (USD MILLION)

- TABLE 215 MIDDLE EAST & AFRICA: AUTOMATION TESTING MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 216 MIDDLE EAST & AFRICA: AUTOMATION TESTING MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 217 MIDDLE EAST & AFRICA: AUTOMATION TESTING MARKET, BY COUNTRY/REGION, 2018-2022 (USD MILLION)

- TABLE 218 MIDDLE EAST & AFRICA: AUTOMATION TESTING MARKET, BY COUNTRY/REGION, 2023-2028 (USD MILLION)

- 12.5.3 GCC COUNTRIES

- TABLE 219 GCC COUNTRIES: AUTOMATION TESTING MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 220 GCC COUNTRIES: AUTOMATION TESTING MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 221 GCC COUNTRIES: AUTOMATION TESTING MARKET, BY TESTING TYPE, 2018-2022 (USD MILLION)

- TABLE 222 GCC COUNTRIES: AUTOMATION TESTING MARKET, BY TESTING TYPE, 2023-2028 (USD MILLION)

- TABLE 223 GCC COUNTRIES: AUTOMATION TESTING MARKET, BY DYNAMIC TESTING, 2018-2022 (USD MILLION)

- TABLE 224 GCC COUNTRIES: AUTOMATION TESTING MARKET, BY DYNAMIC TESTING, 2023-2028 (USD MILLION)

- TABLE 225 GCC COUNTRIES: AUTOMATION TESTING MARKET, BY NON-FUNCTIONAL TESTING, 2018-2022 (USD MILLION)

- TABLE 226 GCC COUNTRIES: AUTOMATION TESTING MARKET, BY NON-FUNCTIONAL TESTING, 2023-2028 (USD MILLION)

- TABLE 227 GCC COUNTRIES: AUTOMATION TESTING MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 228 GCC COUNTRIES: AUTOMATION TESTING MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 229 GCC COUNTRIES: AUTOMATION TESTING MARKET, BY ENDPOINT INTERFACE, 2018-2022 (USD MILLION)

- TABLE 230 GCC COUNTRIES: AUTOMATION TESTING MARKET, BY ENDPOINT INTERFACE, 2023-2028 (USD MILLION)

- TABLE 231 GCC COUNTRIES: AUTOMATION TESTING MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 232 GCC COUNTRIES: AUTOMATION TESTING MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 233 GCC COUNTRIES: AUTOMATION TESTING MARKET, BY COUNTRY/REGION, 2018-2022 (USD MILLION)

- TABLE 234 GCC COUNTRIES: AUTOMATION TESTING MARKET, BY COUNTRY/REGION, 2023-2028 (USD MILLION)

- 12.5.3.1 UAE

- 12.5.3.1.1 Increasing eCommerce surge and smart shopping trends and surge in internet and social media to drive market

- 12.5.3.2 KSA

- 12.5.3.2.1 Supportive regulatory frameworks and increasing smartphone use to fuel demand for automation testing solutions

- 12.5.3.3 REST OF GCC COUNTRIES

- 12.5.3.1 UAE

- 12.5.4 SOUTH AFRICA

- 12.5.4.1 Government initiatives focusing on emerging technologies and rising adoption of digital technologies to spur market growth

- 12.5.5 REST OF MIDDLE EAST & AFRICA

- 12.6 LATIN AMERICA

- 12.6.1 LATIN AMERICA: AUTOMATION TESTING MARKET DRIVERS

- 12.6.2 LATIN AMERICA: RECESSION IMPACT

- TABLE 235 LATIN AMERICA: AUTOMATION TESTING MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 236 LATIN AMERICA: AUTOMATION TESTING MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 237 LATIN AMERICA: AUTOMATION TESTING MARKET, BY TESTING TYPE, 2018-2022 (USD MILLION)

- TABLE 238 LATIN AMERICA: AUTOMATION TESTING MARKET, BY TESTING TYPE, 2023-2028 (USD MILLION)

- TABLE 239 LATIN AMERICA: AUTOMATION TESTING MARKET, BY DYNAMIC TESTING, 2018-2022 (USD MILLION)

- TABLE 240 LATIN AMERICA: AUTOMATION TESTING MARKET, BY DYNAMIC TESTING, 2023-2028 (USD MILLION)

- TABLE 241 LATIN AMERICA: AUTOMATION TESTING MARKET, BY NON-FUNCTIONAL TESTING, 2018-2022 (USD MILLION)

- TABLE 242 LATIN AMERICA: AUTOMATION TESTING MARKET, BY NON-FUNCTIONAL TESTING, 2023-2028 (USD MILLION)

- TABLE 243 LATIN AMERICA: AUTOMATION TESTING MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 244 LATIN AMERICA: AUTOMATION TESTING MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 245 LATIN AMERICA: AUTOMATION TESTING MARKET, BY ENDPOINT INTERFACE, 2018-2022 (USD MILLION)

- TABLE 246 LATIN AMERICA: AUTOMATION TESTING MARKET, BY ENDPOINT INTERFACE, 2023-2028 (USD MILLION)

- TABLE 247 LATIN AMERICA: AUTOMATION TESTING MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 248 LATIN AMERICA: AUTOMATION TESTING MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 249 LATIN AMERICA: AUTOMATION TESTING MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 250 LATIN AMERICA: AUTOMATION TESTING MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 12.6.3 BRAZIL

- 12.6.3.1 Adoption of cloud and rise in demand for software development to boost demand for automation testing solutions

- TABLE 251 BRAZIL: AUTOMATION TESTING MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 252 BRAZIL: AUTOMATION TESTING MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 253 BRAZIL: AUTOMATION TESTING MARKET, BY TESTING TYPE, 2018-2022 (USD MILLION)

- TABLE 254 BRAZIL: AUTOMATION TESTING MARKET, BY TESTING TYPE, 2023-2028 (USD MILLION)

- TABLE 255 BRAZIL: AUTOMATION TESTING MARKET, BY DYNAMIC TESTING, 2018-2022 (USD MILLION)

- TABLE 256 BRAZIL: AUTOMATION TESTING MARKET, BY DYNAMIC TESTING, 2023-2028 (USD MILLION)

- TABLE 257 BRAZIL: AUTOMATION TESTING MARKET, BY NON-FUNCTIONAL TESTING, 2018-2022 (USD MILLION)

- TABLE 258 BRAZIL: AUTOMATION TESTING MARKET, BY NON-FUNCTIONAL TESTING, 2023-2028 (USD MILLION)

- TABLE 259 BRAZIL: AUTOMATION TESTING MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 260 BRAZIL: AUTOMATION TESTING MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 261 BRAZIL: AUTOMATION TESTING MARKET, BY ENDPOINT INTERFACE, 2018-2022 (USD MILLION)

- TABLE 262 BRAZIL: AUTOMATION TESTING MARKET, BY ENDPOINT INTERFACE, 2023-2028 (USD MILLION)

- TABLE 263 BRAZIL: AUTOMATION TESTING MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 264 BRAZIL: AUTOMATION TESTING MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 12.6.4 MEXICO

- 12.6.4.1 Increased investments in digital infrastructure and need to ensure quality and efficiency to fuel demand for testing solutions

- 12.6.5 REST OF LATIN AMERICA

13 COMPETITIVE LANDSCAPE

- 13.1 INTRODUCTION

- 13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- TABLE 265 OVERVIEW OF STRATEGIES ADOPTED BY KEY AUTOMATION TESTING PROVIDERS

- 13.3 REVENUE ANALYSIS

- FIGURE 40 HISTORICAL REVENUE ANALYSIS OF KEY PLAYERS, 2018-2022 (USD MILLION)

- 13.4 MARKET SHARE ANALYSIS

- FIGURE 41 AUTOMATION TESTING MARKET SHARE ANALYSIS, 2022

- TABLE 266 AUTOMATION TESTING MARKET: INTENSITY OF COMPETITIVE RIVALRY

- 13.5 COMPANY EVALUATION MATRIX

- 13.5.1 STARS

- 13.5.2 EMERGING LEADERS

- 13.5.3 PERVASIVE PLAYERS

- 13.5.4 PARTICIPANTS

- FIGURE 42 COMPANY EVALUATION MATRIX, 2022

- 13.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- FIGURE 43 OVERALL COMPANY FOOTPRINT

- TABLE 268 COMPANY OFFERING FOOTPRINT

- TABLE 269 COMPANY ENDPOINT INTERFACE FOOTPRINT

- TABLE 270 COMPANY REGIONAL FOOTPRINT

- 13.6 START-UP/SME EVALUATION MATRIX

- 13.6.1 PROGRESSIVE COMPANIES

- 13.6.2 RESPONSIVE COMPANIES

- 13.6.3 DYNAMIC COMPANIES

- 13.6.4 STARTING BLOCKS

- FIGURE 44 START-UP/SME EVALUATION MATRIX, 2022

- 13.6.5 COMPETITIVE BENCHMARKING

- TABLE 271 DETAILED LIST OF START-UPS/SMES

- TABLE 272 COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

- 13.7 COMPETITIVE SCENARIO AND TRENDS

- 13.7.1 PRODUCT LAUNCHES

- TABLE 273 AUTOMATION TESTING MARKET: PRODUCT LAUNCHES, JULY 2020-DECEMBER 2023

- 13.7.2 DEALS

- TABLE 274 AUTOMATION TESTING MARKET: DEALS, JUNE 2020-JULY 2023

- 13.8 AUTOMATION TESTING PRODUCT BENCHMARKING

- 13.8.1 PROMINENT AUTOMATION TESTING PLAYERS

- FIGURE 45 COMPARATIVE ANALYSIS OF PROMINENT AUTOMATION TESTING VENDORS

- 13.9 VALUATION AND FINANCIAL METRICS OF KEY AUTOMATION TESTING PROVIDERS

- FIGURE 46 VALUATION AND FINANCIAL METRICS OF KEY AUTOMATION TESTING VENDORS

14 COMPANY PROFILES

- (Business overview, Products/Solutions/Services offered, Recent developments & MnM View)**

- 14.1 MAJOR PLAYERS

- 14.1.1 IBM

- TABLE 275 IBM: BUSINESS OVERVIEW

- FIGURE 47 IBM: COMPANY SNAPSHOT

- TABLE 276 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 277 IBM: PRODUCT LAUNCHES

- 14.1.2 ACCENTURE

- TABLE 278 ACCENTURE: BUSINESS OVERVIEW

- FIGURE 48 ACCENTURE: COMPANY SNAPSHOT

- TABLE 279 ACCENTURE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 280 ACCENTURE: DEALS

- 14.1.3 OPENTEXT CORPORATION

- TABLE 281 OPENTEXT CORPORATION: BUSINESS OVERVIEW

- FIGURE 49 OPENTEXT CORPORATION: COMPANY SNAPSHOT

- TABLE 282 OPENTEXT CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 283 OPENTEXT CORPORATION: PRODUCT LAUNCHES

- TABLE 284 OPENTEXT CORPORATION: DEALS

- 14.1.4 CAPGEMINI

- TABLE 285 CAPGEMINI: BUSINESS OVERVIEW

- FIGURE 50 CAPGEMINI: COMPANY SNAPSHOT

- TABLE 286 CAPGEMINI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 287 CAPGEMINI: DEALS

- 14.1.5 MICROSOFT

- TABLE 288 MICROSOFT: BUSINESS OVERVIEW

- FIGURE 51 MICROSOFT: COMPANY SNAPSHOT

- TABLE 289 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 290 MICROSOFT: DEALS

- 14.1.6 BROADCOM

- TABLE 291 BROADCOM: BUSINESS OVERVIEW

- FIGURE 52 BROADCOM: COMPANY SNAPSHOT

- TABLE 292 BROADCOM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 14.1.7 TRICENTIS

- TABLE 293 TRICENTIS: BUSINESS OVERVIEW

- TABLE 294 TRICENTIS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 295 TRICENTIS: PRODUCT LAUNCHES

- TABLE 296 TRICENTIS: DEALS

- TABLE 297 TRICENTIS: OTHERS

- 14.1.8 CIGNITI TECHNOLOGIES

- TABLE 298 CIGNITI TECHNOLOGIES: BUSINESS OVERVIEW

- FIGURE 53 CIGNITI TECHNOLOGIES: COMPANY SNAPSHOT

- TABLE 299 CIGNITI TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 300 CIGNITI TECHNOLOGIES: DEALS

- TABLE 301 CIGNITI TECHNOLOGIES: OTHERS

- 14.1.9 KEYSIGHT TECHNOLOGIES

- TABLE 302 KEYSIGHT TECHNOLOGIES: BUSINESS OVERVIEW

- FIGURE 54 KEYSIGHT TECHNOLOGIES: COMPANY SNAPSHOT

- TABLE 303 KEYSIGHT TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 304 KEYSIGHT TECHNOLOGIES: PRODUCT LAUNCHES

- TABLE 305 KEYSIGHT TECHNOLOGIES: DEALS

- 14.1.10 APEXON

- 14.1.11 CYGNET DIGITAL

- 14.1.12 QUALITYKIOSK TECHNOLOGIES PVT. LTD.

- 14.1.13 INVENSIS TECHNOLOGIES PVT. LTD.

- 14.1.14 QASOURCE INC.

- 14.1.15 IDERA, INC.

- 14.2 START-UPS/SMES

- 14.2.1 SMARTBEAR SOFTWARE

- TABLE 306 SMARTBEAR SOFTWARE: BUSINESS OVERVIEW

- TABLE 307 SMARTBEAR SOFTWARE: PRODUCTS/SOLUTIONS OFFERED

- TABLE 308 SMARTBEAR SOFTWARE: PRODUCT LAUNCHES

- TABLE 309 SMARTBEAR SOFTWARE: DEALS

- 14.2.2 PARASOFT

- TABLE 310 PARASOFT: BUSINESS OVERVIEW

- TABLE 311 PARASOFT: PRODUCTS OFFERED

- TABLE 312 PARASOFT: PRODUCT LAUNCHES

- TABLE 313 PARASOFT: DEALS

- 14.2.3 SAUCE LABS INC.,

- TABLE 314 SAUCE LABS INC.: BUSINESS OVERVIEW

- TABLE 315 SAUCE LABS INC.: PRODUCTS/SOLUTIONS OFFERED

- TABLE 316 SAUCE LABS INC.: PRODUCT LAUNCHES

- TABLE 317 SAUCE LABS INC.: DEALS

- 14.2.4 ACCELQ INC.

- 14.2.5 APPLITOOLS

- 14.2.6 THE QT COMPANY

- 14.2.7 ASTEGIC INC.

- 14.2.8 MOBISOFT INFOTECH

- 14.2.9 THINKSYS INC.

- 14.2.10 QA MENTOR

- 14.2.11 AFOUR TECHNOLOGIES

- 14.2.12 CODOID

- 14.2.13 WORKSOFT, INC.

- 14.2.14 TESTGRID

- *Details on Business overview, Products/Solutions/Services offered, Recent developments & MnM View might not be captured in case of unlisted companies.

15 ADJACENT/RELATED MARKETS

- 15.1 INTRODUCTION

- 15.2 API TESTING MARKET

- 15.2.1 MARKET OVERVIEW

- TABLE 318 COMPONENT: API TESTING TOOLS/SOFTWARE MARKET, BY REGION, 2015-2022 (USD MILLION)

- TABLE 319 COMPONENT: API TESTING SERVICES MARKET, BY REGION, 2015-2022 (USD MILLION)

- TABLE 320 MANAGED SERVICES MARKET, BY REGION, 2015-2022 (USD MILLION)

- TABLE 321 PROFESSIONAL SERVICES MARKET, BY REGION, 2015-2022 (USD MILLION)

- 15.3 CLOUD TESTING MARKET

- 15.3.1 MARKET OVERVIEW

- TABLE 322 TESTING TOOLS/PLATFORMS: CLOUD TESTING MARKET, BY REGION, 2015-2022 (USD MILLION)

- TABLE 323 FUNCTIONAL TESTING TOOLS MARKET, BY REGION, 2015-2022 (USD MILLION)

- TABLE 324 PERFORMANCE/LOAD TESTING TOOLS MARKET, BY REGION, 2015-2022 (USD MILLION)

- TABLE 325 GRAPHICAL USER INTERFACE TESTING TOOLS MARKET, BY REGION, 2015-2022 (USD MILLION)

- TABLE 326 APPLICATION PROGRAMMING INTERFACE TESTING TOOLS MARKET, BY REGION, 2015-2022 (USD MILLION)

- TABLE 327 SERVICE VIRTUALIZATION TOOLS MARKET, BY REGION, 2015-2022 (USD MILLION)

16 APPENDIX

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS