|

|

市場調査レポート

商品コード

1724769

シンタクチックフォームの世界市場:製品タイプ別、マトリクスタイプ別、フィラータイプ別、形状別、化学別、最終用途産業、地域別 - 予測(~2030年)Syntactic Foam Market by Product Type, Matrix Type, Filler Type, Foam, Chemistry, End-use Industry & Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| シンタクチックフォームの世界市場:製品タイプ別、マトリクスタイプ別、フィラータイプ別、形状別、化学別、最終用途産業、地域別 - 予測(~2030年) |

|

出版日: 2025年05月09日

発行: MarketsandMarkets

ページ情報: 英文 260 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界のシンタクチックフォームの市場規模は、2024年に1億7,500万米ドルであり、2030年までに2億3,392万9,500米ドルに達すると予測され、CAGRで5%の成長が見込まれます。

海洋原油生産の増加が、シンタクチックフォーム市場と海洋学活動からの需要を促進しています。石油・ガスは世界的に必要とされる代表的な資源です。そのため、企業は海洋油田を探査しています。シンタクチックフォームは浮力をもたらす、深海用途に最適な軽量材料です。ライザーフロートや、防衛や海洋研究向けのROVやAUVのような深海探査機に使用されています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2023年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2024年~2030年 |

| 単位 | 金額(1,000米ドル)、数量(トン) |

| セグメント | 製品タイプ、マトリクスタイプ、フィラータイプ、形状、化学、最終用途産業、地域 |

| 対象地域 | 北米、欧州、アジア太平洋、中東・アフリカ、南米 |

マトリクスタイプ別では、ポリマーマトリクスが予測期間に最大の市場となりました。

ポリマーマトリクスセグメントが予測期間を通じて最大の市場シェアを占めると予測されます。ガラスで構成されることの多いマイクロスフィアがマトリクスに組み込まれてシンタクチックフォームを作ります。マトリクスにはセラミック、金属、ポリマーの3種類があります。多くの利点があるため、ポリマーマトリクスがもっとも広く利用されています。シンタクチックフォームの中空マイクロスフィアは、ポリマーマトリクスによってつなぎ合わされ、複合材料に望ましい機械的、熱的、音響的性質を与えます。シンタクチックフォームの性能、応用可能性、環境耐性はすべて、ポリマーの選択によって大きく影響されます。接着性、機械的強度、耐薬品性に優れた熱硬化性材料であるエポキシ樹脂がポリマーマトリクスを構成します。

フィラータイプ別では、ガラスマイクロスフィアセグメントが予測期間にもっとも高いCAGRとなりました。

ガラスマイクロスフィアセグメントが予測期間にシンタクチックフォーム市場でもっとも高いCAGRを達成すると予測されます。ガラスマイクロスフィアは非常に軽量であるため、浮力に使用することができます。腐食に耐える能力があるため、特に深海用途ではさらに有益です。シンタクチックフォームは、その優れた断熱性により熱伝導に抵抗します。またガラスは水分に抵抗し、シンタクチックフォーム物質への水の侵入を防ぎます。

最終用途産業別では、海洋・海底が予測期間にもっとも高いCAGRとなりました。

最終用途産業別では、海洋・海底産業がもっとも高いCAGRとなりました。これは海洋油田、海洋学活動、深海探査機の成長によるものです。海洋地域から石油・ガスなどの炭化水素の採掘を検討・調査する国が増えるにつれて、海洋油田の数が増加しています。シンタクチックフォームは、圧縮強度が高く、密度が低く、静水圧や海水に対する耐性に優れているため、このような状況で利用されています。また、構造支持体、断熱パイプラインコーティング、ライザー浮力モジュール、海底浮力モジュールなどの研究に使われています。これには主にROVとAUVが利用されます。

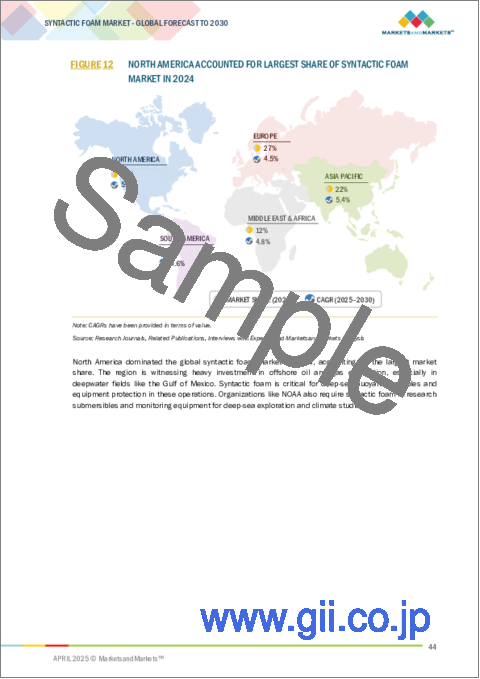

地域別では、アジア太平洋が予測期間にもっとも高いCAGRとなる見込みです。

インド、中国、その他のアジア太平洋を含むアジア太平洋は、シンタクチックフォーム市場でもっとも急成長している地域です。海洋エネルギー、防衛近代化、インフラ開発、建築・モビリティ向け軽量材料への投資の増加が、アジア太平洋におけるシンタクチックフォームの採用を促進しています。この地域の拡大の主な促進要因の1つは、近い将来の海洋油田プロジェクトとスタートアップです。さらに、シンタクチックフォームは潜水艦のような海洋・海底用途にも必要とされており、中国、日本、インドは強力な海洋活動を展開しています。

当レポートでは、世界のシンタクチックフォーム市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 主な調査結果

- シンタクチックフォーム市場の企業にとって魅力的な機会

- シンタクチックフォーム市場:製品タイプ別

- シンタクチックフォーム市場:マトリクスタイプ別

- シンタクチックフォーム市場:フィラータイプ別

- シンタクチックフォーム市場:形状別

- シンタクチックフォーム市場:化学別

- シンタクチックフォーム市場:最終用途産業別

- 北米のシンタクチックフォーム市場:形状別、国別

- シンタクチックフォーム市場:主要国別

第5章 市場の概要

- イントロダクション

- 促進要因

- 抑制要因

- 機会

- 課題

第6章 産業動向

- 顧客ビジネスに影響を与える動向/混乱

- エコシステム分析

- バリューチェーン分析

- 関税と規制情勢

- シンタクチックフォームに関する関税データ

- 規制機関、政府機関、その他の組織

- 規制

- 価格分析

- 主要企業の平均販売価格の動向:フィラータイプ別(2024年)

- 平均販売価格の動向:地域別

- 貿易分析

- 輸入データ(HSコード701820)

- 輸出データ(HSコード701820)

- 輸入データ(HSコード390730)

- 輸出データ(HSコード390730)

- 技術分析

- 主要技術

- 隣接技術

- 補完技術

- 特許分析

- ケーススタディ分析

- AISの浮力モジュールによる効率性の向上

- CMT EUROPE BVのHYTAC WFT熱硬化性シンタクチックフォームは、熱成形プロセスの改良に役立つ

- TRELLEBORG ABのシンタクチックフォームが有人潜水艇の反復的な潜水に寄与

- 主な会議とイベント(2025年)

- シンタクチックフォーム市場におけるAIの影響

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- マクロ経済分析

- GDPの動向と予測

- 2025年の米国関税の影響 - シンタクチックフォーム市場

- イントロダクション

- 主な関税率

- 価格の影響の分析

- 国/地域に対する影響

- 最終用途産業に対する影響

第7章 シンタクチックフォーム市場:製品タイプ別

- イントロダクション

- マイクロスフィア

- マクロスフィア

第8章 シンタクチックフォーム市場:マトリクスタイプ別

- イントロダクション

- 金属

- ポリマー

- セラミック

第9章 シンタクチックフォーム市場:フィラータイプ別

- イントロダクション

- ガラスマイクロスフィア

- セラミックマイクロスフィア

- その他のフィラータイプ

第10章 シンタクチックフォーム市場:形状別

- イントロダクション

- ブロック

- シート・ロッド

第11章 シンタクチックフォーム市場:化学別

- イントロダクション

- エポキシ

- ポリプロピレン

- その他の化学

第12章 シンタクチックフォーム市場:最終用途産業別

- イントロダクション

- 海洋・海底

- 航空宇宙・防衛

- スポーツ・レジャー

- 自動車・輸送

- その他の最終用途産業

第13章 シンタクチックフォーム市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- フランス

- 英国

- イタリア

- スペイン

- ロシア

- その他の欧州

- アジア太平洋

- 中国

- インド

- 日本

- 韓国

- その他のアジア太平洋

- 中東・アフリカ

- GCC諸国

- 南アフリカ

- その他の中東・アフリカ

- 南米

- ブラジル

- アルゼンチン

- その他の南米

第14章 競合情勢

- 概要

- 市場シェア分析

- 製品の比較

- 企業の評価マトリクス:主要企業(2023年)

- 企業の評価マトリクス:スタートアップ/中小企業(2023年)

- 競合シナリオ

第15章 企業プロファイル

- 主要企業

- AKZONOBEL N.V.

- ALCEN

- TRELLEBORG AB

- RESINEX TRADING S.R.L.

- ESCO TECHNOLOGIES INC.

- MATRIX COMPOSITES & ENGINEERING

- DIAB GROUP

- PPG INDUSTRIES, INC.

- DEEPWATER BUOYANCY, INC.

- BALMORAL GROUP

- その他の企業

- ACOUSTIC POLYMERS LTD

- TAIZHOU CBM-FUTURE NEW MATERIALS S&T CO., LTD.

- PRECISION ACOUSTICS LTD.

- ORIENTAL OCEAN TECH.

- AIS

- SYNFOAM

- COCOBUOYANCY

- F-TEC PTY LTD

- BASE MATERIALS LTD

- NUCLEAD MANUFACTURING CO INC

- THERMAL MITIGATION TECHNOLOGIES, LLC.

- CGP EUROPE

- RIZHAO FLOAT NEW MATERIALS CO., LTD

- QINGDAO DOOWIN MARINE ENGINEERING CO., LTD

第16章 隣接市場と関連市場

- イントロダクション

- 複合材料市場

- 市場の定義

- 市場の概要

- 複合材料市場:製造プロセス別

- 複合材料市場:繊維タイプ別

- 複合材料市場:樹脂タイプ別

- 複合材料市場:最終用途産業別

- 複合材料市場:地域別

第17章 付録

List of Tables

- TABLE 1 ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 2 AVERAGE TARIFF OF GLASS MICROSPHERES <= 1 MM IN DIAMETER

- TABLE 3 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 4 SOUTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 5 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY FILLER TYPE (USD/KG), 2024

- TABLE 9 AVERAGE SELLING PRICE TREND OF SYNTACTIC FOAM BY REGION, 2023-2026 (USD/KG)

- TABLE 10 IMPORT DATA FOR HS CODE 701820-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 11 EXPORT DATA FOR HS CODE 701820-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 12 IMPORT DATA FOR HS CODE 390730-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 13 EXPORT DATA FOR HS CODE 390730-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 14 KEY PATENTS, 2021-2024

- TABLE 15 SYNTACTIC FOAM: KEY CONFERENCES AND EVENTS, 2025

- TABLE 16 PORTER'S FIVE FORCES ANALYSIS

- TABLE 17 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES

- TABLE 18 KEY BUYING CRITERIA FOR TOP THREE END-USE INDUSTRIES

- TABLE 19 GLOBAL GDP GROWTH PROJECTIONS, BY REGION, 2021-2028 (USD TRILLION)

- TABLE 20 SYNTACTIC FOAM MARKET, BY PRODUCT TYPE, 2023-2030 (USD THOUSAND)

- TABLE 21 SYNTACTIC FOAM MARKET, BY PRODUCT TYPE, 2023-2030 (TON)

- TABLE 22 SYNTACTIC FOAM MARKET, BY MATRIX TYPE, 2023-2030 (USD THOUSAND)

- TABLE 23 SYNTACTIC FOAM MARKET, BY MATRIX TYPE, 2023-2030 (TON)

- TABLE 24 SYNTACTIC FOAM MARKET, BY FILLER TYPE, 2023-2030 (USD THOUSAND)

- TABLE 25 SYNTACTIC FOAM MARKET, BY FILLER TYPE, 2023-2030 (TON)

- TABLE 26 SYNTACTIC FOAM MARKET, BY FORM, 2023-2030 (USD THOUSAND)

- TABLE 27 SYNTACTIC FOAM MARKET, BY FORM, 2023-2030 (TON)

- TABLE 28 SYNTACTIC FOAM MARKET, BY CHEMISTRY, 2023-2030 (USD THOUSAND)

- TABLE 29 SYNTACTIC FOAM MARKET, BY CHEMISTRY, 2023-2030 (TON)

- TABLE 30 SYNTACTIC FOAM MARKET, BY END-USE INDUSTRY, 2023-2030 (USD THOUSAND)

- TABLE 31 SYNTACTIC FOAM MARKET, BY END-USE INDUSTRY, 2023-2030 (TON)

- TABLE 32 SYNTACTIC FOAM MARKET, BY REGION, 2023-2030 (USD THOUSAND)

- TABLE 33 SYNTACTIC FOAM MARKET, BY REGION, 2023-2030 (TON)

- TABLE 34 NORTH AMERICA: SYNTACTIC FOAM MARKET, BY COUNTRY, 2023-2030 (USD THOUSAND)

- TABLE 35 NORTH AMERICA: SYNTACTIC FOAM MARKET, BY COUNTRY, 2023-2030 (TON)

- TABLE 36 NORTH AMERICA: SYNTACTIC FOAM MARKET, BY FORM, 2023-2030 (USD THOUSAND)

- TABLE 37 NORTH AMERICA: SYNTACTIC FOAM MARKET, BY FORM, 2023-2030 (TON)

- TABLE 38 NORTH AMERICA: SYNTACTIC FOAM MARKET, BY END-USE INDUSTRY, 2023-2030 (USD THOUSAND)

- TABLE 39 NORTH AMERICA: SYNTACTIC FOAM MARKET, BY END-USE INDUSTRY, 2023-2030 (TON)

- TABLE 40 NORTH AMERICA: SYNTACTIC FOAM MARKET, BY FILLER TYPE, 2023-2030 (USD THOUSAND)

- TABLE 41 NORTH AMERICA: SYNTACTIC FOAM MARKET, BY FILLER TYPE, 2023-2030 (TON)

- TABLE 42 NORTH AMERICA: SYNTACTIC FOAM MARKET, BY PRODUCT TYPE, 2023-2030 (USD THOUSAND)

- TABLE 43 NORTH AMERICA: SYNTACTIC FOAM MARKET, BY PRODUCT TYPE, 2023-2030 (TON)

- TABLE 44 US: SYNTACTIC FOAM MARKET, BY FORM, 2023-2030 (USD THOUSAND)

- TABLE 45 US: SYNTACTIC FOAM MARKET, BY FORM, 2023-2030 (TON)

- TABLE 46 US: SYNTACTIC FOAM MARKET, BY END-USE INDUSTRY, 2023-2030 (USD THOUSAND)

- TABLE 47 US: SYNTACTIC FOAM MARKET, BY END-USE INDUSTRY,2023-2030 (TON)

- TABLE 48 CANADA: SYNTACTIC FOAM MARKET, BY FORM, 2023-2030 (USD THOUSAND)

- TABLE 49 CANADA: SYNTACTIC FOAM MARKET, BY FORM, 2023-2030 (TON)

- TABLE 50 CANADA: SYNTACTIC FOAM MARKET, BY END-USE INDUSTRY, 2023-2030 (USD THOUSAND)

- TABLE 51 CANADA: SYNTACTIC FOAM MARKET, BY END-USE INDUSTRY, 2023-2030 (TON)

- TABLE 52 MEXICO: SYNTACTIC FOAM MARKET, BY FORM, 2023-2030 (USD THOUSAND)

- TABLE 53 MEXICO: SYNTACTIC FOAM MARKET, BY FORM, 2023-2030 (TON)

- TABLE 54 MEXICO: SYNTACTIC FOAM MARKET, BY END-USE INDUSTRY, 2023-2030 (USD THOUSAND)

- TABLE 55 MEXICO: SYNTACTIC FOAM MARKET, BY END-USE INDUSTRY, 2023-2030 (TON)

- TABLE 56 EUROPE: SYNTACTIC FOAM MARKET, BY COUNTRY, 2023-2030 (USD THOUSAND)

- TABLE 57 EUROPE: SYNTACTIC FOAM MARKET, BY COUNTRY, 2023-2030 (TON)

- TABLE 58 EUROPE: SYNTACTIC FOAM MARKET, BY FORM, 2023-2030 (USD THOUSAND)

- TABLE 59 EUROPE: SYNTACTIC FOAM MARKET, BY FORM, 2023-2030 (TON)

- TABLE 60 EUROPE: SYNTACTIC FOAM MARKET, BY END-USE INDUSTRY, 2023-2030 (USD THOUSAND)

- TABLE 61 EUROPE: SYNTACTIC FOAM MARKET, BY END-USE INDUSTRY, 2023-2030 (TON)

- TABLE 62 EUROPE: SYNTACTIC FOAM MARKET, BY FILLER TYPE, 2023-2030 (USD THOUSAND)

- TABLE 63 EUROPE: SYNTACTIC FOAM MARKET, BY FILLER TYPE, 2023-2030 (TON)

- TABLE 64 EUROPE: SYNTACTIC FOAM MARKET, BY PRODUCT TYPE, 2023-2030 (USD THOUSAND)

- TABLE 65 EUROPE: SYNTACTIC FOAM MARKET, BY PRODUCT TYPE, 2023-2030 (TON)

- TABLE 66 GERMANY: SYNTACTIC FOAM MARKET, BY FORM, 2023-2030 (USD THOUSAND)

- TABLE 67 GERMANY: SYNTACTIC FOAM MARKET, BY FORM, 2023-2030 (TON)

- TABLE 68 GERMANY: SYNTACTIC FOAM MARKET, BY END-USE INDUSTRY, 2023-2030 (USD THOUSAND)

- TABLE 69 GERMANY: SYNTACTIC FOAM MARKET, BY END-USE INDUSTRY, 2023-2030 (TON)

- TABLE 70 FRANCE: SYNTACTIC FOAM MARKET, BY FORM, 2023-2030 (USD THOUSAND)

- TABLE 71 FRANCE: SYNTACTIC FOAM MARKET, BY FORM, 2023-2030 (TON)

- TABLE 72 FRANCE: SYNTACTIC FOAM MARKET, BY END-USE INDUSTRY, 2023-2030 (USD THOUSAND)

- TABLE 73 FRANCE: SYNTACTIC FOAM MARKET, BY END-USE INDUSTRY, 2023-2030 (TON)

- TABLE 74 UK: SYNTACTIC FOAM MARKET, BY FORM, 2023-2030 (USD THOUSAND)

- TABLE 75 UK: SYNTACTIC FOAM MARKET, BY FORM, 2023-2030 (TON)

- TABLE 76 UK: SYNTACTIC FOAM MARKET, BY END-USE INDUSTRY, 2023-2030 (USD THOUSAND)

- TABLE 77 UK: SYNTACTIC FOAM MARKET, BY END-USE INDUSTRY, 2023-2030 (TON)

- TABLE 78 ITALY: SYNTACTIC FOAM MARKET, BY FORM, 2023-2030 (USD THOUSAND)

- TABLE 79 ITALY: SYNTACTIC FOAM MARKET, BY FORM, 2023-2030 (TON)

- TABLE 80 ITALY: SYNTACTIC FOAM MARKET, BY END-USE INDUSTRY, 2023-2030 (USD THOUSAND)

- TABLE 81 ITALY: SYNTACTIC FOAM MARKET, BY END-USE INDUSTRY, 2023-2030 (TON)

- TABLE 82 SPAIN: SYNTACTIC FOAM MARKET, BY FORM, 2023-2030 (USD THOUSAND)

- TABLE 83 SPAIN: SYNTACTIC FOAM MARKET, BY FORM, 2023-2030 (TON)

- TABLE 84 SPAIN: SYNTACTIC FOAM MARKET, BY END-USE INDUSTRY, 2023-2030 (USD THOUSAND)

- TABLE 85 SPAIN: SYNTACTIC FOAM MARKET, BY END-USE INDUSTRY, 2023-2030 (TON)

- TABLE 86 RUSSIA: SYNTACTIC FOAM MARKET, BY FORM, 2023-2030 (USD THOUSAND)

- TABLE 87 RUSSIA: SYNTACTIC FOAM MARKET, BY FORM, 2023-2030 (TON)

- TABLE 88 RUSSIA: SYNTACTIC FOAM MARKET, BY END-USE INDUSTRY, 2023-2030 (USD THOUSAND)

- TABLE 89 RUSSIA: SYNTACTIC FOAM MARKET, BY END-USE INDUSTRY, 2023-2030 (TON)

- TABLE 90 REST OF EUROPE: SYNTACTIC FOAM MARKET, BY FORM, 2023-2030 (USD THOUSAND)

- TABLE 91 REST OF EUROPE: SYNTACTIC FOAM MARKET, BY FORM, 2023-2030 (TON)

- TABLE 92 REST OF EUROPE: SYNTACTIC FOAM MARKET, BY END-USE INDUSTRY, 2023-2030 (USD THOUSAND)

- TABLE 93 REST OF EUROPE: SYNTACTIC FOAM MARKET, BY END-USE INDUSTRY, 2023-2030 (TON)

- TABLE 94 ASIA PACIFIC: SYNTACTIC FOAM MARKET, BY COUNTRY, 2023-2030 (USD THOUSAND)

- TABLE 95 ASIA PACIFIC: SYNTACTIC FOAM MARKET, BY COUNTRY, 2023-2030 (TON)

- TABLE 96 ASIA PACIFIC: SYNTACTIC FOAM MARKET, BY FORM, 2023-2030 (USD THOUSAND)

- TABLE 97 ASIA PACIFIC: SYNTACTIC FOAM MARKET, BY FORM, 2023-2030 (TON)

- TABLE 98 ASIA PACIFIC: SYNTACTIC FOAM MARKET, BY END-USE INDUSTRY, 2023-2030 (USD THOUSAND)

- TABLE 99 ASIA PACIFIC: SYNTACTIC FOAM MARKET, BY END-USE INDUSTRY, 2023-2030 (TON)

- TABLE 100 ASIA PACIFIC: SYNTACTIC FOAM MARKET, BY FILLER TYPE, 2023-2030 (USD THOUSAND)

- TABLE 101 ASIA PACIFIC: SYNTACTIC FOAM MARKET, BY FILLER TYPE, 2023-2030 (TON)

- TABLE 102 ASIA PACIFIC: SYNTACTIC FOAM MARKET, BY PRODUCT TYPE, 2023-2030 (USD THOUSAND)

- TABLE 103 ASIA PACIFIC: SYNTACTIC FOAM MARKET, BY PRODUCT TYPE, 2023-2030 (TON)

- TABLE 104 CHINA: SYNTACTIC FOAM MARKET, BY FORM, 2023-2030 (USD THOUSAND)

- TABLE 105 CHINA: SYNTACTIC FOAM MARKET, BY FORM, 2023-2030 (TON)

- TABLE 106 CHINA: SYNTACTIC FOAM MARKET, BY END-USE INDUSTRY, 2023-2030 (USD THOUSAND)

- TABLE 107 CHINA: SYNTACTIC FOAM MARKET, BY END-USE INDUSTRY, 2023-2030 (TON)

- TABLE 108 INDIA: SYNTACTIC FOAM MARKET, BY FORM, 2023-2030 (USD THOUSAND)

- TABLE 109 INDIA: SYNTACTIC FOAM MARKET, BY FORM, 2023-2030 (TON)

- TABLE 110 INDIA: SYNTACTIC FOAM MARKET, BY END-USE INDUSTRY, 2023-2030 (USD THOUSAND)

- TABLE 111 INDIA: SYNTACTIC FOAM MARKET, BY END-USE INDUSTRY, 2023-2030 (TON)

- TABLE 112 JAPAN: SYNTACTIC FOAM MARKET, BY FORM, 2023-2030 (USD THOUSAND)

- TABLE 113 JAPAN: SYNTACTIC FOAM MARKET, BY FORM, 2023-2030 (TON)

- TABLE 114 JAPAN: SYNTACTIC FOAM MARKET, BY END-USE INDUSTRY, 2023-2030 (USD THOUSAND)

- TABLE 115 JAPAN: SYNTACTIC FOAM MARKET, BY END-USE INDUSTRY, 2023-2030 (TON)

- TABLE 116 SOUTH KOREA: SYNTACTIC FOAM MARKET, BY FORM, 2023-2030 (USD THOUSAND)

- TABLE 117 SOUTH KOREA: SYNTACTIC FOAM MARKET, BY FORM, 2023-2030 (TON)

- TABLE 118 SOUTH KOREA: SYNTACTIC FOAM MARKET, BY END-USE INDUSTRY, 2023-2030 (USD THOUSAND)

- TABLE 119 SOUTH KOREA: SYNTACTIC FOAM MARKET, BY END-USE INDUSTRY, 2023-2030 (TON)

- TABLE 120 REST OF ASIA PACIFIC: SYNTACTIC FOAM MARKET, BY FORM, 2023-2030 (USD THOUSAND)

- TABLE 121 REST OF ASIA PACIFIC: SYNTACTIC FOAM MARKET, BY FORM, 2023-2030 (TON)

- TABLE 122 REST OF ASIA PACIFIC: SYNTACTIC FOAM MARKET, BY END-USE INDUSTRY, 2023-2030 (USD THOUSAND)

- TABLE 123 REST OF ASIA PACIFIC: SYNTACTIC FOAM MARKET, BY END-USE INDUSTRY, 2023-2030 (TON)

- TABLE 124 MIDDLE EAST & AFRICA: SYNTACTIC FOAM MARKET, BY COUNTRY, 2023-2030 (USD THOUSAND)

- TABLE 125 MIDDLE EAST & AFRICA: SYNTACTIC FOAM MARKET, BY COUNTRY, 2023-2030 (TON)

- TABLE 126 MIDDLE EAST & AFRICA: SYNTACTIC FOAM MARKET, BY FORM, 2023-2030 (USD THOUSAND)

- TABLE 127 MIDDLE EAST & AFRICA: SYNTACTIC FOAM MARKET, BY FORM, 2023-2030 (TON)

- TABLE 128 MIDDLE EAST & AFRICA: SYNTACTIC FOAM MARKET, BY END-USE INDUSTRY, 2023-2030 (USD THOUSAND)

- TABLE 129 MIDDLE EAST & AFRICA: SYNTACTIC FOAM MARKET, BY END-USE INDUSTRY, 2023-2030 (TON)

- TABLE 130 MIDDLE EAST & AFRICA: SYNTACTIC FOAM MARKET, BY FILLER TYPE, 2023-2030 (USD THOUSAND)

- TABLE 131 MIDDLE EAST & AFRICA: SYNTACTIC FOAM MARKET, BY FILLER TYPE, 2023-2030 (TON)

- TABLE 132 MIDDLE EAST & AFRICA: SYNTACTIC FOAM MARKET, BY PRODUCT TYPE, 2023-2030 (USD THOUSAND)

- TABLE 133 MIDDLE EAST & AFRICA: SYNTACTIC FOAM MARKET, BY PRODUCT TYPE, 2023-2030 (TON)

- TABLE 134 GCC COUNTRIES: SYNTACTIC FOAM MARKET, BY FORM, 2023-2030 (USD THOUSAND)

- TABLE 135 GCC COUNTRIES: SYNTACTIC FOAM MARKET, BY FORM, 2023-2030 (TON)

- TABLE 136 GCC COUNTRIES: SYNTACTIC FOAM MARKET, BY END-USE INDUSTRY, 2023-2030 (USD THOUSAND)

- TABLE 137 GCC COUNTRIES: SYNTACTIC FOAM MARKET, BY END-USE INDUSTRY, 2023-2030 (TON)

- TABLE 138 UAE: SYNTACTIC FOAM MARKET, BY FORM, 2023-2030 (USD THOUSAND)

- TABLE 139 UAE: SYNTACTIC FOAM MARKET, BY FORM, 2023-2030 (TON)

- TABLE 140 UAE: SYNTACTIC FOAM MARKET, BY END-USE INDUSTRY, 2023-2030 (USD THOUSAND)

- TABLE 141 UAE: SYNTACTIC FOAM MARKET, BY END-USE INDUSTRY, 2023-2030 (TON)

- TABLE 142 SAUDI ARABIA: SYNTACTIC FOAM MARKET, BY FORM, 2023-2030 (USD THOUSAND)

- TABLE 143 SAUDI ARABIA: SYNTACTIC FOAM MARKET, BY FORM, 2023-2030 (TON)

- TABLE 144 SAUDI ARABIA: SYNTACTIC FOAM MARKET, BY END-USE INDUSTRY, 2023-2030 (USD THOUSAND)

- TABLE 145 SAUDI ARABIA: SYNTACTIC FOAM MARKET, BY END-USE INDUSTRY, 2023-2030 (TON)

- TABLE 146 REST OF GCC COUNTRIES: SYNTACTIC FOAM MARKET, BY FORM, 2023-2030 (USD THOUSAND)

- TABLE 147 REST OF GCC COUNTRIES: SYNTACTIC FOAM MARKET, BY FORM, 2023-2030 (TON)

- TABLE 148 REST OF GCC COUNTRIES: SYNTACTIC FOAM MARKET, BY END-USE INDUSTRY, 2023-2030 (USD THOUSAND)

- TABLE 149 REST OF GCC COUNTRIES: SYNTACTIC FOAM MARKET, BY END-USE INDUSTRY, 2023-2030 (TON)

- TABLE 150 SOUTH AFRICA: SYNTACTIC FOAM MARKET, BY FORM, 2023-2030 (USD THOUSAND)

- TABLE 151 SOUTH AFRICA: SYNTACTIC FOAM MARKET, BY FORM, 2023-2030 (TON)

- TABLE 152 SOUTH AFRICA: SYNTACTIC FOAM MARKET, BY END-USE INDUSTRY, 2023-2030 (USD THOUSAND)

- TABLE 153 SOUTH AFRICA: SYNTACTIC FOAM MARKET, BY END-USE INDUSTRY, 2023-2030 (TON)

- TABLE 154 REST OF MIDDLE EAST & AFRICA: SYNTACTIC FOAM MARKET, BY FORM, 2023-2030 (USD THOUSAND)

- TABLE 155 REST OF MIDDLE EAST & AFRICA: SYNTACTIC FOAM MARKET, BY FORM, 2023-2030 (TON)

- TABLE 156 REST OF MIDDLE EAST & AFRICA: SYNTACTIC FOAM MARKET, BY END-USE INDUSTRY, 2023-2030 (USD THOUSAND)

- TABLE 157 REST OF MIDDLE EAST & AFRICA: SYNTACTIC FOAM MARKET, BY END-USE INDUSTRY, 2023-2030 (TON)

- TABLE 158 SOUTH AMERICA: SYNTACTIC FOAM MARKET, BY COUNTRY, 2023-2030 (USD THOUSAND)

- TABLE 159 SOUTH AMERICA: SYNTACTIC FOAM MARKET, BY COUNTRY, 2023-2030 (TON)

- TABLE 160 SOUTH AMERICA: SYNTACTIC FOAM MARKET, BY FORM, 2023-2030 (USD THOUSAND)

- TABLE 161 SOUTH AMERICA: SYNTACTIC FOAM MARKET, BY FORM, 2023-2030 (TON)

- TABLE 162 SOUTH AMERICA: SYNTACTIC FOAM MARKET, BY END-USE INDUSTRY, 2023-2030 (USD THOUSAND)

- TABLE 163 SOUTH AMERICA: SYNTACTIC FOAM MARKET, BY END-USE INDUSTRY, 2023-2030 (TON)

- TABLE 164 SOUTH AMERICA: SYNTACTIC FOAM MARKET, BY FILLER TYPE, 2023-2030 (USD THOUSAND)

- TABLE 165 SOUTH AMERICA: SYNTACTIC FOAM MARKET, BY FILLER TYPE, 2023-2030 (TON)

- TABLE 166 SOUTH AMERICA: SYNTACTIC FOAM MARKET, BY PRODUCT TYPE, 2023-2030 (USD THOUSAND)

- TABLE 167 SOUTH AMERICA: SYNTACTIC FOAM MARKET, BY PRODUCT TYPE, 2023-2030 (TON)

- TABLE 168 BRAZIL: SYNTACTIC FOAM MARKET, BY FORM, 2023-2030 (USD THOUSAND)

- TABLE 169 BRAZIL: SYNTACTIC FOAM MARKET, BY FORM, 2023-2030 (TON)

- TABLE 170 BRAZIL: SYNTACTIC FOAM MARKET, BY END-USE INDUSTRY, 2023-2030 (USD THOUSAND)

- TABLE 171 BRAZIL: SYNTACTIC FOAM MARKET, BY END-USE INDUSTRY, 2023-2030 (TON)

- TABLE 172 ARGENTINA: SYNTACTIC FOAM MARKET, BY FORM, 2023-2030 (USD THOUSAND)

- TABLE 173 ARGENTINA: SYNTACTIC FOAM MARKET, BY FORM, 2023-2030 (TON)

- TABLE 174 ARGENTINA: SYNTACTIC FOAM MARKET, BY END-USE INDUSTRY, 2023-2030 (USD THOUSAND)

- TABLE 175 ARGENTINA: SYNTACTIC FOAM MARKET, BY END-USE INDUSTRY, 2023-2030 (TON)

- TABLE 176 REST OF SOUTH AMERICA: SYNTACTIC FOAM MARKET, BY FORM, 2023-2030 (USD THOUSAND)

- TABLE 177 REST OF SOUTH AMERICA: SYNTACTIC FOAM MARKET, BY FORM, 2023-2030 (TON)

- TABLE 178 REST OF SOUTH AMERICA: SYNTACTIC FOAM MARKET, BY END-USE INDUSTRY, 2023-2030 (USD THOUSAND)

- TABLE 179 REST OF SOUTH AMERICA: SYNTACTIC FOAM MARKET, BY END-USE INDUSTRY, 2023-2030 (TON)

- TABLE 180 SYNTACTIC FOAM MARKET: OVERVIEW OF STRATEGIES ADOPTED BY MARKET PLAYERS BETWEEN JANUARY 2021 AND MARCH 2025

- TABLE 181 SYNTACTIC FOAM MARKET: DEGREE OF COMPETITION

- TABLE 182 SYNTACTIC FOAM MARKET: REGION FOOTPRINT

- TABLE 183 SYNTACTIC FOAM MARKET: PRODUCT TYPE FOOTPRINT

- TABLE 184 SYNTACTIC FOAM MARKET: MATRIX TYPE FOOTPRINT

- TABLE 185 SYNTACTIC FOAM MARKET: FILLER TYPE FOOTPRINT

- TABLE 186 SYNTACTIC FORM MARKET: FORM FOOTPRINT

- TABLE 187 SYNTACTIC FOAM MARKET: CHEMISTRY FOOTPRINT

- TABLE 188 SYNTACTIC FOAM MARKET: END-USE INDUSTRY FOOTPRINT

- TABLE 189 SYNTACTIC FOAM MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 190 SYNTACTIC FOAM MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES (1/1)

- TABLE 191 SYNTACTIC FOAM MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES (1/2)

- TABLE 192 SYNTACTIC FOAM MARKET: DEALS, JANUARY 2021-MARCH 2025

- TABLE 193 SYNTACTIC FOAM MARKET: EXPANSIONS, JANUARY 2021-MARCH 2025

- TABLE 194 SYNTACTIC FOAM MARKET: OTHERS, JANUARY 2021-MARCH 2025

- TABLE 195 AKZONOBEL N.V.: COMPANY OVERVIEW

- TABLE 196 AKZONOBEL N.V.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 197 AKZONOBEL N.V.: DEALS, JANUARY 2021-MARCH 2025

- TABLE 198 AKZONOBEL N.V.: EXPANSIONS, JANUARY 2021-MARCH 2025

- TABLE 199 ALCEN: COMPANY OVERVIEW

- TABLE 200 ALCEN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 201 TRELLEBORG AB: COMPANY OVERVIEW

- TABLE 202 TRELLEBORG AB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 203 TRELLEBORG AB: EXPANSIONS, JANUARY 2021-MARCH 2025

- TABLE 204 RESINEX TRADING S.R.L.: COMPANY OVERVIEW

- TABLE 205 RESINEX TRADING S.R.L.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 206 RESINEX TRADING S.R.L.: DEALS, JANUARY 2021-MARCH 2025

- TABLE 207 ESCO TECHNOLOGIES INC.: COMPANY OVERVIEW

- TABLE 208 ESCO TECHNOLOGIES INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 209 ESCO TECHNOLOGIES INC.: EXPANSIONS, JANUARY 2021-MARCH 2025

- TABLE 210 MATRIX COMPOSITES & ENGINEERING: COMPANY OVERVIEW

- TABLE 211 MATRIX COMPOSITES & ENGINEERING: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 212 MATRIX COMPOSITES & ENGINEERING: DEALS, JANUARY 2021-MARCH 2025

- TABLE 213 MATRIX COMPOSITES & ENGINEERING: OTHERS, JANUARY 2021-MARCH 2025

- TABLE 214 DIAB GROUP: COMPANY OVERVIEW

- TABLE 215 DIAB GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 216 DIAB GROUP: DEALS, JANUARY 2021-MARCH 2025

- TABLE 217 PPG INDUSTRIES, INC.: COMPANY OVERVIEW

- TABLE 218 PPG INDUSTRIES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 219 DEEPWATER BUOYANCY, INC.: COMPANY OVERVIEW

- TABLE 220 DEEPWATER BUOYANCY, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 221 DEEPWATER BUOYANCY, INC.: DEALS, JANUARY 2021-MARCH 2025

- TABLE 222 DEEPWATER BUOYANCY, INC.: OTHERS, JANUARY 2021-MARCH 2025

- TABLE 223 BALMORAL GROUP: COMPANY OVERVIEW

- TABLE 224 BALMORAL GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 225 BALMORAL GROUP: OTHERS, JANUARY 2021-MARCH 2025

- TABLE 226 ACOUSTIC POLYMERS LTD: COMPANY OVERVIEW

- TABLE 227 TAIZHOU CBM-FUTURE NEW MATERIALS S&T CO., LTD.: COMPANY OVERVIEW

- TABLE 228 PRECISION ACOUSTICS LTD.: COMPANY OVERVIEW

- TABLE 229 ORIENTAL OCEAN TECH.: COMPANY OVERVIEW

- TABLE 230 AIS: COMPANY OVERVIEW

- TABLE 231 SYNFOAM: COMPANY OVERVIEW

- TABLE 232 COCOBUOYANCY: COMPANY OVERVIEW

- TABLE 233 F-TEC PTY LTD: COMPANY OVERVIEW

- TABLE 234 BASE MATERIALS LTD: COMPANY OVERVIEW

- TABLE 235 NUCLEAD MANUFACTURING CO INC: COMPANY OVERVIEW

- TABLE 236 THERMAL MITIGATION TECHNOLOGIES, LLC.: COMPANY OVERVIEW

- TABLE 237 CGP EUROPE: COMPANY OVERVIEW

- TABLE 238 RIZHAO FLOAT NEW MATERIALS CO., LTD: COMPANY OVERVIEW

- TABLE 239 QINGDAO DOOWIN MARINE ENGINEERING CO., LTD: COMPANY OVERVIEW

- TABLE 240 COMPOSITES MARKET, BY MANUFACTURING PROCESS, 2020-2022 (USD MILLION)

- TABLE 241 COMPOSITES MARKET, BY MANUFACTURING PROCESS, 2020-2022 (KILOTON)

- TABLE 242 COMPOSITES MARKET, BY MANUFACTURING PROCESS, 2023-2028 (USD MILLION)

- TABLE 243 COMPOSITES MARKET, BY MANUFACTURING PROCESS, 2023-2028 (KILOTON)

- TABLE 244 COMPOSITES MARKET, BY FIBER TYPE, 2020-2022 (USD MILLION)

- TABLE 245 COMPOSITES MARKET, BY FIBER TYPE, 2020-2022 (KILOTON)

- TABLE 246 COMPOSITES MARKET, BY FIBER TYPE, 2023-2028 (USD MILLION)

- TABLE 247 COMPOSITES MARKET, BY FIBER TYPE, 2023-2028 (KILOTON)

- TABLE 248 COMPOSITES MARKET, BY RESIN TYPE, 2020-2022 (USD MILLION)

- TABLE 249 COMPOSITES MARKET, BY RESIN TYPE, 2020-2022 (KILOTON)

- TABLE 250 COMPOSITES MARKET, BY RESIN TYPE, 2023-2028 (USD MILLION)

- TABLE 251 COMPOSITES MARKET, BY RESIN TYPE, 2023-2028 (KILOTON)

- TABLE 252 COMPOSITES MARKET, BY END-USE INDUSTRY, 2020-2022 (USD MILLION)

- TABLE 253 COMPOSITES MARKET, BY END-USE INDUSTRY, 2020-2022 (KILOTON)

- TABLE 254 COMPOSITES MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 255 COMPOSITES MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- TABLE 256 COMPOSITES MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 257 COMPOSITES MARKET, BY REGION, 2020-2022 (KILOTON)

- TABLE 258 COMPOSITES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 259 COMPOSITES MARKET, BY REGION, 2023-2028 (KILOTON)

List of Figures

- FIGURE 1 SYNTACTIC FOAM MARKET: RESEARCH DESIGN

- FIGURE 2 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 3 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 4 SYNTACTIC FOAM MARKET: APPROACH 1

- FIGURE 5 SYNTACTIC FOAM MARKET: DATA TRIANGULATION

- FIGURE 6 MICRO-SPHERE SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 7 POLYMER MATRIX SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 8 GLASS SEGMENT TO DOMINATE MARKET IN 2030

- FIGURE 9 BLOCK SEGMENT TO DOMINATE MARKET IN 2030

- FIGURE 10 EPOXY SEGMENT TO DOMINATE MARKET IN 2030

- FIGURE 11 MARINE & SUBSEA SEGMENT TO DOMINATE MARKET IN 2030

- FIGURE 12 NORTH AMERICA ACCOUNTED FOR LARGEST SHARE OF SYNTACTIC FOAM MARKET IN 2024

- FIGURE 13 INCREASING OFFSHORE OIL & GAS PRODUCTION AND OCEANOGRAPHIC ACTIVITIES TO DRIVE MARKET

- FIGURE 14 MICRO-SPHERE TO REGISTER HIGHER GROWTH DURING FORECAST PERIOD

- FIGURE 15 POLYMER MATRIX SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 16 GLASS SEGMENT TO DOMINATE MARKET IN 2030

- FIGURE 17 BLOCK SEGMENT TO LEAD MARKET IN 2030

- FIGURE 18 EPOXY SEGMENT TO DOMINATE MARKET IN 2030

- FIGURE 19 MARINE & SUBSEA SEGMENT TO REGISTER FASTEST GROWTH BETWEEN 2025 AND 2030

- FIGURE 20 BLOCK SEGMENT ACCOUNTED FOR LARGER SHARE OF NORTH AMERICA MARKET IN 2024

- FIGURE 21 INDIA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 22 SYNTACTIC FOAM MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 23 NEW OIL AND GAS PRODUCTION DATA FROM OFFSHORE AND ONSHORE FIELDS, 2024

- FIGURE 24 CHANGES IN DEMAND FOR NATURAL GAS

- FIGURE 25 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS BUSINESSES

- FIGURE 26 SYNTACTIC FOAM MARKET: ECOSYSTEM ANALYSIS

- FIGURE 27 SYNTACTIC FOAM MARKET: VALUE CHAIN ANALYSIS

- FIGURE 28 AVERAGE SELLING PRICE TREND OF SYNTACTIC FOAM PROVIDED BY KEY PLAYERS, BY FILLER TYPE, 2024

- FIGURE 29 AVERAGE SELLING PRICE TREND OF SYNTACTIC FOAM, BY REGION, 2023-2026 (USD/KG)

- FIGURE 30 IMPORT DATA FOR HS CODE 701820-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD MILLION)

- FIGURE 31 EXPORT DATA FOR HS CODE 701820-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD MILLION)

- FIGURE 32 IMPORT DATA FOR HS CODE 390730-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD MILLION)

- FIGURE 33 EXPORT DATA FOR HS CODE 390730-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD MILLION)

- FIGURE 34 PATENTS APPLIED AND GRANTED, 2013-2024

- FIGURE 35 JURISDICTION ANALYSIS, 2013-2024

- FIGURE 36 IMPACT OF AI ON SYNTACTIC FOAM MARKET

- FIGURE 37 SYNTACTIC FOAM MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 38 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES

- FIGURE 39 KEY BUYING CRITERIA FOR TOP THREE END-USE INDUSTRIES

- FIGURE 40 MCIRO-SPHERE SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 41 POLYMER MATRIX SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 42 GLASS MICRO-SPHERES SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 43 BLOCKS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 44 EPOXY SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 45 MARINE & SUBSEA SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 46 AIRCRAFT SHIPMENTS IN 2024

- FIGURE 47 INDIA TO BE FASTEST-GROWING MARKET FROM 2025 TO 2030

- FIGURE 48 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE OF SYNTACTIC FOAM MARKET DURING FORECAST PERIOD

- FIGURE 49 NORTH AMERICA: SYNTACTIC FOAM MARKET SNAPSHOT

- FIGURE 50 EUROPE: SYNTACTIC FOAM MARKET SNAPSHOT

- FIGURE 51 SYNTACTIC FOAM MARKET SHARE ANALYSIS, 2024

- FIGURE 52 SYNTACTIC FOAM MARKET: PRODUCT COMPARISON

- FIGURE 53 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- FIGURE 54 SYNTACTIC FOAM MARKET: COMPANY FOOTPRINT

- FIGURE 55 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- FIGURE 56 AKZONOBEL N.V.: COMPANY SNAPSHOT

- FIGURE 57 TRELLEBORG AB: COMPANY SNAPSHOT

- FIGURE 58 ESCO TECHNOLOGIES INC.: COMPANY SNAPSHOT

- FIGURE 59 MATRIX COMPOSITES & ENGINEERING: COMPANY SNAPSHOT

- FIGURE 60 PPG INDUSTRIES, INC.: COMPANY SNAPSHOT

The market for syntactic foam was USD 175,000.0 thousand in 2024 and is projected to reach USD 233,929.5 thousand in 2030 at a CAGR of 5%. The rising offshore crude oil production drives the market for syntactic foam and demand from oceanography activities. Oil and gas are the prominent resources required globally. Therefore, companies are exploring offshore oil fields. Syntactic foam provides buoyancy and is the optimal lightweight material for deep-sea applications. It is used in riser floats and deep-sea vehicles like ROV and AUV for defence and oceanography research.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2023-2030 |

| Base Year | 2024 |

| Forecast Period | 2024-2030 |

| Units Considered | Value (USD Thousand), Volume (Ton) |

| Segments | Product type, matrix type, filler type, foam, chemistry, end-use industry, and Region |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, South America |

By Matrix type, polymer matrix accounted for the largest market during the forecast period.

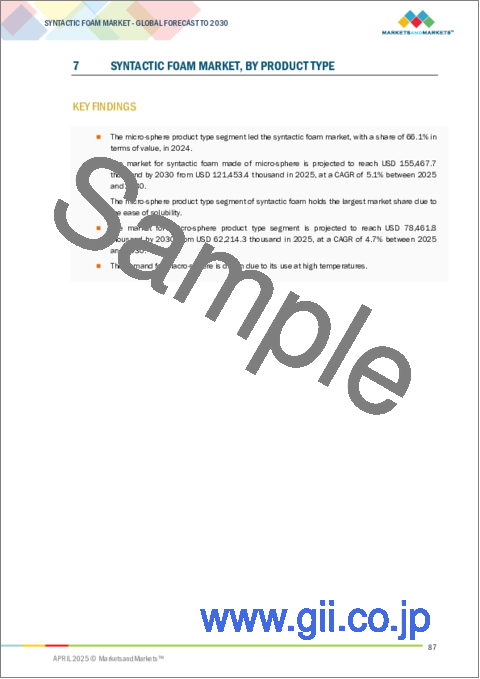

The polymer matrix segment is projected to hold the biggest market share through the forecast period. Microspheres, often composed of glass, are incorporated into a matrix to create syntactic foams. There are three different matrices: ceramic, metal, and polymer. Because of its many benefits, the polymer matrix is the most widely utilized. The hollow microspheres in syntactic foams are held together by a polymer matrix, which gives the composite its desired mechanical, thermal, and acoustic qualities. The performance, application applicability, and environmental resilience of the syntactic foam are all significantly impacted by the polymer selection. Epoxy resin, a thermoset material with superior adhesion, mechanical strength, and chemical resistance, makes up the polymer matrix.

By filler type, the glass micro-spheres segment accounted for the highest CAGR during the forecast period.

The glass micro-spheres segment is expected to attain the highest compound annual growth rate (CAGR) in the syntactic foam market during the forecast period. Due to their extremely low weight, glass microspheres can be used for buoyancy. Their ability to withstand corrosion makes them even more beneficial for use, particularly in deep-sea applications. Syntactic foams resist heat transmission due to their superior thermal insulation qualities, and the glass resists moisture, keeping water out of the syntactic foam substance.

By end-use industry, marine & subsea accounted for the highest CAGR during the forecast period.

By end-use industry, marine & subsea accounted for the highest CAGR, driven by growth in offshore oilfields, oceanography operations, and deep-sea vehicles. As more nations consider and investigate the extraction of hydrocarbons, such as oil and gas, from offshore regions, the number of offshore oil fields is growing. Syntactic foam is utilized in this situation due to its high compressive strength, low density, and superior resistance to hydrostatic pressure and seawater. It is used in studies on structural supports, insulated pipeline coatings, riser buoyancy modules, and subsea buoyancy modules, among other things. For this, ROVs and AUVs are primarily utilized.

BY region, Asia Pacific is projected to account for the highest CAGR during the forecast period.

The Asia Pacific region, including India, China, and the rest of Asia Pacific, is the fastest-growing region in the syntactic foam market. Increased investments in offshore energy, defense modernization, infrastructure development, and lightweight materials for building and mobility are driving syntactic foam adoption in Asia Pacific. One of the main forces for this expansion in the area is the impending offshore oilfield projects and startups. Furthermore, syntactic foams are needed for marine and subsea applications, such as submarines; China, Japan, and India have robust maritime operations.

- By Company Type: Tier 1: 40%, Tier 2: 25%, Tier 3: 35%

- By Designation: C Level: 35%, Director Level: 30%, Others: 35%

- By Region: North America: 25%, Europe: 20%, Asia Pacific: 45%, Middle East & Africa: 5%, and South America: 5%.

Companies Covered:

Akzo Nobel N.V. (Netherlands), ALCEN (France), Trelleborg AB (Sweden), Resinex Trading S.r.l. (Italy), ESCO Technologies Inc. (US), Matrix Composites & Engineering (Australia), DIAB Group (Sweden), PPG Industries, Inc. (US), DeepWater Buoyancy Inc. (US), and Balmoral Group (Scotland) are some key players in syntactic foam Market.

Research Coverage

The study covers the syntactic foam market across various segments. It aims to estimate the market size and the growth potential across different segments based on product type, matrix type, filler type, foam, chemistry, end-use industry, and region. The study also includes an in-depth competitive analysis of key players in the market, their company profiles, key observations related to their products and business offerings, recent developments, and key growth strategies they adopted to improve their position in the syntactic foam market.

Key Benefits of Buying the Report

The report aims to assist market leaders and new entrants in gaining accurate estimates of revenue figures for the overall syntactic foam market, including its segments and sub-segments. This report is projected to help stakeholders understand the market's competitive landscape, gain insights to improve the position of their businesses, and plan suitable go-to-market strategies. The report also aims to help stakeholders understand the pulse of the market and provides them with information on the key market drivers, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (rising offshore crude oil production and demand from oceanography activities), restraints (fluctuations in natural gas demand and prices and environmental and recycling concerns), opportunities (use of syntactic foam in construction and demand from thermoforming applications), and challenges (transportation & logistic costs) influencing the growth of the syntactic foam market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the syntactic foam market

- Market Development: Comprehensive information about profitable markets - the report analyses the syntactic foam market across varied regions

Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the syntactic foam market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players, such as Akzo Nobel N.V. (Netherlands), ALCEN (France), Trelleborg AB (Sweden), Resinex Trading S.r.l. (Italy), ESCO Technologies Inc. (US), Matrix Composites & Engineering (Australia), DIAB Group (Sweden), PPG Industries, Inc. (US), DeepWater Buoyancy Inc. (US), Balmoral Group (Scotland) and others in the syntactic foam market. The report also helps stakeholders understand the pulse of the syntactic foam market and provides them with information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 SYNTACTIC FOAM MARKET SEGMENTATION AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNITS CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 LIMITATIONS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.1.2 List of secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key primary participants

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Breakdown of interviews with experts

- 2.1.2.4 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 TOP-DOWN APPROACH

- 2.2.2 BOTTOM-UP APPROACH

- 2.3 BASE NUMBER CALCULATION

- 2.3.1 SUPPLY-SIDE APPROACH

- 2.4 GROWTH FORECAST

- 2.5 DATA TRIANGULATION

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 FACTOR ANALYSIS

- 2.8 RESEARCH LIMITATIONS

- 2.9 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN SYNTACTIC FOAM MARKET

- 4.2 SYNTACTIC FOAM MARKET, BY PRODUCT TYPE

- 4.3 SYNTACTIC FOAM MARKET, BY MATRIX TYPE

- 4.4 SYNTACTIC FOAM MARKET, BY FILLER TYPE

- 4.5 SYNTACTIC FOAM MARKET, BY FORM

- 4.6 SYNTACTIC FOAM MARKET, BY CHEMISTRY

- 4.7 SYNTACTIC FOAM MARKET, BY END-USE INDUSTRY

- 4.8 NORTH AMERICA: SYNTACTIC FOAM MARKET, BY FORM AND COUNTRY

- 4.9 SYNTACTIC FOAM MARKET, BY KEY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.1.1 DRIVERS

- 5.1.1.1 Rising offshore oil and gas production

- 5.1.1.2 Demand from oceanography activities

- 5.1.2 RESTRAINTS

- 5.1.2.1 Fluctuations in natural gas demand and prices

- 5.1.2.2 Environmental and recycling concerns

- 5.1.3 OPPORTUNITIES

- 5.1.3.1 Development of eco-friendly syntactic foam

- 5.1.3.2 Use of syntactic foams in construction

- 5.1.3.3 Demand from thermoforming applications

- 5.1.4 CHALLENGES

- 5.1.4.1 Limitations of syntactic foam material

- 5.1.4.2 Transportation & logistic costs

- 5.1.4.3 Manufacturing inconsistencies and need for standardization

- 5.1.1 DRIVERS

6 INDUSTRY TRENDS

- 6.1 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.2 ECOSYSTEM ANALYSIS

- 6.3 VALUE CHAIN ANALYSIS

- 6.4 TARIFF AND REGULATORY LANDSCAPE

- 6.4.1 TARIFF DATA RELATED TO SYNTACTIC FOAM

- 6.4.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.4.3 REGULATIONS

- 6.4.3.1 ASTM D35-74 & ASTM D 3039

- 6.4.3.2 DNV-ST-F119

- 6.4.3.3 SOLAS

- 6.5 PRICING ANALYSIS

- 6.5.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY FILLER TYPE, 2024

- 6.5.2 AVERAGE SELLING PRICE TREND, BY REGION

- 6.6 TRADE ANALYSIS

- 6.6.1 IMPORT DATA (HS CODE 701820)

- 6.6.2 EXPORT DATA (HS CODE 701820)

- 6.6.3 IMPORT DATA (HS CODE 390730)

- 6.6.4 EXPORT DATA (HS CODE 390730)

- 6.7 TECHNOLOGY ANALYSIS

- 6.7.1 KEY TECHNOLOGIES

- 6.7.1.1 Mold Casting

- 6.7.2 ADJACENT TECHNOLOGIES

- 6.7.2.1 Stir Casting

- 6.7.2.2 Single Phase Syntactic

- 6.7.3 COMPLEMENTARY TECHNOLOGIES

- 6.7.3.1 Additive Manufacturing

- 6.7.3.2 Computer Numerical Control (CNC) machining

- 6.7.1 KEY TECHNOLOGIES

- 6.8 PATENT ANALYSIS

- 6.9 CASE STUDY ANALYSIS

- 6.9.1 INCREASE IN EFFICIENCY THROUGH AIS'S BUOYANCY MODULES

- 6.9.2 CMT EUROPE BV'S HYTAC WFT THERMOSET SYNTACTIC FOAM HELPS IN IMPROVING THERMOFORMING PROCESS

- 6.9.3 TRELLEBORG AB'S SYNTACTIC FOAM HELPS IN REPETITIVE DIVING OF MANNED SUBMERSIBLE VESSEL

- 6.10 KEY CONFERENCES AND EVENTS, 2025

- 6.11 IMPACT OF AI ON SYNTACTIC FOAM MARKET

- 6.11.1 INTRODUCTION

- 6.12 PORTER'S FIVE FORCES' ANALYSIS

- 6.12.1 THREAT OF NEW ENTRANTS

- 6.12.2 THREAT OF SUBSTITUTES

- 6.12.3 BARGAINING POWER OF SUPPLIERS

- 6.12.4 BARGAINING POWER OF BUYERS

- 6.12.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.13.2 BUYING CRITERIA

- 6.14 MACROECONOMIC ANALYSIS

- 6.14.1 INTRODUCTION

- 6.15 GDP TRENDS AND FORECASTS

- 6.16 IMPACT OF 2025 US TARIFF - SYNTACTIC FOAM MARKET

- 6.16.1 INTRODUCTION

- 6.16.2 KEY TARIFF RATES

- 6.16.3 PRICE IMPACT ANALYSIS

- 6.16.4 IMPACT ON COUNTRY/REGION

- 6.16.4.1 US

- 6.16.4.2 China

- 6.16.4.3 Europe

- 6.16.5 IMPACT ON END-USE INDUSTRIES

7 SYNTACTIC FOAM MARKET, BY PRODUCT TYPE

- 7.1 INTRODUCTION

- 7.2 MICRO-SPHERE

- 7.2.1 ABILITY TO PROVIDE DEEPSEA BUOYANCY TO DRIVE MARKET GROWTH

- 7.3 MACRO-SPHERE

- 7.3.1 PROFICIENCY FOR USE IN LARGE STRUCTURES TO DRIVE MARKET

8 SYNTACTIC FOAM MARKET, BY MATRIX TYPE

- 8.1 INTRODUCTION

- 8.2 METAL

- 8.2.1 USE OF METAL MATRIX SYNTACTIC FOAM IN SANDWICH STRUCTURES TO DRIVE MARKET

- 8.3 POLYMER

- 8.3.1 DEMAND FROM MARINE & SUBSEA MARKET TO DRIVE GROWTH

- 8.4 CERAMIC

- 8.4.1 SUPERIOR QUALITY OF CERAMIC MATRIX TO ENHANCE MARKET GROWTH

9 SYNTACTIC FOAM MARKET, BY FILLER TYPE

- 9.1 INTRODUCTION

- 9.2 GLASS MICRO-SPHERES

- 9.2.1 MULTIPLE PRODUCT ADVANTAGES TO DRIVE MARKET DEMAND

- 9.3 CERAMIC MICRO-SPHERES

- 9.3.1 HIGH TEMPERATURE RESISTANCE OF CERAMIC MICRO-SPHERES TO DRIVE MARKET GROWTH

- 9.4 OTHER FILLER TYPES

10 SYNTACTIC FOAM MARKET, BY FORM

- 10.1 INTRODUCTION

- 10.2 BLOCKS

- 10.2.1 USE IN LARGE STRUCTURES TO DRIVE MARKET DEMAND

- 10.3 SHEET & ROD

- 10.3.1 DEMAND FROM THERMOFORMING INDUSTRY TO DRIVE GROWTH

11 SYNTACTIC FOAM MARKET, BY CHEMISTRY

- 11.1 INTRODUCTION

- 11.2 EPOXY

- 11.2.1 INCREASE IN MARINE & SUBSEA ACTIVITIES TO DRIVE MARKET DEMAND

- 11.3 POLYPROPYLENE

- 11.3.1 PRODUCTION OF SYNTACTIC FOAM USING POLYPROPYLENE REQUIRED TO DRIVE GROWTH

- 11.4 OTHER CHEMISTRIES

12 SYNTACTIC FOAM MARKET, BY END-USE INDUSTRY

- 12.1 INTRODUCTION

- 12.2 MARINE & SUBSEA

- 12.2.1 GROWTH IN OFFSHORE OIL AND GAS PRODUCTION TO DRIVE MARKET

- 12.3 AEROSPACE & DEFENCE

- 12.3.1 INCREASE IN AIR TRAVEL TO INFLUENCE DEMAND

- 12.4 SPORTS & LEISURE

- 12.4.1 BENEFITS OF USE OF SYNTACTIC FOAM IN SPORTS EQUIPMENT TO BOOST DEMAND

- 12.5 AUTOMATIVE & TRANSPORTATION

- 12.5.1 USE OF SYNTACTIC FOAM IN ELECTRIC VEHICLES TO ENHANCE DEMAND

- 12.6 OTHER END-USE INDUSTRIES

13 SYNTACTIC FOAM MARKET, BY REGION

- 13.1 INTRODUCTION

- 13.2 NORTH AMERICA

- 13.2.1 US

- 13.2.1.1 Expanding offshore oil & gas activities and oceanography to drive demand

- 13.2.2 CANADA

- 13.2.2.1 Investment in offshore oil production and participation in oceanographic activities to drive demand

- 13.2.3 MEXICO

- 13.2.3.1 Growing investments in Gulf of Mexico and increased crude oil and natural gas production to drive demand

- 13.2.1 US

- 13.3 EUROPE

- 13.3.1 GERMANY

- 13.3.1.1 Increasing reliance on hydrocarbon imports, exports of automotives, and growing aerospace industry to drive demand

- 13.3.2 FRANCE

- 13.3.2.1 Oceanographic research and increasing adoption of EVs to demand

- 13.3.3 UK

- 13.3.3.1 Growth in EVs and use of syntactic foam in AUVs to propel demand

- 13.3.4 ITALY

- 13.3.4.1 Marine research, aerospace exports, and automotive sector to drive demand

- 13.3.5 SPAIN

- 13.3.5.1 Strong funding in aerospace industry and growing automotive sales and exports to drive market

- 13.3.6 RUSSIA

- 13.3.6.1 Increase in exports of oil and gas and offshore field exploration to drive market

- 13.3.7 REST OF EUROPE

- 13.3.1 GERMANY

- 13.4 ASIA PACIFIC

- 13.4.1 CHINA

- 13.4.1.1 CNOOC's offshore projects and exports of EVs to drive market growth

- 13.4.2 INDIA

- 13.4.2.1 Exploration in offshore fields and investments in oceanographic research to drive demand

- 13.4.3 JAPAN

- 13.4.3.1 Marine research and growth of automobile and electronics industries to drive demand

- 13.4.4 SOUTH KOREA

- 13.4.4.1 Exploration of offshore fields and EV incentives to drive demand

- 13.4.5 REST OF ASIA PACIFIC

- 13.4.1 CHINA

- 13.5 MIDDLE EAST & AFRICA

- 13.5.1 GCC COUNTRIES

- 13.5.1.1 UAE

- 13.5.1.1.1 ADNOC's offshore projects and exploration of new offshore fields to drive market

- 13.5.1.2 Saudi Arabia

- 13.5.1.2.1 Expanding operations of oilfields and natural gas situated offshore, and increase in infrastructure spending to boost growth

- 13.5.1.3 Rest of GCC countries

- 13.5.1.1 UAE

- 13.5.2 SOUTH AFRICA

- 13.5.2.1 Expansion in offshore gas field projects

- 13.5.3 REST OF MIDDLE EAST & AFRICA

- 13.5.1 GCC COUNTRIES

- 13.6 SOUTH AMERICA

- 13.6.1 BRAZIL

- 13.6.1.1 Rising exploration of offshore oil & gas fields to drive market growth

- 13.6.2 ARGENTINA

- 13.6.2.1 Automotive industry to drive market growth

- 13.6.3 REST OF SOUTH AMERICA

- 13.6.1 BRAZIL

14 COMPETITIVE LANDSCAPE

- 14.1 OVERVIEW

- 14.1.1 KEY PLAYERS STRATEGIES/RIGHT TO WIN

- 14.2 MARKET SHARE ANALYSIS

- 14.3 PRODUCT COMPARISON

- 14.4 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 14.4.1 STARS

- 14.4.2 EMERGING LEADERS

- 14.4.3 PERVASIVE PLAYERS

- 14.4.4 PARTICIPANTS

- 14.4.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 14.4.5.1 Company footprint

- 14.4.5.2 Region footprint

- 14.4.5.3 Product type footprint

- 14.4.5.4 Matrix type footprint

- 14.4.5.5 Filler type footprint

- 14.4.5.6 Form footprint

- 14.4.5.7 Chemistry footprint

- 14.4.5.8 End-use industry footprint

- 14.5 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 14.5.1 PROGRESSIVE COMPANIES

- 14.5.2 RESPONSIVE COMPANIES

- 14.5.3 DYNAMIC COMPANIES

- 14.5.4 STARTING BLOCKS

- 14.5.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023

- 14.5.5.1 Detailed list of key startups/SMEs

- 14.5.5.2 Competitive benchmarking of key startups/SMEs

- 14.6 COMPETITIVE SCENARIO

- 14.6.1 DEALS

- 14.6.2 EXPANSIONS

- 14.6.3 OTHERS

15 COMPANY PROFILES

- 15.1 KEY PLAYERS

- 15.1.1 AKZONOBEL N.V.

- 15.1.1.1 Business overview

- 15.1.1.2 Products/Solutions/Services offered

- 15.1.1.3 Recent developments

- 15.1.1.3.1 Deals

- 15.1.1.3.2 Expansions

- 15.1.1.4 MnM view

- 15.1.1.4.1 Right to win

- 15.1.1.4.2 Strategic choices

- 15.1.1.4.3 Weaknesses and competitive threats

- 15.1.2 ALCEN

- 15.1.2.1 Business overview

- 15.1.2.2 Products/Solutions/Services offered

- 15.1.2.3 MnM view

- 15.1.2.3.1 Right to win

- 15.1.2.3.2 Strategic choices

- 15.1.2.3.3 Weaknesses and competitive threats

- 15.1.3 TRELLEBORG AB

- 15.1.3.1 Business overview

- 15.1.3.2 Products/Solutions/Services offered

- 15.1.3.3 Recent developments

- 15.1.3.3.1 Expansions

- 15.1.3.4 MnM view

- 15.1.3.4.1 Right to win

- 15.1.3.4.2 Strategic choices

- 15.1.3.4.3 Weaknesses and competitive threats

- 15.1.4 RESINEX TRADING S.R.L.

- 15.1.4.1 Business overview

- 15.1.4.2 Products/Solutions/Services offered

- 15.1.4.3 Recent developments

- 15.1.4.3.1 Deals

- 15.1.4.4 MnM view

- 15.1.4.4.1 Right to win

- 15.1.4.4.2 Strategic choices

- 15.1.4.4.3 Weaknesses and competitive threats

- 15.1.5 ESCO TECHNOLOGIES INC.

- 15.1.5.1 Business overview

- 15.1.5.2 Products/Solutions/Services offered

- 15.1.5.2.1 Expansions

- 15.1.5.3 MnM view

- 15.1.5.3.1 Right to win

- 15.1.5.3.2 Strategic choices

- 15.1.5.3.3 Weaknesses and competitive threats

- 15.1.6 MATRIX COMPOSITES & ENGINEERING

- 15.1.6.1 Business overview

- 15.1.6.2 Products/Solutions/Services offered

- 15.1.6.3 Recent developments

- 15.1.6.3.1 Deals

- 15.1.6.3.2 Others

- 15.1.6.4 MnM view

- 15.1.6.4.1 Right to win

- 15.1.6.4.2 Strategic choices

- 15.1.6.4.3 Weaknesses and competitive threats

- 15.1.7 DIAB GROUP

- 15.1.7.1 Business overview

- 15.1.7.2 Products/Solutions/Services offered

- 15.1.7.3 Recent developments

- 15.1.7.3.1 Deals

- 15.1.7.4 MnM view

- 15.1.7.4.1 Right to win

- 15.1.7.4.2 Strategic choices

- 15.1.7.4.3 Weaknesses and competitive threats

- 15.1.8 PPG INDUSTRIES, INC.

- 15.1.8.1 Business overview

- 15.1.8.2 Products/Solutions/Services offered

- 15.1.8.3 MnM view

- 15.1.9 DEEPWATER BUOYANCY, INC.

- 15.1.9.1 Business overview

- 15.1.9.2 Products/Solutions/Services offered

- 15.1.9.3 Recent developments

- 15.1.9.3.1 Deals

- 15.1.9.3.2 Others

- 15.1.9.4 MnM view

- 15.1.10 BALMORAL GROUP

- 15.1.10.1 Business overview

- 15.1.10.2 Products/Solutions/Services offered

- 15.1.10.3 Recent developments

- 15.1.10.3.1 Others

- 15.1.10.4 MnM view

- 15.1.1 AKZONOBEL N.V.

- 15.2 OTHER PLAYERS

- 15.2.1 ACOUSTIC POLYMERS LTD

- 15.2.2 TAIZHOU CBM-FUTURE NEW MATERIALS S&T CO., LTD.

- 15.2.3 PRECISION ACOUSTICS LTD.

- 15.2.4 ORIENTAL OCEAN TECH.

- 15.2.5 AIS

- 15.2.6 SYNFOAM

- 15.2.7 COCOBUOYANCY

- 15.2.8 F-TEC PTY LTD

- 15.2.9 BASE MATERIALS LTD

- 15.2.10 NUCLEAD MANUFACTURING CO INC

- 15.2.11 THERMAL MITIGATION TECHNOLOGIES, LLC.

- 15.2.12 CGP EUROPE

- 15.2.13 RIZHAO FLOAT NEW MATERIALS CO., LTD

- 15.2.14 QINGDAO DOOWIN MARINE ENGINEERING CO., LTD

16 ADJACENT & RELATED MARKET

- 16.1 INTRODUCTION

- 16.2 COMPOSITES MARKET

- 16.2.1 MARKET DEFINITION

- 16.2.2 MARKET OVERVIEW

- 16.2.3 COMPOSITES MARKET, BY MANUFACTURING PROCESS

- 16.2.4 COMPOSITES MARKET, BY FIBER TYPE

- 16.2.5 COMPOSITES MARKET, BY RESIN TYPE

- 16.2.6 COMPOSITES MARKET, BY END-USE INDUSTRY

- 16.2.7 COMPOSITES MARKET, BY REGION

17 APPENDIX

- 17.1 DISCUSSION GUIDE

- 17.2 CUSTOMIZATION OPTIONS

- 17.3 RELATED REPORTS

- 17.4 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 17.5 AUTHOR DETAILS