|

|

市場調査レポート

商品コード

1859653

フィールドプログラマブルゲートアレイ(FPGA)の世界市場:コンフィギュレーション別、ノードサイズ別、技術別、業界別、地域別 - 2030年までの予測Field-Programmable Gate Array (FPGA) Market by Configuration (Low-end FPGA, Mid-range FPGA, High-end FPGA), Technology (SRAM, Flash, Antifuse), Node Size (<16 nm, 20-90 nm, >90 nm), Vertical (Telecom, Data Center) and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| フィールドプログラマブルゲートアレイ(FPGA)の世界市場:コンフィギュレーション別、ノードサイズ別、技術別、業界別、地域別 - 2030年までの予測 |

|

出版日: 2025年10月27日

発行: MarketsandMarkets

ページ情報: 英文 389 Pages

納期: 即納可能

|

概要

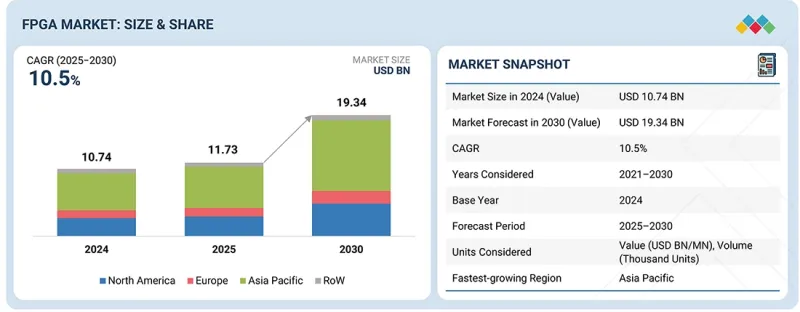

世界のフィールドプログラマブルゲートアレイ(FPGA)の市場規模は、10.5%のCAGRで拡大し、2025年の117億3,000万米ドルから2030年には193億4,000万米ドルに達すると予測されています。

同市場は、AI技術の広範な採用と主要産業における5Gインフラの展開によって力強い成長を遂げています。AIワークロードがますます複雑化するなか、FPGAは航空宇宙・防衛や自動車などの産業でリアルタイムデータ処理、センサーフュージョン、適応学習を加速するために導入されています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント別 | コンフィギュレーション別、ノードサイズ別、技術別、業界別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

5Gネットワークの拡大により、広帯域幅、低遅延通信、再構成可能な信号処理をサポートするFPGAの需要が高まっています。また、進化する規格やプロトコルに柔軟に対応できるFPGAは、次世代通信機器やエッジ・コンピューティング・システムに不可欠です。こうした動向を背景に、FPGAはインテリジェントで高性能な、将来対応可能なデジタル・インフラストラクチャを実現する重要な役割を担っています。

SRAMベースのFPGAは、その優れた再構成性、高速性能、複雑なデジタルシステムへの適合性により、2025年にはFPGA市場で最大のシェアを占めると予想されます。これらのデバイスにより、設計者はハードウェア機能を動的に再プログラムできるため、AIアクセラレーション、データセンター・ネットワーキング、高度通信など、頻繁な更新と設計の柔軟性が求められるアプリケーションに最適です。SRAM技術の継続的な進歩により、ロジック密度の向上、エネルギー効率の改善、セキュリティ機能の強化が可能になり、パフォーマンスが重視される分野での優位性が強化されています。さらに、FPGAロジックをリアルタイムで再構成してワークロードを最適化するアダプティブ・コンピューティング・アーキテクチャの採用が拡大しており、次世代コンピューティングおよび通信システムにおけるSRAMベースFPGAの使用はさらに拡大しています。

データセンターおよびコンピューティング分野は、AI推論、クラウド・アクセラレーション、高性能コンピューティング・ワークロードへのFPGA採用の増加により、FPGA市場で最も高いCAGRを記録すると予測されます。FPGAは比類のない並列処理能力、再構成可能性、電力効率を備えており、リアルタイム・アプリケーションのデータ・スループットの最適化と待ち時間の短縮に非常に効果的です。大手クラウド・サービス・プロバイダーやハイパースケール・オペレーターは、AI、機械学習、アナリティクスなどの多様なワークロードに対応するため、FPGAベースのアクセラレーターの統合を進めています。さらに、ヘテロジニアス・コンピューティング・アーキテクチャへの移行と、進化するアルゴリズムをサポートするカスタマイズ可能なハードウェアに対する需要の高まりが、大規模なコンピューティング・インフラストラクチャへのFPGA導入を後押ししており、このセグメントは持続的な高成長を遂げるものとみられています。

欧州は、強固な産業基盤、戦略的デジタル投資、技術主権に向けた協調的な推進により、2025年に世界のFPGA市場で大きなシェアを獲得すると見られています。同地域はカーエレクトロニクス、産業オートメーション、通信、防衛の分野で主導権を握っており、リコンフィギュラブル・コンピューティング・ソリューションに対する持続的な需要を後押ししています。欧州チップス法(European Chips Act)」と「ホライゾン・欧州(Horizon Europe)」に基づく継続的な取り組みにより、半導体設計、製造、高性能コンピューティングの革新が促進され、FPGAの採用に有利な環境が整いつつあります。2024年4月、OPTIMAイニシアチブはEuroHPC JUの下、産業用をHPCシステムに最適化して移植するためのFPGAベースのチッププラットフォームを開発し、エネルギー効率の高い設計によるプログラマブル・コンピューティングにおける欧州の能力の向上に貢献しました。さらに、欧州ではAIアクセラレーション、エッジインテリジェンス、オープンハードウェアアーキテクチャ(RISC-Vなど)を重視しており、FPGAを次世代コンピューティングインフラの中核として位置付けています。ドイツ、フランス、オランダでは強固な研究開発エコシステムが構築され、学界と産業界の協力関係も拡大していることから、欧州は先進FPGAのイノベーションと展開の重要な拠点としての地位を強化すると予想されます。

当レポートでは、世界のフィールドプログラマブルゲートアレイ(FPGA)市場について調査し、コンフィギュレーション別、ノードサイズ別、技術別、業界別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

よくあるご質問

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- アンメットニーズと空白

- 相互接続された市場と分野横断的な機会

- ティア1/2/3プレイヤーの戦略的動き

第6章 業界動向

- イントロダクション

- ポーターのファイブフォース分析

- マクロ経済指標

- バリューチェーン分析

- エコシステム分析

- 価格分析

- 貿易分析

- 2025年~2026年の主な会議とイベント

- 顧客のビジネスに影響を与える動向/ディスラプション

- 投資と資金調達シナリオ、2021~2025年

- ケーススタディ分析

- 2025年の米国関税の影響

第7章 顧客情勢と購買行動

- 意思決定プロセス

- 主要な利害関係者と購入基準

- 採用障壁と内部課題

- さまざまな業界からのアンメットニーズ

第8章 規制状況

- イントロダクション

- 規制機関、政府機関、その他の組織

- 標準

- 政府規制

第9章 技術、特許、デジタル、AIの導入別戦略的破壊

- 主要な新興技術

- 補完な技術

- 隣接技術

- 技術/製品ロードマップ

- 特許分析

- AIの影響

第10章 FPGAとEFPGAの市場規模

- イントロダクション

- FPGA

- EFPGA

第11章 FPGA市場(コンフィギュレーション別)

- イントロダクション

- ローエンドFPGA

- ミッドレンジFPGA

- ハイエンドFPGA

第12章 FPGA市場(ノードサイズ別)

- イントロダクション

- 16NM以下

- 20~90NM

- 90NM超

第13章 FPGA市場(技術別)

- イントロダクション

- 静的ランダムアクセスメモリ(SRAM)

- フラッシュ

- アンチフューズ

第14章 FPGA市場(業界別)

- イントロダクション

- 電気通信

- 家電

- テスト、測定、エミュレーション

- データセンターとコンピューティング

- 軍事・航空宇宙

- 工業用

- 自動車

- ヘルスケア

- マルチメディア

- 放送

第15章 FPGA市場(地域別)

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- その他

- アジア太平洋

- 中国

- 日本

- インド

- 韓国

- その他

- その他の地域

- 南米

- 湾岸協力理事会(GCC)

- その他

第16章 競合情勢

- 概要

- 主要参入企業の戦略/強み、2021年~2025年

- 収益分析、2021年~2024年

- 市場シェア分析、2024年

- 企業評価と財務指標

- ブランド/製品比較

- FPGAの企業評価マトリックス:主要参入企業、2024年

- FPGA企業評価マトリックス:スタートアップ/中小企業、2024年

- 競合シナリオ

第17章 企業プロファイル

- 主要参入企業

- ADVANCED MICRO DEVICES, INC.

- ALTERA CORPORATION

- MICROCHIP TECHNOLOGY INC.

- LATTICE SEMICONDUCTOR CORPORATION

- ACHRONIX SEMICONDUCTOR CORPORATION

- QUICKLOGIC CORPORATION

- EFINIX, INC.

- SHENZHEN PANGO MICROSYSTEMS CO., LTD.

- GOWIN SEMICONDUCTOR CORP.

- RENESAS ELECTRONICS CORPORATION

- その他の企業

- AGM MICRO

- SHANGHAI ANLOGIC INFOTECH CO., LTD.

- HERCULES MICROELECTRONICS INC.

- XI'AN ZHIDUOJING MICROELECTRONICS CO., LTD.

- NANOXPLORE

- COLOGNE CHIP AG

- LEAFLABS, LLC

- LOGIC FRUIT TECHNOLOGIES PRIVATE LIMITED

- RAPID SILICON

- ZERO ASIC

- ADICSYS

- RAPID FLEX

- MENTA

- SARACA SOLUTIONS PRIVATE LIMITED

- BYTESNAP DESIGN