|

|

市場調査レポート

商品コード

1446306

土地測量機器の世界市場:エンドユーザー (商業・防衛・サービスプロバイダー)・用途 (点検・監視・容積計算・レイアウトポイント)・ソリューション (ハードウェア・ソフトウェア・サービス)・産業・地域別 - 予測(~2028年)Land Survey Equipment Market by End User (Commercial, Defense, Service Providers), Application (Inspection, Monitoring, Volumetric Calculations, layout Points), Solution (Hardware, Software, Services), Industry and Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 土地測量機器の世界市場:エンドユーザー (商業・防衛・サービスプロバイダー)・用途 (点検・監視・容積計算・レイアウトポイント)・ソリューション (ハードウェア・ソフトウェア・サービス)・産業・地域別 - 予測(~2028年) |

|

出版日: 2024年03月01日

発行: MarketsandMarkets

ページ情報: 英文 326 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

土地測量機器の市場規模は、2023年の90億米ドルから、予測期間中は5.2%のCAGRで推移し、2028年には117億米ドルの規模に成長すると予測されています。

市場拡大の背景には、測量機器取引の活発化、再生可能エネルギーおよび輸送部門の進歩があります。全地球航法衛星システム (GNSS) は、近代化されたGPSやGalileoを含む多様な衛星航法システム間の技術的相乗効果と互換性を示します。ワイヤレス通信とネットワークインフラは、差分位置補正をユーザーに中継することで、新しいGNSSアプリケーションの到来を告げます。タイミング精度の向上は、システムの有効性と品質の包括的な向上をもたらします。GNSS技術は戦略的にワイヤレスネットワークに統合され、ほとんどのプロトコルとアルゴリズムは位置データ用に調整されています。ネットワーキングの進歩は、測量エンドユーザーのデータ精度を著しく向上させています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2023-2028年 |

| 基準年 | 2022年 |

| 予測期間 | 2023-2028年 |

| 単位 | 金額 (米ドル) |

| セグメント別 | エンドユーザー・用途・ソリューション・産業・地域別 |

| 対象地域 | 北米・欧州・アジア太平洋・その他の地域 |

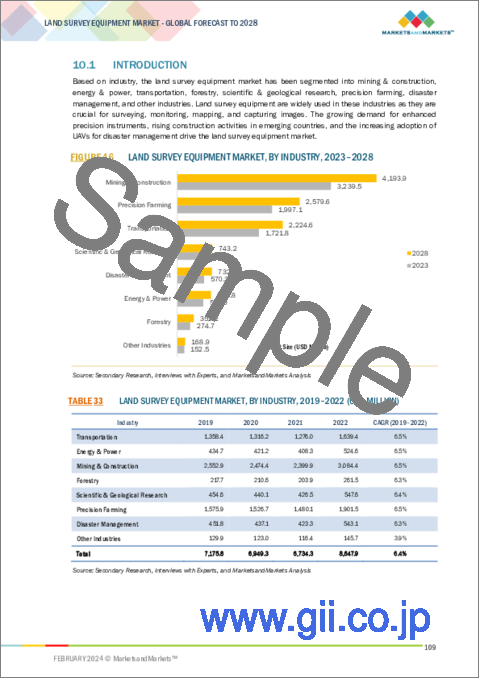

産業別では、鉱業・建設の部門が2023年に35.7%で最大のシェアを示しています。土地測量機器は、正確な測定、地図作成、現場の監視のために、鉱業と建設部門で実質的な有用性を保持しています。特にアジアやアフリカの新興経済圏では都市化が急速に進んでおり、建設産業の拡大が土地測量機器市場の主要促進要因となっています。同時に、世界中で建設契約が増加していることも、この市場の成長をさらに後押ししています。鉱業では、土地測量機器は、鉱物探査、鉱山計画、製造プラントのセットアップやインフラ開発作業を容易にします。トータルステーション、GNSS受信機、水準器、UAVなどの機器は、地質図や鉱床などの探査データセットの分析において極めて重要な役割を果たし、特に測地測量やエンジニアリング測量を支援します。

エンドユーザー別では、商業部門が2023年にもっとも高いシェアを占めると推定されています。商業部門は、主に建設、農業、鉱業、石油・ガス、林業、通信、電力、水道などの産業によって大きな需要があります。メーカー各社は、測量業者やサービスプロバイダーの進化するニーズに対応するため、GNSSなどの先進技術を搭載した機器を継続的に強化しており、採用率の上昇につながっています。アジア太平洋、アフリカ、北米での建設ラッシュ、世界の鉱業の増加、精密農業の進歩などの要因が、この成長軌道を後押ししています。

用途別では、レイアウトポイントの部門が2023年にもっとも高いシェアを占める見込みです。ここ数十年、4Dシミュレーション、AI、VR、ビルディングインフォメーションモデリング (BIM) などのITソリューションを活用し、多様な建設段階を通じてレイアウト計画を最適化する研究が重視されています。中でもBIMは、その包括的なアプローチと統合能力により最大の市場シェアを占め、圧倒的な成長要因として浮上しています。

地域別では、アジア太平洋地域が2020年に37.65%のシェアを示し、2023年も最大のシェアを占める見込みです。この地域には数多くの途上国があり、インフラ整備への多額の投資が促進されています。また、インドやインドネシアなどの国々は農業に大きく依存しており、効率的な土地管理のために堅牢な土地測量ツールが必要とされています。さらに、アジア太平洋地域は、特に中国やオーストラリアといった国々で大規模な採掘事業が行われており、高度な測量技術の需要をさらに押し上げています。

当レポートでは、世界の土地測量機器の市場を調査し、市場概要、市場影響因子および市場機会の分析、技術・特許の動向、法規制環境、ケーススタディ、市場規模の推移・予測、各種区分・地域別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 不況の影響

- 顧客のビジネスに影響を与える動向とディスラプション

- エコシステムマッピング

- 価格分析

- 運用データ

- 貿易データ

- 主なステークホルダーと購入基準

- バリューチェーン分析

- 技術ロードマップ

- トータルステーションの部品表

- ステーション合計の総所有コスト

- 使用事例の分析

- 関税と規制状況

- 主な会議とイベント

- 投資と資金調達のシナリオ

第6章 産業動向

- サプライチェーン分析

- 技術動向

- メガトレンドの影響

- 特許分析

第7章 土地測量機器市場:ソリューション別

- ハードウェア

- GNSS

- トータルステーション・セオドライト

- レベル

- 3Dレーザースキャナー

- レーザー

- 無人航空機 (UAV)

- 機械制御システム

- ソフトウェア

- デスクトップアプリケーション

- モバイルアプリケーション

- リモートセンシングアプリケーション

- 開発者向けアプリケーション

- サービス

- テクニカルサービス

- 校正サービス

- ソフトウェア開発サービス

第8章 土地測量機器市場:用途別

- 点検

- 監視

- 容積計算

- レイアウトポイント

- その他

第9章 土地測量機器市場:エンドユーザー別

- 商業

- 防衛

- サービスプロバイダー

第10章 土地測量機器市場:産業別

- 輸送

- エネルギー・電力

- 石油・ガス

- ユーティリティ

- 再生可能エネルギー

- 鉱業・建設

- 林業

- 科学および地質学的調査

- 精密農業

- 災害管理

- その他

第11章 土地測量機器市場:地域別

- 北米

- アジア太平洋

- 欧州

- 中東

- その他の地域

第12章 競合情勢

- 主要企業の採用戦略

- 収益分析

- 市場シェア分析

- ランキング分析

- 競合評価マトリックス

- 新興企業/中小企業評価マトリックス

- 企業財務指標

- ブランド/製品の比較

- 競合シナリオ

第13章 企業プロファイル

- 主要企業

- HEXAGON AB

- TOPCON CORPORATION

- TRIMBLE INC.

- U-BLOX

- SHANGHAI HUACE NAVIGATION TECHNOLOGY LTD.

- HI-TARGET

- HUDACO INDUSTRIES LTD.

- SUZHOU FOIF CO., LTD.

- STONEX SRL

- SOUTH SURVEYING & MAPPING TECHNOLOGY CO., LTD.

- CST/BERGER

- CHANGZHOU DADI SURVEYING SCIENCE & TECHNOLOGY CO., LTD.

- GUANGDONG KOLIDA INSTRUMENT CO., LTD.

- UNISTRONG

- GEOTECH

- ROBERT BOSCH GMBH

- その他の企業

- HEMISPHERE GNSS, INC.

- ENTEK INSTRUMENTS INDIA PVT. LTD.

- SAMAH AERIAL SURVEY CO., LTD.

- EOS POSITIONING SYSTEMS, INC.

- TI ASAHI CO., LTD.

- GEOSOLUTION I GOTEBORG AB

- THEIS FEINWERKTECHNIK

- EMLID TECH KFT

- TIANJIN XING OU SURVEYING INSTRUMENT MANUFACTURE CO., LTD.

第14章 付録

The Land Survey Equipment market is estimated to grow from USD 11.7 billion by 2028, from USD 9.0 billion in 2023, at a CAGR of 5.2% from 2023 to 2028. The market's expansion stems from heightened trade in survey equipment, advancements in the renewable energy and transportation sectors. Global Navigation Satellite System (GNSS) denotes the technical synergy and compatibility among diverse satellite navigation systems, encompassing modernized GPS and Galileo, among others. Wireless communication and network infrastructures usher in novel GNSS applications by relaying differential position corrections to users. Enhanced timing accuracy yields comprehensive enhancements in system efficacy and quality. GNSS technology is strategically integrated into wireless networks, with most protocols and algorithms tailored for positional data. Networking progressions have notably augmented data precision for survey end-users.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2023-2028 |

| Base Year | 2022 |

| Forecast Period | 2023-2028 |

| Units Considered | Value (USD Million) |

| Segments | By End User, Application, Solution, Industry and Region |

| Regions covered | North America, Europe, APAC, RoW |

"Mining & Construction is estimated to the largest market share in 2023."

Based on industry, the Land Survey Equipment market is categorized into transportation, energy &power, mining & construction, forestry, scientific & geological research, precision farming, disaster management and others. The mining & construction segment having highest share of 35.7%. Land survey equipment holds substantial utility within the mining and construction sectors for the precise measurement, mapping, and monitoring of sites. The expansion of the construction industry stands as a key driver for the land survey equipment market, fueled particularly by the swift urbanization across emerging economies in Asia and Africa. Concurrently, escalating construction contracts worldwide further propel this market growth. Within mining, land survey equipment facilitates mineral exploration, mine planning, manufacturing plant setup, and infrastructural development tasks. Instruments such as total stations, GNSS receivers, levels, and UAVs play pivotal roles in analyzing exploration data sets like geologic maps and mineral deposits, notably aiding in geodetic and engineering survey measurements.

"Commercial segment by end-user is estimated to hold the highest market share in 2023."

Based on End-User, the market is further divided into commercial, defense, service providers. The commercial segment of land survey equipment witnesses substantial demand primarily driven by industries such as construction, agriculture, mining, oil & gas, forestry, telecommunications, electricity, and water utilities. Manufacturers continuously enhance equipment with advanced technologies like GNSS to cater to the evolving needs of surveyors and service providers, leading to heightened adoption. Factors such as burgeoning construction in Asia Pacific, Africa, and North America, global upticks in mining, and advancements in precision farming bolster this growth trajectory. These dynamics collectively underpin the dominant market share held by the commercial segment in the land survey equipment industry.

"Layout Points by application segment is expected to hold the highest market share in 2023."

Based on application, the Land Survey Equipment market is further segmented into inspection, monitoring, volumetric calculations, layout points, and others. Layout point delineation involves the translation of architectural blueprints into marked coordinates for the precise implementation of new constructions, ensuring adherence to design specifications. These points are instrumental in both the advancement of ongoing projects and the enhancement of existing infrastructures, facilitating efficient completion timelines. Recent decades have witnessed significant research emphasis on leveraging Information Technology (IT) solutions such as 4D simulations, Artificial Intelligence (AI), virtual reality, and Building Information Modeling (BIM) to optimize layout planning throughout diverse construction phases. Among these, BIM emerges as the predominant growth factor, commanding the largest market share owing to its comprehensive approach and integration capabilities.

"Asia Pacific is expected to hold the highest market share in 2023."

The Asia Pacific region dominates the land survey equipment market both in terms of demand and the presence of prominent manufacturers. With a commanding share of 37.65% in 2020, Asia Pacific's preeminence stems from several growth drivers. Firstly, the region hosts numerous developing nations, fostering substantial investments in infrastructure development. Secondly, countries such as India and Indonesia rely heavily on agriculture, necessitating robust land surveying tools for efficient land management. Additionally, Asia Pacific boasts significant mining operations, particularly in countries like China and Australia, further propelling demand for advanced surveying technologies. The convergence of these factors underscores Asia Pacific's pivotal role as the largest contributor to the land survey equipment market.

The break-up of the profile of primary participants in the Land Survey Equipment market:

- By Company Type: Tier 1 - 35%, Tier 2 - 45%, and Tier 3 - 20%

- By Designation: C Level - 35%, Director Level - 25%, Others - 40%

- By Region: North America - 25%, Europe - 15%, Asia Pacific - 45%, Middle East 10%, RoW 5%

Hexagon AB (Sweden), Trimble Inc. (US), Topcon (Japan), CHC-Navigation (China), Hi-Target (China), U-Blox Holdings AG (Switzerland), and Hudaco Industries (South Africa) . These key players offer connectivity applicable to various sectors and have well-equipped and strong distribution networks across North America, Europe, Asia Pacific, the Middle East, and ROW, including Africa and Latin America.

Research Coverage:

In terms of Solutions, the Land Survey Equipment market is divided into Hardware, Software, Services. The industry-based segmentation includes transportation, energy &power, mining & construction, forestry, scientific & geological research, precision farming, disaster management and others. Based on Application, the market is segmented into inspection, monitoring, volumetric calculations, layout points, and others. Based on Ens User the market is segmented into the commercial, defense and services providers. This report segments the Land Survey Equipment market across five key regions: North America, Europe, Asia Pacific, the Middle East & ROW (Africa and Latin America), along with their respective key countries. The report's scope includes in-depth information on significant factors, such as drivers, restraints, challenges, and opportunities that influence the growth of the Land Survey Equipment market.

A comprehensive analysis of major industry players has been conducted to provide insights into their business profiles, solutions, and services. This analysis also covers key aspects like agreements, collaborations, new product launches, contracts, expansions, acquisitions, and partnerships associated with the Land Survey Equipment market.

Reasons to buy this report:

This report serves as a valuable resource for market leaders and newcomers in the Land Survey Equipment market, offering data that closely approximates revenue figures for both the overall market and its subsegments. It equips stakeholders with a comprehensive understanding of the competitive landscape, facilitating informed decisions to enhance their market positioning and formulate effective go-to-market strategies for Simulation. The report imparts valuable insights into the market dynamics, offering information on crucial factors such as drivers, restraints, challenges, and opportunities, enabling stakeholders to gauge the market's pulse.

The report provides insights on the following pointers:

- Analysis of the key driver (Infrastructure development a significant driver for the land surveying equipment market, Need for modern land survey equipment, Increasing number of construction projects in Asia Pacific, Advancements in networking for GNSS applications ), restraint (Integration with automation and robotics, high hardware costs) opportunities (Upgrading data management systems in surveys, Integration of terrestrial laser scanners with land survey equipment, subscription and rental models for the land survey equipment, Benefits of electronic devices in land surveys) and challenges (lack of skilled manpower and technical knowledge of latest equipment) there are several factors that could contribute to an increase in the Land Survey Equipment market.

- Market Penetration: Comprehensive information on Land Survey Equipment systems offered by the top players in the market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the Land Survey Equipment market

- Market Development: Comprehensive information about lucrative markets - the report analyses the Land Survey Equipment market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the Land Survey Equipment market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players in the Land Survey Equipment market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 LAND SURVEY EQUIPMENT MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- 1.3.3 YEARS CONSIDERED

- 1.4 INCLUSIONS AND EXCLUSIONS

- TABLE 1 INCLUSIONS AND EXCLUSIONS

- 1.5 CURRENCY CONSIDERED

- TABLE 2 USD EXCHANGE RATES

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

- 1.7.1 RECESSION IMPACT ANALYSIS (RIA)

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 RESEARCH PROCESS FLOW

- FIGURE 3 RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary sources

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Breakdown of primary interviews

- 2.1.2.4 Key industry insights

- 2.2 FACTOR ANALYSIS

- 2.2.1 DEMAND-SIDE INDICATORS

- 2.2.2 SUPPLY-SIDE INDICATORS

- 2.2.3 RECESSION IMPACT

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- TABLE 3 MARKET SIZE ESTIMATION PROCESS

- FIGURE 4 BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- FIGURE 5 TOP-DOWN APPROACH

- 2.4 DATA TRIANGULATION

- FIGURE 6 DATA TRIANGULATION

- 2.4.1 TRIANGULATION THROUGH PRIMARY AND SECONDARY RESEARCH

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

- FIGURE 7 HARDWARE SEGMENT TO HOLD MAXIMUM SHARE IN 2028

- FIGURE 8 LAYOUT POINTS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 9 MINING & CONSTRUCTION TO BE LARGEST SEGMENT IN 2028

- FIGURE 10 COMMERCIAL SEGMENT TO EXHIBIT HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 11 ASIA PACIFIC TO BE LARGEST MARKET FOR LAND SURVEY EQUIPMENT DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN LAND SURVEY EQUIPMENT MARKET

- FIGURE 12 INCREASE IN CONSTRUCTION PROJECTS TO DRIVE GROWTH

- 4.2 LAND SURVEY EQUIPMENT MARKET, BY SOLUTION

- FIGURE 13 HARDWARE TO SURPASS OTHER SEGMENTS DURING FORECAST PERIOD

- 4.3 LAND SURVEY EQUIPMENT MARKET, BY APPLICATION

- FIGURE 14 LAYOUT POINTS SEGMENT TO BE DOMINANT DURING FORECAST PERIOD

- 4.4 LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY

- FIGURE 15 MINING & CONSTRUCTION TO SECURE LEADING MARKET POSITION DURING FORECAST PERIOD

- 4.5 LAND SURVEY EQUIPMENT MARKET, BY END USER

- FIGURE 16 COMMERCIAL SEGMENT TO ACCOUNT FOR LARGEST SHARE IN 2028

- 4.6 LAND SURVEY EQUIPMENT MARKET, BY COUNTRY

- FIGURE 17 GERMANY TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 18 LAND SURVEY EQUIPMENT MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising infrastructure development

- FIGURE 19 GDP GENERATED FROM CONSTRUCTION IN ASIA PACIFIC, 2022

- 5.2.1.2 Need for modern land survey equipment

- 5.2.1.3 Advancements in networking for global navigation satellite system (GNSS) applications

- FIGURE 20 GNSS DEVICE INSTALLATION, 2012-2023

- 5.2.2 RESTRAINTS

- 5.2.2.1 Integration with automation and robotics

- 5.2.2.2 High hardware costs

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Technological advancements in data management systems

- 5.2.3.2 Integration of terrestrial laser scanners into land survey equipment

- 5.2.3.3 Subscription and rental models for land survey equipment

- 5.2.3.4 Benefits of electronic devices in land surveys

- 5.2.4 CHALLENGES

- 5.2.4.1 Lack of skilled workforce and technical knowledge of latest equipment

- 5.3 IMPACT OF RECESSION

- 5.4 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 21 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.5 ECOSYSTEM MAPPING

- 5.5.1 PROMINENT COMPANIES

- 5.5.2 PRIVATE AND SMALL ENTERPRISES

- 5.5.3 END USERS

- FIGURE 22 ECOSYSTEM MAPPING

- TABLE 4 ROLE OF COMPANIES IN ECOSYSTEM

- 5.6 PRICING ANALYSIS

- TABLE 5 AVERAGE SELLING PRICE OF LAND SURVEY EQUIPMENT, BY SOLUTION (USD THOUSAND)

- FIGURE 23 AVERAGE SELLING PRICE OF LAND SURVEY EQUIPMENT, BY SOLUTION (USD THOUSAND)

- TABLE 6 AVERAGE SELLING PRICE OF LAND SURVEY EQUIPMENT, BY REGION (USD THOUSAND)

- FIGURE 24 AVERAGE SELLING PRICE OF LAND SURVEY EQUIPMENT, BY REGION (USD THOUSAND)

- 5.7 OPERATIONAL DATA

- TABLE 7 LAND SURVEY EQUIPMENT VOLUME, BY TYPE, 2019-2022 (UNITS)

- 5.8 TRADE DATA

- TABLE 8 IMPORT DATA (HS CODE: 901520), BY COUNTRY, 2018-2022 (USD THOUSAND)

- FIGURE 25 IMPORT DATA (HS CODE: 901520), BY COUNTRY, 2018-2022 (USD THOUSAND)

- TABLE 9 EXPORT DATA (HS CODE: 901520), BY COUNTRY, 2018-2022 (USD THOUSAND)

- FIGURE 26 EXPORT DATA (HS CODE: 901520), BY COUNTRY, 2018-2022 (USD THOUSAND)

- TABLE 10 IMPORT DATA (HS CODE: 901530), BY COUNTRY, 2018-2022 (USD THOUSAND)

- FIGURE 27 IMPORT DATA (HS CODE: 901530), BY COUNTRY, 2018-2022 (USD THOUSAND)

- TABLE 11 EXPORT DATA (HS CODE: 901530), BY COUNTRY, 2018-2022 (USD THOUSAND)

- FIGURE 28 EXPORT DATA (HS CODE: 901530), BY COUNTRY, 2018-2022 (USD THOUSAND)

- 5.9 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.9.1 STAKEHOLDERS IN BUYING PROCESS

- FIGURE 29 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF LAND SURVEY EQUIPMENT, BY END USER

- TABLE 12 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF LAND SURVEY EQUIPMENT, BY END USER (%)

- 5.9.2 BUYING CRITERIA

- FIGURE 30 KEY BUYING CRITERIA FOR LAND SURVEY EQUIPMENT, BY END USER

- TABLE 13 KEY BUYING CRITERIA FOR LAND SURVEY EQUIPMENT, BY END USER

- 5.10 VALUE CHAIN ANALYSIS

- FIGURE 31 VALUE CHAIN ANALYSIS

- 5.11 TECHNOLOGY ROADMAP

- FIGURE 32 TECHNOLOGY ROADMAP OF LAND SURVEY EQUIPMENT MARKET, 2000-2030

- 5.12 BILL OF MATERIALS FOR TOTAL STATIONS

- FIGURE 33 BILL OF MATERIALS FOR TOTAL STATIONS

- 5.13 TOTAL COST OF OWNERSHIP FOR TOTAL STATIONS

- FIGURE 34 TOTAL COST OF OWNERSHIP FOR TOTAL STATIONS

- 5.14 USE CASE ANALYSIS

- 5.14.1 WINGTRAONE FIXED-WING DRONE

- 5.14.2 SOIL EROSION TRACKING WITH MOBILE MAPPING, GNSS, AND LIDAR

- 5.15 TARIFF AND REGULATORY LANDSCAPE

- TABLE 14 NORTH AMERICA: TARIFFS

- TABLE 15 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.16 KEY CONFERENCES AND EVENTS, 2024

- TABLE 18 KEY CONFERENCES AND EVENTS, 2024

- 5.17 INVESTMENT AND FUNDING SCENARIO

- TABLE 19 VENTURE CAPITAL AND DEALS, 2019-2022

- FIGURE 35 VENTURE CAPITAL AND DEALS, 2019-2022

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 SUPPLY CHAIN ANALYSIS

- FIGURE 36 SUPPLY CHAIN ANALYSIS

- 6.2.1 MAJOR COMPANIES

- 6.2.2 SMALL AND MEDIUM ENTERPRISES

- 6.2.3 END USERS/CUSTOMERS

- 6.3 TECHNOLOGY TRENDS

- 6.3.1 ROBOTIC TOTAL STATIONS AND MOBILE MAPPING SYSTEMS

- 6.3.2 DIGITALIZATION

- 6.3.3 UNMANNED AERIAL VEHICLES

- 6.3.4 LIDAR

- 6.4 IMPACT OF MEGATRENDS

- 6.4.1 ELECTRONIFICATION OF LAND SURVEY EQUIPMENT COMPONENTS

- 6.4.1.1 Electronic distance measurement (EDM) devices

- 6.4.1.2 Electronic theodolites

- 6.4.1.3 Microprocessors

- 6.4.1.4 Storage units

- 6.4.1.5 Other components

- 6.4.2 CLOUD-BASED DATA MANAGEMENT

- 6.4.1 ELECTRONIFICATION OF LAND SURVEY EQUIPMENT COMPONENTS

- 6.5 PATENT ANALYSIS

- FIGURE 37 PATENTS ANALYSIS

- TABLE 20 PATENT ANALYSIS, 2022-2024

7 LAND SURVEY EQUIPMENT MARKET, BY SOLUTION

- 7.1 INTRODUCTION

- FIGURE 38 LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2023-2028

- TABLE 21 LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2019-2022 (USD MILLION)

- TABLE 22 LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- 7.2 HARDWARE

- 7.2.1 ADVANCEMENTS IN AUTOMATION, ROBOTICS, AND SENSOR TECHNOLOGIES TO DRIVE GROWTH

- FIGURE 39 UAVS TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- TABLE 23 LAND SURVEY EQUIPMENT MARKET, BY HARDWARE, 2019-2022 (USD MILLION)

- TABLE 24 LAND SURVEY EQUIPMENT MARKET, BY HARDWARE, 2023-2028 (USD MILLION)

- FIGURE 40 LAND SURVEY EQUIPMENT VOLUME, BY HARDWARE, 2019-2022 (UNITS)

- FIGURE 41 LAND SURVEY EQUIPMENT VOLUME, BY HARDWARE, 2023-2028 (UNITS)

- 7.2.2 GNSS

- 7.2.2.1 Integrated smart antennas

- 7.2.2.2 Modular GNSS

- 7.2.2.3 GNSS network solutions

- 7.2.3 TOTAL STATIONS & THEODOLITES

- 7.2.3.1 Standard/Manual total stations

- 7.2.3.2 Robotic total stations

- 7.2.3.3 Multi-stations

- 7.2.4 LEVELS

- 7.2.4.1 Digital levels

- 7.2.4.2 Automatic levels

- 7.2.5 3D LASER SCANNERS

- 7.2.6 LASERS

- 7.2.6.1 Leveling lasers

- 7.2.6.2 Dual-grade lasers

- 7.2.6.3 Pipe lasers

- 7.2.7 UNMANNED AERIAL VEHICLES (UAVS)

- 7.2.8 MACHINE CONTROL SYSTEMS

- 7.3 SOFTWARE

- 7.3.1 ADVANCEMENTS IN DIGITAL MAPPING AND DATA ANALYTICS TO DRIVE GROWTH

- FIGURE 42 DESKTOP APPLICATIONS TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- TABLE 25 LAND SURVEY EQUIPMENT MARKET, BY SOFTWARE, 2019-2022 (USD MILLION)

- TABLE 26 LAND SURVEY EQUIPMENT MARKET, BY SOFTWARE, 2023-2028 (USD MILLION)

- 7.3.2 DESKTOP APPLICATIONS

- 7.3.3 MOBILE APPLICATIONS

- 7.3.4 REMOTE SENSING APPLICATIONS

- 7.3.5 DEVELOPER APPLICATIONS

- 7.4 SERVICES

- 7.4.1 ADVANCED SOFTWARE INTEGRATION TO DRIVE GROWTH

- FIGURE 43 TECHNICAL SERVICES TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- TABLE 27 LAND SURVEY EQUIPMENT MARKET, BY SERVICE, 2019-2022 (USD MILLION)

- TABLE 28 LAND SURVEY EQUIPMENT MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- 7.4.2 TECHNICAL SERVICES

- 7.4.3 CALIBRATION SERVICES

- 7.4.4 SOFTWARE DEVELOPMENT SERVICES

8 LAND SURVEY EQUIPMENT MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- FIGURE 44 LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2023-2028

- TABLE 29 LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 30 LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 8.2 INSPECTION

- 8.2.1 EMPHASIS ON PREVENTIVE MAINTENANCE AND ASSET MANAGEMENT TO DRIVE GROWTH

- 8.3 MONITORING

- 8.3.1 GROWING AWARENESS OF SAFETY AND RISK MANAGEMENT TO DRIVE GROWTH

- 8.4 VOLUMETRIC CALCULATIONS

- 8.4.1 COMPLIANCE WITH REGULATIONS REGARDING LAND USE AND ENVIRONMENTAL IMPACT TO DRIVE GROWTH

- 8.5 LAYOUT POINTS

- 8.5.1 EMPHASIS ON SUSTAINABILITY AND RESOURCE OPTIMIZATION TO DRIVE GROWTH

- 8.6 OTHER APPLICATIONS

9 LAND SURVEY EQUIPMENT MARKET, BY END USER

- 9.1 INTRODUCTION

- FIGURE 45 LAND SURVEY EQUIPMENT MARKET, BY END USER, 2023-2028

- TABLE 31 LAND SURVEY EQUIPMENT MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 32 LAND SURVEY EQUIPMENT MARKET, BY END USER, 2023-2028 (USD MILLION)

- 9.2 COMMERCIAL

- 9.2.1 RAPID URBANIZATION AND POPULATION EXPANSION TO DRIVE GROWTH

- 9.3 DEFENSE

- 9.3.1 INCREASING INVESTMENTS BY DEFENSE AGENCIES TO DRIVE GROWTH

- 9.4 SERVICE PROVIDERS

- 9.4.1 AVAILABILITY OF DIVERSE SURVEYING SOLUTIONS TO DRIVE GROWTH

10 LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY

- 10.1 INTRODUCTION

- FIGURE 46 LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2023-2028

- TABLE 33 LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 34 LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- 10.2 TRANSPORTATION

- 10.3 ENERGY & POWER

- 10.3.1 OIL & GAS

- 10.3.2 UTILITIES

- 10.3.3 RENEWABLE ENERGY

- 10.4 MINING & CONSTRUCTION

- 10.5 FORESTRY

- 10.6 SCIENTIFIC & GEOLOGICAL RESEARCH

- 10.7 PRECISION FARMING

- 10.8 DISASTER MANAGEMENT

- 10.9 OTHER INDUSTRIES

11 LAND SURVEY EQUIPMENT MARKET, BY REGION

- 11.1 INTRODUCTION

- FIGURE 47 LAND SURVEY EQUIPMENT MARKET, BY REGION, 2023-2028

- TABLE 35 LAND SURVEY EQUIPMENT MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 36 LAND SURVEY EQUIPMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.2 REGIONAL RECESSION IMPACT ANALYSIS

- 11.3 NORTH AMERICA

- FIGURE 48 NORTH AMERICA: LAND SURVEY EQUIPMENT VOLUME, BY HARDWARE (UNITS)

- 11.3.1 RECESSION IMPACT ANALYSIS

- 11.3.2 PESTLE ANALYSIS

- FIGURE 49 NORTH AMERICA: LAND SURVEY EQUIPMENT MARKET SNAPSHOT

- TABLE 37 NORTH AMERICA: LAND SURVEY EQUIPMENT MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 38 NORTH AMERICA: LAND SURVEY EQUIPMENT MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 39 NORTH AMERICA: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2019-2022 (USD MILLION)

- TABLE 40 NORTH AMERICA: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 41 NORTH AMERICA: LAND SURVEY EQUIPMENT MARKET, BY HARDWARE, 2019-2022 (USD MILLION)

- TABLE 42 NORTH AMERICA: LAND SURVEY EQUIPMENT MARKET, BY HARDWARE, 2023-2028 (USD MILLION)

- TABLE 43 NORTH AMERICA: LAND SURVEY EQUIPMENT MARKET, BY SOFTWARE, 2019-2022 (USD MILLION)

- TABLE 44 NORTH AMERICA: LAND SURVEY EQUIPMENT MARKET, BY SOFTWARE, 2023-2028 (USD MILLION)

- TABLE 45 NORTH AMERICA: LAND SURVEY EQUIPMENT MARKET, BY SERVICE, 2019-2022 (USD MILLION)

- TABLE 46 NORTH AMERICA: LAND SURVEY EQUIPMENT MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 47 NORTH AMERICA: LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 48 NORTH AMERICA: LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 49 NORTH AMERICA: LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 50 NORTH AMERICA: LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 51 NORTH AMERICA: LAND SURVEY EQUIPMENT MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 52 NORTH AMERICA: LAND SURVEY EQUIPMENT MARKET, BY END USER, 2023-2028 (USD MILLION)

- 11.3.3 US

- 11.3.3.1 Rising investments in infrastructure renewal and urban development projects to drive growth

- TABLE 53 US: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2019-2022 (USD MILLION)

- TABLE 54 US: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 55 US: LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 56 US: LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 57 US: LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 58 US: LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 59 US: LAND SURVEY EQUIPMENT MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 60 US: LAND SURVEY EQUIPMENT MARKET, BY END USER, 2023-2028 (USD MILLION)

- 11.3.4 CANADA

- 11.3.4.1 Need for advanced surveying equipment to ensure regulatory compliance to drive growth

- TABLE 61 CANADA: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2019-2022 (USD MILLION))

- TABLE 62 CANADA: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 63 CANADA: LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 64 CANADA: LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 65 CANADA: LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 66 CANADA: LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 67 CANADA: LAND SURVEY EQUIPMENT MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 68 CANADA: LAND SURVEY EQUIPMENT MARKET, BY END USER, 2023-2028 (USD MILLION)

- 11.4 ASIA PACIFIC

- FIGURE 50 ASIA PACIFIC: LAND SURVEY EQUIPMENT VOLUME, BY HARDWARE (UNITS)

- 11.4.1 RECESSION IMPACT ANALYSIS

- 11.4.2 PESTLE ANALYSIS

- FIGURE 51 ASIA PACIFIC: LAND SURVEY EQUIPMENT MARKET SNAPSHOT

- TABLE 69 ASIA PACIFIC: LAND SURVEY EQUIPMENT MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 70 ASIA PACIFIC: LAND SURVEY EQUIPMENT MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 71 ASIA PACIFIC: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2019-2022 (USD MILLION)

- TABLE 72 ASIA PACIFIC: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 73 ASIA PACIFIC: LAND SURVEY EQUIPMENT MARKET, BY HARDWARE, 2019-2022 (USD MILLION)

- TABLE 74 ASIA PACIFIC: LAND SURVEY EQUIPMENT MARKET, BY HARDWARE, 2023-2028 (USD MILLION)

- TABLE 75 ASIA PACIFIC: LAND SURVEY EQUIPMENT MARKET, BY SOFTWARE, 2019-2022 (USD MILLION)

- TABLE 76 ASIA PACIFIC: LAND SURVEY EQUIPMENT MARKET, BY SOFTWARE, 2023-2028 (USD MILLION)

- TABLE 77 ASIA PACIFIC: LAND SURVEY EQUIPMENT MARKET, BY SERVICE, 2019-2022 (USD MILLION)

- TABLE 78 ASIA PACIFIC: LAND SURVEY EQUIPMENT MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 79 ASIA PACIFIC: LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 80 ASIA PACIFIC: LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 81 ASIA PACIFIC: LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 82 ASIA PACIFIC: LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 83 ASIA PACIFIC: LAND SURVEY EQUIPMENT MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 84 ASIA PACIFIC: LAND SURVEY EQUIPMENT MARKET, BY END USER, 2023-2028 (USD MILLION)

- 11.4.3 CHINA

- 11.4.3.1 Focus on smart city development and digital economy to drive growth

- TABLE 85 CHINA: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2019-2022 (USD MILLION)

- TABLE 86 CHINA: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 87 CHINA: LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 88 CHINA: LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 89 CHINA: LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 90 CHINA: LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 91 CHINA: LAND SURVEY EQUIPMENT MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 92 CHINA: LAND SURVEY EQUIPMENT MARKET, BY END USER, 2023-2028 (USD MILLION)

- 11.4.4 INDIA

- 11.4.4.1 Extensive infrastructure development programs to drive growth

- TABLE 93 INDIA: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2019-2022 (USD MILLION))

- TABLE 94 INDIA: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 95 INDIA: LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 96 INDIA: LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 97 INDIA: LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 98 INDIA: LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 99 INDIA: LAND SURVEY EQUIPMENT MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 100 INDIA: LAND SURVEY EQUIPMENT MARKET, BY END USER, 2023-2028 (USD MILLION)

- 11.4.5 JAPAN

- 11.4.5.1 Integration of IoT technologies into infrastructure projects to drive growth

- TABLE 101 JAPAN: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2019-2022 (USD MILLION))

- TABLE 102 JAPAN: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 103 JAPAN: LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 104 JAPAN: LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 105 JAPAN: LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 106 JAPAN: LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 107 JAPAN: LAND SURVEY EQUIPMENT MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 108 JAPAN: LAND SURVEY EQUIPMENT MARKET, BY END USER, 2023-2028 (USD MILLION)

- 11.4.6 SOUTH KOREA

- 11.4.6.1 Emphasis on green infrastructure and urban renewal projects to drive growth

- TABLE 109 SOUTH KOREA: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2019-2022 (USD MILLION)

- TABLE 110 SOUTH KOREA: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 111 SOUTH KOREA: LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 112 SOUTH KOREA: LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 113 SOUTH KOREA: LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 114 SOUTH KOREA: LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 115 SOUTH KOREA: LAND SURVEY EQUIPMENT MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 116 SOUTH KOREA: LAND SURVEY EQUIPMENT MARKET, BY END USER, 2023-2028 (USD MILLION)

- 11.4.7 AUSTRALIA

- 11.4.7.1 Rapidly expanding tourism industry to drive growth

- TABLE 117 AUSTRALIA: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2019-2022 (USD MILLION))

- TABLE 118 AUSTRALIA: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 119 AUSTRALIA: LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 120 AUSTRALIA: LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 121 AUSTRALIA: LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 122 AUSTRALIA: LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 123 AUSTRALIA: LAND SURVEY EQUIPMENT MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 124 AUSTRALIA: LAND SURVEY EQUIPMENT MARKET, BY END USER, 2023-2028 (USD MILLION)

- 11.4.8 REST OF ASIA PACIFIC

- TABLE 125 REST OF ASIA PACIFIC: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2019-2022 (USD MILLION))

- TABLE 126 REST OF ASIA PACIFIC: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 127 REST OF ASIA PACIFIC: LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 128 REST OF ASIA PACIFIC: LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 129 REST OF ASIA PACIFIC: LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 130 REST OF ASIA PACIFIC: LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 131 REST OF ASIA PACIFIC: LAND SURVEY EQUIPMENT MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 132 REST OF ASIA PACIFIC: LAND SURVEY EQUIPMENT MARKET, BY END USER, 2023-2028 (USD MILLION)

- 11.5 EUROPE

- FIGURE 52 EUROPE: LAND SURVEY EQUIPMENT VOLUME, BY HARDWARE (UNITS)

- 11.5.1 RECESSION IMPACT ANALYSIS

- 11.5.2 PESTLE ANALYSIS

- FIGURE 53 EUROPE: LAND SURVEY EQUIPMENT MARKET SNAPSHOT

- TABLE 133 EUROPE: LAND SURVEY EQUIPMENT MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 134 EUROPE: LAND SURVEY EQUIPMENT MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 135 EUROPE: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2019-2022 (USD MILLION)

- TABLE 136 EUROPE: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 137 EUROPE: LAND SURVEY EQUIPMENT MARKET, BY HARDWARE, 2019-2022 (USD MILLION)

- TABLE 138 EUROPE: LAND SURVEY EQUIPMENT MARKET, BY HARDWARE, 2023-2028 (USD MILLION)

- TABLE 139 EUROPE: LAND SURVEY EQUIPMENT MARKET, BY SOFTWARE, 2019-2022 (USD MILLION)

- TABLE 140 EUROPE: LAND SURVEY EQUIPMENT MARKET, BY SOFTWARE, 2023-2028 (USD MILLION)

- TABLE 141 EUROPE: LAND SURVEY EQUIPMENT MARKET, BY SERVICE, 2019-2022 (USD MILLION)

- TABLE 142 EUROPE: LAND SURVEY EQUIPMENT MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 143 EUROPE: LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 144 EUROPE: LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 145 EUROPE: LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 146 EUROPE: LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 147 EUROPE: LAND SURVEY EQUIPMENT MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 148 EUROPE: LAND SURVEY EQUIPMENT MARKET, BY END USER, 2023-2028 (USD MILLION)

- 11.5.3 UK

- 11.5.3.1 Advancements in scientific & geological surveying techniques to drive growth

- TABLE 149 UK: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2019-2022 (USD MILLION)

- TABLE 150 UK: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 151 UK: LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 152 UK: LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 153 UK: LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 154 UK: LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 155 UK: LAND SURVEY EQUIPMENT MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 156 UK: LAND SURVEY EQUIPMENT MARKET, BY END USER, 2023-2028 (USD MILLION)

- 11.5.4 RUSSIA

- 11.5.4.1 Need for comprehensive surveying services in construction planning to drive growth

- TABLE 157 RUSSIA: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2019-2022 (USD MILLION)

- TABLE 158 RUSSIA: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 159 RUSSIA: LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 160 RUSSIA: LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 161 RUSSIA: LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 162 RUSSIA: LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 163 RUSSIA: LAND SURVEY EQUIPMENT MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 164 RUSSIA: LAND SURVEY EQUIPMENT MARKET, BY END USER, 2023-2028 (USD MILLION)

- 11.5.5 FRANCE

- 11.5.5.1 Government investments in urban development to drive growth

- TABLE 165 FRANCE: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2019-2022 (USD MILLION)

- TABLE 166 FRANCE: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 167 FRANCE: LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 168 FRANCE: LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 169 FRANCE: LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 170 FRANCE: LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 171 FRANCE LAND SURVEY EQUIPMENT MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 172 FRANCE: LAND SURVEY EQUIPMENT MARKET, BY END USER, 2023-2028 (USD MILLION)

- 11.5.6 ITALY

- 11.5.6.1 Focus on archaeological preservation to drive growth

- TABLE 173 ITALY: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2019-2022 (USD MILLION)

- TABLE 174 ITALY: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 175 ITALY: LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 176 ITALY: LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 177 ITALY: LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 178 ITALY: LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 179 ITALY: LAND SURVEY EQUIPMENT MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 180 ITALY: LAND SURVEY EQUIPMENT MARKET, BY END USER, 2023-2028 (USD MILLION)

- 11.5.7 GERMANY

- 11.5.7.1 Surge in renewable energy projects to drive growth

- TABLE 181 GERMANY: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2019-2022 (USD MILLION)

- TABLE 182 GERMANY: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 183 GERMANY: LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 184 GERMANY: LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 185 GERMANY: LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 186 GERMANY: LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 187 GERMANY: LAND SURVEY EQUIPMENT MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 188 GERMANY: LAND SURVEY EQUIPMENT MARKET, BY END USER, 2023-2028 (USD MILLION)

- 11.5.8 REST OF EUROPE

- TABLE 189 REST OF EUROPE: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2019-2022 (USD MILLION)

- TABLE 190 REST OF EUROPE: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 191 REST OF EUROPE: LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 192 REST OF EUROPE: LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 193 REST OF EUROPE: LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 194 REST OF EUROPE: LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 195 REST OF EUROPE: LAND SURVEY EQUIPMENT MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 196 REST OF EUROPE: LAND SURVEY EQUIPMENT MARKET, BY END USER, 2023-2028 (USD MILLION)

- 11.6 MIDDLE EAST

- FIGURE 54 MIDDLE EAST: LAND SURVEY EQUIPMENT VOLUME, BY HARDWARE (UNITS)

- 11.6.1 RECESSION IMPACT ANALYSIS

- 11.6.2 PESTLE ANALYSIS

- FIGURE 55 MIDDLE EAST: LAND SURVEY EQUIPMENT MARKET SNAPSHOT

- TABLE 197 MIDDLE EAST: LAND SURVEY EQUIPMENT MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 198 MIDDLE EAST: LAND SURVEY EQUIPMENT MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 199 MIDDLE EAST: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2019-2022 (USD MILLION)

- TABLE 200 MIDDLE EAST: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 201 MIDDLE EAST: LAND SURVEY EQUIPMENT MARKET, BY HARDWARE, 2019-2022 (USD MILLION)

- TABLE 202 MIDDLE EAST: LAND SURVEY EQUIPMENT MARKET, BY HARDWARE, 2023-2028 (USD MILLION)

- TABLE 203 MIDDLE EAST: LAND SURVEY EQUIPMENT MARKET, BY SOFTWARE, 2019-2022 (USD MILLION)

- TABLE 204 MIDDLE EAST: LAND SURVEY EQUIPMENT MARKET, BY SOFTWARE, 2023-2028 (USD MILLION)

- TABLE 205 MIDDLE EAST: LAND SURVEY EQUIPMENT MARKET, BY SERVICE, 2019-2022 (USD MILLION)

- TABLE 206 MIDDLE EAST: LAND SURVEY EQUIPMENT MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 207 MIDDLE EAST: LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 208 MIDDLE EAST: LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 209 MIDDLE EAST: LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 210 MIDDLE EAST: LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 211 MIDDLE EAST: LAND SURVEY EQUIPMENT MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 212 MIDDLE EAST: LAND SURVEY EQUIPMENT MARKET, BY END USER, 2023-2028 (USD MILLION)

- 11.6.3 GCC

- 11.6.3.1 Focus on economic diversification to drive growth

- TABLE 213 GCC: LAND SURVEY EQUIPMENT MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 214 GCC: LAND SURVEY EQUIPMENT MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 215 GCC: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2019-2022 (USD MILLION))

- TABLE 216 GCC: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 217 GCC: LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 218 GCC: LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 219 GCC: LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 220 GCC: LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 221 GCC: LAND SURVEY EQUIPMENT MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 222 GCC: LAND SURVEY EQUIPMENT MARKET, BY END USER, 2023-2028 (USD MILLION)

- 11.6.4 TURKEY

- 11.6.4.1 Ongoing developments in construction industry to drive growth

- TABLE 223 TURKEY: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2019-2022 (USD MILLION))

- TABLE 224 TURKEY: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 225 TURKEY: LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 226 TURKEY: LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 227 TURKEY: LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 228 TURKEY: LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 229 TURKEY: LAND SURVEY EQUIPMENT MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 230 TURKEY: LAND SURVEY EQUIPMENT MARKET, BY END USER, 2023-2028 (USD MILLION)

- 11.6.5 ISRAEL

- 11.6.5.1 Adoption of land survey equipment in real estate development projects to drive growth

- TABLE 231 ISRAEL: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2019-2022 (USD MILLION))

- TABLE 232 ISRAEL: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 233 ISRAEL: LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 234 ISRAEL: LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 235 ISRAEL: LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 236 ISRAEL: LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 237 ISRAEL: LAND SURVEY EQUIPMENT MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 238 ISRAEL: LAND SURVEY EQUIPMENT MARKET, BY END USER, 2023-2028 (USD MILLION)

- 11.6.6 REST OF MIDDLE EAST

- TABLE 239 REST OF MIDDLE EAST: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2019-2022 (USD MILLION))

- TABLE 240 REST OF MIDDLE EAST: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 241 REST OF MIDDLE EAST: LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 242 REST OF MIDDLE EAST: LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 243 REST OF MIDDLE EAST: LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 244 REST OF MIDDLE EAST: LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 245 REST OF MIDDLE EAST: LAND SURVEY EQUIPMENT MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 246 REST OF MIDDLE EAST: LAND SURVEY EQUIPMENT MARKET, BY END USER, 2023-2028 (USD MILLION)

- 11.7 REST OF THE WORLD

- FIGURE 56 REST OF THE WORLD: LAND SURVEY EQUIPMENT VOLUME, BY HARDWARE (UNITS)

- 11.7.1 RECESSION IMPACT ANALYSIS

- 11.7.2 PESTLE ANALYSIS

- FIGURE 57 REST OF THE WORLD: LAND SURVEY EQUIPMENT MARKET SNAPSHOT

- TABLE 247 REST OF THE WORLD: LAND SURVEY EQUIPMENT MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 248 REST OF THE WORLD: LAND SURVEY EQUIPMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 249 REST OF THE WORLD: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2019-2022 (USD MILLION)

- TABLE 250 REST OF THE WORLD: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 251 REST OF THE WORLD: LAND SURVEY EQUIPMENT MARKET, BY HARDWARE, 2019-2022 (USD MILLION)

- TABLE 252 REST OF THE WORLD: LAND SURVEY EQUIPMENT MARKET, BY HARDWARE, 2023-2028 (USD MILLION)

- TABLE 253 REST OF THE WORLD: LAND SURVEY EQUIPMENT MARKET, BY SOFTWARE, 2019-2022 (USD MILLION)

- TABLE 254 REST OF THE WORLD: LAND SURVEY EQUIPMENT MARKET, BY SOFTWARE, 2023-2028 (USD MILLION)

- TABLE 255 REST OF THE WORLD: LAND SURVEY EQUIPMENT MARKET, BY SERVICE, 2019-2022 (USD MILLION)

- TABLE 256 REST OF THE WORLD: LAND SURVEY EQUIPMENT MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 257 REST OF THE WORLD: LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 258 REST OF THE WORLD: LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 259 REST OF THE WORLD: LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 260 REST OF THE WORLD: LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 261 REST OF THE WORLD: LAND SURVEY EQUIPMENT MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 262 REST OF THE WORLD: LAND SURVEY EQUIPMENT MARKET, BY END USER, 2023-2028 (USD MILLION)

- 11.7.3 LATIN AMERICA

- 11.7.3.1 Deployment of modern surveying techniques to drive growth

- TABLE 263 LATIN AMERICA: LAND SURVEY EQUIPMENT MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 264 LATIN AMERICA: LAND SURVEY EQUIPMENT MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 265 LATIN AMERICA: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2019-2022 (USD MILLION)

- TABLE 266 LATIN AMERICA: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 267 LATIN AMERICA: LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 268 LATIN AMERICA: LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 269 LATIN AMERICA: LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 270 LATIN AMERICA: LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 271 LATIN AMERICA: LAND SURVEY EQUIPMENT MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 272 LATIN AMERICA: LAND SURVEY EQUIPMENT MARKET, BY END USER, 2023-2028 (USD MILLION)

- 11.7.4 AFRICA

- 11.7.4.1 Fast-improving tourism infrastructure to drive growth

- TABLE 273 AFRICA: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2019-2022 (USD MILLION)

- TABLE 274 AFRICA: LAND SURVEY EQUIPMENT MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 275 AFRICA: LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 276 AFRICA: LAND SURVEY EQUIPMENT MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 277 AFRICA: LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 278 AFRICA: LAND SURVEY EQUIPMENT MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 279 AFRICA: LAND SURVEY EQUIPMENT MARKET, BY END USER, 2019-2022 (USD MILLION)

- TABLE 280 AFRICA: LAND SURVEY EQUIPMENT MARKET, BY END USER, 2023-2028 (USD MILLION)

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 281 STRATEGIES ADOPTED BY KEY PLAYERS, 2019-2022

- 12.3 REVENUE ANALYSIS, 2018-2022

- FIGURE 58 REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2018-2022

- 12.4 MARKET SHARE ANALYSIS, 2022

- FIGURE 59 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2022

- TABLE 282 LAND SURVEY EQUIPMENT MARKET: DEGREE OF COMPETITION

- 12.5 RANKING ANALYSIS, 2022

- FIGURE 60 MARKET RANKING OF KEY PLAYERS, 2022

- 12.6 COMPETITIVE EVALUATION MATRIX, 2022

- 12.6.1 STARS

- 12.6.2 EMERGING LEADERS

- 12.6.3 PERVASIVE PLAYERS

- 12.6.4 PARTICIPANTS

- FIGURE 61 COMPANY EVALUATION MATRIX, 2022

- 12.6.5 COMPANY FOOTPRINT

- TABLE 283 COMPANY FOOTPRINT

- TABLE 284 SOLUTION FOOTPRINT

- TABLE 285 APPLICATION FOOTPRINT

- TABLE 286 REGION FOOTPRINT

- 12.7 START-UP/SME EVALUATION MATRIX, 2022

- 12.7.1 PROGRESSIVE COMPANIES

- 12.7.2 RESPONSIVE COMPANIES

- 12.7.3 DYNAMIC COMPANIES

- 12.7.4 STARTING BLOCKS

- FIGURE 62 START-UP/SME EVALUATION MATRIX, 2022

- 12.7.5 COMPETITIVE BENCHMARKING

- TABLE 287 KEY START-UPS/SMES

- TABLE 288 COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

- 12.8 COMPANY FINANCIAL METRICS, 2022

- FIGURE 63 COMPANY FINANCIAL METRICS, 2022

- 12.9 BRAND/PRODUCT COMPARISON

- TABLE 289 PRODUCT COMPARISON, BY TOTAL STATION

- TABLE 290 PRODUCT COMPARISON, BY LEVEL

- TABLE 291 PRODUCT COMPARISON, BY GNSS

- 12.10 COMPETITIVE SCENARIO

- 12.10.1 MARKET EVALUATION FRAMEWORK

- 12.10.2 PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 292 LAND SURVEY EQUIPMENT MARKET: PRODUCT LAUNCHES/DEVELOPMENTS, 2020-2023

- 12.10.3 DEALS

- TABLE 293 LAND SURVEY EQUIPMENT MARKET: DEALS, 2020-2023

- 12.10.4 OTHERS

- TABLE 294 LAND SURVEY EQUIPMENT MARKET: OTHERS, 2020-2023

13 COMPANY PROFILES

- (Business Overview, Products Offered, Recent Developments, MnM View Right to win, Strategic choices made, Weaknesses and competitive threats) **

- 13.1 KEY PLAYERS

- 13.1.1 HEXAGON AB

- TABLE 295 HEXAGON AB: COMPANY OVERVIEW

- FIGURE 64 HEXAGON AB: COMPANY SNAPSHOT

- TABLE 296 HEXAGON AB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 297 HEXAGON AB: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 298 HEXAGON AB: DEALS

- 13.1.2 TOPCON CORPORATION

- TABLE 299 TOPCON CORPORATION: COMPANY OVERVIEW

- FIGURE 65 TOPCON CORPORATION: COMPANY SNAPSHOT

- TABLE 300 TOPCON CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 301 TOPCON CORPORATION: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 302 TOPCON CORPORATION: DEALS

- 13.1.3 TRIMBLE INC.

- TABLE 303 TRIMBLE INC.: COMPANY OVERVIEW

- FIGURE 66 TRIMBLE INC.: COMPANY SNAPSHOT

- TABLE 304 TRIMBLE INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 305 TRIMBLE INC.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 306 TRIMBLE INC.: DEALS

- TABLE 307 TRIMBLE INC.: OTHERS

- 13.1.4 U-BLOX

- TABLE 308 U-BLOX: COMPANY OVERVIEW

- FIGURE 67 U-BLOX: COMPANY SNAPSHOT

- TABLE 309 U-BLOX.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 310 U-BLOX: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 311 U-BLOX: DEALS

- TABLE 312 U-BLOX: OTHERS

- 13.1.5 SHANGHAI HUACE NAVIGATION TECHNOLOGY LTD.

- TABLE 313 SHANGHAI HUACE NAVIGATION TECHNOLOGY LTD.: COMPANY OVERVIEW

- FIGURE 68 SHANGHAI HUACE NAVIGATION TECHNOLOGY LTD.: COMPANY SNAPSHOT

- TABLE 314 SHANGHAI HUACE NAVIGATION TECHNOLOGY LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 315 SHANGHAI HUACE NAVIGATION TECHNOLOGY LTD.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 316 SHANGHAI HUACE NAVIGATION TECHNOLOGY LTD.: DEALS

- TABLE 317 SHANGHAI HUACE NAVIGATION TECHNOLOGY LTD.: OTHERS

- 13.1.6 HI-TARGET

- TABLE 318 HI-TARGET: COMPANY OVERVIEW

- FIGURE 69 HI-TARGET: COMPANY SNAPSHOT

- TABLE 319 HI-TARGET: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 320 HI-TARGET: PRODUCT LAUNCHES/DEVELOPMENTS

- 13.1.7 HUDACO INDUSTRIES LTD.

- TABLE 321 HUDACO INDUSTRIES LTD.: COMPANY OVERVIEW

- FIGURE 70 HUDACO INDUSTRIES LTD.: COMPANY SNAPSHOT

- TABLE 322 HUDACO INDUSTRIES LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.8 SUZHOU FOIF CO., LTD.

- TABLE 323 SUZHOU FOIF CO., LTD.: COMPANY OVERVIEW

- TABLE 324 SUZHOU FOIF CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.9 STONEX SRL

- TABLE 325 STONEX SRL: COMPANY OVERVIEW

- TABLE 326 STONEX SRL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 327 STONEX SRL: PRODUCT LAUNCHES/DEVELOPMENTS

- 13.1.10 SOUTH SURVEYING & MAPPING TECHNOLOGY CO., LTD.

- TABLE 328 SOUTH SURVEYING & MAPPING TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 329 SOUTH SURVEYING & MAPPING TECHNOLOGY CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 330 SOUTH SURVEYING & MAPPING TECHNOLOGY CO., LTD.: OTHERS

- 13.1.11 CST/BERGER

- TABLE 331 CST/BERGER: COMPANY OVERVIEW

- TABLE 332 CST/BERGER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.12 CHANGZHOU DADI SURVEYING SCIENCE & TECHNOLOGY CO., LTD.

- TABLE 333 CHANGZHOU DADI SURVEYING SCIENCE & TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 334 CHANGZHOU DADI SURVEYING SCIENCE & TECHNOLOGY CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.13 GUANGDONG KOLIDA INSTRUMENT CO., LTD.

- TABLE 335 GUANGDONG KOLIDA INSTRUMENT CO., LTD.: COMPANY OVERVIEW

- TABLE 336 GUANGDONG KOLIDA INSTRUMENT CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 337 GUANGDONG KOLIDA INSTRUMENT CO., LTD.: OTHERS

- 13.1.14 UNISTRONG

- TABLE 338 UNISTRONG: COMPANY OVERVIEW

- FIGURE 71 UNISTRONG: COMPANY SNAPSHOT

- TABLE 339 UNISTRONG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 340 UNISTRONG: PRODUCT LAUNCHES/ DEVELOPMENTS

- 13.1.15 GEOTECH

- TABLE 341 GEOTECH: COMPANY OVERVIEW

- TABLE 342 GEOTECH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.16 ROBERT BOSCH GMBH

- TABLE 343 ROBERT BOSCH GMBH: COMPANY OVERVIEW

- TABLE 344 ROBERT BOSCH GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 345 ROBERT BOSCH GMBH: PRODUCT LAUNCHES/DEVELOPMENTS

- 13.2 OTHER PLAYERS

- 13.2.1 HEMISPHERE GNSS, INC.

- TABLE 346 HEMISPHERE GNSS, INC.: COMPANY OVERVIEW

- 13.2.2 ENTEK INSTRUMENTS INDIA PVT. LTD.

- TABLE 347 ENTEK INSTRUMENTS INDIA PVT. LTD.: COMPANY OVERVIEW

- 13.2.3 SAMAH AERIAL SURVEY CO., LTD.

- TABLE 348 SAMAH AERIAL SURVEY CO., LTD.: COMPANY OVERVIEW

- 13.2.4 EOS POSITIONING SYSTEMS, INC.

- TABLE 349 EOS POSITIONING SYSTEMS, INC.: COMPANY OVERVIEW

- 13.2.5 TI ASAHI CO., LTD.

- TABLE 350 TI ASAHI CO., LTD.: COMPANY OVERVIEW

- 13.2.6 GEOSOLUTION I GOTEBORG AB

- TABLE 351 GEOSOLUTION I GOTEBORG AB: COMPANY OVERVIEW

- 13.2.7 THEIS FEINWERKTECHNIK

- TABLE 352 THEIS FEINWERKTECHNIK: COMPANY OVERVIEW

- 13.2.8 EMLID TECH KFT

- TABLE 353 EMLID TECH KFT: COMPANY OVERVIEW

- 13.2.9 TIANJIN XING OU SURVEYING INSTRUMENT MANUFACTURE CO., LTD.

- TABLE 354 TIANJIN XING OU SURVEYING INSTRUMENT MANUFACTURE CO., LTD.: COMPANY OVERVIEW

- *Details on Business Overview, Products Offered, Recent Developments, MnM View, Right to win, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS