|

|

市場調査レポート

商品コード

1427278

半導体IPの世界市場:設計IP別、IPソース別、IPコア別、インターフェースタイプ別、エンドユーザー別、業界別、地域別 - 予測(~2029年)Semiconductor Intellectual Property (IP) Market by Design IP (Processor IP, Memory IP, Interface IP), IP Source (Royalty, Licensing), IP Core (Hard IP, Soft IP), Interface Type, End User, Vertical and Region - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| 半導体IPの世界市場:設計IP別、IPソース別、IPコア別、インターフェースタイプ別、エンドユーザー別、業界別、地域別 - 予測(~2029年) |

|

出版日: 2024年02月13日

発行: MarketsandMarkets

ページ情報: 英文 251 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

世界の半導体IPの市場規模は、2024年に75億米ドル、2029年までに112億米ドルに達し、2024年~2029年にCAGRで8.5%の成長が予測されています。

組み込みデジタルシグナルプロセッサー(DSP)IPとプログラマブルデジタルシグナルプロセッサー(DSP)IPセグメントの拡大と、自動車や通信データセンターにおける先端半導体部品需要の高まりが、半導体IP市場に有利な機会を提供しています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2029年 |

| 単位 | 10億米ドル |

| セグメント | 設計IP別、IPソース別、IPコア別、インターフェースタイプ別、エンドユーザー別、業界別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

「インターフェースIPセグメントが予測期間に最高の成長率を記録します。」

インターフェースIPセグメントが予測期間に最高のCAGRを記録する見込みです。イーサネット、PCIe、SerDesなどのインタフェースプロトコルは、ハイパースカラー、データ中心ストレージ、データセンター、有線/無線ネットワーキング、新興のAI用途などで需要が高く、いずれも高い帯域幅を必要とします。エンターテインメントデバイス、セキュリティカメラ、スマートホームデバイスも大量のメディアコンテンツを処理するため、増加するマルチメディア処理と接続性のニーズに対応する効率的なインターフェースIPを必要とします。これらすべての要因が、予測期間のインターフェースIPセグメントの成長に寄与すると予測されます。

「アジア太平洋の通信データセンター業界セグメントが予測期間にもっとも高い成長率を記録する見込みです。」

アジア太平洋の通信データセンター業界セグメントは、5G、IoT、エッジデバイスの今後の動向により、予測期間にもっとも高い成長率で成長する見込みです。5G技術はモバイル通信を統合し、IoTを通じて人々とデバイスを接続します。長期的なビジョンとして、5G技術は製品開発を促進し、生産性を向上させ、新産業の登場を可能にします。これらの要因により、アジア太平洋の通信データセンター向け半導体IP市場の成長に新たな道が開けると予測されています。

「欧州の英国が予測期間に第2位の市場シェアを占める見込みです。」

英国は欧州の半導体IP市場で第2位の地位を占めており、今後数年間は2番目に高いCAGRで成長すると予測されています。Bentley Motors、Aston Martin、McLaren、Rolls-Royce、Jaguar Land Rover、Johnson Mattheyなど、自動車と工業製造企業の力強いプレゼンスが、英国の半導体IP市場の成長を支えると予測されます。この地域の主要市場企業は、Arm Limited(英国)、Imagination Technologies(英国)、ALPHAWAVE SEMI(英国)です。Arm Limited(英国)だけで世界の半導体IP市場の約40%を占めています。

当レポートでは、世界の半導体IP市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

- 半導体IP市場の企業にとって大きな機会

- 半導体IP市場:IPソース別

- 半導体IP市場:IPコア別

- アジア太平洋の半導体IP市場:業界別、国別

- 半導体IP市場:業界別

- 半導体IP市場:国別

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 顧客のビジネスに影響を与える動向/混乱

- 価格分析

- バリューチェーン分析

- エコシステム分析

- 半導体IPプロバイダー

- 半導体企業

- OEM

- 技術動向

- 半導体産業で人気を集めるRISC-Vプロセッサー技術

- 半導体IP産業の成長を促進するAI、IoT、その他の主要技術

- 需要を促進する垂直統合システム企業の登場

- ケーススタディ分析

- 特許分析

- 貿易(HSコード8542)と関税分析

- 貿易分析

- 料金分析

- 主な会議とイベント(2024年)

- 規制情勢

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

第6章 半導体IP市場:設計IP別

- イントロダクション

- プロセッサーIP

- マイクロプロセッサーユニット(MPU)

- デジタルシグナルプロセッサー

- インターフェースIP

- メモリIP

- その他のIP

- デジタルアナログコンバーター(DAC)

- アナログデジタルコンバーター(ADC)

第7章 半導体IP市場:IPソース別

- イントロダクション

- ロイヤルティ

- ライセンシング

第8章 半導体IP市場:IPコア別

- イントロダクション

- ソフトIPコア

- ハードIPコア

第9章 半導体IP市場:業界別

- イントロダクション

- コンシューマーエレクトロニクス

- 通信・データセンター

- 工業

- 自動車

- 商業

- その他の業界

第10章 半導体IP市場:エンドユーザー別

- イントロダクション

- 組み込みデバイスメーカー

- ファウンドリ

- その他のエンドユーザー

第11章 半導体IP市場:インターフェースタイプ別

- イントロダクション

- USB

- PCIe

- DDR

- イーサネット、ダイツーダイ、SerDes

- MIPI

- HDMI、SATA、その他

第12章 半導体IP市場:地域別

- イントロダクション

- 北米

- 北米の不況の影響

- 米国

- カナダ

- メキシコ

- 欧州

- 欧州の景気後退の影響

- ドイツ

- 英国

- フランス

- その他の欧州

- アジア太平洋

- アジア太平洋の不況の影響

- 日本

- 中国

- 韓国

- 台湾

- その他のアジア太平洋

- その他の地域

- その他の地域の不況の影響

- 南米

- GCC諸国

- その他の中東・アフリカ

第13章 競合情勢

- 概要

- 主要企業が採用した戦略(2021年~2023年)

- 上位5社の収益分析(2021年~2023年)

- 市場シェア分析(2023年)

- 企業の評価マトリクス(2023年)

- スタートアップ/中小企業の評価マトリクス(2023年)

- 競合シナリオと動向

第14章 企業プロファイル

- イントロダクション

- 主要企業

- ARM LIMITED

- SYNOPSYS, INC.

- CADENCE DESIGN SYSTEMS, INC.

- IMAGINATION TECHNOLOGIES

- CEVA, INC.

- LATTICE SEMICONDUCTOR

- RAMBUS

- EMEMORY TECHNOLOGY INC.

- SILICON STORAGE TECHNOLOGY, INC.

- VERISILICON

- その他の企業

- ACHRONIX SEMICONDUCTOR CORPORATION

- ALPHAWAVE SEMI

- ANALOG BITS

- ARTERIS, INC.

- FRONTGRADE GAISLER

- DOLPHIN DESIGN

- DREAM CHIP TECHNOLOGIES GMBH

- EUREKA TECHNOLOGY, INC.

- FARADAY TECHNOLOGY CORPORATION

- M31 TECHNOLOGY CORPORATION

- SIFIVE, INC.

- RENESAS ELECTRONICS CORPORATION

- SILVACO, INC.

- TRANSPACKET

- ADVANCED MICRO DEVICES, INC.

第15章 付録

The semiconductor intellectual property (IP) market was valued at USD 7.5 billion in 2024 and is projected to reach USD 11.2 billion by 2029; it is expected to grow at a CAGR of 8.5% from 2024 to 2029. Expanding embedded digital signal processor (DSP) IP and programmable digital signal processor (DSP) IP segments and rising demand for advanced semiconductor components in automotive and telecommunications & data center verticals provide lucrative opportunities to the semiconductor intellectual property (IP) market.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD Billion) |

| Segments | By Design IP, IP Source, IP Core, Interface Type, End User, Vertical and Region |

| Regions covered | North America, Europe, APAC, RoW |

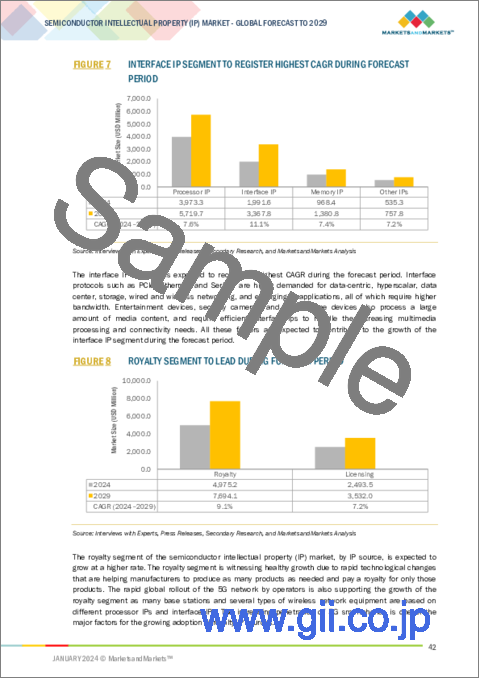

"Interface IP segment to register highest growth rate during the forecast period."

The interface IP segment is expected to record the highest CAGR during the forecast period. Interface protocols such as Ethernet, PCIe, and SerDes are highly demanded for hyperscalar, data-centric storage, data centers, wired and wireless networking, and emerging AI applications, all of which require higher bandwidth. Entertainment devices, security cameras, and smart home devices also process a large amount of media content and require efficient interface Ips to handle the increasing multimedia processing and connectivity needs. All these factors are expected to contribute to the growth of the interface IP segment during the forecast period.

"Telecommunication & data center vertical segment in Asia Pacific region is expected to register highest growth rate during the forecast period."

The telecommunication & data center vertical in the Asia Pacific region is expected to grow with the highest growth rate during the forecast period attributed to the upcoming trends of 5G, IoT, and edge devices. 5G technology will unify mobile communication and connect individuals with devices through IoT. The long-term vision is that 5G technology will encourage product development, increase productivity, and allow new industries to emerge. These factors are expected to create new avenues for the growth of the semiconductor intellectual property (IP) market for the telecommunication & data center vertical in the Asia Pacific region.

"UK in Europe is expected to hold the second-largest market share during the forecast period."

The UK holds the second position in the semiconductor intellectual property (IP) market in Europe and is expected to grow at the second-highest CAGR over the next few years. The strong presence of automotive and industrial manufacturing companies, such as Bentley Motors, Aston Martin, McLaren, Rolls-Royce, Jaguar Land Rover, and Johnson Matthey, is expected to support the growth of the semiconductor intellectual property (IP) market in the UK. The major market players in this region are Arm Limited (UK), Imagination Technologies (UK), and ALPHAWAVE SEMI (UK). Arm Limited (UK) alone holds about 40% of the global semiconductor intellectual property (IP) market.

Following is the breakup of the profiles of the primary participants for the report.

- By Company Type: Tier 1 - 45 %, Tier 2 - 35%, and Tier 3 - 20%

- By Designation: C-Level Executives -32%, Directors- 40%, and Others - 28%

- By Region: North America- 37%, Europe- 15%, Asia Pacific - 40%, and RoW - 8%

The report profiles key semiconductor intellectual property (IP) market players and analyzes their market shares. Players profiled in this report are Arm Limited (UK), Synopsys, Inc. (US), Cadence Design Systems, Inc. (US), Imagination Technologies (UK), CEVA, Inc. (US), Lattice Semiconductor (US), Rambus (US), eMemory Technology Inc. (Taiwan), Silicon Storage Technology, Inc. (US), etc.

Research Coverage

The report defines, describes, and forecasts the semiconductor intellectual property (IP) market based on Design IP, IP Source, IP Core, End User, Interface Type, Vertical, and Region. It provides detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the semiconductor intellectual property (IP) market. It also analyses competitive developments such as product launches, acquisitions, expansions, contracts, partnerships, and actions conducted by the key players to grow in the market.

Reasons to Buy This Report

The report will help the market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall high-speed data converter and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

Analysis of key drivers (Advancements in multicore technology for consumer electronics, increasing demand for modern System on Chip (SoC) designs, the decline in cost associated with chip designing, growing adoption of connected devices for daily use, and increasing demand for electronics in healthcare and telecommunications industries), restraints (Constant technological changes resulting in increased expenditure, and concerns related to Moore's law), opportunities (Expanding embedded digital signal processor (DSP) IP and programmable digital signal processor (DSP) IP segments, and rising demand for advanced semiconductor components in automotive and telecommunications & data center verticals), and challenges (Increasing IP thefts and counterfeiting) influencing the growth of the semiconductor intellectual property (IP) market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the semiconductor intellectual property (IP) market

- Market Development: Comprehensive information about lucrative markets - the report analyses the semiconductor intellectual property (IP) market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the semiconductor intellectual property (IP) market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Arm Limited (UK), Synopsys, Inc. (US), Cadence Design Systems, Inc. (US), Imagination Technologies (UK), CEVA, Inc. (US), Lattice Semiconductor (US), Rambus (US), eMemory Technology Inc. (Taiwan), Silicon Storage Technology, Inc. (US), VeriSilicon (China), Achronix Semiconductor Corporation (US), ALPHAWAVE SEMI (UK), Analog Bits (US), ARTERIS, INC (US), Frontgrade Gaisler (Sweden), Dolphin Design (France, Dream Chip Technologies GmbH (Germany), Eureka Technology, Inc. (US), among others in the semiconductor intellectual property (IP) market strategies. The report also helps stakeholders understand the pulse of the semiconductor intellectual property (IP) market and provides them with information on key market drivers, restraints, challenges, and opportunities

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET SEGMENTATION

- 1.3.2 REGIONAL SCOPE

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

- 1.6.1 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Major secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Participants in primary interviews

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Key industry insights

- 2.1.2.4 Breakdown of primaries

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 3 RESEARCH FLOW OF MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach for estimating market size through bottom-up analysis (demand side)

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach for estimating market size through top-down analysis (supply side)

- 2.2.2.2 Approach for capturing market size from supply side (approach 1)

- 2.2.2.3 Approach for capturing market size from supply side (approach 2)

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 6 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 PARAMETERS CONSIDERED TO ANALYZE RECESSION IMPACT ON SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET

- 2.6 RISK ASSESSMENT

- 2.7 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

- FIGURE 7 INTERFACE IP SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 8 ROYALTY SEGMENT TO LEAD DURING FORECAST PERIOD

- FIGURE 9 CONSUMER ELECTRONICS VERTICAL TO DOMINATE DURING FORECAST PERIOD

- FIGURE 10 ASIA PACIFIC ACCOUNTED FOR LARGEST MARKET SHARE IN 2023

4 PREMIUM INSIGHTS

- 4.1 MAJOR OPPORTUNITIES FOR PLAYERS IN SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET

- FIGURE 11 EXPANDING TELECOMMUNICATIONS & DATA CENTER AND AUTOMOTIVE VERTICALS TO DRIVE MARKET GROWTH

- 4.2 SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET, BY IP SOURCE

- FIGURE 12 ROYALTY SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- 4.3 SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET, BY IP CORE

- FIGURE 13 SOFT IP CORE SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- 4.4 SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET IN ASIA PACIFIC, BY VERTICAL AND COUNTRY

- FIGURE 14 CHINA AND CONSUMER ELECTRONICS VERTICAL TO HOLD LARGEST SHARES OF ASIA PACIFIC MARKET IN 2029

- 4.5 SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET, BY VERTICAL

- FIGURE 15 CONSUMER ELECTRONICS VERTICAL TO HOLD LARGEST MARKET SHARE IN 2029

- 4.6 SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET, BY COUNTRY

- FIGURE 16 SOUTH KOREA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 17 SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Advancements in multicore technology for consumer electronics

- 5.2.1.2 Increasing demand for modern System on Chip (SoC) designs

- 5.2.1.3 Decline in cost associated with chip designing

- 5.2.1.4 Growing adoption of connected devices for daily use

- 5.2.1.5 Increasing demand for electronics in healthcare and telecommunications industries

- FIGURE 18 IMPACT OF DRIVERS ON SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET

- 5.2.2 RESTRAINTS

- 5.2.2.1 Constant technological changes resulting in increased expenditure

- 5.2.2.2 Concerns related to Moore's Law

- FIGURE 19 IMPACT OF RESTRAINTS ON SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Expanding embedded digital signal processor (DSP) IP and programmable digital signal processor (DSP) IP segments

- 5.2.3.2 Rising demand for advanced semiconductor components in automotive and telecommunications & data center verticals

- FIGURE 20 IMPACT OF OPPORTUNITIES ON SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET

- 5.2.4 CHALLENGES

- 5.2.4.1 Increasing IP thefts and counterfeiting

- FIGURE 21 IMPACT OF CHALLENGES ON SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 22 TRENDS INFLUENCING SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) BUSINESS OWNERS

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE TREND, BY DESIGN IP

- 5.5 VALUE CHAIN ANALYSIS

- FIGURE 23 SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET: VALUE CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- FIGURE 24 SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) ECOSYSTEM

- 5.6.1 SEMICONDUCTOR IP PROVIDERS

- 5.6.2 SEMICONDUCTOR COMPANIES

- 5.6.3 OEMS

- TABLE 1 ROLE OF PLAYERS IN SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) ECOSYSTEM

- 5.7 TECHNOLOGY TRENDS

- 5.7.1 RISC-V PROCESSOR TECHNOLOGY TO GAIN POPULARITY IN SEMICONDUCTOR INDUSTRY

- 5.7.2 AI, IOT, AND OTHER KEY TECHNOLOGIES TO DRIVE GROWTH OF SEMICONDUCTOR IP INDUSTRY

- 5.7.3 EMERGENCE OF VERTICALLY INTEGRATED SYSTEM COMPANIES TO DRIVE DEMAND

- 5.8 CASE STUDY ANALYSIS

- 5.8.1 XCONN ACHIEVES FIRST-PASS SILICON SUCCESS FOR CXL SWITCH SOC WITH SYNOPSYS' CXL AND PCI EXPRESS IP PRODUCTS

- 5.8.2 DIGITAL CORE DESIGN ASSISTS TEXAS ADVANCED OPTOELECTRONICS SOLUTIONS TO IMPROVE PERFORMANCE EFFICIENCY

- 5.8.3 SYNOPSYS HELPS NOVATEK TO ACHIEVE FIRST-PASS SILICON SUCCESS FOR MOBILE DISPLAY SOC

- 5.9 PATENT ANALYSIS

- FIGURE 25 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS

- TABLE 2 TOP 20 PATENT OWNERS IN LAST 10 YEARS (US)

- FIGURE 26 NUMBER OF PATENTS GRANTED PER YEAR FROM 2012 TO 2022

- 5.9.1 KEY PATENTS

- TABLE 3 MAJOR PATENTS IN SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET

- 5.10 TRADE (HS CODE 8542) AND TARIFF ANALYSIS

- 5.10.1 TRADE ANALYSIS

- FIGURE 27 IMPORT DATA FOR PRODUCTS COVERED UNDER HS CODE 8542, BY COUNTRY, 2018-2022 (USD THOUSAND)

- FIGURE 28 EXPORT DATA FOR PRODUCTS COVERED UNDER HS CODE 8542, BY COUNTRY, 2018-2022 (USD THOUSAND)

- 5.10.2 TARIFF ANALYSIS

- TABLE 4 MFN TARIFFS FOR HS CODE 8542-COMPLIANT PRODUCTS EXPORTED BY CHINA

- TABLE 5 MFN TARIFFS FOR HS CODE 8542-COMPLIANT PRODUCTS EXPORTED BY SINGAPORE

- TABLE 6 MFN TARIFFS FOR HS CODE 8542-COMPLIANT PRODUCTS EXPORTED BY REPUBLIC OF KOREA

- 5.11 KEY CONFERENCES AND EVENTS, 2024

- TABLE 7 SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET: CONFERENCES AND EVENTS

- 5.12 REGULATORY LANDSCAPE

- 5.12.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 CODES AND STANDARDS RELATED TO SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET

- 5.13 PORTER'S FIVE FORCES ANALYSIS

- TABLE 13 IMPACT OF PORTER'S FIVE FORCES ON SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET

- FIGURE 29 SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.13.1 THREAT OF NEW ENTRANTS

- 5.13.2 THREAT OF SUBSTITUTES

- 5.13.3 BARGAINING POWER OF SUPPLIERS

- 5.13.4 BARGAINING POWER OF BUYERS

- 5.13.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 30 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- TABLE 14 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- 5.14.2 BUYING CRITERIA

- FIGURE 31 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- TABLE 15 KEY BUYING CRITERIA, BY TOP THREE VERTICALS

6 SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET, BY DESIGN IP

- 6.1 INTRODUCTION

- FIGURE 32 SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET, BY DESIGN IP

- FIGURE 33 INTERFACE IP SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 16 SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET, BY DESIGN IP, 2020-2023 (USD MILLION)

- TABLE 17 SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET, BY DESIGN IP, 2024-2029 (USD MILLION)

- 6.2 PROCESSOR IP

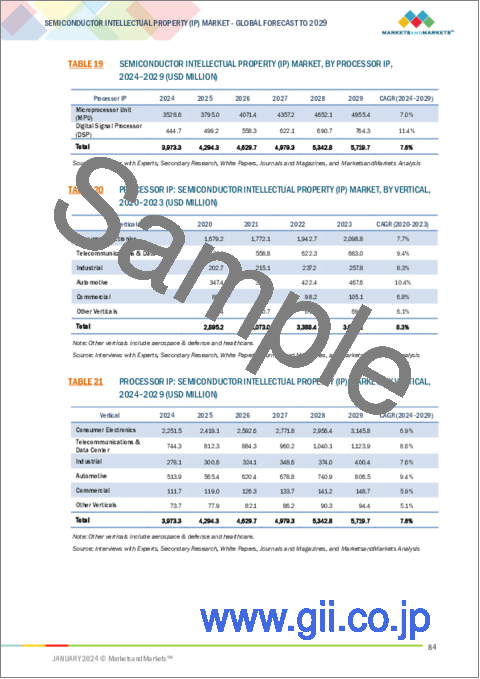

- TABLE 18 SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET, BY PROCESSOR IP, 2020-2023 (USD MILLION)

- TABLE 19 SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET, BY PROCESSOR IP, 2024-2029 (USD MILLION)

- TABLE 20 PROCESSOR IP: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 21 PROCESSOR IP: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 22 PROCESSOR IP: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET, BY IP SOURCE, 2020-2023 (USD MILLION)

- TABLE 23 PROCESSOR IP: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET, BY IP SOURCE, 2024-2029 (USD MILLION)

- TABLE 24 PROCESSOR IP: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET FOR CONSUMER ELECTRONICS VERTICAL, BY REGION, 2020-2023 (USD MILLION)

- TABLE 25 PROCESSOR IP: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET FOR CONSUMER ELECTRONICS VERTICAL, BY REGION, 2024-2029 (USD MILLION)

- TABLE 26 PROCESSOR IP: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET FOR TELECOMMUNICATIONS & DATA CENTER VERTICAL, BY REGION, 2020-2023 (USD MILLION)

- TABLE 27 PROCESSOR IP: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET FOR TELECOMMUNICATIONS & DATA CENTER VERTICAL, BY REGION, 2024-2029 (USD MILLION)

- TABLE 28 PROCESSOR IP: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET FOR INDUSTRIAL VERTICAL, BY REGION, 2020-2023 (USD MILLION)

- TABLE 29 PROCESSOR IP: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET FOR INDUSTRIAL VERTICAL, BY REGION, 2024-2029 (USD MILLION)

- TABLE 30 PROCESSOR IP: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET FOR AUTOMOTIVE VERTICAL, BY REGION, 2020-2023 (USD MILLION)

- TABLE 31 PROCESSOR IP: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET FOR AUTOMOTIVE VERTICAL, BY REGION, 2024-2029 (USD MILLION)

- TABLE 32 PROCESSOR IP: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET FOR COMMERCIAL VERTICAL, BY REGION, 2020-2023 (USD MILLION)

- TABLE 33 PROCESSOR IP: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET FOR COMMERCIAL VERTICAL, BY REGION, 2024-2029 (USD MILLION)

- TABLE 34 PROCESSOR IP: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET FOR OTHER VERTICALS, BY REGION, 2020-2023 (USD MILLION)

- TABLE 35 PROCESSOR IP: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET FOR OTHER VERTICALS, BY REGION, 2024-2029 (USD MILLION)

- 6.2.1 MICROPROCESSOR UNIT (MPU)

- 6.2.1.1 Increasing demand for use across devices to boost market

- TABLE 36 MICROPROCESSOR CLASSIFICATION

- 6.2.2 DIGITAL SIGNAL PROCESSOR

- 6.2.2.1 Rising demand for DSP IPs to drive market

- 6.3 INTERFACE IP

- 6.3.1 RISING DEMAND FOR USE IN VARIOUS APPLICATIONS TO FUEL MARKET

- TABLE 37 INTERFACE IP: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 38 INTERFACE IP: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 39 INTERFACE IP: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET, BY IP SOURCE, 2020-2023 (USD MILLION)

- TABLE 40 INTERFACE IP: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET, BY IP SOURCE, 2024-2029 (USD MILLION)

- TABLE 41 INTERFACE IP: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET FOR CONSUMER ELECTRONICS VERTICAL, BY REGION, 2020-2023 (USD MILLION)

- TABLE 42 INTERFACE IP: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET FOR CONSUMER ELECTRONICS VERTICAL, BY REGION, 2024-2029 (USD MILLION)

- TABLE 43 INTERFACE IP: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET FOR TELECOMMUNICATIONS & DATA CENTER VERTICAL, BY REGION, 2020-2023 (USD MILLION)

- TABLE 44 INTERFACE IP: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET FOR TELECOMMUNICATIONS & DATA CENTER VERTICAL, BY REGION, 2024-2029 (USD MILLION)

- TABLE 45 INTERFACE IP: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) FOR INDUSTRIAL VERTICAL, BY REGION, 2020-2023 (USD MILLION)

- TABLE 46 INTERFACE IP: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET FOR INDUSTRIAL VERTICAL, BY REGION, 2024-2029 (USD MILLION)

- TABLE 47 INTERFACE IP: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET FOR AUTOMOTIVE VERTICAL, BY REGION, 2020-2023 (USD MILLION)

- TABLE 48 INTERFACE IP: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET FOR AUTOMOTIVE VERTICAL, BY REGION, 2024-2029 (USD MILLION)

- TABLE 49 INTERFACE IP: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET FOR COMMERCIAL VERTICAL, BY REGION, 2020-2023 (USD MILLION)

- TABLE 50 INTERFACE IP: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET FOR COMMERCIAL VERTICAL, BY REGION, 2024-2029 (USD MILLION)

- TABLE 51 INTERFACE IP: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET FOR OTHER VERTICALS, BY REGION, 2020-2023 (USD MILLION)

- TABLE 52 INTERFACE IP: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) FOR OTHER VERTICALS, BY REGION, 2024-2029 (USD MILLION)

- 6.4 MEMORY IP

- 6.4.1 INCREASING DEMAND FOR MEMORY-DEPENDENT APPLICATIONS TO DRIVE SEGMENT GROWTH

- TABLE 53 MEMORY IP: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 54 MEMORY IP: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 55 MEMORY IP: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET, BY IP SOURCE, 2020-2023 (USD MILLION)

- TABLE 56 MEMORY IP: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET, BY IP SOURCE, 2024-2029 (USD MILLION)

- TABLE 57 MEMORY IP: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET FOR CONSUMER ELECTRONICS VERTICAL, BY REGION, 2020-2023 (USD MILLION)

- TABLE 58 MEMORY IP: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET FOR CONSUMER ELECTRONICS VERTICAL, BY REGION, 2024-2029 (USD MILLION)

- TABLE 59 MEMORY IP: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET FOR TELECOMMUNICATIONS & DATA CENTER VERTICAL, BY REGION, 2020-2023 (USD MILLION)

- TABLE 60 MEMORY IP: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET FOR TELECOMMUNICATIONS & DATA CENTER VERTICAL, BY REGION, 2024-2029 (USD MILLION)

- TABLE 61 MEMORY IP: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET FOR INDUSTRIAL VERTICAL, BY REGION, 2020-2023 (USD MILLION)

- TABLE 62 MEMORY IP: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET FOR INDUSTRIAL VERTICAL, BY REGION, 2024-2029 (USD MILLION)

- TABLE 63 MEMORY IP: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET FOR AUTOMOTIVE VERTICAL, BY REGION, 2020-2023 (USD MILLION)

- TABLE 64 MEMORY IP: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET FOR AUTOMOTIVE VERTICAL, BY REGION, 2024-2029 (USD MILLION)

- TABLE 65 MEMORY IP: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET FOR COMMERCIAL VERTICAL, BY REGION, 2020-2023 (USD MILLION)

- TABLE 66 MEMORY IP: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET FOR COMMERCIAL VERTICAL, BY REGION, 2024-2029 (USD MILLION)

- TABLE 67 MEMORY IP: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET FOR OTHER VERTICALS, BY REGION, 2020-2023 (USD MILLION)

- TABLE 68 MEMORY IP: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET FOR OTHER VERTICALS, BY REGION, 2024-2029 (USD MILLION)

- 6.5 OTHER IPS

- 6.5.1 DIGITAL-TO-ANALOG CONVERTER (DAC)

- 6.5.2 ANALOG-TO-DIGITAL CONVERTER (ADC)

- TABLE 69 OTHER IPS: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 70 OTHER IPS: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 71 OTHER IPS: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET, BY IP SOURCE, 2020-2023 (USD MILLION)

- TABLE 72 OTHER IPS: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET, BY IP SOURCE, 2024-2029 (USD MILLION)

- TABLE 73 OTHER IPS: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET FOR CONSUMER ELECTRONICS VERTICAL, BY REGION, 2020-2023 (USD MILLION)

- TABLE 74 OTHER IPS: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET FOR CONSUMER ELECTRONICS VERTICAL, BY REGION, 2024-2029 (USD MILLION)

- TABLE 75 OTHER IPS: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET FOR TELECOMMUNICATIONS & DATA CENTER VERTICAL, BY REGION, 2020-2023 (USD MILLION)

- TABLE 76 OTHER IPS: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET FOR TELECOMMUNICATIONS & DATA CENTER VERTICAL, BY REGION, 2024-2029 (USD MILLION)

- TABLE 77 OTHER IPS: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET FOR INDUSTRIAL VERTICAL, BY REGION, 2020-2023 (USD MILLION)

- TABLE 78 OTHER IPS: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET FOR INDUSTRIAL VERTICAL, BY REGION, 2024-2029 (USD MILLION)

- TABLE 79 OTHER IPS: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET FOR AUTOMOTIVE VERTICAL, BY REGION, 2020-2023 (USD MILLION)

- TABLE 80 OTHER IPS: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET FOR AUTOMOTIVE VERTICAL, BY REGION, 2024-2029 (USD MILLION)

- TABLE 81 OTHER IPS: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET FOR COMMERCIAL VERTICAL, BY REGION, 2020-2023 (USD MILLION)

- TABLE 82 OTHER IPS: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET FOR COMMERCIAL VERTICAL, BY REGION, 2024-2029 (USD MILLION)

- TABLE 83 OTHER IPS: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET FOR OTHER VERTICALS, BY REGION, 2020-2023 (USD MILLION)

- TABLE 84 OTHER IPS: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET FOR OTHER VERTICALS, BY REGION, 2024-2029 (USD MILLION)

7 SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET, BY IP SOURCE

- 7.1 INTRODUCTION

- FIGURE 34 SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET, BY IP SOURCE

- FIGURE 35 ROYALTY SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- TABLE 85 SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET, BY IP SOURCE, 2020-2023 (USD MILLION)

- TABLE 86 SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET, BY IP SOURCE, 2024-2029 (USD MILLION)

- 7.2 ROYALTY

- 7.2.1 INCREASING PREFERENCE FOR ROYALTY-BASED BUSINESS MODEL TO DRIVE MARKET

- TABLE 87 ROYALTY: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET, BY DESIGN IP, 2020-2023 (USD MILLION)

- TABLE 88 ROYALTY: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET, BY DESIGN IP, 2024-2029 (USD MILLION)

- 7.3 LICENSING

- 7.3.1 GROWING ADOPTION BY SMALL AND MEDIUM-SIZED VENDORS TO BOOST MARKET

- TABLE 89 LICENSING: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET, BY DESIGN IP, 2020-2023 (USD MILLION)

- TABLE 90 LICENSING: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET, BY DESIGN IP, 2024-2029 (USD MILLION)

8 SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET, BY IP CORE

- 8.1 INTRODUCTION

- FIGURE 36 SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET, BY IP CORE

- FIGURE 37 SOFT IP CORE SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- TABLE 91 SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET, BY IP CORE, 2020-2023 (USD MILLION)

- TABLE 92 SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET, BY IP CORE, 2024-2029 (USD MILLION)

- 8.2 SOFT IP CORE

- 8.2.1 EASE OF CUSTOMIZATION TO DRIVE MARKET

- 8.3 HARD IP CORE

- 8.3.1 SUPERIOR PERFORMANCE TO BOOST DEMAND

9 SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET, BY VERTICAL

- 9.1 INTRODUCTION

- FIGURE 38 SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET, BY VERTICAL

- FIGURE 39 CONSUMER ELECTRONICS VERTICAL TO LEAD DURING FORECAST PERIOD

- TABLE 93 SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 94 SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- 9.2 CONSUMER ELECTRONICS

- 9.2.1 RISING DEMAND FOR CONNECTED DEVICES TO DRIVE MARKET

- TABLE 95 CONSUMER ELECTRONICS: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET, BY DESIGN IP, 2020-2023 (USD MILLION)

- TABLE 96 CONSUMER ELECTRONICS: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET, BY DESIGN IP, 2024-2029 (USD MILLION)

- TABLE 97 CONSUMER ELECTRONICS: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 98 CONSUMER ELECTRONICS: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET, BY REGION, 2024-2029 (USD MILLION)

- 9.3 TELECOMMUNICATIONS & DATA CENTER

- 9.3.1 INCREASING NEED FOR ADVANCED PROCESSORS TO BOOST MARKET

- TABLE 99 TELECOMMUNICATIONS & DATA CENTER: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET, BY DESIGN IP, 2020-2023 (USD MILLION)

- TABLE 100 TELECOMMUNICATIONS & DATA CENTER: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET, BY DESIGN IP, 2024-2029 (USD MILLION)

- TABLE 101 TELECOMMUNICATIONS & DATA CENTER: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 102 TELECOMMUNICATIONS & DATA CENTER: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET, BY REGION, 2024-2029 (USD MILLION)

- 9.4 INDUSTRIAL

- 9.4.1 GROWING DEMAND FOR AUTOMATION AND APPLICATION-SPECIFIC SYSTEMS TO DRIVE MARKET

- TABLE 103 INDUSTRIAL: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET, BY DESIGN IP, 2020-2023 (USD MILLION)

- TABLE 104 INDUSTRIAL: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET, BY DESIGN IP, 2024-2029 (USD MILLION)

- TABLE 105 INDUSTRIAL: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 106 INDUSTRIAL: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET, BY REGION, 2024-2029 (USD MILLION)

- 9.5 AUTOMOTIVE

- 9.5.1 INCREASING DIGITALIZATION OF OPERATIONS TO FUEL MARKET

- TABLE 107 AUTOMOTIVE: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET, BY DESIGN IP, 2020-2023 (USD MILLION)

- TABLE 108 AUTOMOTIVE: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET, BY DESIGN IP, 2024-2029 (USD MILLION)

- TABLE 109 AUTOMOTIVE: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 110 AUTOMOTIVE: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET, BY REGION, 2024-2029 (USD MILLION)

- 9.6 COMMERCIAL

- 9.6.1 RISING NEED FOR ACCESS CONTROL SYSTEMS TO DRIVE DEMAND

- TABLE 111 COMMERCIAL: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET, BY DESIGN IP, 2020-2023 (USD MILLION)

- TABLE 112 COMMERCIAL: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET, BY DESIGN IP, 2024-2029 (USD MILLION)

- TABLE 113 COMMERCIAL: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 114 COMMERCIAL: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET, BY REGION, 2024-2029 (USD MILLION)

- 9.7 OTHER VERTICALS

- TABLE 115 OTHER VERTICALS: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET, BY DESIGN IP, 2020-2023 (USD MILLION)

- TABLE 116 OTHER VERTICALS: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET, BY DESIGN IP, 2024-2029 (USD MILLION)

- TABLE 117 OTHER VERTICALS: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 118 OTHER VERTICALS: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET, BY REGION, 2024-2029 (USD MILLION)

10 SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET, BY END USER

- 10.1 INTRODUCTION

- 10.2 INTEGRATED DEVICE MANUFACTURER

- 10.3 FOUNDRY

- 10.4 OTHER END USERS

11 SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET, BY INTERFACE TYPE

- 11.1 INTRODUCTION

- 11.2 UNIVERSAL SERIAL BUS (USB)

- 11.3 PERIPHERAL COMPONENT INTERCONNECT EXPRESS (PCIE)

- 11.4 DOUBLE DATA RATE (DDR)

- 11.5 ETHERNET, DIE-TO-DIE & SERDES

- 11.6 MOBILE INDUSTRY PROCESSOR INTERFACE (MIPI)

- 11.7 HDMI, SATA & OTHERS

12 SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET, BY REGION

- 12.1 INTRODUCTION

- FIGURE 40 SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET, BY REGION

- FIGURE 41 ASIA PACIFIC MARKET TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 119 SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 120 SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET, BY REGION, 2024-2029 (USD MILLION)

- 12.2 NORTH AMERICA

- FIGURE 42 NORTH AMERICA: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET, BY COUNTRY

- FIGURE 43 NORTH AMERICA: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET SNAPSHOT

- TABLE 121 NORTH AMERICA: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 122 NORTH AMERICA: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 123 NORTH AMERICA: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 124 NORTH AMERICA: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- 12.2.1 NORTH AMERICA: IMPACT OF RECESSION

- FIGURE 44 ANALYSIS OF SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET IN NORTH AMERICA: PRE- AND POST-RECESSION SCENARIOS

- 12.2.2 US

- 12.2.2.1 Increasing production of high-performance IP components to fuel market

- 12.2.3 CANADA

- 12.2.3.1 High demand for embedded electronics to drive market

- 12.2.4 MEXICO

- 12.2.4.1 Potential for foreign investment to drive market

- 12.3 EUROPE

- FIGURE 45 EUROPE: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET, BY COUNTRY

- FIGURE 46 EUROPE: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET SNAPSHOT

- TABLE 125 EUROPE: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 126 EUROPE: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 127 EUROPE: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 128 EUROPE: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- 12.3.1 EUROPE: IMPACT OF RECESSION

- FIGURE 47 ANALYSIS OF SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET IN EUROPE: PRE- AND POST-RECESSION SCENARIOS

- 12.3.2 GERMANY

- 12.3.2.1 High demand in automotive sector to drive market

- 12.3.3 UK

- 12.3.3.1 Presence of industry majors to boost market

- 12.3.4 FRANCE

- 12.3.4.1 Increasing preference for licensing IPs to drive market

- 12.3.5 REST OF EUROPE

- 12.4 ASIA PACIFIC

- FIGURE 48 ASIA PACIFIC: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET, BY COUNTRY

- FIGURE 49 ASIA PACIFIC: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET SNAPSHOT

- TABLE 129 ASIA PACIFIC: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 130 ASIA PACIFIC: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 131 ASIA PACIFIC: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET, BY COUNTRY, 2020-2023 (USD MILLION)

- TABLE 132 ASIA PACIFIC: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- 12.4.1 ASIA PACIFIC: IMPACT OF RECESSION

- FIGURE 50 ANALYSIS OF SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET IN ASIA PACIFIC: PRE- AND POST-RECESSION SCENARIOS

- 12.4.2 JAPAN

- 12.4.2.1 Increasing industrial automation to drive market

- 12.4.3 CHINA

- 12.4.3.1 Growing demand from smartphone companies to propel market

- 12.4.4 SOUTH KOREA

- 12.4.4.1 Increasing SoC development activities to fuel demand

- 12.4.5 TAIWAN

- 12.4.5.1 Presence of top chip-makers to drive market

- 12.4.6 REST OF ASIA PACIFIC

- 12.5 ROW

- FIGURE 51 ROW: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET, BY REGION

- TABLE 133 ROW: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET, BY VERTICAL, 2020-2023 (USD MILLION)

- TABLE 134 ROW: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET, BY VERTICAL, 2024-2029 (USD MILLION)

- TABLE 135 ROW: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET, BY REGION, 2020-2023 (USD MILLION)

- TABLE 136 ROW: SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET, BY REGION, 2024-2029 (USD MILLION)

- 12.5.1 ROW: IMPACT OF RECESSION

- FIGURE 52 ANALYSIS OF SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET IN ROW: PRE- AND POST-RECESSION SCENARIOS

- 12.5.2 SOUTH AMERICA

- 12.5.2.1 Increasing demand for consumer electronics to drive market

- 12.5.3 GCC COUNTRIES

- 12.5.3.1 Support for domestic electronics manufacturing to drive market

- 12.5.4 REST OF MIDDLE EAST & AFRICA

- 12.5.4.1 Increasing industrial automation to fuel market

13 COMPETITIVE LANDSCAPE

- 13.1 OVERVIEW

- 13.1.1 INTRODUCTION

- 13.2 STRATEGIES ADOPTED BY KEY PLAYERS (2021-2023)

- TABLE 137 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET

- 13.3 REVENUE ANALYSIS OF TOP FIVE PLAYERS (2021-2023)

- FIGURE 53 THREE-YEAR REVENUE ANALYSIS OF TOP MARKET PLAYERS, 2021-2023

- 13.4 MARKET SHARE ANALYSIS, 2023

- TABLE 138 SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET: DEGREE OF COMPETITION

- TABLE 139 SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET: RANKING ANALYSIS

- FIGURE 54 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2023

- 13.5 COMPANY EVALUATION MATRIX, 2023

- 13.5.1 STARS

- 13.5.2 EMERGING LEADERS

- 13.5.3 PERVASIVE PLAYERS

- 13.5.4 PARTICIPANTS

- FIGURE 55 SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET: COMPANY EVALUATION MATRIX, 2023

- 13.5.5 COMPANY FOOTPRINT

- TABLE 140 COMPANY DESIGN IP FOOTPRINT (20 COMPANIES)

- TABLE 141 COMPANY VERTICAL FOOTPRINT (20 COMPANIES)

- TABLE 142 COMPANY REGIONAL FOOTPRINT (20 COMPANIES)

- TABLE 143 COMPANY OVERALL FOOTPRINT

- 13.6 START-UP/SME EVALUATION MATRIX, 2023

- 13.6.1 PROGRESSIVE COMPANIES

- 13.6.2 RESPONSIVE COMPANIES

- 13.6.3 DYNAMIC COMPANIES

- 13.6.4 STARTING BLOCKS

- FIGURE 56 SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET: START-UP/SME EVALUATION MATRIX, 2022

- 13.6.5 COMPETITIVE BENCHMARKING

- TABLE 144 SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET: KEY START-UPS/SMES

- 13.6.6 START-UP/SME FOOTPRINT

- TABLE 145 START-UP/SME DESIGN IP FOOTPRINT (FIVE COMPANIES)

- TABLE 146 START-UP/SME VERTICAL FOOTPRINT (FIVE COMPANIES)

- TABLE 147 START-UP/SME REGION FOOTPRINT (FIVE COMPANIES)

- TABLE 148 START-UP/SME OVERALL FOOTPRINT

- 13.7 COMPETITIVE SCENARIO & TRENDS

- 13.7.1 PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 149 SEMICONDUCTOR INTELLECTUAL PROPERTY (IP) MARKET: PRODUCT LAUNCHES/DEVELOPMENTS, 2021-2023

- 13.7.2 DEALS

- TABLE 150 DEALS, 2021-2023

14 COMPANY PROFILES

- 14.1 INTRODUCTION

- 14.2 KEY PLAYERS

(Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)**

- 14.2.1 ARM LIMITED

- TABLE 151 ARM LIMITED: BUSINESS OVERVIEW

- FIGURE 57 ARM LIMITED: COMPANY SNAPSHOT

- TABLE 152 ARM LIMITED: PRODUCTS OFFERED

- TABLE 153 ARM LIMITED: PRODUCT LAUNCHES

- TABLE 154 ARM LIMITED: DEALS

- 14.2.2 SYNOPSYS, INC.

- TABLE 155 SYNOPSYS, INC.: COMPANY OVERVIEW

- FIGURE 58 SYNOPSYS, INC.: COMPANY SNAPSHOT

- TABLE 156 SYNOPSYS, INC.: PRODUCTS OFFERED

- TABLE 157 SYNOPSYS, INC.: PRODUCT LAUNCHES

- TABLE 158 SYNOPSYS, INC.: DEALS

- 14.2.3 CADENCE DESIGN SYSTEMS, INC.

- TABLE 159 CADENCE DESIGN SYSTEMS, INC.: BUSINESS OVERVIEW

- FIGURE 59 CADENCE DESIGN SYSTEMS, INC.: COMPANY SNAPSHOT

- TABLE 160 CADENCE DESIGN SYSTEMS, INC.: PRODUCTS OFFERED

- TABLE 161 CADENCE DESIGN SYSTEMS, INC.: PRODUCT LAUNCHES

- TABLE 162 CADENCE DESIGN SYSTEMS, INC.: DEALS

- 14.2.4 IMAGINATION TECHNOLOGIES

- TABLE 163 IMAGINATION TECHNOLOGIES: BUSINESS OVERVIEW

- TABLE 164 IMAGINATION TECHNOLOGIES: PRODUCTS OFFERED

- TABLE 165 IMAGINATION TECHNOLOGIES: PRODUCT LAUNCHES

- TABLE 166 IMAGINATION TECHNOLOGIES: DEALS

- 14.2.5 CEVA, INC.

- TABLE 167 CEVA, INC.: BUSINESS OVERVIEW

- FIGURE 60 CEVA, INC.: COMPANY SNAPSHOT

- TABLE 168 CEVA, INC.: PRODUCTS OFFERED

- TABLE 169 CEVA, INC.: PRODUCT LAUNCHES

- TABLE 170 CEVA, INC.: DEALS

- 14.2.6 LATTICE SEMICONDUCTOR

- TABLE 171 LATTICE SEMICONDUCTOR: BUSINESS OVERVIEW

- FIGURE 61 LATTICE SEMICONDUCTOR: COMPANY SNAPSHOT

- TABLE 172 LATTICE SEMICONDUCTOR: PRODUCTS OFFERED

- TABLE 173 LATTICE SEMICONDUCTOR: PRODUCT LAUNCHES

- TABLE 174 LATTICE SEMICONDUCTOR: DEALS

- 14.2.7 RAMBUS

- TABLE 175 RAMBUS: BUSINESS OVERVIEW

- FIGURE 62 RAMBUS: COMPANY SNAPSHOT

- TABLE 176 RAMBUS: PRODUCTS OFFERED

- TABLE 177 RAMBUS: PRODUCT LAUNCHES

- TABLE 178 RAMBUS: DEALS

- 14.2.8 EMEMORY TECHNOLOGY INC.

- TABLE 179 EMEMORY TECHNOLOGY INC.: BUSINESS OVERVIEW

- FIGURE 63 EMEMORY TECHNOLOGY INC.: COMPANY SNAPSHOT

- TABLE 180 EMEMORY TECHNOLOGY INC.: PRODUCTS OFFERED

- TABLE 181 EMEMORY TECHNOLOGY INC.: DEALS

- 14.2.9 SILICON STORAGE TECHNOLOGY, INC.

- TABLE 182 SILICON STORAGE TECHNOLOGY, INC.: BUSINESS OVERVIEW

- TABLE 183 SILICON STORAGE TECHNOLOGY, INC.: PRODUCTS OFFERED

- TABLE 184 SILICON STORAGE TECHNOLOGY, INC.: PRODUCT LAUNCHES

- 14.2.10 VERISILICON

- TABLE 185 VERISILICON: BUSINESS OVERVIEW

- TABLE 186 VERISILICON: PRODUCTS OFFERED

- TABLE 187 VERISILICON: PRODUCT LAUNCHES

- TABLE 188 VERISILICON: DEALS

- 14.3 OTHER PLAYERS

- 14.3.1 ACHRONIX SEMICONDUCTOR CORPORATION

- 14.3.2 ALPHAWAVE SEMI

- 14.3.3 ANALOG BITS

- 14.3.4 ARTERIS, INC.

- 14.3.5 FRONTGRADE GAISLER

- 14.3.6 DOLPHIN DESIGN

- 14.3.7 DREAM CHIP TECHNOLOGIES GMBH

- 14.3.8 EUREKA TECHNOLOGY, INC.

- 14.3.9 FARADAY TECHNOLOGY CORPORATION

- 14.3.10 M31 TECHNOLOGY CORPORATION

- 14.3.11 SIFIVE, INC.

- 14.3.12 RENESAS ELECTRONICS CORPORATION

- 14.3.13 SILVACO, INC.

- 14.3.14 TRANSPACKET

- 14.3.15 ADVANCED MICRO DEVICES, INC.

- *Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)** might not be captured in case of unlisted companies.

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGE STORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS