|

|

市場調査レポート

商品コード

1491990

粉体塗装の世界市場:コーティング方法別、樹脂タイプ別、最終用途産業別、地域別 - 予測(~2029年)Powder Coatings Market by Coating Method (Electrostatic Spray, Fluidized Bed), Resin Type (Thermoset, Thermoplastic), End-Use Industry (Appliances, Automotive, General Industrial, Architectural, Furniture) and Region - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| 粉体塗装の世界市場:コーティング方法別、樹脂タイプ別、最終用途産業別、地域別 - 予測(~2029年) |

|

出版日: 2024年06月06日

発行: MarketsandMarkets

ページ情報: 英文 417 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

世界の粉体塗装の市場規模は、2024年の154億米ドルから2029年までに202億米ドルに達すると予測され、CAGRで5.5%の成長が見込まれます。

アジア太平洋が2024年に金額ベースで市場の最大のシェアを占めると推定されます。人気の仕上げ技術として、粉体塗装は自動車、建築、家具、一般工業などの部門で幅広く使用されています。欠け、ひっかき、色あせに強い高品質の仕上げを提供するその能力により、世界中でその需要が後押しされています。さらに、新たな用途の開発や製品特性の向上に焦点を当てた研究開発活動の活発化が、市場の成長をさらに促進しています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 単位 | 金額(100万米ドル/10億米ドル) |

| セグメント | 樹脂タイプ別、用途別、地域別 |

| 対象地域 | アジア太平洋、欧州、北米、中東・アフリカ、南米 |

「家電が市場でもっとも急成長する用途セグメントになると予測されます。」

家電部門では、冷蔵庫、洗濯機、乾燥機などのさまざまな製品のコーティングに熱硬化性粉体塗装が盛んに利用されています。これらのコーティングは、欠けや傷、色あせに強い優れた仕上がりを提供するため、家電の用途に適しています。

特に、熱硬化性粉体塗装は環境にやさしく、揮発性有機化合物(VOC)を含まず、廃棄物も最小限に抑えられます。また、塗布が容易で硬化時間が短いため、製造の生産性が向上します。

世界の家電市場は、技術の進歩、産業の拡大、急速な都市化、1人当たり所得の増加、生活水準の向上、消費者のライフスタイルの変化、小規模世帯の増加などに後押しされて成長を示しています。消費者は環境にやさしくエネルギー効率の高い家電を選好し、この部門における粉体塗装への需要をさらに刺激しています。北米の家電市場は成熟しており、製品の普及率も高いです。この産業は代替財と、現在の住まいを改良するための裁量的投資を行う消費者によって占められています。南米ではブラジルが地域最大の家電市場であり、少数の主要メーカーが支配しています。ビルトイン製品とエアコンの市場浸透率は引き続き緩やかですが、増加しています。

「欧州が金額ベースで市場の第2位のシェアを占める可能性が高いです。」

欧州は、輸送とブロードバンドインフラへの多額の投資により、粉体塗装の第2位の市場として浮上します。特に、鉄道および道路サービスの発展と、官民部門が資金提供するインフラプロジェクトが、同地域の産業成長を後押ししています。

西欧は、国によって消費者ニーズが多様化し、複数のメーカー、ブランド、小売業者が存在する断片化された市場です。過剰生産能力と価格圧力が、規模の経済を獲得するための産業統合を促しています。消費者はオンラインで情報を入手する力を強めており、これは産業の発展に不可欠なものとなっています。D2Cも著しく伸びています。東欧は西欧より普及率が低いですが、代替財市場は拡大しています。欧米のメーカーが市場を独占しています。

これらの用途における粉体塗装に対する需要の高まりは大幅な増加を促し、主要ベンダーはより大きな市場シェアを獲得するため、この地域でのプレゼンスを戦略的に拡大しています。

当レポートでは、世界の粉体塗装市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

- 粉体塗装市場の企業にとって魅力的な機会

- 粉体塗装市場:樹脂タイプ別

- アジア太平洋の粉体塗装市場:最終用途産業別、国別

- 粉体塗装市場:先進国 vs. 発展途上国

- 粉体塗装市場:国別

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- ポーターのファイブフォース分析

- マクロ経済指標

- イントロダクション

- GDPの動向と予測

- 世界の建設産業の動向

- 世界の自動車産業の動向

- 世界の家電産業の動向

第6章 産業動向

- サプライチェーン分析

- エコシステムマップ

- 顧客ビジネスに影響を与える動向と混乱

- 主なステークホルダーと購入基準

- 価格分析

- 平均販売価格の動向:地域別

- 平均販売価格の動向:樹脂タイプ別

- 平均販売価格の動向:最終用途産業別

- 主要企業の平均販売価格の動向:最終用途産業別

- 貿易分析

- 粉体塗装の輸出シナリオ

- 粉体塗装の輸入シナリオ

- 市場成長に影響を与える世界経済のシナリオ

- ロシア・ウクライナ戦争

- 中国

- 欧州

- 規制情勢

- 特許分析

- ケーススタディ分析

- 技術分析

- 主要技術

- 補完技術

- 隣接技術

- 主な会議とイベント(2024年)

- 投資と資金調達のシナリオ

第7章 粉体塗装市場:コーティング方法別

- イントロダクション

- 静電スプレー

- 流動床

- その他のコーティング方法

- 静電流動床

- フレーム溶射

第8章 粉体塗装市場:樹脂タイプ別

- イントロダクション

- 熱硬化性

- 熱可塑性

第9章 粉体塗装市場:最終用途産業別

- イントロダクション

- 家電

- 自動車

- 一般工業

- 建築

- 家具

- その他の最終用途産業

- 顧客の主な要件

- 顧客リスト(コーティング業者)

第10章 粉体塗装市場:地域別

- イントロダクション

- アジア太平洋

- 景気後退の影響

- 中国

- インド

- 日本

- タイ

- 韓国

- インドネシア

- マレーシア

- オーストラリア・ニュージーランド

- その他のアジア太平洋

- 欧州

- 景気後退の影響

- ドイツ

- イタリア

- フランス

- 英国

- スペイン

- ポーランド

- オランダ

- スウェーデン

- ベルギー

- トルコ

- その他の欧州

- 北米

- 景気後退の影響

- 米国

- カナダ

- メキシコ

- 中東・アフリカ

- 景気後退の影響

- GCC諸国

- サウジアラビア

- アラブ首長国連邦

- その他のGCC諸国

- イラン

- イラク

- 南アフリカ

- その他の中東・アフリカ

- 南米

- 景気後退の影響

- ブラジル

- アルゼンチン

- コロンビア

- チリ

- その他の南米

第11章 競合情勢

- 概要

- 主要企業戦略

- 市場シェア分析

- 上位5社の収益分析

- 企業評価と財務指標(2023年)

- ブランド/製品の比較

- 企業評価マトリクス:主要企業(2023年)

- 企業評価マトリクス:スタートアップ/中小企業(2023年)

- 競合シナリオと動向

第12章 企業プロファイル

- 主要企業

- PPG INDUSTRIES, INC.

- THE SHERWIN-WILLIAMS COMPANY

- AKZO NOBEL N.V.

- AXALTA COATING SYSTEMS, LLC

- KANSAI PAINT CO. LTD.

- RPM INTERNATIONAL INC.

- JOTUN

- ASIAN PAINTS

- NIPPON PAINT HOLDINGS CO., LTD.

- PROTECH GROUP

- その他の企業

- TIGER COATINGS GMBH & CO. KG

- ANHUI MEIJIA NEW MATERIAL CO., LTD.

- BERGER PAINTS INDIA LIMITED

- POWDERTECH SURFACE SCIENCE

- SOMAR CORPORATION

- CLOVERDALE PAINT INC.

- FREILACKE

- DIAMOND VOGEL

- IFS COATINGS

- 3M

- ERIE POWDER COATINGS

- KEYLAND POLYMER

- PRIMATEK COATINGS OU

- CARDINAL

- MODERN SAK FACTORY FOR POWDER PAINT

- HENTZEN COATINGS, INC.

- VITRACOAT

- WEG

- EUROPOLVERI SPA

- PULVERIT S.P.A.

- ST POWDER COATINGS S.P.A.

- IBA KIMYA A.S.

- NEOKEM

- TEKNOS GROUP

- KCC CORPORATION

- CWS POWDER COATINGS GMBH

- PULVER INC.

第13章 隣接市場と関連市場

- イントロダクション

- 制限事項

- 塗料・コーティング市場

- 市場の概要

- 塗料・コーティング市場:技術別

- 塗料・コーティング市場:最終用途産業別

- 塗料・コーティング市場:地域別

第14章 付録

The powder coating market size is projected to reach USD 20.2 billion by 2029 at a CAGR of 5.5% from USD 15.4 billion in 2024. Asia pacific is estimated to account for the largest share in terms of value of the powder coating market in 2024. As a popular finishing technique, Powder coating finds extensive use in sectors such as automotive, architectural, furniture and general industrial. Its ability to provide high-quality finish resistant to chipping, scratching, and fading, fuels its demand globally. Additionally, increasing research and development activities focused on exploring new applications and improving product characteristics further propel the growth of the powder coating market.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Million/Billion) |

| Segments | By Resin Type, By Application, and By Region |

| Regions covered | Asia Pacific, Europe, North America, Middle East & Africa, and South America |

"Appliances is projected to be the fastest growing application segment of powder coating market."

In the appliances sector, thermosetting powder coatings are prominently utilized to coat various products such as refrigerators, washing machines, and dryers. These coatings offer a superior finish that is highly resistant to chipping, scratching, and fading, rendering them well-suited for household appliance applications.

Notably, thermosetting powder coatings are environmentally friendly, devoid of volatile organic compounds (VOCs), and generate minimal waste. They boast ease of application and rapid curing times, thereby enhancing manufacturing productivity.

The global appliances market is witnessing growth propelled by technological advancements, expansion in sectors, rapid urbanization, increasing per capita income, elevated living standards, shifts in consumer lifestyles, and a rising number of smaller households. Consumers exhibit a preference for eco-friendly and energy-efficient appliances, further stimulating the demand for powder coatings in this sector. North America's appliance market is mature and has significant product penetration. The industry is dominated by substitute goods and consumers making discretionary investments to improve their current homes. In South America Brazil is the region's largest appliance market, dominated by a few significant manufacturers. Built-in products and air conditioners continue to have modest market penetration, but are increasing.

"Europe is likely to account for the second largest share of powder coating market in terms of value."

Europe emerges as the second-largest market for powder coatings, driven by substantial investments in transportation and broadband infrastructure. Notably, developments in rail and road services, coupled with government and private sector-funded infrastructure projects, have bolstered industrial growth in the region.

Western Europe is a fragmented market with diverse consumer needs across countries and multiple producers, brands, and retailers. Overcapacity and price pressures have prompted industrial consolidation to attain economies of scale. Consumers are gaining more power and access to information online, making this an essential industry development. Direct-to-consumer sales are also growing significantly. Although Eastern Europe has lower penetration rates than Western Europe, there is a growing market for substitute items. Western producers dominate the market.

The heightened demand for powder coatings in these applications has prompted significant increases, with key vendors strategically expanding their presence within the region to capture a larger market share.

Interviews:

- By Company Type: Tier 1 - 39%, Tier 2 - 34%, and Tier 3 - 27%

- By Designation: C Level - 30%, D Level - 30%, and Others - 40%

- By Region: North America - 20%, Europe - 20%, Asia Pacific - 40%, Middle East & Africa - 10% and South America - 10%

The key companies profiled in this report are PPG Industries, Sherwin-Williams, Akzonobel N.V., Axalta Coating Systems, Kansai Paint Limited.

Research Coverage:

The powder coating market has been segmented based on Resin Type (Thermosets and Thermoplastic), Application (Appliances, Automotive, General Industrial, Architectural, Furniture and Other Applications), and by Region (Asia Pacific, North America, Europe, Middle East & Africa, and South America).

This report provides insights on the following pointers:

- Analysis of key drivers (Application growth in appliances, automotive, general industrial) restraints (Difficulty in obtaining thin films), opportunities (Increasing use of powder coating in automotive industry), and challenges (Growing environmental challenges) influencing the growth of the powder coating market.

- Product Development/Innovation: Detailed insight into research & development activities, and new product launches in the powder coating market.

- Market Development: Comprehensive information about markets - the report analyses the powder coating market across varied regions.

- Market Diversification: Exclusive information about the new products & services untapped geographies, recent developments, and investments in the powder coating market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players like PPG Industries, Sherwin-Williams, Akzonobel N.V., Axalta Coating Systems, Kansai Paint Limited in the Powder Coating market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- TABLE 1 INCLUSIONS AND EXCLUSIONS

- 1.2.2 DEFINITION AND INCLUSIONS, BY RESIN TYPE

- 1.2.3 DEFINITION AND INCLUSIONS, BY COATING METHOD

- 1.2.4 DEFINITION AND INCLUSIONS, BY END-USE INDUSTRY

- 1.3 MARKET SCOPE

- FIGURE 1 POWDER COATINGS MARKET SEGMENTATION

- 1.3.1 REGIONS COVERED

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

- 1.7.1 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 POWDER COATINGS MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Breakdown of primaries

- 2.1.2.3 Key primary interview participants

- 2.1.2.4 Key industry insights

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 TOP-DOWN APPROACH

- FIGURE 3 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 4 POWDER COATINGS MARKET SIZE ESTIMATION, BY VALUE

- FIGURE 5 POWDER COATINGS MARKET SIZE ESTIMATION, BY REGION

- FIGURE 6 POWDER COATINGS MARKET SIZE ESTIMATION, BY RESIN TYPE

- FIGURE 7 POWDER COATINGS MARKET SIZE ESTIMATION: BY END-USE INDUSTRY (BOTTOM-UP APPROACH)

- FIGURE 8 POWDER COATINGS MARKET SIZE ESTIMATION, BY END-USE INDUSTRY

- 2.3 MARKET FORECAST

- 2.3.1 SUPPLY-SIDE FORECAST

- FIGURE 9 POWDER COATINGS MARKET: SUPPLY-SIDE FORECAST

- FIGURE 10 SUPPLY-SIDE SIZING OF POWDER COATINGS MARKET

- 2.3.2 DEMAND-SIDE FORECAST

- FIGURE 11 POWDER COATINGS MARKET: DEMAND-SIDE FORECAST

- 2.4 FACTOR ANALYSIS

- FIGURE 12 FACTOR ANALYSIS OF POWDER COATINGS MARKET

- 2.5 DATA TRIANGULATION

- FIGURE 13 POWDER COATINGS MARKET: DATA TRIANGULATION

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 RESEARCH LIMITATIONS

- 2.8 GROWTH RATE ASSUMPTIONS

- 2.9 RISK ASSESSMENT

- 2.10 RECESSION IMPACT

3 EXECUTIVE SUMMARY

- TABLE 2 POWDER COATINGS MARKET SNAPSHOT (2023 VS. 2029)

- FIGURE 14 THERMOSET SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 15 APPLIANCES TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- FIGURE 16 ASIA PACIFIC TO DOMINATE POWDER COATINGS MARKET DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN POWDER COATINGS MARKET

- FIGURE 17 EMERGING ECONOMIES TO OFFER LUCRATIVE GROWTH POTENTIAL FOR MARKET PLAYERS

- 4.2 POWDER COATINGS MARKET, BY RESIN TYPE

- FIGURE 18 THERMOSET SEGMENT TO WITNESS HIGHER GROWTH DURING FORECAST PERIOD

- 4.3 ASIA PACIFIC: POWDER COATINGS MARKET, BY END-USE INDUSTRY AND COUNTRY

- FIGURE 19 CHINA ACCOUNTED FOR LARGEST MARKET SHARE IN 2023

- 4.4 POWDER COATINGS MARKET: DEVELOPED VS. DEVELOPING ECONOMIES

- FIGURE 20 DEMAND FOR POWDER COATINGS TO GROW FASTER IN DEVELOPING COUNTRIES

- 4.5 POWDER COATINGS MARKET, BY COUNTRY

- FIGURE 21 INDIA TO WITNESS HIGHEST GROWTH DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 22 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN POWDER COATINGS MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Eco-friendly properties and reduced carbon footprints

- 5.2.1.2 Surge in demand for automotive parts and components

- 5.2.1.3 Integration of AI technology

- 5.2.1.4 Growing preference for sustainable coatings

- 5.2.2 RESTRAINTS

- 5.2.2.1 Difficulty in achieving thin films

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Customization and personalization

- 5.2.3.2 Applications in shipbuilding and pipeline Industries

- 5.2.3.3 Growing demand for high-performance fluorine resin-based coatings

- 5.2.3.4 Development of new application processes

- 5.2.4 CHALLENGES

- 5.2.4.1 Growing environmental challenges

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- TABLE 3 POWDER COATINGS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 23 PORTER'S FIVE FORCES ANALYSIS: POWDER COATINGS

- 5.3.1 THREAT OF SUBSTITUTES

- 5.3.2 BARGAINING POWER OF BUYERS

- 5.3.3 THREAT OF NEW ENTRANTS

- 5.3.4 BARGAINING POWER OF SUPPLIERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 MACROECONOMICS INDICATOR

- 5.4.1 INTRODUCTION

- 5.4.2 GDP TRENDS AND FORECAST

- TABLE 4 GDP PERCENTAGE (%) CHANGE, KEY COUNTRY, 2020-2028

- 5.4.3 TRENDS IN GLOBAL CONSTRUCTION INDUSTRY

- 5.4.4 TRENDS IN GLOBAL AUTOMOTIVE INDUSTRY

- TABLE 5 TRENDS OF GLOBAL AUTOMOTIVE INDUSTRY

- 5.4.5 TRENDS IN GLOBAL APPLIANCES INDUSTRY

6 INDUSTRY TRENDS

- 6.1 SUPPLY CHAIN ANALYSIS

- FIGURE 24 POWDER COATINGS: SUPPLY CHAIN ANALYSIS

- 6.2 ECOSYSTEM MAP

- TABLE 6 POWDER COATINGS MARKET: ROLE IN ECOSYSTEM

- FIGURE 25 PAINTS & COATINGS MARKET: ECOSYSTEM MAPPING

- FIGURE 26 ECOSYSTEM: POWDER COATINGS MARKET

- 6.3 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 27 POWDER COATING MANUFACTURERS: TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.4 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.4.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 28 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- TABLE 7 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP INDUSTRIES (%)

- 6.4.2 BUYING CRITERIA

- FIGURE 29 KEY BUYING CRITERIA FOR POWDER COATINGS

- TABLE 8 KEY BUYING CRITERIA FOR POWDER COATINGS

- 6.5 PRICING ANALYSIS

- 6.5.1 AVERAGE SELLING PRICE TREND, BY REGION

- FIGURE 30 AVERAGE SELLING PRICE TREND, BY REGION, 2022-2029

- 6.5.2 AVERAGE SELLING PRICE TREND, BY RESIN TYPE

- FIGURE 31 AVERAGE SELLING PRICE TREND, BY RESIN TYPE, 2022-2029

- 6.5.3 AVERAGE SELLING PRICE TREND, BY END-USE INDUSTRY

- FIGURE 32 AVERAGE SELLING PRICE TREND, BY END-USE INDUSTRY, 2022-2029

- 6.5.4 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY END-USE INDUSTRY

- FIGURE 33 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY END-USE INDUSTRY, 2023

- 6.6 TRADE ANALYSIS

- 6.6.1 EXPORT SCENARIO OF POWDER COATING

- FIGURE 34 POWDER COATING EXPORT, BY KEY COUNTRY, 2019-2023 (USD THOUSAND)

- TABLE 9 COUNTRY-WISE EXPORT DATA, 2022-2023 (USD THOUSAND)

- 6.6.2 IMPORT SCENARIO OF POWDER COATING

- FIGURE 35 POWDER COATING IMPORT, BY KEY COUNTRY, 2019-2023 (USD THOUSAND)

- TABLE 10 COUNTRY-WISE IMPORT DATA, 2022-2023 (USD THOUSAND)

- 6.7 GLOBAL ECONOMIC SCENARIO AFFECTING MARKET GROWTH

- 6.7.1 RUSSIA-UKRAINE WAR

- 6.7.2 CHINA

- 6.7.2.1 Decreasing investments lowering growth trajectory

- 6.7.2.2 Environmental commitments

- 6.7.3 EUROPE

- 6.7.3.1 Political and economic instability in Germany

- 6.7.3.2 Energy crisis in Europe

- 6.8 REGULATORY LANDSCAPE

- TABLE 11 INTERNATIONALLY RECOGNIZED TEST METHODS

- TABLE 12 RELEVANT STANDARDS

- 6.8.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.9 PATENT ANALYSIS

- FIGURE 36 MAJOR PATENTS FOR POWDER COATING, 2015-2024

- 6.9.1 MAJOR PATENTS

- 6.10 CASE STUDY ANALYSIS

- 6.10.1 CASE STUDY 1: PPG PARTNERED WITH LAS VEGAS RAIDERS

- 6.10.2 CASE STUDY 2: DECORAL CONDUCTS 5-YEAR LONG TEST, MEETS Q-LAB STANDARDS

- 6.10.3 CASE STUDY 3: DESIGN AND CONSTRUCTION OF MODERN DECORATIVE PAINT MANUFACTURING FACILITY

- 6.11 TECHNOLOGY ANALYSIS

- 6.11.1 KEY TECHNOLOGY

- 6.11.1.1 Low cure technology

- 6.11.1.2 Nano Technology

- 6.11.2 COMPLEMENTARY TECHNOLOGY

- 6.11.2.1 Waterborne powder coating technology

- 6.11.3 ADJACENT TECHNOLOGY

- 6.11.1 KEY TECHNOLOGY

- 6.12 KEY CONFERENCES AND EVENTS, 2024

- TABLE 17 POWDER COATINGS MARKET: KEY CONFERENCES AND EVENTS, 2024

- 6.13 INVESTMENT AND FUNDING SCENARIO

- TABLE 18 INVESTMENT AND FUNDING SCENARIO

7 POWDER COATINGS MARKET, BY COATING METHOD

- 7.1 INTRODUCTION

- 7.2 ELECTROSTATIC SPRAY

- 7.2.1 INCREASING DEMAND FOR DURABLE AND HIGH-QUALITY COATINGS TO DRIVE MARKET

- TABLE 19 ADVANTAGES AND DISADVANTAGES OF ELECTROSTATIC SPRAY

- FIGURE 37 POWDER COATING GUN

- 7.3 FLUIDIZED BED

- 7.3.1 REGULATORY COMPLIANCE AND SAFETY STANDARDS TO DRIVE MARKET

- TABLE 20 ADVANTAGES AND DISADVANTAGES OF FLUIDIZED BED

- FIGURE 38 FLUIDIZED POWDER BED

- 7.4 OTHER COATING METHODS

- 7.4.1 ELECTROSTATIC FLUIDIZED BED

- 7.4.2 FLAME SPRAYING

8 POWDER COATINGS MARKET, BY RESIN TYPE

- 8.1 INTRODUCTION

- FIGURE 39 THERMOSET TYPE TO DOMINATE MARKET DURING FORECAST PERIOD

- TABLE 21 APPLICATION VS. RESIN MAPPING

- TABLE 22 POWDER COATINGS MARKET, BY RESIN TYPE, 2021-2023 (USD MILLION)

- TABLE 23 POWDER COATINGS MARKET, BY RESIN TYPE, 2024-2029 (USD MILLION)

- TABLE 24 POWDER COATINGS MARKET, BY RESIN TYPE, 2021-2023 (KILOTON)

- TABLE 25 POWDER COATINGS MARKET, BY RESIN TYPE, 2024-2029 (KILOTON)

- 8.1.1 THERMOSET AND THERMOPLASTIC RESIN

- 8.2 THERMOSET

- 8.2.1 ADVANCEMENTS IN RESIN TECHNOLOGIES TO DRIVE MARKET

- TABLE 26 THERMOSET: POWDER COATINGS MARKET, RESIN TYPE, 2021-2023 (USD MILLION)

- TABLE 27 THERMOSET: POWDER COATINGS MARKET, RESIN TYPE, 2024-2029 (USD MILLION)

- TABLE 28 THERMOSET: POWDER COATINGS MARKET, RESIN TYPE, 2021-2023 (KILOTON)

- TABLE 29 THERMOSET: POWDER COATINGS MARKET, RESIN TYPE, 2024-2029 (KILOTON)

- TABLE 30 THERMOSET: POWDER COATINGS MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 31 THERMOSET: POWDER COATINGS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 32 THERMOSET: POWDER COATINGS MARKET, BY REGION, 2021-2023 (KILOTON)

- TABLE 33 THERMOSET: POWDER COATINGS MARKET, BY REGION, 2024-2029 (KILOTON)

- 8.2.2 POLYESTER

- TABLE 34 POLYESTER: POWDER COATINGS MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 35 POLYESTER: POWDER COATINGS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 36 POLYESTER: POWDER COATINGS MARKET, BY REGION, 2021-2023 (KILOTON)

- TABLE 37 POLYESTER: POWDER COATINGS MARKET, BY REGION, 2024-2029 (KILOTON)

- 8.2.3 HYBRID (EPOXY POLYESTER)

- TABLE 38 EPOXY POLYESTER HYBRID: POWDER COATINGS MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 39 EPOXY POLYESTER HYBRID POWDER COATINGS MARKET, REGION, 2024-2029 (USD MILLION)

- TABLE 40 EPOXY POLYESTER HYBRID: POWDER COATINGS MARKET, REGION, 2021-2023 (KILOTON)

- TABLE 41 EPOXY POLYESTER HYBRID: POWDER COATINGS MARKET, REGION, 2024-2029 (KILOTON)

- 8.2.4 EPOXY

- TABLE 42 EPOXY: POWDER COATINGS MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 43 EPOXY: POWDER COATINGS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 44 EPOXY: POWDER COATINGS MARKET, BY REGION, 2021-2023 (KILOTON)

- TABLE 45 EPOXY: POWDER COATINGS MARKET, BY REGION, 2024-2029 (KILOTON)

- 8.2.5 ACRYLIC

- TABLE 46 ACRYLIC: POWDER COATINGS MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 47 ACRYLIC: POWDER COATINGS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 48 ACRYLIC: POWDER COATINGS MARKET, BY REGION, 2021-2023 (KILOTON)

- TABLE 49 ACRYLIC: POWDER COATINGS MARKET, BY REGION, 2024-2029 (KILOTON)

- 8.2.6 POLYURETHANE

- TABLE 50 POLYURETHANE: POWDER COATINGS MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 51 POLYURETHANE: POWDER COATINGS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 52 POLYURETHANE: POWDER COATINGS MARKET, BY REGION, 2021-2023 (KILOTON)

- TABLE 53 POLYURETHANE: POWDER COATINGS MARKET, BY REGION, 2024-2029 (KILOTON)

- FIGURE 40 CHARACTERISTICS OF THERMOSET POWDER COATINGS

- 8.3 THERMOPLASTICS

- 8.3.1 LOWER OPERATIONAL TEMPERATURE REQUIREMENTS TO DRIVE MARKET

- TABLE 54 THERMOPLASTIC: POWDER COATINGS MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 55 THERMOPLASTIC: POWDER COATINGS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 56 THERMOPLASTIC: POWDER COATINGS MARKET, BY REGION, 2021-2023 (KILOTON)

- TABLE 57 THERMOPLASTIC: POWDER COATINGS MARKET, BY REGION, 2024-2029 (KILOTON)

- 8.3.2 POLYVINYL CHLORIDE

- 8.3.3 POLYVINYL FLUORIDE

9 POWDER COATINGS MARKET, BY END-USE INDUSTRY

- 9.1 INTRODUCTION

- FIGURE 41 APPLIANCE INDUSTRY TO DOMINATE POWDER COATINGS MARKET DURING FORECAST PERIOD

- TABLE 58 POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 59 POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 60 POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 61 POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- 9.2 APPLIANCES

- 9.2.1 INCREASING DEMAND FOR HIGH-QUALITY AND LONG-LASTING FINISH TO DRIVE MARKET

- TABLE 62 APPLIANCES: POWDER COATINGS MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 63 APPLIANCES: POWDER COATINGS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 64 APPLIANCES: POWDER COATINGS MARKET, BY REGION, 2021-2023 (KILOTON)

- TABLE 65 APPLIANCES: POWDER COATINGS MARKET, BY REGION, 2024-2029 (KILOTON)

- 9.2.2 LIST OF CUSTOMERS

- 9.2.3 OPERATIONAL DRIVERS AND OPPORTUNITIES

- 9.3 AUTOMOTIVE

- 9.3.1 INCREASING DEMAND FROM ELECTRIC AND AUTONOMOUS VEHICLES TO DRIVE MARKET

- TABLE 66 AUTOMOTIVE: POWDER COATINGS MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 67 AUTOMOTIVE: POWDER COATINGS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 68 AUTOMOTIVE: POWDER COATINGS MARKET, BY REGION, 2021-2023 (KILOTON)

- TABLE 69 AUTOMOTIVE: POWDER COATINGS MARKET, BY REGION, 2024-2029 (KILOTON)

- 9.3.2 LIST OF CUSTOMERS

- 9.3.3 OPERATIONAL DRIVERS AND OPPORTUNITIES

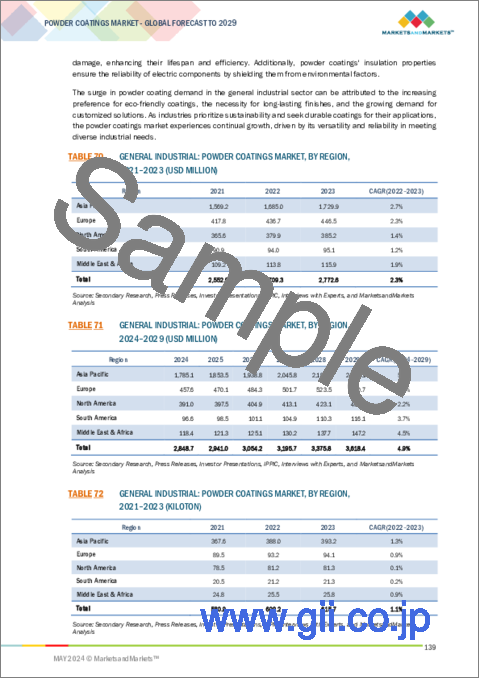

- 9.4 GENERAL INDUSTRIAL

- 9.4.1 DURABILITY AND EASY MAINTENANCE TO DRIVE MARKET

- TABLE 70 GENERAL INDUSTRIAL: POWDER COATINGS MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 71 GENERAL INDUSTRIAL: POWDER COATINGS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 72 GENERAL INDUSTRIAL: POWDER COATINGS MARKET, BY REGION, 2021-2023 (KILOTON)

- TABLE 73 GENERAL INDUSTRIAL: POWDER COATINGS MARKET, BY REGION, 2024-2029 (KILOTON)

- 9.4.2 LIST OF CUSTOMERS

- 9.4.3 OPERATIONAL DRIVERS AND OPPORTUNITIES

- 9.5 ARCHITECTURAL

- 9.5.1 INCREASING EMPHASIS ON SUSTAINABILITY AND LOW-EMISSION PRODUCTS TO DRIVE MARKET

- TABLE 74 ARCHITECTURAL: POWDER COATINGS MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 75 ARCHITECTURAL: POWDER COATINGS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 76 ARCHITECTURAL: POWDER COATINGS MARKET, BY REGION, 2021-2023 (KILOTON)

- TABLE 77 ARCHITECTURAL: POWDER COATINGS MARKET, BY REGION, 2024-2029 (KILOTON)

- 9.5.2 LIST OF CUSTOMERS

- 9.5.3 OPERATIONAL DRIVERS AND OPPORTUNITIES

- 9.6 FURNITURE

- 9.6.1 IMPROVED LIVING STANDARDS TO DRIVE MARKET

- TABLE 78 FURNITURE: POWDER COATINGS MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 79 FURNITURE: POWDER COATINGS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 80 FURNITURE: POWDER COATINGS MARKET, BY REGION, 2021-2023 (KILOTON)

- TABLE 81 FURNITURE: POWDER COATINGS MARKET, BY REGION, 2024-2029 (KILOTON)

- 9.6.2 LIST OF CUSTOMERS

- 9.6.3 OPERATIONAL DRIVERS AND OPPORTUNITIES

- 9.7 OTHER END-USE INDUSTRIES

- TABLE 82 OTHER END-USE INDUSTRIES: POWDER COATINGS MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 83 OTHER END-USE INDUSTRIES: POWDER COATINGS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 84 OTHER END-USE INDUSTRIES: POWDER COATINGS MARKET, BY REGION, 2021-2023 (KILOTON)

- TABLE 85 OTHER END-USE INDUSTRIES: POWDER COATINGS MARKET, BY REGION, 2024-2029 (KILOTON)

- 9.7.1 LIST OF CUSTOMERS

- 9.7.2 OPERATIONAL DRIVERS AND OPPORTUNITIES

- 9.8 CUSTOMERS' KEY REQUIREMENTS

- 9.9 LIST OF CUSTOMERS (COATERS)

10 POWDER COATINGS MARKET, BY REGION

- 10.1 INTRODUCTION

- FIGURE 42 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 86 POWDER COATINGS MARKET, BY REGION, 2021-2023 (USD MILLION)

- TABLE 87 POWDER COATINGS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 88 POWDER COATINGS MARKET, BY REGION, 2021-2023 (KILOTON)

- TABLE 89 POWDER COATINGS MARKET, BY REGION, 2024-2029 (KILOTON)

- 10.2 ASIA PACIFIC

- 10.2.1 RECESSION IMPACT

- FIGURE 43 ASIA PACIFIC: POWDER COATINGS MARKET SNAPSHOT

- TABLE 90 ASIA PACIFIC: POWDER COATINGS MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 91 ASIA PACIFIC: POWDER COATINGS MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 92 ASIA PACIFIC: POWDER COATINGS MARKET, BY COUNTRY, 2021-2023 (KILOTON)

- TABLE 93 ASIA PACIFIC: POWDER COATINGS MARKET, BY COUNTRY, 2024-2029 (KILOTON)

- TABLE 94 ASIA PACIFIC: POWDER COATINGS MARKET, BY RESIN TYPE, 2021-2023 (USD MILLION)

- TABLE 95 ASIA PACIFIC: POWDER COATINGS MARKET, BY RESIN TYPE, 2024-2029 (USD MILLION)

- TABLE 96 ASIA PACIFIC: POWDER COATINGS MARKET, BY RESIN TYPE, 2021-2023 (KILOTON)

- TABLE 97 ASIA PACIFIC: POWDER COATINGS MARKET, BY RESIN TYPE, 2024-2029 (KILOTON)

- TABLE 98 ASIA PACIFIC: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 99 ASIA PACIFIC: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 100 ASIA PACIFIC: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 101 ASIA PACIFIC: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- 10.2.2 CHINA

- 10.2.2.1 Industrial growth and urbanization to drive market

- TABLE 102 CHINA: POWDER COATINGS MARKET, BY RESIN TYPE, 2021-2023 (USD MILLION)

- TABLE 103 CHINA: POWDER COATINGS MARKET, BY RESIN TYPE, 2024-2029 (USD MILLION)

- TABLE 104 CHINA: POWDER COATINGS MARKET, BY RESIN TYPE, 2021-2023 (KILOTON)

- TABLE 105 CHINA: POWDER COATINGS MARKET, BY RESIN TYPE, 2024-2029 (KILOTON)

- TABLE 106 CHINA: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 107 CHINA: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 108 CHINA: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 109 CHINA: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- 10.2.3 INDIA

- 10.2.3.1 Rapid growth in automotive industry to drive market

- TABLE 110 INDIA: POWDER COATINGS MARKET, BY RESIN TYPE, 2021-2023 (USD MILLION)

- TABLE 111 INDIA: POWDER COATINGS MARKET, BY RESIN TYPE, 2024-2029 (USD MILLION)

- TABLE 112 INDIA: POWDER COATINGS MARKET, BY RESIN TYPE, 2021-2023 (KILOTON)

- TABLE 113 INDIA: POWDER COATINGS MARKET, BY RESIN TYPE, 2024-2029 (KILOTON)

- TABLE 114 INDIA: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 115 INDIA: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 116 INDIA: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 117 INDIA: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- 10.2.4 JAPAN

- 10.2.4.1 Increasing demand for advanced coating solutions to drive market

- TABLE 118 JAPAN: POWDER COATINGS MARKET, BY RESIN TYPE, 2021-2023 (USD MILLION)

- TABLE 119 JAPAN: POWDER COATINGS MARKET, BY RESIN TYPE, 2024-2029 (USD MILLION)

- TABLE 120 JAPAN: POWDER COATINGS MARKET, BY RESIN TYPE, 2021-2023 (KILOTON)

- TABLE 121 JAPAN: POWDER COATINGS MARKET, BY RESIN TYPE, 2024-2029 (KILOTON)

- TABLE 122 JAPAN: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 123 JAPAN: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 124 JAPAN: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 125 JAPAN: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- 10.2.5 THAILAND

- 10.2.5.1 Increasing investments in public infrastructure to drive market

- TABLE 126 THAILAND: POWDER COATINGS MARKET, BY RESIN TYPE, 2021-2023 (USD MILLION)

- TABLE 127 THAILAND: POWDER COATINGS MARKET, BY RESIN TYPE, 2024-2029 (USD MILLION)

- TABLE 128 THAILAND: POWDER COATINGS MARKET, BY RESIN TYPE, 2021-2023 (KILOTON)

- TABLE 129 THAILAND: POWDER COATINGS MARKET, BY RESIN TYPE, 2024-2029 (KILOTON)

- TABLE 130 THAILAND: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 131 THAILAND: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 132 THAILAND: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 133 THAILAND: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- 10.2.6 SOUTH KOREA

- 10.2.6.1 Government initiatives for promoting new technologies to drive market

- TABLE 134 SOUTH KOREA: POWDER COATINGS MARKET, BY RESIN TYPE, 2021-2023 (USD MILLION)

- TABLE 135 SOUTH KOREA: POWDER COATINGS MARKET, BY RESIN TYPE, 2024-2029 (USD MILLION)

- TABLE 136 SOUTH KOREA: POWDER COATINGS MARKET, BY RESIN TYPE, 2021-2023 (KILOTON)

- TABLE 137 SOUTH KOREA: POWDER COATINGS MARKET, BY RESIN TYPE, 2024-2029 (KILOTON)

- TABLE 138 SOUTH KOREA: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 139 SOUTH KOREA: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 140 SOUTH KOREA: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 141 SOUTH KOREA: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- 10.2.7 INDONESIA

- 10.2.7.1 Increasing investment in construction sector to drive market

- TABLE 142 INDONESIA: POWDER COATINGS MARKET, BY RESIN TYPE, 2021-2023 (USD MILLION)

- TABLE 143 INDONESIA: POWDER COATINGS MARKET, BY RESIN TYPE, 2024-2029 (USD MILLION)

- TABLE 144 INDONESIA: POWDER COATINGS MARKET, BY RESIN TYPE, 2021-2023 (KILOTON)

- TABLE 145 INDONESIA: POWDER COATINGS MARKET, BY RESIN TYPE, 2024-2029 (KILOTON)

- TABLE 146 INDONESIA: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 147 INDONESIA: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 148 INDONESIA: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 149 INDONESIA: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- 10.2.8 MALAYSIA

- 10.2.8.1 Growing demand for protective and aesthetically appealing finishes to drive market

- TABLE 150 MALAYSIA: POWDER COATINGS MARKET, BY RESIN TYPE, 2021-2023 (USD MILLION)

- TABLE 151 MALAYSIA: POWDER COATINGS MARKET, BY RESIN TYPE, 2024-2029 (USD MILLION)

- TABLE 152 MALAYSIA: POWDER COATINGS MARKET, BY RESIN TYPE, 2021-2023 (KILOTON)

- TABLE 153 MALAYSIA: POWDER COATINGS MARKET, BY RESIN TYPE, 2024-2029 (KILOTON)

- TABLE 154 MALAYSIA: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 155 MALAYSIA: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 156 MALAYSIA: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 157 MALAYSIA: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- 10.2.9 AUSTRALIA & NEW ZEALAND

- 10.2.9.1 High consumer spending to drive market

- TABLE 158 AUSTRALIA & NEW ZEALAND: POWDER COATINGS MARKET, BY RESIN TYPE, 2021-2023 (USD MILLION)

- TABLE 159 AUSTRALIA & NEW ZEALAND: POWDER COATINGS MARKET, BY RESIN TYPE, 2024-2029 (USD MILLION)

- TABLE 160 AUSTRALIA & NEW ZEALAND: POWDER COATINGS MARKET, BY RESIN TYPE, 2021-2023 (KILOTON)

- TABLE 161 AUSTRALIA & NEW ZEALAND: POWDER COATINGS MARKET, BY RESIN TYPE, 2024-2029 (KILOTON)

- TABLE 162 AUSTRALIA & NEW ZEALAND: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 163 AUSTRALIA & NEW ZEALAND: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 164 AUSTRALIA & NEW ZEALAND: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 165 AUSTRALIA & NEW ZEALAND: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- 10.2.10 REST OF ASIA PACIFIC

- TABLE 166 REST OF ASIA PACIFIC: POWDER COATINGS MARKET, BY RESIN TYPE, 2021-2023 (USD MILLION)

- TABLE 167 REST OF ASIA PACIFIC: POWDER COATINGS MARKET, BY RESIN TYPE, 2024-2029 (USD MILLION)

- TABLE 168 REST OF ASIA PACIFIC: POWDER COATINGS MARKET, BY RESIN TYPE, 2021-2023 (KILOTON)

- TABLE 169 REST OF ASIA PACIFIC: POWDER COATINGS MARKET, BY RESIN TYPE, 2024-2029 (KILOTON)

- TABLE 170 REST OF ASIA PACIFIC: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 171 REST OF ASIA PACIFIC: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 172 REST OF ASIA PACIFIC: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 173 REST OF ASIA PACIFIC: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- 10.3 EUROPE

- 10.3.1 RECESSION IMPACT

- FIGURE 44 EUROPE: POWDER COATINGS MARKET SNAPSHOT

- TABLE 174 EUROPE: POWDER COATINGS MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 175 EUROPE: POWDER COATINGS MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 176 EUROPE: POWDER COATINGS MARKET, BY COUNTRY, 2021-2023 (KILOTON)

- TABLE 177 EUROPE: POWDER COATINGS MARKET, BY COUNTRY, 2024-2029 (KILOTON)

- TABLE 178 EUROPE: POWDER COATINGS MARKET, BY RESIN TYPE, 2021-2023 (USD MILLION)

- TABLE 179 EUROPE: POWDER COATINGS MARKET, BY RESIN TYPE, 2024-2029 (USD MILLION)

- TABLE 180 EUROPE: POWDER COATINGS MARKET, BY RESIN TYPE, 2021-2023 (KILOTON)

- TABLE 181 EUROPE: POWDER COATINGS MARKET, BY RESIN TYPE, 2024-2029 (KILOTON)

- TABLE 182 EUROPE: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 183 EUROPE: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 184 EUROPE: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 185 EUROPE: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- 10.3.2 GERMANY

- 10.3.2.1 Rising demand for electric vehicles to drive market

- TABLE 186 GERMANY: POWDER COATINGS MARKET, BY RESIN TYPE, 2021-2023 (USD MILLION)

- TABLE 187 GERMANY: POWDER COATINGS MARKET, BY RESIN TYPE, 2024-2029 (USD MILLION)

- TABLE 188 GERMANY: POWDER COATINGS MARKET, BY RESIN TYPE, 2021-2023 (KILOTON)

- TABLE 189 GERMANY: POWDER COATINGS MARKET, BY RESIN TYPE, 2024-2029 (KILOTON)

- TABLE 190 GERMANY: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 191 GERMANY: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 192 GERMANY: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 193 GERMANY: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- 10.3.3 ITALY

- 10.3.3.1 Surge in industrial robot installations to drive market

- TABLE 194 ITALY: POWDER COATINGS MARKET, BY RESIN TYPE, 2021-2023 (USD MILLION)

- TABLE 195 ITALY: POWDER COATINGS MARKET, BY RESIN TYPE, 2024-2029 (USD MILLION)

- TABLE 196 ITALY: POWDER COATINGS MARKET, BY RESIN TYPE, 2021-2023 (KILOTON)

- TABLE 197 ITALY: POWDER COATINGS MARKET, BY RESIN TYPE, 2024-2029 (KILOTON)

- TABLE 198 ITALY: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 199 ITALY: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 200 ITALY: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 201 ITALY: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- 10.3.4 FRANCE

- 10.3.4.1 Reviving economy and infrastructure to drive market

- TABLE 202 FRANCE: POWDER COATINGS MARKET, BY RESIN TYPE, 2021-2023 (USD MILLION)

- TABLE 203 FRANCE: POWDER COATINGS MARKET, BY RESIN TYPE, 2024-2029 (USD MILLION)

- TABLE 204 FRANCE: POWDER COATINGS MARKET, BY RESIN TYPE, 2021-2023 (KILOTON)

- TABLE 205 FRANCE: POWDER COATINGS MARKET, BY RESIN TYPE, 2024-2029 (KILOTON)

- TABLE 206 FRANCE: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 207 FRANCE: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 208 FRANCE: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 209 FRANCE: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- 10.3.5 UK

- 10.3.5.1 Increasing demand for SUVs and zero-emission vehicles to drive market

- TABLE 210 UK: POWDER COATINGS MARKET, BY RESIN TYPE, 2021-2023 (USD MILLION)

- TABLE 211 UK: POWDER COATINGS MARKET, BY RESIN TYPE, 2024-2029 (USD MILLION)

- TABLE 212 UK: POWDER COATINGS MARKET, BY RESIN TYPE, 2021-2023 (KILOTON)

- TABLE 213 UK: POWDER COATINGS MARKET, BY RESIN TYPE, 2024-2029 (KILOTON)

- TABLE 214 UK: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 215 UK: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 216 UK: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 217 UK: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- 10.3.6 SPAIN

- 10.3.6.1 Increasing demand for machinery & equipment to drive market

- TABLE 218 SPAIN: POWDER COATINGS MARKET, BY RESIN TYPE, 2021-2023 (USD MILLION)

- TABLE 219 SPAIN: POWDER COATINGS MARKET, BY RESIN TYPE, 2024-2029 (USD MILLION)

- TABLE 220 SPAIN: POWDER COATINGS MARKET, BY RESIN TYPE, 2021-2023 (KILOTON)

- TABLE 221 SPAIN: POWDER COATINGS MARKET, BY RESIN TYPE, 2024-2029 (KILOTON)

- TABLE 222 SPAIN: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 223 SPAIN: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 224 SPAIN: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 225 SPAIN: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- 10.3.7 POLAND

- 10.3.7.1 Growing demand for appliances to drive market

- TABLE 226 POLAND: POWDER COATINGS MARKET, BY RESIN TYPE, 2021-2023 (USD MILLION)

- TABLE 227 POLAND: POWDER COATINGS MARKET, BY RESIN TYPE, 2024-2029 (USD MILLION)

- TABLE 228 POLAND: POWDER COATINGS MARKET, BY RESIN TYPE, 2021-2023 (KILOTON)

- TABLE 229 POLAND: POWDER COATINGS MARKET, BY RESIN TYPE, 2024-2029 (KILOTON)

- TABLE 230 POLAND: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 231 POLAND: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 232 POLAND: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 233 POLAND: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- 10.3.8 NETHERLANDS

- 10.3.8.1 Government initiatives and investments to drive market

- TABLE 234 NETHERLANDS: POWDER COATINGS MARKET, BY RESIN TYPE, 2021-2023 (USD MILLION)

- TABLE 235 NETHERLANDS: POWDER COATINGS MARKET, BY RESIN TYPE, 2024-2029 (USD MILLION)

- TABLE 236 NETHERLANDS: POWDER COATINGS MARKET, BY RESIN TYPE, 2021-2023 (KILOTON)

- TABLE 237 NETHERLANDS: POWDER COATINGS MARKET, BY RESIN TYPE, 2024-2029 (KILOTON)

- TABLE 238 NETHERLANDS: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 239 NETHERLANDS: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 240 NETHERLANDS: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 241 NETHERLANDS: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- 10.3.9 SWEDEN

- 10.3.9.1 Increasing investments in rails and road construction to drive market

- TABLE 242 SWEDEN: POWDER COATINGS MARKET, BY RESIN TYPE, 2021-2023 (USD MILLION)

- TABLE 243 SWEDEN: POWDER COATINGS MARKET, BY RESIN TYPE, 2024-2029 (USD MILLION)

- TABLE 244 SWEDEN: POWDER COATINGS MARKET, BY RESIN TYPE, 2021-2023(KILOTON)

- TABLE 245 SWEDEN: POWDER COATINGS MARKET, BY RESIN TYPE, 2024-2029 (KILOTON)

- TABLE 246 SWEDEN: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 247 SWEDEN: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 248 SWEDEN: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 249 SWEDEN: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- 10.3.10 BELGIUM

- 10.3.10.1 Availability of skilled labor to drive market

- TABLE 250 BELGIUM: POWDER COATINGS MARKET, BY RESIN TYPE, 2021-2023 (USD MILLION)

- TABLE 251 BELGIUM: POWDER COATINGS MARKET, BY RESIN TYPE, 2024-2029 (USD MILLION)

- TABLE 252 BELGIUM: POWDER COATINGS MARKET, BY RESIN TYPE, 2021-2023 (KILOTON)

- TABLE 253 BELGIUM: POWDER COATINGS MARKET, BY RESIN TYPE, 2024-2029 (KILOTON)

- TABLE 254 BELGIUM: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 255 BELGIUM: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 256 BELGIUM: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 257 BELGIUM: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- 10.3.11 TURKEY

- 10.3.11.1 Rapid urbanization and diversification in consumer goods to drive market

- TABLE 258 TURKEY: POWDER COATINGS MARKET, BY RESIN TYPE, 2021-2023 (USD MILLION)

- TABLE 259 TURKEY: POWDER COATINGS MARKET, BY RESIN TYPE, 2024-2029 (USD MILLION)

- TABLE 260 TURKEY: POWDER COATINGS MARKET, BY RESIN TYPE, 2021-2023 (KILOTON)

- TABLE 261 TURKEY: POWDER COATINGS MARKET, BY RESIN TYPE, 2024-2029 (KILOTON)

- TABLE 262 TURKEY: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 263 TURKEY: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 264 TURKEY: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 265 TURKEY: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- 10.3.12 REST OF EUROPE

- TABLE 266 REST OF EUROPE: POWDER COATINGS MARKET, BY RESIN TYPE, 2021-2023 (USD MILLION)

- TABLE 267 REST OF EUROPE: POWDER COATINGS MARKET, BY RESIN TYPE, 2024-2029 (USD MILLION)

- TABLE 268 REST OF EUROPE: POWDER COATINGS MARKET, BY RESIN TYPE, 2021-2023 (KILOTON)

- TABLE 269 REST OF EUROPE: POWDER COATINGS MARKET, BY RESIN TYPE, 2024-2029 (KILOTON)

- TABLE 270 REST OF EUROPE: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 271 REST OF EUROPE: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 272 REST OF EUROPE: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 273 REST OF EUROPE: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- 10.4 NORTH AMERICA

- 10.4.1 RECESSION IMPACT

- FIGURE 45 NORTH AMERICA: POWDER COATINGS MARKET SNAPSHOT

- TABLE 274 NORTH AMERICA: POWDER COATINGS MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 275 NORTH AMERICA: POWDER COATINGS MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 276 NORTH AMERICA: POWDER COATINGS MARKET, BY COUNTRY, 2021-2023 (KILOTON)

- TABLE 277 NORTH AMERICA: POWDER COATINGS MARKET, BY COUNTRY, 2024-2029 (KILOTON)

- TABLE 278 NORTH AMERICA: POWDER COATINGS MARKET, BY RESIN TYPE, 2021-2023 (USD MILLION)

- TABLE 279 NORTH AMERICA: POWDER COATINGS MARKET, BY RESIN TYPE, 2024-2029 (USD MILLION)

- TABLE 280 NORTH AMERICA: POWDER COATINGS MARKET, BY RESIN TYPE, 2021-2023 (KILOTON)

- TABLE 281 NORTH AMERICA: POWDER COATINGS MARKET, BY RESIN TYPE, 2024-2029 (KILOTON)

- TABLE 282 NORTH AMERICA: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 283 NORTH AMERICA: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 284 NORTH AMERICA: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 285 NORTH AMERICA: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- 10.4.2 US

- 10.4.2.1 Presence of major coating manufacturers to drive market

- TABLE 286 US: POWDER COATINGS MARKET, BY RESIN TYPE, 2021-2023 (USD MILLION)

- TABLE 287 US: POWDER COATINGS MARKET, BY RESIN TYPE, 2024-2029 (USD MILLION)

- TABLE 288 US: POWDER COATINGS MARKET, BY RESIN TYPE, 2021-2023 (KILOTON)

- TABLE 289 US: POWDER COATINGS MARKET, BY RESIN TYPE, 2024-2029 (KILOTON)

- TABLE 290 US: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 291 US: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 292 US: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 293 US: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- 10.4.3 CANADA

- 10.4.3.1 Increasing residential and infrastructural development to drive market

- TABLE 294 CANADA: POWDER COATINGS MARKET, BY RESIN TYPE, 2021-2023 (USD MILLION)

- TABLE 295 CANADA: POWDER COATINGS MARKET, BY RESIN TYPE, 2024-2029 (USD MILLION)

- TABLE 296 CANADA: POWDER COATINGS MARKET, BY RESIN TYPE, 2021-2023 (KILOTON)

- TABLE 297 CANADA: POWDER COATINGS MARKET, BY RESIN TYPE, 2024-2029 (KILOTON)

- TABLE 298 CANADA: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 299 CANADA: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 300 CANADA: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 301 CANADA: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- 10.4.4 MEXICO

- 10.4.4.1 Investments in infrastructure, energy, and commercial construction projects to drive market

- TABLE 302 MEXICO: POWDER COATINGS MARKET, BY RESIN TYPE, 2021-2023 (USD MILLION)

- TABLE 303 MEXICO: POWDER COATINGS MARKET, BY RESIN TYPE, 2024-2029 (USD MILLION)

- TABLE 304 MEXICO: POWDER COATINGS MARKET, BY RESIN TYPE, 2021-2023 (KILOTON)

- TABLE 305 MEXICO: POWDER COATINGS MARKET, BY RESIN TYPE, 2024-2029 (KILOTON)

- TABLE 306 MEXICO: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 307 MEXICO: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 308 MEXICO: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 309 MEXICO: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- 10.5 MIDDLE EAST & AFRICA

- 10.5.1 RECESSION IMPACT

- FIGURE 46 MIDDLE EAST & AFRICA: POWDER COATINGS MARKET SNAPSHOT

- TABLE 310 MIDDLE EAST & AFRICA: POWDER COATINGS MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 311 MIDDLE EAST & AFRICA: POWDER COATINGS MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 312 MIDDLE EAST & AFRICA: POWDER COATINGS MARKET, BY COUNTRY, 2021-2023 (KILOTON)

- TABLE 313 MIDDLE EAST & AFRICA: POWDER COATINGS MARKET, BY COUNTRY, 2024-2029 (KILOTON)

- TABLE 314 MIDDLE EAST & AFRICA: POWDER COATINGS MARKET, BY RESIN TYPE, 2021-2023 (USD MILLION)

- TABLE 315 MIDDLE EAST & AFRICA: POWDER COATINGS MARKET, BY RESIN TYPE, 2024-2029 (USD MILLION)

- TABLE 316 MIDDLE EAST & AFRICA: POWDER COATINGS MARKET, BY RESIN TYPE, 2021-2023 (KILOTON)

- TABLE 317 MIDDLE EAST & AFRICA: POWDER COATINGS MARKET, BY RESIN TYPE, 2024-2029 (KILOTON)

- TABLE 318 MIDDLE EAST & AFRICA: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 319 MIDDLE EAST & AFRICA: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 320 MIDDLE EAST & AFRICA: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 321 MIDDLE EAST & AFRICA: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- 10.5.2 GCC COUNTRIES

- TABLE 322 GCC COUNTRIES: POWDER COATINGS MARKET, BY RESIN TYPE, 2021-2023 (USD MILLION)

- TABLE 323 GCC COUNTRIES: POWDER COATINGS MARKET, BY RESIN TYPE, 2024-2029 (USD MILLION)

- TABLE 324 GCC COUNTRIES: POWDER COATINGS MARKET, BY RESIN TYPE, 2021-2023 (KILOTON)

- TABLE 325 GCC COUNTRIES: POWDER COATINGS MARKET, BY RESIN TYPE, 2024-2029 (KILOTON)

- TABLE 326 GCC COUNTRIES: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 327 GCC COUNTRIES: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 328 GCC COUNTRIES: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 329 GCC COUNTRIES: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- 10.5.3 SAUDI ARABIA

- 10.5.3.1 Increasing government investments in chemical manufacturing to drive market

- TABLE 330 SAUDI ARABIA: POWDER COATINGS MARKET, BY RESIN TYPE, 2021-2023 (USD MILLION)

- TABLE 331 SAUDI ARABIA: POWDER COATINGS MARKET, BY RESIN TYPE, 2024-2029 (USD MILLION)

- TABLE 332 SAUDI ARABIA: POWDER COATINGS MARKET, BY RESIN TYPE, 2021-2023 (KILOTON)

- TABLE 333 SAUDI ARABIA: POWDER COATINGS MARKET, BY RESIN TYPE, 2024-2029 (KILOTON)

- TABLE 334 SAUDI ARABIA: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 335 SAUDI ARABIA: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 336 SAUDI ARABIA: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 337 SAUDI ARABIA: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- 10.5.4 UAE

- 10.5.4.1 Government policies and R&D investments to drive market

- TABLE 338 UAE: POWDER COATINGS MARKET, BY RESIN TYPE, 2021-2023 (USD MILLION)

- TABLE 339 UAE: POWDER COATINGS MARKET, BY RESIN TYPE, 2024-2029 (USD MILLION)

- TABLE 340 UAE: POWDER COATINGS MARKET, BY RESIN TYPE, 2021-2023 (KILOTON)

- TABLE 341 UAE: POWDER COATINGS MARKET, BY RESIN TYPE, 2024-2029 (KILOTON)

- TABLE 342 UAE: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 343 UAE: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 344 UAE: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 345 UAE: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- 10.5.5 REST OF GCC COUNTRIES

- TABLE 346 REST OF GCC COUNTRIES: POWDER COATINGS MARKET, BY RESIN TYPE, 2021-2023 (USD MILLION)

- TABLE 347 REST OF GCC COUNTRIES: POWDER COATINGS MARKET, BY RESIN TYPE, 2024-2029 (USD MILLION)

- TABLE 348 REST OF GCC COUNTRIES: POWDER COATINGS MARKET, BY RESIN TYPE, 2021-2023 (KILOTON)

- TABLE 349 REST OF GCC COUNTRIES: POWDER COATINGS MARKET, BY RESIN TYPE, 2024-2029 (KILOTON)

- TABLE 350 REST OF GCC COUNTRIES: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 351 REST OF GCC COUNTRIES: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 352 REST OF GCC COUNTRIES: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 353 REST OF GCC COUNTRIES: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- 10.5.6 IRAN

- 10.5.6.1 Increasing demand from automotive, construction, and industrial equipment sectors to drive market

- TABLE 354 IRAN: POWDER COATINGS MARKET, BY RESIN TYPE, 2021-2023 (USD MILLION)

- TABLE 355 IRAN: POWDER COATINGS MARKET, BY RESIN TYPE, 2024-2029 (USD MILLION)

- TABLE 356 IRAN: POWDER COATINGS MARKET, BY RESIN TYPE, 2021-2023 (KILOTON)

- TABLE 357 IRAN: POWDER COATINGS MARKET, BY RESIN TYPE, 2024-2029 (KILOTON)

- TABLE 358 IRAN: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 359 IRAN: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 360 IRAN: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 361 IRAN: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- 10.5.7 IRAQ

- 10.5.7.1 Growing population and increasing urbanization to drive market

- TABLE 362 IRAQ: POWDER COATINGS MARKET, BY RESIN TYPE, 2021-2023 (USD MILLION)

- TABLE 363 IRAQ: POWDER COATINGS MARKET, BY RESIN TYPE, 2024-2029 (USD MILLION)

- TABLE 364 IRAQ: POWDER COATINGS MARKET, BY RESIN TYPE, 2021-2023 (KILOTON)

- TABLE 365 IRAQ: POWDER COATINGS MARKET, BY RESIN TYPE, 2024-2029 (KILOTON)

- TABLE 366 IRAQ: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 367 IRAQ: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 368 IRAQ: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 369 IRAQ: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- 10.5.8 SOUTH AFRICA

- 10.5.8.1 Abundant natural resources and government spending in different industries to drive market

- TABLE 370 SOUTH AFRICA: POWDER COATINGS MARKET, BY RESIN TYPE, 2021-2023 (USD MILLION)

- TABLE 371 SOUTH AFRICA: POWDER COATINGS MARKET, BY RESIN TYPE, 2024-2029 (USD MILLION)

- TABLE 372 SOUTH AFRICA: POWDER COATINGS MARKET, BY RESIN TYPE, 2021-2023 (KILOTON)

- TABLE 373 SOUTH AFRICA: POWDER COATINGS MARKET, BY RESIN TYPE, 2024-2029 (KILOTON)

- TABLE 374 SOUTH AFRICA: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 375 SOUTH AFRICA: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 376 SOUTH AFRICA: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 377 SOUTH AFRICA: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- 10.5.9 REST OF MIDDLE EAST & AFRICA

- TABLE 378 REST OF MIDDLE EAST & AFRICA: POWDER COATINGS MARKET, BY RESIN TYPE, 2021-2023 (USD MILLION)

- TABLE 379 REST OF MIDDLE EAST & AFRICA: POWDER COATINGS MARKET, BY RESIN TYPE, 2024-2029 (USD MILLION)

- TABLE 380 REST OF MIDDLE EAST & AFRICA: POWDER COATINGS MARKET, BY RESIN TYPE, 2021-2023 (KILOTON)

- TABLE 381 REST OF MIDDLE EAST & AFRICA: POWDER COATINGS MARKET, BY RESIN TYPE, 2024-2029 (KILOTON)

- TABLE 382 REST OF MIDDLE EAST & AFRICA: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 383 REST OF MIDDLE EAST & AFRICA: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 384 REST OF MIDDLE EAST & AFRICA: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 385 REST OF MIDDLE EAST & AFRICA: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- 10.6 SOUTH AMERICA

- 10.6.1 RECESSION IMPACT

- FIGURE 47 SOUTH AMERICA: POWDER COATINGS MARKET SNAPSHOT

- TABLE 386 SOUTH AMERICA: POWDER COATINGS MARKET, BY COUNTRY, 2021-2023 (USD MILLION)

- TABLE 387 SOUTH AMERICA: POWDER COATINGS MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 388 SOUTH AMERICA: POWDER COATINGS MARKET, BY COUNTRY, 2021-2023 (KILOTON)

- TABLE 389 SOUTH AMERICA: POWDER COATINGS MARKET, BY COUNTRY, 2024-2029 (KILOTON)

- TABLE 390 SOUTH AMERICA: POWDER COATINGS MARKET, BY RESIN TYPE, 2021-2023 (USD MILLION)

- TABLE 391 SOUTH AMERICA: POWDER COATINGS MARKET, BY RESIN TYPE, 2024-2029 (USD MILLION)

- TABLE 392 SOUTH AMERICA: POWDER COATINGS MARKET, BY RESIN TYPE, 2021-2023 (KILOTON)

- TABLE 393 SOUTH AMERICA: POWDER COATINGS MARKET, BY RESIN TYPE, 2024-2029 (KILOTON)

- TABLE 394 SOUTH AMERICA: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 395 SOUTH AMERICA: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 396 SOUTH AMERICA: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 397 SOUTH AMERICA: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- 10.6.2 BRAZIL

- 10.6.2.1 Increasing demand for modern, attractive, and sustainable building materials to drive market

- TABLE 398 BRAZIL: POWDER COATINGS MARKET, BY RESIN TYPE, 2021-2023 (USD MILLION)

- TABLE 399 BRAZIL: POWDER COATINGS MARKET, BY RESIN TYPE, 2024-2029 (USD MILLION)

- TABLE 400 BRAZIL: POWDER COATINGS MARKET, BY RESIN TYPE, 2021-2023 (KILOTON)

- TABLE 401 BRAZIL: POWDER COATINGS MARKET, BY RESIN TYPE, 2024-2029 (KILOTON)

- TABLE 402 BRAZIL: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 403 BRAZIL: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 404 BRAZIL: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 405 BRAZIL: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- 10.6.3 ARGENTINA

- 10.6.3.1 Increasing population and improved economic conditions to drive market

- TABLE 406 ARGENTINA: POWDER COATINGS MARKET, BY RESIN TYPE, 2021-2023 (USD MILLION)

- TABLE 407 ARGENTINA: POWDER COATINGS MARKET, BY RESIN TYPE, 2024-2029 (USD MILLION)

- TABLE 408 ARGENTINA: POWDER COATINGS MARKET, BY RESIN TYPE, 2021-2023 (KILOTON)

- TABLE 409 ARGENTINA: POWDER COATINGS MARKET, BY RESIN TYPE, 2024-2029 (KILOTON)

- TABLE 410 ARGENTINA: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 411 ARGENTINA: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 412 ARGENTINA: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 413 ARGENTINA: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- 10.6.4 COLOMBIA

- 10.6.4.1 Growth in labor productivity to drive market

- TABLE 414 COLOMBIA: POWDER COATINGS MARKET, BY RESIN TYPE, 2021-2023 (USD MILLION)

- TABLE 415 COLOMBIA: POWDER COATINGS MARKET, BY RESIN TYPE, 2024-2029 (USD MILLION)

- TABLE 416 COLOMBIA: POWDER COATINGS MARKET, BY RESIN TYPE, 2021-2023 (KILOTON)

- TABLE 417 COLOMBIA: POWDER COATINGS MARKET, BY RESIN TYPE, 2024-2029 (KILOTON)

- TABLE 418 COLOMBIA: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 419 COLOMBIA: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 420 COLOMBIA: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 421 COLOMBIA: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- 10.6.5 CHILE

- 10.6.5.1 Economic growth and government initiatives to drive market

- TABLE 422 CHILE: POWDER COATINGS MARKET, BY RESIN TYPE, 2021-2023 (USD MILLION)

- TABLE 423 CHILE: POWDER COATINGS MARKET, BY RESIN TYPE, 2024-2029 (USD MILLION)

- TABLE 424 CHILE: POWDER COATINGS MARKET, BY RESIN TYPE, 2021-2023 (KILOTON)

- TABLE 425 CHILE: POWDER COATINGS MARKET, BY RESIN TYPE, 2024-2029 (KILOTON)

- TABLE 426 CHILE: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 427 CHILE: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 428 CHILE: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 429 CHILE: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

- 10.6.6 REST OF SOUTH AMERICA

- TABLE 430 REST OF SOUTH AMERICA: POWDER COATINGS MARKET, BY RESIN TYPE, 2021-2023 (USD MILLION)

- TABLE 431 REST OF SOUTH AMERICA: POWDER COATINGS MARKET, BY RESIN TYPE, 2024-2029 (USD MILLION)

- TABLE 432 REST OF SOUTH AMERICA: POWDER COATINGS MARKET, BY RESIN TYPE, 2021-2023 (KILOTON)

- TABLE 433 REST OF SOUTH AMERICA: POWDER COATINGS MARKET, BY RESIN TYPE, 2024-2029 (KILOTON)

- TABLE 434 REST OF SOUTH AMERICA: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2021-2023 (USD MILLION)

- TABLE 435 REST OF SOUTH AMERICA: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2024-2029 (USD MILLION)

- TABLE 436 REST OF SOUTH AMERICA: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2021-2023 (KILOTON)

- TABLE 437 REST OF SOUTH AMERICA: POWDER COATINGS MARKET, BY END-USE INDUSTRY, 2024-2029 (KILOTON)

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 KEY PLAYER STRATEGIES

- 11.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY MARKET PLAYERS

- TABLE 438 POWDER COATINGS MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY MARKET PLAYERS, 2019-2024

- 11.3 MARKET SHARE ANALYSIS

- FIGURE 48 POWDER COATINGS MARKET: MARKET SHARE ANALYSIS, 2023

- TABLE 439 POWDER COATINGS MARKET: INTENSITY OF COMPETITIVE RIVALRY, 2023

- 11.3.1 MARKET RANKING ANALYSIS

- FIGURE 49 RANKING OF LEADING PLAYERS IN POWDER COATINGS MARKET, 2023

- 11.4 REVENUE ANALYSIS OF TOP FIVE PLAYERS

- FIGURE 50 POWDER COATINGS MARKET: REVENUE ANALYSIS OF TOP FIVE PLAYERS

- 11.5 COMPANY VALUATION AND FINANCIAL METRICS, 2023

- 11.5.1 COMPANY VALUATION

- FIGURE 51 POWDER COATINGS MARKET: COMPANY VALUATION

- 11.5.2 FINANCIAL METRICS

- FIGURE 52 POWDER COATINGS MARKET: FINANCIAL METRICS

- 11.6 BRAND/PRODUCT COMPARISON

- FIGURE 53 POWDER COATINGS MARKET: BRAND/PRODUCT COMPARISON

- 11.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 11.7.1 STARS

- 11.7.2 EMERGING LEADERS

- 11.7.3 PERVASIVE PLAYERS

- 11.7.4 PARTICIPANTS

- FIGURE 54 POWDER COATINGS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- 11.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- FIGURE 55 OVERALL COMPANY FOOTPRINT (25 COMPANIES)

- TABLE 440 REGION FOOTPRINT (25 COMPANIES)

- TABLE 441 END-USE INDUSTRY FOOTPRINT (25 COMPANIES)

- TABLE 442 RESIN TYPE FOOTPRINT (25 COMPANIES)

- 11.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 11.8.1 PROGRESSIVE COMPANIES

- 11.8.2 RESPONSIVE COMPANIES

- 11.8.3 DYNAMIC COMPANIES

- 11.8.4 STARTING BLOCKS

- FIGURE 56 POWDER COATINGS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- 11.8.5 COMPETITIVE BENCHMARKING

- 11.8.5.1 Detailed list of key startups/SMEs

- TABLE 443 POWDER COATINGS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- 11.8.5.2 Competitive benchmarking of key startups/SMEs

- TABLE 444 POWDER COATINGS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 11.9 COMPETITIVE SCENARIO AND TRENDS

- 11.9.1 POWDER COATINGS MARKET: PRODUCT LAUNCHES, MARCH 2019-MARCH 2024

- TABLE 445 POWDER COATINGS MARKET: PRODUCT LAUNCHES, MARCH 2019-MARCH 2024

- 11.9.2 POWDER COATINGS MARKET: DEALS, MARCH 2019-MARCH 2024

- TABLE 446 POWDER COATINGS MARKET: DEALS, MARCH 2019-MARCH 2024

- 11.9.3 POWDER COATINGS MARKET: EXPANSIONS, MARCH 2019-MARCH 2024

- TABLE 447 POWDER COATINGS MARKET: EXPANSIONS, MARCH 2019-MARCH 2024

12 COMPANY PROFILES

- (Business overview, Products/Solutions/Services offered, Recent Developments, MnM view, Right to win, Strategic choices, Weaknesses and competitive threats) **

- 12.1 KEY PLAYERS

- 12.1.1 PPG INDUSTRIES, INC.

- TABLE 448 PPG INDUSTRIES, INC.: COMPANY OVERVIEW

- FIGURE 57 PPG INDUSTRIES, INC.: COMPANY SNAPSHOT

- TABLE 449 PPG INDUSTRIES, INC.: PRODUCTS /SOLUTIONS/SERVICES OFFERED

- TABLE 450 PPG INDUSTRIES, INC.: PRODUCT LAUNCHES, MARCH 2019-MARCH 2024

- TABLE 451 PPG INDUSTRIES: DEALS, MARCH 2019-MARCH 2024

- TABLE 452 PPG INDUSTRIES, INC.: EXPANSIONS, MARCH 2019-MARCH 2024

- 12.1.2 THE SHERWIN-WILLIAMS COMPANY

- TABLE 453 THE SHERWIN-WILLIAMS COMPANY: COMPANY OVERVIEW

- FIGURE 58 THE SHERWIN-WILLIAMS COMPANY: COMPANY SNAPSHOT

- TABLE 454 THE SHERWIN WILLIAMS COMPANY: PRODUCTS /SOLUTIONS/SERVICES OFFERED

- TABLE 455 THE SHERWIN-WILLIAMS COMPANY: PRODUCT LAUNCHES, MARCH 2019-MARCH 2024

- TABLE 456 THE SHERWIN-WILLIAMS COMPANY: DEALS, MARCH 2019-MARCH 2024

- TABLE 457 THE SHERWIN-WILLIAMS COMPANY: EXPANSIONS, MARCH 2019-MARCH 2024

- 12.1.3 AKZO NOBEL N.V.

- TABLE 458 AKZO NOBEL N.V.: COMPANY OVERVIEW

- FIGURE 59 AKZO NOBEL N.V.: COMPANY SNAPSHOT

- TABLE 459 AKZO NOBEL N.V.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 460 AKZO NOBEL N.V.: PRODUCT LAUNCHES, MARCH 2019-MARCH 2024

- TABLE 461 AKZO NOBEL N.V.: DEALS, MARCH 2019-MARCH 2024

- TABLE 462 AKZO NOBEL N.V.: EXPANSIONS, MARCH 2019-MARCH 2024

- 12.1.4 AXALTA COATING SYSTEMS, LLC

- TABLE 463 AXALTA COATING SYSTEMS, LLC: COMPANY OVERVIEW

- FIGURE 60 AXALTA COATING SYSTEMS, LLC: COMPANY SNAPSHOT

- TABLE 464 AXALTA COATING SYSTEMS, LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 465 AXALTA COATING SYSTEMS, LLC: PRODUCT LAUNCHES, MARCH 2019-MARCH 2024

- TABLE 466 AXALTA COATING SYSTEMS, LLC: DEALS, MARCH 2019-MARCH 2024

- TABLE 467 AXALTA COATING SYSTEMS, LLC: EXPANSIONS, MARCH 2019-MARCH 2024

- 12.1.5 KANSAI PAINT CO. LTD.

- TABLE 468 KANSAI PAINT CO. LTD.: COMPANY OVERVIEW

- FIGURE 61 KANSAI PAINT CO. LTD.: COMPANY SNAPSHOT

- TABLE 469 KANSAI PAINT CO. LTD.: PRODUCTS /SOLUTIONS/SERVICES OFFERED

- TABLE 470 KANSAI PAINT CO. LTD.: DEALS, MARCH 2019-MARCH 2024

- 12.1.6 RPM INTERNATIONAL INC.

- TABLE 471 RPM INTERNATIONAL INC.: COMPANY OVERVIEW

- FIGURE 62 RPM INTERNATIONAL INC.: COMPANY SNAPSHOT

- TABLE 472 RPM INTERNATIONAL INC.: PRODUCTS /SOLUTIONS/SERVICES OFFERED

- TABLE 473 RPM INTERNATIONAL INC.: EXPANSIONS, MARCH 2019-MARCH 2024

- 12.1.7 JOTUN

- TABLE 474 JOTUN: COMPANY OVERVIEW

- FIGURE 63 JOTUN: COMPANY SNAPSHOT

- TABLE 475 JOTUN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 476 JOTUN: DEALS, MARCH 2019-MARCH 2024

- TABLE 477 JOTUN: EXPANSIONS, MARCH 2019-MARCH 2024

- 12.1.8 ASIAN PAINTS

- TABLE 478 ASIAN PAINTS: COMPANY OVERVIEW

- FIGURE 64 ASIAN PAINTS: COMPANY SNAPSHOT

- TABLE 479 ASIAN PAINTS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.1.9 NIPPON PAINT HOLDINGS CO., LTD.

- TABLE 480 NIPPON PAINT HOLDINGS CO., LTD.: COMPANY OVERVIEW

- FIGURE 65 NIPPON PAINT HOLDINGS CO., LTD.: COMPANY SNAPSHOT

- TABLE 481 NIPPON PAINT HOLDINGS CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 482 NIPPON PAINT HOLDINGS CO., LTD.: DEALS, MARCH 2019-MARCH 2024

- TABLE 483 NIPPON PAINT HOLDINGS CO., LTD.: EXPANSIONS, MARCH 2019-MARCH 2024

- 12.1.10 PROTECH GROUP

- TABLE 484 PROTECH GROUP: COMPANY OVERVIEW

- TABLE 485 PROTECH GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 486 PROTECH GROUP: DEALS, MARCH 2019-MARCH 2024

- 12.2 OTHER PLAYERS

- 12.2.1 TIGER COATINGS GMBH & CO. KG

- TABLE 487 TIGER COATINGS GMBH & CO. KG: COMPANY OVERVIEW

- TABLE 488 TIGER COATINGS GMBH & CO. KG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.2.2 ANHUI MEIJIA NEW MATERIAL CO., LTD.

- TABLE 489 ANHUI MEIJIA NEW MATERIAL CO., LTD.: COMPANY OVERVIEW

- TABLE 490 ANHUI MEIJIA NEW MATERIAL CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.2.3 BERGER PAINTS INDIA LIMITED

- TABLE 491 BERGER PAINTS INDIA LIMITED: COMPANY OVERVIEW

- TABLE 492 BERGER PAINTS INDIA LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.2.4 POWDERTECH SURFACE SCIENCE

- TABLE 493 POWDERTECH SURFACE SCIENCE: COMPANY OVERVIEW

- TABLE 494 POWDERTECH SURFACE SCIENCE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.2.5 SOMAR CORPORATION

- TABLE 495 SOMAR CORPORATION: COMPANY OVERVIEW

- TABLE 496 SOMAR CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.2.6 CLOVERDALE PAINT INC.

- TABLE 497 CLOVERDALE PAINT INC.: COMPANY OVERVIEW

- TABLE 498 CLOVERDALE PAINT INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.2.7 FREILACKE

- TABLE 499 FREILACKE: COMPANY OVERVIEW

- TABLE 500 FREILACKE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.2.8 DIAMOND VOGEL

- TABLE 501 DIAMOND VOGEL: COMPANY OVERVIEW

- TABLE 502 DIAMOND VOGEL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.2.9 IFS COATINGS

- TABLE 503 IFS COATINGS: COMPANY OVERVIEW

- TABLE 504 IFS COATINGS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.2.10 3M

- TABLE 505 3M: COMPANY OVERVIEW

- TABLE 506 3M: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.2.11 ERIE POWDER COATINGS

- TABLE 507 ERIE POWDER COATINGS: COMPANY OVERVIEW

- TABLE 508 ERIE POWDER COATINGS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.2.12 KEYLAND POLYMER

- TABLE 509 KEYLAND POLYMER: COMPANY OVERVIEW

- TABLE 510 KEYLAND POLYMER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.2.13 PRIMATEK COATINGS OU

- TABLE 511 PRIMATEK COATINGS OU: COMPANY OVERVIEW

- TABLE 512 PRIMATEK COATINGS OU: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.2.14 CARDINAL

- TABLE 513 CARDINAL: COMPANY OVERVIEW

- TABLE 514 CARDINAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.2.15 MODERN SAK FACTORY FOR POWDER PAINT

- TABLE 515 MODERN SAK FACTORY FOR POWER PLANT: COMPANY OVERVIEW

- TABLE 516 MODERN SAK FACTORY FOR POWER PLANT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.2.16 HENTZEN COATINGS, INC.

- TABLE 517 HENTZEN COATINGS, INC.: COMPANY OVERVIEW

- TABLE 518 HENTZEN COATINGS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.2.17 VITRACOAT

- TABLE 519 VITRACOAT: COMPANY OVERVIEW

- TABLE 520 VITRACOAT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.2.18 WEG

- TABLE 521 WEG: COMPANY OVERVIEW

- TABLE 522 WEG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.2.19 EUROPOLVERI SPA

- TABLE 523 EUROPOLVERI SPA: COMPANY OVERVIEW

- TABLE 524 EUROPOLVERI SPA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.2.20 PULVERIT S.P.A.

- TABLE 525 PULVERIT S.P.A.: COMPANY OVERVIEW

- TABLE 526 PULVERIT S.P.A.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.2.21 ST POWDER COATINGS S.P.A.

- TABLE 527 ST POWER COATINGS S.P.A.: COMPANY OVERVIEW

- TABLE 528 ST POWER COATINGS S.P.A.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.2.22 IBA KIMYA A.S.

- TABLE 529 IBA KIMYA A.S: COMPANY OVERVIEW

- TABLE 530 IBA KIMYA A.S: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.2.23 NEOKEM

- TABLE 531 NEOKEM: COMPANY OVERVIEW

- TABLE 532 NEOKEM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.2.24 TEKNOS GROUP

- TABLE 533 TEKNOS GROUP: COMPANY OVERVIEW

- TABLE 534 TEKNOS GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.2.25 KCC CORPORATION

- TABLE 535 KCC CORPORATION: COMPANY OVERVIEW

- TABLE 536 KCC CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.2.26 CWS POWDER COATINGS GMBH

- TABLE 537 CWS POWDER COATINGS GMBH: COMPANY OVERVIEW

- TABLE 538 CWS POWDER COATINGS GMBH: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- 12.2.27 PULVER INC.

- TABLE 539 PULVER INC. COMPANY OVERVIEW

- TABLE 540 PULVER INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- *Details on Business overview, Products/Solutions/Services offered, Recent Developments, MnM view, Key strengths, Strategic choices, Weaknesses and competitive threats might not be captured in case of unlisted companies.

13 ADJACENT & RELATED MARKETS

- 13.1 INTRODUCTION

- 13.2 LIMITATIONS

- 13.3 PAINTS AND COATINGS MARKET

- 13.3.1 MARKET DEFINITION

- 13.4 MARKET OVERVIEW

- TABLE 541 PAINTS AND COATINGS MARKET, BY RESIN TYPE 2017-2020 (USD MILLION)

- TABLE 542 PAINTS AND COATINGS MARKET, BY RESIN TYPE, 2021-2027(USD MILLION)

- TABLE 543 PAINTS AND COATINGS MARKET, BY RESIN TYPE, 2017-2020 (KILOTON)

- TABLE 544 PAINTS AND COATINGS MARKET, BY RESIN TYPE, 2021-2027(KILOTON)

- 13.5 PAINTS AND COATINGS MARKET, BY TECHNOLOGY

- TABLE 545 PAINTS AND COATINGS MARKET, BY TECHNOLOGY, 2017-2020 (USD MILLION)

- TABLE 546 PAINTS AND COATINGS MARKET, BY TECHNOLOGY, 2021-2027 (USD MILLION)

- TABLE 547 PAINTS AND COATINGS MARKET, BY TECHNOLOGY, 2017-2020 (KILOTON)

- TABLE 548 PAINTS AND COATINGS MARKET, BY TECHNOLOGY, 2021-2027 (KILOTON)

- 13.6 PAINTS AND COATINGS MARKET, BY END-USE INDUSTRY

- TABLE 549 PAINTS AND COATINGS MARKET, BY END-USE INDUSTRY, 2017-2020 (USD MILLION)

- TABLE 550 PAINTS AND COATINGS MARKET, BY END-USE INDUSTRY, 2021-2027 (USD MILLION)

- TABLE 551 PAINTS AND COATINGS MARKET, BY END-USE INDUSTRY, 2017-2020 (KILOTON)

- TABLE 552 PAINTS AND COATINGS MARKET, BY END-USE INDUSTRY, 2021-2027 (KILOTON)

- 13.7 PAINTS AND COATINGS MARKET, BY REGION

- TABLE 553 PAINTS AND COATINGS MARKET, BY REGION, 2017-2020 (USD MILLION)

- TABLE 554 PAINTS AND COATINGS MARKET, BY REGION, 2021-2027 (USD MILLION)

- TABLE 555 PAINTS AND COATINGS MARKET, BY REGION, 2017-2020 (KILOTON)

- TABLE 556 PAINTS AND COATINGS MARKET, BY REGION, 2021-2027 (KILOTON)

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS