|

|

市場調査レポート

商品コード

1650851

生物農薬の世界市場:タイプ別、作物タイプ別、剤形別、原料別、施用方式別、地域別 - 予測(~2029年)Biopesticides Market by Type (Bioinsecticides, Biofungicides, Bionematicides), Crop Type (Cereals & Grains, Oilseeds & Pulses), Formulation (Liquid and Dry), Source (Microbials, Biochemicals), Mode of Application, & Region - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| 生物農薬の世界市場:タイプ別、作物タイプ別、剤形別、原料別、施用方式別、地域別 - 予測(~2029年) |

|

出版日: 2025年02月01日

発行: MarketsandMarkets

ページ情報: 英文 367 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の生物農薬の市場規模は、2024年に推定77億2,000万米ドルであり、2029年までに156億6,000万米ドルに達すると予測され、予測期間にCAGRで15.2%の成長が見込まれます。

生物農薬産業におけるAIの採用は、製品開発を変革し、害虫駆除効果を高め、市場戦略を最適化しています。FMC Corporationなどの企業は、AIを活用して新しい生物農薬を迅速に発見し、商品化しています。2024年5月、FMC Corporationは、発見プロセスを拡大する戦略的な動きの一環として、低分子化合物発見の主要AIソリューション企業であるOptibriumとの提携を発表しました。OptibriumのAugmented Chemistry AI技術と組み合わせることで、有望な化合物の発見を加速し、メーカーのための持続可能な新しいソリューションの開発においてその特性を最適化します。AIが持続可能な製品開発において重要な役割を果たし続けることで、生物農薬市場は大きな成長と革新を遂げることになります。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2024年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 単位 | 金額(100万米ドル)、数量(キロトン) |

| セグメント | タイプ、作物タイプ、施用方式、原料、剤形、地域 |

| 対象地域 | 北米、欧州、南米、アジア太平洋、その他の地域 |

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

- 生物農薬市場の企業にとって魅力的な市場機会

- 北米の生物農薬市場:原料別、国別

- 生物農薬市場:主要国のシェア

- 生物農薬市場:タイプ別、地域別

- 生物農薬市場:剤形別、地域別

- 生物農薬市場:原料別、地域別

- 生物農薬市場:用途別、地域別

- 生物農薬市場:作物タイプ別、地域別

第5章 市場の概要

- イントロダクション

- マクロ経済の見通し

- 有機農業の普及

- 各国政府による有利な農業補助金、支援プログラム

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 生物農薬市場に対するAI/生成AIの影響

- イントロダクション

- 生物農薬における生成AIの使用

- ケーススタディ分析

第6章 産業の動向

- イントロダクション

- バリューチェーン分析

- 研究・製品開発

- 調達

- 生産

- 製剤

- 流通

- 最終用途

- 貿易分析

- 輸出シナリオ(HSコード3808)

- 輸入シナリオ(HSコード3808)

- 技術分析

- 主要技術

- 補完技術

- 隣接技術

- 価格分析

- 主要企業の平均販売価格の動向:タイプ別

- バイオ殺虫剤の平均販売価格の動向:地域別

- バイオ殺菌剤の平均販売価格の動向:地域別

- バイオ殺線虫剤の平均販売価格の動向:地域別

- バイオ除草剤の平均販売価格の動向:地域別

- その他の生物農薬の平均販売価格の動向:地域別

- エコシステム分析

- デマンドサイド

- サプライサイド

- 顧客ビジネスに影響を与える動向/混乱

- 特許分析

- 主な会議とイベント(2025年~2026年)

- 規制情勢

- 規制機関、政府機関、その他の組織

- 米国

- カナダ

- メキシコ

- 欧州

- アジア太平洋

- 南米

- その他の地域

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- ケーススタディ分析

- 投資と資金調達のシナリオ

第7章 生物農薬市場:タイプ別

- イントロダクション

- バイオ殺虫剤

- バイオ殺菌剤

- バイオ殺線虫剤

- バイオ除草剤

- その他の生物農薬

第8章 生物農薬市場:原料別

- イントロダクション

- 微生物

- 生化学

- 益虫・その他のマクロバイアル

第9章 生物農薬市場:剤形別

- イントロダクション

- 液体

- 乾燥

第10章 生物農薬市場:施用方式別

- イントロダクション

- 種子処理

- 土壌処理

- 葉面散布

- その他の施用方式

第11章 生物農薬市場:作物タイプ別

- イントロダクション

- 穀類

- 油糧種子・豆類

- 果物・野菜

- その他の作物タイプ

第12章 生物農薬市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- フランス

- ドイツ

- スペイン

- イタリア

- 英国

- オランダ

- ロシア

- その他の欧州

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- タイ

- インドネシア

- その他のアジア太平洋

- 南米

- ブラジル

- アルゼンチン

- チリ

- その他の南米

- その他の地域

- アフリカ

- 中東

第13章 競合情勢

- 概要

- 主要参入企業の戦略/強み

- セグメント収益分析

- 市場シェア分析(2023年)

- 企業の評価マトリクス:主要企業(2023年)

- 企業の評価マトリクス:スタートアップ/中小企業(2023年)

- 企業の評価と財務指標

- ブランド/製品/サービス分析

- 競合シナリオ

第14章 企業プロファイル

- 主要企業

- BASF SE

- BAYER AG

- CORTEVA

- SYNGENTA GROUP

- FMC CORPORATION

- UPL

- SUMITOMO CHEMICAL CO., LTD.

- NUFARM

- NOVONESIS GROUP

- BIOCERES CROP SOLUTIONS

- KOPPERT

- CERTIS USA L.L.C.

- GOWAN COMPANY

- BIOBEST GROUP NV

- LALLEMAND INC

- その他の企業(中小企業/スタートアップ)

- IPL BIOLOGICALS

- ROVENSA NEXT

- VESTARON CORPORATION

- AGRILIFE

- STK BIO-AG TECHNOLOGIES

- KAY BEE BIO ORGANICS PVT. LTD.

- ANDERMATT GROUP AG

- GENICA

- SEIPASA, S.A.

- BOTANO HEALTH

第15章 隣接市場と関連市場

- イントロダクション

- 制限事項

- 農業用生物製剤市場

- 市場の定義

- 市場の概要

- バイオラショナル農薬市場

- 市場の定義

- 市場の概要

- 生物的防除市場

- 市場の定義

- 市場の概要

第16章 付録

List of Tables

- TABLE 1 BIOPESTICIDES MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 USD EXCHANGE RATES, 2019-2023

- TABLE 3 BIOPESTICIDES MARKET SNAPSHOT, 2024 VS. 2029

- TABLE 4 COUNTRY-WISE EXPORT, 2019-2023 (USD THOUSAND)

- TABLE 5 COUNTRY-WISE IMPORT, 2019-2023 (USD THOUSAND)

- TABLE 6 AVERAGE SELLING PRICE (ASP) TREND OF KEY PLAYERS, BY TYPE, 2023 (USD/KG)

- TABLE 7 AVERAGE SELLING PRICE (ASP) TREND OF BIOPESTICIDES, BY TYPE, 2019-2023 (USD/KG)

- TABLE 8 BIOINSECTICIDES: AVERAGE SELLING PRICE (ASP) TREND OF BIOPESTICIDES, BY REGION, 2019-2023 (USD/KG)

- TABLE 9 BIOFUNGICIDES: AVERAGE SELLING PRICE (ASP) TREND OF BIOPESTICIDES, BY REGION, 2019-2023 (USD/KG)

- TABLE 10 BIONEMATICIDES: AVERAGE SELLING PRICE (ASP) TREND OF BIOPESTICIDES, BY REGION, 2019-2023 (USD/KG)

- TABLE 11 BIOHERBICIDES: AVERAGE SELLING PRICE (ASP) TREND OF BIOPESTICIDES, BY REGION, 2019-2023 (USD/KG)

- TABLE 12 OTHER BIOPESTICIDES: AVERAGE SELLING PRICE (ASP) TREND OF BIOPESTICIDES, BY REGION, 2019-2023 (USD/KG)

- TABLE 13 BIOPESTICIDES MARKET: ECOSYSTEM

- TABLE 14 KEY PATENTS PERTAINING TO BIOPESTICIDES MARKET, 2014-2024

- TABLE 15 BIOPESTICIDES MARKET: DETAILED LIST OF CONFERENCES AND EVENTS, 2025-2026

- TABLE 16 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 PORTER'S FIVE FORCES IMPACT ON BIOPESTICIDES MARKET

- TABLE 20 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR MODE OF APPLICATION

- TABLE 21 KEY BUYING CRITERIA, BY MODE OF APPLICATION

- TABLE 22 BIOPESTICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 23 BIOPESTICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 24 BIOPESTICIDES MARKET, BY TYPE, 2019-2023 (KT)

- TABLE 25 BIOPESTICIDES MARKET, BY TYPE, 2024-2029 (KT)

- TABLE 26 BIOINSECTICIDES MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 27 BIOINSECTICIDES MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 28 BIOINSECTICIDES MARKET, BY REGION, 2019-2023 (KT)

- TABLE 29 BIOINSECTICIDES MARKET, BY REGION, 2024-2029 (KT)

- TABLE 30 BIOINSECTICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 31 BIOINSECTICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 32 BIOFUNGICIDES MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 33 BIOFUNGICIDES MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 34 BIOFUNGICIDES MARKET, BY REGION, 2019-2023 (KT)

- TABLE 35 BIOFUNGICIDES MARKET, BY REGION, 2024-2029 (KT)

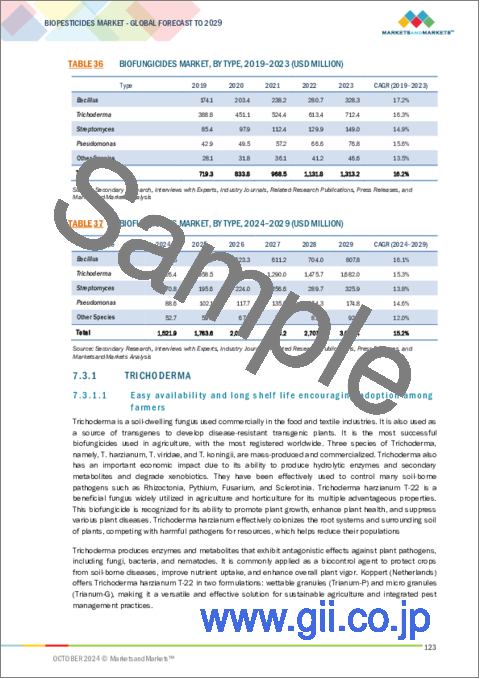

- TABLE 36 BIOFUNGICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 37 BIOFUNGICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 38 SECONDARY METABOLITES RELEASED BY TRICHODERMA SPECIES

- TABLE 39 DISEASES/TARGET PESTS CONTROLLED BY STREPTOMYCES SPECIES

- TABLE 40 BIONEMATICIDES MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 41 BIONEMATICIDES MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 42 BIONEMATICIDES MARKET, BY REGION, 2019-2023 (KT)

- TABLE 43 BIONEMATICIDES MARKET, BY REGION, 2024-2029 (KT)

- TABLE 44 BIONEMATICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 45 BIONEMATICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 46 BIOHERBICIDES MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 47 BIOHERBICIDES MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 48 BIOHERBICIDES MARKET, BY REGION, 2019-2023 (KT)

- TABLE 49 BIOHERBICIDES MARKET, BY REGION, 2024-2029 (KT)

- TABLE 50 OTHER BIOPESTICIDES MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 51 OTHER BIOPESTICIDES MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 52 OTHER BIOPESTICIDES MARKET, BY REGION, 2019-2023 (KT)

- TABLE 53 OTHER BIOPESTICIDES MARKET, BY REGION, 2024-2029 (KT)

- TABLE 54 BIOPESTICIDES MARKET, BY SOURCE, 2019-2023 (USD MILLION)

- TABLE 55 BIOPESTICIDES MARKET, BY SOURCE, 2024-2029 (USD MILLION)

- TABLE 56 MICROBES BIOPESTICIDES MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 57 MICROBES BIOPESTICIDES MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 58 MICROBES BIOPESTICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 59 MICROBES BIOPESTICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 60 BIOCHEMICAL BIOPESTICIDES MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 61 BIOCHEMICAL BIOPESTICIDES MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 62 BIOCHEMICAL BIOPESTICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 63 BIOCHEMICAL BIOPESTICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 64 BENEFICIAL INSECTS & OTHER MACROBIALS BIOPESTICIDES MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 65 BENEFICIAL INSECTS & OTHER MACROBIALS BIOPESTICIDES MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 66 BENEFICIAL INSECTS & OTHER MACROBIALS BIOPESTICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 67 BENEFICIAL INSECTS & OTHER MACROBIALS BIOPESTICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 68 BIOPESTICIDES MARKET, BY FORMULATION, 2019-2023 (USD MILLION)

- TABLE 69 BIOPESTICIDES MARKET, BY FORMULATION, 2024-2029 (USD MILLION)

- TABLE 70 LIQUID BIOPESTICIDES MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 71 LIQUID BIOPESTICIDES MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 72 LIQUID BIOPESTICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 73 LIQUID BIOPESTICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 74 DRY BIOPESTICIDES MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 75 DRY BIOPESTICIDES MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 76 DRY BIOPESTICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 77 DRY BIOPESTICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 78 BIOPESTICIDES MARKET, BY MODE OF APPLICATION, 2019-2023 (USD MILLION)

- TABLE 79 BIOPESTICIDES MARKET, BY MODE OF APPLICATION, 2024-2029 (USD MILLION)

- TABLE 80 BIOPESTICIDE SEED TREATMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 81 BIOPESTICIDE SEED TREATMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 82 BIOPESTICIDE SOIL TREATMENT MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 83 BIOPESTICIDE SOIL TREATMENT MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 84 BIOPESTICIDE FOLIAR SPRAY MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 85 BIOPESTICIDE FOLIAR SPRAY MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 86 OTHER MODES OF BIOPESTICIDE APPLICATION MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 87 OTHER MODES OF BIOPESTICIDE APPLICATION MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 88 BIOPESTICIDES MARKET, BY CROP TYPE, 2019-2023 (USD MILLION)

- TABLE 89 BIOPESTICIDES MARKET, BY CROP TYPE, 2024-2029 (USD MILLION)

- TABLE 90 CEREAL & GRAIN CROPS MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 91 CEREAL & GRAIN CROPS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 92 CEREAL & GRAIN CROPS MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 93 CEREAL & GRAIN CROPS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 94 OILSEED & PULSE CROPS MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 95 OILSEED & PULSE CROPS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 96 OILSEED & PULSE CROPS MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 97 OILSEED & PULSE CROPS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 98 FRUIT & VEGETABLE CROPS MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 99 FRUIT & VEGETABLE CROPS MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 100 FRUIT & VEGETABLE CROPS MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 101 FRUIT & VEGETABLE CROPS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 102 OTHER CROP TYPES MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 103 OTHER CROP TYPES MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 104 BIOPESTICIDES MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 105 BIOPESTICIDES MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 106 BIOPESTICIDES MARKET, BY REGION, 2019-2023 (KT)

- TABLE 107 BIOPESTICIDES MARKET, BY REGION, 2024-2029 (KT)

- TABLE 108 BIOPESTICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 109 BIOPESTICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 110 BIOPESTICIDES MARKET, BY TYPE, 2019-2023 (KT)

- TABLE 111 BIOPESTICIDES MARKET, BY TYPE, 2024-2029 (KT)

- TABLE 112 BIOPESTICIDES MARKET, BY SOURCE, 2019-2023 (USD MILLION)

- TABLE 113 BIOPESTICIDES MARKET, BY SOURCE, 2024-2029 (USD MILLION)

- TABLE 114 BIOPESTICIDES MARKET, BY MODE OF APPLICATION, 2019-2023 (USD MILLION)

- TABLE 115 BIOPESTICIDES MARKET, BY MODE OF APPLICATION, 2024-2029 (USD MILLION)

- TABLE 116 BIOPESTICIDES MARKET, BY FORMULATION, 2019-2023 (USD MILLION)

- TABLE 117 BIOPESTICIDES MARKET, BY FORMULATION, 2024-2029 (USD MILLION)

- TABLE 118 BIOPESTICIDES MARKET, BY CROP TYPE, 2019-2023 (USD MILLION)

- TABLE 119 BIOPESTICIDES MARKET, BY CROP TYPE, 2024-2029 (USD MILLION)

- TABLE 120 NORTH AMERICA: BIOPESTICIDES MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 121 NORTH AMERICA: BIOPESTICIDES MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 122 NORTH AMERICA: BIOPESTICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 123 NORTH AMERICA: BIOPESTICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 124 NORTH AMERICA: BIOPESTICIDES MARKET, BY TYPE, 2019-2023 (KT)

- TABLE 125 NORTH AMERICA: BIOPESTICIDES MARKET, BY TYPE, 2024-2029 (KT)

- TABLE 126 NORTH AMERICA: BIOPESTICIDES MARKET, BY SOURCE, 2019-2023 (USD MILLION)

- TABLE 127 NORTH AMERICA: BIOPESTICIDES MARKET, BY SOURCE, 2024-2029 (USD MILLION)

- TABLE 128 NORTH AMERICA: BIOPESTICIDES MARKET, BY MODE OF APPLICATION, 2019-2023 (USD MILLION)

- TABLE 129 NORTH AMERICA: BIOPESTICIDES MARKET, BY MODE OF APPLICATION, 2024-2029 (USD MILLION)

- TABLE 130 NORTH AMERICA: BIOPESTICIDES MARKET, BY FORMULATION, 2019-2023 (USD MILLION)

- TABLE 131 NORTH AMERICA: BIOPESTICIDES MARKET, BY FORMULATION, 2024-2029 (USD MILLION)

- TABLE 132 NORTH AMERICA: BIOPESTICIDES MARKET, BY CROP TYPE, 2019-2023 (USD MILLION)

- TABLE 133 NORTH AMERICA: BIOPESTICIDES MARKET, BY CROP TYPE, 2024-2029 (USD MILLION)

- TABLE 134 US: BIOPESTICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 135 US: BIOPESTICIDES MARKET, BY FUNCTION, 2024-2029 (USD MILLION)

- TABLE 136 CANADA: BIOPESTICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 137 CANADA: BIOPESTICIDES MARKET, BY FUNCTION, 2024-2029 (USD MILLION)

- TABLE 138 MEXICO: BIOPESTICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 139 MEXICO: BIOPESTICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 140 EUROPE: BIOPESTICIDES MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 141 EUROPE: BIOPESTICIDES MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 142 EUROPE: BIOPESTICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 143 EUROPE: BIOPESTICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 144 EUROPE: BIOPESTICIDES MARKET, BY TYPE, 2019-2023 (KT)

- TABLE 145 EUROPE: BIOPESTICIDES MARKET, BY TYPE, 2024-2029 (KT)

- TABLE 146 EUROPE: BIOPESTICIDES MARKET, BY SOURCE, 2019-2023 (USD MILLION)

- TABLE 147 EUROPE: BIOPESTICIDES MARKET, BY SOURCE, 2024-2029 (USD MILLION)

- TABLE 148 EUROPE: BIOPESTICIDES MARKET, BY MODE OF APPLICATION, 2019-2023 (USD MILLION)

- TABLE 149 EUROPE: BIOPESTICIDES MARKET, BY MODE OF APPLICATION, 2024-2029 (USD MILLION)

- TABLE 150 EUROPE: BIOPESTICIDES MARKET, BY FORMULATION, 2019-2023 (USD MILLION)

- TABLE 151 EUROPE: BIOPESTICIDES MARKET, BY FORMULATION, 2024-2029 (USD MILLION)

- TABLE 152 EUROPE: BIOPESTICIDES MARKET, BY CROP TYPE, 2019-2023 (USD MILLION)

- TABLE 153 EUROPE: BIOPESTICIDES MARKET, BY CROP TYPE, 2024-2029 (USD MILLION)

- TABLE 154 FRANCE: BIOPESTICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 155 FRANCE: BIOPESTICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 156 GERMANY: BIOPESTICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 157 GERMANY: BIOPESTICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 158 SPAIN: BIOPESTICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 159 SPAIN: BIOPESTICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 160 ITALY: BIOPESTICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 161 ITALY: BIOPESTICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 162 UK: BIOPESTICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 163 UK: BIOPESTICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 164 NETHERLANDS: BIOPESTICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 165 NETHERLANDS: BIOPESTICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 166 RUSSIA: BIOPESTICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 167 RUSSIA: BIOPESTICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 168 REST OF EUROPE: BIOPESTICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 169 REST OF EUROPE: BIOPESTICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 170 ASIA PACIFIC: BIOPESTICIDES MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 171 ASIA PACIFIC: BIOPESTICIDES MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 172 ASIA PACIFIC: BIOPESTICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 173 ASIA PACIFIC: BIOPESTICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 174 ASIA PACIFIC: BIOPESTICIDES MARKET, BY TYPE, 2019-2023 (KT)

- TABLE 175 ASIA PACIFIC: BIOPESTICIDES MARKET, BY TYPE, 2024-2029 (KT)

- TABLE 176 ASIA PACIFIC: BIOPESTICIDES MARKET, BY SOURCE, 2019-2023 (USD MILLION)

- TABLE 177 ASIA PACIFIC: BIOPESTICIDES MARKET, BY SOURCE, 2024-2029 (USD MILLION)

- TABLE 178 ASIA PACIFIC: BIOPESTICIDES MARKET, BY MODE OF APPLICATION, 2019-2023 (USD MILLION)

- TABLE 179 ASIA PACIFIC: BIOPESTICIDES MARKET, BY MODE OF APPLICATION, 2024-2029 (USD MILLION)

- TABLE 180 ASIA PACIFIC: BIOPESTICIDES MARKET, BY FORMULATION, 2019-2023 (USD MILLION)

- TABLE 181 ASIA PACIFIC: BIOPESTICIDES MARKET, BY FORMULATION, 2024-2029 (USD MILLION)

- TABLE 182 ASIA PACIFIC: BIOPESTICIDES MARKET, BY CROP TYPE, 2019-2023 (USD MILLION)

- TABLE 183 ASIA PACIFIC: BIOPESTICIDES MARKET, BY CROP TYPE, 2024-2029 (USD MILLION)

- TABLE 184 CHINA: BIOPESTICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 185 CHINA: BIOPESTICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 186 INDIA: BIOPESTICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 187 INDIA: BIOPESTICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 188 JAPAN: BIOPESTICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 189 JAPAN: BIOPESTICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 190 AUSTRALIA: BIOPESTICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 191 AUSTRALIA: BIOPESTICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 192 THAILAND: BIOPESTICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 193 THAILAND: BIOPESTICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 194 INDONESIA: BIOPESTICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 195 INDONESIA: BIOPESTICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 196 REST OF ASIA PACIFIC: BIOPESTICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 197 REST OF ASIA PACIFIC: BIOPESTICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 198 SOUTH AMERICA: BIOPESTICIDES MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 199 SOUTH AMERICA: BIOPESTICIDES MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 200 SOUTH AMERICA: BIOPESTICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 201 SOUTH AMERICA: BIOPESTICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 202 SOUTH AMERICA: BIOPESTICIDES MARKET, BY TYPE, 2019-2023 (KT)

- TABLE 203 SOUTH AMERICA: BIOPESTICIDES MARKET, BY TYPE, 2024-2029 (KT)

- TABLE 204 SOUTH AMERICA: BIOPESTICIDES MARKET, BY SOURCE, 2019-2023 (USD MILLION)

- TABLE 205 SOUTH AMERICA: BIOPESTICIDES MARKET, BY SOURCE, 2024-2029 (USD MILLION)

- TABLE 206 SOUTH AMERICA: BIOPESTICIDES MARKET, BY MODE OF APPLICATION, 2019-2023 (USD MILLION)

- TABLE 207 SOUTH AMERICA: BIOPESTICIDES MARKET, BY MODE OF APPLICATION, 2024-2029 (USD MILLION)

- TABLE 208 SOUTH AMERICA: BIOPESTICIDES MARKET, BY FORMULATION, 2019-2023 (USD MILLION)

- TABLE 209 SOUTH AMERICA: BIOPESTICIDES MARKET, BY FORMULATION, 2024-2029 (USD MILLION)

- TABLE 210 SOUTH AMERICA: BIOPESTICIDES MARKET, BY CROP TYPE, 2019-2023 (USD MILLION)

- TABLE 211 SOUTH AMERICA: BIOPESTICIDES MARKET, BY CROP TYPE, 2024-2029 (USD MILLION)

- TABLE 212 BRAZIL: BIOPESTICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 213 BRAZIL: BIOPESTICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 214 ARGENTINA: BIOPESTICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 215 ARGENTINA: BIOPESTICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 216 CHILE: BIOPESTICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 217 CHILE: BIOPESTICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 218 REST OF SOUTH AMERICA: BIOPESTICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 219 REST OF SOUTH AMERICA: BIOPESTICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 220 ROW: BIOPESTICIDES MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 221 ROW: BIOPESTICIDES MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 222 ROW: BIOPESTICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 223 ROW: BIOPESTICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 224 ROW: BIOPESTICIDES MARKET, BY TYPE, 2019-2023 (KT)

- TABLE 225 ROW: BIOPESTICIDES MARKET, BY TYPE, 2024-2029 (KT)

- TABLE 226 ROW: BIOPESTICIDES MARKET, BY SOURCE, 2019-2023 (USD MILLION)

- TABLE 227 ROW: BIOPESTICIDES MARKET, BY SOURCE, 2024-2029 (USD MILLION)

- TABLE 228 ROW: BIOPESTICIDES MARKET, BY MODE OF APPLICATION, 2019-2023 (USD MILLION)

- TABLE 229 ROW: BIOPESTICIDES MARKET, BY MODE OF APPLICATION, 2024-2029 (USD MILLION)

- TABLE 230 ROW BIOPESTICIDES MARKET, BY FORMULATION, 2019-2023 (USD MILLION)

- TABLE 231 ROW: BIOPESTICIDES MARKET, BY FORMULATION, 2024-2029 (USD MILLION)

- TABLE 232 ROW: BIOPESTICIDES MARKET, BY CROP TYPE, 2019-2023 (USD MILLION)

- TABLE 233 ROW: BIOPESTICIDES MARKET, BY CROP TYPE, 2024-2029 (USD MILLION)

- TABLE 234 AFRICA: BIOPESTICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 235 AFRICA: BIOPESTICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 236 MIDDLE EAST: BIOPESTICIDES MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 237 MIDDLE EAST: BIOPESTICIDES MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 238 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN BIOPESTICIDES MARKET, 2020-2025

- TABLE 239 BIOPESTICIDES MARKET: DEGREE OF COMPETITION

- TABLE 240 BIOPESTICIDES MARKET: REGION FOOTPRINT

- TABLE 241 BIOPESTICIDES MARKET: TYPE FOOTPRINT

- TABLE 242 BIOPESTICIDES MARKET: FORMULATION FOOTPRINT

- TABLE 243 BIOPESTICIDES MARKET: SOURCE FOOTPRINT

- TABLE 244 BIOPESTICIDES MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 245 BIOPESTICIDES MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, 2023

- TABLE 246 BIOPESTICIDES MARKET: PRODUCT/SERVICE LAUNCHES, JANUARY 2020- JANUARY 2025

- TABLE 247 BIOPESTICIDES MARKET: DEALS, JANUARY 2020- JANUARY 2025

- TABLE 248 BIOPESTICIDES MARKET: EXPANSIONS, JANUARY 2020- JANUARY 2025

- TABLE 249 BIOPESTICIDES MARKET: OTHER DEVELOPMENTS, JANUARY 2020-JANUARY 2025

- TABLE 250 BASF SE: COMPANY OVERVIEW

- TABLE 251 BASF SE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 252 BASF SE: PRODUCT LAUNCHES

- TABLE 253 BASF SE: DEALS

- TABLE 254 BASF SE: EXPANSIONS

- TABLE 255 BAYER AG: COMPANY OVERVIEW

- TABLE 256 BAYER AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 257 BAYER AG: PRODUCT LAUNCHES

- TABLE 258 BAYER AG: DEALS

- TABLE 259 BAYER AG: EXPANSIONS

- TABLE 260 CORTEVA: COMPANY OVERVIEW

- TABLE 261 CORTEVA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 262 CORTEVA: PRODUCT LAUNCHES

- TABLE 263 CORTEVA: DEALS

- TABLE 264 SYNGENTA GROUP: COMPANY OVERVIEW

- TABLE 265 SYNGENTA GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 266 SYNGENTA GROUP: PRODUCT LAUNCHES

- TABLE 267 SYNGENTA GROUP: DEALS

- TABLE 268 SYNGENTA GROUP: EXPANSIONS

- TABLE 269 FMC CORPORATION: COMPANY OVERVIEW

- TABLE 270 FMC CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 271 FMC CORPORATION: PRODUCT LAUNCHES

- TABLE 272 FMC CORPORATION: DEALS

- TABLE 273 FMC CORPORATION: EXPANSIONS

- TABLE 274 FMC CORPORATION: OTHER DEVELOPMENTS

- TABLE 275 UPL: COMPANY OVERVIEW

- TABLE 276 UPL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 277 UPL: PRODUCT LAUNCHES

- TABLE 278 UPL: DEALS

- TABLE 279 SUMITOMO CHEMICALS CO., LTD: COMPANY OVERVIEW

- TABLE 280 SUMITOMO CHEMICAL CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 281 SUMITOMO CHEMICAL CO., LTD.: DEALS

- TABLE 282 SUMITOMO CHEMICAL CO., LTD: EXPANSIONS

- TABLE 283 NUFARM: COMPANY OVERVIEW

- TABLE 284 NUFARM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 285 NUFARM: DEALS

- TABLE 286 NUFARM: OTHER DEVELOPMENTS

- TABLE 287 NOVONESIS GROUP: COMPANY OVERVIEW

- TABLE 288 NOVONESIS GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 289 NOVONESIS GROUP: PRODUCT LAUNCHES

- TABLE 290 NOVONESIS GROUP: DEALS

- TABLE 291 BIOCERES CROP SOLUTIONS: COMPANY OVERVIEW

- TABLE 292 BIOCERES CROP SOLUTIONS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 293 BIOCERES CROP SOLUTIONS: PRODUCT LAUNCHES

- TABLE 294 BIOCERES CROP SOLUTIONS: DEALS

- TABLE 295 KOPPERT: COMPANY OVERVIEW

- TABLE 296 KOPPERT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 297 KOPPERT: DEALS

- TABLE 298 KOPPERT: EXPANSIONS

- TABLE 299 CERTIS USA L.L.C.: COMPANY OVERVIEW

- TABLE 300 CERTIS USA L.L.C.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 301 CERTIS USA L.L.C.: PRODUCT LAUNCHES

- TABLE 302 CERTIS USA L.L.C.: DEALS

- TABLE 303 CERTIS USA L.L.C.: OTHER DEVELOPMENTS

- TABLE 304 GOWAN COMPANY: BUSINESS OVERVIEW

- TABLE 305 GOWAN COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 306 GOWAN COMPANY: PRODUCT LAUNCHES

- TABLE 307 GOWAN COMPANY: DEALS

- TABLE 308 BIOBEST GROUP NV: COMPANY OVERVIEW

- TABLE 309 BIOBEST GROUP NV: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 310 BIOBEST GROUP NV: PRODUCT LAUNCHES

- TABLE 311 BIOBEST GROUP NV: DEALS

- TABLE 312 BIOBEST GROUP NV: EXPANSIONS

- TABLE 313 LALLEMAND INC: COMPANY OVERVIEW

- TABLE 314 LALLEMAND INC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 315 LALLEMAND INC: PRODUCT LAUNCHES

- TABLE 316 LALLEMAND INC: DEALS

- TABLE 317 IPL BIOLOGICALS: COMPANY OVERVIEW

- TABLE 318 IPL BIOLOGICALS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 319 IPL BIOLOGICALS: PRODUCT LAUNCHES

- TABLE 320 IPL BIOLOGICALS: DEALS

- TABLE 321 IPL BIOLOGICALS: EXPANSIONS

- TABLE 322 IPL BIOLOGICALS: OTHER DEVELOPMENTS

- TABLE 323 ROVENSA NEXT: COMPANY OVERVIEW

- TABLE 324 ROVENSA NEXT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 325 ROVENSA NEXT: PRODUCT LAUNCHES

- TABLE 326 ROVENSA NEXT: DEALS

- TABLE 327 ROVENSA NEXT: EXPANSIONS

- TABLE 328 ROVENSA NEXT: OTHER DEVELOPMENTS

- TABLE 329 VESTARON CORPORATION: BUSINESS OVERVIEW

- TABLE 330 VESTARON CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 331 VESTARON CORPORATION: PRODUCT LAUNCHES

- TABLE 332 VESTARON CORPORATION: DEALS

- TABLE 333 AGRILIFE: BUSINESS OVERVIEW

- TABLE 334 AGRILIFE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 335 STK BIO-AG TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 336 STK BIO-AG TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 337 STK BIO-AG TECHNOLOGIES: PRODUCT LAUNCHES

- TABLE 338 KAY BEE BIO ORGANICS PVT. LTD.: COMPANY OVERVIEW

- TABLE 339 ANDERMATT GROUP AG: COMPANY OVERVIEW

- TABLE 340 GENICA: COMPANY OVERVIEW

- TABLE 341 SEIPASA, S.A.: COMPANY OVERVIEW

- TABLE 342 BOTANO HEALTH: COMPANY OVERVIEW

- TABLE 343 ADJACENT MARKETS TO BIOPESTICIDES

- TABLE 344 AGRICULTURAL BIOLOGICALS MARKET, BY TYPE, 2019-2023 (USD MILLION)

- TABLE 345 AGRICULTURAL BIOLOGICALS MARKET, BY TYPE, 2024-2029 (USD MILLION)

- TABLE 346 AGRICULTURAL BIOLOGICALS MARKET, BY TYPE, 2019-2023 (KT)

- TABLE 347 AGRICULTURAL BIOLOGICALS MARKET, BY TYPE, 2024-2029 (KT)

- TABLE 348 LIST OF PLANT PRODUCTS REGISTERED AS BIOPESTICIDES

- TABLE 349 BIORATIONAL PESTICIDES MARKET, BY SOURCE, 2018-2022 (USD MILLION)

- TABLE 350 BIORATIONAL PESTICIDES MARKET, BY SOURCE, 2023-2028 (USD MILLION)

- TABLE 351 BIOCONTROL MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 352 BIOCONTROL MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 353 BIOCONTROL MARKET, BY TYPE, 2017-2021 (KT)

- TABLE 354 BIOCONTROL MARKET, BY TYPE, 2022-2027 (KT)

List of Figures

- FIGURE 1 BIOPESTICIDES MARKET SEGMENTATION

- FIGURE 2 BIOPESTICIDES MARKET: RESEARCH DESIGN

- FIGURE 3 KEY DATA FROM PRIMARY SOURCES

- FIGURE 4 BIOPESTICIDES MARKET: DEMAND-SIDE CALCULATION

- FIGURE 5 BIOPESTICIDES MARKET SIZE ESTIMATION STEPS AND RESPECTIVE SOURCES: SUPPLY SIDE

- FIGURE 6 BIOPESTICIDES MARKET: SUPPLY-SIDE ANALYSIS

- FIGURE 7 DATA TRIANGULATION METHODOLOGY

- FIGURE 8 BIOPESTICIDES MARKET, BY TYPE, 2024 VS. 2029 (USD MILLION)

- FIGURE 9 BIOPESTICIDES MARKET, BY FORMULATION, 2024 VS. 2029 (USD MILLION)

- FIGURE 10 BIOPESTICIDES MARKET, BY SOURCE, 2024 VS. 2029 (USD MILLION)

- FIGURE 11 BIOPESTICIDES MARKET, BY MODE OF APPLICATION, 2024 VS. 2029 (USD MILLION)

- FIGURE 12 BIOPESTICIDES MARKET, BY CROP TYPE, 2024 VS. 2029 (USD MILLION)

- FIGURE 13 BIOPESTICIDES MARKET SHARE (2023) AND CAGR (2024-2029), BY REGION

- FIGURE 14 INCREASING AGRICULTURAL DEMANDS, RISING INCIDENCES OF CROP DISEASES, AND ADOPTION OF ORGANIC FARMING PRACTICES DRIVING DEMAND

- FIGURE 15 MICROBES SEGMENT AND US TO ACCOUNT FOR LARGEST SHARE IN NORTH AMERICAN BIOPESTICIDES MARKET IN 2024

- FIGURE 16 US TO ACCOUNT FOR LARGEST SHARE (BY VALUE) IN 2024

- FIGURE 17 BIOINSECTICIDES SEGMENT TO OCCUPY LARGEST MARKET SHARE BY VOLUME DURING FORECAST PERIOD

- FIGURE 18 LIQUID SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 19 MICROBES SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 20 FOLIAR SPRAY TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 21 FRUITS & VEGETABLES TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 22 GLOBAL ORGANIC AGRICULTURAL LAND GROWTH, 2018-2022

- FIGURE 23 MARKET DYNAMICS

- FIGURE 24 TOTAL ORGANIC FOOD SALES IN US, 2013-2022

- FIGURE 25 ADOPTION OF GEN AI IN BIOPESTICIDES PRODUCTION PROCESS

- FIGURE 26 BIOPESTICIDES MARKET: VALUE CHAIN ANALYSIS

- FIGURE 27 COUNTRY-WISE EXPORT, 2019-2023 (USD THOUSAND)

- FIGURE 28 COUNTRY-WISE IMPORT, 2019-2023 (USD THOUSAND)

- FIGURE 29 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY TYPE, 2023

- FIGURE 30 AVERAGE SELLING PRICE TREND, BY TYPE, 2019-2023

- FIGURE 31 AVERAGE SELLING PRICE TREND OF BIOINSECTICIDES, BY REGION

- FIGURE 32 AVERAGE SELLING PRICE TREND OF BIOFUNGICIDES, BY REGION

- FIGURE 33 AVERAGE SELLING PRICE TREND OF BIONEMATICIDES, BY REGION

- FIGURE 34 AVERAGE SELLING PRICE TREND OF BIOHERBICIDES, BY REGION

- FIGURE 35 AVERAGE SELLING PRICE TREND OF OTHER BIOPESTICIDES, BY REGION

- FIGURE 36 KEY STAKEHOLDERS IN BIOPESTICIDES MARKET ECOSYSTEM

- FIGURE 37 BIOPESTICIDES MARKET: TRENDS/DISRUPTING IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 38 PATENTS GRANTED FOR BIOPESTICIDES MARKET, 2014-2024

- FIGURE 39 BIOPESTICIDES MARKET: REGIONAL ANALYSIS OF PATENTS GRANTED, 2014-2024

- FIGURE 40 BIOPESTICIDES MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 41 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR MODE OF APPLICATION

- FIGURE 42 KEY BUYING CRITERIA, BY MODE OF APPLICATION

- FIGURE 43 INVESTMENT & FUNDING SCENARIO OF MAJOR PLAYERS

- FIGURE 44 BIOPESTICIDES MARKET, BY TYPE, 2024 VS. 2029 (USD MILLION)

- FIGURE 45 BIOPESTICIDES MARKET, BY SOURCE, 2024 VS. 2029 (USD MILLION)

- FIGURE 46 BIOPESTICIDES MARKET, BY FORMULATION, 2024 VS. 2029 (USD MILLION)

- FIGURE 47 BIOPESTICIDES MARKET, BY MODE OF APPLICATION, 2024 VS. 2029 (USD MILLION)

- FIGURE 48 BIOPESTICIDES MARKET, BY CROP TYPE, 2024 VS. 2029 (USD MILLION)

- FIGURE 49 ITALY TO RECORD HIGHEST CAGR IN BIOPESTICIDES MARKET

- FIGURE 50 NORTH AMERICA: BIOPESTICIDES MARKET SNAPSHOT

- FIGURE 51 EUROPE: BIOPESTICIDES MARKET SNAPSHOT

- FIGURE 52 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS, 2019-2023 (USD BILLION)

- FIGURE 53 BIOPESTICIDES MARKET: MARKET SHARE ANALYSIS, 2023

- FIGURE 54 BIOPESTICIDES MARKET: COMPANY EVALUATION MATRIX, KEY PLAYERS, 2023

- FIGURE 55 BIOPESTICIDES MARKET: COMPANY FOOTPRINT

- FIGURE 56 BIOPESTICIDES MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 57 COMPANY VALUATION OF FEW MAJOR PLAYERS

- FIGURE 58 EV/EBITDA OF KEY COMPANIES

- FIGURE 59 BRAND/PRODUCT/SERVICE ANALYSIS, BY KEY BRANDS OF BIOPESTICIDES KEY PLAYERS

- FIGURE 60 BASF SE: COMPANY SNAPSHOT

- FIGURE 61 BAYER AG: COMPANY SNAPSHOT

- FIGURE 62 CORTEVA: COMPANY SNAPSHOT

- FIGURE 63 SYNGENTA GROUP: COMPANY SNAPSHOT

- FIGURE 64 FMC CORPORATION: COMPANY SNAPSHOT

- FIGURE 65 UPL LTD: COMPANY SNAPSHOT

- FIGURE 66 SUMITOMO CHEMICALS CO., LTD.: COMPANY SNAPSHOT

- FIGURE 67 NUFARM: COMPANY SNAPSHOT

- FIGURE 68 NOVONESIS GROUP: COMPANY SNAPSHOT

- FIGURE 69 BIOCERES CROP SOLUTIONS: COMPANY SNAPSHOT

The global biopesticides market is estimated at USD 7.72 billion in 2024 and is projected to reach USD 15.66 billion by 2029, at a CAGR of 15.2% during the forecast period. The adoption of AI in the biopesticides industry is transforming product development, enhancing pest control effectiveness, and optimizing market strategies. Companies, such as FMC Corporation, are using AI to rapidly discover and commercialize new biopesticides. In May 2024, FMC Corporation announced a collaboration with Optibrium, the lead AI solutions company for small molecule discovery, as part of its strategic move to expand its discovery process. Coupled with Optibrium's Augmented Chemistry AI technologies, this will speed up the discovery of promising compounds and optimize their properties in the development of new sustainable solutions for growers. As AI continues to play a critical role in sustainable product development, it positions the biopesticides market for significant growth and innovation.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Million) and Volume (Kilotons) |

| Segments | By Type, Crop Type, Mode of Application, Source, Formulation, and Region |

| Regions covered | North America, Europe, South America, Asia Pacific, and RoW |

Opportunities and disruption in the biopesticides market

Biopesticides offer significant business opportunities for both farmers and manufacturers, driven by the increasing shift toward sustainable agriculture. For the farmer, the use of biopesticides can reduce dependency on chemical pesticides, improve crop quality, and enjoy consumers' demand for ecological-friendly products, thus opening up improved profitability and access to markets. Manufacturer benefits from this trend in that the global demand for sustainable agricultural inputs, which are increasing in demand, provide opportunities to expand the product portfolios, invest in R&D, and tie up strategic alliances. Thus, the prospects of this emerging market landscape are promising and lead to long-term sustainability and growth across the agricultural supply chain. The biopesticides market is experiencing significant disruptions driven by technological advancements, regulatory changes, and evolving consumer preferences. Some of the key disruptions in the biopesticides market include:

- AI-driven product discovery: Artificial intelligence (AI) and machine learning are accelerating the identification and optimization of active compounds in biopesticides, which help in fast and efficient product development.

- Advanced delivery technologies: Innovations like microencapsulation and controlled-release formulations improve the erformance of biopesticides by enhancing their efficiency and durability.

- Precision application technologies: The integration of drones, smart sensors, and GPS-based tools helps in accurate and efficient application of biopesticides, hence reducing the wastage of product.

"In 2023, Bioinsecticides stood as the major segment within the type segment of the biopesticides market. "

The bioinsecticides hold a major share in the segment type of biopesticides market because of their potential to target an enormous range of insect pests while remaining nontoxic to many other beneficial organisms. These include biopesticides emanating from natural sources, bacteria, fungi, and plant extracts that reportedly are harmless and serve as alternatives for chemical insecticides. Due to increasing awareness of pesticide resistance and lethal effects on the environment and human health from synthetic chemicals, bioinsecticides have emerged among the favored options for integrated pest management. Its aptitude for sustainable pest control delivery across different crops, especially high-valued fruit and vegetable production, sustained the leading edge in the biopesticides market.

"Within the formulation segment, liquid formulation holds the highest share."

Liquid formulation holds the maximum share in the biopesticides market due to its wide usage and versatility. They are preferred for the ease of application and better coverage of large acres. Liquid biopesticides provide a high active content, which is required in commercial formulation as they aid with spray drifting. Rovensa Next launched a new biofungicide named Milarum in Brazil in June 2024. FMC India introduced ENTAZIA biofungicide in August 2023. Both are liquid products in form, bringing extra versatility and value to their applications.

"Europe is expected to grow at the highest rate in the global biopesticides market."

The European region is expected to record the highest growth rate in the global pesticides market due to increasing demand for organic and sustainable farming practices, stringent environmental regulations, and strong governmental support towards environmental-friendly crop protection solutions. The regional market has concentrated on the decline in the utilization of chemical pesticides, increasing integrated pest management, thereby accelerating the demand for biopesticides and other alternative solutions in the region. The "Farm to Fork" strategy by the European Commission includes the ambition of using 25% of EU farmland for organic farming by 2030. An action plan is designed within the strategy that offers direct financial support to organic producers on a per-hectare payment basis, thus incentivizing the adoption and long-term maintenance of organic farming practices. This kind of incentive will go a long way in fast-tracking the conversion process to organic agriculture. These per-hectare payments are justified to incentivize the positive externalities associated with organic farming and are partly financed by pesticide taxes. This approach creates a favorable environment for the biopesticides market in Europe.

The Break-up of Primaries:

By Company Type: Tire 1- 35%, Tire 2- 40%, Tire 3- 25%

By Designation: CXOs - 30%, Managers - 50%, Executives - 20%

By Region: North America - 25%, Europe - 25%, Asia Pacific - 30%, South America - 10%, RoW - 10%

Key players in this market include BASF SE (Germany), Bayer AG (Germany), Syngenta Group (Switzerland), UPL (India), Corteva (US), FMC Corporation (US), Nufarm (Australia), Sumitomo Chemical Co., Ltd. (Japan), Certis USA L.L.C. (US), Bioceres Crop Solutions (Argentina), Novonesis Group (Denmark), Koppert (Netherlands), Biobest Group NV (Belgium), Gowan Company (US), and Lallemand Inc (Canada).

Research Coverage:

The report segments the biopesticides market based on type, crop type, mode of application, source, formulation, and region. In terms of insights, this report has focused on various levels of analyses-the competitive landscape, end-use analysis, and company profiles, which together comprise and discuss views on the emerging & high-growth segments of the biopesticides market, high-growth regions, countries, government initiatives, drivers, restraints, opportunities, and challenges. A detailed analysis of the key industry players has been done to provide insights into their business overview, solutions, services, key strategies, Contracts, partnerships, and agreements. New product launches, mergers and acquisitions, and recent developments associated with the biopesticides market. Competitive analysis of upcoming startups in the biopesticides market ecosystem is covered in this report.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall biopesticides market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities. The report provides insights on the following pointers:

- Analysis of key drivers (increase in exports of fruits & vegetables, chemical pesticide bans and awareness programs by government agencies, and increase in organic food sales) restraints (technological limitations to use biological products and slow and variable performance) opportunities (advancements in microbial research by key players and adaption and increase in IPM practices) and challenges (high cost of biopesticides compared to synthetic pesticides and lack of awareness and technical knowledge among farmers).

- Product Development/Innovation: Detailed insights on research & development activities and new product launches in the biopesticides market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the biopesticides market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the biopesticides market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players like BASF SE (Germany), Bayer AG (Germany), Syngenta Group (Switzerland), UPL (India), Corteva (US), FMC Corporation (US), Nufarm (Australia), Sumitomo Chemical Co., Ltd. (Japan), Certis USA L.L.C. (US), Bioceres Crop Solutions (Argentina), Novonesis Group (Denmark), Koppert (Netherlands), Biobest Group NV (Belgium), Gowan Company (US), and Lallemand Inc (Canada) in the biopesticides market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.1.1 MARKET DEFINITION

- 1.2 MARKET SCOPE

- 1.2.1 MARKET COVERED AND REGIONAL SCOPE

- 1.2.2 INCLUSIONS AND EXCLUSIONS

- 1.2.3 YEARS CONSIDERED

- 1.2.4 UNIT CONSIDERED

- 1.3 STAKEHOLDERS

- 1.4 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primaries

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to estimate market size using bottom-up analysis

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to estimate market size using top-down analysis

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE MARKET OPPORTUNITIES FOR PLAYERS IN BIOPESTICIDES MARKET

- 4.2 NORTH AMERICA: BIOPESTICIDES MARKET, BY SOURCE AND COUNTRY

- 4.3 BIOPESTICIDES MARKET: SHARE OF MAJOR COUNTRIES

- 4.4 BIOPESTICIDES MARKET, BY TYPE AND REGION

- 4.5 BIOPESTICIDES MARKET, BY FORMULATION AND REGION

- 4.6 BIOPESTICIDES MARKET, BY SOURCE AND REGION

- 4.7 BIOPESTICIDES MARKET, BY MODE OF APPLICATION AND REGION

- 4.8 BIOPESTICIDES MARKET, BY CROP TYPE AND REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MACROECONOMIC OUTLOOK

- 5.2.1 GROWTH IN ORGANIC AGRICULTURAL PRACTICES

- 5.2.2 FAVORABLE AGRICULTURAL SUBSIDIES AND SUPPORT PROGRAMS FROM GOVERNMENTS ACROSS DIFFERENT COUNTRIES

- 5.3 MARKET DYNAMICS

- 5.3.1 DRIVERS

- 5.3.1.1 Increase in demand for fruits and vegetables

- 5.3.1.2 Chemical pesticide bans and awareness programs by government agencies

- 5.3.1.3 Increasing organic food sales

- 5.3.1.4 Advancements in biotechnology support biopesticides market growth

- 5.3.2 RESTRAINTS

- 5.3.2.1 Limited shelf life and storage constraints

- 5.3.2.2 Slow and variable performance

- 5.3.2.3 Complexity in commercialization and limited market establishment

- 5.3.3 OPPORTUNITIES

- 5.3.3.1 Advancements in microbial research undertaken by key players across regions

- 5.3.3.2 Adoption and increase in Integrated Pest Management (IPM) strategies

- 5.3.4 CHALLENGES

- 5.3.4.1 Higher cost of biopesticides than chemical pesticides

- 5.3.4.2 Lack of awareness and technical knowledge of biopesticides among farmers

- 5.3.1 DRIVERS

- 5.4 IMPACT OF AI/GEN AI ON BIOPESTICIDES MARKET

- 5.4.1 INTRODUCTION

- 5.4.2 USE OF GEN AI IN BIOPESTICIDES

- 5.4.3 CASE STUDY ANALYSIS

- 5.4.3.1 Koppert's digital assistant revolutionizing crop protection in biopesticides market

- 5.4.3.2 Leveraging AI to revolutionize biopesticide discovery at Micropep

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 VALUE CHAIN ANALYSIS

- 6.2.1 RESEARCH & PRODUCT DEVELOPMENT

- 6.2.2 SOURCING

- 6.2.3 PRODUCTION

- 6.2.4 FORMULATION

- 6.2.5 DISTRIBUTION

- 6.2.6 END-USE APPLICATION

- 6.3 TRADE ANALYSIS

- 6.3.1 EXPORT SCENARIO (HS CODE 3808)

- 6.3.2 IMPORT SCENARIO (HS CODE 3808)

- 6.4 TECHNOLOGY ANALYSIS

- 6.4.1 KEY TECHNOLOGIES

- 6.4.1.1 Microbial inoculants

- 6.4.2 COMPLEMENTARY TECHNOLOGIES

- 6.4.2.1 Precision Agriculture Technologies

- 6.4.3 ADJACENT TECHNOLOGIES

- 6.4.3.1 Nanotechnology

- 6.4.3.2 RNAi Technology

- 6.4.1 KEY TECHNOLOGIES

- 6.5 PRICING ANALYSIS

- 6.5.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY TYPE

- 6.5.2 AVERAGE SELLING PRICE TREND OF BIOINSECTICIDES, BY REGION

- 6.5.3 AVERAGE SELLING PRICE TREND OF BIOFUNGICIDES, BY REGION

- 6.5.4 AVERAGE SELLING PRICE TREND OF BIONEMATICIDES, BY REGION

- 6.5.5 AVERAGE SELLING PRICE TREND OF BIOHERBICIDES, BY REGION

- 6.5.6 AVERAGE SELLING PRICE TREND OF OTHER BIOPESTICIDES, BY REGION

- 6.6 ECOSYSTEM ANALYSIS

- 6.6.1 DEMAND SIDE

- 6.6.2 SUPPLY SIDE

- 6.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS BUSINESSES

- 6.8 PATENT ANALYSIS

- 6.9 KEY CONFERENCES & EVENTS, 2025-2026

- 6.10 REGULATORY LANDSCAPE

- 6.10.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.10.2 US

- 6.10.3 CANADA

- 6.10.4 MEXICO

- 6.10.5 EUROPE

- 6.10.6 ASIA PACIFIC

- 6.10.6.1 India

- 6.10.6.2 Australia

- 6.10.6.3 Japan

- 6.10.7 SOUTH AMERICA

- 6.10.7.1 Brazil

- 6.10.7.2 Argentina

- 6.10.8 REST OF THE WORLD

- 6.11 PORTER'S FIVE FORCES ANALYSIS

- 6.11.1 INTENSITY OF COMPETITIVE RIVALRY

- 6.11.2 BARGAINING POWER OF SUPPLIERS

- 6.11.3 BARGAINING POWER OF BUYERS

- 6.11.4 THREAT OF SUBSTITUTES

- 6.11.5 THREAT OF NEW ENTRANTS

- 6.12 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.12.2 BUYING CRITERIA

- 6.13 CASE STUDY ANALYSIS

- 6.13.1 KOPPERT BIOLOGICAL SYSTEMS ACQUIRED GEOCOM TO FOCUS ON PRECISION AGRIFARMING

- 6.13.2 ENHANCING BIOPESTICIDE PERFORMANCE WITH BASF'S AGNIQUE BIOHANCE ADJUVANTS

- 6.13.3 ADDRESSING CHALLENGES OF PHYTOSANITARY DEFENSE WITH SYNGENTA'S BIOSOLUTIONS

- 6.14 INVESTMENT AND FUNDING SCENARIO

7 BIOPESTICIDES MARKET, BY TYPE

- 7.1 INTRODUCTION

- 7.2 BIOINSECTICIDES

- 7.2.1 BACILLUS THURINGIENSIS

- 7.2.1.1 Wide-scale availability, target-specificity, and efficiency

- 7.2.2 BEAUVERIA BASSIANA

- 7.2.2.1 Availability in various formulations

- 7.2.3 METARHIZIUM ANISOPLIAE

- 7.2.3.1 Effective in controlling caterpillars

- 7.2.4 VERTICILLIUM LECANII

- 7.2.4.1 Wide applications in ornamentals, vegetable crops, nurseries, lawns, and vegetable field crops

- 7.2.5 BACULOVIRUS

- 7.2.5.1 Significant demand as effective biocontrol tool for IPM programs

- 7.2.6 OTHER BIOINSECTICIDES

- 7.2.1 BACILLUS THURINGIENSIS

- 7.3 BIOFUNGICIDES

- 7.3.1 TRICHODERMA

- 7.3.1.1 Easy availability and long shelf life encouraging adoption among farmers

- 7.3.2 BACILLUS

- 7.3.2.1 Development of bacillus-based products to witness significant demand for biofungicides

- 7.3.3 PSEUDOMONAS

- 7.3.3.1 Rise in demand for pseudomonas-based biofungicide for seed-borne diseases

- 7.3.4 STREPTOMYCES

- 7.3.4.1 Eliminate pathogenic antagonists by secreting volatile compounds

- 7.3.5 OTHER BIOFUNGICIDES

- 7.3.1 TRICHODERMA

- 7.4 BIONEMATICIDES

- 7.4.1 PAECILOMYCES LILACINUS

- 7.4.1.1 Promising as biocontrol agent for controlling growth of root-knot nematodes

- 7.4.2 BACILLUS FIRMUS

- 7.4.2.1 Effective for larvae and adult nematodes

- 7.4.3 PASTEURIA SPECIES

- 7.4.3.1 Effective against plant-parasitic nematodes

- 7.4.4 OTHER BIONEMATICIDES

- 7.4.1 PAECILOMYCES LILACINUS

- 7.5 BIOHERBICIDES

- 7.5.1 BEST ALTERNATIVE FOR WEED CONTROL

- 7.6 OTHER BIOPESTICIDES

8 BIOPESTICIDES MARKET, BY SOURCE

- 8.1 INTRODUCTION

- 8.2 MICROBES

- 8.2.1 REDUCED DEVELOPMENT COSTS FOR MICROBES, PEST-SPECIFICITY, AND RESIDUE-FREE NATURE BIOPESTICIDES

- 8.2.2 BACTERIA

- 8.2.3 FUNGI

- 8.2.4 VIRUS

- 8.2.5 PROTOZOA

- 8.3 BIOCHEMICALS

- 8.3.1 BROAD SPECTRUM ACTIVITY TO INCREASE ADOPTION

- 8.3.2 SEMIOCHEMICALS

- 8.3.3 PLANT EXTRACTS

- 8.3.4 ORGANIC ACIDS & OTHERS

- 8.4 BENEFICIAL INSECTS & OTHER MACROBIALS

- 8.4.1 NATURAL AND UNIQUE MODE OF ACTION AND CONVENIENT APPLICATION TO SPUR USAGE OF BENEFICIAL INSECTS

- 8.4.2 PREDATORS

- 8.4.3 PARASITOIDS

9 BIOPESTICIDES MARKET, BY FORMULATION

- 9.1 INTRODUCTION

- 9.2 LIQUID

- 9.2.1 EMULSIFIABLE CONCENTRATES

- 9.2.1.1 Ease of handling and requires less agitation

- 9.2.2 SUSPENSION CONCENTRATES

- 9.2.2.1 Suspension concentrates to be safe for operator and environment

- 9.2.3 SOLUBLE LIQUID CONCENTRATES

- 9.2.3.1 Soluble liquid concentrates tend to have lower viscosities than suspension concentrates

- 9.2.1 EMULSIFIABLE CONCENTRATES

- 9.3 DRY

- 9.3.1 DRY GRANULES

- 9.3.1.1 Limited application under UV light

- 9.3.2 WATER-DISPERSIBLE GRANULES

- 9.3.2.1 Water-dispersible granules to be relatively dust-free with good storage viability

- 9.3.3 WETTABLE POWDERS

- 9.3.3.1 Fine wettable powders require adequate safety measures while handling

- 9.3.1 DRY GRANULES

10 BIOPESTICIDES MARKET, BY MODE OF APPLICATION

- 10.1 INTRODUCTION

- 10.2 SEED TREATMENT

- 10.2.1 HIGH DEMAND FOR SEED COATING IN COMMERCIAL AGRICULTURE OPERATIONS

- 10.3 SOIL TREATMENT

- 10.3.1 LESSER SOIL CONTAMINATION AND INCREASING DEMAND FOR ORGANIC FOOD

- 10.4 FOLIAR SPRAY

- 10.4.1 QUICK, EFFECTIVE APPLICATION AND RISE IN DEMAND FOR HORTICULTURE CROPS

- 10.5 OTHER MODES OF APPLICATION

11 BIOPESTICIDES MARKET, BY CROP TYPE

- 11.1 INTRODUCTION

- 11.2 CEREALS & GRAINS

- 11.2.1 CORN

- 11.2.1.1 Corn affected by fall armyworm

- 11.2.2 WHEAT

- 11.2.2.1 Aphids causing severe damage to wheat crop

- 11.2.3 RICE

- 11.2.3.1 Bacillus thuringiensis to be effective against leaf folder and stem borer

- 11.2.4 OTHER CEREALS & GRAINS

- 11.2.1 CORN

- 11.3 OILSEEDS & PULSES

- 11.3.1 SOYBEAN

- 11.3.1.1 Infestation from root-knot nematodes to be severe in soybean crops

- 11.3.2 SUNFLOWER

- 11.3.2.1 Preference for sunflower oil and confectionery value of sunflower seed to drive demand

- 11.3.3 OTHER OILSEEDS & PULSES

- 11.3.1 SOYBEAN

- 11.4 FRUITS & VEGETABLES

- 11.4.1 ROOT & TUBER VEGETABLES

- 11.4.1.1 Range of pests, diseases, and nematodes cause economic losses in root & tuber vegetables

- 11.4.2 LEAFY VEGETABLES

- 11.4.2.1 Rapid use of bacillus subtilis, myrothecium verrucaria, and streptomyces lydicus

- 11.4.3 POME FRUITS

- 11.4.3.1 Biocontrol agents found to be effective on pome fruits

- 11.4.4 BERRIES

- 11.4.4.1 Biological solutions augmenting export of berries under increasingly stringent regulations

- 11.4.5 CITRUS FRUITS

- 11.4.5.1 Citrus canker disease boosting use of antagonists

- 11.4.6 OTHER FRUITS & VEGETABLES

- 11.4.1 ROOT & TUBER VEGETABLES

- 11.5 OTHER CROP TYPES

12 BIOPESTICIDES MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 NORTH AMERICA

- 12.2.1 US

- 12.2.1.1 Phase-out of key chemical pesticides

- 12.2.2 CANADA

- 12.2.2.1 Government support for Integrated Pest Management (IPM)

- 12.2.3 MEXICO

- 12.2.3.1 Higher export demand for organic food from US

- 12.2.1 US

- 12.3 EUROPE

- 12.3.1 FRANCE

- 12.3.1.1 Changes in legislation and authorization procedures for registering biocontrol products

- 12.3.2 GERMANY

- 12.3.2.1 Government support for organic farming

- 12.3.3 SPAIN

- 12.3.3.1 Collaborations between agriculture companies

- 12.3.4 ITALY

- 12.3.4.1 Expansion of organic farming sector to fuel demand for biopesticides

- 12.3.5 UK

- 12.3.5.1 Changing consumer preferences

- 12.3.6 NETHERLANDS

- 12.3.6.1 Genoeg scheme to accelerate growth of bio-based products

- 12.3.7 RUSSIA

- 12.3.7.1 Farmers to adopt biopesticides to prevent resistance against wheat aphids causing severe crop losses

- 12.3.8 REST OF EUROPE

- 12.3.1 FRANCE

- 12.4 ASIA PACIFIC

- 12.4.1 CHINA

- 12.4.1.1 Government drive for sustainable agriculture

- 12.4.2 INDIA

- 12.4.2.1 Innovative and effective biopesticide products

- 12.4.3 JAPAN

- 12.4.3.1 Government regulations to minimize usage of chemical pesticides

- 12.4.4 AUSTRALIA

- 12.4.4.1 Vast organic farmland demanding biopesticide products

- 12.4.5 THAILAND

- 12.4.5.1 Efforts to reduce maximum residue levels of pesticides

- 12.4.6 INDONESIA

- 12.4.6.1 Implementation of IPM practices for pest control

- 12.4.7 REST OF ASIA PACIFIC

- 12.4.1 CHINA

- 12.5 SOUTH AMERICA

- 12.5.1 BRAZIL

- 12.5.1.1 Bio-input Program transforming agricultural sector with biobased solutions

- 12.5.2 ARGENTINA

- 12.5.2.1 Collaboration between companies to lead development of new biopesticide products

- 12.5.3 CHILE

- 12.5.3.1 Greater demand for organically grown fruits to increase adoption of biocontrol methods

- 12.5.4 REST OF SOUTH AMERICA

- 12.5.1 BRAZIL

- 12.6 REST OF THE WORLD (ROW)

- 12.6.1 AFRICA

- 12.6.1.1 International organizations collaborating with biopesticide stakeholders to drive market

- 12.6.2 MIDDLE EAST

- 12.6.2.1 High demand for domestically produced organic foods to boost demand

- 12.6.1 AFRICA

13 COMPETITIVE LANDSCAPE

- 13.1 OVERVIEW

- 13.2 KEY PLAYERS' STRATEGIES/RIGHT TO WIN

- 13.3 SEGMENTAL REVENUE ANALYSIS

- 13.4 MARKET SHARE ANALYSIS, 2023

- 13.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 13.5.1 STARS

- 13.5.2 EMERGING LEADERS

- 13.5.3 PERVASIVE PLAYERS

- 13.5.4 PARTICIPANTS

- 13.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 13.5.5.1 Company footprint

- 13.5.5.2 Region footprint

- 13.5.5.3 Type footprint

- 13.5.5.4 Formulation footprint

- 13.5.5.5 Source footprint

- 13.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 13.6.1 PROGRESSIVE COMPANIES

- 13.6.2 RESPONSIVE COMPANIES

- 13.6.3 DYNAMIC COMPANIES

- 13.6.4 STARTING BLOCKS

- 13.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023

- 13.6.5.1 Detailed list of key startups/SMEs

- 13.6.5.2 Competitive benchmarking of key startups/SMEs

- 13.7 COMPANY VALUATION AND FINANCIAL METRICS

- 13.8 BRAND/PRODUCT/SERVICE ANALYSIS

- 13.9 COMPETITIVE SCENARIO

- 13.9.1 PRODUCT LAUNCHES

- 13.9.2 DEALS

- 13.9.3 EXPANSIONS

- 13.9.4 OTHER DEVELOPMENTS

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- 14.1.1 BASF SE

- 14.1.1.1 Business overview

- 14.1.1.2 Products/Solutions/Services offered

- 14.1.1.3 Recent developments

- 14.1.1.3.1 Product launches

- 14.1.1.3.2 Deals

- 14.1.1.3.3 Expansions

- 14.1.1.4 MnM view

- 14.1.1.4.1 Key strengths

- 14.1.1.4.2 Strategic choices

- 14.1.1.4.3 Weaknesses and competitive threats

- 14.1.2 BAYER AG

- 14.1.2.1 Business overview

- 14.1.2.2 Products/Solutions/Services offered

- 14.1.2.3 Recent developments

- 14.1.2.3.1 Product launches

- 14.1.2.3.2 Deals

- 14.1.2.3.3 Expansions

- 14.1.2.4 MnM view

- 14.1.2.4.1 Key strengths

- 14.1.2.4.2 Strategic choices

- 14.1.2.4.3 Weaknesses and competitive threats

- 14.1.3 CORTEVA

- 14.1.3.1 Business overview

- 14.1.3.2 Products/Solutions/Services offered

- 14.1.3.3 Recent developments

- 14.1.3.3.1 Product launches

- 14.1.3.3.2 Deals

- 14.1.3.4 MnM view

- 14.1.3.4.1 Key strengths

- 14.1.3.4.2 Strategic choices

- 14.1.3.4.3 Weaknesses and competitive threats

- 14.1.4 SYNGENTA GROUP

- 14.1.4.1 Business overview

- 14.1.4.2 Products/Solutions/Services offered

- 14.1.4.3 Recent developments

- 14.1.4.3.1 Product launches

- 14.1.4.3.2 Deals

- 14.1.4.3.3 Expansions

- 14.1.4.4 MnM view

- 14.1.4.4.1 Key strengths

- 14.1.4.4.2 Strategic choices

- 14.1.4.4.3 Weaknesses and competitive threats

- 14.1.5 FMC CORPORATION

- 14.1.5.1 Business overview

- 14.1.5.2 Products/Solutions/Services offered

- 14.1.5.3 Recent developments

- 14.1.5.3.1 Product launches

- 14.1.5.3.2 Deals

- 14.1.5.3.3 Expansions

- 14.1.5.3.4 Other developments

- 14.1.5.4 MnM view

- 14.1.5.4.1 Key strengths

- 14.1.5.4.2 Strategic choices

- 14.1.5.4.3 Weaknesses and competitive threats

- 14.1.6 UPL

- 14.1.6.1 Business overview

- 14.1.6.2 Products/Solutions/Services offered

- 14.1.6.3 Recent developments

- 14.1.6.3.1 Product launches

- 14.1.6.3.2 Deals

- 14.1.6.4 MnM view

- 14.1.7 SUMITOMO CHEMICAL CO., LTD.

- 14.1.7.1 Business overview

- 14.1.7.2 Products/Solutions/Services offered

- 14.1.7.3 Recent developments

- 14.1.7.3.1 Deals

- 14.1.7.3.1 Expansions

- 14.1.7.4 MnM view

- 14.1.8 NUFARM

- 14.1.8.1 Business overview

- 14.1.8.2 Products/Solutions/Services offered

- 14.1.8.3 Recent developments

- 14.1.8.3.1 Deals

- 14.1.8.4 MnM view

- 14.1.9 NOVONESIS GROUP

- 14.1.9.1 Business overview

- 14.1.9.2 Products/Solutions/Services offered

- 14.1.9.3 Recent developments

- 14.1.9.3.1 Product launches

- 14.1.9.3.2 Deals

- 14.1.9.4 MnM view

- 14.1.10 BIOCERES CROP SOLUTIONS

- 14.1.10.1 Business overview

- 14.1.10.2 Products/Solutions/Services offered

- 14.1.10.3 Recent developments

- 14.1.10.3.1 Product launches

- 14.1.10.3.2 Deals

- 14.1.10.4 MnM view

- 14.1.11 KOPPERT

- 14.1.11.1 Business overview

- 14.1.11.2 Products/Solutions/Services offered

- 14.1.11.3 Recent developments

- 14.1.11.3.1 Deals

- 14.1.11.3.2 Expansions

- 14.1.11.4 MnM view

- 14.1.12 CERTIS USA L.L.C.

- 14.1.12.1 Business overview

- 14.1.12.2 Products/Solutions/Services offered

- 14.1.12.3 Recent developments

- 14.1.12.3.1 Product launches

- 14.1.12.3.2 Deals

- 14.1.12.3.3 Other developments

- 14.1.12.4 MnM view

- 14.1.13 GOWAN COMPANY

- 14.1.13.1 Business overview

- 14.1.13.2 Product/Solutions/Services offered

- 14.1.13.3 Recent developments

- 14.1.13.3.1 Product launches

- 14.1.13.3.2 Deals

- 14.1.13.4 MnM view

- 14.1.14 BIOBEST GROUP NV

- 14.1.14.1 Business overview

- 14.1.14.2 Product/Solutions/Services offered

- 14.1.14.3 Recent developments

- 14.1.14.3.1 Product launches

- 14.1.14.3.2 Deals

- 14.1.14.3.3 Expansions

- 14.1.14.4 MnM view

- 14.1.15 LALLEMAND INC

- 14.1.15.1 Business overview

- 14.1.15.2 Products/Solutions/Services offered

- 14.1.15.3 Recent developments

- 14.1.15.3.1 Product launches

- 14.1.15.3.2 Deals

- 14.1.15.4 MnM view

- 14.1.1 BASF SE

- 14.2 OTHER PLAYERS (SMES/STARTUPS)

- 14.2.1 IPL BIOLOGICALS

- 14.2.1.1 Business overview

- 14.2.1.2 Products/Solutions/Services offered

- 14.2.1.3 Recent developments

- 14.2.1.3.1 Product launches

- 14.2.1.3.2 Deals

- 14.2.1.3.3 Expansions

- 14.2.1.3.4 Other developments

- 14.2.2 ROVENSA NEXT

- 14.2.2.1 Business overview

- 14.2.2.2 Products/Solutions/Services offered

- 14.2.2.3 Recent developments

- 14.2.2.3.1 Product launches

- 14.2.2.3.2 Deals

- 14.2.2.3.3 Expansions

- 14.2.2.3.4 Other developments

- 14.2.3 VESTARON CORPORATION

- 14.2.3.1 Business overview

- 14.2.3.2 Products/Solutions/Services offered

- 14.2.3.3 Recent developments

- 14.2.3.3.1 Product launches

- 14.2.3.3.2 Deals

- 14.2.4 AGRILIFE

- 14.2.4.1 Business overview

- 14.2.4.2 Product/Solutions/Services offered

- 14.2.5 STK BIO-AG TECHNOLOGIES

- 14.2.5.1 Business overview

- 14.2.5.2 Products/Solutions/Services offered

- 14.2.5.3 Recent developments

- 14.2.5.3.1 Product launches

- 14.2.6 KAY BEE BIO ORGANICS PVT. LTD.

- 14.2.7 ANDERMATT GROUP AG

- 14.2.8 GENICA

- 14.2.9 SEIPASA, S.A.

- 14.2.10 BOTANO HEALTH

- 14.2.1 IPL BIOLOGICALS

15 ADJACENT AND RELATED MARKETS

- 15.1 INTRODUCTION

- 15.2 LIMITATIONS

- 15.3 AGRICULTURAL BIOLOGICALS MARKET

- 15.3.1 MARKET DEFINITION

- 15.3.2 MARKET OVERVIEW

- 15.4 BIORATIONAL PESTICIDES MARKET

- 15.4.1 MARKET DEFINITION

- 15.4.2 MARKET OVERVIEW

- 15.5 BIOCONTROL MARKET

- 15.5.1 MARKET DEFINITION

- 15.5.2 MARKET OVERVIEW

16 APPENDIX

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS