|

|

市場調査レポート

商品コード

1804849

HVDC送電の世界市場:プロジェクトタイプ別、用途別、コンポーネント別、技術別、地域別 - 2030年までの予測HVDC Transmission Market by LCC, VSC, CCC, Converter Stations, Transmission Cables, Point-to-Point Transmission, Back-to-Back Stations, Multi Terminal Systems, Bulk Power Transmission and Interconnecting Grids - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| HVDC送電の世界市場:プロジェクトタイプ別、用途別、コンポーネント別、技術別、地域別 - 2030年までの予測 |

|

出版日: 2025年08月27日

発行: MarketsandMarkets

ページ情報: 英文 265 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

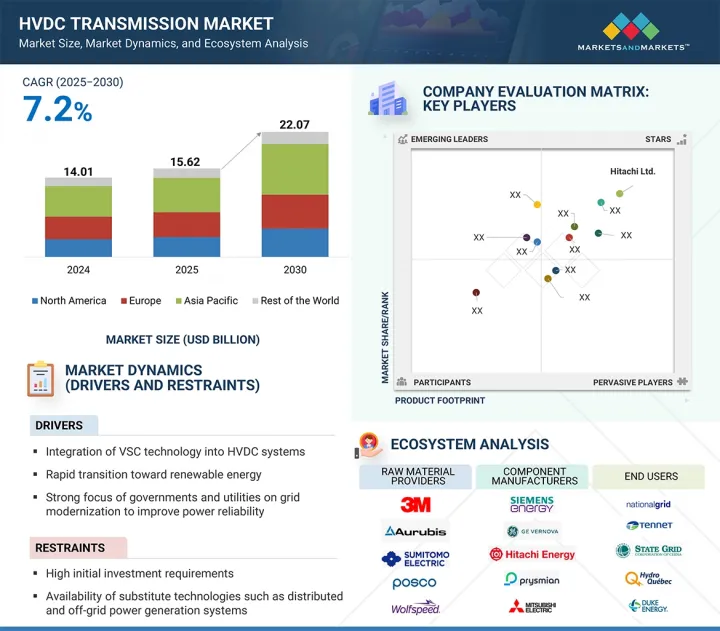

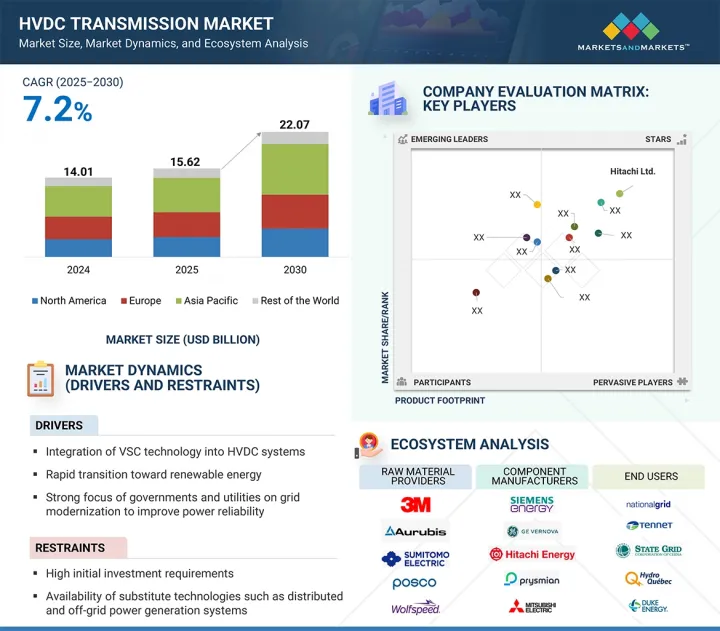

世界のHVDC送電の市場規模は、2025年の156億2,000万米ドルから2030年には220億7,000万米ドルになると推定され、予測期間中のCAGRは7.2%になるとみられています。

HVDC送電市場は、VSC(電圧源コンバータ)技術の統合、再生可能エネルギーへの急速な移行、電力信頼性を向上させるための送電網の近代化に対する政府と電力会社の強い注力によって大きな成長を遂げています。さらに、HVDC送電を促進する政府主導の取り組みが、市場導入をさらに加速させています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント別 | プロジェクトタイプ別、用途別、コンポーネント別、技術別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

しかし、初期投資要件が高く、分散型発電システムやオフグリッド発電システムなどの代替技術が利用可能であることから、市場は課題に直面しています。さらに、HVDCプロジェクトのライフサイクルが複雑なため、導入が遅れ、コストが上昇する可能性があり、市場全体の拡大をやや抑制しています。

電圧源コンバータ(VSC)技術は、予測期間中、HVDC送電市場で最速の成長が見込まれます。VSCは、従来のライン整流コンバータ(LCC)システムと比較して、設置面積の縮小、モジュール設計、ブラックスタート機能、無効電力サポートなどの主な利点を備えています。これらの特徴により、VSCシステムは洋上風力発電所、太陽光発電所、分散型エネルギーシステムなどの再生可能エネルギー源をグリッドに統合するのに特に適しています。さらに、VSC技術は脆弱な送電網や受動的な送電網への接続を可能にするため、遠隔地や島嶼部でのエネルギー導入には不可欠です。各国が再生可能エネルギー容量を拡大し、分散型発電に移行するにつれ、柔軟でスペース効率の高い送電ソリューションへの需要が急増しています。VSCベースのHVDCシステムは、地下や海底でのケーブル送電も可能なため、都市中心部や環境的に敏感な地帯に最適です。さらに、モジュール型マルチレベル・コンバータ(MMC)の技術進歩により、VSCシステムの拡張性、信頼性、コスト効率がさらに向上しています。欧州、アジア太平洋、北米の各国政府は、新しい送電網近代化プロジェクトや国境を越えた相互接続にVSCを採用する傾向が強まっています。エネルギー転換が重視される中、VSCは次世代のHVDCインフラで極めて重要な役割を果たすとみられ、世界的な急速な普及が見込まれています。

サーキットブレーカは、予測期間中、HVDC送電コンポーネント市場のコンバータステーション分野で最速の成長を遂げると予測されています。HVDCシステムにおいて、サーキットブレーカは、故障電流を遮断し、故障箇所を隔離することで機器を保護し、システムの安定性と信頼性を確保するという重要な役割を担っています。洋上風力発電や大規模太陽光発電などの再生可能エネルギーの統合により、信頼性と柔軟性に優れた送電に対する需要が高まっているため、高度なHVDC保護ソリューションに対するニーズが大幅に高まっています。

ハイブリッドHVDCサーキットブレーカの開発を含む最近の技術動向は、ACシステムに比べて従来はより複雑な作業であった直流遮断の課題に対処しています。こうした技術革新は、故障の迅速な除去を可能にし、ダウンタイムを最小限に抑えることで、長距離大容量HVDCプロジェクトの拡大を支えています。さらに、大陸間および国境を越えた電力リンクへの投資の増加や、老朽化した送電網インフラの近代化が、サーキットブレーカーの採用を後押ししています。電力会社が運用の安全性とシステムの効率性を重視する中、サーキットブレーカー分野は力強い勢いを維持し、他のコンバータステーションのコンポーネントを上回る成長率を示すと予想されます。

アジア太平洋地域は、急速な工業化、エネルギー需要の拡大、再生可能エネルギー統合への大規模投資によって、予測期間中にHVDC送電市場で最も速い成長を記録すると予測されています。中国やインドのような国々は、送電網の安定性の課題に対処し、長距離送電をサポートし、遠隔地の再生可能エネルギー発電サイトを消費拠点と接続するために、HVDCシステムの展開を主導しています。特に中国は、超高圧(UHV)直流送電の世界的なパイオニアとなっており、数千キロメートルに及ぶ複数の国横断プロジェクトでギガワットの電力を輸送しています。インドはまた、グリーン・エネルギー回廊や地域間送電の取り組みを通じてHVDCインフラを拡大しています。ベトナムやインドネシアなどの東南アジア諸国は、送電網の信頼性を高め、離島や農村部におけるエネルギー需要の増加に対応するため、HVDCを徐々に模索しています。政府主導の取り組み、有利な政策枠組み、HVDCコンポーネント製造への地域プレーヤーの関与が、採用をさらに加速させています。さらに、都市化の進展と電化への取り組みが、国境を越えた相互接続プロジェクト(中国-ラオス、インド-バングラデシュなど)と相まって、アジア太平洋地域を最も急成長する市場として位置付けています。持続可能な開発とエネルギー安全保障を重視するこの地域にとって、HVDCは将来の送電を可能にする重要な手段です。

当レポートでは、世界のHVDC送電市場について調査し、プロジェクトタイプ別、用途別、コンポーネント別、技術別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- サプライチェーン分析

- エコシステムマッピング

- 投資と資金調達のシナリオ

- 技術分析

- 価格分析

- 特許分析

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- ケーススタディ

- 貿易分析

- 関税と規制状況

- 顧客ビジネスに影響を与える動向/混乱

- 2025年~2026年の主な会議とイベント

- AI/生成AIのHVDC送電市場への影響

- 2025年の米国関税の影響-HVDC送電市場

第6章 HVDC送電における電力定格

- イントロダクション

- 500MW未満

- 501~999MW

- 1,000~2,000MW

- 2,000MW以上

第7章 HVDC送電市場(プロジェクトタイプ別)

- イントロダクション

- 地点間送電

- BTB

- マルチターミナルシステム

第8章 HVDC送電市場(用途別)

- イントロダクション

- バルク電力送電

- 相互接続グリッド

- 都市部供給

第9章 HVDC送電市場(コンポーネント別)

- イントロダクション

- 変換所

- 送電ケーブル

- その他

第10章 HVDC送電市場(技術別)

- イントロダクション

- 直交流コンバータ(LCC)

- 電圧源コンバータ(VSC)

- コンデンサ整流コンバータ(CCC)

第11章 HVDC送電市場(地域別)

- イントロダクション

- 北米

- 北米:マクロ経済見通し

- 米国

- カナダ

- メキシコ

- 欧州

- 欧州:マクロ経済見通し

- 英国

- ドイツ

- フランス

- イタリア

- スペイン

- ポーランド

- 北欧

- その他

- アジア太平洋

- アジア太平洋:マクロ経済見通し

- 中国

- 日本

- 韓国

- インド

- オーストラリア

- インドネシア

- マレーシア

- タイ

- ベトナム

- その他

- その他の地域

- その他の地域:マクロ経済見通し

- 中東

- アフリカ

- 南米

第12章 競合情勢

- イントロダクション

- 主要参入企業が採用する戦略/強み、2020年~2025年

- 市場シェア分析、2024年

- 収益分析、2020年~2024年

- 企業評価と財務指標

- ブランド/製品比較

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 競合シナリオ

第13章 企業プロファイル

- イントロダクション

- 主要参入企業

- HITACHI, LTD.

- SIEMENS ENERGY

- MITSUBISHI ELECTRIC CORPORATION

- GE VERNOVA

- PRYSMIAN GROUP

- TOSHIBA CORPORATION

- NKT A/S

- NEXANS

- LS ELECTRIC CO., LTD.

- NR ELECTRIC CO., LTD.

- その他の企業

- SUMITOMO ELECTRIC INDUSTRIES, LTD.

- ZAPOROZHTRANSFORMATOR

- TRENCH GROUP

- TAIHAN CABLE & SOLUTION CO., LTD.

- AMERICAN SEMICONDUCTOR, INC.

- ZTT

- TBEA CO., LTD.

- EFACEC

- SIEYUAN ELECTRIC CO., LTD.

- XJ ELECTRIC CO., LTD.

- BTW

- CG POWER & INDUSTRIAL SOLUTIONS LTD.

- SGB SMIT

- C-EPRI ELECTRIC POWER ENGINEERING CO., LTD.

- HYOSUNG HEAVY INDUSTRIES

第14章 付録

List of Tables

- TABLE 1 HVDC TRANSMISSION MARKET: ROLE OF KEY PLAYERS IN HVDC TRANSMISSION ECOSYSTEM

- TABLE 2 AVERAGE SELLING PRICE TREND OF COMPONENTS, BY KEY PLAYER, 2021-2024 (USD MILLION)

- TABLE 3 AVERAGE SELLING PRICE TREND OF COMPONENTS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 4 LIST OF PATENTS IN HVDC TRANSMISSION MARKET, 2023-2025

- TABLE 5 HVDC TRANSMISSION MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 6 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP APPLICATIONS (%)

- TABLE 7 KEY BUYING CRITERIA, BY APPLICATION

- TABLE 8 IMPORT DATA FOR HS CODE 8504-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 9 EXPORT DATA FOR HS CODE 8504-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 10 MFN TARIFF FOR HS CODE 8504-COMPLIANT PRODUCTS EXPORTED BY GERMANY, 2024

- TABLE 11 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 HVDC TRANSMISSION MARKET: DETAILED LIST OF CONFERENCES AND EVENTS, 2025-2026

- TABLE 16 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 17 HVDC TRANSMISSION MARKET, BY PROJECT TYPE, 2021-2024 (USD MILLION)

- TABLE 18 HVDC TRANSMISSION MARKET, BY PROJECT TYPE, 2025-2030 (USD MILLION)

- TABLE 19 POINT-TO-POINT TRANSMISSION: HVDC TRANSMISSION MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 20 POINT-TO-POINT TRANSMISSION: HVDC TRANSMISSION MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 21 POINT-TO-POINT TRANSMISSION: HVDC TRANSMISSION MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 22 POINT-TO-POINT TRANSMISSION: HVDC TRANSMISSION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 23 POINT-TO-POINT TRANSMISSION: HVDC TRANSMISSION MARKET FOR BULK POWER TRANSMISSION, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 24 POINT-TO-POINT TRANSMISSION: HVDC TRANSMISSION MARKET FOR BULK POWER TRANSMISSION, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 25 HVDC TRANSMISSION MARKET, BY POINT-TO-POINT TRANSMISSION PROJECT TYPE, 2021-2024 (USD MILLION)

- TABLE 26 HVDC TRANSMISSION MARKET, BY POINT-TO-POINT TRANSMISSION PROJECT TYPE, 2025-2030 (USD MILLION)

- TABLE 27 POINT-TO-POINT TRANSMISSION: HVDC TRANSMISSION MARKET FOR MONOPOLAR TRANSMISSION SYSTEMS, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 28 POINT-TO-POINT TRANSMISSION: HVDC TRANSMISSION MARKET FOR MONOPOLAR TRANSMISSION SYSTEMS, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 29 POINT-TO-POINT TRANSMISSION: HVDC TRANSMISSION MARKET FOR BIPOLAR TRANSMISSION SYSTEMS, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 30 POINT-TO-POINT TRANSMISSION: HVDC TRANSMISSION MARKET FOR BIPOLAR TRANSMISSION SYSTEMS, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 31 BACK-TO-BACK STATIONS: HVDC TRANSMISSION MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 32 BACK-TO-BACK STATIONS: HVDC TRANSMISSION MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 33 BACK-TO-BACK STATIONS: HVDC TRANSMISSION MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 34 BACK-TO-BACK STATIONS: HVDC TRANSMISSION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 35 BACK-TO-BACK STATIONS: HVDC TRANSMISSION MARKET FOR BULK POWER TRANSMISSION, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 36 BACK-TO-BACK STATIONS: HVDC TRANSMISSION MARKET FOR BULK POWER TRANSMISSION, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 37 MULTI-TERMINAL SYSTEMS: HVDC TRANSMISSION MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 38 MULTI-TERMINAL SYSTEMS: HVDC TRANSMISSION MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 39 MULTI-TERMINAL SYSTEMS: HVDC TRANSMISSION MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 40 MULTI-TERMINAL SYSTEMS: HVDC TRANSMISSION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 41 MULTI-TERMINAL SYSTEMS: HVDC TRANSMISSION MARKET FOR BULK POWER TRANSMISSION, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 42 MULTI-TERMINAL SYSTEMS: HVDC TRANSMISSION MARKET FOR BULK POWER TRANSMISSION, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 43 HVDC TRANSMISSION MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 44 HVDC TRANSMISSION MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 45 BULK POWER TRANSMISSION: HVDC TRANSMISSION MARKET, BY PROJECT TYPE, 2021-2024 (USD MILLION)

- TABLE 46 BULK POWER TRANSMISSION: HVDC TRANSMISSION MARKET, BY PROJECT TYPE, 2025-2030 (USD MILLION)

- TABLE 47 HVDC TRANSMISSION MARKET, BY BULK POWER TRANSMISSION APPLICATION, 2021-2024 (USD MILLION)

- TABLE 48 HVDC TRANSMISSION MARKET, BY BULK POWER TRANSMISSION APPLICATION, 2025-2030 (USD MILLION)

- TABLE 49 OVERHEAD: BULK POWER HVDC TRANSMISSION MARKET, BY PROJECT TYPE, 2021-2024 (USD MILLION)

- TABLE 50 OVERHEAD: BULK POWER HVDC TRANSMISSION MARKET, BY PROJECT TYPE, 2025-2030 (USD MILLION)

- TABLE 51 UNDERWATER & UNDERGROUND: BULK POWER HVDC TRANSMISSION MARKET, BY PROJECT TYPE, 2021-2024 (USD MILLION)

- TABLE 52 UNDERWATER & UNDERGROUND: BULK POWER HVDC TRANSMISSION MARKET, BY PROJECT TYPE, 2025-2030 (USD MILLION)

- TABLE 53 INTERCONNECTING GRIDS: HVDC TRANSMISSION MARKET, BY PROJECT TYPE, 2021-2024 (USD MILLION)

- TABLE 54 INTERCONNECTING GRIDS: HVDC TRANSMISSION MARKET, BY PROJECT TYPE, 2025-2030 (USD MILLION)

- TABLE 55 INFEED URBAN AREAS: HVDC TRANSMISSION MARKET, BY PROJECT TYPE, 2021-2024 (USD MILLION)

- TABLE 56 INFEED URBAN AREAS: HVDC TRANSMISSION MARKET, BY PROJECT TYPE, 2025-2030 (USD MILLION)

- TABLE 57 HVDC TRANSMISSION MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 58 HVDC TRANSMISSION MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 59 CONVERTER STATIONS: HVDC TRANSMISSION MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 60 CONVERTER STATIONS: HVDC TRANSMISSION MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 61 CONVERTER STATIONS: HVDC TRANSMISSION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 62 CONVERTER STATIONS: HVDC TRANSMISSION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 63 CONVERTER STATIONS: HVDC TRANSMISSION MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 64 CONVERTER STATIONS: HVDC TRANSMISSION MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 65 CONVERTER STATIONS: HVDC TRANSMISSION MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 66 CONVERTER STATIONS: HVDC TRANSMISSION MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 67 CONVERTER STATIONS: HVDC TRANSMISSION MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 68 CONVERTER STATIONS: HVDC TRANSMISSION MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 69 CONVERTER STATIONS: HVDC TRANSMISSION MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 70 CONVERTER STATIONS: HVDC TRANSMISSION MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 71 VALVES: HVDC TRANSMISSION MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 72 VALVES: HVDC TRANSMISSION MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 73 TRANSMISSION CABLES: HVDC TRANSMISSION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 74 TRANSMISSION CABLES: HVDC TRANSMISSION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 75 TRANSMISSION CABLES: HVDC TRANSMISSION MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 76 TRANSMISSION CABLES: HVDC TRANSMISSION MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 77 TRANSMISSION CABLES: HVDC TRANSMISSION MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 78 TRANSMISSION CABLES: HVDC TRANSMISSION MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 79 TRANSMISSION CABLES: HVDC TRANSMISSION MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 80 TRANSMISSION CABLES: HVDC TRANSMISSION MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 81 TRANSMISSION CABLES: HVDC TRANSMISSION MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 82 TRANSMISSION CABLES: HVDC TRANSMISSION MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 83 OTHER COMPONENTS: HVDC TRANSMISSION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 84 OTHER COMPONENTS: HVDC TRANSMISSION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 85 OTHER COMPONENTS: HVDC TRANSMISSION MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 86 OTHER COMPONENTS: HVDC TRANSMISSION MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 87 OTHER COMPONENTS: HVDC TRANSMISSION MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 88 OTHER COMPONENTS: HVDC TRANSMISSION MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 89 OTHER COMPONENTS: HVDC TRANSMISSION MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 90 OTHER COMPONENTS: HVDC TRANSMISSION MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 91 OTHER COMPONENTS: HVDC TRANSMISSION MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 92 OTHER COMPONENTS: HVDC TRANSMISSION MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 93 HVDC TRANSMISSION MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 94 HVDC TRANSMISSION MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 95 HVDC TRANSMISSION MARKET, BY TECHNOLOGY, 2021-2024 (MW)

- TABLE 96 TRANSMISSION MARKET, BY TECHNOLOGY, 2025-2030 (MW)

- TABLE 97 LINE COMMUTATED CONVERTER (LCC): HVDC TRANSMISSION MARKET, BY PROJECT TYPE, 2021-2024 (USD MILLION)

- TABLE 98 LINE COMMUTATED CONVERTER (LCC): HVDC TRANSMISSION MARKET, BY PROJECT TYPE, 2025-2030 (USD MILLION)

- TABLE 99 LINE COMMUTATED CONVERTER (LCC): HVDC TRANSMISSION MARKET FOR POINT-TO-POINT PROJECT TYPE, 2021-2024 (USD MILLION)

- TABLE 100 LINE COMMUTATED CONVERTER (LCC): HVDC TRANSMISSION MARKET FOR POINT-TO-POINT PROJECT TYPE, 2025-2030 (USD MILLION)

- TABLE 101 HVDC TRANSMISSION MARKET, BY LINE COMMUTATED CONVERTER (LCC) TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 102 HVDC TRANSMISSION MARKET, BY LINE COMMUTATED CONVERTER (LCC) TECHNOLOGY TYPE, 2025-2030 (USD MILLION)

- TABLE 103 VOLTAGE SOURCE CONVERTER (VSC): HVDC TRANSMISSION MARKET, BY PROJECT TYPE, 2021-2024 (USD MILLION)

- TABLE 104 VOLTAGE SOURCE CONVERTER (VSC): HVDC TRANSMISSION MARKET, BY PROJECT TYPE, 2025-2030 (USD MILLION)

- TABLE 105 VOLTAGE SOURCE CONVERTER (VSC): HVDC TRANSMISSION MARKET FOR POINT-TO-POINT TRANSMISSION PROJECT TYPE, 2021-2024 (USD MILLION)

- TABLE 106 VOLTAGE SOURCE CONVERTER (VSC): HVDC TRANSMISSION MARKET FOR POINT-TO-POINT TRANSMISSION PROJECT TYPE, 2025-2030 (USD MILLION)

- TABLE 107 HVDC TRANSMISSION MARKET, BY VOLTAGE SOURCE CONVERTER (VSC) TECHNOLOGY TYPE, 2021-2024 (USD MILLION)

- TABLE 108 HVDC TRANSMISSION MARKET, BY VOLTAGE SOURCE CONVERTER (VSC) TECHNOLOGY TYPE, 2025-2030 (USD MILLION)

- TABLE 109 CAPACITOR COMMUTATED CONVERTER (CCC): HVDC TRANSMISSION MARKET, BY PROJECT TYPE, 2021-2024 (USD MILLION)

- TABLE 110 CAPACITOR COMMUTATED CONVERTER (CCC): HVDC TRANSMISSION MARKET, BY PROJECT TYPE, 2025-2030 (USD MILLION)

- TABLE 111 HVDC TRANSMISSION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 112 HVDC TRANSMISSION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 113 NORTH AMERICA: HVDC TRANSMISSION MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 114 NORTH AMERICA: HVDC TRANSMISSION MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 115 NORTH AMERICA: HVDC TRANSMISSION MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 116 NORTH AMERICA: HVDC TRANSMISSION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 117 US: HVDC TRANSMISSION MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 118 US: HVDC TRANSMISSION MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 119 CANADA: HVDC TRANSMISSION MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 120 CANADA: HVDC TRANSMISSION MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 121 MEXICO: HVDC TRANSMISSION MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 122 MEXICO: HVDC TRANSMISSION MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 123 EUROPE: HVDC TRANSMISSION MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 124 EUROPE: HVDC TRANSMISSION MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 125 EUROPE: HVDC TRANSMISSION MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 126 EUROPE: HVDC TRANSMISSION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 127 UK: HVDC TRANSMISSION MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 128 UK: HVDC TRANSMISSION MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 129 GERMANY: HVDC TRANSMISSION MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 130 GERMANY: HVDC TRANSMISSION MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 131 FRANCE: HVDC TRANSMISSION MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 132 FRANCE: HVDC TRANSMISSION MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 133 ITALY: HVDC TRANSMISSION MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 134 ITALY: HVDC TRANSMISSION MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 135 SPAIN: HVDC TRANSMISSION MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 136 SPAIN: HVDC TRANSMISSION MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 137 POLAND: HVDC TRANSMISSION MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 138 POLAND: HVDC TRANSMISSION MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 139 NORDICS: HVDC TRANSMISSION MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 140 NORDICS: HVDC TRANSMISSION MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 141 REST OF EUROPE: HVDC TRANSMISSION MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 142 REST OF EUROPE: HVDC TRANSMISSION MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 143 ASIA PACIFIC: HVDC TRANSMISSION MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 144 ASIA PACIFIC: HVDC TRANSMISSION MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 145 ASIA PACIFIC: HVDC TRANSMISSION MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 146 ASIA PACIFIC: HVDC TRANSMISSION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 147 CHINA: HVDC TRANSMISSION MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 148 CHINA: HVDC TRANSMISSION MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 149 JAPAN: HVDC TRANSMISSION MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 150 JAPAN: HVDC TRANSMISSION MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 151 SOUTH KOREA: HVDC TRANSMISSION MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 152 SOUTH KOREA: HVDC TRANSMISSION MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 153 INDIA: HVDC TRANSMISSION MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 154 INDIA: HVDC TRANSMISSION MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 155 AUSTRALIA: HVDC TRANSMISSION MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 156 AUSTRALIA: HVDC TRANSMISSION MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 157 INDONESIA: HVDC TRANSMISSION MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 158 INDONESIA: HVDC TRANSMISSION MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 159 MALAYSIA: HVDC TRANSMISSION MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 160 MALAYSIA: HVDC TRANSMISSION MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 161 THAILAND: HVDC TRANSMISSION MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 162 THAILAND: HVDC TRANSMISSION MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 163 VIETNAM: HVDC TRANSMISSION MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 164 VIETNAM: HVDC TRANSMISSION MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 165 REST OF ASIA PACIFIC: HVDC TRANSMISSION MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 166 REST OF ASIA PACIFIC: HVDC TRANSMISSION MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 167 ROW: HVDC TRANSMISSION MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 168 ROW: HVDC TRANSMISSION MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 169 ROW: HVDC TRANSMISSION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 170 ROW: HVDC TRANSMISSION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 171 MIDDLE EAST: HVDC TRANSMISSION MARKET, BY COUNTRY, 2021-2024, (USD MILLION)

- TABLE 172 MIDDLE EAST: HVDC TRANSMISSION MARKET, BY COUNTRY, 2025-2030, (USD MILLION)

- TABLE 173 MIDDLE EAST: HVDC TRANSMISSION MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 174 MIDDLE EAST: HVDC TRANSMISSION MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 175 AFRICA: HVDC TRANSMISSION MARKET, BY COUNTRY, 2021-2024, (USD MILLION)

- TABLE 176 AFRICA: HVDC TRANSMISSION MARKET, BY COUNTRY, 2025-2030, (USD MILLION)

- TABLE 177 AFRICA: HVDC TRANSMISSION MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 178 AFRICA: HVDC TRANSMISSION MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 179 SOUTH AMERICA: HVDC TRANSMISSION MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 180 SOUTH AMERICA: HVDC TRANSMISSION MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 181 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2020-2025

- TABLE 182 HVDC TRANSMISSION MARKET: DEGREE OF COMPETITION, 2024

- TABLE 183 REGION FOOTPRINT

- TABLE 184 COMPONENT FOOTPRINT

- TABLE 185 APPLICATION FOOTPRINT

- TABLE 186 PROJECT TYPE FOOTPRINT

- TABLE 187 HVDC TRANSMISSION MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 188 STARTUPS/SMES FOOTPRINT, BY COMPONENT

- TABLE 189 STARTUPS/SMES FOOTPRINT, BY APPLICATION

- TABLE 190 STARTUPS/SMES FOOTPRINT, BY PROJECT TYPE

- TABLE 191 STARTUPS/SMES FOOTPRINT, BY REGION

- TABLE 192 HVDC TRANSMISSION MARKET: PRODUCT LAUNCHES, JANUARY 2022- JULY 2025

- TABLE 193 HVDC TRANSMISSION MARKET: DEALS, JANUARY 2022- JULY 2025

- TABLE 194 HVDC TRANSMISSION MARKET: OTHER DEVELOPMENTS, JANUARY 2022- JULY 2025

- TABLE 195 HITACHI, LTD.: COMPANY OVERVIEW

- TABLE 196 HITACHI, LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 197 HITACHI, LTD.: DEALS

- TABLE 198 HITACHI, LTD.: OTHER DEVELOPMENTS

- TABLE 199 SIEMENS ENERGY: COMPANY OVERVIEW

- TABLE 200 SIEMENS ENERGY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 201 SIEMENS ENERGY: DEALS

- TABLE 202 SIEMENS ENERGY: OTHER DEVELOPMENTS

- TABLE 203 MITSUBISHI ELECTRIC CORPORATION: COMPANY OVERVIEW

- TABLE 204 MITSUBISHI ELECTRIC CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 205 MITSUBISHI ELECTRIC CORPORATION: DEALS

- TABLE 206 MITSUBISHI ELECTRIC CORPORATION: OTHER DEVELOPMENTS

- TABLE 207 GE VERNOVA: COMPANY OVERVIEW

- TABLE 208 GE VERNOVA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 209 GE VERNOVA: DEALS

- TABLE 210 GE VERNOVA: OTHER DEVELOPMENTS

- TABLE 211 PRYSMIAN GROUP: COMPANY OVERVIEW

- TABLE 212 PRYSMIAN GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 213 PRYSMIAN GROUP: PRODUCT LAUNCHES

- TABLE 214 PRYSMIAN GROUP: DEALS

- TABLE 215 PRYSMIAN GROUP: OTHER DEVELOPMENTS

- TABLE 216 TOSHIBA CORPORATION: COMPANY OVERVIEW

- TABLE 217 TOSHIBA CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 218 TOSHIBA CORPORATION: DEALS

- TABLE 219 TOSHIBA CORPORATION: OTHER DEVELOPMENTS

- TABLE 220 NKT A/S: COMPANY OVERVIEW

- TABLE 221 NKT A/S: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 222 NKT A/S: DEALS

- TABLE 223 NKT A/S: OTHER DEVELOPMENTS

- TABLE 224 NEXANS: COMPANY OVERVIEW

- TABLE 225 NEXANS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 226 NEXANS: DEALS

- TABLE 227 NEXANS: OTHER DEVELOPMENTS

- TABLE 228 LS ELECTRIC CO., LTD.: COMPANY OVERVIEW

- TABLE 229 LS ELECTRIC CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 230 LS ELECTRIC CO., LTD.: DEALS

- TABLE 231 LS ELECTRIC CO., LTD.: OTHER DEVELOPMENTS

- TABLE 232 NR ELECTRIC CO., LTD.: COMPANY OVERVIEW

- TABLE 233 NR ELECTRIC CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

List of Figures

- FIGURE 1 HVDC TRANSMISSION MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 HVDC TRANSMISSION MARKET: RESEARCH DESIGN

- FIGURE 3 BOTTOM-UP APPROACH

- FIGURE 4 TOP-DOWN APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION: DEMAND-SIDE ANALYSIS

- FIGURE 6 MARKET SIZE ESTIMATION: SUPPLY-SIDE ANALYSIS

- FIGURE 7 DATA TRIANGULATION

- FIGURE 8 HVDC TRANSMISSION MARKET, 2021-2030

- FIGURE 9 CONVERTER STATIONS SEGMENT TO DOMINATE MARKET IN 2025

- FIGURE 10 POINT-TO-POINT SEGMENT TO CAPTURE LARGEST MARKET SHARE IN 2030

- FIGURE 11 LINE COMMUTATED COVERTER (LCC) SEGMENT TO SECURE LARGEST MARKET SHARE IN 2030

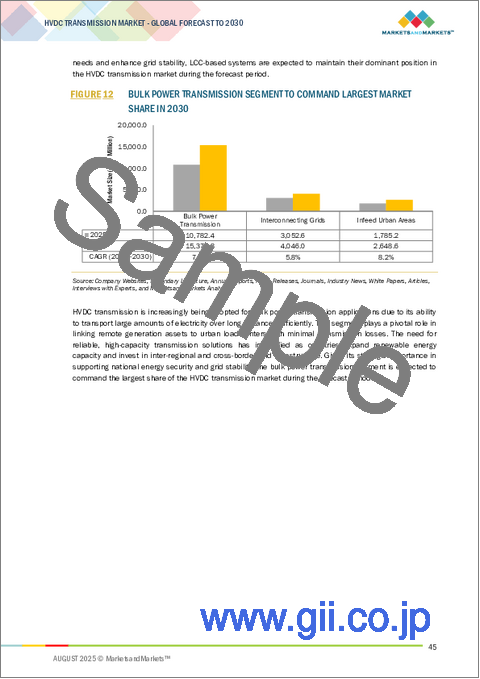

- FIGURE 12 BULK POWER TRANSMISSION SEGMENT TO COMMAND LARGEST MARKET SHARE IN 2030

- FIGURE 13 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 14 TRANSITION TOWARD RENEWABLE ENERGY SOURCES TO SUPPORT MARKET GROWTH

- FIGURE 15 CONVERTER STATIONS SEGMENT TO CAPTURE LARGEST MARKET SHARE IN 2030

- FIGURE 16 LINE COMMUTATED CONVERTER (LCC) SEGMENT TO DOMINATE MARKET IN 2030

- FIGURE 17 POINT-TO-POINT SEGMENT TO SECURE LARGEST MARKET SHARE IN 2030

- FIGURE 18 BULK POWER TRANSMISSION SEGMENT TO LEAD MARKET IN 2030

- FIGURE 19 CONVERTER STATION AND CHINA HELD LARGEST SHARES OF HVDC TRANSMISSION MARKET IN ASIA PACIFIC IN 2024

- FIGURE 20 CHINA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 21 HVDC TRANSMISSION MARKET: MARKET DYNAMICS

- FIGURE 22 ELECTRICITY CONSUMPTION, BY REGION, 2021-2024

- FIGURE 23 IMPACT ANALYSIS OF DRIVERS ON HVDC TRANSMISSION MARKET

- FIGURE 24 IMPACT ANALYSIS OF RESTRAINTS ON HVDC TRANSMISSION MARKET

- FIGURE 25 IMPACT ANALYSIS OF OPPORTUNITIES ON HVDC TRANSMISSION MARKET

- FIGURE 26 IMPACT ANALYSIS OF CHALLENGES ON HVDC TRANSMISSION MARKET

- FIGURE 27 HVDC TRANSMISSION MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 28 HVDC TRANSMISSION MARKET: ECOSYSTEM MAPPING

- FIGURE 29 INVESTMENT AND FUNDING SCENARIO, 2021-2025

- FIGURE 30 AVERAGE SELLING PRICE TREND OF COMPONENTS, BY KEY PLAYER, 2021-2024

- FIGURE 31 AVERAGE SELLING PRICE TREND OF COMPONENTS, BY REGION, 2021-2024

- FIGURE 32 NUMBER OF PATENTS GRANTED IN HVDC TRANSMISSION MARKET, 2015-2024

- FIGURE 33 HVDC TRANSMISSION MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 34 INFLUENCE OF STAKEHOLDERS ON TOP APPLICATIONS

- FIGURE 35 KEY BUYING CRITERIA FOR TOP APPLICATIONS

- FIGURE 36 IMPORT DATA FOR HS CODE 8504-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024

- FIGURE 37 EXPORT DATA FOR HS CODE 8504-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024

- FIGURE 38 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 39 IMPACT OF AI ON HVDC TRANSMISSION MARKET

- FIGURE 40 POINT-TO-POINT SEGMENT TO CAPTURE LARGEST MARKET SHARE IN 2025

- FIGURE 41 BULK POWER TRANSMISSION SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2030

- FIGURE 42 CONVERTER STATIONS SEGMENT TO CAPTURE LARGEST MARKET SHARE IN 2030

- FIGURE 43 LINE COMMUTATED CONVERTER (LCC) SEGMENT TO ACCOUNT FOR LARGEST SHARE OF HVDC TRANSMISSION MARKET FROM 2025 TO 2030

- FIGURE 44 ASIA PACIFIC TO BE FASTEST-GROWING REGION DURING FORECAST PERIOD

- FIGURE 45 NORTH AMERICA: HVDC TRANSMISSION MARKET SNAPSHOT

- FIGURE 46 EUROPE: HVDC TRANSMISSION MARKET SNAPSHOT

- FIGURE 47 ASIA PACIFIC: HVDC TRANSMISSION MARKET SNAPSHOT

- FIGURE 48 HVDC TRANSMISSION MARKET: MARKET SHARE ANALYSIS, 2024

- FIGURE 49 REVENUE ANALYSIS OF KEY PLAYERS IN HVDC TRANSMISSION MARKET, 2020-2024

- FIGURE 50 COMPANY VALUATION, 2025

- FIGURE 51 FINANCIAL METRICS, 2025

- FIGURE 52 BRAND/PRODUCT COMPARISON

- FIGURE 53 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- FIGURE 54 OVERALL COMPANY FOOTPRINT

- FIGURE 55 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- FIGURE 56 HITACHI, LTD.: COMPANY SNAPSHOT

- FIGURE 57 SIEMENS ENERGY: COMPANY SNAPSHOT

- FIGURE 58 MITSUBISHI ELECTRIC CORPORATION: COMPANY SNAPSHOT

- FIGURE 59 GE VERNOVA: COMPANY SNAPSHOT

- FIGURE 60 PRYSMIAN GROUP: COMPANY SNAPSHOT

- FIGURE 61 NKT A/S: COMPANY SNAPSHOT

- FIGURE 62 NEXANS: COMPANY SNAPSHOT

- FIGURE 63 LS ELECTRIC CO., LTD.: COMPANY SNAPSHOT

The global HVDC transmission market is estimated to be valued at USD 22.07 billion by 2030, up from USD 15.62 billion in 2025, at a CAGR of 7.2% during the forecast period. The HVDC transmission market is experiencing significant growth driven by the integration of VSC (voltage source converter) technology, rapid transition toward renewable energy, and strong government and utility focus on modernizing grids to improve power reliability. Additionally, government-led initiatives promoting HVDC transmission are further accelerating market adoption.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Technology, Component, Project Type, Application, and Region |

| Regions covered | North America, Europe, APAC, RoW |

However, the market faces challenges due to high initial investment requirements and the availability of substitute technologies such as distributed and off-grid power generation systems. Moreover, the complex lifecycles of HVDC projects can delay implementation and increase costs, slightly restraining overall market expansion.

"VSC technology is likely to register the fastest growth in the technology segment during the forecast period."

Voltage source converter (VSC) technology is expected to grow fastest in the HVDC transmission market during the forecast period. VSC offers key advantages over traditional Line Commutated Converter (LCC) systems, such as a smaller footprint, modular design, black start capability, and reactive power support. These features make VSC systems particularly suitable for integrating renewable energy sources like offshore wind farms, solar power plants, and distributed energy systems into the grid. Additionally, VSC technology allows for connection to weak or passive grids, which is essential for remote and island-based energy deployments. As countries expand their renewable capacity and move toward decentralized power generation, the demand for flexible, space-efficient transmission solutions is surging. VSC-based HVDC systems also enable underground and subsea cable transmission, making them ideal for urban centers and environmentally sensitive zones. Moreover, technological advancements in modular multilevel converters (MMC) are further enhancing the scalability, reliability, and cost-effectiveness of VSC systems. Governments across Europe, Asia Pacific, and North America increasingly favor VSC for new grid modernization projects and cross-border interconnections. With growing emphasis on energy transition, VSC is poised to play a pivotal role in the next generation of HVDC infrastructure, driving its rapid adoption globally.

Circuit breakers are expected to register the fastest growth rate in the converter station segment during the forecast period.

Circuit breakers are projected to witness the fastest growth within the converter station segment of the HVDC transmission component market during the forecast period. In HVDC systems, circuit breakers play a critical role in protecting equipment by interrupting fault currents and isolating faulty sections, thereby ensuring system stability and reliability. The rising demand for reliable and flexible power transmission, driven by the integration of renewable energy sources such as offshore wind and large scale solar, has significantly increased the need for advanced HVDC protection solutions.

Recent technological advancements, including the development of hybrid HVDC circuit breakers, have addressed the challenges of interrupting direct current which is traditionally a more complex task compared to AC systems. These innovations enable faster fault clearance and minimize downtime, supporting the expansion of long distance high capacity HVDC projects. Furthermore, growing investments in intercontinental and cross border power links, as well as modernization of aging grid infrastructure, are boosting circuit breaker adoption. As utilities focus on operational safety and system efficiency, the circuit breaker segment is expected to maintain strong momentum, outpacing other converter station components in growth rate.

"Asia Pacific is projected to expand at the fastest growth rate during the forecast period."

Asia Pacific is anticipated to register the fastest growth in the HVDC transmission market during the forecast period, driven by rapid industrialization, growing energy demand, and large-scale investments in renewable energy integration. Countries like China and India are leading the deployment of HVDC systems to address grid stability challenges, support long-distance electricity transmission, and connect remote renewable energy generation sites with consumption hubs. China, in particular, has become a global pioneer in ultra-high-voltage (UHV) DC transmission, with several cross-country projects that span thousands of kilometers and transport gigawatts of power. India also expands its HVDC infrastructure through green energy corridors and inter-regional power transfer initiatives. Southeast Asian nations such as Vietnam and Indonesia are gradually exploring HVDC to enhance grid reliability and meet rising energy needs in remote islands and rural areas. Government-led initiatives, favorable policy frameworks, and the involvement of regional players in HVDC component manufacturing are further accelerating adoption. Moreover, rising urbanization and electrification efforts, coupled with cross-border interconnection projects (e.g., China-Laos, India-Bangladesh), position the Asia Pacific as the fastest-growing market. The region's focus on sustainable development and energy security makes HVDC a key enabler for its future power transmission landscape.

The break-up of the profile of primary participants in the HVDC transmission market-

- By Company Type: Tier 1 - 50%, Tier 2 - 30%, Tier 3 - 20%

- By Designation Type: C Level - 35%, Director Level - 30%, Others - 35%

- By Region Type: Asia Pacific - 40%, Europe - 25%, North America - 20%, Rest of the World - 15%

Note: Other designations include sales, marketing, and product managers.

The three tiers of the companies are based on their total revenues as of 2024: Tier 1: >USD 1 billion, Tier 2: USD 500 million-1 billion, and Tier 3: USD 500 million

The major players in the HVDC transmission market with a significant global presence include Hitachi, Ltd. (Japan), Siemens Energy (Germany), Mitsubishi Electric Corporation (Japan), GE Vernova (US), Prysmian Group (Italy), and others.

Research Coverage

The report segments the HVDC transmission market and forecasts its size by technology, component, project type, application, and region. It also provides a comprehensive review of drivers, restraints, opportunities, and challenges influencing market growth. The report covers qualitative aspects in addition to quantitative aspects of the market.

Reasons to buy the report:

The report will help the market leaders/new entrants in this market with information on the closest approximate revenues for the overall HVDC transmission market and related segments. This report will help stakeholders understand the competitive landscape and gain more insights to strengthen their position in the market and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Analysis of key drivers (integration of VSC technology into HVDC systems, rapid transition toward renewable energy, strong focus of governments and utilities on grid modernization to improve power reliability, and government-led policies and initiatives promoting HVDC transmission technology), restraints (high initial investment requirements, availability of substitute technologies such as distributed and off-grid power generation systems, and complex project lifecycles), opportunities (constant advances in power electronics and adoption of digital and automation technologies, electrification of transportation sector, growing demand for integrated networks across long distances, and energy transition strategies in oil-rich economies), and challenges (interoperability issues due to lack of standardization, stringent regulatory landscape and complexities associated with obtaining permit for HVDC projects)

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the HVDC transmission market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the HVDC transmission market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the HVDC transmission market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players, including include Hitachi, Ltd. (Japan), Siemens Energy (Germany), Mitsubishi Electric Corporation (Japan), GE Vernova (US), and Prysmian Group (Italy).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH APPROACH

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Major secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 List of key primary interview participants

- 2.1.2.2 Breakdown of primaries

- 2.1.2.3 Key data from primary sources

- 2.1.2.4 Key industry insights

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to estimate market size using bottom-up analysis

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to estimate market size using top-down analysis

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 FACTOR ANALYSIS

- 2.3.1 DEMAND-SIDE ANALYSIS

- 2.3.2 SUPPLY-SIDE ANALYSIS

- 2.4 GROWTH FORECAST

- 2.5 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN HVDC TRANSMISSION MARKET

- 4.2 HVDC TRANSMISSION MARKET, BY COMPONENT

- 4.3 HVDC TRANSMISSION MARKET, BY TECHNOLOGY

- 4.4 HVDC TRANSMISSION MARKET, BY PROJECT TYPE

- 4.5 HVDC TRANSMISSION MARKET, BY APPLICATION

- 4.6 ASIA PACIFIC: HVDC TRANSMISSION MARKET, BY COMPONENT AND COUNTRY, 2024

- 4.7 HVDC TRANSMISSION MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Integration of VSC technology into HVDC systems

- 5.2.1.2 Global shift toward renewable energy sources

- 5.2.1.3 Importance of grid modernization and reliable energy transmission

- 5.2.1.4 Government-led policies and initiatives to promote HVDC transmission technology

- 5.2.2 RESTRAINTS

- 5.2.2.1 High initial investment

- 5.2.2.2 Availability of substitute technologies

- 5.2.2.3 Complex project lifecycles

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing adoption of digital and automation technologies

- 5.2.3.2 Electrification of transportation sector

- 5.2.3.3 Increasing demand for integrated networks across long distances

- 5.2.3.4 Strategic shift from traditional fossil fuels to sustainable energy

- 5.2.4 CHALLENGES

- 5.2.4.1 Interoperability issues due to lack of standardization

- 5.2.4.2 Complexities associated with obtaining necessary permits

- 5.2.1 DRIVERS

- 5.3 SUPPLY CHAIN ANALYSIS

- 5.4 ECOSYSTEM MAPPING

- 5.5 INVESTMENT AND FUNDING SCENARIO

- 5.6 TECHNOLOGY ANALYSIS

- 5.6.1 KEY TECHNOLOGIES

- 5.6.1.1 Modular multilevel converters (MMC)

- 5.6.1.2 Control & protection systems

- 5.6.2 COMPLEMENTARY TECHNOLOGIES

- 5.6.2.1 SCADA

- 5.6.2.2 HVDC grid control software

- 5.6.3 ADJACENT TECHNOLOGIES

- 5.6.3.1 Offshore energy hubs and interconnectors

- 5.6.3.2 Advanced grid planning and simulation tools

- 5.6.1 KEY TECHNOLOGIES

- 5.7 PRICING ANALYSIS

- 5.7.1 AVERAGE SELLING PRICE TREND OF COMPONENTS, BY KEY PLAYER, 2021-2024

- 5.7.2 AVERAGE SELLING PRICE TREND OF COMPONENTS, BY REGION, 2021-2024

- 5.8 PATENT ANALYSIS

- 5.9 PORTER'S FIVE FORCES ANALYSIS

- 5.9.1 THREAT OF NEW ENTRANTS

- 5.9.2 THREAT OF SUBSTITUTES

- 5.9.3 BARGAINING POWER OF SUPPLIERS

- 5.9.4 BARGAINING POWER OF BUYERS

- 5.9.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.10 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.10.2 BUYING CRITERIA

- 5.11 CASE STUDIES

- 5.11.1 ELECTRIFICATION OF STATOIL TROLL A PLATFORM WITH ABB HVDC LIGHT TECHNOLOGY DELIVERS LOWER EMISSIONS AND IMPROVED EFFICIENCY

- 5.11.2 HITACHI ENERGY HVDC LIGHT INTEGRATION STRENGTHENS NORDIC GRID RESILIENCE AND ENABLES EFFICIENT CROSS-BORDER RENEWABLE ENERGY EXCHANGE

- 5.11.3 SCOTTISH HYDRO ELECTRIC TRANSMISSION AND CAITHNESS-MORAY HVDC COLLABORATED TO STRENGTHEN SCOTLAND'S POWER NETWORK AND ENABLE RELIABLE RENEWABLE ENERGY INTEGRATION

- 5.11.4 MITSUBISHI ELECTRIC CORPORATION ASISTS SWANSEA NORTH SUBSTATION UPGRADE TO HIGHER VOLTAGE SYSTEM

- 5.11.5 HITACHI ENERGY EMPOWERS CROSS-BORDER ENERGY FLOW WITH EAST WEST HVDC INTERCONNECTOR

- 5.12 TRADE ANALYSIS

- 5.12.1 IMPORT DATA

- 5.12.2 EXPORT DATA

- 5.13 TARIFF AND REGULATORY LANDSCAPE

- 5.13.1 TARIFF ANALYSIS

- 5.13.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13.3 STANDARDS

- 5.13.3.1 Europe

- 5.13.3.2 Asia Pacific

- 5.13.3.3 North America

- 5.13.3.4 RoW

- 5.13.4 REGULATIONS

- 5.13.4.1 North America

- 5.13.4.2 Europe

- 5.13.4.3 Asia Pacific

- 5.13.4.4 RoW

- 5.14 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.15 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.16 IMPACT OF AI/GEN AI ON HVDC TRANSMISSION MARKET

- 5.16.1 INTRODUCTION

- 5.17 IMPACT OF 2025 US TARIFF - HVDC TRANSMISSION MARKET

- 5.17.1 INTRODUCTION

- 5.17.1.1 Key tariff rates

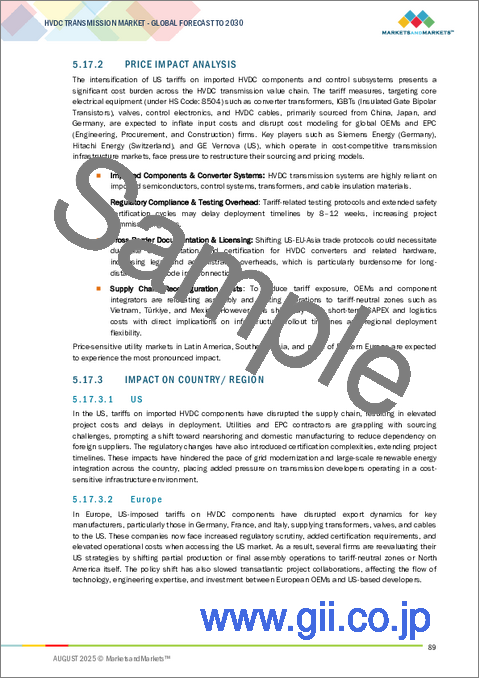

- 5.17.2 PRICE IMPACT ANALYSIS

- 5.17.3 IMPACT ON COUNTRY/ REGION

- 5.17.3.1 US

- 5.17.3.2 Europe

- 5.17.3.3 Asia Pacific

- 5.17.4 IMPACT ON APPLICATIONS

- 5.17.1 INTRODUCTION

6 POWER RATINGS IN HVDC TRANSMISSION

- 6.1 INTRODUCTION

- 6.2 BELOW 500 MW

- 6.3 501-999 MW

- 6.4 1,000-2,000 MW

- 6.5 ABOVE 2,000 MW

7 HVDC TRANSMISSION MARKET, BY PROJECT TYPE

- 7.1 INTRODUCTION

- 7.2 POINT-TO-POINT TRANSMISSION

- 7.2.1 MONOPOLAR TRANSMISSION SYSTEMS

- 7.2.1.1 Suitability for remote area electrification and early-stage HVDC projects to support market growth

- 7.2.2 BIPOLAR TRANSMISSION SYSTEMS

- 7.2.2.1 Rising demand for bulk power transmission from remote renewable sources to fuel market growth

- 7.2.1 MONOPOLAR TRANSMISSION SYSTEMS

- 7.3 BACK-TO-BACK STATIONS

- 7.3.1 GROWING NEED FOR CROSS-BORDER ELECTRICITY TRADE BETWEEN ASYNCHRONOUS NETWORKS TO FOSTER MARKET GROWTH

- 7.4 MULTI-TERMINAL SYSTEMS

- 7.4.1 ABILITY TO AGGREGATE LARGE AMOUNTS OF RENEWABLE ENERGIES COST-EFFECTIVELY TO FUEL MARKET GROWTH

8 HVDC TRANSMISSION MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.2 BULK POWER TRANSMISSION

- 8.2.1 OVERHEAD

- 8.2.1.1 Growing emphasis on enhancing inter-regional connectivity to boost demand

- 8.2.2 UNDERWATER & UNDERGROUND

- 8.2.2.1 Improved energy security with electricity trading to fuel market growth

- 8.2.1 OVERHEAD

- 8.3 INTERCONNECTING GRIDS

- 8.3.1 ONGOING ADVANCEMENTS IN VSC TECHNOLOGY TO DRIVE MARKET

- 8.4 INFEED URBAN AREAS

- 8.4.1 RISING ELECTRICITY DEMAND FROM DENSELY POPULATED URBAN AREAS TO BOOST DEMAND

9 HVDC TRANSMISSION MARKET, BY COMPONENT

- 9.1 INTRODUCTION

- 9.2 CONVERTER STATIONS

- 9.2.1 VALVES

- 9.2.1.1 Thyristor valves

- 9.2.1.1.1 Ongoing advancements to enhance switching speed and efficiency to drive market

- 9.2.1.2 Insulated gate bipolar transistors (IGBTs)

- 9.2.1.2.1 Reduced maintenance requirements and enhanced grid reliability to foster market growth

- 9.2.1.1 Thyristor valves

- 9.2.2 TRANSFORMERS

- 9.2.2.1 Ability to optimize voltage levels to boost demand

- 9.2.3 HARMONIC FILTERS

- 9.2.3.1 AC filters

- 9.2.3.1.1 Increasing application to mitigate harmonic distortions to drive market

- 9.2.3.2 DC filters

- 9.2.3.2.1 Need to maintain efficiency and reliability of offshore wind projects and urban infeed applications to boost demand

- 9.2.3.1 AC filters

- 9.2.4 CIRCUIT BREAKERS

- 9.2.4.1 Rising demand for secure and uninterrupted transmission of electrical power to augment market growth

- 9.2.5 REACTORS

- 9.2.5.1 Need to ensure seamless voltage fluctuations during AC-DC conversion to boost demand

- 9.2.6 SURGE ARRESTERS

- 9.2.6.1 Growing need to shield equipment from overvoltage conditions to drive market

- 9.2.1 VALVES

- 9.3 TRANSMISSION CABLES

- 9.3.1 INCREASING APPLICATION FOR CROSS-BORDER INTERCONNECTIONS AND OFFSHORE WIND INTEGRATION TO FUEL MARKET GROWTH

- 9.4 OTHER COMPONENTS

10 HVDC TRANSMISSION MARKET, BY TECHNOLOGY

- 10.1 INTRODUCTION

- 10.2 LINE COMMUTATED CONVERTER (LCC)

- 10.2.1 HVDC

- 10.2.1.1 Rising need to regulate transmission losses with cost-effective methods to drive market

- 10.2.2 UHVDC

- 10.2.2.1 Ability to enhance grid stability and support long-distance bulk power transfers to foster market growth

- 10.2.1 HVDC

- 10.3 VOLTAGE SOURCE CONVERTER (VSC)

- 10.3.1 HVDC

- 10.3.1.1 Suitability for long-distance power transmissions to drive market

- 10.3.2 UHVDC

- 10.3.2.1 Rising electricity trading with converter stations in different regions and countries to fuel market growth

- 10.3.1 HVDC

- 10.4 CAPACITOR COMMUTATED CONVERTER (CCC)

- 10.4.1 INCREASING NEED TO CONTROL CURRENT, OVERCURRENT, AND VOLTAGE TO DRIVE MARKET

11 HVDC TRANSMISSION MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 11.2.2 US

- 11.2.2.1 Emphasis on developing renewable energy sources and grid modernization to drive market

- 11.2.3 CANADA

- 11.2.3.1 Commitment to reducing greenhouse gas emissions to boost demand

- 11.2.4 MEXICO

- 11.2.4.1 Abundance of wind and solar resources to offer lucrative growth opportunities

- 11.3 EUROPE

- 11.3.1 EUROPE: MACROECONOMIC OUTLOOK

- 11.3.2 UK

- 11.3.2.1 Increasing investments to boost HDVC transmission infrastructure to fuel market growth

- 11.3.3 GERMANY

- 11.3.3.1 Transition to low-carbon energy system to foster market growth

- 11.3.4 FRANCE

- 11.3.4.1 Enhancement of grid connectivity and cross-border electricity exchange to drive market

- 11.3.5 ITALY

- 11.3.5.1 Increasing emphasis on supporting long-distance and high-capacity electricity transmission to propel market growth

- 11.3.6 SPAIN

- 11.3.6.1 Rising focus on modernizing network with high-capacity subsea interconnectors to fuel market growth

- 11.3.7 POLAND

- 11.3.7.1 Need to reduce dependency on coal-based generation to drive market

- 11.3.8 NORDICS

- 11.3.8.1 Growing demand for low-loss transmission over long distances to boost demand

- 11.3.9 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 11.4.2 CHINA

- 11.4.2.1 Expanding renewable energy infrastructure to support market growth

- 11.4.3 JAPAN

- 11.4.3.1 Incorporation of offshore wind power into national energy strategies to drive market

- 11.4.4 SOUTH KOREA

- 11.4.4.1 Government-led initiatives to boost HDVC adoption to fuel market growth

- 11.4.5 INDIA

- 11.4.5.1 Rising focus on modernizing power transmission infrastructure to boost demand

- 11.4.6 AUSTRALIA

- 11.4.6.1 Promotion of clean energy resources to propel market growth

- 11.4.7 INDONESIA

- 11.4.7.1 Strategies to enhance grid flexibility to support market growth

- 11.4.8 MALAYSIA

- 11.4.8.1 Need to interconnect asynchronous grids and move large volumes of power with minimal losses to drive market

- 11.4.9 THAILAND

- 11.4.9.1 Growing emphasis on improving energy security to boost demand

- 11.4.10 VIETNAM

- 11.4.10.1 Increasing focus on enhancing national grid flexibility and resilience to support market growth

- 11.4.11 REST OF ASIA PACIFIC

- 11.5 ROW

- 11.5.1 ROW: MACROECONOMIC OUTLOOK

- 11.5.2 MIDDLE EAST

- 11.5.2.1 Bahrain

- 11.5.2.1.1 Growing focus on strengthening grid reliability and regional power exchange to drive market

- 11.5.2.2 Kuwait

- 11.5.2.2.1 Increasing need to optimize load balancing and ensure emergency energy supply to foster market growth

- 11.5.2.3 Oman

- 11.5.2.3.1 Growing cross-border connectivity and grid modernization to support market growth

- 11.5.2.4 Qatar

- 11.5.2.4.1 Rising focus on improving energy security and supporting integration of large-scale renewable sources to fuel market growth

- 11.5.2.5 Saudi Arabia

- 11.5.2.5.1 Emphasis on supporting regional power trade to boost demand

- 11.5.2.6 UAE

- 11.5.2.6.1 National objectives to decarbonize industrial operations to drive market

- 11.5.2.7 Rest of Middle East

- 11.5.2.1 Bahrain

- 11.5.3 AFRICA

- 11.5.3.1 South Africa

- 11.5.3.1.1 Emphasis on accommodating increasing share of renewables in energy mix to fuel market growth

- 11.5.3.2 Rest of Africa

- 11.5.3.1 South Africa

- 11.5.4 SOUTH AMERICA

- 11.5.4.1 Growing emphasis on grid reliability to support market growth

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 RIGHT TO WIN/KEY STRATEGIES ADOPTED BY KEY PLAYERS, 2020-2025

- 12.3 MARKET SHARE ANALYSIS, 2024

- 12.4 REVENUE ANALYSIS, 2020-2024

- 12.5 COMPANY VALUATION AND FINANCIAL METRICS

- 12.6 BRAND/PRODUCT COMPARISON

- 12.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.7.1 STARS

- 12.7.2 EMERGING LEADERS

- 12.7.3 PERVASIVE PLAYERS

- 12.7.4 PARTICIPANTS

- 12.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.7.5.1 Region footprint

- 12.7.5.2 Component footprint

- 12.7.5.3 Application footprint

- 12.7.5.4 Project type footprint

- 12.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.8.1 PROGRESSIVE COMPANIES

- 12.8.2 RESPONSIVE COMPANIES

- 12.8.3 DYNAMIC COMPANIES

- 12.8.4 STARTING BLOCKS

- 12.8.5 COMPETITIVE BENCHMARKING

- 12.8.5.1 Detailed list of key startups/SMEs

- 12.8.5.2 Competitive benchmarking of key startups/SMEs

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 PRODUCT LAUNCHES

- 12.9.2 DEALS

- 12.9.3 OTHER DEVELOPMENTS

13 COMPANY PROFILES

- 13.1 INTRODUCTION

- 13.2 KEY PLAYERS

- 13.2.1 HITACHI, LTD.

- 13.2.1.1 Business overview

- 13.2.1.2 Products/Solutions/Services offered

- 13.2.1.3 Recent developments

- 13.2.1.3.1 Deals

- 13.2.1.3.2 Other developments

- 13.2.1.4 MnM view

- 13.2.1.4.1 Key strengths/Right to win

- 13.2.1.4.2 Strategic choices

- 13.2.1.4.3 Weaknesses/Competitive threats

- 13.2.2 SIEMENS ENERGY

- 13.2.2.1 Business overview

- 13.2.2.2 Products/Solutions/Services offered

- 13.2.2.3 Recent developments

- 13.2.2.3.1 Deals

- 13.2.2.3.2 Other developments

- 13.2.2.4 MnM view

- 13.2.2.4.1 Key strengths/Right to win

- 13.2.2.4.2 Strategic choices

- 13.2.2.4.3 Weaknesses/Competitive threats

- 13.2.3 MITSUBISHI ELECTRIC CORPORATION

- 13.2.3.1 Business overview

- 13.2.3.2 Products/Solutions/Services offered

- 13.2.3.3 Recent developments

- 13.2.3.3.1 Deals

- 13.2.3.3.2 Other developments

- 13.2.3.4 MnM view

- 13.2.3.4.1 Key strengths/Right to win

- 13.2.3.4.2 Strategic choices

- 13.2.3.4.3 Weaknesses/Competitive threats

- 13.2.4 GE VERNOVA

- 13.2.4.1 Business overview

- 13.2.4.2 Products/Solutions/Services offered

- 13.2.4.3 Recent developments

- 13.2.4.3.1 Deals

- 13.2.4.3.2 Other developments

- 13.2.4.4 MnM view

- 13.2.4.4.1 Key strengths/Right to win

- 13.2.4.4.2 Strategic choices

- 13.2.4.4.3 Weaknesses/Competitive threats

- 13.2.5 PRYSMIAN GROUP

- 13.2.5.1 Business overview

- 13.2.5.2 Products/Solutions/Services offered

- 13.2.5.3 Recent developments

- 13.2.5.3.1 Product launches

- 13.2.5.3.2 Deals

- 13.2.5.3.3 Other developments

- 13.2.5.4 MnM view

- 13.2.5.4.1 Key strengths/ Right to win

- 13.2.5.4.2 Strategic choices

- 13.2.5.4.3 Weaknesses/Competitive threats

- 13.2.6 TOSHIBA CORPORATION

- 13.2.6.1 Business overview

- 13.2.6.2 Products/Solutions/Services offered

- 13.2.6.3 Recent developments

- 13.2.6.3.1 Deals

- 13.2.6.3.2 Other developments

- 13.2.7 NKT A/S

- 13.2.7.1 Business overview

- 13.2.7.2 Products/Solutions/Services offered

- 13.2.7.3 Recent developments

- 13.2.7.3.1 Deals

- 13.2.7.3.2 Other developments

- 13.2.8 NEXANS

- 13.2.8.1 Business overview

- 13.2.8.2 Products/Solutions/Services offered

- 13.2.8.3 Recent developments

- 13.2.8.3.1 Deals

- 13.2.8.3.2 Other developments

- 13.2.9 LS ELECTRIC CO., LTD.

- 13.2.9.1 Business overview

- 13.2.9.2 Products/Solutions/Services offered

- 13.2.9.3 Recent developments

- 13.2.9.3.1 Deals

- 13.2.9.3.2 Other developments

- 13.2.10 NR ELECTRIC CO., LTD.

- 13.2.10.1 Business overview

- 13.2.10.2 Products/Solutions/Services offered

- 13.2.1 HITACHI, LTD.

- 13.3 OTHER PLAYERS

- 13.3.1 SUMITOMO ELECTRIC INDUSTRIES, LTD.

- 13.3.2 ZAPOROZHTRANSFORMATOR

- 13.3.3 TRENCH GROUP

- 13.3.4 TAIHAN CABLE & SOLUTION CO., LTD.

- 13.3.5 AMERICAN SEMICONDUCTOR, INC.

- 13.3.6 ZTT

- 13.3.7 TBEA CO., LTD.

- 13.3.8 EFACEC

- 13.3.9 SIEYUAN ELECTRIC CO., LTD.

- 13.3.10 XJ ELECTRIC CO., LTD.

- 13.3.11 BTW

- 13.3.12 CG POWER & INDUSTRIAL SOLUTIONS LTD.

- 13.3.13 SGB SMIT

- 13.3.14 C-EPRI ELECTRIC POWER ENGINEERING CO., LTD.

- 13.3.15 HYOSUNG HEAVY INDUSTRIES

14 APPENDIX

- 14.1 INSIGHTS FROM INDUSTRY EXPERTS

- 14.2 DISCUSSION GUIDE

- 14.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.4 CUSTOMIZATION OPTIONS

- 14.5 RELATED REPORTS

- 14.6 AUTHOR DETAILS