|

|

市場調査レポート

商品コード

1812625

重要インフラ保護の世界市場:物理セキュリティ、ITサイバーセキュリティソリューション、OTサイバーセキュリティ - 予測(~2030年)Critical Infrastructure Protection Market by Physical Security (Perimeter Protection, Screening & Scanning Systems), IT Cybersecurity Solutions (Compliance & Policy Management, IAM), and OT Cybersecurity (Digital Twin Platform) - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 重要インフラ保護の世界市場:物理セキュリティ、ITサイバーセキュリティソリューション、OTサイバーセキュリティ - 予測(~2030年) |

|

出版日: 2025年09月11日

発行: MarketsandMarkets

ページ情報: 英文 720 Pages

納期: 即納可能

|

概要

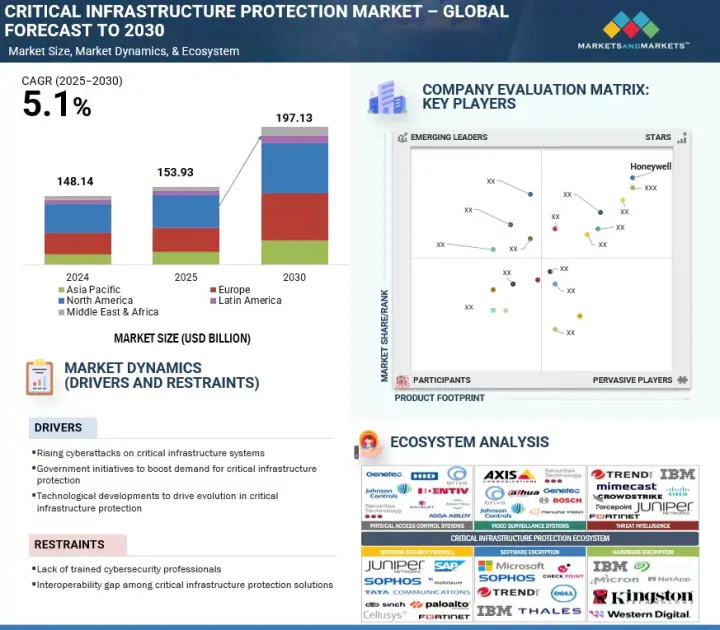

世界の重要インフラ保護(CIP)の市場規模は、2025年の1,539億3,000万米ドルから2030年までに1,971億3,000万米ドルに達すると予測され、予測期間にCAGRで5.1%の成長が見込まれます。

進化するサイバー脅威や物理的脅威から重要な資産やサービスを保護するニーズの高まりが市場を牽引しています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2019年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 単位 | 100万米ドル/10億米ドル |

| セグメント | 提供、業界、地域 |

| 対象地域 | 北米、欧州、アジア太平洋、中東・アフリカ、ラテンアメリカ |

組織は、先進の監視、アクセス制御、脅威検知、サイバーセキュリティ対策を組み合わせた統合保護ソリューションを広く採用し、レジリエンスを強化しています。これにより、エネルギー、公益事業、輸送の各部門で、ダウンタイムの削減、リスクの軽減、業務の継続性が確保されています。

しかし、大きな抑制要因となっているのが、CIPソリューション間の相互運用性のギャップです。多くのツールはサイロ内で開発されているため、効果的に統合できない断片的な保護となっています。このため、セキュリティ管理が複雑になり、重要な資産が脆弱なままになっています。さらに、官民の連携や情報共有が限られているため、統一的な防衛戦略が妨げられています。

「物理的セキュリティ提供の中のサービスセグメントが予測期間にもっとも高いCAGRを記録する見込みです。」

この成長の促進要因は、重要施設を確実に保護するための設計、コンサルティング、統合、メンテナンス、マネージドサービスに対する需要の高まりです。組織が進化する脅威に直面する中、先進の物理セキュリティシステムの展開と継続的なモニタリング・サポートの確保を目的としたプロフェッショナルサービスプロバイダーへの依存度が大幅に高まっています。この動向は、重要インフラのレジリエンスを強化する上で、専門的な知識と継続的なサービスデリバリーが果たす重要な役割を浮き彫りにしています。

「OT・ICSセキュリティプラットフォームセグメントが予測期間に最大の市場シェアを占める見込みです。」

OTサイバーセキュリティソリューション別では、OT・ICSセキュリティプラットフォームセグメントが予測期間に最大の市場シェアを占める見込みです。この優位性は、産業用制御システム(ICS)、SCADAシステム、その他のミッションクリティカルなインフラを含む運用技術環境を保護する必要性が高まっていることに起因しています。産業用ネットワークを標的としたサイバー攻撃の頻度が高まり、ITシステムとOTシステムの融合が進む中、企業は包括的なOT・ICSセキュリティプラットフォームを優先しています。これらのソリューションは、資産の可視化、リアルタイム脅威検知、先進の持続的脅威からの保護を提供し、エネルギー、公益事業、石油・ガス、製造などの重要な部門において、運用のレジリエンスを保証し、ダウンタイムを最小化します。

「北米が予測期間に最大の市場シェアを占める見込みです。」

北米は全地域の中で最大の市場シェアを占めています。また、強力な規制枠組み、セキュリティ技術への高額な投資、統合保護ソリューションの早期採用により、CIP市場をリードしています。エネルギー、金融、輸送が第一のターゲットである北米では、先進のCIPシステムの大規模展開が重視されています。さらに、政府の取り組み、サイバーセキュリティの義務化、部門を超えた協力体制が、米国とカナダにおける採用をさらに加速させています。

当レポートでは、世界の重要インフラ保護市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要な知見

- 主要市場企業にとって魅力的な機会

- 重要インフラ保護市場:提供別

- 重要インフラ保護市場:物理セキュリティ提供別

- 重要インフラ保護市場:システム別

- 重要インフラ保護市場:サービス別

- 重要インフラ保護市場:ITサイバーセキュリティ提供別

- 重要インフラ保護市場、ITサイバーセキュリティソリューション別

- 重要インフラ保護市場、ITサイバーセキュリティサービス別

- 重要インフラ保護市場:OTサイバーセキュリティ提供別

- 重要インフラ保護市場:OTサイバーセキュリティソリューション別

- 重要インフラ保護市場:OTサイバーセキュリティサービス別

- 重要インフラ保護市場:業界別

- 市場投資シナリオ

第5章 市場の概要と産業動向

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- ケーススタディ分析

- ケーススタディ1:ALTA、ゼロトラストCDRで悪意のあるファイルのアップロードを防止

- ケーススタディ2:イタリアの機器メーカー、ForcePointで内部脅威から防御

- ケーススタディ3:AXISの360度カメラとDEDRONEの対ドローンソリューションによる、CONSOLIDATED EDISONのパトロール空域

- ケーススタディ4:TOSIBOX、NWCPUDユーティリティの遠隔接続性を革新

- ケーススタディ5:マニパル大学、HONEYWELLのスマートカードソリューションで物理的なセキュリティとキャンパス経営を強化

- ケーススタディ6:ADTの統合監視システムによりダブリン空港ターミナル2の物理的セキュリティと運用効率が向上

- ケーススタディ7:WESCOの統合ネットワークのアップグレードにより、自治体の下水道インフラの物理セキュリティとサイバーセキュリティが強化される

- ケーススタディ8:CHESAPEAKE BAY BRIDGE-TUNNELにおけるPELCOの物理セキュリティ改革により重要な輸送ルートが確保される

- ケーススタディ9:HAURAKI DISTRICT COUNCIL、DARKTRACE AIを活用して重要なインフラを保護し、サードパーティリスクを管理

- ケーススタディ10:ALGOSEC、NCRのゼロトラストセキュリティ実現を支援

- バリューチェーン分析

- コンポーネントプロバイダー

- 組織の計画と設計

- ソリューション・サービスプロバイダー

- システムインテグレーター

- 小売/流通チャネル

- エンドユーザー

- エコシステム分析

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- 重要インフラ保護市場に対する生成AIの影響

- 生成AI

- 重要インフラ保護市場における主なユースケースと市場の将来性

- 相互接続された隣接エコシステムに対する生成AIの影響

- 価格設定の分析

- 主要企業の平均販売価格の動向:システム別(2024年)

- 参考価格分析:提供別(2024年)

- 技術分析

- 主要技術

- 補完技術

- 隣接技術

- 特許分析

- 関税と規制情勢

- 重要インフラ保護製品に関する関税

- 規制機関、政府機関、その他の組織

- 主な規制

- カスタマービジネスに影響を与える動向と混乱

- 貿易分析

- 輸入データ

- 輸出データ

- 重要インフラ保護市場に対する米国のトランプ関税の影響(2025年)

- イントロダクション

- 主な関税率

- 価格の影響の分析

- 国/地域に対する影響

- 主な会議とイベント(2025年~2026年)

- 投資と資金調達のシナリオ

第6章 重要インフラ保護市場:提供別

- イントロダクション

- 物理セキュリティ提供

- ITサイバーセキュリティソリューション

- OTサイバーセキュリティソリューション

第7章 重要インフラ保護市場:業界別

- イントロダクション

- 金融機関

- 政府

- 防衛

- 輸送・ロジスティクス

- エネルギー・電力

- 商業部門

- 通信

- 化学品・製造

- 石油・ガス

- その他の業界

第8章 重要インフラ保護市場:地域別

- イントロダクション

- 北米

- 北米市場の促進要因

- 北米のマクロ経済の見通し

- 米国

- カナダ

- アジア太平洋

- アジア太平洋市場の促進要因

- アジア太平洋のマクロ経済の見通し

- 中国

- 日本

- インド

- その他のアジア太平洋

- 欧州

- 欧州市場の促進要因

- 欧州のマクロ経済の見通し

- 英国

- ドイツ

- フランス

- イタリア

- その他の欧州

- 中東・アフリカ

- 中東・アフリカ市場の促進要因

- 中東・アフリカのマクロ経済の見通し

- GCC

- 南アフリカ

- その他の中東・アフリカ

- ラテンアメリカ

- ラテンアメリカ市場の促進要因

- ラテンアメリカのマクロ経済の見通し

- ブラジル

- メキシコ

- その他のラテンアメリカ

第9章 競合情勢

- 主要参入企業の戦略/強み(2022年~2024年)

- 収益分析(2020年~2024年)

- 市場シェア分析(2024年)

- ブランド/製品の比較

- HONEYWELL

- BAE SYSTEMS

- THALES

- NORTHROP GRUMMAN

- MOTOROLA SOLUTIONS

- 企業の評価と財務指標

- 企業の評価マトリクス:主要企業(2024年)

- 企業の評価マトリクス:スタートアップ/中小企業(2024年)

- 競合シナリオ

第10章 企業プロファイル

- イントロダクション

- 主要企業

- AXIS COMMUNICATIONS

- FORCEPOINT

- FORTINET

- CISCO

- BAE SYSTEMS

- LOCKHEED MARTIN

- GENERAL DYNAMICS

- NORTHROP GRUMMAN

- HONEYWELL

- AIRBUS

- THALES

- HEXAGON AB

- JOHNSON CONTROLS

- MOTOROLA SOLUTIONS

- TENABLE

- ROLTA

- SERVICENOW

- LUNA-OPTASENSE

- TELTRONIC

- WATERFALL SECURITY SOLUTIONS

- WESTMINISTER GROUP PLC

- OWL CYBER DEFENSE SOLUTIONS

- ACHILLES HEEL TECHNOLOGIES

- CIPS SECURITY

- SUPREMA INC

- INDUSTRIAL DEFENDER

- TERMA

- ERICSSON

- RHEBO AG

- LEIDOS

- MECOM MEDIEN-COMMUNICATIONS

- KLOCH

- SIEMENS

- CAMBIUM NETWORKS

- HUAWEI

- G4S

- GE VERNOVA

- NEC CORPORATION

- BRUKER CORPORATION

- FUJITSU

第11章 隣接市場

- イントロダクション

- サイバーセキュリティ市場

- 運用技術(OT)セキュリティ市場