|

|

市場調査レポート

商品コード

1585123

モジュラーデータセンターの世界市場:ソリューション別、フォームファクター別、建築タイプ別 - 予測(~2030年)Modular Data Center Market by Solutions (All-in-one and Prefabricated Modules (IT, Power, Cooling)), Form Factor (ISO Containers (20 feet, 40 feet), Enclosures, Skid-mounted), Build Type (Semi & Fully-prefabricated) - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| モジュラーデータセンターの世界市場:ソリューション別、フォームファクター別、建築タイプ別 - 予測(~2030年) |

|

出版日: 2024年11月05日

発行: MarketsandMarkets

ページ情報: 英文 385 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界のモジュラーデータセンターの市場規模は、2024年の299億3,000万米ドルから2030年までに794億9,000万米ドルに達すると予測され、予測期間にCAGRで17.7%の成長が見込まれます。

市場は、企業が拡張性と柔軟性に優れたインフラソリューションを求める傾向が強まっていることから、大きな成長が見込まれています。モジュラーデータセンターは、迅速な展開、建設期間の短縮、効率的なエネルギー利用を可能にします。モジュラー電源と冷却システム、プレハブITモジュール、強化されたオートメーションなどの主な進歩は、データセンターの設計と展開の方法を変革しています。これらの構成済み、テスト済みのモジュールは、現場での作業を最小化し、迅速な設置とアップグレードを可能にします。この合理的なアプローチにより、企業は性能とコスト効率を最適化しながら、変化するインフラニーズに迅速に対応することができます。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2019年~2030年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2030年 |

| 単位 | 10億米ドル |

| セグメント | コンポーネント、フォームファクター、建築タイプ、データセンター規模、展開タイプ、エンドユーザー、地域 |

| 対象地域 | 北米、欧州、アジア太平洋、中東・アフリカ、ラテンアメリカ |

「コンポーネント別では、サービスが予測期間にもっとも高いCAGRで成長します。」

モジュラーデータセンター市場において、サービスはこれらの施設のシームレスな機能と最適化を保証する上で重要な役割を果たしています。サービスは、設計・コンサルティング、統合・展開、サポート・メンテナンスの3つに大別されます。設計・コンサルティングサービスは、特定のビジネスニーズに従ってデータセンターソリューションをカスタマイズし、最適なスペース、電力、冷却構成を確保することに重点を置いています。統合・展開サービスでは、モジュラーユニットの組み立てと設置を行い、既存の業務に対する影響を最小化しながら、迅速かつスムーズなセットアップを実現します。サポート・メンテナンスサービスでは、定期的なモニタリング、トラブルシューティング、予防保全など、継続的なケアを行い、高い性能を確保し、ダウンタイムを最小化します。これらのサービスを組み合わせることで、運用の複雑性とコストを削減しながら、モジュラーデータセンターの迅速な展開、拡張、メンテナンスを実現します。新設であれ、既存インフラのアップグレードであれ、これらのサービスを利用することで、企業は進化する技術要件に対応し、データセンター運用の信頼性を確保することができます。

「ソリューションセグメントでは、プレハブモジュールが予測期間に最大のシェアを占めます。」

モジュラーデータセンター市場におけるプレハブモジュールは、現場で迅速に展開できる設計済み・組立済みコンポーネントを提供することで、汎用性の高いアプローチを提供します。これらのモジュールはさらに、プレハブITモジュール、プレハブ電源モジュール、プレハブ冷却モジュールに分類され、それぞれがデータセンターのインフラに対する特定の要件に対応しています。モジュラーであるため、企業はデータセンターの拡張やアップグレードをシームレスに行うことができ、従来の建設に伴う工期やコストを削減することができます。プレハブモジュールは、金融、医療、クラウドサービスプロバイダーなど、需要の変動が激しく、迅速な拡張性と信頼性が重要な産業にとって特に有益です。標準化された設計でありながら柔軟な構成が可能なため、大規模なデータセンターから遠隔地まで、さまざまな環境に適しています。さらに、これらのモジュールは電力と冷却の分配を最適化することでエネルギー効率に寄与し、企業の持続可能性目標の達成を支援します。データセンターの需要が進化するにつれて、プレハブモジュールの採用は拡大しており、インフラの近代化とデジタル時代のダイナミックなニーズへの対応に向けた、実用的でコスト効率の高いソリューションが提供されています。

当レポートでは、世界のモジュラーデータセンター市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

- モジュラーデータセンター市場の企業にとって魅力的な成長機会

- モジュラーデータセンターの市場シェア:コンポーネント別(2024年・2030年)

- モジュラーデータセンターソリューションの市場シェア:タイプ別(2024年・2030年)

- モジュラーデータセンターのプレハブモジュールの市場シェア:タイプ別(2024年・2030年)

- モジュラーデータセンターサービスの市場シェア:タイプ別(2024年・2030年)

- モジュラーデータセンターの市場シェア:フォームファクター別(2024年・2030年)

- モジュラーデータセンターのエンクロージャーの市場シェア:タイプ別(2024年・2030年)

- ISOコンテナーのモジュラーデータセンターの市場シェア:タイプ別(2024年・2030年)

- モジュラーデータセンターのスキッドマウントシステムの市場シェア:タイプ別(2024年・2030年)

- モジュラーデータセンターの市場シェア:展開タイプ別(2024年・2030年)

- モジュラーデータセンターの市場シェア:建築タイプ別(2024年・2030年)

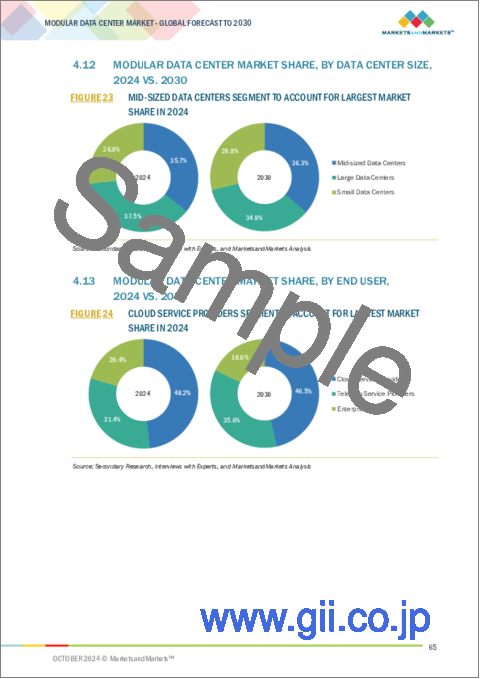

- モジュラーデータセンターの市場シェア:データセンター規模別(2024年・2030年)

- モジュラーデータセンターの市場シェア:エンドユーザー別(2024年・2030年)

- モジュラーデータセンター市場:地域別(2024年・2030年)

第5章 市場の概要と産業動向

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- ケーススタディ分析

- サプライチェーン分析

- エコシステム分析

- 技術分析

- 主要技術

- 補完技術

- 隣接技術

- 価格分析

- 主要企業の平均販売価格の動向:ソリューション別

- 平均販売価格の動向:地域別

- 貿易分析

- 特許分析

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- 規制情勢

- 規制機関、政府機関、その他の組織

- 規制:地域別

- ビジネスモデル分析

- 製品

- 収益源

- 収益モデルの動向

- チャネル

- 顧客セグメント

- 主な会議とイベント(2024年~2025年)

- 投資と資金調達のシナリオ

- モジュラーデータセンター市場に対するAI/生成AIの影響

- 産業動向:ユースケース

- AI/生成AIを採用するトップベンダー

- モジュラーデータセンターの用途

- 処理能力の拡張

- データセンターの拡張

- 災害復旧

- 緊急・一時的展開

- エッジコンピューティング

第6章 モジュラーデータセンター市場:コンポーネント別

- イントロダクション

- ソリューション

- オールインワンソリューション

- プレハブモジュール

- サービス

- 設計・コンサルティング

- 統合・展開

- サポート・メンテナンス

第7章 モジュラーデータセンター市場:フォームファクター別

- イントロダクション

- ISOコンテナー

- 20フィートコンテナー

- 40フィートコンテナー

- スキッドマウントシステム

- 固定式スキッドマウントシステム

- 可動式スキッドマウントシステム

- エンクロージャー

- 低密度エンクロージャー

- 中密度エンクロージャー

- 高密度エンクロージャー

第8章 モジュラーデータセンター市場:建築タイプ別

- イントロダクション

- セミプレハブデータセンター

- フルプレハブデータセンター

- オールインワンデータセンター

第9章 モジュラーデータセンター市場:データセンター規模別

- イントロダクション

- 小規模データセンター

- 中規模データセンター

- 大規模データセンター

第10章 モジュラーデータセンター市場:展開タイプ別

- イントロダクション

- 屋内

- 屋外

第11章 モジュラーデータセンター市場:エンドユーザー別

- イントロダクション

- 通信サービスプロバイダー

- クラウドサービスプロバイダー

- 企業

第12章 モジュラーデータセンター市場:地域別

- イントロダクション

- 北米

- 北米のモジュラーデータセンター市場の促進要因

- 北米のマクロ経済の見通し

- 米国

- カナダ

- 欧州

- 欧州のモジュラーデータセンター市場の促進要因

- 欧州のマクロ経済の見通し

- 英国

- ドイツ

- フランス

- イタリア

- その他の欧州

- アジア太平洋

- アジア太平洋のモジュラーデータセンター市場の促進要因

- アジア太平洋のマクロ経済の見通し

- 中国

- 日本

- オーストラリア・ニュージーランド

- その他のアジア太平洋

- 中東・アフリカ

- 中東・アフリカのモジュラーデータセンター市場の促進要因

- 中東・アフリカのマクロ経済の見通し

- GCC諸国

- 南アフリカ

- その他の中東・アフリカ

- ラテンアメリカ

- ラテンアメリカのモジュラーデータセンター市場の促進要因

- ラテンアメリカのマクロ経済の見通し

- ブラジル

- メキシコ

- その他のラテンアメリカ

第13章 競合情勢

- イントロダクション

- 主要企業が採用した戦略/有力企業

- 市場シェア分析

- ベンダー製品/ブランドの比較

- DELL TECHNOLOGIES - EMC MDC

- SCHNEIDER ELECTRIC - ECOSTRUXURE

- VERTIV - MEGAMOD

- HUAWEI - FUSIONMODULE 2000

- EATON - SMARTRACK

- 収益分析

- 企業の評価マトリクス:主要企業(2023年)

- 企業の評価マトリクス:スタートアップ/中小企業(2023年)

- 主要ベンダーの企業の評価と財務指標

- 競合シナリオ

第14章 企業プロファイル

- イントロダクション

- 主要企業

- DELL

- VERTIV

- SCHNEIDER ELECTRIC

- HUAWEI

- EATON

- RITTAL

- JOHNSON CONTROLS

- ABB

- DELTA ELECTRONICS

- STULZ

- HUBBELL (PCX)

- その他の企業

- IE CORP.

- CANNON TECHNOLOGIES

- EDGE MCS

- ASPERITAS

- RETEX

- BOX MODUL

- BLADEROOM

- WESCO INTERNATIONAL, INC.

- FIBERHOME

- SCALEMATRIX

- EQUINIX

- 365 DATA CENTERS

- CORESITE

- STULZ

- CUPERTINO ELECTRIC

- K-STAR

- IEM

- MODULAR POWER SOLUTIONS

- FAITH TECHNOLOGIES, INC.

- FIBREBOND

- VOLTA

- M.C. DEAN

- DATA SPECIALTIES INC.

- TOTAL SITE SOLUTIONS

- ENVIRONMENTAL AIR SYSTEMS

- TAS

- AWS

- META

- ORACLE

- MICROSOFT

- APPLE

- INTEL

- NVIDIA

- IBM

- SIEMENS

- HPE

第15章 隣接市場と関連市場

- イントロダクション

- 関連市場

- マイクロモバイルデータセンター市場

- モジュラーUPS市場

第16章 付録

List of Tables

- TABLE 1 USD EXCHANGE RATES, 2019-2023

- TABLE 2 FACTOR ANALYSIS

- TABLE 3 INDICATIVE PRICING ANALYSIS OF MODULAR UPS SOLUTIONS

- TABLE 4 AVERAGE SELLING PRICE TREND, BY REGION

- TABLE 5 IMPORT DATA, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 6 EXPORT DATA, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 7 MODULAR DATA CENTER MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 8 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR END USERS

- TABLE 9 KEY BUYING CRITERIA FOR END USERS

- TABLE 10 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 MODULAR DATA CENTER MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2024-2025

- TABLE 15 MODULAR DATA CENTER MARKET, BY COMPONENT, 2019-2023 (USD MILLION)

- TABLE 16 MODULAR DATA CENTER MARKET, BY COMPONENT, 2024-2030 (USD MILLION)

- TABLE 17 MODULAR DATA CENTER SOLUTIONS MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 18 MODULAR DATA CENTER SOLUTIONS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 19 MODULAR DATA CENTER SOLUTIONS MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 20 MODULAR DATA CENTER SOLUTIONS MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 21 MODULAR DATA CENTER MARKET FOR ALL-IN-ONE MODULES, BY REGION, 2019-2023 (USD MILLION)

- TABLE 22 MODULAR DATA CENTER MARKET FOR ALL-IN-ONE MODULES, BY REGION, 2024-2030 (USD MILLION)

- TABLE 23 MODULAR DATA CENTER MARKET FOR PREFABRICATED MODULES, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 24 MODULAR DATA CENTER MARKET FOR PREFABRICATED MODULES, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 25 MODULAR DATA CENTER MARKET FOR PREFABRICATED MODULES, BY REGION, 2019-2023 (USD MILLION)

- TABLE 26 MODULAR DATA CENTER MARKET FOR PREFABRICATED MODULES, BY REGION, 2024-2030 (USD MILLION)

- TABLE 27 MODULAR DATA CENTER MARKET FOR PREFABRICATED IT MODULES, BY REGION, 2019-2023 (USD MILLION)

- TABLE 28 MODULAR DATA CENTER MARKET FOR PREFABRICATED IT MODULES, BY REGION, 2024-2030 (USD MILLION)

- TABLE 29 MODULAR DATA CENTER MARKET FOR PREFABRICATED POWER MODULES, BY REGION, 2019-2023 (USD MILLION)

- TABLE 30 MODULAR DATA CENTER MARKET FOR PREFABRICATED POWER MODULES, BY REGION, 2024-2030 (USD MILLION)

- TABLE 31 MODULAR DATA CENTER MARKET FOR PREFABRICATED COOLING MODULES, BY REGION, 2019-2023 (USD MILLION)

- TABLE 32 MODULAR DATA CENTER MARKET FOR PREFABRICATED COOLING MODULES, BY REGION, 2024-2030 (USD MILLION)

- TABLE 33 MODULAR DATA CENTER SERVICES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 34 MODULAR DATA CENTER SERVICES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 35 MODULAR DATA CENTER SERVICES MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 36 MODULAR DATA CENTER SERVICES MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 37 MODULAR DATA CENTER MARKET FOR DESIGN & CONSULTING SERVICES, BY REGION, 2019-2023 (USD MILLION)

- TABLE 38 MODULAR DATA CENTER MARKET FOR DESIGN & CONSULTING SERVICES, BY REGION, 2024-2030 (USD MILLION)

- TABLE 39 MODULAR DATA CENTER MARKET FOR INTEGRATION & DEPLOYMENT SERVICES, BY REGION, 2019-2023 (USD MILLION)

- TABLE 40 MODULAR DATA CENTER MARKET FOR INTEGRATION & DEPLOYMENT SERVICES, BY REGION, 2024-2030 (USD MILLION)

- TABLE 41 MODULAR DATA CENTER MARKET FOR SUPPORT & MAINTENANCE SERVICES, BY REGION, 2019-2023 (USD MILLION)

- TABLE 42 MODULAR DATA CENTER MARKET FOR SUPPORT & MAINTENANCE SERVICES, BY REGION, 2024-2030 (USD MILLION)

- TABLE 43 MODULAR DATA CENTER MARKET, BY FORM FACTOR, 2019-2023 (USD MILLION)

- TABLE 44 MODULAR DATA CENTER MARKET, BY FORM FACTOR, 2024-2030 (USD MILLION)

- TABLE 45 MODULAR DATA CENTER MARKET FOR ISO CONTAINERS, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 46 MODULAR DATA CENTER MARKET FOR ISO CONTAINERS, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 47 MODULAR DATA CENTER MARKET FOR ISO CONTAINERS, BY REGION, 2019-2023 (USD MILLION)

- TABLE 48 MODULAR DATA CENTER MARKET FOR ISO CONTAINERS, BY REGION, 2024-2030 (USD MILLION)

- TABLE 49 MODULAR DATA CENTER MARKET FOR 20-FEET CONTAINERS, BY REGION, 2019-2023 (USD MILLION)

- TABLE 50 MODULAR DATA CENTER MARKET FOR 20-FEET CONTAINERS, BY REGION, 2024-2030 (USD MILLION)

- TABLE 51 MODULAR DATA CENTER MARKET FOR 40-FEET CONTAINERS, BY REGION, 2019-2023 (USD MILLION)

- TABLE 52 MODULAR DATA CENTER MARKET FOR 40-FEET CONTAINERS, BY REGION, 2024-2030 (USD MILLION)

- TABLE 53 MODULAR DATA CENTER MARKET FOR SKID-MOUNTED SYSTEMS, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 54 MODULAR DATA CENTER MARKET FOR SKID-MOUNTED SYSTEMS, BY TYPE, 2024-2030 (USD MILLION)

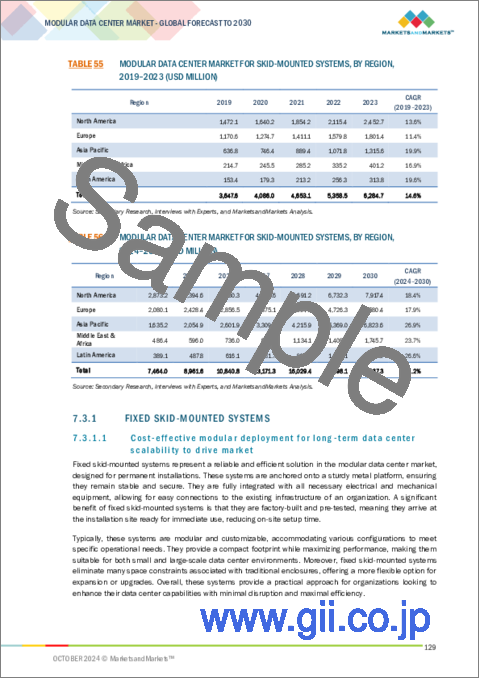

- TABLE 55 MODULAR DATA CENTER MARKET FOR SKID-MOUNTED SYSTEMS, BY REGION, 2019-2023 (USD MILLION)

- TABLE 56 MODULAR DATA CENTER MARKET FOR SKID-MOUNTED SYSTEMS, BY REGION, 2024-2030 (USD MILLION)

- TABLE 57 MODULAR DATA CENTER MARKET FOR FIXED SKID-MOUNTED SYSTEMS, BY REGION, 2019-2023 (USD MILLION)

- TABLE 58 MODULAR DATA CENTER MARKET FOR FIXED SKID-MOUNTED SYSTEMS, BY REGION, 2024-2030 (USD MILLION)

- TABLE 59 MODULAR DATA CENTER MARKET FOR PORTABLE SKID-MOUNTED SYSTEMS, BY REGION, 2019-2023 (USD MILLION)

- TABLE 60 MODULAR DATA CENTER MARKET FOR PORTABLE SKID-MOUNTED SYSTEMS, BY REGION, 2024-2030 (USD MILLION)

- TABLE 61 MODULAR DATA CENTER MARKET FOR ENCLOSURES, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 62 MODULAR DATA CENTER MARKET FOR ENCLOSURES, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 63 MODULAR DATA CENTER MARKET FOR ENCLOSURES, BY REGION, 2019-2023 (USD MILLION)

- TABLE 64 MODULAR DATA CENTER MARKET FOR ENCLOSURES, BY REGION, 2024-2030 (USD MILLION)

- TABLE 65 MODULAR DATA CENTER MARKET FOR LOW-DENSITY ENCLOSURES, BY REGION, 2019-2023 (USD MILLION)

- TABLE 66 MODULAR DATA CENTER MARKET FOR LOW-DENSITY ENCLOSURES, BY REGION, 2024-2030 (USD MILLION)

- TABLE 67 MODULAR DATA CENTER MARKET FOR MEDIUM-DENSITY ENCLOSURES, BY REGION, 2019-2023 (USD MILLION)

- TABLE 68 MODULAR DATA CENTER MARKET FOR MEDIUM-DENSITY ENCLOSURES, BY REGION, 2024-2030 (USD MILLION)

- TABLE 69 MODULAR DATA CENTER MARKET FOR HIGH-DENSITY ENCLOSURES, BY REGION, 2019-2023 (USD MILLION)

- TABLE 70 MODULAR DATA CENTER MARKET FOR HIGH -DENSITY ENCLOSURES, BY REGION, 2024-2030 (USD MILLION)

- TABLE 71 MODULAR DATA CENTER MARKET, BY BUILD TYPE, 2019-2023 (USD MILLION)

- TABLE 72 MODULAR DATA CENTER MARKET, BY BUILD TYPE, 2024-2030 (USD MILLION)

- TABLE 73 MODULAR DATA CENTER MARKET FOR SEMI PREFABRICATED DATA CENTERS, BY REGION, 2019-2023 (USD MILLION)

- TABLE 74 MODULAR DATA CENTER MARKET FOR SEMI PREFABRICATED DATA CENTERS, BY REGION, 2024-2030 (USD MILLION)

- TABLE 75 MODULAR DATA CENTER MARKET FOR FULLY PREFABRICATED DATA CENTERS, BY REGION, 2019-2023 (USD MILLION)

- TABLE 76 MODULAR DATA CENTER MARKET FOR FULLY PREFABRICATED DATA CENTERS, BY REGION, 2024-2030 (USD MILLION)

- TABLE 77 MODULAR DATA CENTER MARKET FOR ALL-IN-ONE DATA CENTERS, BY REGION, 2019-2023 (USD MILLION)

- TABLE 78 MODULAR DATA CENTER MARKET FOR ALL-IN-ONE DATA CENTERS, BY REGION, 2024-2030 (USD MILLION)

- TABLE 79 MODULAR DATA CENTER MARKET, BY DATA CENTER SIZE, 2019-2023 (USD MILLION)

- TABLE 80 MODULAR DATA CENTER MARKET, BY DATA CENTER SIZE, 2024-2030 (USD MILLION)

- TABLE 81 MODULAR DATA CENTER MARKET FOR SMALL DATA CENTERS, BY REGION, 2019-2023 (USD MILLION)

- TABLE 82 MODULAR DATA CENTER MARKET FOR SMALL DATA CENTERS, BY REGION, 2024-2030 (USD MILLION)

- TABLE 83 MODULAR DATA CENTER MARKET FOR MID-SIZED DATA CENTERS, BY REGION, 2019-2023 (USD MILLION)

- TABLE 84 MODULAR DATA CENTER MARKET FOR MID-SIZED DATA CENTERS, BY REGION, 2024-2030 (USD MILLION)

- TABLE 85 MODULAR DATA CENTER MARKET FOR LARGE DATA CENTERS, BY REGION, 2019-2023 (USD MILLION)

- TABLE 86 MODULAR DATA CENTER MARKET FOR LARGE DATA CENTERS, BY REGION, 2024-2030 (USD MILLION)

- TABLE 87 MODULAR DATA CENTER MARKET, BY DEPLOYMENT TYPE, 2019-2023 (USD MILLION)

- TABLE 88 MODULAR DATA CENTER MARKET, BY DEPLOYMENT TYPE, 2024-2030 (USD MILLION)

- TABLE 89 MODULAR DATA CENTER MARKET FOR INDOOR DEPLOYMENT, BY REGION, 2019-2023 (USD MILLION)

- TABLE 90 MODULAR DATA CENTER MARKET FOR INDOOR DEPLOYMENT, BY REGION, 2024-2030 (USD MILLION)

- TABLE 91 MODULAR DATA CENTER MARKET FOR OUTDOOR DEPLOYMENT, BY REGION, 2019-2023 (USD MILLION)

- TABLE 92 MODULAR DATA CENTER MARKET FOR OUTDOOR DEPLOYMENT, BY REGION, 2024-2030 (USD MILLION)

- TABLE 93 MODULAR DATA CENTER MARKET, BY END USER, 2019-2023 (USD MILLION)

- TABLE 94 MODULAR DATA CENTER MARKET, BY END USER, 2024-2030 (USD MILLION)

- TABLE 95 MODULAR DATA CENTER MARKET FOR TELECOM SERVICE PROVIDERS, BY REGION, 2019-2023 (USD MILLION)

- TABLE 96 MODULAR DATA CENTER MARKET FOR TELECOM SERVICE PROVIDERS, BY REGION, 2024-2030 (USD MILLION)

- TABLE 97 MODULAR DATA CENTER MARKET FOR CLOUD SERVICE PROVIDERS, BY REGION, 2019-2023 (USD MILLION)

- TABLE 98 MODULAR DATA CENTER MARKET FOR CLOUD SERVICE PROVIDERS, BY REGION, 2024-2030 (USD MILLION)

- TABLE 99 MODULAR DATA CENTER MARKET FOR ENTERPRISES, BY REGION, 2019-2023 (USD MILLION)

- TABLE 100 MODULAR DATA CENTER MARKET FOR ENTERPRISES, BY REGION, 2024-2030 (USD MILLION)

- TABLE 101 BFSI: MODULAR DATA CENTER MARKET FOR ENTERPRISES, BY REGION, 2019-2023 (USD MILLION)

- TABLE 102 BFSI: MODULAR DATA CENTER MARKET FOR ENTERPRISES, BY REGION, 2024-2030 (USD MILLION)

- TABLE 103 IT & TELECOM: MODULAR DATA CENTER MARKET FOR ENTERPRISES, BY REGION, 2019-2023 (USD MILLION)

- TABLE 104 IT & TELECOM: MODULAR DATA CENTER MARKET FOR ENTERPRISES, BY REGION, 2024-2030 (USD MILLION)

- TABLE 105 GOVERNMENT & DEFENSE: MODULAR DATA CENTER MARKET FOR ENTERPRISES, BY REGION, 2019-2023 (USD MILLION)

- TABLE 106 GOVERNMENT & DEFENSE: MODULAR DATA CENTER MARKET FOR ENTERPRISES, BY REGION, 2024-2030 (USD MILLION)

- TABLE 107 HEALTHCARE & LIFE SCIENCES: MODULAR DATA CENTER MARKET FOR ENTERPRISES, BY REGION, 2019-2023 (USD MILLION)

- TABLE 108 HEALTHCARE & LIFE SCIENCES: MODULAR DATA CENTER MARKET FOR ENTERPRISES, BY REGION, 2024-2030 (USD MILLION)

- TABLE 109 RETAIL & E-COMMERCE: MODULAR DATA CENTER MARKET FOR ENTERPRISES, BY REGION, 2019-2023 (USD MILLION)

- TABLE 110 RETAIL & E-COMMERCE: MODULAR DATA CENTER MARKET FOR ENTERPRISES, BY REGION, 2024-2030 (USD MILLION)

- TABLE 111 MEDIA & ENTERTAINMENT: MODULAR DATA CENTER MARKET FOR ENTERPRISES, BY REGION, 2019-2023 (USD MILLION)

- TABLE 112 MEDIA & ENTERTAINMENT: MODULAR DATA CENTER MARKET FOR ENTERPRISES, BY REGION, 2024-2030 (USD MILLION)

- TABLE 113 MANUFACTURING: MODULAR DATA CENTER MARKET FOR ENTERPRISES, BY REGION, 2019-2023 (USD MILLION)

- TABLE 114 MANUFACTURING: MODULAR DATA CENTER MARKET FOR ENTERPRISES, BY REGION, 2024-2030 (USD MILLION)

- TABLE 115 OTHER VERTICALS: MODULAR DATA CENTER MARKET FOR ENTERPRISES, BY REGION, 2019-2023 (USD MILLION)

- TABLE 116 OTHER VERTICALS: MODULAR DATA CENTER MARKET FOR ENTERPRISES, BY REGION, 2024-2030 (USD MILLION)

- TABLE 117 MODULAR DATA CENTER MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 118 MODULAR DATA CENTER MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 119 NORTH AMERICA: MODULAR DATA CENTER MARKET, BY COMPONENT, 2019-2023 (USD MILLION)

- TABLE 120 NORTH AMERICA: MODULAR DATA CENTER MARKET, BY COMPONENT, 2024-2030 (USD MILLION)

- TABLE 121 NORTH AMERICA: MODULAR DATA CENTER SOLUTIONS MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 122 NORTH AMERICA: MODULAR DATA CENTER SOLUTIONS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 123 NORTH AMERICA: MODULAR DATA CENTER MARKET FOR PREFABRICATED MODULES, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 124 NORTH AMERICA: MODULAR DATA CENTER MARKET FOR PREFABRICATED MODULES, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 125 NORTH AMERICA: MODULAR DATA CENTER SERVICES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 126 NORTH AMERICA: MODULAR DATA CENTER SERVICES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 127 NORTH AMERICA: MODULAR DATA CENTER MARKET, BY FORM FACTOR, 2019-2023 (USD MILLION)

- TABLE 128 NORTH AMERICA: MODULAR DATA CENTER MARKET, BY FORM FACTOR, 2024-2030 (USD MILLION)

- TABLE 129 NORTH AMERICA: MODULAR DATA CENTER MARKET FOR ENCLOSURES, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 130 NORTH AMERICA: MODULAR DATA CENTER MARKET FOR ENCLOSURES, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 131 NORTH AMERICA: MODULAR DATA CENTER MARKET FOR ISO CONTAINERS, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 132 NORTH AMERICA: MODULAR DATA CENTER MARKET FOR ISO CONTAINERS, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 133 NORTH AMERICA: MODULAR DATA CENTER MARKET FOR SKID-MOUNTED SYSTEMS, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 134 NORTH AMERICA: MODULAR DATA CENTER MARKET FOR SKID-MOUNTED SYSTEMS, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 135 NORTH AMERICA: MODULAR DATA CENTER MARKET, BY DEPLOYMENT TYPE, 2019-2023 (USD MILLION)

- TABLE 136 NORTH AMERICA: MODULAR DATA CENTER MARKET, BY DEPLOYMENT TYPE, 2024-2030 (USD MILLION)

- TABLE 137 NORTH AMERICA: MODULAR DATA CENTER MARKET, BY BUILD TYPE, 2019-2023 (USD MILLION)

- TABLE 138 NORTH AMERICA: MODULAR DATA CENTER MARKET, BY BUILD TYPE, 2024-2030 (USD MILLION)

- TABLE 139 NORTH AMERICA: MODULAR DATA CENTER MARKET, BY DATA CENTER SIZE, 2019-2023 (USD MILLION)

- TABLE 140 NORTH AMERICA: MODULAR DATA CENTER MARKET, BY DATA CENTER SIZE, 2024-2030 (USD MILLION)

- TABLE 141 NORTH AMERICA: MODULAR DATA CENTER MARKET, BY END USER, 2019-2023 (USD MILLION)

- TABLE 142 NORTH AMERICA: MODULAR DATA CENTER MARKET, BY END USER, 2024-2030 (USD MILLION)

- TABLE 143 NORTH AMERICA: MODULAR DATA CENTER MARKET FOR ENTERPRISES, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 144 NORTH AMERICA: MODULAR DATA CENTER MARKET FOR ENTERPRISES, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 145 NORTH AMERICA: MODULAR DATA CENTER MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 146 NORTH AMERICA: MODULAR DATA CENTER MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 147 US: MODULAR DATA CENTER MARKET, BY COMPONENT, 2019-2023 (USD MILLION)

- TABLE 148 US: MODULAR DATA CENTER MARKET, BY COMPONENT, 2024-2030 (USD MILLION)

- TABLE 149 CANADA: MODULAR DATA CENTER MARKET, BY COMPONENT, 2019-2023 (USD MILLION)

- TABLE 150 CANADA: MODULAR DATA CENTER MARKET, BY COMPONENT, 2024-2030 (USD MILLION)

- TABLE 151 EUROPE: MODULAR DATA CENTER MARKET, BY COMPONENT, 2019-2023 (USD MILLION)

- TABLE 152 EUROPE: MODULAR DATA CENTER MARKET, BY COMPONENT, 2024-2030 (USD MILLION)

- TABLE 153 EUROPE: MODULAR DATA CENTER SOLUTIONS MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 154 EUROPE: MODULAR DATA CENTER SOLUTIONS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 155 EUROPE: MODULAR DATA CENTER MARKET FOR PREFABRICATED MODULES, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 156 EUROPE: MODULAR DATA CENTER MARKET FOR PREFABRICATED MODULES, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 157 EUROPE: MODULAR DATA CENTER SERVICES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 158 EUROPE: MODULAR DATA CENTER SERVICES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 159 EUROPE: MODULAR DATA CENTER MARKET, BY FORM FACTOR, 2019-2023 (USD MILLION)

- TABLE 160 EUROPE: MODULAR DATA CENTER MARKET, BY FORM FACTOR, 2024-2030 (USD MILLION)

- TABLE 161 EUROPE: MODULAR DATA CENTER MARKET FOR ENCLOSURES, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 162 EUROPE: MODULAR DATA CENTER MARKET FOR ENCLOSURES, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 163 EUROPE: MODULAR DATA CENTER MARKET FOR ISO CONTAINERS, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 164 EUROPE: MODULAR DATA CENTER MARKET FOR ISO CONTAINERS, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 165 EUROPE: MODULAR DATA CENTER MARKET FOR SKID-MOUNTED SYSTEMS, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 166 EUROPE: MODULAR DATA CENTER MARKET FOR SKID-MOUNTED SYSTEMS, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 167 EUROPE: MODULAR DATA CENTER MARKET, BY DEPLOYMENT TYPE, 2019-2023 (USD MILLION)

- TABLE 168 EUROPE: MODULAR DATA CENTER MARKET, BY DEPLOYMENT TYPE, 2024-2030 (USD MILLION)

- TABLE 169 EUROPE: MODULAR DATA CENTER MARKET, BY BUILD TYPE, 2019-2023 (USD MILLION)

- TABLE 170 EUROPE: MODULAR DATA CENTER MARKET, BY BUILD TYPE, 2024-2030 (USD MILLION)

- TABLE 171 EUROPE: MODULAR DATA CENTER MARKET, BY DATA CENTER SIZE, 2019-2023 (USD MILLION)

- TABLE 172 EUROPE: MODULAR DATA CENTER MARKET, BY DATA CENTER SIZE, 2024-2030 (USD MILLION)

- TABLE 173 EUROPE: MODULAR DATA CENTER MARKET, BY END USER, 2019-2023 (USD MILLION)

- TABLE 174 EUROPE: MODULAR DATA CENTER MARKET, BY END USER, 2024-2030 (USD MILLION)

- TABLE 175 EUROPE: MODULAR DATA CENTER MARKET FOR ENTERPRISES, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 176 EUROPE: MODULAR DATA CENTER MARKET FOR ENTERPRISES, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 177 EUROPE: MODULAR DATA CENTER MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 178 EUROPE: MODULAR DATA CENTER MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 179 UK: MODULAR DATA CENTER MARKET, BY COMPONENT, 2019-2023 (USD MILLION)

- TABLE 180 UK: MODULAR DATA CENTER MARKET, BY COMPONENT, 2024-2030 (USD MILLION)

- TABLE 181 GERMANY: MODULAR DATA CENTER MARKET, BY COMPONENT, 2019-2023 (USD MILLION)

- TABLE 182 GERMANY: MODULAR DATA CENTER MARKET, BY COMPONENT, 2024-2030 (USD MILLION)

- TABLE 183 FRANCE: MODULAR DATA CENTER MARKET, BY COMPONENT, 2019-2023 (USD MILLION)

- TABLE 184 FRANCE: MODULAR DATA CENTER MARKET, BY COMPONENT, 2024-2030 (USD MILLION)

- TABLE 185 ITALY: MODULAR DATA CENTER MARKET, BY COMPONENT, 2019-2023 (USD MILLION)

- TABLE 186 ITALY: MODULAR DATA CENTER MARKET, BY COMPONENT, 2024-2030 (USD MILLION)

- TABLE 187 REST OF EUROPE: MODULAR DATA CENTER MARKET, BY COMPONENT, 2019-2023 (USD MILLION)

- TABLE 188 REST OF EUROPE: MODULAR DATA CENTER MARKET, BY COMPONENT, 2024-2030 (USD MILLION)

- TABLE 189 ASIA PACIFIC: MODULAR DATA CENTER MARKET, BY COMPONENT, 2019-2023 (USD MILLION)

- TABLE 190 ASIA PACIFIC: MODULAR DATA CENTER MARKET, BY COMPONENT, 2024-2030 (USD MILLION)

- TABLE 191 ASIA PACIFIC: MODULAR DATA CENTER SOLUTIONS MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 192 ASIA PACIFIC: MODULAR DATA CENTER SOLUTIONS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 193 ASIA PACIFIC: MODULAR DATA CENTER MARKET FOR PREFABRICATED MODULES, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 194 ASIA PACIFIC: MODULAR DATA CENTER MARKET FOR PREFABRICATED MODULES, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 195 ASIA PACIFIC: MODULAR DATA CENTER SERVICES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 196 ASIA PACIFIC: MODULAR DATA CENTER SERVICES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 197 ASIA PACIFIC: MODULAR DATA CENTER MARKET, BY FORM FACTOR, 2019-2023 (USD MILLION)

- TABLE 198 ASIA PACIFIC: MODULAR DATA CENTER MARKET, BY FORM FACTOR, 2024-2030 (USD MILLION)

- TABLE 199 ASIA PACIFIC: MODULAR DATA CENTER MARKET FOR ENCLOSURES, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 200 ASIA PACIFIC: MODULAR DATA CENTER MARKET FOR ENCLOSURES, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 201 ASIA PACIFIC: MODULAR DATA CENTER MARKET FOR ISO CONTAINERS, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 202 ASIA PACIFIC: MODULAR DATA CENTER MARKET FOR ISO CONTAINERS, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 203 ASIA PACIFIC: MODULAR DATA CENTER MARKET FOR SKID-MOUNTED SYSTEMS, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 204 ASIA PACIFIC: MODULAR DATA CENTER MARKET FOR SKID-MOUNTED SYSTEMS, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 205 ASIA PACIFIC: MODULAR DATA CENTER MARKET, BY DEPLOYMENT TYPE, 2019-2023 (USD MILLION)

- TABLE 206 ASIA PACIFIC: MODULAR DATA CENTER MARKET, BY DEPLOYMENT TYPE, 2024-2030 (USD MILLION)

- TABLE 207 ASIA PACIFIC: MODULAR DATA CENTER MARKET, BY BUILD TYPE, 2019-2023 (USD MILLION)

- TABLE 208 ASIA PACIFIC: MODULAR DATA CENTER MARKET, BY BUILD TYPE, 2024-2030 (USD MILLION)

- TABLE 209 ASIA PACIFIC: MODULAR DATA CENTER MARKET, BY DATA CENTER SIZE, 2019-2023 (USD MILLION)

- TABLE 210 ASIA PACIFIC: MODULAR DATA CENTER MARKET, BY DATA CENTER SIZE, 2024-2030 (USD MILLION)

- TABLE 211 ASIA PACIFIC: MODULAR DATA CENTER MARKET, BY END USER, 2019-2023 (USD MILLION)

- TABLE 212 ASIA PACIFIC: MODULAR DATA CENTER MARKET, BY END USER, 2024-2030 (USD MILLION)

- TABLE 213 ASIA PACIFIC: MODULAR DATA CENTER MARKET FOR ENTERPRISES, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 214 ASIA PACIFIC: MODULAR DATA CENTER MARKET FOR ENTERPRISES, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 215 ASIA PACIFIC: MODULAR DATA CENTER MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 216 ASIA PACIFIC: MODULAR DATA CENTER MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 217 CHINA: MODULAR DATA CENTER MARKET, BY COMPONENT, 2019-2023 (USD MILLION)

- TABLE 218 CHINA: MODULAR DATA CENTER MARKET, BY COMPONENT, 2024-2030 (USD MILLION)

- TABLE 219 JAPAN: MODULAR DATA CENTER MARKET, BY COMPONENT, 2019-2023 (USD MILLION)

- TABLE 220 JAPAN: MODULAR DATA CENTER MARKET, BY COMPONENT, 2024-2030 (USD MILLION)

- TABLE 221 AUSTRALIA & NEW ZEALAND: MODULAR DATA CENTER MARKET, BY COMPONENT, 2019-2023 (USD MILLION)

- TABLE 222 AUSTRALIA & NEW ZEALAND: MODULAR DATA CENTER MARKET, BY COMPONENT, 2024-2030 (USD MILLION)

- TABLE 223 REST OF ASIA PACIFIC: MODULAR DATA CENTER MARKET, BY COMPONENT, 2019-2023 (USD MILLION)

- TABLE 224 REST OF ASIA PACIFIC: MODULAR DATA CENTER MARKET, BY COMPONENT, 2024-2030 (USD MILLION)

- TABLE 225 MIDDLE EAST & AFRICA: MODULAR DATA CENTER MARKET, BY COMPONENT, 2019-2023 (USD MILLION)

- TABLE 226 MIDDLE EAST & AFRICA: MODULAR DATA CENTER MARKET, BY COMPONENT, 2024-2030 (USD MILLION)

- TABLE 227 MIDDLE EAST & AFRICA: MODULAR DATA CENTER SOLUTIONS MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 228 MIDDLE EAST & AFRICA: MODULAR DATA CENTER SOLUTIONS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 229 MIDDLE EAST & AFRICA: MODULAR DATA CENTER MARKET FOR PREFABRICATED MODULES, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 230 MIDDLE EAST & AFRICA: MODULAR DATA CENTER MARKET FOR PREFABRICATED MODULES, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 231 MIDDLE EAST & AFRICA: MODULAR DATA CENTER SERVICES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 232 MIDDLE EAST & AFRICA: MODULAR DATA CENTER SERVICES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 233 MIDDLE EAST & AFRICA: MODULAR DATA CENTER MARKET, BY FORM FACTOR, 2019-2023 (USD MILLION)

- TABLE 234 MIDDLE EAST & AFRICA: MODULAR DATA CENTER MARKET, BY FORM FACTOR, 2024-2030 (USD MILLION)

- TABLE 235 MIDDLE EAST & AFRICA: MODULAR DATA CENTER MARKET FOR ENCLOSURES, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 236 MIDDLE EAST & AFRICA: MODULAR DATA CENTER MARKET FOR ENCLOSURES, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 237 MIDDLE EAST & AFRICA: MODULAR DATA CENTER MARKET FOR ISO CONTAINERS, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 238 MIDDLE EAST & AFRICA: MODULAR DATA CENTER MARKET FOR ISO CONTAINERS, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 239 MIDDLE EAST & AFRICA: MODULAR DATA CENTER MARKET FOR SKID-MOUNTED SYSTEMS, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 240 MIDDLE EAST & AFRICA: MODULAR DATA CENTER MARKET FOR SKID-MOUNTED SYSTEMS, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 241 MIDDLE EAST & AFRICA: MODULAR DATA CENTER MARKET, BY DEPLOYMENT TYPE, 2019-2023 (USD MILLION)

- TABLE 242 MIDDLE EAST & AFRICA: MODULAR DATA CENTER MARKET, BY DEPLOYMENT TYPE, 2024-2030 (USD MILLION)

- TABLE 243 MIDDLE EAST & AFRICA: MODULAR DATA CENTER MARKET, BY BUILD TYPE, 2019-2023 (USD MILLION)

- TABLE 244 MIDDLE EAST & AFRICA: MODULAR DATA CENTER MARKET, BY BUILD TYPE, 2024-2030 (USD MILLION)

- TABLE 245 MIDDLE EAST & AFRICA: MODULAR DATA CENTER MARKET, BY DATA CENTER SIZE, 2019-2023 (USD MILLION)

- TABLE 246 MIDDLE EAST & AFRICA: MODULAR DATA CENTER MARKET, BY DATA CENTER SIZE, 2024-2030 (USD MILLION)

- TABLE 247 MIDDLE EAST & AFRICA: MODULAR DATA CENTER MARKET, BY END USER, 2019-2023 (USD MILLION)

- TABLE 248 MIDDLE EAST & AFRICA: MODULAR DATA CENTER MARKET, BY END USER, 2024-2030 (USD MILLION)

- TABLE 249 MIDDLE EAST & AFRICA: MODULAR DATA CENTER MARKET FOR ENTERPRISES, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 250 MIDDLE EAST & AFRICA: MODULAR DATA CENTER MARKET FOR ENTERPRISES, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 251 MIDDLE EAST & AFRICA: MODULAR DATA CENTER MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 252 MIDDLE EAST & AFRICA: MODULAR DATA CENTER MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 253 GCC COUNTRIES: MODULAR DATA CENTER MARKET, BY COMPONENT, 2019-2023 (USD MILLION)

- TABLE 254 GCC COUNTRIES: MODULAR DATA CENTER MARKET, BY COMPONENT, 2024-2030 (USD MILLION)

- TABLE 255 GCC COUNTRIES: MODULAR DATA CENTER MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 256 GCC COUNTRIES: MODULAR DATA CENTER MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 257 SOUTH AFRICA: MODULAR DATA CENTER MARKET, BY COMPONENT, 2019-2023 (USD MILLION)

- TABLE 258 SOUTH AFRICA: MODULAR DATA CENTER MARKET, BY COMPONENT, 2024-2030 (USD MILLION)

- TABLE 259 REST OF MIDDLE EAST & AFRICA: MODULAR DATA CENTER MARKET, BY COMPONENT, 2019-2023 (USD MILLION)

- TABLE 260 REST OF MIDDLE EAST & AFRICA: MODULAR DATA CENTER MARKET, BY COMPONENT, 2024-2030 (USD MILLION)

- TABLE 261 LATIN AMERICA: MODULAR DATA CENTER MARKET, BY COMPONENT, 2019-2023 (USD MILLION)

- TABLE 262 LATIN AMERICA: MODULAR DATA CENTER MARKET, BY COMPONENT, 2024-2030 (USD MILLION)

- TABLE 263 LATIN AMERICA: MODULAR DATA CENTER SOLUTIONS MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 264 LATIN AMERICA: MODULAR DATA CENTER SOLUTIONS MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 265 LATIN AMERICA: MODULAR DATA CENTER MARKET FOR PREFABRICATED MODULES, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 266 LATIN AMERICA: MODULAR DATA CENTER MARKET FOR PREFABRICATED MODULES, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 267 LATIN AMERICA: MODULAR DATA CENTER SERVICES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 268 LATIN AMERICA: MODULAR DATA CENTER SERVICES MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 269 LATIN AMERICA: MODULAR DATA CENTER MARKET, BY FORM FACTOR, 2019-2023 (USD MILLION)

- TABLE 270 LATIN AMERICA: MODULAR DATA CENTER MARKET, BY FORM FACTOR, 2024-2030 (USD MILLION)

- TABLE 271 LATIN AMERICA: MODULAR DATA CENTER MARKET FOR ENCLOSURES, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 272 LATIN AMERICA: MODULAR DATA CENTER MARKET FOR ENCLOSURES, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 273 LATIN AMERICA: MODULAR DATA CENTER MARKET FOR ISO CONTAINERS, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 274 LATIN AMERICA: MODULAR DATA CENTER MARKET FOR ISO CONTAINERS, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 275 LATIN AMERICA: MODULAR DATA CENTER MARKET FOR SKID-MOUNTED SYSTEMS, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 276 LATIN AMERICA: MODULAR DATA CENTER MARKET FOR SKID-MOUNTED SYSTEMS, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 277 LATIN AMERICA: MODULAR DATA CENTER MARKET, BY DEPLOYMENT TYPE, 2019-2023 (USD MILLION)

- TABLE 278 LATIN AMERICA: MODULAR DATA CENTER MARKET, BY DEPLOYMENT TYPE, 2024-2030 (USD MILLION)

- TABLE 279 LATIN AMERICA: MODULAR DATA CENTER MARKET, BY BUILD TYPE, 2019-2023 (USD MILLION)

- TABLE 280 LATIN AMERICA: MODULAR DATA CENTER MARKET, BY BUILD TYPE, 2024-2030 (USD MILLION)

- TABLE 281 LATIN AMERICA: MODULAR DATA CENTER MARKET, BY DATA CENTER SIZE, 2019-2023 (USD MILLION)

- TABLE 282 LATIN AMERICA: MODULAR DATA CENTER MARKET, BY DATA CENTER SIZE, 2024-2030 (USD MILLION)

- TABLE 283 LATIN AMERICA: MODULAR DATA CENTER MARKET, BY END USER, 2019-2023 (USD MILLION)

- TABLE 284 LATIN AMERICA: MODULAR DATA CENTER MARKET, BY END USER, 2024-2030 (USD MILLION)

- TABLE 285 LATIN AMERICA: MODULAR DATA CENTER MARKET FOR ENTERPRISES, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 286 LATIN AMERICA: MODULAR DATA CENTER MARKET FOR ENTERPRISES, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 287 LATIN AMERICA: MODULAR DATA CENTER MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 288 LATIN AMERICA: MODULAR DATA CENTER MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 289 BRAZIL: MODULAR DATA CENTER MARKET, BY COMPONENT, 2019-2023 (USD MILLION)

- TABLE 290 BRAZIL: MODULAR DATA CENTER MARKET, BY COMPONENT, 2024-2030 (USD MILLION)

- TABLE 291 MEXICO: MODULAR DATA CENTER MARKET, BY COMPONENT, 2019-2023 (USD MILLION)

- TABLE 292 MEXICO: MODULAR DATA CENTER MARKET, BY COMPONENT, 2024-2030 (USD MILLION)

- TABLE 293 REST OF LATIN AMERICA: MODULAR DATA CENTER MARKET, BY COMPONENT, 2019-2023 (USD MILLION)

- TABLE 294 REST OF LATIN AMERICA: MODULAR DATA CENTER MARKET, BY COMPONENT, 2024-2030 (USD MILLION)

- TABLE 295 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN MODULAR DATA CENTER MARKET

- TABLE 296 MARKET SHARE OF KEY VENDORS IN MODULAR DATA CENTER MARKET, 2023

- TABLE 297 MODULAR DATA CENTER MARKET: REGION FOOTPRINT

- TABLE 298 MODULAR DATA CENTER MARKET: COMPONENT FOOTPRINT

- TABLE 299 MODULAR DATA CENTER MARKET: END-USER FOOTPRINT

- TABLE 300 MODULAR DATA CENTER MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 301 MODULAR DATA CENTER MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 302 MODULAR DATA CENTER MARKET: PRODUCT LAUNCHES, JANUARY 2021-OCTOBER 2024

- TABLE 303 MODULAR DATA CENTER MARKET: DEALS, JANUARY 2021-OCTOBER 2024

- TABLE 304 DELL: COMPANY OVERVIEW

- TABLE 305 DELL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 306 DELL: PRODUCT LAUNCHES, JANUARY 2021-OCTOBER 2024

- TABLE 307 DELL: DEALS, JANUARY 2021-OCTOBER 2024

- TABLE 308 VERTIV: COMPANY OVERVIEW

- TABLE 309 VERTIV: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 310 VERTIV: PRODUCT LAUNCHES, JANUARY 2021-OCTOBER 2024

- TABLE 311 VERTIV: DEALS, JANUARY 2021-OCTOBER 2024

- TABLE 312 SCHNEIDER ELECTRIC: COMPANY OVERVIEW

- TABLE 313 SCHNEIDER ELECTRIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 314 SCHNEIDER ELECTRIC: PRODUCT LAUNCHES, JANUARY 2021-OCTOBER 2024

- TABLE 315 SCHNEIDER ELECTRIC: DEALS, JANUARY 2021-OCTOBER 2024

- TABLE 316 HUAWEI: COMPANY OVERVIEW

- TABLE 317 HUAWEI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 318 HUAWEI: PRODUCT LAUNCHES, JANUARY 2021-OCTOBER 2024

- TABLE 319 HUAWEI: DEALS, JANUARY 2021-OCTOBER 2024

- TABLE 320 EATON: COMPANY OVERVIEW

- TABLE 321 EATON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 322 EATON: PRODUCT LAUNCHES, JANUARY 2021-OCTOBER 2024

- TABLE 323 EATON: DEALS, JANUARY 2021-OCTOBER 2024

- TABLE 324 EATON: EXPANSIONS, JANUARY 2021-OCTOBER 2024

- TABLE 325 RITTAL: COMPANY OVERVIEW

- TABLE 326 RITTAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 327 RITTAL: PRODUCT LAUNCHES, JANUARY 2021-OCTOBER 2024

- TABLE 328 RITTAL: DEALS, JANUARY 2021-OCTOBER 2024

- TABLE 329 JOHNSON CONTROLS: COMPANY OVERVIEW

- TABLE 330 JOHNSON CONTROLS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 331 JOHNSON CONTROLS: DEALS, JANUARY 2021-OCTOBER 2024

- TABLE 332 ABB: COMPANY OVERVIEW

- TABLE 333 ABB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 334 ABB: DEALS, JANUARY 2021-OCTOBER 2024

- TABLE 335 DELTA ELECTRONICS: COMPANY OVERVIEW

- TABLE 336 DELTA ELECTRONICS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 337 DELTA ELECTRONICS: DEALS, JANUARY 2021-OCTOBER 2024

- TABLE 338 STULZ: COMPANY OVERVIEW

- TABLE 339 STULZ: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 340 STULZ: PRODUCT LAUNCHES, JANUARY 2021-OCTOBER 2024

- TABLE 341 STULZ: DEALS, JANUARY 2021-OCTOBER 2024

- TABLE 342 HUBBELL (PCX): COMPANY OVERVIEW

- TABLE 343 HUBBELL (PCX): PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 344 HUBBELL (PCX): DEALS, JANUARY 2021-OCTOBER 2024

- TABLE 345 MICRO MOBILE DATA CENTER MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 346 MICRO MOBILE DATA CENTER MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 347 MICRO MOBILE DATA CENTER MARKET, BY VERTICAL, 2019-2023 (USD MILLION)

- TABLE 348 MICRO MOBILE DATA CENTER MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 349 MICRO MOBILE DATA CENTER MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 350 MICRO MOBILE DATA CENTER MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 351 MODULAR UPS MARKET, BY COMPONENT, 2014-2018 (USD MILLION)

- TABLE 352 MODULAR UPS MARKET, BY COMPONENT, 2019-2025 (USD MILLION)

- TABLE 353 MODULAR UPS MARKET, BY VERTICAL, 2014-2018 (USD MILLION)

- TABLE 354 MODULAR UPS MARKET, BY VERTICAL, 2019-2025 (USD MILLION)

- TABLE 355 MODULAR UPS MARKET, BY REGION, 2014-2018 (USD MILLION)

- TABLE 356 MODULAR UPS MARKET, BY REGION, 2019-2025 (USD MILLION)

List of Figures

- FIGURE 1 MODULAR DATA CENTER MARKET: RESEARCH DESIGN

- FIGURE 2 BREAKUP OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 3 MODULAR DATA CENTER MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY - BOTTOM-UP APPROACH (SUPPLY SIDE): COLLECTIVE REVENUE OF MODULAR DATA CENTER VENDORS

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY - (SUPPLY SIDE): ILLUSTRATION OF VENDOR REVENUE ESTIMATION

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 2 (DEMAND SIDE): REVENUE GENERATED FROM END USERS

- FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 2 (DEMAND SIDE): MODULAR DATA CENTER MARKET

- FIGURE 9 MODULAR DATA CENTER MARKET SNAPSHOT, 2019-2030 (USD MILLION)

- FIGURE 10 TOP MARKET SEGMENTS IN TERMS OF GROWTH RATE

- FIGURE 11 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SHARE IN 2024

- FIGURE 12 GROWING NEED FOR FLEXIBLE, SCALABLE SOLUTIONS TO ACCELERATE DEMAND

- FIGURE 13 SOLUTIONS TO ACCOUNT FOR LARGER MARKET SHARE IN 2024

- FIGURE 14 PREFABRICATED MODULES SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE IN 2024

- FIGURE 15 PREFABRICATED IT MODULES SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2024

- FIGURE 16 SUPPORT & MAINTENANCE SERVICES TO ACCOUNT FOR LARGEST MARKET SHARE IN 2024

- FIGURE 17 ENCLOSURES SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2024

- FIGURE 18 MEDIUM-DENSITY ENCLOSURES SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2024

- FIGURE 19 40-FEET CONTAINERS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2024

- FIGURE 20 FIXED SKID-MOUNTED SYSTEMS SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE IN 2024

- FIGURE 21 INDOOR SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE IN 2024

- FIGURE 22 FULLY PREFABRICATED DATA CENTERS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2024

- FIGURE 23 MID-SIZED DATA CENTERS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2024

- FIGURE 24 CLOUD SERVICE PROVIDERS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2024

- FIGURE 25 ASIA PACIFIC TO BE BEST MARKET FOR INVESTMENTS IN NEXT FIVE YEARS

- FIGURE 26 MODULAR DATA CENTER MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 27 MODULAR DATA CENTER MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 28 MODULAR DATA CENTER MARKET: ECOSYSTEM ANALYSIS

- FIGURE 29 IMPORT DATA, BY COUNTRY, 2019-2023 (USD MILLION)

- FIGURE 30 EXPORT DATA, BY COUNTRY, 2018-2022 (USD MILLION)

- FIGURE 31 MODULAR DATA CENTER MARKET: PATENT ANALYSIS, 2013-2023

- FIGURE 32 MODULAR DATA CENTER MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 33 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR END USERS

- FIGURE 34 KEY BUYING CRITERIA FOR END USERS

- FIGURE 35 INVESTMENT AND FUNDING SCENARIO OF MAJOR MODULAR DATA CENTER COMPANIES

- FIGURE 36 IMPACT OF GEN AI ON MODULAR DATA CENTER MARKET, 2024

- FIGURE 37 SERVICES SEGMENT TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 38 ALL-IN-ONE MODULES SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 39 PREFABRICATED COOLING MODULES SEGMENT TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 40 SUPPORT & MAINTENANCE SEGMENT TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 41 SKID-MOUNTED SYSTEMS SEGMENT TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 42 20-FEET CONTAINERS SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 43 PORTABLE SKID-MOUNTED SYSTEMS SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 44 HIGH-DENSITY ENCLOSURES SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 45 FULLY PREFABRICATED DATA CENTERS SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 46 SMALL DATA CENTERS SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 47 OUTDOOR SEGMENT TO DOMINATE MARKET IN 2030

- FIGURE 48 TELECOM SERVICE PROVIDERS SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 49 NORTH AMERICA TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 50 NORTH AMERICA: MODULAR DATA CENTER MARKET SNAPSHOT

- FIGURE 51 ASIA PACIFIC: MODULAR DATA CENTER MARKET SNAPSHOT

- FIGURE 52 MODULAR DATA CENTER MARKET SHARE ANALYSIS, 2023

- FIGURE 53 MODULAR DATA CENTER MARKET: VENDOR PRODUCT/BRAND COMPARISON

- FIGURE 54 MODULAR DATA CENTER MARKET: REVENUE ANALYSIS OF KEY PLAYERS, 2019-2023 (USD MILLION)

- FIGURE 55 COMPANY EVALUATION MATRIX FOR KEY PLAYERS: CRITERIA WEIGHTAGE

- FIGURE 56 MODULAR DATA CENTER MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 57 MODULAR DATA CENTER MARKET: COMPANY FOOTPRINT

- FIGURE 58 EVALUATION MATRIX FOR STARTUPS/SMES: CRITERIA WEIGHTAGE

- FIGURE 59 MODULAR DATA CENTER MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 60 COMPANY VALUATION OF KEY VENDORS

- FIGURE 61 EV/EBITDA ANALYSIS OF KEY VENDORS

- FIGURE 62 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 63 DELL: COMPANY SNAPSHOT

- FIGURE 64 VERTIV: COMPANY SNAPSHOT

- FIGURE 65 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

- FIGURE 66 HUAWEI: COMPANY SNAPSHOT

- FIGURE 67 EATON: COMPANY SNAPSHOT

- FIGURE 68 JOHNSON CONTROLS: COMPANY SNAPSHOT

- FIGURE 69 ABB: COMPANY SNAPSHOT

- FIGURE 70 DELTA ELECTRONICS: COMPANY SNAPSHOT

- FIGURE 71 HUBBELL (PCX): COMPANY SNAPSHOT

The modular data center market is expected to grow from USD 29.93 billion in 2024 to USD 79.49 billion by 2030 at a Compound Annual Growth Rate (CAGR) of 17.7% during the forecast period. The modular data center market is expected to see significant growth as organizations increasingly seek scalable and flexible infrastructure solutions. Modular data centers offer rapid deployment, reduced construction time, and efficient energy usage, which are essential as IT demands continue to evolve. Key advancements like modular power and cooling systems, prefabricated IT modules, and enhanced automation are transforming how data centers are designed and deployed. These pre-configured, pre-tested modules minimize on-site work, allowing for faster installation and upgrades. This streamlined approach ensures that businesses can quickly adapt to changing infrastructure needs while optimizing performance and cost-efficiency.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2019-2030 |

| Base Year | 2023 |

| Forecast Period | 2024-2030 |

| Units Considered | USD (Billion) |

| Segments | Component, Form Factor, Build Type, Data Center Size, Deployment Type, End User and Region |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

"As per component, services will grow at the highest CAGR during the forecast period."

Within the modular data center market, services play a vital role in ensuring the seamless functioning and optimization of these facilities. The services are divided into three main categories: design & consulting, integration & deployment, and support & maintenance. Design & consulting services focus on customizing data center solutions according to specific business needs, ensuring optimal space, power, and cooling configurations. Integration & deployment services involve the assembly and installation of modular units, ensuring a swift and smooth setup with minimal disruption to existing operations. Support & maintenance services provide ongoing care, including regular monitoring, troubleshooting, and preventive maintenance to ensure high performance and minimize downtime. Together, these services help organizations rapidly deploy, scale, and maintain their modular data centers while reducing operational complexities and costs. Whether it's a new installation or upgrading an existing infrastructure, these services enable companies to keep up with evolving technological requirements and ensure the reliability of their data center operations.

"As per solutions segment, prefabricated modules will hold the largest share during the forecast period."

Prefabricated modules in the modular data center market offer a versatile approach by providing pre-engineered and pre-assembled components that can be quickly deployed on-site. These modules are further categorized into prefabricated IT modules, prefabricated power modules, and prefabricated cooling modules, each addressing specific requirements for data center infrastructure. The modular nature enables companies to expand or upgrade their data centers seamlessly, reducing construction time and costs associated with traditional builds. Prefabricated modules are especially beneficial for industries with fluctuating demands, such as finance, healthcare, and cloud service providers, where rapid scalability and reliability are crucial. They allow for a standardized design while offering flexibility in configuration, making them suitable for diverse environments, from large data centers to remote locations. Moreover, these modules contribute to energy efficiency by optimizing power and cooling distribution, helping companies achieve their sustainability targets. As data center demands evolve, the adoption of prefabricated modules is growing, providing a practical and cost-effective solution for modernizing infrastructure and meeting the dynamic needs of the digital age.

"As per data center size, the small data center will grow with the highest CAGR during the forecast period."

Small data centers are a vital sub-segment of the modular data center market, designed to meet the growing demand for localized computing power while optimizing space and energy usage. Typically ranging from 100 to 1,000 square feet, these compact facilities can be deployed quickly and scaled as needed, allowing organizations to respond swiftly to evolving requirements. A key advantage is their proximity to end-users, reducing latency and enhancing performance for applications like edge computing. Equipped with advanced cooling solutions, such as in-row cooling and hot aisle/cold aisle containment, small data centers improve energy efficiency and lower operational costs. They often feature energy-efficient equipment, including modular UPS systems and high-density servers, maximizing performance while minimizing the carbon footprint. As data processing demands increase from IoT devices and mobile applications, small data centers provide a flexible, cost-effective solution that supports diverse industry needs, from telecommunications to healthcare. Their ability to adapt and optimize resources ensures their relevance in today's rapidly evolving digital landscape.

The breakup of the profiles of the primary participants is below:

- By Company: Tier I: 30%, Tier II: 45%, and Tier III: 25%

- By Designation: C-Level Executives: 50%, Director Level: 35%, and Others: 15%

- By Region: North America: 50%, Europe: 30%, Asia Pacific: 15%, Rest of World: 5%

Note: Others include sales managers, marketing managers, and product managers

Note: The rest of the World consists of the Middle East & Africa, and Latin America

Note: Tier 1 companies have revenues of more than USD 100 million; tier 2 companies' revenue ranges from USD 10 million to USD 100 million; and tier 3 companies' revenue is less than 10 million

Source: Secondary Literature, Expert Interviews, and MarketsandMarkets Analysis

Major companies offering modular data center solutions and services are Dell (US), Schneider Electric (France), Vertiv (US), Johnson Controls (US), Eaton (US), Delta Electronics (Taiwan), Huawei (China), ABB (Switzerland), Stulz (Germany), Rittal (Germany), Hubbell (PCX) (US).

Research coverage:

In this study, an in-depth analysis of the modular data center market is done based on market trends, potential growth during 2019, and a forecast up to 2024-2030. Further, it gives detailed market trends, a competitive landscape, market size, forecasts, and key players' analysis of the the modular data center market. This market study analyzes the growth rate and penetration of modular data center across all the major regions.

Reasons to buy this report:

The report will aid the market leaders/new entrants in the following: Details regarding the closest approximations of the revenue numbers for the modular data center market and its subsegments. This study will aid the stakeholders in understanding the competitive landscape; it gives more insights to position their businesses better and plan suitable go-to-market strategies. It also helps the stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of critical drivers (rising adoption of cloud computing and services, scalability, disaster recovery benefits, and the growth in edge computing deployments), restraints (high initial capital expenditure), opportunities (rapid scalability and disaster recovery benefits), and challenges (scalability in large data centers, limited customization for specialized needs, and increased maintenance complexity) influencing the growth of the modular data center market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the modular data center market.

- Market Development: In-depth understanding of upcoming technologies, research & development efforts, and new product & service releases in the modular data center market.

- Market Diversification: Comprehensive details on the latest products & services, unexplored regions, recent advancements, and investments in the modular data center market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and Dell (US), Schneider Electric (France), Vertiv (US), Johnson Controls (US), Eaton (US), Delta Electronics (Taiwan), Huawei (China), ABB (Switzerland), Stulz (Germany), Rittal (Germany), Hubbell (PCX) (US), among others in the modular data center market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION & REGIONS COVERED

- 1.3.2 INCLUSIONS AND EXCLUSIONS OF STUDY

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH APPROACH

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakup of primary profiles

- 2.1.2.2 Key industry insights

- 2.2 DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- 2.4 MARKET FORECAST

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR PLAYERS IN MODULAR DATA CENTER MARKET

- 4.2 MODULAR DATA CENTER MARKET SHARE, BY COMPONENT, 2024 VS. 2030

- 4.3 MODULAR DATA CENTER SOLUTIONS MARKET SHARE, BY TYPE, 2024 VS. 2030

- 4.4 MODULAR DATA CENTER MARKET SHARE FOR PREFABRICATED MODULES, BY TYPE, 2024 VS. 2030

- 4.5 MODULAR DATA CENTER SERVICES MARKET SHARE, BY TYPE, 2024 VS. 2030

- 4.6 MODULAR DATA CENTER MARKET SHARE, BY FORM FACTOR, 2024 VS. 2030

- 4.7 MODULAR DATA CENTER MARKET SHARE FOR ENCLOSURES, BY TYPE, 2024 VS. 2030

- 4.8 MODULAR DATA CENTER MARKET SHARE FOR ISO CONTAINERS, BY TYPE, 2024 VS. 2030

- 4.9 MODULAR DATA CENTER MARKET SHARE FOR SKID-MOUNTED SYSTEMS, BY TYPE, 2024 VS. 2030

- 4.10 MODULAR DATA CENTER MARKET SHARE, BY DEPLOYMENT TYPE, 2024 VS. 2030

- 4.11 MODULAR DATA CENTER MARKET SHARE, BY BUILD TYPE, 2024 VS. 2030

- 4.12 MODULAR DATA CENTER MARKET SHARE, BY DATA CENTER SIZE, 2024 VS. 2030

- 4.13 MODULAR DATA CENTER MARKET SHARE, BY END USER, 2024 VS. 2030

- 4.14 MODULAR DATA CENTER MARKET, BY REGION, 2024 VS. 2030

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising adoption of cloud computing and services

- 5.2.1.2 Mobility, scalability, and disaster recovery benefits

- 5.2.1.3 Rapid deployment

- 5.2.2 RESTRAINTS

- 5.2.2.1 High initial capital expenditure

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising demand for IoT, AI, and 5G-driven data infrastructure

- 5.2.3.2 Growth in edge computing deployment

- 5.2.4 CHALLENGES

- 5.2.4.1 Scalability in large data center projects

- 5.2.4.2 Limited customization for specialized needs & increased maintenance complexity

- 5.2.1 DRIVERS

- 5.3 CASE STUDY ANALYSIS

- 5.3.1 T-SYSTEMS AND VERTIV: RAPID DEPLOYMENT OF MODULAR DATA CENTER IN BARCELONA

- 5.3.2 LUZHOU GOVERNMENT PARTNERED WITH HUAWEI TO BUILD EFFICIENT MODULAR DATA CENTER FOR SMART CITY DEVELOPMENT

- 5.3.3 BASILICA DE LA SAGRADA FAMILIA PARTNERED WITH SCHNEIDER ELECTRIC FOR STATE-OF-THE-ART MOBILE DATA CENTER

- 5.3.4 MEEZA COLLABORATED WITH VERTIV TO RAPIDLY SCALE MODULAR DATA CENTERS

- 5.3.5 ANIMAL LOGIC PARTNERED WITH SCHNEIDER ELECTRIC TO DEPLOY SCALABLE, HIGH-PERFORMANCE PREFABRICATED MODULAR DATA CENTER

- 5.4 SUPPLY CHAIN ANALYSIS

- 5.5 ECOSYSTEM ANALYSIS

- 5.6 TECHNOLOGY ANALYSIS

- 5.6.1 KEY TECHNOLOGIES

- 5.6.1.1 Modular design

- 5.6.1.2 Power distribution units (PDUs)

- 5.6.1.3 Data center infrastructure management (DCIM) software

- 5.6.1.4 Cooling systems

- 5.6.2 COMPLEMENTARY TECHNOLOGIES

- 5.6.2.1 Virtualization

- 5.6.2.2 Software-defined networking

- 5.6.2.3 Storage area networks

- 5.6.2.4 Advanced battery storage

- 5.6.3 ADJACENT TECHNOLOGIES

- 5.6.3.1 Edge computing

- 5.6.3.2 Artificial intelligence & machine learning

- 5.6.3.3 Digital twins

- 5.6.3.4 Augmented reality

- 5.6.1 KEY TECHNOLOGIES

- 5.7 PRICING ANALYSIS

- 5.7.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY SOLUTION

- 5.7.2 AVERAGE SELLING PRICE TREND, BY REGION

- 5.8 TRADE ANALYSIS

- 5.9 PATENT ANALYSIS

- 5.10 PORTER'S FIVE FORCES ANALYSIS

- 5.10.1 THREAT OF NEW ENTRANTS

- 5.10.2 THREAT OF SUBSTITUTES

- 5.10.3 BARGAINING POWER OF BUYERS

- 5.10.4 BARGAINING POWER OF SUPPLIERS

- 5.10.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.11 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.11.2 BUYING CRITERIA

- 5.12 REGULATORY LANDSCAPE

- 5.12.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.12.2 REGULATIONS, BY REGION

- 5.13 BUSINESS MODEL ANALYSIS

- 5.13.1 PRODUCT OFFERING

- 5.13.2 REVENUE STREAMS

- 5.13.3 REVENUE MODEL TRENDS

- 5.13.4 CHANNELS

- 5.13.5 CUSTOMER SEGMENTS

- 5.14 KEY CONFERENCES AND EVENTS, 2024-2025

- 5.15 INVESTMENT AND FUNDING SCENARIO

- 5.16 IMPACT OF AI/GEN AI ON MODULAR DATA CENTER MARKET

- 5.16.1 INDUSTRY TRENDS: USE CASES

- 5.16.1.1 Leading retailer enhanced distribution efficiency with AI-driven Vertiv's SmartRow solution

- 5.16.2 TOP VENDORS ADOPTING AI/GEN AI

- 5.16.2.1 Vertiv

- 5.16.2.2 Alibaba Cloud

- 5.16.1 INDUSTRY TRENDS: USE CASES

- 5.17 APPLICATIONS OF MODULAR DATA CENTER

- 5.17.1 CAPACITY EXPANSION

- 5.17.2 DATA CENTER EXPANSION

- 5.17.3 DISASTER RECOVERY

- 5.17.4 EMERGENCY & TEMPORARY DEPLOYMENT

- 5.17.5 EDGE COMPUTING

6 MODULAR DATA CENTER MARKET, BY COMPONENT

- 6.1 INTRODUCTION

- 6.1.1 COMPONENT: MODULAR DATA CENTER MARKET DRIVERS

- 6.2 SOLUTIONS

- 6.2.1 ALL-IN-ONE SOLUTIONS

- 6.2.1.1 Rising demand for edge computing to fuel adoption

- 6.2.2 PREFABRICATED MODULES

- 6.2.2.1 Rapid scalability to drive adoption of prefabricated modules

- 6.2.2.2 Prefabricated IT modules

- 6.2.2.2.1 Optimized IT infrastructure for rapid deployment in scalable data centers to propel market

- 6.2.2.2.2 Servers

- 6.2.2.2.3 Networks

- 6.2.2.2.4 Storage

- 6.2.2.2.5 Others

- 6.2.2.3 Prefabricated power modules

- 6.2.2.3.1 Improved power distribution for critical loads to drive market

- 6.2.2.3.2 Power distribution units

- 6.2.2.3.3 Switchgear

- 6.2.2.3.4 Uninterruptible power supplies

- 6.2.2.3.5 Generators

- 6.2.2.3.6 Others

- 6.2.2.4 Prefabricated cooling modules

- 6.2.2.4.1 Enhanced energy efficiency to drive adoption in modular data centers

- 6.2.2.4.2 Chiller modules

- 6.2.2.4.3 Air handling units

- 6.2.2.4.4 Direct expansion cooling

- 6.2.2.4.5 Others

- 6.2.1 ALL-IN-ONE SOLUTIONS

- 6.3 SERVICES

- 6.3.1 DESIGN & CONSULTING

- 6.3.1.1 Growing demand for end-to-end solutions to drive market

- 6.3.2 INTEGRATION & DEPLOYMENT

- 6.3.2.1 Streamline setup and operation of prefabricated data centers

- 6.3.3 SUPPORT & MAINTENANCE

- 6.3.3.1 Play critical role in ensuring optimal performance, reliability, and longevity of infrastructure

- 6.3.1 DESIGN & CONSULTING

7 MODULAR DATA CENTER MARKET, BY FORM FACTOR

- 7.1 INTRODUCTION

- 7.1.1 FORM FACTOR: MODULAR DATA CENTER MARKET DRIVERS

- 7.2 ISO CONTAINERS

- 7.2.1 20-FEET CONTAINERS

- 7.2.1.1 Provide flexible and small-scale modular solutions for rapid IT capacity expansion

- 7.2.2 40-FEET CONTAINERS

- 7.2.2.1 Offer high-density computing and storage capacity for large-scale data centers

- 7.2.1 20-FEET CONTAINERS

- 7.3 SKID-MOUNTED SYSTEMS

- 7.3.1 FIXED SKID-MOUNTED SYSTEMS

- 7.3.1.1 Cost-effective modular deployment for long-term data center scalability to drive market

- 7.3.2 PORTABLE SKID-MOUNTED SYSTEMS

- 7.3.2.1 Offer rapidly deployable solutions for temporary or remote data center applications

- 7.3.1 FIXED SKID-MOUNTED SYSTEMS

- 7.4 ENCLOSURES

- 7.4.1 LOW-DENSITY ENCLOSURES

- 7.4.1.1 Suitable for environments where equipment density is not priority

- 7.4.2 MEDIUM-DENSITY ENCLOSURES

- 7.4.2.1 Provide balanced performance for scalable data center growth in mid-range applications

- 7.4.3 HIGH-DENSITY ENCLOSURES

- 7.4.3.1 Offer advanced infrastructure for handling high-density computing and storage demands

- 7.4.1 LOW-DENSITY ENCLOSURES

8 MODULAR DATA CENTER MARKET, BY BUILD TYPE

- 8.1 INTRODUCTION

- 8.1.1 BUILD TYPE: MODULAR DATA CENTER MARKET DRIVERS

- 8.2 SEMI PREFABRICATED DATA CENTERS

- 8.2.1 FLEXIBILITY AND ENERGY EFFICIENCY TO DRIVE DEMAND FOR SEMI-PREFABRICATED DATA CENTERS IN VARIOUS INDUSTRIES

- 8.3 FULLY PREFABRICATED DATA CENTERS

- 8.3.1 RAPID DEPLOYMENT AND SCALABILITY TO FUEL MARKET GROWTH

- 8.4 ALL-IN-ONE DATA CENTERS

- 8.4.1 DESIGNED TO MEET DIVERSE NEEDS OF BUSINESSES

9 MODULAR DATA CENTER MARKET, BY DATA CENTER SIZE

- 9.1 INTRODUCTION

- 9.1.1 DATA CENTER SIZE: MODULAR DATA CENTER MARKET DRIVERS

- 9.2 SMALL DATA CENTERS

- 9.2.1 LOCALIZED COMPUTING NEEDS TO DRIVE GROWTH

- 9.3 MID-SIZED DATA CENTERS

- 9.3.1 DESIGNED TO ACCOMMODATE INCREASING DEMAND FOR PROCESSING POWER AND STORAGE

- 9.4 LARGE DATA CENTERS

- 9.4.1 HANDLE SIGNIFICANT WORKLOADS AND HIGH-DENSITY COMPUTING REQUIREMENTS

10 MODULAR DATA CENTER MARKET, BY DEPLOYMENT TYPE

- 10.1 INTRODUCTION

- 10.1.1 DATA CENTER SIZE: MODULAR DATA CENTER MARKET DRIVERS

- 10.2 INDOOR

- 10.2.1 IDEAL CHOICE FOR ORGANIZATIONS SEEKING TO MAXIMIZE EXISTING SPACE

- 10.3 OUTDOOR

- 10.3.1 RAPID SCALABILITY AND LOCATION FLEXIBILITY TO DRIVE GROWTH

11 MODULAR DATA CENTER MARKET, BY END USER

- 11.1 INTRODUCTION

- 11.1.1 END USER: MODULAR DATA CENTER MARKET DRIVERS

- 11.2 TELCOM SERVICE PROVIDERS

- 11.2.1 RAPID SCALABILITY AND FLEXIBILITY TO PROPEL ADOPTION OF MODULAR DATA CENTERS

- 11.3 CLOUD SERVICE PROVIDERS

- 11.3.1 SCALABILITY AND FLEXIBILITY TO DRIVE ADOPTION OF MODULAR DATA CENTERS

- 11.4 ENTERPRISES

- 11.4.1 GROWING DATA DEMAND TO DRIVE MARKET

- 11.4.2 BFSI

- 11.4.2.1 Growing digital economy to drive adoption

- 11.4.2.2 BFSI: Use cases

- 11.4.2.2.1 Disaster recovery & business continuity

- 11.4.2.2.2 Scalable data processing

- 11.4.2.2.3 Compliance & security

- 11.4.2.2.4 Others

- 11.4.3 IT & TELECOM

- 11.4.3.1 Accelerating digital transformation to drive market

- 11.4.3.2 IT & telecom: Use cases

- 11.4.3.2.1 Edge computing

- 11.4.3.2.2 Disaster recovery

- 11.4.3.2.3 Data center expansion

- 11.4.3.2.4 Others

- 11.4.4 GOVERNMENT & DEFENSE

- 11.4.4.1 Rising national security demand to drive growth

- 11.4.4.2 Government & defense: Use cases

- 11.4.4.2.1 Tactical data centers

- 11.4.4.2.2 Disaster recovery & continuity of operations

- 11.4.4.2.3 Secure & classified information processing & storage

- 11.4.4.2.4 Others

- 11.4.5 HEALTHCARE & LIFE SCIENCES

- 11.4.5.1 Growing demand for digital health solutions to fuel adoption

- 11.4.5.2 Healthcare & life sciences: Use cases

- 11.4.5.2.1 Health information management

- 11.4.5.2.2 Telemedicine & remote health services

- 11.4.5.2.3 Others

- 11.4.6 RETAIL & E-COMMERCE

- 11.4.6.1 Surge in online shopping to drive retail adoption of modular data centers for efficiency

- 11.4.6.2 Retail & E-commerce: Use cases

- 11.4.6.2.1 E-commerce & online retail platforms

- 11.4.6.2.2 Point-of-sale systems

- 11.4.6.2.3 Inventory management

- 11.4.6.2.4 Others

- 11.4.7 MEDIA & ENTERTAINMENT

- 11.4.7.1 Enhanced content delivery and user experience to support market growth

- 11.4.7.2 Media & entertainment: Use cases

- 11.4.7.2.1 Content delivery networks

- 11.4.7.2.2 Post-production & video editing

- 11.4.7.2.3 Broadcasting & live streaming

- 11.4.7.2.4 Others

- 11.4.8 MANUFACTURING

- 11.4.8.1 Operational efficiency and digital transformation to drive adoption

- 11.4.8.2 Manufacturing: Use cases

- 11.4.8.2.1 Manufacturing process control

- 11.4.8.2.2 Supply chain management

- 11.4.8.2.3 Quality control & testing

- 11.4.8.2.4 Others

- 11.4.9 OTHER VERTICALS

12 MODULAR DATA CENTER MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 NORTH AMERICA

- 12.2.1 NORTH AMERICA: MODULAR DATA CENTER MARKET DRIVERS

- 12.2.2 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 12.2.3 US

- 12.2.3.1 Technological advancements and significant investments from major players to propel market growth

- 12.2.4 CANADA

- 12.2.4.1 Tax incentives and significant investments in infrastructure to fuel market growth

- 12.3 EUROPE

- 12.3.1 EUROPE: MODULAR DATA CENTER MARKET DRIVERS

- 12.3.2 EUROPE: MACROECONOMIC OUTLOOK

- 12.3.3 UK

- 12.3.3.1 Investments by cloud vendors and hyperscalers to boost market growth

- 12.3.4 GERMANY

- 12.3.4.1 Energy efficiency and major investments to propel market growth

- 12.3.5 FRANCE

- 12.3.5.1 Government incentives and sustainability initiatives to support market growth

- 12.3.6 ITALY

- 12.3.6.1 Surge in investments and partnerships to drive growth

- 12.3.7 REST OF EUROPE

- 12.4 ASIA PACIFIC

- 12.4.1 ASIA PACIFIC: MODULAR DATA CENTER MARKET DRIVERS

- 12.4.2 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 12.4.3 CHINA

- 12.4.3.1 Surging AI demand and government investments to fuel market growth

- 12.4.4 JAPAN

- 12.4.4.1 Rising AI demand to drive market

- 12.4.5 AUSTRALIA & NEW ZEALAND

- 12.4.5.1 Growing data demand and innovation incentives to accelerate modular data center expansion and sustainability

- 12.4.6 REST OF ASIA PACIFIC

- 12.5 MIDDLE EAST & AFRICA

- 12.5.1 MIDDLE EAST & AFRICA: MODULAR DATA CENTER MARKET DRIVERS

- 12.5.2 MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

- 12.5.3 GULF COOPERATION COUNCIL (GCC) COUNTRIES

- 12.5.3.1 Kingdom of Saudi Arabia (KSA)

- 12.5.3.1.1 Digital transformation and investment incentives to propel market

- 12.5.3.2 UAE

- 12.5.3.2.1 Substantial investments in advanced technologies to drive market

- 12.5.3.3 Rest of GCC countries

- 12.5.3.1 Kingdom of Saudi Arabia (KSA)

- 12.5.4 SOUTH AFRICA

- 12.5.4.1 Rising cloud demand and energy resilience to drive modular data center growth and innovation

- 12.5.5 REST OF MIDDLE EAST & AFRICA

- 12.6 LATIN AMERICA

- 12.6.1 LATIN AMERICA: MODULAR DATA CENTER MARKET DRIVERS

- 12.6.2 LATIN AMERICA: MACROECONOMIC OUTLOOK

- 12.6.3 BRAZIL

- 12.6.3.1 Growing industry demand and investments to fuel market growth

- 12.6.4 MEXICO

- 12.6.4.1 Rising cloud demand and investments accelerate modular data center growth and innovation

- 12.6.5 REST OF LATIN AMERICA

13 COMPETITIVE LANDSCAPE

- 13.1 INTRODUCTION

- 13.2 STRATEGIES ADOPTED BY KEY PLAYERS/RIGHT TO WIN

- 13.3 MARKET SHARE ANALYSIS

- 13.4 VENDOR PRODUCT/BRAND COMPARISON

- 13.4.1 DELL TECHNOLOGIES - EMC MDC

- 13.4.2 SCHNEIDER ELECTRIC - ECOSTRUXURE

- 13.4.3 VERTIV - MEGAMOD

- 13.4.4 HUAWEI - FUSIONMODULE2000

- 13.4.5 EATON - SMARTRACK

- 13.5 REVENUE ANALYSIS

- 13.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 13.6.1 STARS

- 13.6.2 EMERGING LEADERS

- 13.6.3 PERVASIVE PLAYERS

- 13.6.4 PARTICIPANTS

- 13.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 13.6.5.1 Company footprint

- 13.6.5.2 Region footprint

- 13.6.5.3 Component footprint

- 13.6.5.4 End-user footprint

- 13.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 13.7.1 PROGRESSIVE COMPANIES

- 13.7.2 RESPONSIVE COMPANIES

- 13.7.3 DYNAMIC COMPANIES

- 13.7.4 STARTING BLOCKS

- 13.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023

- 13.7.5.1 Detailed list of key startups/SMEs

- 13.7.5.2 Competitive benchmarking of startups/SMEs

- 13.8 COMPANY VALUATION AND FINANCIAL METRICS OF KEY VENDORS

- 13.8.1 COMPANY VALUATION

- 13.8.2 FINANCIAL METRICS

- 13.9 COMPETITIVE SCENARIO

- 13.9.1 PRODUCT LAUNCHES

- 13.9.2 DEALS

14 COMPANY PROFILES

- 14.1 INTRODUCTION

- 14.2 KEY PLAYERS

- 14.2.1 DELL

- 14.2.1.1 Business overview

- 14.2.1.2 Products/Solutions/Services offered

- 14.2.1.3 Recent developments

- 14.2.1.3.1 Product launches

- 14.2.1.3.2 Deals

- 14.2.1.4 MnM view

- 14.2.1.4.1 Key strengths

- 14.2.1.4.2 Strategic choices

- 14.2.1.4.3 Weaknesses and competitive threats

- 14.2.2 VERTIV

- 14.2.2.1 Business overview

- 14.2.2.2 Products/Solutions/Services offered

- 14.2.2.3 Recent developments

- 14.2.2.3.1 Product launches

- 14.2.2.3.2 Deals

- 14.2.2.4 MnM view

- 14.2.2.4.1 Key strengths

- 14.2.2.4.2 Strategic choices

- 14.2.2.4.3 Weaknesses and competitive threats

- 14.2.3 SCHNEIDER ELECTRIC

- 14.2.3.1 Business overview

- 14.2.3.2 Products/Solutions/Services offered

- 14.2.3.3 Recent developments

- 14.2.3.3.1 Product launches

- 14.2.3.3.2 Deals

- 14.2.3.4 MnM view

- 14.2.3.4.1 Key strengths

- 14.2.3.4.2 Strategic choices

- 14.2.3.4.3 Weaknesses and competitive threats

- 14.2.4 HUAWEI

- 14.2.4.1 Business overview

- 14.2.4.2 Products/Solutions/Services offered

- 14.2.4.3 Recent developments

- 14.2.4.3.1 Product launches

- 14.2.4.3.2 Deals

- 14.2.4.4 MnM view

- 14.2.4.4.1 Key strengths

- 14.2.4.4.2 Strategic choices

- 14.2.4.4.3 Weaknesses and competitive threats

- 14.2.5 EATON

- 14.2.5.1 Business overview

- 14.2.5.2 Products/Solutions/Services offered

- 14.2.5.3 Recent developments

- 14.2.5.3.1 Product launches

- 14.2.5.3.2 Deals

- 14.2.5.3.3 Expansions

- 14.2.5.4 MnM view

- 14.2.5.4.1 Key strengths

- 14.2.5.4.2 Strategic choices

- 14.2.5.4.3 Weaknesses and competitive threats

- 14.2.6 RITTAL

- 14.2.6.1 Business overview

- 14.2.6.2 Products/Solutions/Services offered

- 14.2.6.3 Recent developments

- 14.2.6.3.1 Product launches

- 14.2.6.3.2 Deals

- 14.2.7 JOHNSON CONTROLS

- 14.2.7.1 Business overview

- 14.2.7.2 Products/Solutions/Services offered

- 14.2.7.3 Recent developments

- 14.2.7.3.1 Deals

- 14.2.8 ABB

- 14.2.8.1 Business overview

- 14.2.8.2 Products/Solutions/Services offered

- 14.2.8.3 Recent developments

- 14.2.8.3.1 Deals

- 14.2.9 DELTA ELECTRONICS

- 14.2.9.1 Business overview

- 14.2.9.2 Products/Solutions/Services offered

- 14.2.9.3 Recent developments

- 14.2.9.3.1 Deals

- 14.2.10 STULZ

- 14.2.10.1 Business overview

- 14.2.10.2 Products/Solutions/Services offered

- 14.2.10.3 Recent developments

- 14.2.10.3.1 Product launches

- 14.2.10.3.2 Deals

- 14.2.11 HUBBELL (PCX)

- 14.2.11.1 Business overview

- 14.2.11.2 Products/Solutions/Services offered

- 14.2.11.3 Recent developments

- 14.2.11.3.1 Deals

- 14.2.1 DELL

- 14.3 OTHER PLAYERS

- 14.3.1 IE CORP.

- 14.3.2 CANNON TECHNOLOGIES

- 14.3.3 EDGE MCS

- 14.3.4 ASPERITAS

- 14.3.5 RETEX

- 14.3.6 BOX MODUL

- 14.3.7 BLADEROOM

- 14.3.8 WESCO INTERNATIONAL, INC.

- 14.3.9 FIBERHOME

- 14.3.10 SCALEMATRIX

- 14.3.11 EQUINIX

- 14.3.12 365 DATA CENTERS

- 14.3.13 CORESITE

- 14.3.14 STULZ

- 14.3.15 CUPERTINO ELECTRIC

- 14.3.16 K-STAR

- 14.3.17 IEM

- 14.3.18 MODULAR POWER SOLUTIONS

- 14.3.19 FAITH TECHNOLOGIES, INC.

- 14.3.20 FIBREBOND

- 14.3.21 VOLTA

- 14.3.22 M.C. DEAN

- 14.3.23 DATA SPECIALTIES INC.

- 14.3.24 TOTAL SITE SOLUTIONS

- 14.3.25 ENVIRONMENTAL AIR SYSTEMS

- 14.3.26 TAS

- 14.3.27 AWS

- 14.3.28 META

- 14.3.29 ORACLE

- 14.3.30 MICROSOFT

- 14.3.31 APPLE

- 14.3.32 INTEL

- 14.3.33 NVIDIA

- 14.3.34 IBM

- 14.3.35 SIEMENS

- 14.3.36 HPE

15 ADJACENT AND RELATED MARKETS

- 15.1 INTRODUCTION

- 15.1.1 RELATED MARKETS

- 15.1.2 MICRO MOBILE DATA CENTER MARKET

- 15.1.3 MODULAR UNINTERRUPTIBLE POWER SUPPLY (UPS) MARKET

16 APPENDIX

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS