|

|

市場調査レポート

商品コード

1807084

硫酸の世界市場:原材料別、用途別、地域別 - 予測(~2030年)Sulfuric Acid Market by Raw Material (Elemental Sulfur, Base Metal Smelters, Pyrite Ore), Application (Fertilizers, Chemical Manufacturing, Metal Processing, Petroleum Refining, Textiles, and Automotive), and Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 硫酸の世界市場:原材料別、用途別、地域別 - 予測(~2030年) |

|

出版日: 2025年08月29日

発行: MarketsandMarkets

ページ情報: 英文 258 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

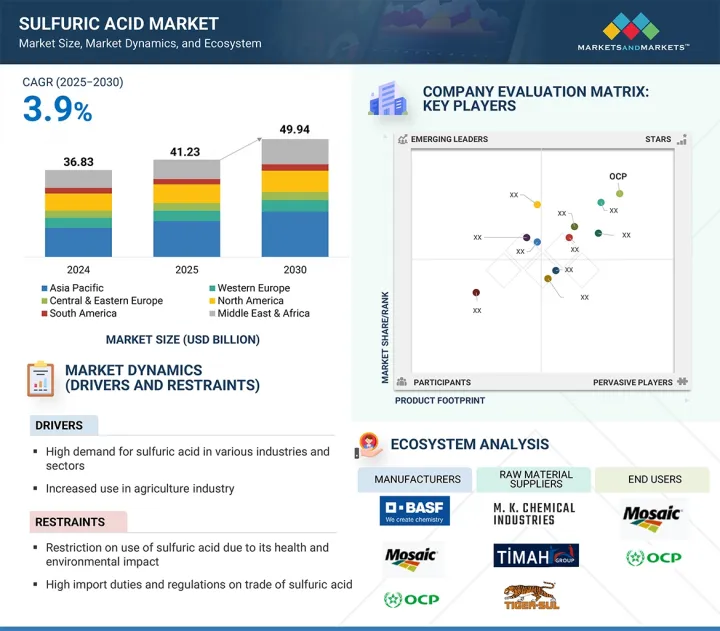

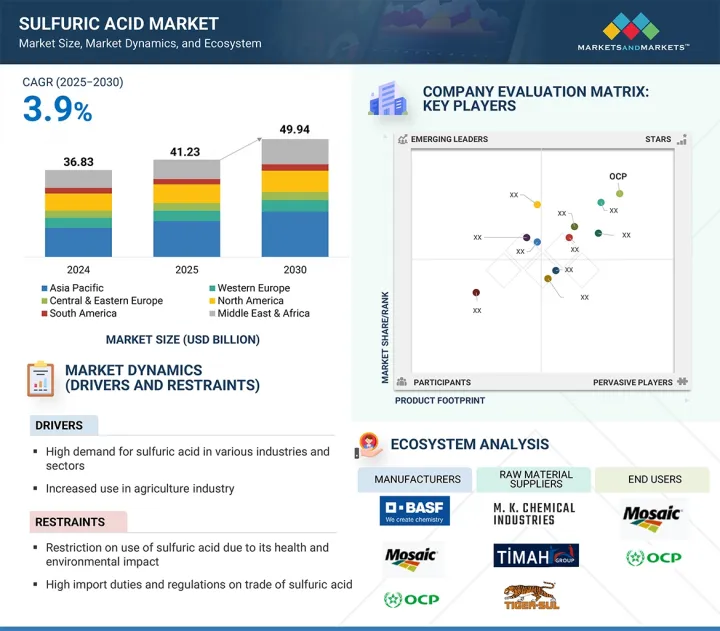

世界の硫酸の市場規模は、2025年の412億3,000万米ドルから2030年までに499億4,000万米ドルに達すると予測され、予測期間にCAGRで3.9%の成長が見込まれます。

硫酸は、その強い酸性と脱水特性により、さまざまな部門で使用される不可欠な工業用化学品です。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 単位 | 100万米ドル、100万トン |

| セグメント | 原材料、グレード、形態、プロセス、用途 |

| 対象地域 | 北米、アジア太平洋、西欧、中南米、中東・アフリカ |

硫酸は主に、元素状硫黄や黄鉄鉱のような原材料を用いて接触プロセスで生産され、肥料、金属加工、石油精製、テキスタイル、化学製造に使用されます。硫酸市場は、化学製造と石油精製における需要の増加により、着実に成長しています。化学製造では、複数の産業で使用される酸や中間体の生産に重要な役割を果たし、石油精製では、よりクリーンな燃料の製造に役立つアルキル化プロセスを支えています。こうした下流製品のニーズの高まりと環境規制の強化が、市場成長の主な促進要因となっています。

「数量では、卑金属製錬原材料セグメントが予測期間に第2位の市場シェアを占めます。」

卑金属製錬セグメントは、銅、亜鉛、ニッケルなどの主な非鉄金属の生産に重要な役割を果たすことから、予測期間に硫酸市場において数量ベースで第2位のシェアを占める見込みです。これらの硫黄を多く含む鉱石の製錬中に、二酸化硫黄ガスが副産物として放出されます。このガスは回収され、接触法のような確立された方法で硫酸に変換されます。建設、電気インフラ、電池製造、再生可能エネルギー技術における広範な使用に支えられた卑金属の需要の増加は、世界中で製錬活動の増加を引き起こしています。さらに、硫黄排出を削減するための厳しい環境規制により、製錬業者は硫黄回収技術の導入を余儀なくされ、それによって硫酸回収が促進されています。環境基準を満たしながら硫酸を生成するという二重の利点により、卑金属製錬は世界の硫酸市場においてますます重要な原材料供給元となっています。

「数量では、化学製造用途セグメントが予測期間に第2位の市場シェアを占めます。」

化学製造用途セグメントは、主に硫酸が広範な工業用化学品を生産する際の原料として重要な役割を担っていることから、予測期間に硫酸市場において数量ベースで第2位のシェアを占める見込みです。硫酸は、塩酸、硝酸、リン酸、各種硫酸塩などの化合物の製造に広く使用されており、これらは洗剤、合成樹脂、染料、医薬品、顔料、火薬の製造において重要な中間体となっています。テキスタイル、医療、プラスチック、消費財などの最終用途産業の拡大に後押しされ、こうした化学品の世界的な需要が伸び続けているため、硫酸のニーズもそれに応じて高まっています。さらに、新興経済圏における大規模化学生産への着実な移行と、管理された化学処理を必要とする環境規制の強化が、硫酸市場におけるこの用途セグメントの成長をさらに後押ししています。

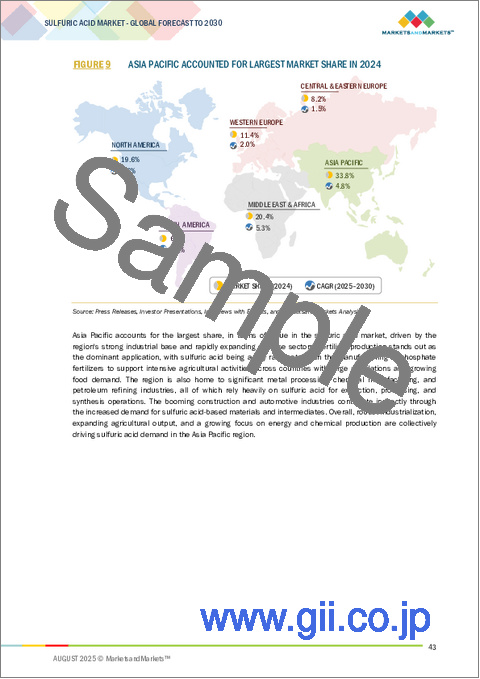

「数量では、中東・アフリカが予測期間に第2位の市場シェアを占めます。」

中東・アフリカは、産業基盤が拡大し、選鉱と肥料生産への注力が高まっていることから、予測期間に硫酸市場において数量ベースで第2位のシェアを占める見込みです。同地域の国々は、特に銅、亜鉛、リン酸塩のような金属の抽出と精製、つまり大量の硫酸を必要とするプロセスに向け、採鉱・冶金プロジェクトに投資しています。さらに、特にアフリカ経済圏では、食料安全保障と農業生産性を支える肥料の需要が高まっており、硫酸の消費をさらに押し上げています。新たな製造・加工施設の開発、インフラの成長、産業の多様化への取り組みが、さまざまな部門で硫酸の旺盛な需要を引き続き後押ししています。

当レポートでは、世界の硫酸市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要な知見

- 硫酸市場の企業にとって魅力的な機会

- 硫酸市場:地域別

- 硫酸市場:用途別

- 硫酸市場:原材料別

- 硫酸市場:主要国別

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

第6章 産業動向

- 世界のマクロ経済の見通し

- サプライチェーン分析

- 原材料供給

- 硫酸製造

- 製品タイプ別

- 流通ネットワーク

- 最終用途産業

- エコシステム分析

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- 価格設定の分析

- 硫酸の平均販売価格の動向:地域別(2022年~2024年)

- テクニカルグレードの平均販売価格の動向:主要企業別(2024年)

- 関税と規制情勢

- 関税分析

- 規制機関、政府機関、その他の組織

- 基準と規制

- 主な会議とイベント(2025年~2026年)

- 特許分析

- 技術分析

- 主要技術

- 隣接技術

- ケーススタディ分析

- 硫酸再生による持続可能性と効率性の向上

- BASF、新しい高純度硫酸プラントの建設で欧州の半導体サプライチェーンを強化

- 貿易データ

- 輸入シナリオ(HSコード280700)

- 輸出シナリオ(HSコード280700)

- カスタマービジネスに影響を与える動向/混乱

- 投資と資金調達のシナリオ

- 硫酸市場に対する生成AIの影響

- イントロダクション

- 硫酸生産の最適化

- 精密農業の実現

- サプライチェーンの合理化

- 環境に対する影響を最小化する

- 硫酸市場に対する米国関税の影響

- 市場に影響を与える主な関税率

- 価格の影響の分析

- さまざまな地域への重要な影響

- 硫酸の最終用途産業に対する影響

第7章 硫酸市場:形態別

- イントロダクション

- 濃硫酸

- 塔/グローバー酸

- チャンバー/肥料酸

- 電池酸

- 66度ボーメ硫酸

- 希硫酸

第8章 硫酸市場:グレード別

- イントロダクション

- テクニカルグレード

- 電池グレード

- CPグレード(化学的に純粋)

第9章 硫酸市場:プロセス別

- イントロダクション

- 接触プロセス

- 二重接触(DCDA)

第10章 硫酸市場:原材料別

- イントロダクション

- 元素状硫黄

- 黄鉄鉱

- 卑金属製錬

- その他の原材料

第11章 硫酸市場:用途別

- イントロダクション

- 肥料

- 金属加工

- パルプ・紙

- 石油精製

- テキスタイル

- 自動車

- 化学製造

- その他の用途

第12章 硫酸市場:地域別

- イントロダクション

- アジア太平洋

- 中国

- 日本

- インド

- インドネシア

- 韓国

- その他のアジア太平洋

- 北米

- 米国

- カナダ

- メキシコ

- 西欧

- ドイツ

- イタリア

- フランス

- 英国

- スペイン

- その他の西欧

- 中欧・東欧

- ロシア

- トルコ

- 中央欧州と東欧のその他の地域

- 中東・アフリカ

- GCC諸国

- モロッコ

- その他の中東・アフリカ

- 南米

- ブラジル

- アルゼンチン

- チリ

- その他の南米

第13章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み

- 収益分析

- 市場シェア分析

- 主要市場企業ランキング(2024年)

- 主要企業の市場シェア(2024年)

- ブランド/製品の比較

- 企業の評価マトリクス:主要企業(2024年)

- 企業の評価マトリクス:スタートアップ/中小企業(2024年)

- 競合シナリオ

- 評価と財務指標

第14章 企業プロファイル

- 主要企業

- MOSAIC

- JIANGXI COPPER CORPORATION

- OCP

- PHOSAGRO GROUP

- AURUBIS AG

- BASF

- CHEMTRADE LOGISTICS

- NOURYON

- Q-ACID

- LANXESS

- PVS CHEMICALS

- MITSUBISHI SHOJI CHEMICAL CORPORATION

- WEYLCHEM INTERNATIONAL GMBH

- CHINA PETROLEUM & CHEMICAL CORPORATION

- KOREAZINC

- TOAGOSEI CO., LTD.

- OCCL LIMITED

- AMAL LTD

- ECOVYST INC.

- BOLIDEN GROUP

- その他の企業

- ACIDOS Y MINERALES DE VENEZUELA C.A.

- INDUSTRIAS BASICAS DE CALDAS S.A.

- DEXO CHEM LABORATORIES

- PCIPL

第15章 隣接市場と関連市場

- イントロダクション

- 制限事項

- 相互接続された市場

- 高純度硫酸市場

- 市場の定義

- 市場の概要

- 高純度硫酸市場:グレード別

- PPB

- PPT

第16章 付録

List of Tables

- TABLE 1 SULFURIC ACID MARKET SNAPSHOT: 2025 VS. 2030

- TABLE 2 REAL GDP GROWTH, BY KEY COUNTRY, 2022-2024 (%)

- TABLE 3 UNEMPLOYMENT RATE, BY KEY COUNTRY, 2022-2024 (%)

- TABLE 4 INFLATION RATE BASED ON AVERAGE CONSUMER PRICES, BY KEY COUNTRY, 2022-2024 (%)

- TABLE 5 FOREIGN DIRECT INVESTMENT, BY REGION, 2022 AND 2023 (USD BILLION)

- TABLE 6 ROLES OF COMPANIES IN SULFURIC ACID ECOSYSTEM

- TABLE 7 SULFURIC ACID MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 8 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END-USE INDUSTRY (%)

- TABLE 9 KEY BUYING CRITERIA, BY END-USE INDUSTRY

- TABLE 10 AVERAGE SELLING PRICE TREND, BY REGION, 2022-2024 (USD/TON)

- TABLE 11 AVERAGE SELLING PRICE TREND FOR TECHNICAL GRADE, BY KEY PLAYER, 2024 (USD/TON)

- TABLE 12 TARIFF ANALYSIS RELATED TO HS CODE 280700-COMPLIANT PRODUCTS, BY COUNTRY, 2024

- TABLE 13 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 SULFURIC ACID MARKET: STANDARDS AND REGULATIONS

- TABLE 18 SULFURIC ACID MARKET: KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 19 SULFURIC ACID MARKET: LIST OF MAJOR PATENTS, 2014-2024

- TABLE 20 IMPORT DATA FOR HS CODE 280700-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2021-2024 (USD THOUSAND)

- TABLE 21 EXPORT DATA FOR HS CODE 280700-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2021-2024 (USD THOUSAND)

- TABLE 22 SULFURIC ACID MARKET, BY RAW MATERIAL, 2021-2024 (MILLION TONS)

- TABLE 23 SULFURIC ACID MARKET, BY RAW MATERIAL, 2025-2030 (MILLION TONS)

- TABLE 24 SULFURIC ACID MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 25 SULFURIC ACID MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 26 SULFURIC ACID MARKET, BY APPLICATION, 2021-2024 (MILLION TONS)

- TABLE 27 SULFURIC ACID MARKET, BY APPLICATION, 2025-2030 (MILLION TONS)

- TABLE 28 FERTILIZERS: SULFURIC ACID MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 29 FERTILIZERS: SULFURIC ACID MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 30 FERTILIZERS: SULFURIC ACID MARKET, BY REGION, 2021-2024 (MILLION TONS)

- TABLE 31 FERTILIZERS: SULFURIC ACID MARKET, BY REGION, 2025-2030 (MILLION TONS)

- TABLE 32 METAL PROCESSING: SULFURIC ACID MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 33 METAL PROCESSING: SULFURIC ACID MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 34 METAL PROCESSING: SULFURIC ACID MARKET, BY REGION, 2021-2024 (MILLION TONS)

- TABLE 35 METAL PROCESSING: SULFURIC ACID MARKET, BY REGION, 2025-2030 (MILLION TONS)

- TABLE 36 PULP & PAPER: SULFURIC ACID MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 37 PULP & PAPER: SULFURIC ACID MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 38 PULP & PAPER: SULFURIC ACID MARKET, BY REGION, 2021-2024 (MILLION TONS)

- TABLE 39 PULP & PAPER: SULFURIC ACID MARKET, BY REGION, 2025-2030 (MILLION TONS)

- TABLE 40 PETROLEUM REFINING: SULFURIC ACID MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 41 PETROLEUM REFINING: SULFURIC ACID MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 42 PETROLEUM REFINING: SULFURIC ACID MARKET, BY REGION, 2021-2024 (MILLION TONS)

- TABLE 43 PETROLEUM REFINING: SULFURIC ACID MARKET, BY REGION, 2025-2030 (MILLION TONS)

- TABLE 44 TEXTILE: SULFURIC ACID MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 45 TEXTILE: SULFURIC ACID MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 46 TEXTILE: SULFURIC ACID MARKET, BY REGION, 2021-2024 (MILLION TONS)

- TABLE 47 TEXTILE: SULFURIC ACID MARKET, BY REGION, 2025-2030 (MILLION TONS)

- TABLE 48 AUTOMOTIVE: SULFURIC ACID MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 49 AUTOMOTIVE: SULFURIC ACID MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 50 AUTOMOTIVE: SULFURIC ACID MARKET, BY REGION, 2021-2024 (MILLION TONS)

- TABLE 51 AUTOMOTIVE: SULFURIC ACID MARKET, BY REGION, 2025-2030 (MILLION TONS)

- TABLE 52 CHEMICAL MANUFACTURING: SULFURIC ACID MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 53 CHEMICAL MANUFACTURING: SULFURIC ACID MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 54 CHEMICAL MANUFACTURING: SULFURIC ACID MARKET, BY REGION, 2021-2024 (MILLION TONS)

- TABLE 55 CHEMICAL MANUFACTURING: SULFURIC ACID MARKET, BY REGION, 2025-2030 (MILLION TONS)

- TABLE 56 OTHER APPLICATIONS: SULFURIC ACID MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 57 OTHER APPLICATIONS: SULFURIC ACID MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 58 OTHER APPLICATIONS: SULFURIC ACID MARKET, BY REGION, 2021-2024 (MILLION TONS)

- TABLE 59 OTHER APPLICATIONS: SULFURIC ACID MARKET, BY REGION, 2025-2030 (MILLION TONS)

- TABLE 60 SULFURIC ACID MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 61 SULFURIC ACID MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 62 SULFURIC ACID MARKET, BY REGION, 2021-2024 (MILLION TONS)

- TABLE 63 SULFURIC ACID MARKET, BY REGION, 2025-2030 (MILLION TONS)

- TABLE 64 ASIA PACIFIC: SULFURIC ACID MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 65 ASIA PACIFIC: SULFURIC ACID MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 66 ASIA PACIFIC: SULFURIC ACID MARKET, BY COUNTRY, 2021-2024 (MILLION TONS)

- TABLE 67 ASIA PACIFIC: SULFURIC ACID MARKET, BY COUNTRY, 2025-2030 (MILLION TONS)

- TABLE 68 ASIA PACIFIC: SULFURIC ACID MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 69 ASIA PACIFIC: SULFURIC ACID MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 70 ASIA PACIFIC: SULFURIC ACID MARKET, BY APPLICATION, 2021-2024 (MILLION TONS)

- TABLE 71 ASIA PACIFIC: SULFURIC ACID MARKET, BY APPLICATION, 2025-2030 (MILLION TONS)

- TABLE 72 CHINA: SULFURIC ACID MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 73 CHINA: SULFURIC ACID MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 74 CHINA: SULFURIC ACID MARKET, BY APPLICATION, 2021-2024 (MILLION TONS)

- TABLE 75 CHINA: SULFURIC ACID MARKET, BY APPLICATION, 2025-2030 (MILLION TONS)

- TABLE 76 JAPAN: SULFURIC ACID MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 77 JAPAN: SULFURIC ACID MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 78 JAPAN: SULFURIC ACID MARKET, BY APPLICATION, 2021-2024 (MILLION TONS)

- TABLE 79 JAPAN: SULFURIC ACID MARKET, BY APPLICATION, 2025-2030 (MILLION TONS)

- TABLE 80 INDIA: SULFURIC ACID MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 81 INDIA: SULFURIC ACID MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 82 INDIA: SULFURIC ACID MARKET, BY APPLICATION, 2021-2024 (MILLION TONS)

- TABLE 83 INDIA: SULFURIC ACID MARKET, BY APPLICATION, 2025-2030 (MILLION TONS)

- TABLE 84 INDONESIA: SULFURIC ACID MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 85 INDONESIA: SULFURIC ACID MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 86 INDONESIA: SULFURIC ACID MARKET, BY APPLICATION, 2021-2024 (MILLION TONS)

- TABLE 87 INDONESIA: SULFURIC ACID MARKET, BY APPLICATION, 2025-2030 (MILLION TONS)

- TABLE 88 SOUTH KOREA: SULFURIC ACID MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 89 SOUTH KOREA: SULFURIC ACID MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 90 SOUTH KOREA: SULFURIC ACID MARKET, BY APPLICATION, 2021-2024 (MILLION TONS)

- TABLE 91 SOUTH KOREA: SULFURIC ACID MARKET, BY APPLICATION, 2025-2030 (MILLION TONS)

- TABLE 92 REST OF ASIA PACIFIC: SULFURIC ACID MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 93 REST OF ASIA PACIFIC: SULFURIC ACID MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 94 REST OF ASIA PACIFIC: SULFURIC ACID MARKET, BY APPLICATION, 2021-2024 (MILLION TONS)

- TABLE 95 REST OF ASIA PACIFIC: SULFURIC ACID MARKET, BY APPLICATION, 2025-2030 (MILLION TONS)

- TABLE 96 NORTH AMERICA: SULFURIC ACID MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 97 NORTH AMERICA: SULFURIC ACID MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 98 NORTH AMERICA: SULFURIC ACID MARKET, BY COUNTRY, 2021-2024 (MILLION TONS)

- TABLE 99 NORTH AMERICA: SULFURIC ACID MARKET, BY COUNTRY, 2025-2030 (MILLION TONS)

- TABLE 100 NORTH AMERICA: SULFURIC ACID MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 101 NORTH AMERICA: SULFURIC ACID MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 102 NORTH AMERICA: SULFURIC ACID MARKET, BY APPLICATION, 2021-2024 (MILLION TONS)

- TABLE 103 NORTH AMERICA: SULFURIC ACID MARKET, BY APPLICATION, 2025-2030 (MILLION TONS)

- TABLE 104 US: SULFURIC ACID MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 105 US: SULFURIC ACID MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 106 US: SULFURIC ACID MARKET, BY APPLICATION, 2021-2024 (MILLION TONS)

- TABLE 107 US: SULFURIC ACID MARKET, BY APPLICATION, 2025-2030 (MILLION TONS)

- TABLE 108 CANADA: SULFURIC ACID MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 109 CANADA: SULFURIC ACID MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 110 CANADA: SULFURIC ACID MARKET, BY APPLICATION, 2021-2024 (MILLION TONS)

- TABLE 111 CANADA: SULFURIC ACID MARKET, BY APPLICATION, 2025-2030 (MILLION TONS)

- TABLE 112 MEXICO: SULFURIC ACID MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 113 MEXICO: SULFURIC ACID MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 114 MEXICO: SULFURIC ACID MARKET, BY APPLICATION, 2021-2024 (MILLION TONS)

- TABLE 115 MEXICO: SULFURIC ACID MARKET, BY APPLICATION, 2025-2030 (MILLION TONS)

- TABLE 116 WESTERN EUROPE: SULFURIC ACID MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 117 WESTERN EUROPE: SULFURIC ACID MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 118 WESTERN EUROPE: SULFURIC ACID MARKET, BY COUNTRY, 2021-2024 (MILLION TONS)

- TABLE 119 WESTERN EUROPE: SULFURIC ACID MARKET, BY COUNTRY, 2025-2030 (MILLION TONS)

- TABLE 120 WESTERN EUROPE: SULFURIC ACID MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 121 WESTERN EUROPE: SULFURIC ACID MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 122 WESTERN EUROPE: SULFURIC ACID MARKET, BY APPLICATION, 2021-2024 (MILLION TONS)

- TABLE 123 WESTERN EUROPE: SULFURIC ACID MARKET, BY APPLICATION, 2025-2030 (MILLION TONS)

- TABLE 124 GERMANY: SULFURIC ACID MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 125 GERMANY: SULFURIC ACID MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 126 GERMANY: SULFURIC ACID MARKET, BY APPLICATION, 2021-2024 (MILLION TONS)

- TABLE 127 GERMANY: SULFURIC ACID MARKET, BY APPLICATION, 2025-2030 (MILLION TONS)

- TABLE 128 ITALY: SULFURIC ACID MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 129 ITALY: SULFURIC ACID MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 130 ITALY: SULFURIC ACID MARKET, BY APPLICATION, 2021-2024 (MILLION TONS)

- TABLE 131 ITALY: SULFURIC ACID MARKET, BY APPLICATION, 2025-2030 (MILLION TONS)

- TABLE 132 FRANCE: SULFURIC ACID MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 133 FRANCE: SULFURIC ACID MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 134 FRANCE: SULFURIC ACID MARKET, BY APPLICATION, 2021-2024 (MILLION TONS)

- TABLE 135 FRANCE: SULFURIC ACID MARKET, BY APPLICATION, 2025-2030 (MILLION TONS)

- TABLE 136 UK: SULFURIC ACID MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 137 UK: SULFURIC ACID MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 138 UK: SULFURIC ACID MARKET, BY APPLICATION, 2021-2024 (MILLION TONS)

- TABLE 139 UK: SULFURIC ACID MARKET, BY APPLICATION, 2025-2030 (MILLION TONS)

- TABLE 140 SPAIN: SULFURIC ACID MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 141 SPAIN: SULFURIC ACID MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 142 SPAIN: SULFURIC ACID MARKET, BY APPLICATION, 2021-2024 (MILLION TONS)

- TABLE 143 SPAIN: SULFURIC ACID MARKET, BY APPLICATION, 2025-2030 (MILLION TONS)

- TABLE 144 REST OF WESTERN EUROPE: SULFURIC ACID MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 145 REST OF WESTERN EUROPE: SULFURIC ACID MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 146 REST OF WESTERN EUROPE: SULFURIC ACID MARKET, BY APPLICATION, 2021-2024 (MILLION TONS)

- TABLE 147 REST OF WESTERN EUROPE: SULFURIC ACID MARKET, BY APPLICATION, 2025-2030 (MILLION TONS)

- TABLE 148 CENTRAL & EASTERN EUROPE: SULFURIC ACID MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 149 CENTRAL & EASTERN EUROPE: SULFURIC ACID MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 150 CENTRAL & EASTERN EUROPE: SULFURIC ACID MARKET, BY COUNTRY, 2021-2024 (MILLION TONS)

- TABLE 151 CENTRAL & EASTERN EUROPE: SULFURIC ACID MARKET, BY COUNTRY, 2025-2030 (MILLION TONS)

- TABLE 152 CENTRAL & EASTERN EUROPE: SULFURIC ACID MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 153 CENTRAL & EASTERN EUROPE: SULFURIC ACID MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 154 CENTRAL & EASTERN EUROPE: SULFURIC ACID MARKET, BY APPLICATION, 2021-2024 (MILLION TONS)

- TABLE 155 CENTRAL & EASTERN EUROPE: SULFURIC ACID MARKET, BY APPLICATION, 2025-2030 (MILLION TONS)

- TABLE 156 RUSSIA: SULFURIC ACID MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 157 RUSSIA: SULFURIC ACID MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 158 RUSSIA: SULFURIC ACID MARKET, BY APPLICATION, 2021-2024 (MILLION TONS)

- TABLE 159 RUSSIA: SULFURIC ACID MARKET, BY APPLICATION, 2025-2030 (MILLION TONS)

- TABLE 160 TURKIYE: SULFURIC ACID MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 161 TURKIYE: SULFURIC ACID MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 162 TURKIYE: SULFURIC ACID MARKET, BY APPLICATION, 2021-2024 (MILLION TONS)

- TABLE 163 TURKIYE: SULFURIC ACID MARKET, BY APPLICATION, 2025-2030 (MILLION TONS)

- TABLE 164 REST OF CENTRAL & EASTERN EUROPE: SULFURIC ACID MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 165 REST OF CENTRAL & EASTERN EUROPE: SULFURIC ACID MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 166 REST OF CENTRAL & EASTERN EUROPE: SULFURIC ACID MARKET, BY APPLICATION, 2021-2024 (MILLION TONS)

- TABLE 167 REST OF CENTRAL & EASTERN EUROPE: SULFURIC ACID MARKET, BY APPLICATION, 2025-2030 (MILLION TONS)

- TABLE 168 MIDDLE EAST & AFRICA: SULFURIC ACID MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 169 MIDDLE EAST & AFRICA: SULFURIC ACID MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 170 MIDDLE EAST & AFRICA: SULFURIC ACID MARKET, BY COUNTRY, 2021-2024 (MILLION TONS)

- TABLE 171 MIDDLE EAST & AFRICA: SULFURIC ACID MARKET, BY COUNTRY, 2025-2030 (MILLION TONS)

- TABLE 172 MIDDLE EAST & AFRICA: SULFURIC ACID MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 173 MIDDLE EAST & AFRICA: SULFURIC ACID MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 174 MIDDLE EAST & AFRICA: SULFURIC ACID MARKET, BY APPLICATION, 2021-2024 (MILLION TONS)

- TABLE 175 MIDDLE EAST & AFRICA: SULFURIC ACID MARKET, BY APPLICATION, 2025-2030 (MILLION TONS)

- TABLE 176 SAUDI ARABIA: SULFURIC ACID MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 177 SAUDI ARABIA: SULFURIC ACID MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 178 SAUDI ARABIA: SULFURIC ACID MARKET, BY APPLICATION, 2021-2024 (MILLION TONS)

- TABLE 179 SAUDI ARABIA: SULFURIC ACID MARKET, BY APPLICATION, 2025-2030 (MILLION TONS)

- TABLE 180 UAE: SULFURIC ACID MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 181 UAE: SULFURIC ACID MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 182 UAE: SULFURIC ACID MARKET, BY APPLICATION, 2021-2024 (MILLION TONS)

- TABLE 183 UAE: SULFURIC ACID MARKET, BY APPLICATION, 2025-2030 (MILLION TONS)

- TABLE 184 MOROCCO: SULFURIC ACID MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 185 MOROCCO: SULFURIC ACID MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 186 MOROCCO: SULFURIC ACID MARKET, BY APPLICATION, 2021-2024 (MILLION TONS)

- TABLE 187 MOROCCO: SULFURIC ACID MARKET, BY APPLICATION, 2025-2030 (MILLION TONS)

- TABLE 188 REST OF MIDDLE EAST & AFRICA: SULFURIC ACID MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 189 REST OF MIDDLE EAST & AFRICA: SULFURIC ACID MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 190 REST OF MIDDLE EAST & AFRICA: SULFURIC ACID MARKET, BY APPLICATION, 2021-2024 (MILLION TONS)

- TABLE 191 REST OF MIDDLE EAST & AFRICA: SULFURIC ACID MARKET, BY APPLICATION, 2025-2030 (MILLION TONS)

- TABLE 192 SOUTH AMERICA: SULFURIC ACID MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 193 SOUTH AMERICA: SULFURIC ACID MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 194 SOUTH AMERICA: SULFURIC ACID MARKET, BY COUNTRY, 2021-2024 (MILLION TONS)

- TABLE 195 SOUTH AMERICA: SULFURIC ACID MARKET, BY COUNTRY, 2025-2030 (MILLION TONS)

- TABLE 196 SOUTH AMERICA: SULFURIC ACID MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 197 SOUTH AMERICA: SULFURIC ACID MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 198 SOUTH AMERICA: SULFURIC ACID MARKET, BY APPLICATION, 2021-2024 (MILLION TONS)

- TABLE 199 SOUTH AMERICA: SULFURIC ACID MARKET, BY APPLICATION, 2025-2030 (MILLION TONS)

- TABLE 200 BRAZIL: SULFURIC ACID MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 201 BRAZIL: SULFURIC ACID MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 202 BRAZIL: SULFURIC ACID MARKET, BY APPLICATION, 2021-2024 (MILLION TONS)

- TABLE 203 BRAZIL: SULFURIC ACID MARKET, BY APPLICATION, 2025-2030 (MILLION TONS)

- TABLE 204 ARGENTINA: SULFURIC ACID MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 205 ARGENTINA: SULFURIC ACID MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 206 ARGENTINA: SULFURIC ACID MARKET, BY APPLICATION, 2021-2024 (MILLION TONS)

- TABLE 207 ARGENTINA: SULFURIC ACID MARKET, BY APPLICATION, 2025-2030 (MILLION TONS)

- TABLE 208 CHILE: SULFURIC ACID MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 209 CHILE: SULFURIC ACID MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 210 CHILE: SULFURIC ACID MARKET, BY APPLICATION, 2021-2024 (MILLION TONS)

- TABLE 211 CHILE: SULFURIC ACID MARKET, BY APPLICATION, 2025-2030 (MILLION TONS)

- TABLE 212 REST OF SOUTH AMERICA: SULFURIC ACID MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 213 REST OF SOUTH AMERICA: SULFURIC ACID MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 214 REST OF SOUTH AMERICA: SULFURIC ACID MARKET, BY APPLICATION, 2021-2024 (MILLION TONS)

- TABLE 215 REST OF SOUTH AMERICA: SULFURIC ACID MARKET, BY APPLICATION, 2025-2030 (MILLION TONS)

- TABLE 216 SULFURIC ACID MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2021-2025

- TABLE 217 SULFURIC ACID MARKET: DEGREE OF COMPETITION, 2023

- TABLE 218 SULFURIC ACID MARKET: REGION FOOTPRINT

- TABLE 219 SULFURIC ACID MARKET: APPLICATION FOOTPRINT

- TABLE 220 SULFURIC ACID MARKET: GRADE FOOTPRINT

- TABLE 221 SULFURIC ACID MARKET: RAW MATERIAL FOOTPRINT

- TABLE 222 SULFURIC ACID MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 223 SULFURIC ACID MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 224 SULFURIC ACID MARKET: DEALS, JANUARY 2021-JULY 2025

- TABLE 225 SULFURIC ACID MARKET: EXPANSIONS, JANUARY 2021-JULY 2025

- TABLE 226 MOSAIC: COMPANY OVERVIEW

- TABLE 227 MOSAIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 228 JIANGXI COPPER CORPORATION: COMPANY OVERVIEW

- TABLE 229 JIANGXI COPPER CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 230 OCP: COMPANY OVERVIEW

- TABLE 231 OCP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 232 PHOSAGRO GROUP: COMPANY OVERVIEW

- TABLE 233 PHOSAGRO GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 234 AURUBIS AG: COMPANY OVERVIEW

- TABLE 235 AURUBIS AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 236 BASF: COMPANY OVERVIEW

- TABLE 237 BASF: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 238 BASF: DEALS (JANUARY 2021-JULY 2025)

- TABLE 239 BASF: EXPANSIONS (JANUARY 2021-JULY 2025)

- TABLE 240 CHEMTRADE LOGISTICS: COMPANY OVERVIEW

- TABLE 241 CHEMTRADE LOGISTICS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 242 CHEMTRADE LOGISTICS: DEALS (JANUARY 2021-JULY 2025)

- TABLE 243 NOURYON: COMPANY OVERVIEW

- TABLE 244 NOURYON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 245 Q-ACID: COMPANY OVERVIEW

- TABLE 246 Q-ACID: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 247 LANXESS: COMPANY OVERVIEW

- TABLE 248 LANXESS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 249 PVS CHEMICALS: COMPANY OVERVIEW

- TABLE 250 PVS CHEMICALS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 251 MITSUBISHI SHOJI CHEMICAL CORPORATION: COMPANY OVERVIEW

- TABLE 252 MITSUBISHI SHOJI CHEMICAL CORPORATION: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 253 WEYLCHEM INTERNATIONAL GMBH: COMPANY OVERVIEW

- TABLE 254 WEYLCHEM INTERNATIONAL GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 255 CHINA PETROLEUM & CHEMICAL CORPORATION: COMPANY OVERVIEW

- TABLE 256 CHINA PETROLEUM & CHEMICAL CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 257 KOREAZINC: COMPANY OVERVIEW

- TABLE 258 KOREAZINC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 259 TOAGOSEI CO., LTD.: COMPANY OVERVIEW

- TABLE 260 TOAGOSEI CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 261 OCCL LIMITED: COMPANY OVERVIEW

- TABLE 262 OCCL LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 263 AMAL LTD: COMPANY OVERVIEW

- TABLE 264 AMAL LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 265 ECOVYST INC.: COMPANY OVERVIEW

- TABLE 266 ECOVYST INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 267 ECOVYST INC.: DEALS (JANUARY 2021-JULY 2025)

- TABLE 268 BOLIDEN GROUP: COMPANY OVERVIEW

- TABLE 269 BOLIDEN GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 270 ACIDOS Y MINERALES DE VENEZUELA C.A.: COMPANY OVERVIEW

- TABLE 271 INDUSTRIAS BASICAS DE CALDAS S.A.: COMPANY OVERVIEW

- TABLE 272 DEXO CHEM LABORATORIES: COMPANY OVERVIEW

- TABLE 273 PCIPL: COMPANY OVERVIEW

- TABLE 274 HIGH PURITY SULFURIC ACID MARKET, BY GRADE, 2021-2024 (USD MILLION)

- TABLE 275 HIGH PURITY SULFURIC ACID MARKET, BY GRADE, 2025-2030 (USD MILLION)

- TABLE 276 HIGH PURITY SULFURIC ACID MARKET, BY GRADE, 2021-2024 (KILOTON)

- TABLE 277 HIGH PURITY SULFURIC ACID MARKET, BY GRADE, 2025-2030 (KILOTON)

List of Figures

- FIGURE 1 SULFURIC ACID MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 BOTTOM-UP APPROACH

- FIGURE 4 TOP-DOWN APPROACH

- FIGURE 5 METHODOLOGY FOR SUPPLY-SIDE SIZING OF SULFURIC ACID MARKET (1/2)

- FIGURE 6 METHODOLOGY FOR SUPPLY-SIDE SIZING OF SULFURIC ACID MARKET (2/2)

- FIGURE 7 DATA TRIANGULATION

- FIGURE 8 FERTILIZERS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 9 ASIA PACIFIC ACCOUNTED FOR LARGEST MARKET SHARE IN 2024

- FIGURE 10 INCREASING USE OF SULFURIC ACID IN WASTEWATER TREATMENT TO CREATE LUCRATIVE OPPORTUNITIES FOR MARKET PLAYERS

- FIGURE 11 ASIA PACIFIC TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 12 FERTILIZERS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 13 PYRITE ORE SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 14 INDIA AND UAE TO REGISTER HIGHEST CAGRS DURING FORECAST PERIOD

- FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN SULFURIC ACID MARKET

- FIGURE 16 AMMONIUM SULPHATE PRODUCTION, 2020-2023

- FIGURE 17 SULFURIC ACID MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 18 SULFURIC ACID MARKET: ECOSYSTEM MAPPING

- FIGURE 19 SULFURIC ACID MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 20 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END-USE INDUSTRY

- FIGURE 21 KEY BUYING CRITERIA, BY END-USE INDUSTRY

- FIGURE 22 AVERAGE SELLING PRICE TREND, BY REGION, 2022-2024 (USD/TON)

- FIGURE 23 AVERAGE SELLING PRICE TREND FOR TECHNICAL GRADE, BY KEY PLAYER, 2024 (USD/TON)

- FIGURE 24 LIST OF MAJOR PATENTS RELATED TO SULFURIC ACID, 2014-2024

- FIGURE 25 IMPORT DATA RELATED TO HS CODE 280700-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2021-2024 (USD THOUSAND)

- FIGURE 26 EXPORT DATA RELATED TO HS CODE 280700-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2021-2024 (USD THOUSAND)

- FIGURE 27 TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS

- FIGURE 28 SULFURIC ACID MARKET: INVESTMENT AND FUNDING SCENARIO, 2021-2025

- FIGURE 29 ELEMENTAL SULFUR SEGMENT TO ACCOUNT FOR LARGEST SHARE OF OVERALL MARKET

- FIGURE 30 FERTILIZERS SEGMENT TO BE LARGEST APPLICATION OF SULFURIC ACID DURING FORECAST PERIOD

- FIGURE 31 ASIA PACIFIC TO LEAD SULFURIC ACID MARKET DURING FORECAST PERIOD

- FIGURE 32 ASIA PACIFIC: SULFURIC ACID MARKET SNAPSHOT

- FIGURE 33 NORTH AMERICA: SULFURIC ACID MARKET SNAPSHOT

- FIGURE 34 SULFURIC ACID MARKET: REVENUE ANALYSIS OF KEY COMPANIES, 2020-2024 (USD BILLION)

- FIGURE 35 RANKING OF KEY PLAYERS IN SULFURIC ACID MARKET, 2024

- FIGURE 36 SULFURIC ACID MARKET SHARE ANALYSIS, 2024

- FIGURE 37 BRAND/PRODUCT COMPARISON

- FIGURE 38 SULFURIC ACID MARKET: COMPANY EVALUATION MATRIX. KEY PLAYERS, 2024

- FIGURE 39 SULFURIC ACID MARKET: COMPANY FOOTPRINT

- FIGURE 40 SULFURIC ACID MARKET: COMPANY EVALUATION MATRIX, STARTUPS/SMES, 2024

- FIGURE 41 EV/EBITDA

- FIGURE 42 ENTERPRISE VALUE

- FIGURE 43 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND FIVE-YEAR STOCK BETA OF KEY MANUFACTURERS

- FIGURE 44 MOSAIC: COMPANY SNAPSHOT

- FIGURE 45 JIANGXI COPPER CORPORATION: COMPANY SNAPSHOT

- FIGURE 46 OCP: COMPANY SNAPSHOT

- FIGURE 47 PHOSAGRO GROUP: COMPANY SNAPSHOT

- FIGURE 48 AURUBIS AG: COMPANY SNAPSHOT

- FIGURE 49 BASF: COMPANY SNAPSHOT

- FIGURE 50 CHEMTRADE LOGISTICS: COMPANY SNAPSHOT

- FIGURE 51 LANXESS: COMPANY SNAPSHOT

- FIGURE 52 CHINA PETROLEUM & CHEMICAL CORPORATION: COMPANY SNAPSHOT

- FIGURE 53 KOREAZINC: COMPANY SNAPSHOT

- FIGURE 54 TOAGOSEI CO., LTD.: COMPANY SNAPSHOT

- FIGURE 55 OCCL LIMITED: COMPANY SNAPSHOT

- FIGURE 56 AMAL LTD: COMPANY SNAPSHOT

- FIGURE 57 ECOVYST INC.: COMPANY SNAPSHOT

- FIGURE 58 BOLIDEN GROUP: COMPANY SNAPSHOT

The global sulfuric acid market is projected to grow from USD 41.23 billion in 2025 to USD 49.94 billion by 2030, at a CAGR of 3.9% during the forecast period. Sulfuric acid is an essential industrial chemical used across various sectors because of its strong acidic and dehydrating properties.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million), Volume (Million Tons) |

| Segments | Raw Material, Grade, Form Type, Process, and Application |

| Regions covered | North America, Asia Pacific, Western Europe, Central & Eastern Europe, South America, and the Middle East & Africa |

It is mainly produced through the contact process using raw materials like elemental sulfur and pyrite ore and is used in fertilizers, metal processing, petroleum refining, textiles, and chemical manufacturing. The sulfuric acid market is steadily growing, driven by increasing demand in chemical manufacturing and petroleum refining. In chemical manufacturing, it plays a crucial role in producing acids and intermediates used in multiple industries, while in petroleum refining, it supports alkylation processes that help create cleaner fuels. The rising need for these downstream products and stricter environmental regulations are key factors fueling market growth.

"In terms of volume, base metal smelters raw material segment to account for second-largest market share during the forecast period"

The base metal smelters segment is expected to hold the second-largest share in the sulfuric acid market by volume during the forecast period, driven by its crucial role in producing key non-ferrous metals such as copper, zinc, and nickel. During the smelting of these sulfur-rich ores, sulfur dioxide gas is released as a by-product. This gas is then recovered and converted into sulfuric acid using established methods like the contact process, which both reduces harmful emissions and creates a valuable industrial chemical. The increase in demand for base metals-supported by their extensive use in construction, electrical infrastructure, battery manufacturing, and renewable energy technologies-has caused a rise in smelting activities worldwide. Additionally, stringent environmental regulations to cut sulfur emissions have compelled smelters to implement sulfur capture technologies, thereby boosting sulfuric acid recovery. This dual advantage of meeting environmental standards and generating acid makes base metal smelters an increasingly important raw material source in the global sulfuric acid market.

"In terms of volume, chemical manufacturing application segment to account for second-largest market share during forecast period"

The chemical manufacturing segment is expected to hold the second-largest share in the sulfuric acid market by volume during the forecast period, mainly because of the acid's key role as a feedstock in producing a wide range of industrial chemicals. Sulfuric acid is widely used in creating compounds such as hydrochloric acid, nitric acid, phosphoric acid, and various sulfates, which are important intermediates in making detergents, synthetic resins, dyes, pharmaceuticals, pigments, and explosives. As global demand for these chemicals continues to grow-propelled by expanding end-use industries like textiles, healthcare, plastics, and consumer goods-the need for sulfuric acid has increased accordingly. Furthermore, the steady move toward large-scale chemical production in emerging economies, along with stricter environmental regulations requiring controlled chemical processing, is further boosting the growth of this application segment in the sulfuric acid market.

"In terms of volume, Middle East & Africa to account for second-largest market share during forecast period"

The Middle East & Africa is expected to hold the second-largest share by volume in the sulfuric acid market during the forecast period, due to the region's growing industrial base and increased focus on mineral processing and fertilizer production. Countries across the region are investing in mining and metallurgy projects, especially for extracting and refining metals like copper, zinc, and phosphate-processes that need large amounts of sulfuric acid. Additionally, the rising demand for fertilizers to support food security and agricultural productivity, particularly in African economies, further boosts sulfuric acid consumption. The development of new manufacturing and processing facilities, infrastructure growth, and industrial diversification efforts continue to fuel strong demand for sulfuric acid across various sectors.

Profile break-up of primary participants for the report:

- By Company Type: Tier 1 - 65%, Tier 2 - 20%, and Tier 3 - 15%

- By Designation: Directors- 25%, Managers- 30%, and Others - 45%

- By Region: North America - 30%, Asia Pacific - 40%, Western Europe - 12%, Central & Eastern Europe - 8%, Middle East & Africa - 7%, and South America - 3%

PhosAgro Group (Russia), Aurubis AG (Germany), Mosaic (US), OCP (Morocco), and Jiangxi Copper Corporation (China) are some of the major players operating in the sulfuric acid market. These players have adopted acquisitions, agreements, joint ventures, and expansions to increase their market share and business revenue.

Research Coverage

The report defines, segments, and projects the sulfuric acid market based on raw material, grade, form type, process, application, and region. It offers detailed insights into the key factors shaping the market's growth, such as drivers, restraints, opportunities, and challenges. It strategically profiles sulfuric acid manufacturers, thoroughly analyzing their market shares and core competencies, and monitors and evaluates competitive developments like acquisitions, agreements, joint ventures, and expansions.

Reasons to Buy the Report

The report is expected to assist market leaders and new entrants by providing them with the most accurate estimates of revenue figures for the sulfuric acid market and its segments. It is also designed to help stakeholders better understand the market's competitive landscape, gather insights to enhance their business positions, and develop effective go-to-market strategies. Additionally, it enables stakeholders to grasp the market's current trends and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following points:

- Analysis of critical drivers (High demand for sulfuric acid in various industries and sectors, and increased use in agriculture sector), restraints (restriction on use of sulfuric acid due to its health and environmental impact, and high import duties and regulations on trade of sulfuric acid), opportunities (increasing use of sulfuric acid in wastewater treatment), and challenges (difficulties involved in transportation of sulfuric acid) influencing the growth of the sulfuric acid market.

- Product Development/Innovation: Detailed insights into upcoming technologies, research & development activities in the sulfuric acid market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the sulfuric acid market across varied regions.

- Market Diversification: Exhaustive information about new products, various types, untapped geographies, recent developments, and investments in the sulfuric acid market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players in the sulfuric acid market, such as PhosAgro Group (Russia), Aurubis AG (Germany), Mosaic (US), OCP (Morocco), and Jiangxi Copper Corporation (China).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNITS CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 List of primary interview participants (demand and supply sides)

- 2.1.2.3 Key industry insights

- 2.1.2.4 Breakdown of interviews with experts

- 2.1.1 SECONDARY DATA

- 2.2 MATRIX CONSIDERED FOR DEMAND-SIDE ANALYSIS

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- 2.3.2.1 Calculations for supply-side analysis

- 2.4 GROWTH FORECAST

- 2.5 DATA TRIANGULATION

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 RESEARCH LIMITATIONS

- 2.8 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN SULFURIC ACID MARKET

- 4.2 SULFURIC ACID MARKET, BY REGION

- 4.3 SULFURIC ACID MARKET, BY APPLICATION

- 4.4 SULFURIC ACID MARKET, BY RAW MATERIAL

- 4.5 SULFURIC ACID MARKET, BY KEY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Strong demand for sulfuric acid in numerous applications

- 5.2.1.2 Increased usage of sulfuric acid in agricultural sector

- 5.2.2 RESTRAINTS

- 5.2.2.1 Restriction on use of sulfuric acid due to health and environmental concerns

- 5.2.2.2 High import duties and regulations on trade of sulfuric acid

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing use of sulfuric acid in wastewater treatment

- 5.2.4 CHALLENGES

- 5.2.4.1 Difficulties associated with transportation

- 5.2.1 DRIVERS

6 INDUSTRY TRENDS

- 6.1 GLOBAL MACROECONOMIC OUTLOOK

- 6.2 SUPPLY CHAIN ANALYSIS

- 6.2.1 RAW MATERIAL SUPPLY

- 6.2.2 SULFURIC ACID PRODUCTION

- 6.2.3 PRODUCT TYPES

- 6.2.4 DISTRIBUTION NETWORK

- 6.2.5 END-USE INDUSTRIES

- 6.3 ECOSYSTEM ANALYSIS

- 6.4 PORTER'S FIVE FORCES ANALYSIS

- 6.4.1 BARGAINING POWER OF SUPPLIERS

- 6.4.2 BARGAINING POWER OF BUYERS

- 6.4.3 THREAT OF NEW ENTRANTS

- 6.4.4 THREAT OF SUBSTITUTES

- 6.4.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.5 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.5.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.5.2 BUYING CRITERIA

- 6.6 PRICING ANALYSIS

- 6.6.1 AVERAGE SELLING PRICE TREND OF SULFURIC ACID, BY REGION, 2022-2024

- 6.6.2 AVERAGE SELLING PRICE TREND FOR TECHNICAL GRADE, BY KEY PLAYER, 2024

- 6.7 TARIFF AND REGULATORY LANDSCAPE

- 6.7.1 TARIFF ANALYSIS

- 6.7.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.7.3 STANDARDS AND REGULATIONS

- 6.8 KEY CONFERENCES AND EVENTS, 2025-2026

- 6.9 PATENT ANALYSIS

- 6.9.1 METHODOLOGY

- 6.10 TECHNOLOGY ANALYSIS

- 6.10.1 KEY TECHNOLOGIES

- 6.10.1.1 Wet Gas Sulfuric Acid (WSA) technology

- 6.10.2 ADJACENT TECHNOLOGIES

- 6.10.2.1 GORE SO2 Control System

- 6.10.1 KEY TECHNOLOGIES

- 6.11 CASE STUDY ANALYSIS

- 6.11.1 ENHANCING SUSTAINABILITY AND EFFICIENCY THROUGH SULFURIC ACID REGENERATION

- 6.11.2 BASF STRENGTHENS EUROPE'S SEMICONDUCTOR SUPPLY CHAIN WITH NEW HIGH-PURITY SULFURIC ACID PLANT

- 6.12 TRADE DATA

- 6.12.1 IMPORT SCENARIO (HS CODE 280700)

- 6.12.2 EXPORT SCENARIO (HS CODE 280700)

- 6.13 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.14 INVESTMENT AND FUNDING SCENARIO

- 6.15 IMPACT OF GENERATIVE AI ON SULFURIC ACID MARKET

- 6.15.1 INTRODUCTION

- 6.15.2 OPTIMIZING SULFURIC ACID PRODUCTION

- 6.15.3 ENABLING PRECISION AGRICULTURE

- 6.15.4 STREAMLINING SUPPLY CHAIN

- 6.15.5 MINIMIZING ENVIRONMENTAL IMPACT

- 6.16 IMPACT OF US TARIFF ON SULFURIC ACID MARKET

- 6.16.1 KEY TARIFF RATES IMPACTING MARKET

- 6.16.2 PRICE IMPACT ANALYSIS

- 6.16.3 KEY IMPACT ON VARIOUS REGIONS

- 6.16.3.1 US

- 6.16.3.2 Europe

- 6.16.3.3 Asia Pacific

- 6.16.4 IMPACT ON END-USE INDUSTRIES OF SULFURIC ACID

- 6.16.4.1 Metal processing

- 6.16.4.2 Pulp & paper

- 6.16.4.3 Petroleum refining

- 6.16.4.4 Textiles

- 6.16.4.5 Automotive

- 6.16.4.6 Chemical manufacturing

7 SULFURIC ACID MARKET, BY FORM TYPE

- 7.1 INTRODUCTION

- 7.2 CONCENTRATED SULFURIC ACID

- 7.2.1 WIDE-RANGING APPLICABILITY TO ACCELERATE MARKET GROWTH

- 7.3 TOWER/GLOVER ACID

- 7.3.1 SUSTAINED USE OF TRADITIONAL ACID PRODUCTION SETUPS AND SPECIFIC INDUSTRIAL PROCESSES TO BOOST MARKET

- 7.4 CHAMBER/FERTILIZER ACID

- 7.4.1 GROWING DEMAND TO SUPPORT GLOBAL FOOD SECURITY TO PROPEL MARKET

- 7.5 BATTERY ACID

- 7.5.1 SUSTAINED DEMAND FOR LEAD-ACID BATTERIES IN CONVENTIONAL AND BACKUP POWER APPLICATIONS TO DRIVE MARKET

- 7.6 66 DEGREE BAUME SULFURIC ACID

- 7.6.1 REQUIREMENT FOR STANDARDIZED AND QUALITY-CONTROLLED ACID FORMS IN INDUSTRIAL PROCESSING TO FUEL MARKET

- 7.7 DILUTE SULFURIC ACID

- 7.7.1 RISING SAFETY AND REGULATORY CONSIDERATIONS TO PROPEL MARKET

8 SULFURIC ACID MARKET, BY GRADE

- 8.1 INTRODUCTION

- 8.2 TECHNICAL GRADE

- 8.2.1 RISING DEMAND IN KEY INDUSTRIAL PROCESSES SUCH AS FERTILIZER MANUFACTURING TO ACCELERATE MARKET GROWTH

- 8.3 BATTERY GRADE

- 8.3.1 GROWING PRODUCTION AND ADOPTION OF LEAD-ACID BATTERIES IN AUTOMOTIVE, INDUSTRIAL, AND BACKUP POWER APPLICATIONS TO FUEL MARKET

- 8.4 CP GRADE (CHEMICALLY PURE)

- 8.4.1 INCREASING NEED FOR ULTRA-PURE CHEMICAL INPUTS IN HIGH-PRECISION SECTORS TO DRIVE MARKET

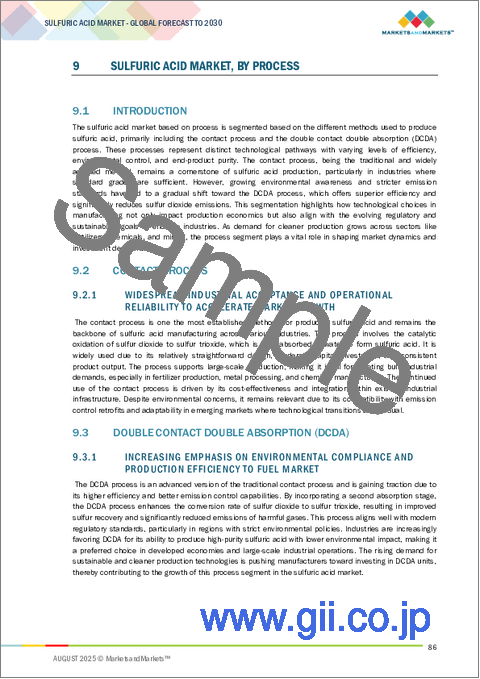

9 SULFURIC ACID MARKET, BY PROCESS

- 9.1 INTRODUCTION

- 9.2 CONTACT PROCESS

- 9.2.1 WIDESPREAD INDUSTRIAL ACCEPTANCE AND OPERATIONAL RELIABILITY TO ACCELERATE MARKET GROWTH

- 9.3 DOUBLE CONTACT DOUBLE ABSORPTION (DCDA)

- 9.3.1 INCREASING EMPHASIS ON ENVIRONMENTAL COMPLIANCE AND PRODUCTION EFFICIENCY TO FUEL MARKET

10 SULFURIC ACID MARKET, BY RAW MATERIAL

- 10.1 INTRODUCTION

- 10.2 ELEMENTAL SULFUR

- 10.2.1 ABUNDANT SUPPLY FROM OIL AND GAS REFINING TO ACCELERATE MARKET GROWTH

- 10.3 PYRITE ORE

- 10.3.1 LOCAL AVAILABILITY IN MINING REGIONS TO FUEL MARKET

- 10.4 BASE METAL SMELTERS

- 10.4.1 INCREASING ENFORCEMENT OF ENVIRONMENTAL REGULATIONS AND INDUSTRY PUSH FOR CLEANER OPERATIONS TO DRIVE MARKET

- 10.5 OTHER RAW MATERIALS

11 SULFURIC ACID MARKET, BY APPLICATION

- 11.1 INTRODUCTION

- 11.2 FERTILIZERS

- 11.2.1 INCREASING DEMAND DRIVEN BY GLOBAL FOOD SECURITY CONCERNS AND INTENSIFIED AGRICULTURAL PRACTICES TO ACCELERATE MARKET

- 11.3 METAL PROCESSING

- 11.3.1 RISING DEMAND FOR BASE AND PRECIOUS METALS DRIVEN BY INDUSTRIAL GROWTH AND CLEAN ENERGY TRANSITION TO FUEL MARKET

- 11.4 PULP & PAPER

- 11.4.1 RISING DEMAND FOR PACKAGING AND HYGIENE PRODUCTS TO DRIVE MARKET

- 11.5 PETROLEUM REFINING

- 11.5.1 INCREASING DEMAND FOR HIGH-OCTANE, LOW-EMISSION FUELS TO BOOST MARKET

- 11.6 TEXTILE

- 11.6.1 RISING PRODUCTION IN EMERGING ECONOMIES AND INCREASING DEMAND FOR HIGH-QUALITY AND FUNCTIONAL FABRICS TO FUEL MARKET

- 11.7 AUTOMOTIVE

- 11.7.1 SUSTAINED DEMAND FOR LEAD-ACID BATTERIES IN CONVENTIONAL AND HYBRID VEHICLES TO FUEL MARKET

- 11.8 CHEMICAL MANUFACTURING

- 11.8.1 INCREASING PRODUCTION OF DIVERSE INDUSTRIAL AND SPECIALTY CHEMICALS TO PROPEL MARKET

- 11.9 OTHER APPLICATIONS

12 SULFURIC ACID MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 ASIA PACIFIC

- 12.2.1 CHINA

- 12.2.1.1 Significant fertilizer production to meet vast demand from agriculture to drive market

- 12.2.2 JAPAN

- 12.2.2.1 Demand from electronics, food processing, and precision metal treatment sectors to boost market

- 12.2.3 INDIA

- 12.2.3.1 Rising fertilizer production aligned with growing agricultural sector to fuel market

- 12.2.4 INDONESIA

- 12.2.4.1 Increasing fertilizer production and mineral processing to boost market

- 12.2.5 SOUTH KOREA

- 12.2.5.1 Expanding demand in semiconductors, battery, and electronics sectors to drive market

- 12.2.6 REST OF ASIA PACIFIC

- 12.2.1 CHINA

- 12.3 NORTH AMERICA

- 12.3.1 US

- 12.3.1.1 Large-scale agricultural exports increasing demand for fertilizer to fuel market growth

- 12.3.2 CANADA

- 12.3.2.1 Robust fertilizer production and large-scale agricultural exports to propel market

- 12.3.3 MEXICO

- 12.3.3.1 Strong agricultural activity and rising demand for phosphate-based fertilizers to fuel market growth

- 12.3.1 US

- 12.4 WESTERN EUROPE

- 12.4.1 GERMANY

- 12.4.1.1 Strong chemical manufacturing and automotive sectors to fuel market

- 12.4.2 ITALY

- 12.4.2.1 Growth of chemical, textile, and automotive sectors to boost market

- 12.4.3 FRANCE

- 12.4.3.1 Rising manufacture of chemicals and automotive to drive demand

- 12.4.4 UK

- 12.4.4.1 Focus on chemical manufacturing, battery production, and industrial environmental compliance to drive market

- 12.4.5 SPAIN

- 12.4.5.1 Extensive agricultural production and high demand for fertilizers to drive market

- 12.4.6 REST OF WESTERN EUROPE

- 12.4.1 GERMANY

- 12.5 CENTRAL & EASTERN EUROPE

- 12.5.1 RUSSIA

- 12.5.1.1 Large-scale fertilizer production and integrated chemical industry to fuel market

- 12.5.2 TURKIYE

- 12.5.2.1 Expanding agricultural base and chemical industry to propel market

- 12.5.3 REST OF CENTRAL & EASTERN EUROPE

- 12.5.1 RUSSIA

- 12.6 MIDDLE EAST & AFRICA

- 12.6.1 GCC COUNTRIES

- 12.6.1.1 Saudi Arabia

- 12.6.1.1.1 Demand from chemical manufacturing and petroleum refining industries to drive market

- 12.6.1.2 UAE

- 12.6.1.2.1 Robust demand from petroleum refining and industrial chemical manufacturing to propel market growth

- 12.6.1.3 Rest of GCC countries

- 12.6.1.1 Saudi Arabia

- 12.6.2 MOROCCO

- 12.6.2.1 Largest phosphate reserves to boost fertilizer production

- 12.6.3 REST OF MIDDLE EAST & AFRICA

- 12.6.1 GCC COUNTRIES

- 12.7 SOUTH AMERICA

- 12.7.1 BRAZIL

- 12.7.1.1 Large-scale fertilizer production and agricultural output to propel market

- 12.7.2 ARGENTINA

- 12.7.2.1 Production of phosphate-based fertilizers to meet major crop nutrient requirements to fuel market

- 12.7.3 CHILE

- 12.7.3.1 Demand for petroleum refining and chemical manufacturing to drive market

- 12.7.4 REST OF SOUTH AMERICA

- 12.7.1 BRAZIL

13 COMPETITIVE LANDSCAPE

- 13.1 INTRODUCTION

- 13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 13.3 REVENUE ANALYSIS

- 13.3.1 TOP 5 PLAYERS' REVENUE ANALYSIS, 2020-2024

- 13.4 MARKET SHARE ANALYSIS

- 13.4.1 RANKING OF KEY MARKET PLAYERS, 2024

- 13.4.2 MARKET SHARE OF KEY PLAYERS, 2024

- 13.5 BRAND/PRODUCT COMPARISON

- 13.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 13.6.1 STARS

- 13.6.2 EMERGING LEADERS

- 13.6.3 PERVASIVE PLAYERS

- 13.6.4 PARTICIPANTS

- 13.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 13.6.5.1 Company footprint

- 13.6.5.2 Region footprint

- 13.6.5.3 Application footprint

- 13.6.5.4 Grade footprint

- 13.6.5.5 Raw material footprint

- 13.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 13.7.1 PROGRESSIVE COMPANIES

- 13.7.2 RESPONSIVE COMPANIES

- 13.7.3 DYNAMIC COMPANIES

- 13.7.4 STARTING BLOCKS

- 13.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 13.7.5.1 Detailed list of key startups/SMES

- 13.7.5.2 Competitive benchmarking of key startups/SMEs

- 13.8 COMPETITIVE SCENARIO

- 13.8.1 DEALS

- 13.8.2 EXPANSIONS

- 13.9 VALUATION AND FINANCIAL METRICS

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- 14.1.1 MOSAIC

- 14.1.1.1 Business overview

- 14.1.1.2 Products/Solutions/Services offered

- 14.1.1.3 MnM view

- 14.1.1.3.1 Right to win

- 14.1.1.3.2 Strategic choices

- 14.1.1.3.3 Weaknesses and competitive threats

- 14.1.2 JIANGXI COPPER CORPORATION

- 14.1.2.1 Business overview

- 14.1.2.2 Products/Solutions/Services offered

- 14.1.2.3 MnM view

- 14.1.2.3.1 Right to win

- 14.1.2.3.2 Strategic choices

- 14.1.2.3.3 Weaknesses and competitive threats

- 14.1.3 OCP

- 14.1.3.1 Business overview

- 14.1.3.2 Products/Solutions/Services offered

- 14.1.3.3 MnM view

- 14.1.3.3.1 Right to win

- 14.1.3.3.2 Strategic choices

- 14.1.3.3.3 Weaknesses and competitive threats

- 14.1.4 PHOSAGRO GROUP

- 14.1.4.1 Business overview

- 14.1.4.2 Products/Solutions/Services offered

- 14.1.4.3 MnM view

- 14.1.4.3.1 Right to win

- 14.1.4.3.2 Strategic choices

- 14.1.4.3.3 Weaknesses and competitive threats

- 14.1.5 AURUBIS AG

- 14.1.5.1 Business overview

- 14.1.5.2 Products/Solutions/Services offered

- 14.1.5.3 MnM view

- 14.1.5.3.1 Right to win

- 14.1.5.3.2 Strategic choices

- 14.1.5.3.3 Weaknesses and competitive threats

- 14.1.6 BASF

- 14.1.6.1 Business overview

- 14.1.6.2 Products/Solutions/Services offered

- 14.1.6.3 Recent developments

- 14.1.6.3.1 Deals

- 14.1.6.3.2 Expansions

- 14.1.7 CHEMTRADE LOGISTICS

- 14.1.7.1 Business overview

- 14.1.7.2 Products/Solutions/Services offered

- 14.1.7.3 Recent developments

- 14.1.7.3.1 Deals

- 14.1.8 NOURYON

- 14.1.8.1 Business overview

- 14.1.8.2 Products/Solutions/Services offered

- 14.1.9 Q-ACID

- 14.1.9.1 Business overview

- 14.1.9.2 Products/Solutions/Services offered

- 14.1.10 LANXESS

- 14.1.10.1 Business overview

- 14.1.10.2 Products/Solutions/Services offered

- 14.1.11 PVS CHEMICALS

- 14.1.11.1 Business overview

- 14.1.11.2 Products/Solutions/Services offered

- 14.1.12 MITSUBISHI SHOJI CHEMICAL CORPORATION

- 14.1.12.1 Business overview

- 14.1.12.2 Products/Solutions/Services offered

- 14.1.13 WEYLCHEM INTERNATIONAL GMBH

- 14.1.13.1 Business overview

- 14.1.13.2 Products/Solutions/Services offered

- 14.1.14 CHINA PETROLEUM & CHEMICAL CORPORATION

- 14.1.14.1 Business overview

- 14.1.14.2 Products/Solutions/Services offered

- 14.1.15 KOREAZINC

- 14.1.15.1 Business overview

- 14.1.15.2 Products/Solutions/Services offered

- 14.1.16 TOAGOSEI CO., LTD.

- 14.1.16.1 Business overview

- 14.1.16.2 Products/Solutions/Services offered

- 14.1.17 OCCL LIMITED

- 14.1.17.1 Business overview

- 14.1.17.2 Products/Solutions/Services offered

- 14.1.18 AMAL LTD

- 14.1.18.1 Business overview

- 14.1.18.2 Products/Solutions/Services offered

- 14.1.19 ECOVYST INC.

- 14.1.19.1 Business overview

- 14.1.19.2 Products/Solutions/Services offered

- 14.1.19.3 Recent developments

- 14.1.19.3.1 Deals

- 14.1.20 BOLIDEN GROUP

- 14.1.20.1 Business overview

- 14.1.20.2 Products/Solutions/Services offered

- 14.1.1 MOSAIC

- 14.2 OTHER PLAYERS

- 14.2.1 ACIDOS Y MINERALES DE VENEZUELA C.A.

- 14.2.2 INDUSTRIAS BASICAS DE CALDAS S.A.

- 14.2.3 DEXO CHEM LABORATORIES

- 14.2.4 PCIPL

15 ADJACENT AND RELATED MARKETS

- 15.1 INTRODUCTION

- 15.2 LIMITATIONS

- 15.3 INTERCONNECTED MARKETS

- 15.4 HIGH PURITY SULFURIC ACID MARKET

- 15.4.1 MARKET DEFINITION

- 15.4.2 MARKET OVERVIEW

- 15.4.3 HIGH PURITY SULFURIC ACID MARKET, BY GRADE

- 15.5 PPB

- 15.5.1 CRUCIAL ROLE IN TRACE METAL ANALYSIS TECHNIQUES TO PROPEL MARKET

- 15.6 PPT

- 15.6.1 DEMAND FOR HIGH-END MICROCHIPS, DISPLAY PANELS, AND NEXT-GENERATION INTEGRATED CIRCUITS TO DRIVE MARKET

16 APPENDIX

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS