|

|

市場調査レポート

商品コード

1873968

ビデオ監視の世界市場:オファリング別、システムタイプ別、業界別、地域別 - 2031年までの予測Video Surveillance Market by Offering (Cameras, Monitors, Storage Devices, Accessories), Software (VMS, VAS), Camera (PTZ, Dome, Box & Bullet, Panoramic, Bodyworn, Fisheye), Storage (DVR, NVR, HVR, IP Storage, Direct), System - Global Forecast to 2031 |

||||||

カスタマイズ可能

|

|||||||

| ビデオ監視の世界市場:オファリング別、システムタイプ別、業界別、地域別 - 2031年までの予測 |

|

出版日: 2025年11月14日

発行: MarketsandMarkets

ページ情報: 英文 398 Pages

納期: 即納可能

|

概要

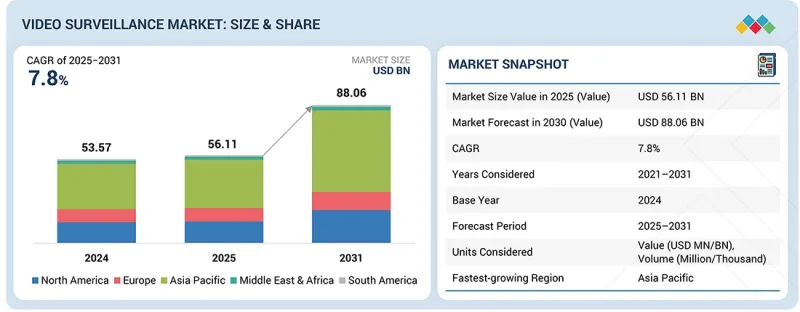

ビデオ監視の市場規模は、2025年に561億1,000万米ドルと評価され、2031年までに880億6,000万米ドルに達すると予測されており、予測期間中にCAGR 7.8%を記録する見込みです。

商業、産業、住宅、公共など様々な分野において、インテリジェントなセキュリティおよび監視ソリューションへの需要が高まる中、ビデオ監視市場は堅調な成長を遂げています。

| 調査範囲 | |

|---|---|

| 調査対象期間 | 2021年~2031年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2031年 |

| 対象単位 | 金額(10億米ドル) |

| セグメント | オファリング別、システムタイプ別、業界別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他地域 |

カメラ、映像管理ソフトウェア、ストレージデバイスなどのコアコンポーネントは、AI駆動型分析、IoT統合、クラウド接続性により強化され、リアルタイム監視と脅威検知の向上を図っています。顔認識、動作分析、遠隔監視などの新興技術により、予防的なセキュリティ管理が可能となっています。スマートシティ構想の推進、安全面への懸念の高まり、IPベースシステムの進歩が市場の拡大をさらに後押しし、世界中でインテリジェントかつ接続された映像監視ソリューションの普及を促進しています。

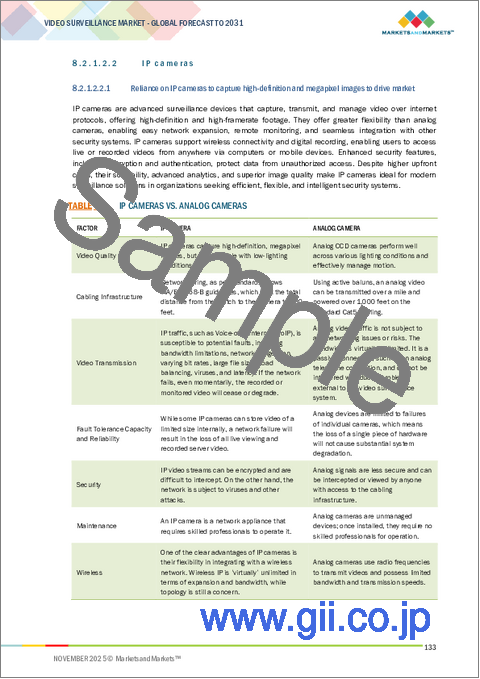

IPカメラセグメントは、優れた画像解像度、拡張性、遠隔アクセス性を提供する先進的なネットワークベース監視ソリューションへの需要増加により、予測期間中に最も高いCAGRで成長すると見込まれます。IPカメラは、従来のアナログシステムと比較して、IPネットワークを介した映像データ伝送により柔軟性が向上し、集中監視やクラウド・IoTプラットフォームとのシームレスな統合を可能にします。これらのカメラは、顔認識、動き検知、行動分析などのAI駆動型分析をサポートし、組織がセキュリティインテリジェンスを強化し、インシデント対応を自動化することを可能にします。スマートシティ構想、交通監視、産業オートメーションの急速な拡大が、その採用をさらに加速させています。さらに、IPベースシステムのコスト低下と、データ圧縮技術およびネットワーク帯域幅効率の向上により、商業施設、住宅、公共インフラなど幅広い用途での導入が容易になっています。これらの要因が相まって、IPカメラは世界的に現代的なインテリジェント映像監視システムにおける最適な選択肢として位置づけられています。

予測期間中、商業分野は監視カメラ市場において最大のシェアを占めると見込まれています。これは、事業施設全体におけるセキュリティ強化、業務効率化、規制順守へのニーズの高まりが背景にあります。小売店舗、企業オフィス、金融機関、医療施設、ホスピタリティ業界では、盗難防止、従業員・顧客の活動監視、安全な環境確保のため、高度な監視システムの導入が拡大しています。AIを活用した分析機能、顔認識技術、自動アラート機能の統合により、企業はリスクを積極的に管理し、業務を最適化することが可能となります。さらに、クラウドベースの映像管理システムや遠隔監視機能の導入拡大は、複数拠点のリアルタイムアクセスと集中管理を支えています。スマートビルディングインフラやデジタルトランスフォーメーションへの投資増加も、インテリジェントな映像監視ソリューションの需要をさらに後押しし、事業継続と資産保護のためのセキュリティ技術において、商業セクターが主導的な導入者としての地位を確立しています。

中国は、大規模な政府主導の取り組み、広範なインフラ整備、そしてHangzhou Hikvision Digital Technology(中国)、Dahua Technology(中国)、Zhejiang Uniview Technologies Co.(中国)といった主要国内メーカーの強力な存在感により、アジア太平洋の映像監視市場を主導しています。同国の急速な都市化と公共安全への取り組みにより、スマートシティ、交通ネットワーク、重要インフラ全体でインテリジェント監視システムが広く導入されています。AI、ビッグデータ分析、5G接続における中国のリーダーシップは、監視ソリューションの機能をさらに強化し、リアルタイム監視、顔認識、行動分析を可能にしています。さらに、コスト効率に優れたハードウェアの現地調達可能性、高度な製造能力、そして研究開発への継続的な投資が、国内市場と輸出市場の両方における中国の優位性を強化しています。これらの要因が相まって、中国は次世代映像監視技術における革新と大規模導入の世界的拠点としての地位を確立し、地域市場における主導的役割を推進しています。

当レポートでは、世界のビデオ監視市場について調査し、オファリング別、システムタイプ別、業界別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

よくあるご質問

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

第3章 重要考察

第4章 市場概要

- イントロダクション

- 市場力学

- アンメットニーズと空白

- 相互接続された市場と分野横断的な機会

- ティア1/2/3企業の戦略的動き

第5章 業界動向

- イントロダクション

- ポーターのファイブフォース分析

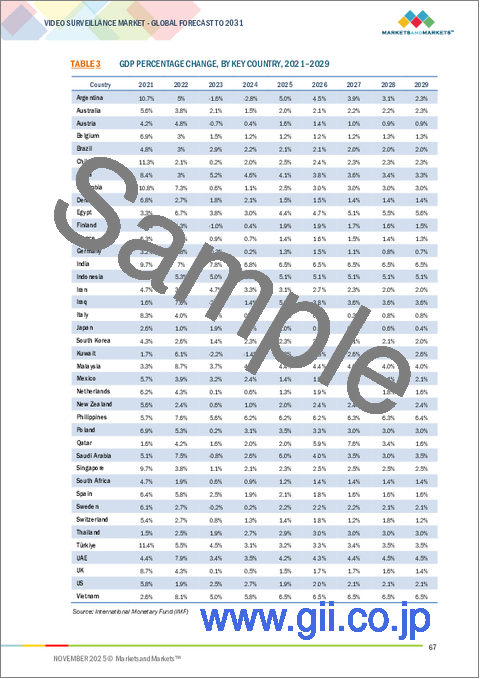

- マクロ経済見通し

- バリューチェーン分析

- エコシステム分析

- 価格分析

- 貿易分析

- 2025年~2026年の主な会議とイベント

- 顧客ビジネスに影響を与える動向/混乱

- 投資と資金調達のシナリオ

- ケーススタディ分析

- 2025年の米国関税の影響- ビデオ監視市場

第6章 技術の進歩、AIによる影響、特許、イノベーション、将来の応用

- 主要な新興技術

- 補完的技術

- 隣接技術

- 技術/製品ロードマップ

- 特許分析、2015年~2024年

- AI世代がビデオ監視市場に与える影響

- ビデオ監視市場におけるAI導入に対する顧客の準備状況

第7章 顧客情勢と購買行動

- 意思決定プロセス

- 購入者の利害関係者と購入評価基準

- 採用障壁と内部課題

- さまざまな業界からのアンメットニーズ

第8章 ビデオ監視市場(オファリング別)

- イントロダクション

- ハードウェア

- ソフトウェア

- サービス

第9章 ビデオ監視市場(システムタイプ別)

- イントロダクション

- アナログ

- IP

- ハイブリッド

第10章 ビデオ監視市場(業界別)

- イントロダクション

- 商業

- インフラ

- 軍事・防衛

- 住宅

- 公共施設

- 工業

第11章 ビデオ監視市場(地域別)

- イントロダクション

- 北米

- 北米のマクロ経済見通し

- ビデオ監視カメラのトップメーカー

- 連邦法および規制の影響

- 米国

- カナダ

- メキシコ

- 欧州

- 欧州のマクロ経済見通し

- ビデオ監視カメラのトップメーカー

- 連邦法および規制の影響

- 英国

- ドイツ

- フランス

- イタリア

- トルコ

- その他

- ロシア

- アジア太平洋

- アジア太平洋のマクロ経済見通し

- ビデオ監視カメラのトップメーカー

- 連邦法および規制の影響

- 中国

- 日本

- 韓国

- インド

- インドネシア

- その他

- その他の地域

- その他の地域のマクロ経済見通し

- ビデオ監視カメラのトップメーカー

- 連邦法および規制の影響

- 中東

- アフリカ

- 南米

第12章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み、2020年~2024年

- 収益分析、2020年~2024年

- 市場シェア分析、2024年

- 企業評価と財務指標、2024年

- ブランド/製品比較

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 競合シナリオ

第13章 企業プロファイル

- 主要参入企業

- HANGZHOU HIKVISION DIGITAL TECHNOLOGY CO., LTD.

- DAHUA TECHNOLOGY CO., LTD

- HANWHA VISION CO., LTD.

- HONEYWELL INTERNATIONAL INC.

- MOTOROLA SOLUTIONS, INC.

- AXIS COMMUNICATIONS AB.

- BOSCH SECURITY SYSTEMS GMBH

- TELEDYNE FLIR LLC

- I-PRO

- ZHEJIANG UNIVIEW TECHNOLOGIES CO., LTD.

- VIVOTEK INC.

- EAGLE EYE NETWORKS

- NEC CORPORATION

- ADT LLC

- MOBOTIX AG

- その他の企業

- IRISITY

- NICE S.P.A.

- CP PLUS INTERNATIONAL

- GENETEC INC.

- CORSIGHT AI

- HEXAGON AB.

- TIANDY TECHNOLOGIES CO., LTD.

- MORPHEAN SA

- VERKADA INC.

- CAMCLOUD

- IVIDEON

- THE INFINOVA GROUP

- SPOT AI, INC.

- INTELEX VISION LTD

- AMBIENT AI