|

|

市場調査レポート

商品コード

1711377

高純度硫酸の世界市場:グレード別、用途別、最終用途産業別、地域別 - 2030年までの予測High-Purity Sulfuric Acid Market by Grade (PPB, PPT), Application (Cleaning, Etching), End-Use Industry (Semiconductor & Electronics, Pharmaceuticals) - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 高純度硫酸の世界市場:グレード別、用途別、最終用途産業別、地域別 - 2030年までの予測 |

|

出版日: 2025年04月07日

発行: MarketsandMarkets

ページ情報: 英文 229 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

高純度硫酸の市場規模は2024年の5億米ドルから2030年には6億7,000万米ドルに成長し、予測期間中のCAGRは6.1%を記録すると予測されています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 金額(100万米ドル/10億米ドル) |

| セグメント | グレード別、用途別、最終用途産業別、地域別 |

| 対象地域 | アジア太平洋、北米、欧州、その他の地域 |

高純度硫酸市場は、半導体・エレクトロニクス分野や製薬分野での洗浄プロセス、エッチングプロセス、精製プロセスでの重要な用途により大きく成長しています。不純物を最小限に抑えた高純度硫酸は、マイクロエレクトロニクス、回路基板、集積チップの製造に大きな役割を果たすため、急成長する半導体セクターでは貴重な存在となっています。洗練された家電製品、5Gネットワーク機器、AI対応機器に対する需要の増加に伴い、半導体産業の成長が高純度硫酸市場を直接牽引しています。さらに、製薬業界は装置の洗浄や医薬品有効成分(API)の精密製造にこの酸を使用しており、市場の成長を支えています。

PPB(Parts Per Billion)グレードは、次世代半導体製造、先端エレクトロニクス、製薬用途での用途拡大に基づき、高純度硫酸市場の中で成長をリードするセグメントです。低グレードの硫酸とは異なり、PPBグレードの硫酸は超低汚染レベルであるため、微量金属不純物が欠陥につながる可能性のある次世代マイクロチップの製造に不可欠な商品となっています。半導体のノードが5nm、さらにはそれ以下になると、チップメーカーは歩留まりを高く保ち、性能を最適化するために超高純度の化学薬品を必要とします。AIプロセッサー、5Gチップ、高密度メモリーへの需要の高まりは、特に半導体製造の中心地であるアジア太平洋における先端半導体製造施設への投資を促進しています。PPBグレードの硫酸は、医薬品製剤やデリケートな洗浄のための厳しいGMP基準によって純粋な化学物質が求められる製薬セクターでも使用されるようになっています。政府や企業は、より精製された汚染のない化学物質を製造するために研究開発費を増やし、PPBグレード硫酸の使用を再び増やしています。高信頼性で汚染のない電子機器への要求の高まりと、いくつかの産業におけるより高い純度要件により、PPBセグメントは高純度硫酸市場で最も成長しているセグメントとなっています。

エッチング分野は高純度硫酸市場において最も開発が進んでいる分野です。なぜなら、エッチングは精密さが命である半導体産業にとって必要不可欠だからです。エレクトロニクスの小型化・複雑化に伴い、高純度化学薬品を使用するハイテク・エッチング・プロセスの需要が高まっています。主にエッチング後のシリコンウエハーの洗浄に使用されるが、洗浄はウエハーの純度にとって極めて重要であり、エッチング市場の需要を間接的に押し上げています。高純度硫酸のビジネスにおけるエッチング市場の急拡大は、特に半導体製造やその他の産業用途での使用において注目すべきものです。ここでは、高純度硫酸の市場需給状況、技術、関連プロセスにおける具体的な用途を探ることで、その動向の理由を探ります。

製薬業界は、高純度硫酸市場における大規模な最終用途業界の一つとして飛躍的に成長しています。これは、医薬品の製造において重要な成分であり、洗浄剤、pH調整剤、化学合成の触媒として使用されるためです。慢性疾患の蔓延とそれに伴うヘルスケア・ニーズの高まりに影響された医薬品需要の増加が、高純度硫酸の消費拡大につながっています。また、医薬品製造レベルでの高純度維持に対する業界の規制ニーズも、超高純度化学物質の使用に大きな関心を寄せています。また、バイオ医薬品、個別化医療、高度な医薬品製剤の拡大により、品質と精度の面で高純度硫酸への依存度が高まっています。莫大な医薬品生産能力を持つインドと中国は、世界的に通用する品質を供給するため、高純度化学プラントを設立しています。特に世界の健康問題に対応するため、ワクチンや特殊医薬品の製造が拡大し、需要をさらに押し上げています。

アジア太平洋は、この化学物質の最大の消費者である半導体・電子産業が活況を呈しているため、高純度硫酸の市場が最も急成長しています。中国、韓国、台湾、日本は半導体製造において世界をリードしており、ウエハー洗浄、エッチング、その他の正確なプロセスに高純度硫酸を必要としています。この地域はまた、特にインドと中国における医薬品製造への投資増加からも恩恵を受けており、厳しい品質規制とともに超高純度化学薬品へのニーズが高まっています。さらに、5G、人工知能、電気自動車などの先端技術の開発により、半導体部品のニーズが高まり、高純度硫酸の需要も増加しています。

当レポートでは、世界の高純度硫酸市場について調査し、グレード別、用途別、最終用途産業別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 生成AIの影響

第6章 業界動向

- イントロダクション

- 顧客ビジネスに影響を与える動向/混乱

- サプライチェーン分析

- 投資と資金調達のシナリオ

- 価格分析

- エコシステム分析

- 技術分析

- 特許分析

- 貿易分析

- 主要な会議とイベント

- 関税と規制状況

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- マクロ経済見通し

- ケーススタディ分析

第7章 高純度硫酸市場、グレード別

- イントロダクション

- PPB

- PPT

第8章 高純度硫酸市場、用途別

- イントロダクション

- クリーニング

- エッチング

- その他の用途

第9章 高純度硫酸市場別、最終用途産業別

- イントロダクション

- 半導体およびエレクトロニクス

- 医薬品

- その他

第10章 高純度硫酸市場、地域別

- イントロダクション

- アジア太平洋

- トランプの影響

- 中国

- 日本

- 台湾

- 韓国

- インド

- その他

- 北米

- トランプの影響

- 米国

- カナダ

- メキシコ

- 欧州

- トランプの影響

- ドイツ

- フランス

- ポーランド

- オランダ

- その他

- その他の地域

- トルコ

- イスラエル

- 南アフリカ

- その他

第11章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み

- 市場シェア分析

- 収益分析

- ブランド/製品比較分析

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 競合シナリオ

第12章 企業プロファイル

- 主要参入企業

- SUMITOMO CHEMICAL CO., LTD.

- BASF

- KANTO KAGAKU

- LS MNM INC.

- CHEMTRADE LOGISTICS

- FUJIFILM WAKO PURE CHEMICAL CORPORATION

- PVS CHEMICALS

- KOREAZINC

- LANXESS

- GRILLO-WERKE AG

- HUIZHOU BAILIHONG HOLDINGS CO., LTD.

- AVANTOR, INC.

- MERCK KGAA

- その他の企業

- ASIA UNION ELECTRONIC CHEMICAL CORP.

- TAMA CHEMICALS CO., LTD

- CRYSTAL CLEAR ELECTRONIC MATERIAL CO., LTD.

- NUOVA SOLMINE

- ANHUI HUAERTAI CHEMICAL CO., LTD.

- RCI LABSCAN LIMITED

- SPECTRUM CHEMICAL

- CHUNG HWA CHEMICAL INDUSTRIAL WORKS, LTD.

- DONAU CHEMIE AG

- TAYCA CO., LTD.

- SCHARLAB S.L.

- MARCHI INDUSTRIALE

第13章 付録

List of Tables

- TABLE 1 AVERAGE SELLING PRICE TREND OF HIGH-PURITY SULFURIC ACID, BY REGION, 2021-2023 (USD/KILOTON)

- TABLE 2 AVERAGE SELLING PRICE TREND OF HIGH-PURITY SULFURIC ACID, BY GRADE, 2021-2023 (USD/KILOTON)

- TABLE 3 AVERAGE SELLING PRICE TREND OF HIGH-PURITY SULFURIC ACID OFFERED BY KEY PLAYERS, 2023 (USD/KILOTON)

- TABLE 4 ROLE OF COMPANIES IN HIGH-PURITY SULFURIC ACID ECOSYSTEM

- TABLE 5 HIGH-PURITY SULFURIC ACID MARKET: KEY TECHNOLOGIES

- TABLE 6 HIGH-PURITY SULFURIC ACID MARKET: COMPLEMENTARY TECHNOLOGIES

- TABLE 7 TOTAL NUMBER OF PATENTS, 2015-2024

- TABLE 8 TOP OWNERS OF PATENTS RELATED TO HIGH-PURITY SULFURIC ACID, 2015-2024

- TABLE 9 HIGH-PURITY SULFURIC ACID MARKET: LIST OF KEY PATENTS, 2015-2024

- TABLE 10 HIGH-PURITY SULFURIC ACID MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 11 TARIFF DATA RELATED TO HS CODE 280700-COMPLIANT PRODUCTS, BY COUNTRY, 2023

- TABLE 12 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 HIGH-PURITY SULFURIC ACID MARKET: STANDARDS AND REGULATIONS

- TABLE 17 HIGH-PURITY SULFURIC ACID MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 18 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END-USE INDUSTRY (%)

- TABLE 19 KEY BUYING CRITERIA, BY END-USE INDUSTRY

- TABLE 20 GDP TRENDS AND FORECASTS, BY COUNTRY, 2023-2025 (USD MILLION)

- TABLE 21 HIGH-PURITY SULFURIC ACID MARKET, BY GRADE, 2021-2024 (USD MILLION)

- TABLE 22 HIGH-PURITY SULFURIC ACID MARKET, BY GRADE, 2025-2030 (USD MILLION)

- TABLE 23 HIGH-PURITY SULFURIC ACID MARKET, BY GRADE, 2021-2024 (KILOTON)

- TABLE 24 HIGH-PURITY SULFURIC ACID MARKET, BY GRADE, 2025-2030 (KILOTON)

- TABLE 25 HIGH-PURITY SULFURIC ACID MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 26 HIGH-PURITY SULFURIC ACID MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 27 HIGH-PURITY SULFURIC ACID MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 28 HIGH-PURITY SULFURIC ACID MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 29 HIGH-PURITY SULFURIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 30 HIGH-PURITY SULFURIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 31 HIGH-PURITY SULFURIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 32 HIGH-PURITY SULFURIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 33 HIGH-PURITY SULFURIC ACID MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 34 HIGH-PURITY SULFURIC ACID MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 35 HIGH-PURITY SULFURIC ACID MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 36 HIGH-PURITY SULFURIC ACID MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 37 ASIA PACIFIC: HIGH-PURITY SULFURIC ACID MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 38 ASIA PACIFIC: HIGH-PURITY SULFURIC ACID MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 39 ASIA PACIFIC: HIGH-PURITY SULFURIC ACID MARKET, BY COUNTRY, 2021-2024 (KILOTON)

- TABLE 40 ASIA PACIFIC: HIGH-PURITY SULFURIC ACID MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 41 ASIA PACIFIC: HIGH-PURITY SULFURIC ACID MARKET, BY GRADE, 2021-2024 (USD MILLION)

- TABLE 42 ASIA PACIFIC: HIGH-PURITY SULFURIC ACID MARKET, BY GRADE, 2025-2030 (USD MILLION)

- TABLE 43 ASIA PACIFIC: HIGH-PURITY SULFURIC ACID MARKET, BY GRADE, 2021-2024 (KILOTON)

- TABLE 44 ASIA PACIFIC: HIGH-PURITY SULFURIC ACID MARKET, BY GRADE, 2025-2030 (KILOTON)

- TABLE 45 ASIA PACIFIC: HIGH-PURITY SULFURIC ACID MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 46 ASIA PACIFIC: HIGH-PURITY SULFURIC ACID MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 47 ASIA PACIFIC: HIGH-PURITY SULFURIC ACID MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 48 ASIA PACIFIC: HIGH-PURITY SULFURIC ACID MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 49 ASIA PACIFIC: HIGH-PURITY SULFURIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 50 ASIA PACIFIC: HIGH-PURITY SULFURIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 51 ASIA PACIFIC: HIGH-PURITY SULFURIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 52 ASIA PACIFIC: HIGH-PURITY SULFURIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 53 CHINA: HIGH-PURITY SULFURIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 54 CHINA: HIGH-PURITY SULFURIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 55 CHINA: HIGH-PURITY SULFURIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 56 CHINA: HIGH-PURITY SULFURIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 57 JAPAN: HIGH-PURITY SULFURIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 58 JAPAN: HIGH-PURITY SULFURIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 59 JAPAN: HIGH-PURITY SULFURIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 60 JAPAN: HIGH-PURITY SULFURIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 61 TAIWAN: HIGH-PURITY SULFURIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 62 TAIWAN: HIGH-PURITY SULFURIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 63 TAIWAN: HIGH-PURITY SULFURIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 64 TAIWAN: HIGH-PURITY SULFURIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 65 SOUTH KOREA: HIGH-PURITY SULFURIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 66 SOUTH KOREA: HIGH-PURITY SULFURIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 67 SOUTH KOREA: HIGH-PURITY SULFURIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 68 SOUTH KOREA: HIGH-PURITY SULFURIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 69 INDIA: HIGH-PURITY SULFURIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 70 INDIA: HIGH-PURITY SULFURIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 71 INDIA: HIGH-PURITY SULFURIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 72 INDIA: HIGH-PURITY SULFURIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 73 REST OF ASIA PACIFIC: HIGH-PURITY SULFURIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 74 REST OF ASIA PACIFIC: HIGH-PURITY SULFURIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 75 REST OF ASIA PACIFIC: HIGH-PURITY SULFURIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 76 REST OF ASIA PACIFIC: HIGH-PURITY SULFURIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 77 NORTH AMERICA: HIGH-PURITY SULFURIC ACID MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 78 NORTH AMERICA: HIGH-PURITY SULFURIC ACID MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 79 NORTH AMERICA: HIGH-PURITY SULFURIC ACID MARKET, BY COUNTRY, 2021-2024 (KILOTON)

- TABLE 80 NORTH AMERICA: HIGH-PURITY SULFURIC ACID MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 81 NORTH AMERICA: HIGH-PURITY SULFURIC ACID MARKET, BY GRADE, 2021-2024 (USD MILLION)

- TABLE 82 NORTH AMERICA: HIGH-PURITY SULFURIC ACID MARKET, BY GRADE, 2025-2030 (USD MILLION)

- TABLE 83 NORTH AMERICA: HIGH-PURITY SULFURIC ACID MARKET, BY GRADE, 2021-2024 (KILOTON)

- TABLE 84 NORTH AMERICA: HIGH-PURITY SULFURIC ACID MARKET, BY GRADE, 2025-2030 (KILOTON)

- TABLE 85 NORTH AMERICA: HIGH-PURITY SULFURIC ACID MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 86 NORTH AMERICA: HIGH-PURITY SULFURIC ACID MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 87 NORTH AMERICA: HIGH-PURITY SULFURIC ACID MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 88 NORTH AMERICA: HIGH-PURITY SULFURIC ACID MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 89 NORTH AMERICA: HIGH-PURITY SULFURIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 90 NORTH AMERICA: HIGH-PURITY SULFURIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 91 NORTH AMERICA: HIGH-PURITY SULFURIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 92 NORTH AMERICA: HIGH-PURITY SULFURIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 93 US: HIGH-PURITY SULFURIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 94 US: HIGH-PURITY SULFURIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 95 US: HIGH-PURITY SULFURIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 96 US: HIGH-PURITY SULFURIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 97 CANADA: HIGH-PURITY SULFURIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 98 CANADA: HIGH-PURITY SULFURIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 99 CANADA: HIGH-PURITY SULFURIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 100 CANADA: HIGH-PURITY SULFURIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 101 MEXICO: HIGH-PURITY SULFURIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 102 MEXICO: HIGH-PURITY SULFURIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 103 MEXICO: HIGH-PURITY SULFURIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 104 MEXICO: HIGH-PURITY SULFURIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 105 EUROPE: HIGH-PURITY SULFURIC ACID MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 106 EUROPE: HIGH-PURITY SULFURIC ACID MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 107 EUROPE: HIGH-PURITY SULFURIC ACID MARKET, BY COUNTRY, 2021-2024 (KILOTON)

- TABLE 108 EUROPE: HIGH-PURITY SULFURIC ACID MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 109 EUROPE: HIGH-PURITY SULFURIC ACID MARKET, BY GRADE, 2021-2024 (USD MILLION)

- TABLE 110 EUROPE: HIGH-PURITY SULFURIC ACID MARKET, BY GRADE, 2025-2030 (USD MILLION)

- TABLE 111 EUROPE: HIGH-PURITY SULFURIC ACID MARKET, BY GRADE, 2021-2024 (KILOTON)

- TABLE 112 EUROPE: HIGH-PURITY SULFURIC ACID MARKET, BY GRADE, 2025-2030 (KILOTON)

- TABLE 113 EUROPE: HIGH-PURITY SULFURIC ACID MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 114 EUROPE: HIGH-PURITY SULFURIC ACID MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 115 EUROPE: HIGH-PURITY SULFURIC ACID MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 116 EUROPE: HIGH-PURITY SULFURIC ACID MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 117 EUROPE: HIGH-PURITY SULFURIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 118 EUROPE: HIGH-PURITY SULFURIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 119 EUROPE: HIGH-PURITY SULFURIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 120 EUROPE: HIGH-PURITY SULFURIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 121 GERMANY: HIGH-PURITY SULFURIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 122 GERMANY: HIGH-PURITY SULFURIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 123 GERMANY: HIGH-PURITY SULFURIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 124 GERMANY: HIGH-PURITY SULFURIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 125 FRANCE: HIGH-PURITY SULFURIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 126 FRANCE: HIGH-PURITY SULFURIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 127 FRANCE: HIGH-PURITY SULFURIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 128 FRANCE: HIGH-PURITY SULFURIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 129 POLAND: HIGH-PURITY SULFURIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 130 POLAND: HIGH-PURITY SULFURIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 131 POLAND: HIGH-PURITY SULFURIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 132 POLAND: HIGH-PURITY SULFURIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 133 NETHERLANDS: HIGH-PURITY SULFURIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 134 NETHERLANDS: HIGH-PURITY SULFURIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 135 NETHERLANDS: HIGH-PURITY SULFURIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 136 NETHERLANDS: HIGH-PURITY SULFURIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 137 REST OF EUROPE: HIGH-PURITY SULFURIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 138 REST OF EUROPE: HIGH-PURITY SULFURIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 139 REST OF EUROPE: HIGH-PURITY SULFURIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 140 REST OF EUROPE: HIGH-PURITY SULFURIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 141 REST OF THE WORLD: HIGH-PURITY SULFURIC ACID MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 142 REST OF THE WORLD: HIGH-PURITY SULFURIC ACID MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 143 REST OF THE WORLD: HIGH-PURITY SULFURIC ACID MARKET, BY COUNTRY, 2021-2024 (KILOTON)

- TABLE 144 REST OF THE WORLD: HIGH-PURITY SULFURIC ACID MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 145 REST OF THE WORLD: HIGH-PURITY SULFURIC ACID MARKET, BY GRADE, 2021-2024 (USD MILLION)

- TABLE 146 REST OF THE WORLD: HIGH-PURITY SULFURIC ACID MARKET, BY GRADE, 2025-2030 (USD MILLION)

- TABLE 147 REST OF THE WORLD: HIGH-PURITY SULFURIC ACID MARKET, BY GRADE, 2021-2024 (KILOTON)

- TABLE 148 REST OF THE WORLD: HIGH-PURITY SULFURIC ACID MARKET, BY GRADE, 2025-2030 (KILOTON)

- TABLE 149 REST OF THE WORLD: HIGH-PURITY SULFURIC ACID MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 150 REST OF THE WORLD: HIGH-PURITY SULFURIC ACID MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 151 REST OF THE WORLD: HIGH-PURITY SULFURIC ACID MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 152 REST OF THE WORLD: HIGH-PURITY SULFURIC ACID MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 153 REST OF THE WORLD: HIGH-PURITY SULFURIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 154 REST OF THE WORLD: HIGH-PURITY SULFURIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 155 REST OF THE WORLD: HIGH-PURITY SULFURIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 156 REST OF THE WORLD: HIGH-PURITY SULFURIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 157 TURKEY: HIGH-PURITY SULFURIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 158 TURKEY: HIGH-PURITY SULFURIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 159 TURKEY: HIGH-PURITY SULFURIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 160 TURKEY: HIGH-PURITY SULFURIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 161 ISRAEL: HIGH-PURITY SULFURIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 162 ISRAEL: HIGH-PURITY SULFURIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 163 ISRAEL: HIGH-PURITY SULFURIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 164 ISRAEL: HIGH-PURITY SULFURIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 165 SOUTH AFRICA: HIGH-PURITY SULFURIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 166 SOUTH AFRICA: HIGH-PURITY SULFURIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 167 SOUTH AFRICA: HIGH-PURITY SULFURIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 168 SOUTH AFRICA: HIGH-PURITY SULFURIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 169 REST OF ROW: HIGH-PURITY SULFURIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 170 REST OF ROW: HIGH-PURITY SULFURIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 171 REST OF ROW: HIGH-PURITY SULFURIC ACID MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 172 REST OF ROW: HIGH-PURITY SULFURIC ACID MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 173 OVERVIEW OF STRATEGIES ADOPTED BY KEY HIGH-PURITY SULFURIC ACID MANUFACTURERS

- TABLE 174 HIGH-PURITY SULFURIC ACID MARKET: DEGREE OF COMPETITION, 2024

- TABLE 175 HIGH-PURITY SULFURIC ACID MARKET: APPLICATION FOOTPRINT

- TABLE 176 HIGH-PURITY SULFURIC ACID MARKET: END-USE INDUSTRY FOOTPRINT

- TABLE 177 HIGH-PURITY SULFURIC ACID MARKET: GRADE FOOTPRINT

- TABLE 178 HIGH-PURITY SULFURIC ACID MARKET: REGION FOOTPRINT

- TABLE 179 HIGH-PURITY SULFURIC ACID MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 180 HIGH-PURITY SULFURIC ACID MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 181 HIGH-PURITY SULFURIC ACID MARKET: DEALS, JANUARY 2021-FEBRUARY 2025

- TABLE 182 HIGH-PURITY SULFURIC ACID MARKET: EXPANSIONS, JANUARY 2021- FEBRUARY 2025

- TABLE 183 HIGH-PURITY SULFURIC ACID MARKET: OTHER DEVELOPMENTS, JANUARY 2021-FEBRUARY 2025

- TABLE 184 SUMITOMO CHEMICAL CO., LTD.: COMPANY OVERVIEW

- TABLE 185 SUMITOMO CHEMICAL CO., LTD.: PRODUCTS OFFERED

- TABLE 186 SUMITOMO CHEMICAL CO., LTD.: DEALS, JANUARY 2021-FEBRUARY 2025

- TABLE 187 SUMITOMO CHEMICAL CO., LTD.: EXPANSIONS, JANUARY 2021-FEBRUARY 2025

- TABLE 188 SUMITOMO CHEMICAL CO., LTD.: OTHER DEVELOPMENTS, JANUARY 2021-FEBRUARY 2025

- TABLE 189 BASF: COMPANY OVERVIEW

- TABLE 190 BASF: PRODUCTS OFFERED

- TABLE 191 BASF: DEALS, JANUARY 2021-FEBRUARY 2025

- TABLE 192 KANTO KAGAKU: COMPANY OVERVIEW

- TABLE 193 KANTO KAGAKU: PRODUCTS OFFERED

- TABLE 194 KANTO KAGAKU: DEALS, JANUARY 2021-FEBRUARY 2025

- TABLE 195 LS MNM INC.: COMPANY OVERVIEW

- TABLE 196 LS MNM INC.: PRODUCTS OFFERED

- TABLE 197 CHEMTRADE LOGISTICS: COMPANY OVERVIEW

- TABLE 198 CHEMTRADE LOGISTICS: PRODUCTS OFFERED

- TABLE 199 CHEMTRADE LOGISTICS: DEALS, JANUARY 2021-FEBRUARY 2025

- TABLE 200 CHEMTRADE LOGISTICS: EXPANSIONS, JANUARY 2021-FEBRUARY 2025

- TABLE 201 FUJIFILM WAKO PURE CHEMICAL CORPORATION: COMPANY OVERVIEW

- TABLE 202 FUJIFILM WAKO PURE CHEMICAL CORPORATION: PRODUCTS OFFERED

- TABLE 203 FUJIFILM WAKO PURE CHEMICAL CORPORATION: DEALS, JANUARY 2021- FEBRUARY 2025

- TABLE 204 PVS CHEMICALS: COMPANY OVERVIEW

- TABLE 205 PVS CHEMICALS: PRODUCTS OFFERED

- TABLE 206 PVS CHEMICALS: DEALS, JANUARY 2021-FEBRUARY 2025

- TABLE 207 PVS CHEMICALS: OTHER DEVELOPMENTS, JANUARY 2021-FEBRUARY 2025

- TABLE 208 KOREAZINC: COMPANY OVERVIEW

- TABLE 209 KOREAZINC: PRODUCTS OFFERED

- TABLE 210 KOREAZINC: OTHER DEVELOPMENTS, JANUARY 2021-FEBRUARY 2025

- TABLE 211 LANXESS: COMPANY OVERVIEW

- TABLE 212 LANXESS: PRODUCTS OFFERED

- TABLE 213 LANXESS: EXPANSIONS, JANUARY 2021-FEBRUARY 2025

- TABLE 214 GRILLO-WERKE AG: COMPANY OVERVIEW

- TABLE 215 GRILLO-WERKE AG: PRODUCTS OFFERED

- TABLE 216 HUIZHOU BAILIHONG HOLDINGS CO., LTD.: COMPANY OVERVIEW

- TABLE 217 HUIZHOU BAILIHONG HOLDINGS CO., LTD.: PRODUCTS OFFERED

- TABLE 218 AVANTOR, INC.: COMPANY OVERVIEW

- TABLE 219 AVANTOR, INC.: PRODUCTS OFFERED

- TABLE 220 AVANTOR, INC.: OTHER DEVELOPMENTS, JANUARY 2021-FEBRUARY 2025

- TABLE 221 MERCK KGAA: COMPANY OVERVIEW

- TABLE 222 MERCK KGAA: PRODUCTS OFFERED

- TABLE 223 MERCK KGAA: DEALS, JANUARY 2021-FEBRUARY 2025

- TABLE 224 ASIA UNION ELECTRONIC CHEMICAL CORP.: COMPANY OVERVIEW

- TABLE 225 TAMA CHEMICALS CO., LTD.: COMPANY OVERVIEW

- TABLE 226 CRYSTAL CLEAR ELECTRONIC MATERIAL CO., LTD.: COMPANY OVERVIEW

- TABLE 227 NUOVA SOLMINE: COMPANY OVERVIEW

- TABLE 228 ANHUI HUAERTAI CHEMICAL CO., LTD.: COMPANY OVERVIEW

- TABLE 229 RCI LABSCAN LIMITED: COMPANY OVERVIEW

- TABLE 230 SPECTRUM CHEMICAL: COMPANY OVERVIEW

- TABLE 231 CHUNG HWA CHEMICAL INDUSTRIAL WORKS, LTD.: COMPANY OVERVIEW

- TABLE 232 DONAU CHEMIE AG: COMPANY OVERVIEW

- TABLE 233 TAYCA CO., LTD.: COMPANY OVERVIEW

- TABLE 234 SCHARLAB S.L.: COMPANY OVERVIEW

- TABLE 235 MARCHI INDUSTRIALE: COMPANY OVERVIEW

List of Figures

- FIGURE 1 HIGH-PURITY SULFURIC ACID MARKET SEGMENTATION AND REGIONAL SNAPSHOT

- FIGURE 2 HIGH-PURITY SULFURIC ACID MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: DEMAND-SIDE APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: REVENUE OF MARKET PLAYERS, 2023

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 8 HIGH-PURITY SULFURIC ACID MARKET: DATA TRIANGULATION

- FIGURE 9 PPT SEGMENT TO DOMINATE MARKET IN 2025

- FIGURE 10 CLEANING SEGMENT TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 11 SEMICONDUCTOR & ELECTRONICS SEGMENT TO REGISTER HIGHEST GROWTH BETWEEN 2025 & 2030

- FIGURE 12 ASIA PACIFIC TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 13 GROWING USE OF HIGH-PURITY SULFURIC ACID IN SEMICONDUCTOR & ELECTRONICS INDUSTRY TO CREATE LUCRATIVE OPPORTUNITIES FOR MARKET PLAYERS

- FIGURE 14 PPT SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 15 CLEANING SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 16 SEMICONDUCTOR & ELECTRONICS SEGMENT TO REGISTER HIGHEST CAGR FROM 2025 TO 2030

- FIGURE 17 CHINA TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 18 HIGH-PURITY SULFURIC ACID MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 19 CHEMICAL COMPANIES EMBRACING AI ACROSS VARIOUS BUSINESS AREAS

- FIGURE 20 TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS

- FIGURE 21 HIGH-PURITY SULFURIC ACID MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 22 HIGH-PURITY SULFURIC ACID MARKET: INVESTMENT AND FUNDING SCENARIO, 2020 VS. 2023 (USD MILLION)

- FIGURE 23 AVERAGE SELLING PRICE TREND OF HIGH-PURITY SULFURIC ACID, BY REGION, 2021-2023 (USD/KILOTON)

- FIGURE 24 AVERAGE SELLING PRICE TREND OF HIGH-PURITY SULFURIC ACID OFFERED BY KEY PLAYERS, BY GRADE, 2023 (USD/KILOTON)

- FIGURE 25 HIGH-PURITY SULFURIC ACID MARKET: ECOSYSTEM ANALYSIS

- FIGURE 26 PATENTS GRANTED OVER LAST 10 YEARS, 2015-2024

- FIGURE 27 PATENT ANALYSIS, BY LEGAL STATUS, 2015-2024

- FIGURE 28 REGIONAL ANALYSIS OF PATENTS GRANTED RELATED TO HIGH-PURITY SULFURIC ACID, 2015-2024

- FIGURE 29 TOP COMPANIES WITH SUBSTANTIAL NUMBER OF PATENTS, 2015-2024

- FIGURE 30 IMPORT DATA RELATED TO HS CODE 280700-COMPLIANT PRODUCTS, BY COUNTRY, 2021-2024 (USD THOUSAND)

- FIGURE 31 EXPORT DATA RELATED TO HS CODE 280700-COMPLIANT PRODUCTS, BY COUNTRY, 2021-2024 (USD THOUSAND)

- FIGURE 32 HIGH-PURITY SULFURIC ACID MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 33 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END-USE INDUSTRY

- FIGURE 34 KEY BUYING CRITERIA, BY END-USE INDUSTRY

- FIGURE 35 PPT SEGMENT TO DOMINATE MARKET IN 2025

- FIGURE 36 CLEANING SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 37 SEMICONDUCTOR & ELECTRONICS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 38 ASIA PACIFIC TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 39 ASIA PACIFIC: HIGH-PURITY SULFURIC ACID MARKET SNAPSHOT

- FIGURE 40 NORTH AMERICA: HIGH-PURITY SULFURIC ACID MARKET SNAPSHOT

- FIGURE 41 EUROPE: HIGH-PURITY SULFURIC ACID MARKET SNAPSHOT

- FIGURE 42 HIGH-PURITY SULFURIC ACID MARKET SHARE ANALYSIS, 2024

- FIGURE 43 REVENUE ANALYSIS OF KEY PLAYERS, 2021-2025 (USD MILLION)

- FIGURE 44 HIGH-PURITY SULFURIC ACID MARKET: BRAND/PRODUCT COMPARATIVE ANALYSIS

- FIGURE 45 HIGH-PURITY SULFURIC ACID MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 46 HIGH-PURITY SULFURIC ACID MARKET: COMPANY FOOTPRINT

- FIGURE 47 HIGH-PURITY SULFURIC ACID MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 48 EV/EBITDA OF KEY VENDORS

- FIGURE 49 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN

- FIGURE 50 SUMITOMO CHEMICAL CO., LTD.: COMPANY SNAPSHOT

- FIGURE 51 BASF: COMPANY SNAPSHOT

- FIGURE 52 LS MNM INC.: COMPANY SNAPSHOT

- FIGURE 53 CHEMTRADE LOGISTICS: COMPANY SNAPSHOT

- FIGURE 54 FUJIFILM WAKO PURE CHEMICAL CORPORATION: COMPANY SNAPSHOT

- FIGURE 55 KOREAZINC: COMPANY SNAPSHOT

- FIGURE 56 LANXESS: COMPANY SNAPSHOT

- FIGURE 57 AVANTOR, INC.: COMPANY SNAPSHOT

- FIGURE 58 MERCK KGAA: COMPANY SNAPSHOT

The High-Purity Sulfuric Acid market size is projected to grow from USD 0.50 billion in 2024 to USD 0.67 billion by 2030, registering a CAGR of 6.1% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/Billion) |

| Segments | Grade, Application, End-Use Industry, and Region |

| Regions covered | Asia Pacific, North America, Europe, Rest of the World. |

The market of high-purity sulfuric acid is growing largely due to its vital uses in the semiconductor & electronics sector as well as in the pharmaceutical segment for cleaning processes, etching processes, and refining processes. High-purity sulfuric acid, with minimum impurities, plays a major role in making microelectronics, circuit boards, and integrated chips, and as such, becomes invaluable in the fast-growing semiconductor sector. With increasing demand for sophisticated consumer electronics, 5G network equipment, and AI-enabled devices, the growth of the semiconductor industry is directly driving the market for high-purity sulfuric acid. Moreover, the pharmaceutical industry uses the acid for washing equipment and precise production of active pharmaceutical ingredients (APIs), hence supporting the growth of the market.

" PPB accounted for the fastest growing in grade segment of High-Purity Sulfuric Acid market in terms of value."

PPB (Parts Per Billion) grade is the growth-leading segment within the high-purity sulfuric acid market based on its expanding application in next-generation semiconductor production, advanced electronics, and pharma applications. Unlike lower grades of sulfuric acid, PPB-grade sulfuric acid has ultra-low contamination levels, and that is what makes it an indispensable commodity for manufacturing next-generation microchips, where trace metal impurities at any level could lead to defects. As semiconductor nodes decrease to 5nm and even smaller, chip makers need ultra-pure chemicals to keep yields high and performance optimal. Increasing demand for AI processors, 5G chips, and high-density memory has driven investment in advanced semiconductor manufacturing facilities, especially in the Asia-Pacific region the epicenter of semiconductor manufacturing. PPB-grade sulfuric acid is also gaining use in the pharmaceutical sector, where pure chemicals are demanded by stringent GMP standards for drug formulation and delicate cleansing. Governments and businesses are increasing R&D spending to produce even more refined and contamination-free chemicals, and again augmenting the use of PPB-grade sulfuric acid. The growing requirement for high-reliability and contamination-free electronic devices, and greater purity requirements in several industries, make the PPB segment the highest-growing segment in the high-purity sulfuric acid market

"Etching accounted for the fastest growing in Application segment of High-Purity Sulfuric Acid market in terms of value."

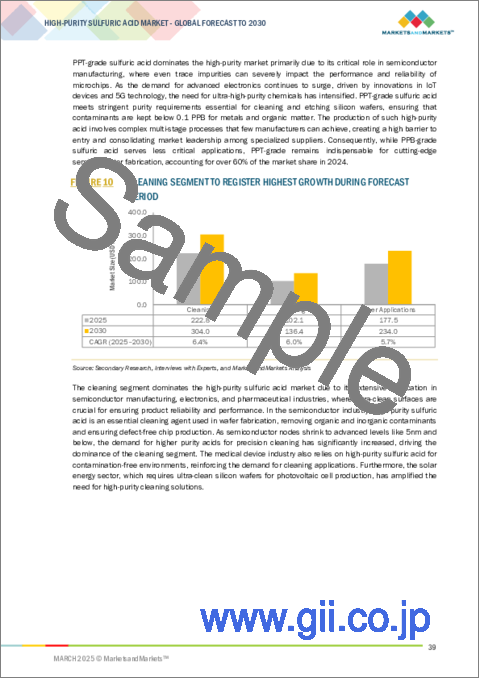

The etching segment is most likely the fastest-developing in the market for high-purity sulfuric acid since it is so essential to the semiconductor industry, wherein precision is the name of the game. With electronics shrinking in size and becoming more complicated, the demand mounts for high-tech etching processes that utilize high-purity chemicals. Although used primarily in the cleaning of silicon wafers after etching, the cleaning is crucial for wafer purity and thereby indirectly propelling demand within the etching market. The rapid expansion of the etching market within the business for high-purity sulfuric acid is something to be kept an eye on, particularly in its use for semiconductor manufacturing and other industrial applications. The conversation here investigates reasons for the trend, through exploring market demand and supply conditions, technology, and specific application in related processes for high-purity sulfuric acid.

"Pharmaceutical accounted for the for the fastest growing in end-use industry segment of High-Purity Sulfuric Acid market in terms of value."

The pharmaceutical industry is growing exponentially as one of the large end-use industries in the high-purity sulfuric acid market. It is due to the fact that it is a critical component in the manufacture of drugs, where it is used as a cleaning agent, pH adjuster, and catalyst in chemical synthesis. The increased demand for drugs, influenced by the spread of chronic disease and the consequent increase in healthcare needs, has led to the enhanced consumption of high-purity sulfuric acid. Industry regulatory needs for high purity to be maintained at the level of drug manufacturing has also focused greater attention on using ultra-pure chemicals. Increased dependence on high-purity sulfuric acid for quality and precision has also been driven by the expansion of biopharmaceuticals, individualized medicine, and advanced drug formulation. India and China, having enormous pharmaceutical production capacity, are setting up high-purity chemical plants to supply globally acceptable quality. Expanded manufacture of vaccines and specialty drugs, especially in response to global health concerns, has further fueled demand.

"Asia pacific is the fastest growing market for High-Purity Sulfuric Acid ."

The Asia Pacific is the fastest-growing market for high-purity sulfuric acid due to its booming semiconductor and electronics industry, which is the largest consumer of the chemical. China, South Korea, Taiwan, and Japan are leading the globe in semiconductor manufacturing, and they require high-purity sulfuric acid for wafer washing, etching, and other exact processes. The area also benefits from rising investments in pharma production, specifically in India and China, where the need for ultra-pure chemicals is growing with stringent quality regulations. Furthermore, the development of advanced technologies, such as 5G, artificial intelligence, and electric vehicles, has also propelled the need for semiconductor components, subsequently increasing the demand for high-purity sulfuric acid.

In-depth interviews were conducted with Chief Executive Officers (CEOs), marketing directors, other innovation and technology directors, and executives from various key organizations operating in the High-Purity Sulfuric Acid market, and information was gathered from secondary research to determine and verify the market size of several segments.

- By Company Type: Tier 1 - 50%, Tier 2 - 30%, and Tier 3 - 20%

- By Designation: Managers- 15%, Directors - 20%, and Others - 65%

- By Region: North America - 25%, Europe - 15%, APAC - 55%, Rest of the World -5%.

The High-Purity Sulfuric Acid market comprises major Sumitomo Chemical Co., Ltd. (Japan), KANTO KAGAKU (Japan), LS MnM Inc. (South Korea), FUJIFILM Wako Pure Chemical Corporation (Japan), BASF (Germany), PVS Chemicals (US), Chemtrade Logistics (Canada), KOREA ZINC (South Korea), LANXESS (Germany), GRILLO-Werke AG (Germany), Huizhou Bailihong Holdings Co., Ltd. (China), Avantor, Inc. (US), Merck KGaA (Germany) . The study includes in-depth competitive analysis of these key players in the High-Purity Sulfuric Acid market, with their company profiles, recent developments, and key market strategies.

Research Coverage

This report segments the market for High-Purity Sulfuric Acid market on the basis of grade, application, end-use industry, and region, and provides estimations for the overall value of the market across various regions. A detailed analysis of key industry players has been conducted to provide insights into their business overviews, products & services, key strategies, and expansions associated with the market for High-Purity Sulfuric Acid market.

Key benefits of buying this report

This research report is focused on various levels of analysis - industry analysis (industry trends), market ranking analysis of top players, and company profiles, which together provide an overall view of the competitive landscape; emerging and high-growth segments of the High-Purity Sulfuric Acid market; high-growth regions; and market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Analysis of drivers: (Surge in demand from semiconductor and electronics industries), restraints (Complex production, high manufacturing costs, and stringent safety & environmental regulations), opportunities (Advancements in production processes), and challenges (Contamination risks due to penetration of metallic ions) influencing the growth of High-Purity Sulfuric Acid market.

- Market Penetration: Comprehensive information on the High-Purity Sulfuric Acid market offered by top players in the global High-Purity Sulfuric Acid market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, new product launches, expansions, and partnerships in the High-Purity Sulfuric Acid market.

- Market Development: Comprehensive information about lucrative emerging markets the report analyzes the markets for High-Purity Sulfuric Acid market across regions.

- Market Capacity: Production capacities of companies producing High-Purity Sulfuric Acid are provided wherever available with upcoming capacities for the High-Purity Sulfuric Acid market.

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the High-Purity Sulfuric Acid market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SNAPSHOT

- 1.3.2 INCLUSIONS & EXCLUSIONS OF STUDY

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key primary sources

- 2.1.2.3 Key participants for primary interviews

- 2.1.2.4 Breakdown of primary interviews

- 2.1.2.5 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 BASE NUMBER CALCULATION

- 2.2.1 SUPPLY-SIDE ANALYSIS

- 2.2.2 DEMAND-SIDE ANALYSIS

- 2.3 GROWTH FORECAST

- 2.3.1 SUPPLY SIDE

- 2.3.2 DEMAND SIDE

- 2.4 MARKET SIZE ESTIMATION

- 2.4.1 BOTTOM-UP APPROACH

- 2.4.2 TOP-DOWN APPROACH

- 2.5 DATA TRIANGULATION

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 GROWTH FORECAST

- 2.8 RISK ASSESSMENT

- 2.9 FACTOR ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN HIGH-PURITY SULFURIC ACID MARKET

- 4.2 HIGH-PURITY SULFURIC ACID MARKET, BY GRADE

- 4.3 HIGH-PURITY SULFURIC ACID MARKET, BY APPLICATION

- 4.4 HIGH-PURITY SULFURIC ACID MARKET, BY END-USE INDUSTRY

- 4.5 HIGH-PURITY SULFURIC ACID MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Surge in demand from semiconductor and electronics industries

- 5.2.1.2 Rising demand from pharmaceutical and renewable energy industries

- 5.2.1.3 Critical for maintaining high product quality and minimizing costly defects

- 5.2.2 RESTRAINTS

- 5.2.2.1 Complex production, high manufacturing costs, and stringent safety & environmental regulations

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Advancements in production processes

- 5.2.4 CHALLENGES

- 5.2.4.1 Contamination risks due to penetration of metallic ions

- 5.2.1 DRIVERS

- 5.3 IMPACT OF GENERATIVE AI

- 5.3.1 INTRODUCTION

- 5.3.2 USE OF GENERATIVE AI IN HIGH-PURITY SULFURIC ACID MARKET

- 5.3.3 IMPACT OF AI ON HIGH-PURITY SULFURIC ACID MARKET

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.3 SUPPLY CHAIN ANALYSIS

- 6.4 INVESTMENT AND FUNDING SCENARIO

- 6.5 PRICING ANALYSIS

- 6.5.1 AVERAGE SELLING PRICE TREND, BY REGION

- 6.5.2 AVERAGE SELLING PRICE TREND, BY GRADE

- 6.5.3 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY GRADE

- 6.6 ECOSYSTEM ANALYSIS

- 6.7 TECHNOLOGY ANALYSIS

- 6.7.1 KEY TECHNOLOGIES

- 6.7.2 COMPLEMENTARY TECHNOLOGIES

- 6.8 PATENT ANALYSIS

- 6.8.1 METHODOLOGY

- 6.8.2 GRANTED PATENTS

- 6.8.2.1 Patent publication trends

- 6.8.3 INSIGHTS

- 6.8.4 LEGAL STATUS

- 6.8.5 JURISDICTION ANALYSIS

- 6.8.6 TOP APPLICANTS

- 6.9 TRADE ANALYSIS

- 6.9.1 IMPORT SCENARIO (HS CODE 280700)

- 6.9.2 EXPORT SCENARIO (HS CODE 280700)

- 6.10 KEY CONFERENCES AND EVENTS

- 6.11 TARIFF AND REGULATORY LANDSCAPE

- 6.11.1 TARIFF ANALYSIS

- 6.11.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.11.3 STANDARDS AND REGULATIONS

- 6.12 PORTER'S FIVE FORCES ANALYSIS

- 6.12.1 THREAT OF NEW ENTRANTS

- 6.12.2 THREAT OF SUBSTITUTES

- 6.12.3 BARGAINING POWER OF SUPPLIERS

- 6.12.4 BARGAINING POWER OF BUYERS

- 6.12.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.13.2 BUYING CRITERIA

- 6.14 MACROECONOMIC OUTLOOK

- 6.14.1 GDP TRENDS AND FORECASTS, BY COUNTRY

- 6.15 CASE STUDY ANALYSIS

- 6.15.1 DEVELOPING CIRCULAR ECONOMY SYSTEM FOR ELECTRONIC-GRADE SULFURIC ACID

- 6.15.2 BUILDING MOBILE CLEANROOM FOR ELECTRONIC-GRADE SULFURIC ACID PRODUCTION

7 HIGH-PURITY SULFURIC ACID MARKET, BY GRADE

- 7.1 INTRODUCTION

- 7.2 PPB

- 7.2.1 CRUCIAL ROLE IN TRACE METAL ANALYSIS TECHNIQUES TO PROPEL MARKET

- 7.3 PPT

- 7.3.1 PRODUCTION OF HIGH-END MICROCHIPS, DISPLAY PANELS, AND NEXT-GENERATION INTEGRATED CIRCUITS TO DRIVE DEMAND

8 HIGH-PURITY SULFURIC ACID MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.2 CLEANING

- 8.2.1 INCREASING MINIATURIZATION OF SEMICONDUCTOR DEVICES TO DRIVE MARKET GROWTH

- 8.3 ETCHING

- 8.3.1 KEY ROLE IN PRECISELY REMOVING MATERIAL LAYERS FROM SURFACES TO DRIVE ADOPTION

- 8.4 OTHER APPLICATIONS

- 8.4.1 TRACE METAL ANALYSIS

- 8.4.2 SYNTHESIS

9 HIGH-PURITY SULFURIC ACID MARKET, BY END-USE INDUSTRY

- 9.1 INTRODUCTION

- 9.2 SEMICONDUCTOR & ELECTRONICS

- 9.2.1 INCREASING INVESTMENTS IN ADVANCED FABRICATION PLANTS TO DRIVE MARKET

- 9.3 PHARMACEUTICAL

- 9.3.1 GROWTH IN GLOBAL PHARMACEUTICAL INDUSTRY TO DRIVE MARKET

- 9.4 OTHER END-USE INDUSTRIES

- 9.4.1 FOOD INDUSTRY

- 9.4.2 CHEMICAL INDUSTRY

10 HIGH-PURITY SULFURIC ACID MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 ASIA PACIFIC

- 10.2.1 TRUMP IMPACT

- 10.2.2 CHINA

- 10.2.2.1 Robust electronics industry to drive market

- 10.2.3 JAPAN

- 10.2.3.1 Government investments and innovation initiatives to propel market

- 10.2.4 TAIWAN

- 10.2.4.1 Government initiatives and major investments in high-tech manufacturing to support market growth

- 10.2.5 SOUTH KOREA

- 10.2.5.1 Strong demand from electronics industries to drive market

- 10.2.6 INDIA

- 10.2.6.1 Rapidly growing semiconductor industry to drive market

- 10.2.7 REST OF ASIA PACIFIC

- 10.3 NORTH AMERICA

- 10.3.1 TRUMP IMPACT

- 10.3.2 US

- 10.3.2.1 Growing need for high-purity chemicals in advanced manufacturing to drive market

- 10.3.3 CANADA

- 10.3.3.1 Growth in semiconductor manufacturing to drive demand

- 10.3.4 MEXICO

- 10.3.4.1 Rising FDI and government initiatives to support market growth

- 10.4 EUROPE

- 10.4.1 TRUMP IMPACT

- 10.4.2 GERMANY

- 10.4.2.1 Significant investments in semiconductor manufacturing and growing pharmaceutical sector to drive market

- 10.4.3 FRANCE

- 10.4.3.1 Rising semiconductor and electronics production to propel market

- 10.4.4 POLAND

- 10.4.4.1 Increased investments in semiconductor industry to drive market

- 10.4.5 NETHERLANDS

- 10.4.5.1 Rising investments in semiconductor, electronics, and pharmaceutical industries to support market growth

- 10.4.6 REST OF EUROPE

- 10.5 REST OF THE WORLD

- 10.5.1 TURKEY

- 10.5.1.1 Rapid expansion of semiconductor and renewable energy sectors to drive demand

- 10.5.2 ISRAEL

- 10.5.2.1 Increasing FDI in semiconductor manufacturing to propel market

- 10.5.3 SOUTH AFRICA

- 10.5.3.1 Increasing investments in technology and industrial infrastructure to support market growth

- 10.5.4 REST OF ROW

- 10.5.1 TURKEY

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 11.3 MARKET SHARE ANALYSIS

- 11.4 REVENUE ANALYSIS

- 11.5 BRAND/PRODUCT COMPARATIVE ANALYSIS

- 11.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.6.1 STARS

- 11.6.2 EMERGING LEADERS

- 11.6.3 PERVASIVE PLAYERS

- 11.6.4 PARTICIPANTS

- 11.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.6.5.1 Company footprint

- 11.6.5.2 Application footprint

- 11.6.5.3 End-use industry footprint

- 11.6.5.4 Grade footprint

- 11.6.5.5 Region footprint

- 11.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.7.1 PROGRESSIVE COMPANIES

- 11.7.2 RESPONSIVE COMPANIES

- 11.7.3 DYNAMIC COMPANIES

- 11.7.4 STARTING BLOCKS

- 11.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 11.7.5.1 Detailed list of key startups/SMEs, 2024

- 11.7.5.2 Competitive benchmarking of key startups/SMEs

- 11.7.6 COMPANY VALUATION AND FINANCIAL METRICS

- 11.8 COMPETITIVE SCENARIO

- 11.8.1 DEALS

- 11.8.2 EXPANSIONS

- 11.8.3 OTHER DEVELOPMENTS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 SUMITOMO CHEMICAL CO., LTD.

- 12.1.1.1 Business overview

- 12.1.1.2 Products offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Deals

- 12.1.1.3.2 Expansions

- 12.1.1.3.3 Other developments

- 12.1.1.4 MnM view

- 12.1.1.4.1 Key strengths

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses and competitive threats

- 12.1.2 BASF

- 12.1.2.1 Business overview

- 12.1.2.2 Products offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Deals

- 12.1.2.4 MnM view

- 12.1.2.4.1 Key strengths

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses and competitive threats

- 12.1.3 KANTO KAGAKU

- 12.1.3.1 Business overview

- 12.1.3.2 Products offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Deals

- 12.1.3.4 MnM view

- 12.1.3.4.1 Key strengths

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses and competitive threats

- 12.1.4 LS MNM INC.

- 12.1.4.1 Business overview

- 12.1.4.2 Products offered

- 12.1.4.3 MnM view

- 12.1.4.3.1 Key strengths

- 12.1.4.3.2 Strategic choices

- 12.1.4.3.3 Weaknesses and competitive threats

- 12.1.5 CHEMTRADE LOGISTICS

- 12.1.5.1 Business overview

- 12.1.5.2 Products offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Deals

- 12.1.5.3.2 Expansions

- 12.1.5.4 MnM view

- 12.1.5.4.1 Key strengths

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses and competitive threats

- 12.1.6 FUJIFILM WAKO PURE CHEMICAL CORPORATION

- 12.1.6.1 Business overview

- 12.1.6.2 Products offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Deals

- 12.1.6.4 MnM view

- 12.1.6.4.1 Key strengths

- 12.1.6.4.2 Strategic choices

- 12.1.6.4.3 Weaknesses and competitive threats

- 12.1.7 PVS CHEMICALS

- 12.1.7.1 Business overview

- 12.1.7.2 Products offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Deals

- 12.1.7.3.2 Other developments

- 12.1.7.4 MnM view

- 12.1.7.4.1 Key strengths

- 12.1.7.4.2 Strategic choices

- 12.1.7.4.3 Weaknesses and competitive threats

- 12.1.8 KOREAZINC

- 12.1.8.1 Business overview

- 12.1.8.2 Products offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Other developments

- 12.1.8.4 MnM view

- 12.1.8.4.1 Key strengths

- 12.1.8.4.2 Strategic choices

- 12.1.8.4.3 Weaknesses and competitive threats

- 12.1.9 LANXESS

- 12.1.9.1 Business overview

- 12.1.9.2 Products offered

- 12.1.9.3 Recent developments

- 12.1.9.3.1 Expansions

- 12.1.9.4 MnM view

- 12.1.9.4.1 Key strengths

- 12.1.9.4.2 Strategic choices

- 12.1.9.4.3 Weaknesses and competitive threats

- 12.1.10 GRILLO-WERKE AG

- 12.1.10.1 Business overview

- 12.1.10.2 Products offered

- 12.1.10.3 MnM view

- 12.1.10.3.1 Key strengths

- 12.1.10.3.2 Strategic choices

- 12.1.10.3.3 Weaknesses and competitive threats

- 12.1.11 HUIZHOU BAILIHONG HOLDINGS CO., LTD.

- 12.1.11.1 Business overview

- 12.1.11.2 Products offered

- 12.1.11.3 MnM view

- 12.1.11.3.1 Key strengths

- 12.1.11.3.2 Strategic choices

- 12.1.11.3.3 Weaknesses and competitive threats

- 12.1.12 AVANTOR, INC.

- 12.1.12.1 Business overview

- 12.1.12.2 Products offered

- 12.1.12.3 Recent developments

- 12.1.12.3.1 Other developments

- 12.1.12.4 MnM view

- 12.1.12.4.1 Key strengths

- 12.1.12.4.2 Strategic choices

- 12.1.12.4.3 Weaknesses and competitive threats

- 12.1.13 MERCK KGAA

- 12.1.13.1 Business overview

- 12.1.13.2 Products offered

- 12.1.13.3 Recent developments

- 12.1.13.3.1 Deals

- 12.1.13.4 MnM view

- 12.1.13.4.1 Key strengths

- 12.1.13.4.2 Strategic choices

- 12.1.13.4.3 Weaknesses and competitive threats

- 12.1.1 SUMITOMO CHEMICAL CO., LTD.

- 12.2 OTHER PLAYERS

- 12.2.1 ASIA UNION ELECTRONIC CHEMICAL CORP.

- 12.2.2 TAMA CHEMICALS CO., LTD

- 12.2.3 CRYSTAL CLEAR ELECTRONIC MATERIAL CO., LTD.

- 12.2.4 NUOVA SOLMINE

- 12.2.5 ANHUI HUAERTAI CHEMICAL CO., LTD.

- 12.2.6 RCI LABSCAN LIMITED

- 12.2.7 SPECTRUM CHEMICAL

- 12.2.8 CHUNG HWA CHEMICAL INDUSTRIAL WORKS, LTD.

- 12.2.9 DONAU CHEMIE AG

- 12.2.10 TAYCA CO., LTD.

- 12.2.11 SCHARLAB S.L.

- 12.2.12 MARCHI INDUSTRIALE

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS