|

|

市場調査レポート

商品コード

1348653

血漿分画市場:製品別、用途別、エンドユーザー別-2028年までの予測Plasma Fractionation Market by Product, Application, End User - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 血漿分画市場:製品別、用途別、エンドユーザー別-2028年までの予測 |

|

出版日: 2023年09月05日

発行: MarketsandMarkets

ページ情報: 英文 374 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の血漿分画の市場規模は、予測期間中に6.9%のCAGRで拡大し、2023年の290億米ドルから2028年には404億米ドルに達すると予測されています。

血漿収集センターの拡大により、市場参入企業はドナーから大量の血漿を収集できるようになっています。この原料供給の増加は、血漿由来製品を大量に生産するための基盤となり、市場の需要拡大に対応します。例えば、2022年12月、CSLベーリング(オーストラリア)は、オーストラリアのビクトリア州に9億米ドルの血漿分画施設を開設すると発表しました。この最新鋭施設は、年間最大920万血漿換算リットルの処理が可能です。

エンドユーザー別では、2022年は、クリニックと病院セグメントが世界の血漿分画市場で最大のシェアを占めました。新興経済諸国や先進経済諸国における病院やクリニックの数の増加やヘルスケアインフラの整備が、このセグメントが市場で大きなシェアを占める要因となっています。同市場の大手企業は、病院と協力して臨床試験を実施し、希少疾患の治療における血漿製品の使用に関する認知度を高めています。血友病、PID、COVID-19のような多くの希少疾患で生命を脅かす疾患の治療に対する血漿製剤の需要は、企業や病院によるこのような取り組みの結果として増加すると予想されます。

用途別では、2022年に、肺科学分野が最も高いCAGRを記録する見込みです。様々な呼吸器疾患の治療に使用される2つの主要な血漿製品は、免疫グロブリンとプロテアーゼ阻害剤です。免疫グロブリンの主な機能は、上気道感染症および下気道感染症の予防と治療です。近年、α-1-アンチトリプシンなどのプロテアーゼ阻害剤の使用量が大幅に増加しているため、呼吸器疾患用途の市場が大きく成長しています。

地域別に見ると、2022年は、北米が血漿分画市場で最大のシェアを占め、次いで欧州、アジア太平洋が続きました。北米が世界市場で優位を占めるのは、主要企業が市場での地位を強化するために、提携、パートナーシップ、買収など、有機的・無機的なさまざまな成長戦略を継続的に採用しているためです。この地域のこの業界の主要参入企業は、主要な成長戦略として最先端技術による分画プラントの拡張を利用しています。また、上位の競合他社は北米での市場シェアを拡大するため、血漿採取施設の買収にも注力しています。

当レポートでは、世界の血漿分画市場について調査し、製品別、用途別、エンドユーザー別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 価格分析

- 顧客のビジネスに影響を与える動向/混乱

- バリューチェーン分析

- サプライチェーン分析

- 生態系市場マップ

- 特許分析

- 2023年~2024年の主な会議とイベント

- 規制分析

- ポーターのファイブフォース分析

- 技術分析

- 主要な利害関係者と購入基準

- エンドユーザー別の主な購入基準

- 血漿収集、量別

- 血漿収集センター

第6章 血漿分画市場、製品別

- イントロダクション

- 免疫グロブリン

- 凝固因子濃縮物

- アルブミン

- プロテアーゼ阻害剤

- その他

第7章 血漿分画市場、用途別

- イントロダクション

- 神経科

- 免疫科

- 血液科

- 救命救急

- 呼吸器科

- 血液腫瘍科

- リウマチ科

- その他

第8章 血漿分画市場、エンドユーザー別

- イントロダクション

- 病院と診療所

- 臨床研究機関

- 学術機関

第9章 血漿分画市場、地域別

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- ラテンアメリカ

- 中東・アフリカ

第10章 競合情勢

- 概要

- 主要参入企業が採用したキー参入企業戦略

- 市場シェア分析

- 血漿分画市場の主要企業の収益シェア分析

- 血漿分画市場の主要企業の企業評価マトリックス

- トップ25参入企業の競合ベンチマーキング

- 血漿分画市場における新興企業/中小企業の企業評価マトリクス

- 新興企業/中小企業の競合ベンチマーキング

- 競争シナリオと動向

第11章 企業プロファイル

- 主要参入企業

- CSL

- TAKEDA PHARMACEUTICAL COMPANY LIMITED

- GRIFOLS, S.A.

- OCTAPHARMA AG

- KEDRION S.P.A

- LFB

- ADMA BIOLOGICS, INC.

- SANQUIN

- CHINA BIOLOGIC PRODUCTS HOLDINGS, INC.

- GC PHARMA

- HUALAN BIOENGINEERING CO., LTD.

- JAPAN BLOOD PRODUCTS ORGANIZATION

- EMERGENT

- SHANGHAI RAAS BLOOD PRODUCTS CO., LTD.

- INTAS PHARMACEUTICALS LTD.

- その他の企業

- BHARAT SERUMS AND VACCINES LIMITED

- SK PLASMA

- SICHUAN YUANDA SHUYANG PHARMACEUTICAL CO., LTD.

- KAMADA PHARMACEUTICALS

- CENTURION PHARMA

- PROTHYA BIOSOLUTIONS B.V.

- PLASMAGEN BIOSCIENCES PVT. LTD.

- VIRCHOW BIOTECH

- FUSION HEALTHCARE

- HEMARUS

第12章 付録

The global plasma fractionation market size is projected to reach USD 40.4 billion by 2028 from USD 29.0 billion in 2023, at a CAGR of 6.9% during the forecast period. Expanding the number of plasma collection centers allows market players to collect a larger volume of plasma from donors. This increased supply of raw materials becomes the foundation for producing a greater quantity of plasma-derived products, meeting the growing demand in the market. For instance, in December 2022, CSL Behring (Australia) announced the opening of a USD 900 million Plasma Fractionation Facility in Victoria, Australia. The new state-of-the-art facility can process up to 9.2 million plasma equivalent liters per annum.

"The hospitals and clinics segment is expected to dominate the market during the forecast period."

Based on end user, the plasma fractionation market is segmented into research laboratories, hospitals and clinics, and academic institutes. In 2022, the clinics and hospitals segment accounted for the largest share of the global plasma fractionation market. The growing number of hospitals and clinics in emerging and developed economies, as well as the improvement in healthcare infrastructure, are attributed to this segment's major share in the market. Leading companies in this market are collaborating with hospitals to conduct clinical trials and promote awareness about the use of plasma products in the treatment of rare diseases. The demand for plasma products for the treatment of many rare and life-threatening disorders like hemophilia, PID, and COVID-19 is anticipated to increase as a result of such initiatives by companies and hospitals.

"The pulmonology application segment will witness the highest growth in the plasma fractionation market."

Based on application, the plasma fractionation market is segmented into hematology, critical care, pulmonology neurology, immunology, , hemato-oncology, rheumatology, and other applications. In 2022, the pulmonology segment is expected to register the highest CAGR during the forecast period. The two major plasma products used in the treatment of various respiratory disorders are immunoglobulins and protease inhibitors. The main functions of immunoglobulins are the prevention and treatment of upper and lower respiratory tract infections. The market for pulmonology applications has grown significantly in recent years due to the significant growth in the usage of protease inhibitors, such as alpha-1-antitrypsin.

"North America will dominate the market during the forecast period."

Based on region, the plasma fractionation market is further segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. In 2022, North America accounted for the largest share of the plasma fractionation market, followed by Europe and the Asia Pacific. North America's dominance in the global market is due to the fact that top players are continuously engaged in adopting various organic and inorganic growth strategies such as collaborations, partnerships, and acquisitions to strengthen their market position. Major players in this industry in the area use the expansion of fractionation plants with cutting-edge technologies as a key growth strategy. The top competitors also focus on acquiring plasma collecting facilities to increase their market share in North America.

The primary interviews conducted for this report can be categorized as follows:

- By Respondent: Supply Side - 70% and Demand Type - 30%

- By Designation: Managers - 45%, Directors - 30%, and Executives - 25%

- By Region: North America -25%, Europe -25%, Asia-Pacific -40%, Latin America-5%, Middle East -2.5% & Africa- 2.5%

List of Companies Profiled in the Report

- CSL (Australia)

- Takeda Pharmaceutical Company Limited (Japan)

- Grifols, S.A. (Spain)

- Octapharma AG (Switzerland)

- Kedrion S.P.A (Italy)

- LFB (France)

- ADMA Biologics (US)

- Sanquin (Netherlands)

- China Biologic Products Holdings Inc. (China)

- GC Pharma (Korea)

- Hualan Bioengineering Co., Ltd. (China)

- Japan Blood Products Organization (Japan)

- Emergent BioSolutions (US)

- Shanghai Raas Blood Products Co., Ltd. (China)

- Intas Pharmaceuticals Ltd. (India)

- Bharat Serum Vaccines Limited (India)

- SK Plasma (Korea)

- Sichuan Yuanda Shuyang Pharmaceutical Co., Ltd. (China)

- Kamada (Israel)

- Centurion Pharma (Istanbul)

- Prothya Biosolutions (Netherlands)

- PlasmaGen BioSciences Pvt. Ltd. (India)

- Virchow Biotech Private Limited (India)

- Fusion Healthcare (India)

- Hemarus Therapeutics Limited (India)

Research Coverage:

This report provides a detailed picture of the plasma fractionation market. It aims at estimating the size and future growth potential of the market across different segments, such as the product, application, end-user, and region. The report also includes an in-depth competitive analysis of the key market players, along with their company profiles, recent developments, and key market strategies.

Reasons to Buy the Report:

The report provides insights on the following pointers:

- Analysis of key drivers (growing use of immunoglobulins in various therapeutic areas, strategic expansion of plasma collection centers/inventories by market players, growing prevalence of respiratory diseases and AATD), restraints (high costs and limited reimbursements for plasma products, market disruption caused by recombinant alternatives), opportunities (government strategies increasing regional self-sufficiency), and challenges (stringent government regulations for maintaining safety and quality of plasma products) influencing the growth of the plasma fractionation market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the plasma fractionation market.

- Market Development: Comprehensive information about lucrative emerging markets. The report analyzes the markets for various plasma fractionation facilities across key geographic regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the plasma fractionation market.

- Competitive Assessment: In-depth assessment of market ranking and strategies of the leading players like CSL (Australia), Takeda Pharmaceutical Company Limited (Japan), Grifols, S.A. (Spain), Octapharma AG (Switzerland), Kedrion S.P.A (Italy), among others in the plasma fractionation market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- FIGURE 1 PLASMA FRACTIONATION MARKET SEGMENTATION

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 RESEARCH LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

- 1.8.1 RECESSION IMPACT: PLASMA FRACTIONATION MARKET

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- FIGURE 3 PLASMA FRACTIONATION MARKET: BREAKDOWN OF PRIMARIES

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 4 MARKET SIZE ESTIMATION: SUPPLY SIDE ANALYSIS, 2022

- FIGURE 5 MARKET SIZE ESTIMATION: APPROACH 1 (REVENUE SHARE ANALYSIS), 2022

- FIGURE 6 ILLUSTRATIVE EXAMPLE OF CSL: REVENUE SHARE ANALYSIS, 2022

- 2.2.1 INSIGHTS FROM PRIMARY EXPERTS

- FIGURE 7 MARKET GROWTH FACTORS VALIDATION FROM PRIMARY EXPERTS

- FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.3 GROWTH FORECAST

- FIGURE 9 PLASMA FRACTIONATION MARKET: CAGR PROJECTIONS, 2023-2028

- FIGURE 10 PLASMA FRACTIONATION MARKET: GROWTH ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 11 DATA TRIANGULATION METHODOLOGY

- 2.5 STUDY ASSUMPTIONS

- 2.6 RISK ANALYSIS

- 2.7 RECESSION IMPACT ANALYSIS: PLASMA FRACTIONATION MARKET

- TABLE 1 GLOBAL INFLATION RATE PROJECTION, 2021-2027 (% GROWTH)

- TABLE 2 US HEALTH EXPENDITURE, 2019-2022 (USD MILLION)

- TABLE 3 US HEALTH EXPENDITURE, 2023-2027 (USD MILLION)

3 EXECUTIVE SUMMARY

- FIGURE 12 PLASMA FRACTIONATION MARKET, BY PRODUCT, 2023 VS. 2028 (USD MILLION)

- FIGURE 13 PLASMA FRACTIONATION MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 14 PLASMA FRACTIONATION MARKET, BY END USER, 2023 VS. 2028 (USD MILLION)

- FIGURE 15 REGIONAL SNAPSHOT: PLASMA FRACTIONATION MARKET

4 PREMIUM INSIGHTS

- 4.1 PLASMA FRACTIONATION MARKET OVERVIEW

- FIGURE 16 GROWING USE OF IMMUNOGLOBULINS IN VARIOUS THERAPEUTIC AREAS TO DRIVE MARKET

- 4.2 NORTH AMERICA: PLASMA FRACTIONATION MARKET, BY PRODUCT AND COUNTRY (2022)

- FIGURE 17 IMMUNOGLOBULINS AND US DOMINATED NORTH AMERICAN PLASMA FRACTIONATION MARKET IN 2022

- 4.3 PLASMA FRACTIONATION MARKET, BY PRODUCT, 2023 VS. 2028 (USD MILLION)

- FIGURE 18 IMMUNOGLOBULINS SEGMENT TO DOMINATE PLASMA FRACTIONATION MARKET DURING FORECAST PERIOD

- 4.4 PLASMA FRACTIONATION MARKET, BY END USER, 2022

- FIGURE 19 HOSPITALS AND CLINICS SEGMENT COMMANDED LARGEST MARKET SHARE IN PLASMA FRACTIONATION MARKET IN 2022

- 4.5 PLASMA FRACTIONATION MARKET: REGIONAL GROWTH OPPORTUNITIES

- FIGURE 20 ASIA PACIFIC TO REGISTER HIGHEST GROWTH RATE IN PLASMA FRACTIONATION MARKET FROM 2023 TO 2028

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- FIGURE 21 PLASMA FRACTIONATION MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2 MARKET DYNAMICS

- TABLE 4 PLASMA FRACTIONATION MARKET: IMPACT ANALYSIS

- 5.2.1 DRIVERS

- 5.2.1.1 Growing use of immunoglobulins in various therapeutic areas

- TABLE 5 OFF-LABEL INDICATIONS OF INTRAVENOUS IMMUNOGLOBULIN (IVIG)

- TABLE 6 ON-LABEL INDICATIONS OF INTRAVENOUS IMMUNOGLOBULIN (IVIG)

- TABLE 7 NUMBER OF CLINICAL STUDIES ON IMMUNOGLOBULINS, BY COUNTRY/REGION (2020-2021)

- TABLE 8 NUMBER OF PATIENTS TREATED FOR TOP 15 TARGET CONDITIONS IN UK

- 5.2.1.2 Strategic expansion of plasma collection centers/inventories by market players

- 5.2.1.3 Growing prevalence of respiratory diseases and Alpha-1-antitrypsin deficiency

- 5.2.2 RESTRAINTS

- 5.2.2.1 High costs and limited reimbursements for plasma-derived products

- 5.2.2.2 Market disruption caused by recombinant alternatives

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Government strategies for increasing regional self-sufficiency in plasma fractionation

- 5.2.4 CHALLENGES

- 5.2.4.1 Stringent government regulations for maintaining safety and quality of plasma-derived products

- 5.3 PRICING ANALYSIS

- TABLE 9 AVERAGE SELLING PRICE OF PLASMA FRACTIONATION PRODUCTS, BY KEY PLAYER, 2022 (USD)

- TABLE 10 AVERAGE SELLING PRICE OF PLASMA FRACTIONATION PRODUCTS, BY REGION, 2021 (USD)

- 5.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 22 REVENUE SHIFT AND NEW POCKETS FOR PLASMA FRACTIONATION PRODUCT PROVIDERS

- 5.5 VALUE CHAIN ANALYSIS

- FIGURE 23 PROCEDURE OF PLASMA FRACTIONATION

- FIGURE 24 VALUE CHAIN ANALYSIS: PLASMA FRACTIONATION MARKET

- 5.6 SUPPLY CHAIN ANALYSIS

- FIGURE 25 SUPPLY CHAIN ANALYSIS: PLASMA FRACTIONATION MARKET

- 5.7 ECOSYSTEM MARKET MAP

- FIGURE 26 ECOSYSTEM MARKET MAP: PLASMA FRACTIONATION MARKET

- TABLE 11 ROLE IN ECOSYSTEM (SUPPLY SIDE/DEMAND SIDE): PLASMA FRACTIONATION MARKET

- 5.8 PATENT ANALYSIS

- FIGURE 27 PATENT APPLICATIONS FOR PLASMA FRACTIONATION MARKET, JANUARY 2013-JULY 2023

- 5.9 KEY CONFERENCES AND EVENTS IN 2023-2024

- TABLE 12 PLASMA FRACTIONATION MARKET: LIST OF CONFERENCES AND EVENTS IN 2023-2024

- 5.10 REGULATORY ANALYSIS

- TABLE 13 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 LATIN AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.10.1 REGULATORY SCENARIO IN DIFFERENT COUNTRIES/REGIONS

- 5.11 PORTER'S FIVE FORCES ANALYSIS

- TABLE 18 PORTER'S FIVE FORCES ANALYSIS: PLASMA FRACTIONATION MARKET

- 5.11.1 THREAT OF NEW ENTRANTS

- 5.11.2 THREAT OF SUBSTITUTES

- 5.11.3 BARGAINING POWER OF BUYERS

- 5.11.4 BARGAINING POWER OF SUPPLIERS

- 5.11.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.12 TECHNOLOGY ANALYSIS

- 5.12.1 COHN'S COLD ETHANOL PLASMA FRACTIONATION

- 5.12.2 GEL FILTRATION PLASMA FRACTIONATION

- 5.12.3 HUMAN PLASMA FRACTIONATION BY POLYETHYLENE GLYCOL

- 5.12.4 PLASMA FRACTIONATION BY AMMONIUM SULFATE

- 5.12.5 PLASMA FRACTIONATION BY CENTRIFUGATION

- 5.12.6 DEPTH FILTRATION PLASMA FRACTIONATION

- 5.12.7 PLASMA FRACTIONATION BY CHROMATOGRAPHY

- 5.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- FIGURE 28 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR PLASMA FRACTIONATION PRODUCTS

- 5.14 KEY BUYING CRITERIA, BY END USER

- FIGURE 29 KEY BUYING CRITERIA OF END USERS IN PLASMA FRACTIONATION MARKET

- 5.15 PLASMA COLLECTION, BY VOLUME

- 5.15.1 US

- 5.15.2 CANADA

- 5.15.3 UK

- 5.15.4 JAPAN

- 5.15.5 INDIA

- 5.15.6 BRAZIL

- 5.16 PLASMA COLLECTION CENTERS

- FIGURE 30 PLASMA COLLECTION CENTERS IN NORTH AMERICA, 2010-2021

- TABLE 19 NUMBER OF PLASMA COLLECTION CENTERS, BY COMPANY, 2021-2022

6 PLASMA FRACTIONATION MARKET, BY PRODUCT

- 6.1 INTRODUCTION

- TABLE 20 PLASMA FRACTIONATION MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- 6.2 IMMUNOGLOBULINS

- TABLE 21 INTRAVENOUS IMMUNOGLOBULINS (IVIG) VS. SUBCUTANEOUS IMMUNOGLOBULINS (SCIG) THERAPY

- TABLE 22 PLASMA FRACTIONATION MARKET FOR IMMUNOGLOBULINS, BY REGION, 2021-2028 (USD MILLION)

- TABLE 23 NORTH AMERICA: PLASMA FRACTIONATION MARKET FOR IMMUNOGLOBULINS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 24 EUROPE: PLASMA FRACTIONATION MARKET FOR IMMUNOGLOBULINS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 25 ASIA PACIFIC: PLASMA FRACTIONATION MARKET FOR IMMUNOGLOBULINS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 26 LATIN AMERICA: PLASMA FRACTIONATION MARKET FOR IMMUNOGLOBULINS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 27 MIDDLE EAST & AFRICA: PLASMA FRACTIONATION MARKET FOR IMMUNOGLOBULINS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 28 PLASMA FRACTIONATION MARKET FOR IMMUNOGLOBULINS, BY TYPE, 2021-2028 (USD MILLION)

- 6.2.1 IVIG

- 6.2.1.1 Intravenous immunoglobulins segment to dominate plasma fractionation immunoglobulins market during study period

- TABLE 29 IVIG OFFERED BY KEY PLAYERS

- TABLE 30 IVIG MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 31 IVIG MARKET, BY REGION, 2021-2028 (METRIC TONS)

- TABLE 32 NORTH AMERICA: IVIG MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 33 NORTH AMERICA: IVIG MARKET, BY COUNTRY, 2021-2028 (METRIC TONS)

- TABLE 34 EUROPE: IVIG MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 35 EUROPE: IVIG MARKET, BY COUNTRY, 2021-2028 (METRIC TONS)

- TABLE 36 ASIA PACIFIC: IVIG MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 37 ASIA PACIFIC: IVIG MARKET, BY COUNTRY, 2021-2028 (METRIC TONS)

- TABLE 38 LATIN AMERICA: IVIG MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 39 LATIN AMERICA: IVIG MARKET, BY COUNTRY, 2021-2028 (METRIC TONS)

- TABLE 40 MIDDLE EAST & AFRICA: IVIG MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 41 MIDDLE EAST & AFRICA: IVIG MARKET, BY COUNTRY, 2021-2028 (METRIC TONS)

- 6.2.2 SCIG

- 6.2.2.1 Ease of self-administration and lower incidence of non-serious systemic adverse reactions to drive segment

- TABLE 42 SCIG OFFERED BY KEY PLAYERS

- TABLE 43 SCIG MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 44 SCIG MARKET, BY REGION, 2021-2028 (METRIC TONS)

- TABLE 45 NORTH AMERICA: SCIG MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 46 NORTH AMERICA: SCIG MARKET, BY COUNTRY, 2021-2028 (METRIC TONS)

- TABLE 47 EUROPE: SCIG MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 48 EUROPE: SCIG MARKET, BY COUNTRY, 2021-2028 (METRIC TONS)

- TABLE 49 ASIA PACIFIC: SCIG MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 50 ASIA PACIFIC: SCIG MARKET, BY COUNTRY, 2021-2028 (METRIC TONS)

- TABLE 51 LATIN AMERICA: SCIG MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 52 LATIN AMERICA: SCIG MARKET, BY COUNTRY, 2021-2028 (METRIC TONS)

- TABLE 53 MIDDLE EAST & AFRICA: SCIG MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 54 MIDDLE EAST & AFRICA: SCIG MARKET, BY COUNTRY, 2021-2028 (METRIC TONS)

- 6.2.3 OTHER IMMUNOGLOBULINS

- TABLE 55 OTHER IMMUNOGLOBULINS OFFERED BY KEY PLAYERS

- TABLE 56 OTHER IMMUNOGLOBULINS MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 57 OTHER IMMUNOGLOBULINS MARKET, BY REGION, 2021-2028 (METRIC TONS)

- TABLE 58 NORTH AMERICA: OTHER IMMUNOGLOBULINS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 59 NORTH AMERICA: OTHER IMMUNOGLOBULINS MARKET, BY COUNTRY, 2021-2028 (METRIC TONS)

- TABLE 60 EUROPE: OTHER IMMUNOGLOBULINS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 61 EUROPE: OTHER IMMUNOGLOBULINS MARKET, BY COUNTRY, 2021-2028 (METRIC TONS)

- TABLE 62 ASIA PACIFIC: OTHER IMMUNOGLOBULINS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 63 ASIA PACIFIC: OTHER IMMUNOGLOBULINS MARKET, BY COUNTRY, 2021-2028 (METRIC TONS)

- TABLE 64 LATIN AMERICA: OTHER IMMUNOGLOBULINS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 65 LATIN AMERICA: OTHER IMMUNOGLOBULINS MARKET, BY COUNTRY, 2021-2028 (METRIC TONS)

- TABLE 66 MIDDLE EAST & AFRICA: OTHER IMMUNOGLOBULINS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 67 MIDDLE EAST & AFRICA: OTHER IMMUNOGLOBULINS MARKET, BY COUNTRY, 2021-2028 (METRIC TONS)

- 6.3 COAGULATION FACTOR CONCENTRATES

- TABLE 68 PLASMA FRACTIONATION MARKET FOR COAGULATION FACTOR CONCENTRATES, BY REGION, 2021-2028 (USD MILLION)

- TABLE 69 NORTH AMERICA: PLASMA FRACTIONATION MARKET FOR COAGULATION FACTOR CONCENTRATES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 70 EUROPE: PLASMA FRACTIONATION MARKET FOR COAGULATION FACTOR CONCENTRATES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 71 ASIA PACIFIC: PLASMA FRACTIONATION MARKET FOR COAGULATION FACTOR CONCENTRATES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 72 LATIN AMERICA: PLASMA FRACTIONATION MARKET FOR COAGULATION FACTOR CONCENTRATES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 73 MIDDLE EAST & AFRICA: PLASMA FRACTIONATION MARKET FOR COAGULATION FACTOR CONCENTRATES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 74 PLASMA FRACTIONATION MARKET FOR COAGULATION FACTOR CONCENTRATES, BY TYPE, 2021-2028 (USD MILLION)

- 6.3.1 FACTOR VIII

- 6.3.1.1 Factor VIII held largest share of coagulation factor concentrates market in 2022

- TABLE 75 FACTOR VIII OFFERED BY KEY PLAYERS

- TABLE 76 FACTOR VIII MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 77 FACTOR VIII MARKET, BY REGION, 2021-2028 (MILLION IU)

- TABLE 78 NORTH AMERICA: FACTOR VIII MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 79 NORTH AMERICA: FACTOR VIII MARKET, BY COUNTRY, 2021-2028 (MILLION IU)

- TABLE 80 EUROPE: FACTOR VIII MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 81 EUROPE: FACTOR VIII MARKET, BY COUNTRY, 2021-2028 (MILLION IU)

- TABLE 82 ASIA PACIFIC: FACTOR VIII MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 83 ASIA PACIFIC: FACTOR VIII MARKET, BY COUNTRY, 2021-2028 (MILLION IU)

- TABLE 84 LATIN AMERICA: FACTOR VIII MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 85 LATIN AMERICA: FACTOR VIII MARKET, BY COUNTRY, 2021-2028 (MILLION IU)

- TABLE 86 MIDDLE EAST & AFRICA: FACTOR VIII MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 87 MIDDLE EAST & AFRICA: FACTOR VIII MARKET, BY COUNTRY, 2021-2028 (MILLION IU)

- 6.3.2 FACTOR IX

- 6.3.2.1 Routine use of human plasma-derived factor IX concentrates in hemophilia treatment to drive segment

- TABLE 88 FACTOR IX OFFERED BY KEY PLAYERS

- TABLE 89 FACTOR IX MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 90 FACTOR IX MARKET, BY REGION, 2021-2028 (MILLION IU)

- TABLE 91 NORTH AMERICA: FACTOR IX MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 92 NORTH AMERICA: FACTOR IX MARKET, BY COUNTRY, 2021-2028 (MILLION IU)

- TABLE 93 EUROPE: FACTOR IX MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 94 EUROPE: FACTOR IX MARKET, BY COUNTRY, 2021-2028 (MILLION IU)

- TABLE 95 ASIA PACIFIC: FACTOR IX MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 96 ASIA PACIFIC: FACTOR IX MARKET, BY COUNTRY, 2021-2028 (MILLION IU)

- TABLE 97 LATIN AMERICA: FACTOR IX MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 98 LATIN AMERICA: FACTOR IX MARKET, BY COUNTRY, 2021-2028 (MILLION IU)

- TABLE 99 MIDDLE EAST & AFRICA: FACTOR IX MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 100 MIDDLE EAST & AFRICA: FACTOR IX MARKET, BY COUNTRY, 2021-2028 (MILLION IU)

- 6.3.3 VON WILLEBRAND FACTOR

- 6.3.3.1 Increasing prevalence and early diagnosis of hemophilia to drive segment

- TABLE 101 VON WILLEBRAND FACTOR OFFERED BY KEY PLAYERS

- TABLE 102 VON WILLEBRAND FACTOR MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 103 VON WILLEBRAND FACTOR MARKET, BY REGION, 2021-2028 (MILLION LITER)

- TABLE 104 NORTH AMERICA: VON WILLEBRAND FACTOR MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

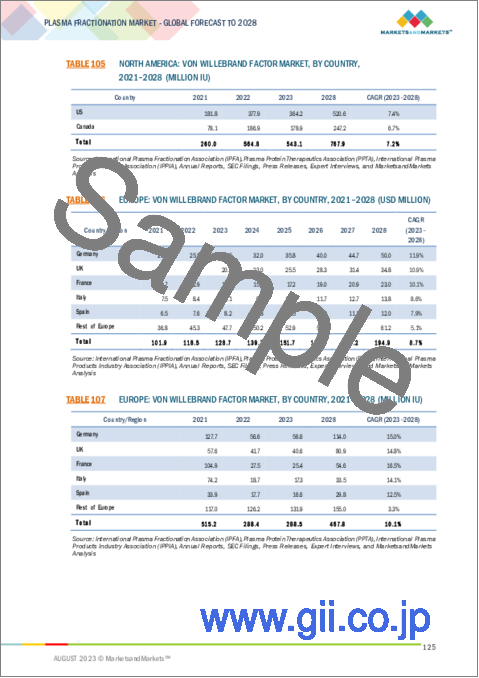

- TABLE 105 NORTH AMERICA: VON WILLEBRAND FACTOR MARKET, BY COUNTRY, 2021-2028 (MILLION IU)

- TABLE 106 EUROPE: VON WILLEBRAND FACTOR MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 107 EUROPE: VON WILLEBRAND FACTOR MARKET, BY COUNTRY, 2021-2028 (MILLION IU)

- TABLE 108 ASIA PACIFIC: VON WILLEBRAND FACTOR MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 109 ASIA PACIFIC: VON WILLEBRAND FACTOR MARKET, BY COUNTRY, 2021-2028 (MILLION IU)

- TABLE 110 LATIN AMERICA: VON WILLEBRAND FACTOR MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 111 LATIN AMERICA: VON WILLEBRAND FACTOR MARKET, BY COUNTRY, 2021-2028 (MILLION IU)

- TABLE 112 MIDDLE EAST & AFRICA: VON WILLEBRAND FACTOR MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 113 MIDDLE EAST & AFRICA: VON WILLEBRAND FACTOR MARKET, BY COUNTRY, 2021-2028 (MILLION IU)

- 6.3.4 PROTHROMBIN COMPLEX CONCENTRATES

- 6.3.4.1 Advantages of prothrombin complex concentrate over fresh frozen plasma to drive segment

- TABLE 114 PROTHROMBIN COMPLEX CONCENTRATES OFFERED BY KEY PLAYERS

- TABLE 115 PROTHROMBIN COMPLEX CONCENTRATES MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 116 PROTHROMBIN COMPLEX CONCENTRATES MARKET, BY REGION, 2021-2028 (MILLION LITER)

- TABLE 117 NORTH AMERICA: PROTHROMBIN COMPLEX CONCENTRATES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 118 NORTH AMERICA: PROTHROMBIN COMPLEX CONCENTRATES MARKET, BY COUNTRY, 2021-2028 (MILLION IU)

- TABLE 119 EUROPE: PROTHROMBIN COMPLEX CONCENTRATES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 120 EUROPE: PROTHROMBIN COMPLEX CONCENTRATES MARKET, BY COUNTRY, 2021-2028 (MILLION IU)

- TABLE 121 ASIA PACIFIC: PROTHROMBIN COMPLEX CONCENTRATES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 122 ASIA PACIFIC: PROTHROMBIN COMPLEX CONCENTRATES MARKET, BY COUNTRY, 2021-2028 (MILLION IU)

- TABLE 123 LATIN AMERICA: PROTHROMBIN COMPLEX CONCENTRATES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 124 LATIN AMERICA: PROTHROMBIN COMPLEX CONCENTRATES MARKET, BY COUNTRY, 2021-2028 (MILLION IU)

- TABLE 125 MIDDLE EAST & AFRICA: PROTHROMBIN COMPLEX CONCENTRATES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 126 MIDDLE EAST & AFRICA: PROTHROMBIN COMPLEX CONCENTRATES MARKET, BY COUNTRY, 2021-2028 (MILLION IU)

- 6.3.5 FIBRINOGEN CONCENTRATES

- 6.3.5.1 Better safety profile, greater accuracy, and higher speed of administration to drive segment

- TABLE 127 FIBRINOGEN CONCENTRATES OFFERED BY KEY PLAYERS

- TABLE 128 FIBRINOGEN CONCENTRATES MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 129 FIBRINOGEN CONCENTRATES MARKET, BY REGION, 2021-2028 (METRIC TONS)

- TABLE 130 NORTH AMERICA: FIBRINOGEN CONCENTRATES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 131 NORTH AMERICA: FIBRINOGEN CONCENTRATES MARKET, BY COUNTRY, 2021-2028 (METRIC TONS)

- TABLE 132 EUROPE: FIBRINOGEN CONCENTRATES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 133 EUROPE: FIBRINOGEN CONCENTRATES MARKET, BY COUNTRY, 2021-2028 (METRIC TONS)

- TABLE 134 ASIA PACIFIC: FIBRINOGEN CONCENTRATES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 135 ASIA PACIFIC: FIBRINOGEN CONCENTRATES MARKET, BY COUNTRY, 2021-2028 (METRIC TONS)

- TABLE 136 LATIN AMERICA: FIBRINOGEN CONCENTRATES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 137 LATIN AMERICA: FIBRINOGEN CONCENTRATES MARKET, BY COUNTRY, 2021-2028 (METRIC TONS)

- TABLE 138 MIDDLE EAST & AFRICA: FIBRINOGEN CONCENTRATES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 139 MIDDLE EAST & AFRICA: FIBRINOGEN CONCENTRATES MARKET, BY COUNTRY, 2021-2028 (METRIC TONS)

- 6.3.6 FACTOR XIII

- 6.3.6.1 Applications in treating rare bleeding disorders and preventing surgical bleeding to drive segment

- TABLE 140 FACTOR XIII OFFERED BY KEY PLAYERS

- TABLE 141 FACTOR XIII MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 142 FACTOR XIII, BY REGION, 2021-2028 (MILLION IU)

- TABLE 143 NORTH AMERICA: FACTOR XIII MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 144 NORTH AMERICA: FACTOR XIII MARKET, BY COUNTRY, 2021-2028 (MILLION IU)

- TABLE 145 EUROPE: FACTOR XIII MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 146 EUROPE FACTOR XIII MARKET, BY COUNTRY, 2021-2028 (MILLION IU)

- TABLE 147 ASIA PACIFIC: FACTOR XIII MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 148 ASIA PACIFIC: FACTOR XIII MARKET, BY COUNTRY, 2021-2028 (MILLION IU)

- TABLE 149 LATIN AMERICA: FACTOR XIII MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 150 LATIN AMERICA: FACTOR XIII MARKET, BY COUNTRY, 2021-2028 (MILLION IU)

- TABLE 151 MIDDLE EAST & AFRICA: FACTOR XIII MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 152 MIDDLE EAST & AFRICA: FACTOR XIII MARKET, BY COUNTRY, 2021-2028 (MILLION IU)

- 6.3.7 OTHER COAGULATION FACTOR CONCENTRATES

- TABLE 153 OTHER COAGULATION FACTOR CONCENTRATES MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 154 NORTH AMERICA: OTHER COAGULATION FACTOR CONCENTRATES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 155 EUROPE: OTHER COAGULATION FACTOR CONCENTRATES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 156 ASIA PACIFIC: OTHER COAGULATION FACTOR CONCENTRATES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 157 LATIN AMERICA: OTHER COAGULATION FACTOR CONCENTRATES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 158 MIDDLE EAST & AFRICA: OTHER COAGULATION FACTOR CONCENTRATES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.4 ALBUMIN

- 6.4.1 RISING DEMAND IN MAINTAINING ONCOTIC PRESSURE AND CONDUCTING MEDICAL TREATMENTS TO DRIVE MARKET

- TABLE 159 ALBUMIN OFFERED BY KEY PLAYERS

- TABLE 160 PLASMA FRACTIONATION MARKET FOR ALBUMIN, BY REGION, 2021-2028 (USD MILLION)

- TABLE 161 PLASMA FRACTIONATION MARKET FOR ALBUMIN, BY REGION, 2021-2028 (MILLION LITER)

- TABLE 162 NORTH AMERICA: PLASMA FRACTIONATION MARKET FOR ALBUMIN, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 163 NORTH AMERICA: PLASMA FRACTIONATION MARKET FOR ALBUMIN, BY COUNTRY, 2021-2028 (METRIC TONS)

- TABLE 164 EUROPE: PLASMA FRACTIONATION MARKET FOR ALBUMIN, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 165 EUROPE: PLASMA FRACTIONATION MARKET FOR ALBUMIN, BY COUNTRY, 2021-2028 (METRIC TONS)

- TABLE 166 ASIA PACIFIC: PLASMA FRACTIONATION MARKET FOR ALBUMIN, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 167 ASIA PACIFIC: PLASMA FRACTIONATION MARKET FOR ALBUMIN, BY COUNTRY, 2021-2028 (METRIC TONS)

- TABLE 168 LATIN AMERICA: PLASMA FRACTIONATION MARKET FOR ALBUMIN, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 169 LATIN AMERICA: PLASMA FRACTIONATION MARKET FOR ALBUMIN, BY COUNTRY, 2021-2028 (METRIC TONS)

- TABLE 170 MIDDLE EAST & AFRICA: PLASMA FRACTIONATION MARKET FOR ALBUMIN, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 171 MIDDLE EAST & AFRICA: PLASMA FRACTIONATION MARKET FOR ALBUMIN, BY COUNTRY, 2021-2028 (METRIC TONS)

- 6.5 PROTEASE INHIBITORS

- 6.5.1 RISING PREVALENCE OF COPD AND OTHER RESPIRATORY DISEASES GLOBALLY TO DRIVE MARKET

- TABLE 172 PROTEASE INHIBITORS OFFERED BY KEY PLAYERS

- TABLE 173 PLASMA FRACTIONATION MARKET FOR PROTEASE INHIBITORS, BY REGION, 2021-2028 (USD MILLION)

- TABLE 174 PLASMA FRACTIONATION MARKET FOR PROTEASE INHIBITORS, BY REGION, 2021-2028 (MILLION IU)

- TABLE 175 NORTH AMERICA: PLASMA FRACTIONATION MARKET FOR PROTEASE INHIBITORS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 176 NORTH AMERICA: PLASMA FRACTIONATION MARKET FOR PROTEASE INHIBITORS, BY COUNTRY, 2021-2028 (MILLION IU)

- TABLE 177 EUROPE: PLASMA FRACTIONATION MARKET FOR PROTEASE INHIBITORS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 178 EUROPE: PLASMA FRACTIONATION MARKET FOR PROTEASE INHIBITORS, BY COUNTRY, 2021-2028 (MILLION IU)

- TABLE 179 ASIA PACIFIC: PLASMA FRACTIONATION MARKET FOR PROTEASE INHIBITORS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 180 ASIA PACIFIC: PLASMA FRACTIONATION MARKET FOR PROTEASE INHIBITORS, BY COUNTRY, 2021-2028 (MILLION IU)

- TABLE 181 LATIN AMERICA: PLASMA FRACTIONATION MARKET FOR PROTEASE INHIBITORS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 182 LATIN AMERICA: PLASMA FRACTIONATION MARKET FOR PROTEASE INHIBITORS, BY COUNTRY, 2021-2028 (MILLION IU)

- TABLE 183 MIDDLE EAST & AFRICA: PLASMA FRACTIONATION MARKET FOR PROTEASE INHIBITORS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 184 MIDDLE EAST & AFRICA: PLASMA FRACTIONATION MARKET FOR PROTEASE INHIBITORS, BY COUNTRY, 2021-2028 (MILLION IU)

- 6.6 OTHER PLASMA PRODUCTS

- TABLE 185 PLASMA FRACTIONATION MARKET FOR OTHER PLASMA PRODUCTS, BY REGION, 2021-2028 (USD MILLION)

- TABLE 186 NORTH AMERICA: PLASMA FRACTIONATION MARKET FOR OTHER PLASMA PRODUCTS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 187 EUROPE: PLASMA FRACTIONATION MARKET FOR OTHER PLASMA PRODUCTS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 188 ASIA PACIFIC: PLASMA FRACTIONATION MARKET FOR OTHER PLASMA PRODUCTS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 189 LATIN AMERICA: PLASMA FRACTIONATION MARKET FOR OTHER PLASMA PRODUCTS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 190 MIDDLE EAST & AFRICA: PLASMA FRACTIONATION MARKET FOR OTHER PLASMA PRODUCTS, BY COUNTRY, 2021-2028 (USD MILLION)

7 PLASMA FRACTIONATION MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- TABLE 191 PLASMA FRACTIONATION MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 7.2 NEUROLOGY

- 7.2.1 RISING PREVALENCE OF AGE-RELATED NEUROLOGICAL DISORDERS TO DRIVE MARKET

- TABLE 192 DISABILITY-ADJUSTED LIFE YEARS (DALYS) FOR NEUROLOGICAL DISORDERS AND PROJECTED PERCENTAGE (2005 VS. 2015 VS. 2030)

- TABLE 193 PLASMA-DERIVED PRODUCTS AND APPLICATIONS IN NEUROLOGY

- TABLE 194 PLASMA FRACTIONATION MARKET FOR NEUROLOGY, BY REGION, 2021-2028 (USD MILLION)

- TABLE 195 NORTH AMERICA: PLASMA FRACTIONATION MARKET FOR NEUROLOGY, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 196 EUROPE: PLASMA FRACTIONATION MARKET FOR NEUROLOGY, 2021-2028 (USD MILLION)

- TABLE 197 ASIA PACIFIC: PLASMA FRACTIONATION MARKET FOR NEUROLOGY, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 198 LATIN AMERICA: PLASMA FRACTIONATION MARKET FOR NEUROLOGY, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 199 MIDDLE EAST & AFRICA: PLASMA FRACTIONATION MARKET FOR NEUROLOGY, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.3 IMMUNOLOGY

- 7.3.1 ADVANCEMENTS IN GENETICS RESEARCH AND NOVEL THERAPEUTIC STRATEGIES TO DRIVE MARKET

- TABLE 200 PHYSICIAN-REPORTED PREVALENCE OF PRIMARY IMMUNODEFICIENCY DISEASES AMONG PATIENTS, BY REGION, 2013-2021

- TABLE 201 LIST OF FDA-APPROVED INDICATIONS FOR IMMUNOGLOBULINS IN IMMUNOLOGY

- TABLE 202 DIAGNOSIS DISTRIBUTION OF DIFFERENT CATEGORIES OF PRIMARY IMMUNODEFICIENCY DISEASES

- TABLE 203 PLASMA-DERIVED PRODUCTS AND THEIR APPLICATIONS IN IMMUNOLOGY

- TABLE 204 PLASMA FRACTIONATION MARKET FOR IMMUNOLOGY, BY REGION, 2021-2028 (USD MILLION)

- TABLE 205 NORTH AMERICA: PLASMA FRACTIONATION MARKET FOR IMMUNOLOGY, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 206 EUROPE: PLASMA FRACTIONATION MARKET FOR IMMUNOLOGY, 2021-2028 (USD MILLION)

- TABLE 207 ASIA PACIFIC: PLASMA FRACTIONATION MARKET FOR IMMUNOLOGY, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 208 LATIN AMERICA: PLASMA FRACTIONATION MARKET FOR IMMUNOLOGY, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 209 MIDDLE EAST & AFRICA: PLASMA FRACTIONATION MARKET FOR IMMUNOLOGY, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.4 HEMATOLOGY

- 7.4.1 GROWING NUMBER OF HEMOPHILIA PATIENTS TO DRIVE DEMAND FOR COAGULATION FACTORS

- TABLE 210 NUMBER OF IDENTIFIED PATIENTS, BY INDICATION, 2021

- FIGURE 31 DISTRIBUTION OF HEMOPHILIA PATIENTS, BY REGION, 2022

- TABLE 211 PLASMA FRACTIONATION MARKET FOR HEMATOLOGY, BY REGION, 2021-2028 (USD MILLION)

- TABLE 212 NORTH AMERICA: PLASMA FRACTIONATION MARKET FOR HEMATOLOGY, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 213 EUROPE: PLASMA FRACTIONATION MARKET FOR HEMATOLOGY, 2021-2028 (USD MILLION)

- TABLE 214 ASIA PACIFIC: PLASMA FRACTIONATION MARKET FOR HEMATOLOGY, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 215 LATIN AMERICA: PLASMA FRACTIONATION MARKET FOR HEMATOLOGY, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 216 MIDDLE EAST & AFRICA: PLASMA FRACTIONATION MARKET FOR HEMATOLOGY, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.5 CRITICAL CARE

- 7.5.1 INCREASING OFF-LABEL USE OF ALBUMIN TO DRIVE DEMAND FOR PLASMA-DERIVED CRITICAL CARE PRODUCTS

- TABLE 217 PLASMA-DERIVED PRODUCTS AND APPLICATIONS IN CRITICAL CARE

- TABLE 218 PLASMA FRACTIONATION MARKET FOR CRITICAL CARE, BY REGION, 2021-2028 (USD MILLION)

- TABLE 219 NORTH AMERICA: PLASMA FRACTIONATION MARKET FOR CRITICAL CARE, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 220 EUROPE: PLASMA FRACTIONATION MARKET FOR CRITICAL CARE, 2021-2028 (USD MILLION)

- TABLE 221 ASIA PACIFIC: PLASMA FRACTIONATION MARKET FOR CRITICAL CARE, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 222 LATIN AMERICA: PLASMA FRACTIONATION MARKET FOR CRITICAL CARE, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 223 MIDDLE EAST & AFRICA: PLASMA FRACTIONATION MARKET FOR CRITICAL CARE, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.6 PULMONOLOGY

- 7.6.1 RISING PREVALENCE OF ALPHA-1-ANTITRYPSIN DEFICIENCY AND COPD TO DRIVE MARKET

- TABLE 224 PLASMA-DERIVED PRODUCTS AND APPLICATIONS IN PULMONOLOGY

- TABLE 225 PLASMA FRACTIONATION MARKET FOR PULMONOLOGY, BY REGION, 2021-2028 (USD MILLION)

- TABLE 226 NORTH AMERICA: PLASMA FRACTIONATION MARKET FOR PULMONOLOGY, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 227 EUROPE: PLASMA FRACTIONATION MARKET FOR PULMONOLOGY, 2021-2028 (USD MILLION)

- TABLE 228 ASIA PACIFIC: PLASMA FRACTIONATION MARKET FOR PULMONOLOGY, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 229 LATIN AMERICA: PLASMA FRACTIONATION MARKET FOR PULMONOLOGY, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 230 MIDDLE EAST & AFRICA: PLASMA FRACTIONATION MARKET FOR PULMONOLOGY, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.7 HEMATO-ONCOLOGY

- 7.7.1 RISING NUMBER OF BLOOD CANCER PATIENTS TO DRIVE MARKET

- TABLE 231 PLASMA-DERIVED PRODUCTS AND APPLICATIONS IN HEMATO-ONCOLOGY

- TABLE 232 PLASMA FRACTIONATION MARKET FOR HEMATO-ONCOLOGY, BY REGION, 2021-2028 (USD MILLION)

- TABLE 233 NORTH AMERICA: PLASMA FRACTIONATION MARKET FOR HEMATO-ONCOLOGY, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 234 EUROPE: PLASMA FRACTIONATION MARKET FOR HEMATO-ONCOLOGY, 2021-2028 (USD MILLION)

- TABLE 235 ASIA PACIFIC: PLASMA FRACTIONATION MARKET FOR HEMATO-ONCOLOGY, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 236 LATIN AMERICA: PLASMA FRACTIONATION MARKET FOR HEMATO-ONCOLOGY, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 237 MIDDLE EAST & AFRICA: PLASMA FRACTIONATION MARKET FOR HEMATO-ONCOLOGY, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.8 RHEUMATOLOGY

- 7.8.1 INCREASING PREVALENCE OF RHEUMATIC ARTHRITIS IN DEVELOPED COUNTRIES TO DRIVE MARKET

- TABLE 238 PLASMA FRACTIONATION MARKET FOR RHEUMATOLOGY, BY REGION, 2021-2028 (USD MILLION)

- TABLE 239 NORTH AMERICA: PLASMA FRACTIONATION MARKET FOR RHEUMATOLOGY, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 240 EUROPE: PLASMA FRACTIONATION MARKET FOR RHEUMATOLOGY, 2021-2028 (USD MILLION)

- TABLE 241 ASIA PACIFIC: PLASMA FRACTIONATION MARKET FOR RHEUMATOLOGY, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 242 LATIN AMERICA: PLASMA FRACTIONATION MARKET FOR RHEUMATOLOGY, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 243 MIDDLE EAST & AFRICA: PLASMA FRACTIONATION MARKET FOR RHEUMATOLOGY, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.9 OTHER APPLICATIONS

- TABLE 244 PLASMA-DERIVED PRODUCTS FOR OTHER APPLICATIONS

- TABLE 245 PLASMA FRACTIONATION MARKET FOR OTHER APPLICATIONS, BY REGION, 2021-2028 (USD MILLION)

- TABLE 246 NORTH AMERICA: PLASMA FRACTIONATION MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 247 EUROPE: PLASMA FRACTIONATION MARKET FOR OTHER APPLICATIONS, 2021-2028 (USD MILLION)

- TABLE 248 ASIA PACIFIC: PLASMA FRACTIONATION MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 249 LATIN AMERICA: PLASMA FRACTIONATION MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 250 MIDDLE EAST & AFRICA: PLASMA FRACTIONATION MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2021-2028 (USD MILLION)

8 PLASMA FRACTIONATION MARKET, BY END USER

- 8.1 INTRODUCTION

- TABLE 251 PLASMA FRACTIONATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 8.2 HOSPITALS AND CLINICS

- 8.2.1 GROWING NUMBER OF SURGERIES AND INCREASING OFF-LABEL USE OF IMMUNOGLOBULINS TO DRIVE MARKET

- TABLE 252 PLASMA FRACTIONATION MARKET FOR HOSPITALS AND CLINICS, BY REGION, 2021-2028 (USD MILLION)

- TABLE 253 NORTH AMERICA: PLASMA FRACTIONATION MARKET FOR HOSPITALS AND CLINICS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 254 EUROPE: PLASMA FRACTIONATION MARKET FOR HOSPITALS AND CLINICS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 255 ASIA PACIFIC: PLASMA FRACTIONATION MARKET FOR HOSPITALS AND CLINICS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 256 LATIN AMERICA: PLASMA FRACTIONATION MARKET FOR HOSPITALS AND CLINICS, 2021-2028 (USD MILLION)

- TABLE 257 MIDDLE EAST & AFRICA: PLASMA FRACTIONATION MARKET FOR HOSPITALS AND CLINICS, BY COUNTRY, 2021-2028 (USD MILLION)

- 8.3 CLINICAL RESEARCH LABORATORIES

- 8.3.1 INCREASING CLINICAL STUDIES ON NEW INDICATIONS FOR PLASMA-DERIVED PRODUCTS TO DRIVE MARKET

- TABLE 258 PLASMA FRACTIONATION MARKET FOR CLINICAL RESEARCH LABORATORIES, BY REGION, 2021-2028 (USD MILLION)

- TABLE 259 NORTH AMERICA: PLASMA FRACTIONATION MARKET FOR CLINICAL RESEARCH LABORATORIES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 260 EUROPE: PLASMA FRACTIONATION MARKET FOR CLINICAL RESEARCH LABORATORIES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 261 ASIA PACIFIC: PLASMA FRACTIONATION MARKET FOR CLINICAL RESEARCH LABORATORIES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 262 LATIN AMERICA: PLASMA FRACTIONATION MARKET FOR CLINICAL RESEARCH LABORATORIES, 2021-2028 (USD MILLION)

- TABLE 263 MIDDLE EAST & AFRICA: PLASMA FRACTIONATION MARKET FOR CLINICAL RESEARCH LABORATORIES, BY COUNTRY, 2021-2028

- 8.4 ACADEMIC INSTITUTES

- 8.4.1 GROWING STUDIES ON SAFETY AND EFFICACY OF PLASMA-DERIVED PRODUCTS TO DRIVE MARKET

- TABLE 264 PLASMA FRACTIONATION MARKET FOR ACADEMIC INSTITUTES, BY REGION, 2021-2028 (USD MILLION)

- TABLE 265 NORTH AMERICA: PLASMA FRACTIONATION MARKET FOR ACADEMIC INSTITUTES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 266 EUROPE: PLASMA FRACTIONATION MARKET FOR ACADEMIC INSTITUTES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 267 ASIA PACIFIC: PLASMA FRACTIONATION MARKET FOR ACADEMIC INSTITUTES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 268 LATIN AMERICA: PLASMA FRACTIONATION MARKET FOR ACADEMIC INSTITUTES, 2021-2028 (USD MILLION)

- TABLE 269 MIDDLE EAST & AFRICA: PLASMA FRACTIONATION MARKET FOR ACADEMIC INSTITUTES, BY COUNTRY, 2021-2028 (USD MILLION)

9 PLASMA FRACTIONATION MARKET, BY REGION

- 9.1 INTRODUCTION

- TABLE 270 PLASMA FRACTIONATION MARKET, BY REGION, 2021-2028 (USD MILLION)

- 9.2 NORTH AMERICA

- FIGURE 32 NORTH AMERICA: PLASMA FRACTIONATION MARKET SNAPSHOT

- TABLE 271 NORTH AMERICA: PLASMA FRACTIONATION MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 272 NORTH AMERICA: PLASMA FRACTIONATION MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 273 NORTH AMERICA: PLASMA FRACTIONATION MARKET FOR IMMUNOGLOBULINS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 274 NORTH AMERICA: PLASMA FRACTIONATION MARKET FOR COAGULATION FACTOR CONCENTRATES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 275 NORTH AMERICA: PLASMA FRACTIONATION MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 276 NORTH AMERICA: PLASMA FRACTIONATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.2.1 US

- 9.2.1.1 US to dominate market for plasma fractionation products during forecast period

- TABLE 277 US: PLASMA FRACTIONATION MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 278 US: PLASMA FRACTIONATION MARKET FOR IMMUNOGLOBULINS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 279 US: PLASMA FRACTIONATION MARKET FOR COAGULATION FACTOR CONCENTRATES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 280 US: PLASMA FRACTIONATION MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 281 US: PLASMA FRACTIONATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.2.2 CANADA

- 9.2.2.1 High per capita usage of immunoglobulins and increased number of blood-related diseases to drive market

- TABLE 282 CANADA: PLASMA FRACTIONATION MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 283 CANADA: PLASMA FRACTIONATION MARKET FOR IMMUNOGLOBULINS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 284 CANADA: PLASMA FRACTIONATION MARKET FOR COAGULATION FACTOR CONCENTRATES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 285 CANADA: PLASMA FRACTIONATION MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 286 CANADA: PLASMA FRACTIONATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.3 EUROPE

- TABLE 287 EUROPE: PLASMA FRACTIONATION MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 288 EUROPE: PLASMA FRACTIONATION MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 289 EUROPE: PLASMA FRACTIONATION MARKET FOR IMMUNOGLOBULINS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 290 EUROPE: PLASMA FRACTIONATION MARKET FOR COAGULATION FACTOR CONCENTRATES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 291 EUROPE: PLASMA FRACTIONATION MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 292 EUROPE: PLASMA FRACTIONATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.3.1 GERMANY

- 9.3.1.1 Largest plasma fractionation capacity and highest number of plasma collection centers in Europe to drive market

- TABLE 293 GERMANY: PLASMA FRACTIONATION MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 294 GERMANY: PLASMA FRACTIONATION MARKET FOR IMMUNOGLOBULINS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 295 GERMANY: PLASMA FRACTIONATION MARKET FOR COAGULATION FACTOR CONCENTRATES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 296 GERMANY: PLASMA FRACTIONATION MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 297 GERMANY: PLASMA FRACTIONATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.3.2 UK

- 9.3.2.1 Increased incidence of hemophilia and lift on ban of plasma donation to drive market

- TABLE 298 UK: PLASMA FRACTIONATION MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 299 UK: PLASMA FRACTIONATION MARKET FOR IMMUNOGLOBULINS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 300 UK: PLASMA FRACTIONATION MARKET FOR COAGULATION FACTOR CONCENTRATES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 301 UK: PLASMA FRACTIONATION MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 302 UK: PLASMA FRACTIONATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.3.3 FRANCE

- 9.3.3.1 High prevalence of bleeding disorders to drive market

- TABLE 303 NUMBER OF PEOPLE WITH BLEEDING DISORDERS IN FRANCE, 2012-2021

- TABLE 304 FRANCE: PLASMA FRACTIONATION MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 305 FRANCE: PLASMA FRACTIONATION MARKET FOR IMMUNOGLOBULINS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 306 FRANCE: PLASMA FRACTIONATION MARKET FOR COAGULATION FACTOR CONCENTRATES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 307 FRANCE: PLASMA FRACTIONATION MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 308 FRANCE: PLASMA FRACTIONATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.3.4 ITALY

- 9.3.4.1 Growth in geriatric population to drive demand for plasma fractionation products

- TABLE 309 PRODUCTION OF PLASMA PRODUCTS IN ITALY (2013, 2018, AND 2023)

- TABLE 310 ITALY: PLASMA FRACTIONATION MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 311 ITALY: PLASMA FRACTIONATION MARKET FOR IMMUNOGLOBULINS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 312 ITALY: PLASMA FRACTIONATION MARKET FOR COAGULATION FACTOR CONCENTRATES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 313 ITALY: PLASMA FRACTIONATION MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 314 ITALY: PLASMA FRACTIONATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.3.5 SPAIN

- 9.3.5.1 Growing demand for plasma products for treatment of chronic diseases in geriatric population to drive market

- TABLE 315 SPAIN: PLASMA FRACTIONATION MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 316 SPAIN: PLASMA FRACTIONATION MARKET FOR IMMUNOGLOBULINS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 317 SPAIN: PLASMA FRACTIONATION MARKET FOR COAGULATION FACTOR CONCENTRATES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 318 SPAIN: PLASMA FRACTIONATION MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 319 SPAIN: PLASMA FRACTIONATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.3.6 REST OF EUROPE

- TABLE 320 REST OF EUROPE: PLASMA FRACTIONATION MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 321 REST OF EUROPE: PLASMA FRACTIONATION MARKET FOR IMMUNOGLOBULINS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 322 REST OF EUROPE: PLASMA FRACTIONATION MARKET FOR COAGULATION FACTOR CONCENTRATES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 323 REST OF EUROPE: PLASMA FRACTIONATION MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 324 REST OF EUROPE: PLASMA FRACTIONATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.4 ASIA PACIFIC

- FIGURE 33 ASIA PACIFIC: PLASMA FRACTIONATION MARKET SNAPSHOT

- TABLE 325 ASIA PACIFIC: PLASMA FRACTIONATION MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 326 ASIA PACIFIC: PLASMA FRACTIONATION MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 327 ASIA PACIFIC: PLASMA FRACTIONATION MARKET FOR IMMUNOGLOBULINS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 328 ASIA PACIFIC: PLASMA FRACTIONATION MARKET FOR COAGULATION FACTOR CONCENTRATES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 329 ASIA PACIFIC: PLASMA FRACTIONATION MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 330 ASIA PACIFIC: PLASMA FRACTIONATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.4.1 CHINA

- 9.4.1.1 Rising incidence of chronic diseases and growing geriatric population to drive market

- TABLE 331 CHINA: PLASMA FRACTIONATION MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 332 CHINA: PLASMA FRACTIONATION MARKET FOR IMMUNOGLOBULINS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 333 CHINA: PLASMA FRACTIONATION MARKET FOR COAGULATION FACTOR CONCENTRATES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 334 CHINA: PLASMA FRACTIONATION MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 335 CHINA: PLASMA FRACTIONATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.4.2 JAPAN

- 9.4.2.1 Rising prevalence of neurological disorders and hematological diseases to drive market

- TABLE 336 MEAN PER CAPITA FACTOR VIII AND IX USE IN JAPAN, 2014 VS. 2018 (IN IU/TOTAL POPULATION)

- TABLE 337 PATIENTS WITH BLEEDING DISORDERS IN JAPAN, 2014 VS. 2021

- TABLE 338 JAPAN: PLASMA FRACTIONATION MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 339 JAPAN: PLASMA FRACTIONATION MARKET FOR IMMUNOGLOBULINS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 340 JAPAN: PLASMA FRACTIONATION MARKET FOR COAGULATION FACTOR CONCENTRATES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 341 JAPAN: PLASMA FRACTIONATION MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 342 JAPAN: PLASMA FRACTIONATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.4.3 AUSTRALIA

- 9.4.3.1 Growing demand for plasma products and rising geriatric population to drive market

- TABLE 343 TOTAL IG (GRAMS) USED IN AUSTRALIA, 2008/09-2017/18

- TABLE 344 AUSTRALIA: BLOOD SECTOR OVERVIEW (2017-2018)

- TABLE 345 AUSTRALIA: PLASMA FRACTIONATION MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 346 AUSTRALIA: PLASMA FRACTIONATION MARKET FOR IMMUNOGLOBULINS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 347 AUSTRALIA: PLASMA FRACTIONATION MARKET FOR COAGULATION FACTOR CONCENTRATES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 348 AUSTRALIA: PLASMA FRACTIONATION MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 349 AUSTRALIA: PLASMA FRACTIONATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.4.4 INDIA

- 9.4.4.1 Growing healthcare awareness, increasing availability of better diagnostic tools, and rising geriatric population to drive market

- TABLE 350 INDIA: NUMBER OF PATIENTS WITH BLEEDING DISORDERS, 2012-2021

- TABLE 351 INDIA: PLASMA FRACTIONATION MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 352 INDIA: PLASMA FRACTIONATION MARKET FOR IMMUNOGLOBULINS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 353 INDIA: PLASMA FRACTIONATION MARKET FOR COAGULATION FACTOR CONCENTRATES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 354 INDIA: PLASMA FRACTIONATION MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 355 INDIA: PLASMA FRACTIONATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.4.5 VIETNAM

- 9.4.5.1 Increasing number of patients suffering from COPD, PID, and bleeding disorders to drive market

- TABLE 356 VIETNAM: PLASMA FRACTIONATION MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 357 VIETNAM: PLASMA FRACTIONATION MARKET FOR IMMUNOGLOBULINS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 358 VIETNAM: PLASMA FRACTIONATION MARKET FOR COAGULATION FACTOR CONCENTRATES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 359 VIETNAM: PLASMA FRACTIONATION MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 360 VIETNAM: PLASMA FRACTIONATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.4.6 INDONESIA

- 9.4.6.1 Rising number of government initiatives and growing geriatric population to boost market

- TABLE 361 INDONESIA: PLASMA FRACTIONATION MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 362 INDONESIA: PLASMA FRACTIONATION MARKET FOR IMMUNOGLOBULINS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 363 INDONESIA: PLASMA FRACTIONATION MARKET FOR COAGULATION FACTOR CONCENTRATES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 364 INDONESIA: PLASMA FRACTIONATION MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 365 INDONESIA: PLASMA FRACTIONATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.4.7 MALAYSIA

- 9.4.7.1 Increasing prevalence of bleeding disorders to drive market

- TABLE 366 MALAYSIA: PLASMA FRACTIONATION MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 367 MALAYSIA: PLASMA FRACTIONATION MARKET FOR IMMUNOGLOBULINS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 368 MALAYSIA: PLASMA FRACTIONATION MARKET FOR COAGULATION FACTOR CONCENTRATES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 369 MALAYSIA: PLASMA FRACTIONATION MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 370 MALAYSIA: PLASMA FRACTIONATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.4.8 REST OF ASIA PACIFIC

- TABLE 371 REST OF ASIA PACIFIC: PLASMA FRACTIONATION MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 372 REST OF ASIA PACIFIC: PLASMA FRACTIONATION MARKET FOR IMMUNOGLOBULINS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 373 REST OF ASIA PACIFIC: PLASMA FRACTIONATION MARKET FOR COAGULATION FACTOR CONCENTRATES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 374 REST OF ASIA PACIFIC: PLASMA FRACTIONATION MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 375 REST OF ASIA PACIFIC: PLASMA FRACTIONATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.5 LATIN AMERICA

- TABLE 376 LATIN AMERICA: PLASMA FRACTIONATION MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 377 LATIN AMERICA: PLASMA FRACTIONATION MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 378 LATIN AMERICA: PLASMA FRACTIONATION MARKET FOR IMMUNOGLOBULINS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 379 LATIN AMERICA: PLASMA FRACTIONATION MARKET FOR COAGULATION FACTOR CONCENTRATES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 380 LATIN AMERICA: PLASMA FRACTIONATION MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 381 LATIN AMERICA: PLASMA FRACTIONATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.5.1 BRAZIL

- 9.5.1.1 Growing incidence of immunodeficiency diseases and rising number of hemophilic patients to drive market

- TABLE 382 BRAZIL: PLASMA FRACTIONATION MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 383 BRAZIL: PLASMA FRACTIONATION MARKET FOR IMMUNOGLOBULINS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 384 BRAZIL: PLASMA FRACTIONATION MARKET FOR COAGULATION FACTOR CONCENTRATES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 385 BRAZIL: PLASMA FRACTIONATION MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 386 BRAZIL: PLASMA FRACTIONATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.5.2 REST OF LATIN AMERICA

- TABLE 387 REST OF LATIN AMERICA: PLASMA FRACTIONATION MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 388 REST OF LATIN AMERICA: PLASMA FRACTIONATION MARKET FOR IMMUNOGLOBULINS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 389 REST OF LATIN AMERICA: PLASMA FRACTIONATION MARKET FOR COAGULATION FACTOR CONCENTRATES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 390 REST OF LATIN AMERICA: PLASMA FRACTIONATION MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 391 REST OF LATIN AMERICA: PLASMA FRACTIONATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.6 MIDDLE EAST & AFRICA

- TABLE 392 HEMOPHILIA PATIENTS IN MIDDLE EAST & AFRICA, BY COUNTRY, 2012-2020

- TABLE 393 MIDDLE EAST & AFRICA: PLASMA FRACTIONATION MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 394 MIDDLE EAST & AFRICA: PLASMA FRACTIONATION MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 395 MIDDLE EAST & AFRICA: PLASMA FRACTIONATION MARKET FOR IMMUNOGLOBULINS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 396 MIDDLE EAST & AFRICA: PLASMA FRACTIONATION MARKET FOR COAGULATION FACTOR CONCENTRATES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 397 MIDDLE EAST & AFRICA: PLASMA FRACTIONATION MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 398 MIDDLE EAST & AFRICA: PLASMA FRACTIONATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.6.1 TURKEY

- 9.6.1.1 Turkey to dominate plasma fractionation market in Middle East & Africa during study period

- TABLE 399 TURKEY: DEMOGRAPHIC INDICATORS

- TABLE 400 TURKEY: PLASMA FRACTIONATION MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 401 TURKEY: PLASMA FRACTIONATION MARKET FOR IMMUNOGLOBULINS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 402 TURKEY: PLASMA FRACTIONATION MARKET FOR COAGULATION FACTOR CONCENTRATES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 403 TURKEY: PLASMA FRACTIONATION MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 404 TURKEY: PLASMA FRACTIONATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.6.2 SAUDI ARABIA

- 9.6.2.1 Developments in healthcare infrastructure to drive market

- TABLE 405 SAUDI ARABIA: PLASMA FRACTIONATION MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 406 SAUDI ARABIA: PLASMA FRACTIONATION MARKET FOR IMMUNOGLOBULINS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 407 SAUDI ARABIA: PLASMA FRACTIONATION MARKET FOR COAGULATION FACTOR CONCENTRATES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 408 SAUDI ARABIA: PLASMA FRACTIONATION MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 409 SAUDI ARABIA: PLASMA FRACTIONATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.6.3 EGYPT

- 9.6.3.1 Increasing research on plasma and plasma derivatives by government organizations to drive market

- TABLE 410 EGYPT: PLASMA FRACTIONATION MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 411 EGYPT: PLASMA FRACTIONATION MARKET FOR IMMUNOGLOBULINS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 412 EGYPT: PLASMA FRACTIONATION MARKET FOR COAGULATION FACTOR CONCENTRATES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 413 EGYPT: PLASMA FRACTIONATION MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 414 EGYPT: PLASMA FRACTIONATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.6.4 UAE

- 9.6.4.1 Growing government initiatives for healthcare infrastructure development to drive market

- TABLE 415 UAE: PLASMA FRACTIONATION MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 416 UAE: PLASMA FRACTIONATION MARKET FOR IMMUNOGLOBULINS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 417 UAE: PLASMA FRACTIONATION MARKET FOR COAGULATION FACTOR CONCENTRATES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 418 UAE: PLASMA FRACTIONATION MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 419 UAE: PLASMA FRACTIONATION MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.6.5 REST OF MIDDLE EAST & AFRICA

- TABLE 420 HEMOPHILIA PATIENTS IN REST OF MIDDLE EAST & AFRICA, 2012 VS. 2017 VS. 2018

- TABLE 421 REST OF MIDDLE EAST & AFRICA: PLASMA FRACTIONATION MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 422 REST OF MIDDLE EAST & AFRICA: PLASMA FRACTIONATION MARKET FOR IMMUNOGLOBULINS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 423 REST OF MIDDLE EAST & AFRICA: PLASMA FRACTIONATION MARKET FOR COAGULATION FACTOR CONCENTRATES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 424 REST OF MIDDLE EAST & AFRICA: PLASMA FRACTIONATION MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 425 REST OF MIDDLE EAST & AFRICA: PLASMA FRACTIONATION MARKET, BY END USER, 2021-2028 (USD MILLION)

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 KEY PLAYER STRATEGIES ADOPTED BY MAJOR PLAYERS

- FIGURE 34 KEY STRATEGIES ADOPTED BY MAJOR PLAYERS IN PLASMA FRACTIONATION MARKET, 2020-2023

- 10.3 MARKET SHARE ANALYSIS

- FIGURE 35 PLASMA FRACTIONATION MARKET: MARKET SHARE ANALYSIS, 2022 (TOP 5 PLAYERS)

- TABLE 426 PLASMA FRACTIONATION MARKET: DEGREE OF COMPETITION

- 10.4 REVENUE SHARE ANALYSIS OF TOP PLAYERS IN PLASMA FRACTIONATION MARKET

- FIGURE 36 REVENUE SHARE ANALYSIS OF KEY PLAYERS IN PLASMA FRACTIONATION MARKET (TOP 5)

- 10.5 COMPANY EVALUATION MATRIX FOR KEY PLAYERS IN PLASMA FRACTIONATION MARKET

- 10.5.1 STARS

- 10.5.2 EMERGING LEADERS

- 10.5.3 PERVASIVE PLAYERS

- 10.5.4 PARTICIPANTS

- FIGURE 37 COMPANY EVALUATION MATRIX FOR KEY PLAYERS IN PLASMA FRACTIONATION MARKET, 2022

- 10.6 COMPETITIVE BENCHMARKING OF TOP 25 PLAYERS

- TABLE 427 END USER FOOTPRINT ANALYSIS (KEY PLAYERS)

- TABLE 428 PRODUCT FOOTPRINT ANALYSIS (KEY PLAYERS)

- TABLE 429 REGIONAL FOOTPRINT ANALYSIS (KEY PLAYERS)

- 10.7 COMPANY EVALUATION MATRIX FOR START-UPS/SMES IN PLASMA FRACTIONATION MARKET

- 10.7.1 PROGRESSIVE COMPANIES

- 10.7.2 STARTING BLOCKS

- 10.7.3 RESPONSIVE COMPANIES

- 10.7.4 DYNAMIC COMPANIES

- FIGURE 38 COMPANY EVALUATION MATRIX FOR START-UPS/SMES IN PLASMA FRACTIONATION MARKET, 2022

- 10.8 COMPETITIVE BENCHMARKING OF START-UPS/SMES

- TABLE 430 DETAILED LIST OF KEY START-UPS/SMES: PLASMA FRACTIONATION MARKET

- TABLE 431 COMPETITIVE BENCHMARKING OF START-UPS/SMES: PLASMA FRACTIONATION MARKET

- 10.9 COMPETITIVE SCENARIOS AND TRENDS

- TABLE 432 KEY PRODUCT LAUNCHES AND APPROVALS, JANUARY 2021-JULY 2023

- TABLE 433 KEY DEALS, JANUARY 2021-JULY 2023

- TABLE 434 OTHER KEY DEVELOPMENTS, JANUARY 2021-JULY 2023

11 COMPANY PROFILES

- (Business Overview, Products Offered, Recent Developments, MnM View Right to win, Strategic choices made, Weaknesses and competitive threats) **

- 11.1 KEY PLAYERS

- 11.1.1 CSL

- TABLE 435 CSL: COMPANY OVERVIEW

- FIGURE 39 CSL: COMPANY SNAPSHOT (2022)

- 11.1.2 TAKEDA PHARMACEUTICAL COMPANY LIMITED

- TABLE 436 TAKEDA PHARMACEUTICAL COMPANY LIMITED: COMPANY OVERVIEW

- FIGURE 40 TAKEDA PHARMACEUTICAL COMPANY LIMITED: COMPANY SNAPSHOT (2022)

- 11.1.3 GRIFOLS, S.A.

- TABLE 437 GRIFOLS, S.A.: COMPANY OVERVIEW

- FIGURE 41 GRIFOLS, S.A.: COMPANY SNAPSHOT (2022)

- 11.1.4 OCTAPHARMA AG

- TABLE 438 OCTAPHARMA AG: COMPANY OVERVIEW

- FIGURE 42 OCTAPHARMA AG: COMPANY SNAPSHOT (2022)

- 11.1.5 KEDRION S.P.A

- TABLE 439 KEDRION S.P.A: COMPANY OVERVIEW

- FIGURE 43 KEDRION S.P.A: COMPANY SNAPSHOT (2022)

- 11.1.6 LFB

- TABLE 440 LFB: COMPANY OVERVIEW

- 11.1.7 ADMA BIOLOGICS, INC.

- TABLE 441 ADMA BIOLOGICS, INC.: COMPANY OVERVIEW

- FIGURE 44 ADMA BIOLOGICS, INC.: COMPANY SNAPSHOT (2022)

- 11.1.8 SANQUIN

- TABLE 442 SANQUIN: COMPANY OVERVIEW

- FIGURE 45 SANQUIN: COMPANY SNAPSHOT (2022)

- 11.1.9 CHINA BIOLOGIC PRODUCTS HOLDINGS, INC.

- TABLE 443 CHINA BIOLOGIC PRODUCTS HOLDINGS, INC.: COMPANY OVERVIEW

- 11.1.10 GC PHARMA

- TABLE 444 GC PHARMA: COMPANY OVERVIEW

- FIGURE 46 GC PHARMA: COMPANY SNAPSHOT (2021)

- 11.1.11 HUALAN BIOENGINEERING CO., LTD.

- TABLE 445 HUALAN BIOENGINEERING CO., LTD.: COMPANY OVERVIEW

- 11.1.12 JAPAN BLOOD PRODUCTS ORGANIZATION

- TABLE 446 JAPAN BLOOD PRODUCTS ORGANIZATION: COMPANY OVERVIEW

- 11.1.13 EMERGENT

- TABLE 447 EMERGENT: COMPANY OVERVIEW

- FIGURE 47 EMERGENT: COMPANY SNAPSHOT (2022)

- 11.1.14 SHANGHAI RAAS BLOOD PRODUCTS CO., LTD.

- TABLE 448 SHANGHAI RAAS BLOOD PRODUCTS CO., LTD.: COMPANY OVERVIEW

- 11.1.15 INTAS PHARMACEUTICALS LTD.

- TABLE 449 INTAS PHARMACEUTICALS LTD.: COMPANY OVERVIEW

- 11.2 OTHER PLAYERS

- 11.2.1 BHARAT SERUMS AND VACCINES LIMITED

- 11.2.2 SK PLASMA

- 11.2.3 SICHUAN YUANDA SHUYANG PHARMACEUTICAL CO., LTD.

- 11.2.4 KAMADA PHARMACEUTICALS

- 11.2.5 CENTURION PHARMA

- 11.2.6 PROTHYA BIOSOLUTIONS B.V.

- 11.2.7 PLASMAGEN BIOSCIENCES PVT. LTD.

- 11.2.8 VIRCHOW BIOTECH

- 11.2.9 FUSION HEALTHCARE

- 11.2.10 HEMARUS

- *Details on Business Overview, Products Offered, Recent Developments, MnM View, Right to win, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS