|

|

市場調査レポート

商品コード

1869556

インタラクティブキオスクの世界市場:タイプ別、オファリング別、場所別、ディスプレイパネルサイズ別、取付けタイプ別、業界別、地域別 - 2030年までの予測Interactive Kiosk Market By Type, Vertical, Mounting Type, Offering and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| インタラクティブキオスクの世界市場:タイプ別、オファリング別、場所別、ディスプレイパネルサイズ別、取付けタイプ別、業界別、地域別 - 2030年までの予測 |

|

出版日: 2025年11月07日

発行: MarketsandMarkets

ページ情報: 英文 270 Pages

納期: 即納可能

|

概要

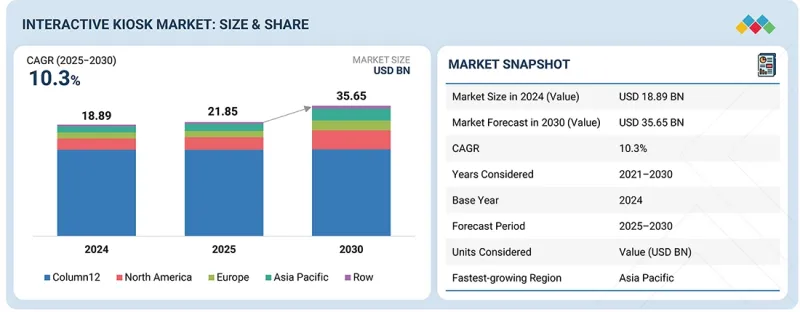

世界のインタラクティブキオスクの市場規模は、2025年の218億5,000万米ドルから2030年までに356億5,000万米ドルに達すると予測されており、予測期間中のCAGRは10.3%を記録する見込みです。

小売、銀行、運輸、医療などの業界における顧客エンゲージメントの強化、業務効率化、セルフサービス自動化への需要の高まりが、市場成長を牽引しています。特に世界的なデジタル化やスマートシティ構想の進展に伴い、安全性、衛生管理、非接触型インタラクションへの関心が高まっていることが、世界的なキオスク導入を促進しております。

| 調査範囲 | |

|---|---|

| 調査対象期間 | 2021年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 対象単位 | 金額(10億米ドル) |

| セグメント | タイプ別、オファリング別、場所別、ディスプレイパネルサイズ別、取付けタイプ別、業界別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

さらに、AI、IoT接続性、データ分析技術の進歩により、パーソナライズされたサービス、リアルタイム監視、企業システムとのシームレスな統合が可能なインテリジェントキオスクが実現しています。モジュール式ハードウェアとクラウドベースソフトウェアプラットフォームの価格競争力が高まっていることも相まって、インタラクティブキオスクは産業用および消費者向けアプリケーションの両方で、拡張性とアクセス性をさらに高めています。

タイプ別では、医療サービスキオスクセグメントが予測期間中に最も高いCAGRを示すと予測されています。この成長は、病院、診療所、薬局における患者登録、待ち行列管理、予約スケジュール管理、遠隔診療サービスのためのキオスク導入増加によって支えられています。加えて、デジタル医療インフラやセルフサービス技術の普及拡大により、キオスク端末と電子カルテ(EMR)システムや遠隔医療プラットフォームの統合が進み、業務効率と患者体験の向上が図られています。医療分野では、インタラクティブキオスクが受付、請求処理、情報提供に活用され、事務負担の軽減とサービスアクセスの向上に貢献しています。さらに、医療サービスのデジタル化を推進する政府の継続的な取り組みや、AI駆動型分析技術・非接触技術の進歩により、予測期間中に医療キオスクが主要な成長分野となることが期待されます。

注文・小売キオスクセグメントは急速な普及が見込まれます。このセグメントの成長は、クイックサービスレストラン(QSR)、スーパーマーケット、小売店舗において、セルフオーダー、非接触決済、パーソナライズされたショッピング体験への需要が高まっていることに起因します。これらのキオスクは、サービスの迅速化、待ち時間の短縮、注文精度の向上を実現し、顧客満足度の向上につながります。リアルタイムメニュー更新、動的価格設定、アップセル機能を備えた先進ソフトウェアの統合により、主要小売チェーンでの導入がさらに促進されています。加えて、データ分析、顧客エンゲージメント、在庫管理のためのAIおよびIoT対応キオスクの普及拡大が、持続的な市場成長を支えています。企業が自動化と効率化に注力する中、注文・小売キオスクは世界的なインタラクティブキオスク市場の主要な推進力として台頭し続けています。

アジア太平洋のインタラクティブキオスク市場は、急速なデジタルトランスフォーメーション、小売インフラの拡大、スマートシティおよび交通プロジェクトへの投資増加によって牽引されています。中国、日本、韓国、インドなどの国々は、銀行、小売、医療、公共サービスを含む様々な分野でインタラクティブキオスクの導入を主導しています。自動化、セルフサービス、非接触技術統合への注力は、空港、地下鉄駅、商業施設における導入を加速させています。さらに、AIを活用した分析、クラウドベースの管理プラットフォーム、多言語インターフェースの普及が進み、多様なユーザー層に向けたキオスクの性能とアクセシビリティが向上しています。デジタルインクルージョンを促進する政府支援プログラムとコスト効率の高い製造能力が相まって、予測期間中、本地域はインタラクティブキオスク市場において最も急速に成長する地域としての地位をさらに固めています。

当レポートでは、世界のインタラクティブキオスク市場について調査し、タイプ別、オファリング別、場所別、ディスプレイパネルサイズ別、取付けタイプ別、業界別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

よくあるご質問

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 顧客ビジネスに影響を与える動向/混乱

- 価格分析

- 2025年~2026年の主な会議とイベント

- バリューチェーン分析

- エコシステム分析

- 技術分析

- 特許分析

- ケーススタディ分析

- 貿易分析

- 関税と規制状況

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- 投資と資金調達シナリオ、2021~2024年

- インタラクティブキオスク市場におけるAI/生成AIの影響

- 2025年の米国関税がインタラクティブキオスク市場に与える影響

第6章 インタラクティブキオスク市場(タイプ別)

- イントロダクション

- 情報・ディレクトリキオスク

- チケット販売・予約キオスク

- 注文・小売キオスク

- 決済・金融サービスキオスク

- ビットコインキオスク

- ヘルスケアサービスキオスク

- ホスピタリティ・トラベルキオスク

- 政府・公共サービスキオスク

- その他

第7章 インタラクティブキオスク市場(オファリング別)

- イントロダクション

- ハードウェア

- ソフトウェア

- サービス

第8章 インタラクティブキオスク市場(場所別)

- イントロダクション

- 屋内

- 屋外

第9章 インタラクティブキオスク市場(ディスプレイパネルサイズ別)

- イントロダクション

- 小

- 中

- 大

第10章 インタラクティブキオスク市場(取付けタイプ別)

- イントロダクション

- フロアスタンド型

- 壁掛け式

- その他

第11章 インタラクティブキオスク市場(業界別)

- イントロダクション

- 小売

- レストラン&クイックサービス

- 輸送

- 健康管理

- 公共部門

- 金融サービス

- ホスピタリティ

- エンターテイメント&レジャー

- その他

第12章 インタラクティブキオスク市場(地域別)

- イントロダクション

- 北米

- 北米のマクロ経済見通し

- 米国

- カナダ

- メキシコ

- 欧州

- 欧州のマクロ経済見通し

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- ポーランド

- 北欧

- その他

- アジア太平洋

- アジア太平洋のマクロ経済見通し

- 中国

- 日本

- 韓国

- インド

- オーストラリア

- その他

- その他の地域

- その他の地域のマクロ経済見通し

- 南米

- 中東

- アフリカ

第13章 競合情勢

- 概要

- 主要参入企業の戦略/強み、2021年~2025年

- 市場シェア分析、2024年

- 収益分析、2021年~2024年

- 企業評価と財務指標

- ブランド/製品比較

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 競合シナリオ

第14章 企業プロファイル

- 主要参入企業

- NCR VOYIX CORPORATION

- DIEBOLD NIXDORF, INCORPORATED

- ZEBRA TECHNOLOGIES CORP.

- ADVANTECH CO., LTD.

- GLORY LTD.

- KIOSK INFORMATION SYSTEMS

- PYRAMID COMPUTER GMBH

- OLEA KIOSKS INC.

- NCR ATLEOS

- MERIDIAN KIOSKS

- その他の企業

- PEERLESS-AV

- SLABB KIOSKS

- SITA

- SOURCE TECHNOLOGIES

- VERIFONE, INC.

- LAMASATECH LTD

- BITACCESS

- GENERAL BYTES

- SHENZHEN LEAN KIOSK SYSTEMS CO., LTD.

- OLICOM INTERNATIONAL S.R.L.

- REDYREF

- GRGBANKING

- EVOKE CREATIVE LIMITED

- PARTTEAM & OEMKIOSKS

- EMBROSS