|

|

市場調査レポート

商品コード

1802918

カオリンの世界市場:タイプ別、プロセス別、最終用途産業別、地域別 - 2030年までの予測Kaolin Market by Type, Process, End-use Industry, and Region - Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| カオリンの世界市場:タイプ別、プロセス別、最終用途産業別、地域別 - 2030年までの予測 |

|

出版日: 2025年08月23日

発行: MarketsandMarkets

ページ情報: 英文 301 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

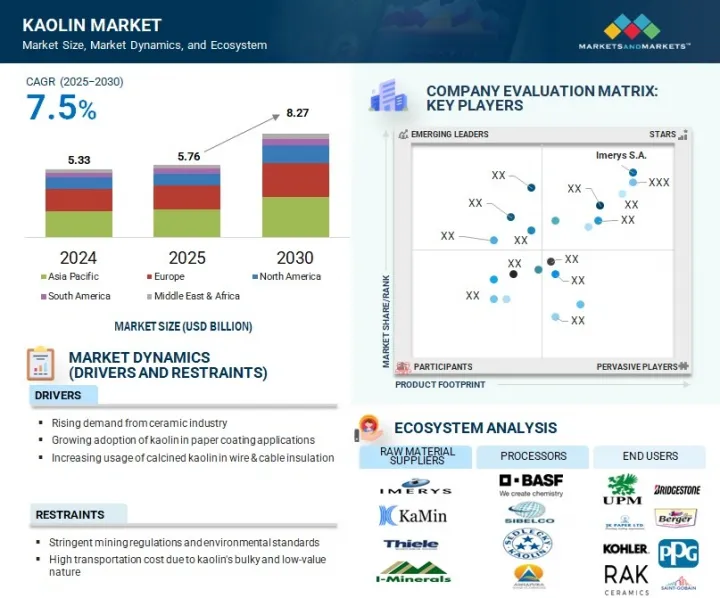

カオリンの市場規模は、2025年の57億6,000万米ドルから2030年には82億7,000万米ドルに達し、CAGRは7.5%と予測されています。

カオリンは製紙、セラミックス、衛生陶器、ガラス繊維、塗料・コーティング、ゴム製造、プラスチックなど様々な産業で広く使用されています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 対象単位 | 数量(キロトン)、金額(100万米ドル/10億米ドル) |

| セグメント | タイプ別、プロセス別、最終用途産業別、地域別 |

| 対象地域 | 北米、アジア太平洋、欧州、南米、中東・アフリカ |

米国、ブラジル、英国など、豊富で高品質なカオリンを埋蔵する国々は、高級カオリンを世界市場に供給する上で重要な役割を果たしています。これらの要因が総合的にカオリン市場の成長を牽引しています。合成カオリンは高コストで基盤が小さいにもかかわらず、ハイテク用途での需要が増加しているため、天然カオリンよりも急速に成長しています。

2024年、製紙業界はカオリン市場において数量・金額ともに最大の最終用途セグメントとなっています。カオリンは引き続き市場をリードしており、今後も安定した成長が見込まれています。紙は印刷媒体や包装に広く使用されており、特に新興国ではeコマースの急成長により、紙ベースの包装ソリューションへの需要が高まっています。インドや中国のような国々は、新聞、書籍、雑誌などの印刷媒体の消費量が多く、eコマース活動も活発化しているため、大きな成長機会をもたらしています。持続可能で生分解可能な包装オプションへの世界的な注目は、製紙業界におけるカオリンの需要をさらに高めています。

予測期間中、デラミネートセグメントが最も高い成長率を示すと予想されます。この成長の原動力となっているのは、より優れた輝度と滑らかさを提供する、高品質で研磨性の低い剥離カオリンの入手可能性が高まっていることです。剥離プロセスでは、積み重なった層から個々のカオリナイトの小板を破断せずに分離するため、正確な機械的力が必要となります。その結果、剥離カオリンは主に製紙業界で印刷適性と表面特性を改善するために使用されています。さらに、高級コート紙の需要の高まりと製紙技術の進歩が、このセグメントの成長を後押ししています。

アジア太平洋は、中国、インド、日本、韓国、オーストラリアなどの国々をカバーする広範な分析により、カオリンの主要市場であり続けています。急速な都市化、良好な人口動態の変化、新興国における経済状況の改善が、この地域をカオリン消費にとって非常に魅力的なものにしています。Ashapura Group(インド)、EICL Limited(インド)、Minotaur Exploration Limited(オーストラリア)などの主要企業は、安定供給を確保するため、製造ユニット、流通チャネル、営業所を通じて現地に強力な足跡を築いています。さらに、インフラ、建設、包装産業への投資の増加は、アジア太平洋全域のカオリン市場の持続的な成長に貢献しています。

当レポートでは、世界のカオリン市場について調査し、タイプ別、プロセス別、最終用途産業別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- サプライチェーン分析

- エコシステム/市場マップ

- 価格分析

- 貿易分析

- 技術分析

- マクロ経済見通し

- 特許分析

- 規制状況

- ケーススタディ分析

- 顧客のビジネスに影響を与える動向と混乱

- 投資と資金調達のシナリオ

- AI/生成AIがカオリン市場に与える影響

- 2025年の米国関税がカオリン市場に与える影響

第6章 カオリン市場(タイプ別)

- イントロダクション

- 天然

- 合成

第7章 カオリン市場(プロセス別)

- イントロダクション

- 水洗浄

- エアフロート

- 焼成

- 剥離

- 表面改質

第8章 カオリン市場(最終用途産業別)

- イントロダクション

- 製紙

- 陶磁器・衛生陶器

- グラスファイバー

- 塗料とコーティング

- ゴム

- プラスチック

- その他の最終用途産業

- 接着剤

- シーラント

- パーソナルケア・ヘルスケア

- 農業

- その他の最終用途産業におけるカオリン市場(地域別)

第9章 カオリン市場(地域別)

- イントロダクション

- カオリン市場(地域別)

- 北米

- アジア太平洋

- 欧州

- 中東・アフリカ

- 南米

第10章 競合情勢

- 概要

- 主要参入企業の戦略/強み、2020年1月~2025年7月

- 収益分析

- 市場シェア分析

- ブランド/製品比較分析

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- カオリンベンダーの評価と財務指標

- 競合シナリオ

第11章 企業プロファイル

- 主要参入企業

- IMERYS S.A.

- 20 MICRONS

- KAMIN LLC.

- ASHAPURA GROUP

- SIBELCO

- THIELE KAOLIN COMPANY

- LB MINERALS, LTD.

- EICL LIMITED

- QUARZWERKE GMBH

- SEDLECKY KAOLIN, A.S.

- その他の企業

- SHREE RAM KAOLIN

- KERAMOST, A.S.

- UMA GROUP OF COMPANIES

- JIANGXI SINCERE MINERAL INDUSTRY CO., LTD.

- ACTIVE MINERALS INTERNATIONAL, LLC

- BURGESS PIGMENT COMPANY

- KAOLIN(MALAYSIA)SDN BHD.

- KERALA CERAMICS LTD.

- MOTA CERAMIC SOLUTIONS

- MANEK GROUP

- ZILLION SAWA MINERALS PRIVATE LIMITED

- HITECH MINERALS AND CHEMICALS GROUP

- AMGEEN MINERALS

- GUJARAT EARTH MINERALS PVT. LTD.

- HD MICRONS LIMITED.

第12章 付録

List of Tables

- TABLE 1 KAOLIN MARKET: IMPACT OF PORTER'S FIVE FORCES

- TABLE 2 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 2 END-USE INDUSTRIES

- TABLE 3 KEY BUYING CRITERIA FOR TOP 3 END-USE INDUSTRIES

- TABLE 4 KAOLIN MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 5 AVERAGE SELLING PRICE TREND IN KAOLIN MARKET, BY REGION (USD/KG), 2021-2030

- TABLE 6 EXPORT DATA FOR HS CODE 2507-COMPLIANT PRODUCTS, BY KEY COUNTRIES, 2024 (USD THOUSAND)

- TABLE 7 IMPORT DATA FOR HS CODE 2507-COMPLIANT PRODUCTS, BY KEY COUNTRIES, 2024 (USD THOUSAND)

- TABLE 8 GDP PERCENTAGE (%) CHANGE, BY KEY COUNTRY, 2021-2029

- TABLE 9 KAOLIN MARKET: GLOBAL PATENTS

- TABLE 10 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 TOP USE CASES AND MARKET POTENTIAL

- TABLE 15 CASE STUDIES OF AI IMPLEMENTATION IN KAOLIN MARKET

- TABLE 16 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 17 EXPECTED CHANGE IN PRICES AND IMPACT ON END-USE MARKET

- TABLE 18 KAOLIN MARKET, BY TYPE, 2021-2024 (USD MILLION)

- TABLE 19 KAOLIN MARKET, BY TYPE, 2021-2024 (KILOTON)

- TABLE 20 KAOLIN MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 21 KAOLIN MARKET, BY TYPE, 2025-2030 (KILOTON)

- TABLE 22 NATURAL KAOLIN MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 23 NATURAL KAOLIN MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 24 NATURAL KAOLIN MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 25 NATURAL KAOLIN MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 26 SYNTHETIC KAOLIN MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 27 SYNTHETIC KAOLIN MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 28 SYNTHETIC KAOLIN MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 29 SYNTHETIC KAOLIN MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 30 KAOLIN MARKET, BY PROCESS, 2021-2024 (USD MILLION)

- TABLE 31 KAOLIN MARKET, BY PROCESS, 2021-2024 (KILOTON)

- TABLE 32 KAOLIN MARKET, BY PROCESS, 2025-2030 (USD MILLION)

- TABLE 33 KAOLIN MARKET, BY PROCESS, 2025-2030 (KILOTON)

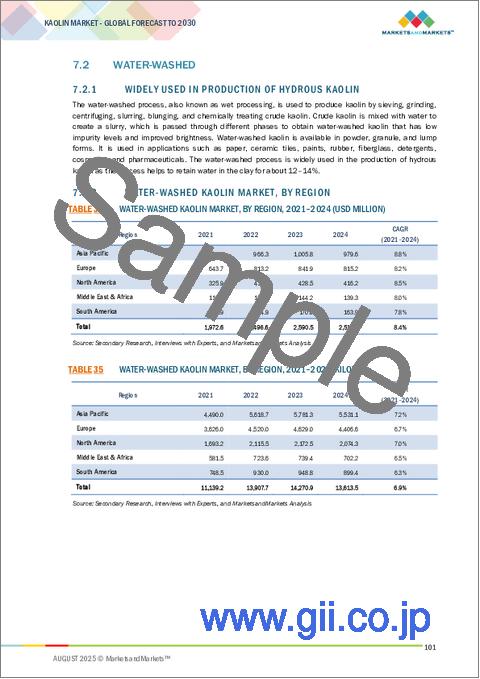

- TABLE 34 WATER-WASHED KAOLIN MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 35 WATER-WASHED KAOLIN MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 36 WATER-WASHED KAOLIN MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 37 WATER-WASHED KAOLIN MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 38 AIRFLOAT KAOLIN MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 39 AIRFLOAT KAOLIN MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 40 AIRFLOAT KAOLIN MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 41 AIRFLOAT KAOLIN MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 42 CALCINED KAOLIN MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 43 CALCINED KAOLIN MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 44 CALCINED KAOLIN MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 45 CALCINED KAOLIN MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 46 DELAMINATED KAOLIN MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 47 DELAMINATED KAOLIN MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 48 DELAMINATED KAOLIN MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 49 DELAMINATED KAOLIN MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 50 SURFACE-MODIFIED KAOLIN MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 51 SURFACE-MODIFIED KAOLIN MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 52 SURFACE-MODIFIED KAOLIN MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 53 SURFACE-MODIFIED KAOLIN MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 54 KAOLIN MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 55 KAOLIN MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 56 KAOLIN MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 57 KAOLIN MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 58 KAOLIN MARKET IN PAPER INDUSTRY, BY REGION, 2021-2024 (USD MILLION)

- TABLE 59 KAOLIN MARKET IN PAPER INDUSTRY, BY REGION, 2021-2024 (KILOTON)

- TABLE 60 KAOLIN MARKET IN PAPER INDUSTRY, BY REGION, 2025-2030 (USD MILLION)

- TABLE 61 KAOLIN MARKET IN PAPER INDUSTRY, BY REGION, 2025-2030 (KILOTON)

- TABLE 62 KAOLIN MARKET IN CERAMICS & SANITARYWARE INDUSTRY, BY REGION, 2021-2024 (USD MILLION)

- TABLE 63 KAOLIN MARKET IN CERAMICS & SANITARYWARE INDUSTRY, BY REGION, 2021-2024 (KILOTON)

- TABLE 64 KAOLIN MARKET IN CERAMICS & SANITARYWARE INDUSTRY, BY REGION, 2025-2030 (USD MILLION)

- TABLE 65 KAOLIN MARKET IN CERAMICS & SANITARYWARE INDUSTRY, BY REGION, 2025-2030 (KILOTON)

- TABLE 66 KAOLIN MARKET IN FIBERGLASS INDUSTRY, BY REGION, 2021-2024 (USD MILLION)

- TABLE 67 KAOLIN MARKET IN FIBERGLASS INDUSTRY, BY REGION, 2021-2024 (KILOTON)

- TABLE 68 KAOLIN MARKET IN FIBERGLASS INDUSTRY, BY REGION, 2025-2030 (USD MILLION)

- TABLE 69 KAOLIN MARKET IN FIBERGLASS INDUSTRY, BY REGION, 2025-2030 (KILOTON)

- TABLE 70 KAOLIN MARKET IN PAINTS & COATINGS INDUSTRY, BY REGION, 2021-2024 (USD MILLION)

- TABLE 71 KAOLIN MARKET IN PAINTS & COATINGS INDUSTRY, BY REGION, 2021-2024 (KILOTON)

- TABLE 72 KAOLIN MARKET IN PAINTS & COATINGS INDUSTRY, BY REGION, 2025-2030 (USD MILLION)

- TABLE 73 KAOLIN MARKET IN PAINTS & COATINGS INDUSTRY, BY REGION, 2025-2030 (KILOTON)

- TABLE 74 KAOLIN MARKET IN RUBBER INDUSTRY, BY REGION, 2021-2024 (USD MILLION)

- TABLE 75 KAOLIN MARKET IN RUBBER INDUSTRY, BY REGION, 2021-2024 (KILOTON)

- TABLE 76 KAOLIN MARKET IN RUBBER INDUSTRY, BY REGION, 2025-2030 (USD MILLION)

- TABLE 77 KAOLIN MARKET IN RUBBER INDUSTRY, BY REGION, 2025-2030 (KILOTON)

- TABLE 78 KAOLIN MARKET IN PLASTICS INDUSTRY, BY REGION, 2021-2024 (USD MILLION)

- TABLE 79 KAOLIN MARKET IN PLASTICS INDUSTRY, BY REGION, 2021-2024 (KILOTON)

- TABLE 80 KAOLIN MARKET IN PLASTICS INDUSTRY, BY REGION, 2025-2030 (USD MILLION)

- TABLE 81 KAOLIN MARKET IN PLASTICS INDUSTRY, BY REGION, 2025-2030 (KILOTON)

- TABLE 82 KAOLIN MARKET IN OTHER END-USE INDUSTRIES, BY REGION, 2021-2024 (USD MILLION)

- TABLE 83 KAOLIN MARKET IN OTHER END-USE INDUSTRIES, BY REGION, 2021-2024 (KILOTON)

- TABLE 84 KAOLIN MARKET IN OTHER END-USE INDUSTRIES, BY REGION, 2025-2030 (USD MILLION)

- TABLE 85 KAOLIN MARKET IN OTHER END-USE INDUSTRIES, BY REGION, 2025-2030 (KILOTON)

- TABLE 86 KAOLIN MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 87 KAOLIN MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 88 KAOLIN MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 89 KAOLIN MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 90 NORTH AMERICA: KAOLIN MARKET, BY PROCESS, 2021-2024 (USD MILLION)

- TABLE 91 NORTH AMERICA: KAOLIN MARKET, BY PROCESS, 2021-2024 (KILOTON)

- TABLE 92 NORTH AMERICA: KAOLIN MARKET, BY PROCESS, 2025-2030 (USD MILLION)

- TABLE 93 NORTH AMERICA: KAOLIN MARKET, BY PROCESS, 2025-2030 (KILOTON)

- TABLE 94 NORTH AMERICA: KAOLIN MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 95 NORTH AMERICA: KAOLIN MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 96 NORTH AMERICA: KAOLIN MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 97 NORTH AMERICA: KAOLIN MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 98 NORTH AMERICA: KAOLIN MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 99 NORTH AMERICA: KAOLIN MARKET, BY COUNTRY, 2021-2024 (KILOTON)

- TABLE 100 NORTH AMERICA: KAOLIN MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 101 NORTH AMERICA: KAOLIN MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 102 US: KAOLIN MARKET, BY PROCESS, 2021-2024 (USD MILLION)

- TABLE 103 US: KAOLIN MARKET, BY PROCESS, 2021-2024 (KILOTON)

- TABLE 104 US: KAOLIN MARKET, BY PROCESS, 2025-2030 (USD MILLION)

- TABLE 105 US: KAOLIN MARKET, BY PROCESS, 2025-2030 (KILOTON)

- TABLE 106 US: KAOLIN MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 107 US: KAOLIN MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 108 US: KAOLIN MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 109 US: KAOLIN MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 110 CANADA: KAOLIN MARKET, BY PROCESS, 2021-2024 (USD MILLION)

- TABLE 111 CANADA: KAOLIN MARKET, BY PROCESS, 2021-2024 (KILOTON)

- TABLE 112 CANADA: KAOLIN MARKET, BY PROCESS, 2025-2030 (USD MILLION)

- TABLE 113 CANADA: KAOLIN MARKET, BY PROCESS, 2025-2030 (KILOTON)

- TABLE 114 CANADA: KAOLIN MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 115 CANADA: KAOLIN MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 116 CANADA: KAOLIN MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 117 CANADA: KAOLIN MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 118 MEXICO: KAOLIN MARKET, BY PROCESS, 2021-2024 (USD MILLION)

- TABLE 119 MEXICO: KAOLIN MARKET, BY PROCESS, 2021-2024 (KILOTON)

- TABLE 120 MEXICO: KAOLIN MARKET, BY PROCESS, 2025-2030 (USD MILLION)

- TABLE 121 MEXICO: KAOLIN MARKET, BY PROCESS, 2025-2030 (KILOTON)

- TABLE 122 MEXICO: KAOLIN MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 123 MEXICO: KAOLIN MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 124 MEXICO: KAOLIN MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 125 MEXICO: KAOLIN MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 126 ASIA PACIFIC: KAOLIN MARKET, BY PROCESS, 2021-2024 (USD MILLION)

- TABLE 127 ASIA PACIFIC: KAOLIN MARKET, BY PROCESS, 2021-2024 (KILOTON)

- TABLE 128 ASIA PACIFIC: KAOLIN MARKET, BY PROCESS, 2025-2030 (USD MILLION)

- TABLE 129 ASIA PACIFIC: KAOLIN MARKET, BY PROCESS, 2025-2030 (KILOTON)

- TABLE 130 ASIA PACIFIC: KAOLIN MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 131 ASIA PACIFIC: KAOLIN MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 132 ASIA PACIFIC: KAOLIN MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 133 ASIA PACIFIC: KAOLIN MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 134 ASIA PACIFIC: KAOLIN MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 135 ASIA PACIFIC: KAOLIN MARKET, BY COUNTRY, 2021-2024 (KILOTON)

- TABLE 136 ASIA PACIFIC: KAOLIN MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 137 ASIA PACIFIC: KAOLIN MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 138 CHINA: KAOLIN MARKET, BY PROCESS, 2021-2024 (USD MILLION)

- TABLE 139 CHINA: KAOLIN MARKET, BY PROCESS, 2021-2024 (KILOTON)

- TABLE 140 CHINA: KAOLIN MARKET, BY PROCESS, 2025-2030 (USD MILLION)

- TABLE 141 CHINA: KAOLIN MARKET, BY PROCESS, 2025-2030 (KILOTON)

- TABLE 142 CHINA: KAOLIN MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 143 CHINA: KAOLIN MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 144 CHINA: KAOLIN MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 145 CHINA: KAOLIN MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 146 JAPAN: KAOLIN MARKET, BY PROCESS, 2021-2024 (USD MILLION)

- TABLE 147 JAPAN: KAOLIN MARKET, BY PROCESS, 2021-2024 (KILOTON)

- TABLE 148 JAPAN: KAOLIN MARKET, BY PROCESS, 2025-2030 (USD MILLION)

- TABLE 149 JAPAN: KAOLIN MARKET, BY PROCESS, 2025-2030 (KILOTON)

- TABLE 150 JAPAN: KAOLIN MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 151 JAPAN: KAOLIN MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 152 JAPAN: KAOLIN MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 153 JAPAN: KAOLIN MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 154 INDIA: KAOLIN MARKET, BY PROCESS, 2021-2024 (USD MILLION)

- TABLE 155 INDIA: KAOLIN MARKET, BY PROCESS, 2021-2024 (KILOTON)

- TABLE 156 INDIA: KAOLIN MARKET, BY PROCESS, 2025-2030 (USD MILLION)

- TABLE 157 INDIA: KAOLIN MARKET, BY PROCESS, 2025-2030 (KILOTON)

- TABLE 158 INDIA: KAOLIN MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 159 INDIA: KAOLIN MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 160 INDIA: KAOLIN MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 161 INDIA: KAOLIN MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 162 SOUTH KOREA: KAOLIN MARKET, BY PROCESS, 2021-2024 (USD MILLION)

- TABLE 163 SOUTH KOREA: KAOLIN MARKET, BY PROCESS, 2021-2024 (KILOTON)

- TABLE 164 SOUTH KOREA: KAOLIN MARKET, BY PROCESS, 2025-2030 (USD MILLION)

- TABLE 165 SOUTH KOREA: KAOLIN MARKET, BY PROCESS, 2025-2030 (KILOTON)

- TABLE 166 SOUTH KOREA: KAOLIN MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 167 SOUTH KOREA: KAOLIN MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 168 SOUTH KOREA: KAOLIN MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 169 SOUTH KOREA: KAOLIN MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 170 AUSTRALIA: KAOLIN MARKET, BY PROCESS, 2021-2024 (USD MILLION)

- TABLE 171 AUSTRALIA: KAOLIN MARKET, BY PROCESS, 2021-2024 (KILOTON)

- TABLE 172 AUSTRALIA: KAOLIN MARKET, BY PROCESS, 2025-2030 (USD MILLION)

- TABLE 173 AUSTRALIA: KAOLIN MARKET, BY PROCESS, 2025-2030 (KILOTON)

- TABLE 174 AUSTRALIA: KAOLIN MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 175 AUSTRALIA: KAOLIN MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 176 AUSTRALIA: KAOLIN MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 177 AUSTRALIA: KAOLIN MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 178 REST OF ASIA PACIFIC: KAOLIN MARKET, BY PROCESS, 2021-2024 (USD MILLION)

- TABLE 179 REST OF ASIA PACIFIC: KAOLIN MARKET, BY PROCESS, 2021-2024 (KILOTON)

- TABLE 180 REST OF ASIA PACIFIC: KAOLIN MARKET, BY PROCESS, 2025-2030 (USD MILLION)

- TABLE 181 REST OF ASIA PACIFIC: KAOLIN MARKET, BY PROCESS, 2025-2030 (KILOTON)

- TABLE 182 REST OF ASIA PACIFIC: KAOLIN MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 183 REST OF ASIA PACIFIC: KAOLIN MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 184 REST OF ASIA PACIFIC: KAOLIN MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 185 REST OF ASIA PACIFIC: KAOLIN MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 186 EUROPE: KAOLIN MARKET, BY PROCESS, 2021-2024 (USD MILLION)

- TABLE 187 EUROPE: KAOLIN MARKET, BY PROCESS, 2021-2024 (KILOTON)

- TABLE 188 EUROPE: KAOLIN MARKET, BY PROCESS, 2025-2030 (USD MILLION)

- TABLE 189 EUROPE: KAOLIN MARKET, BY PROCESS, 2025-2030 (KILOTON)

- TABLE 190 EUROPE: KAOLIN MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 191 EUROPE: KAOLIN MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 192 EUROPE: KAOLIN MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 193 EUROPE: KAOLIN MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 194 EUROPE: KAOLIN MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 195 EUROPE: KAOLIN MARKET, BY COUNTRY, 2021-2024 (KILOTON)

- TABLE 196 EUROPE: KAOLIN MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 197 EUROPE: KAOLIN MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 198 GERMANY: KAOLIN MARKET, BY PROCESS, 2021-2024 (USD MILLION)

- TABLE 199 GERMANY: KAOLIN MARKET, BY PROCESS, 2021-2024 (KILOTON)

- TABLE 200 GERMANY: KAOLIN MARKET, BY PROCESS, 2025-2030 (USD MILLION)

- TABLE 201 GERMANY: KAOLIN MARKET, BY PROCESS, 2025-2030 (KILOTON)

- TABLE 202 GERMANY: KAOLIN MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 203 GERMANY: KAOLIN MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 204 GERMANY: KAOLIN MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 205 GERMANY: KAOLIN MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 206 UK: KAOLIN MARKET, BY PROCESS, 2021-2024 (USD MILLION)

- TABLE 207 UK: KAOLIN MARKET, BY PROCESS, 2021-2024 (KILOTON)

- TABLE 208 UK: KAOLIN MARKET, BY PROCESS, 2025-2030 (USD MILLION)

- TABLE 209 UK: KAOLIN MARKET, BY PROCESS, 2025-2030 (KILOTON)

- TABLE 210 UK: KAOLIN MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 211 UK: KAOLIN MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 212 UK: KAOLIN MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 213 UK: KAOLIN MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 214 FRANCE: KAOLIN MARKET, BY PROCESS, 2021-2024 (USD MILLION)

- TABLE 215 FRANCE: KAOLIN MARKET, BY PROCESS, 2021-2024 (KILOTON)

- TABLE 216 FRANCE: KAOLIN MARKET, BY PROCESS, 2025-2030 (USD MILLION)

- TABLE 217 FRANCE: KAOLIN MARKET, BY PROCESS, 2025-2030 (KILOTON)

- TABLE 218 FRANCE: KAOLIN MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 219 FRANCE: KAOLIN MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 220 FRANCE: KAOLIN MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 221 FRANCE: KAOLIN MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 222 ITALY: KAOLIN MARKET, BY PROCESS, 2021-2024 (USD MILLION)

- TABLE 223 ITALY: KAOLIN MARKET, BY PROCESS, 2021-2024 (KILOTON)

- TABLE 224 ITALY: KAOLIN MARKET, BY PROCESS, 2025-2030 (USD MILLION)

- TABLE 225 ITALY: KAOLIN MARKET, BY PROCESS, 2025-2030 (KILOTON)

- TABLE 226 ITALY: KAOLIN MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 227 ITALY: KAOLIN MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 228 ITALY: KAOLIN MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 229 ITALY: KAOLIN MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 230 SPAIN: KAOLIN MARKET, BY PROCESS, 2021-2024 (USD MILLION)

- TABLE 231 SPAIN: KAOLIN MARKET, BY PROCESS, 2021-2024 (KILOTON)

- TABLE 232 SPAIN: KAOLIN MARKET, BY PROCESS, 2025-2030 (USD MILLION)

- TABLE 233 SPAIN: KAOLIN MARKET, BY PROCESS, 2025-2030 (KILOTON)

- TABLE 234 SPAIN: KAOLIN MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 235 SPAIN: KAOLIN MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 236 SPAIN: KAOLIN MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 237 SPAIN: KAOLIN MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 238 RUSSIA: KAOLIN MARKET, BY PROCESS, 2021-2024 (USD MILLION)

- TABLE 239 RUSSIA: KAOLIN MARKET, BY PROCESS, 2021-2024 (KILOTON)

- TABLE 240 RUSSIA: KAOLIN MARKET, BY PROCESS, 2025-2030 (USD MILLION)

- TABLE 241 RUSSIA: KAOLIN MARKET, BY PROCESS, 2025-2030 (KILOTON)

- TABLE 242 RUSSIA: KAOLIN MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 243 RUSSIA: KAOLIN MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 244 RUSSIA: KAOLIN MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 245 RUSSIA: KAOLIN MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 246 REST OF EUROPE: KAOLIN MARKET, BY PROCESS, 2021-2024 (USD MILLION)

- TABLE 247 REST OF EUROPE: KAOLIN MARKET, BY PROCESS, 2021-2024 (KILOTON)

- TABLE 248 REST OF EUROPE: KAOLIN MARKET, BY PROCESS, 2025-2030 (USD MILLION)

- TABLE 249 REST OF EUROPE: KAOLIN MARKET, BY PROCESS, 2025-2030 (KILOTON)

- TABLE 250 REST OF EUROPE: KAOLIN MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 251 REST OF EUROPE: KAOLIN MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 252 REST OF EUROPE: KAOLIN MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 253 REST OF EUROPE: KAOLIN MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 254 MIDDLE EAST & AFRICA: KAOLIN MARKET, BY PROCESS, 2021-2024 (USD MILLION)

- TABLE 255 MIDDLE EAST & AFRICA: KAOLIN MARKET, BY PROCESS, 2021-2024 (KILOTON)

- TABLE 256 MIDDLE EAST & AFRICA: KAOLIN MARKET, BY PROCESS, 2025-2030 (USD MILLION)

- TABLE 257 MIDDLE EAST & AFRICA: KAOLIN MARKET, BY PROCESS, 2025-2030 (KILOTON)

- TABLE 258 MIDDLE EAST & AFRICA: KAOLIN MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 259 MIDDLE EAST & AFRICA: KAOLIN MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 260 MIDDLE EAST & AFRICA: KAOLIN MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 261 MIDDLE EAST & AFRICA: KAOLIN MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 262 MIDDLE EAST & AFRICA: KAOLIN MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 263 MIDDLE EAST & AFRICA: KAOLIN MARKET, BY COUNTRY, 2021-2024 (KILOTON)

- TABLE 264 MIDDLE EAST & AFRICA: KAOLIN MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 265 MIDDLE EAST & AFRICA: KAOLIN MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 266 SAUDI ARABIA: KAOLIN MARKET, BY PROCESS, 2021-2024 (USD MILLION)

- TABLE 267 SAUDI ARABIA: KAOLIN MARKET, BY PROCESS, 2021-2024 (KILOTON)

- TABLE 268 SAUDI ARABIA: KAOLIN MARKET, BY PROCESS, 2025-2030 (USD MILLION)

- TABLE 269 SAUDI ARABIA: KAOLIN MARKET, BY PROCESS, 2025-2030 (KILOTON)

- TABLE 270 SAUDI ARABIA: KAOLIN MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 271 SAUDI ARABIA: KAOLIN MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 272 SAUDI ARABIA: KAOLIN MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 273 SAUDI ARABIA: KAOLIN MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 274 REST OF GCC COUNTRIES: KAOLIN MARKET, BY PROCESS, 2021-2024 (USD MILLION)

- TABLE 275 REST OF GCC COUNTRIES: KAOLIN MARKET, BY PROCESS, 2021-2024 (KILOTON)

- TABLE 276 REST OF GCC COUNTRIES: KAOLIN MARKET, BY PROCESS, 2025-2030 (USD MILLION)

- TABLE 277 REST OF GCC COUNTRIES: KAOLIN MARKET, BY PROCESS, 2025-2030 (KILOTON)

- TABLE 278 REST OF GCC COUNTRIES: KAOLIN MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 279 REST OF GCC COUNTRIES: KAOLIN MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 280 REST OF GCC COUNTRIES: KAOLIN MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 281 REST OF GCC COUNTRIES: KAOLIN MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 282 SOUTH AFRICA: KAOLIN MARKET, BY PROCESS, 2021-2024 (USD MILLION)

- TABLE 283 SOUTH AFRICA: KAOLIN MARKET, BY PROCESS, 2021-2024 (KILOTON)

- TABLE 284 SOUTH AFRICA: KAOLIN MARKET, BY PROCESS, 2025-2030 (USD MILLION)

- TABLE 285 SOUTH AFRICA: KAOLIN MARKET, BY PROCESS, 2025-2030 (KILOTON)

- TABLE 286 SOUTH AFRICA: KAOLIN MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 287 SOUTH AFRICA: KAOLIN MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 288 SOUTH AFRICA: KAOLIN MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 289 SOUTH AFRICA: KAOLIN MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 290 IRAN: KAOLIN MARKET, BY PROCESS, 2021-2024 (USD MILLION)

- TABLE 291 IRAN: KAOLIN MARKET, BY PROCESS, 2021-2024 (KILOTON)

- TABLE 292 IRAN: KAOLIN MARKET, BY PROCESS, 2025-2030 (USD MILLION)

- TABLE 293 IRAN: KAOLIN MARKET, BY PROCESS, 2025-2030 (KILOTON)

- TABLE 294 IRAN: KAOLIN MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 295 IRAN: KAOLIN MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 296 IRAN: KAOLIN MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 297 IRAN: KAOLIN MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 298 REST OF THE MIDDLE EAST & AFRICA: KAOLIN MARKET, BY PROCESS, 2021-2024 (USD MILLION)

- TABLE 299 REST OF THE MIDDLE EAST & AFRICA: KAOLIN MARKET, BY PROCESS, 2021-2024 (KILOTON)

- TABLE 300 REST OF THE MIDDLE EAST & AFRICA: KAOLIN MARKET, BY PROCESS, 2025-2030 (USD MILLION)

- TABLE 301 REST OF THE MIDDLE EAST & AFRICA: KAOLIN MARKET, BY PROCESS, 2025-2030 (KILOTON)

- TABLE 302 REST OF THE MIDDLE EAST & AFRICA: KAOLIN MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 303 REST OF THE MIDDLE EAST & AFRICA: KAOLIN MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 304 REST OF THE MIDDLE EAST & AFRICA: KAOLIN MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 305 REST OF THE MIDDLE EAST & AFRICA: KAOLIN MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 306 SOUTH AMERICA: KAOLIN MARKET, BY PROCESS, 2021-2024 (USD MILLION)

- TABLE 307 SOUTH AMERICA: KAOLIN MARKET, BY PROCESS, 2021-2024 (KILOTON)

- TABLE 308 SOUTH AMERICA: KAOLIN MARKET, BY PROCESS, 2025-2030 (USD MILLION)

- TABLE 309 SOUTH AMERICA: KAOLIN MARKET, BY PROCESS, 2025-2030 (KILOTON)

- TABLE 310 SOUTH AMERICA: KAOLIN MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 311 SOUTH AMERICA: KAOLIN MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 312 SOUTH AMERICA: KAOLIN MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 313 SOUTH AMERICA: KAOLIN MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 314 SOUTH AMERICA: KAOLIN MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 315 SOUTH AMERICA: KAOLIN MARKET, BY COUNTRY, 2021-2024 (KILOTON)

- TABLE 316 SOUTH AMERICA: KAOLIN MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 317 SOUTH AMERICA: KAOLIN MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 318 BRAZIL: KAOLIN MARKET, BY PROCESS, 2021-2024 (USD MILLION)

- TABLE 319 BRAZIL: KAOLIN MARKET, BY PROCESS, 2021-2024 (KILOTON)

- TABLE 320 BRAZIL: KAOLIN MARKET, BY PROCESS, 2025-2030 (USD MILLION)

- TABLE 321 BRAZIL: KAOLIN MARKET, BY PROCESS, 2025-2030 (KILOTON)

- TABLE 322 BRAZIL: KAOLIN MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 323 BRAZIL: KAOLIN MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 324 BRAZIL: KAOLIN MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 325 BRAZIL: KAOLIN MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 326 ARGENTINA: KAOLIN MARKET, BY PROCESS, 2021-2024 (USD MILLION)

- TABLE 327 ARGENTINA: KAOLIN MARKET, BY PROCESS, 2021-2024 (KILOTON)

- TABLE 328 ARGENTINA: KAOLIN MARKET, BY PROCESS, 2025-2030 (USD MILLION)

- TABLE 329 ARGENTINA: KAOLIN MARKET, BY PROCESS, 2025-2030 (KILOTON)

- TABLE 330 ARGENTINA: KAOLIN MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 331 ARGENTINA: KAOLIN MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 332 ARGENTINA: KAOLIN MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 333 ARGENTINA: KAOLIN MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 334 REST OF SOUTH AMERICA: KAOLIN MARKET, BY PROCESS, 2021-2024 (USD MILLION)

- TABLE 335 REST OF SOUTH AMERICA: KAOLIN MARKET, BY PROCESS, 2021-2024 (KILOTON)

- TABLE 336 REST OF SOUTH AMERICA: KAOLIN MARKET, BY PROCESS, 2025-2030 (USD MILLION)

- TABLE 337 REST OF SOUTH AMERICA: KAOLIN MARKET, BY PROCESS, 2025-2030 (KILOTON)

- TABLE 338 REST OF SOUTH AMERICA: KAOLIN MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 339 REST OF SOUTH AMERICA: KAOLIN MARKET, BY END-USE INDUSTRY, 2021-2024 (KILOTON)

- TABLE 340 REST OF SOUTH AMERICA: KAOLIN MARKET, BY END-USE INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 341 REST OF SOUTH AMERICA: KAOLIN MARKET, BY END-USE INDUSTRY, 2025-2030 (KILOTON)

- TABLE 342 STRATEGIES ADOPTED BY KAOLIN MANUFACTURERS, JANUARY 2020-JULY 2025

- TABLE 343 DEGREE OF COMPETITION: KAOLIN MARKET

- TABLE 344 KAOLIN MARKET: REGION FOOTPRINT (10 COMPANIES)

- TABLE 345 KAOLIN MARKET: TYPE FOOTPRINT (10 COMPANIES)

- TABLE 346 KAOLIN MARKET: PROCESS FOOTPRINT (10 COMPANIES)

- TABLE 347 KAOLIN MARKET: END-USE INDUSTRY FOOTPRINT (10 COMPANIES)

- TABLE 348 KAOLIN MARKET: LIST OF KEY STARTUPS/SMES

- TABLE 349 KAOLIN MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 350 KAOLIN MARKET: DEALS, JANUARY 2020-JUNE 2025

- TABLE 351 KAOLIN MARKET: EXPANSIONS, JANUARY 2020-JUNE 2025

- TABLE 352 KAOLIN MARKET: OTHER DEVELOPMENTS, JANUARY 2020-JUNE 2025

- TABLE 353 IMERYS S.A.: COMPANY OVERVIEW

- TABLE 354 IMERYS S.A.: PRODUCTS OFFERED

- TABLE 355 IMERYS S.A.: DEALS

- TABLE 356 IMERYS S.A.: OTHER DEVELOPMENTS

- TABLE 357 20 MICRONS: COMPANY OVERVIEW

- TABLE 358 20 MICRONS: PRODUCTS OFFERED

- TABLE 359 20 MICRONS: DEALS

- TABLE 360 KAMIN LLC.: COMPANY OVERVIEW

- TABLE 361 KAMIN LLC.: PRODUCTS OFFERED

- TABLE 362 KAMIN LLC.: DEALS

- TABLE 363 ASHAPURA GROUP: COMPANY OVERVIEW

- TABLE 364 ASHAPURA GROUP: PRODUCTS OFFERED

- TABLE 365 SIBELCO: COMPANY OVERVIEW

- TABLE 366 SIBELCO: PRODUCTS OFFERED

- TABLE 367 SIBELCO: EXPANSIONS

- TABLE 368 THIELE KAOLIN COMPANY: COMPANY OVERVIEW

- TABLE 369 THIELE KAOLIN COMPANY: PRODUCTS OFFERED

- TABLE 370 THIELE KAOLIN COMPANY: DEALS

- TABLE 371 LB MINERALS, LTD.: COMPANY OVERVIEW

- TABLE 372 LB MINERALS, LTD.: PRODUCTS OFFERED

- TABLE 373 LB MINERALS, LTD.: EXPANSIONS

- TABLE 374 EICL LIMITED: COMPANY OVERVIEW

- TABLE 375 EICL LIMITED: PRODUCTS OFFERED

- TABLE 376 EICL LIMITED: EXPANSIONS

- TABLE 377 QUARZWERKE GMBH: COMPANY OVERVIEW

- TABLE 378 QUARZWERKE GMBH: PRODUCTS OFFERED

- TABLE 379 SEDLECKY KAOLIN, A.S.: COMPANY OVERVIEW

- TABLE 380 SEDLECKY KAOLIN, A.S.: PRODUCTS OFFERED

- TABLE 381 SEDLECKY KAOLIN, A.S.: EXPANSIONS

- TABLE 382 SHREE RAM KAOLIN: COMPANY OVERVIEW

- TABLE 383 KERAMOST, A.S.: COMPANY OVERVIEW

- TABLE 384 UMA GROUP OF COMPANIES: COMPANY OVERVIEW

- TABLE 385 JIANGXI SINCERE MINERAL INDUSTRY CO., LTD.: COMPANY OVERVIEW

- TABLE 386 ACTIVE MINERALS INTERNATIONAL, LLC: COMPANY OVERVIEW

- TABLE 387 BURGESS PIGMENT COMPANY: COMPANY OVERVIEW

- TABLE 388 KAOLIN (MALAYSIA) SDN BHD.: COMPANY OVERVIEW

- TABLE 389 KERALA CERAMICS LTD.: COMPANY OVERVIEW

- TABLE 390 MOTA CERAMIC SOLUTIONS: COMPANY OVERVIEW

- TABLE 391 MANEK GROUP: COMPANY OVERVIEW

- TABLE 392 ZILLION SAWA MINERALS PRIVATE LIMITED: COMPANY OVERVIEW

- TABLE 393 HITECH MINERALS AND CHEMICALS GROUP: COMPANY OVERVIEW

- TABLE 394 AMGEEN MINERALS: COMPANY OVERVIEW

- TABLE 395 GUJARAT EARTH MINERALS PVT. LTD.: COMPANY OVERVIEW

- TABLE 396 HD MICRONS LIMITED.: COMPANY OVERVIEW

List of Figures

- FIGURE 1 KAOLIN MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 KAOLIN MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 5 KAOLIN MARKET: DATA TRIANGULATION

- FIGURE 6 NATURAL SEGMENT TO DOMINATE KAOLIN MARKET IN 2030

- FIGURE 7 WATER-WASHED PROCESS SEGMENT TO DOMINATE KAOLIN MARKET IN 2030

- FIGURE 8 PAPER END-USE INDUSTRY TO LEAD KAOLIN MARKET IN 2030

- FIGURE 9 KAOLIN MARKET IN ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 10 AVAILABILITY OF LARGE KAOLIN RESERVES IN ASIA PACIFIC TO PROMOTE MARKET GROWTH

- FIGURE 11 NATURAL TYPE DOMINATED KAOLIN MARKET IN 2024

- FIGURE 12 WATER-WASHED AND ASIA PACIFIC SEGMENTS ACCOUNTED FOR LARGEST MARKET SHARES IN 2024

- FIGURE 13 PAPER INDUSTRY TO LEAD MARKET IN 2030

- FIGURE 14 KAOLIN MARKET IN INDIA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 15 KAOLIN MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 16 PORTER'S FIVE FORCES ANALYSIS OF KAOLIN MARKET

- FIGURE 17 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 2 END-USE INDUSTRIES

- FIGURE 18 KEY BUYING CRITERIA FOR TOP 3 END-USE INDUSTRIES

- FIGURE 19 KAOLIN MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 20 KAOLIN MARKET: KEY STAKEHOLDERS IN ECOSYSTEM

- FIGURE 21 KAOLIN MARKET: ECOSYSTEM ANALYSIS

- FIGURE 22 AVERAGE SELLING PRICE OF KAOLIN, BY KEY PLAYERS (USD/KG), 2024

- FIGURE 23 KAOLIN MARKET: AVERAGE SELLING PRICE TRENDS (USD/KG), 2021-2024

- FIGURE 24 EXPORT DATA FOR HS CODE 2507-COMPLIANT PRODUCTS, BY KEY COUNTRIES, 2020-2024

- FIGURE 25 IMPORT DATA FOR HS CODE 2507-COMPLIANT PRODUCTS, BY KEY COUNTRIES, 2020-2024

- FIGURE 26 GLOBAL PATENT ANALYSIS, BY DOCUMENT TYPE

- FIGURE 27 GLOBAL PATENT PUBLICATION TREND, 2015-2025

- FIGURE 28 KAOLIN MARKET: LEGAL STATUS OF PATENTS

- FIGURE 29 GLOBAL JURISDICTION ANALYSIS, 2015-2025

- FIGURE 30 CHINA PETROLEUM & CHEMICAL CORPORATION REGISTERED HIGHEST NUMBER OF PATENTS IN 2024

- FIGURE 31 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS IN KAOLIN MARKET

- FIGURE 32 DEALS AND FUNDING IN KAOLIN MARKET INCREASED IN 2024

- FIGURE 33 SYNTHETIC SEGMENT TO REGISTER HIGHER CAGR THAN NATURAL SEGMENT DURING FORECAST PERIOD

- FIGURE 34 DELAMINATED SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 35 CERAMICS & SANITARYWARE SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 36 INDIA TO BE FASTEST-GROWING KAOLIN MARKET DURING FORECAST PERIOD

- FIGURE 37 NORTH AMERICA: KAOLIN MARKET SNAPSHOT

- FIGURE 38 ASIA PACIFIC: KAOLIN MARKET SNAPSHOT

- FIGURE 39 EUROPE: KAOLIN MARKET SNAPSHOT

- FIGURE 40 KAOLIN MARKET: REVENUE ANALYSIS OF TOP 5 MARKET PLAYERS, 2020-2024

- FIGURE 41 SHARES OF KEY PLAYERS IN KAOLIN MARKET, 2024

- FIGURE 42 RANKING OF TOP 5 PLAYERS IN KAOLIN MARKET, 2024

- FIGURE 43 KAOLIN MARKET: TOP TRENDING BRANDS/PRODUCTS

- FIGURE 44 BRAND/PRODUCT COMPARATIVE ANALYSIS OF KAOLIN MARKET

- FIGURE 45 KAOLIN MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 46 KAOLIN MARKET: COMPANY FOOTPRINT (10 COMPANIES)

- FIGURE 47 KAOLIN MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 48 KAOLIN MARKET: EV/EBITDA OF KEY VENDORS, 2025

- FIGURE 49 KAOLIN MARKET: ENTERPRISE VALUATION OF KEY PLAYERS, 2025

- FIGURE 50 IMERYS S.A.: COMPANY SNAPSHOT

- FIGURE 51 20 MICRONS: COMPANY SNAPSHOT

- FIGURE 52 ASHAPURA GROUP: COMPANY SNAPSHOT

- FIGURE 53 SIBELCO: COMPANY SNAPSHOT

- FIGURE 54 EICL LIMITED: COMPANY SNAPSHOT

The kaolin market is projected to reach USD 8.27 billion by 2030, from USD 5.76 billion in 2025, with a CAGR of 7.5%. Kaolin is widely used in various industries, including paper manufacturing, ceramics, sanitaryware, fiberglass, paints and coatings, rubber production, and plastics.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Volume (Kiloton); Value (USD Million/Billion) |

| Segments | Type, Process, End-use Industry, and Region |

| Regions covered | North America, Asia Pacific, Europe, South America, and Middle East & Africa |

Countries with abundant and high-quality kaolin reserves, such as the US, Brazil, and the UK, play a significant role in supplying premium-grade kaolin to global markets. These factors collectively drive the growth of the kaolin market. Synthetic kaolin is growing faster than natural kaolin due to increasing demand in high-tech applications, despite its higher cost and smaller base.

''Kaolin prompts paper revolution from print to sustainable packaging.''

In 2024, the paper industry became the largest end-use segment in the kaolin market by both volume and value. It continues to lead the market and is expected to experience steady growth in the coming years. Paper is widely used in print media and packaging, with the rapid growth of e-commerce, especially in emerging economies, driving strong demand for paper-based packaging solutions. Countries like India and China offer significant growth opportunities due to their high consumption of print media, including newspapers, books, and magazines, along with increasing e-commerce activity. The global focus on sustainable and biodegradable packaging options is further increasing the demand for kaolin in the paper industry.

''Delaminated emerges as the fastest-growing process.''

The delaminated segment is expected to see the highest growth rate during the forecast period. This increase is driven by the growing availability of high-quality, low-abrasive delaminated kaolin, which provides better brightness and smoothness. The delamination process involves separating individual kaolinite platelets from stacked layers without breaking them, requiring precise mechanical force. As a result, delaminated kaolin is mainly used in the paper industry to improve printability and surface properties. Additionally, rising demand for premium-grade coated paper and advancements in paper manufacturing technologies are boosting the segment growth.

"Asia Pacific remains at the forefront of kaolin demand and growth."

Asia Pacific remains the leading market for kaolin, with extensive analysis covering countries such as China, India, Japan, South Korea, and Australia, among others. Rapid urbanization, favorable demographic shifts, and improved economic conditions in emerging economies make this region highly attractive for kaolin consumption. Key players like Ashapura Group (India), EICL Limited (India), and Minotaur Exploration Limited (Australia) have established strong local footprints through manufacturing units, distribution channels, and sales offices to ensure consistent supply. Furthermore, rising investments in infrastructure, construction, and packaging industries are contributing to the sustained growth of the kaolin market across Asia Pacific.

This study has been validated through primary interviews with industry experts globally. These primary sources have been divided into the following three categories:

- By Company Type - Tier 1 - 40%, Tier 2 - 33%, and Tier 3 - 27%

- By Designation - C-level - 50%, D-level - 30%, and Others - 20%

- By Region - North America - 15%, Europe - 50%, Asia Pacific - 20%, Middle East & Africa - 5%, and South America - 10%

Prominent companies in the kaolin market include Imerys S.A. (France), 20 Microns (India), KaMin LLC (US), Ashapura Group (India), SCR-Sibelco (Belgium), Thiele Kaolin Company (US), LB MINERALS, LTD. (Hungary), EICL Limited (India), Quarzwerke GmbH (Germany), and Sedlecky Kaolin a.s. (Czech Republic).

Research Coverage

This research report categorizes the kaolin market by type (synthetic, natural), process (water-washed, airfloat, calcined, delaminated, and surface-modified & unprocessed), end-use industry (paper, ceramics & sanitaryware, fiberglass, paints & coatings, rubber, plastic, others), and region (North America, Europe, Asia Pacific, Middle East & Africa, and South America). The scope of the report includes detailed information about the major factors affecting the growth of the kaolin market, such as drivers, restraints, challenges, and opportunities. A comprehensive analysis of key industry players has been performed to provide insights into their business overviews, solutions, services, key strategies, contracts, partnerships, and agreements. The report also covers new product and service launches, mergers and acquisitions, and recent developments in the kaolin market. Additionally, it features a competitive analysis of emerging startups within the kaolin market ecosystem.

Reasons to purchase this report:

The report will assist market leaders and new entrants with information on the closest estimates of revenue figures for the overall kaolin market and its subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to better position their businesses and develop effective go-to-market strategies. Additionally, the report helps stakeholders grasp the market dynamics and offers key information on market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Increasing demand from key end-use industries, Rising adoption of kaolin in sustainable and biodegradable packaging), restraints (Environmental concerns and stringent mining regulations), opportunities (Technological advancements in processing techniques, Growing demand for high-performance kaolin in specialized applications), and challenges (Fluctuating raw material prices, Availability of substitutes like calcium carbonate) influencing the growth of the kaolin market

- Product Development/Innovation: Detailed insights on upcoming technologies, R&D activities, and product & service launches in the kaolin market

- Market Development: Comprehensive information about lucrative markets; the report analyzes the kaolin market across various regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the kaolin market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players such as Imerys S.A. (France), 20 Microns (India), KaMin LLC (US), Ashapura Group (India), SCR-Sibelco (Belgium), Thiele Kaolin Company (US), LB MINERALS, LTD. (Hungary), EICL Limited (India), Quarzwerke GmbH (Germany), and Sedlecky Kaolin a.s. (Czech Republic), among others

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key primary interview participants

- 2.1.2.3 Breakdown of primary interviews

- 2.1.2.4 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 TOP-DOWN APPROACH

- 2.2.2 BOTTOM-UP APPROACH

- 2.3 BASE NUMBER CALCULATION

- 2.3.1 APPROACH 1: SUPPLY-SIDE ANALYSIS

- 2.3.2 APPROACH 2: DEMAND-SIDE ANALYSIS

- 2.4 MARKET FORECAST APPROACH

- 2.4.1 SUPPLY SIDE

- 2.4.2 DEMAND SIDE

- 2.5 DATA TRIANGULATION

- 2.6 FACTOR ANALYSIS

- 2.7 RESEARCH ASSUMPTIONS

- 2.8 RESEARCH LIMITATIONS AND RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN KAOLIN MARKET

- 4.2 KAOLIN MARKET, BY TYPE

- 4.3 KAOLIN MARKET, BY PROCESS

- 4.4 KAOLIN MARKET, BY END-USE INDUSTRY

- 4.5 KAOLIN MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

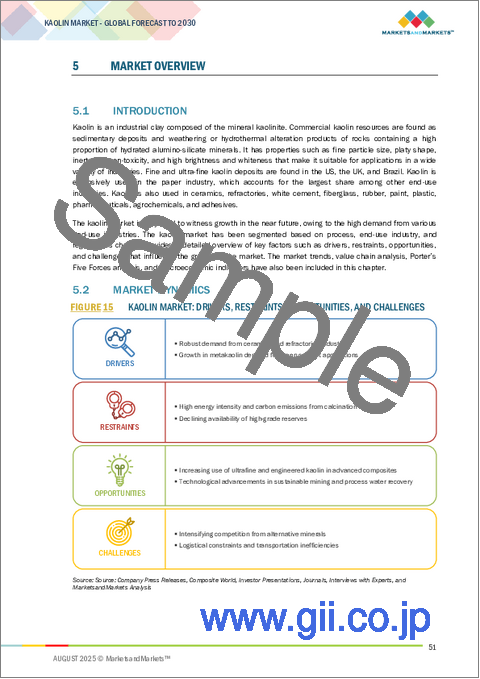

- 5.2.1 DRIVERS

- 5.2.1.1 Robust demand from ceramics and refractory industries

- 5.2.1.2 Growth in metakaolin demand for green cement applications

- 5.2.2 RESTRAINTS

- 5.2.2.1 High energy intensity and carbon emissions from calcination

- 5.2.2.2 Declining availability of high-grade reserves

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing use of ultrafine and engineered kaolin in advanced composites

- 5.2.3.2 Technological advancements in sustainable mining and process water recovery

- 5.2.4 CHALLENGES

- 5.2.4.1 Intensifying competition from alternative minerals

- 5.2.4.2 Logistical constraints and transportation inefficiencies

- 5.2.1 DRIVERS

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 BARGAINING POWER OF BUYERS

- 5.3.2 BARGAINING POWER OF SUPPLIERS

- 5.3.3 THREAT OF NEW ENTRANTS

- 5.3.4 THREAT OF SUBSTITUTES

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.4.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.4.2 BUYING CRITERIA

- 5.5 SUPPLY CHAIN ANALYSIS

- 5.5.1 RAW MATERIAL

- 5.5.2 PROCESSING/MODIFICATION

- 5.5.3 END-USE APPLICATIONS

- 5.6 ECOSYSTEM/MARKET MAP

- 5.7 PRICING ANALYSIS

- 5.7.1 AVERAGE SELLING PRICE, BY KEY PLAYERS

- 5.7.2 AVERAGE SELLING PRICE TREND

- 5.8 TRADE ANALYSIS

- 5.8.1 EXPORT SCENARIO (HS CODE 2507)

- 5.8.2 IMPORT SCENARIO (HS CODE 2507)

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGIES

- 5.9.2 COMPLEMENTARY TECHNOLOGIES

- 5.9.3 ADJACENT TECHNOLOGIES

- 5.10 MACROECONOMIC OUTLOOK

- 5.10.1 INTRODUCTION

- 5.10.2 GDP TRENDS AND FORECAST

- 5.10.3 TRENDS IN GLOBAL KAOLIN INDUSTRY

- 5.11 PATENT ANALYSIS

- 5.11.1 INTRODUCTION

- 5.11.2 METHODOLOGY

- 5.11.3 DOCUMENT TYPE

- 5.11.4 INSIGHTS

- 5.11.5 LEGAL STATUS OF PATENTS

- 5.11.6 JURISDICTION ANALYSIS

- 5.11.7 ANALYSIS OF TOP APPLICANTS

- 5.11.8 PATENTS BY CHINA PETROLEUM & CHEMICAL CORPORATION

- 5.11.9 PATENTS BY BASF CORPORATION

- 5.11.10 PATENTS BY JINGDEZHEN CERAMIC INSTITUTE

- 5.11.11 TOP PATENT OWNERS (US) IN LAST 10 YEARS

- 5.12 REGULATORY LANDSCAPE

- 5.12.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13 CASE STUDY ANALYSIS

- 5.13.1 CASE STUDY 1: IMERYS INVESTED IN SUSTAINABLE KAOLIN PROCESSING TECHNOLOGIES

- 5.13.2 CASE STUDY 2: THIELE KAOLIN EXPANDED OPERATIONS THROUGH STRATEGIC ACQUISITION

- 5.13.3 CASE STUDY 3: SIBELCO DEVELOPED ULTRA-FINE KAOLIN FOR PHARMACEUTICALS AND COSMETICS INDUSTRIES

- 5.14 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.15 INVESTMENT AND FUNDING SCENARIO

- 5.16 IMPACT OF AI/GEN AI ON KAOLIN MARKET

- 5.16.1 TOP USE CASES AND MARKET POTENTIAL

- 5.16.2 CASE STUDIES OF AI IMPLEMENTATION IN KAOLIN MARKET

- 5.17 IMPACT OF 2025 US TARIFFS ON KAOLIN MARKET

- 5.17.1 INTRODUCTION

- 5.17.2 KEY TARIFF RATES

- 5.17.3 PRICE IMPACT ANALYSIS

- 5.17.4 IMPACT ON COUNTRIES/REGIONS

- 5.17.4.1 US

- 5.17.4.2 Europe

- 5.17.4.3 Asia Pacific

- 5.17.5 IMPACT ON END-USE INDUSTRIES

6 KAOLIN MARKET, BY TYPE

- 6.1 INTRODUCTION

- 6.2 NATURAL

- 6.2.1 WIDELY USED FOR FINE PARTICLE SIZE, HIGH BRIGHTNESS, AND CHEMICAL INERTNESS

- 6.2.2 NATURAL KAOLIN MARKET, BY REGION

- 6.3 SYNTHETIC

- 6.3.1 INCREASING DEMAND IN HIGH-PRECISION APPLICATIONS

- 6.3.2 SYNTHETIC KAOLIN MARKET, BY REGION

7 KAOLIN MARKET, BY PROCESS

- 7.1 INTRODUCTION

- 7.2 WATER-WASHED

- 7.2.1 WIDELY USED IN PRODUCTION OF HYDROUS KAOLIN

- 7.2.2 WATER-WASHED KAOLIN MARKET, BY REGION

- 7.3 AIRFLOAT

- 7.3.1 REMOVES MAJOR CONTAMINANTS FOUND IN CLAY

- 7.3.2 AIRFLOAT KAOLIN MARKET, BY REGION

- 7.4 CALCINED

- 7.4.1 REMOVES STRUCTURAL HYDROXYLS BY ENHANCING HARDNESS, BRIGHTNESS, AND POROSITY OF KAOLIN

- 7.4.2 CALCINED KAOLIN MARKET, BY REGION

- 7.5 DELAMINATED

- 7.5.1 INCREASED USE IN PAINTS & COATINGS INDUSTRY

- 7.5.2 DELAMINATED KAOLIN MARKET, BY REGION

- 7.6 SURFACE-MODIFIED

- 7.6.1 INCREASES CHEMICAL BOND STRENGTH OF KAOLIN

- 7.6.2 SURFACE-MODIFIED KAOLIN MARKET, BY REGION

8 KAOLIN MARKET, BY END-USE INDUSTRY

- 8.1 INTRODUCTION

- 8.2 PAPER

- 8.2.1 HIGH DEMAND FOR PAPER PACKAGING TO DRIVE GROWTH

- 8.2.2 STANDARD COATED FINE PAPER

- 8.2.3 LOW-COAT WEIGHT PAPER

- 8.2.4 ART PAPER

- 8.2.5 COATED FINE PAPER

- 8.2.6 COATED GROUNDWOOD PAPER

- 8.2.7 OTHER COATED PAPERS

- 8.2.8 KAOLIN MARKET IN PAPER INDUSTRY, BY REGION

- 8.3 CERAMICS & SANITARYWARE

- 8.3.1 INCREASE IN DEMAND FOR CERAMIC PRODUCTS IN CONSTRUCTION SECTOR TO DRIVE MARKET

- 8.3.2 WHITEWARE

- 8.3.3 PORCELAIN

- 8.3.4 REFRACTORIES

- 8.3.5 KAOLIN MARKET IN CERAMICS & SANITARYWARE INDUSTRY, BY REGION

- 8.4 FIBERGLASS

- 8.4.1 HIGH DEMAND FOR FIBERGLASS ACROSS VARIOUS INDUSTRIES TO DRIVE MARKET

- 8.4.2 KAOLIN MARKET IN FIBERGLASS INDUSTRY, BY REGION

- 8.5 PAINTS & COATINGS

- 8.5.1 RISE IN DEMAND FOR SPECIALTY PAINTS & COATINGS IN CONSTRUCTION AND INDUSTRIAL SECTORS TO DRIVE MARKET

- 8.5.2 AUTOMOTIVE

- 8.5.3 INDUSTRIAL

- 8.5.4 INKS

- 8.5.5 ARCHITECTURAL

- 8.5.6 SPECIALTY COATINGS

- 8.5.7 KAOLIN MARKET IN PAINTS & COATINGS INDUSTRY, BY REGION

- 8.6 RUBBER

- 8.6.1 INCREASE IN DEMAND FOR RUBBER IN FOOTWEAR AND TIRES TO DRIVE MARKET

- 8.6.2 TIRES

- 8.6.3 FOOTWEAR

- 8.6.4 CONVEYOR BELTS

- 8.6.5 KAOLIN MARKET IN RUBBER INDUSTRY, BY REGION

- 8.7 PLASTICS

- 8.7.1 HIGH DEMAND FOR PVC CABLES TO DRIVE MARKET

- 8.7.2 FILMS & SHEETS

- 8.7.3 WIRES & CABLES

- 8.7.4 KAOLIN MARKET IN PLASTICS INDUSTRY, BY REGION

- 8.8 OTHER END-USE INDUSTRIES

- 8.8.1 ADHESIVES

- 8.8.2 SEALANTS

- 8.8.3 PERSONAL CARE & HEALTHCARE

- 8.8.4 AGRICULTURE

- 8.8.5 KAOLIN MARKET IN OTHER END-USE INDUSTRIES, BY REGION

9 KAOLIN MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.1.1 KAOLIN MARKET, BY REGION

- 9.2 NORTH AMERICA

- 9.2.1 NORTH AMERICA: KAOLIN MARKET, BY PROCESS

- 9.2.2 NORTH AMERICA: KAOLIN MARKET, BY END-USE INDUSTRY

- 9.2.3 NORTH AMERICA: KAOLIN MARKET, BY COUNTRY

- 9.2.3.1 US

- 9.2.3.1.1 Increasing demand from paper, ceramics, paints & coatings, and fiberglass industries to drive market

- 9.2.3.1.2 US: Kaolin market, by process

- 9.2.3.1.3 US: Kaolin market, by end-use industry

- 9.2.3.2 Canada

- 9.2.3.2.1 Growing construction sector to drive market

- 9.2.3.2.2 Canada: Kaolin market, by process

- 9.2.3.2.3 Canada: Kaolin market, by end-use industry

- 9.2.3.3 Mexico

- 9.2.3.3.1 Increasing production of plastic products to drive market

- 9.2.3.3.2 Mexico: Kaolin market, by process

- 9.2.3.3.3 Mexico: Kaolin market, by end-use industry

- 9.2.3.1 US

- 9.3 ASIA PACIFIC

- 9.3.1 ASIA PACIFIC: KAOLIN MARKET, BY PROCESS

- 9.3.2 ASIA PACIFIC: KAOLIN MARKET, BY END-USE INDUSTRY

- 9.3.3 ASIA PACIFIC: KAOLIN MARKET, BY COUNTRY

- 9.3.3.1 China

- 9.3.3.1.1 Rise in consumption of packaged food items to drive market

- 9.3.3.1.2 China: Kaolin market, by process

- 9.3.3.1.3 China: Kaolin market, by end-use industry

- 9.3.3.2 Japan

- 9.3.3.2.1 Increased demand for coated and uncoated papers in packaging applications to drive market

- 9.3.3.2.2 Japan: Kaolin market, by process

- 9.3.3.2.3 Japan: Kaolin market, by end-use industry

- 9.3.3.3 India

- 9.3.3.3.1 Presence of strong paper industry to drive market

- 9.3.3.3.2 India: Kaolin market, by process

- 9.3.3.3.3 India: Kaolin market, by end-use industry

- 9.3.3.4 South Korea

- 9.3.3.4.1 Growth in residential construction to drive market

- 9.3.3.4.2 South Korea: Kaolin market, by process

- 9.3.3.4.3 South Korea: Kaolin market, by end-use industry

- 9.3.3.5 Australia

- 9.3.3.5.1 Paper, ceramics, and paints & coatings industries to drive market

- 9.3.3.5.2 Australia: Kaolin market, by process

- 9.3.3.5.3 Australia: Kaolin market, by end-use industry

- 9.3.3.6 Rest of Asia Pacific

- 9.3.3.6.1 Rest of Asia Pacific: Kaolin market, by process

- 9.3.3.6.2 Rest of Asia Pacific: Kaolin market, by end-use industry

- 9.3.3.1 China

- 9.4 EUROPE

- 9.4.1 EUROPE: KAOLIN MARKET, BY PROCESS

- 9.4.2 EUROPE: KAOLIN MARKET, BY END-USE INDUSTRY

- 9.4.3 EUROPE: KAOLIN MARKET, BY COUNTRY

- 9.4.3.1 Germany

- 9.4.3.1.1 Increased use of high-quality paper in packaging applications to drive market

- 9.4.3.1.2 Germany: Kaolin market, by process

- 9.4.3.1.3 Germany: Kaolin market, by end-use industry

- 9.4.3.2 UK

- 9.4.3.2.1 Growth of construction sector to drive market

- 9.4.3.2.2 UK: Kaolin market, by process

- 9.4.3.2.3 UK: Kaolin market, by end-use industry

- 9.4.3.3 France

- 9.4.3.3.1 Increasing demand for coated papers from packaging industry to drive market

- 9.4.3.3.2 France: Kaolin market, by process

- 9.4.3.3.3 France: Kaolin market, by end-use industry

- 9.4.3.4 Italy

- 9.4.3.4.1 Robust growth in food & beverage sector to drive market

- 9.4.3.4.2 Italy: Kaolin market, by process

- 9.4.3.4.3 Italy: Kaolin market, by end-use industry

- 9.4.3.5 Spain

- 9.4.3.5.1 Growing infrastructural activities to drive market

- 9.4.3.5.2 Spain: Kaolin market, by process

- 9.4.3.5.3 Spain: Kaolin market, by end-use industry

- 9.4.3.6 Russia

- 9.4.3.6.1 Increased demand for kaolin from various end-use industries to drive market

- 9.4.3.6.2 Russia: Kaolin market, by process

- 9.4.3.6.3 Russia: Kaolin market, by end-use industry

- 9.4.3.7 Rest of Europe

- 9.4.3.7.1 Rest of Europe: Kaolin market, by process

- 9.4.3.7.2 Russia: Kaolin market, by end-use industry

- 9.4.3.1 Germany

- 9.5 MIDDLE EAST & AFRICA

- 9.5.1 MIDDLE EAST & AFRICA: KAOLIN MARKET, BY PROCESS

- 9.5.2 MIDDLE EAST & AFRICA: KAOLIN MARKET, BY END-USE INDUSTRY

- 9.5.3 MIDDLE EAST & AFRICA: KAOLIN MARKET, BY COUNTRY

- 9.5.3.1 GCC Countries

- 9.5.3.1.1 Saudi Arabia

- 9.5.3.1.1.1 Increase in construction activities to drive market

- 9.5.3.1.1.2 Saudi Arabia: Kaolin market, by process

- 9.5.3.1.1.3 Saudi Arabia: Kaolin market, by end-use industry

- 9.5.3.1.2 Rest of GCC Countries

- 9.5.3.1.2.1 Rest of GCC Countries: Kaolin market, by process

- 9.5.3.1.2.2 Rest of GCC Countries: Kaolin market, by end-use industry

- 9.5.3.1.1 Saudi Arabia

- 9.5.3.2 South Africa

- 9.5.3.2.1 Increase in consumption of plastics to drive market

- 9.5.3.2.2 South Africa: Kaolin market, by process

- 9.5.3.2.3 South Africa: Kaolin market, by end-use industry

- 9.5.3.3 Iran

- 9.5.3.3.1 Increase in demand for residential buildings to drive market

- 9.5.3.3.2 Iran: Kaolin market, by process

- 9.5.3.3.3 Iran: Kaolin market, by end-use industry

- 9.5.3.4 Rest of Middle East & Africa

- 9.5.3.4.1 Rest of the Middle East & Africa: Kaolin market, by process

- 9.5.3.4.2 Rest of the Middle East & Africa: Kaolin market, by end-use industry

- 9.5.3.1 GCC Countries

- 9.6 SOUTH AMERICA

- 9.6.1 SOUTH AMERICA: KAOLIN MARKET, BY PROCESS

- 9.6.2 SOUTH AMERICA: KAOLIN MARKET, BY END-USE INDUSTRY

- 9.6.3 SOUTH AMERICA: KAOLIN MARKET, BY COUNTRY

- 9.6.3.1 Brazil

- 9.6.3.1.1 Packaging and paper industries to fuel kaolin market expansion

- 9.6.3.1.2 Brazil: Kaolin market, by process

- 9.6.3.1.3 Brazil: Kaolin market, by end-use industry

- 9.6.3.2 Argentina

- 9.6.3.2.1 Increasing demand for food packaging applications to drive market

- 9.6.3.2.2 Argentina: Kaolin market, by process

- 9.6.3.2.3 Argentina: Kaolin market, by end-use industry

- 9.6.3.3 Rest of South America

- 9.6.3.3.1 Rest of South America: Kaolin market, by process

- 9.6.3.3.2 Rest of South America: Kaolin market, by end-use industry

- 9.6.3.1 Brazil

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, JANUARY 2020-JULY 2025

- 10.3 REVENUE ANALYSIS

- 10.4 MARKET SHARE ANALYSIS

- 10.4.1 MARKET RANKING ANALYSIS

- 10.5 BRAND/PRODUCT COMPARATIVE ANALYSIS

- 10.5.1 BRAND/PRODUCT COMPARATIVE ANALYSIS

- 10.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.6.1 STARS

- 10.6.2 EMERGING LEADERS

- 10.6.3 PERVASIVE PLAYERS

- 10.6.4 PARTICIPANTS

- 10.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.6.5.1 Company footprint

- 10.6.5.2 Region footprint

- 10.6.5.3 Type footprint

- 10.6.5.4 Process footprint

- 10.6.5.5 End-use industry footprint

- 10.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 10.7.1 PROGRESSIVE COMPANIES

- 10.7.2 RESPONSIVE COMPANIES

- 10.7.3 DYNAMIC COMPANIES

- 10.7.4 STARTING BLOCKS

- 10.7.5 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 10.8 VALUATION AND FINANCIAL METRICS OF KAOLIN VENDORS

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 DEALS

- 10.9.2 EXPANSIONS

- 10.9.3 OTHER DEVELOPMENTS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 IMERYS S.A.

- 11.1.1.1 Business overview

- 11.1.1.2 Products offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Deals

- 11.1.1.3.2 Other developments

- 11.1.1.4 MnM view

- 11.1.1.4.1 Right to win

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses and competitive threats

- 11.1.2 20 MICRONS

- 11.1.2.1 Business overview

- 11.1.2.2 Products offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Deals

- 11.1.2.4 MnM view

- 11.1.2.4.1 Right to win

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses and competitive threats

- 11.1.3 KAMIN LLC.

- 11.1.3.1 Business overview

- 11.1.3.2 Products offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Deals

- 11.1.3.4 MnM view

- 11.1.3.4.1 Right to win

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses and competitive threats

- 11.1.4 ASHAPURA GROUP

- 11.1.4.1 Business overview

- 11.1.4.2 Products offered

- 11.1.4.3 MnM view

- 11.1.4.3.1 Right to win

- 11.1.4.3.2 Strategic choices

- 11.1.4.3.3 Weaknesses and competitive threats

- 11.1.5 SIBELCO

- 11.1.5.1 Business overview

- 11.1.5.2 Products offered

- 11.1.5.3 Recent developments

- 11.1.5.3.1 Expansions

- 11.1.5.4 MnM view

- 11.1.5.4.1 Right to win

- 11.1.5.4.2 Strategic choices

- 11.1.5.4.3 Weaknesses and competitive threats

- 11.1.6 THIELE KAOLIN COMPANY

- 11.1.6.1 Business overview

- 11.1.6.2 Products offered

- 11.1.6.3 Recent developments

- 11.1.6.3.1 Deals

- 11.1.6.4 MnM view

- 11.1.6.4.1 Right to win

- 11.1.6.4.2 Strategic choices

- 11.1.6.4.3 Weaknesses and competitive threats

- 11.1.7 LB MINERALS, LTD.

- 11.1.7.1 Business overview

- 11.1.7.2 Products offered

- 11.1.7.3 Recent developments

- 11.1.7.3.1 Expansions

- 11.1.7.4 MnM view

- 11.1.7.4.1 Right to win

- 11.1.7.4.2 Strategic choices

- 11.1.7.4.3 Weaknesses and competitive threats

- 11.1.8 EICL LIMITED

- 11.1.8.1 Business overview

- 11.1.8.2 Products offered

- 11.1.8.3 Recent developments

- 11.1.8.3.1 Expansions

- 11.1.8.4 MnM view

- 11.1.8.4.1 Right to win

- 11.1.8.4.2 Strategic choices

- 11.1.8.4.3 Weaknesses and competitive threats

- 11.1.9 QUARZWERKE GMBH

- 11.1.9.1 Business overview

- 11.1.9.2 Products offered

- 11.1.9.3 MnM view

- 11.1.9.3.1 Right to win

- 11.1.9.3.2 Strategic choices

- 11.1.9.3.3 Weaknesses and competitive threats

- 11.1.10 SEDLECKY KAOLIN, A.S.

- 11.1.10.1 Business overview

- 11.1.10.2 Products offered

- 11.1.10.3 Recent developments

- 11.1.10.3.1 Expansions

- 11.1.10.4 MnM view

- 11.1.10.4.1 Right to win

- 11.1.10.4.2 Strategic choices

- 11.1.10.4.3 Weaknesses and competitive threats

- 11.1.1 IMERYS S.A.

- 11.2 OTHER PLAYERS

- 11.2.1 SHREE RAM KAOLIN

- 11.2.2 KERAMOST, A.S.

- 11.2.3 UMA GROUP OF COMPANIES

- 11.2.4 JIANGXI SINCERE MINERAL INDUSTRY CO., LTD.

- 11.2.5 ACTIVE MINERALS INTERNATIONAL, LLC

- 11.2.6 BURGESS PIGMENT COMPANY

- 11.2.7 KAOLIN (MALAYSIA) SDN BHD.

- 11.2.8 KERALA CERAMICS LTD.

- 11.2.9 MOTA CERAMIC SOLUTIONS

- 11.2.10 MANEK GROUP

- 11.2.11 ZILLION SAWA MINERALS PRIVATE LIMITED

- 11.2.12 HITECH MINERALS AND CHEMICALS GROUP

- 11.2.13 AMGEEN MINERALS

- 11.2.14 GUJARAT EARTH MINERALS PVT. LTD.

- 11.2.15 HD MICRONS LIMITED.

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS