|

|

市場調査レポート

商品コード

1790688

データセンター冷却の世界市場 (~2032年):ソリューション (空調・冷却ユニット・冷却塔・エコノマイザーシステム・液体冷却システム・制御システム)・サービス・冷却タイプ・データセンタータイプ・エンドユーザー産業・地域別Data Center Cooling Market by Solution (Air Conditioning, Chilling Unit, Cooling Tower, Economizer System, Liquid Cooling System, Control System), Service, Type of Cooling, Data Center Type, End-use Industry, and Region - Global Forecast to 2032 |

||||||

カスタマイズ可能

|

|||||||

| データセンター冷却の世界市場 (~2032年):ソリューション (空調・冷却ユニット・冷却塔・エコノマイザーシステム・液体冷却システム・制御システム)・サービス・冷却タイプ・データセンタータイプ・エンドユーザー産業・地域別 |

|

出版日: 2025年08月11日

発行: MarketsandMarkets

ページ情報: 英文 300 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

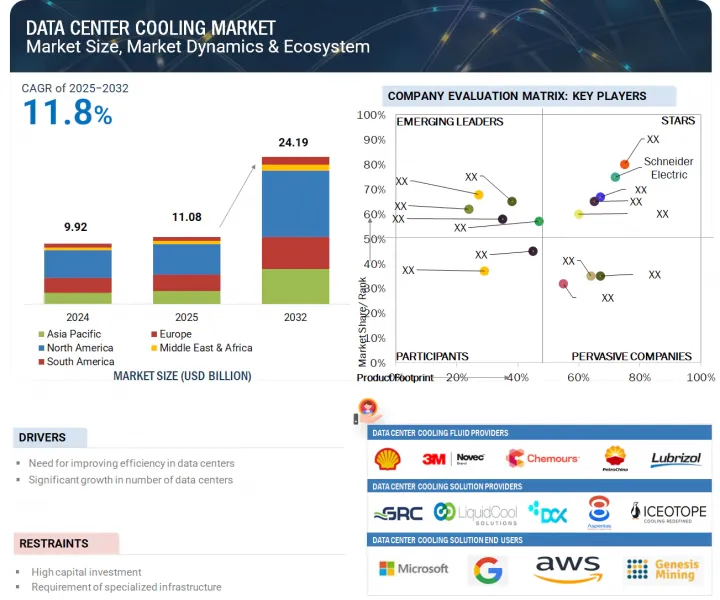

世界のデータセンター冷却の市場規模は、2025年の110億8,000万米ドルから、予測期間中はCAGR 11.8%で推移し、2032年には241億9,000万米ドルに成長すると予測されています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021-2032年 |

| 基準年 | 2024年 |

| 予測期間 | 2025-2032年 |

| 単位 | 金額 (米ドル) |

| 部門 | コンポーネント、サービス、冷却タイプ、データセンタータイプ、ソリューション、エンドユーザー産業、地域 |

| 対象地域 | アジア太平洋、欧州、北米、中東・アフリカ、南米 |

この市場は、データセンターの効率向上の必要性や、IT・通信、BFSI、政府・防衛、研究・学術、医療、製造、小売、エネルギー、その他の産業を含むさまざまなエンドユーザー業界におけるデータセンター数の増加といった要因によって牽引されています。

"サービス別では、設置・導入部門が予測期間中、市場で2番目に大きなシェアを占めると見込まれています。"

この成長は、現代のデータセンターの特定のレイアウトや運用要件に合わせた、カスタマイズ可能で省エネルギー型の冷却システムに対する需要の高まりによって推進されています。特にハイパースケールやコロケーション施設など、データセンターが規模や複雑さを増す中で、企業は液体冷却、チップ直接冷却、コンテインメントシステムといった先進的な冷却技術をシームレスに統合するために、専門のサービスプロバイダーに依存する傾向が強まっています。

設置・導入の段階は、冷却インフラ全体の性能、稼働時間、省エネ効率に直接影響を与えるため極めて重要です。これは、物理的な冷却ユニットの設置にとどまらず、データセンターの電力システム、環境モニタリングツール、制御システムとの統合も含みます。さらに、持続可能性や規制遵守の重要性が高まる中で、専門的な導入により冷却システムがグリーンビル認証や炭素削減目標を満たすことが保証されます。

"ソリューション別では、液体冷却システムが予測期間中、市場で2番目に大きなシェアを占めると見込まれています。"

この成長は、大量の熱を発生させる高性能コンピューティング、AI、高密度サーバーアーキテクチャの採用拡大によって推進されています。これらは従来の空冷方式よりも効率的な冷却方法を必要とします。液体冷却は、優れた熱管理、省エネルギー消費、空間利用の改善を提供し、現代の高密度データセンターに最適です。運営者が持続可能でコスト効率の高いソリューションを求める中で、液体冷却は次世代データセンターインフラにおける重要な要素として浮上しています。

当レポートでは、世界のデータセンター冷却の市場を調査し、市場概要、市場成長への各種影響因子の分析、技術・特許の動向、法規制環境、ケーススタディ、市場規模の推移・予測、各種区分・地域/主要国別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- ポーターのファイブフォース分析

- サプライチェーン分析

- 規制状況

- 特許分析

- ケーススタディ

- 主要なステークホルダーと購入基準

- エコシステム分析

- 顧客の事業に影響を与える動向と混乱

- 技術分析

- 主要技術

- 隣接技術

- 補完的な技術

- 投資と資金調達のシナリオ

- 2025-2026年の主な会議とイベント

- データセンター冷却市場へのAIの影響

- AI駆動型冷却最適化

- 高度な液体冷却技術への移行

- 予測保守とシステムの信頼性

- 持続可能性と規制遵守

- 経済と投資の機会

- 課題と将来の展望

- 世界のマクロ経済見通し

- 2025年の米国関税がデータセンター冷却市場に与える影響

第6章 データセンター冷却市場:コンポーネント別

第7章 データセンター冷却市場:データセンタータイプ別

- 中規模データセンター

- エンタープライズデータセンター

- 大規模データセンター

第8章 データセンター冷却市場:エンドユーザー産業別

- BFSI

- IT・通信

- 研究・学術

- 政府・防衛

- 小売

- エネルギー

- 製造

- ヘルスケア

- その他

第9章 データセンター冷却市場:サービス別

- コンサルティング

- インストール・展開

- メンテナンス・サポート

第10章 データセンター冷却市場:ソリューション別

- 空調

- 冷却ユニット

- 冷却塔

- エコノマイザーシステム

- 液体冷却システム

- 制御システム

- その他

第11章 データセンター冷却市場:冷却タイプ別

- ルームベース冷却

- 列/ラックベース冷却

第12章 データセンター冷却市場:地域別

- アジア太平洋

- 中国

- インド

- 日本

- 韓国

- その他

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- オランダ

- フランス

- イタリア

- その他

- 中東・アフリカ

- アラブ首長国連邦

- サウジアラビア

- GCCのその他の国

- 南アフリカ

- その他

- 南米

- ブラジル

- その他

第13章 競合情勢

- 主要企業の採用戦略

- 収益分析

- 市場シェア分析

- ブランド/製品比較

- 企業評価マトリックス:ティア1

- スタートアップ/中小企業評価マトリックス

- 企業評価と財務指標

- 競合シナリオと動向

第14章 企業プロファイル

- 主要企業

- VERTIV GROUP CORP.

- GREEN REVOLUTION COOLING, INC.

- SUBMER

- ASPERITAS

- COOLIT SYSTEMS

- DCX LIQUID COOLING SYSTEMS

- ICEOTOPE PRECISION LIQUID COOLING

- SCHNEIDER ELECTRIC

- JOHNSON CONTROLS

- CARRIER

- DAIKIN INDUSTRIES, LTD.

- MITSUBISHI ELECTRIC CORPORATION

- RITTAL GMBH & CO. KG

- MIDAS IMMERSION COOLING

- TRANE TECHNOLOGIES PLC

- MUNTERS

- LIQUIDSTACK HOLDING B.V.

- CHILLDYNE, INC.

- DUG TECHNOLOGY

- LIQUIDCOOL SOLUTIONS

- STULZ GMBH

- DELTA POWER SOLUTIONS

- MODINE MANUFACTURING COMPANY

- BOYD

- SUPER MICRO COMPUTER, INC.

- FLEX LTD.

- BLACK BOX

- ALFA LAVAL

- その他の企業

- COOLCENTRIC

- ASETEK

- GIGA-BYTE TECHNOLOGY CO., LTD.

- NVENT

- ACCELSIUS LLC

- KAORI HEAT TREATMENT CO., LTD.

- ZUTACORE, INC.

- NORTEK AIR SOLUTIONS, LLC.

第15章 隣接市場と関連市場

第16章 付録

List of Tables

- TABLE 1 LIMITATIONS AND ASSOCIATED RISKS

- TABLE 2 DATA CENTER COOLING MARKET SNAPSHOT, 2025 VS. 2032

- TABLE 3 PORTER'S FIVE FORCES ANALYSIS: DATA CENTER COOLING MARKET

- TABLE 4 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 5 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES (%)

- TABLE 8 KEY BUYING CRITERIA, BY END-USE INDUSTRY

- TABLE 9 DATA CENTER COOLING MARKET: ROLE IN ECOSYSTEM

- TABLE 10 DATA CENTER COOLING MARKET: CONFERENCES & EVENTS

- TABLE 11 REAL GDP GROWTH (ANNUAL PERCENTAGE CHANGE), BY COUNTRY, 2021-2024

- TABLE 12 UNEMPLOYMENT RATE, BY COUNTRY, 2021-2024 (%)

- TABLE 13 INFLATION RATE (AVERAGE CONSUMER PRICES), BY COUNTRY, 2021-2024 (%)

- TABLE 14 FOREIGN DIRECT INVESTMENT, 2022 VS. 2023 (USD BILLION)

- TABLE 15 US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 16 KEY PRODUCT-RELATED TARIFF EFFECTIVE FOR CHROMIC MATERIAL

- TABLE 17 EXPECTED CHANGE IN PRICES AND LIKELY IMPACT ON END-USE MARKET DUE TO TARIFF IMPACT

- TABLE 18 DATA CENTER COOLING MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 19 DATA CENTER COOLING MARKET, BY COMPONENT, 2025-2032 (USD MILLION)

- TABLE 20 DATA CENTER COOLING MARKET, BY DATA CENTER TYPE, 2021-2024 (USD MILLION)

- TABLE 21 DATA CENTER COOLING MARKET, BY DATA CENTER TYPE, 2025-2032 (USD MILLION)

- TABLE 22 DATA CENTER COOLING MARKET IN MID-SIZED DATA CENTERS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 23 DATA CENTER COOLING MARKET IN MID-SIZED DATA CENTERS, BY REGION, 2025-2032 (USD MILLION)

- TABLE 24 DATA CENTER COOLING MARKET IN ENTERPRISE DATA CENTERS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 25 DATA CENTER COOLING MARKET IN ENTERPRISE DATA CENTERS, BY REGION, 2025-2032 (USD MILLION)

- TABLE 26 DATA CENTER COOLING MARKET IN LARGE DATA CENTERS, BY REGION, 2021-2024 (USD MILLION)

- TABLE 27 DATA CENTER COOLING MARKET IN LARGE DATA CENTERS, BY REGION, 2025-2032 (USD MILLION)

- TABLE 28 DATA CENTER COOLING MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 29 DATA CENTER COOLING MARKET, BY END-USE INDUSTRY, 2025-2032 (USD MILLION)

- TABLE 30 DATA CENTER COOLING MARKET IN BFSI, BY REGION, 2021-2024 (USD MILLION)

- TABLE 31 DATA CENTER COOLING MARKET IN BFSI, BY REGION, 2025-2032 (USD MILLION)

- TABLE 32 DATA CENTER COOLING MARKET IN IT & TELECOM, BY REGION, 2021-2024 (USD MILLION)

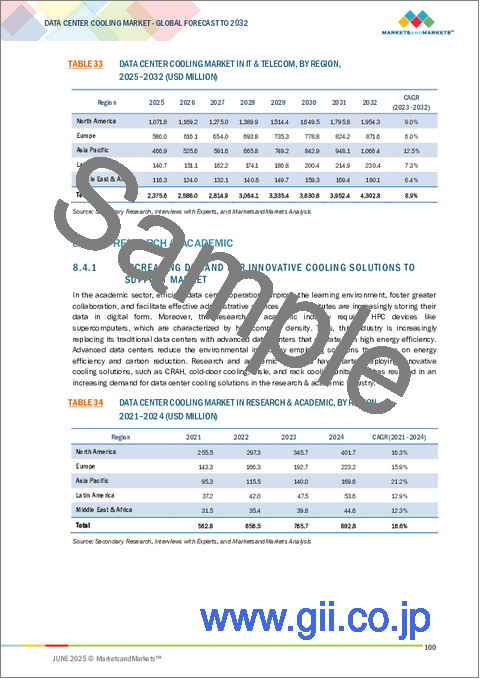

- TABLE 33 DATA CENTER COOLING MARKET IN IT & TELECOM, BY REGION, 2025-2032 (USD MILLION)

- TABLE 34 DATA CENTER COOLING MARKET IN RESEARCH & ACADEMIC, BY REGION, 2021-2024 (USD MILLION)

- TABLE 35 DATA CENTER COOLING MARKET IN RESEARCH & ACADEMIC, BY REGION, 2025-2032 (USD MILLION)

- TABLE 36 DATA CENTER COOLING MARKET IN GOVERNMENT & DEFENSE, BY REGION, 2021-2024 (USD MILLION)

- TABLE 37 DATA CENTER COOLING MARKET IN GOVERNMENT & DEFENSE, BY REGION, 2025-2032 (USD MILLION)

- TABLE 38 DATA CENTER COOLING MARKET IN RETAIL, BY REGION, 2021-2024 (USD MILLION)

- TABLE 39 DATA CENTER COOLING MARKET IN RETAIL, BY REGION, 2025-2032 (USD MILLION)

- TABLE 40 DATA CENTER COOLING MARKET IN ENERGY, BY REGION, 2021-2024 (USD MILLION)

- TABLE 41 DATA CENTER COOLING MARKET IN ENERGY, BY REGION, 2025-2032 (USD MILLION)

- TABLE 42 DATA CENTER COOLING MARKET IN MANUFACTURING, BY REGION, 2021-2024 (USD MILLION)

- TABLE 43 DATA CENTER COOLING MARKET IN MANUFACTURING, BY REGION, 2025-2032 (USD MILLION)

- TABLE 44 DATA CENTER COOLING MARKET IN HEALTHCARE, BY REGION, 2021-2024 (USD MILLION)

- TABLE 45 DATA CENTER COOLING MARKET IN HEALTHCARE, BY REGION, 2025-2032 (USD MILLION)

- TABLE 46 DATA CENTER COOLING MARKET IN OTHER END-USE INDUSTRIES, BY REGION, 2021-2024 (USD MILLION)

- TABLE 47 DATA CENTER COOLING MARKET IN OTHER END-USE INDUSTRIES, BY REGION, 2025-2032 (USD MILLION)

- TABLE 48 DATA CENTER COOLING MARKET, BY SERVICE, 2021-2024 (USD MILLION

- TABLE 49 DATA CENTER COOLING MARKET, BY SERVICE, 2025-2032 (USD MILLION)

- TABLE 50 CONSULTING: DATA CENTER COOLING MARKET FOR SERVICE, BY REGION, 2021-2024 (USD MILLION)

- TABLE 51 CONSULTING: DATA CENTER COOLING MARKET FOR SERVICE, BY REGION, 2025-2032 (USD MILLION)

- TABLE 52 INSTALLATION AND DEPLOYMENT: DATA CENTER COOLING MARKET FOR SERVICE, BY REGION, 2021-2024 (USD MILLION)

- TABLE 53 INSTALLATION AND DEPLOYMENT: DATA CENTER COOLING MARKET FOR SERVICE, BY REGION, 2025-2032 (USD MILLION)

- TABLE 54 MAINTENANCE AND SUPPORT: DATA CENTER COOLING MARKET FOR SERVICE, BY REGION, 2021-2024 (USD MILLION)

- TABLE 55 MAINTENANCE AND SUPPORT: DATA CENTER COOLING MARKET FOR SERVICE, BY REGION, 2025-2032 (USD MILLION)

- TABLE 56 DATA CENTER COOLING MARKET, BY SOLUTION, 2021-2024 (USD MILLION

- TABLE 57 DATA CENTER COOLING MARKET, BY SOLUTION, 2025-2032 (USD MILLION)

- TABLE 58 AIR CONDITIONING: DATA CENTER COOLING MARKET FOR SOLUTION, BY REGION, 2021-2024 (USD MILLION)

- TABLE 59 AIR CONDITIONING: DATA CENTER COOLING MARKET FOR SOLUTION, BY REGION, 2025-2032 (USD MILLION)

- TABLE 60 CHILLING UNITS: DATA CENTER COOLING MARKET FOR SOLUTION, BY REGION, 2021-2024 (USD MILLION)

- TABLE 61 CHILLING UNITS: DATA CENTER COOLING MARKET FOR SOLUTION, BY REGION, 2025-2032 (USD MILLION)

- TABLE 62 COOLING TOWERS: DATA CENTER COOLING MARKET FOR SOLUTION, BY REGION, 2021-2024 (USD MILLION)

- TABLE 63 COOLING TOWERS: DATA CENTER COOLING MARKET FOR SOLUTION, BY REGION, 2025-2032 (USD MILLION)

- TABLE 64 ECONOMIZER SYSTEMS: DATA CENTER COOLING MARKET FOR SOLUTION, BY REGION, 2021-2024 (USD MILLION)

- TABLE 65 ECONOMIZER SYSTEMS: DATA CENTER COOLING MARKET FOR SOLUTION, BY REGION, 2025-2032 (USD MILLION)

- TABLE 66 LIQUID COOLING SYSTEMS: DATA CENTER COOLING MARKET FOR SOLUTION, BY REGION, 2021-2024 (USD MILLION)

- TABLE 67 LIQUID COOLING SYSTEMS: DATA CENTER COOLING MARKET FOR SOLUTION, BY REGION, 2025-2032 (USD MILLION)

- TABLE 68 CONTROL SYSTEMS: DATA CENTER COOLING MARKET FOR SOLUTION, BY REGION, 2021-2024 (USD MILLION)

- TABLE 69 CONTROL SYSTEMS: DATA CENTER COOLING MARKET FOR SOLUTION, BY REGION, 2025-2032 (USD MILLION)

- TABLE 70 OTHERS: DATA CENTER COOLING MARKET FOR SOLUTION, BY REGION, 2021-2024 (USD MILLION)

- TABLE 71 OTHERS: DATA CENTER COOLING MARKET FOR SOLUTION, BY REGION, 2025-2032 (USD MILLION)

- TABLE 72 DATA CENTER COOLING MARKET, BY TYPE OF COOLING, 2021-2024 (USD MILLION)

- TABLE 73 DATA CENTER COOLING MARKET, BY TYPE OF COOLING, 2025-2032 (USD MILLION)

- TABLE 74 DATA CENTER COOLING MARKET FOR ROOM-BASED COOLING, BY REGION, 2021-2024 (USD MILLION)

- TABLE 75 DATA CENTER COOLING MARKET FOR ROOM-BASED COOLING, BY REGION, 2025-2032 (USD MILLION)

- TABLE 76 DATA CENTER COOLING MARKET FOR ROW/RACK-BASED COOLING, BY REGION, 2021-2024 (USD MILLION)

- TABLE 77 DATA CENTER COOLING MARKET FOR ROW/RACK-BASED COOLING, BY REGION, 2025-2032 (USD MILLION)

- TABLE 78 DATA CENTER COOLING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 79 DATA CENTER COOLING MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 80 ASIA PACIFIC: DATA CENTER COOLING MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 81 ASIA PACIFIC: DATA CENTER COOLING MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 82 ASIA PACIFIC: DATA CENTER COOLING MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 83 ASIA PACIFIC: DATA CENTER COOLING MARKET, BY COMPONENT, 2025-2032 (USD MILLION)

- TABLE 84 ASIA PACIFIC: DATA CENTER COOLING MARKET, BY TYPE OF COOLING, 2021-2024 (USD MILLION)

- TABLE 85 ASIA PACIFIC: DATA CENTER COOLING MARKET, BY TYPE OF COOLING, 2025-2032 (USD MILLION)

- TABLE 86 ASIA PACIFIC: DATA CENTER COOLING MARKET, BY DATA CENTER TYPE, 2021-2024 (USD MILLION)

- TABLE 87 ASIA PACIFIC: DATA CENTER COOLING MARKET, BY DATA CENTER TYPE, 2025-2032 (USD MILLION)

- TABLE 88 ASIA PACIFIC: DATA CENTER COOLING MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 89 ASIA PACIFIC: DATA CENTER COOLING MARKET, BY END-USE INDUSTRY, 2025-2032 (USD MILLION)

- TABLE 90 ASIA PACIFIC: DATA CENTER COOLING MARKET, BY SOLUTION, 2021-2024 (USD MILLION)

- TABLE 91 ASIA PACIFIC: DATA CENTER COOLING MARKET, BY SOLUTION, 2025-2032 (USD MILLION)

- TABLE 92 ASIA PACIFIC: DATA CENTER COOLING MARKET, BY SERVICE, 2021-2024 (USD MILLION)

- TABLE 93 ASIA PACIFIC: DATA CENTER COOLING MARKET, BY SERVICE, 2025-2032 (USD MILLION)

- TABLE 94 CHINA: DATA CENTER COOLING MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 95 CHINA: DATA CENTER COOLING MARKET, BY COMPONENT, 2025-2032 (USD MILLION)

- TABLE 96 INDIA: DATA CENTER COOLING MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 97 INDIA: DATA CENTER COOLING MARKET, BY COMPONENT, 2025-2032 (USD MILLION)

- TABLE 98 JAPAN: DATA CENTER COOLING MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 99 JAPAN: DATA CENTER COOLING MARKET, BY COMPONENT, 2025-2032 (USD MILLION)

- TABLE 100 SOUTH KOREA: DATA CENTER COOLING MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 101 SOUTH KOREA: DATA CENTER COOLING MARKET, BY COMPONENT, 2025-2032 (USD MILLION)

- TABLE 102 REST OF ASIA PACIFIC: DATA CENTER COOLING MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 103 REST OF ASIA PACIFIC: DATA CENTER COOLING MARKET, BY COMPONENT, 2025-2032 (USD MILLION)

- TABLE 104 NORTH AMERICA: DATA CENTER COOLING MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 105 NORTH AMERICA: DATA CENTER COOLING MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 106 NORTH AMERICA: DATA CENTER COOLING MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 107 NORTH AMERICA: DATA CENTER COOLING MARKET, BY COMPONENT, 2025-2032 (USD MILLION)

- TABLE 108 NORTH AMERICA: DATA CENTER COOLING MARKET, BY TYPE OF COOLING, 2021-2024 (USD MILLION)

- TABLE 109 NORTH AMERICA: DATA CENTER COOLING MARKET, BY TYPE OF COOLING, 2025-2032 (USD MILLION)

- TABLE 110 NORTH AMERICA: DATA CENTER COOLING MARKET, BY DATA CENTER TYPE, 2021-2024 (USD MILLION)

- TABLE 111 NORTH AMERICA: DATA CENTER COOLING MARKET, BY DATA CENTER TYPE, 2025-2032 (USD MILLION)

- TABLE 112 NORTH AMERICA: DATA CENTER COOLING MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 113 NORTH AMERICA: DATA CENTER COOLING MARKET, BY END-USE INDUSTRY, 2025-2032 (USD MILLION)

- TABLE 114 NORTH AMERICA: DATA CENTER COOLING MARKET, BY SOLUTION, 2021-2024 (USD MILLION)

- TABLE 115 NORTH AMERICA: DATA CENTER COOLING MARKET, BY SOLUTION, 2025-2032 (USD MILLION)

- TABLE 116 NORTH AMERICA: DATA CENTER COOLING MARKET, BY SERVICE, 2021-2024 (USD MILLION)

- TABLE 117 NORTH AMERICA: DATA CENTER COOLING MARKET, BY SERVICE, 2025-2032 (USD MILLION)

- TABLE 118 US: DATA CENTER COOLING MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 119 US: DATA CENTER COOLING MARKET, BY COMPONENT, 2025-2032 (USD MILLION)

- TABLE 120 CANADA: DATA CENTER COOLING MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 121 CANADA: DATA CENTER COOLING MARKET, BY COMPONENT, 2025-2032 (USD MILLION)

- TABLE 122 MEXICO: DATA CENTER COOLING MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 123 MEXICO: DATA CENTER COOLING MARKET, BY COMPONENT, 2025-2032 (USD MILLION)

- TABLE 124 EUROPE: DATA CENTER COOLING MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 125 EUROPE: DATA CENTER COOLING MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 126 EUROPE: DATA CENTER COOLING MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 127 EUROPE: DATA CENTER COOLING MARKET, BY COMPONENT, 2025-2032 (USD MILLION)

- TABLE 128 EUROPE: DATA CENTER COOLING MARKET, BY TYPE OF COOLING, 2021-2024 (USD MILLION)

- TABLE 129 EUROPE: DATA CENTER COOLING MARKET, BY TYPE OF COOLING, 2025-2032 (USD MILLION)

- TABLE 130 EUROPE: DATA CENTER COOLING MARKET, BY DATA CENTER TYPE, 2021-2024 (USD MILLION)

- TABLE 131 EUROPE: DATA CENTER COOLING MARKET, BY DATA CENTER TYPE, 2025-2032 (USD MILLION)

- TABLE 132 EUROPE: DATA CENTER COOLING MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 133 EUROPE: DATA CENTER COOLING MARKET, BY END-USE INDUSTRY, 2025-2032 (USD MILLION)

- TABLE 134 EUROPE: DATA CENTER COOLING MARKET, BY SOLUTION, 2021-2024 (USD MILLION)

- TABLE 135 EUROPE: DATA CENTER COOLING MARKET, BY SOLUTION, 2025-2032 (USD MILLION)

- TABLE 136 EUROPE: DATA CENTER COOLING MARKET, BY SERVICE, 2021-2024 (USD MILLION)

- TABLE 137 EUROPE: DATA CENTER COOLING MARKET, BY SERVICE, 2025-2032 (USD MILLION)

- TABLE 138 GERMANY: DATA CENTER COOLING MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 139 GERMANY: DATA CENTER COOLING MARKET, BY COMPONENT, 2025-2032 (USD MILLION)

- TABLE 140 UK: DATA CENTER COOLING MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 141 UK: DATA CENTER COOLING MARKET, BY COMPONENT, 2025-2032 (USD MILLION)

- TABLE 142 NETHERLANDS: DATA CENTER COOLING MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 143 NETHERLANDS: DATA CENTER COOLING MARKET, BY COMPONENT, 2025-2032 (USD MILLION)

- TABLE 144 FRANCE: DATA CENTER COOLING MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 145 FRANCE: DATA CENTER COOLING MARKET, BY COMPONENT, 2025-2032 (USD MILLION)

- TABLE 146 ITALY: DATA CENTER COOLING MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 147 ITALY: DATA CENTER COOLING MARKET, BY COMPONENT, 2025-2032 (USD MILLION)

- TABLE 148 REST OF EUROPE: DATA CENTER COOLING MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 149 REST OF EUROPE: DATA CENTER COOLING MARKET, BY COMPONENT, 2025-2032 (USD MILLION)

- TABLE 150 MIDDLE EAST & AFRICA: DATA CENTER COOLING MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 151 MIDDLE EAST & AFRICA: DATA CENTER COOLING MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 152 MIDDLE EAST & AFRICA: DATA CENTER COOLING MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 153 MIDDLE EAST & AFRICA: DATA CENTER COOLING MARKET, BY COMPONENT, 2025-2032 (USD MILLION)

- TABLE 154 MIDDLE EAST & AFRICA: DATA CENTER COOLING MARKET, BY TYPE OF COOLING, 2021-2024 (USD MILLION)

- TABLE 155 MIDDLE EAST & AFRICA: DATA CENTER COOLING MARKET, BY TYPE OF COOLING, 2025-2032 (USD MILLION)

- TABLE 156 MIDDLE EAST & AFRICA: DATA CENTER COOLING MARKET, BY DATA CENTER TYPE, 2021-2024 (USD MILLION)

- TABLE 157 MIDDLE EAST & AFRICA: DATA CENTER COOLING MARKET, BY DATA CENTER TYPE, 2025-2032 (USD MILLION)

- TABLE 158 MIDDLE EAST & AFRICA: DATA CENTER COOLING MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 159 MIDDLE EAST & AFRICA: DATA CENTER COOLING MARKET, BY END-USE INDUSTRY, 2025-2032 (USD MILLION)

- TABLE 160 MIDDLE EAST & AFRICA: DATA CENTER COOLING MARKET, BY SOLUTION, 2021-2024 (USD MILLION)

- TABLE 161 MIDDLE EAST & AFRICA: DATA CENTER COOLING MARKET, BY SOLUTION, 2025-2032 (USD MILLION)

- TABLE 162 MIDDLE EAST & AFRICA: DATA CENTER COOLING MARKET, BY SERVICE, 2021-2024 (USD MILLION)

- TABLE 163 MIDDLE EAST & AFRICA: DATA CENTER COOLING MARKET, BY SERVICE, 2025-2032 (USD MILLION)

- TABLE 164 UAE: DATA CENTER COOLING MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 165 UAE: DATA CENTER COOLING MARKET, BY COMPONENT, 2025-2032 (USD MILLION)

- TABLE 166 SAUDI ARABIA: DATA CENTER COOLING MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 167 SAUDI ARABIA: DATA CENTER COOLING MARKET, BY COMPONENT, 2025-2032 (USD MILLION)

- TABLE 168 REST OF THE GCC: DATA CENTER COOLING MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 169 REST OF THE GCC: DATA CENTER COOLING MARKET, BY COMPONENT, 2025-2032 (USD MILLION)

- TABLE 170 SOUTH AFRICA: DATA CENTER COOLING MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 171 SOUTH AFRICA: DATA CENTER COOLING MARKET, BY COMPONENT, 2025-2032 (USD MILLION)

- TABLE 172 REST OF MIDDLE EAST & AFRICA: DATA CENTER COOLING MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 173 REST OF MIDDLE EAST & AFRICA: DATA CENTER COOLING MARKET, BY COMPONENT, 2025-2032 (USD MILLION)

- TABLE 174 SOUTH AMERICA: DATA CENTER COOLING MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 175 SOUTH AMERICA: DATA CENTER COOLING MARKET, BY COUNTRY, 2025-2032 (USD MILLION)

- TABLE 176 SOUTH AMERICA: DATA CENTER COOLING MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 177 SOUTH AMERICA: DATA CENTER COOLING MARKET, BY COMPONENT, 2025-2032 (USD MILLION)

- TABLE 178 SOUTH AMERICA: DATA CENTER COOLING MARKET, BY TYPE OF COOLING, 2021-2024 (USD MILLION)

- TABLE 179 SOUTH AMERICA: DATA CENTER COOLING MARKET, BY TYPE OF COOLING, 2025-2032 (USD MILLION)

- TABLE 180 SOUTH AMERICA: DATA CENTER COOLING MARKET, BY DATA CENTER TYPE, 2021-2024 (USD MILLION)

- TABLE 181 SOUTH AMERICA: DATA CENTER COOLING MARKET, BY DATA CENTER TYPE, 2025-2032 (USD MILLION)

- TABLE 182 SOUTH AMERICA: DATA CENTER COOLING MARKET, BY END-USE INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 183 SOUTH AMERICA: DATA CENTER COOLING MARKET, BY END-USE INDUSTRY, 2025-2032 (USD MILLION)

- TABLE 184 SOUTH AMERICA: DATA CENTER COOLING MARKET, BY SOLUTION, 2021-2024 (USD MILLION)

- TABLE 185 SOUTH AMERICA: DATA CENTER COOLING MARKET, BY SOLUTION, 2025-2032 (USD MILLION)

- TABLE 186 SOUTH AMERICA: DATA CENTER COOLING MARKET, BY SERVICE, 2021-2024 (USD MILLION)

- TABLE 187 SOUTH AMERICA: DATA CENTER COOLING MARKET, BY SERVICE, 2025-2032 (USD MILLION)

- TABLE 188 BRAZIL: DATA CENTER COOLING MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 189 BRAZIL: DATA CENTER COOLING MARKET, BY COMPONENT, 2025-2032 (USD MILLION)

- TABLE 190 REST OF SOUTH AMERICA: DATA CENTER COOLING MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 191 REST OF SOUTH AMERICA: DATA CENTER COOLING MARKET, BY COMPONENT, 2025-2032 (USD MILLION)

- TABLE 192 OVERVIEW OF STRATEGIES ADOPTED BY KEY MANUFACTURERS

- TABLE 193 DATA CENTER COOLING MARKET: DEGREE OF COMPETITION

- TABLE 194 COMPANY, BY REGION FOOTPRINT

- TABLE 195 COMPANY, BY TYPE OF COOLING FOOTPRINT

- TABLE 196 COMPANY, BY SOLUTION FOOTPRINT

- TABLE 197 DATA CENTER COOLING MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 198 DATA CENTER COOLING MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 199 DATA CENTER COOLING MARKET: PRODUCT LAUNCHES (JANUARY 2018-JUNE 2025)

- TABLE 200 DATA CENTER COOLING MARKET: DEALS (JANUARY 2018-JUNE 2025)

- TABLE 201 DATA CENTER COOLING MARKET: OTHER DEVELOPMENTS (2018-2023)

- TABLE 202 VERTIV GROUP CORP.: COMPANY OVERVIEW

- TABLE 203 VERTIV GROUP CORP.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 204 VERTIV GROUP CORP.: PRODUCT LAUNCHES

- TABLE 205 VERTIV GROUP CORP.: DEALS

- TABLE 206 GREEN REVOLUTION COOLING, INC.: COMPANY OVERVIEW

- TABLE 207 GREEN REVOLUTION COOLING, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 208 GREEN REVOLUTION COOLING, INC.: PRODUCT LAUNCHES

- TABLE 209 GREEN REVOLUTION COOLING, INC.: DEALS

- TABLE 210 SUBMER: COMPANY OVERVIEW

- TABLE 211 SUBMER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 212 SUBMER: PRODUCT LAUNCHES

- TABLE 213 SUBMER: DEALS

- TABLE 214 SUBMER: EXPANSIONS

- TABLE 215 SUBMER: OTHERS

- TABLE 216 ASPERITAS: COMPANY OVERVIEW

- TABLE 217 ASPERITAS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 218 ASPERITAS: PRODUCT LAUNCHES

- TABLE 219 ASPERITAS: DEALS

- TABLE 220 ASPERITAS: EXPANSIONS

- TABLE 221 COOLIT SYSTEMS: COMPANY OVERVIEW

- TABLE 222 COOLIT SYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 223 COOLIT SYSTEMS: PRODUCT LAUNCHES

- TABLE 224 COOLIT SYSTEMS: DEALS

- TABLE 225 COOLIT SYSTEMS: EXPANSIONS

- TABLE 226 DCX LIQUID COOLING SYSTEMS: COMPANY OVERVIEW

- TABLE 227 DCX LIQUID COOLING SYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 228 DCX LIQUID COOLING SYSTEMS: PRODUCT LAUNCHES

- TABLE 229 DCX LIQUID COOLING SYSTEMS: OTHERS

- TABLE 230 ICEOTOPE PRECISION LIQUID COOLING: COMPANY OVERVIEW

- TABLE 231 ICEOTOPE PRECISION LIQUID COOLING: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 232 ICEOTOPE PRECISION LIQUID COOLING: PRODUCT LAUNCHES

- TABLE 233 ICEOTOPE PRECISION LIQUID COOLING: DEALS

- TABLE 234 SCHNEIDER ELECTRIC: COMPANY OVERVIEW

- TABLE 235 SCHNEIDER ELECTRIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 236 SCHNEIDER ELECTRIC: DEALS

- TABLE 237 SCHNEIDER ELECTRIC: PRODUCT LAUNCHES

- TABLE 238 JOHNSON CONTROLS: COMPANY OVERVIEW

- TABLE 239 JOHNSON CONTROLS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 240 JOHNSON CONTROLS: DEALS

- TABLE 241 CARRIER: COMPANY OVERVIEW

- TABLE 242 CARRIER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 243 CARRIER: PRODUCT LAUNCHES

- TABLE 244 CARRIER: DEALS

- TABLE 245 DAIKIN INDUSTRIES, LTD.: COMPANY OVERVIEW

- TABLE 246 DAIKIN INDUSTRIES, LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 247 DAIKIN INDUSTRIES, LTD: OTHERS

- TABLE 248 MITSUBISHI ELECTRIC CORPORATION: COMPANY OVERVIEW

- TABLE 249 MITSUBISHI ELECTRIC CORPORATION: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 250 MITSUBISHI ELECTRIC CORPORATION: DEALS

- TABLE 251 RITTAL GMBH & CO. KG: COMPANY OVERVIEW

- TABLE 252 RITTAL GMBH & CO. KG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 253 RITTAL GMBH & CO. KG: DEALS

- TABLE 254 RITTAL GMBH & CO. KG: PRODUCT LAUNCHES

- TABLE 255 MIDAS IMMERSION COOLING: COMPANY OVERVIEW

- TABLE 256 MIDAS IMMERSION COOLING: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 257 MIDAS IMMERSION COOLING: DEALS

- TABLE 258 TRANE TECHNOLOGIES PLC: COMPANY OVERVIEW

- TABLE 259 TRANE TECHNOLOGIES PLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 260 TRANE TECHNOLOGIES PLC: DEALS

- TABLE 261 MUNTERS: COMPANY OVERVIEW

- TABLE 262 MUNTERS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 263 MUNTERS: DEALS

- TABLE 264 MUNTERS: OTHERS

- TABLE 265 LIQUIDSTACK HOLDING B.V.: COMPANY OVERVIEW

- TABLE 266 LIQUIDSTACK HOLDING B.V.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 267 LIQUIDSTACK HOLDING B.V.: DEALS

- TABLE 268 LIQUIDSTACK HOLDING B.V.: OTHERS

- TABLE 269 CHILLDYNE, INC.: COMPANY OVERVIEW

- TABLE 270 CHILLDYNE, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 271 CHILLDYNE, INC.: DEALS

- TABLE 272 DUG TECHNOLOGY: COMPANY OVERVIEW

- TABLE 273 DUG TECHNOLOGY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 274 DUG TECHNOLOGY: DEALS

- TABLE 275 LIQUIDCOOL SOLUTIONS: COMPANY OVERVIEW

- TABLE 276 LIQUIDCOOL SOLUTIONS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 277 LIQUIDCOOL SOLUTIONS: DEALS

- TABLE 278 STULZ GMBH: COMPANY OVERVIEW

- TABLE 279 STULZ GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 280 STULZ GMBH: PRODUCT LAUNCHES

- TABLE 281 DELTA POWER SOLUTIONS: COMPANY OVERVIEW

- TABLE 282 DELTA POWER SOLUTIONS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 283 DELTA POWER SOLUTIONS: DEALS

- TABLE 284 MODINE MANUFACTURING COMPANY: COMPANY OVERVIEW

- TABLE 285 MODINE MANUFACTURING COMPANY: PRODUCTS OFFERED

- TABLE 286 MODINE MANUFACTURING COMPANY: PRODUCT LAUNCHES

- TABLE 287 MODINE MANUFACTURING COMPANY: DEALS

- TABLE 288 MODINE MANUFACTURING COMPANY: EXPANSIONS

- TABLE 289 BOYD: COMPANY OVERVIEW

- TABLE 290 BOYD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 291 SUPER MICRO COMPUTER, INC.: COMPANY OVERVIEW

- TABLE 292 SUPER MICRO COMPUTER, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 293 SUPER MICRO COMPUTER, INC.: DEALS

- TABLE 294 SUPER MICRO COMPUTER, INC.: EXPANSIONS

- TABLE 295 FLEX LTD.: COMPANY OVERVIEW

- TABLE 296 FLEX LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 297 FLEX LTD.: DEALS

- TABLE 298 BLACK BOX: COMPANY OVERVIEW

- TABLE 299 BLACK BOX: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 300 BLACK BOX: DEALS

- TABLE 301 ALFA LAVAL: COMPANY OVERVIEW

- TABLE 302 ALFA LAVAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 303 COOLCENTRIC: COMPANY OVERVIEW

- TABLE 304 ASETEK: COMPANY OVERVIEW

- TABLE 305 GIGA-BYTE TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 306 NVENT: COMPANY OVERVIEW

- TABLE 307 ACCELSIUS LLC: COMPANY OVERVIEW

- TABLE 308 KAORI HEAT TREATMENT CO., LTD.: COMPANY OVERVIEW

- TABLE 309 ZUTACORE, INC.: COMPANY OVERVIEW

- TABLE 310 NORTEK AIR SOLUTIONS, LLC.: COMPANY OVERVIEW

- TABLE 311 COLD PLATE LIQUID COOLING: DATA CENTER LIQUID COOLING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 312 COLD PLATE LIQUID COOLING: DATA CENTER LIQUID COOLING MARKET, BY REGION, 2025-2032 (USD MILLION)

- TABLE 313 IMMERSION LIQUID COOLING: DATA CENTER LIQUID COOLING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 314 IMMERSION LIQUID COOLING: DATA CENTER LIQUID COOLING MARKET, BY REGION, 2025-2032 (USD MILLION)

List of Figures

- FIGURE 1 DATA CENTER COOLING MARKET: RESEARCH DESIGN

- FIGURE 2 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 3 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 4 BASE NUMBER CALCULATION: APPROACH 1

- FIGURE 5 BASE NUMBER CALCULATION: APPROACH 2

- FIGURE 6 DATA TRIANGULATION: DATA CENTER COOLING MARKET

- FIGURE 7 FACTOR ANALYSIS

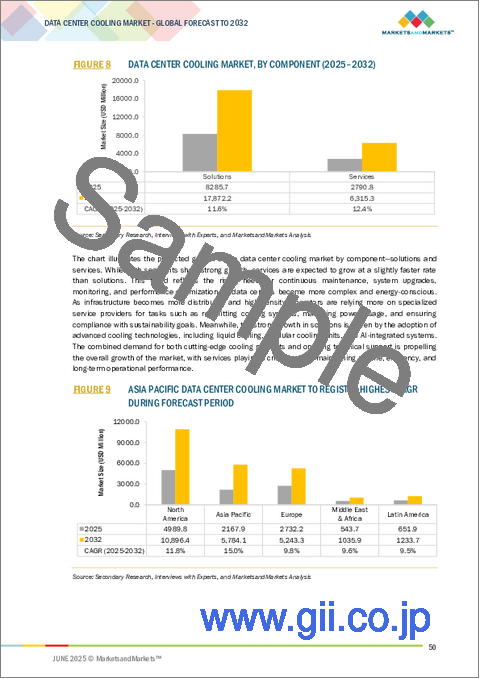

- FIGURE 8 DATA CENTER COOLING MARKET, BY COMPONENT (2025-2032)

- FIGURE 9 ASIA PACIFIC DATA CENTER COOLING MARKET TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 10 DATA CENTER COOLING MARKET, BY TYPE OF COOLING (2025-2032)

- FIGURE 11 IT & TELECOM SECTOR TO OFFER LUCRATIVE GROWTH OPPORTUNITIES

- FIGURE 12 MID-SIZED DATA CENTERS SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 13 SOLUTION SEGMENT ACCOUNTED FOR LARGER MARKET SHARE IN 2024

- FIGURE 14 CHINA TO REGISTER HIGHEST CAGR IN DATA CENTER COOLING MARKET

- FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN DATA CENTER COOLING MARKET

- FIGURE 16 DATA CENTER AVERAGE ANNUAL POWER USAGE EFFECTIVENESS (PUE) WORLDWIDE, 2019-2024

- FIGURE 17 WORLDWIDE NUMBER OF DATA CENTERS IN MARCH 2025

- FIGURE 18 PORTER'S FIVE FORCES ANALYSIS: DATA CENTER COOLING MARKET

- FIGURE 19 DATA CENTER COOLING MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 20 LIST OF MAJOR PATENTS RELATED TO DATA CENTER COOLING SYSTEMS

- FIGURE 21 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES

- FIGURE 22 KEY BUYING CRITERIA IN TOP END-USE INDUSTRIES

- FIGURE 23 DATA CENTER COOLING MARKET: ECOSYSTEM MAPPING

- FIGURE 24 REVENUE SHIFT AND NEW REVENUE POCKETS IN DATA CENTER COOLING MARKET

- FIGURE 25 INVESTMENT AND FUNDING SCENARIO, 2020-2024

- FIGURE 26 SERVICES SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 27 MID-SIZED DATA CENTERS SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 28 GOVERNMENT & DEFENSE SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 29 ROW/RACK-BASED COOLING SEGMENT TO REGISTER HIGHER DURING FORECAST PERIOD

- FIGURE 30 ASIA PACIFIC TO REGISTER HIGHEST CAGR IN DATA CENTER COOLING MARKET

- FIGURE 31 ASIA PACIFIC: DATA CENTER COOLING MARKET SNAPSHOT

- FIGURE 32 NORTH AMERICA: DATA CENTER COOLING MARKET SNAPSHOT

- FIGURE 33 EUROPE: DATA CENTER COOLING MARKET SNAPSHOT

- FIGURE 34 REVENUE ANALYSIS OF KEY COMPANIES (2020-2024)

- FIGURE 35 RANKING OF TOP FIVE PLAYERS IN DATA CENTER COOLING MARKET, 2024

- FIGURE 36 DATA CENTER COOLING MARKET SHARE ANALYSIS

- FIGURE 37 DATA CENTER COOLING MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 38 COMPANY EVALUATION MATRIX: DATA CENTER COOLING MARKET (TIER 1 COMPANIES), 2024

- FIGURE 39 COMPANY OVERALL FOOTPRINT

- FIGURE 40 STARTUP/SME EVALUATION MATRIX: DATA CENTER COOLING MARKET, 2024

- FIGURE 41 DATA CENTER COOLING MARKET: COMPANY VALUATION OF KEY PLAYERS, 2025

- FIGURE 42 DATA CENTER COOLING MARKET: EV/EBITDA OF KEY VENDORS, 2025

- FIGURE 43 DATA CENTER COOLING MARKET: YTD AND 5 YEAR BETA OF KEY VENDORS, 2025

- FIGURE 44 VERTIV GROUP CORP.: COMPANY SNAPSHOT

- FIGURE 45 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

- FIGURE 46 JOHNSON CONTROLS: COMPANY SNAPSHOT

- FIGURE 47 CARRIER: COMPANY SNAPSHOT

- FIGURE 48 DAIKIN INDUSTRIES, LTD.: COMPANY SNAPSHOT

- FIGURE 49 MITSUBISHI ELECTRIC CORPORATION: COMPANY SNAPSHOT

- FIGURE 50 TRANE TECHNOLOGIES PLC: COMPANY SNAPSHOT

- FIGURE 51 MUNTERS: COMPANY SNAPSHOT

- FIGURE 52 DUG TECHNOLOGY: COMPANY SNAPSHOT

- FIGURE 53 DELTA POWER SOLUTIONS: COMPANY SNAPSHOT

- FIGURE 54 MODINE MANUFACTURING COMPANY: COMPANY SNAPSHOT

- FIGURE 55 SUPER MICRO COMPUTER, INC.: COMPANY SNAPSHOT

- FIGURE 56 FLEX LTD.: COMPANY SNAPSHOT

- FIGURE 57 ALFA LAVAL: COMPANY SNAPSHOT

The global data center cooling market is projected to grow from USD 11.08 billion in 2025 to USD 24.19 billion by 2032, at a CAGR of 11.8% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | Value (USD Million/Billion) |

| Segments | Component, Service, Type of Cooling, Data Center Type, Solution, End-use Industry, and Region |

| Regions covered | Asia Pacific, Europe, North America, the Middle East & Africa, and South America |

The market is driven by factors including the need for improving efficiency in data centers and an increase in the number of data centers across various end-use industries, including IT & telecom, BFSI, government & defense, research & academic, healthcare, manufacturing, retail, energy, and other industries.

"Installation and deployment segment, by service, is estimated to account for the second-largest share of the market during the forecast period."

The installation and deployment segment, by service, is projected to account for the second-largest share in the data center cooling market during the forecast period. This growth is driven by the rising demand for customized and energy-efficient cooling systems that are tailored to the specific layout and operational requirements of modern data centers. As data centers expand in size and complexity, especially hyperscale and colocation facilities, organizations increasingly rely on specialized service providers for the seamless integration of advanced cooling technologies such as liquid cooling, direct-to-chip cooling, and containment systems.

The installation and deployment phase is crucial as it directly impacts the overall performance, uptime, and energy efficiency of the cooling infrastructure. It involves not only setting up physical cooling units but also integrating them with the data center's power systems, environmental monitoring tools, and control systems. Additionally, with the growing emphasis on sustainability and regulatory compliance, professional deployment ensures that cooling systems meet green building certifications and carbon reduction goals.

"Liquid cooling systems, by solution, is estimated to account for the second-largest share of the market during the forecast period."

The liquid cooling systems segment, by solution, is projected to hold the second-largest share of the data center cooling market during the forecast period. This growth is fueled by the increasing adoption of high-performance computing, AI, and dense server architectures that generate significant heat, requiring more efficient cooling methods than traditional air systems. Liquid cooling offers superior thermal management, reduced energy consumption, and better space utilization, making it ideal for modern, high-density data centers. As operators seek sustainable and cost-effective solutions, liquid cooling is emerging as a critical component in next-generation data center infrastructure.

Profile break-up of primary participants for the report:

- By Company Type: Tier 1 - 16%, Tier 2 - 36%, and Tier 3 - 48%

- By Designation: C-level- 16%, Director Level- 24%, and Others - 60%

- By Region: North America - 36%, Europe - 24%, Asia Pacific - 20%, Middle East & Africa - 12%, and South America - 8%

Vertiv Group Corp. (US), Green Revolution Cooling, Inc. (US), Submer (Spain), Asperitas (Netherlands), and COOLIT Systems (Canada) are some of the major players operating in the data center cooling market. These players have adopted strategies such as acquisitions, expansions, partnerships, and agreements to increase their market share and business revenue.

Research Coverage:

The report defines, segments, and projects the data center cooling market based on data center type, type of cooling, service, solution, end-use industry, component, and region. It provides detailed information regarding the major factors influencing the growth of the market, such as drivers, restraints, opportunities, and challenges. It strategically profiles data center cooling manufacturers and comprehensively analyzes their market shares and core competencies, as well as tracks and analyzes competitive developments, such as expansions, partnerships, and product launches, undertaken by them in the market.

Reasons to Buy the Report:

The report is expected to help the market leaders/new entrants in the market by providing them with the closest approximations of revenue numbers of the data center cooling market and its segments. This report is also expected to help stakeholders obtain an improved understanding of the competitive landscape of the market, gain insights to improve the position of their businesses, and make suitable go-to-market strategies. It also enables stakeholders to understand the pulse of the market and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (need for improving efficiency in data centers, significant growth in number of data centers), restraints (high capital investment, requirement of specialized infrastructure), opportunities (emergence of liquid cooling technology, growing requirement for modular data center cooling, and development of innovative cooling techniques), and challenges (cooling challenges during power outage and necessity of reducing carbon emissions) influencing the growth of the data center cooling market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities in the data center cooling market.

- Market Development: Comprehensive information about lucrative markets - the report analyzes the data center cooling market across varied regions.

- Market Diversification: Exhaustive information about new products, various types, untapped geographies, recent developments, and investments in the data center cooling market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players such as Carrier (US), Trane Technologies PLC (Ireland), Alfa Laval (Sweden), Daikin Industries Ltd. (Japan), Super Micro Computer Inc. (US), DCX Liquid Cooling Systems (Poland), Johnson Controls, Inc. (US), Modine (US), BOYD (US), Schneider Electric (France), STULZ GMBH (Germany), Delta Power Solution (Taiwan), Vertiv group Corp (US), COOLIT Systems (Canada), Rittal GmbH & Co. KG (Germany), Green Revolution Cooling Inc. (US), Iceotope Precision Liquid Cooling (UK), DUG Technology (Australia), Submer (Spain), Midas Immersion Cooling (US), Chilldyne Inc. (US), Asperitas (Netherlands), Munters (Sweden), Black Box (US), LiquidStack Holdings B.V. (US), Liquid Cool Solutions (US), Mitsubishi Electric Corporation (Japan), Flex Ltd (US), and others in the data center cooling market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 INCLUSIONS & EXCLUSIONS

- 1.3.1 DATA CENTER COOLING MARKET, BY REGION: INCLUSIONS & EXCLUSIONS

- 1.3.2 DATA CENTER COOLING MARKET, BY COMPONENT: INCLUSIONS & EXCLUSIONS

- 1.3.3 DATA CENTER COOLING MARKET, BY SOLUTION: INCLUSIONS & EXCLUSIONS

- 1.3.4 DATA CENTER COOLING MARKET, BY SERVICE: INCLUSIONS & EXCLUSIONS

- 1.3.5 DATA CENTER COOLING MARKET, BY TYPE OF COOLING: INCLUSIONS & EXCLUSIONS

- 1.3.6 DATA CENTER COOLING MARKET, BY DATA CENTER TYPE: INCLUSIONS & EXCLUSIONS

- 1.3.7 DATA CENTER COOLING MARKET, BY END-USE INDUSTRY: INCLUSIONS & EXCLUSIONS

- 1.4 MARKET SCOPE

- 1.4.1 MARKET SEGMENTATION

- 1.5 YEARS CONSIDERED

- 1.6 CURRENCY CONSIDERED

- 1.7 STAKEHOLDERS

- 1.8 RESEARCH LIMITATIONS

- 1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primary interviews

- 2.1.2.4 List of participating companies for primary research

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 TOP-DOWN APPROACH

- 2.2.2 BOTTOM-UP APPROACH

- 2.3 BASE NUMBER CALCULATION

- 2.3.1 FORECAST NUMBER CALCULATION

- 2.4 DATA TRIANGULATION

- 2.5 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 RISK ASSESSMENT

- 2.8 FACTOR ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN DATA CENTER COOLING MARKET

- 4.2 DATA CENTER COOLING MARKET, BY DATA CENTER TYPE

- 4.3 NORTH AMERICA: DATA CENTER COOLING MARKET, BY COMPONENT AND COUNTRY

- 4.4 DATA CENTER COOLING MARKET, BY KEY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Need for improving efficiency in data centers

- 5.2.1.2 Significant growth in number of data centers

- 5.2.2 RESTRAINTS

- 5.2.2.1 High capital investment

- 5.2.2.2 Requirement of specialized infrastructure

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Emergence of liquid cooling technology

- 5.2.3.2 Growing requirement for modular data center cooling

- 5.2.3.3 Development of innovative cooling techniques

- 5.2.4 CHALLENGES

- 5.2.4.1 Cooling challenges during power outage

- 5.2.4.2 Necessity of reducing carbon emissions

- 5.2.1 DRIVERS

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 BARGAINING POWER OF SUPPLIERS

- 5.3.2 THREAT OF NEW ENTRANTS

- 5.3.3 THREAT OF SUBSTITUTES

- 5.3.4 BARGAINING POWER OF BUYERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 SUPPLY CHAIN ANALYSIS

- 5.4.1 DATA CENTER ORIGINAL EQUIPMENT MANUFACTURERS

- 5.4.2 DATA CENTER ORIGINAL DESIGN MANUFACTURERS

- 5.4.3 DATA CENTER COOLING ORIGINAL EQUIPMENT MANUFACTURERS

- 5.4.4 SYSTEM INTEGRATORS

- 5.4.5 VALUE-ADDED SERVICE PROVIDERS

- 5.4.6 END USERS

- 5.5 REGULATORY LANDSCAPE

- 5.5.1 INTRODUCTION

- 5.5.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.5.3 STANDARDS AND GUIDELINES FOR DATA CENTER COOLING

- 5.5.3.1 American National Standards Institute

- 5.5.3.2 American Society of Heating, Refrigerating and Air-conditioning Engineers

- 5.5.3.3 Joint Research Center of European Commission

- 5.5.3.4 Distributed Management Task Force

- 5.5.3.5 Telecommunication Industry Association

- 5.5.3.6 National Electrical Manufacturers Association

- 5.5.3.7 Canadian Standards Association Group

- 5.5.3.8 Underwriters' Laboratory

- 5.5.3.9 Factory Mutual (FM) Approvals

- 5.5.3.10 United States Department of Energy

- 5.5.3.11 United States Environmental Protection Agency

- 5.5.3.12 Statement on Standards for Attestation Engagements No. 16

- 5.5.3.13 International Standards Compliance

- 5.6 PATENT ANALYSIS

- 5.6.1 MAJOR PATENTS

- 5.7 CASE STUDY

- 5.7.1 CASE STUDY 1: REDUCTION IN DATA CENTER ENERGY SPENDING BY ADOPTING IMMERSION COOLING

- 5.7.2 CASE STUDY 2: BETTER PER RACK POWER DENSITY AND SCALABILITY

- 5.7.3 CASE STUDY 3: IMPROVEMENT IN POWER USAGE EFFECTIVENESS

- 5.8 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.8.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.8.2 BUYING CRITERIA

- 5.9 ECOSYSTEM ANALYSIS

- 5.10 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.11 TECHNOLOGY ANALYSIS

- 5.12 KEY TECHNOLOGIES

- 5.12.1 AIR COOLING

- 5.12.2 LIQUID COOLING

- 5.13 ADJACENT TECHNOLOGY

- 5.13.1 THERMOELECTRIC COOLING

- 5.13.2 ON-CHIP COOLING/EMBEDDED MICROFLUIDICS

- 5.14 COMPLEMENTARY TECHNOLOGY

- 5.14.1 ADVANCED THERMAL INTERFACE MATERIALS

- 5.14.2 LIQUID LEAK DETECTION & CONTAINMENT SYSTEMS

- 5.15 INVESTMENT AND FUNDING SCENARIO

- 5.16 KEY CONFERENCES & EVENTS IN 2025-2026

- 5.17 IMPACT OF AI ON DATA CENTER COOLING MARKET

- 5.18 AI-DRIVEN COOLING OPTIMIZATION

- 5.19 SHIFT TO ADVANCED LIQUID COOLING TECHNOLOGIES

- 5.20 PREDICTIVE MAINTENANCE AND SYSTEM RELIABILITY

- 5.21 SUSTAINABILITY AND REGULATORY COMPLIANCE

- 5.22 ECONOMIC AND INVESTMENT OPPORTUNITIES

- 5.23 CHALLENGES AND FUTURE OUTLOOK

- 5.24 GLOBAL MACROECONOMIC OUTLOOK

- 5.24.1 GDP

- 5.25 IMPACT OF 2025 US TARIFF ON DATA CENTER COOLING MARKET

- 5.25.1 KEY TARIFF RATES

- 5.25.2 PRICE IMPACT ANALYSIS

- 5.25.3 IMPACT ON MAJOR COUNTRY/REGION

- 5.25.3.1 US

- 5.25.3.2 Europe

- 5.25.3.3 Asia Pacific

6 DATA CENTER COOLING MARKET, BY COMPONENT

- 6.1 INTRODUCTION

7 DATA CENTER COOLING MARKET, DATA CENTER TYPE

- 7.1 INTRODUCTION

- 7.2 MID-SIZED DATA CENTERS

- 7.2.1 WIDE ADOPTION BY SMES TO INCREASE DEMAND

- 7.3 ENTERPRISE DATA CENTERS

- 7.3.1 HIGH POWER CONSUMPTION MANDATES USE OF EFFICIENT COOLING SOLUTIONS

- 7.4 LARGE DATA CENTERS

- 7.4.1 HIGH SERVER DENSITIES AND NEED FOR OPTIMUM COOLING SOLUTIONS TO DRIVE DEMAND

8 DATA CENTER COOLING MARKET, END-USE INDUSTRY

- 8.1 INTRODUCTION

- 8.2 BFSI

- 8.2.1 ASIA PACIFIC TO BE FASTEST-GROWING MARKET FOR DATA CENTER COOLING IN BFSI SEGMENT

- 8.3 IT & TELECOM

- 8.3.1 GROWING DEMAND FOR EFFICIENT AND SECURE DATA CENTERS TO DRIVE MARKET

- 8.4 RESEARCH & ACADEMIC

- 8.4.1 INCREASING DEMAND FOR INNOVATIVE COOLING SOLUTIONS TO SUPPORT MARKET

- 8.5 GOVERNMENT & DEFENSE

- 8.5.1 GOVERNMENT INITIATIVES TOWARD DIGITALIZATION TO INCREASE DEMAND

- 8.6 RETAIL

- 8.6.1 INCREASING FOCUS BY RETAIL SECTOR TO ENHANCE IT INFRASTRUCTURE TO SUPPORT MARKET GROWTH

- 8.7 ENERGY

- 8.7.1 INCREASING EMPHASIS ON SUSTAINABLE & ENERGY-EFFICIENT DATA CENTER COOLING SOLUTIONS TO DRIVE DEMAND

- 8.8 MANUFACTURING

- 8.8.1 LOWER OPERATIONAL COSTS AND CAPITAL EXPENDITURE TO DRIVE DEMAND

- 8.9 HEALTHCARE

- 8.9.1 GROWING DEMAND FOR CUSTOMIZED DATA SOLUTIONS TO DRIVE MARKET

- 8.10 OTHER END-USE INDUSTRIES

9 DATA CENTER COOLING MARKET, BY SERVICE

- 9.1 INTRODUCTION

- 9.2 CONSULTING

- 9.2.1 NEED TO MINIMIZE RISK AND INCREASE REVENUE TO DRIVE DEMAND

- 9.3 INSTALLATION & DEPLOYMENT

- 9.3.1 INCREASING ADOPTION OF INSTALLATION & DEPLOYMENT SERVICES WITNESSED WORLDWIDE

- 9.4 MAINTENANCE & SUPPORT

- 9.4.1 DOWNTIME RISK ASSOCIATED WITH DATA CENTER FAILURE TO DRIVE ADOPTION OF MAINTENANCE & SUPPORT SERVICES

10 DATA CENTER COOLING MARKET, BY SOLUTION

- 10.1 INTRODUCTION

- 10.2 AIR CONDITIONING

- 10.2.1 LOW INSTALLATION & MAINTENANCE COSTS TO DRIVE DEMAND

- 10.3 CHILLING UNITS

- 10.3.1 LESS COST AND BETTER PERFORMANCE CHARACTERISTICS TO INCREASE ADOPTION

- 10.4 COOLING TOWERS

- 10.4.1 COST-EFFECTIVE COOLING SOLUTIONS TO DRIVE DEMAND

- 10.5 ECONOMIZER SYSTEMS

- 10.5.1 SIGNIFICANT ENERGY SAVING AND INCREASING ADOPTION BY LARGE DATA CENTERS TO SUPPORT GROWTH

- 10.6 LIQUID COOLING SYSTEMS

- 10.6.1 HIGH EFFICIENCY SOLUTIONS TO DRIVE ADOPTION

- 10.7 CONTROL SYSTEMS

- 10.7.1 NECESSITY TO MONITOR & CONTROL COOLING UNITS IN DATA CENTERS LEADING TO DRIVE DEMAND

- 10.8 OTHER SOLUTIONS

11 DATA CENTER COOLING MARKET, BY TYPE OF COOLING

- 11.1 INTRODUCTION

- 11.2 ROOM-BASED COOLING

- 11.2.1 VARIOUS CONSTRAINTS WITH RESPECT TO LAYOUT DESIGN TO LIMIT GROWTH

- 11.3 ROW/RACK-BASED COOLING

- 11.3.1 ADOPTION IN LARGE DATA CENTERS TO DRIVE MARKET

12 DATA CENTER COOLING MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 ASIA PACIFIC

- 12.2.1 CHINA

- 12.2.1.1 Digital transformation to drive data center expansion and data center cooling market

- 12.2.2 INDIA

- 12.2.2.1 Increasing internet users to drive rapid adoption of data center cooling

- 12.2.3 JAPAN

- 12.2.3.1 Presence of large service providers to drive market

- 12.2.4 SOUTH KOREA

- 12.2.4.1 Data center infrastructural investments and digital revolution to drive market

- 12.2.5 REST OF ASIA PACIFIC

- 12.2.1 CHINA

- 12.3 NORTH AMERICA

- 12.3.1 US

- 12.3.1.1 Presence of IT and internet giants to drive market

- 12.3.2 CANADA

- 12.3.2.1 Increased digitization and huge data generation to drive adoption

- 12.3.3 MEXICO

- 12.3.3.1 Exponential growth in data traffic to drive demand

- 12.3.1 US

- 12.4 EUROPE

- 12.4.1 GERMANY

- 12.4.1.1 Growth of data centers in IT and technology sectors to drive market

- 12.4.2 UK

- 12.4.2.1 Surge in data consumption and presence of major hyperscale sites to fuel demand for efficient cooling solutions

- 12.4.3 NETHERLANDS

- 12.4.3.1 Favorable factors, such as tax exemption for green energy usage, to drive market

- 12.4.4 FRANCE

- 12.4.4.1 Growth in ICT sector and focus on environmental sustainability to drive market

- 12.4.5 ITALY

- 12.4.5.1 Rising demand for colocation data centers to boost market

- 12.4.6 REST OF EUROPE

- 12.4.1 GERMANY

- 12.5 MIDDLE EAST & AFRICA

- 12.5.1 UAE

- 12.5.1.1 Increasing adoption of newer technologies to drive market

- 12.5.2 SAUDI ARABIA

- 12.5.2.1 Demand for rugged data center solutions & managed services and digitization to drive market

- 12.5.3 REST OF GCC

- 12.5.4 SOUTH AFRICA

- 12.5.4.1 Developed telecommunication infrastructure to fuel market

- 12.5.5 REST OF MIDDLE EAST & AFRICA

- 12.5.1 UAE

- 12.6 SOUTH AMERICA

- 12.6.1 BRAZIL

- 12.6.1.1 Digital transformation to drive data center cooling market

- 12.6.2 REST OF SOUTH AMERICA

- 12.6.1 BRAZIL

13 COMPETITIVE LANDSCAPE

- 13.1 INTRODUCTION

- 13.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 13.3 REVENUE ANALYSIS

- 13.4 MARKET SHARE ANALYSIS

- 13.4.1 RANKING OF KEY MARKET PLAYERS, 2024

- 13.4.2 MARKET SHARE OF KEY PLAYERS

- 13.5 BRAND/PRODUCT COMPARISON

- 13.6 COMPANY EVALUATION MATRIX (TIER 1), 2024

- 13.6.1 STARS

- 13.6.2 EMERGING LEADERS

- 13.6.3 PERVASIVE PLAYERS

- 13.6.4 PARTICIPANTS

- 13.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 13.6.5.1 Company footprint

- 13.6.5.2 Region footprint

- 13.6.5.3 Type of cooling footprint

- 13.6.5.4 Solution footprint

- 13.7 STARTUP/SME EVALUATION MATRIX, 2024

- 13.7.1 PROGRESSIVE COMPANIES

- 13.7.2 RESPONSIVE COMPANIES

- 13.7.3 DYNAMIC COMPANIES

- 13.7.4 STARTING BLOCKS

- 13.7.5 COMPETITIVE BENCHMARKING

- 13.8 COMPANY VALUATION AND FINANCIAL METRICS

- 13.9 COMPETITIVE SCENARIO AND TRENDS

- 13.9.1 PRODUCT LAUNCHES

- 13.9.2 DEALS

- 13.9.3 OTHER DEVELOPMENTS

14 COMPANY PROFILE

- 14.1 KEY PLAYERS

- 14.1.1 VERTIV GROUP CORP.

- 14.1.1.1 Business overview

- 14.1.1.2 Products/Solutions/Services offered

- 14.1.1.3 Recent developments

- 14.1.1.3.1 Product launches

- 14.1.1.3.2 Deals

- 14.1.1.4 MnM view

- 14.1.1.4.1 Key strengths

- 14.1.1.4.2 Strategic choices

- 14.1.1.4.3 Weaknesses and competitive threats

- 14.1.2 GREEN REVOLUTION COOLING, INC.

- 14.1.2.1 Business overview

- 14.1.2.2 Products/Solutions/Services offered

- 14.1.2.3 Recent developments

- 14.1.2.3.1 Product launches

- 14.1.2.3.2 Deals

- 14.1.2.4 MnM view

- 14.1.2.4.1 Key strengths

- 14.1.2.4.2 Strategic choices

- 14.1.2.4.3 Weaknesses and competitive threats

- 14.1.3 SUBMER

- 14.1.3.1 Business overview

- 14.1.3.2 Products/Solutions/Services offered

- 14.1.3.3 Recent developments

- 14.1.3.3.1 Product launches

- 14.1.3.3.2 Deals

- 14.1.3.3.3 Expansions

- 14.1.3.3.4 Others

- 14.1.3.4 MnM view

- 14.1.3.4.1 Key strengths

- 14.1.3.4.2 Strategic choices

- 14.1.3.4.3 Weaknesses and competitive threats

- 14.1.4 ASPERITAS

- 14.1.4.1 Business overview

- 14.1.4.2 Products/Solutions/Services offered

- 14.1.4.3 Recent developments

- 14.1.4.3.1 Product launches

- 14.1.4.3.2 Deals

- 14.1.4.3.3 Expansions

- 14.1.4.4 MnM view

- 14.1.4.4.1 Key strengths

- 14.1.4.4.2 Strategic choices

- 14.1.4.4.3 Weaknesses and competitive threats

- 14.1.5 COOLIT SYSTEMS

- 14.1.5.1 Business overview

- 14.1.5.2 Products/Solutions/Services offered

- 14.1.5.3 Recent developments

- 14.1.5.3.1 Product launches

- 14.1.5.3.2 Deals

- 14.1.5.3.3 Expansions

- 14.1.5.4 MnM view

- 14.1.5.4.1 Key strengths

- 14.1.5.4.2 Strategic choices

- 14.1.5.4.3 Weaknesses and competitive threats

- 14.1.6 DCX LIQUID COOLING SYSTEMS

- 14.1.6.1 Business overview

- 14.1.6.2 Products/Solutions/Services offered

- 14.1.6.3 Recent developments

- 14.1.6.3.1 Product launches

- 14.1.6.3.2 Others

- 14.1.7 ICEOTOPE PRECISION LIQUID COOLING

- 14.1.7.1 Business overview

- 14.1.7.2 Products/Solutions/Services offered

- 14.1.7.3 Recent developments

- 14.1.7.3.1 Product launches

- 14.1.7.3.2 Deals

- 14.1.8 SCHNEIDER ELECTRIC

- 14.1.8.1 Business overview

- 14.1.8.2 Products/Solutions/Services offered

- 14.1.8.3 Recent developments

- 14.1.8.3.1 Deals

- 14.1.8.3.2 Product launches

- 14.1.8.4 MnM view

- 14.1.8.4.1 Key strengths

- 14.1.8.4.2 Strategic choices

- 14.1.8.4.3 Weaknesses and competitive threats

- 14.1.9 JOHNSON CONTROLS

- 14.1.9.1 Business overview

- 14.1.9.2 Products/Solutions/Services offered

- 14.1.9.3 Recent developments

- 14.1.10 CARRIER

- 14.1.10.1 Business overview

- 14.1.10.2 Products/Solutions/Services offered

- 14.1.10.3 Recent developments

- 14.1.10.3.1 Product launches

- 14.1.10.3.2 Deals

- 14.1.11 DAIKIN INDUSTRIES, LTD.

- 14.1.11.1 Business overview

- 14.1.11.2 Products/Solutions/Services offered

- 14.1.11.3 Recent developments

- 14.1.11.3.1 Others

- 14.1.12 MITSUBISHI ELECTRIC CORPORATION

- 14.1.12.1 Business overview

- 14.1.12.2 Products/Solutions/Services offered

- 14.1.12.3 Recent developments

- 14.1.13 RITTAL GMBH & CO. KG

- 14.1.13.1 Business overview

- 14.1.13.2 Products/Solutions/Services offered

- 14.1.13.3 Recent developments

- 14.1.13.3.1 Deals

- 14.1.13.3.2 Product launches

- 14.1.14 MIDAS IMMERSION COOLING

- 14.1.14.1 Business overview

- 14.1.14.2 Products/Solutions/Services offered

- 14.1.14.3 Recent developments

- 14.1.14.3.1 Deals

- 14.1.15 TRANE TECHNOLOGIES PLC

- 14.1.15.1 Business overview

- 14.1.15.2 Products/Solutions/Services offered

- 14.1.15.3 Recent developments

- 14.1.15.3.1 Deals

- 14.1.16 MUNTERS

- 14.1.16.1 Business overview

- 14.1.16.2 Products/Solutions/Services offered

- 14.1.16.3 Recent developments

- 14.1.16.3.1 Deals

- 14.1.16.3.2 Others

- 14.1.17 LIQUIDSTACK HOLDING B.V.

- 14.1.17.1 Business overview

- 14.1.17.2 Products/Solutions/Services offered

- 14.1.17.3 Recent developments

- 14.1.17.3.1 Deals

- 14.1.17.3.2 Others

- 14.1.18 CHILLDYNE, INC.

- 14.1.18.1 Business overview

- 14.1.18.2 Products/Solutions/Services offered

- 14.1.18.3 Recent developments

- 14.1.18.3.1 Deals

- 14.1.19 DUG TECHNOLOGY

- 14.1.19.1 Business overview

- 14.1.19.2 Products/Solutions/Services offered

- 14.1.19.3 Recent developments

- 14.1.19.3.1 Deals

- 14.1.20 LIQUIDCOOL SOLUTIONS

- 14.1.20.1 Business overview

- 14.1.20.2 Products/Solutions/Services offered

- 14.1.20.3 Recent developments

- 14.1.20.3.1 Deals

- 14.1.21 STULZ GMBH

- 14.1.21.1 Business overview

- 14.1.21.2 Products/Solutions/Services offered

- 14.1.21.3 Recent developments

- 14.1.21.3.1 Product launches

- 14.1.22 DELTA POWER SOLUTIONS

- 14.1.22.1 Business overview

- 14.1.22.2 Products/Solutions/Services offered

- 14.1.22.3 Recent developments

- 14.1.22.3.1 Deals

- 14.1.23 MODINE MANUFACTURING COMPANY

- 14.1.23.1 Business overview

- 14.1.23.2 Products/Solutions/Services offered

- 14.1.23.3 Recent developments

- 14.1.23.3.1 Product launches

- 14.1.23.3.2 Deals

- 14.1.23.3.3 Expansions

- 14.1.24 BOYD

- 14.1.24.1 Business overview

- 14.1.24.2 Products offered

- 14.1.25 SUPER MICRO COMPUTER, INC.

- 14.1.25.1 Business overview

- 14.1.25.2 Products/Solutions/Services offered

- 14.1.25.3 Recent developments

- 14.1.25.3.1 Deals

- 14.1.25.3.2 Expansions

- 14.1.26 FLEX LTD.

- 14.1.26.1 Business overview

- 14.1.26.2 Products/Solutions/Services offered

- 14.1.26.2.1 Deals

- 14.1.27 BLACK BOX

- 14.1.27.1 Business overview

- 14.1.27.2 Products/Solutions/Services offered

- 14.1.27.3 Recent developments

- 14.1.27.3.1 Deals

- 14.1.28 ALFA LAVAL

- 14.1.28.1 Business overview

- 14.1.28.2 Products/Solutions/Services offered

- 14.1.1 VERTIV GROUP CORP.

- 14.2 OTHER PLAYERS

- 14.2.1 COOLCENTRIC

- 14.2.2 ASETEK

- 14.2.3 GIGA-BYTE TECHNOLOGY CO., LTD.

- 14.2.4 NVENT

- 14.2.5 ACCELSIUS LLC

- 14.2.6 KAORI HEAT TREATMENT CO., LTD.

- 14.2.7 ZUTACORE, INC.

- 14.2.8 NORTEK AIR SOLUTIONS, LLC.

15 ADJACENT AND RELATED MARKETS

- 15.1 INTRODUCTION

- 15.2 LIMITATIONS

- 15.3 DATA CENTER COOLING INTERCONNECTED MARKETS

- 15.3.1 DATA CENTER LIQUID COOLING MARKET

- 15.3.1.1 Market definition

- 15.3.1.2 Market overview

- 15.3.1 DATA CENTER LIQUID COOLING MARKET

- 15.4 DATA CENTER LIQUID COOLING MARKET, BY COOLING TYPE

- 15.4.1 COLD PLATE LIQUID COOLING

- 15.4.1.1 Increasing high-density data center installations to drive demand

- 15.4.1 COLD PLATE LIQUID COOLING

- 15.5 IMMERSION LIQUID COOLING

- 15.5.1 ABILITY TO LOWER POWER CONSUMPTION AND CARBON FOOTPRINT TO DRIVE MARKET

- 15.6 SPRAY LIQUID COOLING

- 15.6.1 HIGH ENERGY SAVINGS, EXCELLENT HEAT-DISSIPATION EFFICIENCY, AND SILENT OPERATION TO DRIVE DEMAND

16 APPENDIX

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS